Mining Investment Risk Assessment for Nations along the Belt and Road Initiative

Abstract

1. Introduction

2. Literature Review

2.1. The Perspective of Mineral Investment Risk Assessment

2.2. Mineral Investment Risk Assessment Indicator System

2.3. Research on the Quantitative Evaluation Method of Mineral Resources Investment Risk

2.4. Aims of Research

- Proposes a 6-D risk assessment based on political, economic, social, resource potential, environmental constraints, and China factors. Significantly, the dimension of resource potential is considered from the perspective of overall mineral resources, including ore and metals exports, ore and metals imports, proven reserves of natural gas, proven reserves of crude oil, proven reserves of coal, and mineral resource reserves.

- A fuzzy comprehensive evaluation model based on the entropy method is used to evaluate the overall risk of overseas investment. The obtained results provide guidance and a basis for mineral resources investment decisions.

3. Materials and Methods

3.1. Selection of Targeted Countries

3.2. Indicators and Its Specifications

- Political risk investigates the quality and efficiency of resource country government in dealing with national problems and maintaining political stability and legal construction. Lower political risk reduces the possibility of overseas investment being damaged.

- The economic foundation measures the long-term stability of a country’s investment environment. A country with an excellent economic foundation has a relatively low risk of overseas investment inflow and relatively high profitability and safety of Chinese enterprises’ overseas investment returns.

- Social risk reflects the risk factors caused by the social situation of mining investment target countries: the more stable the country’s social level, the more favorable the investment.

- Resource potential is an important indicator for measuring investment feasibility in resource countries. Countries with abundant resources and excellent resource potential have exceptionally high investment value, which is the basis for obtaining overseas mining investment.

- Environmental risk measures a country’s attention to environmental protection awareness, actions, and policies. As for mining investment, every link of mining development is affected by environmental governance and control by governments of various countries.

- The China factor measures the relationship between a country and China’s trade and investment cooperation. If a country has a more friendly relationship with China, China’s investment risk in local areas will be lower, and the return on investment will increase.

3.3. Entropy Method

3.4. Fuzzy Method

4. Result and Discussion

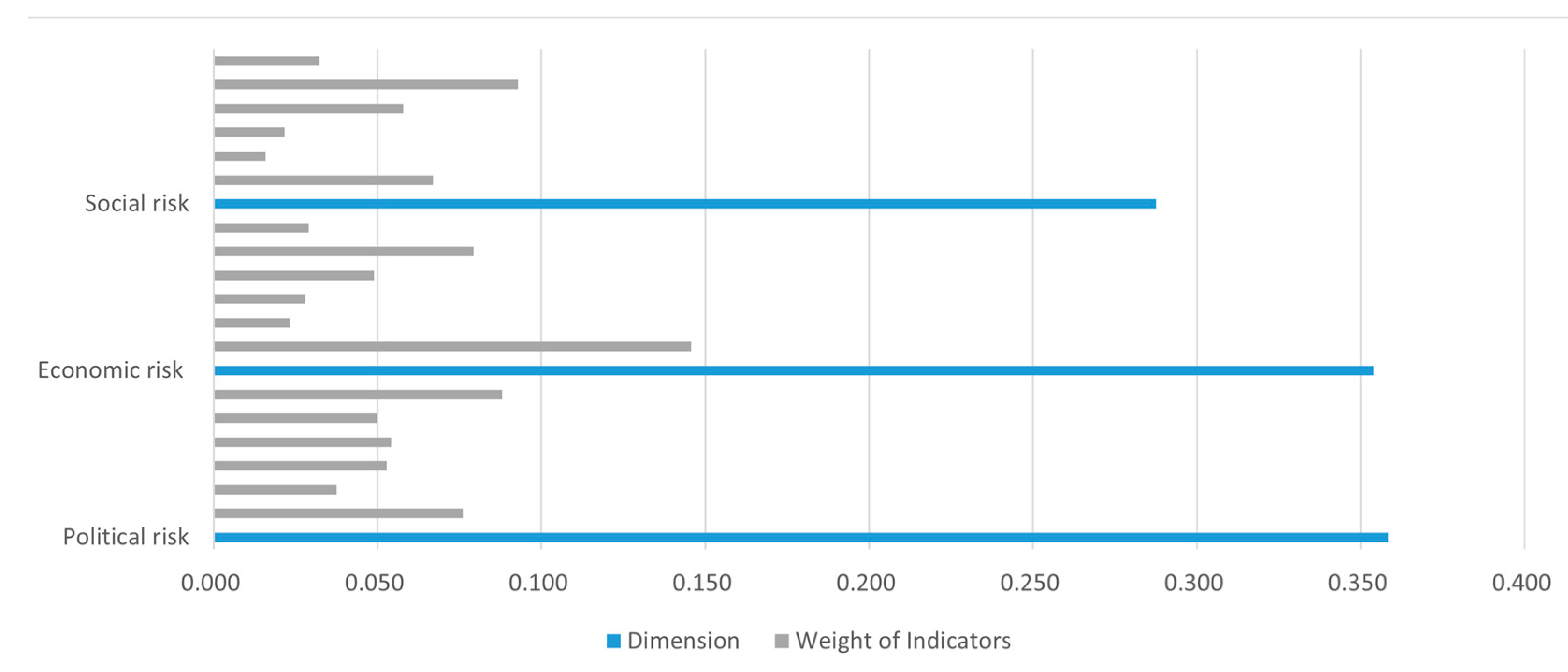

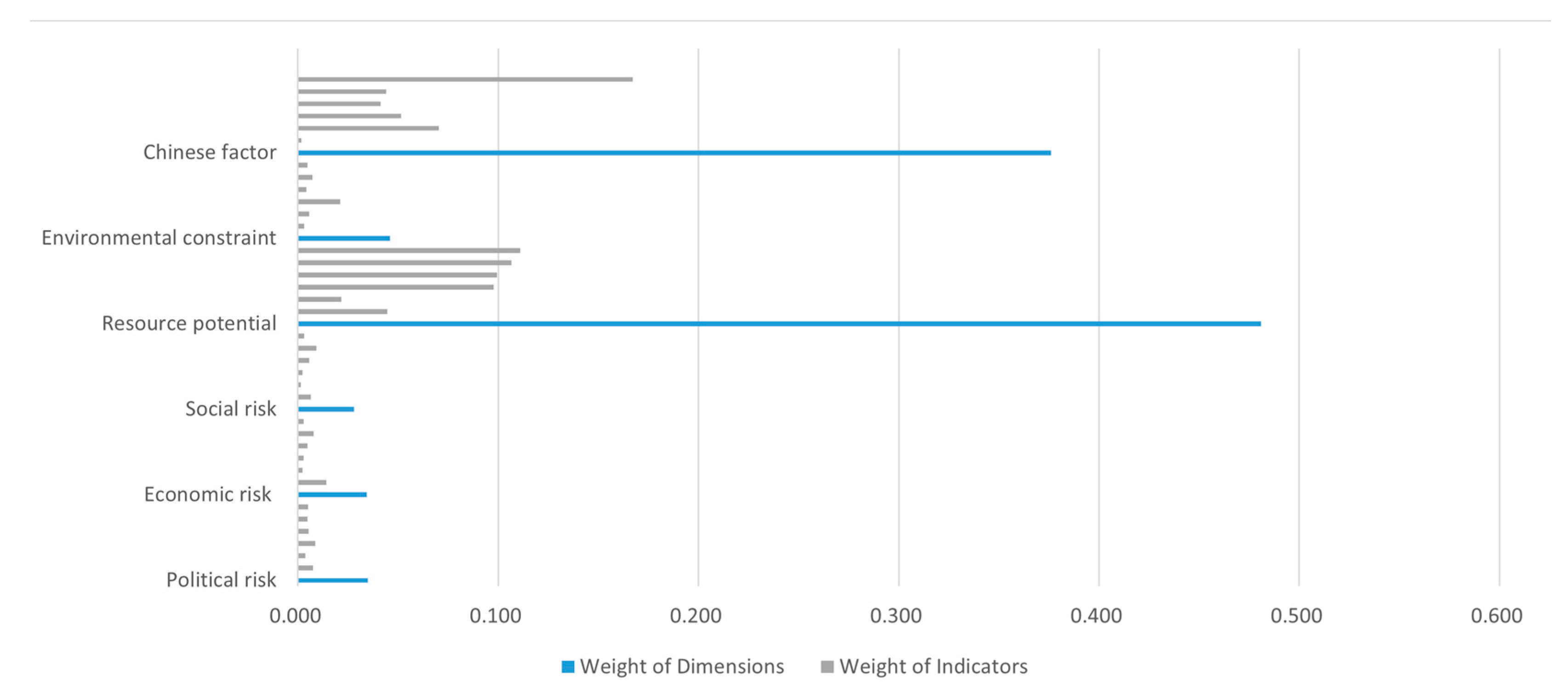

4.1. Comparison of Dimensions and Indicators

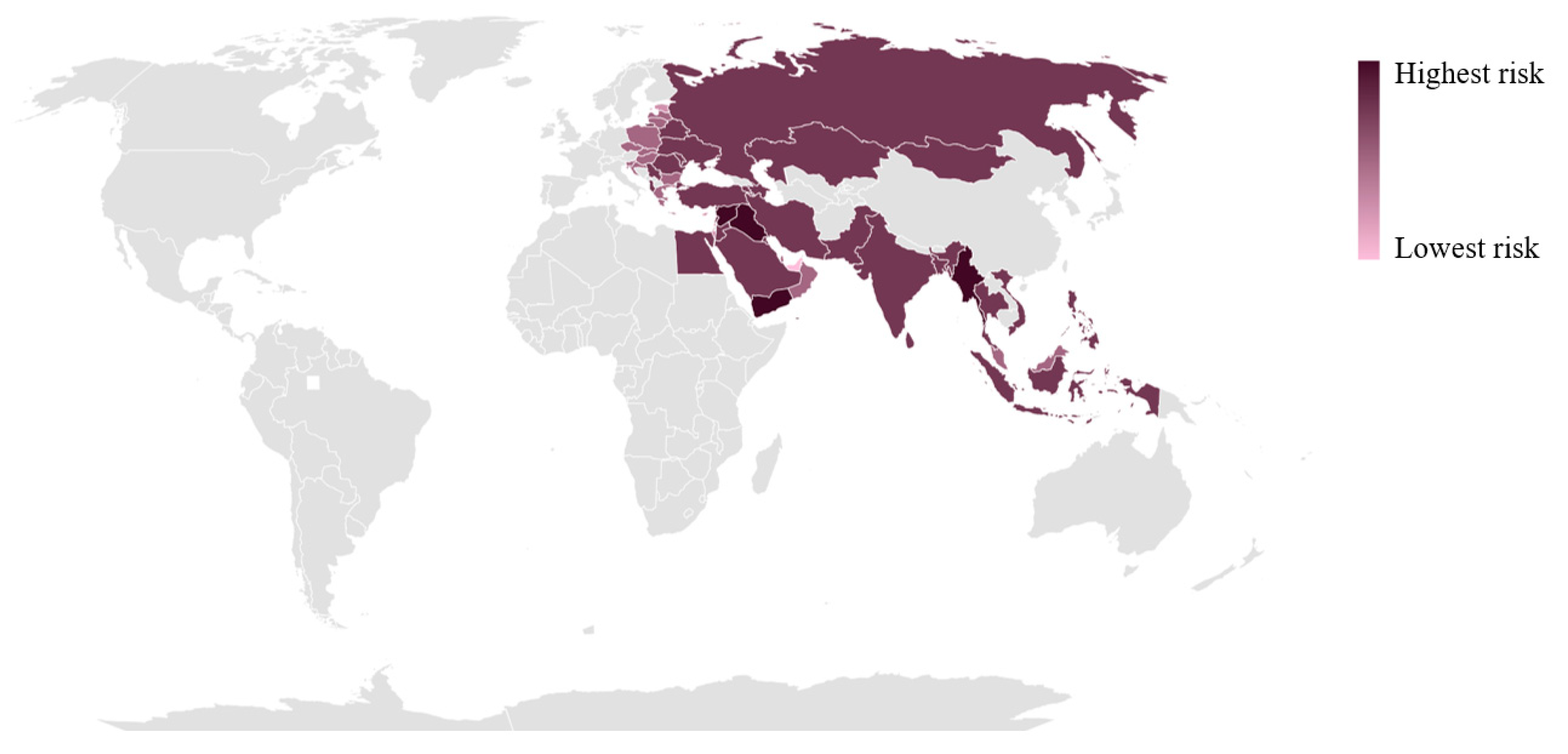

4.2. Comparison of Numerical Trends

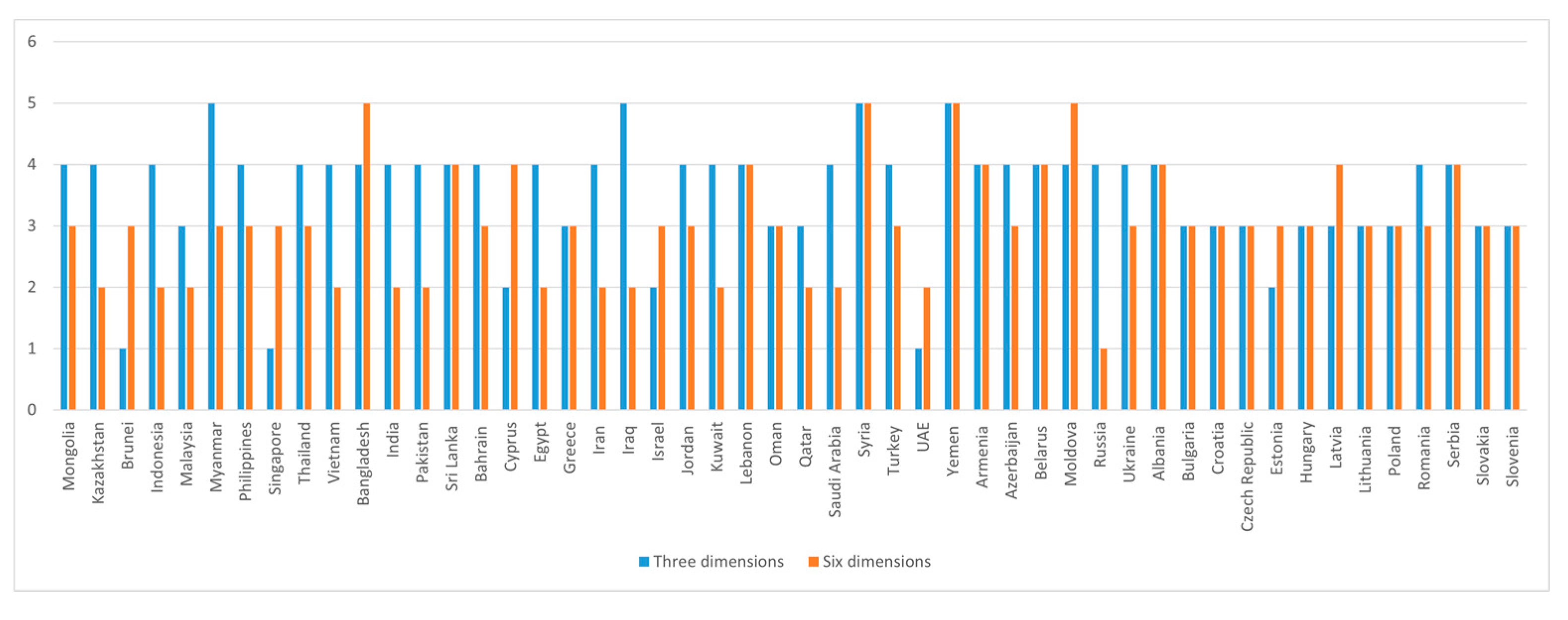

4.3. Comparison of Risk Grades

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Dimension | Indicators | Lowest Risk | Lower Risk | Medium Risk | Higher Risk | Highest Risk |

|---|---|---|---|---|---|---|

| Political risk | Control of Corruption | ≥2.5 | 2.5–1.5 | 1.5–0.5 | 0.5–0.5 | ≤−2.5 |

| Government Effectiveness | ≥2.5 | 2.5–1.5 | 1.5–0.5 | 0.5–0.5 | ≤−2.5 | |

| Political Stability | ≥2.5 | 2.5–1.5 | 1.5–0.5 | 0.5–0.5 | ≤−2.5 | |

| Regulatory Quality | ≥2.5 | 2.5–1.5 | 1.5–0.5 | 0.5–0.5 | ≤−2.5 | |

| Rule of Law | ≥2.5 | 2.5–1.5 | 1.5–0.5 | 0.5–0.5 | ≤−2.5 | |

| Voice and Accountability | ≥2.5 | 2.5–1.5 | 1.5–0.5 | 0.5–0.5 | ≤−2.5 | |

| Economic risk | GDP per capita | ≥4.0 | 4.0–3.5 | 3.5–3 | 3.0–2.5 | ≤2.5 |

| Real GDP growth | ≥8.0 | 8.0–7.0 | 7.0–6.0 | 6.0–5.0 | ≤5 | |

| Annual inflation rate | ≥8.0 | 8.0–7.0 | 7.0–6.0 | 6.0–5.0 | ≤5 | |

| Budget balance as a percentage of GDP | ≥8.0 | 8.0–7.0 | 7.0–6.0 | 6.0–5.0 | ≤5 | |

| Foreign debt as a percentage of GDP | ≥8.0 | 8.0–7.0 | 7.0–6.0 | 6.0–5.0 | ≤5 | |

| Exchange rate stability | ≥8.0 | 8.0–7.0 | 7.0–6.0 | 6.0–5.0 | ≤5 | |

| Social risk | investment freedom | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 |

| Business Freedom | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Labor Freedom | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Unemployment | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Business extent of disclosure index | ≥8.0 | 8.0–7.0 | 7.0–6.0 | 6.0–5.0 | ≤5 | |

| Literacy rate | ≥95 | 95–90 | 90–80 | 80–70 | ≤70 | |

| Resource potential | Ores and metals exports | ≥5 | 5.0–3.0 | 3.0–1.5 | 1.5–0.0 | ≤0 |

| Ores and metals imports | ≥5 | 5.0–3.0 | 3.0–1.5 | 1.5–0.0 | ≤0 | |

| Proved reserves of natural gas | ≥1000 | 1000–100 | 100–10.0 | 10.0–0.1 | ≤0.1 | |

| Crude oil proved reserves | ≥100 | 100–10.0 | 10.0–1.0 | 1.0–0.1 | ≤0.1 | |

| Proven coal reserves | ≥104 | 104–103 | 103–100 | 100–10 | ≤10 | |

| Mineral resources reserves | ≥107 | 107–106 | 106–105 | 105–104 | ≤104 | |

| Environmental constraint | EPI | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 |

| Air Quality | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Forest area (% of land area) | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Climate and Energy | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Air Pollution | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Water and Sanitation | ≥80 | 80–70 | 70–60 | 60–50 | ≤50 | |

| Chinese factor | BIT | ≥9 | 10.0–4.0 | 4.0–2.0 | 2.0–1.0 | ≤0 |

| Outward FDI stock | ≥50 | 50.0–10.0 | 10.0–1.0 | 1.0–0.1 | ≤0.1 | |

| Value of total import from China | ≥100 | 100–10 | 10.0–1.0 | 1.0–0.1 | ≤0.1 | |

| Value of total export from China | ≥100 | 100–10 | 10.0–1.0 | 1.0–0.1 | ≤0.1 | |

| Value of contracted projects | ≥5 × 105 | 5 × 105–105 | 105–104 | 104–103 | ≤1000 | |

| China’s investment in non-performing assets | ≥105 | 105–104 | 104–103 | 103–100 | ≤100 |

References

- Hussain, J.; Zhou, K.; Guo, S.; Khan, A. Investment risk and natural resource potential in “Belt & Road Initiative” countries: A multi-criteria decision-making approach. Sci. Total Environ. 2020, 723, 137981. [Google Scholar] [CrossRef] [PubMed]

- FDI. 2019 Statistical Bulletin of China’s Outward Foreign Direct Investment; China Commerce and Trade Press: Beijing, China, 2019. [Google Scholar]

- Wu, Y.; Wang, J.; Ji, S.; Song, Z. Renewable energy investment risk assessment for nations along China’s Belt & Road Initiative: An ANP-cloud model method. Energy 2020, 190, 116381. [Google Scholar] [CrossRef]

- Huang, J.; Liu, J.; Zhang, H.; Guo, Y. Sustainable risk analysis of China’s overseas investment in iron ore. Resour. Policy 2020, 68, 101771. [Google Scholar] [CrossRef]

- Huang, Y. Environmental risks and opportunities for countries along the Belt and Road: Location choice of China’s investment. J. Clean. Prod. 2019, 211, 14–26. [Google Scholar] [CrossRef]

- Li, Z.-X.; Liu, J.-Y.; Luo, D.-K.; Wang, J.-J. Study of evaluation method for the overseas oil and gas investment based on risk compensation. Pet. Sci. 2020, 17, 858–871. [Google Scholar] [CrossRef]

- Yuan, J.; Li, X.; Xu, C.; Zhao, C.; Liu, Y. Investment risk assessment of coal-fired power plants in countries along the Belt and Road initiative based on ANP-Entropy-TODIM method. Energy 2019, 176, 623–640. [Google Scholar] [CrossRef]

- Zhou, N.; Wu, Q.; Hu, X.; Xu, D.; Wang, X. Evaluation of Chinese natural gas investment along the Belt and Road Initiative using super slacks-based measurement of efficiency method. Resour. Policy 2020, 67, 101668. [Google Scholar] [CrossRef]

- Varol, M.K.; Uğur, İ.; Erçelebi, S.G. Investment Risk Evaluation of Siirt Madenköy Copper Mine in Turkey. Bilge Int. J. Sci. Technol. Res. 2019, 3, 39–50. [Google Scholar] [CrossRef][Green Version]

- Duan, F.; Ji, Q.; Liu, B.-Y.; Fan, Y. Energy investment risk assessment for nations along China’s Belt & Road Initiative. J. Clean. Prod. 2018, 170, 535–547. [Google Scholar] [CrossRef]

- Zhao, Y.; Liu, X.; Wang, S.; Ge, Y. Energy relations between China and the countries along the Belt and Road: An analysis of the distribution of energy resources and interdependence relationships. Renew. Sustain. Energy Rev. 2019, 107, 133–144. [Google Scholar] [CrossRef]

- Duan, X.; Zhao, X.; Liu, J.; Zhang, S.; Luo, D. Dynamic Risk Assessment of the Overseas Oil and Gas Investment Environment in the Big Data Era. Front. Energy Res. 2021, 9, 85. [Google Scholar] [CrossRef]

- Li, B.; Li, H.; Dong, Z.; Lu, Y.; Liu, N.; Hao, X. The global copper material trade network and risk evaluation: A industry chain perspective. Resour. Policy 2021, 74, 102275. [Google Scholar] [CrossRef]

- Buchholz, P.; Liedtke, M.; Gernuks, M. Evaluating supply risk patterns and supply and demand trends for mineral raw materials: Assessment of the zinc market. In Non-Renewable Resource Issues; Springer: Berlin/Heidelberg, Germany, 2012; pp. 157–181. [Google Scholar] [CrossRef]

- Yu, S.; Duan, H.; Cheng, J. An evaluation of the supply risk for China’s strategic metallic mineral resources. Resour. Policy 2021, 70, 101891. [Google Scholar] [CrossRef]

- Ezechi, E.H.; Isa, M.H.; Kutty, S.R.; Sapari, N.B. Boron recovery, application and economic significance: A review. In Proceedings of the 2011 National Postgraduate Conference, Perak, Malaysia, 19–20 September 2011; pp. 1–6. [Google Scholar] [CrossRef]

- Du, L.; Dinçer, H.; Ersin, İ.; Yüksel, S. IT2 fuzzy-based multidimensional evaluation of coal energy for sustainable economic development. Energies 2020, 13, 2453. [Google Scholar] [CrossRef]

- Fleury, A.-M.; Davies, B. Sustainable supply chains—Minerals and sustainable development, going beyond the mine. Resour. Policy 2012, 37, 175–178. [Google Scholar] [CrossRef]

- Schmidt, T.S.; Sewerin, S. Measuring the temporal dynamics of policy mixes—An empirical analysis of renewable energy policy mixes’ balance and design features in nine countries. Res. Policy 2019, 48, 103557. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Umar, M.; Kirikkaleli, D.; Jiao, Z. Consumption-based carbon emissions and international trade in G7 countries: The role of environmental innovation and renewable energy. Sci. Total Environ. 2020, 730, 138945. [Google Scholar] [CrossRef]

- Ken, D. China investment policy: An update. In OECD Working Papers on International Investment; OECD: Paris, France, 2013; Volume 1. [Google Scholar] [CrossRef]

- Cascio, W.F. Training trends: Macro, micro, and policy issues. Hum. Resour. Manag. Rev. 2019, 29, 284–297. [Google Scholar] [CrossRef]

- Buera, F.J.; Kaboski, J.P.; Townsend, R.M. From micro to macro development. CEPR Discuss. Pap. 2021. [Google Scholar] [CrossRef]

- Taroun, A. Towards a better modelling and assessment of construction risk: Insights from a literature review. Int. J. Proj. Manag. 2014, 32, 101–115. [Google Scholar] [CrossRef]

- Root, F.R. The expropriation experience of American companies: What happened to 38 companies. Bus. Horizons 1968, 11, 69–74. [Google Scholar] [CrossRef]

- Kobrin, S.J. Political risk: A review and reconsideration. J. Int. Bus. Stud. 1979, 10, 67–80. [Google Scholar] [CrossRef]

- Kim, W.C.; Hwang, P. Global strategy and multinationals’ entry mode choice. J. Int. Bus. Stud. 1992, 23, 29–53. [Google Scholar] [CrossRef]

- Aven, T. Risk assessment and risk management: Review of recent advances on their foundation. Eur. J. Oper. Res. 2016, 253, 1–13. [Google Scholar] [CrossRef]

- Gatzert, N.; Vogl, N. Evaluating investments in renewable energy under policy risks. Energy Policy 2016, 95, 238–252. [Google Scholar] [CrossRef]

- Zhang, R.; Andam, F.; Shi, G. Environmental and social risk evaluation of overseas investment under the China-Pakistan Economic Corridor. Environ. Monit. Assess. 2017, 189, 253. [Google Scholar] [CrossRef]

- Asiedu, E. On the determinants of foreign direct investment to developing countries: Is Africa different? World Dev. 2002, 30, 107–119. [Google Scholar] [CrossRef]

- Deichmann, J.; Karidis, S.; Sayek, S. Foreign direct investment in Turkey: Regional determinants. Appl. Econ. 2003, 35, 1767–1778. [Google Scholar] [CrossRef]

- Bellak, C.; Leibrecht, M.; Damijan, J.P. Infrastructure endowment and corporate income taxes as determinants of foreign direct investment in Central and Eastern European countries. World Econ. 2009, 32, 267–290. [Google Scholar] [CrossRef]

- Naito, K.; Myoi, H.; Otto, J.; Smith, D.; Kamitani, M. Mineral projects in Asian countries: Geology, regulation, fiscal regimes and the environment. Resour. Policy 1998, 24, 87–93. [Google Scholar] [CrossRef]

- Morgan, P.G. Mineral title management—The key to attracting foreign mining investment in developing countries? Appl. Earth Sci. 2002, 111, 165–170. [Google Scholar] [CrossRef]

- Jasiński, D.; Cinelli, M.; Dias, L.C.; Meredith, J.; Kirwan, K. Assessing supply risks for non-fossil mineral resources via multi-criteria decision analysis. Resour. Policy 2018, 58, 150–158. [Google Scholar] [CrossRef]

- Tracy, E.F.; Shvarts, E.; Simonov, E.; Babenko, M. China’s new Eurasian ambitions: The environmental risks of the Silk Road Economic Belt. Eur. Geogr. Econ. 2017, 58, 56–88. [Google Scholar] [CrossRef]

- Dou, S.-Q.; Liu, J.-Y.; Xiao, J.-Z.; Pan, W. Economic feasibility valuing of deep mineral resources based on risk analysis: Songtao manganese ore-China case study. Resour. Policy 2020, 66, 101612. [Google Scholar] [CrossRef]

- Sekerin, V.; Dudin, M.; Gorokhova, A.; Bank, S.; Bank, O. Mineral resources and national economic security: Current features. Min. Miner. Depos. 2019, 13, 72–79. [Google Scholar] [CrossRef]

- Cui, C.-Q.; Wang, B.; Zhao, Y.-X.; Wang, Q.; Sun, Z.-M. China’s regional sustainability assessment on mineral resources: Results from an improved analytic hierarchy process-based normal cloud model. J. Clean. Prod. 2019, 210, 105–120. [Google Scholar] [CrossRef]

- Wang, T.-C.; Lee, H.-D. Developing a fuzzy TOPSIS approach based on subjective weights and objective weights. Expert Syst. Appl. 2009, 36, 8980–8985. [Google Scholar] [CrossRef]

- Shemshadi, A.; Shirazi, H.; Toreihi, M.; Tarokh, M.J. A fuzzy VIKOR method for supplier selection based on entropy measure for objective weighting. Expert Syst. Appl. 2011, 38, 12160–12167. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, C.; Li, L.; Wang, Y.; Chen, K.; Xu, R. A risk assessment framework of PPP waste-to-energy incineration projects in China under 2-dimension linguistic environment. J. Clean. Prod. 2018, 183, 602–617. [Google Scholar] [CrossRef]

- Zhou, R.; Cai, R.; Tong, G. Applications of entropy in finance: A review. Entropy 2013, 15, 4909–4931. [Google Scholar] [CrossRef]

- Philippatos, G.C.; Wilson, C.J. Entropy, market risk, and the selection of efficient portfolios. Appl. Econ. 1972, 4, 209–220. [Google Scholar] [CrossRef]

- Zhao, D.; Li, C.; Wang, Q.; Yuan, J. Comprehensive evaluation of national electric power development based on cloud model and entropy method and TOPSIS: A case study in 11 countries. J. Clean. Prod. 2020, 277, 123190. [Google Scholar] [CrossRef]

- Zhao, J.; Ji, G.; Tian, Y.; Chen, Y.; Wang, Z. Environmental vulnerability assessment for mainland China based on entropy method. Ecol. Indic. 2018, 91, 410–422. [Google Scholar] [CrossRef]

- Jin, H.; Qian, X.; Chin, T.; Zhang, H. A global assessment of sustainable development based on modification of the human development index via the entropy method. Sustainability 2020, 12, 3251. [Google Scholar] [CrossRef]

- De FSM Russo, R.; Camanho, R. Criteria in AHP: A systematic review of literature. Procedia Comput. Sci. 2015, 55, 1123–1132. [Google Scholar] [CrossRef]

- Delgado, A.; Romero, I. Environmental conflict analysis using an integrated grey clustering and entropy-weight method: A case study of a mining project in Peru. Environ. Model. Softw. 2016, 77, 108–121. [Google Scholar] [CrossRef]

- Blagojević, A.; Stević, Ž.; Marinković, D.; Kasalica, S.; Rajilić, S. A novel entropy-fuzzy PIPRECIA-DEA model for safety evaluation of railway traffic. Symmetry 2020, 12, 1479. [Google Scholar] [CrossRef]

- Dikmen, I.; Birgonul, M.T.; Han, S. Using fuzzy risk assessment to rate cost overrun risk in international construction projects. Int. J. Proj. Manag. 2007, 25, 494–505. [Google Scholar] [CrossRef]

- Fang, S.; Zhou, P.; Dinçer, H.; Yüksel, S. Assessment of safety management system on energy investment risk using house of quality based on hybrid stochastic interval-valued intuitionistic fuzzy decision-making approach. Saf. Sci. 2021, 141, 105333. [Google Scholar] [CrossRef]

- Saraswat, S.; Digalwar, A.K. Evaluation of energy alternatives for sustainable development of energy sector in India: An integrated Shannon’s entropy fuzzy multi-criteria decision approach. Renew. Energy 2021, 171, 58–74. [Google Scholar] [CrossRef]

- Lam, W.S.; Lam, W.H.; Jaaman, S.H.; Liew, K.F. Performance evaluation of construction companies using integrated entropy–fuzzy VIKOR model. Entropy 2021, 23, 320. [Google Scholar] [CrossRef] [PubMed]

- U.S. Geological Survey. 2018 Minerals Yearbook; National Minerals Information Center, U.S. Geological Survey: Reston, VA, USA, 2021.

- British Petroleum. BP Statistical Review of World Energy 2019; British Petroleum: London, UK, 2019. [Google Scholar]

- GMID. Global Mining Industry Development Report 2019; China Nonferrous Metals Daily: Beijing, China, 2019. [Google Scholar]

- Xu, Q. Risk Assessment of Energy Resources Investment under “the Belt and Road” Strategy; National Academy of Development and Strategy: Beijing, China, 2018. [Google Scholar]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 3. [Google Scholar] [CrossRef]

- Yang, R.; Xing, W.; Hou, S. Evaluating the risk factors influencing foreign direct investment in Mongolia’s mining sector: A complex network approach. Emerg. Mark. Rev. 2020, 43, 100692. [Google Scholar] [CrossRef]

- Li, X.; Wang, K.; Liu, L.; Xin, J.; Yang, H.; Gao, C. Application of the Entropy Weight and TOPSIS Method in Safety Evaluation of Coal Mines. Procedia Eng. 2011, 26, 2085–2091. [Google Scholar] [CrossRef]

- Wang, Y.; Yang, X.; Yan, H. Reliable fuzzy tracking control of near-space hypersonic vehicle using aperiodic measurement information. IEEE Trans. Ind. Electron. 2019, 66, 9439–9447. [Google Scholar] [CrossRef]

- Rashidi, K.; Cullinane, K. A comparison of fuzzy DEA and fuzzy TOPSIS in sustainable supplier selection: Implications for sourcing strategy. Expert Syst. Appl. 2019, 121, 266–281. [Google Scholar] [CrossRef]

- Qiu, J.; Sun, K.; Wang, T.; Gao, H. Observer-based fuzzy adaptive event-triggered control for pure-feedback nonlinear systems with prescribed performance. IEEE Trans. Fuzzy Syst. 2019, 27, 2152–2162. [Google Scholar] [CrossRef]

- Amoatey, C.T.; Famiyeh, S.; Andoh, P. Risk assessment of mining projects in Ghana. J. Qual. Maint. Eng. 2017, 23, 22–38. [Google Scholar] [CrossRef]

| Region | Country | Population (Million) | GDP (Billion Dollars) | Ores and Metals Exports (%of Merchandise Exports) | Ores and Metals Imports (%of Merchandise Imports) | Crude Oil Proved Reserves (Billion Barrels) | Proved Reserves of Natural Gas (Trillion Cubic Feet) | Coal Reserves (Million Tons) | Reserves of Metallic and Non-Metallic Mineral Resources (Thousand Tons) |

|---|---|---|---|---|---|---|---|---|---|

| East Asia | Mongolia | 3.17 | 13.35 | 42.89 | 0.26 | 0 | 0 | 2520 | 2,040,006.09 |

| Central Asia | Kazakhstan | 18.28 | 204.0 | 11.55 | 3.43 | 35 | 30 | 25605 | 3,606,001 |

| Brunei | 0.43 | 13.49 | 0.00035 | 1.08334 | 9.5 | 1.1 | 0.00 | 0.00 | |

| Indonesia | 267.66 | 1146.85 | 6.69 | 3.54 | 97.5 | 3.2 | 37,000 | 2,052,902.5 | |

| Malaysia | 31.53 | 382.13 | 4.3 | 5.27 | 84.5 | 3 | 1700 | 110,280 | |

| Myanmar | 53.71 | 84.49 | 5.52 | 0.77 | 41.3 | 0.05 | 258 | 95,410 | |

| Philippines | 106.65 | 340.30 | 5.01 | 2.27 | 3.48 | 0.14 | 0 | 82,290 | |

| Singapore | 5.64 | 333.10 | 0.88 | 1.11 | 0 | 0 | 0 | 0 | |

| Thailand | 69.43 | 442.26 | 1.61 | 4.37 | 6.6 | 0.3 | 1063 | 54,552 | |

| Vietnam | 95.54 | 187.69 | 0.9 | 4.43 | 22.8 | 4.4 | 3360 | 3,854,706 | |

| South Asia | Bangladesh | 161.36 | 194.15 | 0 | 0 | 5.7 | 0.03 | 250 | 0 |

| India | 1352.62 | 2822.17 | 3.3 | 6.03 | 45.5 | 4.5 | 101,363 | 4,484,800 | |

| Pakistan | 212.22 | 254.22 | 2.12 | 4 | 12.9 | 0.25 | 3064 | 0 | |

| Sri Lanka | 21.67 | 85.51 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | |

| West Asia | Bahrain | 1.57 | 33.71 | 22.8 | 5.75 | 6.4 | 0.12 | 0.00 | 0.00 |

| Cyprus | 1.19 | 27.41 | 4.24 | 0.61 | 0 | 0 | 0.00 | 0.00 | |

| Egypt | 98.42 | 286.15 | 4.56 | 5 | 75.5 | 3.3 | 52 | 1,348,000 | |

| Greece | 10.73 | 252.72 | 8.67 | 3.96 | 0.04 | 0.01 | 2876 | 280,000 | |

| Iran | 81.80 | 504.99 | 0 | 0 | 1127.7 | 155.6 | 90 | 2,861,400.393 | |

| Iraq | 38.43 | 210.53 | 0 | 0 | 125.6 | 147.2 | 0 | 0 | |

| Israel | 8.88 | 308.67 | 1.13 | 1.38 | 14.6 | 0.01 | 0 | 67,000 | |

| Jordan | 9.96 | 32.52 | 7.72 | 1.79 | 0.21 | 0 | 0 | 1,000,000 | |

| Kuwait | 4.14 | 137.00 | 0.17 | 3.38 | 59.9 | 101.5 | 0 | 0 | |

| Lebanon | 6.85 | 42.56 | 11.57 | 1.68 | 0 | 0 | 0 | 0 | |

| Oman | 4.83 | 74.22 | 5.42 | 6.36 | 23.5 | 5.4 | 122 | 0 | |

| Qatar | 2.78 | 175.97 | 0.11 | 5.08 | 872.1 | 25.2 | 0 | 0 | |

| Saudi Arabia | 33.70 | 701.62 | 1.18 | 3.41 | 208.1 | 297.7 | 0 | 1,475,000 | |

| Syria | 16.91 | 0.00 | 0 | 0 | 9.5 | 2.5 | 0 | 1,800,000 | |

| Turkey | 82.32 | 1240.47 | 4.32 | 8.2 | 0.22 | 0.27 | 11,526 | 469,200.7 | |

| UAE | 9.63 | 398.02 | 6.55 | 2.91 | 209.7 | 97.8 | 0.00 | 0.00 | |

| Yemen | 28.50 | 18.04 | 0 | 0 | 9.4 | 3 | 0.00 | 0.00 | |

| Russia and CIS | Armenia | 2.95 | 13.01 | 36.88 | 2.01 | 0 | 0 | 0.00 | 0.15 |

| Azerbaijan | 9.94 | 57.66 | 0.92 | 0.9 | 75.2 | 7 | 0.00 | 170.00 | |

| Belarus | 9.48 | 62.46 | 0 | 0 | 0.1 | 0.2 | 0.00 | 0.00 | |

| Moldova | 2.71 | 9.55 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | |

| Russia | 144.48 | 1739.13 | 5.54 | 1.83 | 1375 | 106.2 | 160,364 | 28,580,381.3 | |

| Ukraine | 44.62 | 131.29 | 8.31 | 2.48 | 38.5 | 0.4 | 34,375 | 140,000 | |

| Central and Eastern | Albania | 2.87 | 14.55 | 2.03 | 0.39 | 0.03 | 0.17 | 0 | 0 |

| Europe | Bulgaria | 7.03 | 60.91 | 14.08 | 9.577 | 0.2 | 0.02 | 2366 | 0 |

| Croatia | 4.09 | 65.02 | 3.89 | 2.71 | 0.88 | 0.07 | 0 | 0 | |

| Czech Republic | 10.63 | 247.93 | 1.36 | 2.96 | 0.14 | 0.02 | 2657 | 0 | |

| Estonia | 1.32 | 26.37 | 2.32 | 1.59 | 0 | 0 | 0 | 0 | |

| Hungary | 9.78 | 162.63 | 1.45 | 2.77 | 0.29 | 0.03 | 2876 | 0 | |

| Latvia | 1.93 | 31.25 | 2.13 | 1.36 | 0 | 0 | 0 | 0 | |

| Lithuania | 2.80 | 49.41 | 1.87 | 1.99 | 0 | 0.01 | 0 | 0 | |

| Poland | 37.97 | 633.91 | 3.04 | 3.47 | 2.2 | 0.16 | 26,479 | 29,713 | |

| Romania | 19.47 | 225.62 | 2.18 | 2.48 | 3.6 | 0.6 | 291 | 0 | |

| Serbia | 6.98 | 48.08 | 0 | 0 | 1.7 | 0.08 | 7514 | 0 | |

| Slovakia | 5.45 | 112.06 | 2.06 | 2.92 | 0.5 | 0.01 | 0 | 120,000 | |

| Slovenia | 2.07 | 55.34 | 4 | 5.38 | 0 | 0 | 0 | 0 | |

| Total | 3167.10 | 14,694.55 | NA | NA | 4605.59 | 1001.55 | 427,771 | 54,551,813.13 | |

| World | 7591.93 | 82,892.75 | NA | NA | 6951.8 | 1729.7 | 1,054,782 | 164,007,502.3 | |

| % | 41.72% | 17.73% | NA | NA | 66.25% | 57.90% | 40.56% | 33.26% |

| Dimension | Indicators | Data Source |

|---|---|---|

| Political risk | Control of Corruption | Worldwide Governance Indicators |

| Government Effectiveness | Worldwide Governance Indicators | |

| Political Stability | Worldwide Governance Indicators | |

| Regulatory Quality | Worldwide Governance Indicators | |

| Rule of Law | Worldwide Governance Indicators | |

| Voice and Accountability | Worldwide Governance Indicators | |

| Economic risk | GDP per capita | The International Country Risk Guide |

| Real GDP growth | The International Country Risk Guide | |

| Annual inflation rate | The International Country Risk Guide | |

| Budget balance as a percentage of GDP | The International Country Risk Guide | |

| Foreign debt as a percentage of GDP | The International Country Risk Guide | |

| Exchange rate stability | The International Country Risk Guide | |

| Social risk | Investment freedom | Index of Economic Freedom |

| Business Freedom | Index of Economic Freedom | |

| Labor Freedom | Index of Economic Freedom | |

| Unemployment | World Development Indicators | |

| The business extent of the disclosure index | Worldwide Governance Indicators | |

| Literacy rate | World Development Indicators | |

| Resource potential | Ores and metals exports | World Development Indicators |

| Ores and metals imports | World Development Indicators | |

| Proved reserves of natural gas (trillion cubic feet) | Global Mining Development Report | |

| Crude oil proved reserves(billion barrels) | Global Mining Development Report | |

| Proven coal reserves (million metric tons) | Global Mining Development Report | |

| Mineral resources reserves (thousand metric tons) | Global Mining Development Report | |

| Environmental constraint | EPI | Environmental Performance Index |

| Air Quality | Environmental Performance Index | |

| Forest area (% of land area) | World Development Indicators | |

| Climate and Energy | Environmental Performance Index | |

| Air Pollution | Environmental Performance Index | |

| Water and Sanitation | Environmental Performance Index | |

| Chinese factor | BIT | Ministry of Commerce of China |

| Outward FDI stock | Statistical Bulletin of China’s Outward Foreign Direct Investment | |

| Value of total import from china | UN Comtrade Database | |

| Value of total export from china | UN Comtrade Database | |

| Value of contracted projects | International Statistical Yearbook | |

| China’s investment in non-performing assets | UN Comtrade Database |

| Dimension | Weight of Dimensions | Indicators | Weight of Indicators |

|---|---|---|---|

| Political risk | 0.358 | Control of Corruption: | 0.076 |

| Government Effectiveness | 0.038 | ||

| Political Stability | 0.088 | ||

| Regulatory Quality | 0.054 | ||

| Rule of Law | 0.050 | ||

| Voice and Accountability | 0.053 | ||

| Economic risk | 0.354 | GDP per capita | 0.146 |

| Real GDP growth | 0.023 | ||

| Annual inflation rate | 0.028 | ||

| Budget balance as a percentage of GDP | 0.049 | ||

| Foreign debt as a percentage of GDP | 0.079 | ||

| Exchange rate stability | 0.029 | ||

| Social risk | 0.288 | investment freedom | 0.067 |

| Business Freedom | 0.016 | ||

| Labor Freedom | 0.022 | ||

| Unemployment | 0.058 | ||

| Business extent of disclosure index | 0.093 | ||

| Literacy rate | 0.032 |

| Dimension | Weight of Dimensions | Indicators | Weight of Indicators |

|---|---|---|---|

| Political risk | 0.035 | Control of Corruption: | 0.007 |

| Government Effectiveness | 0.004 | ||

| Political Stability | 0.009 | ||

| Regulatory Quality | 0.005 | ||

| Rule of Law | 0.005 | ||

| Voice and Accountability | 0.005 | ||

| Economic risk | 0.034 | GDP per capita | 0.014 |

| Real GDP growth | 0.002 | ||

| Annual inflation rate | 0.003 | ||

| Budget balance as a percentage of GDP | 0.005 | ||

| Foreign debt as a percentage of GDP | 0.008 | ||

| Exchange rate stability | 0.003 | ||

| Social risk | 0.028 | investment freedom | 0.007 |

| Business Freedom | 0.002 | ||

| Labor Freedom | 0.002 | ||

| Unemployment | 0.006 | ||

| Business extent of disclosure index | 0.009 | ||

| Literacy rate | 0.003 | ||

| Resource potential | 0.481 | Ores and metals exports | 0.045 |

| Ores and metals imports | 0.022 | ||

| Proved reserves of natural gas (trillion cubic feet) | 0.098 | ||

| Crude oil proved reserves (billion barrels) | 0.099 | ||

| Proven coal reserves (million metric tons) | 0.107 | ||

| Mineral resources reserves (thousand metric tons) | 0.111 | ||

| Environmental constraint | 0.046 | EPI | 0.003 |

| Air Quality | 0.006 | ||

| Forest area (% of land area) | 0.021 | ||

| Climate and Energy | 0.004 | ||

| Air Pollution | 0.007 | ||

| Water and Sanitation | 0.005 | ||

| Chinese factor | 0.376 | BIT | 0.002 |

| Outward FDI stock | 0.070 | ||

| Value of total import from China | 0.052 | ||

| Value of total export from China | 0.041 | ||

| Value of contracted projects | 0.044 | ||

| China’s investment in non-performing assets | 0.167 |

| Weight of Indicators | 6-D | Approach I (3-D Approach) | Approach II (Specific Resource) | Approach III (Combination) |

|---|---|---|---|---|

| 0.005 | 41.7% | 0% | 2.8% | 7.7% |

| 0.005–0.01 | 22.2% | 0% | 8.3% | 12.8% |

| 0.01–0.05 | 16.7% | 50% | 75% | 64.1% |

| 0.05–0.1 | 11.1% | 44.4% | 13.9% | 12.8% |

| 0.1 | 8.3% | 5.6% | 0% | 2.6% |

| Country | 6-D Approach | Approach I (3-D Approach) | Approach II (Specific Resource) | Approach III (Combination) |

|---|---|---|---|---|

| Mongolia | Medium risk | |||

| Kazakhstan | Lower risk | |||

| Brunei | Medium risk | NA | ||

| Indonesia | Lower risk | |||

| Malaysia | Lower risk | |||

| Myanmar | Medium risk | NA | ||

| Philippines | Medium risk | |||

| Singapore | Medium risk | |||

| Thailand | Medium risk | |||

| Vietnam | Lower risk | |||

| Bangladesh | Highest risk | |||

| India | Lower risk | |||

| Pakistan | Lower risk | |||

| Sri Lanka | Higher risk | NA |

| Country | 6-D Approach | Approach I (3-D Approach) | Approach II (Specific Resource) | Approach III (Combination) |

|---|---|---|---|---|

| Bahrain | Medium risk | |||

| Cyprus | Highest risk | NA | ||

| Egypt | Lower risk | |||

| Greece | Medium risk | NA | ||

| Iran | Lower risk | |||

| Iraq | Lower risk | |||

| Israel | Medium risk | |||

| Jordan | Medium risk | |||

| Kuwait | Lower risk | |||

| Lebanon | Higher risk | |||

| Oman | Medium risk | |||

| Qatar | Lower risk | |||

| Saudi Arabia | Lower risk | |||

| Syria | Highest risk | |||

| Turkey | Medium risk | |||

| UAE | Lower risk | |||

| Yemen | Highest risk | NA |

| Country | 6-D Approach | Approach I (3-D Approach) | Approach II (Specific Resource) | Approach III (Combination) |

|---|---|---|---|---|

| Armenia | Higher risk | NA | ||

| Azerbaijan | Medium risk | |||

| Belarus | Higher risk | |||

| Moldova | Highest risk | NA | ||

| Russia | Lowest risk | |||

| Ukraine | Medium risk | |||

| Albania | Higher risk | |||

| Bulgaria | Medium risk | |||

| Croatia | Medium risk | |||

| Czech Republic | Medium risk | |||

| Estonia | Medium risk | NA | ||

| Hungary | Medium risk | |||

| Latvia | Higher risk | NA | ||

| Lithuania | Medium risk | NA | ||

| Poland | Medium risk | |||

| Romania | Medium risk | |||

| Serbia | Higher risk | NA | ||

| Slovakia | Medium risk | |||

| Slovenia | Medium risk | NA |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiang, Y.; Zhang, Q.; Wang, D.; Wu, S. Mining Investment Risk Assessment for Nations along the Belt and Road Initiative. Land 2022, 11, 1287. https://doi.org/10.3390/land11081287

Xiang Y, Zhang Q, Wang D, Wu S. Mining Investment Risk Assessment for Nations along the Belt and Road Initiative. Land. 2022; 11(8):1287. https://doi.org/10.3390/land11081287

Chicago/Turabian StyleXiang, Yujing, Qinli Zhang, Daolin Wang, and Shihai Wu. 2022. "Mining Investment Risk Assessment for Nations along the Belt and Road Initiative" Land 11, no. 8: 1287. https://doi.org/10.3390/land11081287

APA StyleXiang, Y., Zhang, Q., Wang, D., & Wu, S. (2022). Mining Investment Risk Assessment for Nations along the Belt and Road Initiative. Land, 11(8), 1287. https://doi.org/10.3390/land11081287