1. Introduction

Even though it was introduced in 2009, the digital currency Bitcoin caught the interest of the mainstream media only in 2012. Due to its supposed anonymity, Bitcoin and other digital currencies are often compared to cash. However, unlike cash, these currencies are purely digital and used primarily online. While digital currencies are widely varied, the decentralized digital currencies that are based primarily on cryptography, called cryptocurrencies, have gotten most attention. Bitcoin is the most prominent of the cryptocurrencies.

The market of competing cryptocurrencies is an interesting market to analyze for several reasons. First, it was a brand new market, with many players entering and competing. It is also an excellent laboratory with well defined, and high quality data on prices and volumes over time.

Further, network effects are likely present in this market. Positive network effects arise when the value of a product or service increases with the number of users. From the network effects literature [

1], in such environments we might expect a winner-take-all dynamics and convergence to one dominant player

1. Currencies in general provide one of the cleanest examples of network effects: The more popular a currency is, the more useful it is, and the easier it attracts new users. Therefore, one might expect that the most popular cryptocurrency would grow even more popular, eventually dominating the whole market. We call this the

reinforcement effect.

Currencies differ, however, in their attributes—and some of those that arrived later to the market may have higher quality. Several cryptocurrencies were developed to fix what their developers perceived as shortcomings of Bitcoin. Some of the changes may have attracted only a narrow group of users, while others may have had wider appeal as alternatives to Bitcoin. In particular, the relatively early competitors to Bitcoin, Litecoin and Peercoin, were developed to address major deficiencies of Bitcoin: namely, slow transaction times, a completely pre-determined number of coins in the Bitcoin system, as well as the incentive structure that promoted the use of very powerful specialized equipment to participate in the network

2. Due to differences on several dimensions, Novacoin was considered by many to be better than Bitcoin, but it was introduced four years later. Availability of other, better or simply differentiated cryptocurrencies allows for a

substitution effect. That is, the users could find it beneficial to substitute one cryptocurrency for another.

These two opposing forces have been also noticed in the industry, and were nicely summarized by Adam Levine, the Founder and Editor-in-Chief of the long running Let’s Talk Bitcoin! show. In an article from 9 September 2013, entitled “The Opportunities of Alt-coins” [

2], he wrote

[I used to believe that] there can only be one. The Network effect is simply too strong. Bitcoin has orders of magnitudes more adoption, acceptance and use compared to any other cryptocurrency on the market. The game is over and Bitcoin won.

Later, however, he noted that it was possible that a

substantially better product will almost always find its place in a market where the cost to move from one option to the other is cheap and easy. Cryptocurrency to Cryptocurrency (Bitcoin to Litecoin for example) transactions are frictionless; what exchange fees exist are minimal, transactions are fast, and no identity is required

As noted above, Novacoin could be considered to be of higher quality than Bitcoin, but it was introduced much later. Similar situations often occur in technology markets. Moreover, it is still not clear how markets in such situations develop. Especially, whether higher quality trumps the advantage of early presence and network effects

3. The detailed data in the cryptocurrency market allows us to analyze this tradeoff. The finely delineated (daily) data makes an examination of this market particularly interesting, and enables us to gain insights into early dynamics of the market.

In this paper we analyze data on competing cryptocurrencies and ask whether the early dynamics could help us predict the outcome in this market. The ability to infer the future of the market from early dynamics would be very valuable for analyzing markets with network effects. What we find is “unfortunately not”—early dynamics do not indicate the eventual outcome in this market.

We began collecting data from this market in November 2013. To assess market expectations about the viability of each cryptocurrency we focus on prices of these cryptocurrencies. Prices (or changes in prices: returns) better reflect market participants’ beliefs about the strength of network effects than other variables (e.g., the number of past transactions using a given cryptocurrency). Indeed, in an efficient market, prices and returns should account for any effects from other variables as well.

We find that, initially, neither the reinforcement nor the substitution effect dominated in the market. Later, as Bitcoin’s price sharply increased beginning in October 2013, we see a clear substitution effect. The prices of other cryptocurrencies increase or fall together with Bitcoin’s. Such dynamics are consistent with cryptocurrencies being purchased as financial assets rather than for usage as currency. We also find that the increase in the substitution effect is driven by the increased general interest in cryptocurrencies, as opposed to Bitcoin specifically.

In the last period of our sample, beginning at the end of April 2014, there is clear reinforcement effect favoring Bitcoin against all other cryptocurrencies. In particular, during this period, the price of Bitcoin increases in USD, while the prices of all other cryptocurrencies decline in USD. This suggests strong network effects and winner-take-all dynamics. Note that it is not that the increase in the price of Bitcoin indicates strong network effects, but rather that the stark movement of Bitcoin and the other currencies in opposite directions does

4.

The strong network effects in favor of Bitcoin continued beyond the end of the period for which we have detailed data. Bitcoin remained at around $400 from the end of April 2014 to the end of February 2016. In contrast, all of the other cryptocurrencies in our sample lost at least two-thirds of their value between April 2014 and February 2016. Peercoin, for example traded at $2.21 on 30 April 2014, and had fallen to 46 cents by 29 February 2016

5. So, in the overall sense, Bitcoin has “won-it-all” in this market.

The paper proceeds as follows: In

Section 2, we provide a brief background on Cryptocurrencies. At the end of this section, we provide a brief description of “mining” which both controls the supply and verifies transactions.

Section 3 discusses related literature. In

Section 4, we discuss the data we employ in the analysis; the analysis itself is in

Section 5.

Section 6 extends the analysis by employing “Google trends data”. In

Section 7 we conclude with some further discussion.

2. Brief Background on Cryptocurrencies

Bitcoin, the first cryptocurrency, came to existence in 2009. In the following years, other cryptocurrencies were introduced as well. Bitcoin and the other digital currencies considered here are decentralized systems, i.e., have no central authority to validate and settle transactions. They use only cryptography (and a clever incentive system) to control transactions, manage the supply, and to prevent fraud. Hence, they often are referred to as cryptocurrencies. Once confirmed, all transactions are stored digitally and recorded in a “blockchain”, which can be thought of as an accounting system. Payments are validated by a decentralized network.

Bitcoin’s algorithm provides an effective safeguard against “counterfeiting” of the currency. However, the eco-system is still vulnerable to theft. Users keep keys to their Bitcoins and make transactions with the help of wallets. Exchanges facilitate trade between Bitcoins and fiat currencies, and also allow for storing Bitcoins. Bitcoins can be stolen through wallets or exchanges. Up until this point, exchanges have been targeted more frequently than wallets. Many wallets are located on users’ computers, while exchanges by their nature are on-line. This makes exchanges an easier target. It was revealed in February 2014 that $350 million worth of Bitcoins were stolen from Mt.Gox, which led to the shut-down of the exchange [

5].

The supply of most cryptocurrencies increases at a predetermined rate, and cannot be changed by any central authority. In the case of Bitcoin, there are about 15 million Bitcoins currently in circulation, with the ultimate number eventually reaching 21 million. This creates concerns about the deflationary aspect of the currency, due to its limited supply in absolute numbers.

Bitcoin was initially popular in part because its (perceived) anonymity enabled trade in illegal goods. On 2 October 2013, the US government shut down the largest website facilitating such trades

6. Despite this, Bitcoin prices continued to climb for a few months afterwards. Overall, Bitcoin experienced massive fluctuations in value, in part due to speculation, security problems, and general uncertainty as to how the industry would develop.

By the end of 2013, virtually all cryptocurrencies were based on the Bitcoin protocol. They provided alternatives to Bitcoin—often aiming to fix Bitcoin’s shortcomings—and therefore are called altcoins. All non-Bitcoin cryptocurrencies in our data are altcoins.

One of the oldest altcoins was Litecoin, created in 2011. The main driving force behind its introduction was the frustration with the complexity of cryptographic tools used in Bitcoin, which promoted the use of powerful specialized hardware in the network. Further, transactions in Litecoin are confirmed in the system in a quarter of the time needed for Bitcoin.

In 2013, Feathercoin further improved on all these dimensions by further changing cryptographic tools, increasing the total number of coins and decreasing the time to confirm transactions. Unfortunately, these changes failed to fix the problem of specialized hardware and deflationary concerns. Peercoin, introduced in 2012, approached the deflationary concerns more effectively by allowing a steady continuous increase in the number of coins in the system

7. But Peercoin had the same problem with cryptographic complexity as the original Bitcoin system. Novacoin, established in 2013, further improved on Peercoin, Peercoin and Novacoin also employed a different incentive system in the process of validation of transactions, which decreased the need for specialized equipment.

Altogether, by 2014 there were several hundred cryptocurrencies traded in the market

8. Most of them provided no improvement over Bitcoin, and they used Bitcoin’s open-source protocol. This surge in entry into the cryptocurrency market was probably due to the fact that on the one hand the entry is relatively costless, and on the other hand the founders of coins have made significant profits: even the coin with the 34th largest market capitalization had a value of more than one million dollars in February 2014 [

7].

Despite the qualitative improvements introduced by other currencies, Bitcoin managed to hold and even increase its leading position in the markets. This is especially interesting because—while it is easy to create a new altcoin with changes in Bitcoin’s protocol—it is very difficult to change the Bitcoin protocol itself: changes have to be done by consensus among loosely connected Bitcoin developers [

8].

Mining Cryptocurrencies

Although this paper does not focus on the technical aspects of the supply of cryptocurrencies, we briefly wanted to summarize how the process occurs. Mining is an important aspect of the Bitcoin “institutional” structure. Since there is no central authority, and hence no central record-keeping, Bitcoin solves the key problems of controlling the supply of new bitcoins and verifying transactions via a “mining” process. Although there are some exceptions, most cryptocurrencies work in a similar manner.

In the process of mining, the `miners’ collect posted transactions into a block. They compete with each other in order to add their block of transactions to the blockchain (the ledger of Bitcoin transactions). In order to succeed, a miner needs to be the first one to solve a difficult factorization problem involving prime numbers. Although it is difficult to solve the problem, it is easy to verify that a proposed solution is correct. The difficulty of the problems is automatically adjusted so that a new problem is solved on average every 10 min. The first miner to solve the problem attaches his or her block of transactions and earns the prize in the form of the new bitcoins. Having a powerful computer increases chances of finding the solution earlier than other miners.

In 2009, miners used standard home computers. By 2011, they discovered computer graphic cards could perform the calculation faster. The continuing competition for faster mining calculations created an arms race. A whole industry of super computers has been created with the sole purpose of mining Bitcoins and Bitcoin mining equipment has become a specialist market. It is no longer worthwhile to mine Bitcoin on a standard home computer.

3. Related Literature

Bitcoin only recently became a subject of research in economics. The topic has been of interest for longer in computer science. A small number of theoretical papers written by computer scientists address incentives. Eyal and Sirer (2013) [

9] show that mining is not incentive-compatible and that the so-called “selfish mining” can lead to higher revenue for miners who collude against others. Babaioff et al. (2012) [

10] argue that the current Bitcoin protocols do not provide an incentive for nodes to broadcast transactions. This is problematic, since the system is based on the assumption that there is such an incentive. Christin (2013) [

11] examines the anonymous online marketplace in cryptocurrencies. Böhme (2013) [

12] examines what can be learned from Bitcoin regarding Internet protocol adoption.

There is some work on Bitcoin in legal journals as well, but there is very little in the economics literature. One of the few exceptions is the [

13] European Central Bank’s (2012) report on virtual currencies. Using two examples, Bitcoin and Linden Dollars, the report focuses on the impact of digital currencies on the use of fiat money. Gans and Halaburda (2015) [

14] analyze the economics of private digital currencies, but they explicitly focus on currencies issued by platforms like Facebook or Amazon (that retain full control), and not decentralized currencies like Bitcoin. Dwyer (2014) [

15] provides institutional details about digital currency developments. Yermack (2013) [

16] analyzes changes in Bitcoin price against fiat currencies and concludes that its volatility undermines its usefulness as currency. Moore and Christin (2013) [

17] empirically examine Bitcoin exchange risk. Using Bitcoin traffic at Wikipedia, Glaser et al. (2014) [

18] examine whether user interest in cryptocurrencies is due to interest in a ew investment asset or in the currencies themselves. Their results suggest that most of the interest is due to the asset aspect. Bohme et al. (2015) [

19] overviews economic forces behind costs and benefits of using Bitcoin. Catalini and Tucker (2016) [

20] use Bitcoin experiment to look for forces driving patterns of technology diffusion. None of those papers considers competition between cryptocurrencies.

5. Analysis

We analyze how the prices of the currencies were changing over time between May 2013 and July 2014. We are particularly interested in how these changes relate one to another.

Specifically, we focus here on two potentially opposing forces present in this market:

- (1)

a reinforcement effect due to network effects

- (2)

a substitution effect due to competition

The reinforcement effect is the result of the network effects present in the currency adoption process: As Bitcoin becomes more popular, more people would believe that it will win the winner-take-all race against other cryptocurrencies. With this expectation, the demand will further increase.

The

substitution effect is the result of either higher quality alternatives or speculative dynamics. The speculative dynamics arise when cryptocurrencies are treated as financial assets. In such a case, when Bitcoin becomes more popular and more expensive, people fear it may be overvalued (or too volatile) and look for alternative cryptocurrency investments

17.

As

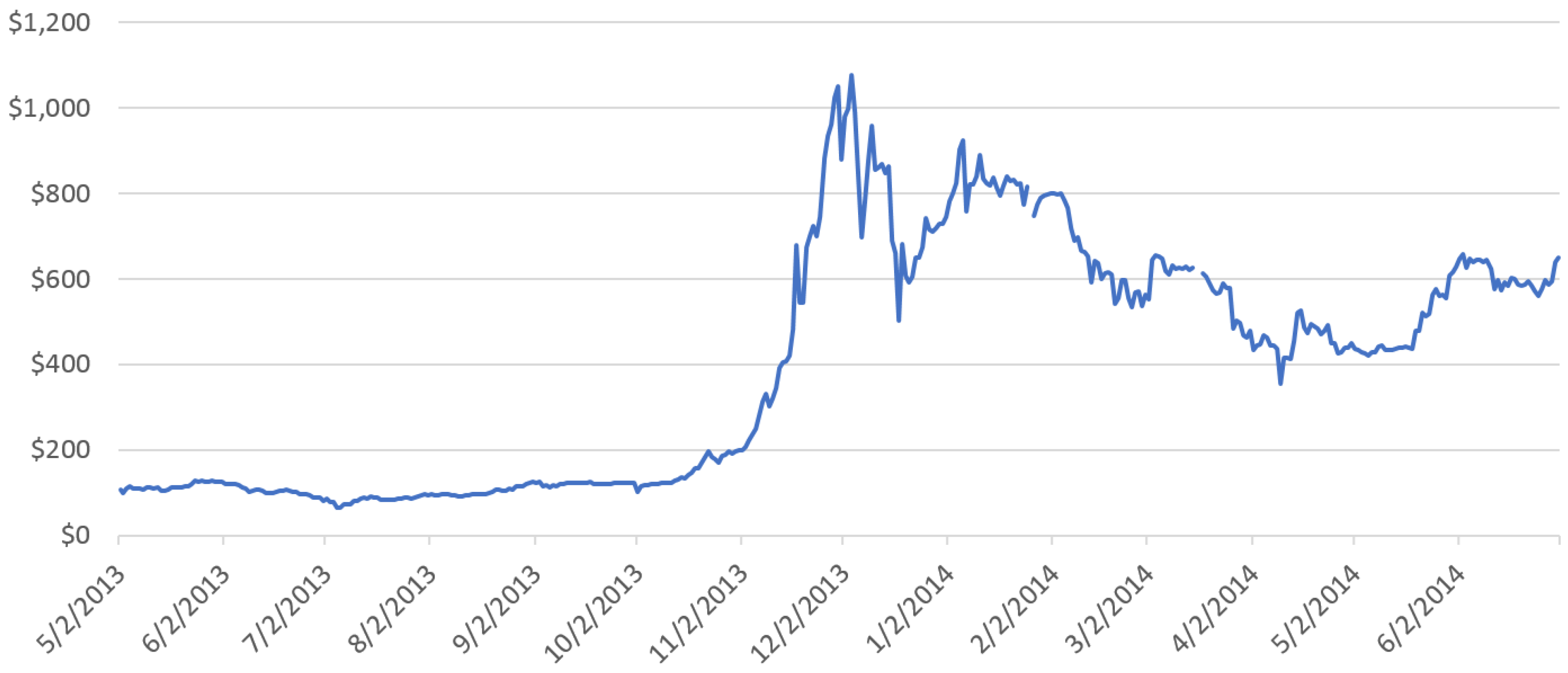

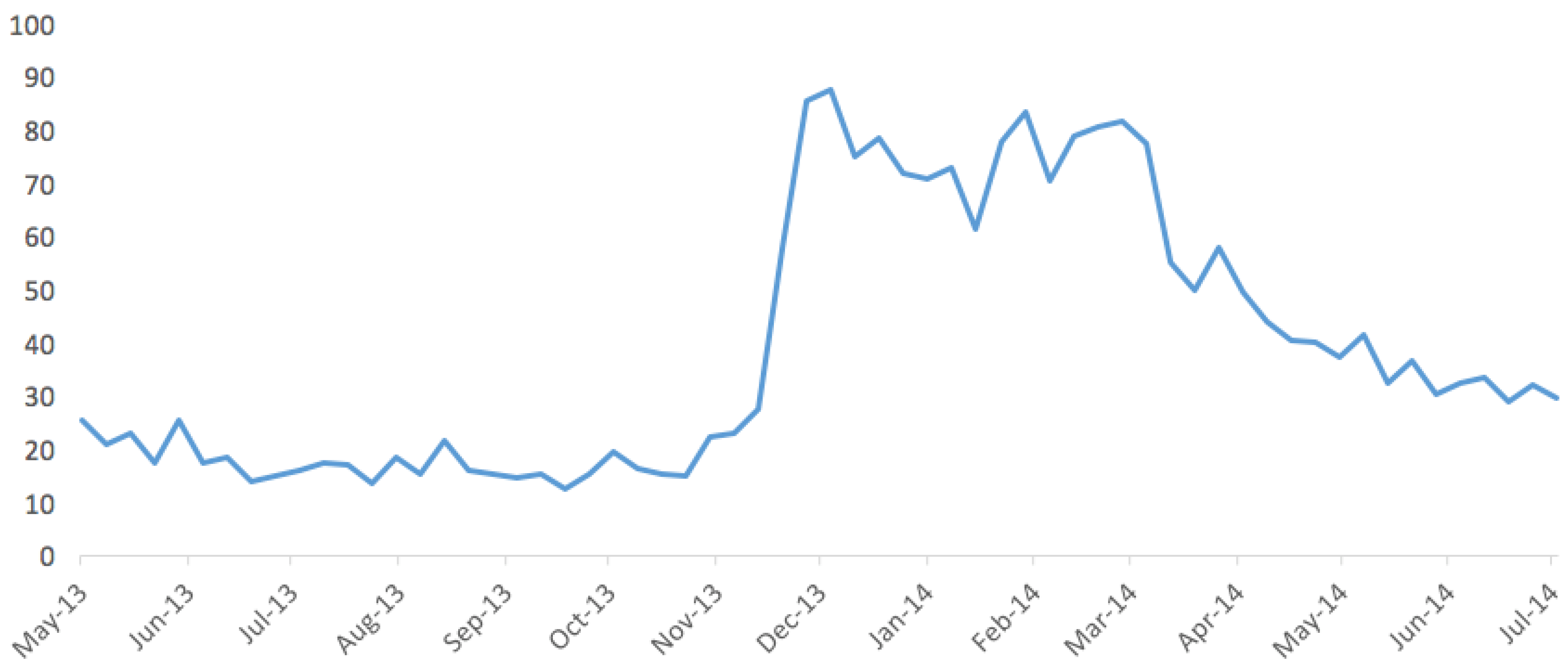

Figure 1 shows, and as many authors pointed out,

18 Bitcoin’s price has been quite volatile throughout its history. The total supply of Bitcoin is governed by an algorithm that does not depend on prices, so there cannot be more Bitcoins created in response to a price increase (much like stocks in the stock market, at least in the short term). Therefore, a change in price indicates a change in the market’s overall expectations of Bitcoin’s future value and its risk. That is, changes in the price of Bitcoin indicate varied interest in the cryptocurrency and possibly changing economic forces affecting this interest. Importantly, this reasoning implies that prices are the appropriate variable to employ in our analysis. Prices should not only reflect other variables that market participants may observe (e.g., the transactions recorded in Bitcoin’s blockchain) but also reflect the expectations of anything that may influence Bitcoin’s value in the future, for example current and expected future strength of the network effects. This feature is particularly helpful since such dimensions may be difficult for an econometrician to capture.

One of these economic forces affecting the interest in Bitcoin is competition between cryptocurrencies

19. If the prices of altcoins are increasing as the price of Bitcoin is increasing, it would indicate a substitution effect between Bitcoin and other cryptocurrencies. If, however, the price of one of the cryptocurrencies increased while others’ prices were decreasing, that would indicate a reinforcement effect, and would suggest winner-take-all dynamics in favor of this cryptocurrency.

The earliest theoretical results on network effects (e.g., Katz and Shapiro 1985) predict that network effects favor the first mover. There is no room for competition. Since Bitcoin is the oldest cryptocurrency, introduction of altcoins would always be unsuccessful—in the light of the earliest theories, what we should see in the data is Bitcoin’s domination. The reinforcement effect in favor of Bitcoin and against newly established altcoin would be immediate.

However, even in the earlier literature there is a debate whether a high quality newcomer can overcome network effects and the first mover advantage (e.g., [

3,

4]). Theoretical results predict that this could happen, but this is not guaranteed even for sufficiently high quality newcomers (e.g., [

22,

23]).

More recent literature on platform competition—reviewed for example in Rysman (2009) [

24]—argues that under some circumstances competing networks may coexist despite the presence of network effects. This may happen when users have different needs and when differentiated network appeals to different types of users (for example, Cennamo and Santalo (2013) [

25] discuss differentiated video game platforms). In such a case, after the introduction of alternatives viably targeting each niche we should observe a sustained substitution effect, as such alternatives become popular and dominant in their own niche. To the best of our knowledge, there are no papers that empirically document how such platform competition develops dynamically and how the interplay of the reinforcement and the substitution effects changes over time.

5.1. Relation between Bitcoin and Litecoin

We start by looking at the relation between Bitcoin (BTC) and Litecoin (LTC), the cryptocurrency that was the second most popular throughout our sample, as measured by market capitalization.

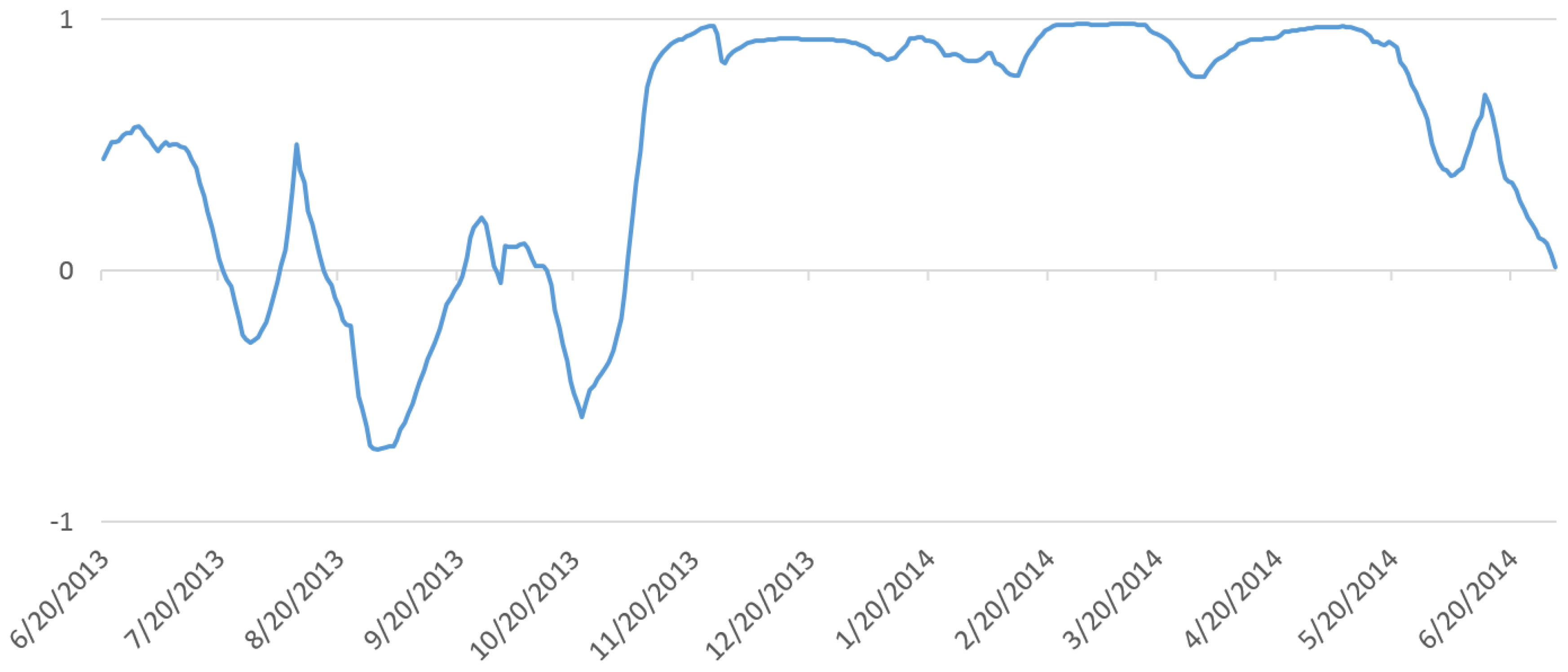

Figure 2 shows that price movements of Litecoin and Bitcoin have some common patterns, but are not perfectly correlated. Because of a large discrepancy in the magnitude of these prices, in

Figure 2 we divide Bitcoin’s price by 100 to improve exposition

20.

When we look at the rolling-window price correlation (

Figure 3), we can see that there are large differences over time. From the beginning of our sample until late October there is a large volatility in correlation. The correlation takes both large positive and large negative values. In contrast, from late October until end of April, the correlation looks quite stable at large positive values. Toward the end of our sample, from early May 2014, we see a start of a declining trend in the correlations.

To assess the dynamics of changes, we separately analyze the three periods:

period 1, from 2 May 2013 to 22 October 2013;

period 2, from 23 October 2013 to 30 April 2014;

period 3, from 1 May 2014 to 1 July 2014.

The price of Bitcoin also behaves somewhat differently in these three periods. Casual observation of Bitcoin prices in

Figure 1 indicates that during the May to late October period (period 1) Bitcoin traded within a relatively narrow range of low prices (from $65/BTC to $185/BTC). In the period from late October 2013 to the end of April 2014 (period 2), the volatility increased greatly and Bitcoin’s prices ranged from $171/BTC to $1076/BTC.

21 Bitcoin rises continuously through December 2013, and then begins falling, reaching a low point of slightly more than $400 at the end of this period. In May 2014, Bitcoin’s price recovers from the turbulent fall and starts steadily climb, reaching $650 on 1 July 2014, when our data ends (period 3)

22.

As noted earlier, there were a number of events in the first half of October that could explain the late October change. On 2 October 2013, US law enforcement raided and shut down Silk Road, a website trading in illegal substances, and using Bitcoin to facilitate anonymity of transactions. In mid-October, Chinese Internet giant Baidu started accepting Bitcoin, which increased Bitcoin’s popularity in China

23. It is not clear, however, what caused the May 2014 change in the trend. It may be worth a separate investigation, but this is beyond the scope of our paper.

In periods 1 and 3 the correlation between Bitcoin and Litecoin is small and negative (−0.32 and −0.03, respectively), which could indicate a mild reinforcement effect—Litecoin giving way to Bitcoin. In period 2, however, the correlation is strongly positive, 0.93, pointing toward substitution effect.

5.2. Other Cryptocurrencies

To get a richer picture of the dynamics in this market we also turn to other cryptocurrencies in our sample: Peercoin, Namecoin, Feathercoin, Novacoin, and Terracoin. They were not traded directly for USD at the beginning of our sample, although some started trading directly for USD later in our sample. They were, however, traded for Bitcoin throughout our sample period. Therefore, to get their value in USD, we multiply their value in Bitcoins with the price of Bitcoin

24:

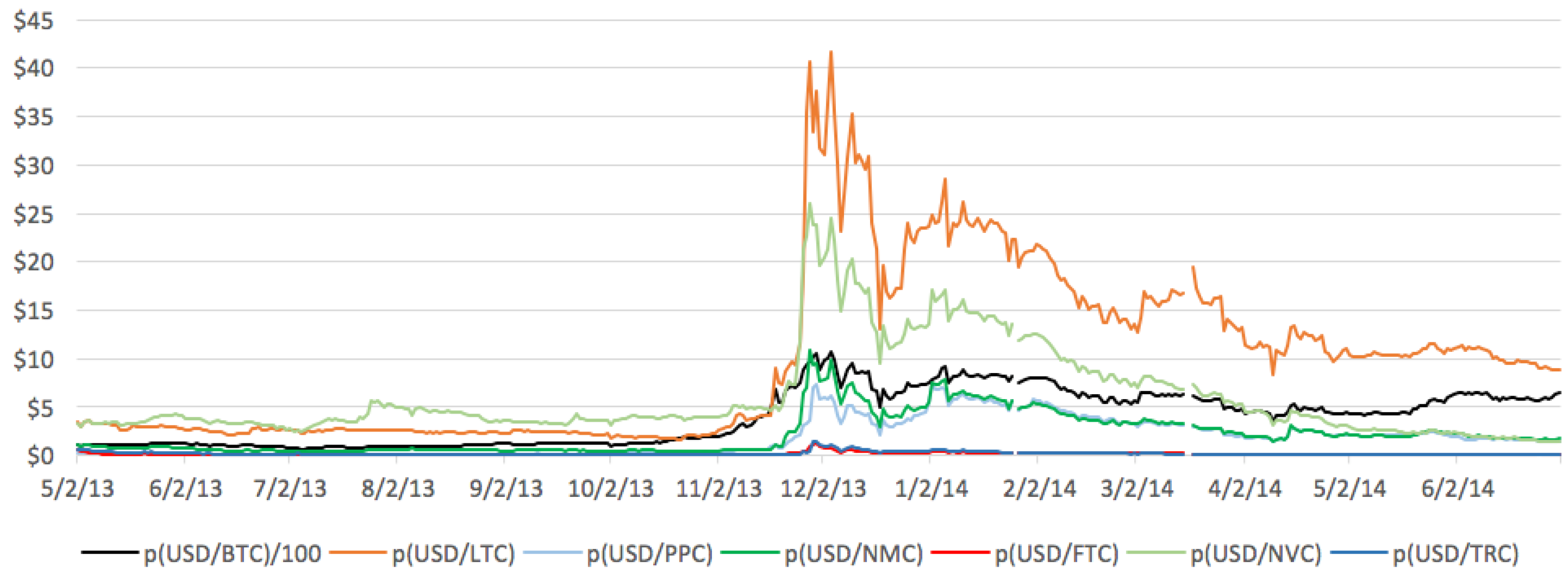

Figure 4 shows all the prices in one graph. As before, for ease of exposition, we plot the Bitcoin’s price divided by 100. We can see that there is some co-movement, especially around the time when Bitcoin’s price spikes. When we look at the rolling-window correlations between Bitcoin’s price and each of the altcoin’s prices (

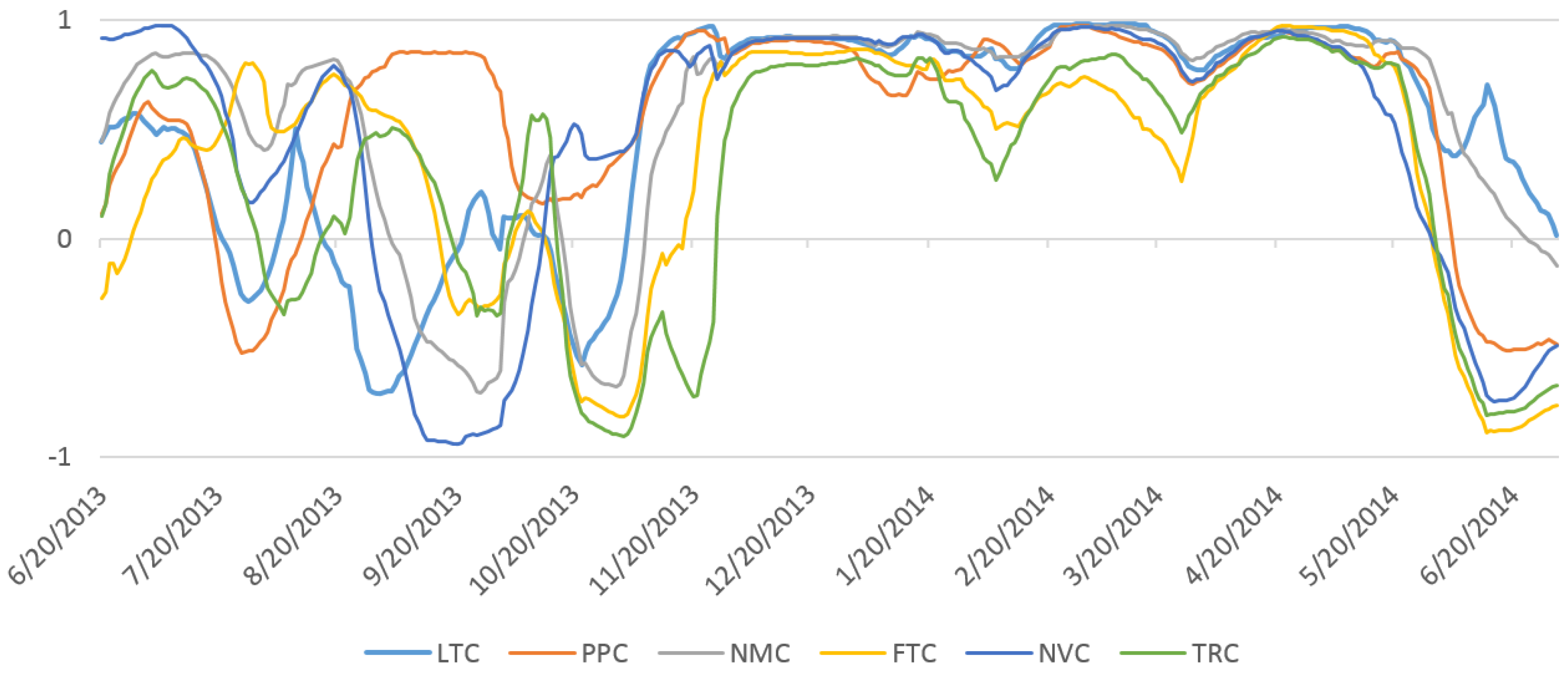

Figure 5), we see a similar pattern as in Litecoin’s rolling-window correlation with Bitcoin. There is a large variability in correlations in the first period, including instances of large positive and large negative correlations. In the second period, correlations are all strong and positive. And in the third period there is a clear trend where correlations fall, some of them reaching large negative values.

Figure 5 shows the rolling-window correlations of prices of individual cryptocurrencies with the price of Bitcoin.

Table 1 provides additional detail by showing correlations between the different altcoins, within each period. We can see an interesting pattern in how the three periods differ.

We noted earlier that in the first period Litecoin is weakly negatively correlated with Bitcoin, which could indicate a mild reinforcement effects. When we look at the relation between Bitcoin and other cryptocurrencies, and between the altcoins themselves in the first period, this effect is no longer visible. The correlations are in most cases small, sometimes positive, sometimes negative. Neither the substitution nor the reinforcement effect is apparently dominating.

In the second period, the correlations are universally positive and large (above 0.7), which suggest a strong substitution effect among different cryptocurrencies is dominating, without any one winner.

In the third period, the correlation between Bitcoin and altcoins are negative, although varying in strength. Bitcoin’s correlation with Litecoin and Namecoin are negative but weak, while correlation with other altcoins are strongly negative. Correlations between altcoins, however, are positive and strong. This suggests that the reinforcement effect in favor of Bitcoin is dominating, while all of the other cryptocurrencies are positively correlated in the “losing” group.

The pattern of Bitcoin “winning it all” in the market emerges only in period 3. We do not observe indicators of such future dynamics in periods 1 and 2.

5.3. Percentage Changes in Prices

When analyzing assets including currencies, researchers and market analysts are typically more interested in returns (i.e., percentage changes) than in price levels. First, returns may be easier to work with if the price level series is nonstationary

25. More importantly, changes in prices (returns) will directly capture changes in the strength of the network effects of different cryptocurrencies. This happens because the attractiveness of the platform increases when its network effects become stronger (e.g., the seminar paper of Katz and Shapiro, 1985). As that happens, the value of being able to participate in the platform increases relative to other goods (i.e., the dollar price of each bitcoin goes up), resulting in a positive return. This increase may in fact directly reflect the growth in the network. If more consumers want to use Bitcoin, they need to acquire units of the cryptocurrency, increasing the demand. Since supply of the cryptocurrency is fixed, prices must adjust, with returns reflecting the direction and the magnitude of shift in demand. Moreover, one can compare the rate of return for two different cryptocurrencies and assess the relative improvements to the network effects on one versus the other: for example, we would expect larger returns for the cryptocurrency that attracts a larger proportion of the market

26.

Depending on whether the substitution or the reinforcement effect dominates, an increase in Bitcoin’s popularity may increase or decrease altcoins’ values. Increased popularity is reflected in a higher price of Bitcoin. Since increased popularity of Bitcoin could also potentially be reflected in volume of Bitcoin to USD trade, we include change in Bitcoin’s volume in the regressions

27.

We run regressions of returns

on

and percentage change in volume,

, for

, where

and percentage change for Bitcoin’s price and volume are calculated similarly.

Table 2 reports the results.

The regression results in

Table 2 are consistent with the second period being a period where the substitution effect dominates, while periods 1 and 3 are periods where the reinforcement effect dominates.

Note first that, on average, the price of Bitcoin appreciated versus the USD in each of the three periods we consider here in the sense that the price of Bitcoin was higher at the end of each of the three periods for which we have data

28. Thus, the new information or change in beliefs that affected exchange rates was, on average, positive for Bitcoin. That information was likely partly driven by news about the overall cryptocurrency market (the attractiveness of cryptcurrencies overall) and partly about information specific to a particular cryptocurrency (e.g., Bitcoin’s competitive advantage versus other cryptocurrencies).

Since the coefficients estimated in

Table 2 are positive, the first channel likely dominates across the overall sample. This is consistent with returns to cryptocurrencies going up in USD overall throughout this period. The first channel should, on average, affect all cryptocurrencies similarly. But the second channel will impact them in opposing ways (good news specifically for Bitcoin is bad news for the competing altcoins). Then, the differences between estimates can be interpreted as being informative about the relative strength of the competitive pressures over time.

Because the estimated coefficients in periods 1 and 3 are generally lower than one, this suggests that the first channel was partly offset by the second channel. This offsetting pressure reflected the reinforcement effect, which was beneficial for Bitcoin in periods 1 and 3. In contrast, almost all estimated coefficients are greater than one in period 2. Indeed, in period 2, with the exception of Novacoin and Terracoin, 95% confidence intervals for the estimated coefficient associated with the variable do not include one in the confidence interval, that is, the lower bound for the 95% confidence interval for that parameter is above one for Litecoin, Peercoin, Namecoin, and Feathercoin.

There was good news overall for the cryptocurrency market in this period. This news was amplified for altcoins other than Bitcoin. Prices of all four “first tier” cryptocurrencies in our sample went up significantly between the beginning and the end of period 2

29. While the price of Bitcoin increased by 143% in this period, the prices of Litecoin, Peercoin, and Namecoin all rose by over 400%. This amplification is consistent with Bitcoin losing some competitive advantage against other cryptocurrencies, perhaps because it was viewed as less likely to dominate the entire cryptocurrency market

30.

Adjusted Rs also give us insights into how the relation between the cryptocurrencies was changing between the periods. In the first period, the estimated coefficients indicate a reinforcement effect in favor of Bitcoin. But the effect does not play a large role in the dynamics of cryptocurrency prices, as the changes in Bitcoin’s returns explain only a very small portion of variation in altcoin’s returns. The changes in altcoins’ prices in this period may have been more influenced by their own development communities.

The relation between Bitcoin and altcoins plays a larger role in the second and third periods. The changes in Bitcoin’s returns explain much more of altrcoins’ variation—at first via substitution effect in period 2, and then via reinforcement effect in period 3. The estimates suggest that up to 60% of altcoin’s variability in period 2 and up to about half of variability in period 3 can be explained by what was happening to Bitcoin in these periods.

5.4. Robustness Analysis

As we noted, BTC-e was the only major exchange that allowed trading in several cryptocurrencies. As a robustness check, we examined data from Bitstamp, which is one of the major cryptocurrency exchanges. As noted earlier, Bitstamp only allows trade between Bitcoin and USD. Hence, we compared Bitcoin’s prices in UDS for BTC-e and Bitstamp for all of our three periods. Correlations between the prices on the two exchanges were 0.9968, 0.9957, and 0.9974 in periods one two and three, respectively. This suggests that Bitcoin to USD price movements were quite similar across exchanges.

We conducted additional robustness analysis by breaking down the data into 60-day periods—and the main results in

Table 1 continue to hold. Namely, in the 60-day periods associated with our “first period”, there is (similar to our results in

Table 1) no special pattern in the correlation rates among the cryptocurrencies. In the 60-day periods associated with our second period, the correlations are universally positive and large, again similar to the results for the full second period reported in

Table 131.

As a final robustness check we also investigated potential interactions between cryptocurrencies. In our analysis above, we focused on the relationship between Bitcoin on the one hand and altcoins on the other. We chose this approach because Bitcoin is the incumbent in the cryptocurrency ecosystem. However, there might be potential interactions between individual altcoins as well. We test for such effects by repeating our baseline regressions by this time relating returns to one altcoin to returns of both Bitcoin and all remaining altcoins. This analysis indicates no patterns in the signs or significance of interactions between individual altcoins. We report the results of this analysis in Table in the

Appendix for the most popular altcoin: Litecoin. The relationship between Litecoin and Bitcoin is very similar to that we report in

Table 2, while the relationship between Litecoin and other altcoins tends to be insignificant and has no consistent sign; where it happens to be significant for one period, it loses significance in another, etc. We conclude that the interactions between individual cryptocurrencies are largely limited to those between Bitcoin and individual altcoins.

6. Accounting for General Interest in Cryptocurrencies

Results in the previous sections suggest that the relative strength of the substitution and reinforcement effects is driven by the general interest in cryptocurrencies as opposed to interest in a particular cryptocurrency, e.g., Bitcoin. To further disentangle the relationship between how (i) Bitcoin and (ii) general interest in cryptocurrencies affected altcoins, we include a proxy for the general interest in cryptocurrencies using Google Trends. To capture this interest, we use the search intensity for the two general terms usually associated with cryptocurrencies, “cryptocurrency” and “virtual currency”, provided by Google Trends

32. We present the pattern in these search terms in

Figure 6. The figure shows steady interest in cryptocurrencies until about the beginning of period 2, when the interest abruptly increases and remains high until about the beginning of period 3, when interest gradually wanes.

Google trend data is only available weekly, so we recalculate the returns on Bitcoin and the altcoins to match that frequency. This reduces our overall sample size to 60 observations. Given the limited number of observations, we no longer further divide the data into the three periods; in fact, we are aiming to explain some of the differences between the periods using our proxy variable for the general interest in cryptocurrencies. We next estimate the regressions, as reported in

Table 3.

We begin with the basic regressions (from

Table 2) that simply relate the percentage changes in the price of each altcoin to USD in the percentage change in Bitcoin’s price over the same week and the percentage change in volume. The results in

Table 3 support those we discussed earlier: we find strong positive correlations between Bitcoin and altcoins; for Litcoin in regression (1), Peercoin in regression (3), etc. The estimated coefficients all exceed 1, which suggests that the particularly turbulent period 2 drives the overall regression results.

We next add two additional explanatory variables: the overall Google search intensity (

) and the interaction between Bitcoin returns and the Google search intensity (

*

)

33. To the extent that Google Trends reflect the overall interest in cryptocurrencies, we expect both the Google Trends variable and the interaction term to capture the substitution effect. This suggests that the coefficients on the Google Trends term and the interaction term should both be positive. This is indeed what we find in

Table 3.

Our results are three-fold. Firstly,

Table 3 shows that the number of Google searches in a given week is positively correlated with returns on each individual altcoin, and for five out of six the relationship is statistically significant at the 10% level.

Secondly, The effect of the interaction term is even stronger. Returns on Bitcoin are more important for the altcoins when they are accompanied by more search activity and hence stronger interest in cryptocurrencies overall. Indeed, the estimated coefficient on the interaction term is positive and statistically significant in all six regressions

34.

Finally and strikingly, controlling for the overall interest in cryptocurrencies, we find that the relationship between Bitcoin and altcoin returns is actually negative or there is no effect. The sign of the estimate is negative for each of the six altcoins we consider here, although only for three is the estimated coefficient significant at the 10% level. These results are consistent with the reinforcement effect, and again suggest that—while the general interest in cryptocurrencies was driving substitution effect in period 2—the reinforcement effect was more important in periods 1 and 3, which were less buoyed by the overall interest in cryptocurrencies

35.

7. Further Discussion

Our data ends in 1 July 2014 due to the technical limitations we discussed earlier. But the reinforcement-effect pattern from the third period is also visible when we look at how those cryptocurrencies are doing at the time of writing, compared to the beginning of the third period. As

Table 4 shows, Bitcoin has maintained its value since 1 May 2014 (beginning of the third period) while other cryptocurrencies have fallen sharply. Some of them by more than 90 percent. Currencies like Feathercoin and Terracoin, while still listed on some exchanges, are all but gone from the market.

Additionally, in February 2016 Bitcoin accounts for 93.5% of the total market capitalization, while Litecoin accounts for 2.5%. Hence, at the time of writing Bitcoin accounts for a larger percentage of market capitalization than it did for the period for which we have detailed data.

Hence, despite its shortcomings, Bitcoin seems to have emerged—at least at this stage—as the clear winner. There may be higher quality alternatives, but, in the end, the network effects led to Bitcoin being the only winner.

As our analysis shows, there was no easy way to predict such an outcome from the early dynamics of the market. After observing the trend in period 2, one may have been tempted to extrapolate continuation of this trend into the future. But such prediction would have been incorrect. Nonetheless, we often encounter such predictions in the world of business and technology. Some of them even enter the popular history as examples of stark misestimations—like Thomas Watson, president of IBM, in 1943 stating “I think there is a world market for maybe five computers”

36.

Our analysis shows how the temptation to make such predictions may arise. But making a prediction that “the market entered a persistent co-evolution of different cryptocurrencies” at the end of period 2 would have been similarly incorrect as that of Thomas Watson’s. This is why it is even more intriguing that we do not know what events brought on the May 2014 change. With a change so clear as this one, we often look for one event that would drive it. We leave this for future research.