Long-Term Hydrocarbon Trade Options for the Maghreb Region and Europe—Renewable Energy Based Synthetic Fuels for a Net Zero Emissions World

Abstract

:1. Introduction

2. Materials and Methods

3. Results

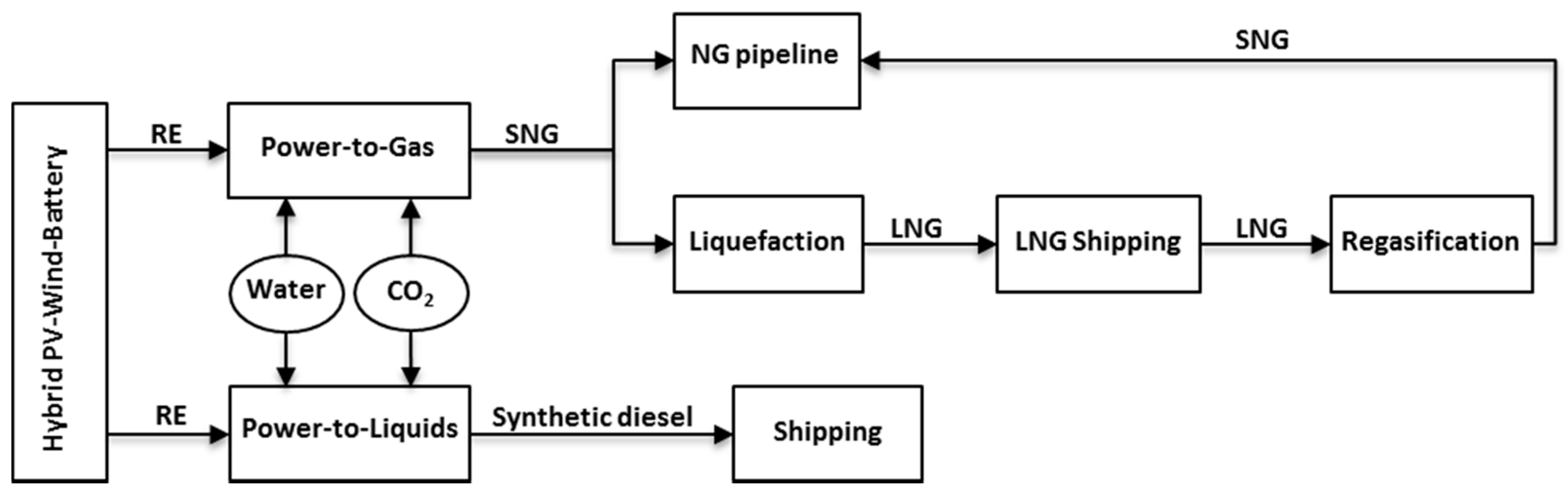

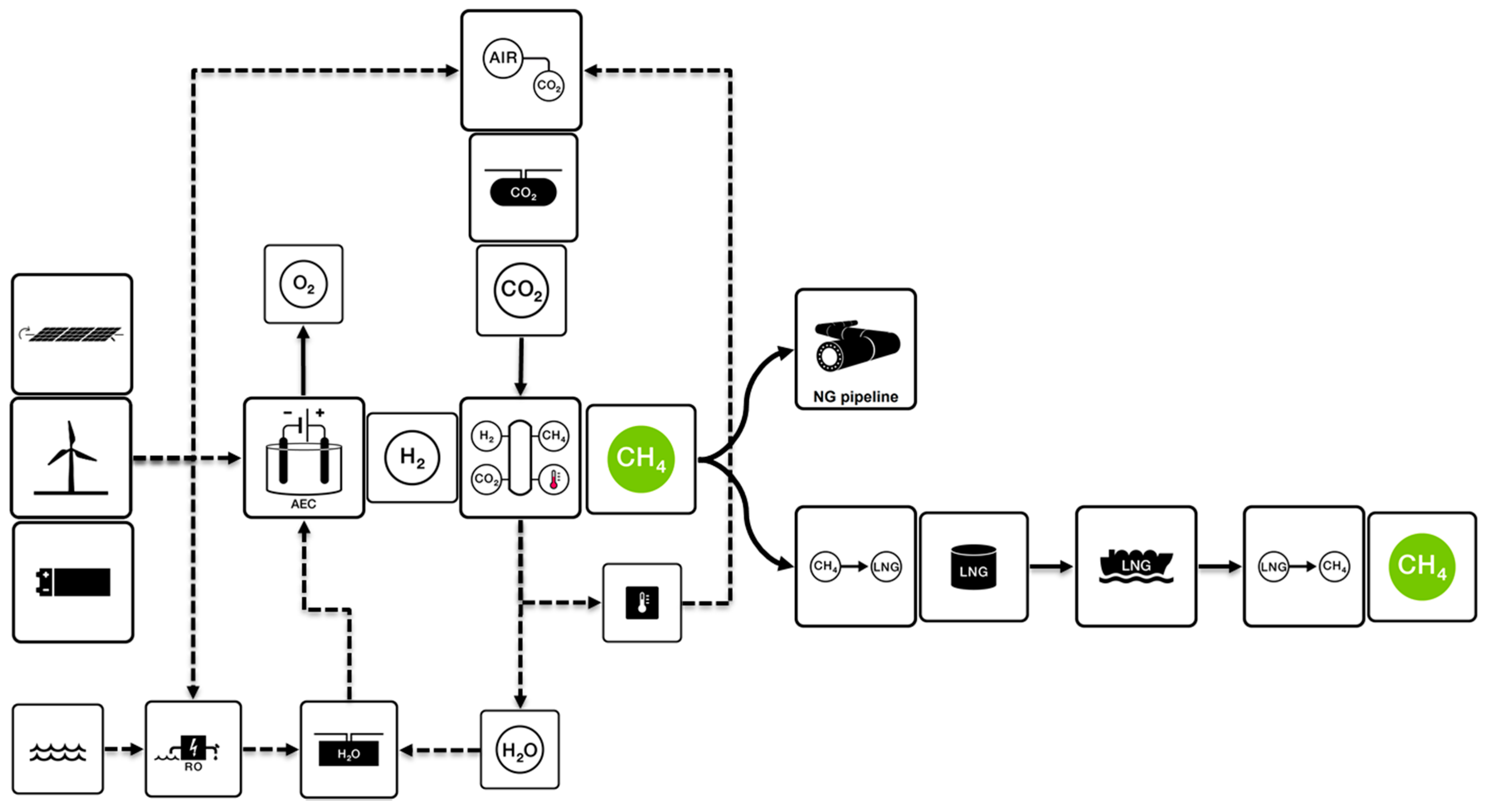

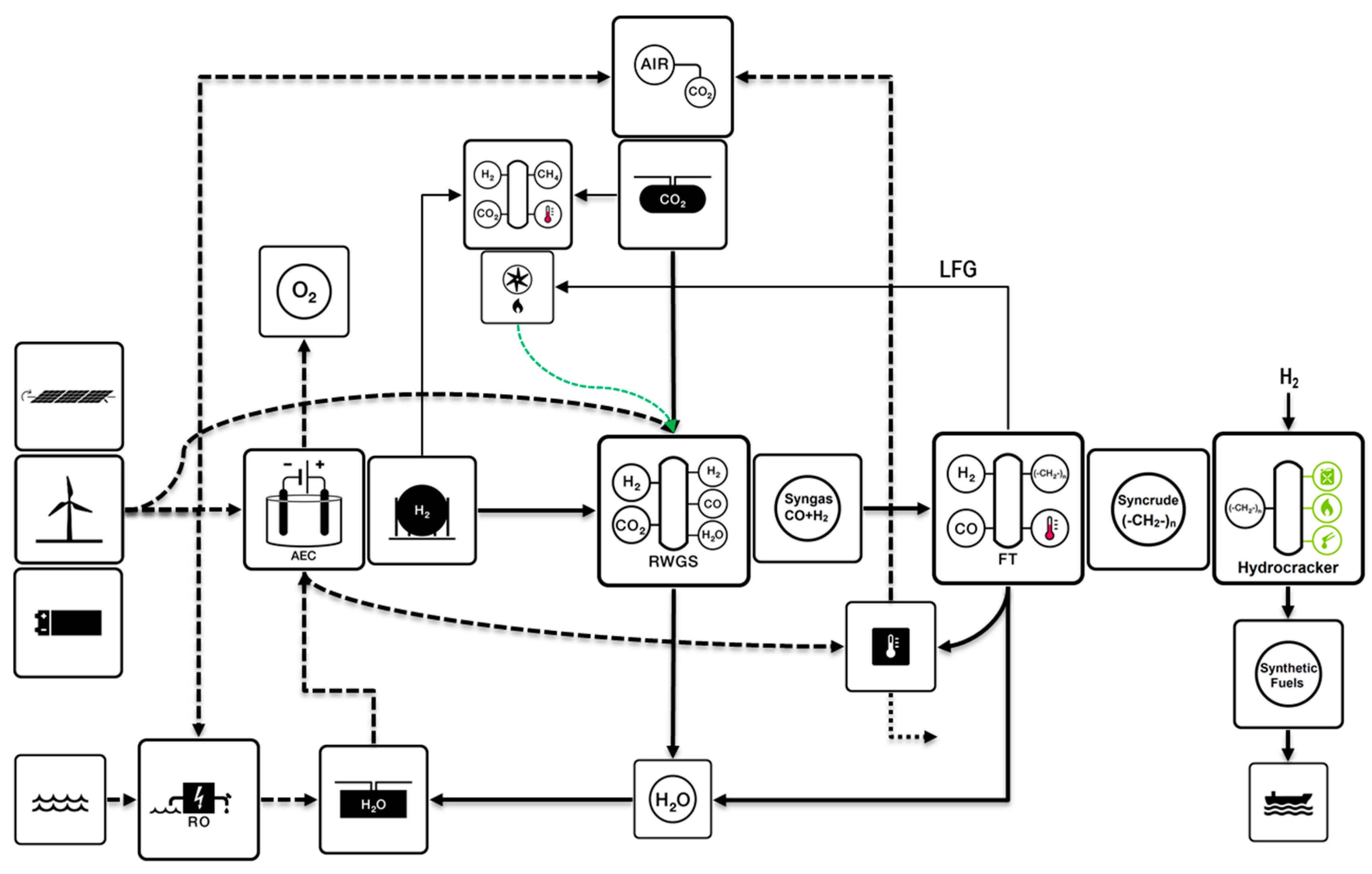

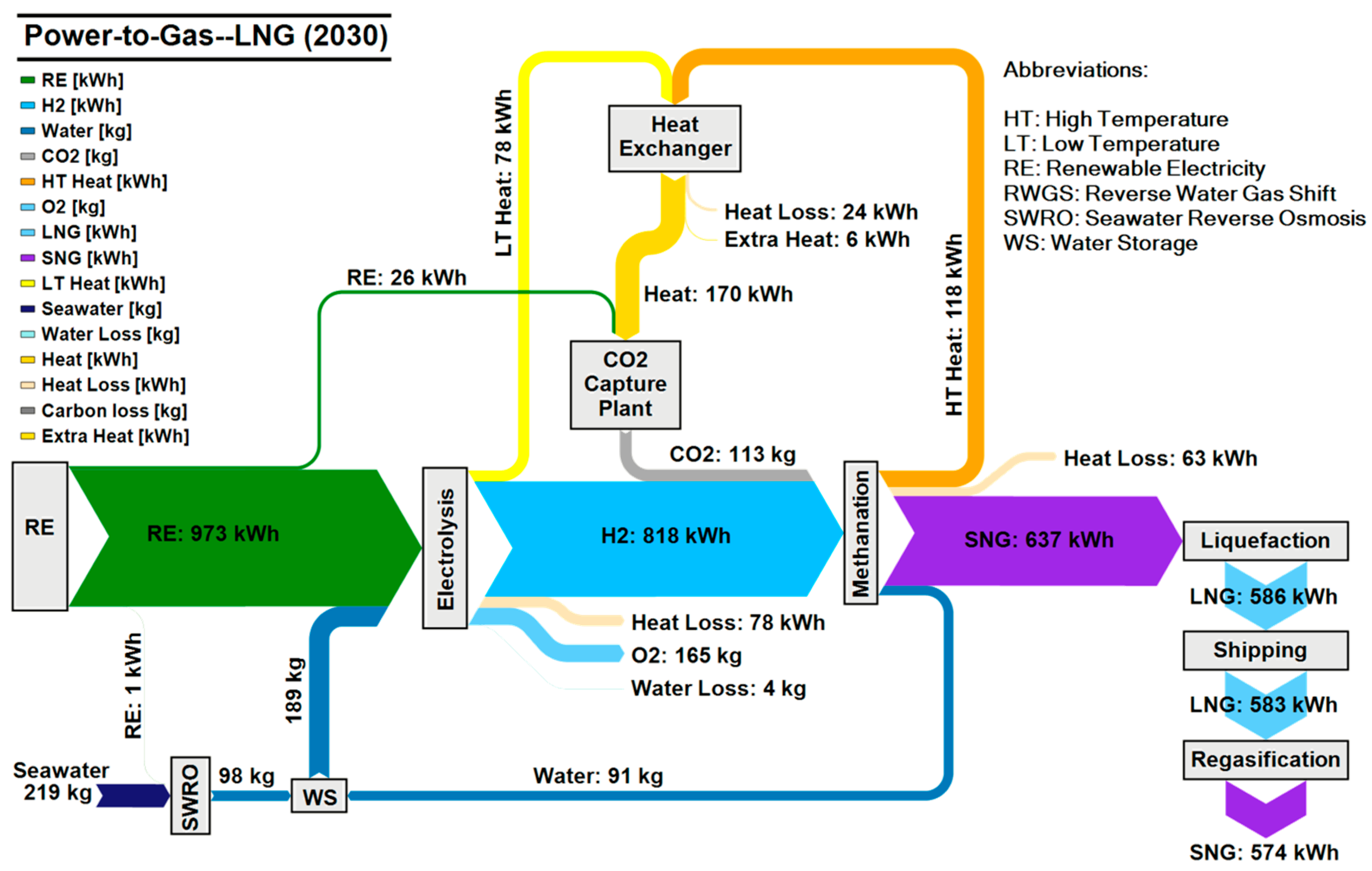

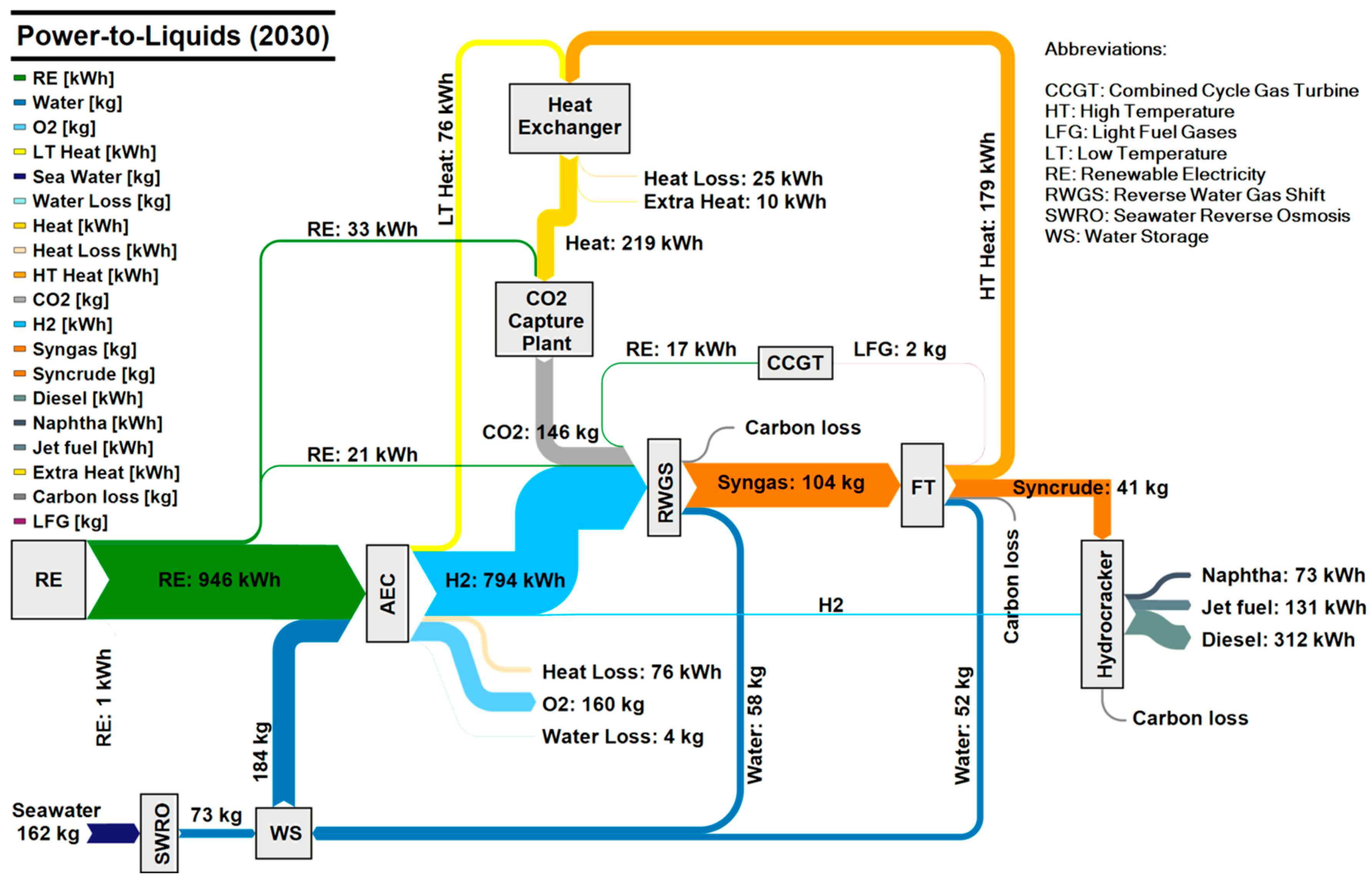

3.1. Energy and Material Flow

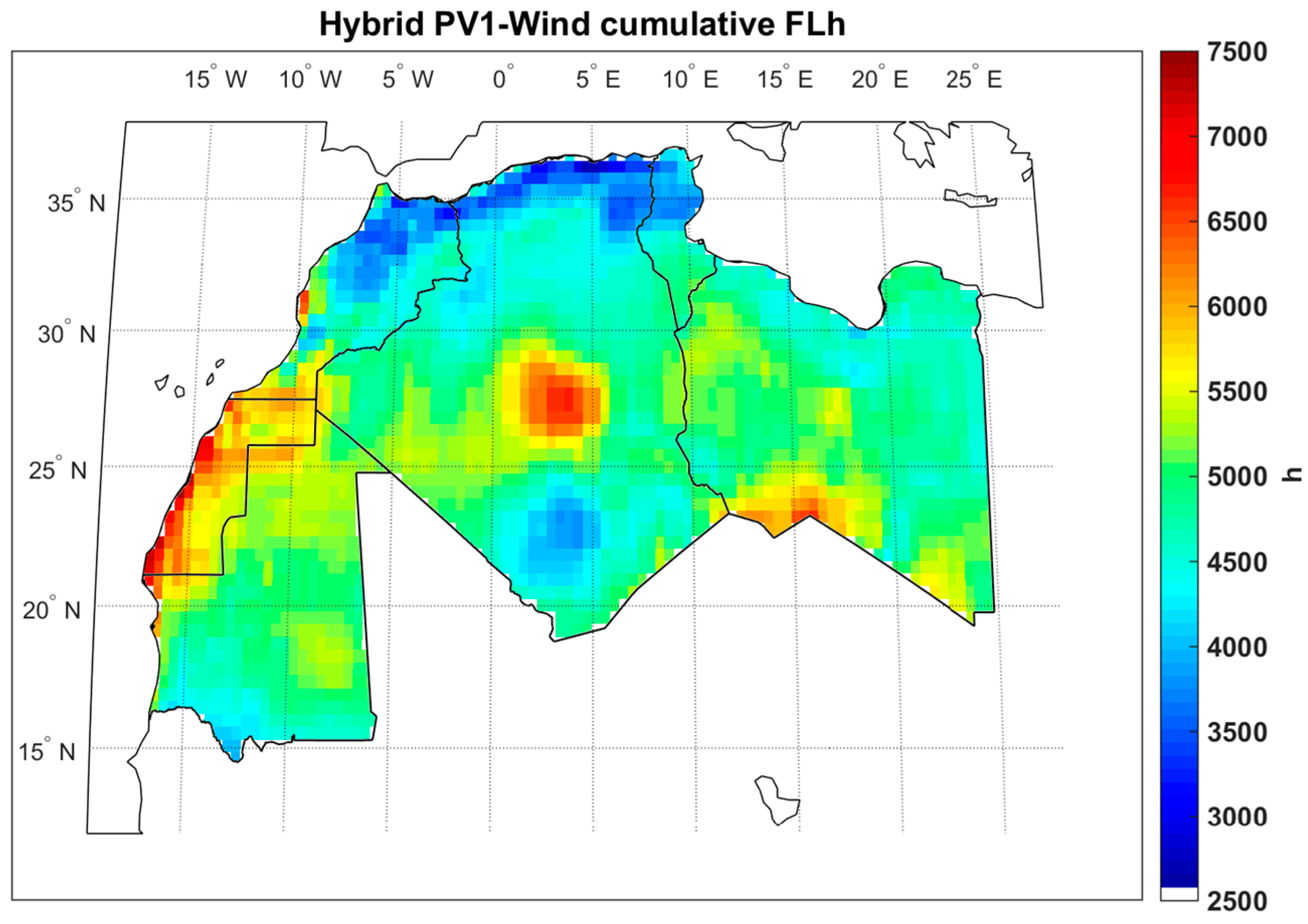

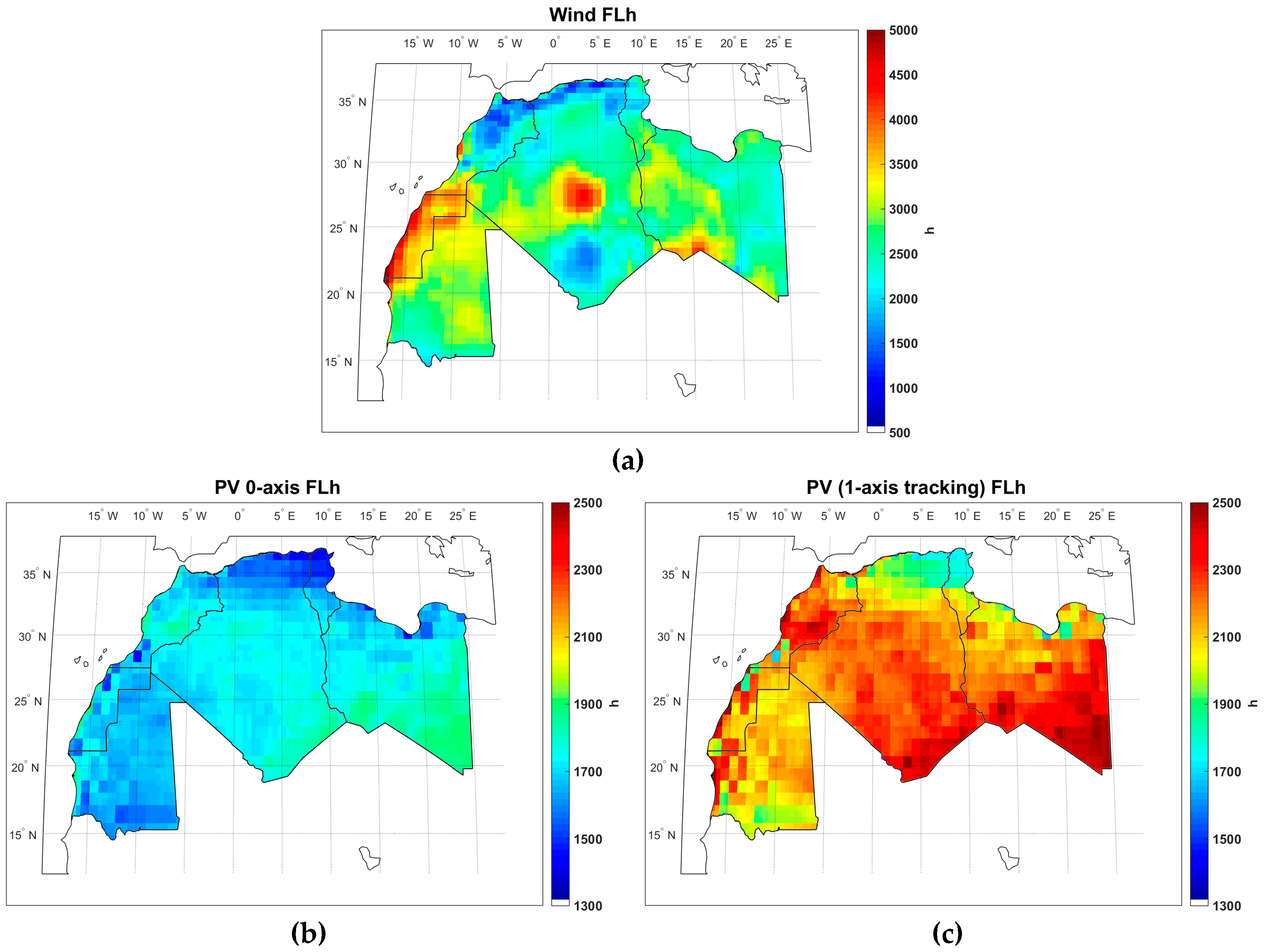

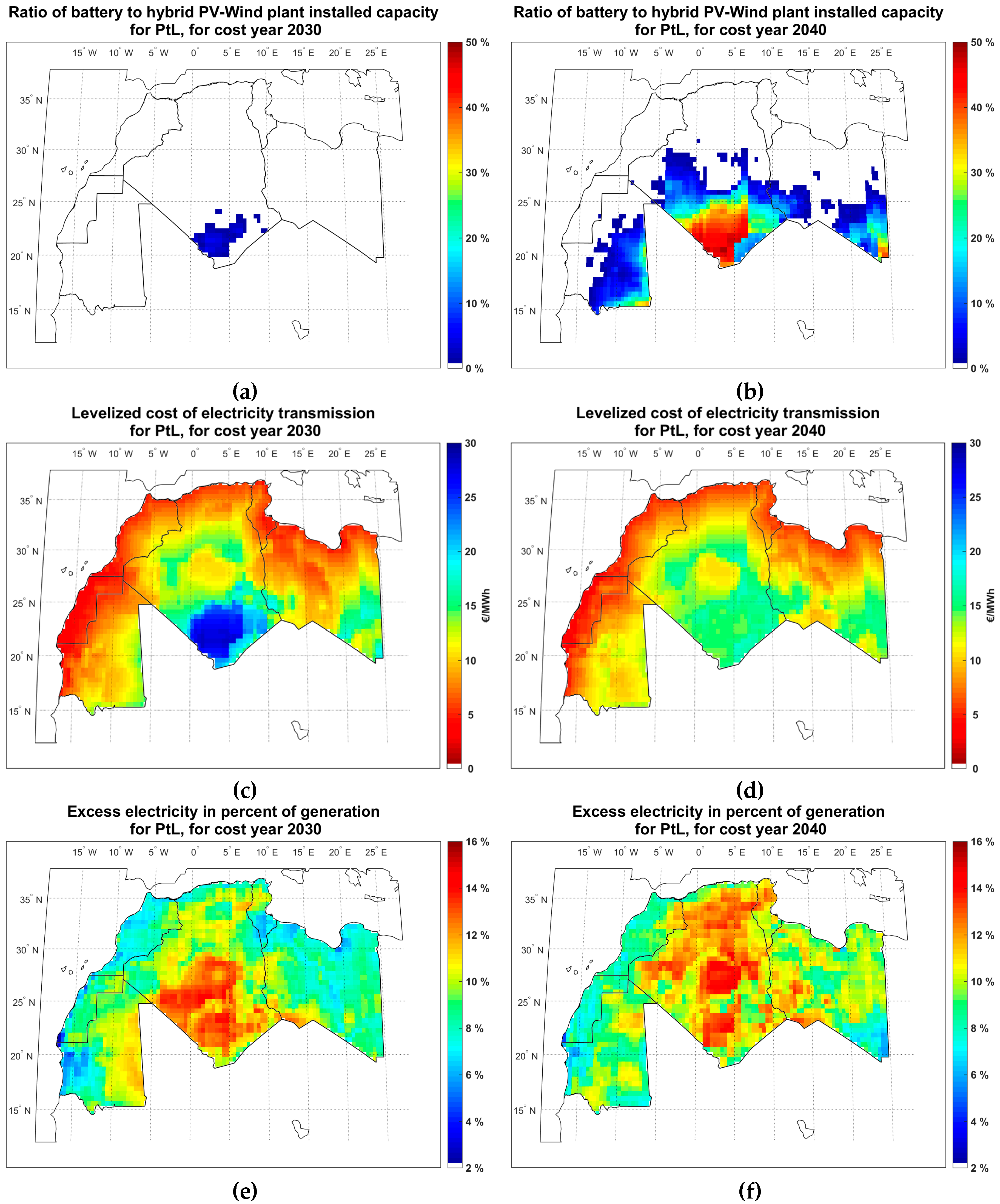

3.2. Hybrid PV–Wind FLh and Levelized Cost of Electricity

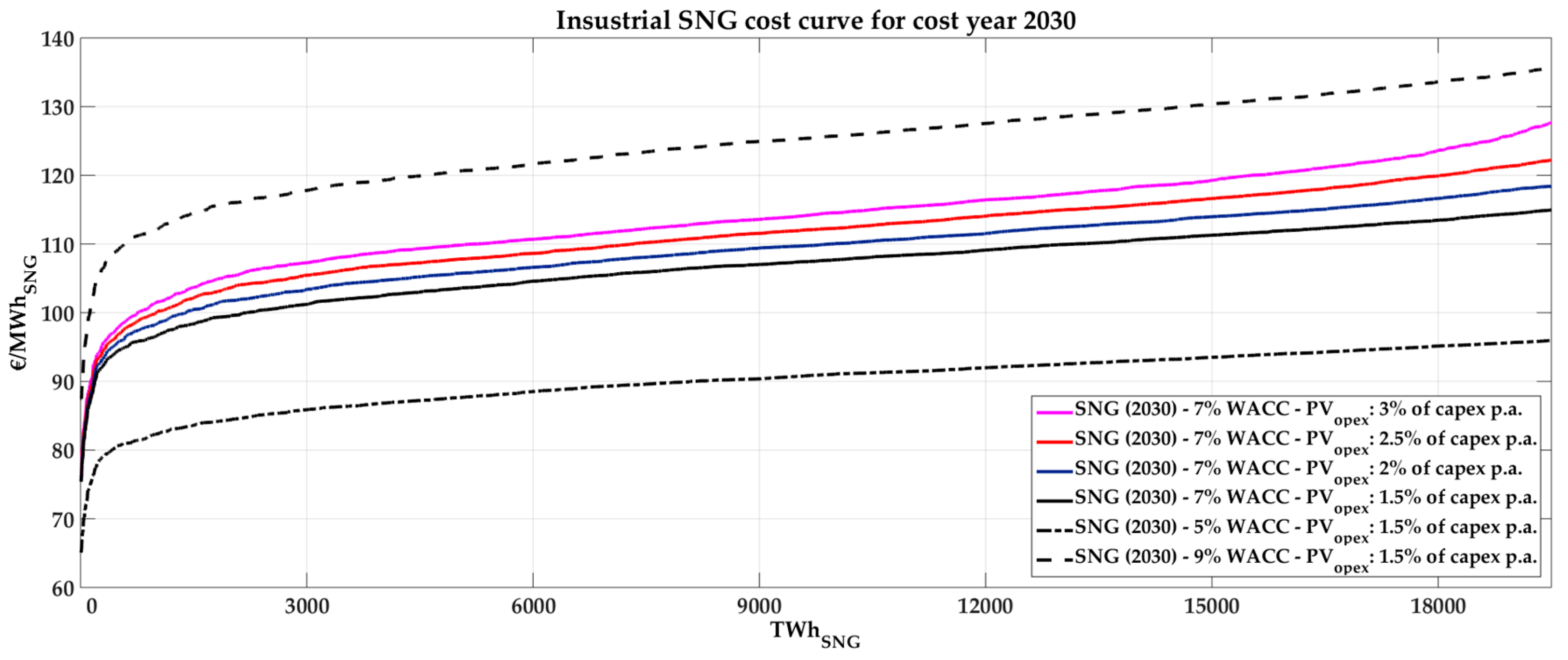

3.3. Levelized Cost and Production Potential of Synthetic Fuels

3.4. Business Case and Cost Drivers for Reaching Fuel-Parity

- the global crude oil price for a price range of 40–200 USD/barrel;

- two scenarios for CO2 emission cost;

- two scenarios for benefits from O2 sales; and

- the cost of delivered RE-SNG or RE-diesel based on two different WACC levels.

4. Discussion and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Nomenclature

| AEC | Alkaline Electrolysis Cell |

| bpd | Barrel per day |

| Capex | Capital Expenditures |

| CCU | Carbon Capture and Utilization |

| CCS | Carbon Capture and Storage |

| COP | Conference of the Parties |

| crf | Capital recovery factor |

| Eq | Equation |

| DAC | Direct Air Capture |

| FLh | Full Load hours |

| FT | Fischer–Tropsch |

| h | hour |

| H2tL | Hydrogen-to-Liquids |

| HHV | Higher Heating Value |

| HT | High Temperature |

| LCOE | Levelized Cost of Electricity |

| LCOF | Levelized Cost of Fuel |

| LFG | Light Fuel Gases |

| LHV | Lower Heating Value |

| LNG | Liquefied Natural Gas |

| LT | Low Temperature |

| N | Lifetime |

| NG | Natural Gas |

| Opex | Operational Expenditures |

| PR | Performance Ratio |

| PtG | Power-to-Gas |

| PtL | Power-to-Liquids |

| PV | Photovoltaic |

| RE | Renewable Electricity |

| RO | Reverse Osmosis |

| RWGS | Reverse Water-Gas Shift |

| SLF | Synthetic Liquid Fuels |

| SNG | Synthetic Natural Gas |

| SWRO | Seawater Reverse Osmosis |

| t | Tonne |

| USD | United States dollar |

| WACC | Weighted Average Cost of Capital |

| WS | Water Storage |

| η | Efficiency |

| Subscripts | |

| el | electricity |

| fix | fixed |

| sf | Synthetic Fuels |

| th | thermal |

| var | variable |

References

- Intergovernmental Panel on Climate Change. Climate Change 2014 Synthesis Report Summary for Policymakers; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2014; Available online: https://goo.gl/AdJEFf (accessed on 6 November 2016).

- Carbon Tracker. Unburnable Carbon 2013: Wasted Capital and Stranded Assets; Carbon Tracker and the Grantham Research Institute: London, UK, 2013; Available online: https://goo.gl/QR6gsc (accessed on 6 November 2016).

- Carbon Tracker. Carbon Asset Risk: From Rhetoric to Action; Carbon Tracker: London, UK, 2015; Available online: https://goo.gl/2A2SSG (accessed on 6 November 2016).

- United Nations Framework Convention on Climate Change. Adoption of the Paris Agreement—Proposal by the President; United Nations Framework Convention on Climate Change (UNFCCC): Paris, France, 2015; Available online: https://goo.gl/t3rLbg (accessed on 6 November 2016).

- Schellnhuber, H.J.; Rahmstorf, S.; Winkelmann, R. Why the right climate target was agreed in Paris. Nat. Clim. Chang. 2016, 6, 649–653. [Google Scholar] [CrossRef]

- Koizumi, T. Biofuels and food security. Renew. Sustain. Energy Rev. 2015, 52, 829–841. [Google Scholar] [CrossRef]

- Tomei, J.; Helliwell, R. Food versus fuel? Going beyond biofuels. Land Use Policy 2016, 56, 320–326. [Google Scholar] [CrossRef]

- Breyer, C.; Tsupari, E.; Tikka, V.; Vainikka, P. Power-to-gas as an emerging profitable business through creating an integrated value chain. Energy Procedia 2015, 73, 182–189. [Google Scholar] [CrossRef]

- Fasihi, M.; Bogdanov, D.; Breyer, C. Economics of Global LNG Trading Based on Hybrid PV-Wind Power Plants. In Proceedings of the 31st European Photovoltaic Solar Energy Conference (EU PVSEC), Hamburg, Germany, 14–18 September 2015; Available online: https://goo.gl/ReTvGn (accessed on 6 November 2016).

- Fasihi, M.; Bogdanov, D.; Breyer, C. Techno-Economic Assessment of Power-to-Liquids (PtL) Fuels Production and Global Trading Based on Hybrid PV-Wind Power Plants. In Proceedings of the 10th International Renewable Energy Storage Conference (IRES), Düsseldorf, Germany, 15–17 March 2016; Available online: https://goo.gl/AonMp4 (accessed on 6 November 2016).

- Fu, Q.; Mabilat, C.; Zahid, M.; Brisse, A.; Gautier, L. Syngas production via high-temperature steam/CO2 co-electrolysis: An economic assessment. Energy Environ. Sci. 2010, 3, 1382. [Google Scholar] [CrossRef]

- Forschungsvereinigung Verbrennungskraftmaschinen. Kraftstoffstudie—Zukünftige Kraftstoffe für Verbrennungsmotoren und Gasturbinen; Forschungsvereinigung Verbrennungskraftmaschinen (FVV): Frankfurt, Germany, 2013; Available online: https://goo.gl/bGpzpn (accessed on 6 November 2016).

- Agora Energiewende. Stromspeicher in der Energiewende; Agora Energiewende: Berlin, Germany, September 2014; Available online: https://goo.gl/OazIzS (accessed on 6 November 2016).

- ETOGAS GmbH. Power to Gas: Intelligente Konvertierung und Speicherung von Energie in der Industriellen Umsetzung; ETOGAS GmbH: Stuttgart, Germany, 2013; Available online: https://goo.gl/E1vzLb (accessed on 6 November 2016).

- König, D.H.; Freiberg, M.; Dietrich, R.U.; Wörner, A. Techno-economic study of the storage of fluctuating renewable energy in liquid hydrocarbons. Fuel 2015, 159, 289–297. [Google Scholar] [CrossRef]

- Konovessis, D. An investigation on cost-effective tanker design configurations for reduced oil outflow. Ocean Eng. 2012, 49, 16–24. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development. Review of Maritime Transport; United Nations Conference on Trade and Development (UNCTAD): New York, NY, USA; Geneva, Switzerland, 2009; Available online: https://goo.gl/YKcRgo (accessed on 6 November 2016).

- MAN Diesel & Turbo. Propulsion Trends in Tankers; MAN Diesel & Turbo—A member of the MAN Group: Copenhagen, Denmark, 2013; Available online: https://goo.gl/d9k8Uj (accessed on 6 November 2016).

- Khalilpour, R.; Karimi, I.A. Evaluation of utilization alternatives for stranded natural gas. Energy 2012, 40, 317–328. [Google Scholar] [CrossRef]

- Lochner, S.; Bothe, D. The development of natural gas supply costs to Europe, the United States and Japan in a globalizing gas market-Model-based analysis until 2030. Energy Policy 2009, 37, 1518–1528. [Google Scholar] [CrossRef]

- Castillo, L.; Dorao, C.A. Influence of the plot area in an economical analysis for selecting small scale LNG technologies for remote gas production. J. Nat. Gas Sci. Eng. 2010, 2, 302–309. [Google Scholar] [CrossRef]

- Vanem, E.; Antão, P.; Østvik, I.; de Comas, F.D. C. Analysing the risk of LNG carrier operations. Reliab. Eng. Syst. Saf. 2007, 93, 1328–1344. [Google Scholar] [CrossRef]

- Maxwell, D.; Zhu, Z. Natural gas prices, LNG transport costs, and the dynamics of LNG imports. Energy Econ. 2011, 33, 217–226. [Google Scholar] [CrossRef]

- Sönmez, E.; Kekre, S.; Scheller-Wolf, A.; Secomandi, N. Strategic analysis of technology and capacity investments in the liquefied natural gas industry. Eur. J. Oper. Res. 2012, 226, 100–114. [Google Scholar] [CrossRef]

- Sea Distances Website. Available online: www.sea-distances.org (accessed on 6 November 2016).

- Alberto Rechelo Neto, C.; Sauer, I.L. LNG as a strategy to establish developing countries’ gas markets: The Brazilian case. Energy Policy 2005, 34, 4103–4114. [Google Scholar] [CrossRef]

- Bogdanov, D.; Breyer, C. North-East Asian Super Grid for 100% renewable energy supply: Optimal mix of energy technologies for electricity, gas and heat supply options. Energy Convers. Manag. 2016, 112, 176–190. [Google Scholar] [CrossRef]

- Kronenberg, D.; (Climeworks AG, Zürich, Switzerland). Personal Communication, 2015.

- Caldera, U.; Bogdanov, D.; Afanasyeva, S.; Breyer, C. Integration of reverse osmosis seawater desalination in the power sector, based on PV and wind energy, for the Kingdom of Saudi Arabia. In Proceedings of the 32nd European Photovoltaic Solar Energy Conference (EU PVSEC), Munich, Germany, 20–24 June 2016; Available online: https://goo.gl/99Z7YY (accessed on 6 November 2016).

- Loutatidou, S.; Chalermthai, B.; Marpu, P.R.; Arafat, H.A. Capital cost estimation of RO plants: GCC countries versus southern Europe. Desalination 2014, 347, 103–111. [Google Scholar] [CrossRef]

- Breyer, C. Economics of Hybrid Photovoltaics Power Plants. Ph.D. Thesis, Faculty of Electrical Engineering and Computer Science, University of Kassel, Kassel, Germany, 2012. Available online: https://goo.gl/Yy6P9X (accessed on 6 November 2016). [Google Scholar]

- Stackhouse, P.; Whitlock, C. (Eds.) Surface Meteorology and Solar Energy (SSE) Release 6.0 Methodology; National Aeronautic and Space Administration (NASA): Langley, VA, USA, 2008; Available online: https://goo.gl/Ty6k0v (accessed on 6 November 2016).

- Stackhouse, P.; Whitlock, C. (Eds.) Surface Meteorology and Solar Energy (SSE) Release 6.0 Methodology; National Aeronautic and Space Administration (NASA): Langley, VA, USA, 2009; Available online: https://goo.gl/Ty6k0v (accessed on 6 November 2016).

- Stetter, D. Enhancement of the REMix Energy System Model: Global Renewable Energy Potentials, Optimized Power Plant Siting and Scenario Validation. Ph.D. Thesis, Faculty of Energy-, Process- and Bio-Engineering, University of Stuttgart, Stuttgart, Germany, 2012. [Google Scholar]

- Gerlach, A.; Stetter, D.; Schmid, J.; Breyer, C. PV and Wind Power—Complementary Technologies. In Proceedings of the 26th European Photovoltaic Solar Energy Conference (EU PVSEC), Hamburg, Germany, 5–9 September 2011; Available online: https://goo.gl/ERHmSm (accessed on 6 November 2016).

- Huld, T.; Šúri, M.; Dunlop, E.D. Geographical variation of the conversion efficiency of crystalline silicon photovoltaic modules in Europe. Prog. Photovolt. Res. Appl. 2008, 16, 595–607. [Google Scholar] [CrossRef]

- Duffie, J.A.; Beckman, W.A. Solar Engineering of Thermal Processes, 4th ed.; Wiley: Hoboken, NJ, USA, 2013. [Google Scholar]

- ENERCON GmbH. ENERCON Product Overview; ENERCON GmbH: Aurich, Germany, 2014; Available online: https://goo.gl/TKdTPE (accessed on 6 November 2016).

- Masson, G. PV Trends & Market Overview. In Proceedings of the Solar United PV Forum, Intersolar, Munich, Germany, 23 June 2016.

- Central Electricity Regulatory Commission. Determination of Benchmark Capital Cost Norm for Solar PV Power Projects and Solar Thermal Power Projects Applicable during FY 2016–17; Petition No. 17/SM/2015; Central Electricity Regulatory Commission (CERC): New Delhi, India, 2016; Available online: https://goo.gl/jXWXx3 (accessed on 6 November 2016).

- Braisaz, B.; Duchayne, C.; Van Iseghem, M.; Radouane, K. PV Aging Model Applied to Several Meteorological Conditions. In Proceedings of the 29th European Photovoltaic Solar Energy Conference (EU PVSEC), Amsterdam, the Netherlands, 22–26 September 2014; Available online: https://goo.gl/sYVBbr (accessed on 6 November 2016).

- Mann, S.A.; De Wild-Scholten, M.J.; Fthenakis, V.M.; Van Sark, W.G.J.H.M.; Sinke, W.C. The energy payback time of advanced crystalline silicon PV modules in 2020: A prospective study. Prog. Photovolt. Res. Appl. 2013, 22, 1180–1194. [Google Scholar] [CrossRef]

- Breyer, C.; Afanasyeva, S.; Brakemeier, D.; Engelhard, M.; Giuliano, S.; Puppe, M.; Schenk, H.; Hirsch, T.; Moser, M. Assessment of Mid-Term Growth Assumptions and Learning Rates for Comparative Studies of CSP and Hybrid PV-Battery Power Plants. In Proceedings of the 22nd Solar Power And Chemical Energy Systems (SolarPACES), Abu Dhabi, UAE, 11–14 October 2016; Available online: https://goo.gl/Vln1nx (accessed on 6 November 2016).

- Dii GmbH. Desert Power 2050: Perspectives on a Sustainable Power System for EUMENA; Dii GmbH: Munich, Germany, 2012; Available online: https://goo.gl/81rJYg (accessed on 6 November 2016).

- European Commission. ETRI 2014—Energy Technology Reference Indicator Projections for 2010–2050; European Commission: Petten, the Netherlands, 2014; Available online: https://goo.gl/06Lxuk (accessed on 6 November 2016).

- Farfan, J.; Breyer, C. Structural Changes of the global power generation capacity towards sustainability and the risk of stranded investments, in preparation. J. Clean. Prod. 2017, 141, 370–384. [Google Scholar] [CrossRef]

- Short, W.; Packey, D.J.; Holt, T. A Manual for the Economic Evaluation of Energy Efficiency and Renewable Energy Technologies; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 1995; Available online: https://goo.gl/aD6zjn (accessed on 18 December 2016).

- BP. BP Statistical Review of World Energy 2015, 64th ed.; BP: London, UK, 2015; Available online: https://goo.gl/WlKvgf (accessed on 6 November 2016).

- European Commission. Quarterly Report on European Gas Markets; European Commission: Brussel, Belgium, 2015; Volume 8, Available online: https://goo.gl/nV0qJZ (accessed on 6 November 2016).

- European Commission. Quarterly Report on European Gas Market; European Commission: Brussel, Belgium, 2016; Volume 9, Available online: https://goo.gl/liHy2K (accessed on 6 November 2016).

- U.S. Energy Information Administration. Gasoline and Diesel Fuel Update; U.S. Energy Information Administration (EIA): Washington, DC, USA, 2015. Available online: https://goo.gl/MK7Xw6 (accessed on 6 November 2016).

- Bloomberg New Energy Finance. New Energy Outlook 2015; Bloomberg New Energy Finance (BNEF): London, UK, 2015; Available online: https://goo.gl/4mu6uW (accessed on 6 November 2016).

- Breyer, C.; Görig, M.; Gerlach, A.-K.; Schmid, J. Fuel-Parity: Impact of Photovoltaics on Global Fossil Fuel Fired Power Plant Business. In Proceedings of the 26 Symposium Photovoltaische Solarenergie, Bad Staffelstein, Germany, 2–4 March 2011; Available online: https://goo.gl/S5bcPU (accessed on 6 November 2016).

- Organisation for Economic Co-operation and Development (OECD). Climate and Carbon: Aligning Prices and Policies; OECD Environment Policy Papers, No. 1; OECD: Paris, France, 2013; Available online: https://goo.gl/DiWzBj (accessed on 6 November 2016).

- Aghahosseini, A.; Bogdanov, D.; Breyer, C. The MENA Super Grid towards 100% Renewable Energy Power Supply by 2030. In Proceedings of the 11th International Energy Conference, Tehran, Iran, 30–31 May 2016; Available online: https://goo.gl/M4ZQvG (accessed on 20 December 2016).

| Device | Unit | 2030/2040 | References |

|---|---|---|---|

| Alkaline Electrolyser | [13,14] | ||

| Capex | €/kWel | 328/268 | |

| Opexfix | % of capex p.a. | 4 | |

| Opexvar | €/kWh | 0.0012 | |

| Lifetime | years | 30 | |

| EtH2 eff. (HHV) | % | 84 | |

| Electricity-to-heat | % of inlet E | 8 | |

| Methanation | [14] | ||

| Capex | €/kWSNG | 278/226 | |

| Opex | % of capex p.a. | 4 | |

| Lifetime | years | 30 | |

| Efficiency (HHV) | % | 77.8 | |

| Hydrogen Storage | |||

| Capex | €/kWhH2 | 0.015 | [15] |

| A Hypothetical H2tL (RWGS, FT and Hydrocracking) Plant | [10,11] | ||

| Capex | k€/bpd | 60/54 | |

| Opex | % of capex p.a. | 3 | |

| Lifetime | years | 30 | |

| RWGS carbon conversion | % | 97.5 | |

| FT carbon conversion | % | 95 | |

| FT C5+ selectivity | % | 95 | |

| hydrocracking eff. | % | 98 | |

| Diesel Shipping | |||

| Ship size | tonne (deadweight) | 100,000 | [16] |

| Capex | m€/ship | 48 | [17] |

| Opex | % of capex p.a. | 3 | [16] |

| Lifetime | years | 25 | [18] |

| Speed | knots | 14 | [19] |

| Device | Unit | 2030/2040 | Reference |

|---|---|---|---|

| Liquefaction Plant | |||

| Capex | k€/mcm/a SNG | 196 | [9] |

| Opex | % of capex p.a. | 3.5 | [20] |

| Lifetime | years | 25 | [21] |

| Efficiency | % | 92 | [9] |

| LNG Shipping | |||

| Ship size | m3 LNG | 138,000 | [22] |

| Capex | m€/ship | 151 | [20] |

| Opex | % of capex p.a. | 3.5 | [20] |

| Lifetime | years | 25 | [23] |

| Boil-off gas | %/day | 0.1 | [24] |

| Speed | knots | 20 | [19] |

| Maghreb—Finland sea distance | km | 5000 | [25] |

| Regasification Plant | |||

| Capex | k€/mcm/a SNG | 74 | [20] |

| Opex | % of capex p.a. | 3.5 | [20] |

| Lifetime | years | 30 | [26] |

| Efficiency | % | 98.5 | [19] |

| Device | Unit | 2030/2040 | References |

|---|---|---|---|

| CO2 Direct Air Capture Plant | |||

| Capex | €/(tCO2∙a) | 228/184 | [13,27] |

| Opex | % of capex p.a. | 4 | |

| Lifetime | years | 30 | |

| Electricity demand | kWhel/tCO2 | 225/210 | [28] |

| Heat demand | kWhth/tCO2 | 1500/1350 | [28] |

| SWRO Desalination | [29,30] | ||

| Capex | €/(m3∙day) | 814/618 | |

| Opex | % of capex p.a. | 4 | |

| Lifetime | years | 30 | |

| Electricity consumption | kWh/m3 | 3.15/2.85 | |

| Water extraction eff. | % | 45 | |

| Device | Unit | 2030/2040 | References |

|---|---|---|---|

| PV Fixed Tilted | |||

| Capex | €/kWp | 480/370 | [27,39,40] |

| Opex | % of capex p.a. | 1.5 | [27] |

| Lifetime | years | 35/40 | [41,42] |

| PV Single-Axis Tracking | |||

| Capex | €/kWp | 530/410 | [27,39,40] |

| Opex | % of capex p.a. | 1.5 | [27] |

| Lifetime | years | 35/40 | [41,42] |

| Wind Energy (Onshore) | [27] | ||

| Capex | €/kW | 1000/940 | |

| Opex | % of capex p.a. | 2 | |

| Lifetime | years | 25 | |

| Battery (Lithium-Ion) | [43] | ||

| Capex | €/kWhel | 150/100 | |

| Opexfix | €/(kWh∙a) | 3.75/2.5 | |

| Opexvar | €/kWh | 0.0002 | |

| Calendar life 1 | years | 20 | |

| Full cycle life 1 | cycles | 10000 | |

| Cycle efficiency | % | 93/95 | |

| Transmission Line | [44] | ||

| Capex | €/kW/km | 0.612 | |

| Opex | €/(kW∙km∙a) | 0.0075 | |

| Lifetime | years | 50 | |

| Efficiency | %/1000 km | 98.4 | |

| Converter Pair Stations | [44] | ||

| Capex | €/kW | 180 | |

| Opex | €/(kW) | 1.8 | |

| Lifetime | years | 50 | |

| Efficiency | %/station pair | 98.6 | |

| Combined Cycle Gas Turbine | |||

| Capex | €/kW | 775 | [45] |

| Opex | % of capex p.a. | 2.5 | [45] |

| Lifetime | years | 35 | [45] |

| Efficiency (LHV) | % | 58/60 | [46] |

| Efficiency (HHV) | % | 52/54 | [46] |

| Unit | 2030 | 2040 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| PtG | PtL | PtG | PtL | ||||||

| Hybrid PV–Wind | SNG | Hybrid PV–Wind | SLF | Hybrid PV–Wind | SNG | Hybrid PV–Wind | SLF | ||

| Capacity | |||||||||

| Algeria | GW | 10,030 | 3055 | 12,499 | 1427 | 14,273 | 3684 | 15,051 | 1614 |

| Libya | GW | 5732 | 1814 | 7593 | 922 | 8699 | 2619 | 10,200 | 1154 |

| Mauritania | GW | 2204 | 573 | 3039 | 365 | 3858 | 984 | 4514 | 500 |

| Morocco | GW | 2680 | 971 | 2772 | 332 | 2841 | 1004 | 2918 | 328 |

| Tunisia | GW | 649 | 196 | 862 | 89 | 991 | 312 | 1069 | 102 |

| Western Sahara | GW | 433 | 119 | 460 | 69 | 534 | 149 | 863 | 111 |

| Total | GW | 21,728 | 6728 | 27,225 | 3204 | 31,196 | 8752 | 34,615 | 3809 |

| Production | |||||||||

| Algeria | TWh | 22,413 | 12,256 | 27,798 | 12,498 | 31,643 | 17,082 | 33,313 | 14,136 |

| Libya | TWh | 13,350 | 7509 | 17,454 | 8074 | 19,957 | 11,078 | 23,199 | 10,106 |

| Mauritania | TWh | 5183 | 2902 | 6931 | 3202 | 8611 | 4862 | 9956 | 4376 |

| Morocco | TWh | 6016 | 3405 | 6209 | 2906 | 6344 | 3540 | 6490 | 2869 |

| Tunisia | TWh | 1256 | 705 | 1671 | 776 | 1906 | 1040 | 2057 | 892 |

| Western Sahara | TWh | 1234 | 694 | 1295 | 601 | 1455 | 814 | 2182 | 975 |

| Total | TWh | 49,452 | 27,471 | 61,358 | 28,057 | 69,916 | 38,416 | 77,197 | 33,354 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fasihi, M.; Bogdanov, D.; Breyer, C. Long-Term Hydrocarbon Trade Options for the Maghreb Region and Europe—Renewable Energy Based Synthetic Fuels for a Net Zero Emissions World. Sustainability 2017, 9, 306. https://doi.org/10.3390/su9020306

Fasihi M, Bogdanov D, Breyer C. Long-Term Hydrocarbon Trade Options for the Maghreb Region and Europe—Renewable Energy Based Synthetic Fuels for a Net Zero Emissions World. Sustainability. 2017; 9(2):306. https://doi.org/10.3390/su9020306

Chicago/Turabian StyleFasihi, Mahdi, Dmitrii Bogdanov, and Christian Breyer. 2017. "Long-Term Hydrocarbon Trade Options for the Maghreb Region and Europe—Renewable Energy Based Synthetic Fuels for a Net Zero Emissions World" Sustainability 9, no. 2: 306. https://doi.org/10.3390/su9020306

APA StyleFasihi, M., Bogdanov, D., & Breyer, C. (2017). Long-Term Hydrocarbon Trade Options for the Maghreb Region and Europe—Renewable Energy Based Synthetic Fuels for a Net Zero Emissions World. Sustainability, 9(2), 306. https://doi.org/10.3390/su9020306