Drivers of Environmental Sustainability, Economic Growth, and Inequality: A Study of Economic Complexity, FDI, and Human Development Role in BRICS+ Nations

Abstract

1. Introduction

2. Literature Review

2.1. ECI and CO2 Emission

2.2. Economic Performance and CO2 Emission

2.3. Income Equality and CO2 Emission

2.4. FDI and CO2 Emission

2.5. HDI and CO2 Emission

3. Methodology

Econometric Methods

4. Results and Discussion

Robustness Check

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Symbols | Variables | Measure | Definition of Variable | Source |

|---|---|---|---|---|

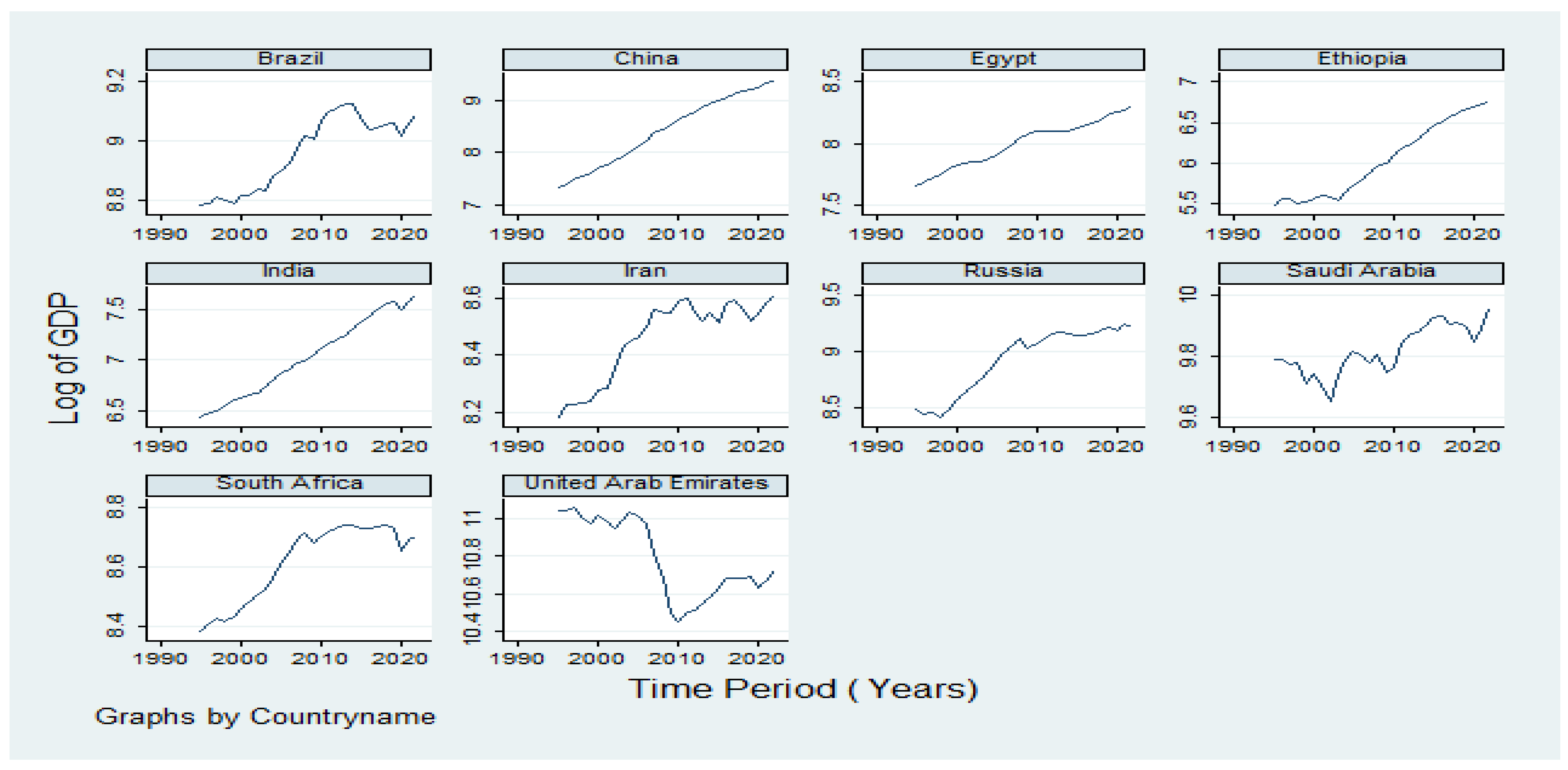

| lnGDP | GDP | Log of GDP per capita (constant 2015 USD) | GDP per capita refers to the gross domestic product divided by the population at the midpoint of the year. The data is presented in constant 2015 U.S. dollars. | Worlddevelopmentindicators |

| GINI | GINI Index | GINI Index | The Gini index measures the extent to which the distribution of income or consumption among individuals or households within an economy deviates from a perfectly equal distribution. A Gini index of 0 represents perfect equality, while an index of 100 implies perfect inequality. | Worlddevelopmentindicators |

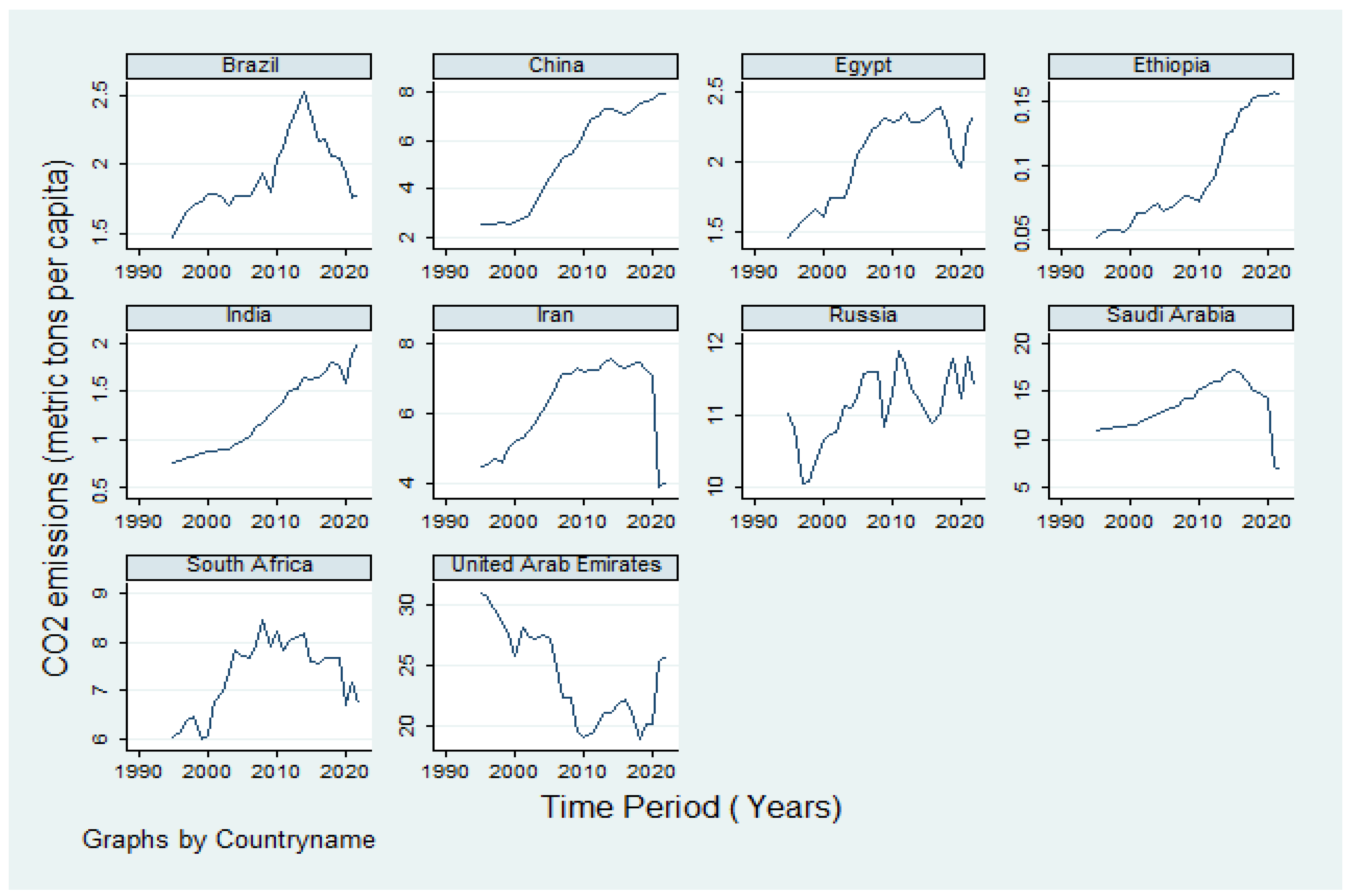

| CO2 | CO2 emissions | Log of CO2 emissions (metric tons per capita) | CO2 emissions are generated through the combustion of fossil fuels and the production of cement. These emissions encompass the release of carbon dioxide during the utilization of solid, liquid, and gaseous fuels, as well as the process of gas flaring. | Worlddevelopmentindicators |

| ECI | Economic Complexity Index | ECI Index | The ECI takes data on exports and reduces a country’s economic system into two dimensions: (i) The “diversity” of products in the export basket, and (ii) the “ubiquity” of products in the export basket. Diversity is the number of products that a country can export competitively. And ubiquity is the number of countries that are able to export a product competitively. | https://ourworldindata.org/grapher/economic-complexity-rankings accessed on 10 April 2025 https://dataverse.harvard.edu/dataverse/atlas accessed on 10 April 2025 |

| FDI | Foreign direct investment | Foreign direct investment, net inflows (% of GDP) | Foreign direct investment isthe net inflows of investment to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. It is the sum of equity capital, reinvestment of earnings, other long-term capital, and short-term capital as shown in the balance of payments. This series shows net inflows (new investment inflows less disinvestment) in the reporting economy from foreign investors, and is divided by GDP. | Worlddevelopmentindicators |

| HDI | The Human Development Index | HDI index | The Human Development Index (HDI) is a summary measure of the average achievement in the key dimensions of human development: a long and healthy life, being knowledgeable and having a decent standard of living. The HDI is the geometric mean of normalized indices for each of the three dimensions | https://hdr.undp.org/data-center/human-development-index#/indicies/HDI accessed on 10 April 2025 |

| Variables | lnGDP | GINI | CO2 | ECI | FDI | HDI |

|---|---|---|---|---|---|---|

| Mean | 8.50 | 0.611 | 7.27 | 0.005 | 2.14 | 0.68 |

| Std.Dev. | 1.29 | 0.060 | 7.17 | 0.60 | 1.83 | 0.134 |

| Maximum | 11.06 | 0.74 | 30.88 | 1.94 | 9.64 | 0.937 |

| Minimum | 5.48 | 0.47 | 0.044 | −1.32 | −1.78 | 0.28 |

| Observations | 280 | 280 | 280 | 280 | 280 | 280 |

References

- Diffenbaugh, N.S.; Singh, D.; Mankin, J.S.; Horton, D.E.; Swain, D.L.; Touma, D.; Charland, A.; Liu, Y.; Haugen, M.; Tsiang, M.; et al. Quantifying the influence of global warming on unprecedented extreme climate events. Proc. Natl. Acad. Sci. USA 2017, 114, 4881–4886. [Google Scholar] [CrossRef] [PubMed]

- Ozturk, I.; Acaravci, A. CO2 emissions, energy consumption and economic growth in Turkey. Renew. Sustain. Energy Rev. 2010, 14, 3220–3225. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar] [CrossRef]

- Friedl, B.; Getzner, M. Determinants of CO2 emissions in a small open economy. Ecol. Econ. 2003, 45, 133–148. [Google Scholar] [CrossRef]

- Holtz-Eakin, D.; Selden, T.M. Stoking the fires? CO2 emissions and economic growth. J. Public Econ. 1995, 57, 85–101. [Google Scholar] [CrossRef]

- Radulescu, M.; Mohammed, K.S.; Kumar, P.; Baldan, C.; Dascalu, N.M. Dynamic effects of energy transition on environmental sustainability: Fresh findings from the BRICS+ 1. Energy Rep. 2024, 12, 2441–2451. [Google Scholar] [CrossRef]

- Mohanty, S.; Sethi, N. Outward FDI, human capital and economic growth in BRICS countries: An empirical insight. Transnatl. Corp. Rev. 2019, 11, 235–249. [Google Scholar] [CrossRef]

- Crespo, N.; Fontoura, M.P. Determinant factors of FDI spillovers—What do we really know? World Dev. 2007, 35, 410–425. [Google Scholar] [CrossRef]

- Kumar, P.; Radulescu, M.; Sharma, H.; Belascu, L.; Serbu, R. Pollution haven hypothesis and EKC dynamics: Moderating effect of FDI. A study in Shanghai Cooperation Organization countries. Environ. Res. Commun. 2024, 6, 115032. [Google Scholar] [CrossRef]

- Iamsiraroj, S. The Foreign Direct Investment–Economic Growth Nexus. Int. Rev. Econ. Financ. 2016, 42, 116–133. [Google Scholar] [CrossRef]

- Ibrahim, M.; Acquah, A.M. Re-examining the causal relationships among FDI, economic growth and financial sector development in Africa. Int. Rev. Appl. Econ. 2020, 35, 45–63. [Google Scholar] [CrossRef]

- Kalai, M.; Zghidi, N. Foreign direct investment, trade, and economic growth in MENA countries: Empirical analysis using ARDL bounds testing approach. J. Knowl. Econ. 2017, 10, 397–421. [Google Scholar] [CrossRef]

- Lau, L.-S.; Choong, C.-K.; Eng, Y.-K. Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: Do foreign direct investment and trade matter? Energy Policy 2014, 68, 490–497. [Google Scholar] [CrossRef]

- Demena, B.A.; van Bergeijk, P.A. A meta-analysis of FDI and productivity spillovers in developing countries. J. Econ. Surv. 2016, 31, 546–571. [Google Scholar] [CrossRef]

- Doğan, B.; Saboori, B.; Can, M. Does economic complexity matter for environmental degradation? An empirical analysis for different stages of development. Environ. Sci. Pollut. Res. 2019, 26, 31900–31912. [Google Scholar] [CrossRef]

- Ouedraogo, N.S. Energy consumption and economic growth: Evidence from the Economic Community of West African States (ECOWAS). Energy Econ. 2013, 36, 637–647. [Google Scholar] [CrossRef]

- Costa, L.; Rybski, D.; Kropp, J.P. A human development framework for CO2 reductions. PLoS ONE 2011, 6, e29262. [Google Scholar] [CrossRef]

- Piketty, T.; Saez, E. Income Inequality in the United States, 1913–1998; (Series Updated to 2000 Available); NBER: Cambridge, MA, USA, 2001. [Google Scholar] [CrossRef]

- Singh, O.; Kumar, P.; Radulescu, M. Analysis of inter-state and inter-region beta-convergence of growth rates in India in post-reform period. Acta Oeconomica 2024, 74, 359–377. [Google Scholar] [CrossRef]

- Liu, C.; Jiang, Y.; Xie, R. Does income inequality facilitate carbon emission reduction in the US? J. Clean. Prod. 2019, 217, 380–387. [Google Scholar] [CrossRef]

- Gao, X.; Fan, M. The effect of income inequality and economic growth on carbon dioxide emission. Environ. Sci. Pollut. Res. 2023, 30, 65149–65159. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, T.; Li, R. Does income inequality reshape the Environmental Kuznets Curve (EKC) hypothesis? A nonlinear panel data analysis. Environ. Res. 2023, 216, 114575. [Google Scholar] [CrossRef]

- Torras, M.; Boyce, J.K. Income, inequality, and pollution: A reassessment of the environmental Kuznets curve. Ecol. Econ. 1998, 25, 147–160. [Google Scholar] [CrossRef]

- Ravallion, M.; Heil, M.; Jalan, J. CO2 emissions and income inequality. Oxf. Econ. Pap. 2000, 52, 651–669. [Google Scholar] [CrossRef]

- Chao, A.; Schor, J.B. Empirical tests of status consumption: Evidence from women’s cosmetics. J. Econ. Psychol. 1998, 19, 107–131. [Google Scholar] [CrossRef]

- Neagu, O.; Teodoru, M. The relationship between economic complexity, energy consumption structure and greenhouse gas emission: Heterogeneous panel evidence from the EU countries. Sustainability 2019, 11, 497. [Google Scholar] [CrossRef]

- Khezri, M.; Heshmati, A.; Khodaei, M. Environmental implications of economic complexity and its role in determining how renewable energies affect CO2 emissions. Appl. Energy 2022, 306, 117948. [Google Scholar] [CrossRef]

- Neagu, O. The link between economic complexity and carbon emissions in the European Union countries: A model based on the Environmental Kuznets Curve (EKC) approach. Sustainability 2019, 11, 4753. [Google Scholar] [CrossRef]

- Doğan, B.; Driha, O.M.; Balsalobre Lorente, D.; Shahzad, U. The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain. Dev. 2020, 29, 1–12. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Rjoub, H.; Akadiri, S.S.; Oladipupo, S.D.; Sharif, A.; Adeshola, I. The role of economic complexity in the environmental Kuznets curve of MINT economies: Evidence from method of moments quantile regression. Environ. Sci. Pollut. Res. 2021, 29, 24248–24260. [Google Scholar] [CrossRef] [PubMed]

- Yilanci, V.; Pata, U.K. Investigating the EKC hypothesis for China: The role of Economic Complexity on ecological footprint. Environ. Sci. Pollut. Res. 2020, 27, 32683–32694. [Google Scholar] [CrossRef]

- Arslan, A.; Qayyum, A.; Tabash, M.I.; Nair, K.; AsadUllah, M.; Nalini Daniel, L. The impact of economic complexity, usage of energy, tourism, and economic growth on carbon emissions: Empirical evidence of 102 countries. Int. J. Energy Econ. Policy 2023, 13, 315–324. [Google Scholar] [CrossRef]

- Laverde-Rojas, H.; Correa, J.C. Economic complexity, economic growth, and emissions: A panel data analysis. Int. Econ. J. 2021, 35, 411–433. [Google Scholar] [CrossRef]

- Fatima, N.; Yanting, Z.; Guohua, N.; Khan, M.K. The dynamics of green technological innovation and environmental policy stringency for sustainable environment in BRICS economies. Nat. Resour. Forum 2024. [Google Scholar] [CrossRef]

- Vavrek, R.; Chovancova, J. Decoupling of greenhouse gas emissions from economic growth in V4 countries. Procedia Econ. Financ. 2016, 39, 526–533. [Google Scholar] [CrossRef]

- Du, X.; Shen, L.; Wong, S.W.; Meng, C.; Yang, Z. Night-time Light Data based decoupling relationship analysis between economic growth and carbon emission in 289 Chinese cities. Sustain. Cities Soc. 2021, 73, 103119. [Google Scholar] [CrossRef]

- Wang, Q.; Jiang, R. Is carbon emission growth decoupled from economic growth in emerging countries? New insights from Labor and investment effects. J. Clean. Prod. 2020, 248, 119188. [Google Scholar] [CrossRef]

- Wang, Q.; Su, M. Drivers of decoupling economic growth from carbon emission—An empirical analysis of 192 countries using decoupling model and decomposition method. Environ. Impact Assess. Rev. 2020, 81, 106356. [Google Scholar] [CrossRef]

- Chang, M.; Zheng, J.; Inoue, Y.; Tian, X.; Chen, Q.; Gan, T. Comparative analysis on the socioeconomic drivers of industrial air-pollutant emissions between Japan and China: Insights for the further-abatement period based on the LMDI method. J. Clean. Prod. 2018, 189, 240–250. [Google Scholar] [CrossRef]

- Wang, Q.; Jiang, R.; Zhan, L. Is decoupling economic growth from fuel consumption possible in developing countries?—A comparison of China and India. J. Clean. Prod. 2019, 229, 806–817. [Google Scholar] [CrossRef]

- Grunewald, N.; Klasen, S.; Martínez-Zarzoso, I.; Muris, C. The trade-off between income inequality and carbon dioxide emissions. Ecol. Econ. 2017, 142, 249–256. [Google Scholar] [CrossRef]

- Jorgenson, A.; Schor, J.; Huang, X. Income inequality and carbon emissions in the United States: A state-level analysis, 1997–2012. Ecol. Econ. 2017, 134, 40–48. [Google Scholar] [CrossRef]

- Zhu, H.; Xia, H.; Guo, Y.; Peng, C. The heterogeneous effects of urbanization and income inequality on CO2 emissions in BRICS economies: Evidence from panel quantile regression. Environ. Sci. Pollut. Res. 2018, 25, 17176–17193. [Google Scholar] [CrossRef] [PubMed]

- Wolde-Rufael, Y.; Idowu, S. Income distribution and CO2 emission: A comparative analysis for China and India. Renew. Sustain. Energy Rev. 2017, 74, 1336–1345. [Google Scholar] [CrossRef]

- Ghazouani, T.; Beldi, L. The impact of income inequality on carbon emissions in Asian countries: Non-parametric panel data analysis. Environ. Model. Assess. 2022, 27, 441–459. [Google Scholar] [CrossRef]

- Yu, Y.; Xu, W. Impact of FDI and R&D on China’s industrial CO2 emissions reduction and trend prediction. Atmos. Pollut. Res. 2019, 10, 1627–1635. [Google Scholar] [CrossRef]

- Shao, Y. Does FDI affect carbon intensity? New evidence from dynamic panel analysis. Int. J. Clim. Chang. Strateg. Manag. 2018, 10, 27–42. [Google Scholar] [CrossRef]

- Ali, M.U.; Gong, Z.; Ali, M.U.; Wu, X.; Yao, C. Fossil energy consumption, economic development, inward FDI impact on CO2 emissions in Pakistan: Testing EKC hypothesis through ARDL model. Int. J. Financ. Econ. 2020, 26, 3210–3221. [Google Scholar] [CrossRef]

- Derindag, O.F.; Maydybura, A.; Kalra, A.; Wong, W.K.; Chang, B.H. Carbon emissions and the rising effect of trade openness and foreign direct investment: Evidence from a threshold regression model. Heliyon 2023, 9, e17448. [Google Scholar] [CrossRef]

- Wang, Y.; Liao, M.; Wang, Y.; Xu, L.; Malik, A. The impact of foreign direct investment on China’s carbon emissions through energy intensity and Emissions Trading System. Energy Econ. 2021, 97, 105212. [Google Scholar] [CrossRef]

- Apergis, N.; Pinar, M.; Unlu, E. How do foreign direct investment flows affect CO2 emission in BRICS countries? Revisiting the pollution haven hypothesis using bilateral FDI flows from OECD to BRICS countries. Environ. Sci. Pollut. Res. 2022, 30, 14680–14692. [Google Scholar] [CrossRef]

- Hossain, M.A.; Chen, S. Nexus Between Human Development Index (HDI) and CO2 emissions in a developing country: Decoupling study evidence from Bangladesh. Environ. Sci. Pollut. Res. 2021, 28, 58742–58754. [Google Scholar] [CrossRef]

- Mannanal, M.S.; Rajagopal, N. Healthcare Expenditure and Human Development Index as determinants of Environmental Quality: A panel study on selected Asian countries. Millenn. Asia 2023. [Google Scholar] [CrossRef]

- Akbar, M.; Hussain, A.; Akbar, A.; Ullah, I. The Dynamic Association between healthcare spending, CO2 emissions, and human development index in OECD countries: Evidence from panel VAR model. Environ. Dev. Sustain. 2020, 23, 10470–10489. [Google Scholar] [CrossRef]

- Boogaard, H.; van Erp, A.M.; Walker, K.D.; Shaikh, R. Accountability Studies on air pollution and health: The HEI experience. Curr. Environ. Health Rep. 2017, 4, 514–522. [Google Scholar] [CrossRef]

- Asongu, S.A.; Uduji, J.I.; Okolo-Obasi, E.N. Thresholds of external flows for inclusive human development in sub-Saharan Africa. Int. J. Community Well-Being 2019, 2, 213–233. [Google Scholar] [CrossRef]

- Kumar, P.; Radulescu, M. CO2 emission, life expectancy, and economic growth: A triad analysis of Sub-Saharan African countries. Environ. Dev. Sustain. 2024, 1–28. [Google Scholar] [CrossRef]

- Tran, N.V.; Tran, Q.V.; Do, L.T.; Dinh, L.H.; Do, H.T. Trade-off between environment, energy consumption and human development: DO levels of economic development matter? Energy 2019, 173, 483–493. [Google Scholar] [CrossRef]

- Chen, L.; Cai, W.; Ma, M. Decoupling or delusion? Mapping carbon emission per capita based on the human development index in Southwest China. Sci. Total Environ. 2020, 741, 138722. [Google Scholar] [CrossRef] [PubMed]

- Li, F.; Chang, T.; Wang, M.C.; Zhou, J. The relationship between health expenditure, CO2 emissions, and economic growth in the BRICS countries—Based on the Fourier ARDL model. Environ. Sci. Pollut. Res. 2022, 29, 10908–10927. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; dos Santos Parente, C.C.; Leitão, N.C.; Cantos-Cantos, J.M. The influence of economic complexity processes and renewable energy on CO2 emissions of BRICS. What about industry 4.0? Resour. Policy 2023, 82, 103547. [Google Scholar] [CrossRef]

- Ali, S.; Xiaohong, Z.; Hassan, S.T. The hidden drivers of human development: Assessing its role in shaping BRICS-T’s economic complexity, and bioenergy transition. Renew. Energy 2024, 221, 119624. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-sectional dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross-sectional dependence in panels. Empir. Econ. 2021, 60, 13–50. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration—With applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Shahbaz, M.; Khraief, N.; Jemaa, M.M.B. On the causal nexus of road transport CO2 emissions and macroeconomic variables in Tunisia: Evidence from combined cointegration tests. Renew. Sustain. Energy Rev. 2015, 51, 89–100. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Natsiopoulos, K.; Tzeremes, N.G. ARDL: An R Package for ARDL Models and Cointegration. Comput. Econ. 2024, 64, 1757–1773. [Google Scholar] [CrossRef]

- Akhtar, N.; Alharthi, M.F.; Khan, M.S. Mitigating multicollinearity in regression: A study on improved ridge estimators. Mathematics 2024, 12, 3027. [Google Scholar] [CrossRef]

- Kalnins, A.; Praitis Hill, K. The VIF score. What is it good for? Absolutely nothing. Organ. Res. Methods 2025, 28, 58–75. [Google Scholar] [CrossRef]

- Angelov, I. Income inequality as a barrier to economic growth. Adv. Soc. Sci. Cult. 2024, 6, 1–6. [Google Scholar] [CrossRef]

- Ndou, E.; Mokoena, T. Does the income inequality channel impact the transmission of monetary policy shocks to economic activity? In Inequality, Output-Inflation Trade-Off and Economic Policy Uncertainty; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 75–86. [Google Scholar] [CrossRef]

- Anyanwu, U.M.; Anyanwu, A.A.; Cieślik, A. Does abundant natural resources amplify the negative impact of income inequality on economic growth? Resour. Policy 2021, 74, 102229. [Google Scholar] [CrossRef]

- Dorofeev, M.L. Interrelations between income inequality and sustainable economic growth: Contradictions of empirical research and new results. Economies 2022, 10, 44. [Google Scholar] [CrossRef]

- Kumar, P.; Radulescu, M.; Rajwani, S. G20 environmental transitions: A holistic exploration of the environmental Kuznets curve (EKC). The role of FDI, urbanization and industrial trends. Environ. Eng. Manag. J. 2024, 23, 1823–1835. [Google Scholar]

- Yan, D.; Liu, C.; Li, P. Effect of carbon emissions and the driving mechanism of economic growth target setting: An empirical study of provincial data in China. J. Clean. Prod. 2023, 415, 137721. [Google Scholar] [CrossRef]

- Nathaniel, S.; Barua, S.; Hussain, H.; Adeleye, N. The determinants and interrelationship of carbon emissions and economic growth in African economies: Fresh insights from static and dynamic models. J. Public Aff. 2020, 21, e2141. [Google Scholar] [CrossRef]

- Androniceanu, A.; Georgescu, I. The impact of CO2 emissions and energy consumption on economic growth: A panel data analysis. Energies 2023, 16, 1342. [Google Scholar] [CrossRef]

- Omri, A.; Nguyen, D.K.; Rault, C. Causal interactions between CO2 emissions, FDI, and economic growth: Evidence from dynamic simultaneous-equation models. Econ. Model. 2014, 42, 382–389. [Google Scholar] [CrossRef]

- Fazaalloh, A.M. FDI and economic growth in Indonesia: A provincial and sectoral analysis. J. Econ. Struct. 2024, 13, 3. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Y. How emissions trading affects income inequality: Evidence from China. Clim. Policy 2022, 23, 593–608. [Google Scholar] [CrossRef]

- Bloom, D.E.; Khoury, A.; Kufenko, V.; Prettner, K. Spurring economic growth through human development: Research results and guidance for policymakers. SSRN Electron. J. 2020, 47, 377–409. [Google Scholar] [CrossRef]

- Suri, T.; Boozer, M.A.; Ranis, G.; Stewart, F. Paths to success: The relationship between human development and economic growth. World Dev. 2011, 39, 506–522. [Google Scholar] [CrossRef]

- Kumar, P.; Fatima, N.; Khan, M.K.; Alnafisah, H. Deciphering the drivers of CO2 emissions in Haryana: A comprehensive analysis from 2005 to 2023. Front. Environ. Sci. 2025, 13, 1391418. [Google Scholar] [CrossRef]

- Kumar, P. Analysis of financial performance of oil and gas industry in India. Think. India J. 2019, 22, 1869–1875. [Google Scholar]

- Gao, C.; Ge, H.; Lu, Y.; Wang, W.; Zhang, Y. Decoupling of provincial energy-related CO2 emissions from economic growth in China and its convergence from 1995 to 2017. J. Clean. Prod. 2021, 297, 126627. [Google Scholar] [CrossRef]

- Macinko, J.A.; Shi, L.; Starfield, B. Wage inequality, the health system, and infant mortality in wealthy industrialized countries, 1970–1996. Soc. Sci. Med. 2004, 58, 279–292. [Google Scholar] [CrossRef]

- Yu, F.; Xiao, D.; Chang, M.S. The impact of carbon emission trading schemes on urban-rural income inequality in China: A multi-period difference-in-differences method. Energy Policy 2021, 159, 112652. [Google Scholar] [CrossRef]

- Ashenafi, B.B. Greenhouse Gas Emission Widens Income Inequality in Africa. Preprint 2021. [Google Scholar] [CrossRef]

- AwoaAwoa, P.; Atangana Ondoa, H.; Ngoa Tabi, H. Natural Resources and Income Inequality: Economic Complexity is the key. Environ. Dev. Econ. 2023, 29, 127–153. [Google Scholar] [CrossRef]

- Soto, G.; Jardon, C.M.; Martinez-Cobas, X. FDI and income inequality in tax-haven countries: The relevance of tax pressure. Econ. Syst. 2024, 48, 101172. [Google Scholar] [CrossRef]

- Akyuz, M.; Gueye, G.N.; Karul, C. Revisiting the long-run relationship between inward/outward FDI and income inequality: New evidence from the OECD. Int. Econ. J. 2023, 37, 220–244. [Google Scholar] [CrossRef]

- Doh, J.P. MNEs, FDI, inequality and growth. Multinatl. Bus. Rev. 2019, 27, 217–220. [Google Scholar] [CrossRef]

- Clark, D.P.; Highfill, J.; de Oliveira Campino, J.; Rehman, S.S. FDI, technology spillovers, growth, and income inequality: A selective survey. Glob. Econ. J. 2011, 11, 1. [Google Scholar] [CrossRef]

- Castells-Quintana, D.; Gradín, C.; Royuela, V. Inequality and Human Development: The Role of Different Parts of the Income Distribution; WIDER Working Paper; World Institute for Development Economic Research (UNU-WIDER): Helsinki, Finland, 2022. [Google Scholar] [CrossRef]

- Espoir, D.K.; Sunge, R.; Bannor, F. Exploring the dynamic effect of economic growth on carbon dioxide emissions in Africa: Evidence from panel PMG estimator. Environ. Sci. Pollut. Res. 2023, 30, 112959–112976. [Google Scholar] [CrossRef] [PubMed]

- Torun, E.; Akdeniz, A.D.; Demireli, E.; Grima, S. Long-term US economic growth and the carbon dioxide emissions Nexus: A wavelet-based approach. Sustainability 2022, 14, 10566. [Google Scholar] [CrossRef]

- Huang, C.; Ren, W.; Fatima, N.; Zhu, J. Carbon intensity constraint, economic growth pressure and China’s low-carbon development. J. Environ. Manag. 2023, 348, 119282. [Google Scholar] [CrossRef]

- Pata, U.K.; Yilanci, V.; Hussain, B.; Naqvi, S.A. Analyzing the role of income inequality and political stability in environmental degradation: Evidence from South Asia. Gondwana Res. 2022, 107, 13–29. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Sofuoğlu, E.; Abbasi, K.R.; Addai, K. Economic complexity and environmental sustainability in Eastern European Economy: Evidence from novel Fourier approach. Reg. Sustain. 2023, 4, 349–358. [Google Scholar] [CrossRef]

- Nan, S.; Huo, Y.; You, W.; Guo, Y. Globalization spatial spillover effects and carbon emissions: What is the role of Economic Complexity? Energy Econ. 2022, 112, 106184. [Google Scholar] [CrossRef]

- Ma, N.; Sun, W.; Wang, Z.; Li, H.; Ma, X.; Sun, H. The effects of different forms of FDI on the carbon emissions of Multinational Enterprises: A Complex Network Approach. Energy Policy 2023, 181, 113731. [Google Scholar] [CrossRef]

- Zheng, J.; Assad, U.; Kamal, M.A.; Wang, H. Foreign direct investment and carbon emissions in China: “Pollution haven” or “Pollution halo”? Evidence from the NARDL model. J. Environ. Plan. Manag. 2022, 67, 662–687. [Google Scholar] [CrossRef]

- Moridian, A.; Radulescu, M.; Kumar, P.; Radu, M.T.; Mohammad, J. New insights on immigration, fiscal policy and unemployment rate in EU countries–A quantile regression approach. Heliyon 2024, 10, e33519. [Google Scholar] [CrossRef] [PubMed]

- Hanif, I.; Faraz Raza, S.M.; Gago-de-Santos, P.; Abbas, Q. Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: Some empirical evidence. Energy 2019, 171, 493–501. [Google Scholar] [CrossRef]

- Shen, H.; Ali, S.A.; Alharthi, M.; Shah, A.S.; Basit Khan, A.; Abbas, Q.; Rahman, S.U. Carbon-free energy and sustainable environment: The role of Human Capital and technological revolutions in attaining SDGs. Sustainability 2021, 13, 2636. [Google Scholar] [CrossRef]

- Sheraz, M.; Deyi, X.; Ahmed, J.; Ullah, S.; Ullah, A. Moderating the effect of globalization on financial development, energy consumption, human capital, and carbon emissions: Evidence from G20 countries. Environ. Sci. Pollut. Res. 2021, 28, 35126–35144. [Google Scholar] [CrossRef]

| Variables | lnGDP | GINI | CO2 | ECI | FDI | HDI |

|---|---|---|---|---|---|---|

| lnGDP | 1.00 | |||||

| GINI | 0.526 | 1.000 | ||||

| CO2 | 0.836 | 0.305 | 1.000 | |||

| ECI | 0.334 | 0.08 | 0.007 | 1.000 | ||

| FDI | 0.004 | −0.061 | −0.037 | 0.046 | 1.000 | |

| HDI | 0.74 | 0.404 | 0.708 | 0.364 | −0.038 | 1.000 |

| VIF | 1.205 | 2.178 | 1.262 | 1.008 | 2.71 | |

| 1/VIF | 0.83 | 0.459 | 0.792 | 0.992 | 0.368 |

| LLC | IPS | ADF-Fisher | PP Fisher | |||||

|---|---|---|---|---|---|---|---|---|

| Series | I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | I(0) | I(1) |

| lnGDP | −1.73 (0.041) | −4.1 (0.000) | 1.58 (0.944) | −4.53 (0.000) | 10.88 (0.949) | 57.97 (0.000) | 10.37 (0.960) | 86.63 (0.000) |

| GINI | −3.20 (0.001) | −3.5 (0.000) | −3.08 (0.944) | 5.39 (0.000) | 48.24 (0.000) | 70.86 (0.000) | 49.82 (0.000) | 99.22 (0.000) |

| CO2 | −0.520 (0.301) | −2.76 (0.000) | 1.10 (0.864) | −3.23 (0.000) | 12.32 (0.904) | 59.50 (0.000) | 12.16 (0.910) | 132.68 (0.000) |

| ECI | 0.96 (0.831) | −5.110 (0.000) | 1.43 (0.924) | −10.23 (0.000) | 9.29 (0.979) | 130.79 (0.000) | 17.15 (0.643) | 215.01 (0.000) |

| FDI | −1.58 (0.055) | −6.888 (0.000) | −2.85 (0.002) | −8.78 (0.000) | 40.33 (0.000) | 109.6 (0.000) | 46.59 (0.000) | 179.5 (0.000) |

| HDI | −2.40 (0.002) | −0.646 (0.000) | 1.83 (0.966) | −3.79 (0.000) | 8.92 (0.983) | 48.74 (0.000) | 14.72 (0.792) | 49.540 (0.000) |

| Test | Statistics | Prob. |

|---|---|---|

| Breusch–Pagan LM | 400.54 | 0.000 |

| Pesaran Scaled LM | 54.42 | 0.000 |

| Pesaran CD | 9.28 | 0.000 |

| Hypothesized No. of CE(s) | Fisher Stat. from Trace Test | Fisher Stat. from Max Test |

|---|---|---|

| None | 282.7 (0.000) | 135.8 (0.000) |

| At Most 1 | 171.3 (0.000) | 87.40 (0.000) |

| At Most 2 | 101 (0.000) | 51.63 (0.000) |

| At Most 3 | 63.88 (0.000) | 34.07 (0.000) |

| At Most 4 | 49.16 (0.000) | 35.34 (0.000) |

| At Most 5 | 46.70 (0.000) | 46.70 (0.000) |

| Kao residuals Co-integration test | ||

| ADF | T-statistics | p-Value |

| −1.55 | 0.005 | |

| Residuals variance | 0.0017 | |

| HAC variance | 0.0024 | |

| FMOLS | DOLS | |||

|---|---|---|---|---|

| Variables | Coefficient | t-stat | Coefficient | t-stat |

| GINI | −1.07 | −0.11 | −3.67 | −8.50 *** |

| CO2 | 0.50 *** | 47.02 | 0.60 | 28.0 *** |

| ECI | −0.04 *** | −15.81 | −0.16 | −5.02 *** |

| FDI | 0.001 *** | 3.58 | 0.01 | 9.02 *** |

| HDI | 3.19 *** | 78.85 | 3.15 | 56.35 *** |

| Country | L1.LGDP | L1.GINI | GINI | L1.CO2 | CO2 | L1.ECI | ECI | L1.FDI | FDI | L1.HDI | HDI |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Brazil | |||||||||||

| Coefficient | 0.74 *** | −0.56 | 1.37 | 0.16 ** | −0.19 *** | 0.02 | −0.09 * | 0.00 | 0.00 | 0.89 | −0.08 |

| t-Value | (4.84) | (−0.81) | (1.94) | (2.77) | (−4.28) | (0.47) | (−2.11) | (0.14) | (−0.33) | (1.06) | (−0.07) |

| Russia | |||||||||||

| Coefficient | 0.62 *** | −0.13 | 0.25 | 0.08 *** | 0.001 | 0.05 | 0.06 | 0.01 | 0.01 | 2.63 | −0.47 |

| t-Value | (4.15) | (−0.31) | (0.72) | (3.39) | (0.12) | (0.82) | (1.31) | (1.67) | (0.98) | (1.90) | (−0.41) |

| India | |||||||||||

| Coefficient | 0.84 *** | −1.76 | 0.56 | 0.30 *** | 0.30 *** | −0.06 | 0.06 | −0.01 | 0.01 | 4.76 *** | −2.87 ** |

| t-Value | (5.30) | (−1.25) | (0.32) | (4.80) | (3.56) | (−0.95) | (1.09) | (−0.79) | (1.16) | (4.01) | (−2.19) |

| China | |||||||||||

| Coefficient | 0.80 * | 0.02 | 0.53 | 0.01 | 0.02 | −0.13 * | −0.06 | 0.01 | 0.00 | 4.16 * | 2.49 |

| t-Value | (2.11) | (0.04) | (0.94) | (0.34) | (0.68) | (−2.22) | (−0.79) | (0.66) | (−0.28) | (2.27) | (0.70) |

| South Africa | |||||||||||

| Coefficient | 0.59 ** | 0.96 * | −0.27 | 0.03 * | −0.01 | −0.02 | 0.02 * | 0.001 | 0.00 | 1.18 | −1.29 |

| t-Value | (2.73) | (2.16) | (−0.59) | (2.51) | (−0.55) | (−1.28) | (2.16) | (0.93) | (0.39) | (1.10) | (−1.19) |

| Egypt | |||||||||||

| Coefficient | 0.91 *** | −0.67 | 0.41 | −0.02 | −0.02 | 0.06 | 0.07 | 0.01 * | 0.00 | −0.38 | 0.64 |

| t-Value | (6.48) | (−0.87) | (0.69) | (−0.56) | (−0.60) | (0.88) | (1.27) | (2.14) | (0.81) | (−0.28) | (0.41) |

| Ethiopia | |||||||||||

| Coefficient | 0.58 ** | 2.35 | −1.60 | 2.01 | −0.52 | 0.04 | −0.05 | −0.01 | 0.00 | 1.57 | 0.10 |

| t-Value | (2.94) | (1.84) | (−1.93) | (1.34) | (−0.37) | (0.55) | (−0.72) | (−1.04) | (−0.39) | (1.58) | (0.07) |

| Iran | |||||||||||

| Coefficient | 0.83 *** | −0.16 | 1.00 | −0.01 | 0.01 | 0.02 | 0.02 | 0.02 | 0.01 | 3.00 | −2.68 ** |

| t-Value | (3.45) | (−0.10) | (0.58) | (−0.79) | (0.84) | (0.32) | (0.45) | (0.86) | (0.39) | (1.22) | (−1.26) |

| Saudi Arabia | |||||||||||

| Coefficient | 0.79 *** | −5.64 | 6.80 | 0.00 | −0.01 | −0.02 | 0.01 | 0.00 | −0.01 | 5.96 * | −5.09 |

| t-Value | (3.12) | (−0.74) | (0.98) | (−0.24) | (−1.22) | (−0.92) | (0.27) | (−0.20) | (−0.86) | (2.32) | (−1.90) |

| United Arab Emirates | |||||||||||

| Coefficient | 0.80 *** | −4.03 | 2.28 | 0.01 * | 0.00 | −0.10 | −0.05 | 0.02 ** | −0.01 | 1.83 | −2.34 * |

| t-Value | (6.10) | (−1.38) | (0.74) | (2.17) | (−0.03) | (−1.26) | (−0.54) | (2.65) | (−1.20) | (1.14) | (−1.15) |

| FMOLS | DOLS | |||

|---|---|---|---|---|

| Variables | Coefficient | t-stat. | Coefficient | t-stat. |

| lnGDP | −0.01 | −1.33 | −0.09 *** | 3.27 |

| CO2 | −0.02 | −1.29 | −0.08 *** | −14.46 |

| ECI | −0.01 *** | −6.24 | −0.03 *** | −2.95 |

| FDI | 0.001 *** | 14.56 | 0.001 *** | 6.56 |

| HDI | 0.33 *** | 9.23 | 1.27 *** | 6.55 |

| Variables | L1.GINI | LGDP | L1.GDP | CO2 | L1.CO2 | ECI | L1.ECI | FDI | L1.FDI | HDI | L1.HDI |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Brazil | |||||||||||

| Coefficient | −0.01 | −0.08 | 0.05 | −0.02 | 0.002 | 0.02 | −0.01 | 0.00 | 0.00 | −0.20 | 0.41 |

| t-Value | (−0.04) | (−0.81) | (0.51) | (−0.74) | (0.06) | (1.24) | (−0.53) | (−0.36) | (0.47) | (−0.60) | (0.99) |

| Russia | |||||||||||

| Coefficient | −0.05 | −0.05 | 0.05 | 0.02 | 0.03 | 0.03 | 0.02 | 0.00 | 0.00 | −0.93 | 0.36 |

| t-Value | (−0.22) | (−0.31) | (0.39) | (1.11) | (1.92) | (0.92) | (0.78) | (0.43) | (0.05) | (−1.02) | (0.52) |

| India | |||||||||||

| Coefficient | 1.08 ** | −0.05 | 0.08 * | 0.01 | −0.05 ** | 0.00 | 0.02 | 0.00 | 0.00 | 0.62 * | −0.65 ** |

| t-Value | (7.88) | (−1.25) | (1.88) | (0.65) | (−3.29) | (−0.07) | (1.70) | (0.11) | (0.87) | (2.44) | (−3.21) |

| China | |||||||||||

| Coefficient | 0.54 * | 0.01 | −0.23 | 0.01 | −0.02 | 0.03 | 0.04 | 0.00 | 0.00 | −0.12 | 2.25 |

| t-Value | (1.90) | (0.04) | (−1.02) | (0.45) | (−1.28) | (0.72) | (0.96) | (0.72) | (0.12) | (−0.11) | (1.19) |

| South Africa | |||||||||||

| Coefficient | 0.59 ** | 0.25 * | −0.02 | −0.01 | −0.01 | 0.003 | 0.009 | 0.001 | 0.002 | −0.27 | 0.25 |

| t-Value | (3.18) | (2.16) | (−0.12) | (−1.04) | (−0.80) | (0.55) | (−0.60) | (−1.01) | (−0.58) | (−0.48) | (0.44) |

| Egypt | |||||||||||

| Coefficient | 0.71 ** | −0.07 | 0.02 | 0.00 | −0.01 | 0.05 ** | 0.01 | 0.00 | 0.00 | −0.15 | 0.20 |

| t-Value | (9.50) | (−0.87) | (0.26) | (0.10) | (−0.64) | (2.63) | (0.67) | (0.92) | (−0.78) | (−0.34) | (0.38) |

| Ethiopia | |||||||||||

| Coefficient | 0.63 ** | 0.08* | −0.04 | 0.00 | 0.07 | −0.01 | 0.00 | 0.00 | 0.00 | 0.23 | −0.44 |

| t-Value | (14.78) | (1.84) | (−0.79) | (0.01) | (0.28) | (−0.38) | (−0.01) | (−0.07) | (−1.40) | (1.22) | (−1.82) |

| Iran | |||||||||||

| Coefficient | 0.88 ** | 0.00 | 0.01 | 0.001 | 0.002 | 0.01 | 0.01 ** | 0.005 | 0.003 | −0.10 | −0.08 |

| t-Value | (6.18) | (−0.10) | (0.11) | (0.55) | (0.52) | (1.42) | (2.04) | (0.37) | (−0.13) | (−0.25) | (−0.22) |

| Saudi Arabia | |||||||||||

| Coefficient | 0.52 * | −0.01 | −0.01 | 0.002 | 0.004 | 0.007 | 0.003 | 0.004 ** | 0.091 | −0.05 | 0.02 |

| t-Value | (2.64) | (−0.74) | (−0.91) | (1.73) | (−1.61) | (−1.18) | (1.07) | (3.91) | (−0.80) | (−0.46) | (0.20) |

| United Arab Emirates | |||||||||||

| Coefficient | 0.96 ** | −0.03 | 0.04 ** | 0.002 | 0.003 | −0.01 | −0.02 ** | 0.002 | 0.004 | −0.09 | 0.25 |

| t-Value | (12.87) | (−1.38) | (2.60) | (0.76) | (0.67) | (−1.87) | (−2.78) | (0.00) | (0.43) | (−0.67) | (1.55) |

| FMOLS | DOLS | |||

|---|---|---|---|---|

| Variables | Coefficient | t-value | Coefficient | t-value |

| lnGDP | 4.80 *** | 46.10 | 4.85 *** | 10.11 |

| GINI | 29.79 | 1.40 | 51.12 *** | 4.49 |

| ECI | −0.12 *** | −11.94 | −0.11 *** | −14.73 |

| FDI | 0.02 *** | 11.32 | 0.03 *** | 9.19 |

| HDI | −2.92 *** | −18.00 | −6.12 *** | −5.01 |

| Country | L1.CO2 | LGDP | L1.GDP | GINI | L1.GINI | ECI | L1.ECI | FDI | L1.FDI | HDI | L1.HDI |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Brazil | |||||||||||

| Coefficient | 0.77 *** | 2.28 ** | −1.29 | −1.97 | −4.66 | 0.12 | 0.39 ** | 0.02 | 0.00 | −5.60 * | 5.98 |

| t-Value | (4.91) | (2.77) | (−1.43) | (−0.74) | (−1.68) | (0.85) | (2.72) | (1.06) | (−0.12) | (−1.86) | (1.49) |

| Russia | |||||||||||

| Coefficient | 0.16 | 5.73 *** | −3.10 * | 3.93 | −3.47 | −0.09 | −0.14 | −0.01 | −0.05 | 0.27 | −9.15 |

| t-Value | (0.68) | (3.39) | (−1.79) | (1.11) | (−1.15) | (−0.17) | (−0.33) | (−0.18) | (−0.75) | (0.02) | (−0.93) |

| India | |||||||||||

| Coefficient | 0.75 *** | 2.01 *** | −1.68 *** | 2.45 | 2.15 | 0.37 ** | −0.20 | −0.01 | 0.00 | −10.69 *** | 6.28 * |

| t-Value | (3.46) | (4.80) | (−3.11) | (0.65) | (0.48) | (2.44) | (−1.55) | (−0.52) | (−0.08) | (−3.12) | (1.78) |

| China | |||||||||||

| Coefficient | 0.61 *** | 0.82 | 7.53 ** | 2.02 | 11.28 ** | −0.54 | −0.16 | 0.18 *** | −0.12 * | 3.83 | −65.56 ** |

| t-Value | (2.90) | (0.34) | (2.10) | (0.45) | (2.45) | (−0.86) | (−0.22) | (2.61) | (−1.83) | (0.19) | (−2.21) |

| South Africa | |||||||||||

| Coefficient | 0.24 | 8.58 ** | −3.45 | −8.10 | 5.53 | 0.29 * | −0.38 ** | 0.02 | −0.07 ** | 12.14 | −18.14 |

| t-Value | (0.92) | (2.51) | (−0.85) | (−1.04) | (0.76) | (1.56) | (−2.09) | (0.58) | (−2.20) | (0.70) | (−1.05) |

| Egypt | |||||||||||

| Coefficient | 0.30 | −1.01 | 3.11 * | 0.58 | −0.08 | 0.69 * | −0.11 | 0.04 ** | −0.02 * | 7.34 | −13.91 |

| t-Value | (1.13) | (−0.56) | (1.80) | (0.10) | (−0.02) | (1.40) | (−0.27) | (2.25) | (−1.53) | (0.80) | (−1.34) |

| Ethiopia | |||||||||||

| Coefficient | 0.56 *** | 0.05 | 0.01 | 0.00 | 0.00 | −0.01 | 0.00 | 0.01 * | 0.00 | −0.08 | −0.07 |

| t-Value | (3.17) | (1.34) | (0.31) | (0.01) | (−0.02) | (−0.87) | (0.04) | (1.58) | (0.27) | (−0.43) | (−0.31) |

| Iran | |||||||||||

| Coefficient | 0.71 ** | −4.05 | 2.01 | 18.24 | −24.44 | −0.92 | −0.50 | 0.10 | 0.33 | 43.52 | −31.01 |

| t-Value | (2.39) | (−0.79) | (0.31) | (0.55) | (−0.71) | (−0.97) | (−0.53) | (0.27) | (0.86) | (0.85) | (−0.70) |

| Saudi Arabia | |||||||||||

| Coefficient | 0.79 *** | −2.41 | 21.68 * | 47.87 * | 122.18 | 0.63 | −0.94 | −0.63 *** | 0.01 | 72.07 | −40.77 |

| t-Value | (4.01) | (−0.24) | (1.91) | (1.73) | (0.44) | (0.63) | (−1.00) | (−2.64) | (0.06) | (0.63) | (−0.35) |

| United Arab Emirates | |||||||||||

| Coefficient | 0.69 ** | 17.33 ** | −15.55 ** | 82.42 | −91.61 | 3.54 * | 0.81 | −0.20 | 0.18 | −88.35 * | 66.58 |

| t-Value | (2.31) | (2.17) | (−2.02) | (0.76) | (−0.85) | (1.32) | (0.28) | (−0.68) | (0.73) | (−1.61) | (0.91) |

| Null Hypothesis | W-Stat. | Z.-Stat | Prob. | Causality Direction |

|---|---|---|---|---|

| GINI⇏lnGDP | 5.99 | 9.37 | 0.000 | ↔ |

| lnGDP⇏GINI | 7.64 | 12.52 | 0.000 | |

| CO2⇏lnGDP | 1.96 | 0.060 | 0.000 | ↔ |

| lnGDPS⇏lnCO2 | 2.11 | 7.45 | 0.000 | |

| ECI⇏lnGDP | 1.40 | 3.0 | 0.54 | → |

| lnGDP⇏ECI | 4.99 | −0.61 | 9 × 10−14 | |

| FDI⇏lnGDP | 2.66 | 5.91 | 0.000 | ↔ |

| lnGDP⇏FDI | 0.77 | 10.20 | 0.005 | |

| CO2⇏GINI | 6.31 | 9.99 | 0.000 | ↔ |

| GINI⇏lnCO2 | 6.53 | 10.40 | 0.000 | |

| ECI⇏GINI | 2.89 | 3.44 | 0.000 | ↔ |

| GINI⇏ECI | 2.39 | 2.49 | 0.000 | ↔ |

| FDI⇏GINI | 1.09 | 0.00 | 0.996 | |

| GINI⇏FDI | 0.53 | −1.06 | 0.288 | |

| HDI⇏GINI | 4.39 | 6.32 | 3 × 10−10 | ↔ |

| GINI⇏HDI | 5.46 | 8.36 | 0.000 |

| Model 1 | Model 2 | Model 3 | ||||

|---|---|---|---|---|---|---|

| Variables | Coefficient | T | Coefficient | Standard Err. | Coefficient | t |

| lnGDP | - | −0.01 | −0.46 | 3.71 *** | 31.57 | |

| GINI | −1.12 | 1.58 | - | 27.71 | 0.83 | |

| CO2 | 0.49 *** | 31.94 | −0.02 | −0.82 | - | |

| ECI | −0.4 *** | −7.88 | −0.01 *** | −3.72 | −0.29 *** | 6.99 |

| FDI | 0.001 *** | 2.87 | 0.001 *** | 10.66 | 0.01 *** | 7.69 |

| HDI | 3.22 *** | 65.79 | 0.30 *** | −7.41 | −4.56 *** | −14.52 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, P.; Kaur, R.; Radulescu, M.; Kalaš, B.; Hagiu, A. Drivers of Environmental Sustainability, Economic Growth, and Inequality: A Study of Economic Complexity, FDI, and Human Development Role in BRICS+ Nations. Sustainability 2025, 17, 4180. https://doi.org/10.3390/su17094180

Kumar P, Kaur R, Radulescu M, Kalaš B, Hagiu A. Drivers of Environmental Sustainability, Economic Growth, and Inequality: A Study of Economic Complexity, FDI, and Human Development Role in BRICS+ Nations. Sustainability. 2025; 17(9):4180. https://doi.org/10.3390/su17094180

Chicago/Turabian StyleKumar, Parveen, Rajbeer Kaur, Magdalena Radulescu, Branimir Kalaš, and Alina Hagiu. 2025. "Drivers of Environmental Sustainability, Economic Growth, and Inequality: A Study of Economic Complexity, FDI, and Human Development Role in BRICS+ Nations" Sustainability 17, no. 9: 4180. https://doi.org/10.3390/su17094180

APA StyleKumar, P., Kaur, R., Radulescu, M., Kalaš, B., & Hagiu, A. (2025). Drivers of Environmental Sustainability, Economic Growth, and Inequality: A Study of Economic Complexity, FDI, and Human Development Role in BRICS+ Nations. Sustainability, 17(9), 4180. https://doi.org/10.3390/su17094180