The Impact of ESG Performance on Green Technology Innovation: A Moderating Effect Based on Digital Transformation

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypotheses

2.1. Corporate ESG Performance and Green Technology Innovation

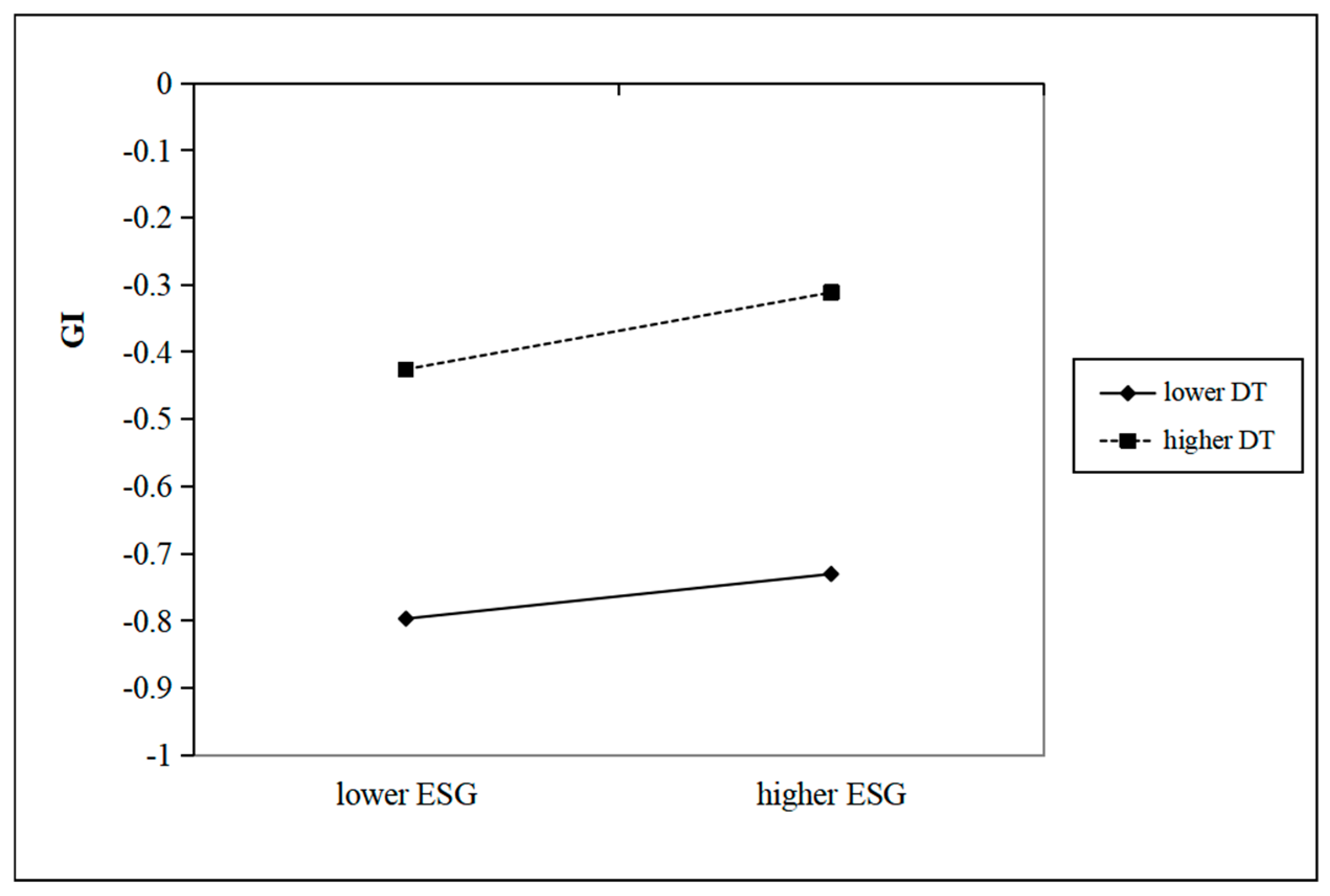

2.2. The Moderating Role of Digital Transformation

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Definitions

3.2.1. Explained Variable

3.2.2. Explanatory Variable

3.2.3. Moderator Variable

3.2.4. Control Variables

3.3. Model Design

4. Empirical Results and Analyses

4.1. Descriptive Statistics

4.2. Regression Analysis

5. Endogeneity Tests and Robustness Tests

5.1. Instrumental Variables Method

5.2. Heckman Two-Stage Model

5.3. Generalized Method of Moment Estimation (GMM)

5.4. Reconsidering Lag Effects

5.5. Replacing Explanatory Variable

5.6. Other Robustness Tests

6. Heterogeneity Analysis

6.1. Heterogeneity Analysis of Individual ESG Indicators

6.2. Heterogeneity Analysis of Industry Portability

6.3. Heterogeneity Analysis of Marketisation Levels

7. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bertani, F.; Ponta, L.; Raberto, M.; Teglio, A.; Cincotti, S. The complexity of the intangible digital economy: An agent-based model. J. Bus. Res. 2021, 129, 527–540. [Google Scholar] [CrossRef]

- Houston, J.F.; Shan, H. Corporate ESG profiles and banking relationships. Rev. Financ. Stud. 2022, 35, 3373–3417. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Cui, J.; Jo, H.; Na, H. Does corporate social responsibility affect information asymmetry? J. Bus. Ethics 2018, 148, 549–572. [Google Scholar]

- Zhang, D.; Lucey, B.M. Sustainable behaviors and firm performance: The role of financial constraints’ alleviation. Econ. Anal. Policy 2022, 74, 220–233. [Google Scholar] [CrossRef]

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Account. Rev. 2022, 97, 147–175. [Google Scholar] [CrossRef]

- Lenz, I.; Wetzel, H.A.; Hammerschmidt, M. Can doing good lead to doing poorly? Firm value implications of CSR in the face of CSI. J. Acad. Mark. Sci. 2017, 45, 677–697. [Google Scholar] [CrossRef]

- Ng, A.C.; Rezaee, Z. Business sustainability performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar]

- Chang, X.; Fu, K.; Jin, Y.; Liem, P.F. Sustainable finance: ESG/CSR, firm value, and investment returns. Asia-Pac. J. Financ. Stud. 2022, 51, 325–371. [Google Scholar]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Li, Q.; Li, M.; Zhang, L. Revisiting the relationship between ESG, institutional ownership, and corporate innovation: An efficiency perspective. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 6504–6525. [Google Scholar] [CrossRef]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar]

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

- Lazzolino, G.; Bruni, M.E.; Veltri, S.; Morea, D.; Baldissarro, G. The impact of ESG factors on financial efficiency: An empirical analysis for the selection of sustainable firm portfolios. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1917–1927. [Google Scholar] [CrossRef]

- Chen, Z.; Xie, G. ESG disclosure and financial performance: Moderating role of ESG investors. Int. Rev. Financ. Anal. 2022, 83, 102291. [Google Scholar] [CrossRef]

- Ferdous, L.T.; Rana, T.; Yeboah, R. Decoding the impact of firm-level ESG performance on financial disclosure quality. Bus. Strategy Environ. 2024, 34, 162–186. [Google Scholar]

- Postiglione, M.; Carini, C.; Falini, A. ESG and firm value: A hybrid literature review on cost of capital implications from Scopus database. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 6457–6480. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Chan, K.; Cheng, L.T.; Wang, X. The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Financ. Res. Lett. 2021, 38, 101716. [Google Scholar]

- Yuan, X.; Li, Z.; Xu, J.; Shang, L. ESG disclosure and corporate financial irregularities–Evidence from Chinese listed firms. J. Clean. Prod. 2022, 332, 129992. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Zhang, C. Corporate social responsibility and firm risk: Theory and empirical evidence. Manag. Sci. 2019, 65, 4451–4469. [Google Scholar]

- Luo, W.; Tian, Z.; Fang, X.; Deng, M. Can good ESG performance reduce stock price crash risk? Evidence from Chinese listed companies. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 1469–1492. [Google Scholar] [CrossRef]

- Chang, X.; Fu, K.; Low, A.; Zhang, W. Non-executive employee stock options and corporate innovation. J. Financ. Econ. 2015, 115, 168–188. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Jo, H. Corporate governance and firm value: The impact of corporate social responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar]

- McGuinness, P.B.; Vieito, J.P.; Wang, M. The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. J. Corp. Financ. 2017, 42, 75–99. [Google Scholar] [CrossRef]

- Albitar, K.; Al-Shaer, H.; Liu, Y.S. Corporate commitment to climate change: The effect of eco-innovation and climate governance. Res. Policy 2023, 52, 104697. [Google Scholar] [CrossRef]

- Chen, Z.; Xiao, Y.; Jiang, K. Corporate green innovation and stock liquidity in China. Account. Financ. 2023, 63, 1381–1415. [Google Scholar] [CrossRef]

- Umme, H.; Cao, X.B.; Ahsan, A. Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 2022, 193, 1082–1093. [Google Scholar]

- Wang, X.Y.; Sun, X.M.; Zhang, H.T.; Xue, C. Does green financial reform pilot policy promote green technology innovation? Empirical evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 77283–77299. [Google Scholar] [CrossRef]

- Wang, J.; Ma, M.; Dong, T.; Zhang, Z. Do ESG ratings promote corporate green innovation? A quasi-natural experiment based on SynTao Green Finance’s ESG ratings. Int. Rev. Financ. Anal. 2023, 87, 102623. [Google Scholar] [CrossRef]

- Xu, J.; Liu, F.; Shang, Y. R&D investment, ESG performance and green innovation performance: Evidence from China. Kybernetes 2021, 50, 737–756. [Google Scholar]

- Fang, L.H.; Lerner, J.; Wu, C. Intellectual property rights protection, ownership, and innovation: Evidence from China. Rev. Financ. Stud. 2017, 30, 2446–2477. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Long, H.; Feng, G.-F.; Chang, C.-P. How does ESG performance promote corporate green innovation. Econ. Change Restruct. 2023, 56, 2889–2913. [Google Scholar] [CrossRef]

- Wu, B.; Gu, Q.; Liu, Z.; Liu, J. Clustered institutional investors, shared ESG preferences and low-carbon innovation in family firm. Technol. Forecast. Soc. Change 2023, 194, 122676. [Google Scholar] [CrossRef]

- Zheng, M.; Feng, G.F.; Jiang, R.A.; Chang, C.P. Does environmental, social, and governance performance move together with corporate green innovation in China? Bus. Strategy Environ. 2023, 32, 1670–1679. [Google Scholar] [CrossRef]

- Yang, C.; Zhu, C.; Albitar, K. ESG ratings and green innovation: A U-shaped journey towards sustainable development. Bus. Strategy Environ. 2024, 33, 4108–4129. [Google Scholar] [CrossRef]

- Cohen, L.; Gurun, U.G.; Nguyen, Q. The ESG-innovation disconnect: Evidence from green patenting. J. Financ. Econ. 2022, 146, 761–779. [Google Scholar]

- Raghunandan, A.; Rajgopal, S. Do ESG funds make stakeholder-friendly investments? Rev. Account. Stud. 2022, 27, 822–863. [Google Scholar] [CrossRef]

- Krüger, P. Corporate Goodness and Shareholder Wealth. J. Financ. Econ. 2015, 115, 304–329. [Google Scholar] [CrossRef]

- Hsu, P.-H.; Li, K.; Tsou, C.-Y. The effect of ESG ratings on innovation efficiency. Manag. Sci. 2023, 69, 2564–2582. [Google Scholar]

- Bai, C.A.; Cordeiro, J.; Sarkis, J. Blockchain technology: Business, strategy, the environment, and sustainability. Bus. Strategy Environ. 2020, 29, 321–322. [Google Scholar] [CrossRef]

- Shaik, A.S.; Alshibani, S.M.; Jain, G.; Gupta, B.; Mehrotra, A. Artificial intelligence (AI)-driven strategic business model innovations in small- and medium-sized enterprises. Insights on technological and strategic enablers for carbon neutral businesses. Bus. Strategy Environ. 2024, 33, 2731–2751. [Google Scholar] [CrossRef]

- Hinings, B.; Gegenhuber, T.; Greenwood, R. Digital innovation and transformation: An institutional perspective. Inf. Organ. 2018, 28, 52–61. [Google Scholar] [CrossRef]

- Liu, Q.; Liu, J.; Gong, C. Digital transformation and corporate innovation: A factor input perspective. Manag. Decis. Econ. 2023, 44, 2159–2174. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. The dynamic impact of digital economy on carbon emission reduction: Evidence city-level empirical data in China. J. Clean. Prod. 2022, 351, 131570. [Google Scholar]

- Ding, X.; Sheng, Z.; Appolloni, A.; Shahzad, M.; Han, S. Digital transformation, ESG practice, and total factor productivity. Bus. Strategy Environ. 2024, 33, 4547–4561. [Google Scholar]

- Liu, Y.; He, Q. Digital transformation, external financing, and enterprise resource allocation efficiency. Manag. Decis. Econ. 2024, 45, 2321–2335. [Google Scholar] [CrossRef]

- Wang, J.; Hu, Y.; Zhang, Z. Skill-biased technological change and labor market polarization in China. Econ. Model. 2021, 100, 105507. [Google Scholar] [CrossRef]

- Wang, S.; Esperança, J.P. Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs. J. Clean. Prod. 2023, 419, 137980. [Google Scholar] [CrossRef]

- Fichman, R.G.; Dos Santos, B.L.; Zheng, Z.Q. Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Q. 2014, 38, 329–343. [Google Scholar] [CrossRef]

- Fang, M.; Nie, H.; Shen, X. Can enterprise digitization improve ESG performance? Econ. Model. 2023, 118, 106101. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, Z.; Hu, L. Can enterprise digital transformation improve ESG performance? Manag. Decis. Econ. 2024, 45, 5088–5103. [Google Scholar] [CrossRef]

- Niehoff, S. Aligning digitalisation and sustainable development? Evidence from the analysis of worldviews in sustainability reports. Bus. Strategy Environ. 2022, 31, 2546–2567. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M.; Grybauskas, A.; Vilkas, M.; Petraite, M. Industry 4.0, innovation, and sustainable development: A systematic review and a roadmap to sustainable innovation. Bus. Strategy Environ. 2021, 30, 4237–4257. [Google Scholar] [CrossRef]

- Tang, M.G.; Liu, Y.L.; Hu, F.X.; Wu, B.J. Effect of digital transformation on enterprises’ green innovation: Empirical evidence from listed companies in China. Energy Econ. 2023, 128, 107135. [Google Scholar] [CrossRef]

- De Luca, L.M.; Herhausen, D.; Troilo, G.; Rossi, A. How and when do big data investments pay off? The role of marketing affordances and service innovation. J. Acad. Mark. Sci. 2021, 49, 790–810. [Google Scholar] [CrossRef]

- Song, Y.; Du, C.; Du, P.; Liu, R.; Lu, Z. Digital transformation and corporate environmental performance: Evidence from Chinese listed companies. Technol. Forecast. Soc. Change 2024, 201, 123159. [Google Scholar] [CrossRef]

- Upadhayay, N.B.; Rocchetta, S.; Gupta, S.; Kamble, S.; Stekelorum, R. Blazing the trail: The role of digital and green servitization on technological innovation. Technovation 2024, 130, 102922. [Google Scholar] [CrossRef]

- Li, C.M.; Xu, Y.; Zheng, H.; Wang, Z.Y.; Han, H.T.; Zeng, L.E. Artificial intelligence, resource reallocation, and corporate innovation efficiency: Evidence from China’s listed companies. Resour. Policy 2023, 81, 103324. [Google Scholar] [CrossRef]

- Rahmani, A.; Naeini, A.B.; Mashayekh, J.; Aboojafari, R.; Daim, T.; Yalcin, H. Green innovation for a greener future: A meta-analysis of the impact on environmental performance. J. Clean. Prod. 2024, 460, 142547. [Google Scholar] [CrossRef]

- Gao, H.; Wang, H.; Wang, X.; Wen, H. ESG-oriented analysts and corporate green innovation. Account. Financ. 2024, 64, 4977–5008. [Google Scholar] [CrossRef]

- Cheng, Y.; Du, K.; Yao, X. Stringent environmental regulation and inconsistent green innovation behavior: Evidence from air pollution prevention and control action plan in China. Energy Econ. 2023, 120, 106571. [Google Scholar] [CrossRef]

- Kong, D.; Wang, Y.; Zhang, J. Efficiency wages as gift exchange: Evidence from corporate innovation in China. J. Corp. Financ. 2020, 65, 101725. [Google Scholar] [CrossRef]

- Huang, X.; Liu, W.; Zhang, Z.; Zou, X.; Li, P. Quantity or quality: Environmental legislation and corporate green innovations. Ecol. Econ. 2023, 204, 107684. [Google Scholar] [CrossRef]

- Caragea, D.; Cojoianu, T.; Dobri, M.; Hoepner, A.G.; Peia, O.; Romelli, D. Competition and innovation in the financial sector: Evidence from the rise of FinTech start-ups. J. Financ. Serv. Res. 2024, 65, 103–140. [Google Scholar] [CrossRef]

- He, J.J.; Tian, X. The dark side of analyst coverage: The case of innovation. J. Financ. Econ. 2013, 109, 856–878. [Google Scholar] [CrossRef]

- Lin, Y.; Fu, X.; Fu, X. Varieties in state capitalism and corporate innovation: Evidence from an emerging economy. J. Corp. Financ. 2021, 67, 101919. [Google Scholar] [CrossRef]

- Zhong, X.; Ren, G. Independent and joint effects of CSR and CSI on the effectiveness of digital transformation for transition economy firms. J. Bus. Res. 2023, 156, 113478. [Google Scholar] [CrossRef]

- Liu, M.; Li, C.; Wang, S.; Li, Q. Digital transformation, risk-taking, and innovation: Evidence from data on listed enterprises in China. J. Innov. Knowl. 2023, 8, 100332. [Google Scholar] [CrossRef]

- He, F.; Du, H.; Yu, B. Corporate ESG performance and manager misconduct: Evidence from China. Int. Rev. Financ. Anal. 2022, 82, 102201. [Google Scholar]

- Dyck, A.; Lins, K.V.; Roth, L.; Wagner, H.F. Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 2019, 131, 693–714. [Google Scholar]

- Grewal, J.; Hauptmann, C.; Serafeim, G. ESG Debt: The Hidden Costs of Delayed Sustainability Investments. J. Account. Econ. 2023, 76, 101592. [Google Scholar]

- Garel, A.; Petit-Romec, A. Investor rewards to environmental responsibility: Evidence from the COVID-19 crisis. J. Corp. Financ. 2021, 68, 101948. [Google Scholar]

- Deng, M.; Tang, H.; Luo, W. Can the green experience of CEO improve ESG performance in heavy polluting companies? Evidence from China. Manag. Decis. Econ. 2024, 45, 2373–2392. [Google Scholar]

- Guo, C.; Su, W.; Song, X.; Hu, X. Heterogeneous debt financing and environmental research & development: Evidence from China. Int. Rev. Econ. Financ. 2022, 82, 65–81. [Google Scholar]

- Kim, E.H.; Lyon, T.P. Greenwash vs. brownwash: Exaggeration and undue modesty in corporate sustainability disclosure. Organ. Sci. 2015, 26, 705–723. [Google Scholar]

| Variable Type | Variable Name | Variable Symbol | Calculation Method |

|---|---|---|---|

| explanatory variable | ESG performance | ESG | Source from CSI ESG Ratings |

| explained variable | Green technology innovation | GI | Ln (total number of green patent applications for the year + 1) |

| moderator variable | Digital transformation | DT | Ln (total word frequency of digital transformation + 1) |

| control variable | Enterprise scale | Size | Ln (total assets at end of period + 1) |

| Financial leverage | Lev | Total liabilities/total assets | |

| Return on assets | Roa | Total income/total assets | |

| Research and development expenditures | RD | Ln (total R&D expenditures at the end of period+ 1) | |

| Cash flow ratio | Cashflow | Net cash flows from operating activities/total assets | |

| Revenue growth rate | Growth | Increase in operating income for the current year/operating income for the previous year | |

| Board size | Board | Ln (number of board members) | |

| Market performance | TobinQ | Market value/replacement cost | |

| Institutional investor shareholding | INST | Total number of shares held by institutional investors/outstanding share capital | |

| Years of company establishment | FirmAge | Ln(current year − year of incorporation + 1) | |

| Whether audited by a Big Four accounting firm | Big4 | Companies audited by Big Four firms are 1, otherwise 0 |

| Variable | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| GI | 35,156 | 0.354 | 0.761 | 0 | 3.555 |

| ESG | 35,156 | 73.470 | 4.918 | 58.030 | 84.070 |

| DT | 35,156 | 2.940 | 1.257 | 0 | 6.999 |

| Size | 35,156 | 22.230 | 1.279 | 19.990 | 26.210 |

| Lev | 35,156 | 0.414 | 0.205 | 0.051 | 0.889 |

| Roa | 35,156 | 0.046 | 0.063 | −0.221 | 0.227 |

| RD | 35,156 | 8.456 | 9.080 | 0 | 24.630 |

| Cashflow | 35,156 | 0.049 | 0.069 | −0.157 | 0.247 |

| Growth | 35,156 | 0.169 | 0.373 | −0.539 | 2.275 |

| Board | 35,156 | 2.126 | 0.199 | 1.609 | 2.708 |

| TobinQ | 35,156 | 2.030 | 1.280 | 0.846 | 8.406 |

| INST | 35,156 | 0.445 | 0.250 | 0.003 | 0.909 |

| FirmAge | 35,156 | 2.892 | 0.345 | 1.792 | 3.526 |

| Big4 | 35,156 | 0.063 | 0.244 | 0 | 1 |

| GI | ESG | DT | Size | Lev | Roa | RD | Cashflow | Growth | Board | TobinQ | INST | FirmAge | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GI | 0.127 *** | 0.180 *** | 0.112 *** | 0.070 *** | 0.016 *** | 0.183 *** | −0.013 ** | 0.034 *** | 0.015 *** | −0.030 *** | −0.002 | −0.031 *** | |

| ESG | 0.131 *** | 0.101 *** | 0.148 *** | −0.066 *** | 0.212 *** | 0.098 *** | 0.077 *** | 0.055 *** | 0.012 ** | −0.100 *** | 0.083 *** | −0.028 *** | |

| DT | 0.172 *** | 0.101 *** | 0.069 *** | −0.054 *** | 0.038 *** | 0.438 *** | −0.021 *** | 0.035 *** | −0.109 *** | 0.046 *** | −0.108 *** | 0.099 *** | |

| Size | 0.171 *** | 0.183 *** | 0.060 *** | 0.530 *** | −0.120 *** | 0.190 *** | 0.059 *** | 0.022 *** | 0.239 *** | −0.504 *** | 0.406 *** | 0.225 *** | |

| Lev | 0.088 *** | −0.074 *** | −0.063 *** | 0.525 *** | −0.430 *** | −0.008 | −0.142 *** | 0.014 *** | 0.147 *** | −0.358 *** | 0.206 *** | 0.152 *** | |

| Roa | 0.018 *** | 0.213 *** | −0.005 | −0.051 *** | −0.383 *** | 0.028 *** | 0.412 *** | 0.346 *** | −0.024 *** | 0.281 *** | 0.074 *** | −0.146 *** | |

| RD | 0.140 *** | 0.075 *** | 0.414 *** | 0.106 *** | −0.052 *** | −0.017 *** | 0.075 *** | −0.005 | −0.108 *** | −0.102 *** | −0.059 *** | 0.297 *** | |

| Cashflow | −0.003 | 0.069 *** | −0.021 *** | 0.060 *** | −0.151 *** | 0.412 *** | 0.067 *** | 0.058 *** | 0.039 *** | 0.110 *** | 0.130 *** | 0.015 *** | |

| Growth | 0.005 | −0.001 | 0.018 *** | 0.037 *** | 0.035 *** | 0.265 *** | −0.031 *** | 0.032 *** | −0.006 | 0.108 *** | 0.030 *** | −0.120 *** | |

| Board | 0.030 *** | 0.021 *** | −0.100 *** | 0.255 *** | 0.155 *** | −0.004 | −0.129 *** | 0.038 *** | −0.006 | −0.138 *** | 0.228 *** | 0.008 | |

| TobinQ | −0.044 *** | −0.096 *** | 0.019 *** | −0.356 *** | −0.260 *** | 0.200 *** | −0.070 *** | 0.126 *** | 0.065 *** | −0.119 *** | −0.132 *** | −0.119 *** | |

| INST | 0.022 *** | 0.085 *** | −0.116 *** | 0.429 *** | 0.210 *** | 0.096 *** | −0.093 *** | 0.118 *** | 0.041 *** | 0.237 *** | −0.041 *** | 0.010 * | |

| FirmAge | −0.015 *** | −0.034 *** | 0.089 *** | 0.196 *** | 0.164 *** | −0.128 *** | 0.306 *** | 0.023 *** | −0.077 *** | 0.006 | −0.028 *** | 0.005 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| GI | GI | GI | GI | |

| ESG | 0.004 *** | 0.005 *** | 0.004 *** | 0.003 *** |

| (4.58) | (5.76) | (3.88) | (3.75) | |

| DT | 0.015 *** | |||

| (2.67) | ||||

| ESG*DT | 0.002 *** | |||

| (2.73) | ||||

| Size | 0.082 *** | 0.055 *** | 0.051 *** | |

| (8.69) | (4.19) | (3.82) | ||

| Lev | 0.047 | 0.013 | 0.017 | |

| (1.42) | (0.34) | (0.44) | ||

| Roa | 0.100 | 0.073 | 0.073 | |

| (1.61) | (1.10) | (1.10) | ||

| RD | 0.005 *** | 0.008 *** | 0.007 *** | |

| (9.05) | (8.25) | (8.05) | ||

| Cashflow | −0.133 *** | −0.091 * | −0.090 * | |

| (−2.84) | (−1.87) | (−1.86) | ||

| Growth | −0.024 *** | −0.021 *** | −0.021 *** | |

| (−3.74) | (−3.10) | (−3.15) | ||

| Board | −0.013 | −0.014 | −0.016 | |

| (−0.41) | (−0.39) | (−0.43) | ||

| TobinQ | 0.013 *** | 0.009 ** | 0.009 ** | |

| (4.10) | (2.41) | (2.30) | ||

| INST | −0.125 *** | −0.104 ** | −0.103 ** | |

| (−4.01) | (−2.53) | (−2.50) | ||

| FirmAge | −0.005 | 0.061 | 0.063 | |

| (−0.20) | (0.67) | (0.70) | ||

| Big4 | 0.028 | 0.025 | 0.025 | |

| (0.78) | (0.63) | (0.65) | ||

| Constant | −0.125 | −1.829 *** | −1.348 *** | −1.285 *** |

| (−1.31) | (−8.70) | (−3.67) | (−3.50) | |

| Firm FE | YES | NO | YES | YES |

| Industry FE | YES | NO | YES | YES |

| Year FE | YES | NO | YES | YES |

| Observations | 35,156 | 35,156 | 35,156 | 35,156 |

| R-squared | 0.025 | 0.026 | 0.030 | 0.031 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| ESG | GI | ESG_bin | GI | GI | |

| ESG | 0.093 *** | 0.004 *** | 0.017 ** | ||

| (4.75) | (4.94) | (2.15) | |||

| Fundnumber | 0.000 *** | ||||

| (7.98) | |||||

| ESGFV | 0.000 *** | ||||

| (11.23) | |||||

| imr | −0.169 *** | ||||

| (−2.87) | |||||

| L.GI | 0.798 *** | ||||

| (10.20) | |||||

| Size | 0.974 *** | −0.040 * | 0.173 *** | 0.031 *** | −0.069 |

| (16.29) | (−1.76) | (18.45) | (2.73) | (−0.93) | |

| Lev | −4.343 *** | 0.406 *** | −0.888 *** | 0.113 ** | 0.827 * |

| (−18.98) | (4.36) | (−18.45) | (2.48) | (1.77) | |

| Roa | 6.374 *** | −0.511 *** | 3.227 *** | −0.299 ** | −0.590 |

| (13.05) | (−3.44) | (21.74) | (−2.08) | (−0.59) | |

| RD | 0.060 *** | 0.002 | 0.022 *** | 0.005 *** | −0.002 |

| (8.25) | (1.16) | (9.72) | (4.19) | (−0.10) | |

| Cashflow | −2.199 *** | 0.101 | −0.344 *** | −0.054 | 1.055 |

| (−5.93) | (1.42) | (−2.96) | (−1.10) | (1.14) | |

| Growth | −0.436 *** | 0.019 | −0.200 *** | 0.001 | 0.062 |

| (−7.31) | (1.49) | (−9.82) | (0.08) | (0.44) | |

| Board | −0.551 *** | 0.035 | −0.144 *** | 0.002 | 0.170 |

| (−2.79) | (1.09) | (−3.82) | (0.07) | (0.81) | |

| TobinQ | −0.126 *** | 0.016 *** | −0.108 *** | 0.018 *** | −0.007 |

| (−4.88) | (3.87) | (−14.24) | (4.03) | (−0.20) | |

| INST | −0.014 | −0.126 *** | −0.036 | −0.111 *** | −0.978 ** |

| (−0.06) | (−3.48) | (−1.10) | (−3.78) | (−2.00) | |

| FirmAge | −1.739 *** | 0.204 *** | −0.199 *** | 0.077 * | 0.128 |

| (−4.82) | (3.17) | (−8.26) | (1.66) | (0.40) | |

| Big4 | 0.068 | 0.018 | 0.098 *** | 0.015 | 0.232 |

| (0.35) | (0.61) | (3.07) | (0.62) | (1.43) | |

| Constant | 61.211 *** | −6.574 *** | −2.830 *** | −0.762 *** | −1.845 |

| (36.95) | (−5.60) | (−13.14) | (−2.59) | (−0.86) | |

| Industry FE | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES |

| Observations | 35,156 | 35,156 | 35,156 | 35,156 | 29,150 |

| R-squared | 0.052 | 0.086 | 0.031 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| GI | GI | GI | GI | GI | GI | |

| L.ESG | 0.004 *** | 0.004 *** | 0.003 *** | |||

| (4.12) | (3.43) | (3.26) | ||||

| Bloomberg | 0.007 *** | 0.006 *** | 0.005 *** | |||

| (3.56) | (3.00) | (2.89) | ||||

| DT | 0.014 ** | 0.008 | ||||

| (2.23) | (0.76) | |||||

| M | 0.002 ** | 0.002 * | ||||

| (2.27) | (1.65) | |||||

| Size | 0.053 *** | 0.049 *** | 0.049 * | 0.046 * | ||

| (3.41) | (3.13) | (1.85) | (1.72) | |||

| Lev | −0.015 | −0.010 | 0.024 | 0.025 | ||

| (−0.34) | (−0.23) | (0.31) | (0.33) | |||

| Roa | 0.102 | 0.098 | 0.236 | 0.234 | ||

| (1.35) | (1.29) | (1.62) | (1.61) | |||

| RD | 0.007 *** | 0.007 *** | 0.009 *** | 0.009 *** | ||

| (7.37) | (7.23) | (5.84) | (5.80) | |||

| Cashflow | −0.087 | −0.086 | −0.117 | −0.118 | ||

| (−1.60) | (−1.58) | (−1.23) | (−1.24) | |||

| Growth | −0.020 *** | −0.021 *** | −0.017 | −0.017 | ||

| (−2.62) | (−2.68) | (−1.50) | (−1.51) | |||

| Board | −0.007 | −0.008 | −0.028 | −0.030 | ||

| (−0.17) | (−0.21) | (−0.38) | (−0.40) | |||

| TobinQ | 0.009 ** | 0.009 ** | 0.006 | 0.005 | ||

| (2.17) | (2.16) | (0.86) | (0.81) | |||

| INST | −0.097 ** | −0.096 ** | −0.194 ** | −0.193 ** | ||

| (−2.06) | (−2.06) | (−2.22) | (−2.21) | |||

| FirmAge | 0.055 | 0.060 | 0.173 | 0.173 | ||

| (0.51) | (0.56) | (0.88) | (0.88) | |||

| Big4 | 0.012 | 0.013 | −0.012 | −0.012 | ||

| (0.29) | (0.31) | (−0.20) | (−0.20) | |||

| Constant | −0.049 | −1.235 *** | −1.179 *** | 0.158 *** | −1.216 * | −1.172 |

| (−0.52) | (−2.86) | (−2.74) | (2.66) | (−1.69) | (−1.63) | |

| Firm FE | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Observations | 29,150 | 29,150 | 29,150 | 12,362 | 12,362 | 12,362 |

| R-squared | 0.021 | 0.026 | 0.026 | 0.047 | 0.054 | 0.054 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| GI | GI | GI | GI | |

| ESG2 | 0.000 | |||

| (1.59) | ||||

| ESG | −0.020 | 0.005 *** | 0.004 *** | 0.004 *** |

| (−1.37) | (4.75) | (3.91) | (3.77) | |

| DT | 0.016 *** | |||

| (2.76) | ||||

| ESG*DT | 0.002 *** | |||

| (2.74) | ||||

| Size | 0.055 *** | 0.053 *** | 0.049 *** | |

| (4.19) | (3.86) | (3.56) | ||

| Lev | 0.012 | −0.005 | −0.001 | |

| (0.32) | (−0.12) | (−0.02) | ||

| Roa | 0.075 | 0.083 | 0.080 | |

| (1.12) | (1.24) | (1.19) | ||

| RD | 0.007 *** | 0.008 *** | 0.007 *** | |

| (8.19) | (8.08) | (7.90) | ||

| Cashflow | −0.091 * | −0.075 | −0.073 | |

| (−1.88) | (−1.50) | (−1.48) | ||

| Growth | −0.020 *** | −0.020 *** | −0.020 *** | |

| (−3.06) | (−2.80) | (−2.83) | ||

| Board | −0.014 | 0.007 | 0.006 | |

| (−0.39) | (0.15) | (0.13) | ||

| TobinQ | 0.009 ** | 0.007 * | 0.007 * | |

| (2.38) | (1.75) | (1.67) | ||

| INST | −0.104 ** | −0.000 | 0.005 | |

| (−2.52) | (−0.01) | (0.08) | ||

| FirmAge | 0.061 | 0.050 | 0.056 | |

| (0.67) | (0.49) | (0.55) | ||

| Big4 | 0.025 | 0.029 | 0.030 | |

| (0.64) | (0.72) | (0.74) | ||

| ATO | −0.012 | −0.012 | ||

| (−0.91) | (−0.87) | |||

| INV | 0.054 | 0.054 | ||

| (0.97) | (0.99) | |||

| FIXED | 0.003 | 0.004 | ||

| (0.06) | (0.07) | |||

| Indep | 0.001 | 0.001 | ||

| (0.87) | (0.90) | |||

| Top10 | −0.171 ** | −0.181 ** | ||

| (−2.06) | (−2.19) | |||

| Balance | −0.009 | −0.009 | ||

| (−0.38) | (−0.37) | |||

| ListAge | −0.008 | −0.011 | ||

| (−0.47) | (−0.70) | |||

| Mshare | 0.001 | 0.000 | ||

| (0.86) | (0.81) | |||

| Constant | −0.488 | −0.138 | −1.305 *** | −1.251 *** |

| (−0.81) | (−1.43) | (−3.20) | (−3.08) | |

| Firm FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Observations | 35,156 | 33,887 | 33,887 | 33,887 |

| R-squared | 0.031 | 0.026 | 0.032 | 0.033 |

| Variables | (1) Environment | (2) Society | (3) Internal Governance | (4) Heavily Polluting Industries | (5) Non-Heavily Polluting Industries | (6) High Marketization Areas | (7) Low Marketization Areas |

|---|---|---|---|---|---|---|---|

| GI | GI | GI | GI | GI | GI | GI | |

| E | 0.001 | ||||||

| (1.58) | |||||||

| S | 0.002 *** | ||||||

| (3.49) | |||||||

| G | 0.002 *** | ||||||

| (2.80) | |||||||

| ESG | 0.003 ** | 0.004 *** | 0.004 *** | 0.002 | |||

| (2.04) | (3.24) | (3.77) | (1.06) | ||||

| Size | 0.058 *** | 0.056 *** | 0.057 *** | 0.028 | 0.071 *** | 0.062 *** | 0.014 |

| (4.41) | (4.23) | (4.35) | (1.37) | (4.15) | (4.24) | (0.51) | |

| Lev | −0.002 | −0.004 | 0.013 | −0.072 | 0.039 | 0.013 | 0.007 |

| (−0.05) | (−0.11) | (0.35) | (−1.23) | (0.78) | (0.31) | (0.10) | |

| Roa | 0.095 | 0.084 | 0.081 | 0.220 ** | 0.018 | 0.082 | 0.078 |

| (1.43) | (1.27) | (1.22) | (2.03) | (0.21) | (1.09) | (0.58) | |

| 0.008 *** | 0.007 *** | 0.008 *** | 0.008 *** | 0.008 *** | 0.008 *** | 0.006 *** | |

| (8.38) | (8.12) | (8.43) | (3.39) | (7.68) | (7.18) | (3.59) | |

| Cashflow | −0.098 ** | −0.095 ** | −0.093 * | 0.023 | −0.140 ** | −0.134 ** | 0.116 |

| (−2.03) | (−1.97) | (−1.92) | (0.32) | (−2.25) | (−2.50) | (1.01) | |

| Growth | −0.022 *** | −0.022 *** | −0.022 *** | 0.004 | −0.027 *** | −0.028 *** | 0.003 |

| (−3.25) | (−3.26) | (−3.23) | (0.32) | (−3.33) | (−3.52) | (0.29) | |

| Board | −0.016 | −0.018 | −0.013 | −0.007 | −0.034 | −0.015 | −0.034 |

| (−0.44) | (−0.50) | (−0.36) | (−0.11) | (−0.76) | (−0.36) | (−0.45) | |

| TobinQ | 0.009 ** | 0.009 ** | 0.009 ** | 0.009 * | 0.006 | 0.010 ** | 0.000 |

| (2.38) | (2.28) | (2.38) | (1.83) | (1.16) | (2.42) | (0.01) | |

| INST | −0.103 ** | −0.102 ** | −0.106 ** | −0.070 | −0.098 * | −0.106 ** | −0.058 |

| (−2.49) | (−2.47) | (−2.56) | (−1.04) | (−1.80) | (−2.27) | (−0.69) | |

| FirmAge | 0.054 | 0.053 | 0.063 | −0.169 | 0.161 | 0.109 | −0.285 |

| (0.60) | (0.59) | (0.69) | (−1.16) | (1.45) | (1.14) | (−1.11) | |

| Big4 | 0.025 | 0.026 | 0.025 | 0.012 | 0.024 | −0.003 | 0.189 |

| (0.63) | (0.65) | (0.63) | (0.25) | (0.47) | (−0.08) | (1.20) | |

| Constant | −1.175 *** | −1.178 *** | −1.289 *** | −0.371 | −1.903 *** | −1.616 *** | 0.383 |

| (−3.25) | (−3.31) | (−3.51) | (−0.63) | (−3.98) | (−4.07) | (0.40) | |

| Firm FE | YES | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES |

| Observations | 35,156 | 35,156 | 35,156 | 12,003 | 23,153 | 29,211 | 5945 |

| R-squared | 0.030 | 0.030 | 0.030 | 0.021 | 0.040 | 0.035 | 0.023 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, C.; He, Y. The Impact of ESG Performance on Green Technology Innovation: A Moderating Effect Based on Digital Transformation. Sustainability 2025, 17, 3170. https://doi.org/10.3390/su17073170

Xu C, He Y. The Impact of ESG Performance on Green Technology Innovation: A Moderating Effect Based on Digital Transformation. Sustainability. 2025; 17(7):3170. https://doi.org/10.3390/su17073170

Chicago/Turabian StyleXu, Chen, and Yu He. 2025. "The Impact of ESG Performance on Green Technology Innovation: A Moderating Effect Based on Digital Transformation" Sustainability 17, no. 7: 3170. https://doi.org/10.3390/su17073170

APA StyleXu, C., & He, Y. (2025). The Impact of ESG Performance on Green Technology Innovation: A Moderating Effect Based on Digital Transformation. Sustainability, 17(7), 3170. https://doi.org/10.3390/su17073170