This section deals with forecasting demand by stage and amendment methods for the three stages of demand forecasting throughout the PLC. This is based on weekly forecasts, and daily forecasts are offered as reference points. The Bass diffusion model is used for forecasts.

3.1. Long-Term Demand Forecasting Prior to Product Launch

The purpose of this stage is to forecast the demand curve prior to product launch, which shows the entire demand pattern over the term of the PLC. The result of this stage is required by a production department to do capacity planning, a purchasing department to secure the raw materials, and so on. This stage goes through the following steps.

- •

Step 1: Determine the planned sales volume and launch date of the new product.

- •

Step 2: Select reference models.

- •

Step 3: Analyze the past data of the selected reference models. Create and analyze the demand curve of the new product.

The method of selecting reference models in step 2 differs depending on whether the product is entirely new with no previous models, or builds on an existing product; the majority of products are of the latter kind. Suppose that the product to be launched is an entirely new product that differs completely from previous products. The demand-forecasting manager compares the characteristics of the new product with previous products, and selects reference models. Then, similarity index values for the selected reference models are assigned by the demand-forecasting manager. The similarity index values are distributed between 0 and 1, where the sum of all similarity index values is 1.

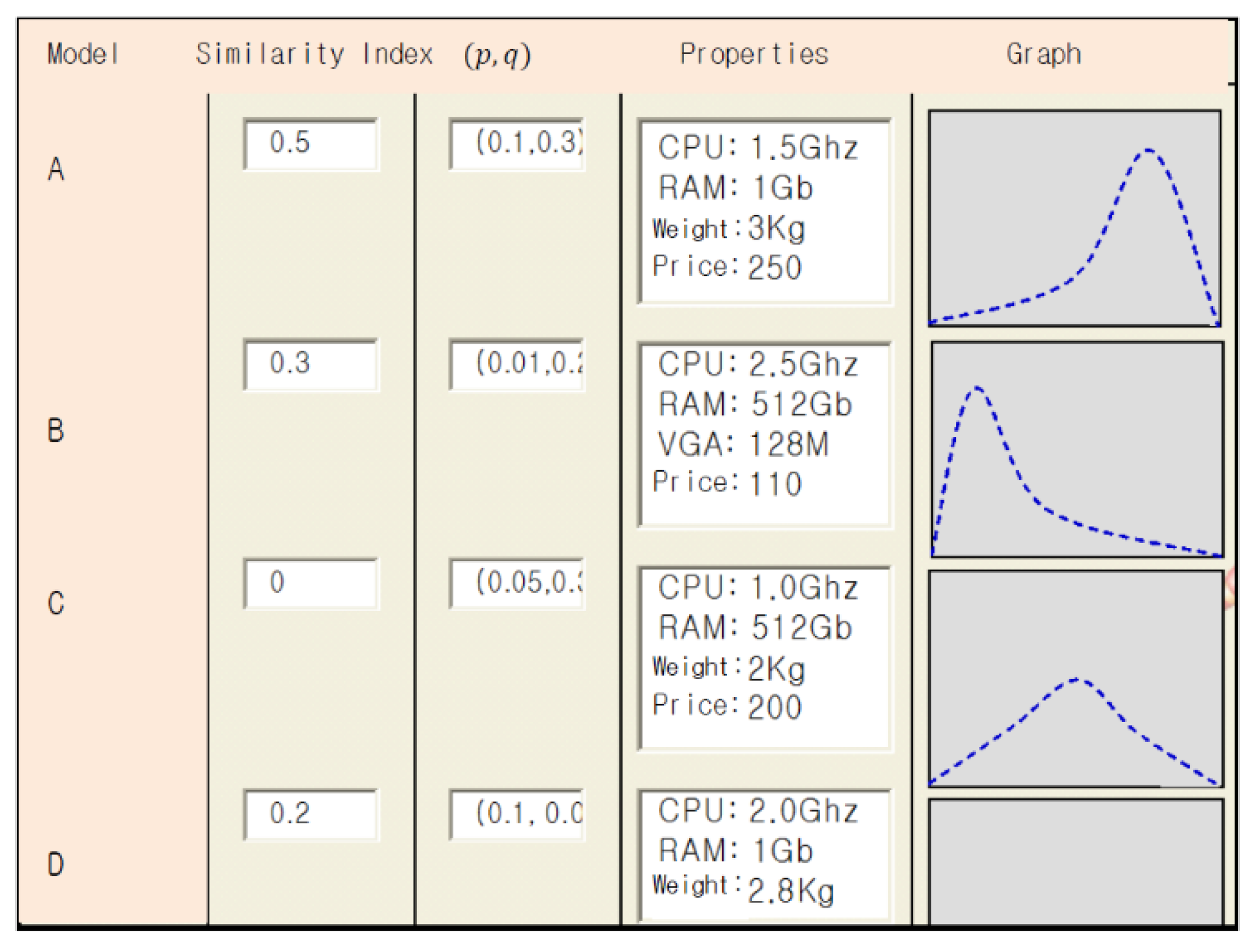

Figure 2 shows a screen from the program developed to select reference models of new products. The product characteristics as shown in the “Properties” section are examined, and a number is assigned for the similarity index. Three products were selected in the example shown in

Figure 2, and the sum of the similarity indexes is 1. At this point,

are parameters used in the Bass model where the cumulative demand by period

is denoted by:

where

indicates the coefficient of innovation (external influence) and

is the coefficient of imitation (internal influence), which are saved along with the product information. In other words,

indicates the extent of the influence of product-external factors on demand irrelevant to the product itself, such as the purchasing power of the consumer and market conditions.

indicates the extent of the influence of product-internal factors on demand such as product design and product pricing (Bass, 1969).

is the total number of people who will eventually use the product.

In Step 3, for the selected reference models in Step 2, the three parameters of the Bass model (

,

, and

) are estimated using their past sales data. Normally, firms possess the sales data for products that have been sold in the past few years. The sales of data of these products are fitted into the Bass model and the estimates for

,

, and

of previously sold products are saved in the database. These saved data are provided as a reference model to the user when demand is forecasted for the new product. These parameters go through the following stages to be estimated. First, any seasonal fluctuation in demand (seasonal effect) are removed from the past sales data of the selected reference models.

indicates the actual sales data at a point of time in the past,

, while

indicates a value where the seasonal effect is removed from

. The seasonal coefficient at

can be represented by

to yield the following well-known function to derive the sales data without the seasonal effects.

Next, the Bass model is converted into a second-degree regression analysis. In the Equation (2) specified below,

indicates the cumulative sales records of the reference model up to the point

.

is the Bass model where

is the change of the installed base fraction (

i.e.,

is the probability of purchasing products), and

is the installed base fraction. Sales

is the rate of change of installed base, which is

multiplied by the ultimate market potential

. Cumulative sales

is the installed base fraction, which is

multiplied by the ultimate market potential

. By replacing

with

, and replacing

with

, we have:

A regression analysis can be performed on the independent variable

and the response variable

to yield a regression function, where the estimated intercept, the coefficient of

, and the coefficient of

are called

,

, and

, respectively. Then, this function can be described as

, and

, and the values of

,

, and

can be calculated by solving these equations. If estimation is completed using the

and

values from the regression analysis only, we have experienced that the model fit is not satisfactory regarding its accuracy. As such, we have devised a method where the value of

is held constant and

and

values are amended to increase the accuracy of the model. After obtaining the values of

and

using regression analysis, we applied an additional method. The method used is a simple search of a certain area, where the lower and upper values are set for

and

. The values of

and

are increased from their lower to upper values, which allows the determination of the values of

and

that minimize the sum of squared errors.

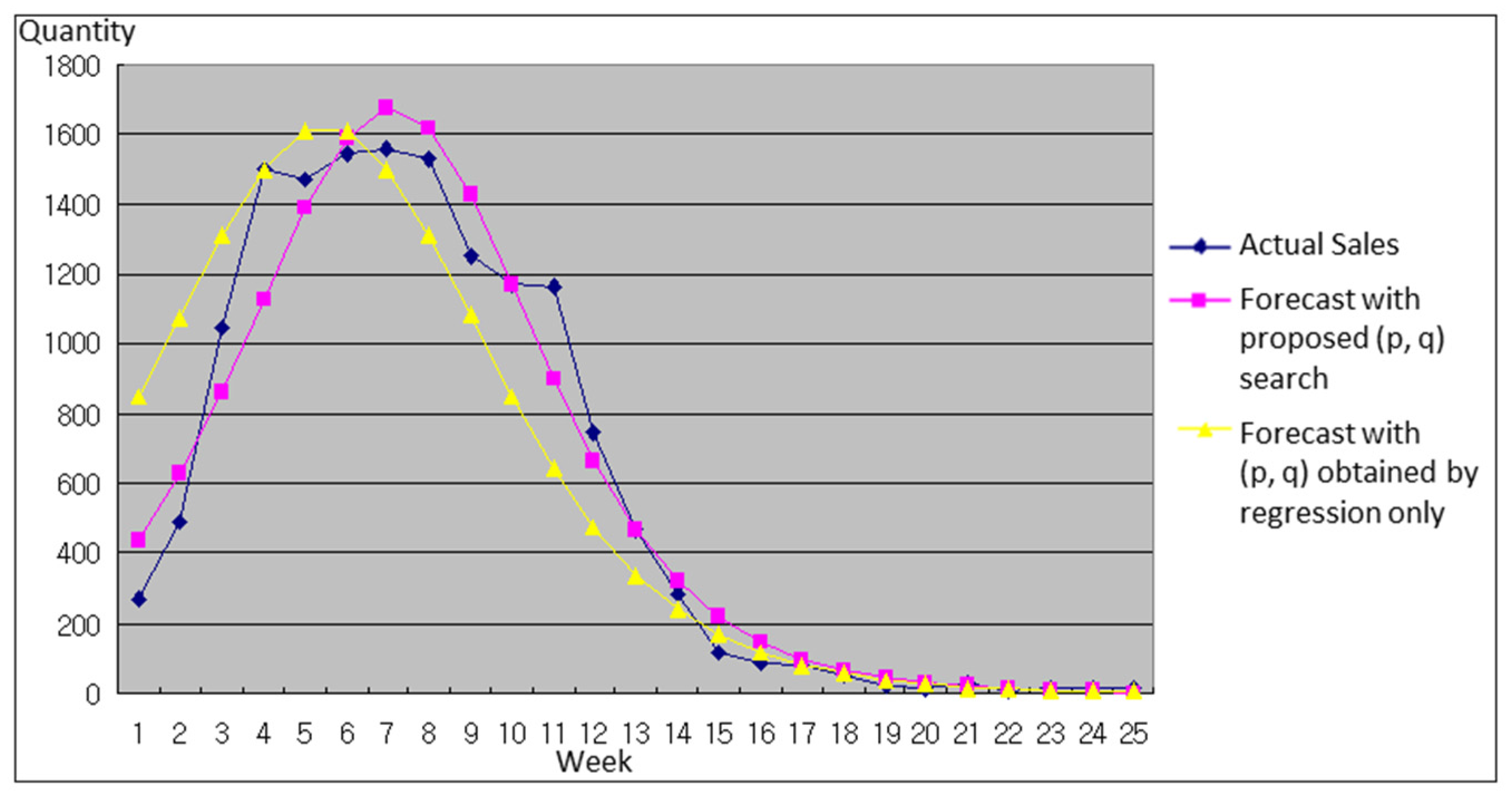

Figure 3 shows an example which compares two forecast results with the actual sales data. In this example, it can be found that forecasting using the values of

and

after additional search process results in improvement in model fit. At least, the error sum of squares after the additional search process cannot be increased when the additional searching process is applied.

Figure 4 shows the results of estimating the parameters to be used for the new product, which are estimated by using the parameters of the selected reference models in step 2. The parameters

and

for the new product are estimated using the following function, and the

value is determined by the demand-forecasting manager.

In Equation (3),

is the number of selected reference models,

,

, and

show the similarity index values of the

th reference model, and values of

and

. In other words, similarity index was utilized to calculate a weighted average.

Figure 5 is an example of the generated demand curve (base line) for the new product. This curve is generated by using Equation (3). In this figure, the upper line shows a weekly demand forecast and the graph below indicates a cumulative graph.

The final demand-forecasting graph is used as the base line for short-term forecasting in the next stage, which is the product launch. After the launch, as new data are acquired, the base line is continuously amended for long-term forecasts. The drawn demand forecast graph can be analyzed to estimate the peak time where the sales volume is maximized (peak time

), and the maximum sales volume (

); these can be calculated using the following well-known equations in Bass [

2] as well.

3.2. Amendments to Long-Term Demand Forecasts after Product Launch

At this stage, the base line that was formed in the forecast prior to launch is amended when actual sales data are gathered after product launch; these amendments are done 3 weeks after the launch, which is relatively long-term. Production related departments need the result of this second stage, with the improved accuracy than that of the first stage, to confirm the weekly production plan. The similarity index for the forecast prior to launch is a number between 0 and 1, and the values of the similarity index are amended at this stage. The updating method is based on the Bayesian updating method for the Bass diffusion model, suggested by Zhu and Thonemann [

15]. This method is used to simultaneously update the parameters that determine the shape of demand forecasting curve,

,

, and

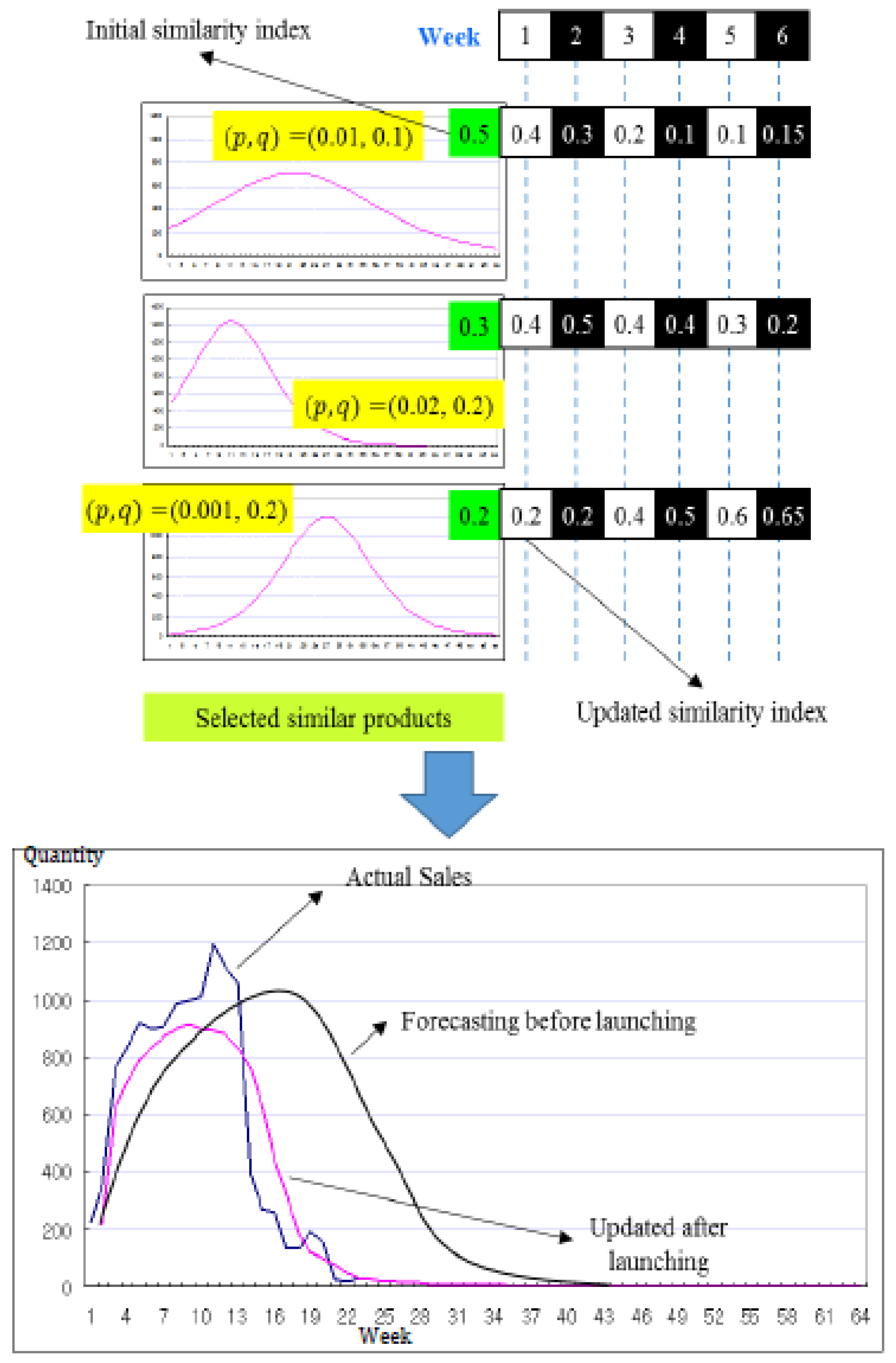

, which show the total sales volume. The example in

Figure 6 shows three reference models, with initial similarity index values of 0.5, 0.3, and 0.2, respectively. These initial values were assigned by the marketing manager. Then, a week later the similarity index values are updated using the Equation (5). Suppose that the updated values of the three models are 0.4, 0.4, and 0.2, respectively. In this way, the values of the three models are updated to 0.15, 0.2, and 0.65 at week 6, respectively. Note that values in

Figure 6 are arbitrarily chosen to illustrate the procedure. The performance of the updates can be seen in the picture below, and it can be seen that the data estimated using the updated

,

, and

are similar to the actual sales data. A comprehensive method of updating

and

is shown in Algorithm 1. A detailed calculation of the posterior probability in the Bass diffusion model can be found in Zhu and Thonemann [

15].

| Algorithm 1: Long-term forecast values amendment process. |

| Initialize | 1. Estimate the shape parameters of and of the Bass diffusion model for number of selected reference models, and formulate pairs of and , .

2. For each pair of , define the prior probability and the prior distribution to sales . The initial prior probability value is the initially estimated similarity index value.

3. |

| Repeat | 1. Calculate the posterior probability and posterior distribution for each and calculate the estimated sales volume. indicates the actual sales volume at week .

2. |

| Until | |

According to Zhu and Thonemann [

15], the posterior probability

is calculated as follows.

where

is defined as:

with

and

and

is the expected fraction of demand that occurs in period t and and are the prior mean and the prior variance, respectively.

3.3. Amendments to Short-Term Demand Forecasts after Product Launch

Now, we present a newly developed forecasting method for short-term demand forecasts of 1–2 weeks using the actual sales data post-launch. While the previous sections have estimated and amended the demand patterns of the PLC of a product by utilizing well-known methods, this section aims to devise a novel method to reflect temporary increases or decreases in demand and to reduce the margins of error. This short-term demand forecast result with the higher fidelity is used to detect the change of sales pattern. The forecast method is based on the well-known Winter’s model, which is an extension of the linear exponential smoothing. When applied, it showed high accuracy for a product with relatively stable sales patterns.

A method of changing the Winter’s model to fit this study is explained below. Winter’s model is an appropriate forecasting method for products with long PLCs, and is not appropriate for products with short PLCs such as PCs, which is the focus of this study. As such, we developed a new short-term demand forecasting methodology by combining Winter’s model and the curve of the Bass diffusion model, which can be explained using the following pseudo code. Winter’s model reflects the randomness of demand, as well as the demand trend and seasonal effects. The trend in week

is indicated by

, and the seasonal effect is indicated by

.

is decided by the demand-forecasting manager beforehand.

is a smoothed value where the seasonal effect has been removed, and

is the actual sales volume in week

.

| Algorithm 2: Short-term forecast for week . |

| Initialize | Set

Use the estimated value from the Bass curve (base line) for , i.e., .

Set . |

| Repeat |

|

| Until | |

In the above pseudo-code,

,

, and

are the adjustable parameters used in Winter’s model. We made a rule-of-thumb estimate for these values. The estimate value for the time

is shown as

.

indicates the rate of change of base line at time

, which can be calculated by differentiating the Bass model.

shows the rate of short-term demand change at the time

. The major difference between the original Winter’s model and ours is how to calculate trend factor

. The above method refines the trend factor using the slope vector of the Bass curve and reflects the trend more effectively. According to the definition of

,

is the composition of two trend factors (or vectors): short-term demand change at the time

(denoted by

) and the rate of change of PLC curve at the time

(denoted by

). In

Figure 7, the compositions of two vectors are described at times

and

, respectively. By considering

, when calculating

, the long-term trend caused by PLC can be reflected in short-term forecasting. It improves the accuracy of forecasting.