Green Process Innovation and Innovation Benefit: The Mediating Effect of Firm Image

Abstract

1. Introduction

2. Literature and Hypotheses

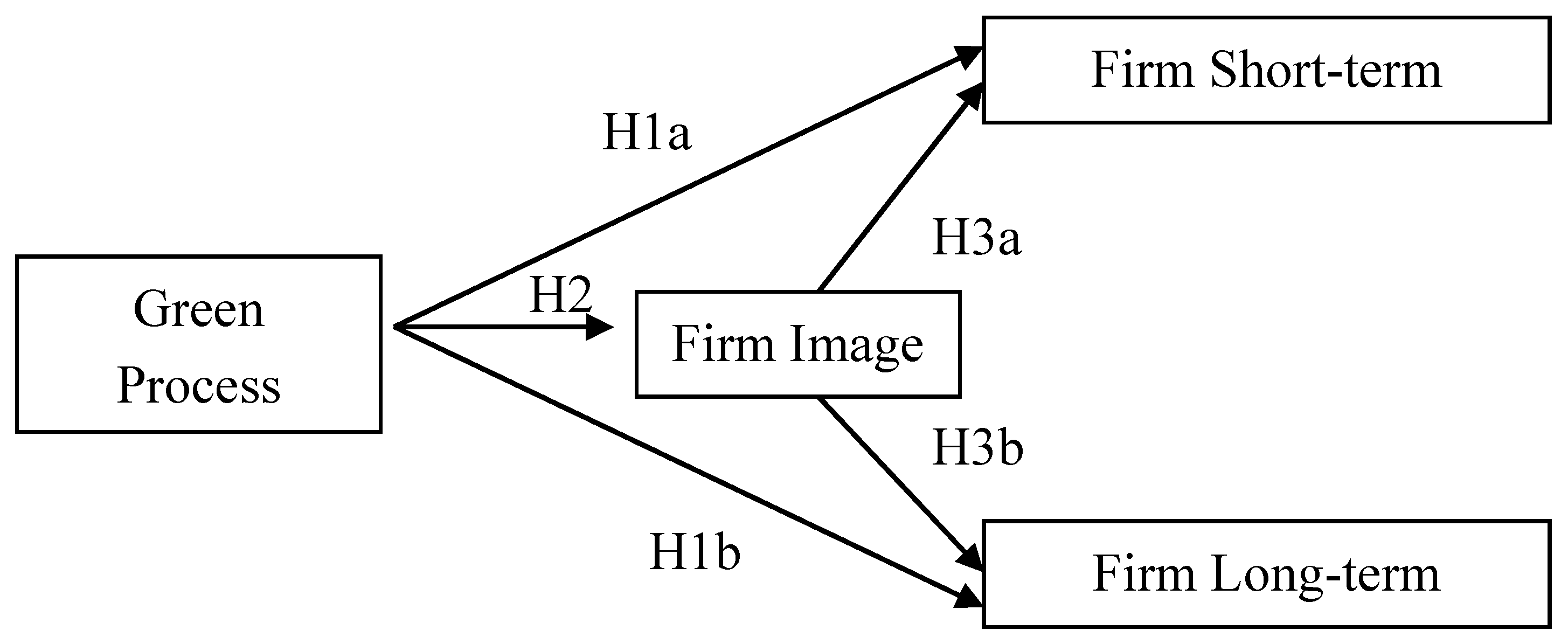

2.1. Green Process Innovation and Firm Benefit

2.2. Green Process Innovation’s Direct Effect on Firm’s Benefit

2.3. Green Process Innovation and Firm Image

2.4. Firm Image and Firm Benefit

3. Methodology and Measurement

3.1. Choice of Industry

3.2. Data Collection and Sample

3.3. Measurement of Variables

3.4. Measurement Properties

4. Empirical Results

4.1. Correlation Analysis Results

4.2. Regression Results

4.3. Discussions

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Variables | Items (Relative to Your Major Competitors, Please Evaluate How Well or Poorly Your Firm Has Done during the Past 3 Years) |

|---|---|

| Green process innovation | The emission of hazardous substances is reduced in the mining process (GPI1). |

| The energy efficiency is increased in the mining process (GPI2). | |

| The material efficiency is increased in the mining process (GPI3). | |

| The wastes are treated and re-used in the mining process (GPI4). | |

| Firm image | The firm communicates with the public about its environmental concern and achievement (FI1). |

| The community is not familiar with the firm (FI2, reverse question) | |

| The firm concerns for users about environmental management (FI3). | |

| The reputation of the firm in the community is good (FI4). | |

| Short-term benefit | The mining cost is reduced (FB1). |

| The environmental penalty is reduced (FB2). | |

| Our product sells a lot (FB3). | |

| Long-term benefit | The relationship between government and the firm is good (FB4). |

| The firm can attract more competent employees (FB5). | |

| The firm has influential power in the industry (FB6). |

References

- Marchi, V. Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Res. Policy 2012, 41, 614–623. [Google Scholar]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L. Necessity as the mother of green inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Shrivastava, P. Environmental technologies and competitive advantage. Strateg. Manag. J. 1995, 16, 183–200. [Google Scholar] [CrossRef]

- Chen, Y. The driver of green innovation and green image: Green core competence. J. Bus. Ethics 2008, 81, 531–543. [Google Scholar] [CrossRef]

- Qi, G.; Zeng, S.; Tam, C.; Yin, H.; Zou, H. Stakeholers’ influences on corporate green innovation strategy: A case study of manufacruting firms in China. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 1–14. [Google Scholar]

- Amores-Salvadó, J.; Castro, M.; Navas-lópez, J. Green corporate image: Moderating the connection between environmental product innovation and firm performance. J. Clean. Prod. 2014, 83, 356–365. [Google Scholar] [CrossRef]

- Lee, K.H.; Kim, J.W. Integrating suppliers into green product innovation development: An empirical case study in the semiconductor industry. Bus. Strateg. Environ. 2011, 20, 527–538. [Google Scholar] [CrossRef]

- Lin, R.J.; Tan, K.H.; Geng, Y. Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 2013, 40, 101–107. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D.; Pontrandolfo, P. Green Product Innovation in Manufacturing Firms: A Sustainability-Oriented Dynamic Capability Perspective. Bus. Strateg. Environ. 2017, 26, 490–506. [Google Scholar] [CrossRef]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar] [CrossRef]

- Voss, G.B.; Sirdeshmukh, D.; Voss, Z.G. The effects of slack resources and environmental threat on product exploration and exploitation. Acad. Manag. J. 2008, 51, 147–164. [Google Scholar] [CrossRef]

- Hart, S. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar]

- Jaggi, B.; Freedman, M. An examination of the impact of pollution performance on economic and market performance: Pulp and paper firms. J. Bus. Financ. Account. 1992, 19, 697–713. [Google Scholar] [CrossRef]

- Mantovani, A. Complementarity between product and process innovation in a monopoly setting. Econ. Innov. New Technol. 2006, 15, 219–234. [Google Scholar] [CrossRef]

- Weng, H.H.R.; Chen, J.S.; Chen, P.C. Effects of green innovation on environmental and corporate performance: A stakeholder perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef]

- Salzmanna, O.; Ionescu-somersa, A.; Stegera, U. The business case for corporate sustainability: Literature review and research options. Eur. Manag. J. 2005, 23, 27–36. [Google Scholar] [CrossRef]

- Walker, K.; Wan, F. The harm of symbolic actions and green-washing: Corporate actions and communications on environmental performance and their financial implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pontrandolfo, P. Being “green and competitive”: The impact of environmental actions and collaborations on firm performance. Bus. Strateg. Environ. 2015, 24, 413–430. [Google Scholar] [CrossRef]

- Lanoie, P.; Laurent-Lucchetti, J. Environmental policy, innovation and performance: New insights on the porter hypothesis. J. Econ. Manag. Strategy 2011, 20, 803–842. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, I.; Molina-Azorin, J. ISO 14001 certification and financial performance: Selection-effect versus treatment-effect. J. Clean. Prod. 2011, 19, 1–12. [Google Scholar] [CrossRef]

- Rexhäuser, S.; Rammer, C. Environmental innovations and firm profitability: Unmasking the Porter hypothesis. Environ. Resour. Econ. 2014, 57, 145–167. [Google Scholar] [CrossRef]

- Aragon-Correa, J.; Sharma, S. A contingent resource-based view of proactive corporate environmental strategy. Acad. Manag. Rev. 2003, 28, 71–89. [Google Scholar]

- Sharma, S.; Henriques, I. Stakeholder influences on sustainability practices in the Canadian forest products industry. Strateg. Manag. J. 2005, 26, 159–180. [Google Scholar] [CrossRef]

- Wagner, M. The role of corporate sustainability performance for economic performance: A firm level analysis of moderation effects. Ecol. Econ. 2010, 69, 1553–1560. [Google Scholar] [CrossRef]

- Teece, D. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Wang, Z.; Feng, C.A. Performance evaluation of the energy, environmental, and economic efficiency and productivity in China: An application of global data envelopment analysis. Appl. Energy 2015, 147, 617–626. [Google Scholar] [CrossRef]

- Warhurst, A.; Bridge, G. Improving environmental performance through innovation: Recent trends in the mining industry. Miner. Eng. 1996, 9, 907–921. [Google Scholar] [CrossRef]

- Marquis, C.; Zhang, J.J.; Zhou, Y.H. Regulatory uncertainty and corporate responses to environmental protection in China. Calif. Manag. Rev. 2012, 55, 39–63. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, B.; Zeng, H. The effect of environmental regulation on external trade: Empirical evidences from Chinese economy. J. Clean. Prod. 2016, 114, 55–61. [Google Scholar] [CrossRef]

- Cao, L.; Qi, Z.; Ren, J. China’s industrial total-factor energy productivity growth at sub-industry level: A two-step stochastic metafrontier malmquist index approach. Sustainability 2017, 9, 1384. [Google Scholar] [CrossRef]

- Sokolov, T.; Smirnov, A.; Yu, G. Resource-saving technology for underground mining of high-value quartz in Kyshtym. J. Min. Sci. 2015, 51, 1191–1202. [Google Scholar] [CrossRef]

- Cainelli, G.; Maichi, V.; Grandinetti, R. Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. J. Clean. Prod. 2015, 94, 211–220. [Google Scholar] [CrossRef]

- Nishitani, K. An empirical analysis of the effects on firm’s economic performance of implementing environmental management system. Environ. Resour. Econ. 2011, 48, 569–586. [Google Scholar] [CrossRef]

- Wagner, M. The link of environmental and economic performance: Drivers and limitations of sustainability integration. J. Bus. Res. 2015, 68, 1306–1317. [Google Scholar] [CrossRef]

- Mitchell, R.; Agle, B.; Wood, D. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar]

- Ambec, S.; Lanoie, P. Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 2008, 22, 45–62. [Google Scholar]

- Richard, P.; Devinney, T.; Yip, G. Measuring organizational performance: Towards methodological best practice. J. Manag. 2009, 35, 718–804. [Google Scholar] [CrossRef]

- Miles, M.P.; Covin, J.G. Environmental marketing: A source of reputational, competitive, and financial advantage. J. Bus. Ethics 2000, 23, 299–311. [Google Scholar] [CrossRef]

- Lavie, D.; Lechner, C.; Singh, H. The performance implications of timing of entry and involvement in multipartner alliances. Acad. Manag. J. 2007, 50, 578–604. [Google Scholar] [CrossRef]

- Razan, L.; Ithai, S.; Edward, Z. When do firms change technology-sourcing vehicles? The role of poor innovative performance and financial slack. Strateg. Manag. J. 2016, 37, 855–869. [Google Scholar]

- Steensma, H.; Tihanyi, L.; Lyles, M. The evolving value of foreign partnerships in transitioning economies. Acad. Manag. J. 2005, 48, 213–235. [Google Scholar] [CrossRef]

- Gaur, A.; Mukherjee, D.; Gaur, S.; Schmid, F. Environmental and firm level influences on inter-organizational trust and SME performance. J. Manag. Stud. 2011, 48, 1752–1781. [Google Scholar] [CrossRef]

- Labuschagne, C.; Brent, A.C.; van Erck, G. Assessing the sustainability performances of industries. J. Clean. Prod. 2005, 13, 373–385. [Google Scholar] [CrossRef]

- Porter, M.; van der Linde, C. Toward a new conception of the environmental -competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Darnall, N. Regulatory stringency, green production offsets, and organization’s financial performance. Public Admin. Rev. 2009, 69, 418–434. [Google Scholar] [CrossRef]

- Wolf, J. The relationship between sustainable supply chain management, stakeholder pressure and corporate sustainability. J. Bus. Ethics 2014, 119, 317–328. [Google Scholar] [CrossRef]

- Barla, P. ISO14001 certification and environmental performance in Quebec’s pulp and paper industy. J. Environ. Econ. Manag. 2007, 53, 291–306. [Google Scholar] [CrossRef]

- Nehrt, C. Timing and intensity of environmental investments. Strateg. Manag. J. 1996, 17, 535–547. [Google Scholar] [CrossRef]

- Cappelli, P.; Keller, J. Classifying work in the new economy. Acad. Manag. Rev. 2013, 38, 575–596. [Google Scholar] [CrossRef]

- Li, Y.; Peng, M.W.; Macaulay, C.D. Market–political ambidexterity during institutional transitions. Strateg. Organ. 2013, 11, 205–213. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Cronin, J.; Smith, J.S.; Gleim, M. Green marketing strategies: An examination of stakeholders and the opportunities they present. J. Acad. Mark. Sci. 2011, 39, 158–174. [Google Scholar] [CrossRef]

- Cordano, M.; Frieze, I. Pollution reduction preferences of U.S. environmental managers: Applying Ajzen’s theory of planned behavior. Acad. Manag. J. 2000, 43, 627–641. [Google Scholar] [CrossRef]

- Gupta, A.; Briscoe, F.; Hambrick, D.C. Red, blue, and purple firms: Organizational political ideology and corporate social responsibility. Strateg. Manag. J. 2017, 38, 1018–1040. [Google Scholar] [CrossRef]

- Flammer, C.; Luo, J. Corporate social responsibility as an employee governance tool: Evidence from a quasi-experiment. Strateg. Manag. J. 2017, 38, 163–183. [Google Scholar] [CrossRef]

- Barney, J.B.; Ketchen, D.J.; Wright, M. The future of resource-based theory: Revitalization or decline? J. Manag. 2011, 37, 1299–1315. [Google Scholar] [CrossRef]

- Wan, H.; Schell, R. Reassessing corporate image: An examination of how image bridegs symbolic relationships with behavioral relationships. J. Public Relat. Res. 2007, 19, 25–45. [Google Scholar]

- Konar, S.; Cohen, M. Does the market value environmental performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C.; Rennings, K. Determinants of eco-innovation by types of environmental impact—The role of regulatory push/pull, technology push or market pull. Ecol. Econ. 2012, 78, 112–122. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- Inoue, E.; Arimura, T.; Nakano, M. A new insight into environmental innovation: Does the maturity of environmental management systems matter? Ecol. Econ. 2013, 94, 156–163. [Google Scholar] [CrossRef]

- Grilovich, T.; Griffin, D.; Kahneman, D. Heuristics and Biases: The Psychology of Intuitive Judgment; Cambridge University Press: New York, NY, USA, 2002. [Google Scholar]

- Wall, T.; Michie, J.; Patterson, M. On the validity of subjective measures of company performance. Pers. Psychol. 2004, 57, 95–118. [Google Scholar] [CrossRef]

- Winter, S. Mistaken perceptions: Cases and consequences. Br. J. Manag. 2003, 14, 39–44. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Gonzalez-Benito, J. Environmental proactivity and business performance: An empirical analysis. Omega 2005, 33, 1–15. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W. Multivariate Data Analysis, 5th ed.; Prentice Hall International: New York, NY, USA, 1998. [Google Scholar]

- Jacobson, R. The validity of ROI as a measure of business performance. Am. Econ. Rev. 1987, 77, 470–478. [Google Scholar]

- Baker, G.P.; Kennedy, R.E. Survivorship and the economic grim reaper. J. Law Econ. Organ. 2002, 18, 324–361. [Google Scholar] [CrossRef]

- Rosenzweig, P. Misunderstanding the nature of company performance: The halo effect and other business delusion. Calif. Manag. Rev. 2007, 49, 6–20. [Google Scholar] [CrossRef]

- Hamilton, B.; Nickerson, J. Correcting for endogeneity in strategic management research. Strateg. Organ. 2003, 1, 51–78. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- James, L.R.; Brett, J.M. Mediators, moderators, and tests for mediation. J. Appl. Psychol. 1984, 69, 307. [Google Scholar] [CrossRef]

- Delmas, M.A.; Toffel, M.W. Organizational responses to environmental demands: Opening the black box. Strateg. Manag. J. 2008, 29, 1027–1055. [Google Scholar] [CrossRef]

- Kassinis, G.; Vafeas, N. Stakeholder pressures and environmental performance. Acad. Manag. J. 2006, 49, 145–159. [Google Scholar] [CrossRef]

- Hojnik, J.; Ruzzier, M. What drives eco-innovation? A review of an emerging literature. Environ. Innov. Soc. Transit. 2016, 19, 31–41. [Google Scholar] [CrossRef]

| Items | Components | |||

|---|---|---|---|---|

| GPI | FI | Short-Term | Long-Term | |

| GPI1 | 0.760 | |||

| GPI2 | 0.767 | |||

| GPI3 | 0.778 | |||

| GPI4 | 0.716 | |||

| FI1 | 0.746 | |||

| FI2 | 0.782 | |||

| FI3 | 0.693 | |||

| FI4 | 0.812 | |||

| FB1 | 0.849 | |||

| FB2 | 0.890 | |||

| FB3 | 0.795 | |||

| FB4 | 0.727 | |||

| FB5 | 0.887 | |||

| FB6 | 0.676 | |||

| KMO | 0.715 | 0.635 | 0.733 | |

| % Explained variance | 69.797 | 60.812 | 17.914 | 56.972 |

| % Accumulated variance | 17.914 | 74.886 | ||

| Cronbach’s | 0.863 | 0.895 | 0.881 | |

| Mean | Standard Deviation | Green Process Innovation | Firm Image | Short-Term Benefit | Long-Term Benefit | |

|---|---|---|---|---|---|---|

| Green process innovation | 3.8443 | 0.6098 | 1.000 | |||

| Firm image | 3.2847 | 0.7760 | 0.234 *** | 1.000 | ||

| Short-term benefit | 3.7713 | 0.7091 | 0.240 ** | 0.373 *** | 1.000 | |

| Long-term benefit | 3.5109 | 0.7462 | 0.510 ** | 0.585 *** | 0.581 *** | 1.000 |

| Short-Term Benefit | Long-Term Benefit | FI | ||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 6 | Model 5 | |

| Firm size | 0.386 *** | 0.330 *** | 0.208 *** | 0.325 ** | 0.097 | 0.252 *** |

| Firm age | 0.188 ** | 0.193 ** | 0.142 | 0.232 *** | 0.213 *** | 0.122 ** |

| Firm owner | 0.476 *** | 0.435 *** | 0.349 *** | 0.332 *** | 0.256 *** | 0.253 ** |

| Resource reservation | 0.149 * | 0.083 | 0.160 ** | 0.013 | 0.009 | 0.216 *** |

| Green process Innovation (GPI) | 0.018 | 0.378 *** | 0.216 *** | 0.215 *** | ||

| Firm image (FI) | 0.185 | 0.203 *** | 0.273 *** | |||

| R2 | 0.319 | 0.341 | 0.445 | 0.332 | 0.549 | 0.348 |

| F | 10.128 *** | 11.190 *** | 17.353 *** | 16.459 *** | 22.452 *** | 11.578 *** |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, Y.; Hou, G.; Xin, B. Green Process Innovation and Innovation Benefit: The Mediating Effect of Firm Image. Sustainability 2017, 9, 1778. https://doi.org/10.3390/su9101778

Ma Y, Hou G, Xin B. Green Process Innovation and Innovation Benefit: The Mediating Effect of Firm Image. Sustainability. 2017; 9(10):1778. https://doi.org/10.3390/su9101778

Chicago/Turabian StyleMa, Yuan, Guisheng Hou, and Baogui Xin. 2017. "Green Process Innovation and Innovation Benefit: The Mediating Effect of Firm Image" Sustainability 9, no. 10: 1778. https://doi.org/10.3390/su9101778

APA StyleMa, Y., Hou, G., & Xin, B. (2017). Green Process Innovation and Innovation Benefit: The Mediating Effect of Firm Image. Sustainability, 9(10), 1778. https://doi.org/10.3390/su9101778