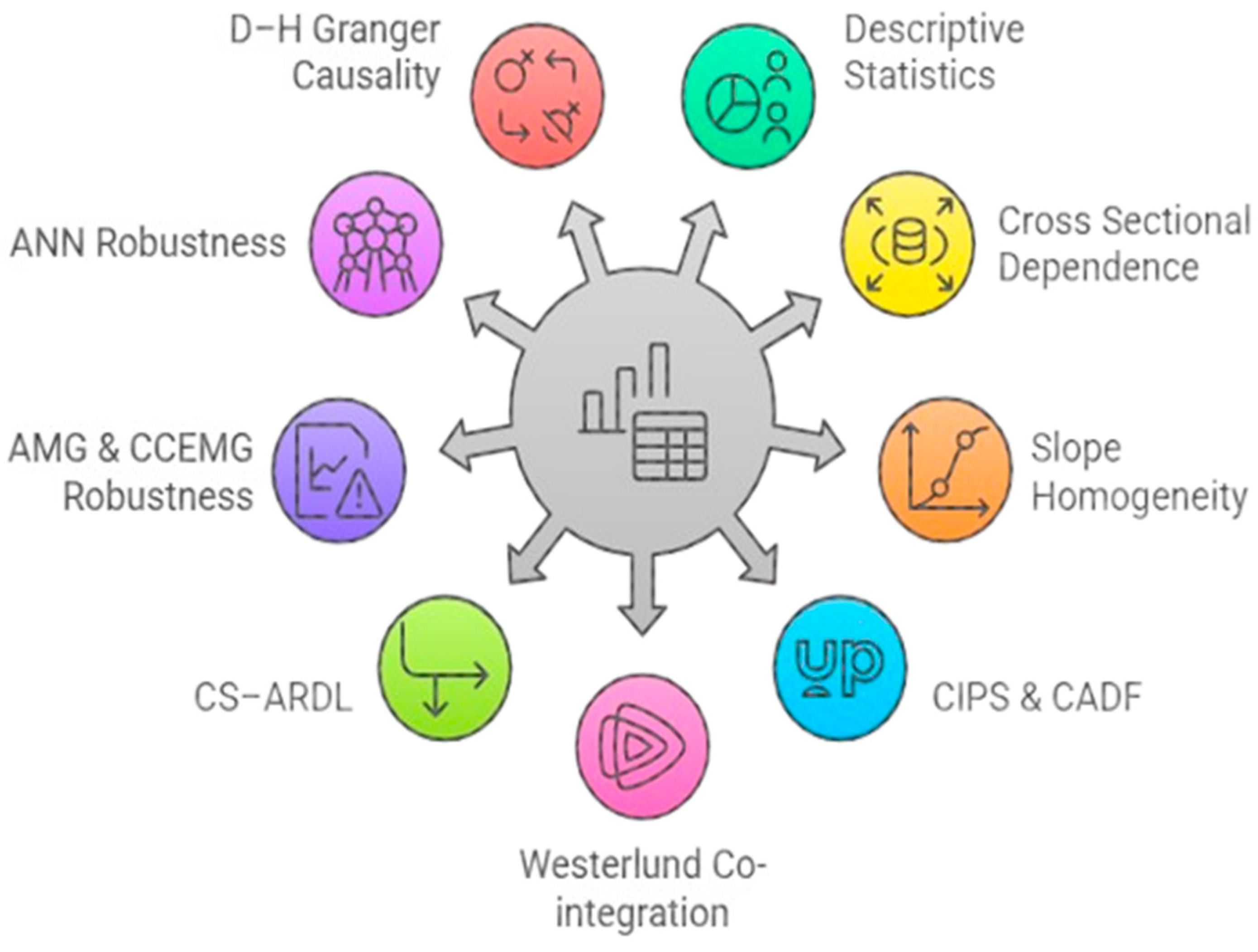

1. Introduction

The most urgent challenges confronting the world now are environmental degradation (ED) and ecological shifts. Hence, it is imperative for both developing and developed countries to advocate for sustainable development (SD) policies [

1,

2]. Human activities, including deforestation, air pollution, overfishing, and extraction of natural resources (NRS), have had a detrimental impact on the global ecosystem [

3]. The outcome was a persistent trend of increasingly rapid ED and a substantial scarcity of NRS. These changes are intricately interconnected and will provide significant challenges in the upcoming decades [

4]. To avert the direst circumstances, there was a plea for international measures. An example of a worldwide initiative is the introduction of the Sustainable Development Goals (SDGs), specifically, SDG-7, SDG-12, and SDG-13 [

5]. SDG 7 focuses on expanding access to clean and affordable energy while promoting renewable sources and energy efficiency. SDG 12 emphasizes sustainable consumption and production by reducing waste, improving resource efficiency, and encouraging responsible business practices. SDG 13 calls for urgent action to combat climate change through policy integration, resilience-building, and international cooperation [

6]. These goals are central to our study, as they align with the role of fintech, environmental regulations, and institutional quality in fostering sustainability within the G20. These goals, which must be achieved by the end of 2030, serve as a global call for action and aim to allocate resources towards the attainment of sustainable SD. Moreover, despite increased awareness of climate change mitigation, the global ecosystem’s degradation remains inadequately addressed [

7]. Current estimates indicate that almost 98% of the global population is subjected to environmental pollution due to depletion of biodiversity [

8]. The depletion of biodiversity is a direct result of overfishing, over harvesting of forests, and the excessive release of carbon dioxide into the atmosphere, beyond the capacity of nature to absorb and regenerate these resources.

The G20 member countries include Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom, the United States, and the European Union. These countries play a crucial role in driving global development and growth, as they control over 85% of the worldwide economic development (ECD) and rule 65% of the global population [

9,

10]. Without a doubt, these benefits are significant. However, it is important to note that the bloc also accounts for over 75% of the world’s ecological footprint (EF). Although the G20 countries have different paths of growth, their collective influence and power make them largely responsible for most of the world’s current environmental issues. EF Per capita consumption measures the average amount of resources consumed by everyone in a country. Generally, industrialized nations exhibit higher per capita consumption rates because of elevated living standards and improved access to resources. Australia, Canada, and Germany are examples of countries that have relatively high per capita consumption. In contrast, developing nations such as China, India, and Mexico have lower per capita consumption, which can be attributed to limited resource availability, and distinct spending patterns.

The ecological footprint (EF) reflects the balance between renewable resource availability and human consumption patterns. Over the past decades, resource accessibility has rapidly declined, with developed nations generally experiencing ecological deficits, meaning they consume more resources and generate more waste than their ecosystems can sustain. Countries like Italy, Japan, and Australia are projected to see significant increases in their EF deficits by 2050 compared to 2018 levels [

11,

12]. Conversely, developing nations such as Indonesia, India, and Turkey are expected to maintain positive EF balances, indicating more sustainable resource utilization. However, the rapid economic growth in China, India, and Indonesia—driven by industrial expansion and rising consumer purchasing power—is expected to accelerate consumption rates by 97%, 76%, and 61%, respectively [

13]. This trend underscores the resource-intensive nature of economic development. In contrast, Germany and France are anticipated to experience declines in overall consumption but continue to face ecological deficits due to their high resource demands [

14]. Meanwhile, countries like Brazil, China, and Indonesia display mixed projections regarding biocapacity, reflecting the diverse effects of development policies on ecological sustainability [

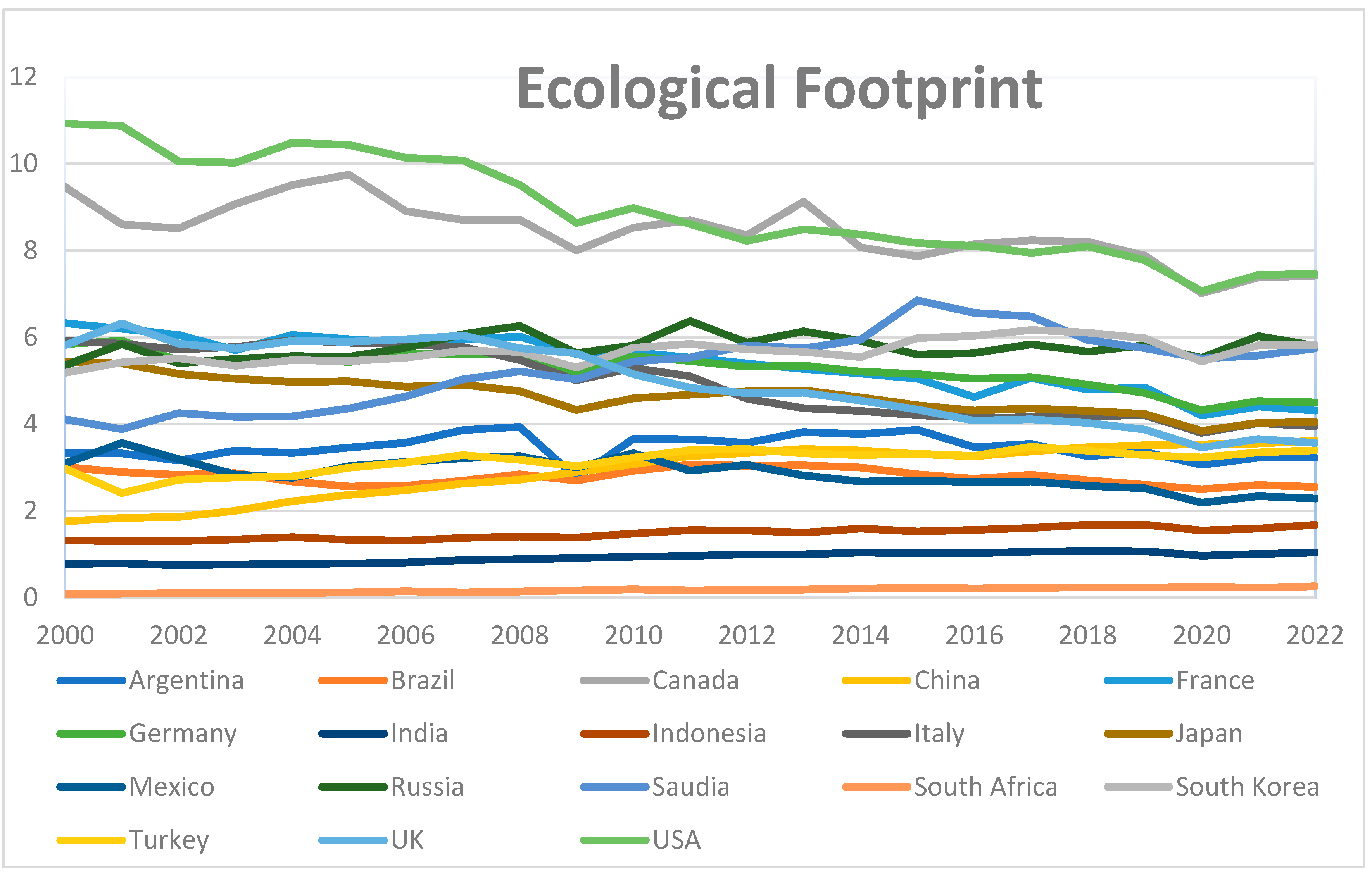

15]. Given these disparities, examining EF trends within G20 nations alongside key economic variables is essential. The ecological footprint (EF) trends for G20 countries, as shown in

Figure 1, reveal significant variations in environmental impact. Notably, Canada and the United States consistently display the highest EF values, indicating greater per capita resource consumption and environmental strain. In contrast, countries like India and Indonesia exhibit lower EF values, suggesting relatively lower resource use and environmental pressure. To enhance clarity, the figure highlights the persistent gap between high and low EF nations, emphasizing the disparities in ecological sustainability. These variations underscore the necessity for differentiated environmental policies and targeted sustainability strategies tailored to each country’s economic and environmental context.

The primary aim of the United Nations’ SDG-12 is to address the ED caused by population and ECD and promote a shift towards a more environmentally friendly and socially inclusive global ECD [

16,

17]. Nevertheless, the progress in minimizing our ecological impact may be hindered, as all nations tend to prioritize economic expansion over enacting measures to mitigate the effects [

18]. As a result of policies that prioritize ECD and the emergence of more affordable and efficient energy sources, there has been a significant increase in the demand for NRS and their subsequent processing during the previous century. This has led to a significant expansion of our EF [

19,

20]. On certain occasions, this has resulted in significant damage to humans [

21]. Since 1961, the global EF of humans has increased twofold, and now, we deplete renewable resources at a rate of 20 to 50% faster than the world can replenish them [

22]. On a global scale, no country has successfully achieved sustainable resource utilization; in fact, we are increasingly deviating from sustainable principles [

23,

24]. The primary objective of the EF is to measure the utilization of NRS and the degree to which nature can replace this utilization [

25]. In addition, a significant scarcity of NRS plays a significant role in causing ecological strain due to the requirements of water, energy and infrastructural systems [

26]. The literature extensively explores the economic consequences of natural resource exploitation and depletion. In this context, the ecological footprint (EF) has proven to be a reliable indicator of the environmental pressure caused by human resource consumption [

27]. The original concept of EF assesses the biologically productive land required to sustain a given population, while it also measures the ecological assets necessary to produce environmental resources. It is vital to prioritize the G-20 as a focal point for EF research on ecological viability due to multiple factors.

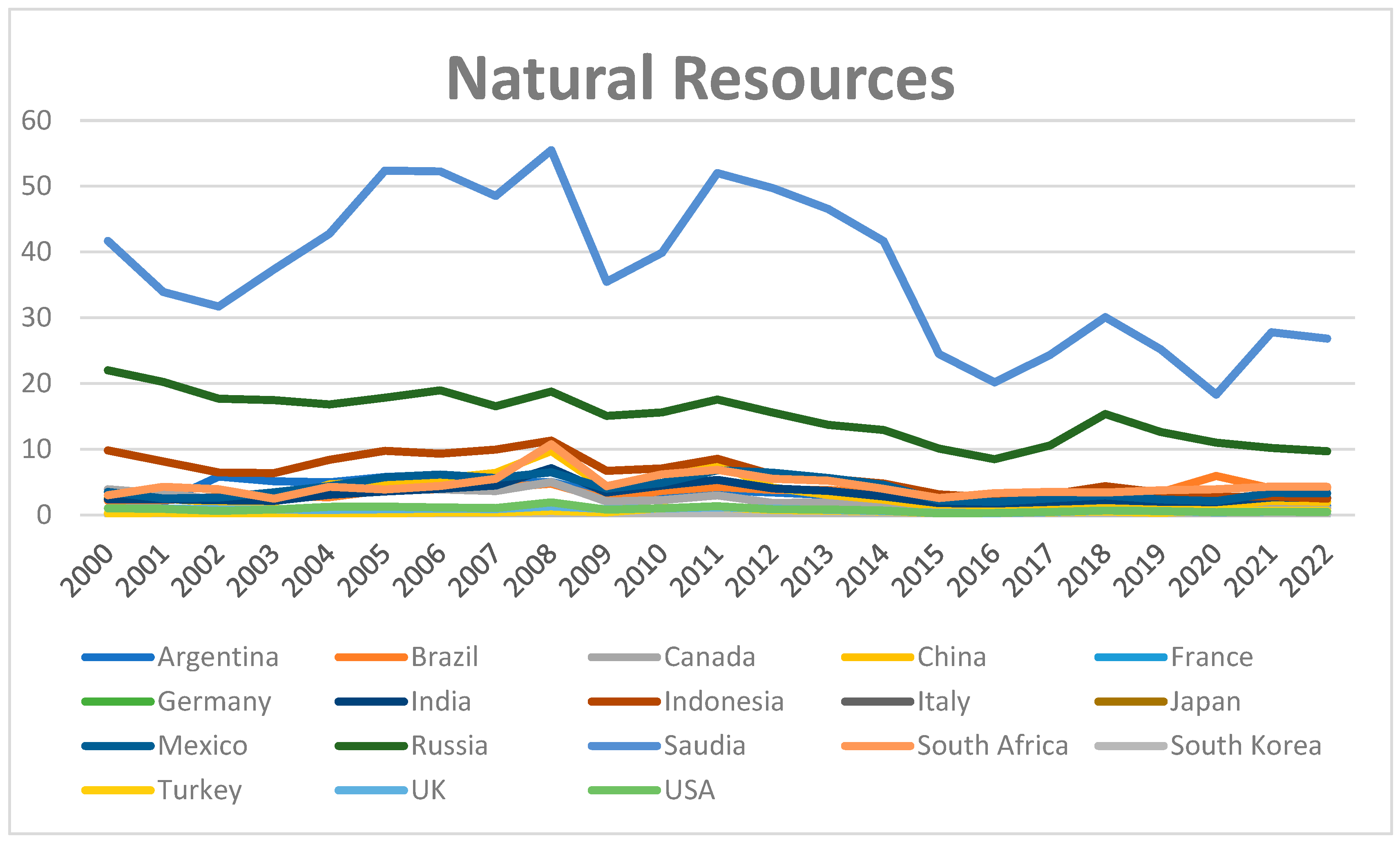

Figure 2 illustrates the trends in NRS utilization across G20 countries from 2000 to 2022. Saudi Arabia exhibits the highest NRS consumption, particularly peaking between 2005 and 2013. The United States and Russia also demonstrate relatively high yet stable consumption patterns, whereas China and India show a gradual increase in resource utilization over time. Conversely, European nations such as Germany, France, and the UK maintain consistently lower levels of NRS consumption. These trends reflect varying resource dependencies across economies, shaping their sustainability challenges and policy needs.

There has been a significant and swift rise in ecological breakdowns, affecting all economies globally. This means that every country is vulnerable to the consequences of climate change [

28,

29]. During serious environmental problems, the financial markets and institutions have undergone significant changes due to the emergence of new financial technology developments [

30]. However, fintech (FNT) refers to technology-based advancements and is based on the principles of Industry 4.0 and promotes the adoption of circular economy practices [

31,

32]. Therefore, it offers the potential to foster ECD while ensuring SD [

33]. Moreover, FNT instruments reduces the expenses associated with standardized financial processes and the imbalance of information while effectively using less resources and encouraging sustainable methods of financing [

34]. As a result, FNT is strategically environmentally friendly and essential for promoting SD and optimizing resource allocation. Moreover, worldwide, the revenues generated from the use of FNT have increased twofold since 2017. According to the facts, the entire value of FNT improvements is projected to reach USD 179 billion by 2022. Additionally, it is estimated that 30,000 entrepreneurs will benefit from these enhancements. FNT developments ultimately discourage reliance on NRS and traditional energy sources by promoting the adoption of green energy and sophisticated green technologies [

35,

36]. According to a recent assessment by [

37], FNT promotes green digital trading and green innovations by reducing the financial risks connected with them. This ultimately contributes to the development of low-carbon economies. Moreover, FNT enhances the process of creating capital and attracting investments in industries that are abundant in resources and have a high carbon footprint, resulting in increased energy consumption and carbon emissions [

38,

39]. Similarly, the enhanced FNT-related apps consume significant resources, require electricity, and produce electronic trash, hence contributing to the depletion of resources and environmental footprint [

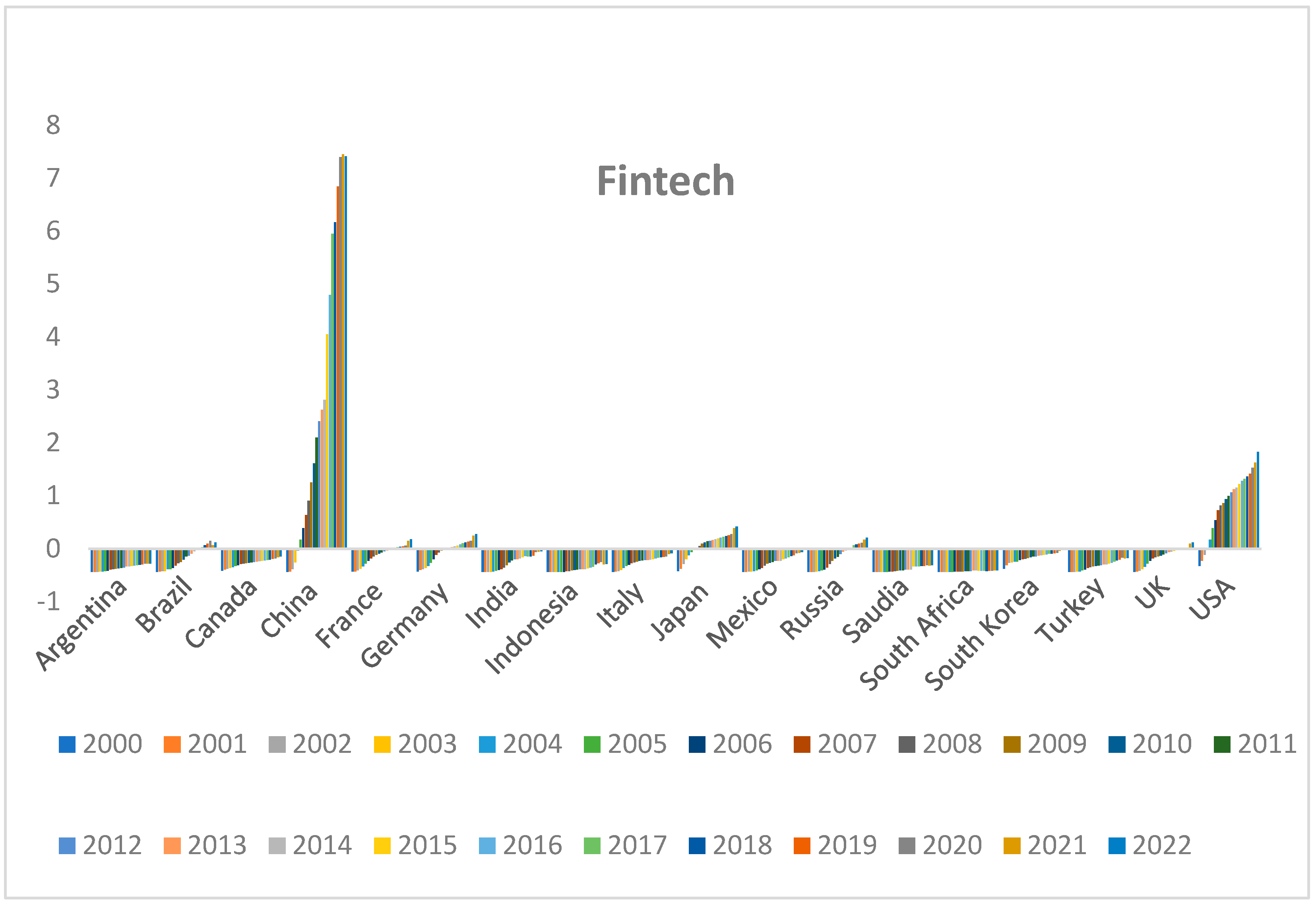

40]. In continuation of this information,

Figure 3 indicates the FNT trends in G20. From 2000 to 2022, the FNT indices for the G20 countries reveal several trends. China shows a remarkable and consistent rise, peaking at 7.412 in 2022. Similarly, the USA demonstrates a steady upward trend, reaching 1.826 in 2022. Conversely, most other countries, including Argentina, Germany, and South Africa, display negative values, suggesting less significant growth in their FNT sectors. These data indicate substantial FNT advancement in China and the USA, contrasting with slower or negative growth in many other G20 nations.

Furthermore, it is imperative for the government to develop and implement comprehensive environmental regulatory frameworks that promote the use of sustainable energy and hinder the excessive use of resources and development of waste. Ecological regulations can be designed to achieve various advantages. For example, strict environmental policies can help improve energy efficiency, reduce the use of fossil fuels, encourage the production of renewable energy (RE), and mitigate the anticipated negative environmental effects of ECD [

41]. Nevertheless, permissive environmental law (ENL) and inadequate institutional framework allow for influx of foreign direct investment into outdated technology [

28]. The statement suggests that ENL lacks the necessary capacity to fully benefit from the positive environmental effects. This happens because environmental regulations are not strictly enforced, allowing industries to keep using old, polluting technologies. As a result, the benefits of environmental laws—like reducing pollution, saving resources, and supporting sustainability—are weakened, making them less effective in protecting the environment. Consequently, several studies have confirmed that ENL plays a negligible role in reducing the EF [

42]. Furthermore, ecological governance rules are formulated with a long-term perspective, requiring enterprises to adapt their operations based on the impact of marginal taxes [

43]. Thus, it is crucial to reassess the function of ENL in reducing EF. Research indicates that the G20 nations are prioritizing the regulation of ED through the implementation of effective ENL. These laws are seen as crucial tools for enhancing the overall SD of G20 countries. According to ENL [

44], nations such as France and Germany, who have high stringency ratings and are seeing rising trends, should continue to improve their regulatory systems. On the other hand, countries like Russia and South Africa, who have lower or inconsistent ENL scores, would benefit from implementing stronger policies and utilizing international collaborations to strengthen their ENL frameworks. It is imperative for these emerging nations to implement policies that promote SD and a transition towards environmentally friendly economies. A more detailed view can be seen from

Figure 4, where ENL trends in G20 have been shown. Notably, Brazil and China exhibit a substantial increase in scores, with Brazil peaking in 2007 and China showing steady growth. On the other hand, countries like Argentina and Saudi Arabia have more fluctuating patterns, with notable highs and lows throughout the period. Most of the G20 countries, including the USA, UK, and Germany, display a general upward trend, reflecting enhanced environmental regulations and enforcement over the years.

The preceding discourse promotes additional empirical inquiries and the development of more accurate remedies through further scientific investigation to aid diverse policymakers. Undoubtedly, institutional studies emphasize the urgency of addressing sustainable development (SD) as a critical concern for communities and governments, necessitating the implementation of related policies and actions [

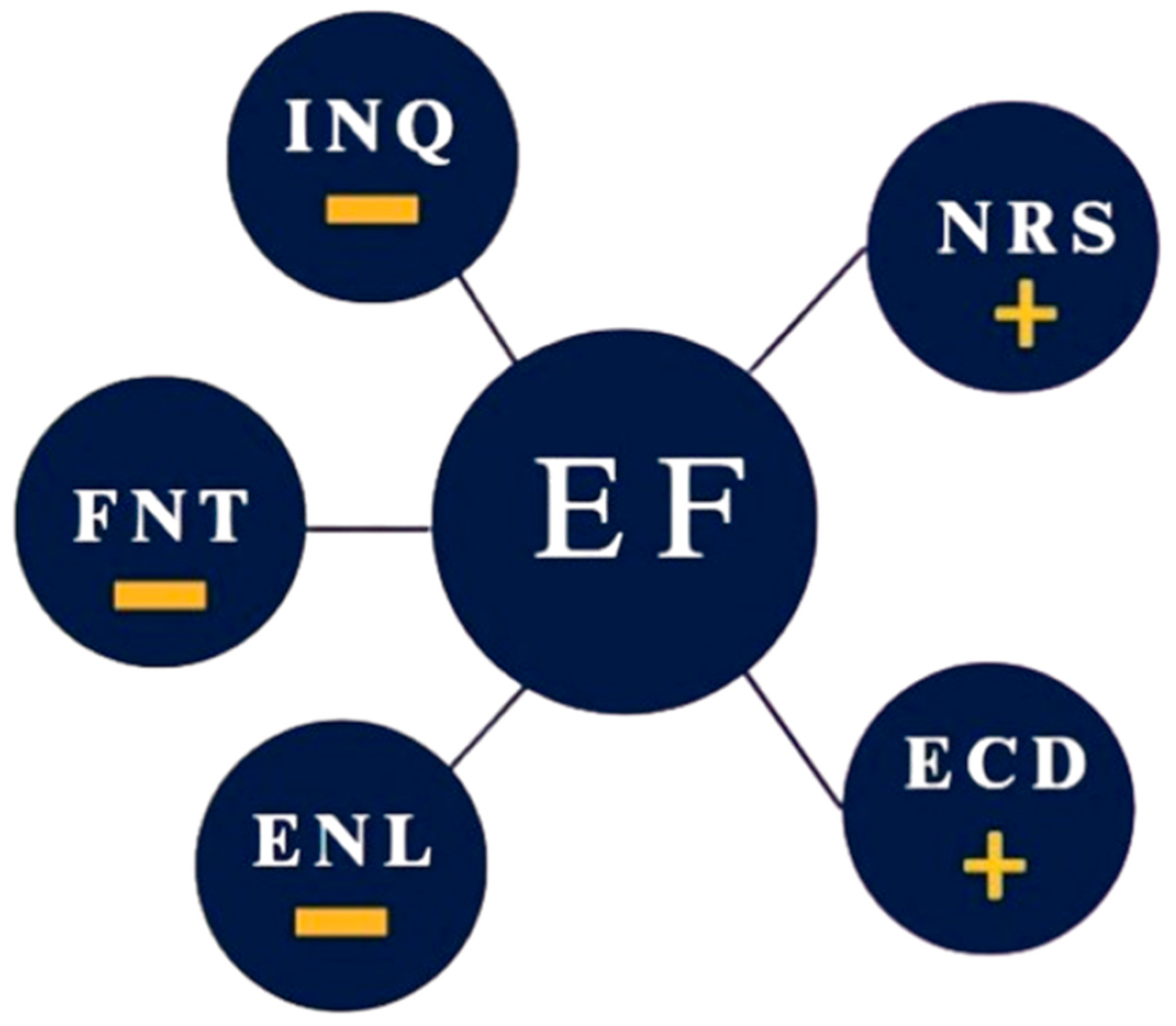

45]. Hence, the main objective of this study is to investigate the impact of institutional quality (INQ), fintech (FNT) and environmental law (ENL) on ecological sustainability and economic competitiveness in the G20 nations by examining three current inquiries: What is the immediate influence of fintech and natural resources on the ecological footprint? Can FNT and NRS efficiently regulate the relationship between important socioeconomic variables and the EF? Furthermore, can environmental regulations adequately address the unforeseen external disruptions that have impacted the global ECD and therefore affected environmental conditions? Responding to these inquiries will assist us in providing accurate assessments and identifying domains where policy conflicts arise within the recipient panel.

Moreover, this research is crucial due to the urgent necessity to tackle the deteriorating ecological crisis resulting from pollution and our reliance on conventional energy sources and NRS. Hence, numerous nations, including those in the G-20, endorse the necessity of SD and carbon neutrality as delineated in the SDGs [

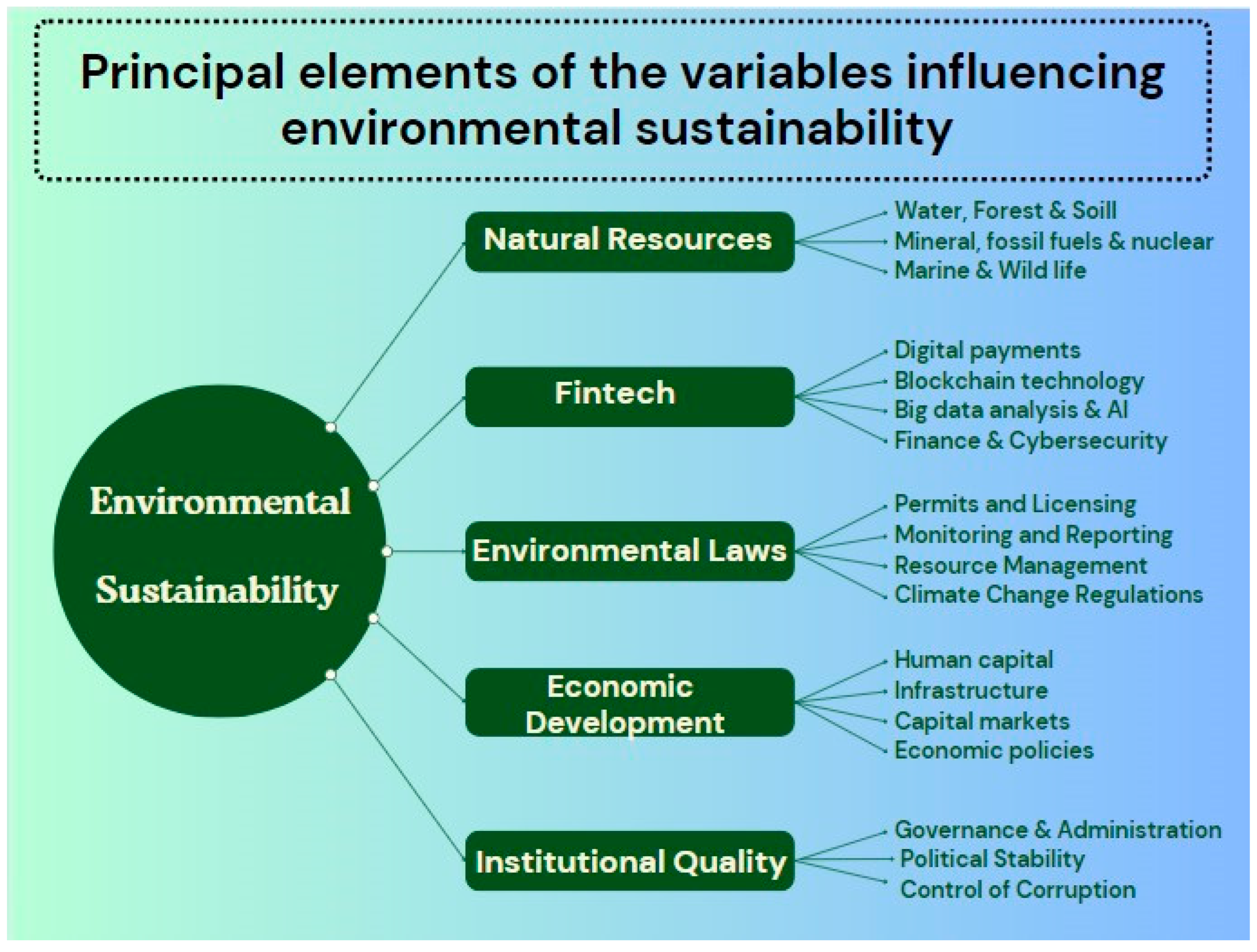

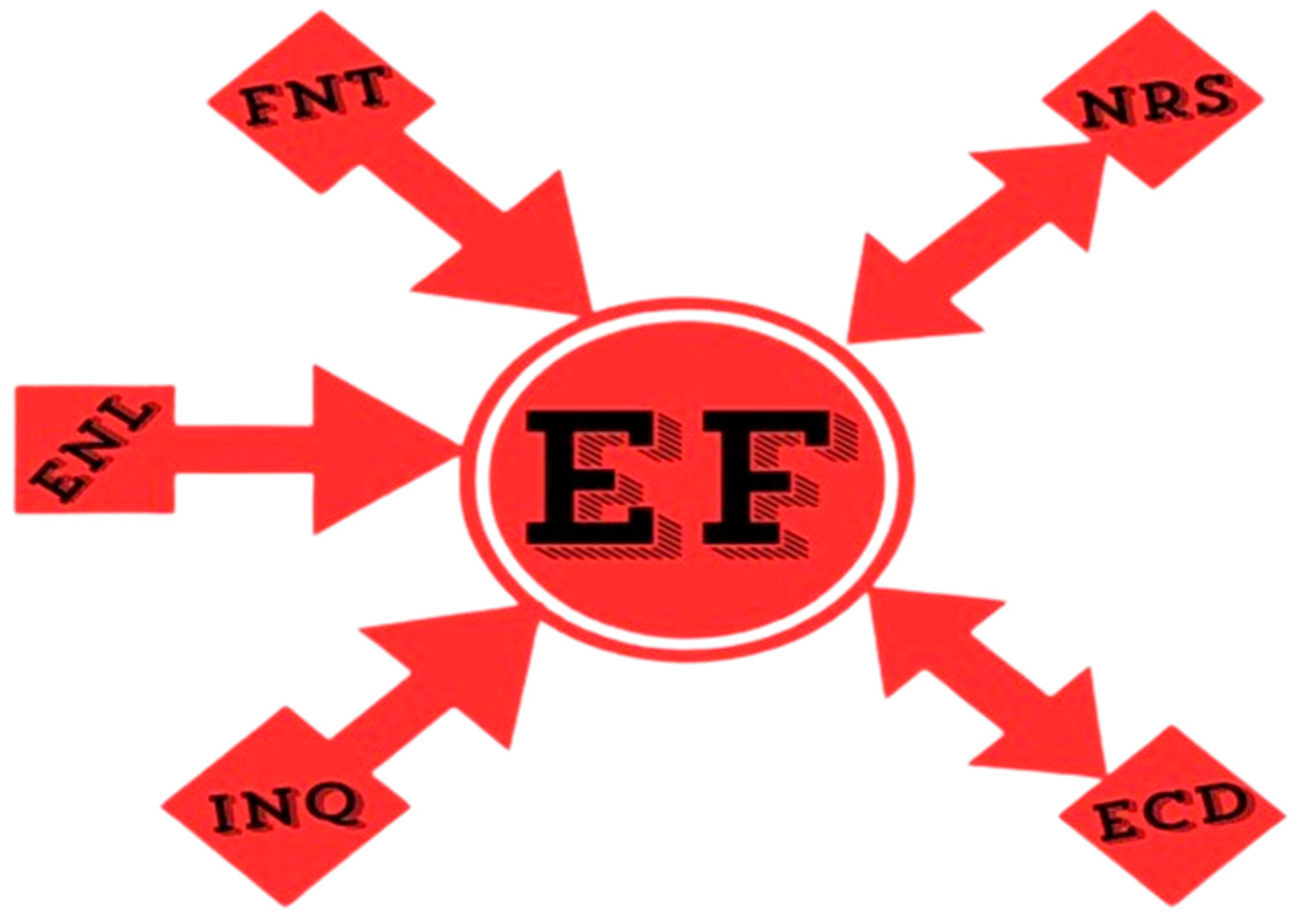

46]. SDG7 aims to achieve modern, reliable, and ecologically sustainable energy sources by the year 2030. The accomplishment of this objective can solely be attained by shifting away from fossil fuels. This study centers on G20 nations, as they have made a commitment to fully eliminate the usage of fossil fuels and transition to RE sources by the year 2040. Therefore, this study is conducted to enhance the current information base and offer valuable insights for policymakers, and the scientific community by examining the SD in the G20 countries by analyzing the influence of NRS, FNT, and ENL. This study uses panel models to evaluate the influence of NRS, ENL, and FNT on EF in the G20 nations. This study aims to fill a knowledge gap regarding the efficacy of FNT and ENL in reducing environmental impacts. The study also examines the relationship between ECD, INQ, and EF. It offers insights into the dynamics and trajectories of ecological impacts. Considering the pressing nature of the climate emergency, the G20 nations have established a target of achieving complete neutrality in emissions by 2040, which is five years ahead of the original schedule. It intends to transition to RE sources to meet all its energy requirements by that same year. To summarize how the variables’ elements impact sustainability, we presented the summary in

Figure 5 to illustrate the principal factors impacting the SD in G20. It illustrates the key elements influencing environmental sustainability in G20 countries. It highlights how natural resources, fintech, environmental laws, economic development, and institutional quality interact to shape sustainability outcomes. These factors contribute by affecting resource management, technological advancements, policy enforcement, financial systems, and governance structures. Each component plays a critical role in either promoting or hindering sustainable practices [

47].

The remaining sections of the article are as follows: Section two discusses the literature review on EF, NRS, ENL, FNT, ECD, and INQ. Section three covers the data, methodology, preliminary tests, and regression techniques. Section four uncovers the study’s findings. Section five is about the discussion of outcomes. The last section of the study represents the conclusion and policy recommendations, as well as the study’s limitations.

4. Results

Table 2 presents the descriptive statistics for G20 countries, highlighting significant variability across key variables. The ecological footprint (EF) averages 4.28, with a slight right skewness, indicating that while most countries have lower EF values, a few exhibit much higher footprints (0.09–10.93). Natural resource extractions (NRS) show substantial heterogeneity, with a mean of 4.73 and a large standard deviation of 9.15, reflecting stark differences in resource dependence. Similarly, economic development (ECD) varies widely, averaging 13,418 with a high standard deviation (16,960) and a range from −9601.34 to 61,855.52, emphasizing economic disparities within the G20. Environmental laws (ENL) exhibit positive skewness, with most countries having moderate regulatory frameworks but a few enforcing much stronger policies (1.45–25.23). Fintech (FNT) is highly skewed, with minimal development in most countries but significantly higher levels in a few (−0.43 to 7.45). Institutional quality (INQ) averages 65.94, showing a relatively balanced distribution but with notable governance disparities (6.53–97.56). The high variability in NRS, ECD, and INQ underscores the diverse economic, governance, and environmental contexts among G20 nations, influencing sustainability outcomes and policy effectiveness.

Moreover, liberalization and globalization have transformed the world into a highly interconnected global community, where economic and environmental changes in one country can influence others [

94]. Given this interdependence, addressing CD in panel data is crucial. This study employs the CD test to assess the extent of interrelationships among G20 nations, focusing on EF, NRS, FNT, ENL, ECD, and INQ. The test results, presented in

Table 3, indicate a significant CD at the 1% level, confirming that changes in these variables in one G20 country can transmit effects across the group. For instance, fluctuations in NRS or ENL in one nation can shape sustainability policies and economic growth trajectories in others. Similarly, FNT and INQ can have spillover effects, influencing financial systems and governance structures beyond national borders. These findings underscore the G20’s economic and environmental interconnectedness, reinforcing the need for coordinated policies. Ignoring CD could lead to biased estimates and misinterpretation of policy impacts. Therefore, accounting for CD ensures a more robust analysis of sustainability trends and policy implications within the G20 framework.

After confirming the presence of CD in the dataset, it is essential to assess the homogeneity of slope coefficients to determine whether G20 countries exhibit similar relationships among the studied variables. The null hypothesis (H

0) assumes slope homogeneity, implying uniform effects across countries, while its rejection suggests heterogeneity.

Table 4 presents the slope homogeneity test results, showing that the null hypothesis is rejected at a 1% significance level (

p-values for both delta and adj. delta = 0.000). This confirms significant variations among the G20 countries, indicating that environmental sustainability determinants differ based on country-specific economic structures, policy frameworks, and resource endowments. These findings highlight the need for tailored policy approaches rather than one-size-fits-all solutions.

After confirming the presence of CD and data heterogeneity, it is crucial to assess the stationarity properties of the variables to ensure the reliability of regression analysis. Given the presence of CD, second-generation unit root tests, such as CIPS and CADF, are employed for more accurate stationarity detection.

Table 5 presents the results, indicating that all variables—EF, NRS, FNT, ENL, ECD, and INQ—are non-stationary at level but become stationary at I(1). In CADF, EF, ECD, and INQ achieve stationarity at I(1) at the 5% level, while the remaining variables are significant at the 1% level. In CIPS, all variables are stationary at I(1) at the 1% significance level. The presence of unit roots at level suggests that these variables exhibit long-term trends, meaning shocks can have persistent effects. However, stationarity at first difference (I(1)) ensures valid long-run relationships, supporting the suitability of cointegration techniques for policy-relevant insights into environmental sustainability dynamics in G20 countries.

After confirming the integration order of the data series, it is necessary to check for co-integration among the time series to verify the long-run relationships among the variables. When CD and heterogeneity are present in the panel data, the second-generation co-integration tests are recommended. This is why Westerlund co-integration is a good way to look at the long-term equilibrium between the variables because it can deal with CD and different types of data. In our study, CD and slope heterogeneity exist in the dataset; therefore, we used a second-generation Westerlund co-integration test to check the long-run co-integration among the study variables EF, NRS, FNT, ENL, ECD, and INQ for the G20 countries. The null hypothesis of Westerlund co-integration indicates that there is no co-integration among the time series, and H

1 rejects that hypothesis.

Table 6 displays the results of the Westerlund co-integration test. The

p-values of Gt and Pt at the 1% level of significance indicate the rejection of H

0 and acceptance of H1. Hence, there is long-term co-integration among the study variables.

To ensure the reliability of our findings, we evaluated model selection using the Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC). Lower AIC and BIC values indicate a better-fitting model. As shown in

Table 7, the full model, which includes all explanatory variables, has the lowest AIC (278.54) and BIC (287.91), confirming its superior fit compared to other specifications. Additionally, we conducted a robustness check using the Common Correlated Effects Mean Group (CCEMG) model, which accounts for cross-sectional dependencies. The CCEMG robustness model yielded an AIC of 283.76 and a BIC of 292.43, reinforcing the validity of our main results. These findings confirm that the selected model effectively captures the relationship between financial technology, environmental policies, and ecological footprint in G20 economies.

After performing the pre-requisite tests, including CD, slope homogeneity, unit root, Westerlund co-integration and AIC/BIC, the next stage is to evaluate the long-run and short-run impact of FNT, NRS, ENL, ECD and INQ on EF for G20 countries. As is evident from the results of CD, slope test, and Westerlund co-integration test, there exist CD and SH among the data series, indicating that our dataset exhibits mixed co-integration and non-linear linkage. Due to mixed co-integration and the presence of CD and heterogeneity, the preferred regression method is CS-ARDL. The long- and short-run results of CS-ARDL have been shown in

Table 8.

The findings indicate that NRS have a significant positive effect (0.1103,

p < 0.01), implying that resource exploitation contributes to environmental pressure in the long run. Whereas ENL demonstrates a significant negative impact (−0.0664,

p < 0.01), suggesting that stronger environmental regulations help mitigate environmental degradation. Furthermore, FNT also shows a negative and significant effect (−0.2539,

p < 0.01), implying that advancements in financial technology contribute to environmental sustainability. ECD has a small but significant positive coefficient (0.0002,

p < 0.01), suggesting that higher economic activity may intensify environmental pressure. Finally, INQ has a negative coefficient (−0.0324,

p < 0.01), indicating that better governance contributes to environmental improvements. The ECT is negative (−0.1218,

p < 0.01), confirming the model’s convergence to long-run equilibrium. In the short run, NRS maintains a positive effect (0.1509,

p < 0.01), consistent with long-term findings. ENL remains negatively significant (−0.0220,

p < 0.05), reinforcing its role in mitigating environmental degradation. FNT continues to exhibit negative effects (−0.0269,

p < 0.05), though its magnitude is smaller than in the long run. ECD has a significant positive impact (0.0121,

p < 0.05), indicating short-term economic activities contribute to environmental strain. INQ remains negatively associated (−0.0152,

p < 0.05), implying its role in short-term environmental improvements. These results highlight both immediate and long-term dynamics of environmental sustainability determinants within the G20 context. The graphical representation of these findings is shown in

Figure 7.

Furthermore, our study employs AMG and CCEMG techniques to validate the CS-ARDL findings, addressing issues such as CD, fractional integration, and slope heterogeneity in panel data. These second-generation methods are particularly useful for handling non-stationarity and unobserved common factors, enhancing the robustness of our analysis.

Table 9 presents the results, showing that AMG and CCEMG confirm the CS-ARDL findings, reinforcing the reliability of our conclusions. Specifically, NRS and ECD exhibit a positive relationship with EF, while FNT, ENL, and INQ show an inverse relationship across all methods. However, slight variations in coefficient magnitudes between AMG, CCEMG, and CS-ARDL may arise due to differences in estimation techniques and their sensitivity to cross-sectional dependencies. These differences highlight the need for a nuanced interpretation of the results, ensuring that policy recommendations account for methodological variations. The consistent directional findings across all models emphasize the robustness of our conclusions and the necessity for targeted policies to balance economic development and sustainability in G20 countries.

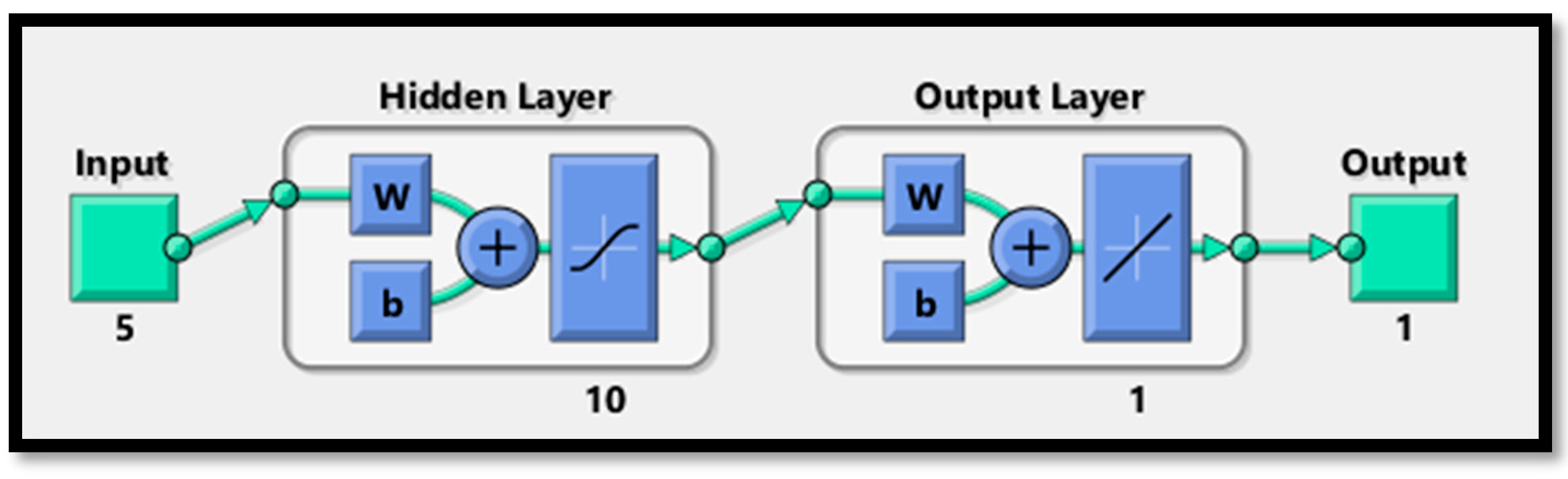

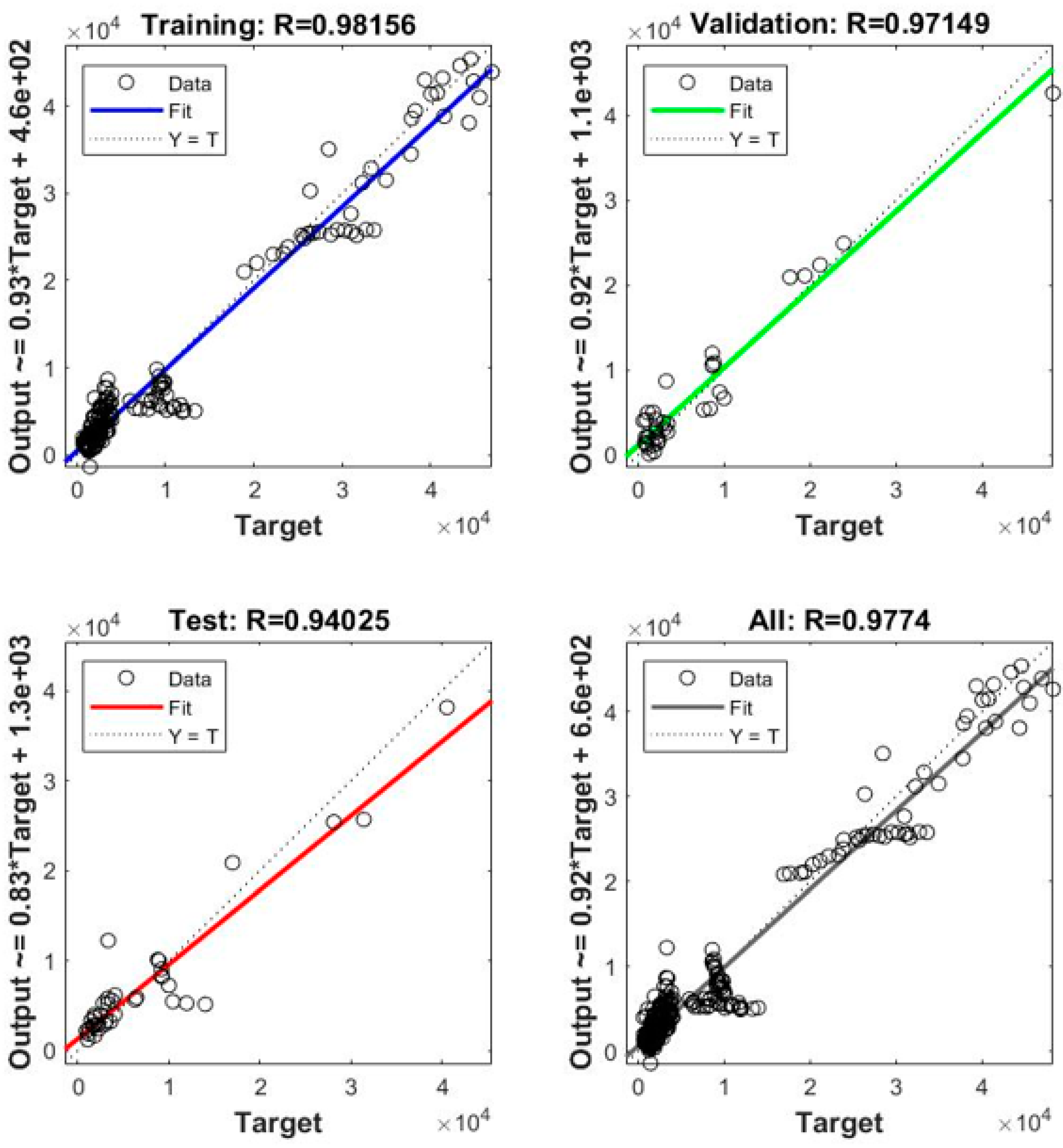

After assessing the durability of CS-ARDL using AMG and CCEMG, our study additionally employs the Artificial Neural Network (ANN) method to enhance the reliability of our results. In the field of artificial intelligence, ANN is a highly accurate and reliable approach for choosing study variables. Furthermore, we used ANN models to address the issue of improving prediction accuracy and identifying the most influential factors. We believe that using ANN may be an efficient and effective method for projecting the economies of the G20 nations, resulting in improved EF management. The research used an ANN model with 5 input variables, a hidden layer of 10 neurons, an output layer, and a solitary output variable.

Figure 8 illustrates the network structure of the ANN model used in this study.

The dataset was divided into three subsets: a training set (70%), a validation set (15%), and a testing set (15%). The model was trained using the Levenberg–Marquardt backpropagation technique, ensuring efficient convergence and optimal weight adjustments.

Figure 9 presents the ANN model’s predictive performance, demonstrating a strong correlation between predicted and actual values, as indicated by the high overall R value of 0.915. The high R value of 0.915 indicates strong predictive accuracy, suggesting that the ANN model effectively captures the underlying relationships between variables. This result reinforces the reliability of the model in predicting ecological outcomes based on input factors. Additionally, the consistency of high R values across training, validation, and test sets implies that the model generalizes well without significant overfitting. Compared to econometric models, which assume specific functional relationships, ANN offers a more flexible, data-driven approach that adapts to non-linear and complex interactions. This capability is particularly valuable in environmental studies, where multiple factors interact in dynamic and non-linear ways. The strong predictive performance of the ANN model underscores its potential as a complementary tool alongside traditional econometric methods, enhancing the study’s methodological depth.

Moreover, EF, NRS, FNT, ENL, ECD, and INQ are interrelated variables influencing environmental and economic dynamics in the G20 countries. However, correlation does not imply causation; therefore, we employ the Dumitrescu–Hurlin (D-H) causality test to determine the direction of these relationships.

Table 10 presents the findings, highlighting both bidirectional and unidirectional causalities.

The bidirectional causality between NRS, ECD, and EF suggests a reinforcing cycle where natural resource utilization and economic development both drive and are influenced by environmental changes. This aligns with resource-based economic theories, which argue that environmental degradation results from resource exploitation while, in turn, resource availability is affected by ecological conditions. Similarly, the reciprocal causality between ECD and EF implies that economic complexity contributes to environmental impacts, while environmental degradation may, in turn, shape economic decisions through regulatory policies or sustainability-driven market shifts. Conversely, the unidirectional causality from FNT, ENL, and INQ to EF indicates that financial technologies, energy consumption, and institutional quality drive ecological changes, but not vice versa. This aligns with the argument that financial advancements, energy use patterns, and governance structures shape environmental policies and sustainability outcomes, but environmental factors alone do not necessarily alter these determinants in the short run. These findings underscore the complex interactions within G20 economies, emphasizing the need for policy interventions that consider both direct and feedback effects in environmental sustainability strategies.

Figure 10 provides a visual representation of these relationships.

5. Discussion

Our findings indicate that natural resource extraction (NRS) significantly contributes to increasing the ecological footprint (EF) in G20 nations. The results from

Table 8 reveal that in the long run, a 1% increase in NRS leads to a 0.11025% rise in EF, while in the short run, the increase is 0.1508%. Although these values may seem numerically small, their cumulative impact is substantial, given the scale of resource exploitation in G20 economies. For instance, countries heavily dependent on natural resources, such as Brazil (due to deforestation) and Saudi Arabia (due to oil extraction), experience severe environmental degradation. Our findings support H1, demonstrating that NRS adversely affects environmental sustainability in G20 nations. This aligns with the results of [

117,

118], though it contrasts with [

119], which found differing outcomes for BRICS nations. In contrast, some studies suggest that resource-rich nations can mitigate these impacts by adopting sustainable extraction technologies and green energy transitions, a strategy that the G20 must further integrate. A key finding in this study is that effective environmental legislation (ENL) significantly reduces the ecological footprint in both the short and long run. A 1% increase in ENL leads to a 0.0664% decrease in EF in the long run and a 0.0219% reduction in the short run. The results of our study confirm H3, which states that effective environmental legislation (ENL) in the G20 strengthens environmental sustainability by encouraging green technology and cleaner production. Our findings are consistent with the findings of [

28,

58]. However, ref. [

42] findings for MENA countries do not align with our study’s findings. These findings demonstrate that stronger regulatory frameworks play a crucial role in reducing the ecological footprint and promoting sustainable economic transitions. Furthermore, the practical significance of this effect can be observed in countries such as Germany, which has effectively utilized carbon taxes and renewable energy subsidies to limit ecological harm. These policies have led to a measurable decline in carbon emissions and resource depletion.

Similarly, financial technology (FNT) plays a crucial role in reducing EF. The results show that a 1% increase in FNT leads to a 0.2538% reduction in EF in the long run and a 0.0268% decrease in the short run. The results of our study validate H2, indicating that financial technology (FNT) improves environmental sustainability in G20 nations. Our findings highlight the role of FNT in facilitating green investments, enhancing energy efficiency, and promoting sustainable financial practices that contribute to lower ecological footprints. Furthermore, this result aligns with the findings of [

57]. However, findings of [

56] contradict ours outcomes. The impact of FNT is particularly notable in developing economies within the G20, where digital financial services have improved accessibility to green investments and low-carbon technologies. For instance, during the COVID-19 pandemic, financial technology facilitated a surge in digital transactions, reducing reliance on paper-based banking and transportation-related emissions. The strong negative relationship between FNT and EF indicates that expanding digital financial solutions, such as green bonds, carbon trading platforms, and blockchain-based sustainability tracking, could further mitigate environmental damage. Institutional quality (INQ) is another essential factor influencing environmental sustainability. Our study finds a 0.0323% reduction in EF for a 1% increase in INQ in the long run and a 0.0151% decrease in the short run. The findings support H4, confirming that higher institutional quality (INQ) in G20 nations enhances environmental sustainability by promoting clean energy adoption and ensuring equitable resource distribution. These results align with the findings of [

120,

121], reinforcing the critical role of strong institutions in driving sustainable environmental policies. Countries with higher institutional transparency and governance, such as Canada and Australia, have successfully leveraged their institutional frameworks to reduce pollution and enforce climate policies. The results highlight the need for G20 nations to strengthen governance mechanisms that promote accountability, transparency, and regulatory compliance to achieve long-term environmental goals. Economic development (ECD), on the other hand, is positively associated with EF, indicating that growth-driven expansion increases environmental burdens. A 1% rise in ECD leads to a 0.0002% increase in EF in the long run and a 0.01205% rise in the short run. Although the numerical values are small, the impact becomes significant when scaled across high-growth economies like China, India, and the U.S. Our findings confirm H5, indicating that economic development (ECD) negatively impacts environmental sustainability in G20 nations. This result aligns with the findings of [

122], further emphasizing the environmental challenges associated with economic expansion. For instance, the expansion of fossil fuel-based industries and deforestation for infrastructure development are major contributors to EF in fast-growing economies. Therefore, sustainable development strategies—such as green economic policies, circular economy initiatives, and low-carbon industrial frameworks—are crucial for balancing economic progress with environmental conservation.

This study makes a significant contribution by presenting a triple helix approach to environmental sustainability in the G20, integrating environmental law, financial technology, and institutional quality as critical enablers of ecological resilience. Unlike previous research that largely focuses on economic growth and emissions, our study provides a more comprehensive perspective by highlighting the interplay between governance, technological advancement, and financial mechanisms. By contextualizing effect sizes and demonstrating their practical implications, we offer actionable insights for policymakers, advocating for stricter regulations, fintech-driven green financing, and governance reforms as essential tools to mitigate the ecological footprint. Our findings underscore that while economic growth and resource dependence pose environmental challenges, strategic policy interventions—rooted in law, technology, and governance—can pave the way for a greener and more sustainable future in the G20 and beyond.

6. Conclusions and Policy Implications

Environmental degradation (ED) remains a critical global challenge, threatening ecosystems, climate stability, and human well-being. This issue is particularly pressing within the G20, where industrialization and economic expansion exert immense pressure on natural resources and contribute to environmental stress. To assess environmental sustainability in G20 economies, this study examines the long-run and short-run relationships between EF and key determinants, including NRS, FNT, ENL, INQ, ECD, using data from 2000 to 2022.

Employing the CS-ARDL approach, we establish that ECD and NRS significantly increase EF in both the long and short run, indicating that economic expansion and resource extraction contribute to environmental degradation. Conversely, FNT, ENL, and INQ demonstrate a negative association with EF, suggesting their role in mitigating ecological pressures. Robustness checks using MG and CCEMG confirm these relationships, and the ANN model further strengthens the reliability of our findings. The Dumitrescu–Hurlin causality test identifies bi-directional causality between NRS and ECD, reinforcing the interconnected nature of economic growth and resource utilization, while unidirectional causality from FNT, ENL, and INQ to EF highlights their independent influence on sustainability.

While these findings highlight pathways to reducing environmental footprints, they also expose the inherent tensions between economic growth and sustainability. Policymakers must navigate trade-offs between resource-driven economic expansion and ecological preservation. For instance, while promoting industrialization fosters economic development, it simultaneously amplifies environmental pressures. Similarly, fintech and institutional improvements can enhance sustainability, yet their effectiveness may vary depending on regulatory frameworks and economic structures. These findings contribute to the theoretical discourse by underscoring the dual role of economic development and natural resource exploitation in shaping environmental outcomes. The study extends the sustainability literature by demonstrating how fintech and institutional factors can counterbalance the ecological footprint driven by economic and resource-intensive activities. Furthermore, the results align with ecological modernization theory, which posits that technological and institutional advancements can facilitate environmental improvements despite economic expansion. By integrating fintech as a transformative force, this research broadens existing perspectives on the digital economy’s potential role in sustainability transitions within industrialized economies.

Moreover, effective policy interventions are crucial for balancing economic growth with environmental sustainability in the G20 nations. Given the diverse development stages, institutional frameworks, and ecological challenges across these countries, tailored strategies are essential. Policies should focus on sustainable resource management, green financial innovations, stricter environmental regulations, and institutional transparency to mitigate ecological degradation while fostering long-term economic resilience.

Since NRS positively impacts EF, implementing strict resource management, promoting resource-efficient technologies, and incentivizing alternative industries can help mitigate environmental degradation.

Given that FNT negatively influences EF, fostering green fintech solutions, integrating sustainable finance mechanisms, and expanding digital financial tools can support environmental sustainability.

Because ENL reduces EF, strengthening environmental laws, ensuring strict enforcement, and integrating market-based incentives will drive sustainable practices.

Considering that INQ lowers EF, enhancing governance, reducing corruption, and promoting institutional transparency can improve environmental policies and resource management.

As ECD contributes to EF, balancing economic growth with sustainability through investments in green technologies, renewable energy, and circular economy practices is necessary.

Recognizing the diversity among G20 nations, policy strategies should be tailored—developed economies can spearhead green innovations, while emerging economies should prioritize capacity-building and policy reforms for sustainable development.

Although this study provides a comprehensive analysis of the relationships among FNT, ENL, NRS, ECD, INQ, and EF within G20 countries, certain limitations present opportunities for further research. Future studies could explore additional factors influencing environmental sustainability, such as the digital economy, technological forecasting, social change, economic complexity, tourism, net savings, and human capital, particularly in relation to EF and biocapacity. Moreover, expanding the scope beyond G20 to include regions such as CAREC, ASEAN, APEC, SAARC, GCC, and OPEC could offer comparative insights into the impact of economic variables on environmental outcomes. Extending the study period beyond 2000–2022 would also allow for assessing long-term trends and policy shifts. Methodologically, future research could employ alternative techniques like Driscoll-Kraay Standard Errors, MMQR, Dynamic Common Correlated Effects, Generalized Method of Moments, and Panel Smooth Transition Regression to enhance robustness. Additionally, multi-model approaches could complement single-model frameworks, leading to more comprehensive findings. Addressing these gaps will contribute to a deeper understanding of environmental sustainability and inform more targeted policy interventions.