The Relationship between Housing Price, Teacher Salary Improvement, and Sustainable Regional Economic Development

Abstract

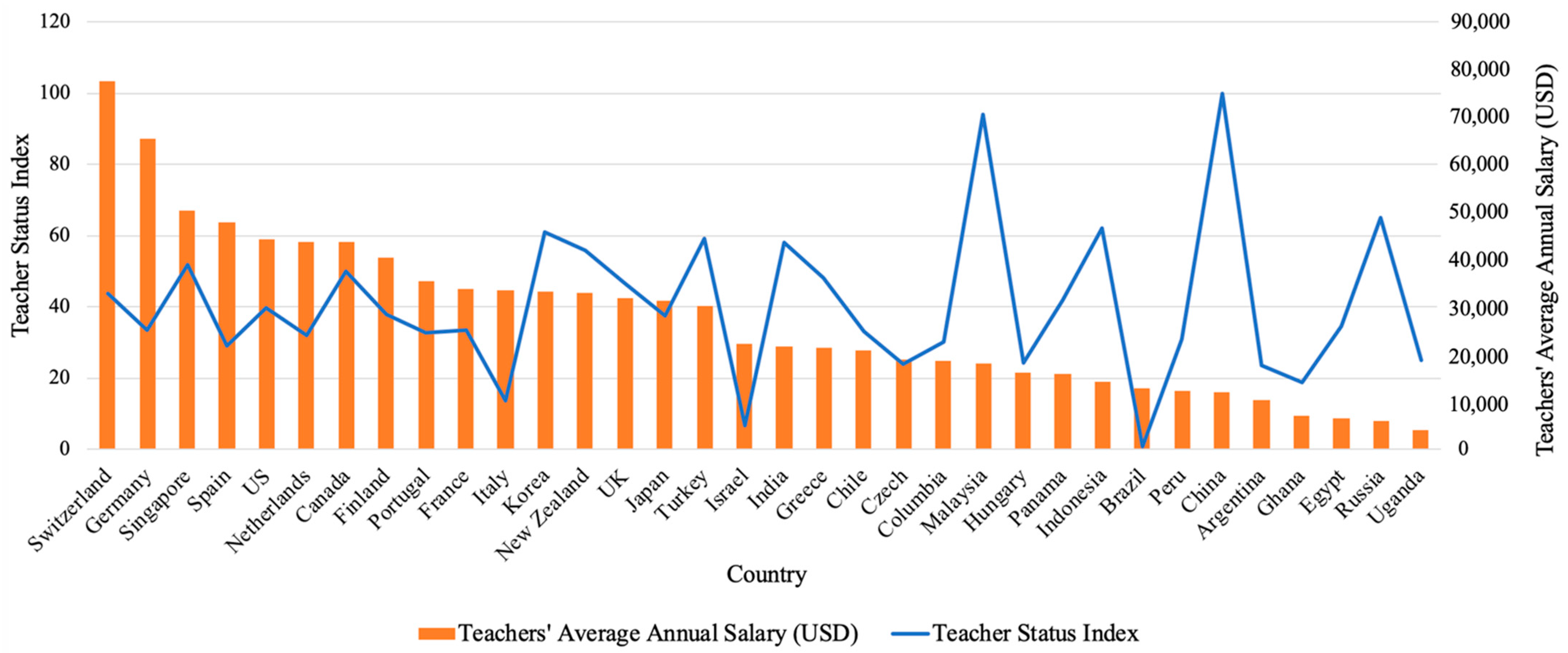

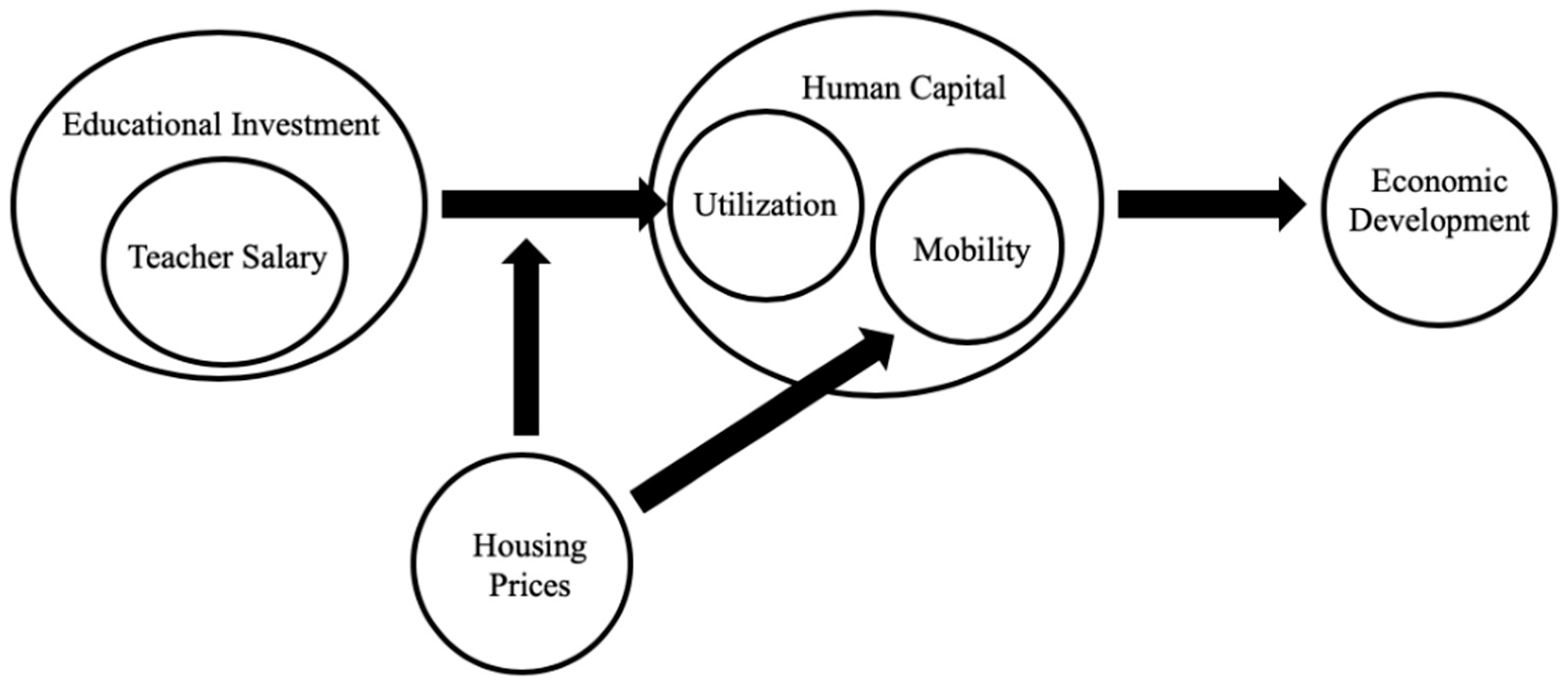

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Education and Regional Economic Development

2.2. The Role of Housing Price

3. Materials and Methods

3.1. Variable Selection and Data Collection

3.2. Empirical Models

3.2.1. Benchmark Model

3.2.2. Moderation Model

4. Empirical Results and Discussion

4.1. Baseline Regression Analysis with the Moderating Effect of Housing Price

4.2. Analysis with the Moderating Effect of Housing Price across Regions

4.3. Robustness Checks

4.4. Discussion

5. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Tao, Y.; Chuang, H.; Lin, E.S. Compensation and performance in Major League Baseball: Evidence from salary dispersion and team performance. Int. Rev. Econ. Financ. 2016, 43, 151–159. [Google Scholar] [CrossRef]

- Hanushek, E.A. The economic value of higher teacher quality. Econ. Educ. Rev. 2011, 30, 466–479. [Google Scholar] [CrossRef]

- Reitz, J.G. Immigrant skill utilization in the Canadian labour market: Implications of human capital research. J. Int. Migr. Integr. 2001, 2, 347–378. [Google Scholar] [CrossRef]

- Fleisher, B.; Li, H.; Zhao, M.Q. Hunan capital, economic growth, and regional inequality in China. J. Dev. Econ. 2010, 92, 215–231. [Google Scholar] [CrossRef]

- Teixeira, A.A.; Queirós, A.S.S. Economic growth, human capital and structural change: A dynamic panel data analysis. Res. Policy 2016, 45, 1636–1648. [Google Scholar] [CrossRef]

- Atalay, R. The education and the human capital to get rid of the middle-income trap and to provide the economic development. Procedia Soc. Behav. Sci. 2015, 174, 969–976. [Google Scholar] [CrossRef]

- Walker, M. A capital or capabilities education narrative in a world of staggering inequalities? Int. J. Educ. Dev. 2012, 32, 384–393. [Google Scholar] [CrossRef]

- Plazzesi, M.; Schneider, M.; Tuzel, S. Housing, consumption and asset pricing. J. Financ. Econ. 2007, 83, 531–569. [Google Scholar] [CrossRef]

- Epple, D.; Gordon, B.; Sieg, H. A new approach to estimating the production function for housing. Am. Econ. Rev. 2010, 100, 905–924. [Google Scholar] [CrossRef]

- Chen, P.; Chien, M.; Lee, C. Dynamic modeling of regional house price diffusion in Taiwan. J. Hous. Econ. 2011, 20, 315–332. [Google Scholar] [CrossRef]

- Dohmen, T.J. Housing, Mobility and Unemployment. Reg. Sci. Urban Econ. 2005, 35, 305–325. [Google Scholar] [CrossRef]

- Herrera, L.; Muñoz-Doyague, M.F.; Nieto, M. Mobility of public researchers, scientific knowledge transfer, and the firm’s innovation process. J. Bus. Res. 2010, 63, 510–518. [Google Scholar] [CrossRef]

- Grandstein, M.; Justman, M. Education, social cohesion, and economic growth. Am. Econ. Rev. 2002, 92, 1192–1204. [Google Scholar] [CrossRef]

- Siddiqui, A.; Rehman, A. The human capital and economic growth nexus: In East and South Asia. Appl. Econ. 2016, 49, 2697–2710. [Google Scholar] [CrossRef]

- Gylfason, T. Natural resources, education, and economic development. Eur. Econ. Rev. 2001, 45, 847–859. [Google Scholar] [CrossRef]

- Hanushek, E.A.; Woessmann, L. The role of education quality for economic growth. In World Bank Policy Research Working Paper; The World Bank: Washington, DC, USA, 2007. [Google Scholar] [CrossRef]

- Hanushek, E.A.; Woessmann, L. The role of cognitive skills in economic development. J. Econ. Lit. 2008, 46, 607–668. [Google Scholar] [CrossRef]

- Lucas, R.E., Jr. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Bénassy, J.-P.; Brezis, E.S. Brain drain and development traps. J. Dev. Econ. 2013, 102, 15–22. [Google Scholar] [CrossRef]

- Florida, R.; Mellander, C.; Stolarick, K. Inside the black box of regional development: Human capital, the creative class and tolerance. J. Econ. Geogr. 2008, 8, 615–649. [Google Scholar] [CrossRef]

- Hanushek, E.A.; Ruhose, J.; Woessmann, L. Knowledge capital and aggregate income differences: Development accounting for US States. Am. Econ. J. Macroecon. 2017, 9, 184–224. [Google Scholar] [CrossRef]

- Bound, J.; Lovenheim, M.F.; Turner, S. Why have college completion rates declined? An analysis of changing student preparation and collegiate resources. Am. Econ. J.-Appl. Econ. 2010, 2, 129–157. [Google Scholar] [CrossRef]

- Zhang, Y.; Xie, H. Interactive Relationship among Urban Expansion, Economic Development, and Population Growth since the Reform and Opening up in China: An Analysis Based on a Vector Error Correction Model. Land 2019, 8, 153. [Google Scholar] [CrossRef]

- Wu, Y.; Yang, Y.; Xu, W.; Chen, Q. The Influence of Innovation Resources in Higher Education Institutions on the Development of Sci-Tech Parks’ Enterprises in the Urban Innovative Districts at the Stage of Urbanization Transformation. Land 2020, 9, 396. [Google Scholar] [CrossRef]

- Lin, T.C. The role of higher education in economic development: An empirical study of Taiwan case. J. Asian Econ. 2004, 15, 355–371. [Google Scholar] [CrossRef]

- Denison, E.F. Education, economic growth, and gaps in information. J. Political Econ. 1962, 70, 124–128. [Google Scholar] [CrossRef]

- Nowak, A.Z.; Dahal, G. The contribution of education to economic growth: Evidence from Nepal. Int. J. Econ. Sci. 2016, 5, 22–41. [Google Scholar] [CrossRef]

- Harrison, J.; Turok, I. Universities, knowledge and regional development. Reg. Stud. 2017, 51, 977–981. [Google Scholar] [CrossRef]

- Carrell, S.E.; Hoekstra, M. Are school counselors an effective education input? Econ. Lett. 2014, 125, 66–69. [Google Scholar] [CrossRef]

- Jackson, C.K.; Johnson, R.C.; Persico, C. The effects of school spending on educational and economic outcomes: Evidence from school finance reforms. Q. J. Econ. 2016, 131, 157–218. [Google Scholar] [CrossRef]

- Speroni, C.; Wellington, A.; Burkander, P.; Chiang, H.; Herrmann, M.; Hallgren, K. Do educator performance incentives help students? Evidence from the Teacher Incentive Fund National Evaluation. J. Labor Econ. 2020, 38, 843–872. [Google Scholar] [CrossRef]

- Katayama, H.; Nuch, H. A game-level analysis of salary dispersion and team performance in the national basketball association. Appl. Econ. 2011, 43, 1193–1207. [Google Scholar] [CrossRef]

- Liu, S. The influences of school climate and teacher compensation on teachers’ turnover intention in China. Educ. Psychol. 2012, 32, 553–569. [Google Scholar] [CrossRef]

- Trevor, C.O.; Wazeter, D.L. Contingent view of reactions to objective pay conditions: Interdependence among pay structure characteristics and pay relative to internal and external referents. J. Appl. Psychol. 2006, 91, 1260–1275. [Google Scholar] [CrossRef]

- Christoffersen, S.E.; Sarkissian, S. City size and fund performance. J. Financ. Econ. 2009, 92, 252–275. [Google Scholar] [CrossRef]

- Glaeser, E.L. Triumph of the city: How our greatest invention makes us richer, smarter, greener, healthier, and happier (an excerpt). J. Econ. Sociol. 2013, 14, 75–94. [Google Scholar] [CrossRef]

- Scott, A.J. Jobs or amenities? Destination choices of migrant engineers in the USA. Pap. Reg. Sci. 2010, 89, 43–63. [Google Scholar] [CrossRef]

- Hanushek, E.A.; Kain, J.F.; Rivkin, S.G. Why public schools lose teachers. J. Hum. Resour. 2004, 39, 326–354. Available online: https://www.nber.org/papers/w8599 (accessed on 3 June 2022). [CrossRef]

- Greenberg, D.; McCall, J. Teacher mobility and allocation. J. Hum. Resour. 1974, 9, 480–502. [Google Scholar] [CrossRef]

- Levy, A.J.; Joy, L.; Ellis, P.; Jablonski, E.; Karelitz, T.M. Estimating teacher turnover costs: A case study. J. Educ. Financ. 2012, 38, 102–129. Available online: http://www.jstor.org/stable/23353968 (accessed on 4 June 2022).

- Barnes, G.; Crowe, E.; Schaefer, B. The cost of teacher turnover in five school districts: A pilot study. In National Commission on Teaching and America’s Future; NCTAF: Washington, DC, USA, 2007. [Google Scholar]

- Feng, L. Teacher placement, mobility, and occupational choices after teaching. Educ. Econ. 2014, 22, 24–47. [Google Scholar] [CrossRef]

- Wang, F.; Tang, H.; Shen, W.; Wang, Y.; Lo, L.N. Factors influencing teachers’ willingness to move in the Chinese school system. Asia Pac. J. Educ. 2021, 1–16. [Google Scholar] [CrossRef]

- Barbieri, G.; Rossetti, C.; Sestito, P. The determinants of teacher mobility: Evidence using Italian teachers’ transfer applications. Econ. Educ. Rev. 2011, 30, 1430–1444. [Google Scholar] [CrossRef]

- Boyd, D.; Grossman, P.; Ing, M.; Lankford, H.; Loeb, S.; Wyckoff, J. The influence of school administrators on teacher retention decisions. Am. Educ. Res. J. 2011, 48, 303–333. [Google Scholar] [CrossRef]

- Boyd, D.; Lankford, H.; Loeb, S.; Wyckoff, J. Explaining the short careers of high-achieving teachers in schools with low-performing students. Am. Econ. Rev. 2005, 95, 166–171. [Google Scholar] [CrossRef]

- Feng, L.; Sass, T.R. Teacher quality and teacher mobility. Educ. Financ. Policy 2017, 12, 396–418. [Google Scholar] [CrossRef]

- Han, L. Is centralized teacher deployment more equitable? Evidence from rural China. China Econ. Rev. 2013, 24, 65–76. [Google Scholar] [CrossRef]

- An, X.H. The different allocation of teachers between urban and rural schools within county and policy suggestions. Natl. Cent. Educ. Res. 2013, 8, 50–56. [Google Scholar]

- Wei, Y.; Zhou, S. Are better teachers more likely to move? Examining teacher mobility in rural China. Asia-Pac. Edu. Res. 2019, 28, 171–179. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Yuan, Y. China’s regional sustainability and diversified resource allocation: DEA environmental assessment on economic development and air pollution. Energy Econ. 2015, 49, 239–256. [Google Scholar] [CrossRef]

- Xie, Y.; Hannum, E. Regional variation in earnings inequality in reform-era urban China. Am. J. Sociol. 1996, 101, 950–992. [Google Scholar] [CrossRef]

- Psacharopoulos, G.; Patrinos, H.A. Returns to investment in education: A decennial review of the global literature. Educ. Econ. 2018, 26, 445–458. [Google Scholar] [CrossRef]

- Akiba, M.; LeTendre, G.K.; Scribner, J.P. Teacher quality, opportunity gap, and national achievement in 46 countries. Educ. Res. 2007, 36, 369–387. [Google Scholar] [CrossRef]

- Meng, X. Labor market outcomes and reforms in China. J. Econ. Perspect. 2012, 26, 75–102. [Google Scholar] [CrossRef]

- Zhang, J.; Huang, J.; Wang, J.; Guo, L. Return migration and Hukou registration constraints in Chinese cities. China Econ. Rev. 2020, 63, 101498. [Google Scholar] [CrossRef]

- Chan, K.W.; Buckingham, W. Is China abolishing the hukou system? China Q. 2008, 195, 582–606. [Google Scholar] [CrossRef]

- Guo, S.; Guo, Y. Spotlight on China: Changes in Education under China’s Market Economy; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Wu, L.; Zhang, W. Rural migrants’ homeownership in Chinese urban destinations: Do institutional arrangements still matter after Hukou reform? Cities 2018, 79, 151–158. [Google Scholar] [CrossRef]

- Fields, G.; Song, Y. Modeling migration barriers in a two-sector framework: A welfare analysis of the hukou reform in China. Econ. Model. 2020, 84, 293–301. [Google Scholar] [CrossRef]

- Bosker, M.; Deichmann, U.; Roberts, M. Hukou and highways the impact of China’s spatial development policies on urbanization and regional inequality. Reg. Sci. Urban Econ. 2018, 71, 91–109. [Google Scholar] [CrossRef]

- Pi, J.; Zhang, P. Hukou system reforms and skilled-unskilled wage inequality in China. China Econ. Rev. 2016, 41, 90–103. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, R.; Lu, C. A quantitative analysis of Hukou reform in Chinese cities: 2000–2016. Growth Change 2019, 50, 201–221. [Google Scholar] [CrossRef]

- Song, Y. What should economists know about the current Chinese hukou system? China Econ. Rev. 2014, 29, 200–212. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, S.; Li, G.; Zhang, H.; Jin, L.; Su, Y.; Wu, K. Identifying the determinants of housing prices in China using spatial regression and the geographical detector technique. Appl. Geogr. 2017, 79, 26–36. [Google Scholar] [CrossRef]

- Antolin, P.; Bover, O. Regional migration in Spain: The effect of personal characteristics and of unemployment, wage and house price differentials using pooled cross-sections. Oxf. Bull. Econ. Stat. 1997, 59, 215–235. [Google Scholar] [CrossRef] [PubMed]

- Van Nieuwerburgh, S.; Weill, P.O. Why has house price dispersion gone up? Rev. Econ. Stud. 2010, 77, 1567–1606. [Google Scholar] [CrossRef]

- Leung, C.K.Y. Error correction dynamics of house prices: An equilibrium benchmark. J. Hous. Econ. 2014, 25, 75–95. [Google Scholar] [CrossRef]

- Chen, N.K.; Cheng, H.L. House price to income ratio and fundamentals: Evidence on long-horizon forecastability. Pac. Econ. Rev. 2017, 22, 293–311. [Google Scholar] [CrossRef]

- Gallin, J. The long-run relationship between house prices and income: Evidence from local housing markets. Real Estate Econ. 2006, 34, 417–438. [Google Scholar] [CrossRef]

- Andre, C.; Gil-Alana, L.A.; Gupta, R. Testing for persistence in housing price-to-income and price-to-rent ratios in 16 OECD countries. Appl. Econ. 2014, 46, 2127–2138. [Google Scholar] [CrossRef]

- Yin, S.; Ma, Z.; Song, W.; Liu, C. Spatial justice of a Chinese metropolis: A perspective on housing price-to-income ratios in nanjing, China. Sustainability 2019, 11, 1808. [Google Scholar] [CrossRef]

- Hanson, G.H. Market potential, increasing returns and geographic concentration. J. Int. Econ. 2005, 67, 1–24. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Kolko, J.; Saiz, A. Consumer city. J. Econ. Geogr. 2001, 1, 27–50. [Google Scholar] [CrossRef]

- Abowd, J.M.; Vilhuber, L. Did the housing price bubble clobber local labor market job and worker flows when it burst? Am. Econ. Rev. 2012, 102, 589–593. [Google Scholar] [CrossRef][Green Version]

- Agrawal, A.; Cockburn, L.; McHale, J. Gone but not forgotten: Knowledge flows, labor mobility, and enduring social relationships. J. Econ. Geogr. 2006, 6, 571–591. [Google Scholar] [CrossRef]

- Hsieh, C.; Moretti, E. Housing constraints and spatial misallocation. Am. Econ. J.-Macroecon. 2019, 11, 1–39. [Google Scholar] [CrossRef]

- Zhao, S.; Zhao, K.; Zhang, P. Spatial Inequality in China’s Housing Market and the Driving Mechanism. Land 2021, 10, 841. [Google Scholar] [CrossRef]

- Kim, L.; Seo, W. Micro-Analysis of Price Spillover Effect among Regional Housing Submarkets in Korea: Evidence from the Seoul Metropolitan Area. Land 2021, 10, 879. [Google Scholar] [CrossRef]

- Escobari, D.; Damianov, D.S.; Bello, A. A time series test to identify housing bubbles. J. Econ. Financ. 2015, 39, 136–152. [Google Scholar] [CrossRef][Green Version]

- Campbell, J.Y.; Cocco, J.F. How do house prices affect consumption? Evidence from micro data. J. Monet. Econ. 2007, 54, 591–621. [Google Scholar] [CrossRef]

- Chaney, T.; Thesmar, D. The collateral channel: How real estate shocks affect corporate investment. Am. Econ. Rev. 2012, 102, 2381–2409. [Google Scholar] [CrossRef]

- Chen, T.; Liu, L.X.; Zhou, L. The crowding-out effects of real estate shocks: Evidence from China. Soc. Sci. Electron. Publ. 2015. [Google Scholar] [CrossRef]

- Bleck, A.; Liu, X. Credit expansion and credit misallocation. J. Monet. Econ. 2017, 94, 27–40. [Google Scholar] [CrossRef]

- Mockutė, E.; Birškytė, L. Sustainable economic development of APEC countries. In Proceedings of the 11th International Scientific Conference “Business and Management 2020”, Vilnius, Lithuania, 7–8 May 2020. [Google Scholar]

- Li, Y.; Hu, R. China’s real estate price and macroeconomic fluctuation—Based on PVAR model. Macroeconomics 2011, 2, 26–30. [Google Scholar]

- Wang, D.H.; Guan, W.J.; Zhao, Z.B. The impact of land and housing supply on housing price changes and economic growth—also on the reasons for China’s high housing prices and continued rising. Financ. Res. 2015, 2015, 50–67. [Google Scholar]

- Yang, Z.; Pan, Y. Human capital, housing prices, and regional economic development: Will “vying for talent” through policy succeed? Cities 2020, 98, 102577. [Google Scholar] [CrossRef]

- Podrecca, E.; Carmeci, G. Fixed investment and economic growth: New results on causality. Appl. Econ. 2010, 5, 177–182. [Google Scholar] [CrossRef]

- Gennaioli, N.; La Porta, R.; Lopez-De-Silanes, F.; Shleifer, A. Human capital and regional development. Q. J. Econ. 2013, 8, 105–164. [Google Scholar] [CrossRef]

- Akbar, Y.H.; McBride, J.B. Multinational enterprise strategy, foreign direct investment and economic development: The case of the Hungarian banking industry. J. World Bus. 2004, 39, 89–105. [Google Scholar] [CrossRef]

- Dustmann, D.; Okatenko, A. Out-migration, wealth constraints and the quality of local amenities. J. Dev. Econ. 2014, 110, 52–63. [Google Scholar] [CrossRef]

- Meulemeester, J.; Rochat, D. A causality analysis of the link between higher education and economic development. Econ. Educ. Rev. 1995, 14, 351–361. [Google Scholar] [CrossRef]

- Charles, K.K.; Hurst, E.; Notowidigdo, M.J. Housing booms and busts, labor market opportunities, and college attendance. Am. Econ. Rev. 2018, 108, 2947–2994. [Google Scholar] [CrossRef]

- Meen, G.; Nygaard, A. Housing and Regional Economic Disparities. Economics Paper, Department for Communities and Local Government. 2010. Available online: https://www.gov.uk/government/publications/housing-and-regional-economic-disparities-economics-paper-5 (accessed on 9 June 2022).

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Ji, L.; Zhang, W. Fiscal incentives and sustainable urbanization: Evidence from China. Sustainability 2020, 12, 103. [Google Scholar] [CrossRef]

- Ladd, H.F. Teacher labor markets in developed countries. Future Child. 2007, 17, 201–217. Available online: http://www.jstor.org/stable/4150026 (accessed on 15 June 2022). [CrossRef]

- Schultz, T.P. Education investments and returns. Handb. Dev. Econ. 1988, 1, 543–630. [Google Scholar] [CrossRef]

- Sianesi, B.; Reenen, J.V. The returns to education: Macroeconomics. J. Econ. Surv. 2003, 17, 157–200. [Google Scholar] [CrossRef]

- Hanushek, E.A. Measuring investment in education. J. Econ. Perspect. 1996, 10, 9–30. [Google Scholar] [CrossRef]

- Psacharopoulos, G. Returns to education: A further international update and implication. J. Hum. Resour. 1985, 20, 583–604. [Google Scholar] [CrossRef]

- Psacharopoulos, G.; Patrinos, H.A. Returns to investment in education: A further update. Educ. Econ. 2004, 12, 111–134. [Google Scholar] [CrossRef]

- Brunner, J.J. The retionale for higher education investment in Ibero-Ameraica. In Oecd Develoopment Centre Working Paper No.319; OECD Development Centre: Paris, France, 2013. [Google Scholar]

- De La Fuente, A.; Vives, X. Infrastructure and education as instruments of regional policy: Evidence from Spain. Econ. Policy 1995, 10, 11–51. [Google Scholar] [CrossRef]

- Liao, L.; Du, M.; Wang, B.; Yu, Y. The impact of educational investment on sustainable economic growth in Guangdong, China: A cointegration and causality analysis. Sustainability 2019, 11, 766. [Google Scholar] [CrossRef]

- Kooiman, N.; Latten, J.; Bontje, M. Human capital migration: A longitudinal perspective. Tijdschr. Voor Econ. Soc. Geogr. 2018, 109, 644–660. [Google Scholar] [CrossRef]

- Zhou, J.; Xiong, J. Resource Opportunity in China’s Market Transition and Governance: Time Factor in Urban Housing Inequality. Land 2021, 10, 1331. [Google Scholar] [CrossRef]

- Kishor, N.K.; Marfatia, H.A. The dynamic relationship between housing prices and the macroeconomy: Evidence from OECD countries. J. Real Estate Financ. Econ. 2017, 54, 237–268. [Google Scholar] [CrossRef]

- Feng, H.; Lu, M. School quality and housing prices: Empirical evidence from a natural experiment in Shanghai, China. J. Hous. Econ. 2013, 22, 291–307. [Google Scholar] [CrossRef]

- Wen, H.; Zhang, Y.; Zhang, L. Do educational facilities affect housing price? An empirical study in Hangzhou, China. Habitat Int. 2014, 42, 155–163. [Google Scholar] [CrossRef]

- Gingrich, J.; Ansell, B. Sorting for schools: Housing, education and inequality. Socio-Econ. Rev. 2014, 12, 329–351. [Google Scholar] [CrossRef]

- Zhang, J.; Li, H.; Lin, J.; Zheng, W.; Li, H.; Chen, Z. Meta-analysis of the relationship between high quality basic education resources and housing prices. Land Use Policy 2020, 99, 104843. [Google Scholar] [CrossRef]

- Yi, Y.; Kim, E.; Choi, E. Linkage among school performance, housing prices, and residential mobility. Sustainability 2017, 9, 1075. [Google Scholar] [CrossRef]

- Gan, L.; Ren, H.; Xiang, W.; Wu, K.; Cai, W. Nonlinear Influence of Public Services on Urban Housing Prices: A Case Study of China. Land 2021, 10, 1007. [Google Scholar] [CrossRef]

| Province | GDP Per Capita (CNY) | Average Teacher Salary (CNY) | Housing Price (CNY/m2) | Province | GDP Per Capita (CNY) | Average Teacher Salary (CNY) | Housing Price (CNY/m2) |

|---|---|---|---|---|---|---|---|

| Beijing | 153,095 | 161,029 | 15,924 | Hubei | 71,109 | 85,045 | 8136 |

| Tianjin | 85,757 | 138,011 | 37,420 | Hunan | 52,809 | 79,209 | 5473 |

| Hebei | 43,108 | 77,715 | 7567 | Guangdong | 88,781 | 109,022 | 12,915 |

| Shanxi | 43,010 | 72,783 | 6649 | Guangxi | 40,012 | 74,077 | 5959 |

| Inner Mongolia | 63,772 | 85,643 | 5340 | Hainan | 52,801 | 88,920 | 14,105 |

| Liaoning | 53,872 | 76,151 | 7358 | Chongqing | 69,901 | 101,579 | 8190 |

| Jilin | 415,16 | 75,836 | 6801 | Sichuan | 51,556 | 83,030 | 6691 |

| Heilongjiang | 33,977 | 77,787 | 6678 | Guizhou | 42,767 | 84,484 | 5129 |

| Shanghai | 148,744 | 114,749 | 28,981 | Yunnan | 43,366 | 101,239 | 7384 |

| Jiangsu | 115,930 | 113,637 | 10,542 | Tibet | 45,476 | 138,809 | 6915 |

| Zhejiang | 101,813 | 123,681 | 15,242 | Shaanxi | 62,195 | 75,909 | 7922 |

| Anhui | 54,078 | 98,697 | 6937 | Gansu | 30,797 | 83,981 | 5387 |

| Fujian | 98,542 | 94,333 | 10,613 | Qinghai | 45,739 | 101,131 | 5937 |

| Jiangxi | 49,013 | 76,544 | 6540 | Ningxia | 51,248 | 83,660 | 4737 |

| Shandong | 66,472 | 94,149 | 7386 | Xinjiang | 51,950 | 78,255 | 5427 |

| Henan | 52,114 | 71,053 | 5531 | Average | 64,688 | 94,198 | 9542 |

| Variable | Definition | Unit |

|---|---|---|

| PGDP | Natural logarithm of per capita gross regional product. | CNY |

| Salary | Natural logarithm of the average annual teacher salaries. | CNY |

| HP | Natural logarithm of the housing price. | CNY |

| Unemployment | Natural logarithm of the unemployment rate. | % |

| Openness | The economic openness of a province. Measured by natural logarithm of the proportion of total export–import volume of goods in GDP. | 10−6 |

| Innovation | Natural logarithm of the annual number of patents for innovations granted to the domestic applicant. | - |

| Edu | Natural logarithm of the education level of a province. | - |

| PGreen | Natural logarithm of the city’s per capita green area. | Square meters/person |

| Transport | Natural logarithm of the number of buses shared by 10,000 people. | - |

| Medical | Natural logarithm of the number of beds in medical institutions shared by 10,000 people. | - |

| Variable | Mean | Std. Dev. | Min | Median | Max |

|---|---|---|---|---|---|

| PGDP | 10.607 | 0.537 | 8.981 | 10.623 | 11.939 |

| Salary | 10.897 | 0.414 | 10.006 | 10.906 | 11.989 |

| HP | 8.592 | 0.518 | 7.692 | 8.516 | 10.530 |

| Unemployment | 1.217 | 0.229 | 0.182 | 1.253 | 1.629 |

| Openness | 3.266 | 0.972 | 0.916 | 2.997 | 5.499 |

| Innovation | 7.298 | 1.761 | 1.386 | 7.402 | 10.883 |

| Investment | 9.064 | 1.008 | 5.767 | 9.208 | 10.939 |

| Edu | 2.238 | 0.087 | 1.951 | 2.230 | 2.551 |

| PGreen | 2.675 | 0.603 | 1.078 | 2.645 | 4.053 |

| Transport | 1.105 | 0.511 | −0.120 | 1.105 | 2.501 |

| Medical | 3.716 | 0.321 | 1.116 | 3.766 | 4.278 |

| Dependent Variable | PGDP | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Variable | Full Sample | Full Sample | Full Sample | Full Sample |

| Salary | 0.814 *** (44.58) | 0.372 *** (6.34) | 0.297 *** (4.66) | 1.469 *** (6.37) |

| HP | 0.155 *** (2.85) | 1.770 *** (5.70) | ||

| Salary × HP | −0.146 *** (−5.28) | |||

| Unemployment | −0.168 *** (−2.63) | −0.172 *** (−2.72) | −0.180 *** (−2.96) | |

| Openness | 0.078 *** (3.70) | 0.075 *** (3.61) | 0.041 * (1.93) | |

| Innovation | 0.058 *** (3.12) | 0.046 ** (2.48) | 0.063 *** (3.47) | |

| Edu | 1.116 *** (3.44) | 1.117 *** (3.48) | 1.188 *** (3.85) | |

| PGreen | 0.029 (1.09) | 0.018 (0.68) | 0.011 (0.44) | |

| Transport | 0.016 (0.33) | 0.023 (0.47) | 0.032 (0.70) | |

| Medical | 0.188 *** (4.99) | 0.189 *** (5.07) | 0.156 *** (4.29) | |

| Province fixed effect | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.949 | 0.964 | 0.965 | 0.968 |

| N | 370 | 370 | 370 | 370 |

| Dependent Variable | PGDP | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Variable | Full sample | East China | Central China | Western China |

| Salary | 1.469 *** (6.37) | 1.334 *** (3.78) | 1.611 *** (3.26) | 2.779 *** (3.74) |

| HP | 1.770 *** (5.70) | 1.649 *** (3.30) | 1.906 *** (3.21) | 3.539 *** (3.74) |

| Salary × HP | −0.146 *** (−5.28) | −0.122 *** (−2.82) | −0.155 *** (−2.98) | −0.328 *** (−3.71) |

| Unemployment | −0.180 *** (−2.96) | −0.119 (−1.41) | −0.085 (−0.49) | −0.150 (−1.25) |

| Openness | 0.041 * (1.93) | 0.005 (0.12) | −0.014 (−0.30) | 0.019 (0.62) |

| Innovation | 0.063 *** (3.47) | 0.072 *** (2.78) | 0.057 (1.32) | 0.091 ** (2.60) |

| Edu | 1.188 *** (3.85) | 0.740 *** (1.42) | 1.184 (0.23) | 1.530 *** (3.13) |

| PGreen | 0.011 (0.44) | −0.068 ** (−2.19) | −0.153 (−1.29) | 0.140 ** (2.53) |

| Transport | 0.032 (0.70) | −0.074 (−0.83) | 0.029 (0.24) | 0.111 (1.42) |

| Medical | 0.156 *** (4.29) | 0.102 *** (2.88) | 0.267 (1.20) | 0.362 *** (2.48) |

| Province fixed effect | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.968 | 0.976 | 0.967 | 0.958 |

| N | 370 | 144 | 106 | 120 |

| Dependent Variable | PGDP | |

|---|---|---|

| (1) | (2) | |

| Variable | S-GMM model 1 | S-GMM model 2 |

| L.PGDP | 1.031 *** (0.041) | 1.108 *** (0.042) |

| Salary | 0.074 ** (0.029) | 1.177 *** (0.212) |

| HP | 1.535 *** (0.295) | |

| Salary × HP | −0.133 *** (0.026) | |

| Province fixed effect | Yes | Yes |

| p-value of AR (1) | 0.22 | 0.21 |

| p-value of AR (2) | 0.13 | 0.27 |

| p-value of Hansen stat. | 0.95 | 0.58 |

| N | 370 | 370 |

| Dependent Variable | Revenue | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Variable | Full Sample | East China | Central China | Western China |

| Salary | 2.213 *** (0.561) | 2.814 *** (0.833) | 4.181 *** (1.025) | 8.410 *** (1.528) |

| HP | 4.357 *** (0.756) | 5.263 *** (1.177) | 6.742 *** (1.230) | 11.605 *** (1.946) |

| Salary × HP | −0.382 *** (0.067) | −0.450 *** (0.101) | −0.570 *** (0.108) | −1.030 *** (0.182) |

| Province fixed effect | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.962 | 0.959 | 0.913 | 0.977 |

| N | 370 | 144 | 106 | 120 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shen, C.; Sheng, T.; Shi, X.; Fang, B.; Lu, X.; Zhou, X. The Relationship between Housing Price, Teacher Salary Improvement, and Sustainable Regional Economic Development. Land 2022, 11, 2190. https://doi.org/10.3390/land11122190

Shen C, Sheng T, Shi X, Fang B, Lu X, Zhou X. The Relationship between Housing Price, Teacher Salary Improvement, and Sustainable Regional Economic Development. Land. 2022; 11(12):2190. https://doi.org/10.3390/land11122190

Chicago/Turabian StyleShen, Chaohai, Tong Sheng, Xingheng Shi, Bingquan Fang, Xiaoqian Lu, and Xiaolan Zhou. 2022. "The Relationship between Housing Price, Teacher Salary Improvement, and Sustainable Regional Economic Development" Land 11, no. 12: 2190. https://doi.org/10.3390/land11122190

APA StyleShen, C., Sheng, T., Shi, X., Fang, B., Lu, X., & Zhou, X. (2022). The Relationship between Housing Price, Teacher Salary Improvement, and Sustainable Regional Economic Development. Land, 11(12), 2190. https://doi.org/10.3390/land11122190