1. Introduction

Given their lower starting levels of urbanization and larger populations than cities in developed countries, it is not surprising that cities in many developing countries are expected to grow rapidly in the new century. The United Nations reported that by 2050, 37% of projected urban population growth globally will happen in just three Asian and African countries, namely India, Nigeria, and China [

1]. The urbanization of a population directly results in urban expansion. However, the matched growth relationship between the two may be problematic.

In China, urbanization of the population increased from 20.2% to 54.7% between 1981 and 2014, at an average annual increase rate of 1.04%, meaning that more than 10 million people migrated into cities every year. Meanwhile, the national urban built-up area increased from 7400 km

2 to 49,800 km

2 in the same period, with an average annual increase rate of more than 5%, almost five times faster than previously experienced [

2]. While more people moved from rural areas to cities, improving their access to working opportunities and improved quality of life [

3], the rapid urban expansion has also been associated with some negative impacts, such as loss of cultivated land, increases in commute distances, inflated cost of infrastructure, urban heat island effects, and so on [

4,

5,

6,

7]. In order to explore sustainable urban expansion paths that may avoid these undesirable impacts, it is essential to learn more about the determinants.

Driving factors of urban expansion have attracted significant attention around the world, shedding light on studies in transitional China. The urban economic literature has determined that population, income, cost of transportation, and farmland rent are key factors in the process of urban expansion [

8,

9,

10,

11,

12]. In comparison, institutional dynamics have been more strongly emphasized in empirical studies of China’s urban expansion, where land finance has been identified as a unique factor [

13,

14,

15,

16,

17,

18].

Land finance is defined as local governments’ fiscal reliance on land transfers (which entails a land conveyance income in China) and land-related taxation [

13,

19,

20]. Transfers of public land are not rare in developing countries, such as India, South Africa, and Turkey [

20]. In contrast, reliance on land-related taxation is common in many developed countries where most land is privately owned. Specifically, property tax is one of the most fundamental fiscal resources of local governments in many developed countries, such as America, Australia, and Canada. However, China has undergone some reforms and experiences that have led to unique and unpredictable policy effects.

On the one hand, China introduced extensive reforms to the tax sharing system in 1994, which resulted in centralization of fiscal power and decentralization of administrative authority [

13,

21]. The reform led to enormous fiscal pressure on local governments, leading them to seek extra budgetary revenue; land finance has proved to be one of the most effective tools so far for generating revenue. On the other hand, the urban–rural dual land administration system in China authorizes local governments to expropriate land from farmers at a low price and sell the land for urban construction purposes at a high price [

22], which can result in considerable profit for local governments via land value increments. Consequently, local governments prefer to obtain financial revenue from land transfers of undeveloped land in order to capture land value increments [

23,

24], which could provide considerable payback to cover ever-increasing municipal expenditures. In 2014, the ratio of land conveyance income to municipal budgetary revenue nationwide reached 45%, and in some cities even exceeded 250%, up from an average of 10% in 1999 [

25].

Local governments’ enthusiasm for, and dependence on, land finance inevitably leads to land acquisition, transfer, and development, resulting in urban expansion. Some scholars have argued that land development has been pursued by local governments as a tool to generate financial revenue and accumulate capital, i.e., that land finance accounts for urban expansion [

15]. However, the production of urban built-up environments should not be regarded as a process of urbanization of capital, but rather capitalization on urban land. Faced with shortages of capital, local governments utilize urban land not because of capital surplus or low capital profit in manufacture; rather, they use undeveloped land in rural areas as an asset and seek profit from land transfers in order to pay for city development expenditures. Due to land-based finance, local governments in China have taken a city-based and land-centered strategic approach since the 1990s [

15,

22]. Several case studies from Jiangsu province, Chongqing city, Beijing city and Guangdong province support the hypothesis of the impacts of land finance on rapid urban expansion [

17,

26,

27].

However, some research issues remain understudied. Since the uneven landscape of land and urban development of Chinese cities is complex [

28], the theory behind how urban expansion in China is driven primarily by land finance is poorly understood [

29]. More importantly, it is still in its infancy regarding the issue of whether the roles of land finance in urban expansion vary in different local fiscal circumstances with their own distinct pressures. The goal of this paper is to examine mathematically, using a quantitative method based on the Alonso–Muth–Mills model, whether land finance combined with varying fiscal pressures has different impacts on urban expansion in China. An empirical test was also carried out among 231 Chinese prefecture-level and above cities from 2010 to 2014 using a fixed-effect threshold model to investigate the interaction effects of land finance and fiscal pressure on urban expansion. The results of the paper show that urban expansion can be better explained by incorporating both fiscal factors, providing some new insights into urban expansion in institutional contexts under a view of local governments as “spatial producers”.

The rest of the paper is organized as follows.

Section 2 constructs a conceptual framework and builds a mathematical model to explain whether, and how, urban expansion is related to land finance, in which the interaction between land finance and fiscal pressure is taken into consideration. Data, methodology, and empirical results follow in

Section 3 and

Section 4. Discussion and conclusions are drawn in

Section 5.

2. Framework and Modeling

First proposed by Alonso [

30], and further developed by Muth [

31] and Mills [

32], and Brueckner and Fansler [

9], the urban land bid–rent model explains urban expansion using a comparative static method. Residents and developers make decisions and play roles in the model; the influential factors, namely population, income, transportation cost, and farmland rent, are identified under the view of market domination. The basic model was further developed to explore the relationship between institutional dynamics, i.e., property tax, and urban expansion, in the context of American cities [

33,

34].

The application of Alonso–Muth–Mills model (AMM model) is not confined to US cities. For example, based on an AMM model, a global dataset was constructed by Angel et al. [

8], including 3646 metropolitan agglomerations in 2000 and found that market forces could effectively explain the growth of the urban built-up area. Specifically, in the transitional cities of China, scholars found that the AMM model still has power, although the model need to be improved. For instance, grounded on a revised AMM model, Ke et al. [

11] found that “the estimates are surprisingly similar to those found for US cities, with four basic factors (population, income, commuting cost and price of rural land) explaining most of the variation in urban spatial scale of Chinese cities.” (p. 2795) while central planned features still impose an impact. Deng et al. [

10] and Li et al. [

35] had the parallel observation to support AMM model’s validity in China’s context. Behind the AMM model’s application in China is the market-oriented transition and consequent suburbanization. Feng et al. [

36] further proposed that some transitional cities in China have seen a trend of suburbanization driven by suburban housing development and rising car ownership since the 1990s.

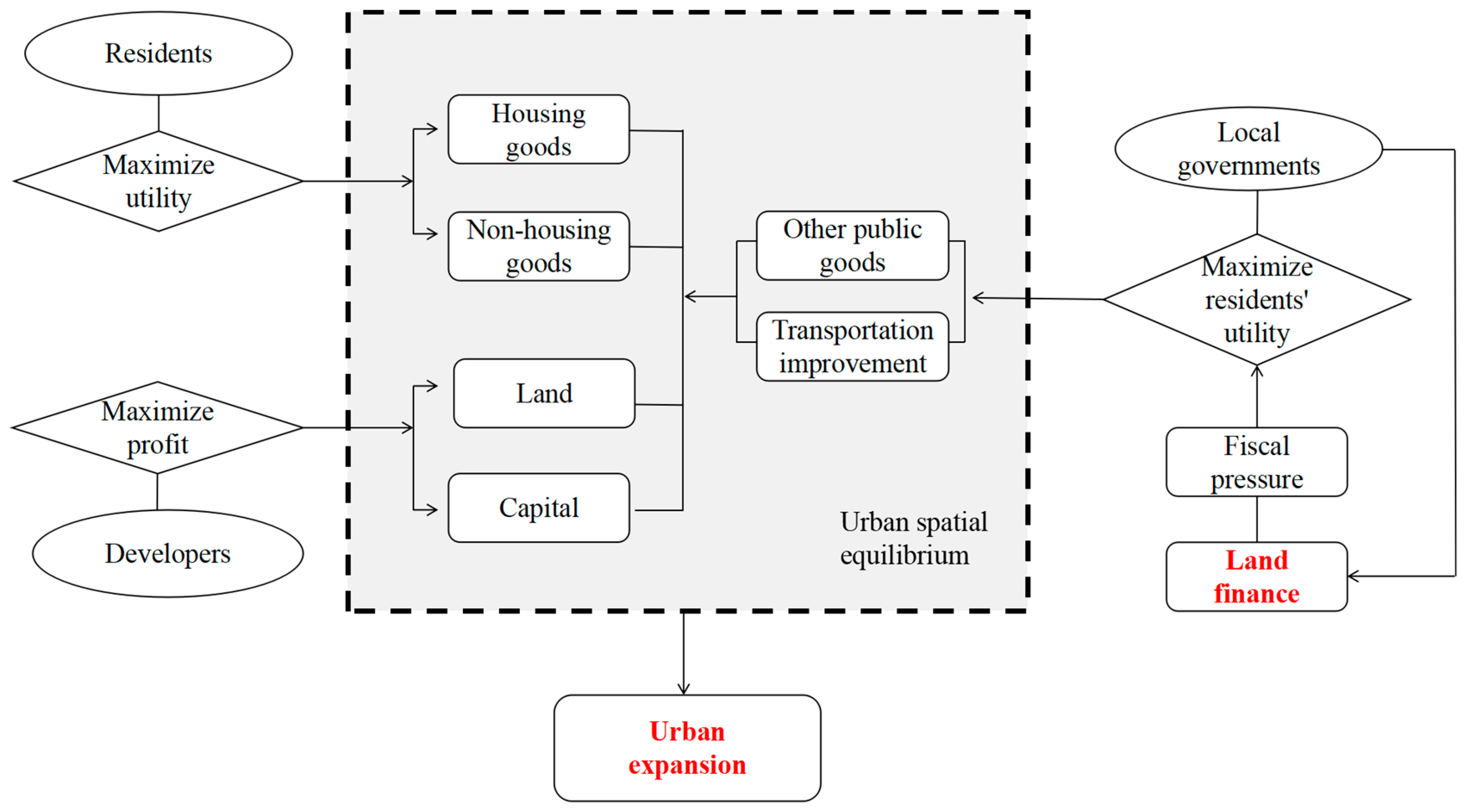

Grounded on AMM’s basic framework, and taking China’s local governments into consideration, we developed a mathematical model to explain the process of urban expansion in the institutional context of Chinese cities. The variables of land finance and fiscal pressure were considered in the model in addition to the traditional factors used to model the situation of Chinese cities. Residents with budget constraints try to maximize their utility, as measured by private consumption including housing and non-housing goods, developers try to maximize profit, and local governments attempt to maximize residents’ utility by allocating public financial resources to transportation goods and non-transportation public goods. Urban expansion takes place as the equilibrium changes (

Figure 1).

2.1. Suppositions and Conditions

City. Suppose the city is linear, with a width of 1. Only one employment center exists, located on the starting point of the line. Beyond the ending point is farmland, which has constant rent. A closed city is assumed, meaning there is no migration between cities.

Residents. There is no difference in the income (

y) of urban residents, whose utility comes from consumption of housing (

q), non-housing goods (

c), and non-transportation public goods (

Q). Generally, suppose the price of non-housing goods is 1. Let housing price be

p and income tax rate be

. Individuals’ income tax is gathered by local governments to provide public goods. Residents living a distance of

x from the city center commute for work at a cost

t. As (1) shows, residents attempt to maximize their utility at the budget constraints. This means that individuals’ income after tax equals the sum of consumption of housing, non-housing goods, and transportation cost. Here, we simplify the utility function in a log-linear form [

34]. In the utility function (2), W is substitution parameter of non-transportation public goods:

where

u is utility of the resident,

c is the quantity of non-housing goods,

q is the quantity of housing goods,

p is the unit price of housing,

y is individuals’ income,

Q is quantity of non-transportation public goods,

is income tax rate,

t is unit transportation cost,

x is distance to the city center, and W is weight for non-transportation public goods.

Land developers. Assume that housing goods consist of land (

L) and capital (

K). Following the production function, we build a connection between output and input, as shown in (3). In the function, the power parameter, which can be assigned any number between 0 and 1 without changing the trend of the result, is assigned 1/2 for an easy solution [

34]. The capital-land ratio (

S) is of primary interest. Function h is used to describe how much housing can be produced with

S, as shown in (4). Land developers maximize profit per unit land (

). Revenue equals housing price multiplied by

h(

S), while expenditure equals the sum of land rent (

) and capital cost (i ×

S).

where

Y is the output of production,

K is the input of capital,

L is the input of labor,

S is the capital-land ratio,

h is the production function of the capital-land ratio,

π is developers’ profit,

p is the unit price of housing,

is urban land rent at a distance

x from the city center, and i is the interest rate of capital.

Local government. Assume that local government tries to maximize residents’ utility using public resource allocation, as shown in (9). Let the land conveyance income per capita be

, budget expenditure per capita be

, and budget revenue per capita from individuals’ tax be

F. Assume that

and

have a linear relationship with

F, the slopes of which are, respectively,

and

(6). We suppose that

is spent on transportation improvement, which leads to reduction of transportation cost of

(7), while remaining money is used to provide non-transportation public goods (8):

where

is the land conveyance income per capita,

is the budget expenditure per capita,

is the expenditure on transportation improvement,

F is budget revenue,

is the ratio of

to

F,

μ is the ratio of

to

F,

is the proportion of public expenditure spent on transportation improvement,

is the original transportation cost, and

is the effect of transportation investment.

We must admit that the assumption may not reflect all local governments’ characteristics in China. To capture the major features of the real world, every model has its simplification by using assumptions. There may be other assumptions, such as maximizing the revenue. But in this paper, our concern is how local governments allocate the transportation public goods and other public goods under fiscal pressure. This could be the fundamental function of transitional state of China. Extension may be straightforward but complicates the analysis without adding much insight.

Equilibrium conditions. More conditions must be satisfied for the spatial equilibrium. First, with competition, profit must be zero when no more companies enter the market (10). Second, in (11), urban land rent (

) equals farmland rent (

) at the edge of the city. Third, the urban population (

N) is the accumulation of every location, shown as (12).

where

is developer’s profit,

is urban land rent at distance

x from the city center,

is rural land rent,

is distance from the edge of the city to the center, and

N is the urban population.

2.2. Solution

Given (1), we can solve (2) via the Lagrange multiplication method to obtain (13) and (14):

Solving (5) by using the first-order condition under the constraints of (4) and (10), we obtain (15) and (16):

From the equilibrium condition (5), it is easy to obtain Equation (17):

Using (11) and (12), we have (18) and (19), which means that (9) is the same as (20):

It can be easily deduced from (18) that (21) is correct. Using the first-order condition in (20), we get the optimal

as (22).

2.3. Hypotheses

From (23), we propose the first hypothesis (I) of the paper: when all other conditions are held constant, the city becomes larger with higher land finance ratio (

), i.e., land finance leads to urban expansion. This is consistent with the empirical study of Ye and Wu [

29]. In our model, the increase of

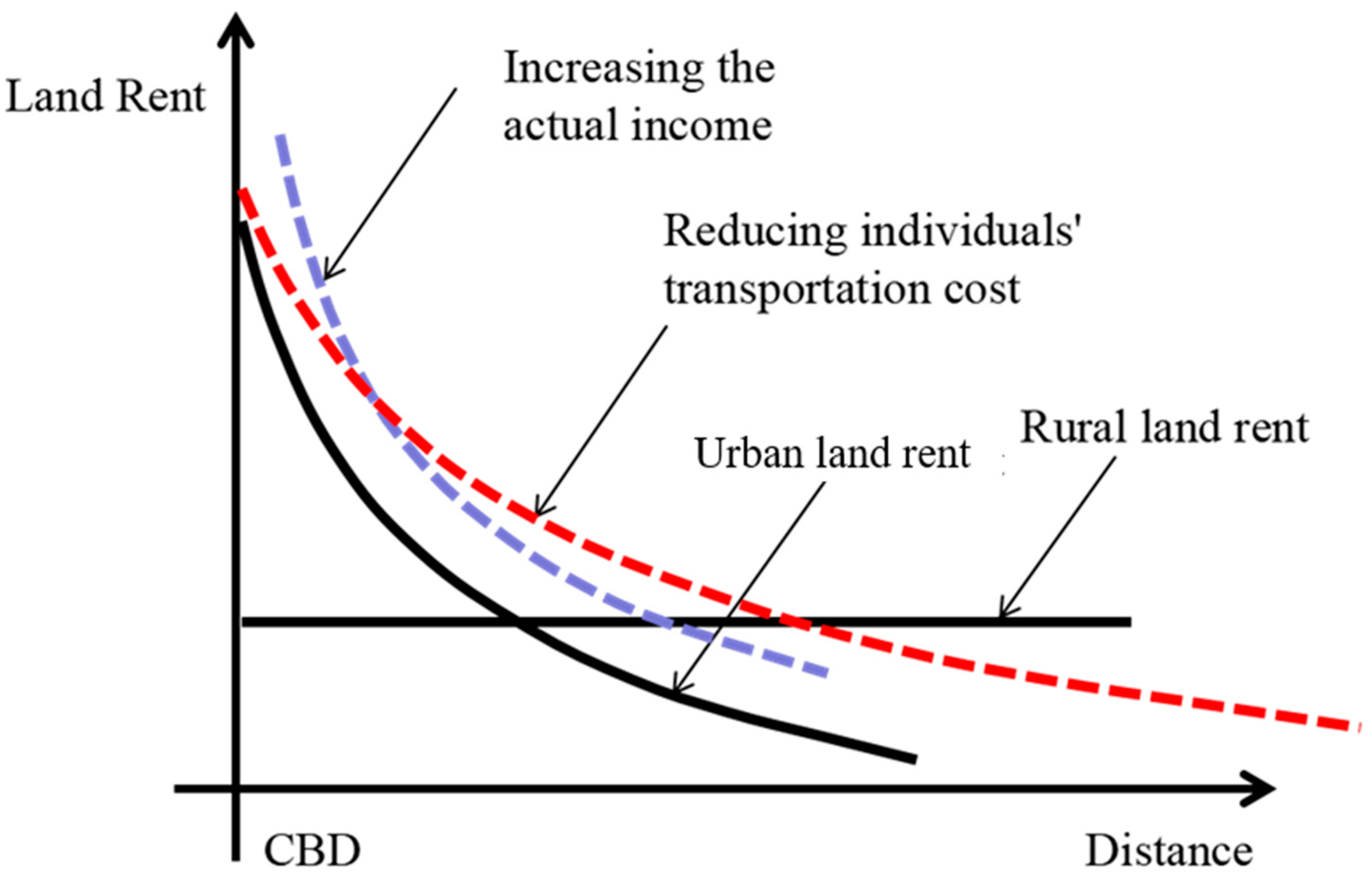

means the local government can provide relatively more public resources by either reducing individuals’ transportation cost or increasing their actual income by reducing the cost of non-transportation public goods, both of which will lead to urban expansion (see

Figure 2).

Equation (24) implies that the impact of land finance on urban expansion varies with differing fiscal pressure. In the condition that the total transportation cost for all people in a city in a unit area is larger than half of farmland rent, which is shown in (25), the greater the fiscal pressure will be, and the larger the impact of land finance on urban expansion is, which is the second hypothesis (II) of the paper. It implies a various effects of land finance under different fiscal pressure.

Local governments that are short of money are more eager to be involved in the production of built-up urban environments by seeking land finance. On the contrary, ‘rich’ governments with greater revenues are more likely to spend more on industrial and public service provisions, such as business and technology incubators, education and medical services, or affordable housing, thus attracting higher quality industries and talented workers to make contributions to the city’s economy [

20]. This mirrors the proposal by Harvey [

37] of “the tertiary circuit of capital”: capital switches into investment in technology, science, and a wide range of social expenditures following the primary circuit of capital, flows of production and consumption, and the secondary circuit of capital, in which cities invest in the built environment of production and consumption.

It should not be ignored that there is a reciprocal impact of land expansion on land finance. Land expansion driven either by socio-economic growth or by financial gain is likely to synchronously affect the measurement of land finance. In this paper, we only emphasize the theoretic roles of land finance on land expansion without consideration of these loops. However, while using the empirical data to test the theoretical hypotheses in the following section, we adopt lagged variables to mitigate the endogeneity problem.

3. Data and Methodology

3.1. Overview of China’s Urban Expansion and Land Finance

China’s rapid urbanization is one of the most significant contributions to the world economy in the past 40 years. In addition to hundreds of millions of rural people flowing into cities, a great amount of agricultural land has been converted to urban use.

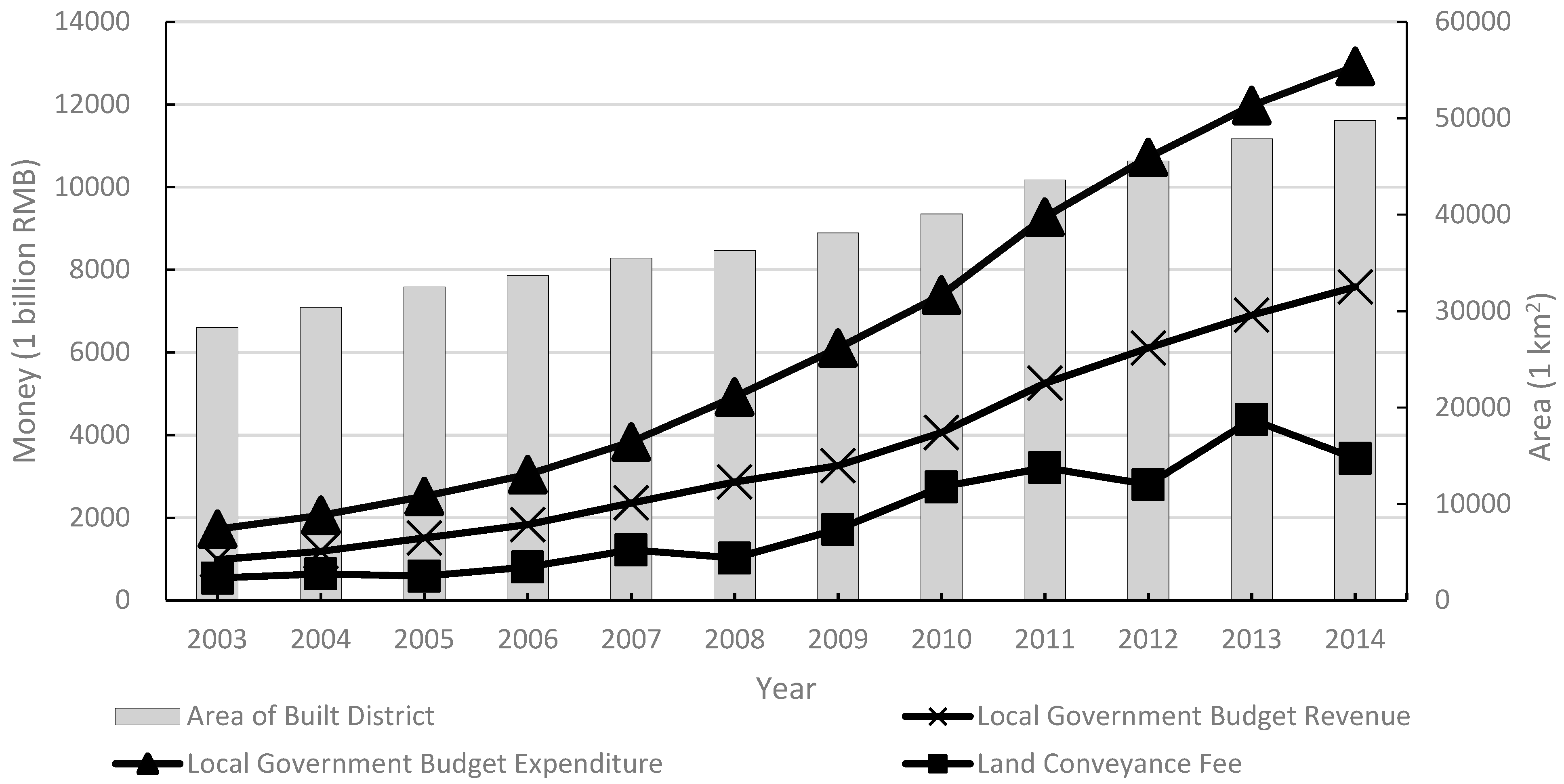

Figure 3 shows that between 2003 and 2014, around 2000 km

2 of undeveloped land was developed yearly in urban areas. Behind the large scale of urban expansion was the changing situation of local governments in public finance. While the gap between expenditure and revenue skyrocketed from around 700 billion RMB to about 80,000 billion RMB, land conveyance income increased rapidly from 540 billion RMB to 3600 billion RMB. This change seems to be one of the drivers of urban expansion.

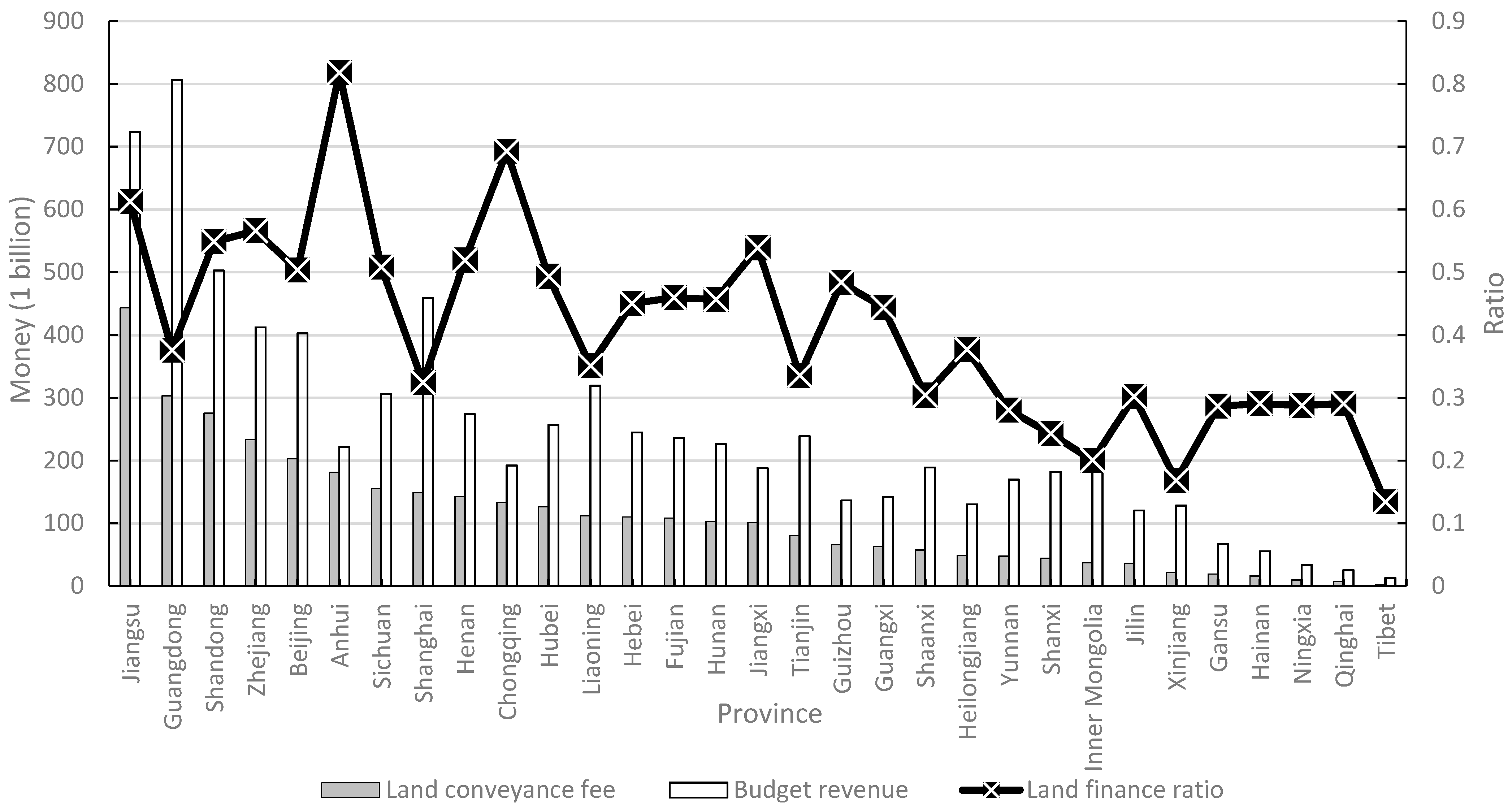

However, the capacity of, and demand for, financial benefits from urban expansion are different in provinces (

Figure 4). While Jiangsu, a coastal province, generated 443 billion RMB from land conveyance income in 2014, Tibet, an inland province, generated just 1.6 billion RMB during the same time. On the other hand, land finance ratios didn’t show the same trend as land conveyances fee. Anhui province’s land finance ratio was twice that of Guangdong, but the former only obtained about 60% as much money from land as the latter. Can the variation of land finance ratio explain urban expansion? More analyses need to be done later.

3.2. Model Specification

To explore the relationship between land finance and urban expansion, three statistical models were constructed. To begin with, two fixed effect panel models (one with the explained variable of land finance ratio and one without) are built based on AMM theoretical model [

9]. As shown in equation (26),

Yit is the explained variable, that is, the urban spatial size of the

ith city in the

tth year;

Xit is the explanatory variable: the land finance ratio of the

ith city in the

tth year (LDF). In order to solve the problem of endogeneity, the lagged variable of LDF is used here to measure the average ratio of land conveyance income to budget financial revenue in the last three years.

Zit is a vector of variables including urban population, income, transportation cost, and farmland rent;

is a fixed effect and

is an error term.

,

are the coefficients of the corresponding variables. According to the first hypothesis of the paper,

will be positive since a city would become larger with higher land finance ratio if all other conditions remain steady.

In addition, a fixed effect panel threshold model [

38] is constructed (Model 3), as shown in Equation (27). This model is used to test the second hypothesis of the paper that the impact of land finance on urban expansion varies with different fiscal pressure among cities: the greater the fiscal pressure, the larger the impact of land finance on urban expansion. The threshold model helps to identify the nonlinear relationship between the variables. When the threshold variable exceeds a certain threshold value, the coefficient of the explanatory variable will change. The optimal threshold is computed by trying all values. In the equation,

Xit is the land finance ratio as given in (26).

is the threshold value and

q is the threshold variable, which is the fiscal pressure (FPR) measured by the mean of the ratio of budget expenditure to revenue lagged over three years.

is an indicator function: when the criterion is true, the value of the function is 1; otherwise, its value is 0.

,

are different coefficients of the variables of land finance ratio; other variables and their coefficients are the same as in (26).

3.3. Data

To implement empirical analyses of the models, the following information was collected: city spatial size, urban population, income, transportation costs, farmland rent, land finance ratio, and fiscal pressure. These data are drawn from the China City Statistical Yearbook, China Urban Construction Statistical Yearbook, China Land Resource Year Book, and China Regional Economic Statistical Yearbook. Except for time range of land finance ratio and fiscal pressure, which was from 2007–2013 for the purpose of calculating lagged variables, all other data was collected from 2010–2014. This period was chosen for two reasons. First, updates to China Regional Economic Statistical Yearbook ceased in 2015. Second, as of 2014, local governments were authorized to issue local bonds under the modified Budget Law of People’s Republic of China. This may weaken the effect of land finance and make the statistical results vary for periods before and after this modification.

Data cleaning was done before the study. China City Statistical Yearbook covers 286 prefecture and above cities in China, and these cities form the foundation of our data. First, a few outlying data were carefully deleted. Then panel equalization, which is required by threshold panel models, was automatically processed in STATA 14.0 and samples with missing data were deleted. Finally, 231 cities were used in the regression model, while 55 cities, mainly in Sichuan, Tibet, Xinjiang, and Qinghai provinces, were excluded due to missing data.

The following measurement variables were used. Urban spatial size (USS) is the dependent variable in the model, and it is measured by the size of urban built-up area of each city. Although this is a gross variable per city, the marginal effect can be estimated from the parameters of the panel model. What we are interested in is whether urban expansion happens if any of the observed variables change.

Land finance ratio (LDF) is the independent variable of primary interest in the empirical model to test the two hypotheses. LDF is usually defined as the city land conveyance income for a certain year divided by the city budget revenue for the same year [

28]. Although this definition underestimates the real LDF because of the exclusion of all land-related taxation, which is difficult to collect, it is commonly used in related research for its representativeness and conciseness [

28]. In this paper, in order to solve the problem of endogeneity that while LDF affects land expansion, land expansion may simultaneously affect LDF, the lagged LDF is used to measure the mean LDF over the last three years, which represents almost a complete cycle for a construction project [

24]. Current land expansion does not impact past LDF, thus mitigating the problem of endogeneity.

The ratio of fiscal budget expenditure and fiscal budget revenue is used to measure the fiscal pressure (FPR) in the model. It is used to test the second hypothesis of the paper, that land finance may play a bigger role in urban expansion when fiscal pressure exceeds a certain threshold. FPR is also in the form of the mean of the past three years.

Based on the Alonso–Muth–Mills model, population, income, transportation costs, and farmland rents are considered as the main exogenous variables affecting urban spatial size. Following McGrath [

12] and Ke et al. [

11], permanent urban population (POP) is used to measure the urban population, average wage of employees (INCOME) is used to measure income, road area per capita (ROAD) is used to measure transportation cost, and the index of average yield per hectare (AGR) is used to measure the rent of farmland. While there is no doubt that POP and INCOME are critical in urban expansion, the significance of ROAD and AGR may need more explanation. Some scholars have noted China’s urban expansion is driven by rising car ownership [

35], so we take ROAD as a proxy of transportation costs given that commuting time is not available. AGR may be important in urban expansion because national strategy of Food Security

1. High grain productivity regions may be protected with more strict policies, which increases the costs to expand urban area. The variables POP, INCOME, and ROAD (more roads means lower cost) are expected to have positive signs, while the variable AGR is expected to have a negative sign (

Table 1).

The values of the variables in 2010 and 2014 are shown in

Table 2. In the five years under consideration, the average urban built-up area (USS) of the sample cities expanded rapidly from 117.15 km

2 to 148.18 km

2, while the average urban population (POP) increased from 1.09 million to 1.19 million. It is not surprising that the average yearly employee wage (INCOME) rose from 33,700 RMB to 51,600 RMB, while road area per capita (ROAD) rose from 10.63 m

2/person to 13.00 m

2/person. The average grain yield of unit area (AGR) increased from 0.54 tons/hectare to 0.61 tons/hectare, the mean of land finance ratio (LDF) rose from 0.52 to 0.68, and the mean of fiscal pressure (FPR) dropped slightly from 2.64 to 2.53.

4. Results

Three empirical models were built in the paper to examine the relationship between land finance and urban expansion (

Table 3). Model 1 is a basic model that includes only market factors. The land finance variable is added to Model 2, and Model 3 is a comprehensive model that incorporates both land finance and fiscal pressure.

Model testing was done before the analyses of the results. First, it can be seen from the correlation coefficient matrix that the correlation coefficient between the variables is low. Second, the normal QQ diagram shows that the dependent variable basically conforms to the assumption of normal distribution. Third, through the Hausmann test, we reject the null hypothesis that the random effect is consistent with the fixed effect, so the fixed effect model is chosen. Furthermore, all three models are highly significant based on an F test of the hypothesis that all coefficients are zero, showing that the individual fixed effect is significant.

4.1. Model 1: Baseline Model

Consistent with the AMM model, as well as some existing empirical studies, Model 1 shows that market factors, such as population, income, and transportation cost, have undoubted impacts on urban expansion of the Chinese cities under examination [

11]. The positive coefficient of urban population (lnPOP) is significant in the model, showing that urban population growth is one of the most fundamental factors in urban expansion. It is easily understood that a city will grow larger if people migrate to the city or more babies are born to residents. It is also not surprising that the coefficient of income (INCOME) is significantly positive. As incomes increase, people generally choose to live in larger dwellings, which consumes more land with the same density. At the same time, developers will construct more buildings in response to the increasing demand. When it comes to transportation costs, this variable (ROAD) is significant and positive, indicating that if more roads are built and the transportation cost declines as a result, the city will expand as more residents are able to live farther from the city center.

It is not surprising to find that the variable of agricultural land rent is not significant in the model. The probable reason is that China’s primary land market (rural-to-urban conversion) is monopolized by city governments and the production yield of farmland cannot fully reflect the land’s market value.

4.2. Model 2: Enhanced Model with Land Finance

In comparison to Model 1, the adjusted R2 of Model 2 increases when the variable of land finance is added. Moreover, the variables of population, income, transportation cost, and farmland rent remain almost the same as in Model 1.

Importantly, the coefficient of land finance (LDF), the variable of primary interest in this paper, is significantly positive in Model 2. The resulting coefficient implies that if the land finance ratio increases by 10%, the urban spatial size will increase by 0.46%. This means that the first hypothesis of the paper is supported. The city becomes larger with higher land finance ratio, all other conditions held constant. Furthermore, this result was observed in several case studies in China, such as Jiangsu province, Chongqing city, Beijing city, and Guangdong province [

15,

17,

26,

27,

29].

4.3. Model 3: Enhanced Model with Land Finance and Fiscal Pressure

Model 3 shows additional improvement when the variables of land finance and fiscal pressure are both included and a threshold model is applied. Unlike the result from Model 2 showing that land finance significantly drives urban expansion, Model 3 shows that the effect of land finance is not constant. For cities with relatively low fiscal pressure (smaller than 3.46 in the empirical model), the positive impact of land finance on urban expansion is very small (the coefficient is 0.018), failing to reach significance when tested by the regression model. Only in cities with high fiscal pressure is the role of land finance on urban expansion significant. The empirical analysis shows that the urban spatial size will increase by 1.1% while land finance increases 10% for these cities, which is more than twice the result in Model 2. However, nearly all current studies have ignored, as with Model 2, the fact that the impact of land finance on expansion varies with varying fiscal pressure. In fact, because cities with different fiscal pressure have always been mixed in empirical studies, the impact of land finance on urban expansion was overestimated for cities without heavy fiscal pressure and underestimated for cities with relatively heavy fiscal pressure.

This strongly supports the second hypothesis and can easily be explained. Governments with a greater shortage of money have a stronger desire to expand the size of the city for the sake of land finance. On the contrary, local governments that are not lacking fiscal revenue seem less eager to be involved in the production of urban built environment for the purposes of land finance. Even in cases where a significant increase in local finance relies on land revenue in recent years, the increased revenue from land in these rich cities may be spent on improvements to public services rather than producing urban space, due to the lack of finance pressure.

5. Discussion and Conclusions

Around 100 years ago, Sun Yat-sen, the first president of the Republic of China, was inspired by Henry George’s Progress and Poverty, and proposed using land value increments to finance public services [

39,

40,

41]. He believed that land policy and land-based taxation are essential for China’s economic development and social equality. With almost 100 years passing, land value capture is still of significance for urban development in current China’s cities.

The development and maturity of the land market in socialist China has been explored using a market-oriented model in this paper. Consistent with other studies [

11,

18], population, individuals’ income, and transportation costs have a significant influence on urban spatial size. Meanwhile, land-centered development undertaken by local governments has been illustrated by the positive relationship between land finance ratio and urban expansion, which has also been observed in other literature [

15,

17,

26,

27,

29]. However, it is our contribution to find that this development model varies with different levels of municipal fiscal pressure.

Using 231 Chinese prefecture-level and above cities as samples, a fixed threshold model was adopted in the paper that incorporates land finance and fiscal pressure in order to explore their roles in urban expansion in the Chinese context. The model shows that in cities under heavy fiscal pressure, the impact of land finance on urban expansion is larger than in cities with less fiscal pressure. This result may be further explained by the fact that those governments with heavy fiscal pressure rely more on land-centered development because they lack revenue from industry-related taxation. Additionally, land prices in such cities are lower due to their poor economic performance. As a result, the impact of land finance on expansion is higher.

For example, An Kang, a small city in Shaanxi province of west China, experienced rapid growth of its built-up area during the period under study. In 2006, its built-up area was 27 km2, which increased to 40 km2 by 2014. During this period, An Kang suffered heavy fiscal pressure. Its financial expenditure was about five times greater than its revenue. At the same time, revenues from the land conveyance income were about 130% of the budgetary revenue in 2014. Also, land prices (granting through bidding, auction and listing) were not high: 1107 RMB/m2 in 2014, which was below the average price for the country, 1216 RMB/m2, and far below the land price in Beijing of 13,320 RMB/m2. An Kang is just one example of the land-centered development model that was pervasive among “poor” local governments. The value of land in these cities in the land market is not as high as the land value in rich cities; however, it is also small cities that are eager to expand and sell lands because of insufficient budget revenue.

To our limited knowledge, this paper is the first to demonstrate the combined impact of land finance and fiscal pressure on urban expansion. However, it is rooted in many other studies. First, it supports existing ideas of capitalization of urban land and urbanization of capital [

37]. At first sight, it is strange that developing countries, which are always short of capital, will absorb surplus capital in the process of urbanization [

15]. It violates the rule of secondary circuits of capital flow. In this rule, capital should have flowed from production itself to the production of built-up urban environment, thus fixing the problem of over-accumulation [

37]. Instead of a process of urbanization of capital, Lin &Yi [

15] thought local governments in China usually suffer from fiscal deficits, so they finance urban land development by land commodification. However, this may be only half the truth. The landscape of land development and land finance is uneven in China [

28], which means that prosperous cities and poor cities exist at the same time. While some poor cities try to accelerate the process of secondary capital flow to produce urban space with the help of land finance, rich cities do not care about that and may step directly into the tertiary circuits of capital flow, where investment in science and technology as well as social expenditures (such as medical care and affordable housing) top their lists. It has been recently reported that the fight for talent among first- and second-tier cities in China is becoming fiercer [

42]. Cities such as Shanghai and Shenzhen offer attractive conditions to both individual talent and creative companies, which spend significant amounts of money locally. This is the other half of the story of urbanization of capital, though in an advanced form of the tertiary circuit of capital flow.

Secondly, it is interesting to compare our empirical results with research by Song and Zenou [

34] on American cities, which showed a significant negative effect of property tax on urban expansion. The difference can be explained by different patterns of revenue generation and the differing roles of local governments. Land conveyance income is a kind of land rent that has no impact on expansion [

33], but it is the active role played by governments of Chinese cities in the production of the urban built environment that matters in urban expansion. With the help of this “windfall” from land conveyance income, municipalities in China can distribute more resources to urban spatial development in competition with others. On the contrary, “small” local governments in America spend most of their property tax revenue on public services, especially education. The different roles of value capture from land have different effects on urban expansion.

Further policy suggestions should be carefully made according to this research, which indicates that attention must be paid to the role of land finance in urban expansion. Firstly, as local governments have the power to regulate the circuit of capital via land commodification, tertiary circuits of capital, namely investment in human capital and technology, should be encouraged, while secondary circuits of capital flowing into the built environment should be carefully guided [

43]. Not all cities need to build broad roads, tall buildings, or subways, but all cities and all people should have access to high-quality schools and hospitals. Only by making full use of land finance and offering sufficient public services can China’s cities encourage high-skilled workers and other people to stay in the city, giving “the right to the city” [

44] to everyone.

Secondly, under the rule of public purpose and just compensation, policies of land expropriation, which are at the root of land finance in China, should be carefully redesigned to be effective tools in the policy toolbox. Behind land finance lies the dual track of land ownership that gave local governments lucrative opportunities to profit from land expropriation. Although the law of “Land Administration of the People’s Republic of China” was modified in 2019, limiting land expropriation by shrinking the range of expropriation and adding some processes of public participation, more detailed policies should be made at different levels of government.

Thirdly, instead of relying heavily on land conveyance income, property tax should be implemented on a large scale, which may curb expansion to some extent [

34,

45]. Property tax also provides more sustainable revenue for municipal governments than public land sales.

Finally, the paper has the following limitations. Although the problem of endogeneity is handled in our regression model with lagged variables, more theoretical configuration should be done to explore the interaction between urban expansion and land finance. Moreover, some factors, especially policy factors in China, such as planning and land quotas, were not taken into consideration in the paper, although a fixed panel model can mitigate the effect of omission of variables. Finally, the assumption of local governments could be extended in the future research to depict the various motivations behind land finance.