Genuine Savings as an Indicator for “Weak” Sustainability: Critical Survey and Possible Ways forward in Practical Measuring

Abstract

:1. Introduction

2. Weak Sustainability

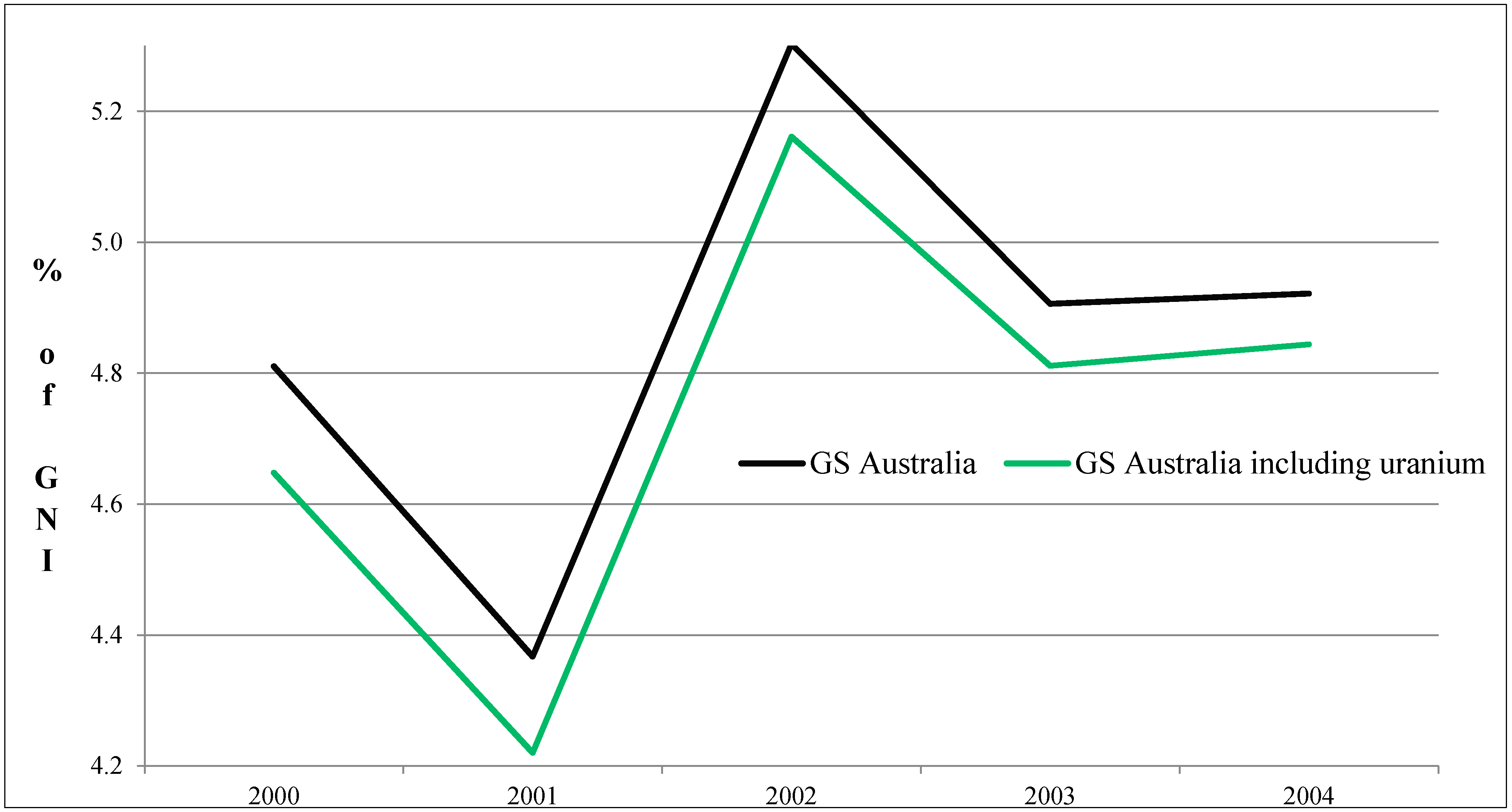

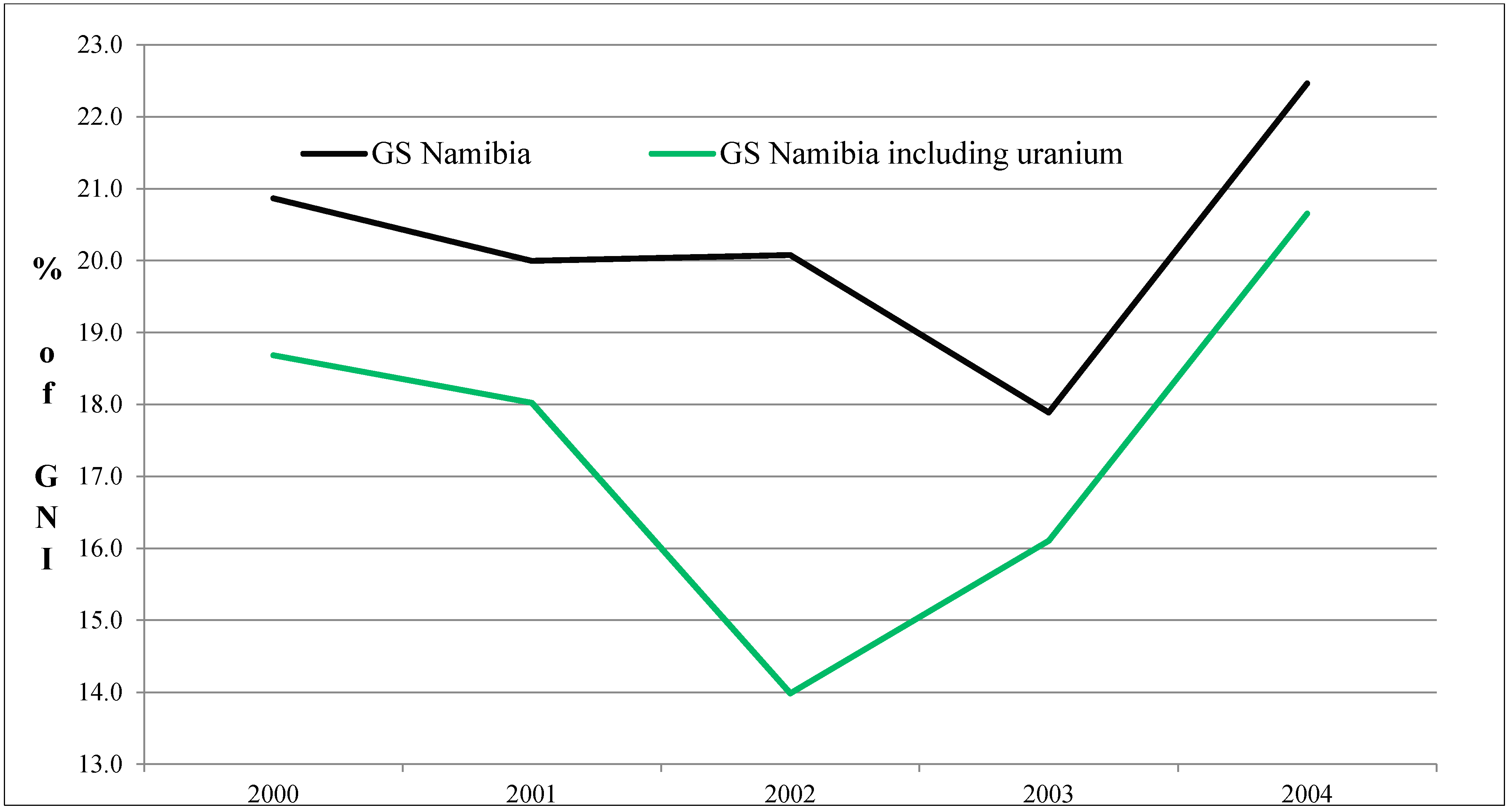

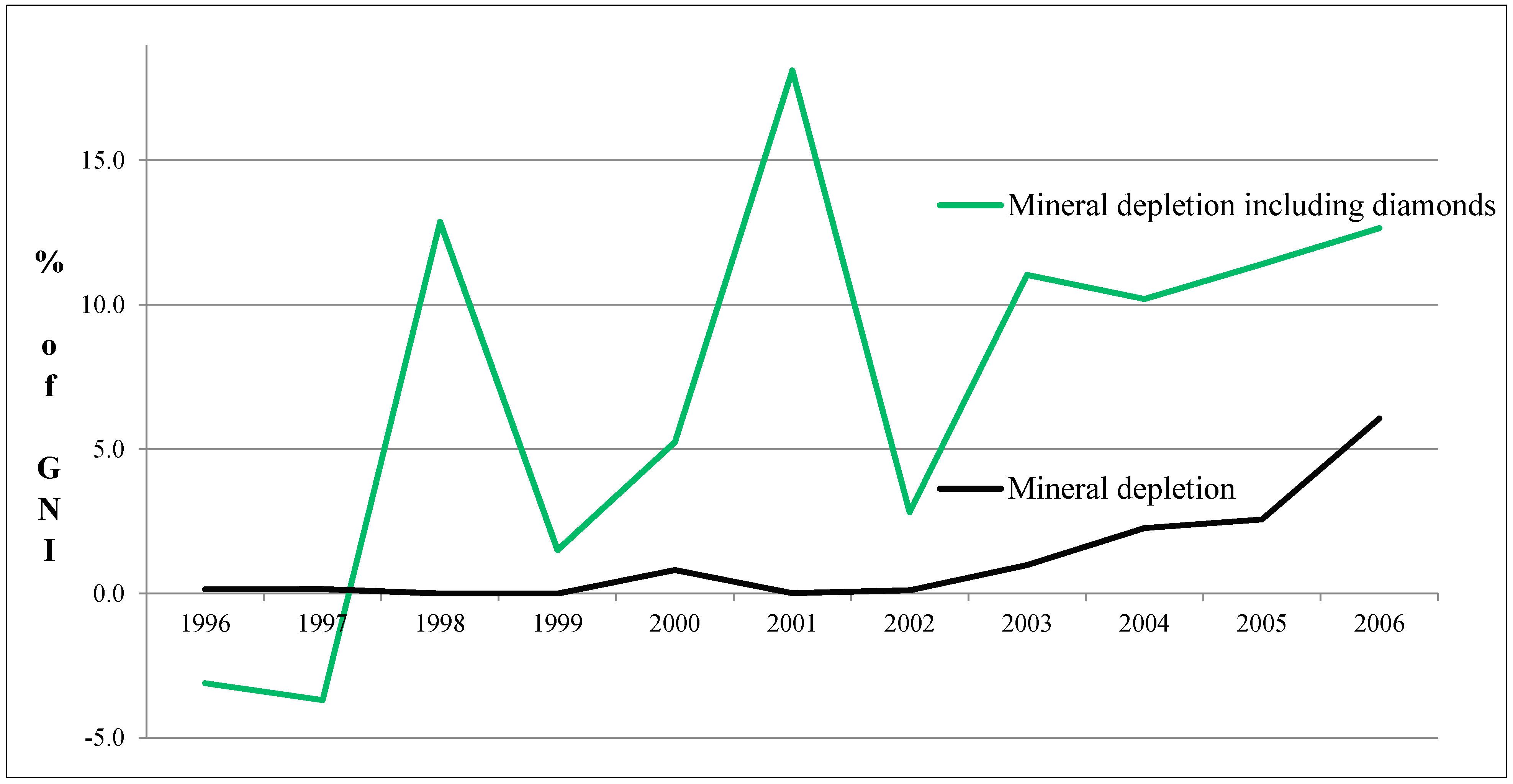

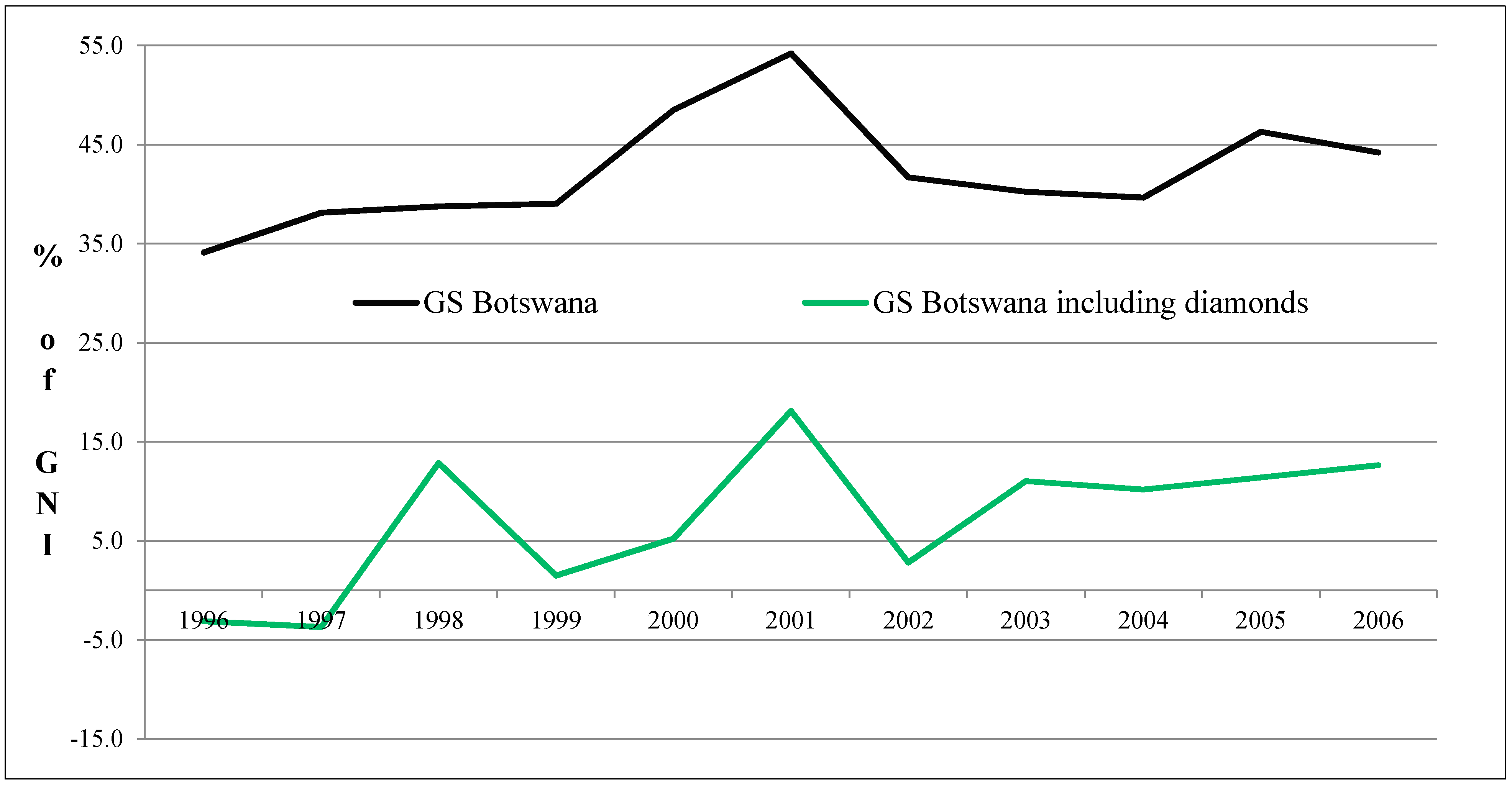

3. Genuine Savings (GS)

4. Critique and Possible Extensions

4.1. Theoretical Background

4.2. Population Growth and GS per Capita

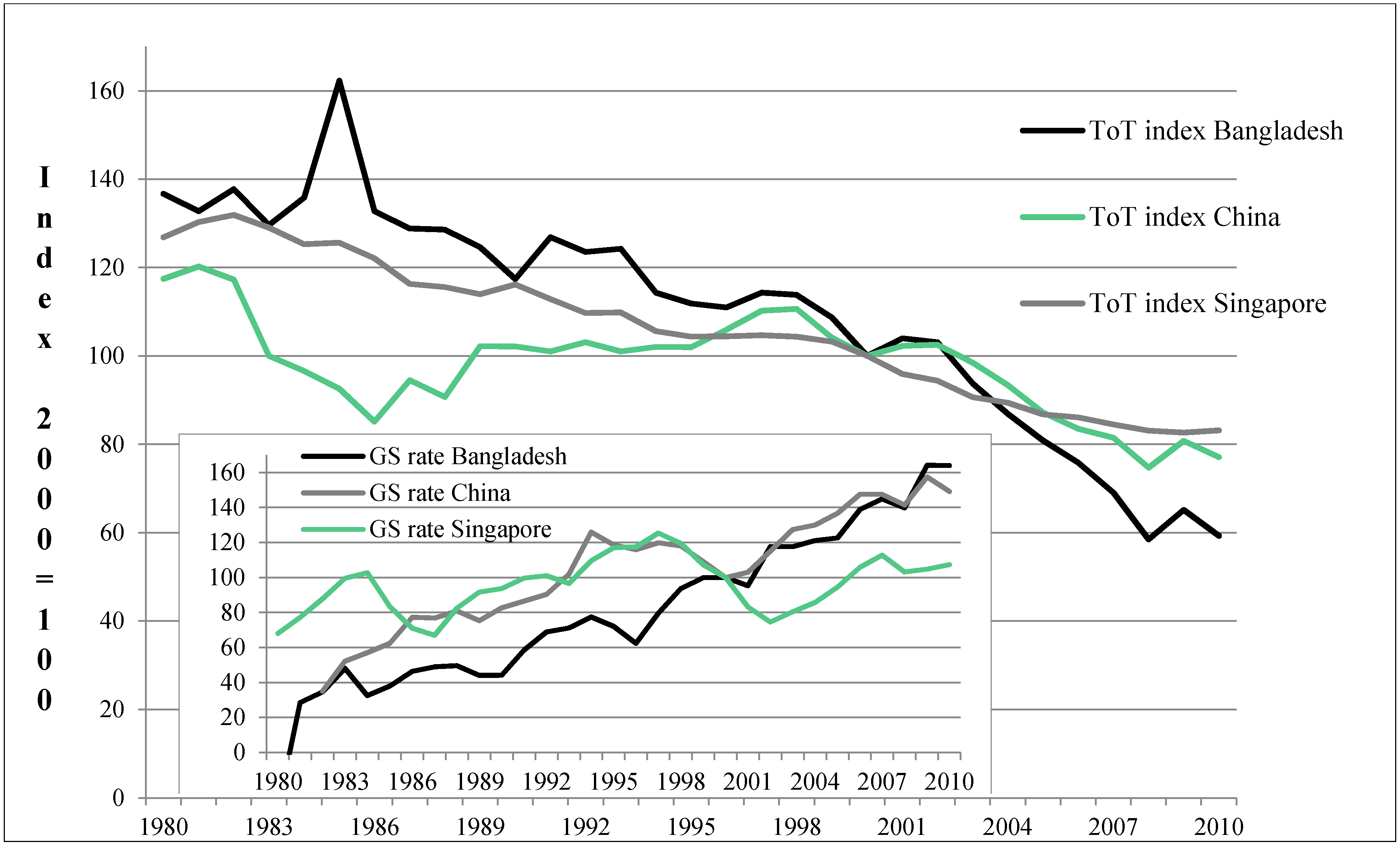

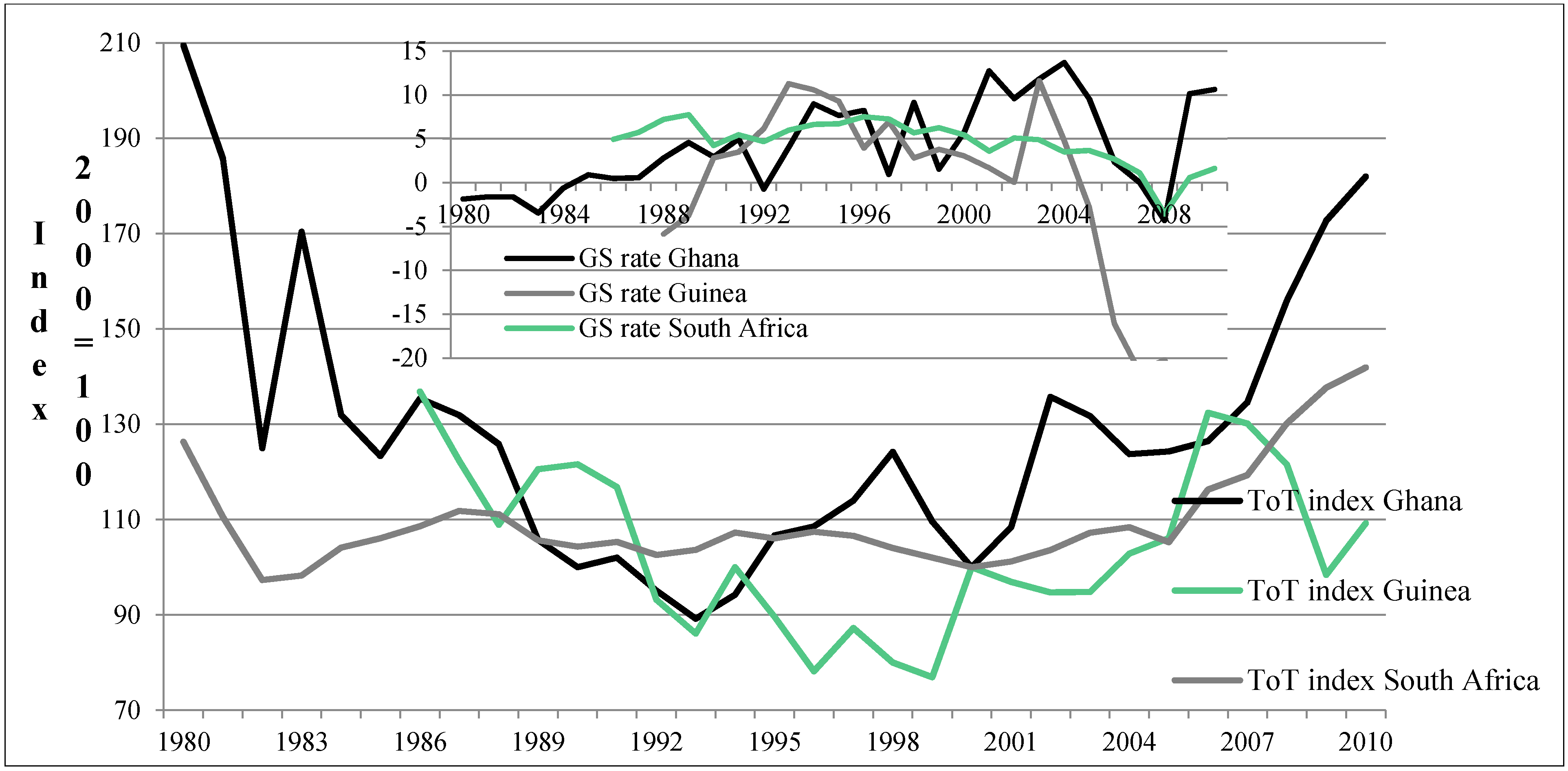

4.3. Open Economies and Volatile Terms of Trade (ToT)

4.4. Gross National Savings (GNS)

4.4.1. Consumption versus Investment

4.4.2. Net Current Transfers (NCT)

4.5. Net National Savings

4.5.1. Depreciation of Physical Capital

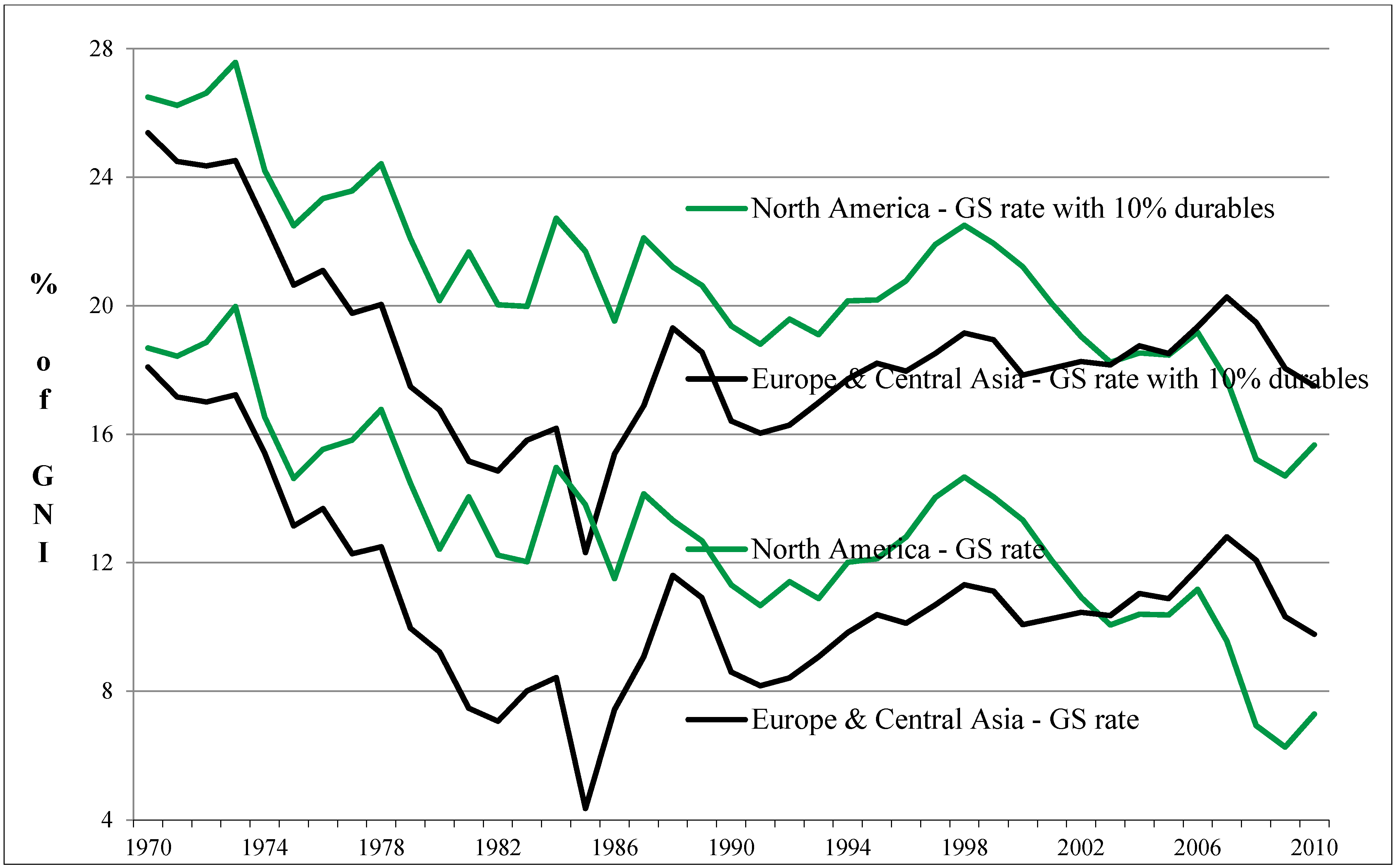

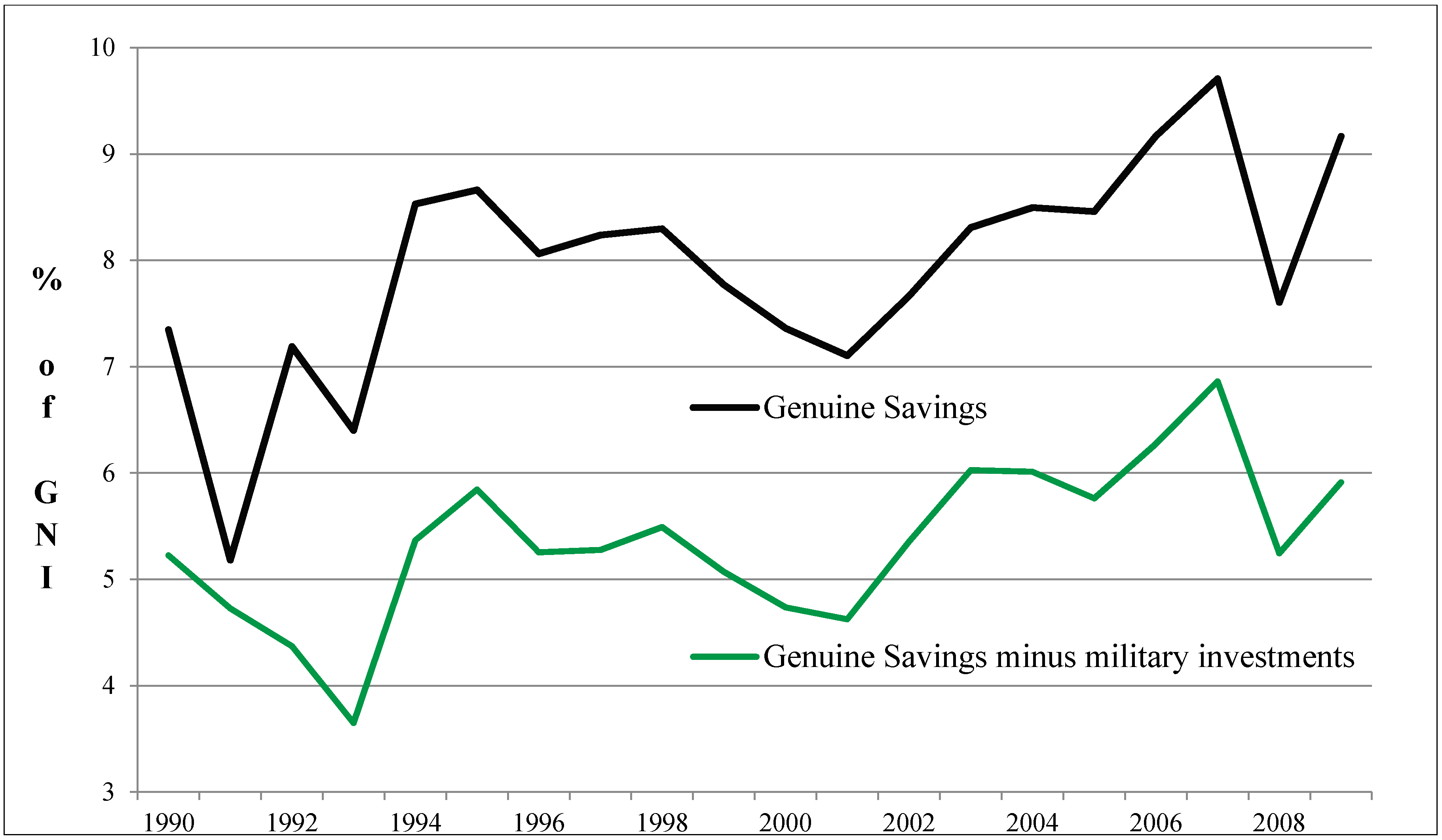

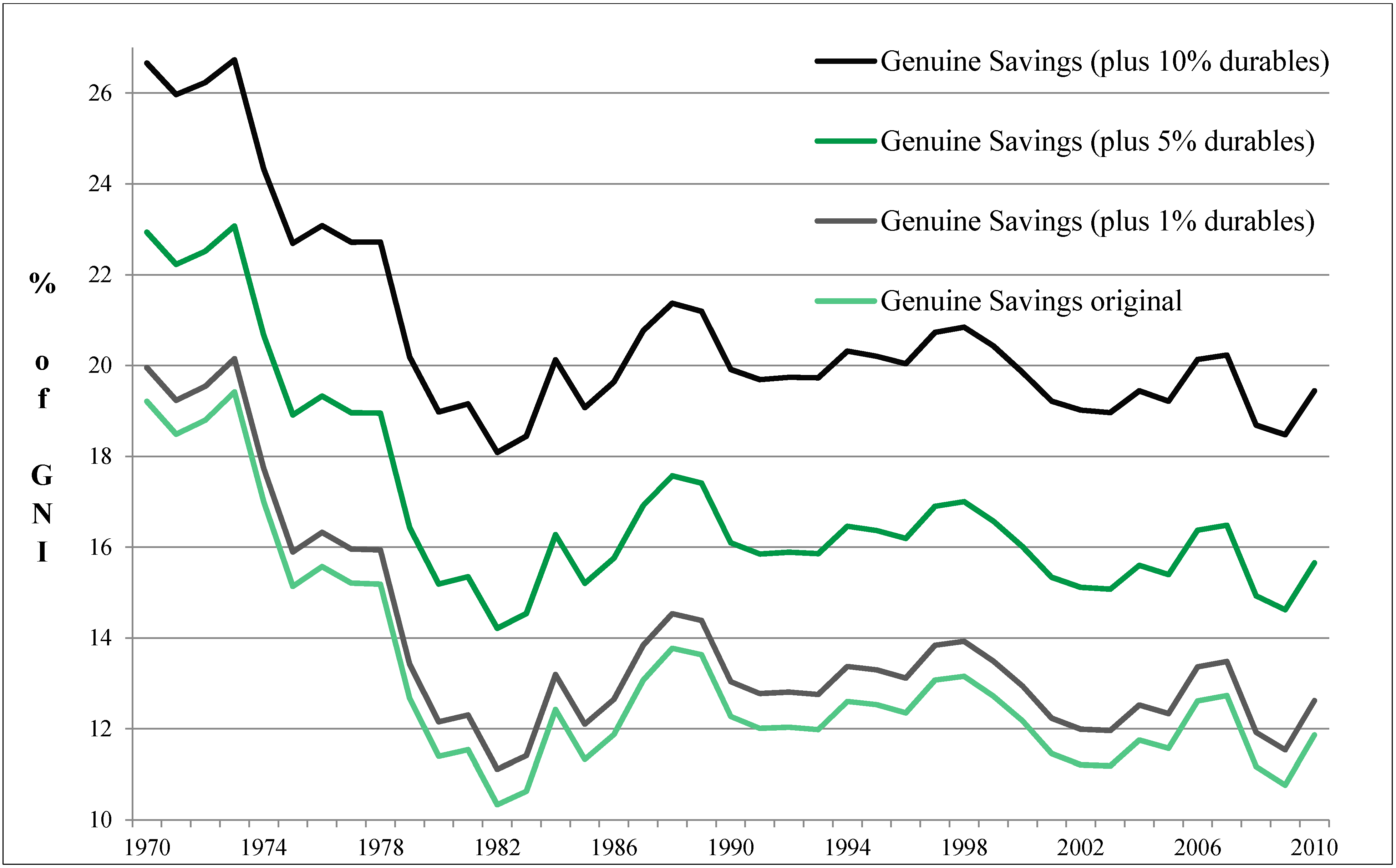

4.5.2. Defensive Investments

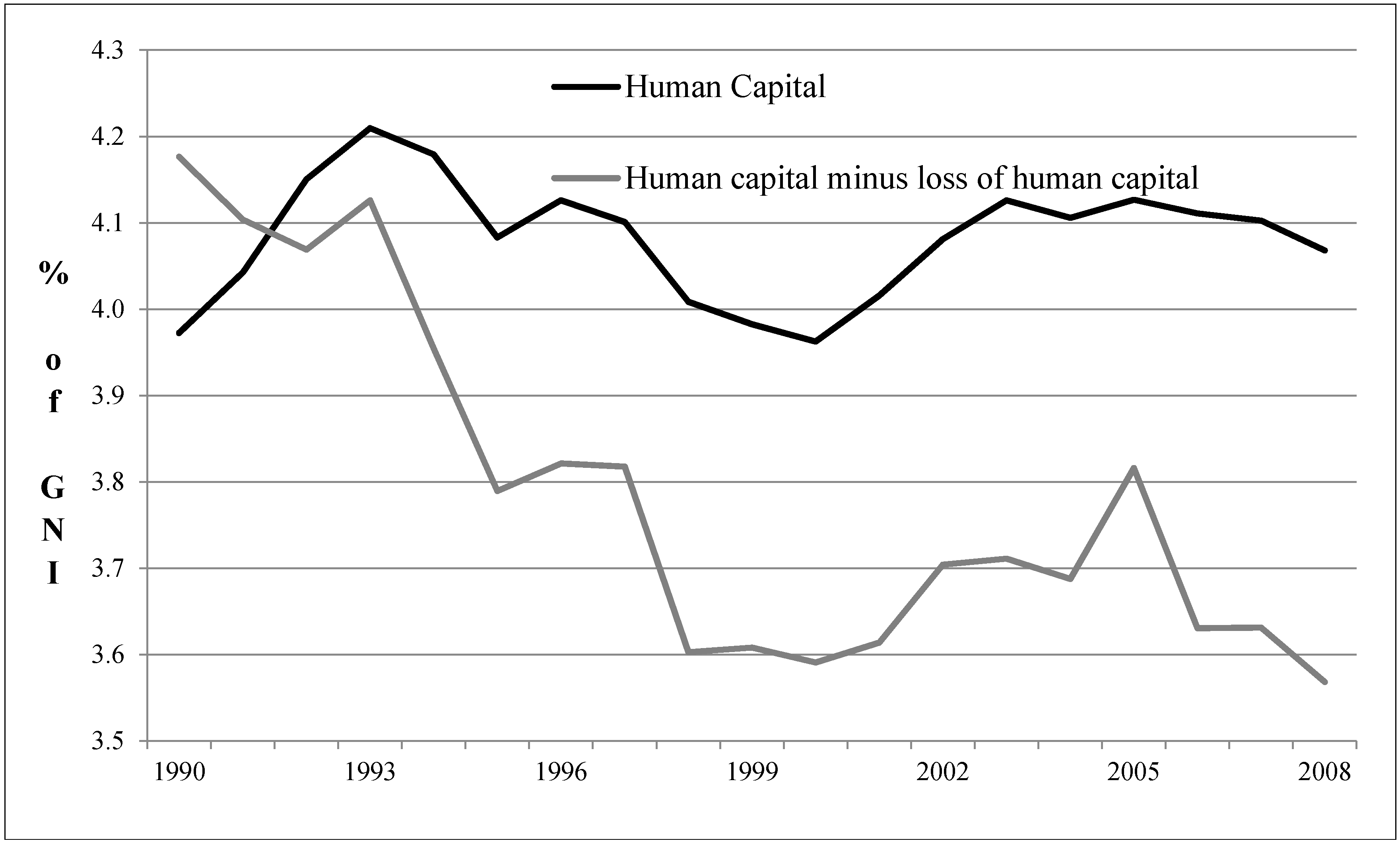

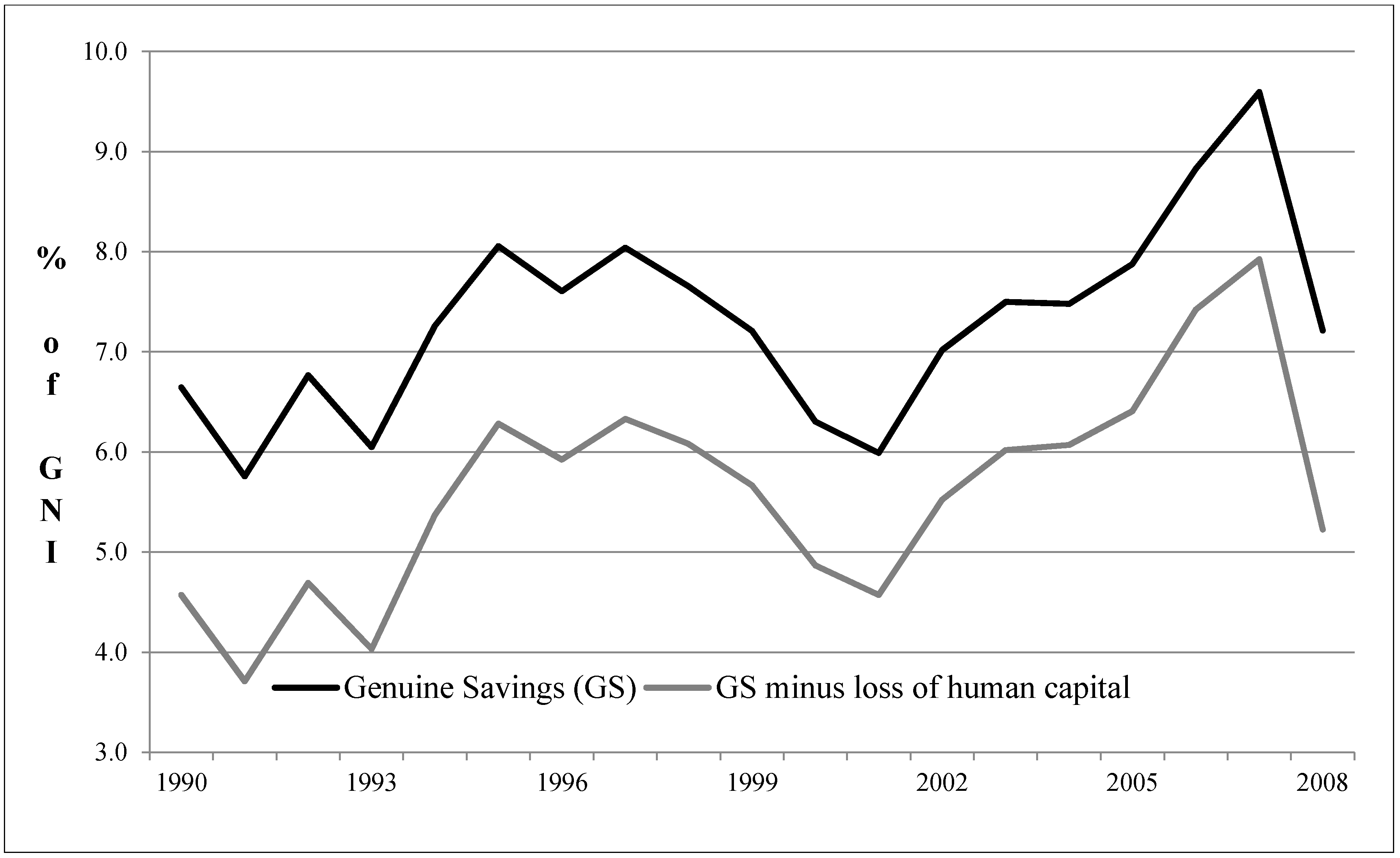

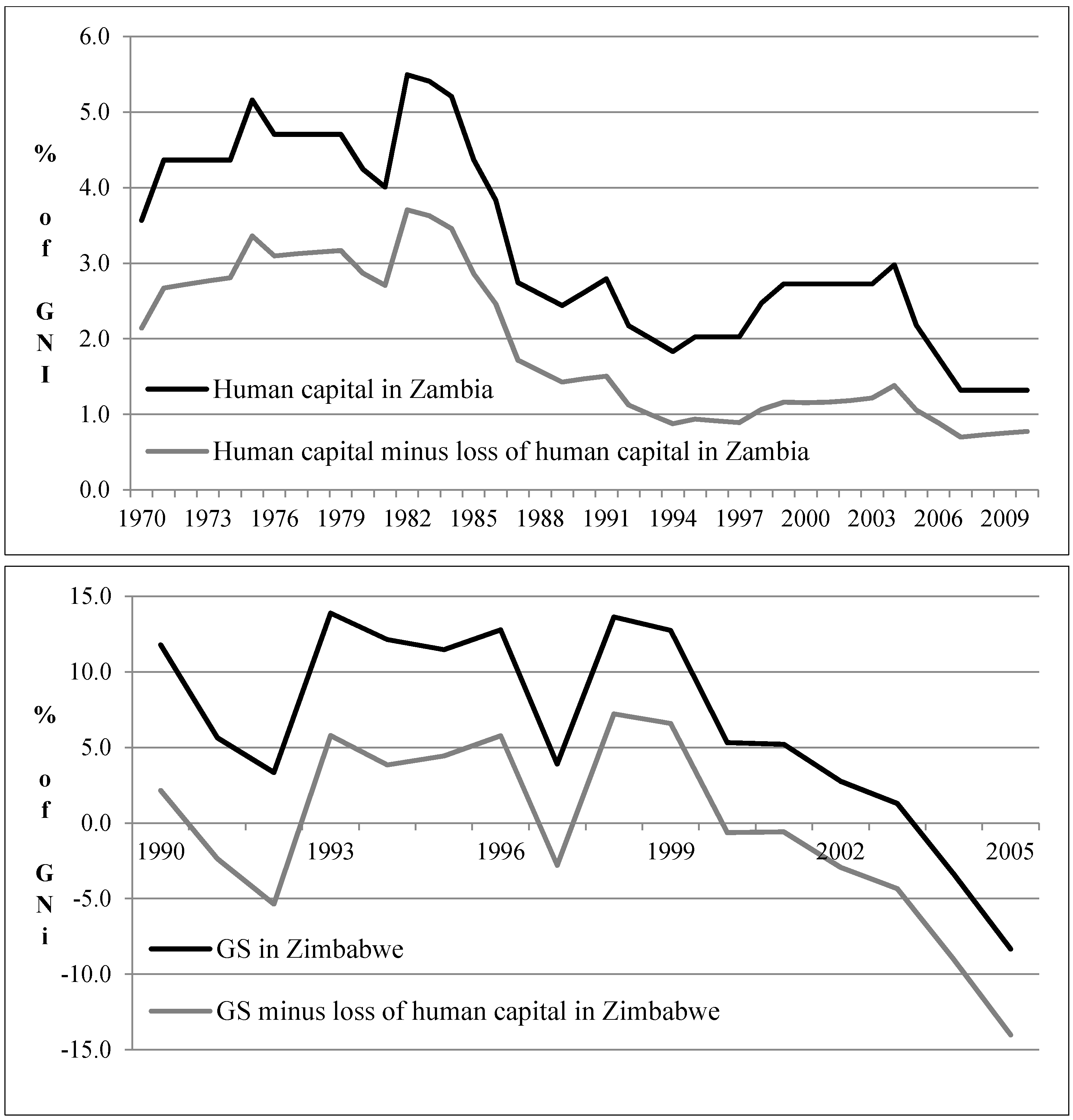

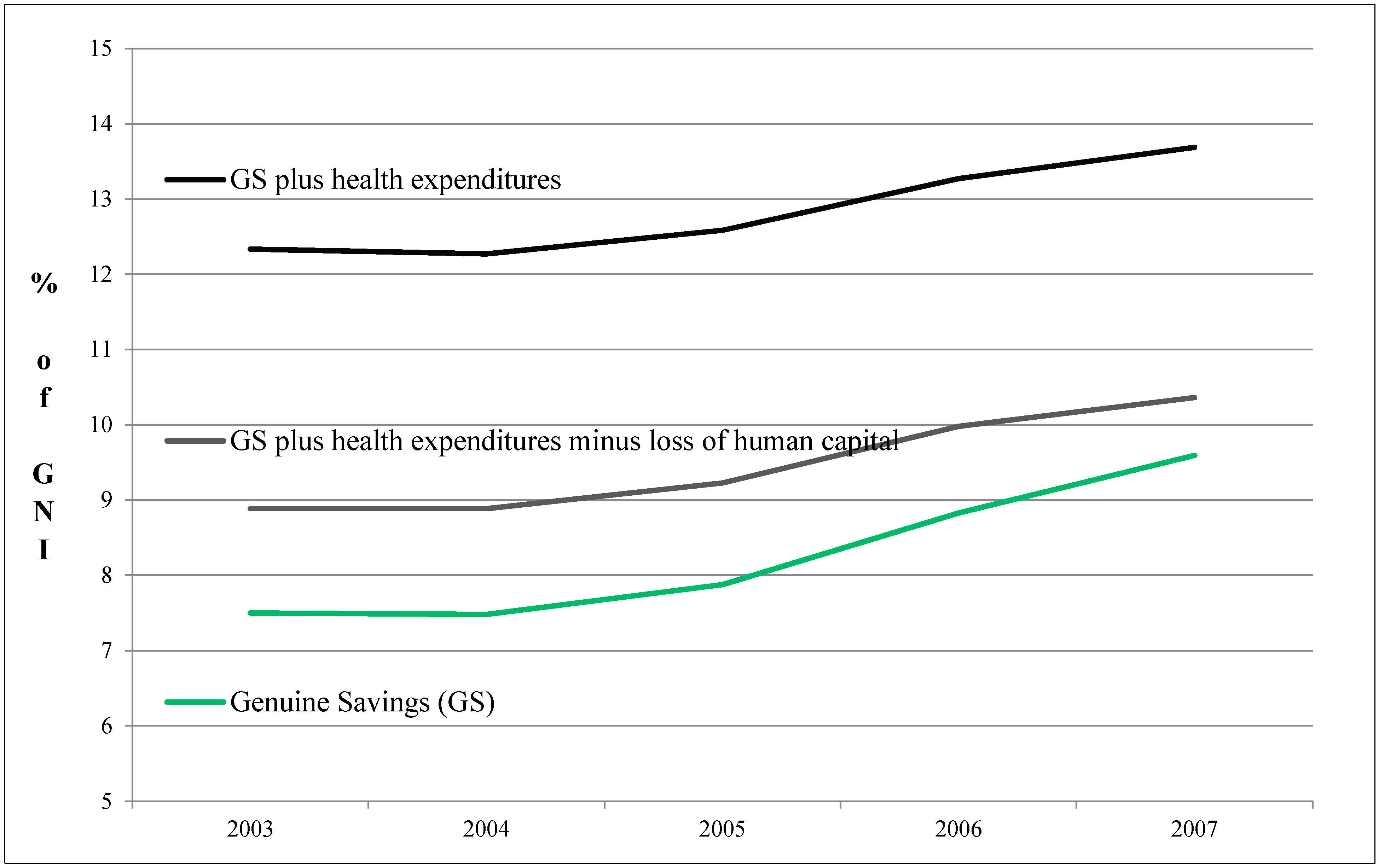

4.5.3. Human Capital

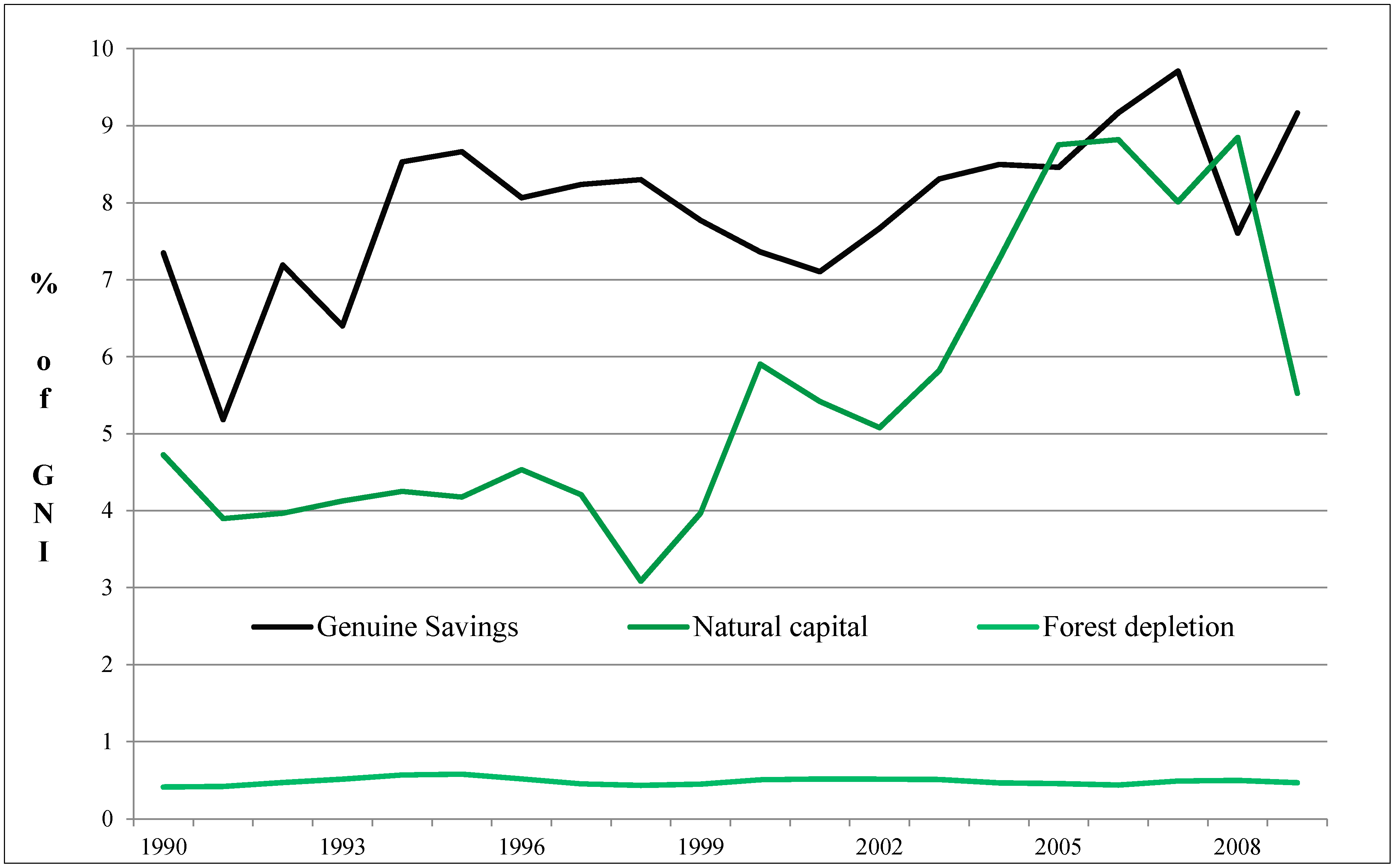

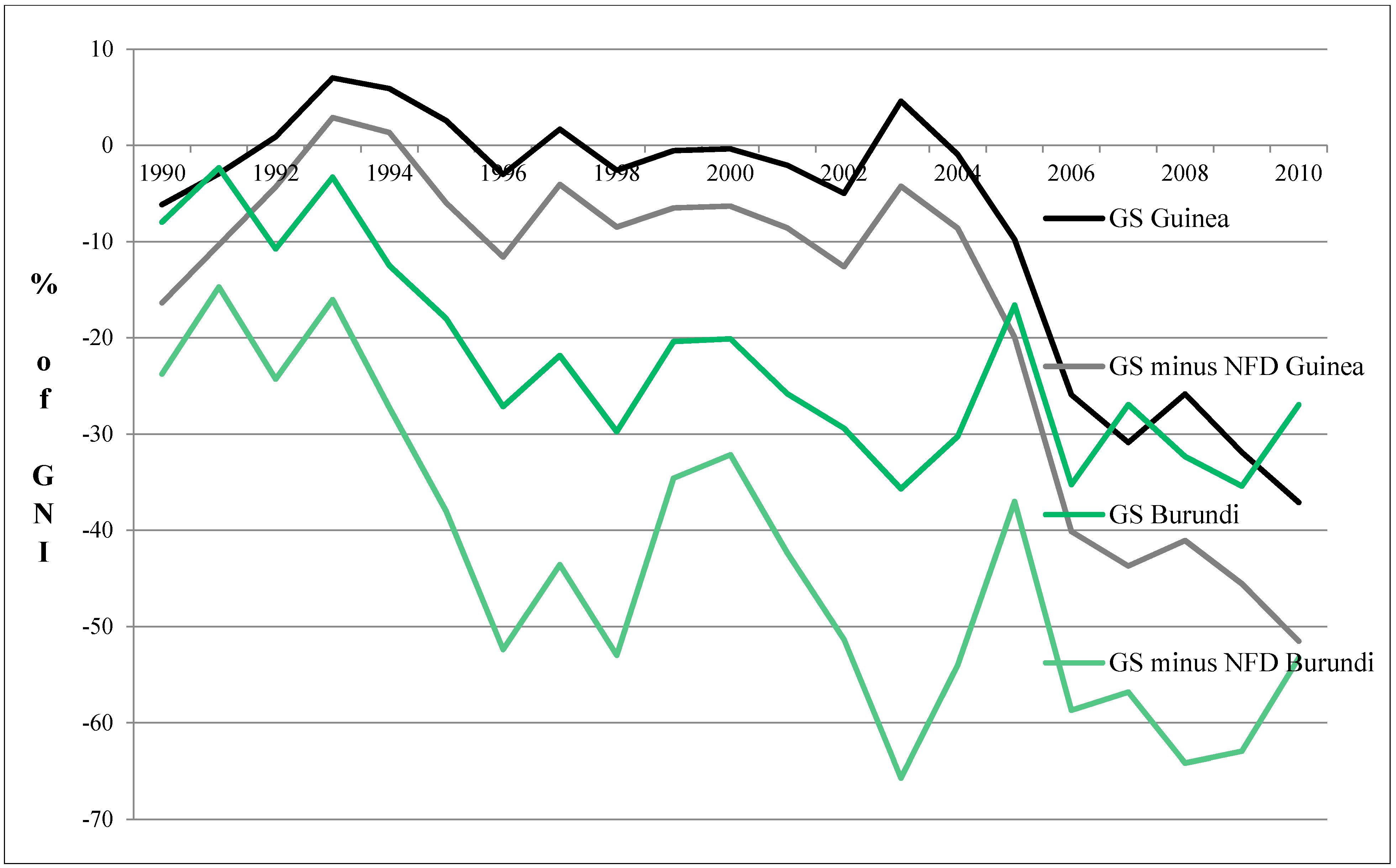

4.6. Natural Capital

4.6.1. Energy Depletion

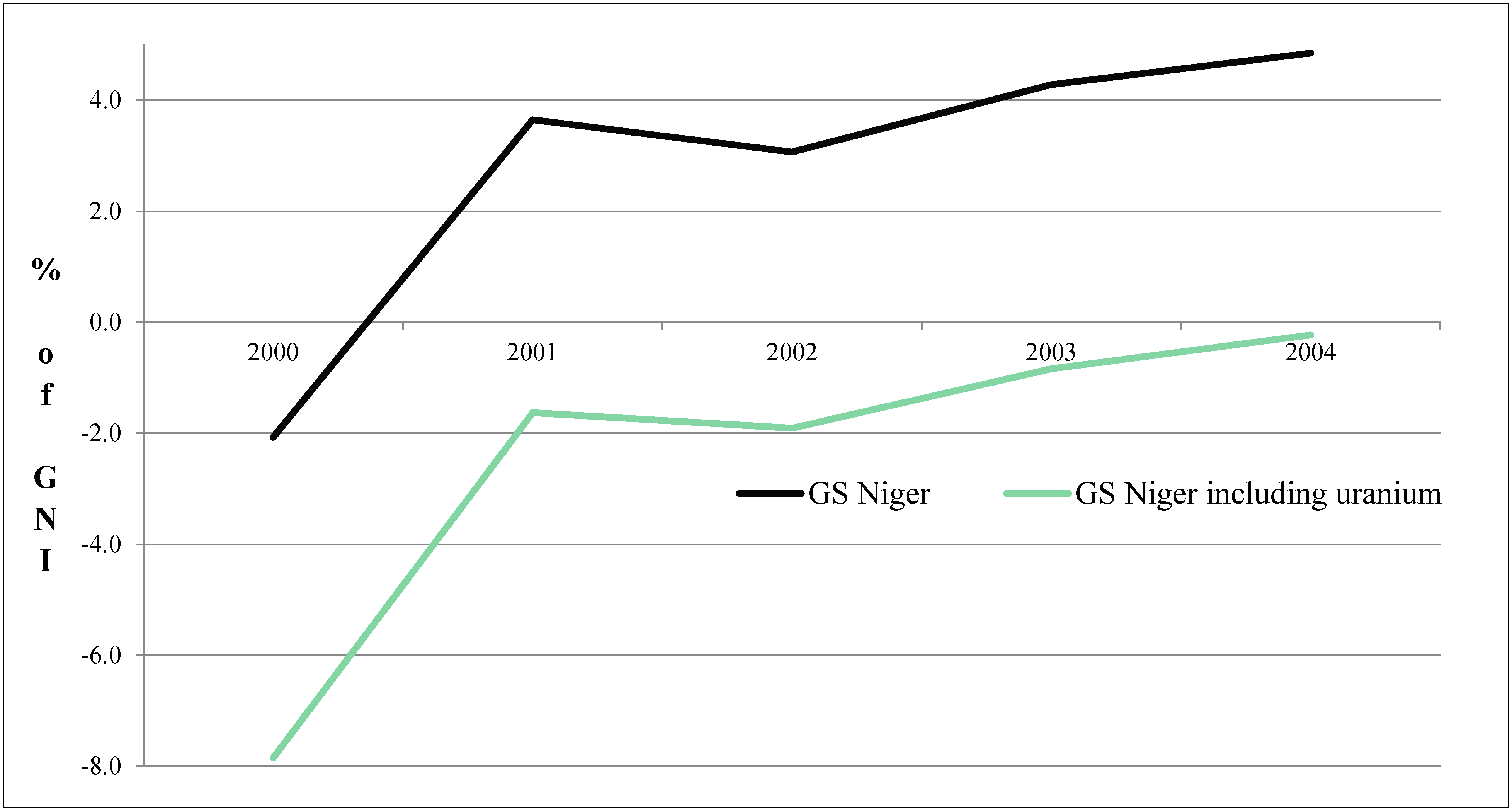

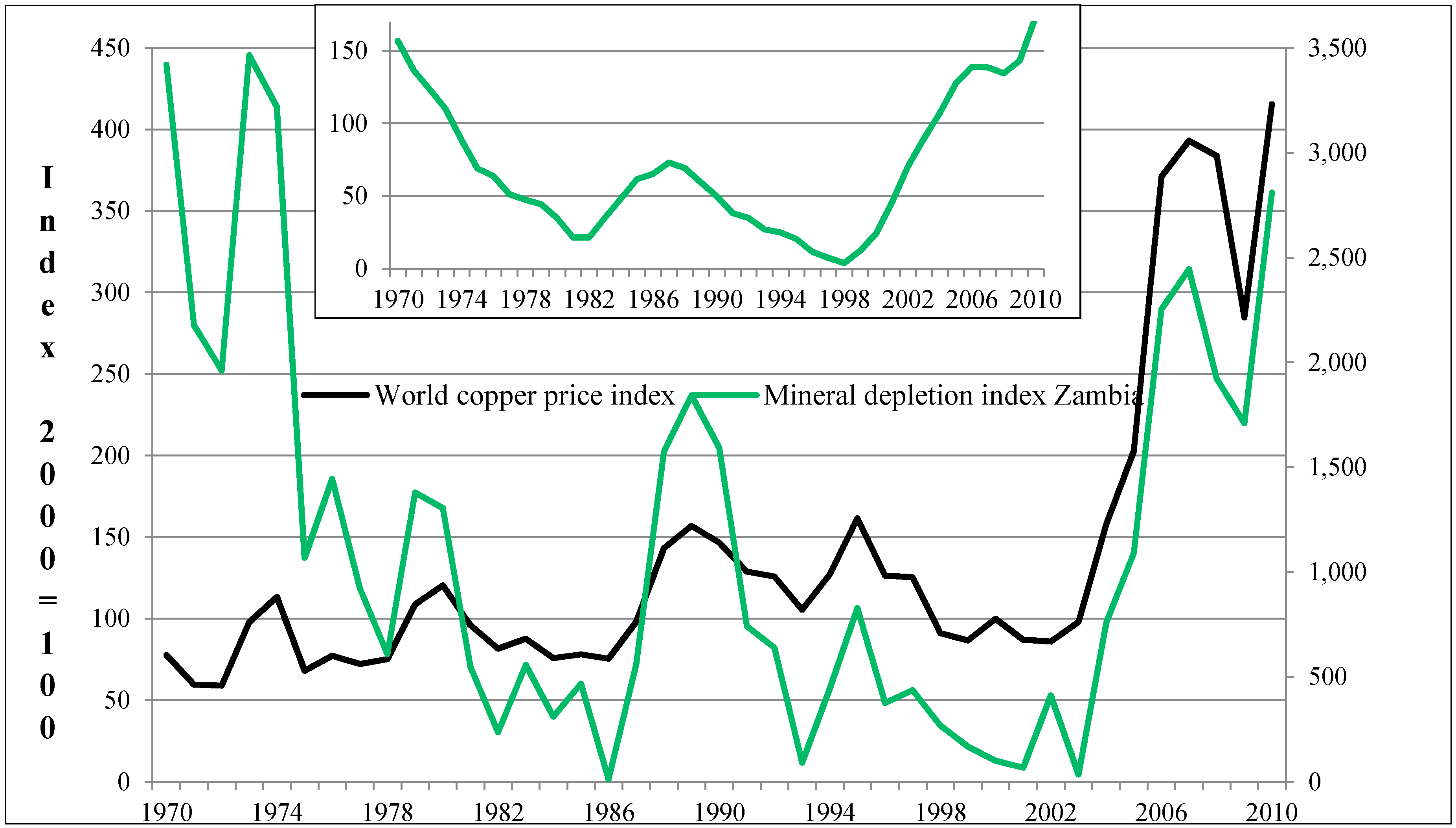

4.6.2. Metal and Mineral Depletion

4.6.3. Net Forest Depletion

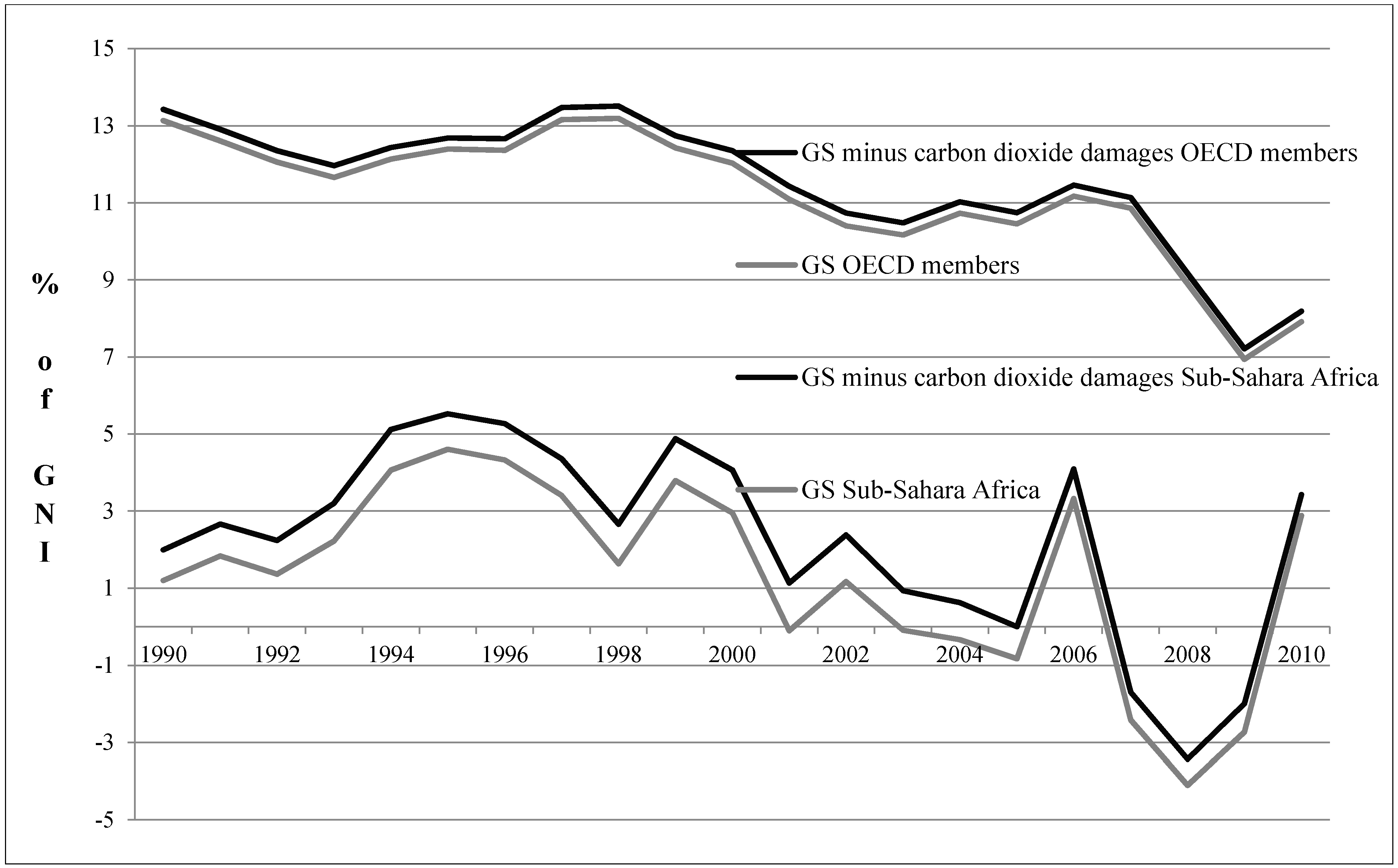

4.6.4. Air Pollution Damages

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Dietz, S.; Neumayer, E. Genuine Savings: A critical analysis of its policy-guiding value. Int. J. Environ. Sustain. Dev. 2004, 3, 276–292. [Google Scholar] [CrossRef]

- Dietz, S.; Neumayer, E. A critical appraisal of genuine savings as an indicator of sustainability. In Sustainable Development Indicators in Ecological Economics. Current Issues in Ecological Economics; Lawn, P., Ed.; Edward Elgar: Cheltenham, UK, 2006; pp. 117–138. [Google Scholar]

- Carlowitz, H.C. Sylvicultura Oeconomica, 2nd ed.; Kessel: Leipzig, Germany, 2009. [Google Scholar]

- Malthus, T. An Essay on the Principle of Population; J. Johnson: London, UK, 1798. [Google Scholar]

- Rao, P.K. Sustainable Development; Blackwell: Malden, MA, USA, 2000; pp. 1–30. [Google Scholar]

- Elliott, J.A. An Introduction to Sustainable Development, 3rd ed.; Routledge: London, UK, 2006; pp. 7–43. [Google Scholar]

- Rogers, P.P.; Jalal, K.F.; Boyd, J.A. An Introduction to Sustainable Development; Earthscan: London, UK; Sterling, VA, USA, 2008; pp. 20–41. [Google Scholar]

- Meadows, D.H. The Limits to Growth, a Report for the Club of Rome’s Project on the Predicament of Mankind; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Dasgupta, P.; Heal, G. The Optimal Depletion of Exhaustible Resources. Rev. Econ. Stud. 1974, 41, 3–28. [Google Scholar] [CrossRef]

- Solow, R.M. Intergenerational Equity and Exhaustible Resources. Rev. Econ. Stud. 1974, 41, 29–45. [Google Scholar] [CrossRef]

- Solow, R.M. The Economics of Resources or the Resources of Economics. Am. Econ. Rev. 1974, 64, 29–45. [Google Scholar]

- Stiglitz, J. Growth with Exhaustible Natural Resources: Efficient and Optimal Growth Paths. Rev. Econ. Stud. 1974, 41, 123–137. [Google Scholar] [CrossRef]

- Pezzey, J. Sustainability: An Interdisciplinary Guide. Environ. Values 1992, 1, 321–362. [Google Scholar] [CrossRef]

- Hartwick, J.M. Intergenerational Equity and the Investing of Rents from Exhaustible Resources. Am. Econ. Rev. 1977, 67, 972–974. [Google Scholar]

- Harris, J.M. A Survey of Sustainable Development. Social and Economic Dimensions; Island Press: Washington, DC, USA, 2001. [Google Scholar]

- Atkinson, G.; Dietz, S.; Neumayer, E. Handbook of Sustainable Development; Elgar: Cheltenham, UK, 2008. [Google Scholar]

- Pezzey, J.; Toman, M.A. The economics of sustainability: A Review of Journal Articles. In Discussion Paper 02–03; Resources for the Future: Washington, DC, USA, 2002. [Google Scholar]

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK; New York, NY, USA, 1987. [Google Scholar]

- Baker, S. Sustainable Development; Routledge: London, UK; New York, NY, USA, 2006. [Google Scholar]

- Bell, S.; Morse, S. Sustainability Indicators. Measuring the Immeasurable? 2nd ed.; Earthscan: London, UK; Sterling, VA, USA, 2008. [Google Scholar]

- Neumayer, E. Weak versus Strong Sustainability: Exploring the Limits of Two Opposing Paradigms, 3rd ed.; Edward Elgar: Cheltenham, UK, 2010. [Google Scholar]

- Pearce, D.W.; Markandya, A.; Barbier, E. Blueprint for a Green Economy; Earthscan: London, UK, 1989. [Google Scholar]

- Daly, H.E. Steady-State Economics, 2nd ed.; Earthscan: London, UK, 1992. [Google Scholar]

- Ayres, R.U. On the practical limits to substitution. Ecol. Econ. 2007, 61, 115–128. [Google Scholar] [CrossRef]

- Hartwick, J.M. Investing returns from depleting renewable resource stocks and intergenerational equity. Econ. Lett. 1978, 1, 85–88. [Google Scholar] [CrossRef]

- Hartwick, J.M. Natural resources, national accounting and economic depreciation. J. Public Econ. 1990, 43, 291–304. [Google Scholar] [CrossRef]

- Hartwick, J.M. Notes on Economic Depreciation of Natural Resource Stocks and National Accounting. In Approaches to Environmental Accounting, Proceedings of the IARIW Conference on Environmental Accounting; Franz, A., Stahmer, C., Eds.; Physica: Heidelberg, Gemany, 1993; pp. 167–198. [Google Scholar]

- Hartwick, J.M. Constant Consumption Paths in Open Economies with Exhaustible Resources. Rev. Int. Econ. 1995, 3, 275–283. [Google Scholar] [CrossRef]

- Solow, R.M. On the Intergenerational Allocation of Natural Resources. Scan. J. Econ. 1986, 88, 141–149. [Google Scholar] [CrossRef]

- Solow, R.M. Sustainability: An Economist’s Perspective. In Eighteenth J. Steward Johnson Lecture to the Marine Policy Center; Woods Hole Oceanographic Institution: Woods Hole, MA, USA, 14 June 1991; pp. 179–187. [Google Scholar]

- Solow, R.M. An almost practical step toward sustainability. Resour. Policy 1993, 19, 162–172. [Google Scholar] [CrossRef]

- Hartwick, J.M. What would Solow Say? J. Natl. Resour. Policy Res. 2009, 1, 91–96. [Google Scholar] [CrossRef]

- Hartwick, J.M. Sustainable consumption programs. In Handbook of Environmental Accounting; Aronsson, T., Lofgren, K.G., Eds.; Edward Elgar Publishing: Northhampton, MA, USA, 2010; pp. 207–236. [Google Scholar]

- Costanza, R.; Daly, H.E. Natural Capital and Sustainable Development. Conserv. Biol. 1992, 6, 37–46. [Google Scholar] [CrossRef]

- Atkinson, G.; Hamilton, K. Progress along the path: Evolving issues in the measurement of genuine saving. Environ Resour. Econ. 2007, 37, 43–61. [Google Scholar] [CrossRef]

- Hamilton, K.; Clemens, M. Genuine Savings Rates in Developing Countries. World Bank Econ. Rev. 1999, 13, 333–356. [Google Scholar] [CrossRef]

- Pearce, D.W.; Atkinson, G.D. Capital theory and the measurement of sustainable development: An indicator of “weak” sustainability. Ecol. Econ. 1993, 8, 103–108. [Google Scholar] [CrossRef]

- World Bank (Ed.) Where is the Wealth of Nations? Measuring Capital for the 21st Century; World Bank: Washington, DC, USA, 2006.

- World Bank (Ed.) The Changing Wealth of Nations. Measuring Sustainable Development in the New Millennium; World Bank: Washington, DC, USA, 2011.

- Hamilton, K. Green adjustments to GDP. Resour. Policy 1994, 20, 155–168. [Google Scholar] [CrossRef]

- Hamilton, K. Pollution and Pollution Abatement in the National Accounts. Rev. Income Wealth 1996, 42, 13–33. [Google Scholar] [CrossRef]

- Pearce, D.; Hamilton, K.; Atkinson, G. Measuring sustainable development: Progress on indicators. Environ. Dev. Econ. 1996, 1, 85–101. [Google Scholar] [CrossRef]

- Atkinson, G.; Dubourg, R.; Hamilton, K.; Munasinghe, M.; Pearce, D.; Young, C. Measuring Sustainable Development: Macroeconomics and Environment; Edward Elgar: Cheltenham, UK, 1997. [Google Scholar]

- Atkinson, G. Re-thinking Economic Progress. World Econ. 2000, 1, 153–166. [Google Scholar]

- Hartwick, J.M. “Net Investment” and Sustainability. Natl. Resour. Model. 2003, 16, 145–160. [Google Scholar] [CrossRef]

- Dietz, S.; Neumayer, E.; Soysa, I. Corruption, the resource curse and genuine saving. Environ. Dev. Econ. 2007, 12, 33–53. [Google Scholar] [CrossRef]

- Hamilton, K.; Atkinson, G.; Pearce, D. Genuine Savings as an Indicator of Sustainability; CSERGE Working Paper GEC 97–03 GEC97; GSERGE: Norwich, UK, 1997. [Google Scholar]

- Hartwick, J.M.; Long, N.V.; Tian, H. On the Peaking of Consumption with Exhaustible Resources and Zero Net Investment. Environ. Resour. Econ. 2003, 24, 235–244. [Google Scholar] [CrossRef]

- Hamilton, K.; Atkinson, G. Wealth, Welfare and Sustainability: Advances in Measuring Sustainable Development; Edward Elgar Publishing Limited: Cheltenham, UK, 2006. [Google Scholar]

- Pezzey, J. One-sided sustainability tests with amenities, and changes in technology, trade and population. J. Environ. Econ. Manag. 2004, 48, 613–631. [Google Scholar] [CrossRef]

- Hamilton, K. Genuine Savings as a Sustainability Indicator. In Frameworks to Measure Sustainable Development. An OECD Expert Workshop; OECD, Ed.; OECD: Paris, France, 2000; pp. 65–77. [Google Scholar]

- Bolt, K.; Matete, M.; Clemens, M. Manual for Calculating Adjusted Net Savings; World Bank: Washington, DC, USA, 2002. [Google Scholar]

- World Bank (Ed.) World Development Indicators 2012; World Bank: Washington, DC, USA, 2012.

- World Development Indicators. Available online: http://data.worldbank.org/data-catalog/world-development-indicators (accessed on 16 November 2014).

- Fankhauser, S. The economic costs of global warming damage: A survey. Glob. Environ. Change 1994, 4, 301–309. [Google Scholar] [CrossRef]

- Soysa, I.; Bailey, J.; Neumayer, E. Free to Squander? Democracy and Sustainable Development, 1975–2000. In Global Environmental Change and Human Security; Matthew, R.A., Ed.; MIT Press: Cambridge, UK, 2010; pp. 262–289. [Google Scholar]

- Neumayer, E. Weak versus Strong Sustainability. Exploring the Limits of Two Opposing Paradigms; Edward Elgar: Cheltenham, UK, 1999. [Google Scholar]

- Neumayer, E. Weak versus Strong Sustainability: Exploring the Limits of Two Opposing Paradigms, 2nd ed.; Edward Elgar: Cheltenham, UK, 2003. [Google Scholar]

- Beckerman, W. ‘Sustainable Development’: Is it a Useful Concept? Environ. Values 1994, 3, 191–209. [Google Scholar] [CrossRef]

- Beckerman, W. How would you Like your ‘Sustainability’, Sir? Weak or Strong? A Reply to my Critics. Environ. Values 1995, 4, 169–179. [Google Scholar] [CrossRef]

- Jacobs, M. Sustainable Development, Capital Substitution and Economic Humility: A Response to Beckerman. Environ. Values 1995, 4, 57–68. [Google Scholar]

- Daly, H.E. On Wilfred Beckerman’s Critique of Sustainable Development. Environ. Values 1995, 4, 49–55. [Google Scholar] [CrossRef]

- Neumayer, E. Scarce or abundant? The Economics of Natural Resource Availability. J. Econ. Surv. 2000, 14, 307–335. [Google Scholar] [CrossRef]

- Simpson, R.D.; Toman, M.A.; Ayres, R.U. Scarcity and Growth Revisited: Natural Resources and the Environment in the New Millennium; Resources for the Future: Washington, DC, USA, 2005. [Google Scholar]

- Hamilton, K.; Atkinson, G. Air pollution and green accounts. Valuing air pollution damage. Energy Policy 1996, 24, 675–684. [Google Scholar] [CrossRef]

- Hamilton, K.; Hartwick, J.M. Investing exhaustible resource rents and the path of consumption. Can. J. Econ. 2005, 38, 615–621. [Google Scholar] [CrossRef]

- Hamilton, K.; Bolt, K. Genuine saving as an indicator of sustainability. In Handbook of Sustainable Development; Atkinson, G., Dietz, S., Neumayer, E., Eds.; Edward Elgar: Cheltenham, UK, 2008. [Google Scholar]

- Hamilton, K. Sustaining Economic Welfare: Estimating Changes in Total and Per Capita Wealth. Environ. Dev. Sustain. 2003, 5, 419–436. [Google Scholar] [CrossRef]

- Dasgupta, P. Human Well-being and the Natural Environment; University Press: Oxford, UK; New York, NY, USA, 2001. [Google Scholar]

- Arrow, K.J.; Dasgupta, P.; Goulder, L.H.; Mumford, K.J.; Oleson, K. Sustainability and the measurement of wealth. Environ. Dev. Econ. 2012, 17, 317–353. [Google Scholar] [CrossRef]

- Dasgupta, P. Valuing Objects and Evaluating Policies in Imperfect Economies. Econ. J. 2001, 111, 1–29. [Google Scholar] [CrossRef]

- Dasgupta, P.; Mäler, K.G. Wealth as a Criterion for Sustainable Development; University of Cambridge and Beijer International Institute of Ecological Economics: Stockholm, Sweden, 2001. [Google Scholar]

- Hamilton, K. Sustaining per Capita Welfare with Growing Population: Theory and Measurement; Paper Presented at the Second World Congress of Environmental and Resource Economists. World Bank: Washington, DC, USA, 2002. Available online: http://econweb.ucsd.edu/~carsonvs/papers/681.doc (accessed on 8 April 2015).

- Arrow, K.J.; Dasgupta, P.; Mäler, K.G. The genuine savings criterion and the value of population. Econ. Theory 2003, 21, 217–225. [Google Scholar] [CrossRef]

- Arrow, K.J.; Dasgupta, P.; Goulder, L.; Daily, G.; Ehrlich, P.; Heal, G.; Levin, S.; Mäler, K.G.; Schneider, S.; Starrett, D.; et al. Are We Consuming Too Much? J. Econ. Perspect. 2004, 18, 147–172. [Google Scholar] [CrossRef]

- Arrow, K.J.; Bensoussan, A.; Feng, Q.; Sethi, S.P. The genuine savings criterion and the value of population in an economy with endogenous fertility rate. In Optimal Control of Age-Structured Populations in Economy, Demography, and the Environment, Routledge Explorations in Environmental Economics No. 29; Boucekkine, R., Hritonenko, N., Yatsenko, Y., Eds.; Routledge: London, UK; New York, NY, USA, 2010; pp. 20–44. [Google Scholar]

- Hamilton, K. Testing Genuine Savings; World Bank Policy Research Work. Paper; World Bank: Washington, DC, USA, 2005. [Google Scholar]

- Ferreira, S.; Vincent, J.R. Genuine Savings: Leading Indicator of Sustainable Development? Econ. Dev. Cult. Change 2005, 53, 737–754. [Google Scholar] [CrossRef]

- Vincent, J.R.; Panayotou, T.; Hartwick, J.M. Resource Depletion and Sustainability in Small Open Economies. J. Environ. Econ. Manag. 1997, 33, 274–286. [Google Scholar] [CrossRef]

- Asheim, G.B. Hartwick’s Rule in Open Economies. Can. J. Econ. 1986, 19, 395–402. [Google Scholar] [CrossRef]

- Sefton, J.A.; Weale, M.R. The net national product and exhaustible resources: The effects of foreign trade. J. Public Econ. 1996, 61, 21–47. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. Natural Resource Abundance and Economic Growth. Available online: http://www.cid.harvard.edu/ciddata/warner_files/natresf5.pdf (accessed on 8 April 2015).

- Neumayer, E. Does the “Resource Curse” hold for Growth in Genuine Income as Well? World Dev. 2004, 32, 1627–1640. [Google Scholar] [CrossRef]

- Boos, A.; Holm-Müller, K. The Relationship between the Resource Curse and Genuine Savings: Empirical Evidence. J. Sustain. Dev. 2013, 6, 59–72. [Google Scholar] [CrossRef]

- Boos, A.; Holm-Müller, K. A theoretical overview of the relationship between the resource curse and genuine savings as an indicator for “weak” sustainability. Natl. Resour. Forum 2012, 36, 145–159. [Google Scholar] [CrossRef]

- Boos, A.; Holm-Müller, K. The Zambian Resource Curse and its influence on Genuine Savings as an indicator for “weak” sustainable development. Environ. Dev. Sustain. 2015, in press. [Google Scholar]

- Hamilton, K.; Atkinson, G.; Pearce, D. Savings Rules and Sustainability: Selected Extensions; World Bank: Washington, DC, USA; London, UK, 1998. [Google Scholar]

- Haber, S.; Menaldo, V. Do Natural Resources Fuel Authoritarianism? A Reappraisal of the Resource Curse. Am. Polit. Sci. Rev. 2011, 105, 1–26. [Google Scholar] [CrossRef]

- Proops, J.L.R.; Atkinson, G.; Schlotheim, B.F.v.; Simon, S. International trade and the sustainability footprint: A practical criterion for its assessment. Ecol. Econ. 1999, 28, 75–97. [Google Scholar] [CrossRef]

- Daly, H.E.; Cobb, J.B. For the Common Good: Redirecting the Economy toward Community, the Environment, and a Sustainable Future; Beacon Press: Boston, MA, USA, 1994; ISBN 978-0807047057. [Google Scholar]

- Cobb, C.W.; Cobb, J.B. The Green National Product: A Proposed Index of Sustainable Economic Welfare; University Press of America: Lanham, MD, USA, 1994. [Google Scholar]

- Stockhammer, E.; Hochreiter, H.; Obermayr, B.; Steiner, K. The index of sustainable economic welfare (ISEW) as an alternative to GDP in measuring economic welfare. The results of the Austrian (revised) ISEW calculation 1955–1992. Ecol. Econ. 1997, 21, 19–34. [Google Scholar] [CrossRef]

- Castaneda, B.E. An index of sustainable economic welfare (ISEW) for Chile. Ecol. Econ. 1999, 28, 231–244. [Google Scholar] [CrossRef]

- Neumayer, E. The ISEW—Not an Index of Sustainable Economic Welfare. Soc. Indic. Res. 1999, 48, 77–101. [Google Scholar] [CrossRef]

- Lawn, P.A. A theoretical foundation to support the Index of Sustainable Economic Welfare (ISEW), Genuine Progress Indicator (GPI), and other related indexes. Ecol. Econ. 2003, 44, 105–118. [Google Scholar] [CrossRef]

- Lawn, P.A. An assessment of alternative measures of sustainable economic welfare. In Sustainable Development Indicators in Ecological Economics. Current Issues in Ecological Economics; Lawn, P., Ed.; Edward Elgar: Cheltenham, UK, 2006; pp. 139–165. [Google Scholar]

- Robinson, J.A.; Torvik, R. White elephants. J. Public Econ. 2005, 89, 197–210. [Google Scholar] [CrossRef]

- López Córdova, E.; Olmedo, A. International Remittances and Development. Existing Evidence, Policies and Recommendations; Institute for the Integration of Latin America and the Caribbean: Buenos Aires, Argentina, 2006. [Google Scholar]

- National Accounts: A Practical Introduction. Studies in Methods Handbook of National Accounting; United Nations (Ed.) Series F, No. 85; United Nations Publication: New York, NY, USA, 2003.

- OECD (Ed.) Measuring Capital: OECD Manual. Measurement of Capital Stocks, Consumption of Fixed Capital and Capital Services; OECD Publications Service: Paris, France, 2001.

- United Nations (Ed.) Links between Business Accounting and National Accounting. Studies in Methods; Handbook of National Accounting, Series F, No. 76; United Nations publication: New York, NY, USA, 2000.

- Jacobs, M. The Green Economy: Environment, Sustainable Development, and the Politics of the Future; Pluto Press: London, UK, 1991. [Google Scholar]

- O’Sullivan, A.; Sheffrin, S.M. Economics, Principles in Action; Pearson/Prentice Hall: Boston, MA, USA, 2007. [Google Scholar]

- Mincer, J. Schooling, Experience, and Earnings; National Bureau of Economic Research: New York, NY, USA, 1974. [Google Scholar]

- Mankiw, N.G. Brief Principles of Macroeconomics, 5th ed.; South-Western Cengage Learning: Mason, OH, USA, 2008. [Google Scholar]

- International Labour Organization (Ed.) Setting Social Security Standards in a Global Society; Social Security Policy Briefings, Paper 2; ILO Publications: Geneva, Switzerland, 2008.

- World Bank (Ed.) Africa Development Indicators 2014; World Bank: Washington, DC, USA, 2014. Available online: http://databank.worldbank.org/data/views/variableselection/selectvariables.aspx?source=africa-development-indicators#s_a (accessed on 16 November 2014).

- Statistics. Bank of Botswana: Gaborone, 2014. Available online: http://www.bankofbotswana.bw/index.php/content/2009110615029-other-data-sources (accessed on 16 November 2014).

- Central Statistics Office (Ed.) Sector Statistics Trade. In In Central Statistics Office: Gaborone, 2014. Available online: http://www.cso.gov.bw/index.php/sector-statistics/trade (accessed on 16 November 2014).

- UN Cometrade Database. Data. Available online: http://comtrade.un.org/data/ (accessed on 16 November 2014).

- Merlo, M.; Croitoru, L. (Eds.) Valuing Mediterranean Forests: Towards Total Economic Value; CABI Publishing: Wallingford, Germany, 2005.

- Food and Agriculture Organization of the United Nations (Ed.) Fishery and Aquaculture Country Profiles: The Republic of Guinea-Bissau; FAO: Rome, Italy, 1999. Available online: ftp://ftp.fao.org/FI/DOCUMENT/fcp/en/FI_CP_GW.pdf (accessed on 16 November 2014).

- Food and Agriculture Organization of the United Nations (Ed.) Fishery and Aquaculture Country Profiles: The Republic of Sierra Leone; FAO: Rome, Italy, 2006. Available online: http://www.fao.org/fishery/facp/SLE/en#CountrySector-Overview (accessed on 16 November 2014).

- Markandya, A.; Hunt, A.; Mason, P. Valuing Damages for Green Accounting Purposes: The GARPII Approach; FEEM Nota di Lavoro No. 93.2000; Foundazione Eni Enrico Mattei (FEEM): Milan, Italy, 2000. [Google Scholar]

- Hartridge, O.; Pearce, D.W. Is UK Agriculture Sustainable? Environmentally Adjusted Economic Accounts for UK Agriculture; CSERGE-Economics: London, UK, 2001. [Google Scholar]

- AEA Technology (Ed.) An Evaluation of the Air Quality Strategy; Report to the Department for Environment, Food and Rural Affairs (DEFRA): London, UK, 2004.

- World Bank (Ed.) World Development Indicators 2005; World Bank: Washington, DC, USA, 2005.

- Department for Environment, Food and Rural Affairs (DEFRA) (Ed.) Digest of Environmental Statistics; DEFRA: London, UK, 2005.

- Kunnas, J.; McLaughlin, E.; Hanley, N.; Oxley, L.; Greasley, D.; Warde, P. How Environmental Pollution from Fossil Fuels can be included in measures of National Accounts and Estimates of Genuine Savings. Stirl. Econ. Discuss. Paper 2012, 16, 1–28. [Google Scholar]

- Ferreira, S.; Moro, M. Constructing genuine savings indicators for Ireland, 1995–2005. J. Environ. Manag. 2011, 92, 542–553. [Google Scholar] [CrossRef]

- World Bank (Ed.) World Development Indicators 2014; World Bank: Washington, DC, USA, 2014. Available online: http://databank.worldbank.org/data/views/variableSelection/selectvariables.aspx?source=world-development-indicators (accessed on 16 November 2014).

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Boos, A. Genuine Savings as an Indicator for “Weak” Sustainability: Critical Survey and Possible Ways forward in Practical Measuring. Sustainability 2015, 7, 4146-4182. https://doi.org/10.3390/su7044146

Boos A. Genuine Savings as an Indicator for “Weak” Sustainability: Critical Survey and Possible Ways forward in Practical Measuring. Sustainability. 2015; 7(4):4146-4182. https://doi.org/10.3390/su7044146

Chicago/Turabian StyleBoos, Adrian. 2015. "Genuine Savings as an Indicator for “Weak” Sustainability: Critical Survey and Possible Ways forward in Practical Measuring" Sustainability 7, no. 4: 4146-4182. https://doi.org/10.3390/su7044146

APA StyleBoos, A. (2015). Genuine Savings as an Indicator for “Weak” Sustainability: Critical Survey and Possible Ways forward in Practical Measuring. Sustainability, 7(4), 4146-4182. https://doi.org/10.3390/su7044146