Abstract

Recently, innovative changes in information technology (IT) trends, such as cloud computing and deep learning, have led IT companies to focus on collaboration for sustainable growth. This paper investigates collaboration strategies and success factors for IT service companies via a survey-based empirical study of Korean leading IT firms. Four types of collaboration were identified by considering the types of customer relationship and the target market: offshore, joint venture, collaboration with small and medium-sized enterprises (SMEs), and partnership with major local firms. Then, based on a Plan-Do-See management activity process, this paper considers success factors in the planning process and collaboration process, and analyzes an impact of these factors on collaboration performance such as financial performance, process innovation, improving competitiveness, and technology acquisition. As a result, the success factors differ according to the types of performance measures as well as the collaboration types. In particular, the characteristics of partners positively influence competitiveness in captive and global markets, while they improve process innovation in open and domestic markets. This study attempts to provide insight for companies in the IT service industry about how collaboration activities could enhance performance, depending on the alliance types.

1. Introduction

Companies are increasingly cultivating collaborative relationship with a variety of external partners such as customers, suppliers and competitors to integrate value creation processes for sustainable growth [1,2]. While some studies have investigated internal organization for innovation, other researchers concentrate on inter-organizational forms of collaboration in the development and commercialization of new products and services [3]. Thus, external collaboration is a critical means to augment the internal value creation activities of an organization and reinforce its competitive advantages because the locus of innovation lies not inside the firm but in the spaces between the firm and its external partners [4,5]. In addition, the inter-firm collaboration can achieve sustainable growth by building various eco-networks [6]. For example, in a food supply chain, different collaboration forms between actors of upstream and downstream in each stage of supply chain enable the successful implementation of sustainability practices [7]. In particular, collaboration in various functions such as R&D activities, design, marketing and production is at the center of the recent changes for sustainable growth in the IT service industry across the globe. It has become clear that such changes in large industries should not be led by only one company, but should only occur when several market players and stakeholders collaborate in order to maximize the performance of resource utilization for long-term sustainability [8].

Previous studies on inter-organizational collaboration dealt with various subjects that collaboration strategy could be successful, including types of collaborations [9], mechanisms for partner selection [10], and modification of the inter-organizational relationship [11]. In addition, the motivation for collaborative agreements has been recognized in diverse perspectives such as transaction cost economics, resource-based view, resource dependence theory, governance and administrational justice, and knowledge management and organizational learning. For instance, the transaction cost economics theory regards opportunity cost as the key reason for collaboration to minimize cost inefficiency. In the perspectives of resource-based and resource dependence, researchers consider collaboration an external resource to extend organizational competence and market power [12]. Thus, in the context of collaboration, complementarity amongst resources is an important driver of partner selection and alliance performance [13].

However, managing collaborative relationships is challenging as these relationships show high failure rate [14]. Many studies have identified possible reasons on collaboration failure, including governance issues, cultural conflicts, coordination costs, unintended knowledge spillovers, organizational rigidity and divergent goals [15]. Nevertheless, existing literature has paid little attention to different contexts and success factors of collaboration. In order to assess the success factors in collaboration, both the purpose and the type of collaboration need to be intensively examined. Collaboration purposes include technical development as well as business expansion. In addition, types of collaboration can be either vertical or horizontal [16,17], and involve either other companies or governmental/educational institutions [18]. Ollila and Elmquist [18] focused on research institutions and the government—the main agents of open innovation—instead of companies, investigating collaboration via joint studies. They suggest three types of issues that need to be considered for managing such collaboration: issues arising from sharing with partners, issues arising from collaboration between partners, and issues arising from the arena itself.

The collaboration purposes and success factors in the IT industry are unique due to the IT industry’s short technical cycles. Chatenier et al. [19] found brokering solutions that lead to the coexistence of team members, the understanding of social phenomena, and networking abilities were important factors in the IT industry. In particular, Parida et al. [20] analyzed the environment of open innovation with technology-based small to medium-sized enterprises (SMEs) in the IT industry and concluded that innovation results varied depending on open innovation activities and that technology outsourcing yielded a radical innovation performance while technology scouting yielded a progressive innovation performance. In the IT service industry, since IT service providers provided services to companies in direct competition with their existing clients, client companies are worried about knowledge leakages and the replication of IT systems [21]. Thus, the characteristics of collaboration in IT service industry should be considered to achieve successful collaboration.

However, several limitations can be seen in the existing research, as it does not tend to differentiate between the types of collaboration found in the IT service industry. To overcome this issue, we adopt a case study approach to analyze a leading Korean IT service company and its collaborators, and thereby extract four types of collaboration. The success factors for each type of collaboration are then investigated using statistical analyses such as Kruskal–Wallis test and multiple regression analysis. Our study should assist in formulating critical recommendations for institutions and companies by providing new insights into ways in which collaboration activities could enhance performance, depending on the collaboration type.

The remainder of this paper is structured as follows. In the next section, the theoretical background behind the success factors for collaboration, changes, and innovation in the IT service market is described. This is followed by an explanation of the research processes and methodology as well as the development of four hypotheses. Finally, the results and implications of the statistical analyses are discussed, and conclusions are presented.

2. Theoretical Background

2.1. Success Factors for Collaboration

Many studies have attempted to assess the critical success factors (CSFs) for collaboration. In these studies, CSFs can be classified into factors influencing the likelihood of collaboration, factors influencing the performance of collaboration, and those influencing the collaboration type.

Mohr and Spekman [22] found the key characteristics of successful vertical collaboration to be confidence, adaptation, devotion, quality of communication, degree of participation, and the methods of solving common problems. In horizontal collaborations between companies, they found that employees needed to understand the collaborative relationship from a strategic perspective; they believed that effective communication was important to that process [23,24]. Many studies have found that the importance of confidence between partners is an important success factor; the types of confidence include confidence in the agreement, confidence in the partners’ ability, and confidence in the mutual benefits of the project [25,26,27].

The following factors have been found to be critical in impacting the performance of the collaboration: partnership attributes, communication, conflict resolution, partner-company selection process [28], joint planning, the sharing of benefits and risks, scalability and confidence, the sharing of systematic work information, work control between companies, and the mutual establishment of a corporate culture [29]. Das and Teng [30] analyzed success factors in terms of the characteristics of partner companies, concluding that while collaboration between companies in the same market can be improved, conflicts can arise as collaboration intensity increases. They also suggested that the mobility of resources, imitability, and substitutability could lower collaboration performance by disturbing the mutual dependence between partners. Gray and Stites [31] suggested a model of four factors that influence partner outcomes: external drivers, partner motivations, partner and partnership characteristics and process issues. In particular, the key external drivers include social perceptions, expectations and preferences, technological development, concerns about globalization, the regulatory environment, the efficiency of government.

Knowledge acquisition abilities, diversity, and openness have been found to have positive effects on performance in reference to innovation. Durst and Ståhle [32] regarded the key success factors for open innovation to include relational aspects, human resources, governance, facilitators, resource supply, strategies, process management, leadership, and culture. Likewise, Tranekjer and Knudsen [33] found success factors for SMEs to include knowledge-sharing cultures, the sharing of collaboration experience, openness, and exchange collaboration. In addition, Un et al. [34] insisted that various types of R&D collaboration differ in terms of the breath of new knowledge and in the ease of access of the new knowledge. Finally, Sieg et al. [35] discovered that it is crucial to standardize the R&D issues that enable cooperation among internal scientists, ensure appropriate issue selection, and create new solutions by which R&D issues are solved through an innovation intermediary. Table 1 summarizes the results of these and other studies on the success factors for collaboration.

Table 1.

Success factors for collaboration.

2.2. Collaboration Performance

Many studies have sought to determine how to measure collaboration performance. Collaboration performance can be broadly classified into quantitative and qualitative performance. The former includes sales, number of new customers, improvement in production, and number of joint development projects. Financial indices include ROI, the degree of improvement in productivity and profitability, cost reduction [22,30,54], increase in net profit, increase in sales, cost reduction, and increase in perceived satisfaction [30]. However, because the profit creation period varies according to relationship type, it is inappropriate to compare only financial performance indicators such as ROI [45], and it is very difficult to secure appropriate data on financial indices. Thus, qualitative indices such as perceived satisfaction [28,30], status of goal accomplishment, contribution to core competence, and predominance in competition [45] have been developed.

Collaboration success factors can vary depending on how performance is defined. Information exchange and the degree of immersion have been shown to have positive effects on financial performance indicators such as sales, but confidence has negative effects on satisfaction with the collaboration [55]. Finding alternatives to participation in an inbound open innovation is more important when the ability to absorb knowledge is low [56,57]. For outbound open innovation, Lichtenthaler [46] concluded that a higher degree of technological turbulence and a higher transfer ratio in the technological market had positive effects on collaboration, while strict protection for patents lowered the performance of outbound open innovation. In addition, Nieto and Santamaría [58] shows that the impact of collaboration in small and medium-sized firms is more significant for product innovation than process innovation, and vertical collaboration has the greatest impact on firm innovativeness.

3. Theory and Hypotheses

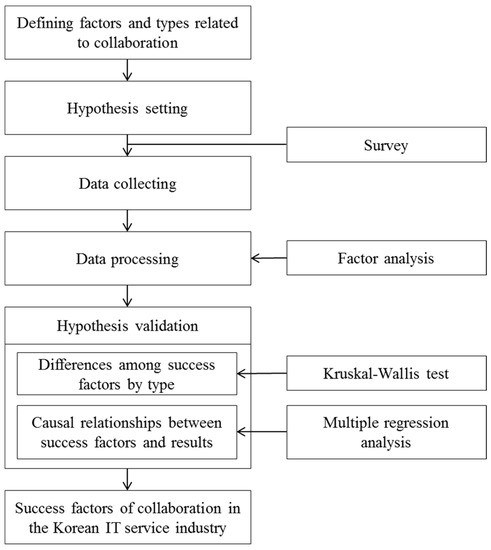

In this study, the success factors for collaboration in the Korean IT service market are derived using the procedures shown in Figure 1. (1) This study defines the collaboration success factors and factors relating to collaboration performance through analysis of the literature. The study then presents hypotheses and a model based on the influence between success factors and performance factors, and relationships among the factors; (2) Data on professionals in the IT service industry are gathered and processed; (3) The results of the analysis are used in an empirical analysis and the success factors are validated; (4) The IT service industry collaboration types are identified and analyzed to determine the differences between their success factors; (5) The success factors in the performance of each collaboration type are empirically analyzed and validated; (6) Based on the results of the empirical analysis and validation, the success factors of each IT service industry collaboration type are identified.

Figure 1.

Research Framework.

3.1. Collaboration in the Korean IT Service Industry

Information technology (IT) services started to be recognized as a new business in Korea when companies began to establish computing divisions and teams mainly dedicated to installing and operating mainframe-based hardware. Understanding the hardware was considered more important than software development, which was little recognized or implemented at that time. Companies were offered business opportunities through the spread of computers in the workplace, and software became more important. Korean conglomerates seized these opportunities and gathered human resources in their computing divisions to establish new affiliated companies.

Despite the increase in IT-related business, IT service companies found it difficult to bear the fixed costs required to maintain the necessary labor. Moreover, due to the increasing effects of price competition on the order-made production industry (where orders are made based on the budget ranges of both government and private customers), large IT service firms focused on utilizing their partner companies. Analysis, design, and project management were carried out on the premise that large companies could guarantee the quality of the entire project, and SME developers focused on coding work.

However, the IT environment has undergone rapid changes as the price of hardware constantly decreased while development proceeded from mainframe systems to Unix, Linux, and the cloud. Furthermore, open source computing and a business model requiring users to pay according to the amount of use were promoted, making it more difficult for IT service companies to grow. This problem intensified when market growth started to slow as companies reduced their IT investments due to the financial crisis triggered by the Lehman Brothers collapse in 2008. Moreover, because of the Korean government’s effort to foster SMEs, affiliates of conglomerates could no longer play a major role in system integration projects in the public market, and they were forced to partially open the captive market to SMEs. Consequently, the IT service providers of large corporations could not expect significant growth in the Korean market.

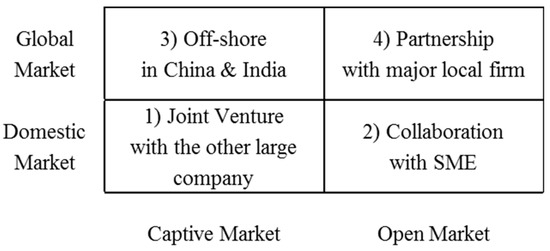

Considering the changes that have occurred in IT service companies, the changes in the types of collaboration can be categorized as shown in Figure 2. Two dimensions that identify the characteristics of target markets consist of geographical locations (global markets vs. domestic markets) and customer relationships (captive markets vs. open markets). The combinations of two dimensions yield the four cells in Figure 2. The first type is ‘joint venture with another large company’. When the IT industry began, companies depended on the captive markets of large corporations and established joint venture partnerships to benchmark management techniques in advanced countries such as the United States to frame the new industry. The second type of collaboration is ‘collaboration with SME’. As competition in markets such as the public and financial markets intensified, large corporations started to collaborate with SMEs to secure price competitiveness and management efficiency. The third type of collaboration is ‘offshore in developing countries’. Since 2010, Korean companies have been seeking different momentum generators such as global market entry to overcome stagnant growth in the domestic market, expecting to achieve market growth through collaboration. In the beginning stage of globalization, most companies tended to focus on a captive market in the form of offshoring. However, a globalization-oriented company can have strong ‘partnership with major local firms’ to extend into a global open market.

Figure 2.

Types of collaboration of an IT company.

3.2. Hypotheses Development

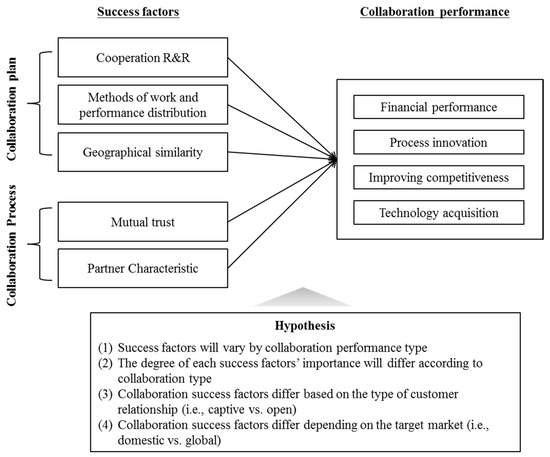

An objective of this study is to determine whether the success factors derived from the analysis of previous empirical studies on collaboration are applicable to the Korean IT service market. Through this case study, success factors are identified in this paper, first by the type of service industry performance measure and second by the type of collaboration. Then, considering the characteristics of the Korean IT service market, the study identifies collaboration success factors by customer relationship type and market type. To this end, a survey was conducted on the managers and employees of a leading Korean IT service firm and related companies. The data is used to test the four hypotheses developed as shown in Figure 3.

Figure 3.

Research concept.

Firms collaborate to enhance performance. Such performance can be roughly divided into quantitative performance (such as revenue increases and cost reduction) and qualitative performance (such as satisfaction from collaboration and acquiring competitive advantage). Studies have shown that success factors differ depending on the collaboration performance measures used. Nielsen [59] derived collaboration success factors in international strategic alliances, showing that, while country risk and collaboration know-how influenced financial performance and learning, they did not meaningfully influence increases in efficiency. Mohr and Spekman [22] found that communication quality positively influenced the degree of satisfaction with collaboration, but was unrelated to financial performance, and that the degree of joint participation in planning and goal-setting had a positive effect on revenue but did not meaningfully impact the degree of satisfaction. It is thus expected that success factors will differ according to the type of performance measure. We thus propose the following hypothesis:

Hypothesis 1.

Success factors will vary by collaboration performance types.

Studies have analyzed the differences in collaboration success factors driven by collaboration purpose (such as technology development or business expansion) and collaboration partner (such as the government and universities [16,17,18]). Möller and Rajala [60] suggested three types of business networks including current business nets, business renewal nets and emerging new business nets and then showed that they pose wide different conditions and requirement for collaboration. Likewise, Nieto and Santamaría [61] analyzed the role of different types of collaborative networks in achieving product innovation. In addition, the value of alternating co-location and physical separation in the collaboration according to the requirement of specific project phases is discussed to address the interaction with other departments [62]. Major Korean IT service firms use various types of collaboration depending on the purpose. IT service firms established a joint venture with STM, an American company, in order to enter the IT service industry. Furthermore, collaboration via outsourcing to SMEs was used to build competitiveness in winning contracts following entry into the open market. Offshore centers were set up in China and India to explore overseas markets and improve profit margins, and IT service firms are currently strengthening their alliances with local firms for full-fledged entry into global markets. This study identifies four types of collaboration based on customer relationships and target markets that reflect the characteristics of the IT service industry and seeks to confirm the differences among their success factors. We therefore propose the following hypothesis:

Hypothesis 2.

The degree of the importance of each success factor will differ according to collaboration types.

The most significant defining characteristic of the Korean IT service firm is the nature of the captive market. A captive market is a business structure that services the subsidiaries of the same conglomerate and is heavily dependent on the captive customers of conglomerates such as Samsung and SK. Studies show that the revenues of IT service firms are highly correlated with the revenues of captive customers, which are linked to the profits of the firm [63]. Keck et al. [64] researched the success factors for insurance firms in a captive market and emphasized the importance of internal investment and goal-oriented management in effectively managing the firm. On the other hand, mediator qualities such as trust, satisfaction, and websites are regarded as important success factors in the open market [65]. Ultimately, differences appear among the success factors based on the type of customers the collaboration serves, making it necessary to consider success factors on a type-by-type basis, as hypothesis 3 proposes. We thus propose the following hypothesis:

Hypothesis 3.

Collaboration success factors differ based on the types of customer relationship (i.e., captive vs. open).

Global IT service firms have achieved growth and globalization through continuous alliances with foreign companies. For overseas IT service projects, service capability can be seen as more important than development capability for project success. In these projects, which reflect the needs of the clients, language and cultural barriers were considerable [66]. The preferred standards differed according to the country. China was found to prefer technology transfers, while Japan was found to prefer repair and maintenance support through the founding of local branches. On the other hand, other factors were likely influencing the success of collaboration for market expansion, as firms are more likely to be selected as service providers based on their reputation in their domestic market, followed by factors such as IT knowledge, price, degree of service satisfaction, technology transfer, and repair and maintenance [67]. Therefore, this study also identifies success factors based on the target market. The following hypothesis is therefore proposed.

Hypothesis 4.

Collaboration success factors differ depending on the target markets (i.e., domestic vs. global).

4. Methodology

4.1. Data Collection

In the survey, the respondents selected the type of collaboration they had experienced and indicated their success factors. The 18 success factors determined from the literature analysis were divided into “collaboration planning” and “collaboration process”. In addition, an expert reviewed the survey questions to ensure the construct validity. The final survey is described below.

Four collaboration types were examined in the case study on Company A. First, for joint ventures, a survey was performed of the personnel involved in setting up a joint venture with STM in 1987, its operations and reconciliation of shareholding relationships, until Company A fully acquired Company B in 2002. Second, collaborating with SMEs involves submitting proposals, executing the project, and developing solutions jointly with the SMEs and other venture firms and this type represents the most common collaboration type. Personnel of the SMEs and venture firms were surveyed for this type. Third, for offshore collaborations, personnel who helped execute the projects or set up the operations of the Indian or Chinese offices of Company A, were surveyed. Finally, for partnerships with major local firms, managers and employees who have helped major local firms find overseas solutions were targeted in the survey.

The sample of this study consists of 250 managers and employees of Company A as well as the employees of related companies, on whom the survey was carried out from 1 May 2015 to 15 June 2015. Phone calls and emails were used to improve the response rate, resulting in 129 responses (a response rate of 51.6%). Excluding responses that were inappropriate, 127 responses were analyzed using the statistical package SPSS 18.0. Among the 127 responses, 80% of the responses were collected from large companies and the remaining responses were collected from SMEs. In terms of business areas of companies, most of the respondents (58.3%) are included in system integration/system maintenance businesses and the second rank (20%) is new solution businesses. In addition, their main works are system management (39%), IT marketing (28%), and IT development (18%). Table 2 shows the results of frequency analysis of the samples in company size, occupation, and business area categories to examine the characteristics of 127 samples.

Table 2.

Composition of the sample.

4.2. Variables

The 18 collaboration success factors derived from a review of the literature were organized using the Plan-Do-See management activity process. Since the governance can be split into two components, clear role setting and defining performance measurement methods, the total number of success factors becomes 18. The factors were divided into success factors in the planning stage, then success factors in the “doing” stage of the collaboration. Then, additional outcome performance measures were classified as “seeing” factors, as summarized in Table 3. A 5-point Likert scale was used to determine the importance of the factors and the level of performance, with 1 point indicating “not important” and 5 points indicating “very important.” When respondents believed collaboration was unaffected, the response was recorded as 0.

Table 3.

Success and collaboration performance factors.

Since the size of the identified success factors is too large to perform meaningful analysis, an exploratory factor analysis is employed to reduce the factors by grouping similar factors. Thus, three variables are extracted from eight success factors in the planning process (the “planning” stage) and nine factors were grouped into two variables in the collaboration process (the “doing” stage). Among the 18 success factors, the experience from previous collaboration of which the commonality is less than 0.4 was excluded. The variables in the planning stage include cooperation role and responsibility (R&R) methods of work and performance allocation, and geographical similarity [28,38,39,41]. The next category, the “doing” phase, consists of two variables: mutual trust and partner characteristic [16,29,40,41,44,49,51]. In the social sciences, a Cronbach’s alpha coefficient of more than 0.6 is considered to be reliable [68]. These success factors in this research are all found to be more than 0.7, and are thus considered reliable. In terms of the ten collaboration performance factors, they can be grouped into four variables through factor analysis. Thus, the dependent variables are financial performance, process innovation, improving competitiveness, and technology acquisition. In addition, firm size was treated as a control variable in the regression procedure.

4.3. Analysis

First, a correlation analysis was utilized between each of the hypothesized variables and the four performance variables in order to examine their individual relationships. Then, a Kruskal–Wallis test and multiple regression models were run to determine which combinations of factors affected collaboration performance, statistically testing the suggested four hypotheses. In particular, in the regression for hypothesis 1, Model 1 includes variables of the success factors of the collaboration plan, Model 2 consisted of the success factors of the collaboration process, and Model 3 incorporates both sets of variables.

5. Data Analysis and Results

A correlation analysis was performed to understand variable characteristics such as mean, standard deviation, and the relationships between variables. If the correlation coefficient value is less than 0.2, the correlation is considered to be meaningless or should be ignored. At around 0.4, the correlation is considered weak, while a correlation of more than 0.7 is considered strong. The results of the Pearson correlation coefficient between the 10 dependent, independent, and control variables are in most cases not over 0.4; the relationships between mutual trust and economic performance, and between mutual trust and collaborating firms and regulations prior to collaboration were found to be over 0.4, and thus slightly correlated.

Moreover, the factors with positive influences differ according to performance. As there are no relationships between performance types, each type can be analyzed separately. On the other hand, the correlation coefficients between independent variables are statistically significant and can thus result in multicollinearity issues if the multiple regression analysis was performed to confirm the hypotheses. If regression analyses are performed in the presence of multicollinearity, the regression coefficient can be unstable; if the variance inflation factor is more than 10, multicollinearity is considered to exist. Normally, if the variance inflation factor (VIF) is more than 10 and multicollinearity is confirmed, the regression analysis is repeated with the variable removed. Therefore, this study will measure VIF when analyzing hypotheses 1, 3, and 4 to measure multicollinearity.

5.1. Variety of Success Factors According to Collaboration Performance Types

Twelve multiple regression analyses were performed to determine the influence of the success factors of the planning stage and of the collaboration process on collaboration performance in the hypothesis 1. The results are shown in Table 4. Among the 12 models, 11 were found to be statistically significant. Therefore, factors such as collaboration R&R, method of work and performance allocation, geographical similarity, mutual trust, and partner characteristics were valid independent variables for collaboration performance.

Table 4.

Results of multiple regression analysis in the IT service industry.

A more comprehensive organization of the results was then performed. When all success factors were considered, with no difference seen in planning and doing processes, the method of work and performance allocation was found to positively and significantly influence process innovation, and geographical similarity was found to significantly and positively affect technology acquisition. Mutual trust has a positive and significant influence on financial performance, and partner characteristics was found to influence process innovation and competitiveness improvements. Thus, each success factor has a different influence on performance. However, cooperation R&R is irrelevant for all of the performances.

5.2. Differences in the Importance of Success Factors According to Collaboration Types

To determine which collaboration types of the four (i.e., Joint Venture, SMEs, offshore, local partner) are important, a Kruskal–Wallis test for hypothesis 2 is performed. If the compared samples do not have normality and follow a normal distribution, the mean cannot be used to compare between types, and a non-parametric method is used that does not take into account the parent sample.

Among the planning stage success factors, a Kruskal–Wallis test was performed on collaboration types using the “method of work and performance allocation” factor responses. Table 5 shows that the chi-squared value is 11.31, with a significance level of 0.05. This demonstrates that the importance of the “method of work and performance allocation” factor differs depending on collaboration type. The difference is large between joint venture and offshore; while the joint venture type emphasizes “methods of work and performance allocation” and “partner characteristic”, the offshore type does not. On the other hand, “collaboration R&R” and “geographical similarity” are not statistically significant.

Table 5.

Results of Kruskal–Wallis test.

Moreover, the collaboration of mutual trust and partner characteristics factors display chi-squared values of 12.05 and 8.79, respectively, both with significance levels of 0.05. The importance of collaboration culture, immersion, and the importance accorded to communication in the mutual trust variables differs according to types. While mutual trust was considered important in collaboration with a major local firm, this was not so for joint venture collaborations. In a joint venture, a new firm is created; planning is thus regarded as more important than long-term collaboration. Concerning partner characteristics, joint ventures tend to strongly value diversity in partner characteristics, while this is not regarded as important in collaboration with SMEs. Therefore, the hypothesis that the importance of success factors differs according to collaboration type is partially validated.

5.3. Differences in Success Factors Based on the Types of Customer Relationship

This study divided customer relationships into those based on a captive market of subsidiaries (the general characteristic of the Korean IT service industry) and those based on the open market (a competitive market that includes the public and financial sectors). Collaboration types change based on these customer relationships: joint venture and offshore types operate in the captive market, and SME and major local firm types operate in the open market. Multiple regression analysis was performed on the collaborative capabilities and the influencing independent variables depending on the customer relationships.

The suitability of the regression model for hypothesis testing can be assessed through the modified R value of the independence variable factors. The modified R square values of financial performance and improving competitiveness are 47% and 49%, respectively; process innovation and technology acquisition produced low values of less than 20%, indicating that the explanatory power of financial performance and improving competitiveness is very high, as shown in Table 6. Therefore, in captive markets, financial performance and improving competitiveness are influenced by the success factors.

Table 6.

Results of multiple regression analyses in the type of customer relationship.

Regarding captive markets, when the regression coefficient values for each variable are examined, the regression coefficient for methods of work and performance allocation is 0.62 (p < 0.01) and that for geographic similarity is 0.34 (p < 0.05), indicating significantly positive influences on economic performance. However, collaboration R&R and mutual trust are not significant. Moreover, improving competitiveness and partner characteristics have regression coefficient values of 0.91 (p < 0.01), and the remaining independent variables have insignificant influences, indicating that strong financial performance among captive customers requires that a work and performance division methodology be followed and that a geographical similarity exist. The acceptability and diversity of partners are important for increasing competitiveness.

Results for the open market segment differ. Collaboration R&R has a value of 0.36 (p < 0.05) and is significantly negative, while mutual trust 0.60 (p < 0.01) is significantly positive. However, the method of work and performance allocation, geographical significance, and partner characteristics are not statistically significant. Moreover, for the influence on process innovation, the regression coefficient of partner characteristic is 0.29 (p < 0.05), thus positively influential. However, the remaining success factors are not statistically significant.

Of the success factors influencing increased competitiveness, only collaboration R&R has a regression coefficient value of 0.14 (p < 0.05) and is therefore statistically positive, a result that differs from that for financial performance. Finally, geographic similarity is the success factor that influences technology acquisition, with a regression coefficient of 0.41 (p < 0.01) and is therefore significantly positive. Based on these results, Hypothesis 3 (that collaboration success factors in the IT service industry differ depending on the customer relationship) is supported.

5.4. Differences in Success Factors Depending on the Target Markets

Multiple regression analysis was performed to verify whether the target market influences the collaboration success factors proposed in the hypothesis 4. Table 7 shows the factors influencing collaboration success in the global market, involving the offshore and major local firm collaboration types and the results for the domestic market, involving the joint venture and SME collaboration types.

Table 7.

Results of multiple regression analyses in target market.

Regarding the regression coefficients for the global market, only partner characteristics have a positive impact on competitive performance (p < 0.01). This result suggests that previous collaboration success factors are unlikely to influence performance in the global IT service market and that a diverse range of partners and information must be considered to increase competitiveness.

Regarding the reliability of the regression model for hypothesis validation, the explanatory power of the independent variable influencing collaboration performance in the domestic markets, the modified R-squared value, is 24% for financial performance, 21% for process innovation, 10% for increasing competitiveness, and 22% for technology acquisition. The F-values, indicating the reliability of the regression coefficient and the regression function of the analytical model, were 5.50 for financial performance, 4.82 for process innovation, 2.58 for improving competitiveness, and 5.01 for technology acquisition, all of which are significant at a 0.05 level and are thus reliable.

Regarding the regression coefficients for the domestic market, mutual trust (p < 0.01) influences financial performance, while none of the other independent variables is influential. The factors influencing process innovation were the method of work and performance allocation and partner characteristic, with regression coefficient values of 0.23 (p < 0.05) and 0.21 (p < 0.05), respectively. For improving competitiveness, the firm size control variable is influential, while none of the other independent variables is statistically significant. For technology acquisition, geographic similarity has a regression coefficient of 0.22 (p < 0.05) and is therefore significantly positive. Therefore, hypothesis 4 (that collaboration success factors will differ depending on the target market) is validated.

6. Discussion and Implications

The proposed four hypotheses are mostly supported with high statistical significance. First, success factors differently influences performance factors. While partner characteristics in collaboration can enhance two performances such as process innovation and competitiveness improvement, other success factors affect single different performance (mutual trust to financial performance, method of work and performance allocation to process innovation and geographical similarity—technical acquisition). Second, in most of success factors, there are significant differences in importance of factors among collaboration types. The result supports that each collaboration type has relevant success factors for collaboration, and managers or facilitators should consider different strategies in pursuing collaboration. Third, from the results of hypothesis 3, captive markets and open markets have different success factors in collaboration because the objectives and strategies of customer relationship are totally different. Finally, success factors for global markets differ with those for domestic markets. Since market extension into global markets needs to be distinguished from market retention in domestic markets, companies disparately think success factors according to types of target markets. The results of hypothesis verified by the Kruskal–Wallis test and multiple regression analysis were summarized in Table 8.

Table 8.

Results of hypothesis testing.

The results of hypotheses provide useful implications in collaboration among companies. In the analysis of performance types, building mutual trust is more important for achieving financial performance than either role- or goal-setting. For process innovation and competitiveness improvement, diversity, technological ability and knowledge absorption ability should be emphasized in partner selection. Moreover, a clear performance measurement and regulation must be set to accelerate the process innovation through collaboration. Geographic similarity must be considered in technology acquisition. On the contrary, clear cooperation R&R does not influence any types of performance. Thus, in the collaboration of IT service sector more practical factors such as performance allocation, geographical similarity, mutual trust and partner characteristics are more critical than a general factor in the early stage of planning process. In the perspectives of collaboration types, differences were also found in their degrees of importance for each type. For example, methods of work and performance allocation were important for joint ventures but not for offshore collaboration. Partner characteristics were also important for joint ventures but not for collaborating with SMEs. However, cooperation R&R and geographical similarity do not show significant differences among collaboration types because those factors are basic in the collaboration process of all types. Success factors also differed depending on customer types. Geographical similarity and methods of work and performance allocation were important for achieving financial performance in captive markets, while cooperation R&R and mutual trust was important for the open markets. Since companies have long, strong relationship with customers in captive markets, they generally focus on financial performance in an efficient way. However, in open markets, partners think highly of mutual trust and clear role and responsibility in a competitive environment. In terms of target markets, in the global market, only the factor of partner characteristics influences increasing competitiveness; none of the factors influences competitiveness in the domestic market. This result indicates that collaboration in the global market is carried out to increase competitiveness, but is performed for other reasons such as increasing profits and technological innovation in domestic markets.

7. Conclusions

This study identified success factors according to the types of performance measures and collaboration types seen in the IT service market, as well as according to customer relationship types, including those with the captive markets, which defines the Korean IT service firm. Success factors relating to target markets were also identified, including those for overseas markets, which have attracted much attention recently. Then, the strategic characteristics of those success factors are investigated, considering performance types, collaboration types, customer relationship types and target market types by applying quantitative methodologies. This study applied Kruskal–Wallis test and multiple regression analysis to derive success factors influencing performance. In the regression analysis, independent variables are two types of success factors based on the Plan-Do-See management activity process: success factors in the planning process and the collaboration process. The success factors in the planning process are cooperation R&R, methods of work and performance distribution, and geographical similarity. The success factors in the collaboration process can be divided into mutual trust and partner characteristic. There are four types of dependent variables to identify collaboration performance: financial performance, process innovation, improving competitiveness, and technology acquisition. As a result of the analysis, important success factors are different according to cooperation types, and the success factors that affect performance differ depending on the achievement types. Joint venture emphasizes the distribution of collaboration results while offshore does not consider allocation rules relatively important. In the global market, the partner characteristic and geographical similarity have a positive impact on performance; however in the domestic market it is necessary to consider the method of work and performance distribution and mutual trust.

Limitations always exist, and in this case, data on collaboration was collected from only one of the large companies, SI (Company A). As collaboration always begins with a bilateral relationship, the opinions of all parties should be gathered in order to analyze their similarities and differences. A more in-depth study involving Company A and its collaboration partners would produce a more detailed list of success factors.

Korean IT service firms are at a crossroads of change and are seeking to collaborate with other firms through methods that differ from those they have used in the past. The revealed importance of focusing on partner diversity in foreign markets to compensate for insufficient capabilities is an important consideration for overseas business expansion strategies. It is hoped that this study will help firms seek the appropriate methodologies for success according to their goals and performance, beyond the limitations of their current methods, while setting and executing their corporate strategies.

Acknowledgments

This work was supported by the Dongguk university research fund (S-2017-G0001-00020).

Author Contributions

Changbyung Yoon designed the study, collected the data, and interpreted the results. Keeeun Lee conducted the analysis and wrote the manuscript. Byungun Yoon outlined the methodology and helped complete the draft of this research. Omar Toulan implemented the research, designed the study, and discussed the structure and content of the hypotheses. All authors have read and approved the final manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Noseleit, F.; de Faria, P. Complementarities of internal R & D and alliances with different partner types. J. Bus. Res. 2013, 66, 2000–2006. [Google Scholar]

- Bjärstig, T. Does Collaboration Lead to Sustainability? A Study of Public–Private Partnerships in the Swedish Mountains. Sustainability 2017, 9, 1685. [Google Scholar] [CrossRef]

- Yli-Renko, H.; Autio, E.; Sapienza, H.J. Social capital, knowledge acquisition, and knowledge exploitation in young technology-based firms. Strateg. Manag. J. 2001, 22, 587–613. [Google Scholar] [CrossRef]

- Powell, W.W.; Koput, K.W.; Smith-Doer, L. Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Adm. Sci. Q. 1996, 41, 116–145. [Google Scholar] [CrossRef]

- Giroud, A.; Ha, Y.; Yamin, M. Foreign subsidiaries’ internal and external R&D cooperation in South Korea: Explanatory factors and interaction. Asian Bus. Manag. 2014, 13, 227–256. [Google Scholar]

- Patala, S.; Hämäläinen, S.; Jalkala, A.; Pesonen, H.L. Towards a broader perspective on the forms of eco-industrial networks. J. Clean. Prod. 2014, 82, 166–178. [Google Scholar] [CrossRef]

- León-Bravo, V.; Caniato, F.; Caridi, M.; Johnsen, T. Collaboration for Sustainability in the Food Supply Chain: A Multi-Stage Study in Italy. Sustainability 2017, 9, 1253. [Google Scholar] [CrossRef]

- Ang, S.H. Competitive intensity and collaboration: Impact on firm growth across technological environments. Strateg. Manag. J. 2008, 29, 1057–1075. [Google Scholar] [CrossRef]

- De Faria, P.; Lima, F.; Santos, R. Cooperation in innovation activities: The importance of partners. Res. Policy 2010, 39, 1082–1092. [Google Scholar] [CrossRef]

- Emden, Z.; Calantone, R.J.; Droge, C. Collaborating for new product development: Selecting the partner with maximum potential to create value. J. Prod. Innov. Manag. 2006, 23, 330–341. [Google Scholar] [CrossRef]

- Young-Ybarra, C.; Wiersema, M. Strategic flexibility in information technology alliances: The influence of transaction cost economics and social exchange theory. Organ. Sci. 1999, 10, 439–459. [Google Scholar] [CrossRef]

- Martin-Rios, C. Why do firms seek to share human resourcemanagement knowledge? The importance of inter-firm networks. J. Bus. Res. 2014, 67, 190–199. [Google Scholar] [CrossRef]

- Chand, M.; Katou, A.A. Strategic determinants for the selection of partner alliances in the Indian tour operator industry: A cross-national study. J. World Bus. 2012, 47, 167–177. [Google Scholar] [CrossRef]

- Park, S.H.; Ungson, G.R. Interfirm rivalry and managerial complexity: A conceptual framework of alliance failure. Organ. Sci. 2001, 12, 37–53. [Google Scholar] [CrossRef]

- Sivadas, E.; Dwyer, F.R. An examination of organizational factors influencing new product success in internal and alliance-based processes. J. Mark. 2000, 64, 31–49. [Google Scholar] [CrossRef]

- Schiele, H. Accessing supplier innovation by being their preferred customer. Res.-Tech. Manag. 2012, 55, 44–50. [Google Scholar] [CrossRef]

- Lee, S.M.; Hwang, T.; Choi, D. Open innovation in the public sector of leading countries. Manag. Decis. 2012, 50, 147–162. [Google Scholar] [CrossRef]

- Ollila, S.; Elmquist, M. Managing open innovation: Exploring challenges at the interfaces of an open innovation arena. Creativity Innov. Manag. 2011, 20, 273–283. [Google Scholar] [CrossRef]

- Chatenier, E.D.; Verstegen, J.A.; Biemans, H.J.; Mulder, M.; Omta, O.S. Identification of competencies for professionals in open innovation teams. R D Manag. 2010, 40, 271–280. [Google Scholar] [CrossRef]

- Parida, V.; Westerberg, M.; Frishammar, J. Inbound open innovation activities in high-tech SMEs: The impact on innovation performance. J. Small Bus. Manag. 2012, 50, 283–309. [Google Scholar] [CrossRef]

- Miozzo, M.; Grimshaw, D. Modularity and innovation inknowledge-intensive business services: IT outsourcing in Germany and the UK. Res. Policy 2005, 34, 1419–1439. [Google Scholar] [CrossRef]

- Mohr, J.; Spekman, R. Characteristics of partnership success: Partnership attributes, communication behavior, and conflict resolution techniques. Strateg. Manag. J. 1994, 15, 135–152. [Google Scholar] [CrossRef]

- Krause, D.R. The antecedents of buying firms’ efforts to improve suppliers. J. Oper. Manag. 1999, 17, 205–224. [Google Scholar] [CrossRef]

- Hemmert, M.; Meyer-Ohle, H. Outward globalization and collaboration in Asia: Revisiting the global business landscape. Asian Bus. Manag. 2014, 13, 191–195. [Google Scholar] [CrossRef]

- Sako, M.; Helper, S. Determinants of trust in supplier relations: Evidence from the automotive industry in Japan and the United States. J. Econ. Behav. Organ. 1998, 34, 387–417. [Google Scholar] [CrossRef]

- Fjeldstad, Ø.; Snow, C.; Miles, R.; Lettl, C. The architecture of collaboration. Strateg. Manag. J. 2012, 33, 734–750. [Google Scholar] [CrossRef]

- Lee, K.; Go, D.; Park, I.; Yoon, B. Exploring Suitable Technology for Small and Medium-Sized Enterprises (SMEs) Based on a Hidden Markov Model Using Patent Information and Value Chain Analysis. Sustainability 2017, 9, 1100. [Google Scholar] [CrossRef]

- Monczka, R.M.; Petersen, K.J.; Handfield, R.B.; Ragatz, G.L. Success Factors in Strategic Supplier Alliances: The Buying Company Perspective. Decis. Sci. 1998, 29, 553–577. [Google Scholar] [CrossRef]

- Cooper, M.C.; Lambert, D.M.; Pagh, J.D. Supply chain management: More than a new name for logistics. Int. J. Logist. Manag. 1997, 8, 1–14. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.S. Partner analysis and alliance performance. Scand. J. Manag. 2003, 19, 279–308. [Google Scholar] [CrossRef]

- Gray, B.; Stites, J.P. Sustainability through Partnerships. Capitalizing on Collaboration; Case Study; Network for Business Sustainability: London, ON, Canada, 2013. [Google Scholar]

- Durst, S.; Ståhle, P. Success Factors of Open Innovation-A Literature Review. Int. J. Bus. Res. Manag. 2013, 4, 111–131. [Google Scholar]

- Tranekjer, T.L.; Knudsen, M.P. The (Unknown) Providers to Other Firms’ New Product Development: What’s in it for them? J. Prod. Innov. Manag. 2012, 29, 986–999. [Google Scholar] [CrossRef]

- Un, C.A.; Cuervo-Cazurra, L.; Asakawa, K. R & D Collaborations and Product Innovation. J. Prod. Innov. Manag. 2010, 27, 673–689. [Google Scholar]

- Sieg, J.H.; Wallin, M.W.; Von Krogh, G. Managerial challenges in open innovation: A study of innovation intermediation in the chemical industry. R D Manag. 2010, 40, 281–291. [Google Scholar] [CrossRef]

- Brouthers, K.D.; Brouthers, L.E.; Wilkinson, T.J. Strategic alliances: Choose your partners. Long Range Plan. 1995, 28, 2–25. [Google Scholar] [CrossRef]

- Van de Vrande, V.; De Jong, J.P.; Vanhaverbeke, W.; De Rochemont, M. Open innovation in SMEs: Trends, motives and management challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef]

- Feller, J.; Finnegan, P.; Nilsson, O. Open innovation and public administration: Transformational typologies and business model impacts. Eur. J. Inf. Syst. 2011, 20, 358–374. [Google Scholar] [CrossRef]

- Buse, K.; Harmer, A.M. Seven habits of highly effective global public–private health partnerships: Practice and potential. Soc. Sci. Med. 2007, 64, 259–271. [Google Scholar] [CrossRef] [PubMed]

- Feller, J.; Finnegan, P.; Hayes, J.; O’Reilly, P. Institutionalising information asymmetry: Governance structures for open innovation. Inf. Technol. People 2009, 22, 297–316. [Google Scholar] [CrossRef]

- Sherer, S.A. Critical success factors for manufacturing networks as perceived by network coordinators. J. Small Bus. Manag. 2003, 41, 325–345. [Google Scholar] [CrossRef]

- Wahab, S.A.; Rose, R.C.; Jegak, U.; Abdullah, H. Effects of inter-firm technology transfer characteristics on degree of inter-firm technology transfer in international joint ventures. Eur. J. Sci. Res. 2009, 35, 474–491. [Google Scholar]

- Buganza, T.; Chiaroni, D.; Colombo, G.; Frattini, F. Organisational implications of open innovation: An analysis of inter-industry patterns. Int. J. Innov. Manag. 2011, 15, 423–455. [Google Scholar] [CrossRef]

- Bogers, M. The open innovation paradox: Knowledge sharing and protection in R & D collaborations. Eur. J. Innov. Manag. 2011, 14, 93–117. [Google Scholar]

- Saxton, T. The effects of partner and relationship characteristics on alliance outcomes. Acad. Manag. J. 1997, 40, 443–461. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Outbound open innovation and its effect on firm performance: Examining environmental influences. R D Manag. 2009, 39, 317–330. [Google Scholar] [CrossRef]

- Westergren, U.H. Opening up innovation: The impact of contextual factors on the co-creation of IT-enabled value adding services within the manufacturing industry. Inf. Syst. E Bus. Manag. 2011, 9, 223–245. [Google Scholar] [CrossRef]

- Colombo, G.; Dell’Era, C.; Frattini, F. New product development (NPD) service suppliers in open innovation practices: Processes and organization for knowledge exchange and integration. Int. J. Innov. Manag. 2011, 15, 165–204. [Google Scholar] [CrossRef]

- Østergaard, C.R.; Timmermans, B.; Kristinsson, K. Does a different view create something new? The effect of employee diversity on innovation. Res. Policy 2011, 40, 500–509. [Google Scholar] [CrossRef]

- Bullinger, A.C.; Rass, M.; Adamczyk, S.; Moeslein, K.M.; Sohn, S. Open innovation in health care: Analysis of an open health platform. Health Policy 2012, 105, 165–175. [Google Scholar] [CrossRef] [PubMed]

- Nakagaki, P.; Aber, J.; Fetterhoff, T. The challenges in implementing open innovation in a global innovation-driven corporation. Res.-Tech. Manag. 2012, 55, 32–38. [Google Scholar] [CrossRef]

- Whelan, E.; Parise, S.; De Valk, J.; Aalbers, R. Creating employee networks that deliver open innovation. MIT Sloan Manag. Rev. 2011, 53, 37–44. [Google Scholar]

- Muller, A.; Hutchins, N. Open innovation helps Whirlpool Corporation discover new market opportunities. Strateg. Leadersh. 2012, 40, 36–42. [Google Scholar] [CrossRef]

- Ahn, G.; Park, Y.; Hur, S. Probabilistic Graphical Framework for Estimating Collaboration Levels in Cloud Manufacturing. Sustainability 2017, 9, 277. [Google Scholar] [CrossRef]

- Kim, S.H.; Kim, J.H. Success Factors of Inter-Firm Collaboration: Moderated Effects of Contextual Factors. Korean Acad. Assoc. Bus. 2007, 20, 913–937. [Google Scholar]

- Spithoven, A.; Clarysse, B.; Knockaert, M. Building absorptive capacity to organise inbound open innovation in traditional industries. Technovation 2011, 31, 10–21. [Google Scholar] [CrossRef]

- Howard, M.; Steensma, H.; Lyles, M.; Danaraj, C. Learning to collaborate through collaboration: How allying with expert firms influences collaborative innovation within novice firms. Strateg. Manag. J. 2016, 37, 2092–2103. [Google Scholar] [CrossRef]

- Nieto, M.J.; Santamaría, L. Technological Collaboration: Bridging the Innovation Gap between Small and Large Firms. J. Small Bus. Manag. 2010, 48, 44–69. [Google Scholar] [CrossRef]

- Nielsen, B.B. Determining international strategic alliance performance: A multidimensional approach. Int. Bus. Rev. 2007, 16, 337–361. [Google Scholar] [CrossRef]

- Möller, K.; Rajala, A. Rise of strategic nets—New modes of value creation. Ind. Mark. Manag. 2007, 36, 895–908. [Google Scholar] [CrossRef]

- Nieto, M.J.; Santamaría, L. The importance of diverse collaborative networks for the novelty of product innovation. Technovation 2007, 27, 367–377. [Google Scholar] [CrossRef]

- Lakemond, N.; Berggren, C. Co locating NPD? The need for combining project focus and organizational integration. Technovation 2006, 26, 807–819. [Google Scholar] [CrossRef]

- Kang, U.S. A Study on a Growth Model for IT Service Companies in Korea. Ph.D. Thesis, Kookmin University, Seoul, Korea, 15 February 2010. [Google Scholar]

- Keck, K.L.; Leigh, T.W.; Lollar, J.G. Critical success factors in captive, multi-line insurance agency sales. J. Pers. Sell. Sales Manag. 1995, 15, 17–33. [Google Scholar]

- Ha, S.H.; Liu, L.T. Critical Success Factors of Open Markets on the Internet in Terms of Buyers. In Software Services for E-World; Springer: Berlin/Heidelberg, Germany, 2010; pp. 282–291. [Google Scholar]

- Gu, Y.H. A Strategy for Overseas Expansion of System Integration Business in IT Service Industry: A Case of R & D Project for the Overseas Implementation of Finance Solution. Master’s Thesis, Korea University, Seoul, Korea, 15 February 2013. [Google Scholar]

- Oh, C.R. A Study on Cooperative Model for Oversee Market in IT Service Industry. Master’s Thesis, Korea University, Seoul, Korea, 15 February 2007. [Google Scholar]

- Nunally, J.C.; Bernstein, I.H. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).