1. Introduction

In January 2020, Coronavirus Disease 2019 (COVID-19) broke out in Wuhan and spread rapidly. Since the Spring Festival is the period when the population flows most numerously and frequently across provinces and cities in China, COVID-19 quickly spread from Wuhan to economically developed areas across the country. As a region with close economic ties with Wuhan, the Yangtze River Delta and its cities bore the brunt of the impact. Shanghai, Hangzhou, Wenzhou, Taizhou and other places have become the hardest-hit areas of the pandemic. As of 24 March 2020, a total of 81,747 confirmed cases and 3283 deaths have been reported nationwide. In terms of the speed of transmission and the number of infections, COVID-19 far exceeds SARS, which gave the world its first coronavirus epidemic in 2003.

As a serious public health crisis event, the pandemic has disrupted the normal economic order of human society, thereby affecting the expectations of producers, consumers and investors. Without effective control, the pandemic could cause huge economic and property losses in human society. In order to alleviate the impact of the pandemic on the economy, various countries have adopted the method of increasing the supply of money. This led to a rise in real estate prices in the United States, China and other countries. However, the effort to boost economies using loose monetary policies is national, and the various cities within each country are affected by the pandemic differently. Therefore, it is possible to compare the impact of different degrees of the COVID-19 pandemic on urban real estate prices.

Scholars have often discussed the short-term and long-term economic impacts of the series of sudden public crises presented by the pandemic, but they have not reached a consensus.

Some scholars have examined the impact of public crises, such as plague, explosions and floods, on surrounding asset prices. They believe that, in the short term, public crisis events have a significant inhibitory effect on asset prices, but in the long term, the negative impact will disappear [

1,

2,

3,

4]. Huang et al. found that after the explosion of Tianjin Port in 2015, the surrounding housing prices dropped by an average of 24%, but returned to normal within a few months [

5]. Rajapaksa et al. investigated the impact of floods on Brisbane housing prices. The study found that flooding caused real estate prices in the disaster area to drop by 5%. However, housing prices in high-income suburbs began to recover after two years, while housing prices in low-income suburbs continued to decline [

6]. Wong analyzed the impact of 2003’s SARS outbreak on the weekly real-estate prices Hong Kong and found that the real estate market was not excessively affected: average housing prices dropped by 1–3% [

7]. In the 10 years following that epidemic, housing prices in Hong Kong rose rapidly. It can, therefore, be seen that the impact of the epidemic was short-lived and controllable. The government can stimulate the rapid recovery of the economy through macro-policy intervention and solve the problem of market failure caused by the pandemic.

At present, the research into the short-term and medium-term impact of COVID-19 pandemic on the real estate market is also gradually emerging [

8,

9]. Tomal used a GJR-GARCHX model to investigate the impact of COVID-19 pandemic waves on real estate stock returns, and found that pandemic outbreak had a limited impact on real estate company stocks. The first pandemic wave only led to a decline in stock returns in the US [

10]. Allan et al. examined the contemporary effect of the COVID-19 pandemic on commercial property rent dynamics in the Asia-Pacific region and the research showed that the impact was detrimental but could be moderated by fiscal stimuli [

11]. Cheung et al. applied a price gradient analysis to identify the pandemic’s impact and found that the risk of COVID-19 pandemic is localized and transitory [

12]. Del Giudice et al. developed a real estate pricing model, Lotka–Volterra, and found that the housing prices drop by 4.16% in the short term and 6.49% in the mid-term [

13].

However, other research found that public crises have a long-term and continuously negative impact on urban economic development. In 1918, the Spanish Flu not only caused 40 million infections, but also caused a sharp drop in housing prices in the United States after World War I. Despite the gradual recovery of the economy, the real estate market remained at a low ebb for a long time [

14]. Ambrus et al. studied the short-term and long-term effects on rents of a cholera outbreak that occurred in London’s Broad Street in 1854. The study showed that ten years after the outbreak of cholera, the rent value of houses in the local area had dropped by about 15%, and they remained in a state of low value for more than 160 years [

15].

Some researchers believe that the impact of public crises on asset prices is not necessarily entirely negative. Hornbeck and Keniston regarded the Boston Fire in 1872 as a quasi-natural experiment. They found that the prices of the land destroyed by the fire had risen by 15% a year later. The reconstruction after the fire also led to an increase in land prices in the surrounding unburnt areas [

16]. The United States, despite becoming a serious disaster area in the COVID-19 pandemic, has shown “unprecedented prosperity” in its residential real estate market. In May 2020, data released by the National Association of Realtors (NAR) showed that the annual sales rate of housing in the United States in August increased by 2.4% on a month-by-month basis, reaching a new high following its peak in December 2006.

Therefore, the impact of public crisis on asset prices is complex and heterogeneous. The extent and direction of its impact involves not only the severity of the crisis itself, but may also be closely related to people’s perception of risk, the government’s governance and prevention abilities, regional resource endowment, and urban resilience.

In the face of complex public crises with highly uncertain risk profiles, the traditional strategy of passive disaster reduction and prevention has been unable to ensure the safety of people and property and realize the sustainable development of urban economies. As a result, the scholars’ research on crisis management has gradually changed from a defensive and fragile perspective to an urban resilience perspective. Holling describes resilience as an ecosystem’s ability to continue to perform its existing functions when changes occur [

17]. The strength of the system’s resilience determines the maintenance of the system’s relationship and how the system absorbs the changes. To be more specific, the resilience is defined as how fast a system that has been displaced from equilibrium by a disturbance or shock returns to that equilibrium. Meerow et al. further believe that “urban resilience refers to the ability of an urban system, and all its constituent socio-ecological and socio-technical networks across temporal and spatial scales, to maintain or rapidly return to desired functions in the face of a disturbance, to adapt to change, and to quickly transform systems that limit current or future adaptive capacity” [

18]. Alberti et al. also propose that urban resilience can be understood as the ability and extent to absorb and resolve changes before urban structural changes are reorganized [

19]. James Simmie argues that the regional economic resilience is the capacity of a local economy to maintain, resume or improve its historical growth path, and the output, employment, income and welfare associated with it, following the immediate impacts of unpredictable external or endogenous shocks, by adapting or reconfiguring its economic, social and institutional structures and arrangements in order to do so [

20]. Ron Martin distinguishes four main dimensions of economic resilience: resistance, recovery, re-orientation, and renewal. Then, he expands the definition of regional economic resilience as the capacity of a regional or local economy to withstand or recover from market, competitive and environmental shocks to its developmental growth path, if necessary by undergoing adaptive changes to its economic structures and its social and institutional arrangements, so as to maintain or restore its previous developmental path, or transit to a new sustainable path characterized by a fuller and more productive use of its physical, human and environmental resources [

21].

Although the academic definition of urban resilience is complex, some scholars have condensed urban resilience into three aspects (maintenance, resistance and recovery) and construct new indicators to evaluate the strength of urban resilience after public crises. Chen et al. explore the relationship between urban resilience and important factors such as population shift, population, city size, and medical resource reserves through the lens of the COVID-19 pandemic. Their study uses the period from the day of the first confirmed case of COVID-19 to the day after three successive days without a confirmed COVID-19 case to measure the urban resilience [

22]. Meanwhile, Zhang et al. used the intra-city travel intensity index in Baidu Migration Data and built the Relative Return-to-Work Index to measure the degree of urban economic recovery after the epidemic [

23]. It can, therefore, be seen that there are various measures of urban resilience under abnormal conditions. From the perspectives of crisis control, economic recovery and population mobility, indicators can be found to assess the strength of urban resilience. However, this paper believes that the above indicators are still relatively unsophisticated when measuring urban resilience. For example, Chen only considers the resilience of different cities in terms of controlling the spread of the disease, which is mainly reflected in the maintenance and resistance dimensions of urban resilience. However, this method of measurement ignores the recovery dimension. In the actual practice of disease control, many cities in China have achieved good results in controlling the spread of the COVID-19 through administrative but compulsory measures, such as the suspension of work and school, and issuing “road cards” to restrict population travel. However, the economic cost of these control measures has not been taken into account. In addition, although the Return-to-Work Index constructed by Zhang accounts for the dimension of urban economic recovery, its calculations will be affected by cross-regional migration during the Spring Festival, so it cannot accurately reflect the true urban resumption of production and work.

Building on the existing literature, an exploratory theoretical framework has been constructed. In the market, real estate prices will change with the adjustment of supply and demand. As a serious public health crisis, the COVID-19 pandemic threatens people’s lives. At the same time, it also brings huge risks to the sustainable development of the city’s economy. On the demand side, in order to ensure the safety of people, the government has appealed for people to stay at home and reduce unnecessary travel. These measures have largely restrained the consumption or investment demands in the real estate market, leading to a sharp drop in real estate transaction volume compared with that during the Spring Festival period.

However, urban resilience can alleviate the negative impact of the epidemic on the real estate market. Theoretically, urban resilience can enhance people’s confidence in consumption and investment in the real estate market, for those who perceived the risk of public crises. If local governments have achieved good results in controlling the spread of the epidemic and restoring urban economic, this means that the city is safer for investors and consumers, and that the urban resilience is stronger. Therefore, the cities have actually sent a signal of greater resilience to domestic and international talents and capital through this crisis. While stabilizing the investment expectations of the natives, they also attracted more foreign investors and consumers. Finally, more investment and population inflow can speed up the recovery of the local real estate market.

Based on the theoretical framework, this paper regards the COVID-19 pandemic as a quasi-natural experiment, selects the real estate market in the Yangtze River Delta as the analysis object, and uses the Difference in Difference model to investigate the short-term impact of the COVID-19 on the prices of residential land and houses in the Yangtze River Delta. In addition, the research also reconstructs the urban Return-to-Work Index as a proxy variable of urban resilience, and performs an in-depth analysis of the impact of urban resilience on real estate prices. Finally, based on the results of the empirical test, reasonable policy recommendations are put forward to restore the vitality of the real estate market, attracting talent and capital inflow, and improving government governance and urban resilience.

In terms of research contributions, this study firstly uses the background of the COVID-19 pandemic to re-evaluate urban resilience using intra-city travel intensity data, and measures resilience to the impact of the pandemic from the three previously described aspects of maintenance, resistance and recovery. In addition, the research clarifies the relationship between the COVID-19 pandemic, urban resilience and real estate prices, and found that urban resilience alleviated the negative impact of the epidemic on the real estate market, and provided some policy recommendations for the prevention and control of public crisis and urban governance. Secondly, in order to capture the net effect of public crises, the existing literature has mostly constructed traditional DID models by setting the interaction terms of dummy variables to identify the differences in spatial and temporal dimensions. As the spread of COVID-19 has been both rapid and extensive, there are few cities that have not been impacted. Subjective grouping will lead to inaccurate model recognition. Based on these considerations, this paper chooses a continuous DID model and constructs the continuous variable, the severity of the pandemic, as the core explanatory variable. This can, therefore, identify the changes in real estate prices caused by the differences in pandemic severity in various cities.

4. Further Discussions

A large number of empirical studies have confirmed the negative impact on asset prices of public crises such as epidemics, floods and nuclear leaks [

28]. In the short term, the more serious the crisis, the greater the decline in asset prices; however, the long-term impact of the crisis is more controversial. The differences in economic development level and resource endowment between regions may lead to the heterogeneity of the impact.

This research uses the DID model to confirm that, after removing other disruptive factors, the more severely affected a city is by the pandemic in the Yangtze River Delta, the more rapidly the price of new houses and residential land will decline in the short term. In recent years, the cities in Yangtze River Delta have been an economic benchmark for other cities in transforming development patterns, optimizing economic structure and transforming growth momentum. However, the sudden COVID-19 outbreak added great uncertainty to urban economic development. Most of the cities are facing production stagnation, consumption and investment demand decline, as well as other serious problems. Specifically, due to the COVID-19 pandemic and in light of the fact that the virus is highly contagious and harmful, the China Real Estate Association proposed on January 26 that “real estate development companies should temporarily stop sales office activities and resume after the epidemic” (Available online:

http://www.fangchan.com/prefecture/41/2020-01-26/6627165527213412844.html accessed on 10 December 2020). In late January, real estate turnover plummeted 95% compared with the previous Spring Festival period. Before mid-February, most of the sales offices were essentially closed, the demand for homes was suppressed, and real estate sales decreased significantly in the short term. Sales obstruction increased the pressure on capital turnover for real estate enterprises, and the ability to acquire land and build houses has declined in the short term. In terms of production and construction, some cities with severe outbreaks will continue to postpone their resumption. Workers cannot return to work, and scheduled development projects are continuously delayed. According to “the land price test report of major cities in China in the first quarter of 2020”, the growth rate of residential land prices in major cities decreased by 0.32% compared with the previous quarter (Available online:

http://gi.mnr.gov.cn/202004/t20200417_2508842.html accessed on 10 December 2020). Based on this, in the short term, both supply and demand in the real estate markets in the Yangtze River Delta have been negatively affected by the pandemic and entered a period of stagnation, and the real estate market prices have been suppressed as a result.

In addition to the direct impact of the pandemic, asset price changes also depend on the adjustment of a series of investment or consumption decisions based on the risk perception of public crises [

29]. Behavioral economics and psychological theories have pointed out that people’s perceived risk of public crisis events is different from the actual risks as assessed and determined by experts. Perceived risks are not only derived from the hazards of the incident itself, but also affected by factors such as government control capabilities, regional resource endowments and media propaganda [

30,

31]. The size of the perceived risk will eventually make people adjust the structure and direction of investment and consumption, thereby affecting the changes in asset prices.

From the perspective of epidemic prevention consequences, local authorities in China have shown completely different governance capabilities, so the government is not a “monolithic” one. Different crisis management capabilities of local governments directly lead to great differences in their urban resilience. In the process of combatting the pandemic, the central authorities in China issued a guideline “on the premise of ensuring effective epidemic control, accelerating the restoration of production and living order, and successfully completing all the work for economic and social development” (Available online:

https://baijiahao.baidu.com/s?id=1662541336518395006&wfr=spider&for=pc accessed on 24 August 2021). The local authorities were required to implement differentiated combatting strategies. Therefore, local authorities have greater autonomy in formulating and implementing specific epidemic prevention strategies. Central authorities will monitor the local epidemic prevention performance. On the one hand, they encourage and promote good local policy innovations. On the other hand, they promptly curb local authorities from using the power of epidemic prevention to disrupt the production and living order.

For example, after the outbreak of the epidemic, the Wuhan Government not only failed to disclose important information in time, but also did not take effective measures to control the spread of the virus, causing panic and outflow among the people. In contrast, in Henan Province, in order to achieve good epidemic prevention results, the local government adopted a “one size fits all” blockade policy. For example, the main roads were cut off, the basic demands for living were restricted, and public power was not constrained under the cloak of epidemic prevention. The epidemic was quickly controlled, but this also severely disrupted the normal order of life and production in the city. However, the Hangzhou government has balanced the relationship between epidemic control and economic recovery well. It was the first to introduce a “health code” system and implement the three-color dynamic management of “green code, red code, and yellow code” for citizens and those who intend to enter Hangzhou. A large number of people returned to work after applying for health codes. The “health code” system played an important role in restoring the normal operation of Hangzhou’s economy while carrying out effective epidemic management for citizens. Due to the “health code”, the system has achieved good epidemic prevention consequences. Therefore, the central authority has promoted it in all parts of the country and realized the mutual recognition of “health codes” in various regions.

The introduction of various public policies is an important manifestation of urban resilience under abnormal conditions. Therefore, the COVID-19 pandemic is not only a crisis, but also a test of the social governance system, governance capabilities and urban resilience [

32,

33].

The cities that achieved good pandemic prevention results conveyed strong signals to talent and capital in both domestic and international markets. A large number of studies have shown that the formation of the market and profitable space is inseparable from the support of local governance. The quality of public services provided by local governments under normal and abnormal conditions will determine the strength of urban resilience, thereby affecting people’s investment and consumption choices. Cities with higher resilience tend to have an advantage in the competition, attracting capital and talent between cities. More investment and population inflow will be more conducive to the development of the urban real estate market. It will have a positive effect on the residential housing and land prices [

34]. The empirical results of this paper also show that urban resilience can effectively withstand the negative impact of the COVID-19 pandemic on the urban real estate market. The stronger the urban resilience, the faster housing and residential land prices will recover.

5. Conclusions and Outlook

5.1. Conclusions

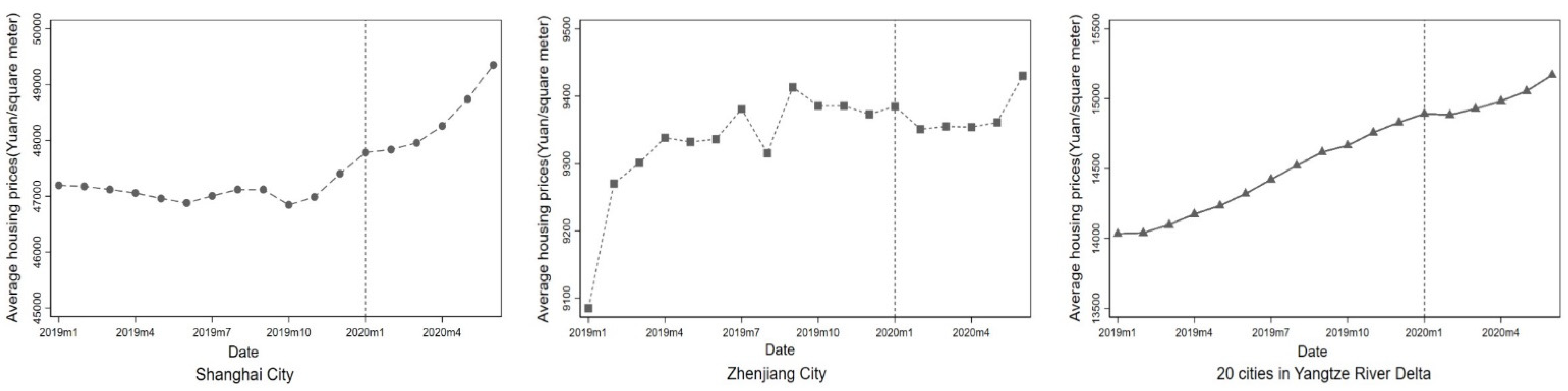

The COVID-19 pandemic has severely disrupted the normal order of the Chinese economy and brought the real estate market to a standstill. In order to ensure the safety of people’s lives and property and to ease the pressure of the economic downturn, the central government formulated guidelines for “scientific and precise prevention and control” and local governments also launched an emergency response mechanism for major public health emergencies. These measures consolidated people’s confidence in investment and consumption and promoted the gradual recovery of the city’s main asset prices. The empirical results of this study show that, in the short term, the COVID-19 pandemic has had a significant negative effect on the prices of new houses and residential land in the Yangtze River Delta. As a benchmark for China’s regional economy, real estate prices in the Yangtze River Delta have generally maintained an upward trend in recent years. However, the pandemic has led to large differences in the price fluctuations in houses and residential land in various cities. Specifically, for every additional unit of pandemic severity, the prices of new houses and residential land will drop by 1.5% and 13.7%, respectively.

In addition, this study also confirmed the positive effect of urban resilience signals on the urban housing and residential land markets during the pandemic. The pandemic’s severity has tested both the Chinese government’s governance ability and Chinese urban resilience in extraordinary conditions. In the early stage of the pandemic, different local governments also fully exerted their autonomy and initiative to implement a series of pandemic response measures, and quickly received feedback. Some cities gradually resumed economic production while controlling the spread of the disease via digital means. However, others have violated basic market regulations in order to achieve pandemic prevention targets. Therefore, the strength of resilience in different cities can be fully demonstrated through the efficiency of production and work resumption. While controlling the pandemic, cities with stronger resilience also actively promote the resumption of production and work, meaning that urban vitality recovers faster. However, cities with weak resilience often cannot balance the relationship between pandemic control and the resumption of work, and urban vitality recovers more slowly. The urban resilience signals transmitted through the pandemic response effect will then affect the flow of talent or capital between various cities. Therefore, this study used marginal travel intensity as an indicator of urban resilience, and constructed a generalized DID model. This found that cities with stronger resilience will send stronger signals, and its new housing and residential land markets will also recover faster from the negative impact of the pandemic.

5.2. Policy Implications

In this crisis, the stable operation of the urban real estate market is inseparable from the effective control of the pandemic. This study shows that the more severe the pandemic, the greater the negative impact on the real estate market. Therefore, only by controlling the highly contagious and harmful coronavirus within the minimum range in the shortest time can the negative impact of the pandemic be minimized.

First, as the main implementer of pandemic prevention and control, the government should not only adopt administrative control methods, but also actively mobilize social forces to improve the efficacy of resource allocation. Besides this, governments should fully endorse people’s autonomy in pandemic prevention; guide the people to realize the seriousness of the pandemic through publicity, education, information disclosure and other means; and enhance their risk perception within a short time, so as to make scientific consumption or investment decisions.

Second, the government should attach importance to the value of social organizations in epidemic and pandemic prevention, embed the strength of social organizations into the whole national epidemic prevention system, and maximize allocation efficiency according to the respective resource advantages of multiple subjects.

Third, local governments should improve urban resilience, cope with the uncertainty of urban risk by making use of resilience thinking, and allow for the management of uncertain risks and the construction of resilient cities under normal conditions to be effectively connected. It is important to balance the relationship between epidemic control and economic development. The examination of the pandemic confirms that the resilience of Chinese cities is uneven. The construction of governance systems under abnormal conditions in some regions is still in the exploratory stage. A lot of experience has been gained and lessons learned in epidemic control. Some cities have also created a precedent in their digital management of the pandemic. Some measures are promoted nationwide, such as those of Hangzhou and Shanghai. The empirical results of this paper show that the improvement in urban resilience can not only minimize the negative impact of the pandemic on asset prices, but also accelerate the recovery of urban asset prices in the pandemic’s aftermath. Stronger resilience often means that, in conjunction with effective control of the pandemic, the city’s vitality will recover faster, and the resumption of production and work will proceed more efficiently. People will also prefer to invest or consume in such a city, thereby attracting more capital and increasing the population. Therefore, in order to improve governance capabilities, local governments should actively promote digital transformation and fully accept the potential role of big data in crisis management. It is vital to strengthen learning among cities, break information islands, realize governance transformation and construct resilient cities as soon as possible. In the end, the healthy and sustainable development of the real estate market in the Yangtze River Delta will be realized.

5.3. Outlook for the Research

In future research, alongside the enrichment of data, it is important to compare the trends of housing prices in different countries and regions before and after the epidemic under the influence of various monetary policies, cultures, investors’ uniqueness and the competences of public authorities.