Trust and Trustworthiness in Corrupted Economic Environments

Abstract

1. Introduction

Testable Predictions and Summary of Findings

2. The Experimental Design

2.1. Baseline Game and Additional Treatments

2.2. Procedures

2.3. Hypothesis Testing

3. Empirical Findings

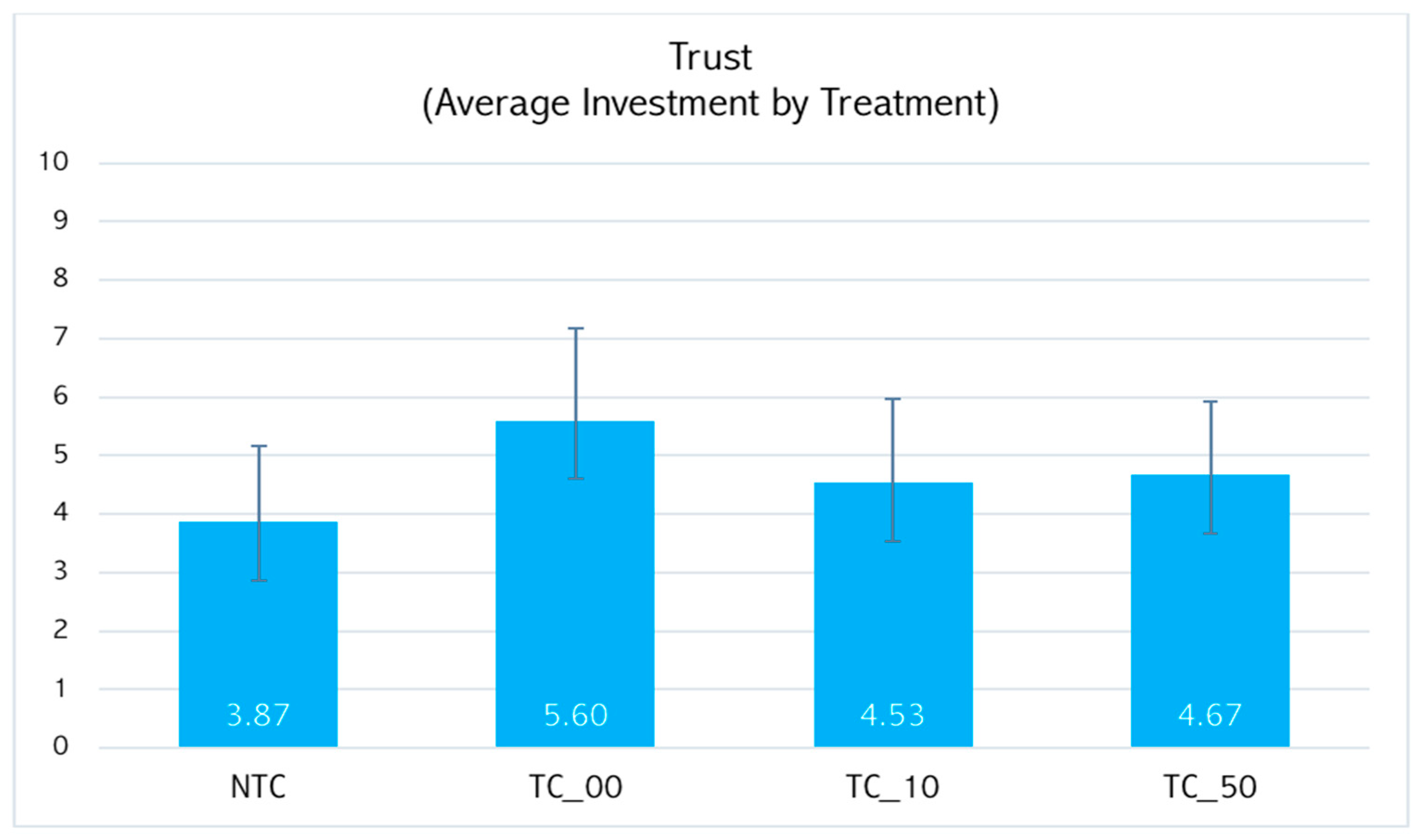

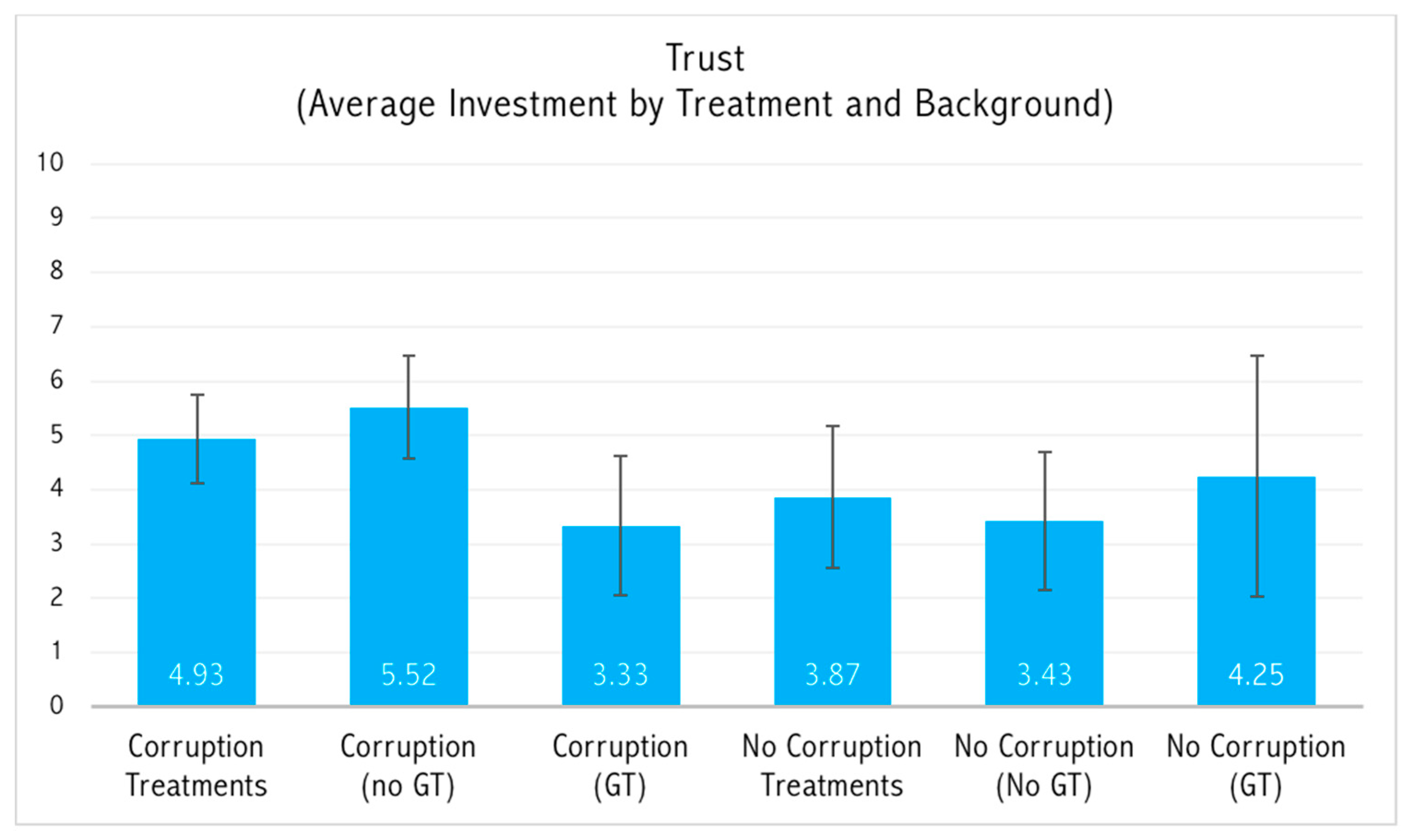

3.1. Behavior of the Trustor

3.1.1. Behavior of the Trustor’s Expectations of the Withdrawal of the Third Agent

3.1.2. Trustor’s Expectations of Trustee’s Giving

3.1.3. Trustor’s Expectations of Returns of Her Strategies

3.1.4. Discussion on Trustor’s Behavior

3.2. Behavior of the Trustee

Interpretation of Trustees’ Excess Reciprocity

3.3. Behavior of the Third Agent

4. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A (not for Publication). Experimental Instructions

- Welcome and thank you for participating in this experiment.

- During the experimental session, you are not allowed to communicate with the other subjects. If you have any questions, please raise your hand and one of the assistants will come to your place and answer you.

- Following these instructions carefully, you could gain an amount of money (in EUR) which depends on both your choices and those taken by the subjects you will interact with. The following rules are the same for all the subjects involved in this experiment.

- During the experimental session, earnings will be expressed in tokens. At the end of the experiment, the overall tokens will be converted into EUR at the exchange rate of 2 tokens = 1 EUR. Your final earnings in EUR will be paid in cash at the end of the session.

- 15 subjects will participate in this experimental session.

- At the beginning of the experiment, the computer will form 5 groups of 3 subjects each randomly and anonymously.

- During the experiment, each subject will interact with the remaining 2 subjects in her/his group only. Choices will remain anonymous throughout the experiment.

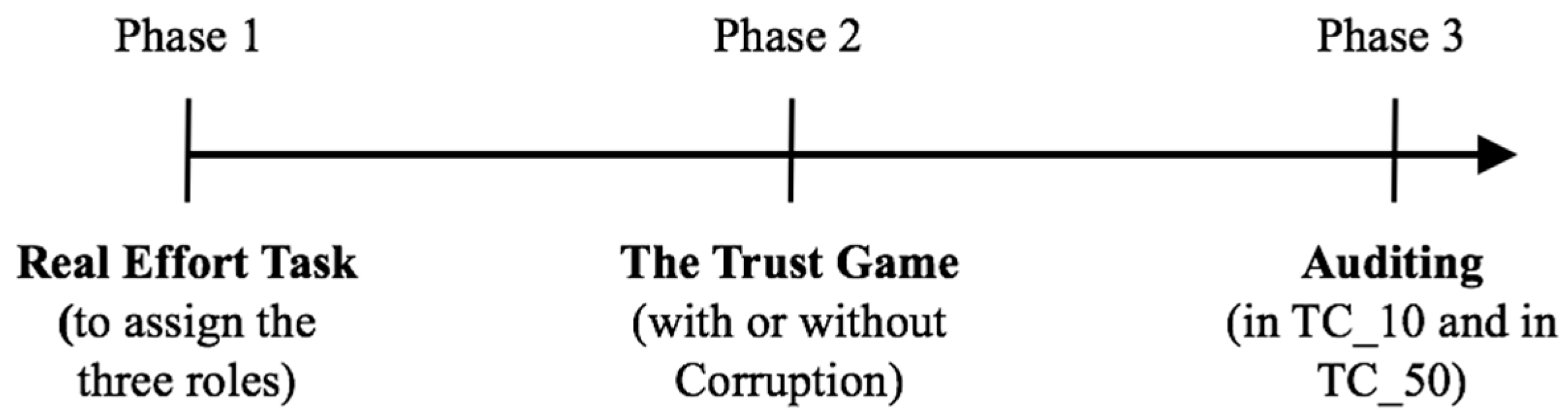

- The interaction across the 3 group members proceeds in 3 consecutive phases. The final earnings of each subject depend on the choices made by the group members in the 3 phases.

- Schematically:

- -

- In PHASE 1: the 3 group members will compete in an ability task. The 2 best performers in the group will be assigned to roles A and B. The subject with the lowest score will be assigned to role C.

- -

- In PHASE 2: Both A and B will be assigned an endowment of 10 tokens. A will choose how many tokens of her/his endowment to send to B. B will receive a number of tokens that is equal to three times those sent by A. Of the received tokens, B will choose how many tokens to send to A.

- -

- In PHASE 3: C will be assigned an endowment of 10 tokens. C will choose how many tokens of the “surplus” generated during the interaction between A and B in PHASE 2 to keep for herself/himself. The “surplus” is given by 2 times the number of tokens sent by A in PHASE 2. Given the choice of C, earnings obtained by A and B in PHASE 2 will be reduced accordingly, in proportion to the share of surplus obtained by each subject in PHASE 2. With a probability of 50%, the choice of C will be audited by the computer. If C has not kept any tokens of the surplus, the audit procedure does not exert any effect on her/his earnings. Instead, in the case of auditing and if C has kept a positive number of tokens, then her/his earnings will be reduced by the number of tokens kept plus a fine that is equal to 1 token for every 2 subtracted from the surplus. The audit procedure does not exert any effect on A’s and B’s payoffs, which will remain equal to those obtained in PHASE 2 minus the tokens kept by C in PHASE 3.

- The instructions of each of the three phases will be distributed at the beginning of the corresponding phase.

- In PHASE 1, you and the other two members of you group will compete in an ability task.

- The computer will show a screen containing a number of “sliders” of the following form:

- By using the mouse and the arrow keys

, your task will be to align the cursor on the left of the slider to the value “50”.

- The competition lasts 120 s. At the end of the 120 s, the computer will inform you about your final score given by the number of sliders for which you successfully centered the cursor on the value “50”.

- Given the final scores, each group member will be assigned to one of three possible roles, either A, B, or C. In particular, the two subjects with the highest scores will be randomly assigned either A or B. Instead, the subject totalizing the lowest score will be assigned role C. Ties will be randomly broken by the computer.

- In PHASE 2, only A and B will make choices. C will not make any choice in this phase.

- Both A and B will be assigned an endowment of 10 tokens.

- A will choose how many tokens to send to B. She/he can choose to send any number of tokens between 0 and 10.

- The amount sent by A will be tripled such that B will receive 3 tokens for each token sent by A.

- Given the received amount, B will choose how many tokens to send to A. She/he can choose to send any number of tokens between 0 and 3 times the amount initially sent by A.

- Given their choices, A’s and B’s earnings in PHASE 2 will be given by:

- -

- For A: 10 tokens − tokens sent to B + tokens sent by B;

- -

- For B: 10 tokens + 3 * tokens sent by A − tokens sent to A.

- Example: If A sends x tokens to B and B sends y tokens to A, A earns 10 − x + y tokens and B earns 10 + 3x − y tokens.

- C’s earnings are null in PHASE 2.

- B will make her/his choice before knowing the number of tokens effectively sent by A. In particular, B will choose how many tokens to send to A for each possible amount that A could have sent to her/him (1–10 tokens). Since there are 10 possible cases, B will make 10 choices.

- Given the 10 choices made by B, only the one corresponding to the effective choice made by A will be used to determine earnings in PHASE 2.

- At the end of PHASE 2, A and B will be informed about their earnings in tokens before C makes her/is choice.

- In PHASE 3, only C will make her/his choice. A and B will not make any choices in this phase.

- C will be assigned an endowment of 10 tokens.

- C will choose how many tokens of the “Surplus” generated during the interaction between A and B in PHASE 2 to keep for herself/himself. The “Surplus” is given by 2 times the number of tokens sent by A in PHASE 2. Thus, the “Surplus” increases in the number of tokens sent by A in PHASE 2 and is null if A has sent nothing to B.

- Given the choice made by C, earnings obtained by A and B in PHASE 2 will be reduced accordingly, in proportion to the share of “Surplus” obtained by each subject in PHASE 2. In particular, on the basis of the “Surplus” generated during the interaction between A and B in PHASE 2, the shares obtained by A and B are given by:

- Example: Suppose that, at the end of PHASE 2, the “surplus generated during the interaction between A and B in PHASE 2 is equal to 10 tokens, A’s earnings are equal to 16 tokens and, finally, B’s earnings are equal to 14 tokens. Suppose that C chooses to keep 10 tokens for herself/himself. Given the previous expressions, A’s and B’s shares of “Surplus” are given by e . Thus, the reduction in earnings will be, respectively, tokens for A and tokens for B.

- C will make her/his choice before knowing the effective size of the “Surplus” generated in PHASE 2. In particular, C will choose how many tokens to keep for herself/himself for each possible amount of the “Surplus” (2–20 tokens). Since there are 10 possible cases, C will make 10 choices.

- Given the 10 choices made by C, only the one corresponding to the effective size of the “Surplus” generated in PHASE 2 will be used to determine earnings.

- With certain probability, C’s choice can be audited by the computer.

- If C’s choice is not audited, C’s earnings will be equal to the endowment of 10 tokens plus the tokens of the “Surplus” generated in PHASE 2 kept by C for herself/himself.

- Instead, in the case of auditing and if C has kept a positive number of tokens of the “Surplus” generated in PHASE 2 for herself/himself, then her/his earnings will be reduced by the number of tokens kept plus a fine that is equal to 1 token for every 2 subtracted from the surplus. In this case, C’s earnings will be equal to the endowment of 10 tokens minus one token for every two subtracted from the surplus.

- The audit procedure does not exert any effect on A’s and B’s payoffs, which will remain equal to those obtained in PHASE 2 minus the tokens kept by C in PHASE 3.

- Example: Suppose that C keeps z tokens from the effective “Surplus” generated in PHASE 2. Then, C earns 10 + z tokens if her/his choice is not audited, while she/he earns 10 − z/2 tokens if her/his choice is audited.

- The audit procedure follows a random scheme. In particular, after C makes her/his choice, the computer will select an integer between 1 and 100 randomly and with equal probability. If the selected number is between 1 and 50, then C’s choice will be audited. Instead, if the selected number is between 51 and 100, then C’s choice will not be audited. This means that C’s choice will be audited with a probability of 50 percent. Moreover, the random selection of the number neither depends on the choice of C, nor on those made by the other group members.

- At the end of PHASE 3, A and B will be informed about how many tokens of the “Surplus” have been kept by C for herself/himself, while C will be informed about the outcome of the audit procedure and her/his earnings in tokens.

- Before being informed about the final results of the experiment, A and B will be given the opportunity to increase their payoffs by guessing the choices of the other group members in PHASE 2 and PHASE 3. Instead, C will not express any conjecture. The procedure used to pay conjectures is such that A and B should express their conjecture accurately and truthfully. Indeed, A and B will receive 3 tokens only if their conjectures will be correct.

- B has to guess the number of tokens sent by A in PHASE 2.

- If B’s conjecture is correct, B will earn 3 additional tokens.

- In PHASE 2, B has made 10 choices about the tokens sent by A, one for each of the possible positive amounts that A could send (1–10 tokens). A has to guess the number of tokens chosen by B for each of the 10 possible cases.

- The computer will randomly select one of the 10 conjectures expressed by A. If the selected conjecture is correct, then A will earn 3 additional tokens.

- In PHASE C, C has made 10 choices about the tokens to keep from the “Surplus” generated during the interaction between A and B in PHASE 2, one for each of possible positive size of the “Surplus” (2–20 tokens). Both A and B have to guess the number of tokens kept by C for each of the 10 possible cases.

- For each of the two subjects, A and B, the computer will randomly select one of the 10 conjectures. If the selected conjecture is correct, then the corresponding subject will earn 3 additional tokens.

- After expressing their conjectures, A and B will be informed about their correctness and final earnings from participating in the experiment.

References

- Arrow, K. The Limits of Organisations; W.W. Norton: New York, NY, USA, 1974. [Google Scholar]

- Knack, S.; Keefer, P. Does social capital have an economic payoff? A cross-country investigation. Q. J. Econ. 1997, 112, 1251–1288. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. The Role of social capital in financial development. Am. Econ. Rev. 2004, 94, 526–556. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. Cultural biases in economic exchange. Q. J. Econ. 2009, 124, 1095–1131. [Google Scholar] [CrossRef]

- Helliwell, J.F.; Aknin, L.B.; Shiplett, H.; Huang, H.; Wang, S. Social capital and prosocial behavior as sources of well-being. In Handbook of Well-Being; Diener, E., Oishi, S., Tay, L., Eds.; DEF Publishers: Salt Lake City, UT, USA, 2018. [Google Scholar]

- Lambsdorff, G.J. How corruption affects productivity. Kyklos 2003, 56, 457–474. [Google Scholar] [CrossRef]

- Mauro, P. Corruption and growth. Q. J. Econ. 1995, 10, 681–712. [Google Scholar] [CrossRef]

- Rivera-Batiz, F.L. Democracy, governance, and economic growth: Theory and evidence. Rev. Dev. Econ. 2002, 6, 225–247. [Google Scholar] [CrossRef]

- Li, H.; Xu, L.C.; Zou, H. Corruption, income distribution, and growth. Econ. Politics 2000, 12, 155–182. [Google Scholar] [CrossRef]

- Anokhin, S.; Schulze, W. Entrepreneurship, innovation, and corruption. J. Bus. Ventur. 2009, 24, 465–476. [Google Scholar] [CrossRef]

- Kaufmann, D.; Kraay, A. Governance and Growth: Which Causes Which? The World Bank Working Papers; World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Bauman, Y.; Rose, E. Selection or indoctrination: Why do economics students donate less than the rest? J. Econ. Behav. Organ. 2011, 79, 318–327. [Google Scholar] [CrossRef]

- Berg, J.; Dickhaut, J.; McCabe, K. Trust, reciprocity, and social history. Games Econ. Behav. 1995, 10, 122–142. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez de Silanes, F.; Shleifer, A.; Vishny, R. Trust in Large Organizations. Am. Econ. Rev. 1997, 87, 333–338. [Google Scholar]

- Bjornskov, C. Combating corruption: On the interplay between institutional quality and social trust. J. Law Econ. 2011, 54, 135–159. [Google Scholar] [CrossRef]

- Moreno, A. Corruption and democracy: A cultural assessment. Comp. Sociol. 2002, 1, 495–507. [Google Scholar] [CrossRef]

- Seligson, M. The impact of corruption on regime legitimacy: A comparative study of four Latin American countries. J. Politics 2001, 64, 408–433. [Google Scholar] [CrossRef]

- Rotondi, V.; Stanca, L. The effect of particularism on corruption: Theory and empirical evidence. J. Econ. Psychol. 2015, 51, 219–235. [Google Scholar] [CrossRef]

- Bardhan, P. Corruption and development: A review of issues. J. Econ. Lit. 1997, 35, 1320–1346. [Google Scholar]

- Innes, R.; Mitra, A. Is dishonesty contagious? Econ. Inq. 2013, 51, 722–734. [Google Scholar]

- Anderson, C.J.; Tverdova, J. Corruption, political allegiances, and attitudes toward Government in contemporary democracies. Am. J. Political Sci. 2003, 47, 91–109. [Google Scholar] [CrossRef]

- Chang, E.; Chu, Y. Corruption and trust: Exceptionalism in Asian democracies. J. Politics 2006, 68, 259–271. [Google Scholar] [CrossRef]

- Della Porta, D. Social capital, beliefs in government and political corruption. In Disaffected Democracies: What’s Troubling the Trilateral Countries? Pharr, S.J., Putnam, R.D., Eds.; Princeton University Press: Princeton, NJ, USA, 2000. [Google Scholar]

- Uslaner, E.M. Corruption, Inequality, and the Rule of Law; Cambridge University Press: New York, NY, USA, 2008. [Google Scholar]

- Banerjee, R. Corruption, norm violation and decay in social capital. J. Public Econ. 2016, 137, 14–27. [Google Scholar] [CrossRef]

- Ball, S. Entitlements in laboratory experiments. In Behavioural and Experimental Economics; Palgrave Macmillan: London, UK, 2010; pp. 73–74. [Google Scholar]

- Gill, D.; Prowse, V. A structural analysis of disappointment aversion in a real effort competition. Am. Econ. Rev. 2012, 102, 469–503. [Google Scholar] [CrossRef]

- Buchanan, J.M. Fairness, hope and justice. In New Directions in Economic Justice; Skurski, R., Ed.; University of Notre Dame Press: Notre Dame, IN, USA, 1983; pp. 53–89. [Google Scholar]

- Faillo, M.; Rizzolli, M.; Tontrup, S. Thou shalt not steal: Taking aversion with legal property claims. J. Econ. Psychol. 2019, 71, 88–101. [Google Scholar] [CrossRef]

- Gall, T.; Hu, X.; Vlassopoulos, M. Dynamic incentive effects of assignment mechanisms: Experimental evidence. J. Econ. Manag. Strategy 2019, 28, 687–712. [Google Scholar] [CrossRef]

- Fischbacher, U. z-Tree: Zurich toolbox for ready-made economic experiments. Exp. Econ. 2007, 10, 171–178. [Google Scholar] [CrossRef]

- Costa, D.L.; Kahn, M.E. Cowards and heroes: Group loyalty in the American Civil War. Q. J. Econ. 2003, 118, 519–548. [Google Scholar] [CrossRef]

- Dufwenberg, M. Marital investment, time consistency and emotions. J. Econ. Behav. Organ. 2002, 48, 57–69. [Google Scholar] [CrossRef]

- Battigalli, P.; Dufwenberg, M. Guilt in games. Am. Econ. Rev. 2007, 97, 170–176. [Google Scholar] [CrossRef]

- Isoni, A.; Sugden, R. Reciprocity and the Paradox of Trust in psychological game theory. J. Econ. Behav. Organ. 2019, 167, 219–227. [Google Scholar] [CrossRef]

- Guerra, G.; Zizzo, D.J. Trust responsiveness and beliefs. J. Econ. Behav. Organ. 2004, 55, 25–30. [Google Scholar] [CrossRef]

- Bacharach, M.; Guerra, G.; Zizzo, D.J. The self-fulfilling property of trust: An experimental study. Theory Decis. 2007, 63, 349–388. [Google Scholar] [CrossRef]

- Pelligra, V. Under trusting eyes: The responsive nature of trust. In Economics and Social Interaction: Accounting for the Interpersonal Relations; Sugden, R., Gui, B., Eds.; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

- Pelligra, V. Trust responsiveness: On the dynamics of fiduciary interactions. J. Socio-Econ. 2010, 39, 653–660. [Google Scholar] [CrossRef][Green Version]

- Charness, G.; Dufwenberg, M. Promises and Partnership. Econometrica 2006, 74, 1579–1601. [Google Scholar] [CrossRef]

- Dufwenberg, M.; Gächter, S.; Hennig-Schmidt, H. The framing of games and the psychology of play. Games Econ. Behav. 2011, 73, 459–478. [Google Scholar] [CrossRef]

- Stanca, L.; Bruni, L.; Corazzini, L. Testing theories of reciprocity: Do motivations matter? J. Econ. Behav. Organ. 2009, 71, 233–245. [Google Scholar] [CrossRef]

- Rabin, M. Incorporating fairness into game theory and economics. Am. Econ. Rev. 1993, 83, 1281–1302. [Google Scholar]

| 1. | According to [1] (p. 357), trust is “the lubricant of the social system”. In [2], it is documented that the levels of trust among people are higher in countries with low income inequality, more efficient institutions, and better-educated citizens. Trust has a positive effect on the development of a country’s financial system and even on cross-country trade [3,4]. In [5], a positive link is found between trust and the level of subjective well-being. |

| 2. | The economic impact of corruptive practices has inspired, in recent years, a large body of research that has documented a negative relationship between the level of corruption and foreign direct investment [7,8], productivity [7,9], income inequality [10], entrepreneurship [11], and growth in income [12]. |

| 3. | The extremely limited number of observations for each intersection explains the lack of consistency of behavior when moving from treatments of lower to higher probabilities of audit (i.e., there is only one player who knows game theory and participates in a treatment with corruption and highest probability of prosecution). |

| 4. | Beyond this general finding, however, we know that trustors who know game theory underestimate trustees’ giving in treatments with corruption, while trustors who do not know game theory overestimate trustees’ giving in treatments without corruption (see Table 3). |

| 5. | The decision to maximize one’s own payoff is declared ex post by 45 percent of trustees who know game theory against 32 percent of those who do not know it. |

| 6. | Of course, in the hero–common people reaction scheme, the excess reciprocity is not directed toward the hero but is addressed to her/his same cause. This does not change the essence of our reasoning. |

| 7. | The authors find that, on average, trust does not pay in their 32 observations (average amount sent 5.16, average payback 4.66). However, for trustors sending the entire amount (10 ECUs), trust did pay (average payback 10.2). |

| 8. | Previous studies, however, tend to support the former explanation [36]. |

| Corruption vs. Non-Corruption Treatments | Trustors only (Corr. vs. Non-Corr. Treatments) | Trustees only (Corr. vs. Non-Corr. Treatments) | Trustor vs. Trustee | Trustor vs. Third Corrupting Agent | Trustee vs. Third Corrupting Agent | |

|---|---|---|---|---|---|---|

| Male | 0.520 (0.603) | 0.000 (1.000) | −0.148 (0.882) | 0.55 (0.585) | −1.68 (0.093) | −2.21 (0.027) |

| Age | 2.23 (0.024) | 1.771 (0.077) | −0.301 (0.764) | −0.14 (0.887) | 1.07 (0.204) | 1.27 (0.203) |

| Voluntary status | 0.53 (0.598) | −0.699 (0.485) | 1.645 (0.100) | −2.131 (0.033) | 0.029 (0.977) | 1.812 (0.070) |

| Years of education | −0.005 (0.998) | −1.330 (0.1835) | 1.481 (0.139) | −0.961 (0.343) | −0.847 (0.402) | 0.092 (0.932) |

| Risk aversion * | −1.624 (0.104) | −0.952 (0.341) | 0.027 (0.979) | −0.073 (0.941) | 0.485 (0.628) | 0.535 (0.593) |

| Game theory knowledge | 0.359 (0.730) | −1.881 (0.060) | 0.307 (0.759) | 0.381 (0.703) | 0.381 (0.703) | 0.000 (1.00) |

| (1) | (2) | |

|---|---|---|

| S | 0.615 *** | 0.641 *** |

| (0.026) | (0.033) | |

| S × TC_10 | 0.057 | −0.008 |

| (0.037) | (0.046) | |

| S × TC_50 | 0.019 | −0.035 |

| (0.037) | (0.043) | |

| S × Game Theory | 0.421 *** | |

| (0.104) | ||

| S × TC_10 × Game Theory | −0.305 *** | |

| (0.117) | ||

| S × TC_50 × Game Theory | −0.486 *** | |

| (0.116) | ||

| Constant | 0.416 ** | 0.416 ** |

| (0.190) | (0.185) | |

| F-stat | ||

| 587.12 | 311.59 | |

| p > F | 0.00 | 0.00 |

| Observations | 450 | 450 |

| R-squared (within) | 0.814 | 0.824 |

| Number of id. | 45 | 45 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All Data | Game Theory = 1 | Game Theory = 0 | All Data | |

| 1.232 *** | 1.058 *** | 1.430 *** | 1.430 *** | |

| (0.071) | (0.091) | (0.104) | (0.102) | |

| × TC_0 | −0.252 ** | −0.327 ** | −0.284 ** | −0.284 ** |

| (0.100) | (0.139) | (0.139) | (0.136) | |

| × TC_10 | −0.266 *** | −0.304 ** | −0.359 *** | −0.359 *** |

| (0.100) | (0.147) | (0.136) | (0.133) | |

| × TC_50 | 0.036 | 0.458 * | −0.181 | −0.181 |

| (0.100) | (0.274) | (0.128) | (0.125) | |

| × Game Theory | −0.373 *** | |||

| (0.140) | ||||

| × TC_0 × Game Theory | −0.043 | |||

| (0.200) | ||||

| × TC_10 × Game Theory | 0.056 | |||

| (0.204) | ||||

| × TC_50 × Game Theory | 0.639 ** | |||

| (0.313) | ||||

| Constant | 0.373 * | 0.630 * | 0.245 | 0.373 * |

| (0.220) | (0.358) | (0.271) | (0.216) | |

| F-stat | 249.55 | 64.90 | 195.13 | 131.40 |

| p > F | (0.000) | (0.000) | (0.000) | (0.000) |

| Observations | 600 | 200 | 400 | 600 |

| R-squared | 0.651 | 0.596 | 0.687 | 0.664 |

| Number of id. | 60 | 20 | 40 | 60 |

| Expected Return on Giving | ||||

|---|---|---|---|---|

| Players who know game theory | ||||

| NTC (n = 7) | 4.25 | 1.06 | 6 percent | |

| TC_0 (n = 6) | 4.16 | 0.60 | 64 percent | Negative |

| TC_10 (n = 5) | 2.2 | 0.73 | 74 percent | Negative |

| TC_50 (n = 1) | 4 | 1.06 | 100 percent | negative |

| Players who do not know game theory | ||||

| NTC (n = 8) | 4.25 | 1.43 | 43 percent | |

| TC_0 (n = 9) | 6.55 | 1.15 | 64 percent | 5.4 percent |

| TC_10 (n = 10) | 5.7 | 1.08 | 64 percent | 2.9 percent |

| TC_50 (n = 14) | 4.71 | 1.43 | 64 percent | 15.5 percent |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All Data | Game Theory = 1 | Game Theory = 0 | All Data | |

| S | 0.638 *** | 0.608 *** | 0.665 *** | 0.665 *** |

| (0.026) | (0.041) | (0.033) | (0.035) | |

| S × TC_10 | 0.060 | 0.142 ** | 0.014 | 0.014 |

| (0.036) | (0.067) | (0.044) | (0.046) | |

| S × TC_50 | 0.001 | −0.004 | −0.001 | −0.001 |

| (0.036) | (0.060) | (0.046) | (0.048) | |

| S × Game Theory | −0.060 | |||

| (0.052) | ||||

| S × TC_10 × Game Theory | 0.131 * | |||

| (0.078) | ||||

| S × TC_50 × Game Theory | 0.003 | |||

| (0.073) | ||||

| Constant | 0.116 | 0.427 | −0.074 | 0.116 |

| (0.184) | (0.323) | (0.221) | (0.184) | |

| F-stat | 657.19 | 203.17 | 470.22 | 330.13 |

| p > F | 0.00 | 0.00 | 0.00 | 0.00 |

| Observations | 450 | 170 | 280 | 450 |

| R-squared | 0.831 | 0.803 | 0.850 | 0.832 |

| Number of id. | 45 | 17 | 28 | 45 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| All Data | Game Theory = 1 | Game Theory = 0 | All Data | All Data | |

| 0.669 *** | 0.796 *** | 0.605 *** | 0.605 *** | 0.605 *** | |

| (0.057) | (0.091) | (0.069) | (0.067) | (0.071) | |

| × Game Theory | −0.191 | −0.191 | |||

| (0.117) | (0.123) | ||||

| × TC_0 | 0.248 *** | 0.052 | 0.373 *** | 0.373 *** | |

| (0.080) | (0.119) | (0.104) | (0.101) | ||

| × TC_10 | −0.107 | −0.545 *** | 0.069 | 0.069 | |

| (0.080) | (0.137) | (0.096) | (0.093) | ||

| × TC_50 | 0.422 *** | −0.014 | 0.692 *** | 0.692 *** | |

| (0.080) | (0.123) | (0.100) | (0.098) | ||

| × TC_0 × Game Theory | −0.321 * | ||||

| (0.161) | |||||

| × TC_10 × Game Theory | −0.614 *** | ||||

| (0.170) | |||||

| × TC_50 × Game Theory | 0.705 *** | ||||

| (0.162) | |||||

| × TC | 0.356 *** | ||||

| (0.083) | |||||

| × TC × Game Theory | −0.467 *** | ||||

| (0.141) | |||||

| Constant | 0.612 *** | 0.612 ** | 0.612 *** | 0.612 *** | 0.612 *** |

| (0.176) | (0.269) | (0.220) | (0.171) | (0.180) | |

| F-stat | 217.19 | 73.13 | 164.46 | 119.73 | 200.91 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| Observations | 600 | 220 | 380 | 600 | 600 |

| R-squared | 0.618 | 0.601 | 0.661 | 0.643 | 0.600 |

| Number of id. | 60 | 22 | 38 | 60 | 60 |

| (1) | (2) | |

|---|---|---|

| S | 0.627 *** | 0.652 *** |

| (0.018) | (0.024) | |

| S × TC_10 | 0.058 ** | 0.005 |

| (0.026) | (0.033) | |

| S × TC_50 | 0.010 | −0.024 |

| (0.026) | (0.032) | |

| S × Game Theory | 0.035 | |

| (0.043) | ||

| S × TC_10 × Game Theory | 0.057 | |

| (0.059) | ||

| S × TC_50 × Game Theory | −0.094 * | |

| (0.057) | ||

| Constant | 0.266 ** | 0.266 ** |

| (0.132) | (0.132) | |

| F-stat | 1245.26 | 628.31 |

| p > F | (0.000) | (0.000) |

| Observations | 900 | 900 |

| R-squared | 0.822 | 0.824 |

| Number of id. | 90 | 90 |

| (1) | (2) | |

|---|---|---|

| S | 0.708 *** | 0.638 *** |

| (0.026) | (0.037) | |

| S × Game Theory | 0.131 *** | |

| (0.050) | ||

| S × TC_10 | 0.055 | 0.083 * |

| (0.036) | (0.048) | |

| S × TC_50 | −0.057 | −0.068 |

| (0.036) | (0.050) | |

| S × TC_10 × Game Theory | −0.006 | |

| (0.073) | ||

| S × TC_50 × Game Theory | 0.041 | |

| (0.071) | ||

| Constant | −0.201 | −0.201 |

| (0.184) | (0.180) | |

| F-stat | 759.04 | 403.48 |

| p > F | 0.000 | 0.000 |

| Observations | 450 | 450 |

| R-squared | 0.850 | 0.859 |

| Number of id. | 45 | 45 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Becchetti, L.; Corazzini, L.; Pelligra, V. Trust and Trustworthiness in Corrupted Economic Environments. Games 2021, 12, 16. https://doi.org/10.3390/g12010016

Becchetti L, Corazzini L, Pelligra V. Trust and Trustworthiness in Corrupted Economic Environments. Games. 2021; 12(1):16. https://doi.org/10.3390/g12010016

Chicago/Turabian StyleBecchetti, Leonardo, Luca Corazzini, and Vittorio Pelligra. 2021. "Trust and Trustworthiness in Corrupted Economic Environments" Games 12, no. 1: 16. https://doi.org/10.3390/g12010016

APA StyleBecchetti, L., Corazzini, L., & Pelligra, V. (2021). Trust and Trustworthiness in Corrupted Economic Environments. Games, 12(1), 16. https://doi.org/10.3390/g12010016