1. Introduction

The reduction of carbon emissions is a critical concern for supply chains and public policy due to the significant increase in greenhouse gas emissions, particularly CO

2, which has intensified global warming [

1,

2,

3]. To address climate change, some countries have established carbon dioxide emission restrictions, including carbon allowance programs [

4,

5,

6]. To attain low-carbon development, governments are concurrently promoting the generation and utilization of clean or low-carbon energy as substitutes for fossil fuels. The effectiveness of these carbon reduction initiatives may be undermined by the interaction between the carbon and renewable energy markets. Achieving low-carbon objectives becomes challenging if the reduction of carbon allowances adversely affects the clean energy sector. Consequently, for policymakers focused on low-carbon development, it is crucial to understand the interaction between the carbon and renewable energy markets.

Although several research have investigated the correlation between carbon markets and energy markets [

7,

8,

9,

10,

11,

12,

13,

14,

15,

16,

17] or the association between EUAs and stock markets [

18,

19,

20,

21,

22,

23,

24,

25,

26], there is a scarcity of analyses concerning clean energy stock prices. This study employs a Granger-causality framework in quantiles to investigate the dynamic link between carbon pricing and clean energy indices throughout the distribution. We choose EUA futures and four clean energy indices in different countries or dimensions—global, European, US, and Chinese—during the timeframe from January, 2012, to May, 2023. This period encompasses the final year of Phase II, the complete duration of Phase III, and the initial two and a half years of Phase IV of the EU ETS.

This paper aims to close the research gap by examining the Granger-causality in quantiles between EUAs and four clean energy stock indices. An extensive amount of research has been conducted to investigate the connection between carbon and traditional energy markets. The majority of these studies have concentrated on the prices of EUA and traditional energy [

7,

8,

9,

10,

11,

12,

13,

14,

15,

27,

28], and they have consistently discovered a substantial association between the two. Another line of inquiry studies the relationship between energy prices and the stock prices of clean energy companies [

29,

30,

31,

32,

33]. This line of inquiry focusses specifically on the substitution effect that exists between oil prices and clean energy indices [

34,

35,

36,

37,

38,

39,

40,

41,

42].

There are still very few research that explicitly relate carbon markets with clean energy equities, and the conclusions of these studies are inconsistent. The findings of Kumar et al. [

43] and Dutta [

44] indicate that there is no statistical evidence of Granger-causation between EUA prices and U.S. clean energy indices. On the other hand, Dutta et al. [

45] discovered a volatility nexus with European clean energy stocks. In contrast, Hanif et al. [

46] and Tiwari et al. [

47] revealed that EUAs are spillover receivers from clean energy stocks. Wang et al. [

48] observed a positive association between EUA prices and clean energy indices. Both of these studies were conducted in the United States. These findings were further demonstrated by Mo et al. [

49], who established that EUA prices have dynamic effects on the returns of green energy stock.

Nevertheless, current studies investigating the relationship between carbon prices and clean energy indices predominantly emphasize average effects, neglecting fluctuations across diverse market situations. Unlike conventional mean regression models that evaluate causality at the mean of the distribution, our approach searches causal links all around the entire conditional distribution including its tails. This difference is crucial since causal effects might only show up in very rare market environments. A parametric test which is put forward by Troster [

50] is applied in our analysis to evaluate the causality between carbon market and clean energy stocks in all quantiles of the distribution, as opposed to focusing on an essential condition for Granger-causality—causality in mean. Compared to Chuang et al. [

51] who test the quantile causal relations based on the specific specification of the quantile regression model by using the sup–Wald test proposed by Koenker and Machado [

52], the test of Troster [

50] needs only a marginal quantile regression model under the null hypothesis of noncausality. Moreover, compared with the nonparametric tests of Hong et al. [

53] and Balcilar et al. [

54], the parametric test of Troster [

50] requires no mixing assumptions, and needs only less restrictive α-mixing assumptions for the validity of the subsampling. Therefore, this parametric test method is conducive to explore the causal effects on each quantile of the distribution and distinguish between causal relations in the distribution’s median and tails.

China has become the foremost clean energy market worldwide, investing USD 380 billion in 2021, succeeded by the European Union with USD 260 billion and the United States with USD 215 billion [

55]. Since 2015, industrialized economies and China have propelled global renewable energy investments, whereas emerging and developing economies have experienced stagnation [

56]. Although China excels in clean energy infrastructure, prior research predominantly emphasizes global, European, or U.S. indices, neglecting the interrelations between the EU ETS and China’s clean energy sector. It is noteworthy that only a small number of studies have investigated China’s clean energy business, despite the fact that China is the largest clean energy market in the world. This study fills this vacuum by adopting a quantile Granger-causality framework to investigate the asymmetric and region-specific relationship between carbon prices and clean energy stock returns. Specifically, the study focusses on clean energy stock returns. Through the identification of causal changes across a variety of market situations, our findings provide policymakers with significant insights that can be utilized in the formulation of carbon pricing and clean energy policies that are relevant to certain regions.

This study examines the research question: “How do fluctuations in carbon prices affect clean energy stock returns under varying market conditions, and do these effects differ by region?” Theoretically, there is a bidirectional relationship between carbon markets and clean energy stocks. Rising carbon prices increase compliance costs for high-emission industries. This incentivizes firms to adopt clean energy to reduce emissions, driving the performance of clean energy firms upward. In contrast, rapid scaling of renewables reduces fossil energy dependency, which weakens the demand for carbon allowances, potentially suppressing carbon prices if policy caps of emissions remain static. Additionally, surges in clean energy stock performance signal investor confidence in the energy transition. Investors may short carbon assets and increase the investment of clean energy assets, thereby influencing carbon price volatility. Furthermore, the policy environments may vary with different regions or countries (manifested as differentiated carbon trading mechanism, financial incentive, regulatory policy and so on), which results in the changes in the relations between the carbon market and clean energy stocks.

We utilize a quantile Granger-causality method to empirically analyze the evolution of the causal relationship between carbon pricing and clean energy stocks over the return distribution, especially in bullish and bearish market scenarios. We additionally evaluate if these consequences vary among global, European, U.S., and Chinese markets.

This study makes three key contributions:

Quantile-based insights—we examine the causal relationship between carbon markets and clean energy stocks across different quantiles, enabling policymakers to tailor strategies based on varying market conditions.

Regional specificity—by analyzing global, European, U.S., and Chinese clean energy indices, we identify region-specific causal effects. Notably, we explore the underexamined nexus between the EU ETS and China’s clean energy market.

Advanced methodology—using Troster’s quantile causality test, we investigate median and tail causality, offering a nuanced understanding of the carbon–clean energy relationship during Phases III and IV of the EU ETS.

Findings reveal a bidirectional Granger-causality between carbon prices and clean energy stocks in the conditional tails but not at the median. Additionally, the causal effects vary by region: while carbon markets negatively impact global, European, and U.S. clean energy stocks during bullish and bearish trends, they positively influence China’s clean energy stocks under similar conditions. These results offer essential direction for policymakers in formulating region-specific carbon and renewable energy strategies to facilitate low-carbon growth.

The subsequent sections of this work are structured as follows:

Section 2 delineates the methodology and data,

Section 3 gives the empirical analysis,

Section 4 discusses the finishes with policy implications, and

Section 5 concludes.

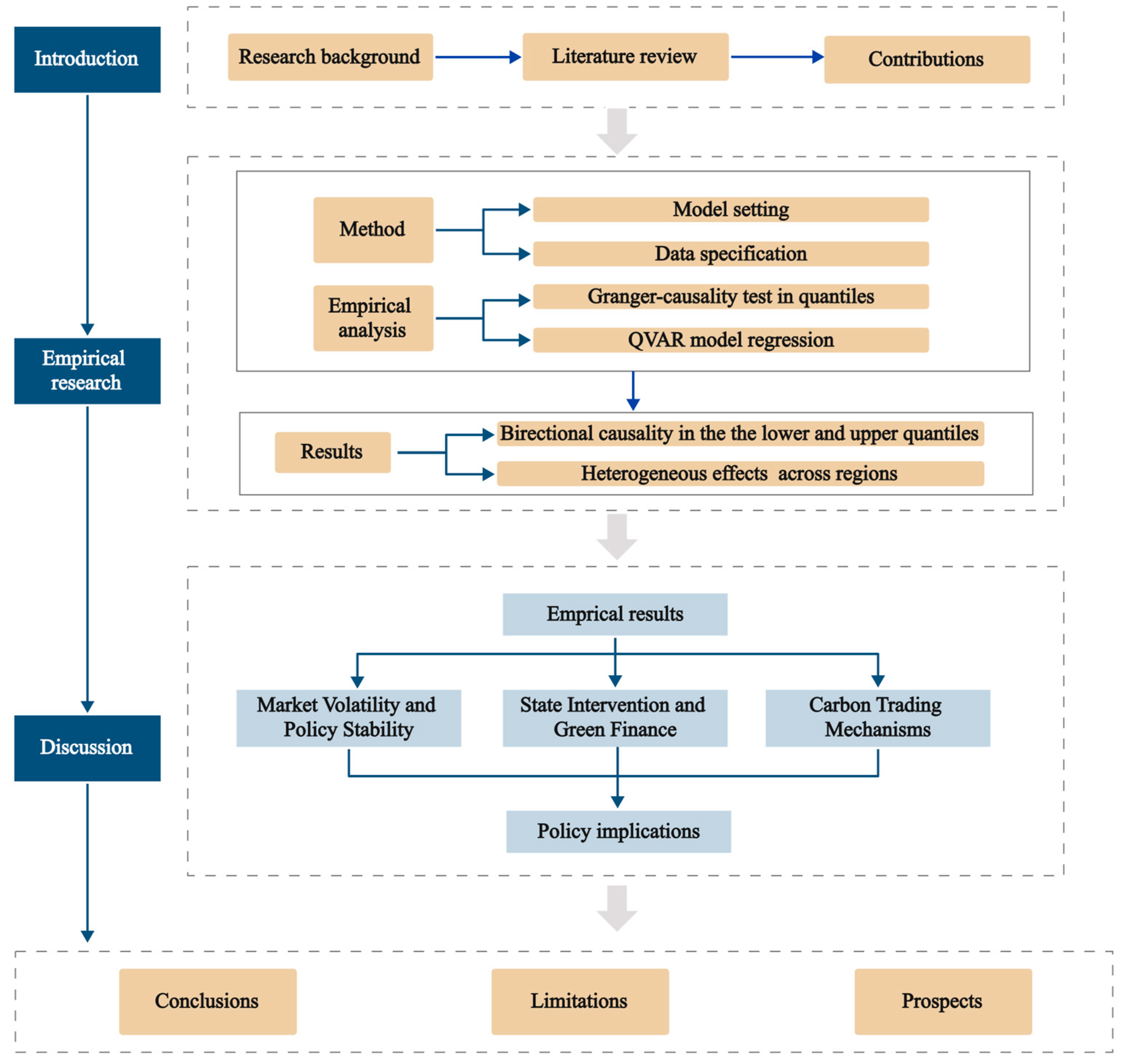

Figure 1 depicts the research framework of this study.

3. Results

This section provides a detailed explanation of the most important empirical findings that were obtained using the quantile Granger-causality paradigm. Particular attention is paid to the asymmetry and geographical patterns that exist between the carbon price and clean energy stock indexes. Specifically, at extreme quantiles, the findings highlight nonlinear market interactions and suggest that there is a bidirectional causal relationship being established. During times of market volatility, carbon markets have a negative influence on clean energy equities in global, European, and American markets. On the other hand, they have a favorable impact on clean energy stocks in China. According to these data, fluctuations in the price of carbon have localized implications, which necessitates the implementation of targeted policy actions. The appendix includes exhaustive statistical findings, and the ensuing section discusses the implications of these findings for a variety of stakeholders, including legislators, investors, and sustainable energy programs.

Figure 2 delineates the price and return dynamics of the European Union Allowance (EUA) in conjunction with four renewable energy indices, thereby emphasizing notable trends and volatility patterns throughout the duration of the study.

A significant observation is the substantial rise in EUA costs since 2018, reaching a peak in 2022, which reflects the increasing stringency of carbon pricing frameworks. This growing trend contrasts with the more erratic performance of clean energy indices, especially ECO, which demonstrate a fast increase followed by a substantial drop after 2021. The significant volatility in ECO pricing indicates more speculative behavior or changes in policy on clean energy projects.

Figure 2 illustrates the price and return dynamics of the EUA alongside four renewable energy indices, highlighting significant trends and volatility patterns over the study period. A notable finding is the considerable increase in EUA prices since 2018, culminating in a high in 2022, indicative of the escalating rigor of carbon pricing mechanisms.

The price levels of SPGCE, ERIXP, and CSINEI demonstrate a consistent increase, underscoring the long-term rise of clean energy investments despite temporary variations. The comparatively steadier trend of SPGCE and ERIXP indicates that European and U.S. clean energy indices are less influenced by sudden market fluctuations than ECO.

The image illustrates the diverse reactions of clean energy indices to carbon pricing dynamics, indicating that regional differences in volatility and return stability reveal differing sensitivities of different markets to carbon price movements.

The descriptive statistics of the log returns of our variables are displayed in

Table 1. We find that all the series are significantly non-normal by the application of the Jarque and Bera [

58] test. This suggests that quantile regression approach, for which the hypothesis of normality of variables is not necessary in estimation, is more applicable in our analysis. The results of the ADF test show that the log return data of target variables are significantly stationary. Therefore, we apply the price data of our variables in the following cointegration analysis and the return data, i.e., the logarithmic difference data, in our following Granger-causality study.

Next, we perform the

test of Troster [

50] in Equation (6) over 19 conditional quantiles (from

to

) to examine the causality between ΔCPt and all ΔSPGCEt, ΔERIXPt, ΔECOt, and ΔCSINEIt in each quantile. Consistent with Troster [

50] and Troster et al. [

57], we apply three quantile autoregression models with different lag settings in Equation (7) to estimate the test statistic

. The size of the subsample is set to

in which k and T are equal to 5 and 593, respectively. Therefore, the size of the subsample is 64. The detailed

p-values of the

test are presented in

Table A1,

Table A2,

Table A3 and

Table A4 (see

Appendix A). In addition, in order to ensure the robustness of the results, we also employ the

test through the other specifications of the subsample size and changing the empirical sample period. Considering a large surplus of EUAs occurred due to the absence of reliable emissions data and the economic crisis in Phase II (2008–2012) of EU ETS, the carbon pricing cannot fully reflect the real supply and demand of carbon. Therefore, we further conduct the

test after excluding the observations during 2012 (53 observations excluded). The unpresented results suggest that our following conclusions are robust to the different subsample size and sample period.

In

Table 2, we report the results of the

test for the quantile causality based on the QAR (3) model in Equation (7) between each pair of time series over the five key quantiles (

). For lower quantiles and higher quantiles

, we find that fluctuations in returns on CP Granger-cause the variations in returns on clean energy indices, and vice versa. In addition, the changes in the four clean energy indices significantly have an impact on the carbon prices at the 5% level.

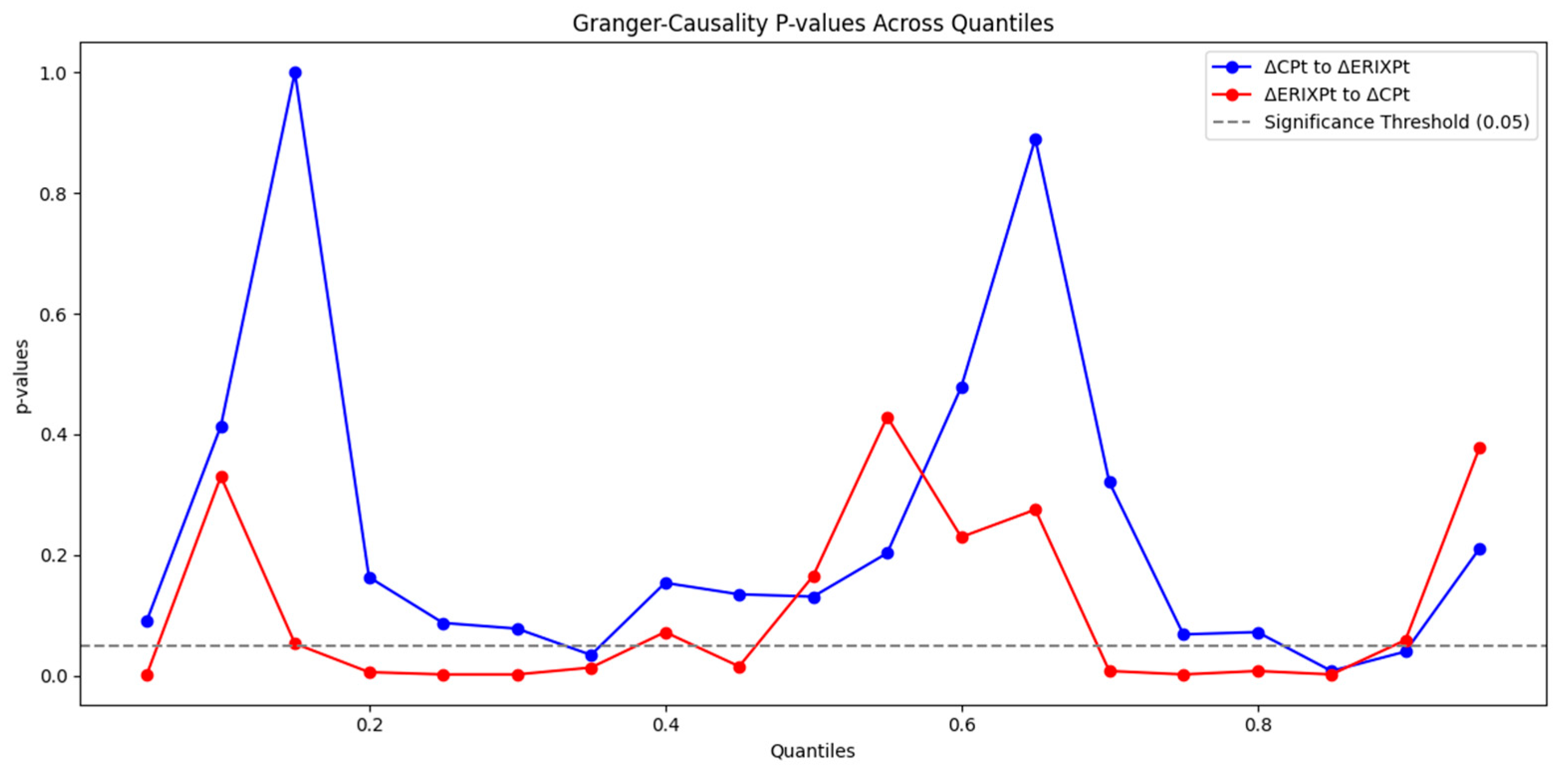

We additionally illustrate the

p-values of the test for quantile Granger-causality between carbon and four clean energy indexes.

Figure 3 illustrates the Granger-causality

p-values across quantiles for the bidirectional link between ΔCPt and ΔERIXPt. The blue line denotes the

p-values for assessing whether ΔCPt Granger-causes ΔERIXPt, whereas the red line signifies the

p-values for the inverse causality. The dashed horizontal line at 0.05 indicates the standard significance threshold. Values below this level indicate statistically significant causation at the respective quantiles. The results indicate differences in causal influence at various quantile levels, suggesting possible nonlinear dynamics in the link between the two variables. Similarly, the unprecedented data indicate that nonlinear dynamics exist in the causal relationships between quantiles among CP, SPGCE, ECO, and CSINEI.

Moreover, following Troster et al. [

57], we estimate the coefficient

in Equation (8) so that we can identify the causal relations between ΔCP

t and all ΔSPGCE

t, ΔERIXP

t, ΔECO

t, and ΔCSINEI

t. The estimated value of coefficient

for each conditional quantile is presented in

Table 3 and

Table 4. To ensure brevity and readability, we only present the regression coefficients for the key quantiles

in the main text. The estimates coefficients for all the 19 quantiles of the distribution are provided in the

Appendix A.2.

Table 3 reports the signs of the causality from carbon prices to four clean energy indices (i.e., SPGCE, ERIXP, ECO, and CSINEI). Significantly, the results vary with the indices. For the tail causal relations from ΔCP

t to ΔSPGCE

t, ΔERIXP

t or ΔERIXP

t, the estimated coefficients are negative for all the equally spaced grid of 19 quantiles. Therefore, variations in carbon price returns negatively affect the variations in SPGCE, ERIXP or ECO. The results are counterintuitive and against our expectations. Generally, the rise in carbon prices directly affects the operating costs and profit models of businesses, thereby promoting the demand for clean energy and driving the performance of the clean energy industry. We argue that the negative effects of carbon prices on clean energy stock prices are most likely due to the comparative cost disadvantage and cost of production. About the former, positive fluctuations in carbon prices can make fossil fuel-based energy sources relatively more expensive compared to cleaner alternatives. However, on the one hand, clean energy technologies are still in various stages of development and deployment, and their costs remain relatively higher than traditional energy sources in some cases. On the other hand, in the short run, it is difficult for traditional companies to adjust their energy structure, which makes their demand for traditional energy sources inelastic. As a result, clean energy companies may face challenges in competing with fossil fuel-based companies that can pass on the increased cost burden to consumers. As for the latter, rising carbon prices impact the usage cost of other commodities, such as natural gas or coal, which are often required by clean energy companies to carry out production activities. Therefore, a rise in commodity prices can influence the profitability of clean energy companies and affect investor perceptions of their financial viability.

When focusing on the Granger-causality from ΔCPt to ΔCSINEIt, the estimated coefficients are positive for all the quantiles of the conditional distribution, which indicate that carbon price has a positive effect on CSINEI. Thus, sufficiently large carbon shocks positively affect the variations in CSINEI. The results conform to the expectations. As discussed already, rising carbon prices cause traditional energy sources to become more costly. By contrast, fewer or no carbon emissions are produced by clean energy sources such hydroelectric power, solar, and wind. As a result, their relative cost competitiveness rises, which boosts demand and drives higher stock prices for businesses engaged in clean energy generation.

Initially, policy frameworks, market dynamics, and the makeup of the energy sector in every location affect how variations in carbon prices affect the worldwide, European, U.S., and Chinese clean energy markets. One important consideration is China’s different approach to renewable energy policies and carbon pricing than those of industrialized nations. China has implemented a range of initiatives to support clean energy development, including ambitious renewable energy targets. The government’s strong commitment to clean energy has fostered a favorable policy environment, boosting investor confidence and generating positive market sentiment. In contrast, the United States has a more fragmented policy landscape, with varying levels of clean energy support at the federal and state levels. Inconsistent regulatory incentives and a lack of a single federal carbon pricing mechanism have reduced investor confidence in the U.S. clean energy sector. These variations in policy support systems and regulatory strategies help to explain why changes in the carbon price have diverse effects on clean energy stock values in various areas.

Second, the dynamics of renewable energy marketplaces in China, Europe, and the United States vary considerably, influencing the effects of carbon price variations on stock prices. The clean energy business in China has undergone swift growth, propelled by significant government investments, favorable regulatory frameworks, and a sizable domestic market. These considerations have drawn significant capital inflows, cultivating a vigorous and swiftly expanding market for clean energy equities. Conversely, although the renewable energy sector in the United States and Europe has had significant development, these markets are more developed and intensely competitive. Both in Europe and the United States, the renewable energy industries have a diverse range of well-known businesses and upstart companies, each showing varying degrees of financial stability. Therefore, the effect of carbon prices on clean energy stock performance in these markets is more complex since market reactions are much influenced by company-specific elements.

At last, the makeup of the energy sector differs greatly between China and Western nations, which shapes how carbon pricing affects markets for clean energy. China still mostly depends on coal for generation of electricity; hence, carbon pricing becomes more important in guiding the change towards greener energy sources. Investors expect a move towards renewable alternatives as growing carbon costs raise the cost of coal-based electricity; hence, driving more demand for clean energy equities. By comparison, coal plays quite a small role in the energy mix in the United States and the European Union; natural gas and renewable energy make up a larger share here. Consequently, as the shift toward lower-carbon energy sources is already more advanced and incorporated into market systems, the effect of carbon pricing on clean energy stock performance in these markets is rather less marked.

Table 4 reports the sign of the causality from four clean energy indices to carbon prices. In the following analysis, we focus on the signs of the Granger-causality of the tails of the distribution

because the causality from ΔSPGCE

t, ΔERIXP

t, ΔECO

t or ΔCSINEI

t to ΔCP

t are significant at 5% level over these three quantiles according to the

test. From ΔSPGCE

t to ΔCP

t, the estimated coefficients are negative at the 25th percentiles, and positive for

(the estimate values are small, however). From ΔERIXP

t to ΔCP

t, the estimated coefficients are negative except for

; from ΔECO

t to ΔCP

t, the estimated coefficients are positive for all the five quantiles; from ΔCSINEI

t to ΔCP

t, the estimated coefficients are positive except for

, but their values are small.

The empirical results show a direct causal link between carbon markets and clean energy stocks at the tails of the conditional distribution. However, at the median quantile of the distribution (in the periods of the low market volatility), our quantile-based causality analysis suggests that the causal influence of carbon prices on clean energy stocks is not significant. To be specific, our empirical results show that the signs of the Granger-causality running from carbon markets to clean energy stocks are country- or region-specific. There are negative effects of carbon markets on global, European and U.S. clean energy stock prices but positive effects of that on China clean energy stocks (SPGCE, ERIXP, ECO and CSINEI are global, European, US and China clean energy indices, respectively) under bullish or bearish market conditions. Therefore, we call on policymakers in different countries or regions to implement differentiated carbon and clean energy policies. However, we do not find clear signs of the causal relations from clean energy stocks to carbon prices. Our findings imply that the clean energy indices can act as the hedging assets of carbon when in bullish or bearish market conditions and can also act as diversifiers of carbon under normal market conditions.

5. Conclusions

This study provides new insights into the dynamic relationship between carbon markets and clean energy stocks, emphasizing nonlinear dependencies and region-specific effects. By employing a quantile Granger-causality framework, we reveal that causal linkages are strongest in extreme market conditions, while remaining insignificant at the median. The findings underscore the critical role of market structures, policy interventions, and financial mechanisms in shaping the effectiveness of carbon pricing on clean energy investments. Beyond identifying causal dynamics, this study highlights key policy considerations. In Western markets, carbon price volatility introduces investment uncertainty, necessitating stabilization mechanisms to ensure a predictable policy environment. In contrast, China’s state-driven approach to green finance mitigates these risks, allowing carbon pricing to function as an investment signal rather than a cost burden. These distinctions emphasize the need for regionally tailored carbon and clean energy policies to promote sustainable energy transitions.

However, there are still some limitations of this study. First, this study does not consider the Granger-causality in quantiles between fossil energy, carbon, and clean energy markets, as the fluctuations in conventional energy prices have an impact on the carbon and clean energy markets. Second, we do not empirically investigate the effects of macroeconomic factors such as economic policy uncertainty and geopolitical risks on the carbon–clean energy nexus. Therefore, future research can be extended from the above two directions. Future research should explore additional macroeconomic factors influencing the carbon–clean energy nexus, such as economic policy uncertainty, interest rate policies, geopolitical risks, and energy transition commitments. Additionally, expanding the analysis to firm-level ESG data and sector-specific carbon pricing effects could further refine our understanding of how carbon markets drive investment behavior. Furthermore, integrating green financial innovations, such as blockchain-based carbon trading and sustainability-linked bonds, into empirical models could provide a more comprehensive assessment of financial instruments in stabilizing clean energy investment.

By deepening the understanding of quantile-specific and region-specific interactions, this study contributes to the broader literature on climate finance and sustainable investment strategies, offering valuable implications for investors, policymakers, and researchers navigating the evolving carbon market landscape.