1. Introduction

Climate change poses a significant threat to sustainable socioeconomic development and human survival [

1,

2]. Human activities are the primary driver of climate change. They have significantly contributed to the acceleration of global temperature increases through greenhouse gas emissions [

3]. Moreover, environmental degradation has also exerted a negative effect on household financial conditions [

4]. The Central Committee of the Communist Party of China and the State Council issued a notice at the end of July 2024 calling for the comprehensive advancement of the Beautiful China initiative. The notice emphasized the acceleration of modernization that promotes harmony between humans and nature. It also stressed the need to drive the greening and low-carbon development of the economy and society. This policy orientation not only requires a significant reduction in carbon dioxide emissions through technological innovation [

5] but also aims to drive systemic social change through daily green consumption and investment behaviors of residents. It is based on this practical need that green assets, as a key link between individual actions and ecological sustainability, are increasingly valued strategically. These assets guide residents in allocating funds to environmentally friendly products and services, which can effectively promote the transition to a green and low-carbon economy and strengthen the foundation for individual action in coping with climate change [

6,

7,

8,

9]. Therefore, this study defines green assets as investment decisions and product choices made by residents based on environmental benefits [

10]. Their aim is to achieve an organic unity between environmental protection and individual economic actions through market-oriented means.

A review of the relevant literature suggests that public climate concerns can impact asset pricing [

11,

12] and the extent of corporate ESG disclosure [

13]. From the perspective of air pollution, when pollution reaches a certain threshold, people tend to choose low-carbon emission products [

14,

15,

16], and their investment sentiment is also linked to the stability of the financial market [

17,

18,

19]. In addition, several surveys of the public in Europe, India, and Malaysia have revealed that their subjective norms, attitudes, and financial performance affect their asset selection preferences [

20,

21,

22,

23].

However, the response of Chinese residents’ green asset choices to their perceptions of climate change has rarely been studied, and the impact between them is uncertain. Although some scholars have argued that concern for the climate can increase the demand for green assets [

24], another view suggests that there is no significant relationship between environmental concern and investors’ choices of green assets [

21]. Our study seeks to determine which view is valid.

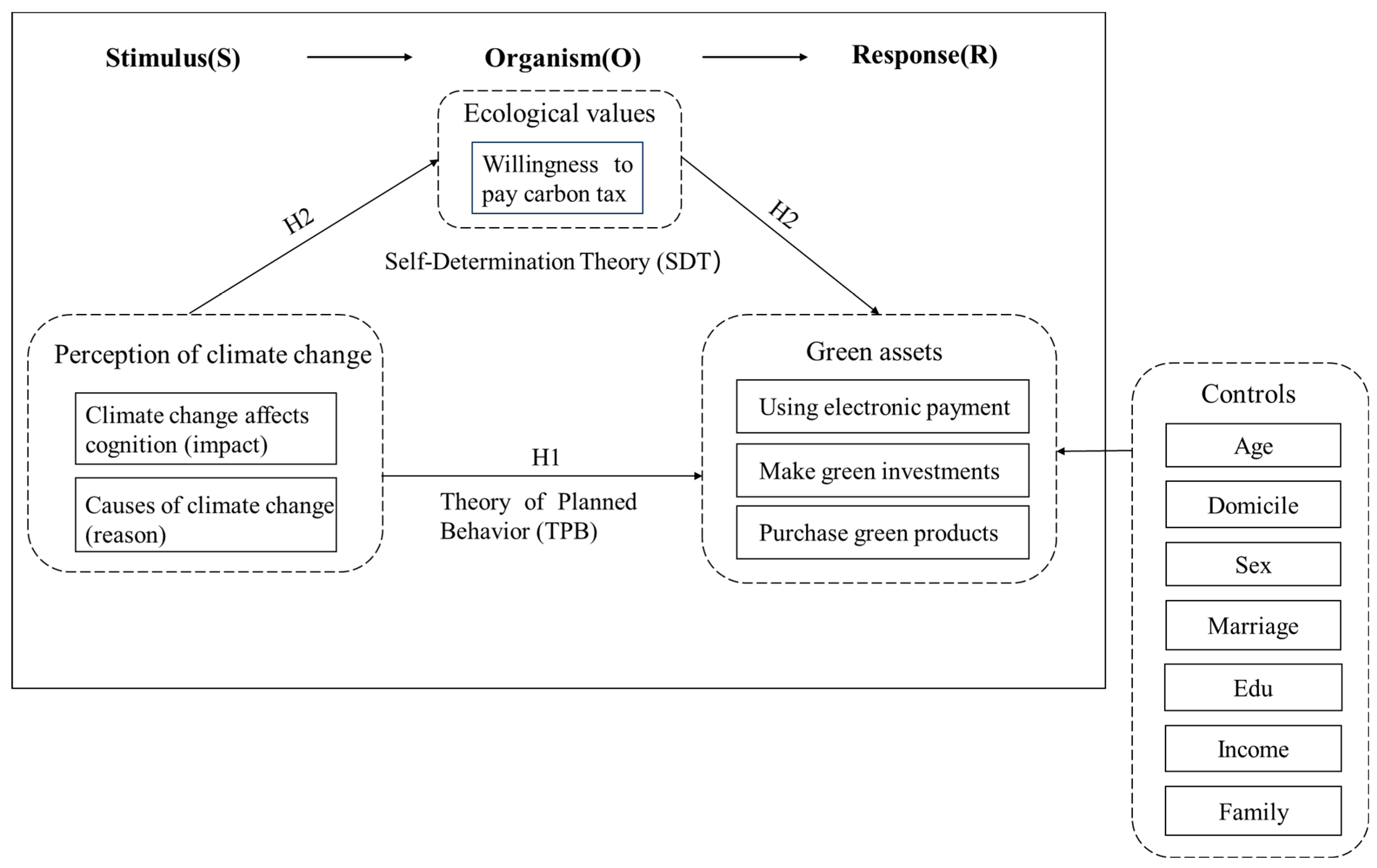

This paper aims to investigate the relationship between residents’ perceptions of climate change and their choices of green assets. The findings will be compared with results from other countries. This study also aims to assess the varying sensitivity to climate change perceptions among different groups of green asset investors. Additionally, it will verify the intermediary role of ecological values. We used questionnaires to elicit responses and applied multiple linear regression, multivariate ordered probit models, and quantile regression to analyze the survey results. This study categorizes the selection of green assets into three aspects: purchasing green products, engaging in green investments, and using electronic payments. This enriches and clarifies the research landscape.

The present study makes three contributions to the field. First, this study introduces a quantile regression model to address the issue of heterogeneous behavior distribution in traditional analytical frameworks. Most existing research analyzes average effects but fails to explain why identical perceptions of climate change lead to different behavioral responses across groups. This paper demonstrates that low-quantile groups are far more sensitive to climate change perceptions than high-quantile groups, thereby enriching the existing body of literature. Next, our study examines the mediating role of ecological values, offering a distinct theoretical framework for value-driven policies that is separate from the path of religious ethics. While existing research confirms the significant impact of religious values on green investment, it overlooks the broader role of ecological values. This research quantifies the transmission efficiency of ecological values between perceptions of climate change and green asset choices. Finally, this paper provides new instrumental variables for future research.

The rest of this article is structured as follows:

Section 2 introduces the theoretical framework and reviews the relevant literature.

Section 3 describes the sample sources, elucidates the variable design, and explains the specific model used.

Section 4 presents the empirical results, discusses endogeneity, provides robustness checks, and conducts heterogeneity analysis.

Section 5 provides a comprehensive discussion of the research findings. The final section summarizes the article’s conclusions and provides policy recommendations.

4. Empirical Results

4.1. Benchmark Result Analysis

Table 7 presents the benchmark regression results for Model (1). In column (1), all control variables are excluded. Only the independent variables—causes of climate change and climate change impacts cognition—are considered concerning the dependent variable, i.e., green asset selection. The regression coefficients for both variables are significantly positive at the 1% statistical level, with values of 0.593 and 0.478, respectively. Column (2) shows the estimation results after all control variables are included. In column 3, the bootstrap autonomous sampling method is employed to enhance the effectiveness and consistency of the parameter estimation results through parameter estimation. Columns (4) and (5) present the results after the regions and occupations are clustered. The regression results are significantly positive at the 1% level. These findings indicate that residents’ perceptions of climate change positively influence their choice of green assets. Residents’ perceptions of climate change have increased their willingness to choose green assets, driving their purchasing or investment behavior in relation to green financial products. Hypothesis 1 has received preliminary validation.

The selection of green assets is then divided into green product purchases, green investment, and electronic payments. Multiple-ordered logit regression and multiple-ordered probability regression analyses were conducted, and the results are shown in

Table 8. The regression results indicate that residents’ perceptions of climate change have a positive effect on their choice of green assets, particularly electronic payments. This suggests that the popularization of electronic payments as a financial service is conducive to reducing transaction costs and service barriers, promoting the growth of a green economy [

62].

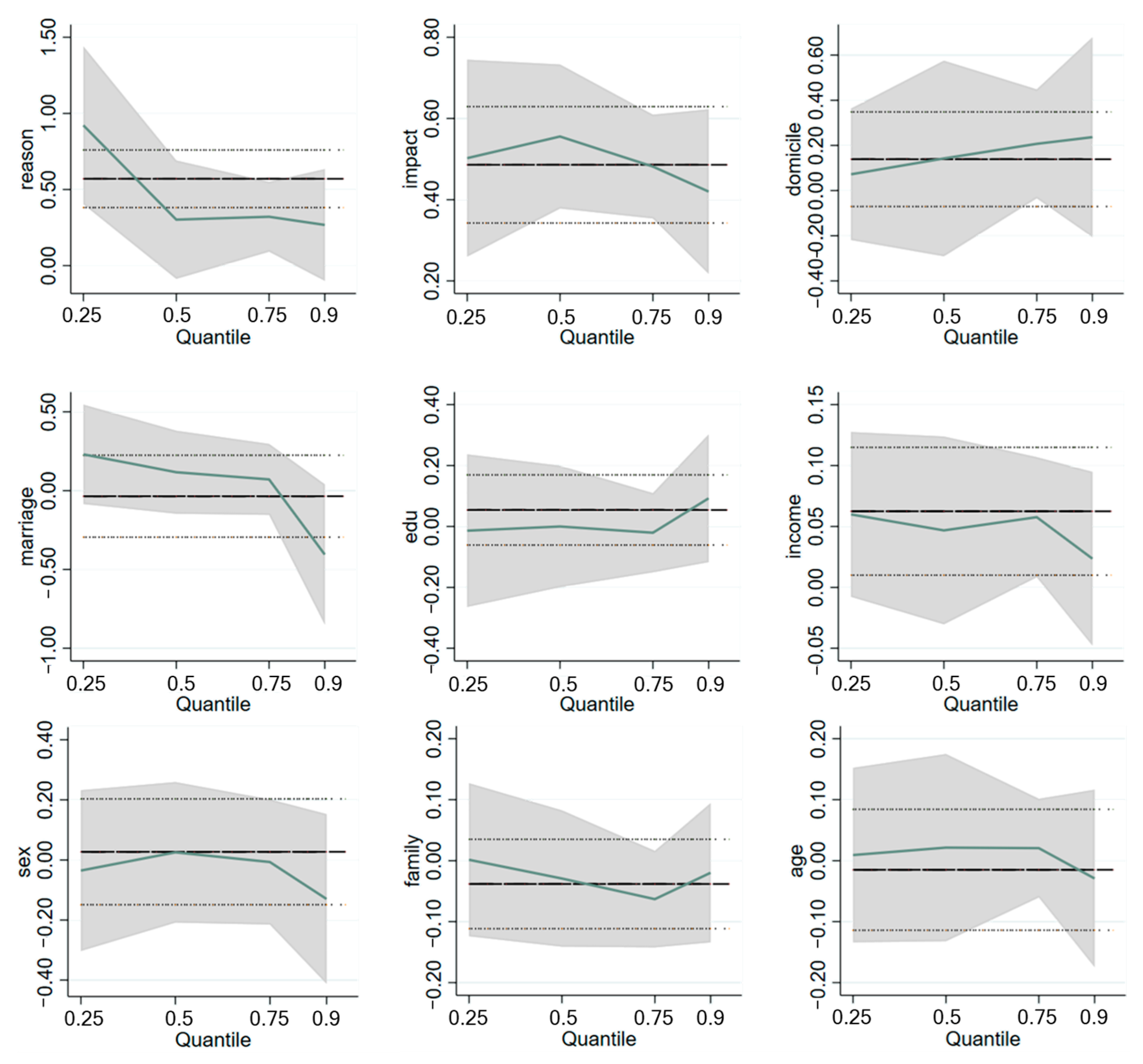

4.2. Quantile Regression

We conducted quantile regression to investigate the effect of residents’ green asset choices on different quantiles. The regression results are shown in

Table 9 and

Figure 4. The graph shows that the factors affecting residents’ choice of green assets vary, and the impact coefficients of each factor on residents’ choice of green assets vary significantly across quantiles, which are reflected in the following two observations.

On the one hand, the impact of climate change awareness on individual green asset choices initially decreases, then increases, and finally decreases again as the quantile of residents’ green asset selection behavior increases. This finding suggests that enhancing climate change awareness among individuals with a low willingness to choose green assets and those in the 50th to 70th percentiles of green asset selection behavior can more effectively increase demand for green assets. On the other hand, the influence of climate change impact perceptions on the choice of green assets increases continuously up to the 50th percentile and then shows a downward trend. This also suggests the need to raise climate change awareness among groups with low intentions to choose green assets.

4.3. Endogeneity Discussion

The measurement of the effects of climate change on people’s cognition proposed in this article may have inevitable errors, and a more accurate method of identifying it is still needed. In addition, although this study attempted to control variables that affect the selection of green assets as much as possible, there may still be omitted variables. Potential measurement errors and omitted variables may have affected our empirical results. There may be inevitable endogeneity issues in the regression results. Therefore, we adopted the instrumental variable method to reduce the bias caused by endogeneity issues.

In this study, we select the degree of residents’ trust in the climate information provided by the government (gov) and the frequency of natural disasters in the area where residents live (disaster) as instrumental variables for regression. In terms of relevance, the higher the residents’ trust in the climate information provided by the government, the better their understanding of climate change. Residents in areas prone to natural disasters can more acutely feel the challenges of climate change, so the correlation is valid. Regarding exogeneity, there is no evidence that trust or natural disasters are directly linked to residents’ choices of green assets. The regression results are presented in

Table 10 as instrumental variable estimates.

The first column in the table presents the regression results of the first stage. The positive impacts of gov and disaster on climate change perception are significant at the 1% level, aligning with prior analyses. The first-stage F-statistic of 15.595, exceeding 10, confirms the validity of the instrumental variables. Column (2) shows the second-stage regression results. The Hansen-J statistic, above 0.1, indicates no over-identification, proving the exogeneity of the instrumental variables. Thus, the effectiveness of the instrumental variables is established. The coefficient of climate change perception is more significant than in the benchmark regression, indicating some endogeneity in the model. The positive effect of climate change perception on green asset choice is more potent than in the benchmark regression.

4.4. Robustness Test

Our study uses the model averaging method to address the uncertainty of the model [

63]. The estimated results of the model averages are reported in columns 1 to 4 of

Table 11. We conducted multiple regressions again to evaluate the AIC, BIC, AICC, and NOIC. The results indicate that there is no significant difference in the sign and significance of the coefficients compared with those of the baseline regression and that the results are robust. The fifth column represents a re-estimation of the sample after excluding individuals aged 60 and above from the population. The results still indicate that the greater a resident’s perception of climate change, the more likely they are to choose green assets, suggesting that the conclusion is robust.

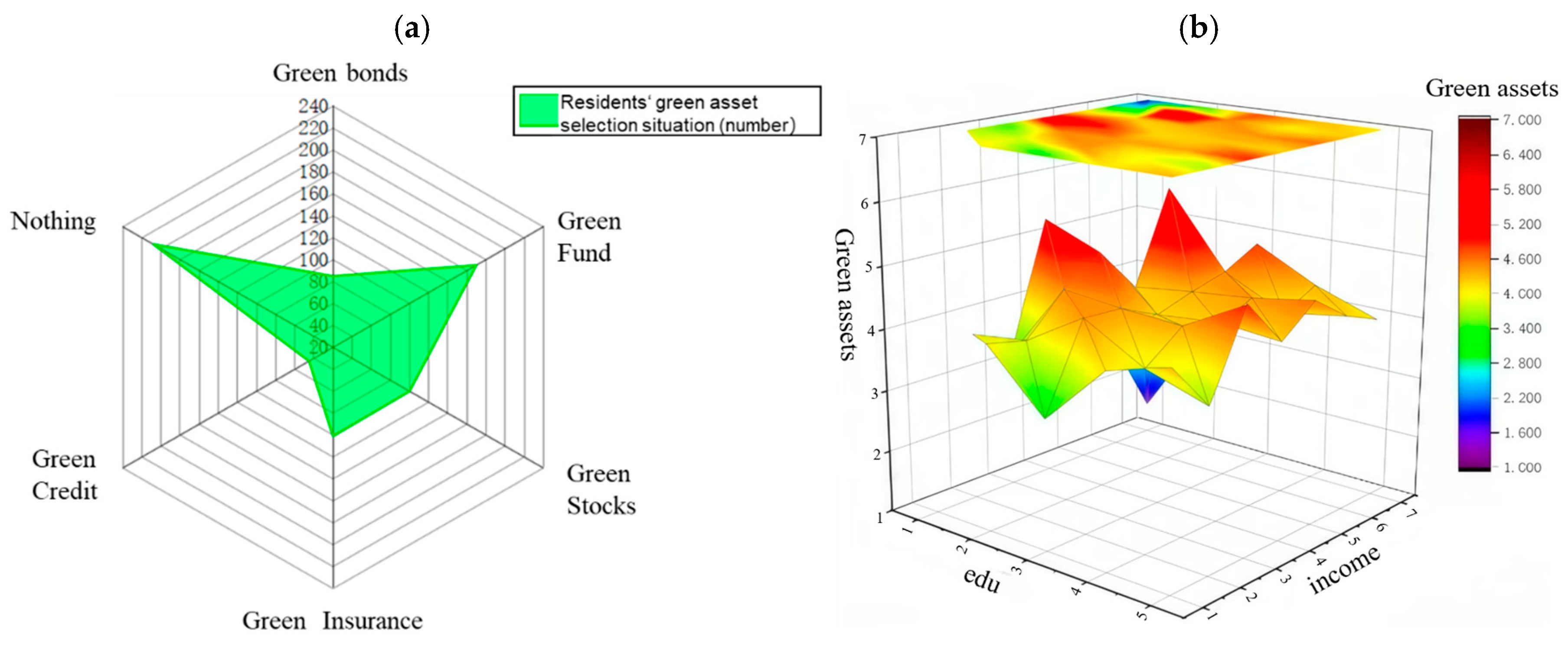

In addition, robustness tests were conducted by replacing the regression model and the dependent variable. We assessed residents’ choice behaviors concerning green assets by asking whether they had ever purchased green financial products, including green funds, stocks, credit, bonds, and insurance. A value of 1 was assigned if a resident had made such a purchase, and 0 otherwise.

This study employs logit and probit regression models for analyzing data with a binary dependent variable. The specific results are presented in

Table 12. The first and third columns display the regression results without controlling for control variables, while the second and fourth columns show the results after controlling for all variables. Both findings suggest that climate change perception has a positive impact on the selection of green assets, underscoring the robustness of our results.

4.5. Examination of the Mediating Effect

In this section, we explore the mediating effects of values. In addition to the increased demand for green assets due to rising climate risk [

31], financial factors influence individuals’ choice of green assets. The imposition of a carbon tax affects household budget constraints and increases the relative price of green assets [

64]. If residents are still more willing to pay, this indicates more significant environmental concern and a stronger ecological value orientation. Like Yin Bai et al. [

65] and Sakari Tolppanen et al. [

54], we employed a five-level Likert scale to assess whether residents are willing to accept a carbon tax as a standard measure of ecological value.

The second column of

Table 13 reports the regression results of residents’ perceptions of climate change on their values. The cognitive impact of climate change on residents is significantly positive at the 1% level, indicating that the mental effects of climate change can shape the formation of individual values. The regression results for values on green asset selection are presented in column 3 of

Table 13. The value coefficient is also significantly positive at the 1% level, indicating that residents with higher ecological values are more likely to choose green assets. Hypothesis 2 is thus validated.

4.6. Heterogeneity Analysis

The impact of residents’ perceptions of climate change on green asset choice varies across different groups. Some scholars argue that women tend to exhibit stronger intentions for green consumption and are more likely to hold risky financial assets, such as green stocks [

66,

67,

68]. However, Jianchi Tian et al. [

59] argue that men are more likely to consume green products than women. In addition, different ESG performances have varying impacts on green asset selection [

69]. Therefore, this study further explores the effects of gender and residents’ ESG awareness on green asset selection.

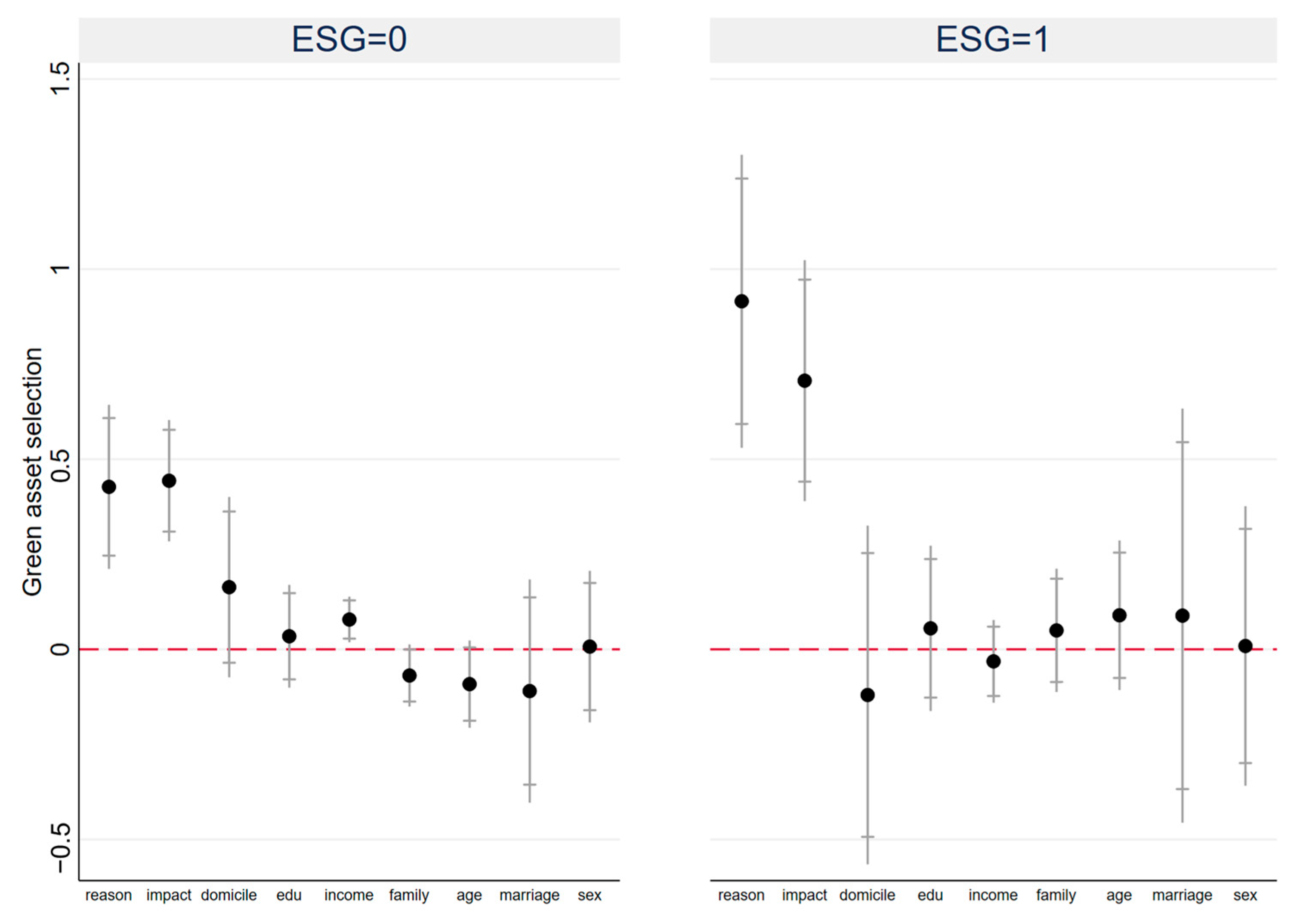

A heterogeneity analysis was performed after assigning a value of 1 to males and 0 to females.

Table 14 shows that there is not much difference in the impact of climate change cognition on green asset selection among different gender groups. However, the effect of climate change cognition on males is significantly lower than that on females by 0.652, indicating that the promotion effect of cognition related to climate change on green asset selection is more pronounced in females, which is consistent with Cynthia Assaf et al.’s [

68] conclusion. In addition, people who are “completely unaware of ESG” and those with “little understanding of ESG” are classified as the “not aware of ESG” group. “Slightly familiar” and “very familiar” are classified as the “ESG understanding” group. The results in columns (3) and (4) of

Figure 5 and

Table 14 indicate that residents who are not aware of ESG principles have a significantly lower impact of climate change perceptions on green asset selection compared with residents who are aware of ESG principles. This is because, in the process of understanding ESG principles, residents increase their awareness of and sense of responsibility for environmental protection, forming a concept of sustainable consumption. As a result, they pay more attention to the environmental impact of their asset choices in their daily lives. However, few residents are familiar with ESG principles, so it is necessary to increase its awareness and promote its adoption.

In addition, this article categorizes temperature into five classes based on climate reports and related documents published by meteorological departments and relevant agencies (0–10 °C is cold, 11–21 °C is warm, 22–30 °C is hot, 31–34 °C is extremely hot, 35–39 °C is bizarre hot), and a heterogeneity analysis is conducted.

As shown in

Table 15, residents living in highly high-temperature environments significantly increase their selection of green assets due to their heightened perception of the causes of climate change. This may be attributed to the direct and frequent exposure of such residents to extreme weather events caused by climate change, such as prolonged heatwaves and droughts. These personal experiences profoundly reinforce their understanding of the reality and urgency of climate change. Furthermore, when residents recognize the strong link between climate change and human activities (e.g., fossil fuel combustion and deforestation), they are more inclined to examine and adjust their behaviors to reduce environmental impacts, thereby actively embracing a green lifestyle [

70]. In addition, the sample distribution reveals a notable trend: the highest proportion of residents live in extremely high-temperature areas. This reflects the severity of rising temperatures in China and signals the increasing frequency of extreme weather events. In this context, promoting a green lifestyle to combat climate change has become an urgent social necessity.

5. Discussion

Green assets are essential for sustainable development and climate change mitigation [

7]. Our study finds that residents’ perceptions of climate change positively impact their selection of green assets, consistent with Aijun Guo et al. [

27] and Shivam Azad et al. [

28]. Notably, this positive effect is more potent in Zhejiang Province than in the US, UK, and India [

22,

28,

34]. This could be because Zhejiang’s high per capita disposable income allows residents to pursue environmental values through green consumption or investment after meeting basic needs. In contrast, Indian investors may face economic constraints that hinder the conversion of environmental awareness into payment actions. Additionally, collectivism in Chinese culture makes individuals more responsive to socially advocated green transition goals, while the link between environmental awareness and individual behavior is looser in individualistic Western cultures. To maximize this positive impact across different countries, location-specific policies are crucial. For instance, low-income countries could establish micro-green financial ecosystems through mobile payment networks, integrating climate action into basic survival needs (e.g., clean cookstove rentals that offset medical expenses). High-income countries, such as the US and the UK, could link green consumption points to carbon-trading markets, turning personal carbon reductions into inheritable digital assets. They could also incorporate climate contributions into social platforms to influence rankings and personal credit systems.

Additionally, the quantile regression analysis reveals that the bottom 25% of individuals, in terms of willingness to choose green assets, exhibit a response elasticity to climate change perception that is 1.9 times greater than that of the high-quantile group. This discrepancy may arise from differential risk exposure. Low-quantile groups (e.g., low-income, low-education residents), who are often directly exposed to climate risks (e.g., extreme droughts in agriculture-dependent areas), have survival security closely linked to climate change. When perceiving climate threats, the marginal utility of behavioral adjustment for these groups is significantly higher than for high-willingness groups with established green behavior inertia [

70]. Furthermore, disparities in information acquisition costs exacerbate sensitivity differences [

61]. Low-quantile groups, reliant on fragmented social media information, may experience a short-term increase in climate change awareness when sudden climate events trigger an algorithm-based information bombardment.

Ultimately, ecological values serve as a mediating factor in residents’ perceptions of climate change, influencing their decisions regarding green asset choices. When residents perceive climate change threats, their re-evaluation of ecosystems, triggered by environmental risk awareness, forms a deep-seated value orientation toward human–nature coexistence [

27]. This ecological perspective enables individuals to view green consumption as a means of self-actualization, not just an economic decision. They can thus overcome short-term cost barriers to prioritize sustainable products and fulfill their environmental responsibilities. This finding has dual implications for policy optimization. Traditional, economically incentive-based intervention models, such as consumption subsidies, have limitations. While stimulating green consumption in the short term, this approach can lead to dependence on economic incentives, resulting in unsustainable behavior after the policy is implemented and potentially intensifying the conflict between economic interests and environmental goals. In contrast, a value-driven mechanism, by cultivating individuals’ endogenous environmental responsibility, enables them to maintain low-carbon behaviors without external incentives, holding greater strategic value for long-term governance. Therefore, policy design should incorporate value cultivation.

6. Conclusions

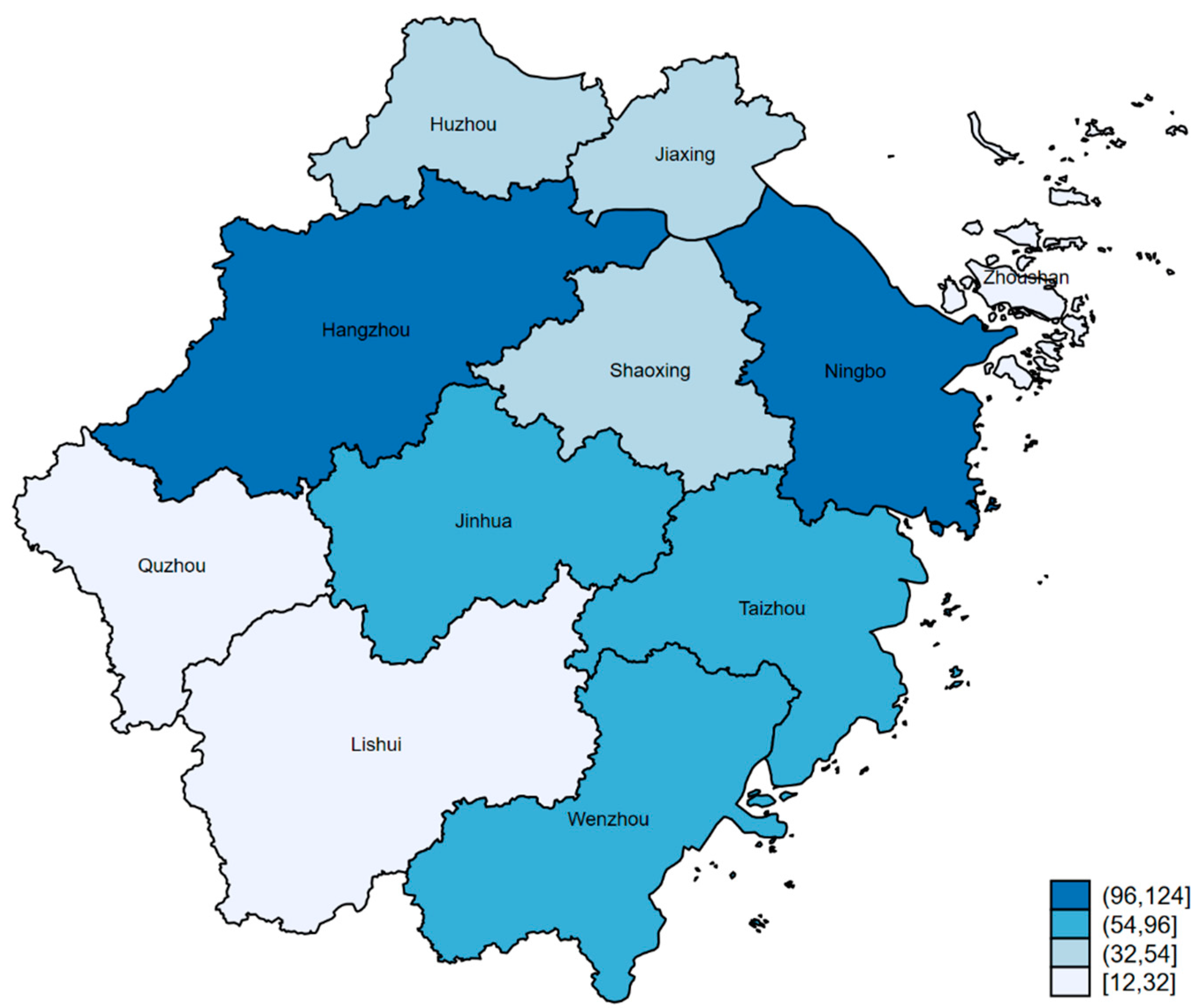

This paper utilized questionnaire data from a survey of residents in Zhejiang Province, conducted from January to August 2024. Building on a review of the relevant literature and theoretical foundations, we carried out an empirical analysis. The aim was to investigate the direct and indirect relationships between residents’ perceptions of climate change and their choices regarding green assets in Zhejiang Province, China.

Firstly, the higher the residents’ perception of climate change, the more likely they are to choose green assets. Therefore, to further strengthen residents’ choice of green assets, climate change education should be enhanced through media, the internet, and other channels. This can be achieved by using vivid visual presentations and diversified dissemination methods, such as VR technology simulations, to enhance residents’ understanding of climate change and popularize ESG-related knowledge. Simultaneously, a personal green behavior points system can be embedded in government service apps. This system would convert consumption data, such as the purchase of energy-saving appliances and the use of new energy vehicles, into carbon points that can be exchanged for public service discounts, allowing residents to experience the benefits of green consumption tangibly.

Secondly, the quantile regression analysis indicates that the lower-quantile group (those with green asset choice willingness at or below the 25th percentile) exhibits a significant marginal sensitivity to enhanced climate change perception, with a higher behavioral response elasticity compared to the middle- and high-quantile groups. This suggests that policymakers should abandon the broad-based approach and instead adopt a stratified policy-making approach. For the lower-quantile group, it is necessary to strengthen their realistic perception through high-frequency and low-threshold intervention means. For instance, binding electronic payment scenarios with climate impact data to display carbon emissions from consumption behaviors in real time and linking them to local extreme weather cases (such as the frequent super-high temperatures in Zhejiang in recent years) can transform abstract climate risks into concrete economic losses. Additionally, designing an immediate feedback mechanism for behavior benefits is an option, for example, issuing electronic consumption vouchers or carbon points to residents who purchase green financial products for the first time, with these points exchangeable for public transport discounts or priority in community public services. For the middle- and high-quantile groups, the focus should be on long-term institutional incentives. For example, consumers who consistently participate in green investments or hold environmentally friendly products for an extended period can be included on a green credit whitelist. Individuals can enjoy tax reduction policies for new energy vehicle purchases, and commercial banks can provide a green channel and interest rate discounts for their housing loan applications. Meanwhile, linking the sustainable consumption records of these groups to the acquisition of public service resources, such as establishing a green behavior points exchange mechanism in areas like public resource allocation and children’s education, can form a positive feedback loop across various fields.

Thirdly, ecological values mediate the impact of residents’ perceptions of climate change on their decisions regarding green assets. This intrinsic motivation drives more sustainable green behavior. Therefore, environmental education should be incorporated into the national education system, from kindergarten to university, to cultivate ecological awareness and responsibility through curricula and activities. For example, primary and secondary schools could offer nature experience courses and organize tree-planting and waste classification activities to instill the habit of respecting and protecting nature from a young age. Moreover, a green default option can be embedded in financial infrastructure. For instance, the default investment ratio for pension accounts could lean toward ESG funds, leveraging the default effect to encourage participation in environmentally responsible behaviors. A system for visualizing the ecological impact of individual choices in real time could also be designed on consumption pages, showing the potential contribution of these choices to ecosystem services. Supporting the generation of ecological behavior milestone badges that can be shared across platforms could utilize social network effects to create a positive feedback loop reinforcing values. At the social mobilization level, it is crucial to leverage peer effects. For example, in areas prone to extreme heat waves, families affected by climate disasters could be invited to serve as green-living ambassadors. They could share their transformation stories, from climate disaster victims to low-carbon activists, on short video platforms, triggering imitative behaviors through emotional resonance.

This study makes three key theoretical contributions. First, in Zhejiang Province, China, residents’ perception of climate change-related knowledge shows a stronger positive impact on green asset choice ( = 0.571, = 0.486) than in the USA ( = 0.419), the UK ( = 0.2), and India ( = 0.022). This suggests that the influence of climate change perception on green asset choice has been underestimated in prior research. Our study confirms the importance of enhancing climate change awareness among Chinese residents and proposes differentiated policy recommendations that take into account the heterogeneity among various groups. Second, using quantile regression, we find that the behavioral malleability of low-quantile groups is significantly higher than expected. This highlights the potential of tail-driven policies and offers a new theoretical perspective on resource allocation. Third, the mediating effect of ecological values confirms the “cognition–values–behavior” chain transmission path, providing a theoretical basis for value-driven policies.

Future research can investigate the long-term effects of policy interventions and incorporate additional influential factors into the research framework. It can also focus on how the dynamic evolution of climate change cognition interacts with green financial innovation to shift green asset choices from self-interest to social norms.