Spatiotemporal Effects of Main Impact Factors on Residential Land Price in Major Cities of China

Abstract

1. Introduction

2. Variables and Methodology

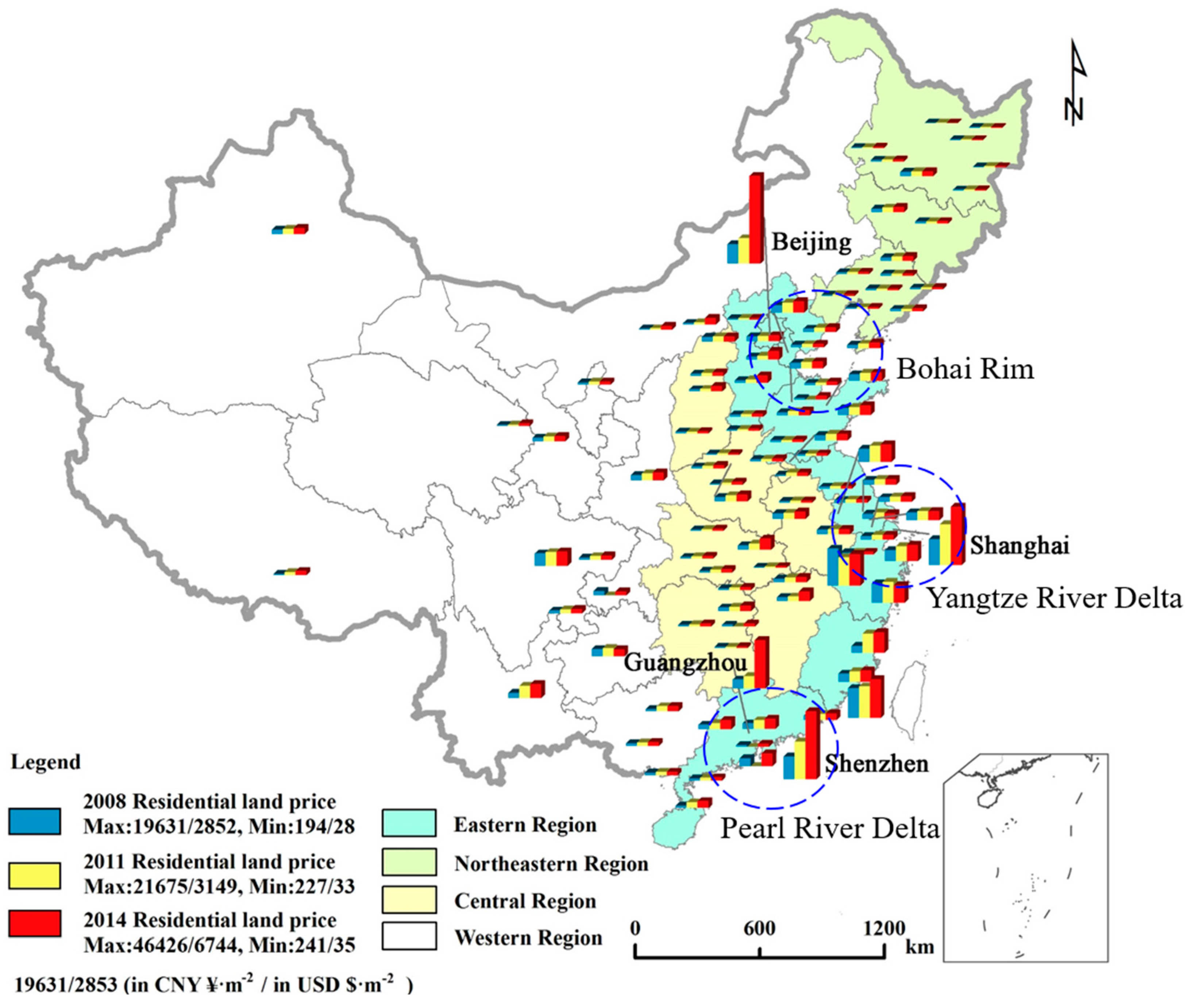

2.1. Urban Residential Land Price

2.2. Impact Factors

2.3. Methods

2.3.1. Geographically Weighted Regression

2.3.2. Geographical Detector

3. Results

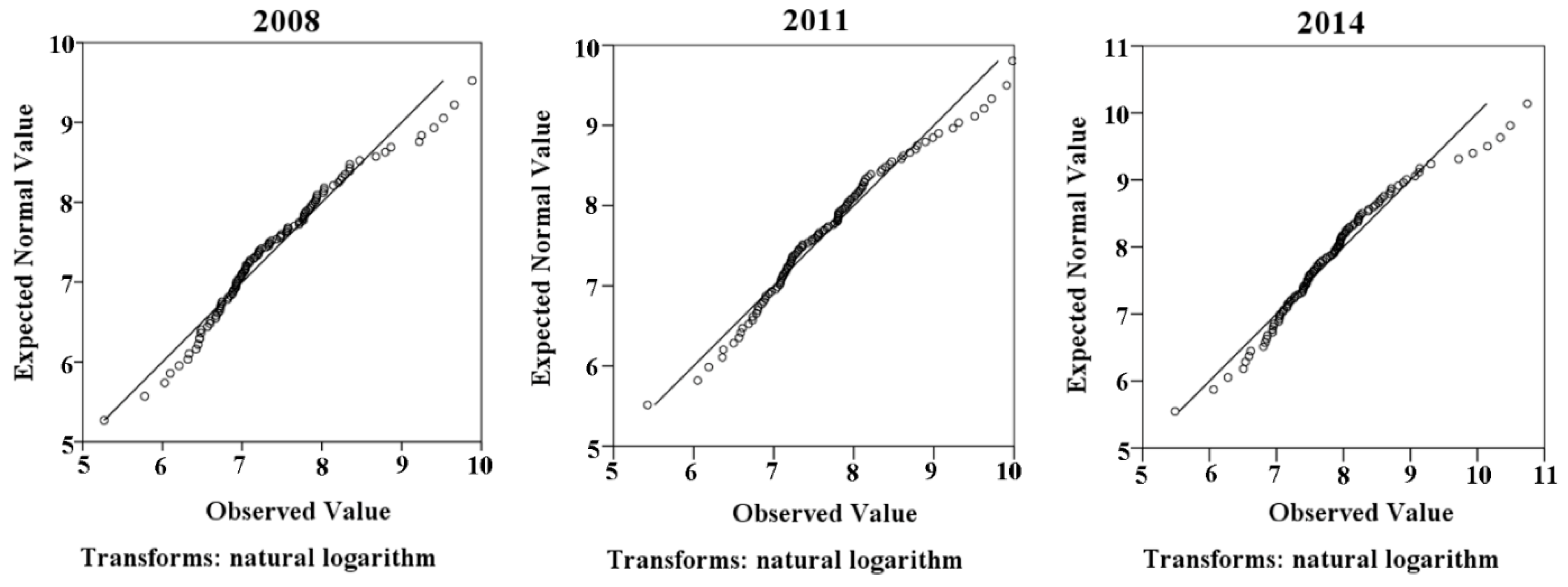

3.1. Estimation of GWR Models

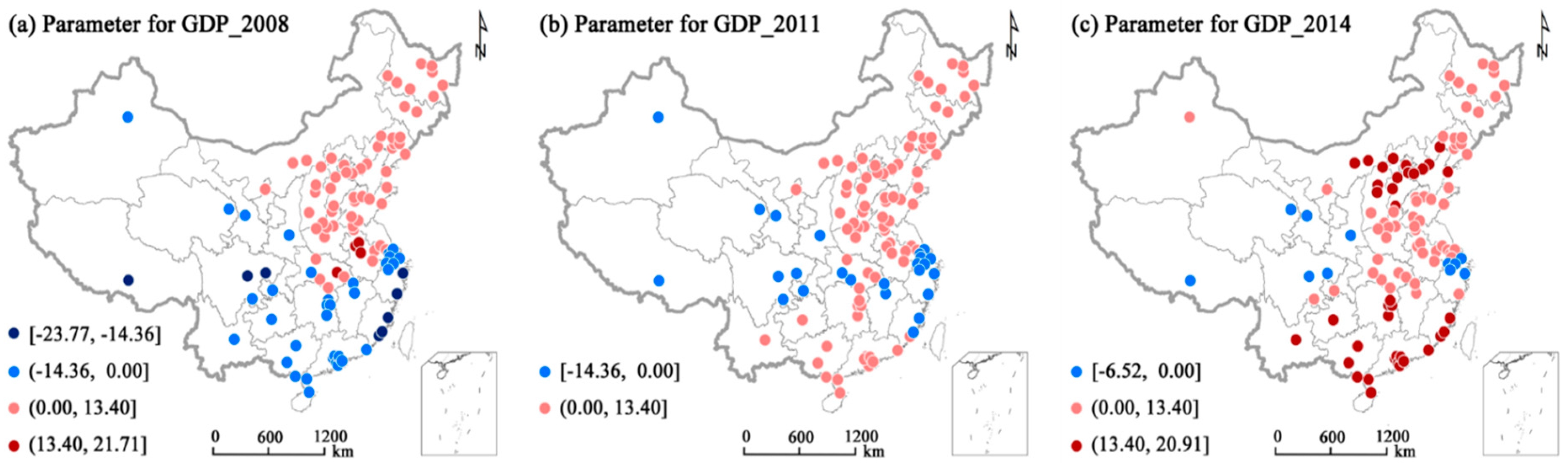

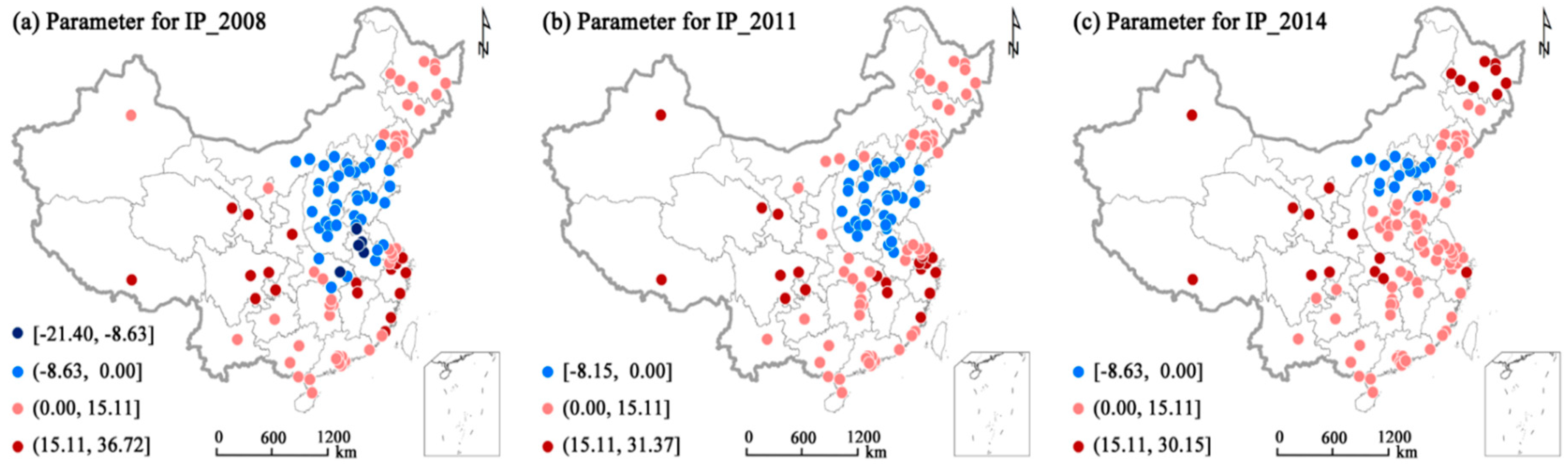

3.2. Spatially Varying Effects of Impact Factors

3.3. Factors Detection

4. Discussion

4.1. Relationship between Land Price and GDP

4.2. Relationship between Land Price and Immigrant Population

4.3. Relationship between Land Price and Investment in Residential Buildings

4.4. Potential Strategies on Residential Land Price Management

4.5. Limitations of This Study

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Siciliano, G. Urbanization strategies, rural development and land use changes in China: A multiple-level integrated assessment. Land Use Policy 2012, 29, 165–178. [Google Scholar] [CrossRef]

- Yang, X.J. China’s rapid urbanization. Science 2013, 342, 310. [Google Scholar] [CrossRef] [PubMed]

- Long, H. Land use policy in China: introduction. Land Use Policy 2014, 40, 1–5. [Google Scholar] [CrossRef]

- Chen, M.; Liu, W.; Lu, D. Challenges and the way forward in China’s new-type urbanization. Land Use Policy 2016, 55, 334–339. [Google Scholar] [CrossRef]

- Bai, X.; Shi, P.; Liu, Y. Realizing China’s urban dream. Nature 2014, 509, 158–160. [Google Scholar] [CrossRef] [PubMed]

- Ottensmann, J.R. Urban sprawl, land values and the density of development. Land Econ. 1977, 53, 389–400. [Google Scholar] [CrossRef]

- Gillen, M.; Fisher, P. Residential developer behaviour in land price determination. J. Prop. Res. 2002, 19, 39–59. [Google Scholar] [CrossRef]

- Wen, H.; Goodman, A.C. Relationship between urban land price and housing price: Evidence from 21 provincial capitals in China. Habitat Int. 2013, 40, 9–17. [Google Scholar] [CrossRef]

- Zou, G.L.; Chau, K.W. Determinants and sustainability of house prices: The case of Shanghai, China. Sustainability 2015, 7, 4524–4548. [Google Scholar] [CrossRef]

- Glaeser, E.; Huang, W.; Ma, Y.; Shleifer, A. A real estate boom with Chinese Characteristics. J. Econ. Perspect. 2017, 31, 93–116. [Google Scholar] [CrossRef]

- The Economist. For Whom the Bubble Blows: House Prices are Soaring in Big Cities, but Oversupply Plagues Much of the Country. Available online: http://www.economist.com/news/finance-and-economics/21694530-house-prices-are-soaring-big-cities-oversupply-plagues-much (accessed on 25 September 2016).

- Hui, C.M.; Wang, X.R.; Jia, S.H. Fertility rate, inter-generation wealth transfer and housing price in China: A theoretical and empirical study based on the overlapping generation model. Habitat Int. 2016, 53, 369–378. [Google Scholar] [CrossRef]

- Wu, J.; Gyourko, J.; Deng, Y. Evaluating the risk of Chinese housing markets: What we know and what we need to know. China Econ. Rev. 2016, 39, 91–114. [Google Scholar] [CrossRef]

- Potepan, M.J. Explaining intermetropolitan variation in housing prices, rents and land prices. Real Estate Econ. 1996, 24, 219–245. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Hoesli, M.; Scognamiglio, D.; Zhang, S. Land leverage and house prices. Reg. Sci. Urban Econ. 2011, 41, 134–144. [Google Scholar] [CrossRef]

- Ding, C. Policy and praxis of land acquisition in China. Land Use Policy 2007, 24, 1–13. [Google Scholar] [CrossRef]

- Wang, R. The structure of Chinese urban land prices: Estimates from benchmark land price data. J. Real Estate Financ. Econ. 2009, 39, 24–38. [Google Scholar] [CrossRef]

- Burnett, P. Land use regulations and regional economic development. Land Econ. 2016, 92, 237–255. [Google Scholar] [CrossRef]

- Song, Y. Hukou-based labour market discrimination and ownership structure in urban China. Urban Stud. 2015, 53, 1657–1673. [Google Scholar] [CrossRef]

- China Railway. Interpretation of 2014 Railway and Outlook of 2015 Railway. 2015. Available online: http://www.chnrailway.com/html/20150213/804453.shtml (accessed on 15 September 2016).

- Voith, R. How responsive is the demand for residential land to changes in its price? Bus. Rev. 2001, Q3, 33–39. [Google Scholar]

- Van der Vlist, A.J.; Czamanski, D.; Folmer, H. Immigration and urban housing market dynamics: The case of Haifa. Ann. Reg. Sci. 2011, 47, 585–598. [Google Scholar] [CrossRef]

- China Urban Land Price Dynamic Monitor. Available online: http://www.landvalue.com.cn (accessed on 10 February 2016).

- Roback, J. Wages, rents, and the quality of life. J. Political Econ. 1982, 90, 1257–1278. [Google Scholar] [CrossRef]

- Bischoff, O. Explaining regional variation in equilibrium real estate prices and income. J. Hous. Econ. 2012, 21, 1–15. [Google Scholar] [CrossRef]

- Katz, L.; Rosen, K.T. The interjurisdictional effects of growth controls on housing prices. J. Law Econ. 1987, 30, 149. [Google Scholar] [CrossRef]

- Ihlanfeldt, K.R. The effect of land use regulation on housing and land prices. J. Urban Econ. 2007, 61, 420–435. [Google Scholar] [CrossRef]

- Pollakowski, H.O.; Wachter, S.M. The effects of land-use constraints on housing prices. Land Econ. 1990, 66, 315–324. [Google Scholar] [CrossRef]

- Chattopadhyay, S. Estimating the demand for air quality: New evidence based on the Chicago housing market. Land Econ. 1999, 75, 22–38. [Google Scholar] [CrossRef]

- Bramley, G. The impact of land use planning and tax subsidies on the supply and price of housing in Britain. Urban Stud. 1996, 30, 5–30. [Google Scholar] [CrossRef]

- Fehribach, F.A.; Rutherford, R.C.; Akin, M.E. An analysis of the determinants of residential property valuation. J. Real Estate Res. 1993, 8, 365–376. [Google Scholar]

- Rose, L.A. Urban land supply: Natural and contrived restrictions. J. Urban Econ. 1989, 25, 325–345. [Google Scholar] [CrossRef]

- Rye, J.F. Youth migration, rurality and class: A Bourdieusian approach. Eur. Urban Reg. Stud. 2011, 18, 170–183. [Google Scholar] [CrossRef]

- Saiz, A. Immigration and housing rents in American cities. J. Urban Econ. 2007, 61, 345–371. [Google Scholar] [CrossRef]

- Quan, D.C.; Titman, S. Do real estate prices and stock prices move together? An international analysis. Real Estate Econ. 1999, 27, 183–207. [Google Scholar] [CrossRef]

- Costa-I-Font, J.; Rodriguez-oreggia, E. Is the impact of public investment neutral across the regional income distribution? Evidence from Mexico. Econ. Geogr. 2005, 81, 305–322. [Google Scholar] [CrossRef]

- Seko, M. Determinants of Prefectural House Price Dynamics in Japan 1980–2002; Discussion Paper, DP2003-18; Keio University: Tokyo, Japan, 2003. [Google Scholar]

- Liu, Z.; Wang, P.; Zha, T. Land-price dynamics and macroeconomic fluctuations. Econometrica 2013, 81, 1147–1184. [Google Scholar]

- Wang, R.; Hou, J.; He, X. Real estate price and heterogeneous investment behavior in china. Econ. Model. 2017, 60, 271–280. [Google Scholar] [CrossRef]

- Liu, F.; Matsuno, S.; Malekian, R.; Yu, J.; Li, Z. A vector auto regression model applied to real estate development investment: A statistic analysis. Sustainability 2016, 8, 1082. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China. China City Statistical Yearbook; China Statistics Press: Beijing, China, 2009/2012/2015. (In Chinese)

- Shimizu, C. Estimation of Hedonic single-family house price function considering neighborhood effect variables. Sustainability 2014, 6, 2946–2960. [Google Scholar] [CrossRef]

- Clapp, J.M. A semiparametric method for estimating local house price indices. Real Estate Econ. 2004, 32, 127–160. [Google Scholar] [CrossRef]

- Clapp, J.M.; Salavei, K. Hedonic pricing with redevelopment options: A new approach to estimating depreciation effects. J. Urban Econ. 2010, 67, 362–377. [Google Scholar] [CrossRef]

- Brunsdont, C.; Fotheringham, A.S.; Chariton, M. Geographically weighted regression-modelling spatial non-stationarity. J. R. Stat. Soc. 1998, 47, 431–443. [Google Scholar] [CrossRef]

- Li, H.; Liu, Y. Neighborhood socioeconomic disadvantage and urban public green spaces availability: A localized modeling approach to inform land use policy. Land Use Policy 2016, 57, 470–478. [Google Scholar] [CrossRef]

- Pribadi, D.O.; Pauleit, S. Peri-urban agriculture in Jabodetabek Metropolitan Area and its relationship with the urban socioeconomic system. Land Use Policy 2016, 55, 265–274. [Google Scholar] [CrossRef]

- Margaritis, E.; Kang, J. Relationship between green space-related morphology and noise pollution. Ecol. Indic. 2017, 72, 921–933. [Google Scholar] [CrossRef]

- Cockx, K.; Canters, F. Incorporating spatial non-stationarity to improve dasymetric mapping of population. Appl. Geogr. 2015, 63, 220–230. [Google Scholar] [CrossRef]

- Lee, K.H.; Schuett, M.A. Exploring spatial variations in the relationships between residents’ recreation demand and associated factors: A case study in Texas. Appl. Geogr. 2014, 53, 213–222. [Google Scholar] [CrossRef]

- Hu, S.G.; Yang, S.F.; Li, W.D.; Zhang, C.R.; Xu, F. Spatially non-stationary relationships between urban residential land price and impact factors in Wuhan city, China. Appl. Geogr. 2016, 68, 48–56. [Google Scholar] [CrossRef]

- Wang, J.F.; Li, X.H.; Christakos, G.; Liao, Y.L.; Zhang, T.; Gu, X.; Zheng, X.Y. Geographical detectors-based health risk assessment and its application in the neural tube defects study of the Heshun Region, China. Int. J. Geogr. Inf. Sci. 2010, 24, 107–127. [Google Scholar] [CrossRef]

- Wang, J.F.; Zhang, T.L.; Fu, B.J. A measure of spatial stratified heterogeneity. Ecol. Indic. 2016, 67, 250–256. [Google Scholar] [CrossRef]

- Ren, Y.; Deng, L.; Zuo, S.; Luo, Y.; Shao, G.; Wei, X.; Yang, Y. Geographical modeling of spatial interaction between human activity and forest connectivity in an urban landscape of southeast China. Landsc. Ecol. 2014, 29, 1741–1758. [Google Scholar] [CrossRef]

- Yang, R.; Xu, Q.; Long, H. Spatial distribution characteristics and optimized reconstruction analysis of China’s rural settlements during the process of rapid urbanization. J. Rural Stud. 2016, 47, 413–424. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, S.; Li, G.; Zhang, H.; Jin, L.; Su, Y.; Wu, K. Identifying the determinants of housing prices in China using spatial regression and the geographical detector technique. Appl. Geogr. 2017, 79, 26–36. [Google Scholar] [CrossRef]

- Nakaya, T.; Fotheringham, A.S.; Charlton, M.; Brundsdon, C. Semiparametric Geographically Weighted Generalised Linear Modelling in GWR 4.0. Presented at the GeoComputation 10th International Conference on GeoComputation, Sydney, Australia, 30 November–2 December 2009. [Google Scholar]

- Afridi, F.; Xin, S.; Ren, Y. Social identity and inequality: The impact of China’s hukou system. J. Public Econ. 2015, 123, 17–29. [Google Scholar] [CrossRef]

- Yan, S.; Janet, X.; Wu, Q. Government intervention in land market and its impacts on land supply and new housing supply: Evidence from major Chinese markets. Habitat Int. 2014, 44, 517–527. [Google Scholar] [CrossRef]

- Du, J.; Peiser, R.B. Land supply, pricing and local governments’ land hoarding in China. Reg. Sci. Urban Econ. 2014, 48, 180–189. [Google Scholar] [CrossRef]

- Guo, F.; Huang, Y.S. Does “hot money” drive China’s real estate and stock markets? Int. Rev. Econ. Financ. 2010, 19, 452–466. [Google Scholar] [CrossRef]

- Miller, T. China’s urban billion: The story behind the biggest migration in human history. In Asian Arguments; Zed Books: London, UK; New York, NY, USA, 2012. [Google Scholar]

- Coulson, N.E.; Tang, M. Regional science and urban economics institutional and demographic in fluencies on the presence, scale and geographic scope of individual Chinese real estate investment. Reg. Sci. Urban Econ. 2013, 43, 187–196. [Google Scholar] [CrossRef]

- Cohen, J.P.; Ioannides, Y.M.; Wirathip, W. Spatial effects and house price dynamics in the USA. J. Hous. Econ. 2016, 31, 1–13. [Google Scholar] [CrossRef]

- Zhu, Y.; Qi, X.; Shao, H.; He, K. The evolution of China’s in situ urbanization and its planning and environmental implications: Case studies from Quanzhou municipality. In Urban Population–Environment Dynamics in the Developing World: Case Studies and Lessons Learned; Sherbinin, A.D., Rahman, A., Barbieri, A.F., Eds.; Committee for International Co-Operation in National Research in Demography (CICRED): Paris, France, 2009; pp. 213–246. [Google Scholar]

- Paciorek, A. Supply constraints and housing market dynamics. J. Urban Econ. 2013, 77, 11–26. [Google Scholar] [CrossRef]

- Zhang, H. Effects of urban land supply policy on real estate in China: An econometric analysis. J. R. Estate Lit. 2008, 16, 55–72. [Google Scholar]

- Chen, G.; Zhao, K.; McDermid, G.J.; Hay, G.J. The influence of sampling density on geographically weighted regression: A case study using forest canopy height and optical data. Int. J. Remote Sens. 2012, 33, 2909–2924. [Google Scholar] [CrossRef]

- Páez, A.; Farber, S.; Wheeler, D. A simulation-based study of geographically weighted regression as a method for investigating spatially varying relationships. Environ. Plan. A 2011, 43, 2992–3010. [Google Scholar] [CrossRef]

| GDP | IP | IRB | ||

|---|---|---|---|---|

| Variable | Gross domestic product | Immigrant population | Investment in residential buildings | |

| Description | Per capita gross domestic product in a city. | Migrated from other cities or regions and became local residents after getting hukou. It is one of the important indices to weigh a city’s attractiveness. | The total investment in urban residential buildings in a city. It represents the investment enthusiasm for the real estate market in a city. | |

| Unit | Billion yuan | 10 thousand persons | Billion yuan | |

| Minimum | 2008 | 2.52 | 1.95 | 0.30 |

| 2011 | 4.28 | 2.13 | 0.75 | |

| 2014 | 13.02 | 2.32 | 0.17 | |

| Maximum | 2008 | 1356.04 | 872.78 | 92.45 |

| 2011 | 1897.16 | 1210.10 | 173.53 | |

| 2014 | 2329.20 | 1677.79 | 215.60 | |

| Mean | 2008 | 141.67 | 88.89 | 12.86 |

| 2011 | 219.52 | 119.06 | 23.59 | |

| 2014 | 296.93 | 161.26 | 34.15 | |

| Std. Dev | 2008 | 205.22 | 155.22 | 17.35 |

| 2011 | 309.83 | 205.62 | 30.58 | |

| 2014 | 412.04 | 277.16 | 41.71 | |

| r | 2008 | 0.64 ** | 0.29 ** | 0.58 ** |

| 2011 | 0.71 ** | 0.32 ** | 0.55 ** | |

| 2014 | 0.82 ** | 0.43 ** | 0.59 ** | |

| VIF | 2008 | 3.80 | 1.76 | 3.74 |

| 2011 | 3.79 | 2.03 | 3.73 | |

| 2014 | 3.37 | 2.13 | 3.37 | |

| Year | n | Residuals Moran’s I | AIC | R2 | Adjusted R2 |

|---|---|---|---|---|---|

| 2008 | 105 | −0.01 | 1939.50 | 0.65 | 0.54 |

| 2011 | 105 | 0.01 | 1930.30 | 0.74 | 0.66 |

| 2014 | 105 | −0.01 | 2031.82 | 0.79 | 0.73 |

| Variable | Min | Lwr Quartile | Median | Upr Quartile | Max | DIFF of Criterion |

|---|---|---|---|---|---|---|

| β1_GDP_2008 | −23.77 | −5.18 | 6.18 | 8.36 | 21.71 | −7.14 |

| β2_IP_2008 | −21.40 | −2.71 | 1.76 | 11.72 | 36.72 | −3.15 |

| β3_IRB_2008 | −17.89 | 11.77 | 41.93 | 90.81 | 231.71 | −8.35 |

| β1_GDP_2011 | −14.36 | 0.28 | 3.89 | 5.95 | 13.40 | −1.22 |

| β2_IP_2011 | −8.15 | −0.89 | 5.95 | 12.40 | 31.37 | 0.48 |

| β3_IRB_2011 | −81.60 | 4.01 | 12.06 | 29.76 | 66.31 | −4.76 |

| β1_GDP_2014 | −6.52 | 4.67 | 9.78 | 17.32 | 20.91 | −4.00 |

| β2_IP_2014 | −8.64 | −0.34 | 6.67 | 13.36 | 30.16 | 1.54 |

| β3_IRB_2014 | −95.11 | −38.45 | −16.74 | 18.07 | 70.19 | 1.74 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.; Hu, S.; Li, W.; Zhang, C.; Torres, J.A. Spatiotemporal Effects of Main Impact Factors on Residential Land Price in Major Cities of China. Sustainability 2017, 9, 2050. https://doi.org/10.3390/su9112050

Yang S, Hu S, Li W, Zhang C, Torres JA. Spatiotemporal Effects of Main Impact Factors on Residential Land Price in Major Cities of China. Sustainability. 2017; 9(11):2050. https://doi.org/10.3390/su9112050

Chicago/Turabian StyleYang, Shengfu, Shougeng Hu, Weidong Li, Chuanrong Zhang, and José A. Torres. 2017. "Spatiotemporal Effects of Main Impact Factors on Residential Land Price in Major Cities of China" Sustainability 9, no. 11: 2050. https://doi.org/10.3390/su9112050

APA StyleYang, S., Hu, S., Li, W., Zhang, C., & Torres, J. A. (2017). Spatiotemporal Effects of Main Impact Factors on Residential Land Price in Major Cities of China. Sustainability, 9(11), 2050. https://doi.org/10.3390/su9112050