Will Rural Collective-Owned Commercial Construction Land Marketization Impact Local Governments’ Interest Distribution? Evidence from Mainland China

Abstract

1. Introduction

2. Literature Review

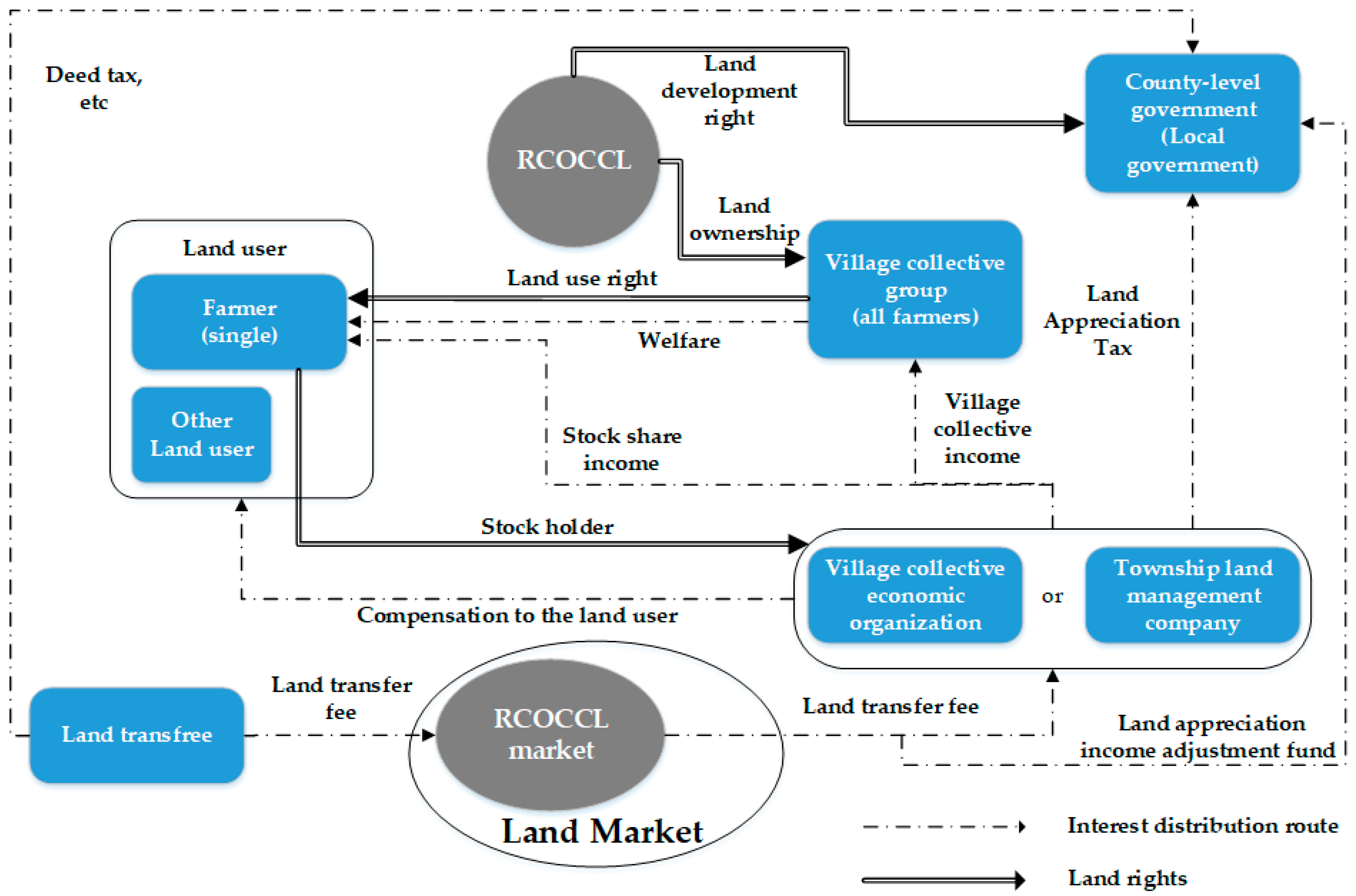

3. Interest Distribution Framework of Rural Collective-Owned Commercial Construction Land Marketization

4. Materials and Methods

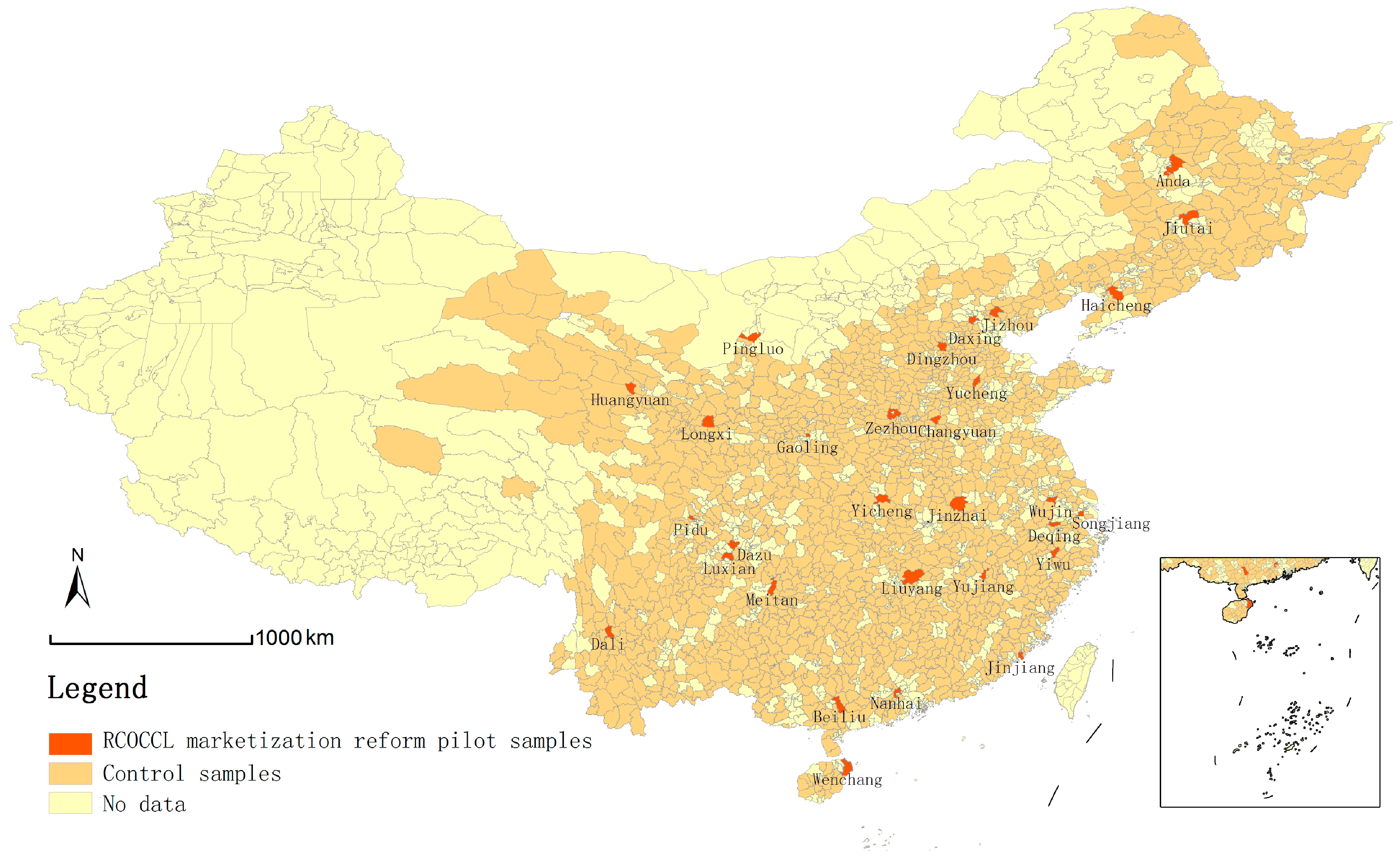

4.1. Selection of Study Samples

4.2. Establishment of Empirical Model

4.2.1. Difference-in-Difference Method

4.2.2. Variable Selection

Dependent Variable

Difference-in-Difference Analysis Variables

Control Variables

4.2.3. Empirical Model Construction

Fixed-Effects Difference-in-Difference Model

Propensity Score-Matching Difference-in-Difference (PSM-DID) Method

4.3. Data Source and Preparation

5. Results

5.1. Results of the Fixed-Effects DID Model

5.2. Robustness Test of the DID Model

5.2.1. Results of the Counterfactual Test

5.2.2. Results of the PSM-DID Method

5.2.3. Results of the Heckman Two-Step Method

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Descriptive Statistics of Variables

| Year | Variable | Min | Max | Mean | Standard Deviation | Median |

| 2010 | GR | 300.0 | 1,631,331.0 | 56,371.9 | 108,144.5 | 28,305.0 |

| HRPS | 1.0 | 233.0 | 52.4 | 35.7 | 44.0 | |

| GDP | 11,200.0 | 21,002,800.0 | 1,116,947.7 | 1,597,056.7 | 700,600.0 | |

| PSTI | 0.023 | 0.994 | 0.775 | 0.124 | 0.787 | |

| RD | 2600.0 | 15,448,609.0 | 626,432.6 | 910,742.4 | 406,828.0 | |

| GVIE | 100.0 | 65,908,022.0 | 1,738,703.2 | 3,961,337.5 | 638,597.0 | |

| PD | 0.2 | 2727.3 | 336.3 | 294.5 | 235.0 | |

| 2011 | GR | 485.0 | 2,002,188.0 | 73,250.7 | 130,060.6 | 37,418.0 |

| HRPS | 1.0 | 236.0 | 52.6 | 36.1 | 44.0 | |

| GDP | 13,348.1 | 22,570,284.0 | 1,228,677.8 | 1,718,190.7 | 765,798.1 | |

| PSTI | 0.030 | 0.994 | 0.769 | 0.125 | 0.779 | |

| RD | 4383.0 | 16,301,524.0 | 723,712.5 | 1,000,984.2 | 479,110.0 | |

| GVIE | 100.0 | 72,822,072.0 | 2,154,756.0 | 4,566,898.9 | 851,688.0 | |

| PD | 0.2 | 2727.3 | 338.3 | 299.0 | 236.8 | |

| 2012 | GR | 872.0 | 2,202,750.0 | 88,607.0 | 145,898.0 | 47,153.0 |

| HRPS | 1.0 | 238.0 | 52.7 | 36.2 | 44.0 | |

| GDP | 15,496.2 | 24,137,769.0 | 1,340,386.2 | 1,842,292.8 | 840,627.6 | |

| PSTI | 0.108 | 0.994 | 0.766 | 0.129 | 0.777 | |

| RD | 8952.0 | 18,232,871.0 | 860,276.0 | 1,143,143.1 | 575,852.0 | |

| GVIE | 100.0 | 76,868,173.0 | 2,418,879.1 | 4,841,973.1 | 1,010,697.5 | |

| PD | 0.3 | 2696.6 | 338.7 | 297.5 | 237.8 | |

| 2013 | GR | 1082.0 | 2,435,188.0 | 109,751.1 | 169,523.7 | 59,612.0 |

| HRPS | 1.0 | 242.0 | 52.9 | 36.5 | 44.0 | |

| GDP | 18,004.0 | 29,200,800.0 | 1,653,603.2 | 2,200,118.6 | 1,048,722.0 | |

| PSTI | 0.319 | 0.994 | 0.798 | 0.108 | 0.808 | |

| RD | 201.0 | 19,715,140.0 | 995,126.6 | 1,276,898.5 | 673,966.0 | |

| GVIE | 100.0 | 81,572,964.0 | 2,747,876.4 | 5,260,945.3 | 1,173,290.0 | |

| PD | 0.2 | 2809.0 | 340.1 | 300.2 | 238.4 | |

| 2014 | GR | 1292.0 | 2,636,593.0 | 120,321.4 | 189,101.7 | 64,117.5 |

| HRPS | 1.0 | 243.0 | 53.2 | 36.7 | 44.0 | |

| GDP | 21,300.0 | 30,007,053.0 | 1,772,049.8 | 2,333,464.5 | 1,128,448.0 | |

| PSTI | 0.311 | 0.994 | 0.802 | 0.106 | 0.813 | |

| RD | 7429.0 | 20,812,189.0 | 1,111,478.6 | 1,359,950.8 | 763,480.5 | |

| GVIE | 101.0 | 78,523,910.0 | 3,008,304.1 | 5,511,444.5 | 1,291,493.5 | |

| PD | 0.2 | 2809.0 | 341.9 | 301.2 | 239.4 | |

| 2015 | GR | 2614.0 | 2,847,589.0 | 126,824.9 | 204,514.9 | 65,280.0 |

| HRPS | 1.0 | 246.0 | 53.2 | 36.8 | 44.0 | |

| GDP | 23,189.0 | 30,800,198.0 | 1,851,434.8 | 2,395,443.2 | 1,188,088.0 | |

| PSTI | 0.297 | 0.992 | 0.803 | 0.106 | 0.813 | |

| RD | 14,810.0 | 22,256,788.0 | 1,247,966.9 | 1,482,458.9 | 872,426.5 | |

| GVIE | 101.0 | 82,709,675.0 | 3,140,648.7 | 5,688,341.8 | 1,327,365.5 | |

| PD | 0.2 | 2809.0 | 342.8 | 302.9 | 239.3 | |

| 2016 | GR | 2174.2 | 2,791,485.1 | 117,815.8 | 196,171.5 | 60,444.0 |

| HRPS | 1.0 | 244.0 | 53.5 | 37.0 | 44.0 | |

| GDP | 25,613.8 | 27,661,996.0 | 1,735,578.7 | 2,237,672.5 | 1,101,613.6 | |

| PSTI | 0.386 | 0.993 | 0.825 | 0.094 | 0.834 | |

| RD | 14,603.4 | 21,048,171.0 | 1,228,735.0 | 1,424,355.8 | 860,517.6 | |

| GVIE | 102.0 | 83,832,389.0 | 3,282,341.4 | 5,920,942.3 | 1,359,987.5 | |

| PD | 0.2 | 140,000.0 | 477.2 | 3739.5 | 242.1 | |

| 2017 | GR | 1292.8 | 3,085,497.2 | 125,721.5 | 217,713.9 | 64,480.0 |

| HRPS | 1.0 | 247.0 | 53.6 | 37.4 | 44.0 | |

| GDP | 25,872.9 | 30,813,501.0 | 1,893,669.6 | 2,512,522.2 | 1,185,127.8 | |

| PSTI | 0.382 | 0.993 | 0.838 | 0.093 | 0.851 | |

| RD | 16,139.6 | 21,654,279.0 | 1,349,839.5 | 1,523,119.7 | 961,750.0 | |

| GVIE | 50.0 | 86,819,784.0 | 3,541,701.0 | 6,307,144.3 | 1,445,835.9 | |

| PD | 0.2 | 3033.7 | 346.0 | 308.5 | 243.0 | |

| 2018 | GR | 0.0 | 4,308,273.3 | 137,517.7 | 257,467.8 | 70,724.8 |

| HRPS | 1.2 | 247.4 | 53.6 | 37.3 | 44.3 | |

| GDP | 28,385.0 | 33,542,675.3 | 2,025,306.6 | 2,684,352.0 | 1,251,747.5 | |

| PSTI | 0.373 | 0.993 | 0.840 | 0.092 | 0.854 | |

| RD | 17,008.8 | 23,311,821.9 | 1,503,455.4 | 1,682,044.9 | 1,064,535.6 | |

| GVIE | 100.0 | 89,807,178.0 | 3,806,290.5 | 6,702,655.2 | 1,534,847.0 | |

| PD | 0.2 | 3078.7 | 346.7 | 309.6 | 243.5 |

Appendix B. Variation of Standardization Deviation of Characteristic Indicators

| Year | Variables | Matching Situation | Standardization Deviation | Variation of Standardization Deviation | t | p |

| 2010 | HRPS | Before | 67.16% | 90.11% | 3.572 | 0.001 |

| After | 6.64% | 0.253 | 0.801 | |||

| GDP | Before | 70.70% | 99.68% | 2.878 | 0.008 | |

| After | −0.23% | −0.009 | 0.993 | |||

| PD | Before | 66.82% | 93.46% | 3.123 | 0.004 | |

| After | 4.37% | 0.166 | 0.869 | |||

| PSTI | Before | 52.81% | 85.73% | 4.583 | 0 | |

| After | −7.54% | −0.287 | 0.775 | |||

| GVIE | Before | 52.80% | 99.48% | 2.178 | 0.038 | |

| After | −0.28% | −0.011 | 0.992 | |||

| RD | Before | 66.95% | 81.71% | 2.621 | 0.014 | |

| After | 12.24% | 0.466 | 0.643 | |||

| 2011 | GDP | Before | 72.05% | 94.32% | 2.936 | 0.007 |

| After | 4.09% | 0.156 | 0.877 | |||

| HRPS | Before | 68.57% | 83.33% | 3.64 | 0.001 | |

| After | 11.43% | 0.435 | 0.665 | |||

| PD | Before | 68.13% | 62.10% | 3.159 | 0.004 | |

| After | 25.82% | 0.983 | 0.33 | |||

| PSTI | Before | 65.63% | 93.26% | 3.761 | 0.001 | |

| After | −4.42% | −0.168 | 0.867 | |||

| RD | Before | 68.32% | 85.86% | 2.68 | 0.012 | |

| After | 9.66% | 0.368 | 0.714 | |||

| GVIE | Before | 55.29% | 91.93% | 2.315 | 0.028 | |

| After | 4.46% | 0.17 | 0.866 | |||

| 2012 | PD | Before | 68.09% | 89.15% | 3.159 | 0.004 |

| After | −7.39% | −0.281 | 0.779 | |||

| PSTI | Before | 62.31% | 90.25% | 3.528 | 0.001 | |

| After | −6.08% | −0.231 | 0.818 | |||

| GVIE | Before | 55.25% | 85.65% | 2.317 | 0.028 | |

| After | 7.93% | 0.302 | 0.764 | |||

| RD | Before | 70.74% | 83.92% | 2.777 | 0.01 | |

| After | 11.37% | 0.433 | 0.667 | |||

| HRPS | Before | 67.79% | 94.44% | 3.571 | 0.001 | |

| After | −3.77% | −0.144 | 0.886 | |||

| GDP | Before | 73.06% | 88.51% | 2.981 | 0.006 | |

| After | 8.39% | 0.32 | 0.75 | |||

| 2013 | HRPS | Before | 64.32% | 93.50% | 3.355 | 0.002 |

| After | −4.18% | −0.159 | 0.874 | |||

| GDP | Before | 74.80% | 92.85% | 3.066 | 0.005 | |

| After | 5.35% | 0.204 | 0.839 | |||

| RD | Before | 73.13% | 80.85% | 2.871 | 0.008 | |

| After | 14.00% | 0.533 | 0.596 | |||

| GVIE | Before | 57.71% | 85.42% | 2.399 | 0.023 | |

| After | 8.42% | 0.32 | 0.75 | |||

| PSTI | Before | 65.95% | 92.40% | 3.737 | 0.001 | |

| After | −5.01% | −0.191 | 0.849 | |||

| PD | Before | 64.67% | 92.59% | 3.009 | 0.005 | |

| After | −4.79% | −0.182 | 0.856 | |||

| 2014 | HRPS | Before | 62.87% | 68.15% | 3.414 | 0.002 |

| After | −20.02% | −0.762 | 0.449 | |||

| GDP | Before | 74.86% | 97.21% | 3.055 | 0.005 | |

| After | 2.09% | 0.08 | 0.937 | |||

| RD | Before | 73.92% | 84.15% | 2.91 | 0.007 | |

| After | 11.71% | 0.446 | 0.657 | |||

| GVIE | Before | 60.01% | 94.37% | 2.477 | 0.02 | |

| After | 3.38% | 0.129 | 0.898 | |||

| PD | Before | 63.79% | 67.25% | 3.031 | 0.005 | |

| After | −20.89% | −0.795 | 0.43 | |||

| PSTI | Before | 66.04% | 91.98% | 3.688 | 0.001 | |

| After | 5.30% | 0.202 | 0.841 | |||

| 2015 | HRPS | Before | 62.61% | 85.46% | 3.394 | 0.002 |

| After | 9.11% | 0.347 | 0.73 | |||

| GDP | Before | 76.83% | 99.52% | 3.158 | 0.004 | |

| After | −0.37% | −0.014 | 0.989 | |||

| RD | Before | 74.28% | 96.76% | 2.933 | 0.007 | |

| After | 2.40% | 0.092 | 0.927 | |||

| GVIE | Before | 60.20% | 98.27% | 2.48 | 0.019 | |

| After | −1.04% | −0.04 | 0.969 | |||

| PD | Before | 64.03% | 89.76% | 3.001 | 0.006 | |

| After | 6.55% | 0.25 | 0.804 | |||

| PSTI | Before | 64.48% | 96.82% | 3.581 | 0.001 | |

| After | −2.05% | −0.078 | 0.938 | |||

| 2016 | HRPS | Before | 62.96% | 99.43% | 3.409 | 0.002 |

| After | −0.36% | −0.014 | 0.989 | |||

| GDP | Before | 77.13% | 93.64% | 3.169 | 0.004 | |

| After | −4.91% | −0.187 | 0.852 | |||

| RD | Before | 75.85% | 88.60% | 3 | 0.006 | |

| After | 8.65% | 0.329 | 0.743 | |||

| GVIE | Before | 58.92% | 96.10% | 2.412 | 0.023 | |

| After | −2.30% | −0.088 | 0.931 | |||

| PD | Before | 3.28% | −78.09% | 0.741 | 0.459 | |

| After | 5.84% | 0.222 | 0.825 | |||

| PSTI | Before | 57.65% | 77.92% | 3.739 | 0.001 | |

| After | −12.73% | −0.485 | 0.63 | |||

| 2017 | HRPS | Before | 64.55% | 79.42% | 3.48 | 0.002 |

| After | 13.29% | 0.506 | 0.615 | |||

| GDP | Before | 75.09% | 98.19% | 3.085 | 0.005 | |

| After | 1.36% | 0.052 | 0.959 | |||

| RD | Before | 76.94% | 95.33% | 3.054 | 0.005 | |

| After | 3.59% | 0.137 | 0.892 | |||

| GVIE | Before | 59.18% | 96.77% | 2.422 | 0.022 | |

| After | 1.91% | 0.073 | 0.942 | |||

| PSTI | Before | 72.47% | 82.13% | 4.359 | 0 | |

| After | −12.95% | −0.493 | 0.624 | |||

| PD | Before | 65.16% | 77.06% | 3.094 | 0.004 | |

| After | −14.95% | −0.569 | 0.572 | |||

| 2018 | GDP | Before | 75.22% | 87.23% | 3.091 | 0.004 |

| After | −9.60% | −0.366 | 0.716 | |||

| RD | Before | 78.02% | 94.03% | 3.105 | 0.004 | |

| After | 4.65% | 0.177 | 0.86 | |||

| HRPS | Before | 66.44% | 85.14% | 3.544 | 0.001 | |

| After | −9.87% | −0.376 | 0.709 | |||

| GVIE | Before | 59.31% | 95.06% | 2.428 | 0.022 | |

| After | −2.93% | −0.112 | 0.912 | |||

| PSTI | Before | 73.17% | 93.93% | 4.427 | 0 | |

| After | −4.44% | −0.169 | 0.866 | |||

| PD | Before | 66.37% | 91.57% | 3.109 | 0.004 | |

| After | −5.60% | −0.213 | 0.832 |

References

- Bunce, B. Dairy Joint Ventures in South Africa’s Land and Agrarian Reform Program: Who Benefits? Land 2020, 9, 328. [Google Scholar] [CrossRef]

- Ngarava, S. Impact of the Fast Track Land Reform Programme (FTLRP) on agricultural production: A tobacco success story in Zimbabwe? Land Use Policy 2020, 99, 105000. [Google Scholar] [CrossRef]

- Albertus, M.; Espinoza, M.; Fort, R. Land reform and human capital development: Evidence from Peru. J. Dev. Eco-Nomics 2020, 147, 102540. [Google Scholar] [CrossRef]

- Chikaya-Banda, J.; Chilonga, D. Key challenges to advancing land tenure security through land governance in Malawi: Impact of land reform processes on implementation efforts. Land Use Policy 2020, 104994. [Google Scholar] [CrossRef]

- Hoggart, K.; Paniagua, A. What rural restructuring? J. Rural Stud. 2001, 17, 41–62. [Google Scholar] [CrossRef]

- Gao, J.L.; Liu, Y.; Chen, J. China’s initiatives towards rural land system reform. Land Use Policy 2020, 94, 104567. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, X.; Liu, Y. Rural land system reforms in China: History, issues, measures and prospects. Land Use Policy 2020, 91, 104330. [Google Scholar] [CrossRef]

- Xie, L. Land expropriation, shock to employment, and employment differentiation: Findings from land-lost farmers in Nanjing, China. Land Use Policy 2019, 87, 104040. [Google Scholar] [CrossRef]

- Li, Y.H.; Li, Y.; Westlund, H.; Liu, Y. Urban–rural transformation in relation to cultivated land conversion in China: Implications for opti-mizing land use and balanced regional development. Land Use Policy 2015, 47, 218–224. [Google Scholar] [CrossRef]

- Decision of the CPC Central Committee on Several Major Issues of Promoting Rural Reform and Development. Available online: http://www.gov.cn/test/2008-10/31/content_1136796.html (accessed on 15 January 2021).

- Feng, Q.C.; Tao, Q.Z. The Impact of Rural collective Commercial Construction Land Marketization on Urbanization. Rural Econ. 2014, 8, 36–40. (In Chinese) [Google Scholar]

- Yang, Q.Y.; Yang, R.; Zeng, L.; Chen, Y. Transaction of Rural Commercial Collective-Owned Construction Land Increases Farmers’ Land Property Income: A Case Study of Pidu District, Chengdu Ctiy. Econ. Geogr. 2017, 37, 155–161. [Google Scholar]

- Bi, B.D. Land Economic; China Renmin University Press: Beijing, China, 2001; pp. 21–34. [Google Scholar]

- Lin, Q.W.; Tan, S.; Zhang, L.; Wang, S.; Wei, C.; Li, Y. Conflicts of land expropriation in China during 2006–2016: An overview and its spatio-temporal characteristics. Land Use Policy 2018, 76, 246–251. [Google Scholar] [CrossRef]

- Wang, H.; Zhu, P.; Chen, X.; Swider, S. Land expropriation in urbanizing China: An examination of negotiations and compensation. Urban Geogr. 2017, 38, 401–419. [Google Scholar] [CrossRef]

- Zhao, P.; Zhang, M. The Role of Villages and Townships in Informal Land Development in China: An Investigation on the City Fringe of Beijing. Sustainability 2016, 8, 255. [Google Scholar] [CrossRef]

- Chen, H.R. Institutional credibility and informal institutions: The case of extralegal land development in China. Cities 2020, 97, 102519. [Google Scholar] [CrossRef]

- Cao, Y.; Zhang, X.L. Are they satisfied with land taking? Aspects on procedural fairness, monetary compensation and behavioral simulation in China’s land expropriation story. Land Use Policy 2018, 74, 166–178. [Google Scholar] [CrossRef]

- Huang, X.J.; Huang, X.; He, Y.; Yang, X. Assessment of livelihood vulnerability of land-lost farmers in urban fringes: A case study of Xi’an, China. Habitat Int. 2017, 59, 1–9. [Google Scholar] [CrossRef]

- John, M. Principles of Political Economy; The Commercial Press: Beijing, China, 2005; pp. 390–394. [Google Scholar]

- George, H. Progress and Poverty; The Hogarth Press LTD: London, UK, 1979. [Google Scholar]

- Samuelson, P.A.; Nordhaus, W.D. Economics; Posts & Telecom Press: Beijing, China, 2008; pp. 233–240. [Google Scholar]

- Zhu, Y.Z.; Cao, Y. Allocating Land Value Increment from the Perspective of Land Development Right. Econ. Geogr. 2012, 32, 133–138. [Google Scholar]

- Qian, Z.; Ma, K. Construction land market in China: Monopoly, segmentation and integration. Manag. World 2007, 6, 38–44. (In Chinese) [Google Scholar]

- Zhou, C. Some Theoretical Issues on Incremental Value Created by Non-Agricultural Use of Farmland in China. Issues Agric. Econ. 2006, 10, 4–7, 79. [Google Scholar]

- Liu, Q.Q.; Liu, W.D. Analysis of the rural collective construction land use right transfer and interest distribution. Agric. Econ. 2014, 3, 30–32. (In Chinese) [Google Scholar]

- Tang, Y.; Mason, R.J.; Sun, P. Interest distribution in the process of coordination of urban and rural construction land in China. Habitat Int. 2012, 36, 388–395. [Google Scholar] [CrossRef]

- Zhou, X.R.; Chen, L. Study on the role of government in the land appreciation distribution from farmland expropriation. Rev. Econ. Manag. 2013, 29, 27–33. (In Chinese) [Google Scholar]

- Wang, Y.; Chen, L.; Long, K. Farmers’ identity, property rights cognition and perception of rural residential land distributive justice in China: Findings from Nanjing, Jiangsu Province. Habitat Int. 2018, 79, 99–108. [Google Scholar] [CrossRef]

- Wang, W.; Hong, Y.M.; Peng, W.Y. Revenue Realization and Distribution in the Transfer of Rural Collective Con-struction Land Leasehold. China Land Sci. 2009, 23, 20–23, 65. (In Chinese) [Google Scholar]

- Zhou, L.; Zhang, W.; Fang, C.; Sun, H.; Lin, J. Actors and network in the marketization of rural collectively-owned commercial construction land (RCOCCL) in China: A pilot case of Langfa, Beijing. Land Use Policy 2020, 99, 104990. [Google Scholar] [CrossRef]

- Wang, J.; Aenis, T. Stakeholder analysis in support of sustainable land management: Experiences from southwest China. J. Environ. Manag. 2019, 243, 1–11. [Google Scholar] [CrossRef]

- Li, H.; Zhang, X.; Li, H. Has farmer welfare improved after rural residential land circulation? J. Rural Stud. 2019. [Google Scholar] [CrossRef]

- Tan, R.; Qu, F.; Heerink, N.; Mettepenningen, E. Rural to urban land conversion in China—How large is the over-conversion and what are its welfare implications? China Econ. Rev. 2011, 22, 474–484. [Google Scholar] [CrossRef]

- Chen, M. Assessment and Outlook on the Reform of Rural Collective Business Construction Lan: And on the Market Orientation of Rural “Three Pieces of Land” Reforms. Issues Agric. Econ. 2018, 4, 71–81. (In Chinese) [Google Scholar]

- Dimitrovová, K.; Perelman, J.; Serrano-Alarcón, M. Effect of a national primary care reform on avoidable hospital admissions (2000–2015): A dif-ference-in-difference analysis. Soc. Sci. Med. 2020, 252, 112908. [Google Scholar] [CrossRef]

- Wang, H.; Wu, X.; Wu, D.; Nie, X. Will land development time restriction reduce land price? The perspective of American call options. Land Use Policy 2019, 83, 75–83. [Google Scholar] [CrossRef]

- Lechner, M. The Estimation of Causal Effects by Difference-in-Difference Methods. Found. Trends Econom. 2011, 4, 165–224. [Google Scholar] [CrossRef]

- Li, S.Q.; Wang, M.H.; Huang, B.X.; Huang, J.C.; Wan, G.Q.; Wan, Z.B.; Meng, J.J.; Wang, P.; Wang, D.; Wang, W.H.; et al. Appendix: Explanation of Main Indicators. In Chinese Statistical Yearbook (County Level); China Statistics Press: Beijing, China, 2019; pp. 433, 435–436. [Google Scholar]

- Decision of the National People’s Congress on Authorizing the State Council to Temporarily Adjust and Implement Relevant Laws and Regulations in the 33 Pilot Counties. Available online: http://www.gov.cn/xinwen/2015-02/28/content_2822866.htm (accessed on 22 January 2021).

- Zeng, K.H.; Li, S.; Li, Q. The Impact of Economic Growth and Tax Reform on Tax Revenue and Structure: Evidence from China Experience. Mod. Econ. 2013, 4, 412091. [Google Scholar] [CrossRef][Green Version]

- Lin, B.Q.; Jia, Z.J. Tax rate, government revenue and economic performance: A perspective of Laffer curve. China Econ. Rev. 2019, 56, 101307. [Google Scholar] [CrossRef]

- Wang, J.D. The fiscal impact of economic growth and development on local government revenue capacity. J. Public Budg. Account. Financ. Manag. 2004, 16, 413–423. [Google Scholar] [CrossRef]

- Liu, T.; Qi, Y.J.; Cao, G.Z. China’s floating population in the 21st century: Uneven landscape, influencing factors, and effects on urbanization. Acta Geogr. Sin. 2015, 70, 567–581. (In Chinese) [Google Scholar]

- Li, Y. Explore the Causes of Growth of Fiscal Revenue of China—Concurrently Analysis the Strategy and Problems of Revenue of Local Government. Econ. Issues China 2013, 2, 38–45. [Google Scholar]

- Lewis, J.S.; Logan, K.A.; Alldredge, M.W.; Bailey, L.L.; VandeWoude, S.; Crooks, K.R. The effects of Urbanization on Population Density Occupancy, and Detection Probability of Wild Fields. Ecol. Appl. 2015, 25, 1880–1895. [Google Scholar] [CrossRef]

- Berk, R.A. An Introduction to Sample Selection Bias in Sociological data. Am. Sociol. Rev. 1983, 48, 386–398. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The Central Role of the Propensity Score in Observational Studies for Causal Effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Heckman, J.J.; Ichimura, H.; Todd, P.E. Matching as an Econometric Evaluation Estimator: Evidence from Evaluation a Job Training Program. Rev. Econ. Stud. 1997, 64, 605–654. [Google Scholar] [CrossRef]

- Abadie, A. Semiparametric Difference-in-difference Estimation. Rev. Econ. Stud. 2005, 72, 1–19. [Google Scholar] [CrossRef]

- Lu, J. The performance of performance-based contracting in human services: A quasi-experiment. J. Public Adm. Res. Theory 2015, 26, 277–293. [Google Scholar] [CrossRef]

- Chien, L.C.; Gakh, M. The lagged effect of state gun laws on the reduction of state-level firearm homicide mortality in the United States from 1999 to 2017. Public Health 2020, 189, 73–80. [Google Scholar] [CrossRef]

- Cesare, D.L.; Sportelli, M. Fiscal policy lags and income adjustment processes. Chaos Solitons Fractals 2012, 45, 433–438. [Google Scholar] [CrossRef]

- Li, W.J.; Wang, L. Analysis of the advantages and disadvantages of the “urban-land taking and rural-land giving” policy. Land Resour. Inf. 2009, 4, 34–37. (In Chinese) [Google Scholar]

- North, D. Institutions and Credible Commitment. J. Inst. Theor. Econ. 1995, 149, 11–23. [Google Scholar]

| Test Type | Related Models | Descriptive Statistics |

|---|---|---|

| F test | FE model and POOL model | F (1631, 13,050) = 12.613, p = 0.000 |

| BP test | RE model and POOL model | χ2(1) = 18,400.285, p = 0.000 |

| Hausman test | FE model and RE model | χ2(5) = 54.946, p = 0.000 |

| Variables | Coef. | Std. Err | t | p |

|---|---|---|---|---|

| Intercept | 11,266.541 | 9478.33 | 1.189 | 0.235 |

| HRPS | 92.451 | 163.876 | 0.564 | 0.573 |

| PD | 21.607 | 3586.163 | 0.006 | 0.995 |

| GDP | 0.085 | 0.001 | 102.204 | 0.000 ** |

| PSTI | −59,650.088 | 5801.207 | −10.282 | 0.000 ** |

(DID variable) | 17,884.613 | 6412.568 | 2.789 | 0.005 ** |

| Statistics of model: R2 = 0.475, Adjust R2 = 0.409, F = 2358.477, p = 0.000 | ||||

| Model | Statistics of Model | ||||

|---|---|---|---|---|---|

| Counterfactual situation 1: start in 2014 | R2 = 0.475, Adjust R2 = 0.409, F = 2358.850, p = 0.000 | ||||

| Variable | Coefficient | Standard Error | T-Test Value | Sig. | |

| DID variable | 19,063.645 | 6441.031 | 2.96 | 0.003 ** | |

| Counterfactual situation 2: start in 2016 | R2 = 0.475, Adjust R2 = 0.409, F =2357.212, p = 0.000 | ||||

| Variable | Coefficient | Standard Error | T-Test Value | Sig. | |

| DID variable | 14,216.722 | 6736.578 | 2.11 | 0.035 * | |

| Variables | Coef. | Std. Err | t | p |

|---|---|---|---|---|

| Model 1 (no time-lag) | R2 = 0.868, Adjust R2 = 0.866, F = 481.514, p = 0.000 | |||

| Intercept | 10,255.328 | 85,943.313 | 0.119 | 0.905 |

| HRPS | −758.584 | 229.530 | −3.305 | 0.001 ** |

| PD | 173,863.109 | 232,171.801 | 0.749 | 0.454 |

| GDP | 0.082 | 0.002 | 41.297 | 0.000 ** |

| PSTI | −19,426.084 | 100,878.352 | −0.193 | 0.847 |

| 1351.944 | 19,869.923 | 0.068 | 0.946 | |

| 73,667.697 | 21,348.887 | 3.451 | 0.001 ** | |

(DID variable) | −53,696.542 | 29,799.873 | −1.802 | 0.072 |

| Model 2 (with time-lag) | R2 = 0.868, adjust R2 = 0.865, F = 373.081, p = 0.000 | |||

| −5652.358 | 44,528.066 | −0.127 | 0.899 | |

| 6863.855 | 38,554.296 | 0.005 | 0.178 | |

(DID variable) | −52,891.698 | 40,454.680 | −1.307 | 0.192 |

| Coef. | St. Err. | t-Value | p-Value | 95% Conf. | Interval | Sig | |

|---|---|---|---|---|---|---|---|

| 22,153.707 | 8533.663 | 2.60 | 0.009 | 5428.035 | 38,879.378 | ** | |

| 103,122.79 | 29,042.065 | 3.55 | 0 | 46,201.384 | 160,044.19 | ** | |

| DID variable | 32,375.02 | 41,051.445 | 0.79 | 0.43 | −48,084.335 | 112,834.38 | |

| HRPS | 0 | 0.001 | −0.32 | 0.747 | −0.001 | 0.001 | |

| GDP | 0 | 0 | 45.30 | 0 | 0 | 0 | ** |

| PSTI | 3.032 | 0.201 | 15.12 | 0 | 2.639 | 3.425 | ** |

| PD | 0 | 0 | −5.93 | 0 | −0.001 | 0 | ** |

| Constant | −4.744 | 0.169 | −28.11 | 0 | −5.075 | −4.414 | ** |

| lambda | −177,733.49 | 6889.406 | −25.80 | 0 | −191,236.48 | −164,230.5 | ** |

| Dependent variable: GR | |||||||

| Mean dependent var | 273,428.254 | SD dependent var | 290,019.804 | ||||

| Number of obs | 14,688 | Chi-square | 41.586 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, M.; Chen, Q.; Zhang, K.; Yang, D. Will Rural Collective-Owned Commercial Construction Land Marketization Impact Local Governments’ Interest Distribution? Evidence from Mainland China. Land 2021, 10, 209. https://doi.org/10.3390/land10020209

Zhang M, Chen Q, Zhang K, Yang D. Will Rural Collective-Owned Commercial Construction Land Marketization Impact Local Governments’ Interest Distribution? Evidence from Mainland China. Land. 2021; 10(2):209. https://doi.org/10.3390/land10020209

Chicago/Turabian StyleZhang, Mingyu, Qiuxiao Chen, Kewei Zhang, and Dongye Yang. 2021. "Will Rural Collective-Owned Commercial Construction Land Marketization Impact Local Governments’ Interest Distribution? Evidence from Mainland China" Land 10, no. 2: 209. https://doi.org/10.3390/land10020209

APA StyleZhang, M., Chen, Q., Zhang, K., & Yang, D. (2021). Will Rural Collective-Owned Commercial Construction Land Marketization Impact Local Governments’ Interest Distribution? Evidence from Mainland China. Land, 10(2), 209. https://doi.org/10.3390/land10020209