The Peer Effects of Green Management Innovation in China’s Listed Companies

Abstract

1. Introduction

2. Literature Review and Hypothesis

2.1. Literature Review

2.1.1. Peer Effect

2.1.2. The Impact of Green Management Innovation

2.2. Research Hypotheses

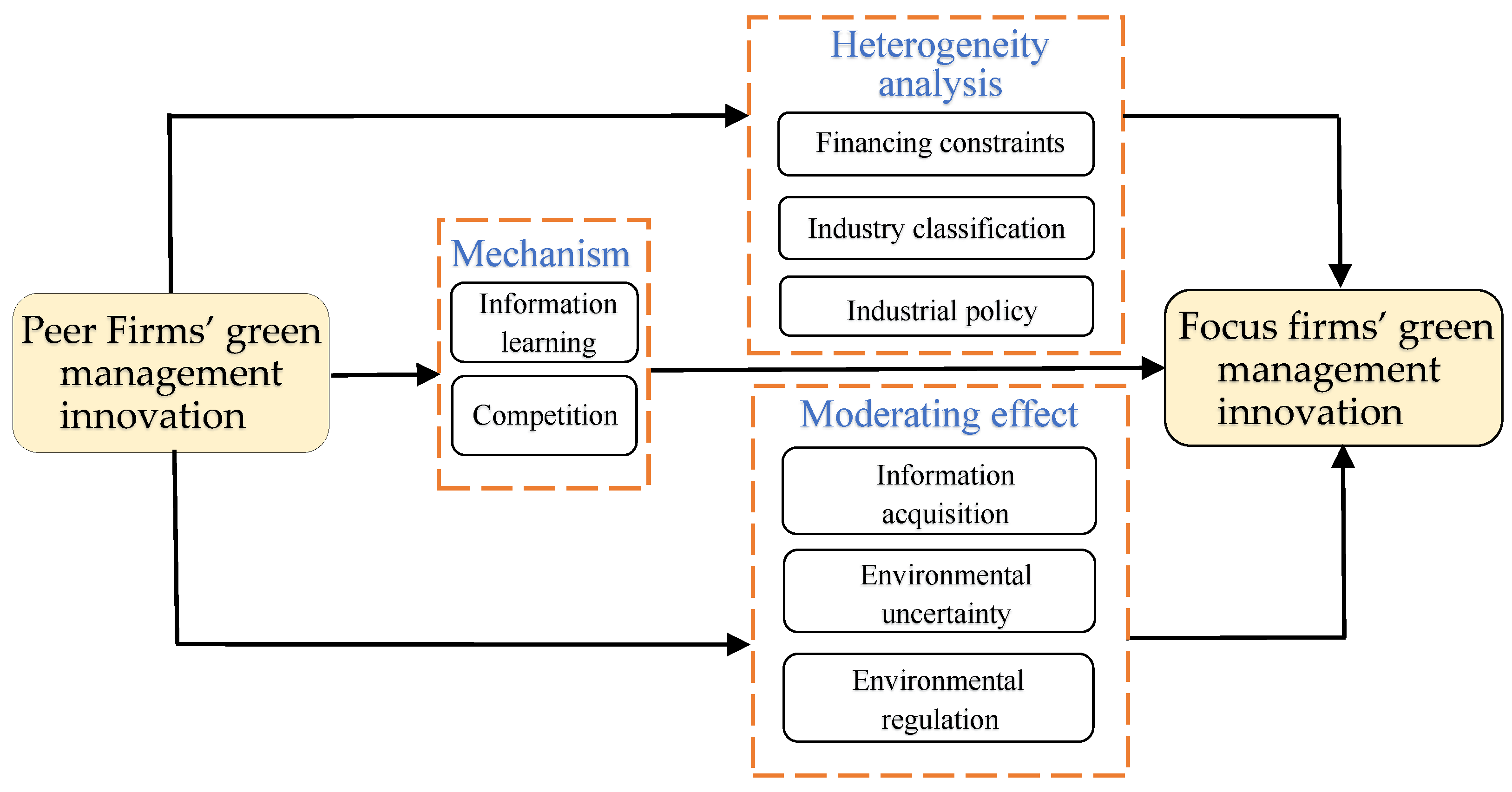

2.2.1. Peer Effects of Green Management Innovation

2.2.2. Information Learning Mechanism of Green Management Innovation Peer Effects

2.2.3. Competitive Mechanism of Green Management Innovation Peer Effects

3. Research Design

3.1. Data Source and Sample

3.2. Measures

3.2.1. Green Management Innovation

3.2.2. Green Management Innovation of Peer Firms

3.2.3. Control Variables

3.3. Model Specification

4. Empirical Results and Analysis

4.1. Descriptive Statistical Analysis

4.2. Basic Regression Results

4.3. Endogeneity Test

4.3.1. Explanatory Variable with One-Period Lag

4.3.2. Propensity Score Matching Test

4.3.3. Instrumental Variable Method

4.4. Robustness Testing

4.4.1. Changing the Regression Model

4.4.2. Changing the Sample Period

4.5. Mechanism Analysis

4.6. Moderating Effect Analysis

4.6.1. Moderating Effect of Information Acquisition

4.6.2. Moderating Effect of Environmental Uncertainty

4.6.3. Moderating Effect of Environmental Regulation

4.7. Heterogeneity Analysis

4.7.1. Grouping Study Based on Financing Constraints

4.7.2. Grouping Study Based on Industry Classification

4.7.3. Grouping Study Based on Industrial Policy

5. Conclusions and Implications

5.1. Conclusions and Discussion

5.2. Inspiration and Suggestions

5.3. Research Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, S.; Zhao, S.; Shao, D.; Liu, H. Impact of government subsidies on manufacturing innovation in China: The moderating role of political connections and investor attention. Sustainability 2020, 12, 7740. [Google Scholar] [CrossRef]

- Huang, M.; Li, M.; Liao, Z. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2021, 278, 123634. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Rennings, K.; Ziegler, A.; Ankele, K.; Hoffmann, E. The influence of different characteristics of the EU environmental management and auditing scheme on technical environmental innovations and economic performance. Ecol. Econ. 2006, 57, 45–59. [Google Scholar] [CrossRef]

- Rennings, K.; Rammer, C. The impact of regulation-driven environmental innovation on innovation success and firm performance. Ind. Innov. 2011, 18, 255–283. [Google Scholar] [CrossRef]

- Leary, M.T.; Roberts, M.R. Do peer firms affect corporate financial policy? J. Financ. 2014, 69, 139–178. [Google Scholar] [CrossRef]

- Manski, C.F. Economic analysis of social interactions. J. Econ. Perspect. 2000, 14, 115–136. [Google Scholar] [CrossRef]

- Zhang, H.; Feng, Y.; Wang, Y.; Ni, J. Peer effects in corporate financialization: The role of Fintech in financial decision making. Int. Rev. Financ. Anal. 2024, 94, 103267. [Google Scholar] [CrossRef]

- Chen, S.; Ma, H. Peer effects in decision-making: Evidence from corporate investment. China J. Account. Res. 2017, 10, 167–188. [Google Scholar] [CrossRef]

- Gu, Y.; Ben, S.; Lv, J. Peer effect in merger and acquisition activities and its impact on corporate sustainable development: Evidence from China. Sustainability 2022, 14, 3891. [Google Scholar] [CrossRef]

- Aghamolla, C.; Thakor, R.T. IPO peer effects. J. Financ. Econ. 2022, 144, 206–226. [Google Scholar] [CrossRef]

- Seo, H. Peer effects in corporate disclosure decisions. J. Account. Econ. 2021, 71, 101364. [Google Scholar]

- Wang, J.; Wu, G.; Huang, X.; Sun, D.; Song, Z. Peer effects of corporate product quality information disclosure: Learning and competition. J. Int. Financ. Mark. Inst. Money 2023, 88, 101824. [Google Scholar]

- Zhong, T.; Zhang, T. “Peer effects” in capital structure decision of Chinese firms-empirical investigation based on Chinese a-share listed firms. Nankai Bus. Rev. Int. 2018, 9, 289–315. [Google Scholar] [CrossRef]

- Lahno, A.M.; Serra-Garcia, M. Peer effects in risk taking: Envy or conformity? J. Risk Uncertain. 2015, 50, 73–95. [Google Scholar]

- Ren, X.; Zeng, G.; Sun, X. The peer effect of digital transformation and corporate environmental performance: Empirical evidence from listed companies in China. Econ. Model. 2023, 128, 106515. [Google Scholar]

- Zhang, X.; Du, X. Industry and Regional Peer Effects in Corporate Digital Transformation: The Moderating Effects of TMT Characteristics. Sustainability 2023, 15, 6003. [Google Scholar] [CrossRef]

- Yang, R.; Yang, J. Why has top executive compensation increased so much in China: A explanation of peer-effects. Pac. Econ. Rev. 2009, 14, 705–716. [Google Scholar] [CrossRef]

- Smith, S.; Windmeijer, F.; Wright, E. Peer effects in charitable giving: Evidence from the (running) field. Econ. J. 2015, 125, 1053–1071. [Google Scholar]

- Wan, L.; Liang, C.; Rao, J. Industry peer effect in M&A decisions of China’s listed companies. Nankai Bus. Rev. 2016, 19, 40–50. [Google Scholar]

- Gao, Y.; Cai, C.; Cai, Y. Regional peer effects of corporate tax avoidance. Front. Psychol. 2021, 12, 744371. [Google Scholar]

- Li, C.; Wang, X. Local peer effects of corporate social responsibility. J. Corp. Financ. 2022, 73, 102187. [Google Scholar]

- Yang, X.; Li, F.; Liu, Y. Industry and Regional Peer Effects on Company Innovation: An Empirical Study from Listed Companies in China. Financ. Res. Lett. 2024, 67, 105719. [Google Scholar]

- Wang, J.; Zhao, L.; Zhu, R. Peer effect on green innovation: Evidence from 782 manufacturing firms in China. J. Clean. Prod. 2022, 380, 134923. [Google Scholar]

- Yi, Y.; Zeng, S.; Chen, H. Benchmarking effect: How information accessibility affects focal firms’ imitation of successful peers’ green innovation. IEEE Trans. Eng. Manag. 2023, 71, 8979–8989. [Google Scholar]

- Wu, X.; Li, Y.; Feng, C. Green innovation peer effects in common institutional ownership networks. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 641–660. [Google Scholar]

- Xu, R.; He, C.; Li, Y.; Kong, L. Peer effects of corporate green innovation: Evidence from China’s listed firms. Financ. Res. Lett. 2024, 61, 105025. [Google Scholar]

- Ma, Y.; Hou, G.; Yin, Q.; Xin, B.; Pan, Y. The sources of green management innovation: Does internal efficiency demand pull or external knowledge supply push? J. Clean. Prod. 2018, 202, 582–590. [Google Scholar] [CrossRef]

- Sun, B.; Cong, J.; Tian, S. The influence mechanism of environmental regulation on enterprise green innovation: Dual adjustment based on strategic flexibility and regional differences. Sci. Technol. Prog. Policy 2022, 39, 94–102. [Google Scholar]

- Han, C.; Gao, S. Institutional Support, Strategic Flexibility, and Corporation Green Management. West Forum Econ. Manag. 2019, 30, 64–70. [Google Scholar]

- Wang, C.; Qiu, J.; Chen, B.; Deng, X. Green finance, green culture and corporate green management innovation: Evidence from Chinese listed companies. Financ. Res. Lett. 2024, 67, 105774. [Google Scholar] [CrossRef]

- Xi, L.; Zhao, H. Senior executive dual environmental cognition, green innovation and enterprise sustainable development performance. Bus. Manag. J. 2022, 44, 139–158. [Google Scholar]

- Bo, H.; Li, T.; Sun, Y. Board attributes and herding in corporate investment: Evidence from Chinese-listed firms. Eur. J. Financ. 2016, 22, 432–462. [Google Scholar] [CrossRef]

- Bikhchandani, S.; Huang, C.-F. The economics of treasury securities markets. J. Econ. Perspect. 1993, 7, 117–134. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 2018, 176, 110–118. [Google Scholar] [CrossRef]

- Dodgson, M. Organizational learning: A review of some literatures. Organ. Stud. 1993, 14, 375–394. [Google Scholar] [CrossRef]

- Bikhchandani, S.; Hirshleifer, D.; Welch, I. Learning from the behavior of others: Conformity, fads, and informational cascades. J. Econ. Perspect. 1998, 12, 151–170. [Google Scholar] [CrossRef]

- Smallwood, D.E.; Conlisk, J. Product quality in markets where consumers are imperfectly informed. Q. J. Econ. 1979, 93, 1–23. [Google Scholar] [CrossRef]

- Gimeno, J.; Hoskisson, R.E.; Beal, B.D.; Wan, W.P. Explaining the clustering of international expansion moves: A critical test in the US telecommunications industry. Acad. Manag. J. 2005, 48, 297–319. [Google Scholar] [CrossRef]

- Abbas, J.; Sağsan, M. Impact of knowledge management practices on green innovation and corporate sustainable development: A structural analysis. J. Clean. Prod. 2019, 229, 611–620. [Google Scholar] [CrossRef]

- Li, W.; Zhang, Y.; Zheng, M.; Li, X.; Cui, G.; Li, H. Research on green governance and evaluation of Chinese listed companies. J. Manag. World 2019, 35, 126–133. [Google Scholar]

- Zhao, X.; Zhao, Y.; Zeng, S.; Zhang, S. Corporate behavior and competitiveness: Impact of environmental regulation on Chinese firms. J. Clean. Prod. 2015, 86, 311–322. [Google Scholar] [CrossRef]

- ISO14001. Available online: https://www.iso.org/iso-14001-environmental-management.html (accessed on 20 June 2023).

- ISO9001. Available online: https://www.iso.org/iso-9001-quality-management.html (accessed on 20 June 2023).

- Wang, Y.; He, Y. Environmental regulations, relocation of heavy polluting enterprises and collaborative governance effect: Evidence based on the establishment of subsidiaries in different places. Econ. Sci. (Jingji Kexue) 2021, 5, 130–145. [Google Scholar]

- Lu, R.; Wang, C.; Deng, M. Peer effect in capital structure of China’s listed firms. Bus. Manag. J. 2017, 39, 181–194. [Google Scholar]

- Peress, J. Product market competition, insider trading, and stock market efficiency. J. Financ. 2010, 65, 1–43. [Google Scholar] [CrossRef]

- Wu, N.; Bai, Y.; An, Y. Active imitation or passive reaction: Research on the peer effect on trade credit. Nankai Bus. Rev. Int. 2023, 14, 505–531. [Google Scholar] [CrossRef]

- Hens, T.; Schenk-Hoppé, K.R. Handbook of Financial Markets: Dynamics and Evolution; Elsevier: Amsterdam, The Netherlands, 2009. [Google Scholar]

- Li, W.; Qi, L.; Ding, Z. Listen broadly or not? The information effect of funds network on investment efficiency. Bus. Manag. J. 2017, 39, 44–61. [Google Scholar]

- Koch, A.; Panayides, M.; Thomas, S. Common ownership and competition in product markets. J. Financ. Econ. 2021, 139, 109–137. [Google Scholar] [CrossRef]

- He, J.; Huang, J. Product market competition in a world of cross-ownership: Evidence from institutional blockholdings. Rev. Financ. Stud. 2017, 30, 2674–2718. [Google Scholar] [CrossRef]

- Du, Y.; Liu, T. Research on the Peer Effect of Corporate Financialization Based on Interlocking Director Network. Financ. Econ. 2021, 4, 11–27. [Google Scholar]

- Niu, J.; Zhao, J. Information cost, environmental uncertainty and independent directors’ premium. Nankai Bus. Rev. 2012, 2, 70–80. [Google Scholar]

- Azimli, A. The impact of climate policy uncertainty on firm value: Does corporate social responsibility engagement matter? Financ. Res. Lett. 2023, 51, 103456. [Google Scholar] [CrossRef]

- Chen, J.; Wang, X.; Peng, X. Environment uncertainty, customer concentration and cost of equity capital. Account. Res. 2016, 11, 76–82. [Google Scholar]

- Lin, Z.; Zheng, J.; Bu, J. Environmental uncertainty, diversification and Capital cost. Account. Res. 2015, 2, 36–43. [Google Scholar]

- Foucault, T.; Fresard, L. Learning from peers’ stock prices and corporate investment. J. Financ. Econ. 2014, 111, 554–577. [Google Scholar] [CrossRef]

- Ghosh, D.; Olsen, L. Environmental uncertainty and managers’ use of discretionary accruals. Account. Organ. Soc. 2009, 34, 188–205. [Google Scholar] [CrossRef]

- Shen, H. The effect of environment uncertainty on earnings management. Audit. Res. 2010, 1, 89–96. [Google Scholar]

- Porter, M. America’s green strategy. Sci. Am. 1991, 264, 168. [Google Scholar] [CrossRef]

- Porter, M.; Van der Linde, C. Green and competitive: Ending the stalemate. Dyn. Eco-Effic. Econ. Environ. Regul. Compet. Advant. 1995, 33, 120–134. [Google Scholar]

- Peng, H.; Shen, N.; Ying, H.; Wang, Q. Can environmental regulation directly promote green innovation behavior?—Based on situation of industrial agglomeration. J. Clean. Prod. 2021, 314, 128044. [Google Scholar] [CrossRef]

- Liu, C.; Pan, H.; Li, P.; Feng, Y. Impact and mechanism of digital transformation on the green innovation efficiency of manufacturing enterprises in China. China Soft Sci. 2023, 4, 121–129. [Google Scholar]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Ju, X.; Lu, D.; Yu, Y. Financing constraints, working capital management and the persistence of firm innovation. Econ. Res. J. 2013, 1, 4–16. [Google Scholar]

- Tang, G.; Li, L.; Wu, D. Environmental regulation, industry attributes and corporate environmental investment. Account. Res 2013, 6, 83–89+96. [Google Scholar]

- Pan, A.-L.; Liu, X.; Qiu, J.-L.; Shen, Y. Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. China Ind. Econ. 2019, 2, 174–192. [Google Scholar]

- Farla, K. Institutions and financial deepening. Rev. Econ. Inst. 2014, 5, 28. [Google Scholar] [CrossRef]

- Zhou, B.; Zhao, S. Industrial policy and corporate investment efficiency. J. Asian Econ. 2022, 78, 101406. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, H.; Mbanyele, W.; Wei, Z.; Li, X. How does green industrial policy affect corporate green innovation? Evidence from the green factory identification in China. Energy Econ. 2025, 141, 108047. [Google Scholar] [CrossRef]

- Guo, F.; Ma, R.; Xie, X. Industrial Policy, Business Environment, and Enterprises Shifting from Virtual to Real: Empirical Evidence Based on the National “Five-Year Plan”. J. Financ. Econ. 2022, 48, 33–46. [Google Scholar]

| Variable Type | Variable Name | Variable Symbol | Measurement of Variable |

|---|---|---|---|

| Interpreted variable | Green management innovation of object firms | CGM | Natural logarithm of (five indicators of green management innovation for the object firms add up +1) |

| Explanatory variable | Green management innovation of peer firms | PGM | Natural logarithm of (the average sum of five indicators of green management innovation of other firms in the same industry and year as the object firms +1) |

| Control variables | Firm size | Size | Natural logarithm of (the total assets +1) |

| Asset–liability ratio | Lev | Total liability/Total assets | |

| Return on total assets | Roa | Net profit/Total assets | |

| Cash flow | Cashflow | Net cash flow from operating activities/Total assets | |

| Size of the board of directors | Board | Natural logarithm of the board member count | |

| Dual role | Dual | The board chairman and general manager equal 1; otherwise, 0 | |

| Largest shareholder shareholding | Top1 | The proportion of the largest shareholder | |

| Company value | TobinQ | (Market value of circulating shares + number of non-circulating shares × net asset value per share + book value of liabilities)/period | |

| Corporate age | ListAge | Natural logarithm of firm listing time | |

| Firm dummy variable | Firm FE | Firm fixed effects | |

| Year dummy variable | Year FE | Year fixed effects |

| Variable | Obs | Mean | Std.Dev. | Min | Median | Max |

|---|---|---|---|---|---|---|

| CGM | 34,026 | 0.564 | 0.574 | 0.000 | 0.693 | 1.792 |

| PGM | 34,026 | 0.712 | 0.202 | 0.201 | 0.736 | 1.124 |

| Size | 34,026 | 22.218 | 1.299 | 19.922 | 22.022 | 26.276 |

| Lev | 34,026 | 0.413 | 0.205 | 0.053 | 0.403 | 0.896 |

| ROA | 34,026 | 0.042 | 0.066 | −0.232 | 0.040 | 0.224 |

| Cashflow | 34,026 | 0.048 | 0.068 | −0.152 | 0.047 | 0.242 |

| TobinQ | 34,026 | 2.012 | 1.287 | 0.841 | 1.596 | 8.514 |

| ListAge | 34,026 | 2.027 | 0.958 | 0.000 | 2.197 | 3.367 |

| Board | 34,026 | 2.114 | 0.196 | 1.609 | 2.197 | 2.639 |

| Dual | 34,026 | 0.301 | 0.459 | 0.000 | 0.000 | 1.000 |

| Top1 | 34,026 | 0.339 | 0.148 | 0.084 | 0.317 | 0.742 |

| Variable | (1) | (2) |

|---|---|---|

| CGM | ||

| PGM | 0.276 *** | 0.267 *** |

| (6.269) | (6.140) | |

| Size | 0.084 *** | |

| (8.516) | ||

| Lev | −0.007 | |

| (−0.207) | ||

| ROA | 0.051 | |

| (0.877) | ||

| Cashflow | −0.000 | |

| (−0.006) | ||

| TobinQ | 0.007 ** | |

| (2.018) | ||

| ListAge | 0.004 | |

| (0.383) | ||

| Board | −0.054 * | |

| (−1.948) | ||

| Dual | −0.004 | |

| (−0.435) | ||

| Top1 | 0.072 | |

| (1.162) | ||

| _cons | 0.367 *** | −1.429 *** |

| (11.769) | (−6.522) | |

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| F | 39.302 | 13.553 |

| adj_R2 | 0.557 | 0.560 |

| N | 33,597 | 33,597 |

| Variable | (1) | (2) |

|---|---|---|

| CGM | ||

| PGM (One-Period Lag) | 0.171 *** | 0.173 *** |

| (3.872) | (3.956) | |

| Size | 0.083 *** | |

| (7.808) | ||

| Lev | 0.024 | |

| (0.665) | ||

| ROA | 0.055 | |

| (0.919) | ||

| Cashflow | 0.038 | |

| (0.787) | ||

| TobinQ | 0.016 *** | |

| (4.381) | ||

| ListAge | −0.035 *** | |

| (−2.723) | ||

| Board | −0.048 | |

| (−1.615) | ||

| Dual | 0.005 | |

| (0.517) | ||

| Top1 | 0.053 | |

| (0.812) | ||

| _cons | 0.450 *** | −1.284 *** |

| (14.895) | (−5.440) | |

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| F | 14.994 | 10.080 |

| adj_R2 | 0.565 | 0.567 |

| N | 28,587 | 28,587 |

| Variable | (1) | (2) |

|---|---|---|

| CGM | ||

| PGM | 0.274 *** | 0.266 *** |

| (6.244) | (6.114) | |

| Size | 0.084 *** | |

| (8.542) | ||

| Lev | −0.009 | |

| (−0.267) | ||

| ROA | 0.049 | |

| (0.853) | ||

| Cashflow | 0.002 | |

| (0.036) | ||

| TobinQ | 0.007 ** | |

| (1.987) | ||

| ListAge | 0.005 | |

| (0.408) | ||

| Board | −0.054 * | |

| (−1.940) | ||

| Dual | −0.004 | |

| (−0.430) | ||

| Top1 | 0.072 | |

| (1.162) | ||

| _cons | 0.368 *** | −1.433 *** |

| (11.801) | (−6.542) | |

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| F | 38.983 | 13.536 |

| adj_R2 | 0.557 | 0.560 |

| N | 33,594 | 33,594 |

| Variable | (1) | (2) |

|---|---|---|

| First-Stage Regression | Second-Stage Regression | |

| PGM | CGM | |

| PeerShock | −0.084 *** | |

| (−29.554) | ||

| PGM | 0.994 *** | |

| (6.944) | ||

| Size | 0.035 *** | 0.068 *** |

| (11.232) | (7.031) | |

| Lev | −0.057 *** | 0.016 |

| (−5.136) | (0.446) | |

| ROA | −0.019 | 0.055 |

| (−1.097) | (0.960) | |

| Cashflow | −0.015 | −0.001 |

| (−1.285) | (−0.024) | |

| TobinQ | −0.003 *** | 0.006 * |

| (−3.065) | (1.895) | |

| ListAge | 0.103 *** | −0.034 * |

| (40.833) | (−1.789) | |

| Board | −0.023 *** | −0.043 |

| (−2.605) | (−1.529) | |

| Dual | 0.001 | −0.004 |

| (0.213) | (−0.391) | |

| Top1 | −0.080 *** | 0.111 * |

| (−4.047) | (1.784) | |

| _cons | −1.549 *** | |

| (−7.667) | ||

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| adj_R2 | 0.359 | 0.034 |

| N | 33,597 | 33,597 |

| Unidentifiable test | 512.966 *** | |

| Weak instrumental variable test | 873.460 <16.38> | |

| Variable | (1) | (2) |

|---|---|---|

| CGM | ||

| PGM | 0.523 *** | 0.529 *** |

| (21.825) | (22.437) | |

| Size | 0.097 *** | |

| (20.447) | ||

| Lev | −0.044 ** | |

| (−1.980) | ||

| ROA | 0.048 | |

| (1.012) | ||

| Cashflow | 0.054 | |

| (1.326) | ||

| TobinQ | 0.009 *** | |

| (3.570) | ||

| ListAge | −0.038 *** | |

| (−7.311) | ||

| Board | 0.001 | |

| (0.034) | ||

| Dual | −0.001 | |

| (−0.144) | ||

| Top1 | 0.074 ** | |

| (2.433) | ||

| _cons | 0.144 *** | −1.920 *** |

| (7.858) | (−19.062) | |

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| N | 34,026 | 34,026 |

| Log likelihood | −20,406.012 | −20,145.766 |

| Chi2 | 1989.632 | 2568.124 |

| Variable | (1) | (2) |

|---|---|---|

| CGM | ||

| PGM | 0.260 *** | 0.259 *** |

| (4.722) | (4.706) | |

| Size | 0.024 | |

| (1.641) | ||

| Lev | −0.054 | |

| (−1.092) | ||

| ROA | −0.141 | |

| (−1.424) | ||

| Cashflow | 0.043 | |

| (0.684) | ||

| TobinQ | −0.015 *** | |

| (−3.278) | ||

| ListAge | 0.048 ** | |

| (2.418) | ||

| Board | −0.033 | |

| (−0.815) | ||

| Dual | −0.012 | |

| (−0.842) | ||

| Top1 | 0.073 | |

| (0.905) | ||

| _cons | 0.313 *** | −0.205 |

| (9.093) | (−0.645) | |

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| F | 22.302 | 5.304 |

| adj_R2 | 0.610 | 0.611 |

| N | 14,171 | 14,171 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Information Learning Mechanism | Competitive Mechanism | ||||

| CGM | |||||

| PGM | 0.159 *** | 0.162 *** | −0.004 | −0.009 | 0.211 *** |

| (3.331) | (3.442) | (−0.084) | (−0.186) | (4.596) | |

| PGM × DUMMYHHI | 0.083 ** (2.056) | ||||

| DUMMYHHI | −0.030 | ||||

| (−1.067) | |||||

| Size | 0.061 *** | 0.114 *** | 0.086 *** | ||

| (3.677) | (5.730) | (8.597) | |||

| Lev | 0.049 | −0.029 | −0.006 | ||

| (0.962) | (−0.405) | (−0.174) | |||

| ROA | 0.168 ** | 0.074 | 0.067 | ||

| (2.398) | (0.467) | (1.167) | |||

| Cashflow | 0.094 | −0.041 | −0.005 | ||

| (1.342) | (−0.455) | (−0.117) | |||

| TobinQ | −0.000 | 0.004 | 0.006 | ||

| (−0.031) | (0.682) | (1.642) | |||

| ListAge | −0.089 *** | 0.030 | 0.002 | ||

| (−2.923) | (1.479) | (0.199) | |||

| Board | −0.013 | −0.035 | −0.046 * | ||

| (−0.308) | (−0.595) | (−1.650) | |||

| Dual | 0.015 | −0.001 | −0.003 | ||

| (0.976) | (−0.058) | (−0.344) | |||

| Top1 | −0.128 | 0.076 | 0.075 | ||

| (−1.166) | (0.583) | (1.199) | |||

| _cons | 0.423 *** | −0.671 * | 0.568 *** | −1.973 *** | −1.457 *** |

| (15.745) | (−1.828) | (21.677) | (−4.308) | (−6.609) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| F | 11.097 | 4.792 | 0.007 | 4.505 | 11.743 |

| adj_R2 | 0.584 | 0.587 | 0.585 | 0.589 | 0.553 |

| N | 9810 | 9810 | 9615 | 9615 | 33,597 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Information Acquisition | Environmental Uncertainty | Environmental Regulation | |

| CGM | |||

| PGM | 0.254 *** | 0.232 *** | 0.221 *** |

| (5.807) | (5.108) | (4.670) | |

| COZ | −0.100 | ||

| (−1.445) | |||

| PGM × COZ | 0.215 ** | ||

| (2.378) | |||

| EU | −0.023 ** | ||

| (−2.341) | |||

| PGM × EU | 0.048 *** | ||

| (3.046) | |||

| ERI | −0.015 ** | ||

| (−1.985) | |||

| PGM × ERI | 0.026 ** | ||

| (2.573) | |||

| Size | 0.082 *** | 0.084 *** | 0.083 *** |

| (8.108) | (8.345) | (8.277) | |

| Lev | 0.001 | −0.003 | −0.002 |

| (0.024) | (−0.077) | (−0.060) | |

| ROA | 0.054 | 0.058 | 0.064 |

| (0.948) | (1.018) | (1.121) | |

| Cashflow | 0.002 | 0.003 | 0.003 |

| (0.041) | (0.063) | (0.059) | |

| TobinQ | 0.006 * | 0.007 * | 0.007 ** |

| (1.763) | (1.835) | (1.961) | |

| ListAge | 0.005 | 0.000 | 0.002 |

| (0.409) | (0.011) | (0.205) | |

| Board | −0.053 * | −0.054 ** | −0.054 ** |

| (−1.918) | (−1.965) | (−1.961) | |

| Dual | −0.005 | −0.005 | −0.005 |

| (−0.500) | (−0.493) | (−0.490) | |

| Top1 | 0.073 | 0.071 | 0.072 |

| (1.177) | (1.137) | (1.162) | |

| _cons | −1.382 *** | −1.404 *** | −1.385 *** |

| (−6.219) | (−6.336) | (−6.240) | |

| Firm FE | Yes | Yes | Firm FE |

| Year FE | Yes | Yes | Year FE |

| F | 10.701 | 11.596 | 11.073 |

| adj_R2 | 0.560 | 0.560 | 0.552 |

| N | 33,597 | 33,597 | 33,597 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| High Financing Constraints | Low Financing Constraints | Heavily Polluting Industries | Non-Heavily Polluting Industries | Industrial Policy Support | Without Industrial Policy Support | |

| CGM | ||||||

| PGM | 0.291 *** | 0.154 ** | −0.011 | 0.210 *** | 0.190 *** | 0.101 |

| (4.735) | (2.428) | (−0.096) | (4.301) | (2.645) | (1.643) | |

| Size | 0.076 *** | 0.094 *** | 0.070 *** | 0.088 *** | 0.089 *** | 0.073 *** |

| (4.968) | (6.413) | (3.054) | (7.547) | (6.058) | (4.763) | |

| Lev | −0.016 | −0.016 | −0.000 | −0.014 | 0.000 | −0.022 |

| (−0.334) | (−0.308) | (−0.005) | (−0.371) | (0.006) | (−0.467) | |

| ROA | −0.039 | 0.169 ** | 0.005 | 0.093 | 0.014 | 0.092 |

| (−0.462) | (2.097) | (0.033) | (1.467) | (0.182) | (1.136) | |

| Cashflow | 0.069 | −0.034 | −0.084 | 0.034 | 0.075 | 0.032 |

| (1.052) | (−0.556) | (−0.854) | (0.674) | (1.159) | (0.516) | |

| TobinQ | 0.001 | 0.007 | −0.010 | 0.008 ** | 0.009 ** | −0.001 |

| (0.264) | (1.360) | (−1.027) | (2.137) | (1.977) | (−0.287) | |

| ListAge | −0.015 | 0.016 | 0.052 * | −0.007 | 0.006 | 0.006 |

| (−0.711) | (1.021) | (1.887) | (−0.520) | (0.354) | (0.322) | |

| Board | 0.024 | −0.123 *** | −0.170 ** | −0.020 | −0.061 | 0.012 |

| (0.569) | (−3.345) | (−2.490) | (−0.663) | (−1.587) | (0.306) | |

| Dual | 0.016 | −0.018 | −0.025 | 0.004 | −0.003 | −0.003 |

| (1.125) | (−1.269) | (−1.024) | (0.336) | (−0.249) | (−0.177) | |

| Top1 | 0.088 | 0.051 | 0.011 | 0.133 ** | 0.025 | 0.214 ** |

| (0.942) | (0.551) | (0.075) | (1.991) | (0.273) | (2.390) | |

| _cons | −1.400 *** | −1.413 *** | −0.555 | −1.577 *** | −1.420 *** | −1.350 *** |

| (−4.171) | (−4.309) | (−1.110) | (−6.136) | (−4.356) | (−4.031) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| F | 5.689 | 7.436 | 2.778 | 9.378 | 6.006 | 4.324 |

| adj_R2 | 0.539 | 0.592 | 0.534 | 0.551 | 0.550 | 0.565 |

| N | 16,919 | 16,532 | 7376 | 26,194 | 19,926 | 12,876 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, G.; Zhu, L. The Peer Effects of Green Management Innovation in China’s Listed Companies. Sustainability 2025, 17, 2929. https://doi.org/10.3390/su17072929

Zhang G, Zhu L. The Peer Effects of Green Management Innovation in China’s Listed Companies. Sustainability. 2025; 17(7):2929. https://doi.org/10.3390/su17072929

Chicago/Turabian StyleZhang, Ge, and Lianmei Zhu. 2025. "The Peer Effects of Green Management Innovation in China’s Listed Companies" Sustainability 17, no. 7: 2929. https://doi.org/10.3390/su17072929

APA StyleZhang, G., & Zhu, L. (2025). The Peer Effects of Green Management Innovation in China’s Listed Companies. Sustainability, 17(7), 2929. https://doi.org/10.3390/su17072929