Does Intellectual Capital Disclosure Matter for Audit Risk? Evidence from the UK and Italy

Abstract

:1. Introduction

2. Literature Review

2.1. Disclosure Theory and Non-Financial Voluntary Disclosures

2.2. Intellectual Capital Disclosure

2.3. Audit Risk

2.4. Audit Fees

2.5. The Relationship Between Intellectual Capital Disclosure, Audit Risk and Audit Fees

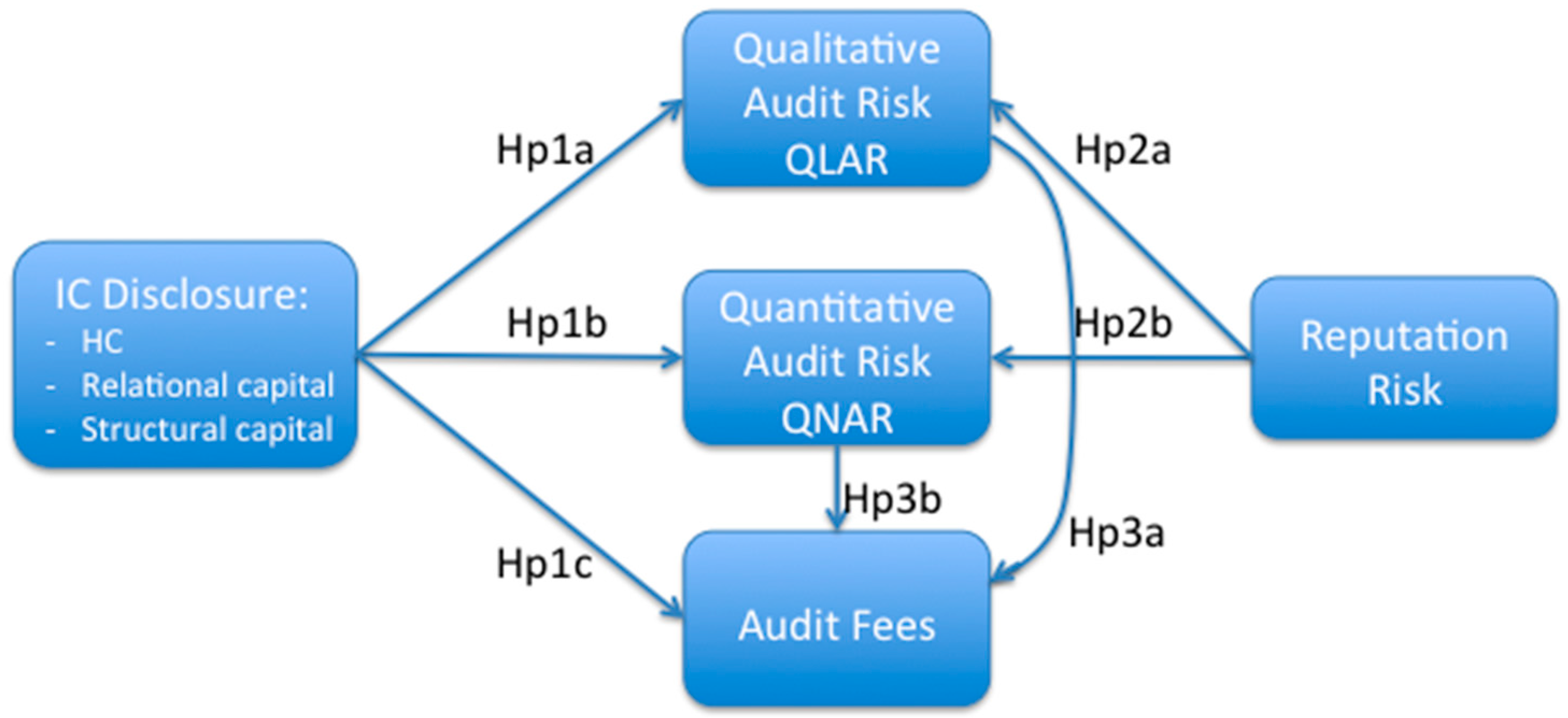

3. Hypotheses and Research Questions

4. Sample and Methodology

4.1. Sample Definition and Data Collection

4.2. Empirical Models

5. Empirical Results

5.1. Effect of Intellectual Capital Disclosure on Qualitative Audit Risk

5.2. Effect of Intellectual Capital Disclosure on Quantitative Audit Risk

5.3. Effects of Intellectual Capital Disclosure on Audit Fees

5.4. Further Findings: Sub-Sample Analysis

6. Discussion

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Item | Factor Loading | Eigen Value | % of Variance | Cronbach’s Alpha |

|---|---|---|---|---|

| Qualitative Audit Risk | ||||

| Board Functions Audit Committee Independence | 0.937 | 3.429 | 68.585 | 0.865 |

| Board Functions Audit Committee Management Independence | 0.895 | 9.547 | ||

| Board Structure Experienced Board | 0.628 | 2.064 | ||

| Board Structure Independent Board Members | 0.740 | 5.137 | ||

| Corporate Governance Score | 0.899 | 14.667 | ||

| Quantitative Audit Risk | ||||

| Net sales or revenues | 0.781 | 17.720 | 0.770 | |

| Total assets | 0.885 | 2.518 | 62.957 | |

| Total shareholders’equity | 0.771 | 12.480 | ||

| Litigation expenses | 0.729 | 6.844 | ||

| Accruals | ||||

| Total inventories | 0.913 | 1.667 | 83.337 | 0.787 |

| Total receivables | 0.913 | 16.663 |

Appendix B

| TEST | Model 1 (y = QLAR) | Model 2 (y = QNAR) | Model 3 (y = Audit Fees) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | |

| Chi2 | 2.8 × 1032 | 34,923.930 | 408.74 | 5.2 × 1032 | 1.8 × 1032 | 25.560 | 2.3 × 1033 | 2.8 × 1031 | 25.590 |

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| TEST | Model 1 (y = QLAR) | Model 2 (y = QNAR) | Model 3 (y = Audit Fees) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | |

| chi2 | 653.962 | 2699.187 | 0.000 | 226.391 | 1502.766 | 80.619 | 761.327 | 0.000 | 788.058 |

| Pr | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| TEST | Model 1 (y = QLAR) | Model 2 (y = QNAR) | Model 3 (y = Audit Fees) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | |

| Pr(Skewness) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Pr(Kurtosis) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| TEST | Model 1 (y = QLAR) | Model 2 (y = QNAR) | Model 3 (y = Audit Fees) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | Synthetic | Extended | Pooled | |

| F | 216.027 | 176.145 | 216.027 | 22.793 | 22.272 | 216.027 | 23.081 | 22.967 | 23.070 |

| Prob > F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

References

- Beattie, V.; McInnes, W.; Fearnley, S. Through the Eyes of Management: Narrative Reporting across Three Sectors: Final Report; Centre for Business Performance: London, UK, 2004; p. 139. [Google Scholar]

- Holland, J. Fund management, intellectual capital, intangibles and private disclosure. Manag. Finance 2006, 32, 277–316. [Google Scholar] [CrossRef]

- Beattie, V.; Smith, S.J. Evaluating disclosure theory using the views of UK finance directors in the intellectual capital context. Account. Bus. Res. 2012, 42, 471–494. [Google Scholar] [CrossRef]

- Elliot, R.K.; Jacobson, P.D. Costs and benefits of business information. Account. Horiz. 1994, 8, 80–96. [Google Scholar]

- Guthrie, J.; Ricceri, F.; Dumay, J. Reflections and projections: A decade of intellectual capital accounting research. Br. Account. Rev. 2012, 44, 68–82. [Google Scholar] [CrossRef]

- Ball, R.; Jayaraman, S.; Shivakumar, L. Audited financial reporting and voluntary disclosure as complements: A test of the Confirmation Hypothesis. J. Account. Econ. 2012, 53, 136–166. [Google Scholar] [CrossRef]

- Chen, L.; Srinidhi, B.; Tsang, A.; Yu, W. Corporate Social Responsibility, Audit Fees, and Audit Opinions. Audit Fees Audit Opin. 2012. Available online: http://sa.shufe.edu.cn/upload/_info/2002000049/95384_1204050830422.docx (accessed on 29 May 2016). [Google Scholar]

- Graham, R.E.; Ahn, A.C.; Davis, R.B.; O’Connor, B.B.; Eisenberg, D.M.; Phillips, R.S. Use of complementary and alternative medical therapies among racial and ethnic minority adults: Results from the 2002 National Health Interview Survey. J. Natl. Med. Assoc. 2005, 97, 535–545. [Google Scholar] [PubMed]

- Verrecchia, R.E. Essays on disclosure. J. Account. Econ. 2001, 32, 97–180. [Google Scholar] [CrossRef]

- Bozzolan, S.; Favotto, F.; Ricceri, F. Italian annual intellectual capital disclosure: An empirical analysis. J. Intellect. Cap. 2003, 4, 543–558. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 2012, 86, 59–100. [Google Scholar] [CrossRef]

- Wallage, P. Assurance on sustainability reporting: An auditor’s view. Audit. J. Pract. Theory 2000, 19, 53–65. [Google Scholar] [CrossRef]

- Meek, G.K.; Roberts, C.B.; Gray, S.J. Factors Influencing Voluntary Annual Report Disclosures by U.S., U.K. and Continental European Multinational Corporations. J. Int. Bus. Stud. 1995, 26, 555–572. [Google Scholar] [CrossRef]

- Deumes, R.; Knechel, W.R. Economic incentives for voluntary reporting on internal risk management and control systems. Audit. J. Pract. Theory 2008, 27, 35–66. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. Green accounting: Reflections from a CSR and environmental disclosure perspective. Crit. Perspect. Account. 2013, 24, 443–447. [Google Scholar] [CrossRef]

- AIMR. AIMR Conference Proceedings, 1992. Available online: http://www.cfapubs.org/toc/cp.1/1992/2 (accessed on 25 May 2016).

- Rogers, R.K.; Grant, J. Content analysis of information cited in reports of sell-side financial analysts. J. Financial Statement Anal. 1997, 3, 17–30. [Google Scholar]

- Breton, G.; Taffler, R.J. Accounting information and analyst stock recommendation decisions: A content analysis approach. Acc. Bus. Res. 2001, 31, 91–101. [Google Scholar] [CrossRef]

- Bontis, N. Assessing knowledge assets: A review of the models used to measure intellectual capital. Int. J. Manag. Rev. 2001, 3, 41–60. [Google Scholar] [CrossRef]

- Nielsen, C.; Madsen, M.T. Discourses of transparency in the intellectual capital reporting debate: Moving from generic reporting models to management defined information. Crit. Perspect. Account. 2009, 20, 847–854. [Google Scholar] [CrossRef]

- Sveiby, K.E. The Intangible assets monitor. J. Hum. Resour. Costing Account. 1997, 2, 73–97. [Google Scholar] [CrossRef]

- Bontis, N. Intellectual capital disclosure in Canadian corporations. J. Hum. Resour. Costing Account. 2003, 7, 9–20. [Google Scholar] [CrossRef]

- Clarke, M.; Seng, D.; Whiting, R.H. Intellectual capital and firm performance in Australia. J. Intellect. Cap. 2011, 12, 505–530. [Google Scholar] [CrossRef]

- Brennan, N. Reporting intellectual capital in annual reports: Evidence from Ireland. Account. Audit. Account. J. 2001, 14, 423–436. [Google Scholar] [CrossRef]

- Vergauwen, P.G.; Van Alem, F.J. Annual report IC disclosures in the Netherlands, France and Germany. J. Intellect. Cap. 2005, 6, 89–104. [Google Scholar] [CrossRef]

- Ramírez-Córcoles, Y.; Manzaneque-Lizano, M. The relevance of intellectual capital disclosure: Empirical evidence from Spanish universities. Knowl. Manag. Res. Pract. 2015, 13, 31–44. [Google Scholar] [CrossRef]

- Yi, A.; Davey, H. Intellectual capital disclosure in Chinese (mainland) companies. J. Intellect. Cap. 2010, 11, 326–347. [Google Scholar] [CrossRef]

- Khan, H.-U.-Z.; Khan, R. Human capital disclosure practices of top Bangladeshi companies. J. Hum. Resour. Costing Account. 2010, 14, 329–349. [Google Scholar] [CrossRef]

- Abeysekera, I.; Guthrie, J. An empirical investigation of annual reporting trends of intellectual capital in Sri Lanka. Crit. Perspect. Account. 2005, 16, 151–163. [Google Scholar] [CrossRef]

- Wagiciengo, M.M.; Belal, A.R. Intellectual capital disclosures by South African companies: A longitudinal investigation. Adv. Account. 2012, 28, 111–119. [Google Scholar] [CrossRef]

- Petty, R.; Cuganesan, S. Voluntary disclosure of intellectual capital by Hong Kong companies: Examining size, industry and growth effects over time. Aust. Account Rev. 2005, 15, 40–50. [Google Scholar] [CrossRef]

- Dobre, E.; Stanila, G.O.; Brad, L. The Influence of Environmental and Social Performance on Financial Performance: Evidence from Romania’s Listed Entities. Sustainability 2015, 7, 2513–2553. [Google Scholar] [CrossRef]

- Brüggen, A.; Vergauwen, P.; Dao, M. Determinants of intellectual capital disclosure: Evidence from Australia. Manag. Decis. 2009, 47, 233–245. [Google Scholar] [CrossRef]

- Mangena, M.; Pike, R.H.; Li, J. Intellectual Capital Disclosure Practices and Effects on the Cost of Equity Capital: UK Evidence; Institute of Chartered Accountants of Scotland: Edinburgh, UK, 2010. [Google Scholar]

- Vafaei, A.; Taylor, D.; Ahmed, K. The value relevance of intellectual capital disclosures. J. Intellect. Cap. 2011, 12, 407–429. [Google Scholar] [CrossRef]

- Murthy, V.; Mouritsen, J. The performance of intellectual capital: Mobilising relationships between intellectual and financial capital in a bank. Account. Audit. Account. J. 2011, 24, 622–646. [Google Scholar] [CrossRef]

- Catasús, B.; Gröjer, J.-E. Indicators: On visualizing, classifying and dramatizing. J. Intellect. Cap. 2006, 7, 187–203. [Google Scholar] [CrossRef]

- Armitage, S.; Marston, C. Corporate Disclosure and the Cost of Capital: The Views of Finance Directors [Internet]. ICAEW Centre for Business Performance London, 2007. Available online: https://www.icaew.com/~/media/Files/Technical/Research-and-academics/publications-and-projects/financial-reporting-publications/briefing-corporate-disclosure-and-the-cost-of-capital.pdf (accessed on 29 May 2016).

- Dusenbury, R.B.; Reimers, J.L.; Wheeler, S.W. The audit risk model: An empirical test for conditional dependencies among assessed component risks. Audit. J. Pract. Theory 2000, 19, 105–117. [Google Scholar] [CrossRef]

- American Institute of Certified Public Accountants (AICPA). Consideration of Fraud in a Financial Statement Audit, 2002. Available online: https://pcaobus.org/Standards/Auditing/pages/au316.aspx (accessed on 25 May 2016).

- Fukukawa, H.; Mock, T.J. Audit risk assessments using belief versus probability. Audit. J. Pract. Theory 2011, 30, 75–99. [Google Scholar] [CrossRef]

- Budescu, D.V.; Peecher, M.E.; Solomon, I. The joint influence of the extent and nature of audit evidence, materiality thresholds, and misstatement type on achieved audit risk. Audit. J. Pract. Theory 2012, 31, 19–41. [Google Scholar] [CrossRef]

- Contessotto, C.; Moroney, R. The association between audit committee effectiveness and audit risk. Account. Finance 2014, 54, 393–418. [Google Scholar] [CrossRef]

- Botez, D. Study Regarding the Need to Develop an Audit Risk Model. Audit Financiar 2015, 13, 69–74. [Google Scholar]

- Shibano, T. Assessing audit risk from errors and irregularities. J. Account. Res. 1990, 28, 110–140. [Google Scholar] [CrossRef]

- Strawser, J.R. Examination of the Effect of Risk Model Components on Perceived Audit Risk; American Accounting Associate: Sarasota, FL, USA, 1991; Volume 10, pp. 126–135. [Google Scholar]

- Matarneh, G.F.A. The Commitment of Jordanian Auditors to Assess Audit Risks. Int. J. Bus. Manag. 2011, 6, 267. [Google Scholar] [CrossRef]

- Bell, T.B.; Landsman, W.R.; Shackelford, D.A. Auditors’ perceived business risk and audit fees: Analysis and evidence. J. Account. Res. 2001, 39, 35–43. [Google Scholar] [CrossRef]

- Stanley, J.D. Is the audit fee disclosure a leading indicator of clients’ business risk? Audit. J. Pract. Theory 2011, 30, 157–179. [Google Scholar] [CrossRef]

- Bedard, J.C.; Johnstone, K.M. Earnings manipulation risk, corporate governance risk, and auditors’ planning and pricing decisions. Account. Rev. 2004, 79, 277–304. [Google Scholar] [CrossRef]

- Hogan, C.E.; Martin, R.D. Risk shifts in the market for audits: An examination of changes in risk for “second tier” audit firms. Audit. J. Pract. Theory 2009, 28, 93–118. [Google Scholar] [CrossRef]

- Pratt, J.; Stice, J.D. The effects of client characteristics on auditor litigation risk judgments, required audit evidence, and recommended audit fees. Account. Rev. 1994, 69, 639–656. [Google Scholar]

- Heltzer, W.; Shelton, S.W. Book-Tax Differences and Audit Risk: Evidence from the United States. J. Account. Ethics Public Policy 2015, 16, 691–733. [Google Scholar]

- Maletta, M.J.; Kida, T. The effect of risk factors on auditors’ configural information processing. Account. Rev. 1993, 68, 681–691. [Google Scholar]

- Mock, T.J.; Wright, A. An exploratory study of auditors’ evidential planning judgments. Auditing 1993, 12, 39. Available online: http://search.proquest.com/openview/276b13f5c276dc60b9b1c4096a3f6f36/1?pq-origsite=gscholar&cbl=31718 (accessed on 25 May 2016). [Google Scholar]

- Arens, A.A.; Best, P.; Shailer, G.; Fiedler, B.; Elder, R.J.; Beasley, M. Auditing and Assurance Services in Australia: An Integrated Approach. Available online: http://eprints.usq.edu.au/18601 (accessed on 24 May 2016).

- Cohen, J.; Krishnamoorthy, G.; Wright, A. Corporate Governance in the Post-Sarbanes-Oxley Era: Auditors’ Experiences. Contemp. Account. Res. 2010, 27, 751–786. [Google Scholar] [CrossRef]

- Ruhnke, K.; Schmidt, M. The audit expectation gap: Existence, causes, and the impact of changes. Account. Bus. Res. 2014, 44, 572–601. [Google Scholar] [CrossRef]

- Simunic, D.A. The pricing of audit services: Theory and evidence. J. Account. Res. 1980, 18, 161–190. [Google Scholar] [CrossRef]

- Hay, D.C.; Knechel, W.R.; Wong, N. Audit Fees: A Meta-analysis of the Effect of Supply and Demand Attributes. Contemp. Acc. Res. 2006, 23, 141–191. [Google Scholar] [CrossRef]

- Han, S.; Rezaee, Z.; Xue, L.; Zhang, J.H. The Association between Information Technology Investments and Audit Risk. J. Inf. Syst. 2016, 30, 93–116. [Google Scholar] [CrossRef]

- Mock, T.J.; Wright, A.M. Are audit program plans risk-adjusted? Audit. J. Pract. Theory 1999, 18, 55–74. [Google Scholar] [CrossRef]

- Jiang, W.; Son, M. Do Audit Fees Reflect Risk Premiums for Control Risk? J. Account. Audit. Finance 2015, 30, 318–340. [Google Scholar] [CrossRef]

- Hogan, C.E.; Wilkins, M.S. Evidence on the Audit Risk Model: Do Auditors Increase Audit Fees in the Presence of Internal Control Deficiencies? Contemp. Account. Res. 2008, 25, 219–242. [Google Scholar] [CrossRef]

- Houston, R.W.; Peters, M.F.; Pratt, J.H. The audit risk model, business risk and audit-planning decisions. Account. Rev. 1999, 74, 281–298. [Google Scholar] [CrossRef]

- Public Company Accounting Oversight Board (PCAOB). An Audit of Internal Control over Financial Reporting that Is Integrated with an Audit of Financial Statements. Available online: https://pcaobus.org/Standards/Auditing/pages/auditing_standard_5.aspx (accessed on 25 May 2016).

- Krishnan, G.V.; Pevzner, M.; Sengupta, P. How do auditors view managers’ voluntary disclosure strategy? The effect of earnings guidance on audit fees. J. Account. Public Policy 2012, 31, 492–515. [Google Scholar] [CrossRef]

- Zhanxia, W.; Jie, Z.; Mengqi, L. An Empirical Study of Relationship between the Intellectual Capital and Audit Results: Based on Statistics of Domestic Accounting Firms in 2010. In Proceedings of the 2011 International Conference on Business Computing and Global Informatization, Shanghai, China, 29–31 July 2011.

- Coram, P.J.; Monroe, G.S.; Woodliff, D.R. The value of assurance on voluntary nonfinancial disclosure: An experimental evaluation. Audit. J. Pract. Theory 2009, 28, 137–151. [Google Scholar] [CrossRef]

- Orlitzky, M.; Benjamin, J.D. Corporate social performance and firm risk: A meta-analytic review. Bus. Soc. 2001, 40, 369–396. [Google Scholar] [CrossRef]

- Fombrun, C. Reputation: Realizing Value from the Corporate Image; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Scandizzo, S. A framework for the analysis of reputation risk. J. Oper. Risk 2011, 6, 41–63. [Google Scholar] [CrossRef]

- Ball, R.; Kothari, S.P.; Robin, A. The effect of international institutional factors on properties of accounting earnings. J Account. Econ. 2000, 29, 1–51. [Google Scholar] [CrossRef]

- Hope, O.-K. Disclosure practices, enforcement of accounting standards, and analysts’ forecast accuracy: An international study. J Account. Res. 2003, 41, 235–272. [Google Scholar] [CrossRef]

- García-Meca, E.; Martínez, I. The use of intellectual capital information in investment decisions: An empirical study using analyst reports. Int. J. Account. 2007, 42, 57–81. [Google Scholar] [CrossRef]

- Brown, T.A. Confirmatory Factor Analysis for Applied Research; Guilford Publications: New York, NY, USA, 2015. [Google Scholar]

- Dawson, J.F.; Richter, A.W. Probing three-way interactions in moderated multiple regression: Development and application of a slope difference test. J. Appl. Psychol. 2006, 91, 917–926. [Google Scholar] [CrossRef] [PubMed]

- Cohen, J.; Cohen, P.; West, S.G.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences; Routledge: London, UK, 2013. [Google Scholar]

- Hausman, J.A. Specification tests in econometrics. Econ. J. Econ. Soc. 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Watson, A.; Shrives, P.; Marston, C. Voluntary disclosure of accounting ratios in the UK. Br. Account. Rev. 2002, 34, 289–313. [Google Scholar] [CrossRef]

- Pena, I. Intellectual capital and business start-up success. J. Intellect. Cap. 2002, 3, 180–198. [Google Scholar] [CrossRef]

- Deegan, C.M.; Samkin, G. New Zealand Financial Accounting; McGraw-Hill Higher Education: Sydney, Australia, 2008. [Google Scholar]

- Bozzolan, S.; O’Regan, P.; Ricceri, F. Intellectual capital disclosure (ICD) A comparison of Italy and the UK. J. Hum. Resour. Costing Account. 2006, 10, 92–113. [Google Scholar] [CrossRef]

- Jaggi, B.; Low, P.Y. Impact of culture, market forces, and legal system on financial disclosures. Int. J. Account. 2000, 35, 495–519. [Google Scholar] [CrossRef]

- O’Sullivan, N. The impact of board composition and ownership on audit quality: Evidence from large UK companies. Br. Account. Rev. 2000, 32, 397–414. [Google Scholar] [CrossRef]

| Research Variable | Relational Capital (RC Disclosure) | Human Capital (HC Disclosure) | Structural Capital (SC Disclosure) |

|---|---|---|---|

| Items in the research variable | 1. Brand value | 1. Average age | 1. Cost of innovations |

| 2. Customer satisfaction | 2. Average training hours | 2. Lost time for injury rate | |

| 3. Customer satisfaction transparency | 3. Employee satisfaction | 3. Total employee injury rate | |

| 4. Consumer complaints | 4. Employee productivity | 4. Total accidents | |

| 5. Shareholder loyalty | 5. Internal promotion | 5. Six Sigma and Quality Management Systems | |

| 6. Management training | |||

| 7. Turnover of employees | |||

| 8. Training cost total | |||

| 9. Training hours total | |||

| 10. Women managers |

| Variable | Min | Max | Mean | Standard Deviation | Obs. |

|---|---|---|---|---|---|

| ICD | 0.000 | 18.000 | 7.621 | 2.921 | 1528 |

| RC disclosure | 0.000 | 5.000 | 2.086 | 0.871 | 1528 |

| SC disclosure | 0.000 | 5.000 | 2.008 | 0.802 | 1528 |

| HC disclosure | 0.000 | 10.000 | 3.527 | 1.732 | 1528 |

| Qualitative Audit Risk | 9.000 | 358.000 | 278.398 | 38.386 | 1431 |

| Quantitative Audit Risk | 9.227 | 57.003 | 27.697 | 7.132 | 1528 |

| Accruals | 0.000 | 67,692,128.000 | 2,040,207.000 | 5,747,811.000 | 1457 |

| Reputation Risk | 1.000 | 4.000 | 2.432 | 0.603 | 1528 |

| Audit fees | 24.000 | 13,913,000.000 | 17,499.280 | 380,048.000 | 1472 |

| VIF | RC Disclosure | HC Disclosure | SC Disclosure | ICD | Audit Fees | QLAR | Accruals | QNAR | Reputation Risk | |

|---|---|---|---|---|---|---|---|---|---|---|

| RC disclosure | 1.000 | |||||||||

| HC disclosure | 0.522 ** | 1.000 | ||||||||

| SC disclosure | 0.577 ** | 0.629 ** | 1.000 | |||||||

| ICD | 1.38 | 1.000 | ||||||||

| Audit fees | 0.078 ** | 0.146 ** | 0.071 ** | 0.130 ** | 1.000 | |||||

| QLAR * | 1.31 | 0.537 ** | 0.413 ** | 0.562 ** | 0.560 ** | 0.069 ** | 1.000 | |||

| Accruals | 1.03 | 0.086 ** | 0.209 ** | 0.130 ** | 0.188 ** | 0.144 ** | 0.053 * | 1.000 | ||

| QNAR ** | 1.12 | 0.186 ** | 0.320 ** | 0.244 ** | 0.318 ** | 0.411 ** | 0.123 ** | 0.108 ** | 1.000 | |

| Reputation Risk | 1.07 | 0.196 ** | 0.132 ** | 0.203 ** | 0.192 ** | −0.085 ** | 0.444 | 0.051 | −0.085 ** | 1.00 |

| Mean VIF | 1.18 | |||||||||

| Model 1 (y = Qualitative Audit Risk) Robust Coefficients | Model 2 (y = Quantitative Audit Risk) Robust Coefficients | Model 3 (y = Audit Fees) Robust Coefficients | ||||

|---|---|---|---|---|---|---|

| Synthetic | Extended | Synthetic | Extended | Synthetic | Extended | |

| ICD | 3.955 *** (0.206) | 1.660 *** (0.208) | 0.082 (0.043) | |||

| HC disclosure | 0.786 *** (0.194) | 0.658 ** (0.262) | 0.004 (0.038) | |||

| SC disclosure | 1.931 *** (0.181) | 0.379 (0.247) | 0.041 (0.031) | |||

| RC disclosure | 2.832 *** (0.219) | 1.025 *** (0.292) | 0.072 (0.044) | |||

| Reputation risk | 0.676 *** (0.101) | 0.831 *** (0.092) | −0.343 *** (0.125) | −0.360 *** (0.125) | ||

| Accruals | 0.239 (0.300) | 0.064 (0.142) | 0.364 ** (0.184) | 0.376 ** (0.183) | 0.433 *** (0.037) | 0.434 *** (0.037) |

| Qualitative Audit Risk | −0.017 *** (0.005) | −0.019 *** (0.005) | ||||

| Quantitative Audit Risk | 0.009 *** (0.003) | 0.009 *** (0.003) | ||||

| Constant | −4.800 *** (2.307) | −2.809 *** (1.8823) | 22.862 *** (2.432) | 22.680 *** (2.422) | 1.721 *** (0.260) | 1.718 *** (0.259) |

| R2 (overall) | 0.271 | 0.408 | 0.114 | 0.100 | 0.023 | 0.022 |

| F (Wald-Chi2) | 150.930 *** | 1142.730 *** | (78.230) *** | (82.790) *** | 41.640 *** | 28.160 *** |

| SE of regression | 3.072 | 3.527 | 4.662 | 4.672 | 0.461 | 0.461 |

| Rho | 0.414 | 0.643 | 0.386 | 0.383 | 0.470 | 0.471 |

| Hausman test (p-value) | FE 0.000 | RE 0.000 | RE 0.051 | RE 0.080 | FE 0.000 | |

| Obs. | 1267 | 1457 | 1371 | 1103 | ||

| Groups | 189 | 190 | 189 | 179 | ||

| Panel A: Italian Firms | |||

| Model 1 (y = Qualitative Audit Risk) Robust Coefficients | Model 2 (y = Quantitative Audit Risk) Robust Coefficients | Model 3 (y = Audit Fees) Robust Coefficients | |

| ICD | 3.634 *** (0.216) | 1.219 *** | 0.285 ** (0.118) |

| Reputation risk | 0.479 ** (0.217) | −0.263 (0.350) | |

| Accruals | −0.075 (0.425) | −0.453 (0.622) | 0.651 *** (0.199) |

| Qualitative Audit Risk | −0.072 *** (0.022) | ||

| Quantitative Audit Risk | 0.025 ** (0.012) | ||

| Constant | −6.713 (6.178) | 39.492 *** (8.980) | −2.772 (2.954) |

| R2 (overall) | 0.561 | 0.134 | 0.173 |

| Wald-Chi2 or F | 336.120 *** | 8.140 * | 27.890 *** |

| SE of regression (Sigma e) | 3.112 | 5.781 | 0.754 |

| Rho | 0.485 | 0.593 | 0.652 |

| Hausman test (p-value) | RE | RE | RE |

| Obs. | 210 | 195 | 137 |

| Groups | 27 | 27 | 24 |

| Panel B: UK Firms | |||

| Model 1 (y = Qualitative Audit Risk) Robust Coefficients | Model 2 (y = Quantitative Audit Risk) Robust Coefficients | Model 3 (y = Audit Fees) Robust Coefficients | |

| ICD | 5.211 *** (0.200) | 1.432 *** (0.249) | 0.058 (0.036) |

| Reputation risk | 0.915 *** (0.100) | −0.273 ** (0.128) | |

| Accruals | 0.307 ** (0.145) | 0.139 (0.191) | 0.032 (0.028) |

| Qualitative Audit Risk | −0.002 (0.004) | ||

| Quantitative Audit Risk | |||

| Constant | 0.010 *** (0.0032789) | ||

| R2 (overall) | −4.727 ** (1.886) | 25.017 *** (2.4882) | 6.868 *** (0.374) |

| Wald-Chi2 or F | 0.478 | 0.049 | 0.163 |

| SE of regression (Sigma e) | 848.690 *** | 37.600 *** | 17.220 ** |

| Rho | 3.5920.441 | 4.3700.306 | 03.5310.391 |

| Hausman test (p-value) | RE | RE | RE |

| Obs. | 1247 | 1176 | 1148 |

| Groups | 163 | 162 | 158 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Demartini, C.; Trucco, S. Does Intellectual Capital Disclosure Matter for Audit Risk? Evidence from the UK and Italy. Sustainability 2016, 8, 867. https://doi.org/10.3390/su8090867

Demartini C, Trucco S. Does Intellectual Capital Disclosure Matter for Audit Risk? Evidence from the UK and Italy. Sustainability. 2016; 8(9):867. https://doi.org/10.3390/su8090867

Chicago/Turabian StyleDemartini, Chiara, and Sara Trucco. 2016. "Does Intellectual Capital Disclosure Matter for Audit Risk? Evidence from the UK and Italy" Sustainability 8, no. 9: 867. https://doi.org/10.3390/su8090867

APA StyleDemartini, C., & Trucco, S. (2016). Does Intellectual Capital Disclosure Matter for Audit Risk? Evidence from the UK and Italy. Sustainability, 8(9), 867. https://doi.org/10.3390/su8090867