Factors Influencing the Coupling of the Development of Rural Urbanization and Rural Finance: Evidence from Rural China

Abstract

:1. Introduction

2. Literature Review

3. Comprehensive Evaluation of Rural Urbanization and Rural Financial Development

3.1. Data Sources

3.2. Construction of Index System for Rural Urbanization

3.3. Construction of a Rural Financial Index System

3.4. Comprehensive Evaluation Method

- (1)

- Positive index treatment method:

- (2)

- Negative index treatment method:

3.5. Comprehensive Evaluation Results of Rural Urbanization and Rural Financial Development

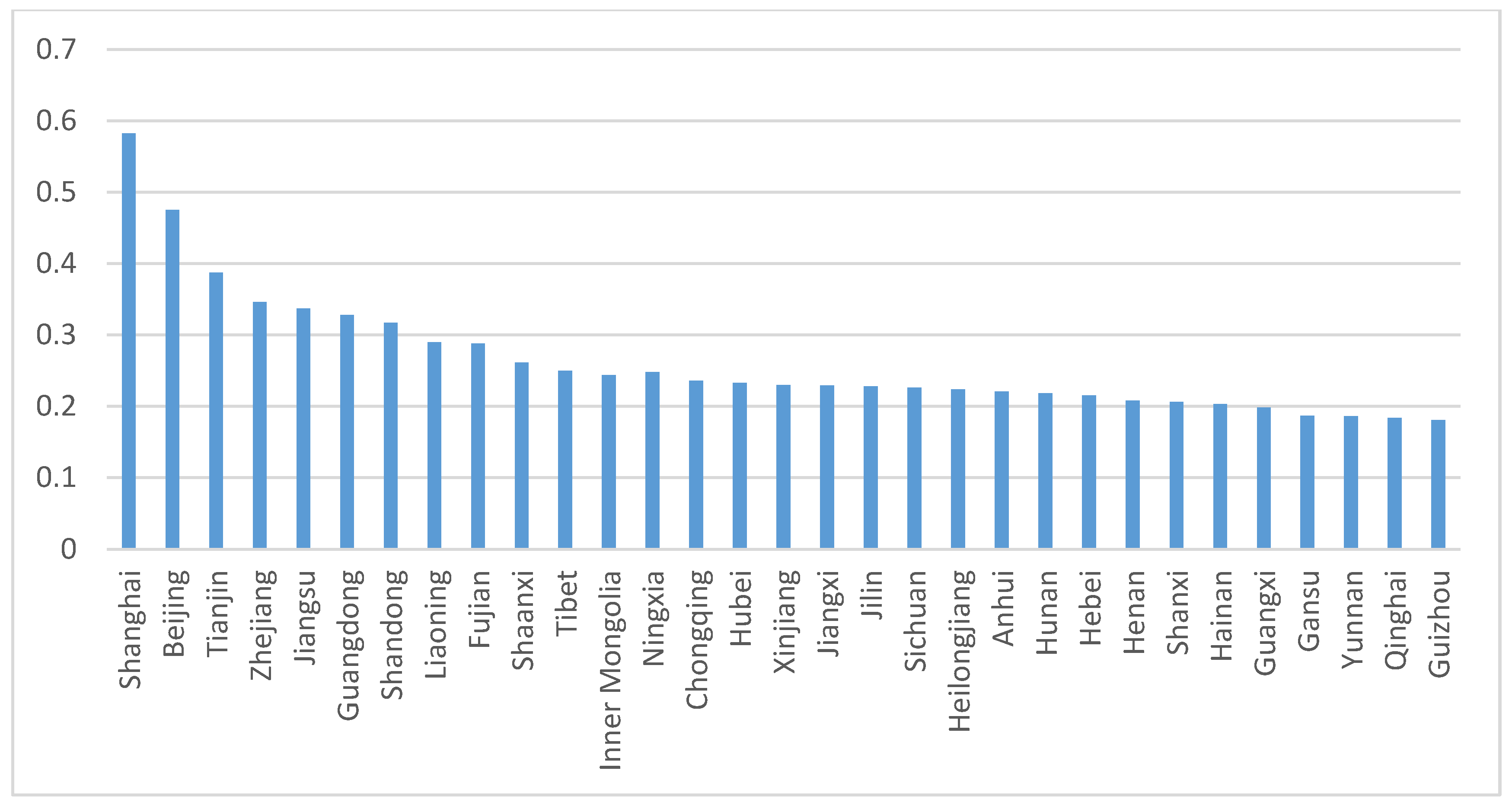

3.5.1. Comprehensive Evaluation Results of Urbanization Development in Rural Areas

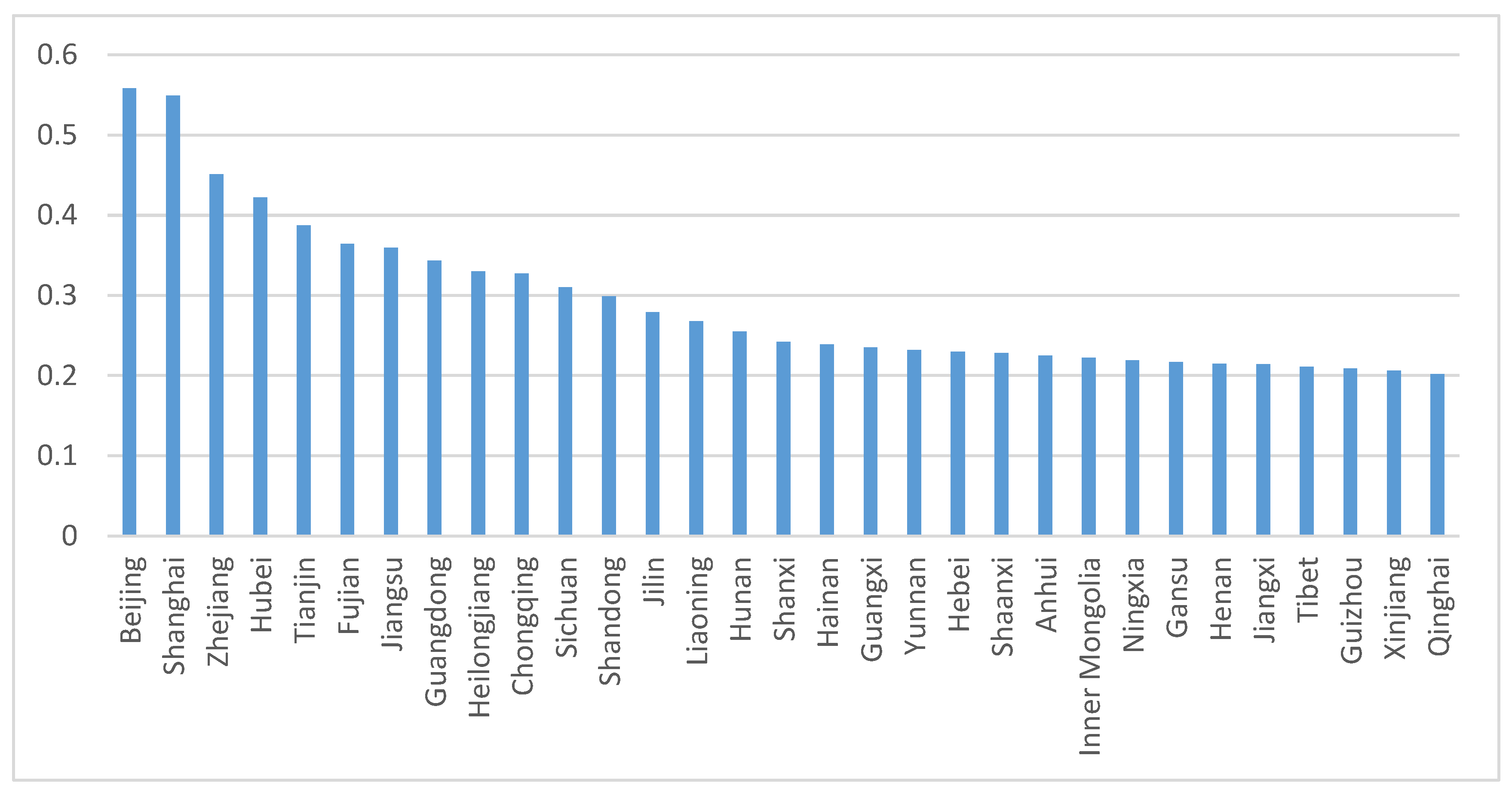

3.5.2. Comprehensive Evaluation Results of Rural Financial Development

4. Research on the Coupling and Coordination Degree of Rural Urbanization and Rural Finance

4.1. Coupling Coordination Degree Model

4.2. Classification of the Coupling Degree and Coupling Coordination Degree

4.3. Measurement of Coupling Degree and Coupling Coordination Degree

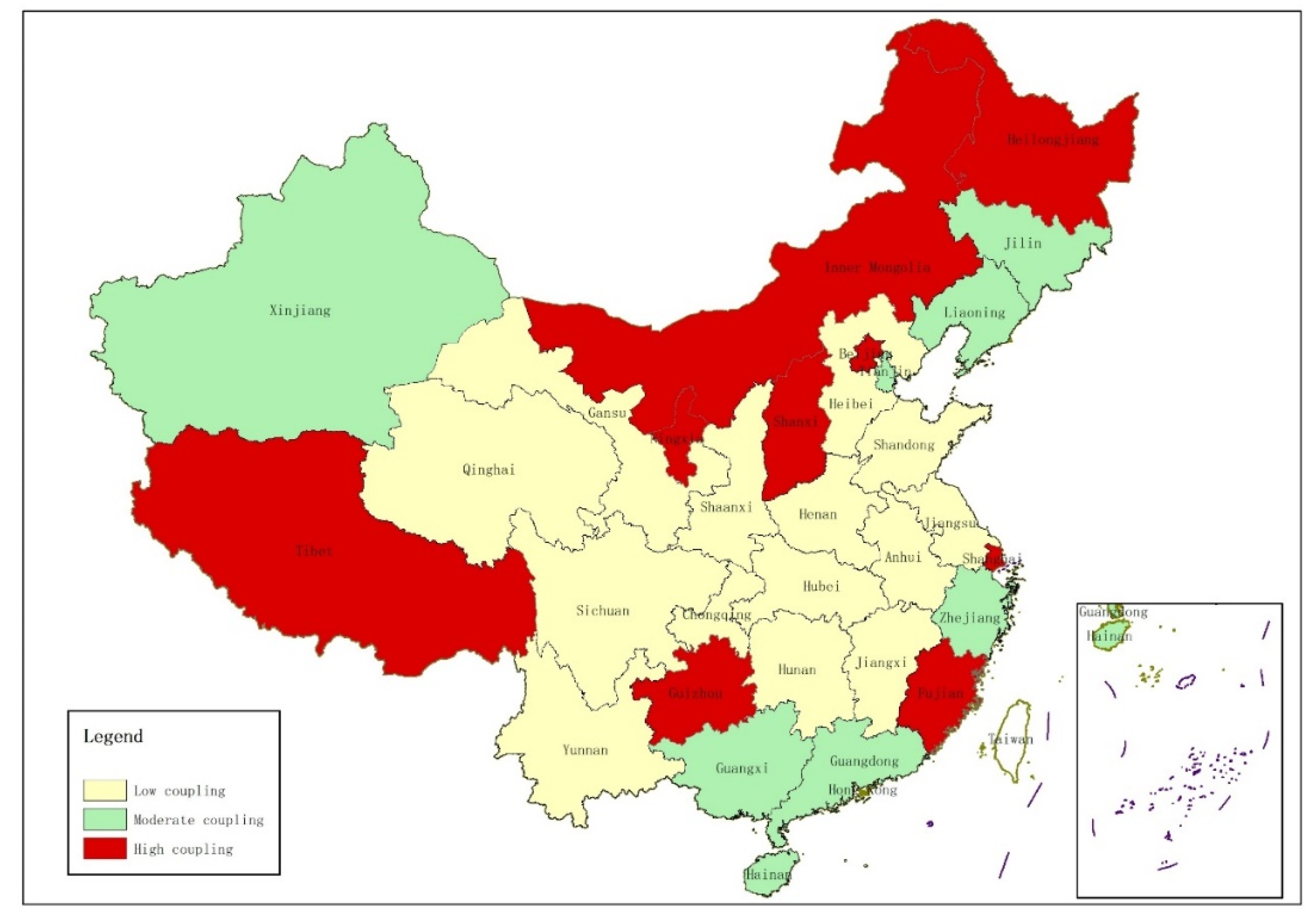

4.3.1. Coupling Measurement Results

4.3.2. Calculation Results of Coupling Coordination Degree

5. An Empirical Analysis of Factors Influencing the Coupling Development of Rural Urbanization and Rural Finance

5.1. Model Building

5.2. Steadiness Test

5.3. Empirical Analysis Based on Panel Quantile Model

- (1)

- The regression coefficient of urban population density was negative and significant from (at) q = 0.1 to q = 0.7, but not from (at) q = 0.8 and q = 0.9. This indicates that, compared with the areas with a higher coupling coordination degree, the effects of urban population density (UPD) are more significant in those with a low coupling coordination degree. Moreover, the population density in urban areas negatively affected the coupling coordination degree of rural urbanization and rural finance, and it may have a greater effect where the degree is higher. Although urban population density affected the coupling coordination degree of rural urbanization and rural finance, the effect was related to the coupling coordination degree in the current period. This occurred because urban population density was subordinate to population urbanization. When the coupling coordinated development of rural urbanization and rural finance in an area is low, the increase of urban population density will destroy the original balance and negatively affect the coupling coordination degree of rural urbanization and rural finance. When the coupling coordinated development of rural urbanization and rural finance in a region is relatively high, the influence of urban population density on the coupling coordination degree cannot be clearly reflected. The per capita disposable income of rural residents (PCDIRR) was not significant in Model 1 and Model 2 and negatively correlated with the coupling coordination degree of rural urbanization and rural finance.

- (2)

- The proportion of educational expenditure to GDP (PEEGDP) was not significant in Model 1. In Model 2, the proportion of educational expenditure to GDP was significant and positively correlated from (at) q = 0.1 to q = 0.3. The major reason is that most areas below 30% of the coupling coordination degree between rural urbanization and rural finance are those with backward educational capabilities, such as Guizhou and Yunnan; thus, increasing the proportion of educational expenditure to GDP will promote the development of rural urbanization in these areas. The increase of educational expenditure indicates that the investment in rural areas in these areas is augmenting, thereby promoting the development of the financial industry. Finally, this process will promote the coupling coordination between rural urbanization and rural finance. However, after the quantile of q = 0.3, the effect of education expenditure on the proportion of GDP was not significant. It can be explained that the educational level is better in areas where the coupling coordination degree of rural urbanization and rural finance is more than 30%. Thus, the increase of education funds cannot significantly affect the coupling coordination degree of rural urbanization and rural finance. From the regression coefficient of the model, the influence of the proportion of education expenditure to GDP on the coupling coordination degree of rural urbanization and rural finance gradually decreased. Areas with a low degree of coupling coordination positively affected the degree of coupling coordination; with its increase, the effect became smaller. For areas with a higher degree of coupling coordination, increasing educational expenditure reduced the degree of coupling coordination. However, on the contrary, financial development efficiency (FDE) exerted the opposite influence, indicating that the effect of financial development efficiency on the coupling coordination degree between rural urbanization and rural finance may increase gradually. In areas with a low degree of coupling coordination, the effect of financial development efficiency was negative; in areas with a high degree of coupling coordination, the effect of financial development efficiency was positive.

- (3)

- In Model 1 and Model 2, the effect of per capita GDP (PCGDP) was significant, from q = 0.1 to q = 0.9, and positively correlated with the coupling coordination degree of rural urbanization and rural finance. GDP per capita reflects the per capita output value of a region. The increase of GDP per capita will promote the development of urbanization in rural areas. Furthermore, the increase of GDP per capita in rural areas indicates that the economic development in this area is flourishing, thereby developing the rural financial industry. At this time, the development of rural finance and rural urbanization will be more coordinated. Similarly, the effect of per capita fiscal expenditure (PCFE) within the quantiles ranging from q = 0.1 to q = 0.9 was positive, indicating that the coupling coordination development of rural urbanization and rural finance was promoted.

- (4)

- In Model 1 and Model 2, the per capita built-up area (PCBA) was significant within the quantiles ranging from q = 0.1 to q = 0.9 and positively correlated with the coupling coordination degree of rural urbanization and rural finance. The per capita area of built-up areas reflects the level of urbanization in a region and the regional economic development. If a region has a large built-up area per capita, the urbanization degree of rural areas in the region is high. Higher efficiency of rural urbanization will promote the development of rural economy, subsequently promoting the development of rural finance. Therefore, the increase of built-up area per capita leads to more coordinated rural urbanization and rural finance.

- (5)

- The regression coefficient of financial development scale (FDSC) was statistically significant. At quantile q = 0.1, the regression coefficient was positive. Within quantiles ranging from q = 0.2 to q = 0.9, the regression coefficient was negative. This indicates that, in areas with a low degree of coupling coordination, the scale of rural financial development significantly positively affected the coupling coordination of rural urbanization and rural finance. However, in areas with a high degree of coupling coordination, the scale of rural financial development significantly negatively correlated with the degree of coupling coordination. The possible reason for this is that, in areas with a low degree of coupling coordination, the growth of rural financial development scale can directly affect the coupling and coordination degree of rural urbanization and rural finance, thereby promoting their coupled development. In areas with a high degree of coupling coordination, the role of rural financial development scale is not obvious, thereby reducing the coupling and coordination of rural urbanization and rural finance.

- (6)

- The financial development structure (FDST) mainly indicates the allocation structure and resource distribution structure of rural financial funds. In Model 1, the financial development structure was statistically significant. In Model 2, despite its not being significant at quantile of q = 0.1, it was significant within quantiles from q = 0.2 to q = 0.9 and positively correlated with the coupling coordination degree of rural urbanization and rural finance. This indicates that, in the areas where the coupling coordination degree of rural urbanization and rural finance is more than 20%, the optimization of rural financial development structure will make the allocation of funds more reasonable, can significantly promote the development of rural economy, and can promote the coordinated development of rural urbanization. Consequently, the optimization of the financial development structure will promote the coordination between rural urbanization and rural finance.

6. Conclusions and Policy Recommendation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lu, M. From Dispersion to Agglomeration: Theory, Misunderstanding and Reform of Rural Urbanization. Issues Agric. Econ. 2021, 9, 27–35. [Google Scholar]

- Luo, B. Study on Rural Urbanization. Issues Agric. Econ. 2021, 9, 4. [Google Scholar]

- King, R.G.; Levine, R. Finance and Growth—Schumpeter Might Be Right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- Meyer-Clement, E. Rural urbanization under Xi Jinping: From rapid community building to steady urbanization? China Inf. 2020, 34, 187–207. [Google Scholar] [CrossRef]

- Ahlers, A.L. Weaving the Chinese Dream on the Ground? Local Government Approaches to “New-Typed” Rural Urbanization. J. Chin. Political Sci. 2015, 20, 121–142. [Google Scholar] [CrossRef]

- Ha, T.V.; Tuohy, M.; Irwin, M.; Tuan, P.V. Monitoring and mapping rural urbanization and land use changes using Landsat data in the northeast subtropical region of Vietnam. Egypt. J. Remote Sens. Space Sci. 2020, 23, 11–19. [Google Scholar] [CrossRef]

- Yep, R. Local alliances in rural urbanization: Land transfer in contemporary China. China Inf. 2020, 34, 168–186. [Google Scholar] [CrossRef]

- Mughal, M.A.Z. Rural urbanization, land, and agriculture in Pakistan. Asian Geogr. 2019, 36, 81–91. [Google Scholar] [CrossRef]

- Butler, J.; Wildermuth, G.A.; Thiede, B.C.; Brown, D.L. Population Change and Income Inequality in Rural America. Popul. Res. Policy Rev. 2020, 39, 889–911. [Google Scholar] [CrossRef]

- Labbe, D. Critical reflections on land appropriation and alternative urbanization trajectories in periurban Vietnam. Cities 2016, 53, 150–155. [Google Scholar] [CrossRef]

- Kumar, A.; Sharma, S.; Mahdavi, M. Machine Learning (ML) Technologies for Digital Credit Scoring in Rural Finance: A Literature Review. Risks 2021, 9, 192. [Google Scholar] [CrossRef]

- Blakeslee, D.; Chaurey, R.; Fishman, R.; Malik, S. Land Rezoning and Structural Transformation in Rural India: Evidence from the Industrial Areas Program. World Bank Econ. Rev. 2022, 36, 488–513. [Google Scholar] [CrossRef]

- Abate, G.T.; Rashid, S.; Borzaga, C.; Getnet, K. Rural Finance and Agricultural Technology Adoption in Ethiopia: Does the Institutional Design of Lending Organizations Matter? World Dev. 2016, 84, 235–253. [Google Scholar] [CrossRef] [Green Version]

- Zhou, L.; Feng, H.; Dong, X. From State Predation to Market Extraction: The Political Economy of China’s Rural Finance, 1979–2012. Mod. China 2016, 42, 607–637. [Google Scholar] [CrossRef]

- Qian, M.J.; Huang, Y.S. Political institutions, entrenchments, and the sustainability of economic development—A lesson from rural finance. China Econ. Rev. 2016, 40, 152–178. [Google Scholar] [CrossRef]

- Khanal, A.R.; Omobitan, O. Rural Finance, Capital Constrained Small Farms, and Financial Performance: Findings from a Primary Survey. J. Agric. Appl. Econ. 2020, 52, 288–307. [Google Scholar] [CrossRef] [Green Version]

- Wu, Y.H.; Wu, P.; Ma, W.C. The Inclusive Reform of Rural Finance in Eastern Coastal Areas under the Background of Internet Finance and Its Promotion to Fishery Economy. J. Coast. Res. 2020, 115, 31–34. [Google Scholar] [CrossRef]

- Tang, S.; Zhang, C. Empirical research on the role of rural financial development in rural urbanization. J. Commercial Econ. 2013, 20, 60–62. [Google Scholar]

- Ding, R.; Duan, Y. Construction of the Rural Financial System: The Important Impetus in Accelerating China’s Urbanization. Financ. Econ. 2014, 1, 10–18. [Google Scholar]

- Yan, L.; Yang, W. The role of finance in rural Urbanization development. Agric. Econ. 2015, 8, 114–115. [Google Scholar]

- Yu, J.; Kong, W. A Study on the Change and Reform of the Environment for Rural Finance in China: Under the Background of Rural Urbanization. J. Peking Univ. Philos. Soc. Sci. 2016, 53, 106–112. [Google Scholar]

- Ran, M.; Ran, X. Selection of organizational Forms of rural financial institutions in the process of rural Urbanization. Rural Econ. 2017, 11, 75–78. [Google Scholar]

- Liu, X.; Wang, S. Research on the relationship between urbanization and financial development based on coupling Perspective. Stat. Decis. 2016, 20, 167–170. [Google Scholar]

- Wen, X.; Wang, C.; Xiong, Y.; Xiao, J.; Xie, W. Coupling Coordination Development between New Urbanization and Financial Support in Hunan Province. Econ. Geogr. 2019, 39, 96–105. [Google Scholar]

- Tang, W.; Tang, T. Study on the Coupling Effect Between New Urbanization Development and Financial Support in the Central Provinces’ Cities. China Soft Sci. 2017, 3, 140–151. [Google Scholar]

- Wang, G.; Ye, S. Research on the coordination between economic growth, financial development and urbanization from the perspective of space: A case study of Urban agglomerations in China. Inquiry Econ. Issues 2016, 11, 51–58. [Google Scholar]

- Johnson, K.M.; Lichter, D.T. Metropolitan Reclassification and the Urbanization of Rural America. Demography 2020, 57, 1929–1950. [Google Scholar] [CrossRef]

- Moomaw, R.L.; Shatter, A.M. Urbanization and economic development: A bias toward large cities? J. Urban Econ. 1996, 40, 13–37. [Google Scholar] [CrossRef] [Green Version]

- Kalnay, E.; Cai, M. Impact of urbanization and land-use change on climate. Nature 2003, 423, 528–531. [Google Scholar] [CrossRef]

- Hu, Z.; Chen, H. An empirical analysis of rural financial development, Urbanization and urban-rural income gap. Inquiry Econ. Issues 2013, 6, 63–68. [Google Scholar]

- Chen, S. Local Financial Structure, Government Behavior and Economic Performance in Rural Areas. J. Quant. Tech. Econ. 2009, 26, 81–90+105. [Google Scholar]

- Ren, B.; Yao, B. Empirical Study on Relationship between Farmers’ Property Income and Rural Financial Development in the Process of Urbanization. Mod. Financ. Econ. J. Tianjin Univ. Financ. Econ. 2013, 33, 45–51+61. [Google Scholar]

- Xie, J. The Impact of the Rural Financial Development on the Urban-Rural Income Gap in China: Mechanism Simulation and Empirical Test. Econ. Probl. 2016, 2, 103–110. [Google Scholar]

- Wang, J. Rural Financial Development, Capital Stock Increase, and Rural Economy Growth. J. Quant. Tech. Econ. 2018, 35, 64–81. [Google Scholar]

- Wang, X.; Guan, J. The Income Distribution Effect and Measure of Rural Financial Inclusion in China. China Soft Sci. 2014, 8, 150–161. [Google Scholar]

- Sun, Y.; Zhou, N.; Li, P. Research on the rural residents’ income effect of rural financial development. Stat. Res. 2014, 31, 90–95. [Google Scholar]

- Li, D. The impact of financial development on farmers’ income in China’s prefecture-level cities: A Case study of 17 cities in Shandong Province. Shandong Soc. Sci. 2018, 12, 36–46. [Google Scholar]

- Ding, Z.; Zhang, Y.; Gao, Q. Analysis of rural financial factors influencing rural economic development based on regional economic differences. Chin. Rural Econ. 2014, 3, 4–13+26. [Google Scholar]

- Lin, Y.; Christopher, G.; Xie, Z. Research on the impact of rural financial market competition on the credit risk of rural credit Cooperatives: Based on the data of Fujian county rural credit cooperatives. J. Agrotech. Econ. 2017, 01, 85–97. [Google Scholar]

- Li, H.; Zhang, Q. An empirical analysis of the impact of rural financial development on farmers’ non-agricultural income. Stat. Decis. 2019, 35, 111–114. [Google Scholar]

- Guo, G.; Wang, X. The Rural Financial Supporting to Rural Economic Development in Central Region: Empirical Analysis Based on Panel Date from 2002 to 2011. Syst. Eng. 2012, 30, 86–91. [Google Scholar]

- Jia, L.; Tang, M.; Hu, J. The Measurement and Empirical Analysis on China’s Rural Financial Maturity. J. Nanjing Audit. Univ. 2017, 14, 21–28. [Google Scholar]

- Liu, S.; Zhu, J. The Income Effect of Rural Finance Based on RD-ARDL-SSpace Model. Syst. Eng. 2018, 36, 13–23. [Google Scholar]

- Zhu, J.; Li, R. Mechanism analysis of rural finance influencing green development in western China under the background of rural revitalization: A case study of Guizhou Province. Jiangsu Agric. Sci. 2021, 49, 1–7. [Google Scholar]

- Tang, Z. An integrated approach to evaluating the coupling coordination between tourism and the environment. Tourism Manag. 2015, 46, 11–19. [Google Scholar] [CrossRef]

- Wang, R.; Cheng, J.H.; Zhu, Y.L.; Lu, P.X. Evaluation on the coupling coordination of resources and environment carrying capacity in Chinese mining economic zones. Resour. Policy 2017, 53, 20–25. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Su, Z.G.; Li, G.; Zhuo, Y.F.; Xu, Z.G. Spatial-Temporal Evolution of Sustainable Urbanization Development: A Perspective of the Coupling Coordination Development Based on Population, Industry, and Built-Up Land Spatial Agglomeration. Sustainability 2018, 10, 1766. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Li, R.; Jin, H. Nonlinear Effect of Financial Ecology Coupling on New Urbanization: An Empirical Study Based on Double Threshold Panel Data Model. Mod. Financ. Econ. J. Tianjin Univ. Financ. Econ. 2016, 36, 36–44. [Google Scholar]

- Yuan, J.; Wu, Y. Evaluation on the Level and Coupling of Countryside Development in China under the Strategy of Rural Revitalization. J. Agro. For. Econ. Manag. 2018, 17, 218–226. [Google Scholar]

- Geng, Y.Q.; Wei, Z.J.; Zhang, H.; Maimaituerxun, M. Analysis and Prediction of the Coupling Coordination Relationship between Tourism and Air Environment: Yangtze River Economic Zone in China as Example. Discret. Dyn. Nat. Soc. 2020, 30, 27–33. [Google Scholar] [CrossRef]

- Lai, Z.Z.; Ge, D.M.; Xia, H.B.; Yue, Y.L.; Wang, Z.L. Coupling coordination between environment, economy and tourism: A case study of China. PLoS ONE 2020, 15, 13–26. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hausman, J.A. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef] [Green Version]

| Comprehensive Index | Sub- Layers | Index | No. | Index Definition | Attribute |

|---|---|---|---|---|---|

| Rural urbanization | Economic urbanization | Economic level | 1 | Per capita GDP (PCGDP) (yuan) | + |

| 2 | Per capita disposable income of rural residents (PCDIR) | + | |||

| Investment level | 3 | Per capita investment in fixed assets | + | ||

| Fiscal level | 4 | Per capita fiscal expenditure (PCFE) | + | ||

| Population urbanization | Population size | 5 | Urban population density (UPD) (person/km2) | + | |

| 6 | Proportion of urban population | + | |||

| Population quality | 7 | Number of college students per 100,000 people | + | ||

| Economic group | 8 | Proportion of employees in secondary and tertiary industries in total employment (%) | + | ||

| Social urbanization | Educational level | 9 | Proportion of educational expenditure to GDP (PEEGDP) (%) | + | |

| Living standard | 10 | Per capita consumption of rural residents | + | ||

| Spatial urbanization | Urban scale | 11 | Proportion of built-up area in total urban area | + | |

| Living space | 12 | Per capita built-up area (PCBA) (m2) | + | ||

| 13 | Urban road area per capita (m2) | + | |||

| Afforestation level | 14 | Per capita park and greenspace area(m2) | + | ||

| Environmental urbanization | Environmental quality | 15 | Harmless disposal rate (%) of urban household waste | + | |

| 16 | Amount of household waste disposal (10,000 tons) | + | |||

| 17 | Green coverage (%) of built-up areas | + |

| Sub- Layers | Index | No. | Index Definition | Weight |

|---|---|---|---|---|

| Economic urbanization | Economic level | 1 | Per capita GDP (PCGDP) (yuan) | 0.04 |

| 2 | Per capita disposable income of rural residents (PCDIR) | 0.05 | ||

| Investment level | 3 | Per capita investment in fixed assets | 0.05 | |

| Fiscal level | 4 | Per capita fiscal expenditure (PCFE) | 0.01 | |

| Population urbanization | Population size | 5 | Urban population density (UPD) (person/km2) | 0.28 |

| 6 | Proportion of urban population | 0.03 | ||

| Population quality | 7 | Number of college students per 100,000 people | 0.03 | |

| Economics group | 8 | Proportion of employees in secondary and tertiary industries in total employment (%) | 0.05 | |

| Social urbanization | Educational level | 9 | Proportion of educational expenditure to GDP (PEEGDP) (%) | 0.09 |

| Living standard | 10 | Per capita consumption of rural residents | 0.08 | |

| Spatial urbanization | Urban scale | 11 | Proportion of built-up area in total urban area | 0.04 |

| Living space | 12 | Per capita built-up area (PCBA) (m2) | 0.08 | |

| 13 | Urban road area per capita (m2) | 0.03 | ||

| Afforestation level | 14 | Per capita park and greenspace area(m2) | 0.03 | |

| Environmental urbanization | Environmental quality | 15 | Harmless disposal rate (%) of urban household waste | 0.02 |

| 16 | Amount of household waste disposal (10,000 tons) | 0.08 | ||

| 17 | Green coverage (%) of built-up areas | 0.01 |

| Region | Average Comprehensive Evaluation Index | Region | Average Comprehensive Evaluation Index | Region | Average Comprehensive Evaluation Index | Region | Average Comprehensive Evaluation Index |

|---|---|---|---|---|---|---|---|

| Shanghai | 0.582 | Fujian | 0.288 | Jiangxi | 0.229 | Shanxi | 0.206 |

| Beijing | 0.475 | Shaanxi | 0.261 | Jilin | 0.228 | Hainan | 0.203 |

| Tianjin | 0.387 | Tibet | 0.250 | Sichuan | 0.226 | Guangxi | 0.198 |

| Zhejiang | 0.346 | Inner Mongolia | 0.244 | Heilongjiang | 0.224 | Gansu | 0.187 |

| Jiangsu | 0.337 | Ningxia | 0.248 | Anhui | 0.221 | Yunnan | 0.186 |

| Guangdong | 0.328 | Chongqing | 0.236 | Hunan | 0.218 | Qinghai | 0.184 |

| Shandong | 0.317 | Hubei | 0.233 | Hebei | 0.215 | Guizhou | 0.181 |

| Liaoning | 0.290 | Xinjiang | 0.230 | Henan | 0.208 | ||

| Region | Average Comprehensive Evaluation Index | Region | Average Comprehensive Evaluation Index | Region | Average Comprehensive Evaluation Index | Region | Average Comprehensive Evaluation Index |

|---|---|---|---|---|---|---|---|

| Beijing | 0.558 | Heilongjiang | 0.330 | Hainan | 0.239 | Gansu | 0.217 |

| Shanghai | 0.549 | Chongqing | 0.327 | Guangxi | 0.235 | Henan | 0.215 |

| Zhejiang | 0.451 | Sichuan | 0.310 | Yunnan | 0.232 | Jiangxi | 0.214 |

| Hubei | 0.422 | Shandong | 0.299 | Hebei | 0.230 | Tibet | 0.211 |

| Tianjin | 0.387 | Jilin | 0.279 | Shaanxi | 0.228 | Guizhou | 0.209 |

| Fujian | 0.364 | Liaoning | 0.268 | Anhui | 0.225 | Xinjiang | 0.206 |

| Jiangsu | 0.359 | Hunan | 0.255 | Inner Mongolia | 0.222 | Qinghai | 0.202 |

| Guangdong | 0.343 | Shanxi | 0.242 | Ningxia | 0.219 |

| Coupling Value Range | Coupling Degree | Value Range of Coupling Coordination Degree | Coordination Degree |

|---|---|---|---|

| 0 < C ≤ 0.4 | Low coupling | 0 < C ≤ 0.4 | Low coordination |

| 0.4 < C ≤ 0.7 | Moderate coupling | 0.4 < C ≤ 0.7 | Moderate coordination |

| 0.7 < C ≤ 1.0 | High coupling | 0.7 < C ≤ 1.0 | High coordination |

| Coupling Degree | Region | Value of C | Coupling Degree | Region | Value of C | Coupling Degree | Region | Value of C |

|---|---|---|---|---|---|---|---|---|

| High coupling degree | Shanghai | 0.991 | Moderate coupling degree | Xinjiang | 0.694 | Low coupling degree | Sichuan | 0.342 |

| Beijing | 0.990 | Jilin | 0.676 | Hebei | 0.325 | |||

| Tibet | 0.962 | Tianjin | 0.651 | Jiangsu | 0.317 | |||

| Shanxi | 0.926 | Guangdong | 0.638 | Qinghai | 0.293 | |||

| Inner Mongolia | 0.895 | Liaoning | 0.529 | Gansu | 0.267 | |||

| Fujian | 0.885 | Zhejiang | 0.500 | Shaanxi | 0.243 | |||

| Heilongjiang | 0.791 | Guangxi | 0.472 | Yunnan | 0.216 | |||

| Guizhou | 0.726 | Hainan | 0.466 | Chongqing | 0.207 | |||

| Ningxia | 0.714 | Hunan | 0.157 | |||||

| Henan | 0.152 | |||||||

| Shandong | 0.143 | |||||||

| Jiangxi | 0.141 | |||||||

| Hubei | 0.137 | |||||||

| Anhui | 0.126 | |||||||

| Coordination Degree | Region | Value of D | Coordination Degree | Region | Value of D | Region | Value of D |

|---|---|---|---|---|---|---|---|

| High coordination degree | Shanghai | 0.724 | Low coordination degree | Zhejiang | 0.321 | Qinghai | 0.189 |

| Beijing | 0.709 | Jilin | 0.320 | Shaanxi | 0.184 | ||

| Moderate coordination degree | Tibet | 0.533 | Liaoning | 0.308 | Gansu | 0.175 | |

| Inner Mongolia | 0.425 | Guizhou | 0.294 | Chongqing | 0.162 | ||

| Tianjin | 0.426 | Jiangsu | 0.258 | Shandong | 0.158 | ||

| Fujian | 0.422 | Hainan | 0.256 | Yunnan | 0.141 | ||

| Low coordination degree | Shanxi | 0.397 | Guangxi | 0.233 | Henan | 0.137 | |

| Guangdong | 0.378 | Hebei | 0.207 | Jiangxi | 0.135 | ||

| Heilongjiang | 0.364 | Anhui | 0.204 | Hunan | 0.132 | ||

| Ningxia | 0.350 | Sichuan | 0.202 | Hubei | 0.127 | ||

| Xinjiang | 0.332 | ||||||

| Variables | Average | Median | Maximum | Minimum | Standard Deviation | Number of Observations |

|---|---|---|---|---|---|---|

| CCD | 0.287 | 0.265 | 0.763 | 0.085 | 0.157 | 310 |

| UPD | 306.503 | 137.718 | 3427.409 | 0.557 | 609.992 | 310 |

| PCGDP | 42350 | 36825 | 107960 | 639 | 22835 | 310 |

| PCDIRR | 23418 | 22638 | 52859 | 13188 | 6443 | 310 |

| PCFE | 10706.83 | 8646.116 | 42637.795 | 854.458 | 6685.606 | 310 |

| PEEGDP | 5.313 | 4.592 | 18.022 | 2.654 | 2.381 | 310 |

| PCBA | 68.162 | 62.676 | 171.04 | 39.445 | 23.008 | 310 |

| FDE | 13414.9 | 10481.4 | 54929.9 | 267.1 | 10500.8 | 310 |

| FDSC | 8.722 | 3.585 | 82.803 | 1.731 | 16.54 | 310 |

| FDST | 0.005 | 0.002 | 0.049 | 0.001 | 0.008 | 310 |

| Variables | LLC Test | Breitung Test | IPS Test | ADF-Fisher Test | PP-Fisher Test |

|---|---|---|---|---|---|

| UPD | 5.305 (1.000) | −2.021 (0.023) | −1.145 (0.126) | 6.281 (0.184) | 19.709 (0.001) |

| PCGDP | 2.071 (0.908) | −1.462 (0.072) | −2.052 (0.021) | 11.330 (0.023) | 20.263 (0.000) |

| PCDIRR | 3.359 (0.996) | −1.787 (0.049) | −2.411 (0.059) | 13.959 (0.074) | 47.847 (0.000) |

| PCFE | 2.272 (0.988) | 0.456 (0.675) | −1.601 (0.054) | 8.493 (0.071) | 25.949 (0.000) |

| PEEGDP | 8.885 (1.000) | 0.645 (0.744) | −0.256 (0.393) | 3.448 (0.485) | 25.343 (0.000) |

| PCBA | 4.573 (1.000) | −0.100 (0.432) | −0.168 (0.431) | 3.307 (0.505) | 15.369 (0.040) |

| FDE | 4.177 (1.000) | −1.407 (0.098) | −1.684 (0.041) | 8.977 (0.063) | 26.532 (0.000) |

| FDSC | 3.564 (0.999) | −0.549 (0.296) | −2.210 (0.036) | 12.446 (0.014) | 21.392 (0.003) |

| FDST | 7.015 (1.000) | −1.180 (0.119) | −0.544 (0.293) | 4.074 (0.361) | 25.712 (0.000) |

| Variables | LLC Test | Breitung Test | IPS Test | ADF-Fisher Test | PP-Fisher Test |

|---|---|---|---|---|---|

| UPD | −10.729 (0.000) | −0.876 (0.190) | −10.024 (0.000) | 109.234 (0.000) | 194.471 (0.000) |

| PCGDP | −5.429 (0.000) | −2.014 (0.025) | −7.244 (0.000) | 76.850 (0.000) | 214.820 (0.000) |

| PCDIRR | −7.129 (0.000) | −1.456 (0.073) | −9.013 (0.000) | 78.802 (0.000) | 119.619 (0.000) |

| PCFE | −3.893 (0.000) | −0.810 (0.258) | −9.857 (0.000) | 86.134 (0.000) | 109.610 (0.000) |

| PEEGDP | −6.059 (0.000) | −1.638 (0.057) | −12.573 (0.000) | 115.354 (0.000) | 203.197 (0.000) |

| PCBA | −5.665 (0.000) | −2.3118 (0.014) | −9.178 (0.000) | 80.131 (0.000) | 205.054 (0.000) |

| FDE | −8.468 (0.000) | −2.345 (0.093) | −9.399 (0.000) | 81.835 (0.000) | 201.094 (0.000) |

| FDSC | −6.188 (0.000) | −2.125 (0.018) | −9.532 (0.000) | 82.190 (0.000) | 202.226 (0.000) |

| FDST | −2.873 (0.002) | −2.542 (0.061) | −8.512 (0.000) | 82.236 (0.000) | 219.880 (0.000) |

| Model 1: OLS Regression of Normal Panels | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Constant C | UPD | PCGDP | PCDIRR | PCFE | PEEGDP | PCBA | FDE | FDSC | FDST | R2 |

| −1507.0 *** (72.330) | −0.292 (0.319) | 0.032 ** (0.056) | 0.022 (0.032) | 99.228 *** (13.618) | −1.091 (3.320) | 1450.292 *** (934.5) | 0.021 (0.042) | −0.034 * (0.014) | 0.072 ** (0.024) | 0.989 |

| Model 2: Panel Quantile Regression | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Quantile | q = 0.1 | q = 0.2 | q = 0.3 | q = 0.4 | q = 0.5 | q = 0.6 | q = 0.7 | q = 0.8 | q = 0.9 |

| Constant C | −1502.8 *** (180.299) | −1590.3 *** (190.221) | −1609.6 *** (121.229) | −1704.2 *** (163.940) | −1830.4 *** (144.111) | −1848.0 *** (138.509) | −1898.2 *** (128.628) | −1861.9 *** (130.128) | −1888.9 *** (120.841) |

| UPD | −5.198 ** (1.335) | −5.224 ** (1.296) | −3.907 ** (1.584) | −3.462 ** (9.897) | −3.123 ** (0.791) | −3.709 ** (0.271) | −2.820 ** (1.436) | −2.236 (2.099) | −2.182 (2.184) |

| PCGDP | 0.0352 ** (0.011) | 0.032 ** (0.013) | 0.023 ** (0.015) | 0.054 ** (0.021) | 0.056 ** (0.019) | 0.054 ** (0.012) | 0.059 ** (0.018) | 0.055 ** (0.012) | 0.072 ** (0.011) |

| PCDIRR | −0.085 * (0.038) | −0.085 (0.068) | −0.093 (0.073) | −0.038 (0.087) | 0.016 (0.047) | 0.011 (0.040) | 0.094 (0.043) | 0.046 (0.051) | 0.019 (0.048) |

| PCFE | 327.188 *** (61.163) | 317.195 *** (71.528) | 297.526 *** (63.824) | 266.323 *** (47.114) | 272.801 *** (31.140) | 268.387 *** (29.024) | 222.122 *** (49.582) | 182.901 *** (84.220) | 202.227 ** (79.170) |

| PEEGDP | 14.293 ** (4.501) | 8.824 * (4.383) | 9.126 * (2.179) | −1.549 (6.522) | −0.066 (6.838) | −1.225 (6.218) | −6.097 (7.275) | −5.186 (5.216) | −4.105 (4.166) |

| PCBA | 95544 *** (15023) | 111090 *** (14250) | 116657 *** (11004) | 144944 *** (12937) | 147826 *** (15482) | 152174 *** (15582) | 166458 *** (18272) | 169663 *** (19233) | 171865 *** (15922) |

| FDE | −0.039 * (0.0297) | −0.056 * (0.0316) | −0.047 (0.0167) | −0.019 (0.016) | −0.013 (0.025) | −0.015 (0.024) | 0.098 (0.034) | 0.018 (0.043) | 0.021 (0.057) |

| FDSC | 0.038 * (0.096) | −0.044 * (0.019) | −0.025 * (0.028) | −0.023 * (0.005) | −0.010 ** (0.004) | −0.085 ** (0.059) | −0.014 * (0.018) | −0.010 * (0.011) | −0.015 * (0.017) |

| FDST | 0.013 (0.014) | 0.040 * (0.011) | 0.047 ** (0.019) | 0.074 ** (0.024) | 0.048 *** (0.012) | 0.048 *** (0.013) | 0.056 ** (0.013) | 0.053 ** (0.016) | 0.043 ** (0.013) |

| Pseudo R2 | 0.987 | 0.984 | 0.983 | 0.987 | 0.980 | 0.981 | 0.980 | 0.984 | 0.986 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, J.; Fan, X.; Li, C.; Shang, G. Factors Influencing the Coupling of the Development of Rural Urbanization and Rural Finance: Evidence from Rural China. Land 2022, 11, 853. https://doi.org/10.3390/land11060853

Zhou J, Fan X, Li C, Shang G. Factors Influencing the Coupling of the Development of Rural Urbanization and Rural Finance: Evidence from Rural China. Land. 2022; 11(6):853. https://doi.org/10.3390/land11060853

Chicago/Turabian StyleZhou, Jiali, Xiangbo Fan, Chenggang Li, and Guofei Shang. 2022. "Factors Influencing the Coupling of the Development of Rural Urbanization and Rural Finance: Evidence from Rural China" Land 11, no. 6: 853. https://doi.org/10.3390/land11060853

APA StyleZhou, J., Fan, X., Li, C., & Shang, G. (2022). Factors Influencing the Coupling of the Development of Rural Urbanization and Rural Finance: Evidence from Rural China. Land, 11(6), 853. https://doi.org/10.3390/land11060853