Digital Transformation and Corporate Carbon Emissions: Evidence from China’s Listed Companies

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Hypothesis Formulation

3.1. Digital Transformation and Corporate Carbon Emissions

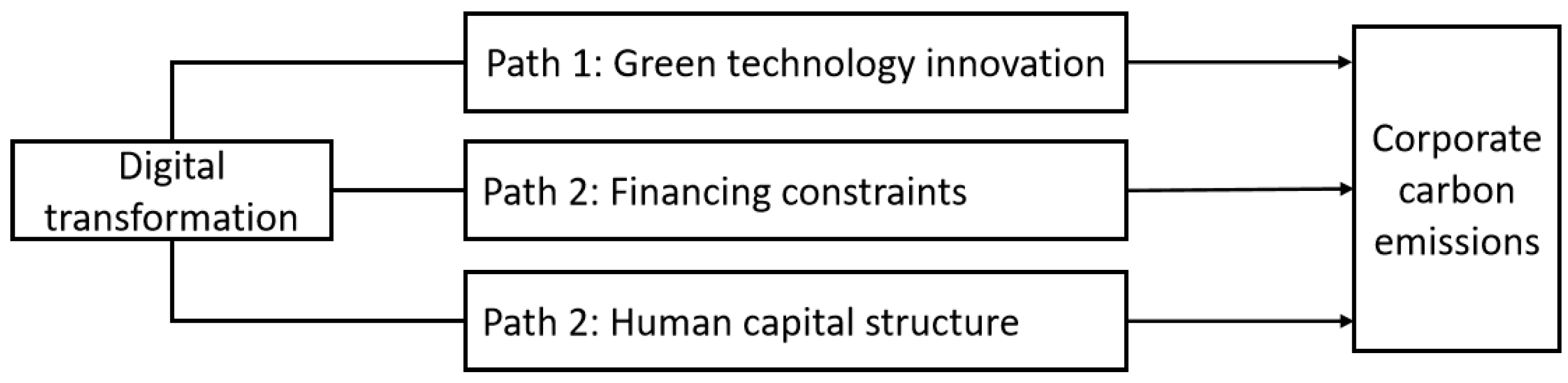

3.2. The Impact Mechanism of Digital Transformation on Corporate Carbon Emissions

3.2.1. Digital Transformation, Green Technology Innovation, and Corporate Carbon Emissions

3.2.2. Digital Transformation, Financing Constraints, and Corporate Carbon Emissions

3.2.3. Digital Transformation, Human Capital Structure, and Corporate Carbon Emissions

4. Study Design

4.1. Sample and Data

4.2. Variable Measurement and Description

4.2.1. Carbon Emissions (CE)

4.2.2. Digital Transformation (Digital)

4.2.3. Mediating Variables

4.2.4. Control Variables

4.3. Models Setting

4.3.1. Regression Mode

4.3.2. The Mechanism Test Model

5. Results and Discussion

5.1. Descriptive Statistical Analysis

5.2. Baseline Regression

5.3. Robustness Test

5.3.1. Replacing the Independent Variable

5.3.2. Replacing the Dependent Variable

5.3.3. Shorten the Sample Interval

5.3.4. Counterfactual Test

5.3.5. Instrumental Variable Method

5.3.6. Propensity Score Matching

5.4. Mechanism Test

5.4.1. Green Technology Innovation

5.4.2. Financing Constraints

5.4.3. Human Capital Structure

5.5. Heterogeneity Analysis

5.5.1. Enterprise Technological Attributes

5.5.2. Property Rights

5.5.3. Carbon Emission Characteristics

5.5.4. Regional Location

6. Conclusions and Implications

6.1. Conclusions

- (1)

- Digital transformation can significantly reduce enterprises’ carbon emissions, which still holds even after undergoing various robustness tests.

- (2)

- The mechanism assessment reveals that digital transformation has the potential to decrease carbon emissions within enterprises via three distinct pathways. The first pathway, referred to as the “technology” pathway, suggests that digital transformation facilitates a reduction in carbon emissions by fostering proactive green innovation initiatives. Consequently, this leads to a decrease in the costs associated with green technology innovation and enhances the overall efficiency of such innovations. The second is the “capital” path, where enterprise digital transformation reduces carbon emissions by expanding financing channels, increasing financing scale, and reducing financing costs. The third is the “talent” path, where enterprise digital transformation reduces carbon emissions by optimizing the function and quality structure of human capital.

- (3)

- The heterogeneous results are categorized into four types. First, in terms of industry heterogeneity, digital transformation significantly promotes carbon emission reductions in high-tech enterprises, but the results are not significant in non-high-tech enterprises. Second, from the perspective of property rights heterogeneity, digital transformation has a more significant effect on promoting carbon emission reductions in non-state-owned enterprises, but it does not perform as well in state-owned enterprises. Third, from the perspective of carbon emission characteristics, digital transformation has a more significant effect on promoting carbon emission reductions among enterprises in the high-carbon emissions group. Fourth, from the perspective of regional heterogeneity, digital transformation significantly reduces carbon emissions of enterprises in the eastern region, whereas the impact on the central and western cities is not significant.

6.2. Policy Recommendations

- (1)

- The government should enhance its support for the digital transformation of enterprises and foster the progression of this process.

- (2)

- The government should offer comprehensive and strategic support to enterprises to achieve their carbon emission reduction targets during their digital transformation. This holistic approach involves multiple facets, each designed to incentivize, facilitate, and enhance enterprises’ efforts in minimizing their environmental footprint.

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tang, J.; Zhong, S.; Xiang, G. Environmental Regulation, Directed Technical Change, and Economic Growth: Theoretic Model and Evidence from China. Int. Reg. Sci. Rev. 2019, 42, 519–549. [Google Scholar] [CrossRef]

- Bashir, M.F.; Shahbaz, M.; Malik, M.N.; Ma, B.; Wang, J. Energy transition, natural resource consumption and environmental degradation: The role of geopolitical risk in sustainable development. Resour. Policy 2023, 85, 103985. [Google Scholar] [CrossRef]

- Rong, L.; Wang, Z.; Li, Z. Unraveling the role of Financial Risk, social globalization and Economic Risk towards attaining sustainable environment in China: Does resources curse still holds. Resour. Policy 2024, 88, 104375. [Google Scholar] [CrossRef]

- Xia, Q.; Li, L.; Zhang, B.; Dong, J. Nonlinear Influence of Land-Use Transition on Carbon Emission Transfer: A Threshold Regression Analysis of the Middle Reaches of the Yangtze River in China. Land 2022, 11, 1531. [Google Scholar] [CrossRef]

- Cheng, X.; Ouyang, S.; Quan, C.; Zhu, G. Regional allocation of carbon emission quotas in China under the total control target. Environ. Sci. Pollut. Res. 2023, 30, 66683–66695. [Google Scholar] [CrossRef]

- Zhou, Z.; Zhang, T.; Wen, K.; Zeng, H. Carbon risk, cost of debt financing and the moderation effect of media attention: Evidence from Chinese companies operating in high-carbon industries. Bus. Strategy Environ. 2018, 27, 1131–1144. [Google Scholar] [CrossRef]

- Liu, Y.; Hao, Y. How does coordinated regional digital economy development improve air quality? New evidence from the spatial simultaneous equation analysis. J. Environ. Manag. 2023, 342, 118235. [Google Scholar] [CrossRef]

- Wang, W.; He, Y.; Lei, Y.; Zhou, X.; Li, Z. Digital economy sectors are key CO2 transmission centers in the economic system. J. Clean. Prod. 2023, 407, 136873. [Google Scholar] [CrossRef]

- Ding, T.; Li, J.; Shi, X.; Li, X.; Chen, Y. Is artificial intelligence associated with carbon emissions reduction? Case of China. Resour. Policy 2023, 85, 103892. [Google Scholar] [CrossRef]

- Li, D.; Huang, M.; Ren, S.; Chen, X.; He, X. Environmental Legitimacy, Green Innovation, and Corporate Carbon Disclosure: Evidence from CDP China 100. J. Bus. Ethics 2018, 150, 1089–1104. [Google Scholar] [CrossRef]

- Jalil, F.M.; Marikan, A.B.A.D.; Jais, B.M.; Zainal, N.B.; Othman, R.B. Kickstart manufacturing SMEs’ go green journey: A green hydrogen acceptance framework to enhance low carbon emissions through green digital technologies. Int. J. Hydrogen Energy 2025, 105, 592–610. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Yang, G.; Nie, Y.; Li, H.; Zhang, P.; Wang, X. Digital transformation and low-carbon technology innovation in manufacturing firms: The mediating role of dynamic capabilities. Int. J. Prod. Econ. 2023, 263, 108969. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Zeng, H.; Ran, H.; Zhou, Q.; Jin, Y.; Cheng, X. The financial effect of firm digitalization: Evidence from China. Technol. Forecast. Soc. Change 2022, 183, 121951. [Google Scholar] [CrossRef]

- Wang, L.; Shao, J. Digital economy, entrepreneurship and energy efficiency. Energy 2023, 269, 126801. [Google Scholar] [CrossRef]

- Wang, S.L. Digital economy development for urban carbon emissions: ‘accelerator’ or ‘speed bump’? China Popul. Resour. Environ. 2023, 33, 11–22. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Y.; Ramsey, T.S.; Li, J.; Zhang, W. Will researching digital technology really empower green development? Technol. Soc. 2021, 66, 101638. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, X.; Wang, D.; Zhou, P.; Zhang, Y. Digital economy and carbon emission performance: Evidence at China’s city level. Energy Policy 2022, 165, 112927. [Google Scholar] [CrossRef]

- Xu, Q.; Zhong, M.; Li, X. How does digitization affect energy? International evidence. Energy Econ. 2022, 107, 105879. [Google Scholar] [CrossRef]

- Bai, L.; Guo, T.; Xu, W.; Zhang, Y.; Wang, C. Effects of digital economy on carbon emission intensity in Chinese cities: A life-cycle theory and the application of non-linear spatial panel smooth transition threshold model. Energy Policy 2023, 183, 113792. [Google Scholar] [CrossRef]

- Zhang, J.; Hou, Y.; Liu, S.; Li, X.; Wang, Y. Can the Energy Internet promote China’s energy system to achieve carbon emission peak goal? J. Clean. Prod. 2023, 417, 138014. [Google Scholar] [CrossRef]

- Sadorsky, P. Information communication technology and electricity consumption in emerging economies. Energy Policy 2012, 48, 130–136. [Google Scholar] [CrossRef]

- Zhang, Y.; Ran, C. Effect of digital economy on air pollution in China? New evidence from the “National Big Data Comprehensive Pilot Area” policy. Econ. Anal. Policy 2023, 79, 986–1004. [Google Scholar] [CrossRef]

- Yang, Z.; Gao, W.; Han, Q.; Li, X.; Chen, Y. Digitization and carbon emissions: How does digital city construction affect China’s carbon emission reduction? Sustain. Cities Soc. 2022, 87, 104201. [Google Scholar] [CrossRef]

- Yang, X.; Wang, H.; Yan, T.; Cao, M.; Han, Y.; Pan, Y.; Feng, Y. The road to inclusive green growth in China: Exploring the impact of digital-real economy integration on carbon emission efficiency. J. Environ. Manag. 2024, 370, 122989. [Google Scholar] [CrossRef]

- Zheng, R.; Wu, G.; Cheng, Y.; Li, X.; Wang, L. How does digitization drive carbon emissions? The inverted U-shaped effect in China. Environ. Impact Assess. Rev. 2023, 102, 107203. [Google Scholar] [CrossRef]

- Wang, W.; Zhou, S.; Li, D.; Zhang, Y.; Chen, X. Disentangling the non-linear relationships and interaction effects of urban digital transformation on carbon emission intensity. Urban Clim. 2025, 59, 102283. [Google Scholar] [CrossRef]

- Wang, S.; Li, J. Does Digital Transformation Promote Green and Low-Carbon Synergistic Development in Enterprises? A Dynamic Analysis Based on the Perspective of Chinese Listed Enterprises in the Heavy Pollution Industry. Sustainability 2023, 15, 15600. [Google Scholar] [CrossRef]

- Ma, Y.; Tao, P. A Perspective on Management Myopia: The Impact of Digital Transformation on Carbon Emission Intensity. Sustainability 2023, 15, 9417. [Google Scholar] [CrossRef]

- Zhong, T.Y.; Ma, F.Q. Carbon Reduction Effect of Enterprise Digital Transformation: Theoretical Mechanism and Empirical Test. Jianghai Acad. J. 2022, 99–105. [Google Scholar] [CrossRef]

- Shang, Y.; Raza, S.A.; Huo, Z.; Yang, X.; Wang, C. Does enterprise digital transformation contribute to the carbon emission reduction? Micro-level evidence from China. Int. Rev. Econ. Financ. 2023, 86, 1–13. [Google Scholar] [CrossRef]

- Zhao, Y.; Wang, W. The multiple empowerment effects of digital transformation on carbon emissions in manufacturing industry from the prospective of factor allocation: Theoretical analysis and empirical evidence. Environ. Impact Assess. Rev. 2025, 110, 107698. [Google Scholar] [CrossRef]

- Zhang, Y.; Jia, K.; Cen, L.; Li, X.; Wang, M. Does digital transformation promote corporate carbon reduction? Evidence from Chinese A-share listed companies. Environ. Dev. Sustain. 2024, 1–28. [Google Scholar] [CrossRef]

- Yu, C.J.; Tang, W. Can Digital Transformation of Industrial Enterprises Contribute to Carbon Emission Reduction: Evidence Based on Chinese A-share Listed Industrial Enterprises. Macroeconomics 2023, 97–110+127. [Google Scholar] [CrossRef]

- Lin, Y.; Qi, X.; Wang, L. Digital Transformation and Carbon Intensity: Evidence from Chinese Tourism Companies. Sustainability 2024, 16, 9454. [Google Scholar] [CrossRef]

- He, L.Y.; Chen, K.X. Digital transformation and carbon performance: Evidence from firm-level data. Environ. Dev. Sustain. 2023, 1–26. [Google Scholar] [CrossRef]

- Ying, X.; Fu, J.; Lujie, C.; Zhang, R.; Wang, L. Does digital transformation foster carbon emissions reduction? Evidence from China’s manufacturing supply chain. Int. J. Logist. Manag. 2024, 35, 1827–1846. [Google Scholar] [CrossRef]

- Zheng, D.; Song, H.; Zhao, C.; Wang, Y.; Liu, Y. Is it possible for semiconductor companies to reduce carbon emissions through digital transformation? Evidence from China. Int. J. Prod. Econ. 2024, 272, 109246. [Google Scholar] [CrossRef]

- Chen, Y.; Liu, S.; Xiao, Y.; Li, Y.; Zhang, W. Can Digital Transformation Reduce Enterprise Carbon Intensity? An Empirical Analysis of Chinese Manufacturers. Sustainability 2024, 16, 5236. [Google Scholar] [CrossRef]

- Guo, L.; Tang, M. How Does Digital Transformation Improve Corporate Carbon Emission Reduction Performance? An Empirical Study on Data from Listed Companies in China. Sustainability 2024, 16, 3499. [Google Scholar] [CrossRef]

- Liu, H.; Han, P.; Wang, D.; Li, X.; Zhang, Y. Decoding enterprise digital transformation: External oversight and carbon emission reduction performance. J. Environ. Manag. 2024, 359, 121039. [Google Scholar] [CrossRef] [PubMed]

- Zou, S.; Fan, X.; Zhou, Y.; Chen, J.; Li, W. Achieving collaborative pollutant and carbon emissions reduction through digital governance: Evidence from Chinese enterprises. Environ. Res. 2024, 263, 120197. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Guo, Z.; Lei, Z. Research on the mechanisms of the digital transformation of manufacturing enterprises for carbon emissions reduction. J. Clean. Prod. 2024, 449, 141817. [Google Scholar] [CrossRef]

- Zhang, C.; Fang, J.; Ge, S.; Sun, G. Research on the impact of enterprise digital transformation on carbon emissions in the manufacturing industry. Int. Rev. Econ. Financ. 2024, 92, 211–227. [Google Scholar] [CrossRef]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Gupta, S.; Qian, X.; Bhushan, B.; Luo, Z. Role of cloud ERP and big data on firm performance: A dynamic capability view theory perspective. Manag. Decis. 2019, 57, 1857–1882. [Google Scholar] [CrossRef]

- Aben, T.A.E.; van der Valk, W.; Roehrich, J.K.; Selviaridis, K. Managing information asymmetry in public–private relationships undergoing a digital transformation: The role of contractual and relational governance. Int. J. Oper. Prod. Manag. 2021, 41, 1145–1191. [Google Scholar] [CrossRef]

- Xiao, J.; Zeng, P.; Ren, G. Digital Transformation, Absorptive Capacity and Dual Performance of Manufacturing Enterprises—Moderating Effect of Regional Digital Level. R&D Manag. 2023, 35, 129–143. [Google Scholar] [CrossRef]

- Liu, H.M.; Long, J.C.; Shen, Z.H. Research on the impact of digital transformation on the green innovation of enterprises. Sci. Res. Manag. 2023, 44, 22–34. [Google Scholar] [CrossRef]

- Zhao, C.Y. Digital development and servitization: Empirical evidence from listed manufacturing companies. Nankai Bus. Rev. 2021, 24, 149–163. [Google Scholar] [CrossRef]

- Li, W.H.; Li, N. Green innovation, digital transformation and energy-intensive enterprises carbon emission reduction performance. J. Ind. Eng. Eng. Manag. 2023, 37, 66–76. [Google Scholar] [CrossRef]

- Jing, W.J.; Sun, B.W. Digital Economy Promotes High-quality Economic Development:A Theoretical Analysis Framework. Economist 2019, 2, 66–73. [Google Scholar] [CrossRef]

- Haefner, N.; Wincent, J.; Parida, V.; Gassmann, O. Artificial intelligence and innovation management: A review, framework, and research agenda. Technol. Forecast. Soc. Change 2021, 162, 120392. [Google Scholar] [CrossRef]

- Song, D.Y.; Zhu, W.B.; Ding, H.C. Can Firm Digitalization Promote Green Technological Innovation? An Examination Based on Listed Companies in Heavy Pollution Industries. J. Financ. Econ. 2022, 48, 34–48. [Google Scholar] [CrossRef]

- Xiao, R.Q.; Wang, R.; Qian, L. The Non-linear Impact of Digitalization Level on Corporate Carbon Performance: The Mediating Effect of Green Technology Innovation. Sci. Technol. Prog. Policy 2023, 40, 96–106. [Google Scholar] [CrossRef]

- Rodgers, W.; Cardenas, J.A.; Gemoets, L.A.; Sarfi, R.J. A smart grids knowledge transfer paradigm supported by experts’ throughput modeling artificial intelligence algorithmic processes. Technol. Forecast. Soc. Change 2023, 190, 122373. [Google Scholar] [CrossRef]

- Rehman, S.U.; Kraus, S.; Shah, S.A.; Khanin, D.; Mahto, R. Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technol. Forecast. Soc. Change 2021, 163, 120481. [Google Scholar] [CrossRef]

- Sohag, K.; Husain, S.; Hammoudeh, S.; Omar, N. Innovation, militarization, and renewable energy and green growth in OECD countries. Environ. Sci. Pollut. Res. 2021, 28, 36004–36017. [Google Scholar] [CrossRef]

- Li, C.; Huo, P.; Wang, Z.; Zhang, W.; Liang, F.; Mardani, A. Digitalization generates equality? Enterprises’ digital transformation, financing constraints, and labor share in China. J. Bus. Res. 2023, 163, 113924. [Google Scholar] [CrossRef]

- Chen, W.; Yuan, X. Financial inclusion in China: An overview. Front. Bus. Res. China 2021, 15, 4. [Google Scholar] [CrossRef]

- Luo, J.; Wang, Z.; Wu, M. Effect of place-based policies on the digital economy: Evidence from the Smart City Program in China. J. Asian Econ. 2021, 77, 101402. [Google Scholar] [CrossRef]

- Jin, X.K.; Xu, L.P.; Xin, Y. Corporate Digitalization and the Cost of Equity Capital. J. Financ. Econ. 2023, 49, 79–93+123. [Google Scholar] [CrossRef]

- Wang, J.Y.; Sun, T.; Li, P.; Gong, Y. Digital Transformation and Financing Constraints of Small and Medium-sized Enterprises: Empirical Evidence Based on GEM Listed Companies. Sci. Decis. Mak. 2022, 1–23. Available online: https://read.cnki.net/web/Journal/Article/KXJC202211001.html (accessed on 14 April 2025).

- Umar, M.; Mirza, N.; Hasnaoui, J.A.; Rochoń, M.P. The nexus of carbon emissions, oil price volatility, and human capital efficiency. Resour. Policy 2022, 78, 102876. [Google Scholar] [CrossRef]

- Yami, S.; M’Chirgui, Z.; Spano, C.; Barykina, O.J. Reinventing science and technology entrepreneurship education: The role of human and social capitals. Technol. Forecast. Soc. Change 2021, 164, 120044. [Google Scholar] [CrossRef]

- Wadley, D. Technology, capital substitution and labor dynamics: Global workforce disruption in the 21st century? Futures 2021, 132, 102802. [Google Scholar] [CrossRef]

- Lai, X.B.; Yue, S.J. Do Pilot Smart Cities Promote Corporate Digital Transformation? An Empirical Study Based on a Quasi-natural Experiment. Foreign Econ. Manag. 2022, 44, 117–133. [Google Scholar] [CrossRef]

- Sun, Y.F.; Zhao, Y. The influence of internal and external environment on TFP of manufacturing enterprises: Findings from fsQCA. Syst. Eng. 2023, 10, 1–14. [Google Scholar]

- Wu, Q.; Yao, Y.X. Firm Digital Transformation and Supply Chain Configuration: Centralization or Diversification. China Ind. Econ. 2023, 99–117. [Google Scholar] [CrossRef]

- Wang, H.; Liu, J.Z.; Zhang, L.H. Carbon Emissions and Assets Pricing--Evidence from Chinese Listed Firms. China J. Econ. 2022, 9, 28–75. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise Digital Transformation and Capital Market Performance: Empirical Evidence from Stock Liquidity. J. Manag. World 2021, 37, 130–144+10. [Google Scholar] [CrossRef]

- Kammerer, D. The effects of customer benefit and regulation on environmental product innovation.: Empirical evidence from appliance manufacturers in Germany. Ecol. Econ. 2009, 68, 2285–2295. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial constraints risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Yu, M.G.; Ma, L.; Wang, K. Digital Transformation of Commercial Banks and Labor Demand: Creation or Destruction? Manag. World 2022, 38, 212–230. [Google Scholar] [CrossRef]

- Kong, D.; Zhang, B.; Zhang, J. Higher education and corporate innovation. J. Corp. Financ. 2022, 72, 102165. [Google Scholar] [CrossRef]

- Gan, J.; Liu, L.; Qiao, G.; Zhang, Q. The role of robot adoption in green innovation: Evidence from China. Econ. Model. 2023, 119, 106128. [Google Scholar] [CrossRef]

- Lee, C.C.; Chang, Y.F.; Wang, E.Z. Crossing the rivers by feeling the stones: The effect of China’s green credit policy on manufacturing firms’ carbon emission intensity. Energy Econ. 2022, 116, 106413. [Google Scholar] [CrossRef]

- Zhang, L.; Ren, S.; Chen, X.; Li, D.; Yin, D. CEO Hubris and Firm Pollution: State and Market Contingencies in a Transitional Economy. J. Bus. Ethics 2020, 161, 459–478. [Google Scholar] [CrossRef]

- Zhao, C.Y.; Wang, W.C.; Li, X.S. How Does Digital Transformation Affect the Total Factor Productivity of Enterprises? Financ. Trade Econ. 2021, 42, 114–129. [Google Scholar] [CrossRef]

- Shen, H.T.; Huang, N. Will the Carbon Emission Trading Scheme Improve Firm Value? Financ. Trade Econ. 2019, 40, 144–161. [Google Scholar] [CrossRef]

- Zhou, S.; Zhou, P.; Ji, H. Can digital transformation alleviate corporate tax stickiness: The mediation effect of tax avoidance. Technol. Forecast. Soc. Change 2022, 184, 122028. [Google Scholar] [CrossRef]

- Xiao, H.J.; Yang, Z.; Liu, M.Y. The Promotion Effect of Corporate Digitalization on Corporate Social Responsibility: A Test of Internal and External Dual Paths. Bus. Manag. J. 2021, 43, 52–69. [Google Scholar]

- Ma, H.; Chen, S.L. Digital Transformation, Bad News Withholding, and Stock Price Crash Risk. Account. Res. 2022, 31–44. [Google Scholar] [CrossRef]

- Li, D.; Xin, L.; Chen, X.; Ren, S. Corporate social responsibility, media attention and firm value: Empirical research on Chinese manufacturing firms. Qual. Quant. 2017, 51, 1563–1577. [Google Scholar] [CrossRef]

- Zhou, A.; Li, J. Impact of anti-corruption and environmental regulation on the green development of China’s manufacturing industry. Sustain. Prod. Consum. 2021, 27, 1944–1960. [Google Scholar] [CrossRef]

| Variable | N | Mean | S.D. | Min. | Max. | VIF |

|---|---|---|---|---|---|---|

| CE | 20,278 | 90.45 | 54.932 | 12.87 | 336.986 | |

| Digital | 20,278 | 2.752 | 1.149 | 0 | 5.811 | 1.31 |

| Size | 20,278 | 7.578 | 1.182 | 4.905 | 11.074 | 2.7 |

| Lev | 20,278 | 0.374 | 0.193 | 0.007 | 0.976 | 1.34 |

| ROE | 20,278 | 0.078 | 0.083 | −0.299 | 0.31 | 1.24 |

| Indep | 20,278 | 0.38 | 0.064 | 0.267 | 0.6 | 1.02 |

| Dual | 20,278 | 0.309 | 0.462 | 0 | 1 | 1.07 |

| Er | 20,278 | 0.002 | 0.002 | 0 | 0.009 | 1.29 |

| Market | 20,278 | 9.683 | 1.639 | 4.138 | 12.39 | 1.33 |

| Innovation | 17,574 | 0.936 | 1.16 | 0 | 7.319 | 1.39 |

| WW | 16,664 | −1.018 | 0.069 | −1.234 | −0.865 | 2.78 |

| Edu | 13,333 | 28.531 | 18.473 | 3.83 | 84.36 | 1.40 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | CE | CE | CE |

| Digital | −2.745 *** | −2.981 *** | −1.907 *** |

| (0.282) | (0.320) | (0.533) | |

| Size | 2.530 *** | 3.377 *** | |

| (0.552) | (1.252) | ||

| Lev | 25.04 *** | 23.29 *** | |

| (2.337) | (4.435) | ||

| ROE | 91.74 *** | 86.39 *** | |

| (3.021) | (4.757) | ||

| Indep | 9.159 ** | 11.03 ** | |

| (4.215) | (4.765) | ||

| Dual | −1.130 | −1.478 | |

| (0.710) | (1.025) | ||

| Er | −1202 *** | −406.5 * | |

| (163.4) | (234.8) | ||

| Market | −1.714 *** | −0.570 | |

| (0.349) | (0.730) | ||

| Constant | 98.00 *** | 78.91 *** | 87.89 *** |

| (0.798) | (4.703) | (19.80) | |

| Firm FE | Yes | Yes | Yes |

| Year/Industry FE | No | No | Yes |

| Observations | 20,278 | 20,278 | 20,278 |

| R-sq Within | 0.006 | 0.068 | 0.100 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | CE | CE | CE2 | CE | CE |

| Digital | −0.725 *** | −2.173 *** | |||

| (0.220) | (0.654) | ||||

| digital1 | −0.961 ** | ||||

| (0.446) | |||||

| digital2 | −7.959 ** | ||||

| (3.620) | |||||

| digital3 | −3.340 | ||||

| (3.019) | |||||

| Size | 3.205 ** | 3.182 *** | −0.650 * | 2.264 | 2.685 * |

| (1.252) | (1.224) | (0.359) | (1.782) | (1.550) | |

| Lev | 23.39 *** | 23.50 *** | −1.221 | 15.96 ** | 28.61 *** |

| (4.441) | (4.464) | (1.464) | (6.343) | (5.681) | |

| ROE | 85.89 *** | 85.93 *** | −1.557 | 66.56 *** | 86.02 *** |

| (4.760) | (4.762) | (1.943) | (6.565) | (6.586) | |

| Indep | 11.33 ** | 11.32 ** | 3.525 | 15.27 *** | 19.23 *** |

| (4.776) | (4.781) | (2.559) | (5.891) | (5.676) | |

| Dual | −1.503 | −1.520 | 0.112 | −0.381 | −1.928 |

| (1.027) | (1.027) | (0.445) | (1.376) | (1.238) | |

| Er | −393.0 * | −399.0 * | 113.7 | −111.0 | −337.5 |

| (234.6) | (234.3) | (118.3) | (257.0) | (260.3) | |

| Market | −0.516 | −0.526 | −0.354 | 0.467 | −0.114 |

| (0.731) | (0.731) | (0.317) | (0.813) | (0.797) | |

| Constant | 83.03 *** | 83.53 *** | 179.7 *** | 37.48 ** | 69.62 *** |

| (20.11) | (20.00) | (6.619) | (16.76) | (23.15) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year/Industry FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 20,278 | 20,278 | 20,278 | 11,928 | 13,569 |

| R-sqWithin | 0.099 | 0.100 | 0.006 | 0.086 | 0.102 |

| IV | PSM | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| First-stage | Second-stage | Nearest neighbor matching | |

| Variable | Digital | CE | CE |

| iv | 0.895 *** | ||

| (0.0141) | |||

| Digital | −3.388 ** | −1.875 *** | |

| (1.598) | (0.710) | ||

| Size | 0.131 *** | 8.307 *** | 4.643 *** |

| (0.0112) | (0.917) | (1.385) | |

| Lev | 0.0126 | 47.06 *** | 25.98 *** |

| (0.0682) | (5.202) | (5.340) | |

| ROE | 0.00965 | 128.8 *** | 85.44 *** |

| (0.0983) | (7.548) | (6.790) | |

| Indep | 0.110 | −14.49 * | 13.00 ** |

| (0.132) | (8.303) | (6.530) | |

| Dual | 0.00923 | −4.702 *** | 0.946 |

| (0.0215) | (1.338) | (1.176) | |

| Er | 1.475 | −114.1 | −594.6 * |

| (5.581) | (440.5) | (307.9) | |

| Market | −0.0120 * | 3.229 *** | −1.691 * |

| (0.00642) | (0.569) | (0.920) | |

| Firm FE | Yes | Yes | Yes |

| Year/Industry FE | Yes | Yes | Yes |

| Observations | 20,278 | 20,278 | 10,163 |

| R-sqWithin | 0.335 | 0.115 | |

| Kleibergen–Paap rk LM statistic | 531.557 *** | ||

| Kleibergen–Paap rk Wald F | 4016.797 [16.38] | ||

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variable | Innovation | CE | WW | CE | Edu | CE |

| Digital | 0.0687 *** | −1.992 *** | −0.00181 *** | −1.468 *** | 0.721 *** | −1.549 ** |

| (0.0123) | (0.548) | (0.000578) | (0.556) | (0.162) | (0.641) | |

| Innovation | −1.062 ** | |||||

| (0.431) | ||||||

| WW | 33.27 *** | |||||

| (12.64) | ||||||

| Edu | −0.258 *** | |||||

| (0.0916) | ||||||

| Size | 0.312 *** | 3.361 ** | −0.0297 *** | 4.224 *** | −4.823 *** | 0.780 |

| (0.0270) | (1.365) | (0.00146) | (1.352) | (0.608) | (2.048) | |

| Lev | 0.122 | 24.91 *** | −0.0135 *** | 22.44 *** | 3.029 ** | 23.58 *** |

| (0.0910) | (4.838) | (0.00467) | (4.760) | (1.419) | (5.754) | |

| ROE | −0.101 | 85.29 *** | −0.193 *** | 93.06 *** | 2.049 | 84.88 *** |

| (0.110) | (5.150) | (0.00552) | (5.449) | (1.248) | (5.432) | |

| Indep | −0.0597 | 10.17 ** | 0.00911 | 13.06 ** | −1.443 | 13.66 ** |

| (0.146) | (5.068) | (0.00594) | (5.309) | (1.376) | (5.386) | |

| Dual | 0.00714 | −1.101 | −0.000962 | −1.424 | 0.408 | −1.182 |

| (0.0267) | (1.119) | (0.00115) | (1.059) | (0.309) | (1.091) | |

| Er | 8.485 | −548.4 ** | −0.302 | −571.8 ** | −26.73 | −273.9 |

| (5.465) | (241.1) | (0.308) | (236.7) | (66.74) | (301.9) | |

| Market | −0.00769 | −0.905 | −0.00128 | −0.642 | −0.267 | −1.065 |

| (0.0196) | (0.828) | (0.000893) | (0.848) | (0.200) | (0.855) | |

| Constant | −2.613 *** | 85.90 *** | −0.686 *** | 113.0 *** | 54.11 *** | 91.23 *** |

| (0.472) | (17.47) | (0.0314) | (22.43) | (10.94) | (34.14) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year/Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 17,574 | 17,574 | 16,664 | 16,664 | 13,333 | 13,333 |

| R-sqWithin | 0.200 | 0.102 | 0.463 | 0.110 | 0.242 | 0.104 |

| Panel A | (1) | (2) | (3) | (4) | |

|---|---|---|---|---|---|

| High-Tech | Non-High-Tech | State-Owned | Non-State-Owned | ||

| Variable | CE | CE | CE | CE | |

| Digital | −2.325 *** | −0.876 | −1.348 | −2.662 *** | |

| (0.719) | (0.751) | (1.028) | (0.621) | ||

| Size | 2.035 | 4.240 *** | −1.331 | 5.535 *** | |

| (1.804) | (1.629) | (2.780) | (1.230) | ||

| Lev | 35.71 *** | −2.376 | 17.69 * | 19.98 *** | |

| (5.705) | (7.163) | (10.59) | (4.494) | ||

| ROE | 90.00 *** | 81.48 *** | 88.62 *** | 84.05 *** | |

| (6.018) | (7.753) | (8.822) | (5.667) | ||

| Indep | 10.03 * | 8.324 | 13.93 | 8.695 | |

| (5.667) | (8.107) | (9.041) | (5.456) | ||

| Dual | −1.873 | −0.448 | 0.363 | −1.963 | |

| (1.197) | (1.863) | (1.968) | (1.220) | ||

| Er | −319.9 | −601.3 | −1114 *** | −85.12 | |

| (294.8) | (376.8) | (387.8) | (287.4) | ||

| Market | 0.214 | −2.485 * | −4.118 *** | 1.525 * | |

| (0.792) | (1.488) | (1.345) | (0.877) | ||

| Constant | 144.8 *** | 113.4 *** | 140.8 *** | 94.39 *** | |

| (22.48) | (19.42) | (28.49) | (29.65) | ||

| Firm FE | Yes | Yes | Yes | Yes | |

| Year/Industry FE | Yes | Yes | Yes | Yes | |

| Observations | 13,664 | 6614 | 6025 | 14,253 | |

| R-sq Within | 0.097 | 0.120 | 0.137 | 0.108 | |

| Panel B | (1) | (2) | (3) | (4) | (5) |

| High-Carbon Emissions | Low-Carbon Emissions | Eastern | Central | Western | |

| Variable | CE | CE | CE | CE | CE |

| Digital | −2.091 ** | −0.364 | −2.286 *** | −1.122 | −0.609 |

| (0.845) | (0.272) | (0.659) | (1.162) | (1.305) | |

| Size | −1.364 | 3.731 *** | 4.153 *** | 2.714 | −2.602 |

| (2.461) | (0.547) | (1.604) | (2.779) | (3.297) | |

| Lev | 22.47 *** | 3.768 * | 22.29 *** | 23.24 ** | 27.87 *** |

| (7.849) | (2.042) | (5.544) | (9.878) | (9.937) | |

| ROE | 74.79 *** | 46.09 *** | 84.94 *** | 88.71 *** | 105.4 *** |

| (8.322) | (2.855) | (5.775) | (11.03) | (12.78) | |

| Indep | 11.81 | 4.300 | 11.39 ** | 14.45 | −1.887 |

| (7.855) | (2.898) | (5.604) | (10.78) | (12.58) | |

| Dual | −0.556 | −0.567 | −1.940 | 2.376 | −5.543 ** |

| (1.777) | (0.537) | (1.200) | (2.491) | (2.492) | |

| Er | −1275 *** | 179.5 | −704.2 ** | −2013 *** | −180.5 |

| (390.5) | (128.9) | (289.5) | (587.0) | (537.3) | |

| Market | −0.249 | 0.106 | 1.028 | −1.897 | −3.751 * |

| (1.308) | (0.401) | (0.901) | (2.497) | (2.113) | |

| Constant | 134.1 *** | 52.24 *** | 72.95 *** | 69.01* | 98.19 *** |

| (34.21) | (8.110) | (25.58) | (36.54) | (33.64) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year/Industry FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 10,166 | 10,112 | 14,710 | 3200 | 2368 |

| R-sq Within | 0.085 | 0.129 | 0.105 | 0.126 | 0.152 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, X.; Zhang, Z.; He, D.; Quan, C. Digital Transformation and Corporate Carbon Emissions: Evidence from China’s Listed Companies. Sustainability 2025, 17, 3944. https://doi.org/10.3390/su17093944

Cheng X, Zhang Z, He D, Quan C. Digital Transformation and Corporate Carbon Emissions: Evidence from China’s Listed Companies. Sustainability. 2025; 17(9):3944. https://doi.org/10.3390/su17093944

Chicago/Turabian StyleCheng, Xiaojuan, Zihao Zhang, Duojun He, and Chunguang Quan. 2025. "Digital Transformation and Corporate Carbon Emissions: Evidence from China’s Listed Companies" Sustainability 17, no. 9: 3944. https://doi.org/10.3390/su17093944

APA StyleCheng, X., Zhang, Z., He, D., & Quan, C. (2025). Digital Transformation and Corporate Carbon Emissions: Evidence from China’s Listed Companies. Sustainability, 17(9), 3944. https://doi.org/10.3390/su17093944