Abstract

This paper investigates the influence of organizations’ board independence on corporate social performance (CSP) using a meta-analytic approach. A sample of 87 published papers is used to identify a set of underlying moderating effects in that relationship. Specifically, differences in the system of corporate governance, CSP measurement models and market conditions have been considered as moderating variables. The results show that the independence of a company’s board positively influences CSP. This is because companies with more independent directors in their boards are more likely to commit to stakeholder engagement, environmental preservation and community well-being. Interestingly, the results also show that the positive connection between board independence and CSP is stronger in civil law countries and when CSP is measured by self-reporting data. Finally, the strength of the influence of the independence of a firm’s board on CSP varies significantly in different market conditions. The paper concludes by presenting the main implications for academics, practitioners and policy makers.

1. Introduction

Society’s awareness of sustainable business models [1] has had a significant influence on companies’ commitment to corporate social responsibility (CSR) and practices related to corporate sustainability. This has resulted in the appearance of different models of corporate governance (CG) that, in general, recognize key stakeholders’ claims in the corporate decision-making process. At the same time, significant environmental and social scandals in the corporate sphere have led governments and independent institutions to recommend principles and codes of conduct (a total of 461 codes of conduct were published by approximately one hundred countries and regulators between 1993 and 2016) to encourage companies’ management to develop more sustainable CG approaches [2]. The awareness of institutions, and of society in general, of sustainable development has put it on the agenda of governments around the world. In fact, corporate contributions to sustainable development goals have attracted the attention of politicians, practitioners and academics. These contributions have been studied from different perspectives [3,4], but most previous research has focused on identifying and measuring the positive and negative organizational impacts on society and the environment [5,6]. As a result, some sustainability-related concepts have appeared, such as corporate social performance (CSP) [7] and corporate sustainability performance [8], which address corporations’ contributions to environmental preservation, societies’ economic progress and human well-being. The academic literature related to corporate objectives and sustainability has grown substantially during the last two decades. Many papers focus on the influence of the adoption of different CG approaches on CSP [9,10,11,12,13,14]. However, these studies have not arrived at a consensus, and report contradictory and inconsistent results (e.g., while Cuadrado-Ballesteros et al. [15] and Rao et al. [16] found a positive connection, Sundarasen et al. [17] and Walls et al. [18] found a negative association, and Walls and Berrone [19] and Harjoto et al. [20] found no significant relationship).

Although previous research addressed the influence of some CG-related issues [10,12,21,22,23] (e.g., the independence, gender balance, size and remuneration of company boards, among others), the present paper contributes to the existing literature by providing the first meta-analysis of the influence of the independence of a company’s board on CSP. To that end, a sample of 87 previously published papers is analyzed. This paper also contributes to previous research by collating a set of variables that have a potential moderating effect in the relationship between a corporation’s board independence and CSP. Specifically, the following variables are considered to be tested as moderators in the relationship: (i) CG systems; (ii) CSP measurement approaches; and (iii) the economic conditions.

The paper is organized as follows. Section 2 introduces the theoretical foundations. Section 3 comprises the literature review and explains the research hypotheses. Section 4 focuses on the research design by describing the econometric notations of the meta-analytic approach. Section 5 shows the data collection procedure, inclusion criteria and measurement of the variables. Section 6 contains the results of the empirical analysis. Finally, the last section concludes that paper.

2. Theoretical Background

Over the last forty years, a large body of academic research has examined the theoretical notions of CSR and CSP from different perspectives [24,25,26]. Some definitions of CSR and CSP have been suggested [7,27], and there is not complete clarity about the interpretation of the key ideas that underlie these concepts. This has been addressed by Clarkson [28], who stated that the “fundamental problem in the field of business and society has been that there are no definitions of corporate social performance, corporate social responsibility, or corporate social responsiveness that provide a framework or model for the systematic collection, organization and analysis of corporate data relating to these important concepts”. Carroll [29] suggests that the social responsibility of business encompasses the economic, legal, ethical and philanthropic responsibilities. Following Carroll [29], Wood [30] provides one of the first definitions of CSP, indicating that it refers to “a business organization’s configuration of principles of social responsibility, process of social responsiveness, and policies, programs, and observable outcomes as they relate to the firm’s societal relationships”. Other researchers provide additional definitions of CSP, such as that given by Lu et al. [31]. This confusion means that there are many ways to model CSP and to investigate its relationship with some organizational outputs such as corporate financial performance (CFP) [32]. Because there are many previously published papers addressing the links between the independence of firms’ boards and CSP, this paper adopts the broad definition of CSP suggested by Visser et al. [33] and discussed by Swanson and Orlitzky [7]. In this way, CSP is considered to be the actual organizational social, environmental and economic results rather than the general notion of business accountability or responsibility to society as a whole. Using this definition of CSP, Orlitzky et al. [34] found that CSP is associated with the following four measurement strategies: (i) CSP disclosures; (ii) CSP reputation ratings; (iii) social audits, CSP processes, and observable outcomes; and (iv) managerial CSP principles and values.

Most mainstream studies have used stakeholder theory when addressing firms’ incentives to engage with CSR-related practices and to understand differences in CSP between organizations [35]. Stakeholder theory [36] argues that companies should guarantee the protection of the interest of all the firms’ stakeholders, arguing that companies are open systems that affect and can be affected by other agents outside and inside them. This reciprocity between companies and their stakeholders may be affected by the links that firms build with their stakeholders. The relationships can provide channels for communication with, and access to support from, external organizations [37] and other kinds of stakeholders. This perspective makes it necessary to revisit the concept of the effectiveness of a company’s board from a shareholder perspective to assess its validity in stakeholder theory [38]. It has been suggested that the stakeholder perspective of CG should be linked to CSP [39].

Among the different mechanisms of internal organizational governance [40], the independence of firms’ boards is considered a key issue to ensure effective monitoring by the board [41], and to improve the range of firms’ key strategic policies that address their stakeholders requirements [42], thus providing companies the ability to strengthen their links with their stakeholders [43,44,45] and to adapt to the external environment and increase efficiency [46]. As in the case of CSP, different authors have addressed the theoretical definition of corporate board independence. Historically, the degree of independence of director was assessed by addressing the absence of financial, family or professional ties between them and the companies whose boards they are part of [47]. Accordingly, three main approaches to measuring board independence have been recognized. Specifically, these approaches address the percentage of the presence of the following type of directors in companies’ boards: (i) executive/non-executive directors; (ii) inside/outside directors; and, (iii) independent/non independent directors [48,49,50]. The presence of independent directors on companies’ boards has its origins in the Anglo-Saxon economic systems [47], mainly driven by the absence of large shareholders who can directly control decisions about the firm’s strategic management. Agency theory addresses the advantages of having independent directors on companies’ boards [41,51], because they have the ability to mitigate the conflicts between shareholders and managers, providing a valuable protection mechanism [52]. The independence of firms’ boards has become a key element of CG that goes beyond the function of organizational control, and allows companies to gain legitimacy and advice and connection with other organizations [53].

Under the stakeholder theory, those companies with greater board independence are more likely to consider other sensitivities and interests than those of managers and the majority of shareholders [21]. Stakeholder theory suggests that the appointment of independent directors to companies’ boards gives companies’ the opportunity to develop strategic policies that address a wider range of their key stakeholder needs and claims [54], because the human capital resources of the firms’ board are based on the collective experience and expertise of board members [9]. Stakeholder theory argues for independent directors on company boards, because they are more effective in monitoring other societal realities, and therefore more sensitive to stakeholders’ needs [55,56]. In general, independent directors are those with little connection with the CEO and others executive board members. Their personal background and their personal skills should increase their sensitivity to a broader context than the conventional view of business objectives (e.g., profits maximization). Stakeholder theory predicts some benefits for companies with more independent boards, including (i) legitimation of company activities [54]; (ii) safeguarding the interests of corporate stakeholders [46]; (iii) ensuring stakeholders’ concerns are considered in corporate decision-making; (iv) increasing brand loyalty by building trust in customers [57]; and, (v) making workers more committed to business objectives [32].

The instrumental perspective of stakeholder theory [58] has been the main theoretical approach used to analyze the influence of several CG-related issues on CSP. In general, instrumental stakeholder theory argues that a company’s board members should be responsible for setting the organization’s mission and the strategies to achieve it [59]. It suggests that a company’s board should be the main body responsible for designing, implementing and improving the companies’ contributions to sustainable development and human well-being. The alignment of governance structures and business processes with CSR activities will make it possible to manage all the stakeholders’ claims and needs in the core decision-making process. This will allow corporations to enhance their levels of both transparency and CSP [59,60,61]. Moreover, instrumental stakeholder theory predicts that those companies that have greater board independence should be more committed to CSR and also to satisfying the legitimate interests of their key stakeholders [36]. Therefore, it is expected that the presence of independent directors should improve a company’s CSP [36]. In this way, instrumental stakeholder theory, [36,62] provides a theoretical basis that links the independence of a company’s board and their CSP [20,63,64]. The influence of the independence of a firm’s board on CSP has been extensively studied in recent decades by academic researchers, but studies have produced mixed and contradictory results. These are examined and studied in the following section with the aim of developing the research hypotheses.

3. Literature Review and Hypotheses Development

There is a large body of research analyzing the influence of some CG variables on different organizational outcomes. The existing literature also includes several meta-analyses designed to capture the global effect between specific corporate variables and CG-related issues. Such meta-analyses mainly focus on: (i) testing the link between CG variables and CFP [65]; (ii) evaluating the influence of a corporation’s board gender composition on CFP [64]; (iii) addressing the impact of companies’ board size and composition on CFP [49,66]; (iv) testing the relationship between a company’s board leadership structure and CFP [67]; (v) testing the influence of companies’ ownership structures on CFP [68]; and, (vi) testing the influence of corporate ownership concentration on CFP [69]. The literature also includes several meta-analyses on the influence of CSP on CFP [34,70,71], and a meta-analysis assessing the influence of a company’s board gender composition on corporate environmental performance (CEP) [72]. However, to the best of the authors’ knowledge, a meta-analysis of the impact of the independence of a corporation’s board on CSP has not been performed, although many papers have reported studies of that relationship. Those papers are reviewed in the following section, and summarized in Table 1.

Table 1.

Overview of studies included in the meta-analysis.

3.1. Linking Board Independence and Corporate Social Performance

Ntim and Soobaroyen [73] focused on a sample of South African firms and found a positive influence of the board’s independence on both CFP and CSP. Similarly, Dunn and Sainty [74] studied a sample of 104 Canadian firms and concluded that companies with more independent boards generally obtain higher levels of CSP. In the same vein, Jo and Harjoto [59] studied a sample of nearly 15,000 U.S. firms, and found a positive connection between the independence of the board and CSP. This effect occurs because greater independence reduces conflicts of interests among different stakeholders. Further research, such as that developed by Sahin et al. [75], analyzed a sample of 165 Turkish firms and concluded that a higher proportion of independent board members allows companies to obtain better levels of CSP. Mallin et al. [76] examined the 100 U.S. best corporate citizens and found that companies with more independent boards often implement a business model that includes stakeholder management, and that ultimately has a positive influence on their CSP.

Choi et al. [92] conclude that the presence of independent members on companies’ boards has a positive impact on companies CSP, measured by the KEJI Index, which has scores for the following categories: (i) companies’ contributions to communities; (ii) employee and consumer protection and satisfaction; (iii) firms’ environmental protection; and, (iv) companies’ contributions to economic growth. Barako and Brown [83] analyzed a sample of 40 Kenyan banks and provided empirical evidence of a positive influence of board independence on CSP. Focusing on the largest 100 Australian firms, Rao et al. [16] found a positive relationship between board independence and CSP, measured by social and environmental disclosures. Furthermore, Zhang et al. [148], focused on the 500 largest companies listed on the U.S. stock exchanges and concluded that having more outside directors on a corporation’s board raises CSP levels. Cuadrado-Ballesteros et al. [15] analyzed a sample of 1043 international companies and found that board independence has a positive effect on CSP. Zhang [147] focused on a sample of 475 publicly traded Fortune 500 companies and found that more outside directors has a positive influence on CSP. Post et al. [131] analyzed 78 Fortune 1000 firms and found a positive connection between board independence and CSP, measured by Kinder, Lydenberg and Domini (KLD) ratings.

However, several studies find a negative connection between the independence of a company’s board and CSP [17]. Hanniffa and Cook [14], Nurhayati et al. [130], Walls et al. [18] and Ortiz-de-Mandojana et al. [130] all found that the presence of non-executive and independent directors on company boards has a negative influence on CSP. In addition, Rodríguez-Ariza et al. [135], Benomran et al. [85] and Walls et al. [19,144] found no significant association between board independence and CSP.

Based on the previous discussion, the following hypothesis is proposed for testing:

Hypothesis 1 (H1).

Companies with higher levels of board independence will exhibit superior corporate social performance.

3.2. The Moderating Role of Approaches to the Measurement of Corporate Social Performance, Corporate Governance Systems, and the Economic Conditions

Although this paper contributes to the literature by providing a meta-analysis of the influence of the independence of companies’ boards on CSP, some variables that are usually considered to have a significant impact on CSP will be treated as moderators of that relationship. The first moderating variable is related to the different approaches to CSP measurement used in previous research. Zahra and Pearce [149] found that the use of different methods of measuring CSP significantly affects how this concept is linked with other organizational processes and outcomes. Dixon-Fowler et al. [150] grouped the different measures of CSP into two categories: (i) self-report measures; and, (ii) externally-reported or archival data measures [150]. Self-reported measures of CSP are usually associated with social and environmental reports that companies disclose to their stakeholders. These reports show the positive and negative externalities that company processes and decisions have on the community, environment, and society as a whole. Externally-reported measures are related with CSP indicators that are commonly reported by external agencies (e.g., TRI, KLD, ASSET4, Bloomberg, Jantzi and HEXUN). CSP ratings and reputational rankings are also considered externally reported or archival measures of CSP. The difference between self-reported and externally-reported CSP measurement approaches is analogous to the difference between accounting and market based measures that are commonly used to measure CFP [64,65,66,67,68,150,151,152]. To test for the moderating effect of the CSP measurement approach, the sample was divided on the basis of the two categories. 52 of the 87 papers (59.77%) use self-reported measures and the other 35 papers use archival data measures (40.23%) (see Table 2 and Table A1 in the Appendix A for more information). We anticipate that the relationship between the independence of a firm’s board and CSP would be significantly affected by the approach adopted to measuring CSP. Therefore, the following hypothesis will be tested:

Table 2.

Influence of the independence of companies’ boards on corporate social performance.

Hypothesis 2 (H2).

The positive link between the independence of a company’s board and CSP will be higher when the latter is modelled using self-reported measures.

The second moderating variable considered in the analysis is related to the corporate governance system existing in specific countries. Previous research on CSP has mainly addressed the influence of the role of the company in a given society on its commitment to stakeholder engagement, environmental preservation and community involvement [15,24,101,153]. It is expected that different corporate governance systems in different countries will have a significant effect on the relationship between the independence of firms’ boards and CSP.

Corporate governance structures are considered to be one of the most relevant factors in the relationship between companies and their stakeholders [154]. Governance structures are conditioned by: (i) national cultural institutions; (ii) national legal systems [155]; and (iii) national business systems [156,157,158]. Haake [159] classified countries as individualistic or communitarian, which is consistent with the classification provided by Ball et al. [155] based on proxies for the legal systems [160]. Individualistic countries (i.e., those exhibiting a common-law legal system) are mainly found in the U.S. and other Anglo Saxon countries [161]. These countries have a shareholder orientation [162] because the primary purpose of their firms consists in maximizing shareholder wealth. Haake [159] (p. 720) defines individualistic business systems as systems “in which actors safeguard their individual autonomy through loose interfaces” and therefore have the power to define corporate responsibility for themselves [161], creating a lot of freedom for the shareholders. As a result, firms in common-law countries may have less pressure to improve their CSP. In contrast, communitarian countries (i.e., codified law countries) include many continental European countries. These countries tend to promulgate laws to protect the rights of workers and other stakeholders [161], and are societies based on close and stable relationships between actors. This situation generates key responsibilities not only towards shareholders [161]. Accordingly, these countries have a stakeholder orientation [162], and therefore are more likely to attain higher levels of CSP.

Cuadrado-Ballesteros et al. [15] differentiate four main corporate governance systems (i.e., legal systems) from a global perspective: (i) Anglo-saxon; (ii) Germanic; (iii) Latin; and, (iv) Asian. The main issues that differentiate these governance systems are: (i) the instrumentalist or institutionalist view of the company; (ii) the level of business concentration; (iii) the importance of the capital market in a given economy; and, (iv) the relationship between performance and executives´ remuneration. Other corporate governance systems have also been suggested by researchers. For example, Sanchez-Ballesta and García-Meca [68] considered the Anglo Saxon and continental systems in a study of the influence of corporate ownership structure on CFP. Similarly, Garcia-Meca and Sánchez-Ballesta [50] considered the Anglo Saxon, continental and Asian systems to study the links between the independence of a firm’s board, ownership concentration and voluntary disclosure. Siddiqui [65] used a more restricted classification and grouped corporate governance systems into two categories: (i) common law systems; and, (ii) civil or codified law systems. We follow this broad approach because it is consistent with the approach used in most previous research on CSP and board independence, and because the use of two categories means there will be enough companies in each group to permit a robust empirical analysis.

Based on the previous discussion, we propose to test the following hypothesis:

Hypothesis 3 (H3).

The positive link between the independence of a company’s board and CSP will be higher for companies in codified law systems.

Previous research found significant variations in CSP during different market cycles [163,164]. The underlying idea is that CSP is an organizational outcome, which is influenced by companies’ strategic management decisions. If CSP is significantly different in a bull market from in a bear market, the link between the independence of a firm’s board and CSP should also be different in different market/economic conditions. To determine the role of the market conditions in this relationship, we must be able to differentiate between bull and bear market cycles for the studies included in the meta-analysis. The first period, from 1999 to 2001, is characterized by consistent economic growth in most economies of the world. Several economics scandals occurred at the end of the twentieth century (e.g., Enron, Tyco, Worldcom and Parmalat, among others), which stimulated government regulation [2] intended to change the structure of firms’ boards to ensure their efficiency [165]. Zhang et al. [148] found that the Sarbanes-Oxley Act had a great impact on the structure of corporate boards and has produced an increase of outsider and women directors. This informs the second time-period considered, from 2002 to 2006. The second cutoff point is placed in 2007, and the global financial crisis and the sovereign debt crisis in Western Europe. Thus, the third period considered in the empirical analysis runs from 2007 to 2009. Dividing the studies between these three periods will make it possible to test whether the relationship between the independence of companies’ boards and CSP is influenced by the different economic conditions. In fact, the European Commission [166] detected some shortcomings in CG (e.g., lack of board diversity) that have played an important role in the financial crisis. Previous research has indicated that firms’ boards pay special attention to shareholders during bear market conditions, giving priority to financial and economic performance over CSP [167]. Research [164] also reveals that companies tend to decrease their attention to CSP-related issues during market downturns in order to reduce costs [168]. However, other works argue the opposite, indicating that corporations are more likely to focus on CSP practices during economic recessions in order to strengthen their relationships with their stakeholders and to ameliorate their CFP levels [169]. Finally, the last time-period studied is from 2010 to 2017, when most of the developed world economies began to recover from the negative consequences of the financial crisis. Based on the previous reasoning, the following hypothesis is proposed for testing:

Hypothesis 4 (H4).

The positive link between the independence of a company’s board and CSP will be weaker in bear market periods.

4. Meta-Analytic Procedure

The main advantage of meta-analyses is that they make it possible to summarize and quantify the often conflicting evidence found in different studies that focus on a specific topic. A meta-analysis aims to obtain a set of objective, replicable and accurate statistical data [170] that provide additional evidence that is drawn from the entire sample of the studies analyzed, and that it could not be obtained from individual studies [171,172]. Two main statistical models have been applied in previous meta-analyses: (i) the fixed effects model; and, (ii) the random effects model [173,174]. The fixed effects approach assumes that all studies in the sample are studying the same effect size (i.e., correlation coefficient in this case) and the observed variability is exclusively attributable to the sampling error. The random effects approach considers the factors moderating the relationship between the variables and assumes that the studies included in the sample are not homogeneous. The random effects model has the ability to differentiate subgroups in which the effect size differs. Because we expect that the associations between the independence of a firm’s board and CSP will not be the same in different circumstances, this paper adopts a random effects model.

Another key issue in meta-analysis econometrics is the measurement of the effect size, which reveals the magnitude of the relationship between two studied variables [171]. Taking data contained in the papers included in the sample, the effect size is measured using the average correlation coefficient, and this will inform conclusions about the influence of board independence on CSP. This paper implements the Hedges and Olkin [173,174,175] meta-analytic technique (HOMA), which is described below.

The average correlation coefficient of the relationship between the independence of a firm’s board and CSP is computed as a weighted average of the observed correlations obtained from the papers in the sample. Observed correlation coefficients are first converted to a standard normal metric (i.e., Fisher´s z; Zr), calculated by the following expression.

where is the correlation coefficient between the independence of a firm’s board and CSP found in study i. The transformed effects are used to compute the weighted average effect, as given by Equation (2):

where k is the number of studies in the meta-analysis and is the weight of each study [176]. The average correlation coefficient, , and standard deviation, are used compute the appropriate confidence interval (in this case at a 95% confidence level) as shown in Equation (3):

To convert the Fisher’s z values (average effect and confidence interval) back to a correlation, the following expression is used:

To analyze the homogeneity of the observed correlations, the Cochram’s Q statistic [172,177] is computed by Equation (5):

If the correlations are homogeneous, the Q statistic follows Pearson´s distribution with K − 1 degrees of freedom. If the calculated value exceeds the tabulated one for the specified level of significance, the hypothesis that the correlations are homogeneous must be rejected. The main limitation of this approach is that, although provides evidence about the possible existence of heterogeneity in the studied correlations, it does not quantify it. To measure the level of heterogeneity, the Higgings and Thompson I2 statistic is computed [178], using Equation (6).

In order to test the significance of the moderating effects, the full sample has been divided into different sub-samples according with the values of the discrete variables (i.e., moderating variables). The meta-analytical approach described above is then applied to each sub-sample to investigate possible differences in the influence of board independence on CSP between groups identified using the moderating variables.

5. Research Design: Inclusion Criteria, Search Process, Study Coding and Variables’ Measurement

Different search techniques have been implemented to identify and select the relevant papers included in the sample [176]:

- First, relevant electronic databases (e.g., Proquest, EBSCO, Emerald, Wiley, Sciencedirect and Google scholar) are examined by different searches with different combinations of the following keywords: (i) corporate social performance; (ii) corporate environmental performance; (iii) corporate governance; (iv) board structure; and, (v) board independence. This step provided a total of 300 studies.

- In a second step, the initial searches were refined by further examining the different issues of academic journals that publish most of the papers addressing the influence of CG approaches on CSP (e.g., Journal of Business Ethics, Corporate Governance: An International Review, Journal of Financial Economics, International Journal of Economics and Financial Issues). 28 additional papers were included in the sample, giving a total of 328 works.

- In the third step, only those papers focusing on the influence of board independence on CSP from an empirical point of view were selected. After this step, 168 papers were removed from the sample, producing a total of 160 studies.

- In a final step, those empirical studies that did not provided the required statistical data (i.e., correlation coefficients between the variables or the corresponding data to obtain them using Lipsey and Wilson´s [171] conversion method) were removed (73). The final sample included 87 papers.

For those papers providing various effect sizes (i.e., reporting two correlation coefficients between the independence of a firm’s board and environmental performance and social performance respectively), we followed the approach adopted by Hunter and Schmidt [172] of computing the average correlation [67]. Articles included in the final sample were coded by addressing the following issues: (i) authors; (ii) year of publication; (iii) CSP measurement model; (iv) correlation coefficient (observed or calculated); (v) countries covered by the sample; (vi) CG systems covered by the sample; and, (vii) sample period (see Table A1 in the Appendix A for detailed information).

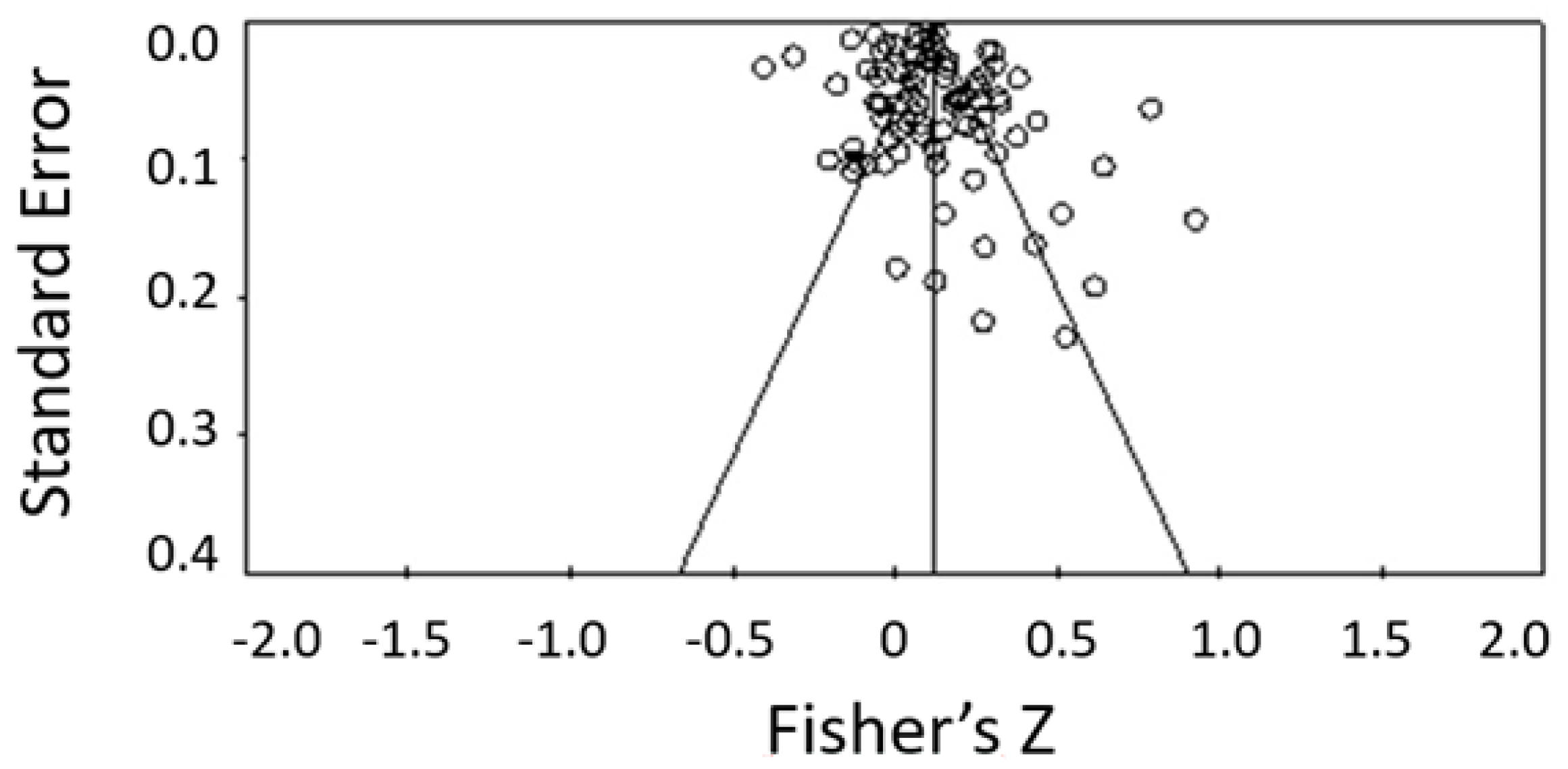

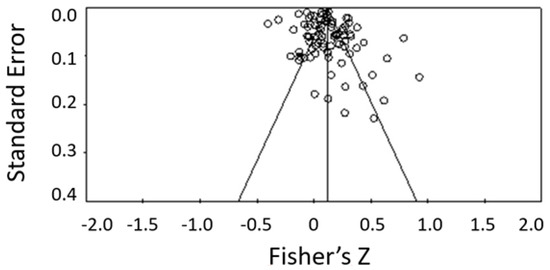

One of the most important biases in meta-analytic studies is related with the publication bias [179]; studies with less significant results between the variables studied are more difficult to publish than the studies that show significant results, both as a result of the reluctance of publishers [180], and as a result of the non-delivery/presentation of such results by the researchers [181]. In order to test for the presence/absence of publication bias, the tolerance index of null results provided by Rosenthal (Fail-safe N) is computed. This approach estimates the number of unpublished studies that that would be necessary to reduce the effect size to a negligible level. We also used funnel plot analysis to visually identify outliers for removal.

Finally, this paper addresses previous discussions on how to measure the two studied variables (i.e., board independence and CSP) appropriately. On the one hand, the independence of a firm’s board has been defined as the extent to which the board of directors operates independently from executive directors [182] and it has been usually measured as the percentage of board members who are non-executive directors, outside directors and independent directors [49,50,67,183]. On the other hand, Dunn and Sainty [74] state that “the essence of CSP is the recognition or awareness that there are multiple stakeholders against which a business has responsibility towards in the longer term”. This definition involves broadening the focus on financial targets and including social and environmental targets, producing a need to measure and assess economic, social and environmental performance. Therefore, CSP not only addresses companies’ economic success, but also includes the effects of the companies’ activities on the environment and society as a whole [184]. This is consistent with the definition used by Orlitzky et al. [34], who, in their meta-analysis, used the definition of CSP provided by Wood [30] (p. 693), who indicated that CSP is a construct comprising “a business organization’s configuration of principles of social responsibility, processes of social responsiveness, and policies, programs, and observable outcomes as they relate to the firm’s societal relationships”.

6. Results and Discussion

Table 2 presents the estimates obtained by applying HOMA meta-analytic method that will provide the required information to test the working hypotheses. The estimate for the direct effect (i.e., impact of the independence of a company’s board on CSP) is positive ( = 0.1258). This result indicates that the independence of company boards is positively connected with CSP, the greater the independence, the higher their level of CSP. The significance of the relationship is evaluated by through examining the size effect confidence interval. As the confidence interval [0.0946, 0.1566] does not include the value zero, it indicates that the effect is significant. Therefore hypothesis H1 cannot be rejected, implying that the presence of outside and independent directors on company boards have a positive influence on CSP. Additional tests need to be conducted to ensure the robustness of the result. First, the value of the Q statistic indicates that the results reported are not homogeneous. Second, the I2 statistic indicates that the observed positive influence of board independence on CSP is very variable and, the introduction of moderating variables should be considered to reduce the variability. The value of the Rosenthal Fail-safe is higher than 12,000, indicating that the number of unpublished papers required to reduce the observed direct size effect to negligible is very large, so it is unlikely that there is any publication bias present. Finally, Figure 1 shows the Funnel plot, which also indicates an absence of publication bias, thus reinforcing the robustness of the observed global effect.

Figure 1.

Funnel plot of standard error by Fisher’s Z.

The observed positive connection between the independence of a company’s board and CSP is in line with previous research findings [96]. The positive influence of the presence of outside and independent directors on company boards on CSP is in line with the assumptions of the instrumental stakeholder theory, because companies with more independent boards are more likely to consider the concerns and claims of their stakeholders. This produces a strategic management model that is more closely linked with sustainability, environmental preservation and society’s well-being. The observed heterogeneity in the main size effect suggests that further examination of the moderating role of variables in the relationship is needed.

Table 2 also shows the information to test the other working hypotheses (H2, H3 and H4). H2 predicts that the positive influence of the board’s independence on CSP is higher when CSP is measured trough companies’ self-reported data. The estimates show that the parameter associated with the self-reported CSP measures ( = 0.1386) is higher than that observed for the external CSP data measures ( = 0.1096). Both size effects are significant because their confidence intervals do not include the value of zero (i.e., [0.0966, 0.1800] and [0.0612, 0.1575] respectively). These findings mean that the positive influence of the board’s independence on CSP is higher when CSP is measured by self-reported data. This provides empirical evidence that different CSP measurement approaches act as a moderator in the main relationship, providing support for H2.

H3 predicts that the positive impact of board independence on CSP is greater in companies operating in civil law countries. The estimates show that the parameter associated with civil law countries ( = 0.1838) is higher than the observed for common law countries ( = 0.1293) and for countries with mixed systems ( = 0.1217). The three size effects are significant because their confidence intervals do not include the value of zero (i.e., [0.0828, 0.2811], [0.0869, 0.1712] and [0.0537, 0.1887] respectively). These findings indicate that the positive influence of board independence on CSP is higher for companies in codified law countries. This finding is consistent with the view that companies in civil law countries exhibit a more stakeholder oriented management approach [36], instead of the shareholder oriented management model that is usually attributed to firms in common law countries [41,185]. In fact, the result suggests that, the selection of directors in stakeholder-oriented management models is more effective in reinforcing their advice function [186], and ultimately having a greater influence on CSP levels. On the other hand, companies operating in common-law countries often select their board members with the aim of improving CFP [149], resulting in lower levels of CSP. The results provide empirical evidence that the different corporate governance systems moderate the link between board independence and CSP, and provide support for H3. Further empirical evidence of the significance of this moderator variable is that the heterogeneity decreases in two of the four sub-samples.

The last hypothesis, H4, predicts that the positive influence of board independence on CSP is lower during bear market periods. The estimates for each period show significant variations in the connection between the independence of a company’s board and CSP. With the exception of the papers focusing on samples earlier than 2002, a positive and significant connection between the variables is observed through all the time-periods that were considered. The link between board independence on CSP is not significant for the studies prior to the scandals at the beginning of the century ( = 0.0710, with a 95% CI of [−0.0509, 0.1907]) and positive and significant in studies in the following period ( = 0.1096, with a 95% CI [0.0373, 0.1808]), which was characterized companies adopting new CG models that led companies’ boards to increase their independence ratio. Moreover, the strength of the link between board independence and CSP is greater during the global economic recession period, from 2007 to 2009, following the financial crisis (= 0.1688, with a 95% CI of [0.0977, 0.2382]). Finally, the strongest relationship is observed for the last period considered, from 2001 to 2007, which was mainly characterized by sustained economic growth in the main developed economies of the world. These findings suggest that there is a positive trend in the strength of the connection between the independence of a firm’s board and CSP in the different samples considered; papers focusing on recent time-periods find a stronger connection between board independence and CSP than those focusing on earlier samples. Although these findings indicate that the economic conditions, of bull and bear markets, do moderate the relationship between the variables, they do not support H4.

7. Conclusions

This paper provides, to the best of the authors’ knowledge, the first meta-analysis of evidence about the influence of the independence of a company’s board on CSP. The potential effects of some moderating variables are investigated, with the aim of obtaining a better understanding of the connection between board independence and CSP. Specifically, the role of the different CG systems, the different approaches to measuring CSP and the economic conditions are examined.

The results indicate that the independence of a firm’s board is positively connected with CSP, and that the more independent the board is the higher their levels of CSP. In line with instrumental stakeholder theory, this finding can be explained because companies with more independent boards are more likely to commit to CSR issues and stakeholder engagement, thus attaining a higher degree of CSP. The overall effect of having an independent board on CSP is very heterogeneous, suggesting the existence of additional moderating variables that play a significant role in the relationship. This paper addresses the issue by introducing a number of moderating variables into the model. The results show that the relationship between board independence and CSP is stronger when CSP is measured using self-reported data. Although this moderating variable is significant, this finding should be interpreted with caution because self-reported CSP measures may have social desirability bias [187]. That is to say, self-reported levels of CSP may be higher than those measured with external CSP measures, because company boards have greater control over the provision of the former. The results also show that the positive influence of the independence of a firm’s board on CSP is greater in companies in codified law countries. In general, previous research has found that companies operating in civil law countries adopt a stakeholder-oriented management model, with more focus on environmental and social issues. Our findings are in line with this idea, indicating that the presence of outside and independent directors on company boards acts as a positive driver of their CSP levels. Our results also provide evidence of notable variations in the strength of the connection between board independence and CSP in different market conditions. Although a positive and significant influence of board independence on CSP is found in all the time-periods examined (except for the period before 2002), the strength of the connection grows over time. This contradicts the anticipated idea that companies operating in adverse economic settings will reduce their focus on CSR issues and place more attention on cost reduction.

This paper provides interesting insights for future research in the field. As a number of moderating variables have been shown to be significant in the relationship between board independence and CSP, further moderating effects should be examined. The size of a company’s board, whether the CEO and Chair of the Board are the same person, characteristics of ownership, the concentration of shareholding and the participation of institutional investors in the decision-making process are likely candidates for inclusion, and would provide a more comprehensive overview of the relationship. Future research could also analyze the connection between the independence of an organization’s board and CSP by implementing a meta-regression approach, and that might provide additional and complimentary empirical evidence about the relationship.

The present research is not free from limitations. Although the meta-analytical research design includes most of the previous literature about the influence of the independence of a firm’s board on CSP, it could not detect endogeneity or reverse causality if the original papers did not control for this effect [183]. The limited number of papers in some sub-samples when testing for moderating effects is another limitation of the current research.

Acknowledgments

The authors acknowledge the financial support of the Spanish Education Ministry (research project ECO2016-74920-C2-1-R) and the Basque Country Government (research project IT1073-16).

Author Contributions

Eduardo Ortas and Igor Álvarez were involved in the conception and design of the experiments. Eugenio Zubeltzu performed the experiments and all authors wrote the paper. Eugenio Zubeltzu contributed research materials and analysis tools. Eduardo Ortas and Igor Álvarez participated in the literature review and theoretical foundations. All authors gave thought to the conclusions. All authors read and approved the submitted manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Details of the moderating variables for each study included in the meta-analysis.

Table A1.

Details of the moderating variables for each study included in the meta-analysis.

| Code | Authors | Year | Sample Size | Sample Period | Countries | CSP Measurement Model | CG System |

|---|---|---|---|---|---|---|---|

| 1 | Amran et al. [77] | 2014 | 113 | 2010 | Global | Self-reported | Others |

| 2 | Amran et al. (B) [78] | 2014 | 111 | 2008 | Global | External-reported | Others |

| 3 | Arayssi et al. [79] | 2016 | 975 | 2007–2012 | UK | Self-reported | Common-law |

| 4 | Arena et al. [80] | 2015 | 288 | 2008–2010 | US | External-reported | Common-law |

| 5 | Arora and Dharwadkar [81] | 2011 | 1522 | 2001–2005 | US | External-reported | Common-law |

| 6 | Barakat et al. [82] | 2015 | 101 | 2011 | Palestine/Jordan | Self-reported | Mixed-law |

| 7 | Barako and Brown [83] | 2008 | 40 | 2007 | Kenya | Self-reported | Common-law |

| 8 | Bear et al. [9] | 2010 | 51 | 2009 | US | External-reported | Common-law |

| 9 | Ben-Amar et al. [84] | 2015 | 541 | 2008–2014 | Canada | Self-reported | Common-law |

| 10 | Benomran et al. [85] | 2015 | 162 | 2006–2012 | Libya | Self-reported | Mixed-law |

| 11 | Berrone and Gómez-Mejía [86] | 2009 | 2088 | 1997–2003 | US | Self-reported | Common-law |

| 12 | Boulouta [87] | 2013 | 820 | 1999–2003 | US | External-reported | Common-law |

| 13 | Bowrin [88] | 2013 | 96 | 2010 | Caribe | Self-reported | Mixed-law |

| 14 | Brammer et al. [89] | 2009 | 199 | 2002 | UK | External-reported | Common-law |

| 15 | Burke et al. [90] | 2017 | 11458 | 2003–2013 | US | External-reported | Common-law |

| 16 | Cho et al. [91] | 2015 | 10297 | 2003–2011 | US | External-reported | Common-law |

| 17 | Choi et al. [92] | 2013 | 2042 | 2002–2008 | Korea | External-reported | Civil-law |

| 18 | Cormier et al. [93] | 2011 | 137 | 2005 | Canada | Self-reported | Common-law |

| 19 | David et al. [94] | 2007 | 730 | 1992–1998 | US | External-reported | Common-law |

| 20 | De Villiers [22] | 2011 | 5997 | 2003–2004 | US | External-reported | Common-law |

| 21 | Deschênes et al. [95] | 2015 | 192 | 2004–2008 | Canada | External-reported | Common-law |

| 22 | Ducassy [96] | 2015 | 41 | 2011 | France | External-reported | Civil-law |

| 23 | Dunn and Sainty [74] | 2009 | 174 | 2002, 2004–2006 | Canada | External-reported | Common-law |

| 24 | Esa et al. [97] | 2012 | 54 | 2005–2007 | Malaysia | Self-reported | Mixed-law |

| 25 | Fernández-Gago et al. [98] | 2016 | 145 | 2005–2010 | Spain | External-reported | Civil-law |

| 26 | Frias-Aceituno et al. [99] | 2013 | 1575 | 2008–2010 | Global | Self-reported | Others |

| 27 | Galbreath [100] | 2011 | 161 | 2004 | Australia | Self-reported | Common-law |

| 28 | Galbreath [23] | 2016 | 300 | 2012 | Australia | External-reported | Common-law |

| 29 | García-Sánchez et al. [101] | 2015 | 5380 | 2003–2009 | Global | Self-reported | Mixed-law |

| 30 | García-Sánchez [102] | 2014 | 686 | 2004–2010 | Spain | Self-reported | Civil-law |

| 31 | Ghazali and Weetman [103] | 2006 | 87 | 2001 | Malaysia | Self-reported | Mixed-law |

| 32 | Gupta et al. [104] | 2015 | 1153 | 2012 | US | External-reported | Common-law |

| 33 | Habbash [105] | 2016 | 267 | 2007–2011 | Saudi Arabia | Self-reported | Mixed-law |

| 34 | Hafsi and Turgut [106] | 2013 | 95 | 2005 | US | External-reported | Common-law |

| 35 | Haldar and Mishra [107] | 2015 | 24 | 2014 | India | Self-reported | Common-law |

| 36 | Haniffa and Cook [14] | 2005 | 278 | 1996, 2002 | Malaysia | Self-reported | Mixed-law |

| 37 | Harjoto et al. [20] | 2015 | 9001 | 1999–2010 | US | External-reported | Common-law |

| 38 | Hogan et al. [108] | 2014 | 540 | 2003–2011 | US | External-reported | Common-law |

| 39 | Hoje and Harjoto [109] | 2011 | 13389 | 1993–2004 | US | External-reported | Common-law |

| 40 | Htay et al. [110] | 2012 | 120 | 1996–2005 | Malaysia | Self-reported | Mixed-law |

| 41 | Huang [111] | 2010 | 297 | 2006–2007 | Taiwan | Self-reported | Civil-law |

| 42 | Hussain et al. [112] | 2016 | 152 | 2007–2011 | US | Self-reported | Common-law |

| 43 | Ienciu et al. [113] | 2012 | 54 | 2009 | Global | Self-reported | Others |

| 44 | Janggu et al. [114] | 2014 | 100 | 2010 | Malaysia | Self-reported | Mixed-law |

| 45 | Javaid Lone et al. [115] | 2016 | 250 | 2010–2014 | Pakistan | Self-reported | Mixed-law |

| 46 | Jizi [116] | 2017 | 1155 | 2007–2012 | UK | External-reported | Common-law |

| 47 | Jizi et al. [117] | 2014 | 291 | 2009–2011 | US | Self-reported | Common-law |

| 48 | Johnson and Greening [12] | 1999 | 252 | 1993 | US | External-reported | Common-law |

| 49 | Khan et al. [118] | 2013 | 580 | 2005–2009 | Bangladeshi | Self-reported | Mixed-law |

| 50 | Khan [119] | 2010 | 30 | 2007–2008 | Bangladeshi | Self-reported | Mixed-law |

| 51 | Kiliç et al. [120] | 2015 | 3106 | 2008–2012 | Turkey | Self-reported | Civil-law |

| 52 | Kock et al. [121] | 2012 | 657 | 1998, 2000 | US | Self-reported | Common-law |

| 53 | Li et al. [122] | 2013 | 613 | 2009–2010 | China | External-reported | Mixed-law |

| 54 | Liao et al. [123] | 2015 | 329 | 2011 | UK | Self-reported | Common-law |

| 55 | Lim et al. [124] | 2007 | 181 | 2001 | Australia | Self-reported | Common-law |

| 56 | Lu [125] | 2013 | 2098 | 2007–2011 | US | External-reported | Common-law |

| 57 | Mallin et al. [76] | 2013 | 221 | 2005–2007 | US | External-reported | Common-law |

| 58 | Martínez-Ferrero et al. [126] | 2015 | 877 | 2004–2010 | Global | External-reported | Mixed-law |

| 59 | Michelon and Parbonetti [13] | 2012 | 114 | 2005–2007 | Global | self-reported | Mixed-law |

| 60 | Mohamad et al. [127] | 2011 | 795 | 2005–2007 | Malaysia | self-reported | Mixed-law |

| 61 | Musteen [128] | 2010 | 324 | 2000 | US | External-reported | Common-law |

| 62 | Ntim and Soobaroyen [73] | 2013 | 600 | 2002–2009 | South Africa | self-reported | Mixed-law |

| 63 | Nurhayati et al. [129] | 2015 | 285 | 2010–2012 | India | self-reported | Common-law |

| 64 | Ortiz de Mandojana et al. [130] | 2016 | 210 | 2008 | Global | self-reported | Mixed-law |

| 65 | Post et al. [131] | 2011 | 78 | 2007 | US | self-reported | Common-law |

| 66 | Post et al. [72] | 2015 | 180 | 2004–2008 | US | self-reported | Common-law |

| 67 | Prado-Lorenzo et al. [132] | 2009 | 288 | 2004–2006 | Spain | self-reported | Civil-law |

| 68 | Prado-Lorenzo and García-Sánchez [133] | 2010 | 283 | 2007 | Global | External-reported | Mixed-law |

| 69 | Rao and Tilt [134] | 2016 | 345 | 2009–2011 | Australia | self-reported | Common-law |

| 70 | Rao et al. [16] | 2012 | 96 | 2008 | Australia | self-reported | Common-law |

| 71 | Rodríguez-Ariza et al. [135] | 2014 | 3521 | 2004–2009 | Global | self-reported | Mixed-law |

| 72 | Rodríguez-Domínguez et al. [136] | 2009 | 351 | 2009 | Global | self-reported | Mixed-law |

| 73 | Roitto [137] | 2013 | 31 | 2012 | Finland | External-reported | Civil-law |

| 74 | Rouf [138] | 2011 | 93 | 2007 | Bangladesh | self-reported | Mixed-law |

| 75 | Sahin et al. [75] | 2011 | 96 | 2007 | Turkey | self-reported | Civil-law |

| 76 | Said et al. [139] | 2009 | 150 | 2006 | Malaysia | self-reported | Mixed-law |

| 77 | Said et al. [140] | 2013 | 120 | 2009 | Malaysia | self-reported | Mixed-law |

| 78 | Sharif and Rashid [141] | 2014 | 22 | 2005–2010 | Pakistan | self-reported | Mixed-law |

| 79 | Shaukat et al. [142] | 2016 | 2028 | 2002–2010 | UK | External-reported | Common-law |

| 80 | Sundarasen et al. [17] | 2016 | 450 | 2011–2012 | Malaysia | self-reported | Mixed-law |

| 81 | Tauringana and Chithambo [143] | 2015 | 860 | 2008–2011 | UK | self-reported | Common-law |

| 82 | Walls and Berrone [19] | 2015 | 1320 | 2001–2007 | US | External-reported | Common-law |

| 83 | Walls and Hoffman [144] | 2013 | 1881 | 2002–2008 | US | External-reported | Common-law |

| 84 | Walls et al. [18] | 2012 | 2002 | 1997–2005 | US | External-reported | Common-law |

| 85 | Wang et al. [145] | 2012 | 446 | 2008 | China | self-reported | Mixed-law |

| 86 | Williams [146] | 2003 | 185 | 1991–1994 | US | self-reported | Common-law |

| 87 | Zhang [147] | 2012 | 475 | 2007–2008 | US | External-reported | Common-law |

This table shows the main details of the moderating variables of the papers included in the final sample of the meta-analysis.

References

- Bhattacharya, C.B.; Sen, S. Doing better at doing good: When, why, and how consumers respond to corporate social initiatives. Calif. Manag. Rev. 2004, 47, 9–24. [Google Scholar] [CrossRef]

- ECGI European Corporate Governance Institute. Index of Codes. Available online: http://www.ecgi.org/codes/all_codes.php (accessed on 6 June 2017).

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Moon, J. The contribution of corporate social responsibility to sustainable development. Sustain. Dev. 2007, 15, 296–306. [Google Scholar] [CrossRef]

- Epstein, M.J.; Buhovac, A.R. Making Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental, and Economic Impacts; Berrett-Koehler Publishers: Oakland, CA, USA, 2014. [Google Scholar]

- Martin, R.L. The virtue matrix: Calculating the return on corporate responsibility. Harv. Bus. Rev. 2002, 80, 68–75. [Google Scholar] [PubMed]

- Swanson, D.L.; Orlitzky, M. Toward a Conceptual Integration of Corporate Social and Financial Performance. In Handbook of Integrated CSR Communication; Springer: New York City, NY, USA, 2017; pp. 129–148. [Google Scholar]

- Schaltegger, S.; Wagner, M. Managing sustainability performance measurement and reporting in an integrated manner. Sustainability accounting as the link between the sustainability balanced scorecard and sustainability reporting. In Sustainability Accounting and Reporting; Springer: New York, NY, USA, 2006; pp. 681–697. [Google Scholar]

- Bear, S.; Rahman, N.; Post, C. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. J. Bus. Ethics 2010, 97, 207–221. [Google Scholar] [CrossRef]

- Byron, K.; Post, C. Women on Boards of Directors and Corporate Social Performance: A Meta-Analysis. Corp. Gov. Int. Rev. 2016, 24, 428–442. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. Corporate governance and firm value: The impact of corporate social responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar] [CrossRef]

- Johnson, R.A.; Greening, D.W. The effects of corporate governance and institutional ownership types on corporate social performance. Acad. Manag. J. 1999, 42, 564–576. [Google Scholar] [CrossRef]

- Michelon, G.; Parbonetti, A. The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 2012, 16, 477–509. [Google Scholar] [CrossRef]

- Haniffa, R.M.; Cooke, T.E. The impact of culture and governance on corporate social reporting. J. Account. Public Policy 2005, 24, 391–430. [Google Scholar] [CrossRef]

- Ballesteros, B.C.; Rubio, R.G.; Ferrero, J.M. Efecto de la composición del consejo de administración en las prácticas de responsabilidad social corporativa. Rev. Contab. 2015, 18, 20–31. [Google Scholar] [CrossRef]

- Kathy Rao, K.; Tilt, C.A.; Lester, L.H. Corporate governance and environmental reporting: An Australian study. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 143–163. [Google Scholar] [CrossRef]

- Sundarasen, S.D.D.; Je-Yen, T.; Rajangam, N.; Eweje, G.; Eweje, G. Board Composition and Corporate Social Responsibility in an Emerging Market. Corp. Gov. Int. J. Bus. Soc. 2016, 16. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P. The power of one to make a difference: How informal and formal CEO power affect environmental sustainability. J. Bus. Ethics 2015, 1–16. [Google Scholar] [CrossRef]

- Harjoto, M.; Laksmana, I.; Lee, R. Board diversity and corporate social responsibility. J. Bus. Ethics 2015, 132, 641–660. [Google Scholar] [CrossRef]

- Ayuso, S.; Argandoña, A. Responsible Corporate Governance: Towards a Stakeholder Board of Directors? Working Paper No. 701; IESE Business School: Barcelona, Spain, 2007. [Google Scholar]

- De Villiers, C.; Naiker, V.; van Staden, C.J. The effect of board characteristics on firm environmental performance. J. Manag. 2011, 37, 1636–1663. [Google Scholar] [CrossRef]

- Galbreath, J. The Impact of Board Structure on Corporate Social Responsibility: A Temporal View. Bus. Strategy Environ. 2016. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Rupp, D.E.; Williams, C.A.; Ganapathi, J. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad. Manag. Rev. 2007, 32, 836–863. [Google Scholar] [CrossRef]

- Wood, D.J. Measuring corporate social performance: A review. Int. J. Manag. Rev. 2010, 12, 50–84. [Google Scholar] [CrossRef]

- Garriga, E.; Melé, D. Corporate social responsibility theories: Mapping the territory. J. Bus. Ethics 2004, 53, 51–71. [Google Scholar] [CrossRef]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Clarkson, M.E. A stakeholder framework for analyzing and evaluating corporate social performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Wood, D.J. Corporate social performance revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar]

- Lu, W.; Chau, K.; Wang, H.; Pan, W. A decade’s debate on the nexus between corporate social and corporate financial performance: A critical review of empirical studies 2002–2011. J. Clean. Prod. 2014, 79, 195–206. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social and financial performance. Ann Arbor 2007, 1001. Available online: https://www.hks.harvard.edu/m-rcbg/papers/seminars/margolis_november_07.pdf (accessed on 5 June 2017).

- Visser, W.; Matten, D.; Pohl, M.; Tolhurst, N. The A to Z of Corporate Social Responsibility; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Ortas, E.; Álvarez, I.; Garayar, A. The environmental, social, governance, and financial performance effects on companies that adopt the United Nations Global Compact. Sustainability 2015, 7, 1932–1956. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A stakeholder Approach; Pitman Publishing Inc.: Marshfield, MA, USA, 1984. [Google Scholar]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Garcia-Torea, N.; Fernandez-Feijoo, B.; de la Cuesta, M. Board of director’s effectiveness and the stakeholder perspective of corporate governance: Do effective boards promote the interests of shareholders and stakeholders? BRQ Bus. Res. Q. 2016, 19, 246–260. [Google Scholar] [CrossRef]

- Jamali, D.; Safieddine, A.M.; Rabbath, M. Corporate governance and corporate social responsibility synergies and interrelationships. Corp. Gov. Int. Rev. 2008, 16, 443–459. [Google Scholar] [CrossRef]

- Brown, P.; Beekes, W.; Verhoeven, P. Corporate governance, accounting and finance: A review. Account. Financ. 2011, 51, 96–172. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Milliken, F.J.; Martins, L.L. Searching for common threads: Understanding the multiple effects of diversity in organizational groups. Acad. Manag. Rev. 1996, 21, 402–433. [Google Scholar]

- Daily, C.M.; Dalton, D.R.; Cannella, A.A. Corporate governance: Decades of dialogue and data. Acad. Manag. Rev. 2003, 28, 371–382. [Google Scholar]

- Van den Berghe, L.A.A.; Levrau, A. Evaluating boards of directors: What constitutes a good corporate board? Corp. Gov. Int. Rev. 2004, 12, 461–478. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Boards of directors as an endogenously determined institution: A survey of the economic literature. Econ. Policy Rev. 2003, 9, 7–26. [Google Scholar]

- Freeman, R.E.; Evan, W.M. Corporate governance: A stakeholder interpretation. J. Behav. Econ. 1990, 19, 337–359. [Google Scholar] [CrossRef]

- Ferrarini, G.A.; Filippelli, M. Independent Directors and Controlling Shareholders around the World; Law Working Paper; European Corporate Governance Institute (ECGI): Brussels, Belgium, 2014. [Google Scholar]

- Daily, C.M.; Johnson, J.L.; Dalton, D.R. On the measurements of board composition: Poor consistency and a serious mismatch of theory and operationalization. Decis. Sci. 1999, 30, 83–106. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Ellstrand, A.E.; Johnson, J.L. Meta-analytic reviews of board composition, leadership structure, and financial performance. Strateg. Manag. J. 1998, 19, 269–290. [Google Scholar] [CrossRef]

- Garcia-Meca, E.; Sánchez-Ballesta, J.P. The association of board independence and ownership concentration with voluntary disclosure: A meta-analysis. Eur. Account. Rev. 2010, 19, 603–627. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Bertoni, F.; Meoli, M.; Vismara, S. Board independence, ownership structure and the valuation of IPOs in continental Europe. Corp. Gov. Int. Rev. 2014, 22, 116–131. [Google Scholar] [CrossRef]

- Johanson, D.; Østergren, K. The movement toward independent directors on boards: A comparative analysis of Sweden and the UK. Corp. Gov. Int. Rev. 2010, 18, 527–539. [Google Scholar] [CrossRef]

- Evan, W.M.; Freeman, R.E. A stakeholder theory of the modern corporation: Kantian capitalism. In Ethical Theory and Business; Beauchamp, T., Bowie, N., Eds.; Prentice Hall, Englewood Cliffs: Upper Saddle River, NJ, USA, 1993; pp. 75–83. [Google Scholar]

- Ibrahim, N.A.; Howard, D.P.; Angelidis, J.P. Board members in the service industry: An empirical examination of the relationship between corporate social responsibility orientation and directorial type. J. Bus. Ethics 2003, 47, 393–401. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Angelidis, J.P. The corporate social responsiveness orientation of board members: Are there differences between inside and outside directors? J. Bus. Ethics 1995, 14, 405–410. [Google Scholar] [CrossRef]

- Pivato, S.; Misani, N.; Tencati, A. The impact of corporate social responsibility on consumer trust: The case of organic food. Bus. Ethic 2008, 17, 3–12. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar]

- Jo, H.; Harjoto, M.A. The causal effect of corporate governance on corporate social responsibility. J. Bus. Ethics 2012, 106, 53–72. [Google Scholar] [CrossRef]

- De Graaf, F.J.; Stoelhorst, J. The role of governance in corporate social responsibility: Lessons from Dutch finance. Bus. Soc. 2009, 52, 282–317. [Google Scholar] [CrossRef]

- Stuebs, M.; Sun, L. Corporate governance and social responsibility. Int. J. Law Manag. 2015, 57, 38–52. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Dienes, D.; Velte, P. The impact of supervisory board composition on CSR reporting. Evidence from the German two-tier system. Sustainability 2016, 8, 63. [Google Scholar] [CrossRef]

- Post, C.; Byron, K. Women on boards and firm financial performance: A meta-analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Siddiqui, S.S. The association between corporate governance and firm performance—A meta-analysis. Int. J. Account. Inf. Manag. 2015, 23, 218–237. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Johnson, J.L.; Ellstrand, A.E. Number of directors and financial performance: A meta-analysis. Acad. Manag. J. 1999, 42, 674–686. [Google Scholar] [CrossRef]

- Rhoades, D.L.; Rechner, P.L.; Sundaramurthy, C. Board composition and financial performance: A meta-analysis of the influence of outside directors. J. Manag. Issues 2000, 12, 76–91. [Google Scholar]

- Sánchez-Ballesta, J.P.; García-Meca, E. A meta-analytic vision of the effect of ownership structure on firm performance. Corp. Gov. Int. Rev. 2007, 15, 879–892. [Google Scholar] [CrossRef]

- Heugens, P.P.; Van Essen, M.; van Oosterhout, J.H. Meta-analyzing ownership concentration and firm performance in Asia: Towards a more fine-grained understanding. Asia Pac. J. Manag. 2009, 26, 481–512. [Google Scholar] [CrossRef]

- Allouche, J.; Laroche, P. A meta-analytical investigation of the relationship between corporate social and financial performance. Rev. Gest. Ressour. Hum. 2005, 57, 18–41. [Google Scholar]

- Margolis, J.D.; Walsh, J.P. Misery Loves Companies: Whither Social Initiatives by Business? Citeseer: State College, PA, USA, 2001. [Google Scholar]

- Post, C.; Rahman, N.; McQuillen, C. From board composition to corporate environmental performance through sustainability-themed alliances. J. Bus. Ethics 2015, 130, 423–435. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate governance and performance in socially responsible corporations: New empirical insights from a Neo-Institutional framework. Corp. Gov. Int. Rev. 2013, 21, 468–494. [Google Scholar] [CrossRef]

- Dunn, P.; Sainty, B. The relationship among board of director characteristics, corporate social performance and corporate financial performance. Int. J. Manag. Financ. 2009, 5, 407–423. [Google Scholar] [CrossRef]

- Sahin, K.; Basfirinci, C.S.; Ozsalih, A. The impact of board composition on corporate financial and social responsibility performance: Evidence from public-listed companies in Turkey. Afr. J. Bus. Manag. 2011, 5, 2959. [Google Scholar]

- Mallin, C.; Michelon, G.; Raggi, D. Monitoring intensity and stakeholders’ orientation: How does governance affect social and environmental disclosure? J. Bus. Ethics 2013, 114, 29–43. [Google Scholar] [CrossRef]

- Amran, A.; Lee, S.P.; Devi, S.S. The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Bus. Strategy Environ. 2014, 23, 217–235. [Google Scholar] [CrossRef]

- Amran, A.; Periasamy, V.; Zulkafli, A.H. Determinants of climate change disclosure by developed and emerging countries in Asia Pacific. Sustain. Dev. 2014, 22, 188–204. [Google Scholar] [CrossRef]

- Arayssi, M.; Arayssi, M.; Dah, M.; Dah, M.; Jizi, M.; Jizi, M. Women on boards, sustainability reporting and firm performance. Sustain. Account. Manag. Policy J. 2016, 7, 376–401. [Google Scholar] [CrossRef]

- Arena, C.; Bozzolan, S.; Michelon, G. Environmental reporting: Transparency to stakeholders or stakeholder manipulation? An analysis of disclosure tone and the role of the board of directors. Corp Soc. Responsib. Environ. Manag. 2015, 22, 346–361. [Google Scholar] [CrossRef]

- Arora, P.; Dharwadkar, R. Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corp. Gov. Int. Rev. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Barakat, F.S.; Pérez, M.V.L.; Ariza, L.R. Corporate social responsibility disclosure (CSRD) determinants of listed companies in Palestine (PXE) and Jordan (ASE). Rev. Manag. Sci. 2015, 9, 681–702. [Google Scholar] [CrossRef]

- Barako, D.G.; Brown, A.M. Corporate social reporting and board representation: Evidence from the Kenyan banking sector. J. Manag. Gov. 2008, 12, 309–324. [Google Scholar] [CrossRef]

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board gender diversity and corporate response to sustainability initiatives: evidence from the Carbon Disclosure Project. J. Bus. Ethics 2017, 142, 369–383. [Google Scholar] [CrossRef]

- Benomran, N.A.; Haat, M.H.C.; Hashim, H.B.; Mohamad, N.R.B. Influence of Corporate Governance on the Extent of Corporate Social Responsibility and Environmental Reporting. J. Environ. Ecol. 2015, 6, 48–68. [Google Scholar] [CrossRef]

- Berrone, P.; Gomez-Mejia, L.R. Environmental performance and executive compensation: An integrated agency-institutional perspective. Acad. Manag. J. 2009, 52, 103–126. [Google Scholar] [CrossRef]

- Boulouta, I. Hidden connections: The link between board gender diversity and corporate social performance. J. Bus. Ethics 2013, 113, 185–197. [Google Scholar] [CrossRef]

- Bowrin, A.R. Corporate social and environmental reporting in the Caribbean. Soc. Responsib. J. 2013, 9, 259–280. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A.; Pavelin, S. Corporate reputation and women on the board. Br. J. Manag. 2009, 20, 17–29. [Google Scholar] [CrossRef]

- Burke, J.J.; Hoitash, R.; Hoitash, U. The Heterogeneity of Board-Level Sustainability Committees and Corporate Social Performance. J. Bus. Ethics 2017. [Google Scholar] [CrossRef]

- Cho, C.H.; Jung, J.H.; Kwak, B.; Lee, J.; Yoo, C. Professors on the Board: Do They Contribute to Society Outside the Classroom? J. Bus. Ethics 2015, 141, 393–409. [Google Scholar] [CrossRef]

- Choi, B.B.; Lee, D.; Park, Y. Corporate social responsibility, corporate governance and earnings quality: Evidence from Korea. Corp. Gov. Int. Rev. 2013, 21, 447–467. [Google Scholar] [CrossRef]

- Cormier, D.; Ledoux, M.; Magnan, M. The informational contribution of social and environmental disclosures for investors. Manag. Decis. 2011, 49, 1276–1304. [Google Scholar] [CrossRef]

- David, P.; Bloom, M.; Hillman, A.J. Investor activism, managerial responsiveness, and corporate social performance. Strateg. Manag. J. 2007, 28, 91–100. [Google Scholar] [CrossRef]

- Deschênes, S.; Rojas, M.; Boubacar, H.; Prud'homme, B.; Ouedraogo, A. The impact of board traits on the social performance of Canadian firms. Corp. Gov. 2015, 15, 293–305. [Google Scholar] [CrossRef]

- Ducassy, I.; Montandrau, S. Corporate social performance, ownership structure, and corporate governance in France. Res. Int. Bus. Financ. 2015, 34, 383–396. [Google Scholar] [CrossRef]

- Esa, E.; Anum Mohd Ghazali, N. Corporate social responsibility and corporate governance in Malaysian government-linked companies. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 292–305. [Google Scholar] [CrossRef]

- Fernández-Gago, R.; Cabeza-García, L.; Nieto, M. Corporate social responsibility, board of directors, and firm performance: An analysis of their relationships. Rev. Manag. Sci. 2016, 10, 85–104. [Google Scholar] [CrossRef]

- Frias-Aceituno, J.V.; Rodriguez-Ariza, L.; Garcia-Sanchez, I. The role of the board in the dissemination of integrated corporate social reporting. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 219–233. [Google Scholar] [CrossRef]

- Galbreath, J. Are there gender-related influences on corporate sustainability? A study of women on boards of directors. J. Manag. Organ. 2011, 17, 17–38. [Google Scholar] [CrossRef]

- García-Sánchez, I.; Rodríguez-Domínguez, L.; Frías-Aceituno, J. Board of directors and ethics codes in different corporate governance systems. J. Bus. Ethics 2015, 131, 681–698. [Google Scholar] [CrossRef]

- Garcia-Sanchez, I.; Cuadrado-Ballesteros, B.; Sepulveda, C. Does media pressure moderate CSR disclosures by external directors? Manag. Decis. 2014, 52, 1014–1045. [Google Scholar] [CrossRef]

- Ghazali, N.A.M.; Weetman, P. Perpetuating traditional influences: Voluntary disclosure in Malaysia following the economic crisis. J. Int. Account. Audit. Tax. 2006, 15, 226–248. [Google Scholar] [CrossRef]

- Gupta, P.P.; Lam, K.C.; Sami, H.; Zhou, H. Board Diversity and Its Long-Term Effect on Firm Financial and Non-Financial Performance. Available online: http://dx.doi.org/10.2139/ssrn.2531212 (accessed on 30 January 2017).

- Habbash, M. Corporate governance and corporate social responsibility disclosure: Evidence from Saudi Arabia. J. Econ. Soc. Dev. 2016, 3, 87. [Google Scholar] [CrossRef]

- Hafsi, T.; Turgut, G. Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence. J. Bus. Ethics 2013, 112, 463–479. [Google Scholar] [CrossRef]

- Haldar, P.; Mishra, L. The Changing Facets of Corporate Governance and Corporate Social Responsibilities in India and their Interrelationship. Inf. Manag. Bus. Rev. 2015, 7, 6–16. [Google Scholar]

- Hogan, K.; Olson, G.T.; Sharma, R. The Role of Corporate Philanthropy on Ratings of Corporate Social Responsibility and Shareholder Return. J. Leadersh. Account. Ethics 2014, 11, 108. [Google Scholar]

- Harjoto, M.A.; Jo, H. Corporate governance and CSR nexus. J. Bus. Ethics 2011, 100, 45–67. [Google Scholar] [CrossRef]

- Htay, S.N.N.; Ab Rashid, H.M.; Adnan, M.A.; Meera, A.K.M. Impact of corporate governance on social and environmental information disclosure of Malaysian listed banks: Panel data analysis. Asian J. Financ. Account. 2012, 4. Available online: http://www.macrothink.org/journal/index.php/ajfa/article/view/810/1060 (accessed on 6 June 2017). [CrossRef]

- Huang, C. Corporate governance, corporate social responsibility and corporate performance. J. Manag. Organ. 2010, 16, 641–655. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate Governance and Sustainability Performance: Analysis of Triple Bottom Line Performance. J. Bus. Ethics 2016, 1–22. [Google Scholar] [CrossRef]

- Ienciu, I.; Popa, I.E.; Ienciu, N.M. Environmental reporting and good practice of corporate governance: Petroleum industry case study. Proc. Econ. Financ. 2012, 3, 961–967. [Google Scholar] [CrossRef]

- Janggu, T.; Darus, F.; Zain, M.M.; Sawani, Y. Does good corporate governance lead to better sustainability reporting? An analysis using structural equation modeling. Proc. Soc. Behav. Sci. 2014, 145, 138–145. [Google Scholar] [CrossRef]

- Javaid Lone, E.; Javaid Lone, E.; Ali, A.; Ali, A.; Khan, I.; Khan, I. Corporate governance and corporate social responsibility disclosure: Evidence from Pakistan. Corp. Gov. Int. J. Bus. Soc. 2016, 16, 785–797. [Google Scholar] [CrossRef]

- Jizi, M. The Influence of Board Composition on Sustainable Development Disclosure. Bus. Strategy Environ. 2017. [Google Scholar] [CrossRef]

- Jizi, M.I.; Salama, A.; Dixon, R.; Stratling, R. Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector. J. Bus. Ethics 2014, 125, 601–615. [Google Scholar] [CrossRef]

- Khan, A.; Muttakin, M.B.; Siddiqui, J. Corporate governance and corporate social responsibility disclosures: Evidence from an emerging economy. J. Bus. Ethics 2013, 114, 207–223. [Google Scholar] [CrossRef]

- Khan, H. The effect of corporate governance elements on corporate social responsibility (CSR) reporting: Empirical evidence from private commercial banks of Bangladesh. Int. J. Law Manag. 2010, 52, 82–109. [Google Scholar] [CrossRef]

- Kiliç, M.; Kuzey, C.; Uyar, A. The impact of ownership and board structure on Corporate Social Responsibility (CSR) reporting in the Turkish banking industry. Corp. Gov. 2015, 15, 357–374. [Google Scholar] [CrossRef]

- Kock, C.J.; Santaló, J.; Diestre, L. Corporate governance and the environment: What type of governance creates greener companies? J. Manag. Stud. 2012, 49, 492–514. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, J.; Foo, C.T. Towards a theory of social responsibility reporting: Empirical analysis of 613 CSR reports by listed corporations in China. Chin. Manag. Stud. 2013, 7, 519–534. [Google Scholar] [CrossRef]