Investment Risk Assessment and Countermeasure Strategies for Highway PPP Projects in Western China: A Dynamic Risk Accumulation Modeling Approach

Abstract

1. Introduction

2. Literature Review

2.1. Research on Risk Identification Based on Sustainability Factors

2.2. Research on Risk Management of PPP Projects in Transportation Infrastructure

2.3. Dynamic Modeling Approaches for Risk Assessment

- Integration of economic, environmental, and social risk interactions within a unified framework, particularly critical for irreversible thresholds that demand threshold-driven models over dynamic feedbacks [58];

- Quantitative analysis of time-delayed effects from policy adjustments and market fluctuations;

- Simulation of cumulative impacts from long-term risk factors such as climate change;

- Rapid risk screening capabilities through modular designs, as validated in public health emergencies where time-sensitive decisions prioritize causal chains over feedback loops [59].

- Identification of critical risk transmission pathways and cascade effects

- Quantification of time-delayed impacts and nonlinear risk accumulation

- Provision of dynamic simulation support for investment decision-making. This modular design echoes Rouwette et al. [60]’s emphasis on screening tools that sacrifice complexity for transparency and speed.

2.4. Model Scope Delimitation

3. Methodology and Data Presentation

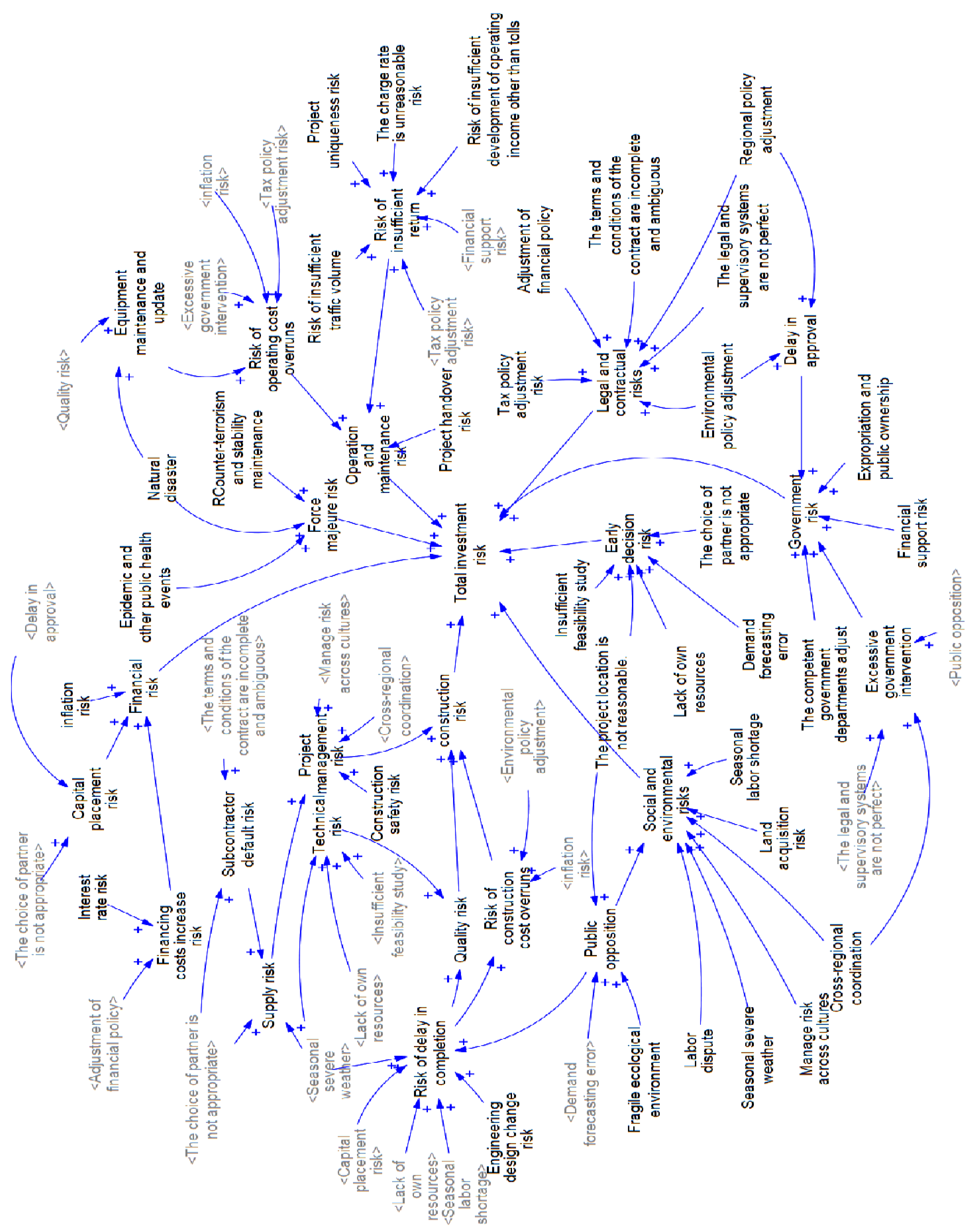

3.1. Risk Identification

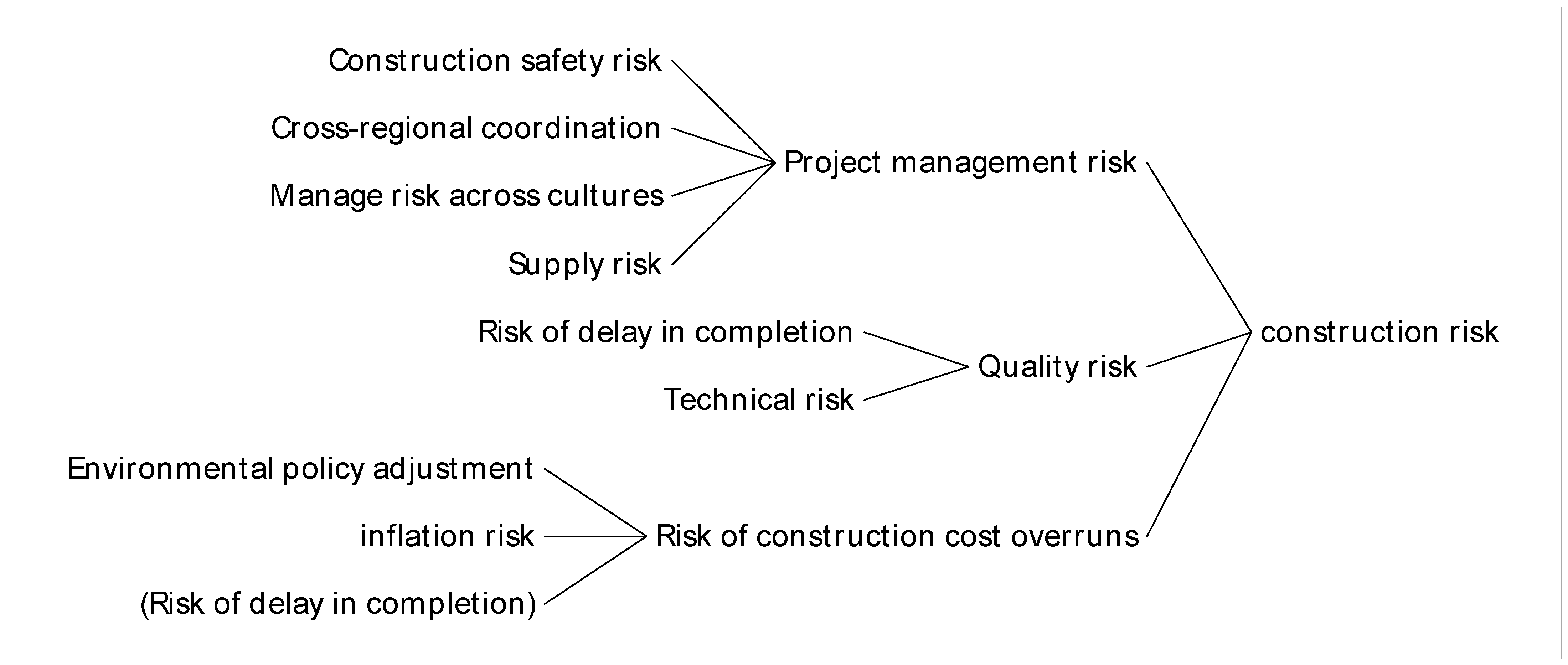

3.2. Risk Analysis

3.2.1. Project Internal Risk

3.2.2. Project External Risk

3.3. Development of a Dynamic Risk Accumulation Model Based on Systems Thinking

- Clarify project characteristics and research objectives;

- Identify critical risk factors (sub-objective layer risks) and delineate system boundaries;

- Establish risk propagation pathways (e.g., ecological sensitivity → design modifications → schedule delays → budget overruns).

- Develop causal loop diagrams to visualize variable interactions;

- Deliberately defer the incorporation of feedback loops (a hallmark of system dynamics) to prioritize risk threshold identification, thereby addressing urgent decision-making needs for PPP project portfolios.

- Define stock variables (project duration status, financial health, policy stability);

- Specify flow variables (evolution rates of various risks);

- Establish auxiliary variables and constant parameters.

- Quantify risk interrelationships, with risk accumulation mechanisms serving as the foundational modeling principle to characterize risk progression toward critical thresholds (e.g., construction cost overruns → payment default risks → operational revenue shortfalls → financial risk escalation);

- Initialize parameters (detailed in subsequent sections);

- Conduct model verification and parameter calibration.

- Validate the model using historical data and expert assessments;

- Perform sensitivity analysis and parameter optimization;

- Ensure congruence between model behavior and real-world system dynamics.

- Design multi-dimensional risk scenarios for simulation;

- Evaluate risk severity levels based on simulation outcomes;

- Generate decision-support materials incorporating both quantitative and qualitative risk analyses.

- Continuously collect real-time project progression data;

- Periodically update model parameters and structures (e.g., upon validating risk accumulation mechanisms, develop bidirectional dynamic relationships: payment default risks ⇄ cost overrun risks);

- Implement dynamic risk assessment and management protocols.

SD Model Function Relationship Was Established

3.4. Data Source

3.4.1. Micro-Risk Initial Value Calculation

3.4.2. Joint Weighting Method to Determine the Risk Weights

4. Calculation Results and Analysis

4.1. Calculation Result

4.2. Risk Grade Determination

4.3. Sensitivity Analysis

5. Discussion

5.1. Discussion on Conclusion of Risk Assessment

5.2. Key Risk Control Measures

6. Conclusions and Future Works

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hong, J.; Chu, Z.; Wang, Q. Transport Infrastructure and Regional Economic Growth: Evidence from China. Transportation 2011, 38, 737–752. [Google Scholar] [CrossRef]

- Li, Z.; Wang, H. Institutional Quality, Economic Development, and the Sustainable Outcomes of PPP projects: An Empirical Analysis of Failed PPP Projects in China from 2014 to 2020. Heliyon 2024, 10, e30977. [Google Scholar] [CrossRef] [PubMed]

- Chowdhury, A.N.; Chen, P.H.; Tiong, R.L.K. Credit Enhancement Factors for Financing Independent Power Producer (IPP) Projects in Asia. Int. J. Proj. Manag. 2015, 33, 1576–1587. [Google Scholar] [CrossRef]

- Carnis, L.; Yuliawati, E. Nusantara: Could the PPP be the Solution for Indonesian Airport Infrastructures Between sky and Earth? Case Stud. Transp. Policy 2013, 1, 18–26. [Google Scholar] [CrossRef]

- Jiang, W.; Yang, Q.; Jiang, J. Operational Risk Management of Public–Private Partnership Infrastructure Projects: A Bibliometric Literature Review. Buildings 2022, 12, 1905. [Google Scholar]

- National Development and Reform Commission (NDRC). Guiding Opinions on Regulating the Implementation of the New Mechanism for Public-Private Partnerships (Document No. 1092); Retrieved from National Development and Reform Commission. 2023. Available online: https://www.ndrc.gov.cn (accessed on 20 September 2024).

- Zhang, Y. Research on the Identification Model of Interest Conflict Influencing Factors in PPP Projects Construction of Smart City. Alex. Eng. J. 2022, 61, 12689–12698. [Google Scholar] [CrossRef]

- Zhang, L.; Sun, X.; Xue, H. Identifying critical risks in Sponge City PPP projects using DEMATEL method: A case study of China. J. Clean. Prod. 2019, 226, 949–958. [Google Scholar] [CrossRef]

- AlGeelani, A.; Abu Dabous, S.; Venkatachalam, S. Investigation of Project Delivery Risks in Public-Private-Partnership (PPP) Infrastructure Projects in UAE-A Stakeholder’s Perspective. In 2020 Advances in Science and Engineering Technology International Conferences (ASET); IEEE: New York, NY, USA, 2020; pp. 1–5. [Google Scholar]

- Sastoque, L.M.; Arboleda, C.A.; Ponz, J.L. A Proposal for Risk Allocation in Social Infrastructure Projects Applying PPP in Colombia. Procedia Eng. 2016, 145, 1354–1361. [Google Scholar] [CrossRef]

- Fu, L.; Sun, H.; Fang, Y.; Xu, K. A Systematic Review of the Public-Private-Partnership Literature Published Between 2012 and 2021. J. Civ. Eng. Manag. 2023, 29, 238–252. [Google Scholar] [CrossRef]

- Owolabi, H.A.; Bilal, M.; Oyedele, L.O.; Alaka, H.A.; Ajayi, S.O.; Akinade, O.O. Predicting Completion Risk in PPP Projects Using Big Data Analytics. IEEE Trans. Eng. Manag. 2018, 67, 430–453. [Google Scholar] [CrossRef]

- Shi, Q.; Liu, Y.; Zuo, J.; Pan, N.; Ma, G. On the management of social risks of hydraulic infrastructure projects in China: A case study. Int. J. Proj. Manag. 2015, 33, 483–496. [Google Scholar] [CrossRef]

- Tarazona, A.; Coelho, M.; Fernandes, S.; Matos, J. Transport Infrastructure Risk Management in the Context of Climate Change: Policies, Challenges, and Opportunities. Transp. Res. Procedia 2023, 72, 1404–1411. [Google Scholar] [CrossRef]

- Ministry of Finance of China. Notice on Further Promoting the Standardized Development and Transparent Operation of Public-Private Partnerships (PPP); No. 119 2022; Government of the People’s Republic of China: Beijing, China, 2022. Available online: https://www.gov.cn/zhengce/zhengceku/2022-11/18/content_5727758.htm (accessed on 1 October 2024).

- Flyvbjerg, B. What you Should Know About Megaprojects and Why: An Overview. Proj. Manag. J. 2014, 45, 6–19. [Google Scholar] [CrossRef]

- Grimsey, D.; Lewis, M.K. Public Private Partnerships: The Worldwide Revolution in Infrastructure Provision and Project Finance; Edward Elgar Publishing: Cheltenham, UK, 2004; pp. 89–112. [Google Scholar]

- World Bank. Mexico Toll Road Restructuring: Lessons Learned; Report No. 78556-MX; World Bank: Washington, DC, USA, 2013; Available online: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/785561468260476690/mexico-toll-road-restructuring-lessons-learned (accessed on 5 October 2024).

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone Publishing: Oxford, UK, 1998; pp. 73–95. [Google Scholar]

- Ameyaw, E.E.; Chan, A.P. Evaluating Key Risk Factors for PPP Water Projects in Ghana. J. Facil. Manag. 2015, 13, 133–155. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; Resolution A/RES/70/1; United Nations: New York, NY, USA, 2015; Available online: https://sdgs.un.org/2030agenda (accessed on 5 October 2024).

- Asian Infrastructure Investment Bank (AIIB). Moonshots for the eMerging World; AIIB: Beijing, China, 2022; Available online: https://www.aiib.org/en/news-events/asian-infrastructure-finance/_common/pdf/AIIB-Asian-Infrastructure-Finance-2022.pdf (accessed on 16 October 2024).

- Li, S.Z. Research on the Sustainable Development Path of PPP Projects under the ESG Concept. In China PPP Industry Development Report (2022); Ma, H.T., Yang, J.M., Eds.; Social Sciences Academic Press: Beijing, China, 2023; pp. 308–320. [Google Scholar]

- IPCC. Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report; Cambridge University Press: Cambridge, UK, 2021; Available online: https://www.ipcc.ch/report/ar6/wg1/ (accessed on 16 October 2024).

- Forman, R.T.T.; Sperling, D.; Bissonette, J.A.; Clevenger, A.P. Road Ecology: Science and Solutions; Island Press: Washington, DC, USA, 2003; pp. 201–230. [Google Scholar]

- Hodge, G.A.; Greve, C. Public–Private Partnerships: An International Performance Review. Public Adm. Rev. 2007, 67, 545–558. [Google Scholar] [CrossRef]

- World Bank. Policy Consistency in Infrastructure PPPs; Infrastructure Finance Series; World Bank: Washington, DC, USA, 2020; Available online: https://openknowledge.worldbank.org/handle/10986/33845 (accessed on 16 October 2024).

- International Chamber of Commerce (ICC). Dispute Resolution Statistics 2021; ICC: Paris, France, 2022; Available online: https://iccwbo.org/dispute-resolution-services/arbitration/arbitration-statistics (accessed on 16 October 2024).

- Grimsey, D.; Lewis, M.K. Evaluating the Risks of Public Private Partnerships for Infrastructure Projects. Int. J. Proj. Manag. 2002, 20, 107–118. [Google Scholar] [CrossRef]

- Shen, L.Y.; Platten, A.; Deng, X.P. Role of Public Private Partnerships to Manage Risks in Public Sector Projects in Hong Kong. Int. J. Proj. Manag. 2006, 24, 587–594. [Google Scholar] [CrossRef]

- Mazher, K.M.; Chan, A.P.C.; Choudhry, R.M.; Zahoor, H.; Edwards, D.J.; Ghaithan, A.M.; Mohammed, A.; Aziz, M. Identifying Measures of Effective Risk Management for Public–Private Partnership Infrastructure Projects in Developing Countries. Sustainability 2022, 14, 14149. [Google Scholar] [CrossRef]

- Bai, L.; Li, Y.; Du, Q. A Fuzzy Comprehensive Evaluation Model for Sustainability Risk Evaluation of PPP Projects. Sustainability 2017, 9, 1890. [Google Scholar] [CrossRef]

- Xu, Y.; Yeung, J.F.Y.; Chan, A.P.C. Developing a Risk Assessment Model for PPP Projects in China—A Fuzzy Synthetic Evaluation Approach. Autom. Constr. 2010, 19, 929–943. [Google Scholar] [CrossRef]

- Jokar, E.; Aminnejad, B.; Lork, A. Assessing and Prioritizing Risks in Public-Private Partnership (PPP) Projects Using the Integration of Fuzzy Multi-Criteria Decision-Making Methods. Oper. Res. Perspect. 2021, 8, 100190. [Google Scholar] [CrossRef]

- Jiang, X.; Lu, K.; Xia, B.; Liu, Y.; Cui, C. Identifying Significant Risks and Analyzing Risk Relationships for Construction PPP Projects in China Using Integrated FISM-MICMAC Approach. Sustainability 2019, 11, 5206. [Google Scholar] [CrossRef]

- Fang, C.; Marle, F.; Xie, M.; Zio, E. An Integrated Framework for Risk Response Planning Under Resource Constraints in Large Engineering Projects. IEEE Trans. Eng. Manag. 2013, 60, 627–639. [Google Scholar] [CrossRef]

- Akbari, A.A.; Heravi, G. Risk Assessment Framework of PPP-megaprojects Focusing on Risk Interaction and Project Success. Transp. Res. Part A Policy Pract. 2019, 124, 169–188. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, C.; Li, L.; Wang, Y.; Chen, K.; Xu, R. A risk Assessment Framework of PPP Waste-to-energy Incineration Projects in China Under a 2-dimension Linguistic Environment. J. Clean. Prod. 2018, 183, 602–617. [Google Scholar] [CrossRef]

- Darko, D.; Zhu, D.; Quayson, M.; Hossin, A.; Omoruyi, O.; Bediako, A.K. A multicriteria decision framework for governance of PPP projects towards sustainable development. Socio-Econ. Plan. Sci. 2023, 87, 101580. [Google Scholar] [CrossRef]

- Wang, J.; Luo, L.; Sa, R. A Quantitative Analysis of Decision-Making Risk Factors for Mega Infrastructure Projects in China. Sustainability 2023, 15, 15301. [Google Scholar] [CrossRef]

- Kaewunruen, S.; Baniotopoulos, C.; Guo, Y.; Sengsri, P.; Teuffel, P.; Bajare, D. 6D-BIM Applications to Enrich Circular Value Chains and Stakeholder Engagement Within Built Environments. In Lecture Notes in Civil Engineering, Proceedings of the 4th International Conference “Coordinating Engineering for Sustainability and Resilience” & Midterm Conference of CircularB “Implementation of Circular Economy in the Built Environment”, Timișoara, Romania, 29–31 May 2024; Ungureanu, V., Bragança, L., Baniotopoulos, C., Abdalla, K.M., Eds.; Springer Nature: Cham, Switzerland, 2024; Volume 489, pp. 346–356. [Google Scholar]

- Kaewunruen, S.; Sresakoolchai, J.; Ma, W.; Phil-Ebosie, O. Digital Twin Aided Vulnerability Assessment and Risk-Based Maintenance Planning of Bridge Infrastructures Exposed to Extreme Conditions. Sustainability 2021, 13, 2051. [Google Scholar] [CrossRef]

- Maneerat, P.; Rungskunroch, P.; Persaud, P. Seismic hazard analysis and financial impact assessment of railway infrastructure in the US West Coast: A machine learning approach. PLoS ONE 2024, 19, e0308255. [Google Scholar] [CrossRef]

- Cao, Y.; Li, H.; Su, L. Deciphering the Difference Puzzle of Risk-sharing: A Comparative Analysis of Infrastructure PPP Development Within China and US. Proj. Leadersh. Soc. 2024, 5, 100135. [Google Scholar] [CrossRef]

- Fleta-Asín, J.; Muñoz, F. How does Risk Transference to Private Partners Impact Public-Private-Partnerships’ Success? Empirical Evidence from Developing Economies. Socio-Econ. Plan. Sci. 2020, 72, 100869. [Google Scholar] [CrossRef]

- Pagoni, E.G.; Georgiadis, P. System Dynamics Approaches to Public-Private-Partnerships: A Literature Review. Syst. Res. Behav. Sci. 2020, 37, 277–291. [Google Scholar] [CrossRef]

- Dziadosz, A.; Rejment, M. Risk Analysis in Construction Project - Chosen Methods. Procedia Eng. 2015, 122, 258–265. [Google Scholar] [CrossRef]

- Liu, X.; Zeng, M. Renewable Energy Investment Risk Evaluation Model Based on System Dynamics. Renew. Sustain. Energy Rev. 2017, 73, 782–788. [Google Scholar] [CrossRef]

- Sterman, J.D. All models are wrong: Reflections on becoming a systems scientist. Syst. Dyn. Rev. 2002, 18, 501–531. [Google Scholar] [CrossRef]

- Riaz, H.; Khan, K.I.A.; Ullah, F.; Tahir, M.B.; Alqurashi, M.; Alsulami, B.T. Key Factors for Implementing Total Quality Management in Construction Sector: A System Dynamics Approach. Ain Shams Eng. J. 2023, 14, 101903. [Google Scholar] [CrossRef]

- Liu, A.; Chen, K.; Huang, X.; Li, D.; Zhang, X. Dynamic Risk Assessment Model of Buried Gas Pipelines Based on System Synamics. Reliab. Eng. Syst. Saf. 2021, 208, 107326. [Google Scholar] [CrossRef]

- Wu, W.; Sheng, L.; Tang, F.; Zhang, A.; Liu, J. A System Dynamics Model of Green Innovation and Policy Simulation with an Application in Chinese ManuFacturing Industry. Sustain. Prod. Consum. 2021, 28, 987–1005. [Google Scholar] [CrossRef]

- Xu, Y.; Du, R.; Pei, J. The Investment Risk Evaluation for Onshore and Offshore Wind Power Based on System Dynamics Method. Sustain. Energy Technol. Assessments 2023, 58, 103328. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhang, M.; Liu, T.; Mebarki, A. Impact of safety attitude, safety knowledge and safety leadership on chemical industry workers’ risk perception based on Structural Equation Modelling and System Dynamics. J. Loss Prev. Process Ind. 2021, 72, 104542. [Google Scholar] [CrossRef]

- Lu, Q.; Liu, M. Research on risks and prevention of low-carbon transition in cement enterprises based on system dynamics. Manag. Adm. 2024, 1–16, in press. (In Chinese) [Google Scholar] [CrossRef]

- Chen, X.; Zhao, Y.; Xue, S. A Study on the Dynamic Evolution Paths of Social Risks in PPP Projects of Water Environmental Governance—From the Vulnerability Perspective. Sustainability 2024, 16, 3951. [Google Scholar] [CrossRef]

- Lyneis, J.M.; Ford, D.N. System dynamics applied to project management: A survey, assessment, and directions for future research. Syst. Dyn. Rev. 2007, 23, 157–189. [Google Scholar] [CrossRef]

- Ford, A. Modeling the environment: An introduction to system dynamics models of environmental systems. Syst. Dyn. Rev. 1999, 15, 269–294. [Google Scholar] [CrossRef]

- Homer, J.B.; Hirsch, G.B. System dynamics modeling for public health: Background and opportunities. Syst. Dyn. Rev. 2006, 222, 123–136. [Google Scholar] [CrossRef]

- Rouwette, E.A.; Vennix, J.A.; van Mullekom, T. Group model building effectiveness: A review of assessment studies. Syst. Dyn. Rev. 2002, 18, 5–45. [Google Scholar] [CrossRef]

- Dasgupta, P. The Economics of Biodiversity: The Dasgupta Review; HM Treasury: London, UK, 2021. [Google Scholar]

- Stewart, R.W.; Fortune, J. Application of systems thinking to the identification, avoidance and prevention of risk. Int. J. Proj. Manag. 1995, 13, 279–286. [Google Scholar] [CrossRef]

- Nabawy, M.; Ofori, G.; Morcos, M.; Egbu, C. Risk Identification Framework in Construction of Egyptian Mega Housing Projects. Ain Shams Eng. J. 2021, 12, 2047–2056. [Google Scholar] [CrossRef]

- ISO 31000:2018; Risk Management—Guidelines. International Organization for Standardization: Geneva, Switzerland, 2018.

- Wei, Y.P. Risk Assessment of Private Sector in Rail Transit PPP Projects Based on System Dynamics; Zhongnan University of Economics and Law: Wuhan, China, 2022. [Google Scholar]

| Macro Risk | Medium Risk | Micro Risk | Micro-Risk Description |

|---|---|---|---|

| Project internal risk | Early decision risk | Insufficient feasibility study | The lack of research and analysis in the early stage of the project leads to insufficient decision-making basis. |

| The project location is not reasonable. | The selected project location is unsuitable for project implementation and may affect project efficiency. | ||

| Lack of own resources | Participants lack the technical, human, or financial resources to support the project. | ||

| The choice of partner is not appropriate. | The selected partner’s lack of competence or credibility will affect the project’s cooperation. | ||

| Demand forecasting error | Inaccurate estimates of future usage requirements of the project affect revenue expectations. | ||

| Construction risk | Project management risk | Lack of project management ability may lead to inefficient project implementation. | |

| Supply risk | The supply of raw materials or equipment is unstable, affecting the project schedule and cost. | ||

| Subcontractor default risk | The subcontractor’s failure to perform contractual obligations affects the quality and schedule of the project. | ||

| Technical risk | The technology used is not mature or applicable, affecting the project’s implementation effect. | ||

| Quality risk | Project quality is not up to standard, which may result in rework or security risks. | ||

| Risk of construction cost overruns | The actual construction cost exceeded the budget, affecting the financial balance of the project. | ||

| Construction safety risk | Safety accidents occur during construction, resulting in casualties or economic losses. | ||

| Risk of delay in completion | The project cannot be completed on time, affecting the start time of operation. | ||

| Engineering design change risk | Frequent design changes lead to increased costs and schedule delays. | ||

| Operation and maintenance risk | Risk of operating cost overruns | Actual operating costs were higher than expected, affecting project profitability. | |

| Risk of insufficient traffic volume | Actual traffic flow was lower than expected, affecting revenue. | ||

| Risk of insufficient return | The revenue generated by the project is lower than expected, affecting the return on investment. | ||

| The charge rate is an unreasonable risk. | The set charging standard is unreasonable, affecting the utilization rate or revenue. | ||

| Project uniqueness risk | The project lacks differentiated competitive advantages or faces homogeneous competition, resulting in insufficient market appeal. | ||

| Risk of insufficient development of operating income other than tolls | Failure to fully develop other sources of income limits earnings potential. | ||

| Project handover risk | Disputes arise, or assets are in poor condition when the project is handed over. | ||

| Equipment maintenance and update | Improper maintenance or delayed updates of equipment may affect operational efficiency. | ||

| Project external risk | Financial risk | Financing costs increase risk | Financing costs rise, increasing the financial pressure on projects. |

| Capital placement risk | Financing, loans, subsidies and other funds did not arrive on time, affecting the progress of the project. | ||

| Inflation risk | Inflation is higher than expected, affecting project costs and benefits. | ||

| Interest rate risk | Interest rate changes affect project financing costs and investment returns. | ||

| Legal and contractual risks | The terms and conditions of the contract are incomplete and ambiguous | There are loopholes or ambiguities in the contract, which may cause disputes. | |

| Adjustment of financial policy | Changes in financial policies affect project financing and operations. | ||

| Tax policy adjustment | Changes in tax policies affect the project’s financial status. | ||

| Environmental policy adjustment | Environmental policy changes increase project costs or restrict operations. | ||

| Regional policy adjustment | Related policy changes affect project support or preferential terms. | ||

| The legal and supervisory systems are not perfect | The imperfect laws and regulations increase the legal risk of the project. | ||

| Government risk | Delay in approval | The administrative approval process is slow, delaying the project’s progress. | |

| The competent government departments adjust. | Changes in government institutions or personnel affect project progress. | ||

| Excessive government intervention | Too much government interference in the operation of projects affects efficiency. | ||

| Financial support risk | Government financial support is insufficient or not timely, affecting the project capital chain. | ||

| Expropriation and public ownership | Government expropriation or public ownership of projects affects investors’ rights and interests. | ||

| Social and environmental risks | Public opposition | Projects encounter public opposition, affecting implementation or operation. | |

| Labor dispute | Improper handling of labor relations leads to disputes affecting the project. | ||

| Manage risk across cultures. | Cultural differences lead to management conflicts and affect project collaboration. | ||

| Fragile ecological environment | The project site is sensitive to the ecological environment, increasing environmental protection pressure. | ||

| Cross-regional coordination | Cross-regional project coordination is complicated and affects efficiency. | ||

| Seasonal severe weather | Extreme weather affects construction schedules and operational safety. | ||

| Seasonal labor shortage | The shortage of labor supply in certain seasons affects the project schedule. | ||

| Land acquisition risk | Land acquisition is difficult or costly, which affects project implementation. | ||

| Force majeure risk | Natural disaster | Natural disasters such as heavy snow and ice caused project losses. | |

| Epidemic and other public health events | Public health emergencies affect project schedules and operations. | ||

| Counter-terrorism and stability maintenance | The regional security situation affects the safety and regular operation of the project. |

| Lv. | Score | Occurrence Probability (%) | Instructions |

|---|---|---|---|

| Level 1 | 1 | [0,20] | Minimal probability of occurrence |

| Level 2 | 2 | (20,40] | Small probability of occurrence |

| Level 3 | 3 | (40,60] | Moderate probability |

| Level 4 | 4 | (60,80] | Greater probability of occurrence |

| Level 5 | 5 | (80,100] | Maximum probability of occurrence |

| Lv. | Score | Rank of Influence | Instructions |

|---|---|---|---|

| A | 1 | tiny | The consequences are negligible, but records should be kept. |

| B | 2 | lesser | Using fewer control measures can achieve the goal. |

| C | 3 | moderation | This can be achieved with large-scale controls. |

| D | 4 | larger | Using large-scale control measures can partially achieve the goal. |

| E | 5 | maximum | The project failed or was canceled. |

| Assignment | Assignment Meaning |

|---|---|

| 1.0 | Equally important |

| 1.2 | Slightly important |

| 1.4 | Obvious importance |

| 1.6 | Strongly important |

| 1.8 | vital |

| Risk Level | Value-at-Risk |

|---|---|

| Low risk | [0, 1/5Xmax] |

| Medium-low risk | [1/5Xmax, 2/5Xmax] |

| Medium risk | [2/5Xmax, 3/5Xmax] |

| Medium-high risk | [3/5Xmax, 4/5Xmax] |

| High risk | [4/5Xmax, Xmax] |

| Time (Year) | Early Decision Risk | Construction Risk | Operation and Maintenance Risk | Financial Risk | Social and Environmental Risks | Government Risk | Legal and Contractual Risks | Force Majeure Risk |

|---|---|---|---|---|---|---|---|---|

| 1 | 2.484 | 5.463 | 0 | 3.3367 | 2.604 | 2.968 | 2.034 | 2.339 |

| 5 | 12.422 | 17.236 | 11.616 | 15.306 | 13.290 | 16.872 | 10.174 | 11.698 |

| 10 | 24.844 | 17.236 | 41.982 | 28.317 | 26.646 | 38.451 | 20.349 | 23.396 |

| 15 | 37.266 | 17.236 | 72.677 | 41.329 | 40.003 | 60.036 | 30.524 | 35.094 |

| 20 | 49.688 | 17.236 | 103.372 | 54.340 | 53.360 | 81.622 | 40.699 | 46.793 |

| 25 | 62.110 | 17.236 | 134.067 | 67.351 | 66.716 | 103.208 | 50.874 | 58.491 |

| 30 | 74.533 | 17.236 | 164.762 | 80.362 | 80.073 | 124.794 | 61.049 | 70.189 |

| Boundary Risk Factor | Change in Investment Risk |

|---|---|

| Financial support risk | 3.7% |

| Risk of public health events such as epidemics | 3.5% |

| Risk of inadequate legal or regulatory systems | 2.9% |

| Inflation risk | 1.8% |

| Project uniqueness risk | 1.8% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, M.; Wu, X.; Yue, X.; Dai, X. Investment Risk Assessment and Countermeasure Strategies for Highway PPP Projects in Western China: A Dynamic Risk Accumulation Modeling Approach. Sustainability 2025, 17, 4200. https://doi.org/10.3390/su17094200

Li M, Wu X, Yue X, Dai X. Investment Risk Assessment and Countermeasure Strategies for Highway PPP Projects in Western China: A Dynamic Risk Accumulation Modeling Approach. Sustainability. 2025; 17(9):4200. https://doi.org/10.3390/su17094200

Chicago/Turabian StyleLi, Mengzhuo, Xincheng Wu, Xiying Yue, and Xiaomin Dai. 2025. "Investment Risk Assessment and Countermeasure Strategies for Highway PPP Projects in Western China: A Dynamic Risk Accumulation Modeling Approach" Sustainability 17, no. 9: 4200. https://doi.org/10.3390/su17094200

APA StyleLi, M., Wu, X., Yue, X., & Dai, X. (2025). Investment Risk Assessment and Countermeasure Strategies for Highway PPP Projects in Western China: A Dynamic Risk Accumulation Modeling Approach. Sustainability, 17(9), 4200. https://doi.org/10.3390/su17094200