Abstract

Renewable energy development is paramount in supporting the transition to a cleaner environment through green transition policies. Thus, policies and measures that support renewable energy development are fundamental. To this end, studies that examine how renewable energy development is achieved have been performed, but the role of research and development, which is crucial in fostering technological innovations and the role of investment in energy in achieving renewable energy development, is lacking. Therefore, this research was employed to investigate the role of research and development and investment in energy in the BRICS economies. The data of the BRICS economies were used for the period from 2000 to 2021. This study used the ‘Methods of Moments Quantile Regression’ to ensure robust findings are presented, hence informing policies that are crucial in achieving environmental sustainability through using renewable energy in the BRICS economies. Major findings showed that investment in energy, research and development, economic growth, and the overall inflation rate raised RE use in the BRICS countries. Oil rent, financial development, and institutional quality reduced RE development. This research suggests the adoption of vigorous policies that ensure financial resources are channeled toward financing the development of RE in the BRICS economies. Through supporting investment in energy and research and development, the BRICS economies can achieve the goal of sustainable carbon neutrality.

1. Introduction

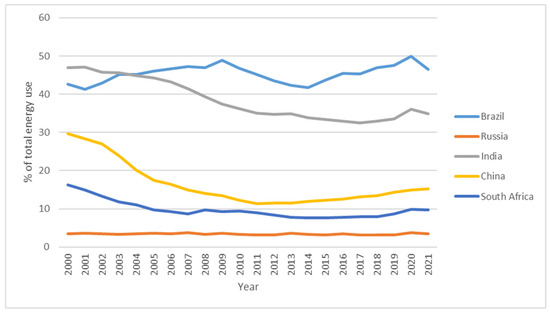

Sustainable development (SD) is fundamental in ensuring that future generations remain with the natural resources (NR) that can be used to meet their demand for economic goods [1]. However, the extensive and widespread deterioration of the environment (ED) in the world is shocking, and many are worried about what will be left for the generations to come. Pollution is increasing at a high rate each day, causing the problem of climate change to worsen, thereby exacerbating droughts, floods, and the temperature rises in all countries. The use of fossil fuel (FF) in advancing economic goods is greatly blamed for the rising problems of ED in the world [2]. Many studies have advocated for energy transition, whereby FF use is required to be abandoned for cleaner and safer renewable energy (RE) sources [3]. However, some regions still struggle to transition to RE sources, and the BRICS economies are not an exception. Ref. [4] highlighted that emerging economies like China achieved EG with the extensive use of FF. Most emerging countries have exhibited similar conditions since they have developed their economies by relying on FF as the source of energy in the production of products [5]. To this day, China is the top emitter of carbon dioxide (CO2) in the world, and India is third, yet both these countries are emerging economies. Thus, economic development in emerging economies has been achieved at the expense of the environment. The BRICS countries fall under the emerging economies, hence the need for this trading bloc to develop vigorous policies that enable the use of RE among all its members. Such policies, if enacted and implemented in the BRICS, as the trading bloc, will significantly foster SD in the countries. The high use of FF in BRICS economies is evidenced by the low use of RE, according to the data from the World Bank [6]. Figure 1 shows the major trends in the use of RE among the BRICS economies from 2000 to 2021, according to the World Bank [6]. Thus, from Figure 1, it is clear that the BRICS economies are struggling to develop RE sources since they have less than 50% use of RE as a percent of total energy use, with Brazil being the only thriving country. Figure 1 shows that Russia is at the bottom, with an average of less than 4%, followed by South Africa, with an average of below 10%. The drop in the use of RE in China and India, with China dropping from 30% in 2000 to below 12% in 2011, though it later increased to around 15% until 2021, is alarming. Thus, the significant (sig) drops in the RE use among the BRICS economies does not reflect the urgency among these economies in ensuring the development of RE.

Figure 1.

Renewable energy use in BRICS (data source: World Bank) [7].

In order to achieve RE development in the BRICS economies, organization and household participation that is backed by government commitment is essential. Thus, green innovation policies that can be implemented by different sectors of the economy, both private and public, should be developed and implemented. Most importantly, the government should channel funds toward developing and producing RE sources. Empirical studies have shown that financial development (FD) in collaboration with the national income as represented by economic growth (EG) are the major drivers to RE development [5,8]. Thus, with a strong funding base in the economy, achieving RE development is made possible. This is supported in [9], articulating the need of strong financial resources for an economy to achieve RE development. Other empirical studies have also supported the need for funds to finance RE projects and have shown that developing nations could obtain such funds from the foreign direct investment (FDI) inflows [10]. The need for funds either through improving the financial system of the nation, national income, or from FDI inflows in supporting RE projects brings us to the importance of investment in energy and research and development (R&D) in supporting RE development. Thus, the dearth in the literature on how R&D and investment in energy supports RE development calls for the need for more state-of-the-art research that could be used to inform green transition policies. RE development is also hindered by skyrocketing energy prices and inflation rates [11,12], calling for the economies to consider adopting some stabilization policies on these key macroeconomic indicators.

This study contributes to sustainability in that it examines the various ways that can be adopted to improve RE, a key element toward green transition that is key in advancing environmental sustainability. Moreover, the originality of the study comes in four important ways: firstly, it investigates on how investment in energy can be capitalized in developing RE in the BRICS economies. Thus, this research persuades governments to channel funds in supporting RE development. Secondly, the research sheds light on how R&D acts as a key driver toward achieving RE development in the BRICS. This calls for the need to increase R&D expenditures in the BRICS economies, a necessary step in inventing and developing clean energy in this region. Thirdly, the study also employs oil rents and the Gross Domestic Product (GDP) deflator to investigate the need to stabilize these factors in order to ensure RE development is achieved. The use of the GDP deflator in this research enables the presentation of robust results that could inform policies on how the overall inflation rate affect RE, differing from studies that have used Consumer Price Index (CPI) inflation rate that only measures increases of prices in a specific consumer basket in an economy. Fourthly, the research examines on how institutional quality can be used as the driving force to RE development. This research contributes methodologically by employing the ‘Methods of Moments Quantile Regression (MMQR)’ technique in order to overcome ‘heterogeneity’ and ‘cross-sectional dependence (CD)’ [13]. Therefore, robust findings that are essential for the BRICS economies to achieve the goal of carbon neutrality through using RE are presented in this study.

2. Materials and Methods

2.1. Literature Gap and Contribution

The literature provides overwhelming evidence on how key factors, like EG and FD, improve the development of RE in different regions. For instance, the research of [8,14] has shown that both EG and FD helped in the development of RE of Turkiye. EG was also shown to significantly influence RE in the OECD nations [15]. Moreover, [12] postulated that FD and EG are vital in the development of RE of the West African economies, while similar results are also presented in the research of [5] in the case of the emerging economies. The emerging economies investigated in the research of [5] also include some nations that are part of the BRICS bloc. Thus, the research of [5] is fundamental and is the basis for directing the present research analysis. Other empirical findings related to the BRICS economies include the study of [16] in China that has shown the effect of FD on RE development. The link of FD and RE development has also been studied in various other regions like the OECD, EU, ASEAN, MENA, and BRICS, and the importance of FD is supported [9,17]. Apart from FD improving RE development, FDI is also recognized as key in maintaining RE development; see in [10]. Ref. [12] also supported that the emerging economies can substantially improve RE production and use, with the income generated through foreign investment inflows. Additionally, studies like [9,18] have supported that with advancements in the economic development of economies through rising EG, RE is developed. This argument has also been supported in many other studies, like [16,19,20]. Therefore, the evidence pointing to the significant positive influence of EG on RE is ample in making informed policies by governments toward directing the road to a cleaner environment that relies on RE. EG and FD have generally been presented in the literature to support energy production, including other sources like FF. For instance, [21,22] depicted that these indicators promoted total energy production. However, because of climate change issues and the ongoing deterioration of the environment, green transition policies that support the use of RE by firms and households recommend the use of RE and not FF [23]. Therefore, the attention of this research is to investigate more regarding what can be done to achieve energy transition and maintain a carbon-free environment in the future.

While FD, EG, and FDI support the production and use of RE, it is important to further investigate on how these factors bring about the development in RE. RE production requires funding, and such funds can only be provided if the financial system of an economy, that is, its markets and institutions, are strong. This allows the government and companies to generate funds that can be channeled toward the development of RE. Furthermore, high income levels in an economy, as represented by high EG means the availability of funds to spend on RE by firms, households, and governments. Thus, with high income levels in an economy, the production and use of RE are promoted. Therefore, it is important to examine on how investment in energy, especially RE, affects the production and use of RE. Studies that have investigated this relationship are scant. Ref. [24] showed that RE development in China was linked with investment in RE in a ‘V’-shaped connection. The outcomes depicted that investment in RE initially reduces RE development and later increases it once the threshold is attained [24]. The study recommended the continuous investment in RE by the Chinese government through using its financial strength and improving the efficiency of the financial markets. RE development can also be supported through channeling funds on the R&D of RE sources. The ongoing program where developing nations are receiving funds to help them support R&D on RE is fundamental in supporting green technological innovations, known as Our World in Data [6]. Moreover, in order for these funds to be used for developing RE, developing countries should improve their institutional quality by means of lowering corruption and political instabilities. The ‘resource curse’ in the developing nations is a very good example of the need to improve institutional quality in these nations in order to promote economic development [25]. Therefore, this research furthers the body of knowledge by providing new insights on how investment in energy, R&D, and institutional quality can promote RE development in the BRICS economies.

Now, turning to some indicators that are detrimental to RE development, inflation rate and energy prices are chief. In the pioneer studies of [26,27], energy prices were presented as key in determining the development of RE. In recent studies, different proxies, such as oil prices and the inflation rate, have been used. The authors of [11,12,18,28] have concurred that oil prices reduce the development of RE. Recent studies have also presented robust results that have shown that oil prices affect RE by means of lowering it; see [5] for research of the emerging economies. Moreover, the inflation rate was found to inhibit RE development, thereby hindering the production and use of RE in the economies [29]. These postulations have been supported by recent studies that have employed the percentage change in the CPI to represent the inflation rate [5,8]. While the energy prices and inflation rate reduce RE development as supported by past studies, the influence of oil rents on RE development is understudied. Moreover, using the CPI to proxy inflation rate, limitations arise in understanding on how the overall inflation rate affects RE in an economy. The CPI inflation can be seen as providing the background necessary to undertake more studies leading to the development of robust policies on this subject. Thus, this research addresses these gaps by employing the oil rent to examine on how it influences RE development. Additionally, this research employs the GDP deflator that represents the overall inflation rate in economies to further the understanding on the influence of inflation rates on RE development.

2.2. Model and Data

The literature presents four arguments on how energy and EG are related. First is the notion that economies expand through the use of energy; that is, energy is a factor of production (FOP), and this is termed the growth hypothesis [30]. Second is the idea that the demand of energy is affected by EG; that is, GDP growth significantly affects energy consumption in what is known as the conservation hypothesis [31]. Third, other studies have provided what is known as the feedback hypothesis, which shows that energy and EG influence each other. The feedback hypothesis is true because of various studies that have shown that different energy sources like RE and FF affect EG, while EG also affects these energy sources [5,30,32]. Fourth is the neutrality hypothesis that presents the existence of a non-mutual relationship between energy and EG [31]. Therefore, this research upholds the feedback hypothesis and specifies EG as the determinant of RE in the BRICS economies. The effects of RE on EG were not examined in this research because of the many studies that have examined this relationship; hence, no literature gap exists on this link [32] This approach has been supported by various studies such as [5,8,12]. Moreover, following these studies, FD has also been employed to explain RE development in the BRICS economies [33]. Ref. [9] have also shown that nations that have more financial resources have an advantage of financing the development of RE. Therefore, this research examines the effects of investment in energy on the RE development of the BRICS economies. The investigation of this relationship is lacking in the literature, yet investment in energy is presented to foster EG [5]. Additionally, R&D that drives technological innovations is undoubtedly the most important determinant of the invention of clean energies. The data of Our World in [6] shows that developing countries receive funds meant to promote R&D on clean energy. Therefore, this research employs R&D to explain on how it affects RE development in the BRICS countries. Oil rents and the GDP deflator are employed following the studies that have presented that energy prices and inflation rate hinders RE development, hence the need to present policies toward their stabilization as well as subsidize RE sources [3,19]. Moreover, because of the need of strong government policies and green transition policies to achieve carbon neutrality, this research employs the institutional quality to examine on how the government policies can improve RE development [16]. Thus, following the analysis and evidence presented above, our model is specified as shown in Equation (1).

In this equation, the superscript t represents the five BRICS (South Africa, China, India, Russia, and Brazil) economies included in the panel data, and the superscript i is the time factor of the data, which are annual data from 2000 to 2021. The period was limited to this period in line with the data availability of the factors considered in this study. Moreover, is the model’s constant term; are the model parameters, that is, the independent variables’ coefficients; and the white noise is represented by μ. RE is the dependent variable representing the use of renewable energies in the BRICS economies. This study took the RE use as a % of total energy used a of the World Bank (WB) as the indicator of RE. EG is the GDP growth rate in an economy, expressed as ,% and the WB indicator was used in this research. R&D represents the research and development expenditure in an economy as represented by the WB indicator, which is the % of income used to support R&D initiatives. IQ is the institutional quality, representing the capacity of the state to foster and enforce its policies as well as reducing corruption. The institutional quality index adopted in this research was calculated with the ‘Principal Component Analysis (PCA)’ with the use of the government effectiveness (GE) and control of corruption (CC) dimensions of the WB indicators. These indicators of CC and GE were estimated to be between −2.5 to 2.5. OR is the oil rent indicator of the WB, expressed as a percent of GDP. Oil rent was calculated as the difference between regional prices of crude oil’s value of production and total production costs (World Bank, 2025). FD is the ‘International Monetary Fund (IMF)’ index of financial development, which measures the financial markets and institutions’ depth, reliability and accessibility. GDPD is the GDP deflator representing the overall inflation rate in the economy. This research used the GDP deflator index of the WB for this purpose. Lastly, IIE is the investment in energy and the index of the WB indicators, which is expressed in current U.S. Dollars, was also used for this purpose. To summarize the measurements and sources of the variables, Table 1 is presented. Moreover, to provide the measures of dispersion and central tendency, Table 2 is presented.

Table 1.

Summary Statistics.

Table 2.

Descriptive statistics.

2.3. Method

Firstly, in this research, the ‘Variance Inflation Factor (VIF)’ analysis was conducted to check the appropriateness of the model specified in Equation (1) and the independent variables employed. The VIF analysis conducted showed no ‘multi-collinearity’ in the independent variables, as shown in Table A1 in Appendix A; thus, the model was correctly specified [23,34,35]. This research used the MMQR method and verified it with the PCSE method to ensure the reliability and validity of the findings [13,36]. The MMQR was selected in this research following the preliminary tests that pointed to the importance of using the MMQR method. For instance, the significant presence of CD in the variables and model and ‘heterogeneity’ in the model, as shown in Table A2 in Appendix A, called for the use of ‘second-generation (SG)’ methods [37,38,39,40,41,42]. Therefore, the MMQR method was employed in order to overcome CD and ‘heterogeneity’ problems, hence presenting reliable results that could inform appropriate policies. The unit root (UR) analysis that was carried out with the SG techniques of CIPS and CADF showed that variables with I(0) and I(1) integration orders were employed [43,44]. The UR findings are presented in Table A3 in Appendix A. Additionally, the MMQR was employed because of the significant cointegration in the model, as shown by the results in Table A4 in Appendix A. In testing cointegration, the Kao and Pedroni methods were used, and the demean option that subtracts ‘cross-sectional means’ was selected in order to overcome CD problems [23]. The MMQR method was employed where long-run (LR) connections were significant in the model because it provides heterogeneous results in different quantiles [45]. Lower-quantile outcomes can be used to represent findings in the short run (SR) or lower-quantile countries, while upper-quantile outcomes represent LR results or results of upper-quantile countries [23]. This research specifies the MMQR statistical equation as illustrated by Equation (1).

where is the conditional quantile of RE, which is the dependent variable, and the other indicators and parameters expressed are explained in Equation (1).

The study also employs the Panel Correlated Standard Error (PCSE) method in order to ensure the robustness of the findings presented by the MMQR technique [46].

3. Results and Discussion

Table 3 represents the MMQR and PCSE method results. The MMQR results in Table 3 depict the importance of EG, R&D, GDP deflator, and investment in energy in supporting RE development in the BRICS countries. This is also supported by the findings of the PCSE method in Table 3. Moreover, the MMQR results in Table 3 show that institutional quality, oil rent, and FD were associated with a negative effect on RE development in the BRICS countries. The PCSE method results in Table 3 also support the detrimental effects of institutional quality, oil rent, and FD on RE development in this region.

Table 3.

Results of the MMQR and PCSE methods.

Starting with R&D, the findings of the MMQR method show that when R&D was increased by one unit, this resulted in an increase in the RE by 25.7, 22.24, 16.79, 14.46, and 12.02 units in all the quantiles. These findings show that R&D presented significant symmetric effects on RE development in the BRICS countries. Thus, all the BRICS countries received significant influence of technological innovations as represented by R&D in advancing RE development in this region. The symmetric effects also show that R&D was fundamental in supporting RE development in the SR and in the LR. Moreover, the outcomes of the PCSE method in Table 3 support the MMQR outcomes by showing that increases in R&D by approximately one -unit were associated with increases in the RE development by an average of 18.36 units in the BRICS countries. The importance of R&D in affecting RE development has not been widely investigated; hence, a literature gap is present in the field. However, R&D is known as the driver behind the various technological innovations that are responsible for inventing new RE sources, as well as technologies that are clean and safe to the environment [6]. Technological innovation is also widely recognized as an important driver toward achieving ES, and this is achieved through advancements in green technological innovations that are driven through improvements in the R&D of countries [23]. Therefore, it is important for the BRICS economies to ensure financing R&D in their countries in order to ensure the development of RE sources.

On the effect of investment in energy on RE development in the BRICS countries, the findings of the MMQR method show that increases in the investment in energy by 1% led to increases in the RE development by 0.46%, 0.77%, 0.9%, and 1.04% in the 0.25–0.9 quantiles. In the 0.1 quantile, the effect of investment in energy on RE was positive but not significant. Thus, the MMQR findings that show that investment in energy present insignificant effects in the 0.1 quantile, but significant effects in the middle and upper quantiles, show the existence of asymmetric effects of investment in energy on RE development in the BRICS countries. This shows that investment in energy is important in improving RE development in the LR of the BRICS countries. The importance of investment in energy in supporting RE development is also supported by the PCE method results, which showed that increasing investment in energy by one percent resulted in an approximate increase in RE development by 0.68%. The influence of investment in energy on RE development has not received wide investigations, hence the existence of a gap in the literature. However, among the few studies that have been carried out, it has been observed that investment in energy is important in supporting economic development of China [47]. Moreover, past studies that have shown the importance of FD in supporting RE development have supported the importance of investment in energy in improving RE development [8,47]. Therefore, the BRICS countries should support the channeling of financial resources toward supporting investment in energy, especially RE development, in order to improve the use of RE in this region, and hence, achieve ES.

This research also shows that EG is important in improving RE development in the BRICS countries. The MMQR findings present that EG improved RE development in the BRICS countries, only in the 0.1–0.5 quantiles. The outcomes presented depict that increasing EG by one unit can be associated with an approximate increase in the RE development by 1.22 units, 0.99 units, and 0.64 units in the 0.1–0.5 quantiles. The effect of EG in the 0.75 and 0.9 quantiles was positive but insignificant. This shows that EG exhibited significant asymmetric effects, whereby it improved RE development in the SR and not in the LR. The results of the PCSE method in Table 3 also support the importance of EG in improving RE development in the BRICS countries. The PCSE method results depict that increasing EG by one unit can be associated with an approximate increase in the RE development by 0.744 units. The importance of EG in supporting the development of RE has been supported by many studies that are presented in the literature (Mukhtarov et al., 2022; Akpanke et al., 2023; Deka et al., 2024 [8,12,47]). Moreover, the importance of EG in improving RE is supported by the feedback hypothesis, which shows the importance of income from GDP in supporting energy development. The energy ladder and energy stacking models that also support the importance of income in lowering energy poverty support these findings. Therefore, it is important to adopt policies that allow part of the income generated through economic development to be channeled toward the development of RE in the BRICS.

In addition, Table 3 shows that the GDP deflator that was employed to represent the overall inflation rate of the BRICS economies presented a significant positive impact on the RE development. The MMQR results show that an increase in the GDP deflator resulted in an approximate increase in the RE development by 0.713, 0.723, 0.727, and 0.731 units in the 0.25–0.9 quantiles. In the 0.1 quantile, the effect of GDP deflator on RE development was positive, but insignificant. This shows that the GDP deflator, which is the overall inflation rate of the BRICS economies, was associated with an increase in the RE development in the LR. The PCSE method also showed in its results that the GDP deflator was associated with an increase in the RE development. Table 3 depicts that raising the GDP deflator by one unit was associated with an increase in the RE development by 0.72 units according to the PCSE method. Generally, the overall inflation rate should reduce RE development, as supported in the studies of [8]. However, the positive effect of the overall inflation rate on RE development has also been supported by other studies [47], and this has been explained by the expensiveness of RE sources as compared to the FF [48]. Therefore, it is important for the BRICS economies to monitor and stabilize the inflation rate, as well as subsidize the prices of RE, in order to improve its affordability to all citizens.

This research also shows that institutional quality in the BRICS economies was associated with a decrease in the RE development. The MMQR findings depict that increasing institutional quality by one unit was associated with a decrease in the RE development by an approximate magnitude from 18.73 units to 14.79 units in all quantiles. The PCSE method also supports that institutional quality was associated by a decrease in RE development in the BRICS countries by presenting that increasing institutional quality by one unit was associated with an approximate decrease in the RE development by 16.6 units. Therefore, we showed that institutional quality did not support RE development in the BRICS countries. This was because of the existence of high corruption levels, poor governance, and low government effectiveness, which hindered the transition of these economies to clean energy use. Therefore, it is important for the BRICS countries to improve institutional quality in their countries to ensure that the level of corruption is minimized and ensure that the rule of law is followed so that companies can adopt green transition policies; hence, the development and use of RE will be improved.

Oil rent was also observed to present a significant negative effect on the RE development in the BRICS countries. The MMQR findings depict that increasing oil rent by one unit was associated with an increase in the RE development by an approximate magnitude of between 5.69 units and 4.87 units in all the quantiles. This shows that oil rent presented symmetric negative effects on the RE development. The PCSE method also supports the findings of the MMQR method by showing that increases in the oil rent were associated with decreases in the RE development by 5.25 units. The negative effect of oil rent on RE development has been supported by various studies that have shown that energy prices reduce the development of energy or RE in various regions [11]. These results are also supported by other studies that have used the CPI inflation to proxy energy prices and have observed that the inflation rate is associated with negative influence on the RE development [8]. Therefore, it is important for the BRICS countries to stabilize the prices of energy, as well as the oil prices, in order to ensure the affordability of RE sources, and hence promote its development and use.

In the case of FD, it was observed to significantly reduce RE development in the BRICS economies. The findings of the MMQR method depict that increases in the FD in this region resulted in a decrease in the RE development by a greater magnitude in the 0.1–0.75 quantiles. However, in the 0.9 quantile, while the effect of FD was negative, it was observed to be insignificant; hence, it had a negligible effect on the RE development of the BRICS economies. This shows that FD significantly reduced RE development in the SR, but in the LR, it presented an insignificant influence. The PCSE method also supports the negative effects of FD on RE development by showing that it significantly reduced RE development by a greater multitude in the BRICS economies. FD has been supported in the various empirical studies, as it has been observed to present positive influence on the development of RE in various regions [9,49], and it has been shown that countries that have more financial resources are at an advantage as they can capitalize on improving RE development with the financial resources endowed in their countries. Therefore, the negative effect observed in this study can be explained by the poor institutional quality that was associated with high corruption levels and the low rule of law in the BRICS countries, causing poor allocation of financial resources in supporting RE development. Therefore, this study informs policymakers in the BRICS countries to develop some vigorous policies that allow for the channeling of financial resources toward the development of RE.

Table 4 below provides a summary of the effects of the RE development on the dependent variables specified in this research.

Table 4.

Summary of the findings.

4. Conclusions

This research provides special insights toward supporting RE development in the BRICS countries and other countries that might have almost similar conditions to those of the BRICS countries. This study is important in covering the gap that exists in the literature on how technological innovation, which is supported through R&D, can affect and promote RE development. Moreover, the study adds to the literature by showing the contribution of investment in energy in supporting RE development in the BRICS countries. These two factors of R&D and investment in energy are crucial and critical in ensuring a transition toward clean energy in these countries. With the use of the MMQR method in this study, robust findings are given that could be used to inform policies toward green transition in the BRICS economies. This research shows that R&D, investment in energy, and EG are fundamental in supporting RE development in the BRICS economies. The research also shows that the GDP deflator, which represents the overall inflation level of the BRICS economies, is associated with an increase in the RE development. This study also shows that unlike the postulations of various empirical studies that depict that FD fosters the development of RE, FD is counterproductive, as it is associated with a negative effect on the development and use of RE in the BRICS economies. Furthermore, oil rent and institutional quality were observed to significantly reduce the development of RE in the BRICS economies. Therefore, this study recommends the BRICS economies to correct institutional quality dimensions including the reduction of corruption and advancements in the rule of law, which is necessary in promoting and making the green transition policies binding. With strong institutional quality in the BRICS economies, it is possible to inform policies toward supporting green technological innovations among organizations and enforce them, and hence improve the development of RE in this region. Moreover, strong institutional qualities in the BRICS economies can enable these countries to channel financial resources on green development programs and ensure that they are used for the intended purposes through avoiding various embezzlements that might arise. The BRICS economies can also work toward RE development through investing in energy, especially RE. This shows that the BRICS countries should make it a priority to finance the development of clean energies and to promote the R&D meant to invest in new clean technologies and clean energies in these economies. RE development can also be achieved through using part of the national income that is generated by the economy toward financing RE development. This is so because with high EG in the BRICS economies, the country can afford funds to support RE development, and the citizens can also afford to consume more of RE sources. In the same lines, the prices of oil and energy should be stabilized in order to improve the affordability of RE in the BRICS economies. This can be achieved through subsidizing the production of RE, which will result in lower prices of RE to households and firms. This research limitation can be explained as follows: the time considered was short because of limited data in some variables in longer periods; thus future, studies can consider longer periods. The research was also limited to the use of the MMQR and PCSE method; hence, future studies are recommended to consider other contemporary methods that captures country specific trends. Furthermore, the current study findings showing that overall inflation increases RE, while FD and institutional quality reduces RE needs to be further examined for robust policy implications in the BRICS nations. Additionally, considering the lack of studies that have investigated how R&D or technological innovation affects RE development in the various regions, this study recommends future studies to investigate on how technological innovation can be used as a tool toward green transition in the world. Moreover, the importance of investment in energy on RE has not been widely examined, calling for more studies to investigate how investment in energy can be promoted in various regions of the world to support RE development.

Author Contributions

Conceptualization, A.M.A.A. and P.H.K.; methodology, A.M.A.A. and S.I.; formal analysis, P.H.K.; investigation, A.M.A.A.; resources, A.M.A.A., P.H.K. and S.I.; writing—original draft, P.H.K.; writing—review & editing, P.H.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

VIF findings.

Table A1.

VIF findings.

| Variable | VIF | 1/VIF |

|---|---|---|

| IQ | 4.10 | 0.2441 |

| RD | 4.02 | 0.2486 |

| OR | 3.20 | 0.3125 |

| FD | 2.54 | 0.3942 |

| GDPD | 2.49 | 0.4020 |

| EG | 1.81 | 0.5519 |

| logIIE | 1.31 | 0.7639 |

| Mean VIF | 2.78 |

Table A2.

CD and heterogeneity findings.

Table A2.

CD and heterogeneity findings.

| Pesaran (2004) [37] | CD Test in Model | ||||

|---|---|---|---|---|---|

| RE | 4.57 *** | 0.000 | Pesaran (2015) [38] | 1.155 | 0.2482 |

| EG | 9.00 *** | 0.000 | Friedman | 31.340 *** | 0.0000 |

| RD | −0.98 | 0.327 | Frees | 0.536 *** | |

| IQ | −2.51 ** | 0.012 | |||

| OR | 11.15 *** | 0.000 | Heterogeneity | ||

| FD | 7.76 *** | 0.000 | Δ | 3.699 *** | 0.000 |

| GDPD | 3.40 *** | 0.001 | Δ adj. | 4.813 *** | 0.000 |

| logIIE | 1.38 | 0.168 | |||

Note: ** is 5% sig level; *** is 1% sig level.

Table A3.

CIPS results.

Table A3.

CIPS results.

| Level | 1stD | |

|---|---|---|

| RE | −2.100 | −3.055 *** |

| EG | −3.281 *** | |

| RD | −1.778 | −3.421 *** |

| IQ | −1.627 | −5.180 *** |

| OR | −2.681 *** | |

| FD | −1.765 | −4.674 *** |

| GDPD | −3.370 *** | |

| logIIE | −3.143 *** |

Note: *** is 1% sig level.

Table A4.

Cointegration outcomes.

Table A4.

Cointegration outcomes.

| Statistic | p-Value | |

|---|---|---|

| Kao test | ||

| MDF | −4.4498 *** | 0.0000 |

| DF | −3.8250 *** | 0.0001 |

| ADF | −2.8901 *** | 0.0019 |

| UMDF | −4.0872 *** | 0.0000 |

| UDF | −3.7558 *** | 0.0001 |

| Pedroni test | ||

| MPP | 3.4336 *** | 0.0003 |

| PP | 1.6122 * | 0.0535 |

| ADF | 1.6958 ** | 0.0450 |

Note: DF is Dickey Fuller; MDF is modified DF; ADF is augmented Dickey Fuller; UMDF is unadjusted MDF; UDF is unadjusted DF; PP is Phillips–Perron; MPP is modified PP. * is 10% sig level; ** is 5% sig level; *** is 1% sig level.

References

- Hussen, A. Principles of Environmental Economics: An Integrated Economic and Ecological Approach; Routledge Taylor & Francis: London, UK; New York, NY, USA, 2000. [Google Scholar]

- Akpanke, T.A.; Deka, A.; Ozdeser, H.; Seraj, M. Does foreign direct investment promote renewable energy use? An insight from West African countries. Renew. Energy Focus 2023, 44, 124–131. [Google Scholar]

- Deka, A.; Dube, S. Analyzing the causal relationship between exchange rate, renewable energy and inflation of Mexico (1990–2019) with ARDL bounds test approach. Renew. Energy Focus 2021, 37, 78–83. [Google Scholar] [CrossRef]

- Qin, L.; Hou, Y.; Miao, X.; Zhang, X.; Rahim, S.; Kirikkaleli, D. Revisiting financial development and renewable energy electricity role in attaining China’s carbon neutrality target. J. Environ. Manag. 2021, 297, 113335. [Google Scholar] [CrossRef]

- Deka, A.; Özdeşer, H.; Seraj, M. The impact of oil prices, financial development and economic growth on renewable energy use. Int. J. Energy Sect. Manag. 2024, 18, 351–368. [Google Scholar]

- Our World in Data. International Finance Received for Clean Energy. 2025. Available online: https://ourworldindata.org/grapher/international-finance-clean-energy (accessed on 15 February 2025).

- World Bank. World Bank Open Data. 2025. Available online: https://data.worldbank.org/ (accessed on 15 February 2025).

- Mukhtarov, S.; Yüksel, S.; Dinçer, H. The impact of financial development on renewable energy consumption: Evidence from Turkey. Renew. Energy 2022, 187, 169–176. [Google Scholar] [CrossRef]

- Usman, M.; Makhdum, M.S.A.; Kousar, R. Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustain. Cities Soc. 2021, 65, 102590. [Google Scholar]

- Kutan, A.M.; Paramati, S.R.; Ummalla, M.; Zakari, A. Financing renewable energy projects in major emerging market economies: Evidence in the perspective of sustainable economic development. Emerg. Mark. Financ. Trade 2018, 54, 1761–1777. [Google Scholar] [CrossRef]

- Sadorsky, P. Renewable energy consumption and income in emerging economies. Energy Policy 2009, 37, 4021–4028. [Google Scholar]

- Akpanke, T.A.; Deka, A.; Ozdeser, H.; Seraj, M. The role of forest resources, energy efficiency, and renewable energy in promoting environmental quality. Environ. Monit. Assess. 2023, 195, 1071. [Google Scholar]

- Machado, J.A.; Silva, J.S. Quantiles via moments. J. Econom. 2019, 213, 145–173. [Google Scholar]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean. Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Raifu, I.A.; Obaniyi, F.A.; Nnamani, G.; Salihu, A.A. Revisiting Causal Relationship between Renewable Energy and Economic Growth in OECD Countries: Evidence from a Novel JKS’s Granger Non-Causality Test. Renew. Energy 2025, 244, 122559. [Google Scholar]

- Wang, Y.; Liao, W.; Zhao, X.; Lian, P. Energy Transition Policy and Green Innovation Quality. Financ. Res. Lett. 2024, 73, 106633. [Google Scholar]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar]

- Mukhtarov, S.; Humbatova, S.; Hajiyev, N.G.O. Is the transition to renewable energy consumption hampered by high oil prices? Int. J. Energy Econ. Policy 2021, 11, 377–380. [Google Scholar]

- Eren, B.M.; Taspinar, N.; Gokmenoglu, K.K. The impact of financial development and economic growth on renewable energy consumption: Empirical analysis of India. Sci. Total Environ. 2019, 663, 189–197. [Google Scholar]

- Shahbaz, M.; Topcu, B.A.; Sarıgül, S.S.; Vo, X.V. The effect of financial development on renewable energy demand: The case of developing countries. Renew. Energy 2021, 178, 1370–1380. [Google Scholar]

- Mukhtarov, S.; Mikayilov, J.I.; Mammadov, J.; Mammadov, E. The impact of financial development on energy consumption: Evidence from an oil-rich economy. Energies 2018, 11, 1536. [Google Scholar] [CrossRef]

- Kareem, P.H.; Ali, M.; Tursoy, T.; Khalifa, W. Testing the effect of oil prices, ecological footprint, banking sector development and economic growth on energy consumptions: Evidence from bootstrap ARDL approach. Energies 2023, 16, 3365. [Google Scholar] [CrossRef]

- Deka, A.; Abshir, H.M.; Ozdeser, H. The influence of effective capital, technological innovation and energy efficiency on environmental sustainability on the European region. Int. J. Environ. Sci. Technol. 2024, 22, 6651–6664. [Google Scholar]

- Xu, G.; Yang, M.; Li, S.; Jiang, M.; Rehman, H. Evaluating the impact of renewable energy investment on renewable energy development in China with panel threshold model. Energy Policy 2024, 187, 114029. [Google Scholar]

- Auty, R.M. The political economy of resource-driven growth. Eur. Econ. Rev. 2001, 45, 839–846. [Google Scholar] [CrossRef]

- Chang, S.C. Effects of financial developments and income on energy consumption. Int. Rev. Econ. Financ. 2015, 35, 28–44. [Google Scholar]

- Ali, H.S.; Yusop, Z.B.; Hook, L.S. Financial development and energy consumption nexus in Nigeria: An application of autoregressive distributed lag bound testing approach. Int. J. Energy Econ. Policy 2015, 5, 816–821. [Google Scholar]

- Karaaslan, A.; Camkaya, S. The relationship between CO2 emissions, economic growth, health expenditure, and renewable and non-renewable energy consumption: Empirical evidence from Turkey. Renew. Energy 2022, 190, 457–466. [Google Scholar]

- Deka, A.; Cavusoglu, B.; Dube, S. Does renewable energy use enhance exchange rate appreciation and stable rate of inflation? Environ. Sci. Pollut. Res. 2022, 29, 14185–14194. [Google Scholar]

- Deka, A.; Ozdeser, H.; Seraj, M. The impact of primary energy supply, effective capital and renewable energy on economic growth in the EU-27 countries. A dynamic panel GMM analysis. Renew. Energy 2023, 219, 119450. [Google Scholar]

- Faisal, F.; Tursoy, T.; Resatoglu, N.G. Energy consumption, electricity, and GDP causality; the case of Russia, 1990–2011. Procedia Econ. Financ. 2016, 39, 653–659. [Google Scholar]

- Kadir, M.O.; Deka, A.; Ozdeser, H.; Seraj, M.; Turuc, F. The impact of energy efficiency and renewable energy on GDP growth: New evidence from RALS-EG cointegration test and QARDL technique. Energy Effic. 2023, 16, 46. [Google Scholar]

- Assi, A.F.; Isiksal, A.Z.; Tursoy, T. Renewable energy consumption, financial development, environmental pollution, and innovations in the ASEAN+ 3 group: Evidence from (P-ARDL) model. Renew. Energy 2021, 165, 689–700. [Google Scholar]

- Kadir, M.O.; Deka, A.; Ozdeser, H.; Seraj, M. The role of natural resources rent, energy efficiency and governance in reducing pollution–New evidence with MMQR method. Environ. Prog. Sustain. Energy 2024, 44, e14510. [Google Scholar] [CrossRef]

- Omar, S.A.S.; Khalifa, W.M.S.; Kareem, P.H. The influence of trade, technology and economic growth on environmental sustainability in the Gulf cooperation countries—New evidence with the MMQR method. Sustainability 2025, 17, 419. [Google Scholar] [CrossRef]

- Beck, N.; Katz, J.N. What to do (and not to do) with time-series cross-section data. Am. Political Sci. Rev. 1995, 89, 634–647. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross section dependence in panels. Economics 2004. [Google Scholar] [CrossRef]

- Pesaran, M.H. Testing weak cross-sectional dependence in large panels. Econom. Rev. 2015, 34, 1089–1117. [Google Scholar] [CrossRef]

- Frees, E.W. Assessing cross-sectional correlation in panel data. J. Econom. 1995, 69, 393–414. [Google Scholar] [CrossRef]

- Frees, E.W. Longitudinal and Panel Data: Analysis and Applications in the Social Sciences; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

- Friedman, M. The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J. Am. Stat. Assoc. 1937, 32, 675–701. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Lv, Z.; Chen, L.; Ali, S.A.; Muda, I.; Alromaihi, A.; Boltayev, J.Y. Financial technologies, green technologies and natural resource nexus with sustainable development goals: Evidence from resource abundant economies using MMQR estimation. Resour. Policy 2024, 89, 104649. [Google Scholar] [CrossRef]

- Deka, A. Juxtaposing the role of effective capital, energy efficiency and technological innovations on environmental sustainability in the EU countries. Manag. Environ. Qual. Int. J. 2025. ahead-of-print. [Google Scholar] [CrossRef]

- Deka, A. The role of investment in energy and industry value added in the presence of financial resourcesin fostering sustainable economic growth of China. SN Bus. Econ. 2024, 4, 104. [Google Scholar] [CrossRef]

- Deka, A. The role of natural resources rent, trade openness and technological innovations on environmental sustainability–Evidence from resource-rich african nations. Resour. Policy 2024, 98, 105364. [Google Scholar] [CrossRef]

- Akpanke, T.A.; Deka, A.; Ozdeser, H.; Seraj, M. Ecological footprint in the OECD countries: Do energy efficiency and renewable energy matter? Environ. Sci. Pollut. Res. 2024, 31, 15289–15301. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).