Farmers’ Attitudes towards Risk—An Empirical Study from Poland

Abstract

:1. Introduction

2. Farmers’ Risk Preferences—Theoretical Framework and Empirical Approaches

2.1. Risk Aversion and Methods of Eliciting Risk Preferences

- based on observed economic behaviour from secondary data, including econometric and mathematical methods. The underlying assumption of these methods is to estimate risk preferences based on “observed behaviour of agricultural producers with respect to input and output choices to behaviour predicted by theoretical models incorporating risk and risk preferences” Iyer et al. [7] (pp.6). Examples of such an approach to determine risk aversion can be found in numerous studies [53,54,55,56,57,58],

- based on elicited preferences from primary data, including multi-item scales and lottery-choices tasks. The methods based on multi-item scales specify the attitude towards risk by obtaining an answer to a series of multi-item and scale-based questions. This type of research takes the form of various types of surveys and questionnaires. It is aimed at identifying actual decisions (preferences) and actions taken by decision-makers [59,60] and presented by many researchers [3,38,61,62,63,64].

2.2. Farmers Risk Aversion

3. Materials and Methods

3.1. Case Study Area—Background Information on Polish Agriculture

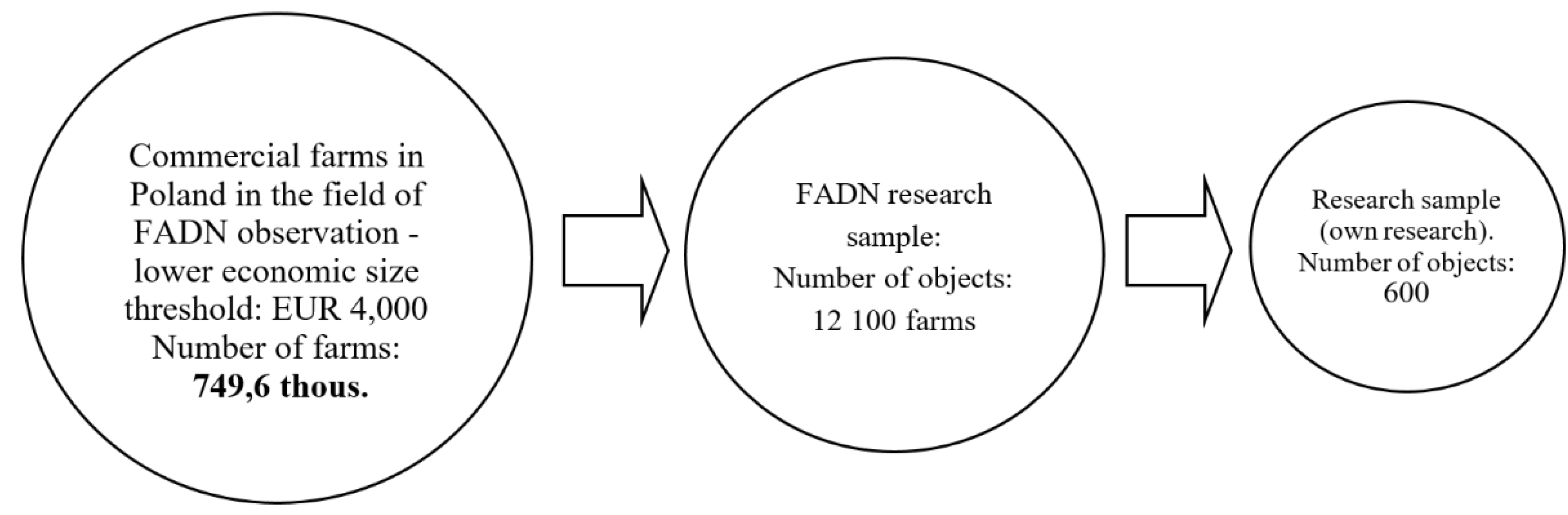

3.2. Data Collection

- 4 layers due to the specialization criterion,

- 3 layers due to the economic size criterion measured by the standard output (below 25, between 25 and 100, and above 100 thousand EUR),

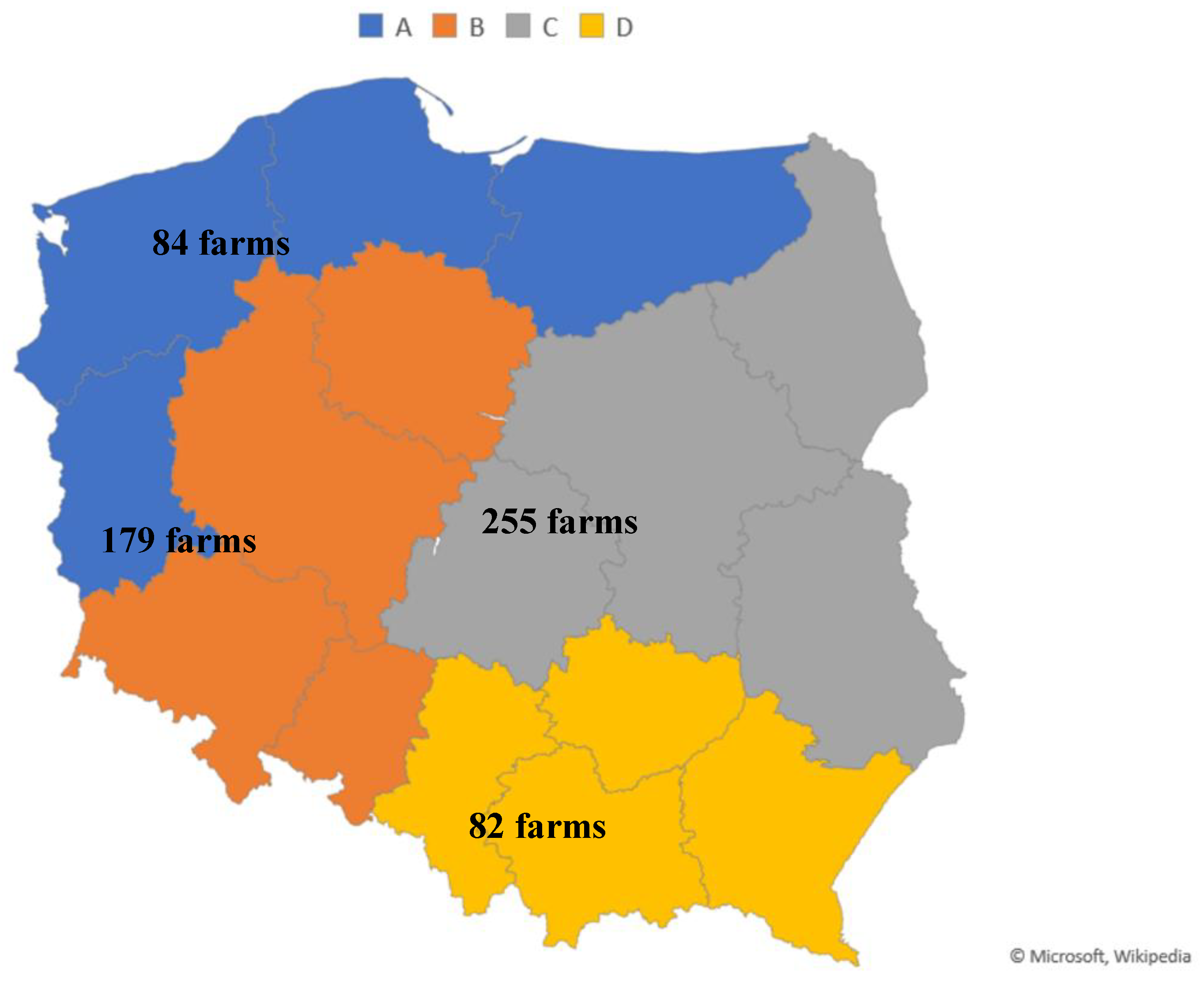

- 4 layers due to the localization within the FADN regions (see Figure 3).

- crop production farms—this includes farms specializing in field crops (TF1), horticultural crops (TF2), permanent crops (TF4);

- cattle farms—this includes farms specializing in rearing dairy cows (TF5) and herbivorous animals (TF6);

- pig farms—this includes units specializing in rearing animals fed with concentrated feed (mainly pigs TF 71 and poultry TF 72);

- mixed farms—this includes mixed farms (TF8).

3.3. Methods

4. Results

4.1. Farmers’ Risk Aversion and Farms’ Economic Size and Production Type

4.2. Farmers’ Risk Aversion and Their Attitudes Toward Specified Risky Situations

4.3. Farmers’ Risk Aversion and Perception of Production Risk Factors

4.4. Farmers’ Risk Aversion and Preferred Risk Management Tools

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Cao, R.; Carpentier, A.; Gohin, A. Measuring Farmers’ Risk Aversion: The Unknown Properties of the Value Function. In Proceedings of the 13th EAAE Congress Change and Uncertainty Challenges for Agriculture, Food and Natural Resources, Zurich, Switzerland, 30 August–2 September 2011; p. 13. [Google Scholar]

- Pope, R.D. Expected profit, price change, and risk aversion. Am. J. Agric. Econ. 1982, 64, 581–584. [Google Scholar] [CrossRef]

- Flaten, O.; Lien, G.; Koesling, M.; Valle, P.S.; Ebbesvik, M. Comparing risk perceptions and risk management in organic and conventional dairy farming: Empirical results from Norway. Livest. Prod. Sci. 2005, 95, 11–25. [Google Scholar] [CrossRef] [Green Version]

- Ullah, R.; Shivakoti, G.P.; Ali, G. Factors effecting farmers’ risk attitude and risk perceptions: The case of Khyber Pakhtunkhwa, Pakistan. Int. J. Disaster Risk Reduct. 2015, 13, 151–157. [Google Scholar] [CrossRef]

- Bard, S.; Barry, P. Assessing farmers’ attitudes toward risk using the “closing-in” method. J. Agric. Resour. Econ. 2001, 26, 248–260. [Google Scholar]

- Vollmer, E.; Hermann, D.; Musshoff, O. Is the risk attitude measured with the Holt and Laury task reflected in farmers’ production risk? Eur. Rev. Agric. Econ. 2017, 44, 399–424. [Google Scholar] [CrossRef]

- Iyer, P.; Bozzola, M.; Hirsch, S.; Meraner, M.; Finger, R. Measuring farmer risk preferences in Europe: A systematic review. J. Agric. Econ. 2020, 71, 3–26. [Google Scholar] [CrossRef] [Green Version]

- Kumbhakar, S.C. Risk preference and productivity measurement under output price uncertainty. Empir. Econ. 2002, 27, 461–472. [Google Scholar] [CrossRef]

- Feder, G. Farm size, risk aversion and the adoption of new technology under uncertainty. Oxf. Econ. Pap. 1980, 32, 263–283. [Google Scholar] [CrossRef]

- Alcamo, J.; Moreno, J.M.; Nováky, B.; Bindi, M.; Corobov, R.; Devoy, R.; Giannakopoulos, C.; Martin, E.; Olesen, J.E.; Shvidenko, A. Europe. In Climate Change 2007: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change; Parry, M.L., Canziani, O.F., Palutikof, J.P., van der Linden, P.J., Hanson, C.E., Eds.; Cambridge University Press: Cambridge, UK, 2007; pp. 541–580. [Google Scholar]

- Selvaraju, R. Climate risk assessment and management in agriculture. In Building Resilience for Adaptation to Climate Change in the Agriculture Sector. Proceedings of the Joint FAO/OECD Workshop; Meybeck, A., Lankoski, J., Redfern, S., Azzu, N., Gitz, V., Eds.; OECD: Rome, Italy, 2012; pp. 71–90. [Google Scholar]

- Asfaw, S.; Lipper, L. Managing Climate Risk Using Climate-Smart Agriculture; FAOUN: Rome, Italy, 2016. [Google Scholar]

- Bureau, J.C.; Jean, S.; Matthews, A. The consequences of agricultural trade liberalization for developing countries: Distinguishing between genuine benefits and false hopes. World Trade Rev. 2006, 5, 225–249. [Google Scholar] [CrossRef] [Green Version]

- Bureau, J.-C.; Guimbard, H.; Jean, S. Agricultural trade liberalisation in the 21st century: Has it done the business? J. Agric. Econ. 2019, 70, 3–25. [Google Scholar] [CrossRef]

- European Commission. Common Agricultural Policy Post-2020: Simplification and Modernisation; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Meuwissen, M.P.; De Mey, Y.; Van Asseldonk, M. Prospects for agricultural insurance in Europe. Agric. Financ. Rev. 2018, 78, 174–182. [Google Scholar] [CrossRef]

- Vrolijk, H.C.J.; De Bont, K.C.J.A.M.; van der Veen, H.B.; Wisman, J.H.; Poppe, K.J. Volatility of Farm Incomes, Prices and Yields in the European Union; LEI Wageningen: The Hague, The Netherlands, 2009. [Google Scholar]

- European Commission. Risk Management Tools for EU Agriculture (with a Special Focus on Insurance); European Commission: Brussels, Belgium, 2001. [Google Scholar]

- European Parliament. Regulation (EU) No 1305/2013 of the European Parliament and of the Council of 17 December 2013 on Support for Rural Development by the European Agricultural Fund for Rural Development (EAFRD) and Repealing Council Regulation (EC) No 1698/2005; European Parliament: Brussels, Belgium, 2013. [Google Scholar]

- OECD. Managing Risk in Agriculture: A Holistic Approach; OECD Publishing: Paris, France, 2009. [Google Scholar]

- OECD. Managing Risk in Agriculture: Policy Assessment and Design; OECD Publishing: Paris, France, 2011. [Google Scholar]

- Capitanio, F.; De Pin, A. Measures of efficiency of agricultural insurance in Italy, economic evaluations. Risks 2018, 6, 126. [Google Scholar] [CrossRef] [Green Version]

- Komarek, A.M.; de Pinto, A.; Smith, V.H. A review of types of risks in agriculture: What we know and what we need to know. Agric. Syst. 2020, 178, 102738. [Google Scholar] [CrossRef]

- Picazo-Tadeo, A.J.; Wall, A. Production risk, risk aversion and the determination of risk attitudes among Spanish rice producers. Agric. Econ. 2011, 42, 451–464. [Google Scholar] [CrossRef]

- Matthews, A. Use of Risk Management Tools in the CAP. Available online: http://capreform.eu/use-of-risk-management-tools-in-the-cap/ (accessed on 28 July 2020).

- Berg, E.; Huirne, R.B.M.; Majewski, E.; Meuwissen, M.P.M. Income Stabilization in a Changing Agricultural World: Policy and Tools; Editorial House Wies Jutra, Limited: Warsaw, Poland, 2009. [Google Scholar]

- Mateos-Ronco, A.; Server Izquierdo, R.J. Risk management tools for sustainable agriculture: A model for calculating the average price for the season in revenue insurance for citrus fruit. Agronomy 2020, 10, 198. [Google Scholar] [CrossRef] [Green Version]

- Lang, V.; Pop, C.; Woidich, A. Economic Accounts for Agriculture. Total Agricultural Output in the EU up by 0.6% in 2018; Eurostat Press Office: Luxemoburg, 2019. [Google Scholar]

- EU Expenditure and Revenue 2014–2020|European Commission. Available online: https://ec.europa.eu/budget/graphs/revenue_expediture.html (accessed on 18 September 2020).

- Santeramo, F. Study on Risk Management in EU Agriculture Annex 2-Case Study 2 How to Enhance the Participation of Small-Scale and Non-Specialised Farms in Crop Insurance Schemes; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Sulewski, P.; Kłoczko-Gajewska, A. Farmers’ risk perception, risk aversion and strategies to cope with production risk: An empirical study from Poland. Stud. Agric. Econ. 2014, 116, 140–147. [Google Scholar] [CrossRef] [Green Version]

- Pawłowska-Tyszko, J.; Gorzelak, A.; Kopa, J.H.; Kulawik, J.; Osuch, D.; Pawłowska, J.; Skarzyńska, A. Ocena Funkcjonowania Ubezpieczeń Upraw i Zwierząt Gospodarskich w Polskim Rolnictwie; Pawłowska-Tyszko, J., Ed.; Instytut Ekonomiki Rolnictwa i Gospodarki Zywnosciowej Panstwowy Instytut Badawczy: Warsaw, Poland, 2017. [Google Scholar]

- Crop and Farm Animal Insurance Act of 7 July 2005; Polish Parliament: Warsaw, Poland, 2019; p. 10.

- Wąs, A.; Kobus, P. Factors differentiating the level of crop insurance at Polish farms. Agric. Financ. Rev. 2018, 78, 209–222. [Google Scholar] [CrossRef]

- Janowicz-Lomott, M.; Łyskawa, K. Funkcjonowanie Dotowanych Ubezpieczeń Upraw w Polsce; Polska Izba Ubezpieczen: Warsaw, Poland, 2016. [Google Scholar]

- Ministry of Agriculture and Rural Development Economic Insurance in Holistic Risk Management in Sustainable Agriculture, Implementation of Innovation and Technology, and Counteracting Climate Change (Research Project). 2019. Available online: https://www.gov.pl/documents/912055/913531/UBROL_prezentacja.pdf/a6232043-c6ca-6227-c340-2fe76aabe96a (accessed on 1 October 2020).

- Milionis, N.; Jereb, S.; Henderson, K.; Vrabić, J.; Viegas, H.F.; Ollier, C.; Oliveira, P.; Stasia, A.; Huth, J.; Lanzutti, M.; et al. Special Report 23/2019: Farmers’ Income Stabilisation; European Court of Auditors: Luxembourg, 2019. [Google Scholar]

- Sulewski, P.; Majewski, E.; Meuwissen, M. Mutual insurance fund as a form of risk mitigation in agriculture. Probl. Agric. Econ. 2014, 2, 127–144. [Google Scholar]

- Cordier, J.; Santeramo, F. Mutual funds and the income stabilisation tool in the EU: Retrospect and prospects. EuroChoices 2020, 19, 53–58. [Google Scholar] [CrossRef]

- Sulewski, P. Farmers’ attitudes towards risk and strategies of risk reduction. Rocz. Nauk. Ekon. Rol. Rozw. Obsz. Wiej. Rozw. Obsz. Wiej. 2014, 101, 116–126. [Google Scholar]

- Van Winsen, F. Rethinking Farmers’ Intended Risk Behaviour: The Role of Risk Perception, Risk Attitude and Decision Context. Ph.D. Thesis, Ghent University, Ghent, Belgium, 2014. [Google Scholar]

- Eckel, C.C.; Grossman, P.J. Forecasting risk attitudes: An experimental study using actual and forecast gamble choices. J. Econ. Behav. Organ. 2008, 68, 1–17. [Google Scholar] [CrossRef]

- Anderson, J.R.; Dillon, J.L. Risk analysis in dryland farming systems. Farm Syst. Manag. Ser. 1992, 2, 1–109. [Google Scholar]

- Newbery, D.M.; Stiglitz, J.E. The Theory of Commodity Prices Stabilization; Oxford University Press: Oxford, UK, 1981. [Google Scholar]

- Karni, E. Savage’s subjective expected utility model. In The New Palgrave Dictionary of Economics; Palgrave Macmillan: London, UK, 2008; pp. 1–5. [Google Scholar]

- Hammond, P. Handbook of Utility Theory; Barbera, S., Hammond, P., Seidl, C., Eds.; Springer: New York, NY, USA, 1989. [Google Scholar]

- Pratt, J.W. Risk aversion in the small and in the large. Econometrica 1964, 32, 122. [Google Scholar] [CrossRef]

- Arrow, K.J. Aspects of The Theory of Risk-Bearing; Yrjo Jahnssonin Saatio: Helsinki, Finland, 1965. [Google Scholar]

- Hardaker, J.B. Some issues in dealing with risk in agriculture. Work. Pap. Ser. Agric. Resour. Econ. 2000, 3, 1–18. [Google Scholar]

- Eeckhoudt, L.; Gollier, C. Risk: Evaluation, Management and Sharing; Harvester Wheatsheaf: London, UK, 1995. [Google Scholar]

- Hamal, K.B.; Anderson, J.R. A note on decreasing absolute risk aversion among farmers in Nepal. Aust. J. Agric. Econ. 1982, 26, 220–225. [Google Scholar] [CrossRef] [Green Version]

- Charness, G.; Gneezy, U.; Imas, A. Experimental methods: Eliciting risk preferences. J. Econ. Behav. Organ. 2013, 87, 43–51. [Google Scholar] [CrossRef]

- Antle, J.M. Infrastructure and aggregate agricultural productivity: International evidence. Econ. Dev. Cult. Change 1983, 31, 609–619. [Google Scholar] [CrossRef]

- Antle, J.M. Econometric estimation of producers’ risk attitudes. Am. J. Agric. Econ. 1987, 69, 509–522. [Google Scholar] [CrossRef]

- Chavas, J.-P.; Holt, M.T. Economic behavior under uncertainty: A joint analysis of risk preferences and technology. Rev. Econ. Stat. 1996, 78, 329–335. [Google Scholar] [CrossRef]

- Wolff, H.; Heckelei, T. Estimation of constrained optimisation models for agricultural supply analysis based on generalised maximum entropy in European. Eur. Rev. Agric. Econ. 2003, 30, 27–50. [Google Scholar]

- Arata, L.; Donati, M.; Sckokai, P.; Arfini, F. Incorporating risk in a positive mathematical programming framework: A dual approach. Aust. J. Agric. Resour. Econ. 2017, 61, 265–284. [Google Scholar] [CrossRef] [Green Version]

- Kobus, P.; Wąs, A. Changes in Polish farmers’ attitudes toward risk after Poland’s accession to the EU. J. Food Prod. Mark. 2017, 23, 357–366. [Google Scholar] [CrossRef]

- Damodaran, A. Strategic Risk Taking: A Framework for Risk Management; FT Press: Upper Saddle River, NJ, USA, 2007. [Google Scholar]

- Weber, E.U.; Blais, A.R.; Betz, N.E. A domain-specific risk-attitude scale: Measuring risk perceptions and risk behaviors. J. Behav. Decis. Mak. 2002, 15, 263–290. [Google Scholar] [CrossRef]

- Meuwissen, M.; Hardaker, J.B.; Huirne, R.B.M.; Dijkhuizen, A.A. Sharing risks in agriculture; principles and empirical results. NJAS Wagening. J. Life Sci. 2001, 49, 343–356. [Google Scholar] [CrossRef] [Green Version]

- Sauter, P.; Hermann, D.; Mußhoff, O. Risk attitudes of foresters, farmers and students: An experimental multimethod comparison. Diskussionbeitrag 2015, 1514, 1–42. [Google Scholar]

- Howley, P.; Dillon, E.; Heanue, K.; Meredith, D. Worth the risk? The behavioural path to well-being. J. Agric. Econ. 2017, 68, 534–552. [Google Scholar] [CrossRef] [Green Version]

- Meuwissen, M.P.M.; van Asseldonk, M.A.P.M.; Huirne, R.B.M. Income Stabilisation in European Agriculture: Design and Economic Impact of Risk Management tools; Wageningen Academic Publishers: Wageningen, The Netherlands, 2008; ISBN 978-90-8686-079-1. [Google Scholar]

- Halter, A.N.; Mason, R. Utility measurement for those who need to know. West. J. Agric. Econ. 1978, 3, 99–110. [Google Scholar]

- Lin, W.; Dean, G.W.; Moore, C.V. An empirical test of utility vs. profit maximization in agricultural production. Am. J. Agric. Econ. 1974, 56, 497–508. [Google Scholar] [CrossRef]

- Dillon, J.L.; Scandizzo, P.L. Risk attitudes of subsistence farmers in Northeast Brazil: A sampling approach. Am. J. Agric. Econ. 1978, 60, 425–435. [Google Scholar] [CrossRef]

- Kobus, P. Wielowymiarowe Modelowanie Ryzyka Dochodowego w Rolnictwie; Wydawnictwo SGGW: Warsaw, Poland, 2019. [Google Scholar]

- Rommel, J.; Hermann, D.; Müller, M.; Mußhoff, O. Contextual framing and monetary incentives in field experiments on risk preferences: Evidence from German farmers. J. Agric. Econ. 2018, 70, 408–425. [Google Scholar] [CrossRef]

- Schaak, H.; Buchholz, M.; Hermann, D.; Holst, G.S.; Musshoff, O. The predictive power of experimental risk attitude measures for farm diversification. Eur. Rev. Agric. Econ. 2013, 40, 807–833. [Google Scholar]

- Holt, C.A.; Laury, S.K. Risk aversion and incentive effects. Am. Econ. Rev. 2002, 92, 1644–1655. [Google Scholar] [CrossRef] [Green Version]

- Pennings, J.M.E.; Garcia, P. Measuring producers’ risk preferences: A global risk-attitude construct. Am. J. Agric. Econ. 2001, 83, 993–1009. [Google Scholar] [CrossRef]

- Lins, D.A.; Gabriel, S.C.; Sonka, S.T. An analysis of the risk aversion of farm operators: An asset portfolio approach. West. J. Agric. Econ. 1981, 6, 1–16. [Google Scholar]

- Roe, T. Empirical estimation and use of risk preference: discussion. Am. J. Agric. Econ. 1982, 64, 394–396. [Google Scholar] [CrossRef]

- Antle, J.M. Nonstructural risk attitude estimation. Am. J. Agric. Econ. 1989, 71, 774–784. [Google Scholar] [CrossRef]

- Binswanger, H.P. Attitudes toward risk: experimental measurement in rural India. Am. J. Agric. Econ. 1980, 62, 395–407. [Google Scholar] [CrossRef] [Green Version]

- Shee, A.; Azzarri, C.; Haile, B. Farmers’ willingness to pay for improved agricultural technologies: Evidence from a field experiment in Tanzania. Sustainability 2019, 12, 216. [Google Scholar] [CrossRef] [Green Version]

- Saha, A.; Shumway, C.R.; Talpaz, H. Joint estimation of risk preference structure and technology using expo-power utility. Am. J. Agric. Econ. 1994, 76, 173–184. [Google Scholar] [CrossRef]

- Love, H.A.; Buccola, S.T. Joint risk preference-technology estimation with a primal system. Am. J. Agric. Econ. 1991, 73, 765–774. [Google Scholar] [CrossRef]

- Saha, A. Expo-power utility: A ’flexible ’ form for absolute and relative risk aversion. Am. J. Agric. Econ. 1993, 75, 905–913. [Google Scholar] [CrossRef]

- Pennings, J.M.E.; Smidts, A. Assessing the construct validity of risk attitude. SSRN Electron. J. 2000, 46, 1337–1348. [Google Scholar] [CrossRef] [Green Version]

- Lybbert, T.J.; Just, D.R. Is risk aversion really correlated with wealth? How estimated probabilities introduce spurious correlation. Am. J. Agric. Econ. 2007, 89, 964–979. [Google Scholar] [CrossRef]

- Meuwissen, M.; Hardaker, J.B.; Huirne, R.B.M. Perceptions of risk and risk management strategies: An analysis of Dutch livestock farmers. Am. J. Agric. Econ. 1999, 81, 1284. [Google Scholar] [CrossRef]

- Harrison, G.W.; Lau, M.I.; Rutström, E.E. Estimating risk attitudes in Denmark: A field experiment. Scand. J. Econ. 2007, 109, 341–368. [Google Scholar] [CrossRef] [Green Version]

- Lucas, M.P.; Pabuayon, I.M. Risk perceptions, attitudes, and influential factors of rainfed lowland rice farmers in Ilocos Norte, Philippines. Asian J. Agric. Dev. 2011, 8, 1–17. [Google Scholar]

- Kisaka-Lwayo, M.; Obi, A. Risk perceptions and management strategies by smallholder farmers in KwaZulu-Natal Province, South Africa. Int. J. Agric. Manag. 2012, 1, 1–12. [Google Scholar]

- Tanaka, T.; Camerer, C.F.; Nguyen, Q. Risk and time preferences: Linking experimental and household survey data from Vietnam. Am. Econ. Rev. 2010, 100, 557–571. [Google Scholar] [CrossRef] [Green Version]

- Ayinde, O.E. Effect of socio-economic factors on risk behaviour of farming households: An empirical evidence of small-scale crop producers in Kwara State, Nigeria. Agric. J. 2008, 3, 447–453. [Google Scholar]

- Sherrick, B.J.; Barry, P.J.; Ellinger, P.N.; Schnitkey, G.D. Factors influencing farmers crop insurance decisions. Am. J. Agric. Econ. 2004, 86, 103–114. [Google Scholar] [CrossRef]

- Koundouri, P.; Nauges, C.; Tzouvelekas, V. Technology adoption under production uncertainty: Theory and application to irrigation technology. Am. J. Agric. Econ. 2006, 88, 657–670. [Google Scholar] [CrossRef] [Green Version]

- Monjardino, M.; Hochman, Z.; Horan, H. Yield potential determines Australian wheat growers’ capacity to close yield gaps while mitigating economic risk. Agron. Sustain. Dev. 2019, 39. [Google Scholar] [CrossRef]

- Abdulkadri, A.O.; Langemeier, M.R.; Featherstone, A.M. Estimating risk aversion coefficients for dry land wheat, irrigated corn and dairy producers in Kansas. Appl. Econ. 2003, 35, 825–834. [Google Scholar] [CrossRef]

- Serra, T.; Zilberman, D.; Gil, J.M. Differential uncertainties and risk attitudes between conventional and organic producers: The case of Spanish arable crop farmers. Agric. Econ. 2008, 39, 219–229. [Google Scholar] [CrossRef] [Green Version]

- Chavas, J.; Holt, M.T. Acreage decisions under risk: The case of corn and soybeans. Am. J. Agric. Econ. 1990, 72, 529–538. [Google Scholar] [CrossRef] [Green Version]

- Holt, M.; Moschini, G. Alternative measures of risk in commodity supply models: An analysis of sow farrowing decisions in the United States. J. Agric. Resour. Econ. 1992, 17, 1–12. [Google Scholar]

- Sandmo, A. Agnar on the theory of the competitive firm under price uncertainty. Am. Econ. Rev. 1971, 61, 65–73. [Google Scholar]

- Hennessy, D.A. The production effects of agricultural income support policies under uncertainty. Am. J. Agric. Econ. 1998, 80, 46–57. [Google Scholar] [CrossRef]

- GUS. Rolnictwo w 2017r.; CSO: Warsaw, Poland, 2018. [Google Scholar]

- Central Statistical Office. Charakterystyka Gospdoarstw Rolnych w 2016 r.; Central Statistical Office: Warsaw, Poland, 2017. [Google Scholar]

- Wąs, A. Modelowanie Przemian Strukturalnych Polskiego Rolnictwa; Wydawnictwo SGGW: Warsaw, Poland, 2013. [Google Scholar]

- Smiglak-Krajewska, M. Sposoby ograniczania ryzyka w gospodarstwach rolnych z terenu województwa kujawsko-pomorskiego. Rocz. Nauk. Ekon. Rol. Rozw. Obsz. Wiej. 2014, 101, 136–143. [Google Scholar]

- Kaczała, M.; Łyskawa, K. Ubezpieczenie indeksowe suszy. Wiadomości Ubezpieczeniowe 2012, 4, 40. [Google Scholar]

- Doroszewski, A.; Jóźwicki, T.; Wróblewska, E.; Kozyra, J. Susza Rolnicza w Polsce w Latach 1961–2010; IUNG: Pulawy, Poland, 2014. [Google Scholar]

- Handschke, J.; Kaczała, M.; Łyskawa, K. Koncepcja Polis Indeksowych i Możliwość ich Zastosowania w Systemie Obowiązkowych Dotowanych Ubezpieczeń Upraw w Polsce; Polska Izba Ubezpieczeń: Warsaw, Poland, 2015. [Google Scholar]

- FADN FADN—Farm Accountancy Data Network. Available online: https://ec.europa.eu/agriculture/rica/ (accessed on 26 August 2020).

- Floriańczyk, Z.; Osuch, D.; Bocian, M.; Malachowska, B.; Cholewa, I. Plan Wyboru Próby Gospodarstw Rolnych Polskiego FADN od Roku Obrachunkowego 2019 Wersja z dn. 25.10.2018 Roku; FADN: Warsaw, Poland, 2019. [Google Scholar]

- FADN. Plan Wyboru Próby Gospodarstw Rolnych Polskiego FADN (Plan of Sampling for Polish FADN); FADN: Warsaw, Poland, 2008. [Google Scholar]

- Neyman, J. On the two different aspects of the representative method: The method of stratified sampling and the method of purposive selection. J. R. Stat. Soc. 1934, 97, 558–625. [Google Scholar] [CrossRef]

- Dohmen, T.; Falk, A.; Huffman, D.; Sunde, U.; Schupp, J.; Wagner, G.G. Individual risk attitudes: Measurement, determinants, and behavioral consequences. J. Eur. Econ. Assoc. 2011, 9, 522–550. [Google Scholar] [CrossRef] [Green Version]

- Menapace, L.; Colson, G.; Raffaelli, R. Risk aversion, subjective beliefs, and farmer risk management strategies. Am. J. Agric. Econ. 2013, 95, 384–389. [Google Scholar] [CrossRef]

- Kavcic, S.; Žgajnar, J. IndIrect estImatIon of farm’s rIsk aversIon: mathematIcal programmIng approach. Bulg. J. Agric. Sci. 2011, 17, 218–231. [Google Scholar]

- Markowitz, H. Portfolio Selection; Wiley Publishing: Hoboken, NJ, USA, 1952; Volume 7. [Google Scholar]

- Franken, J.R.V.; Pennings, J.M.E.; Garcia, P. Measuring the effect of risk attitude on marketing behavior. Agric. Econ. 2014, 45, 525–535. [Google Scholar] [CrossRef]

- Dohmen, T.; Falk, A.; Huffman, D.; Sunde, U.; Schupp, J.; Wagner, G.G. Individual risk attitudes: New evidence from a large, representative, experimentally-validated survey. IZA DP 2005, 1730, 1–59. [Google Scholar]

- Fausti, S.; Gillespie, J.M. Measuring risk attitude of agricultural producers using a mail survey: How consistent are the methods? Aust. J. Agric. Resour. Econ. 2006, 50, 171–188. [Google Scholar] [CrossRef] [Green Version]

- Meuwissen, M.P.M.; Huirne, R.B.M.; Hardaker, J.B. Risk and risk management: An empirical analysis of Dutch livestock farmers. Livest. Prod. Sci. 2001, 69, 43–53. [Google Scholar] [CrossRef]

- Meraner, M.; Finger, R. Data on German farmers risk preference, perception and management strategies. Data Brief 2017, 15, 102–105. [Google Scholar] [CrossRef]

- Greiner, R.; Patterson, L.; Miller, O. Motivations, risk perceptions and adoption of conservation practices by farmers. Agric. Syst. 2009, 99, 86–104. [Google Scholar] [CrossRef]

- Udmale, P.; Ichikawa, Y.; Manandhar, S.; Ishidaira, H.; Kiem, A.S. Farmers’ perception of drought impacts, local adaptation and administrative mitigation measures in Maharashtra State, India. Int. J. Disaster Risk Reduct. 2014, 10, 250–269. [Google Scholar] [CrossRef] [Green Version]

- Eitzinger, A.; Binder, C.R.; Meyer, M.A. Risk perception and decision-making: Do farmers consider risks from climate change? Clim. Change 2018, 151, 507–524. [Google Scholar] [CrossRef] [Green Version]

- Stepien, S.; Polcyn, J. Risk Management in Small Family Farms in Poland. In Proceedings of the 20th International Scientific Conference Economic Science for Rural Development, Jeglava, Latvia, 9–10 May 2019; Volume 50, pp. 382–388. [Google Scholar]

- Akcaoz, H.; Ozkan, B. Determining risk sources and strategies among farmers of contrasting risk awareness: A case study for Cukurova region of Turkey. J. Arid Environ. 2005, 62, 661–675. [Google Scholar] [CrossRef]

- Asravor, R.K. Livelihood diversification strategies to climate change among smallholder farmers in Northern Ghana. J. Int. Dev. 2018, 30, 1318–1338. [Google Scholar] [CrossRef]

- Van Winsen, F.; de Mey, Y.; Lauwers, L.; van Passel, S.; Vancauteren, M.; Wauters, E. Determinants of risk behaviour: Effects of perceived risks and risk attitude on farmers adoption of risk management strategies. J. Risk Res. 2016, 19, 56–78. [Google Scholar] [CrossRef]

| Category | Units | Farm Population in Poland | FADN Field of Observation | FADN Field of Observation in Farm Population |

|---|---|---|---|---|

| Standard production | mln PLN * | 73,699 | 68,563 | 93.0% |

| UAA area | th. ha | 14,447 | 12,291 | 85.1% |

| Number of livestock | LU ** | 10,377,506 | 10,055,995 | 96.9% |

| Labour resources | AWU *** | 2,811,622 | 1,868,527 | 66.5% |

| Economic Farm Size Type of Farming | Standard Output [Thousand EUR] | Total | ||

|---|---|---|---|---|

| Below 25 | 25 < 100 | Above 100 | ||

| Crop production | 133 | 111 | 23 | 267 |

| Granivores (pigs & poultry) | 0 | 10 | 22 | 32 |

| Cattle | 38 | 93 | 8 | 139 |

| Mixed | 69 | 64 | 29 | 162 |

| Total | 240 | 278 | 82 | 600 |

| Grouping Criterion and Farm Classes | Risk Aversion | |||

|---|---|---|---|---|

| Low | Medium | High | ||

| Share of Farmers [%] | ||||

| Economic size [th. EUR SO] | below 25 | 20.8 | 57.8 | 21.5 |

| 25–100 | 24.9 | 47.7 | 27.4 | |

| above 100 | 26.8 | 51.8 | 21.4 | |

| Farm type | Cattle | 29.9 | 54.9 | 15.3 |

| Mixed | 16.4 | 52.7 | 30.9 | |

| Crop | 23.7 | 52.6 | 23.7 | |

| Pig | 21.1 | 52.6 | 26.3 | |

| Total | 23.0 | 53.2 | 23.8 | |

| Type of Statement | Risk Aversion | The Farmer’s Self-Assessment of the Degree of Compliance with a Given Statement | Chi2 | p-Value | ||

|---|---|---|---|---|---|---|

| Definitely Not or Probably Not | Neither Yes nor No | Rather Yes or Definitely Yes | ||||

| Share of Answers [%] | ||||||

| “I sometimes make risky decisions on the farm.” | low | 36.2 | 17.4 | 46.4 | 17.246 | 0.0017 |

| medium | 48.0 | 20.7 | 29.8 | |||

| high | 55.9 | 19.6 | 23.1 | |||

| total | 47.2 | 19.7 | 32.0 | |||

| “I have concerns about taking loans.” | low | 34.8 | 16.7 | 48.6 | 8.452 | 0.0763 |

| medium | 28.5 | 14.7 | 56.7 | |||

| high | 20.3 | 16.1 | 62.9 | |||

| total | 28.0 | 15.5 | 56.3 | |||

| “I implement new technologies and plant varieties.” | low | 21.0 | 5.8 | 73.2 | 10.961 | 0.0270 |

| medium | 22.6 | 15.0 | 62.4 | |||

| high | 18.2 | 17.5 | 62.9 | |||

| total | 21.2 | 13.5 | 65.0 | |||

| “I accept a narrow production specialization on the farm.” | low | 47.8 | 10.9 | 41.3 | 7.412 | 0.1156 |

| medium | 48.9 | 17.6 | 33.2 | |||

| high | 56.6 | 13.3 | 29.4 | |||

| total | 50.5 | 15.0 | 34.2 | |||

| Farmer Risk Aversion | Risk Factors | |||||

|---|---|---|---|---|---|---|

| Drought | Crop Pest and Diseases | Spring Frosts | Hail | Poor Overwintering | Storm | |

| share of farmers indicating a frequent occurrence of the risks factors [%] | ||||||

| low | 72.5 | 60.1 | 36.5 | 21.2 | 14.8 | 5.4 |

| medium | 82.4 | 64.2 | 49.4 | 23.0 | 24.3 | 3.7 |

| high | 83.2 | 56.0 | 54.9 | 29.6 | 24.3 | 4.0 |

| total | 80.3 | 61.3 | 47.7 | 24.1 | 22.1 | 4.1 |

| Chi2 | 7.062 | 3.2001 | 10.249 | 3.153 | 5.434 | 0.7471 |

| p-value | 0.0292 | 0.2018 | 0.0059 | 0.2066 | 0.0660 | 0.6882 |

| share of farmers indicating a substantial threat resulting from a given risk factor [%] | ||||||

| low | 86.2 | 61.6 | 67.4 | 52.2 | 49.3 | 61.6 |

| medium | 94.0 | 61.1 | 63.9 | 53.0 | 57.1 | 61.1 |

| high | 94.4 | 60.1 | 67.1 | 57.3 | 60.8 | 60.1 |

| total | 92.3 | 61.0 | 65.5 | 53.8 | 56.2 | 61.0 |

| Chi2 | 9.443 | .0671 | .726 | .955 | 4.031 | 1.113 |

| p-value | 0.01539 | 0.96697 | 0.69545 | 0.6202 | 0.13319 | 0.57318 |

| Farmer Risk Aversion | Risk Management Method | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Improvement of Crop Protection Practices | Diversification of Production Structure | Planning the Production Based on Market Information | Technology Improvements to limit The Effects of Adverse Weather | Using Crop Insurance | Raising Qualifications, Acquiring New Knowledge | Cooperation with Other Farmers | Crop Sales Contracts | Taking Off-fArm Employment | Developing Off-Farm Business | |

| share of farmers confirming the usefulness of given risk management methods [%] | ||||||||||

| low | 61.6 | 51.4 | 53.6 | 65.9 | 67.4 | 89.1 | 73.2 | 70.3 | 55.8 | 31.2 |

| medium | 62.4 | 54.2 | 52.0 | 67.1 | 67.7 | 82.1 | 63.9 | 66.1 | 59.6 | 28.5 |

| high | 61.5 | 55.9 | 46.2 | 57.3 | 69.2 | 83.2 | 61.5 | 62.2 | 61.5 | 26.6 |

| total | 62.0 | 54.0 | 51.0 | 64.5 | 68.0 | 84.0 | 65.5 | 66.2 | 59.2 | 28.7 |

| Chi2 | 0.042 | 0.585 | 1.861 | 4.255 | 0.135 | 3.596 | 4.942 | 2.034 | 1.002 | 4.249 |

| p-value | 0.9790 | 0.746 | 0.3942 | 0.1191 | 0.935 | 0.1655 | 0.0844 | 0.3616 | 0.606 | 0.1194 |

| Farmer Risk Aversion | Risk Management Method | ||||||

|---|---|---|---|---|---|---|---|

| Crop Irrigation | Improvement of Crop Protection Practices | Developing Infrastructure Protecting Multi-Perennial Crops | New Crop Cultivation Technologies | Developing of a Crop Storage Facility | Crop Sales Contracts | Developing New Sales Channels | |

| share of farmers who introduced specified risk management method in the last five years [%] | |||||||

| low | 12.9 | 59.4 | 8.8 | 33.3 | 26.2 | 38.1 | 18.8 |

| medium | 12.4 | 71.8 | 12.6 | 38.0 | 24.1 | 36.5 | 20.7 |

| high | 6.0 | 74.8 | 7.0 | 37.2 | 23.5 | 41.3 | 14.4 |

| total | 11.0 | 69.7 | 10.6 | 36.7 | 24.4 | 38.0 | 18.8 |

| Chi2 | 4.562 | 9.114 | 2.071 | 0.850 | 0.2900 | 0.922 | 2.367 |

| p-value | 0.1021 | 0.0104 | 0.3549 | 0.6537 | 0.8650 | 0.6305 | 0.3061 |

| Farmer Risk Aversion | Possible Adaptation Measures | |||||||

|---|---|---|---|---|---|---|---|---|

| Increasing the Scale of Production | Giving Up Commercial Farming | Continue Present Strategy Without Changes | Taking Off-Farm Employment | Adjusting Farm Production Structure | Developing Off-Farm Business | Decreasing Investment Expenditures | Decreasing On-Farm Employment | |

| % of farmers | ||||||||

| low | 39.1 | 29.7 | 28.3 | 38.4 | 48.6 | 39.1 | 60.9 | 5.1 |

| medium | 27.3 | 23.2 | 35.7 | 43.6 | 59.2 | 36.7 | 64.9 | 8.2 |

| high | 25.9 | 21.0 | 28.7 | 38.5 | 59.4 | 32.2 | 76.2 | 10.5 |

| total | 29.7 | 24.2 | 32.3 | 41.2 | 56.8 | 36.2 | 66.7 | 8.0 |

| Chi2 | 7.785 | 3.270 | 3.611 | 1.629 | 5.013 | 1.551 | 8.417 | 2.820 |

| p-value | 0.0203 | 0.1949 | 0.1643 | 0.4427 | 0.0815 | 0.4603 | 0.0148 | 0.2440 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sulewski, P.; Wąs, A.; Kobus, P.; Pogodzińska, K.; Szymańska, M.; Sosulski, T. Farmers’ Attitudes towards Risk—An Empirical Study from Poland. Agronomy 2020, 10, 1555. https://doi.org/10.3390/agronomy10101555

Sulewski P, Wąs A, Kobus P, Pogodzińska K, Szymańska M, Sosulski T. Farmers’ Attitudes towards Risk—An Empirical Study from Poland. Agronomy. 2020; 10(10):1555. https://doi.org/10.3390/agronomy10101555

Chicago/Turabian StyleSulewski, Piotr, Adam Wąs, Paweł Kobus, Kinga Pogodzińska, Magdalena Szymańska, and Tomasz Sosulski. 2020. "Farmers’ Attitudes towards Risk—An Empirical Study from Poland" Agronomy 10, no. 10: 1555. https://doi.org/10.3390/agronomy10101555