If the direct results of parameter changes caused by technological progress, institutional regulation, or other factors are equivalent, then the effects of these factors can be modeled by adjusting the parameters. In Equation (

9), both parameters

and

are associated with the distributive institutional structure. Consider a situation where adjustments in the institutional structure lead to an increased share of labor income. On the one hand, an increase in the surplus value rate implies a rise in

. On the other hand, higher wages will result in greater disposable income, thereby expanding the market size, increasing

. Parameter

is associated with the productive institutional structure in Equation (

8). An increased willingness to accumulate capital is modeled by a reduction in

As

increases, the path of improved technological innovation jumps upward, leading to breakthrough technological innovation, enhanced labor productivity, and reduced unit commodity values.

Which means one eigenvalue is negative and the other is positive. Therefore, the equilibrium solution is the saddle point and is unstable.

At this point, changes in parameters may cause a pair of complex conjugate eigenvalues to cross the imaginary axis and enter the right half-plane simultaneously, leading to a Hopf bifurcation. Bifurcation refers to the emergence of topologically unequal trajectories caused as parameters vary [

35].

Figure 1 is the correlation diagram of the technological innovation and long wave model. The intersection points of four curves including two coordinate axes in the diagram represent the equilibrium points, and the number of intersection points corresponds to the number of equilibrium solutions.

Figure 1a shows four intersections:

that is, four equilibrium solutions, while

Figure 1b shows three intersections:

, that is, three equilibrium solutions. In a third case, when the two curves do not intersect, the origin

is the only equilibrium solution.

3.1. Endogenous Technological Innovation and Economic Long Wave

According to the instability conditions of the equilibrium solution in the above model, several sufficient conditions exist for the emergence of basic innovation clusters that drive the long wave upward period and achieve economic recovery and prosperity. Due to the lack of analytical solutions for the nonlinear dynamic model in this paper, only numerical simulation analysis can be conducted, focusing on the impact of economic crises and market expansion on technological innovation. The values of the economically meaningful parameters in stages will be determined as follows: (a) with other parameters undetermined, the market scale can be any positive number, which can be set to 2; (b) since the upper bound of the effective capacity utilization rate is 100%, is set to 1; (c) under the condition of zero effective capacity, when the surplus market scale increases from zero to half of the potential market scale, its growth rate reduces from 100% to 50% in the process, so is set to 1; (d) when the capacity utilization rate reaches 100% and the productivity level reaches its maximum, the growth rate of new products is . Under this most favorable production condition, an actual output annual growth rate of 50% is assumed, it is assumed that the limit of improved technological innovation is to double labor productivity, therefore , and it is assumed that, under the most unfavorable technological conditions, new products can be produced precisely when the capacity utilization rate is 100%, so . Combining these assumptions, are obtained; (e) using the previously determined parameters, , are obtained; (f) assuming the initial value of and , it is easy to prove that . If , then when takes values of 0.5, 0.6, and 0.7, the capacity utilization rates are 80%, 77%, and 74%, respectively, and the differences are not significant and acceptable. We might as well set . (g) when takes values of 3, 4, and 5, and the capacity utilization rates are 65%, 62%, and 60%, respectively, with little difference and which are acceptable. If the value is too small, the improved technological innovation is not obvious, and the difficulty of developing new technological products is relatively high. Therefore, we can make . The typical parameter values of the model can be set to , , , .

Under these parameters, we can verify that: (a) if the initial value of effective production capacity is zero, then the phase trajectory will converge to the equilibrium point , meaning that the effective production capacity is zero; (b) if the initial value of effective production capacity is sufficiently large, the phase trajectory will converge to a stable equilibrium solution. These characteristics align with reality and are of methodological significance, as the development of new technology products is not achieved overnight and requires a series of conditions. Moreover, these characteristics enable exploration of the conditions for new technological development and the institutional causes of economic cycles and crises.

The historical experience of capitalist economy shows that basic innovations often emerge during crises and depressions of economic long waves. How can this phenomenon be explained? Mensch, Van Duijn, and Perez [

18,

19,

23] of the neo-Schumpeter school all attribute the motivation for basic innovation to the subjective psychological factors of capitalists. Crisis has lowered the standards for capitalists to adopt new technologies because the average profit margin during the crisis period is unbearable, and the new technologies could be adopted even if they can only achieve a low level of normal profit margin. However, an important objective factor that led to the basic innovation during the recession was overlooked by them. As is well known, the emergence of innovation clusters relies on large-scale fixed capital investment, especially the fundamental infrastructure investment that serves the entire production and circulation process. The economic depression is accompanied by various specific forms of capital surplus, resulting in the depreciation of existing capital, that is, the loss of the value of capital. Among them, the depreciation of fixed capital itself is a factor that increases profit margins, thus providing a strong objective driving force for the emergence of basic innovation.

Based on this model, the economic recession lowers the standards for capitalists to adopt new technologies, which can be represented by a decrease in the parameter

. Moreover, the capital depreciation further reduces the unit commodity value under the new technologies, also reflected as a decrease in the parameter

. Therefore, we characterize the specific mechanism of depression leading to the basic innovation through the bifurcation caused by variations in the parameter

.

Figure 2a,b show the bifurcation diagram and output change diagram of the basic innovation caused by the depression, respectively. The dot-dashed lines in the bifurcation diagram represent unstable steady states, and the maximum and minimum values of the limit cycle correspond to the extremes of the periodic solution. Points

are bifurcation points. At the initial stage (

), before the crisis and depression phase of the economic long wave, the material conditions for the basic innovation have already matured. However, the output under the new technologies remains at a low-level steady state

, and the value of the parameter

is located in the interval

. At this point, unless there is an appropriate industrial policy as an external driving force, a high-level stable state cannot be spontaneously achieved by private capital in a free market. However, the high-level stability of the new technologies can be achieved through a tortuous and painful way of crisis and depression. As the economic long wave enters a crisis and depression phase, the average profit margin under the old technological paradigm falls, and the fixed capital depreciates, with

gradually decreasing and falling below the bifurcation point

at time

. Subsequently, the low-level steady state loses stability, and the stable limit cycle becomes an attractor. The innovation clusters emerge and rapidly spread, leading the economic long wave into a recovery phase. After the emergence of the basic innovation, as average profit margins and the value of fixed capital gradually recover,

gradually returned to the pre-crisis levels of point

at time

, and the high-level stable steady states becomes an attractor, resulting in continued growth in output under the new technologies.

However, economic crises and depression are insufficient to trigger the emergence of innovation clusters. We know that the realization of the value of products under the new technology needs a large enough market demand. As depicted in

Figure 3, the bifurcation points are points

. Only when the surplus market scale

exceeds

can the basic innovation escape the low-level steady state, otherwise the bifurcation point

will be lower than the parameter value

under the normal economic operation conditions. Furthermore, the surplus market scale expands (

) and eventually increases to the bifurcation point

at time

. Afterwards, the low-level steady state loses stability, and the stable limit cycle becomes an attractor. The expansion of demand enhances the realized value of commodities and capital productivity, prompting capitalists to pursue improved innovation, hereby consolidating the advantages of new technologies. At time t

2,

returns to its pre-crisis level (

), and the high-level stable steady state again becomes the attractor, fostering continued output growth under the new technologies.

The above analysis explains why some innovations emerge during the crisis periods while others tend to appear during the periods of economic recovery and prosperity. It is worth noting that there is a unique dialectical relationship between basic innovation and improvement innovation. First, improvement innovation is based on basic innovation and is a further extension and development of basic innovation. Second, improved innovation introduces a lag effect in the economic dynamic system. Within a certain range, even if the average profit margin recovers to pre-crisis levels, basic innovation may still dominate, indicating that improved innovation helps consolidate the achievements of basic innovation.

3.2. Long Wave Motion and Institutional Regulation

The institutional structure is divided into two categories: distributive and productive. Here, we examine how these structures coordinate to enhance labor productivity potential and ensure the stability of economic growth, that is, how SSA is consolidated. Simultaneously, we investigate how the institutional structure regulation fails, that is, how crises and depressions occur or how SSA declines, and explore the impact of institutional structure regulation on the long wave economic cycle.

Figure 4a is the bifurcation diagram for productive institution regulation, which shows that, at the inception of SSA, the institution structure is imperfect, and the productive institution parameter

is slightly higher than

, placing the equilibrium output at a low steady state level. With the adjustment in the productive institutional structure (i.e., parameter

increases), the technological potential is gradually released. The labor productivity and the balanced output are gradually improved, and SSA tends to be perfected and consolidated. However, when the productive institutional structure adjustments continue beyond a certain degree (parameter

exceeds the Hopf bifurcation point

), economic growth begins to fluctuate dramatically, with production cyclically expanding and contracting. Unless accompanied by synchronous adjustments in the distributive institutional structure, such increased volatility may lead to periodic disruptions and wastage of productivity. This endogenous instability directly reflects the opposition between the organization of production in individual factories and the anarchy of production in the whole society. The latter is a manifestation of the internal contradictory movement between the socialization of production and capitalist private ownership. On the one hand, the productivity improves significantly; on the other hand, the outdated production relations prevent the broad social realization of these advanced productive forces, while capital accumulates excessively driven by higher private interests. Consequently, the market contracts and production becomes paralyzed, as society lacks sufficient effective demand to sustain the capitalist production system. Thus, although the adjustments in the productive institutional structure promote capital accumulation and stable economic growth, they can also impose constraints on further capital accumulation and stable economic growth when the existing institutional framework or shell cannot accommodate more advanced productive forces. According to SSA theory, when SSA is no longer effective in promoting capital accumulation, it tends to disappear due to the loss of historical inevitability and urgently needs to reform production relations or rebuild institutional structures.

Herein, we also discuss the influence of the adjustment of distributive institutional structure on long wave motion. The distributive institutional structure affects class contradictions, labor–capital relations, and income distribution. The effective adjustment

in this structure can stabilize labor–capital relations, mitigate class contradictions, and improve income distribution patterns, thereby ensuring the smooth and orderly accumulation of capital. According to the degree of response of enterprise production to changes in capital profitability and the effect of wage changes on the potential market size of innovative products, the adjustment of distributive institutional structure has different output effects. We first consider a scenario where wage income changes have an insignificant impact on the potential market size of innovative products, that is, the parameters remain almost unchanged. In this case, the role of the distributive institutional structure is primarily reflected in the parameter

(see

Figure 4b). When the structural adjustment of the distributive system is appropriate for establishing stable labor–capital relations, that is,

, the equilibrium effective production capacity reaches the maximum steady state level, which can not only fully unleash the potential of innovative technology but also avoid the economic fluctuations caused by the fundamental contradictions of capitalism. However, under the condition of individual decentralized decision making, institutional structures often deviate from this optimal configuration. With bias in the distributive institutional structure, two different long-term situations may arise. In any case, when the bias of distributive institutional structure develops to a certain extent it will produce “material means to eliminate itself”. One scenario is that the distributive institutional structure is gradually tilting towards the interests of the capital. When the distributive institutional structure is slightly biased towards enhancing the strength of the bourgeoisie (i.e.,

), due to the ineffective expansion of the potential market size, the excessive accumulation of capital hinders the long-term process of capital accumulation, and capitalist production gradually shrinks. When the institutional structure continues to focus on enhancing the power of the bourgeoisie (i.e.,

), although the capital profitability may temporarily increase, the capitalist economy ultimately contracts rapidly due to overproduction. However, in this situation, the surplus productive capacity is forcibly partially destroyed, and capitalist production enters a new cycle of expansion and decline. When the structure of the distributive system leads to excessive power of the bourgeoisie (i.e.,

), increased profitability leads to excessive capital accumulation, inflicting unprecedented damage on productivity. Once the economic system falls into crisis, society becomes moribund as productive forces and products are insufficient, helpless in the face of the absurd contradiction that producers have nothing to consume because of the lack of consumers. The adjustment of the existing institutional structure is insufficient to rescue capitalism from the quagmire of crisis. The second is that the distributive institutional structure leans towards the interests of the labor. When the institutional structure emphasizes enhancing the power of the working class

), although overproduction is avoided and production remains stable, the increase in real wages brought about by the enhancement of labor bargaining power erodes profits, and the motivation for capital accumulation decreases. When the power of the working class is too strong

), capitalism will fall into an economic crisis of profit squeeze. It is noteworthy that, in Marxist economic crisis theory, the profit-squeeze concept emerged in the 1970s [

37], positing that enhanced labor power disrupts the balance between labor and capital, which leads to the decline of capital income share, as the reason for the decline of profit rate, thus attributing economic crises to pure labor capital relations. The SSA school agrees with this theory and even believes that every cyclical economic depression between 1948 and 1973 was the result of profit squeeze under interventionism [

38].

Then, we consider another scenario where changes in wage income significantly impact the potential market size for innovative products. In this case, the role of the distributive institutional structure is reflected in the parameters

and

.

Figure 5 shows the dynamic properties of the system with different combinations of parameters

and

. In regions A and D, the attractor is point

(see

Figure 1); in region B, the attractor is point

; and in region C, the attractor is a limit cycle. According to

Figure 5, if wage changes have a minor impact on the potential market scale of innovative products, as

increases, the change in the parameter combination roughly follows the direction of the arrow

. In this case, a conclusion similar to that of the first scenario can be achieved. However, if wage changes greatly impact the potential market size of innovative products, the change in the parameter combination is roughly along the arrow

, and the role of distributive institutional adjustment is primarily reflected in

. Combined with the bifurcation diagram of parameter

, it can be found that: (a) when the wage level is lower than a certain critical value, the potential market size remains limited, and capitalism faces a crisis of insufficient effective demand, i.e., the crisis of insufficient consumption. According to the lag effect of the bifurcation, simply tilting the distributive institutional structure towards the interests of labor is insufficient to overcome the crisis. The SSA school contends that the crisis of free SSA is caused by insufficient aggregate demand due to the weak bargaining power of labor, and therefore the solution to the crisis is to enhance labor power [

22]; (b) when wage levels exceed the critical value but remain low, if the distributive institutional structure favors labor, the increase in effective demand will promote the steady accumulation of capital. At this time, the labor management relationship is in a relatively harmonious state; (c) when the distributive institutional structure further tilts towards labor, the strong effective demand may stimulate excessive capital accumulation in innovative enterprises, leading to cyclical damage to productivity; (d) when the distributive institutional structure excessively tilts towards the interests of labor, the exceptionally strong effective demand can trigger the collapse of the capitalist production system due to excessive capital accumulation. In such cases, the decline in effective production capacity results in reduced per-unit commodity value and sharply decreased capital profitability after overproduction by enterprises. The economic crisis reveals that the current institutional framework is inadequate to control the productivity gains driven by technological innovation.

In the above analysis, we discussed the different forms of capitalist economic crisis outbreak under different combinations of the impact of wage changes on the market scale of innovative products and the bias of distributive institutional structure toward capital interests. Specifically, when the impact of wage changes on the market size of innovative products is relatively low, a distributive institutional structure biased toward capital ultimately leads to an overproduction crisis, whereas a distributive institutional structure biased towards the interests of labor eventually triggers a profit-squeeze crisis.

3.3. Institutional Regulation and Social Interests

Through the study of long wave movements under institutional regulation, it has been found that only when two types of institutions are adjusted synchronously and coordinated with each other can stable and efficient economic development be realized while achieving broad social benefits. There are two discussions as follows:

Scenario 1: Wage changes have little impact on the potential market size of innovative products. In this case, an appropriate combination of institutional structure can maintain harmonious labor relations and realize broad social benefits. Assuming parameter

remains constant, for different productive institutional structures represented by the parameter

, there exists an optimal distributive institutional structure represented by parameter

that ensures that the equilibrium output under the new technology is maximized at a stable steady state, i.e., the steady state value corresponding to the parameter

in

Figure 4b or the steady state value corresponding to the Hopf bifurcation point. At this point, the relationship between the two types of institutional parameters is shown in

Figure 6. We find that, as the productive institutional structure is adjusted, the potential optimal output tends to increase as indicated by the dashed line in

Figure 6, but this optimal output can only be realized smoothly if the distributive institutional structure is adjusted correspondingly to improve the income distribution of the working class. This means that appropriate institutional structures can transform the potential of new technologies into broad social benefits.

Scenario 2: Wage changes have a significant impact on the potential market size of innovative products. When the productive institutional structure is imperfect, adjusting the distributive institutional structure to enable workers to obtain more benefits is conducive to expanding the potential market scale and promoting stable output growth. This adjustment compensates for the losses capitalists suffer from a reduced share of capital income. Based on the above study, the following policies can be suggested to help nations to achieve sustainable and efficient economic development. For instance, when the productive institutional structure is relatively well-developed, the government could levy taxes on enterprises to reduce capital profitability and avoid drastic economic fluctuations. By leveraging government public expenditure, productivity gains can be transformed into public welfare. It is worth noting that the optimal institutional structure cannot be achieved spontaneously by individual capitalists and workers. In contrast, in the neoliberal SSA, institutional adjustment tends to increase the share of capital income, which is far from the optimal institutional structure.

3.5. Robustness Discussion

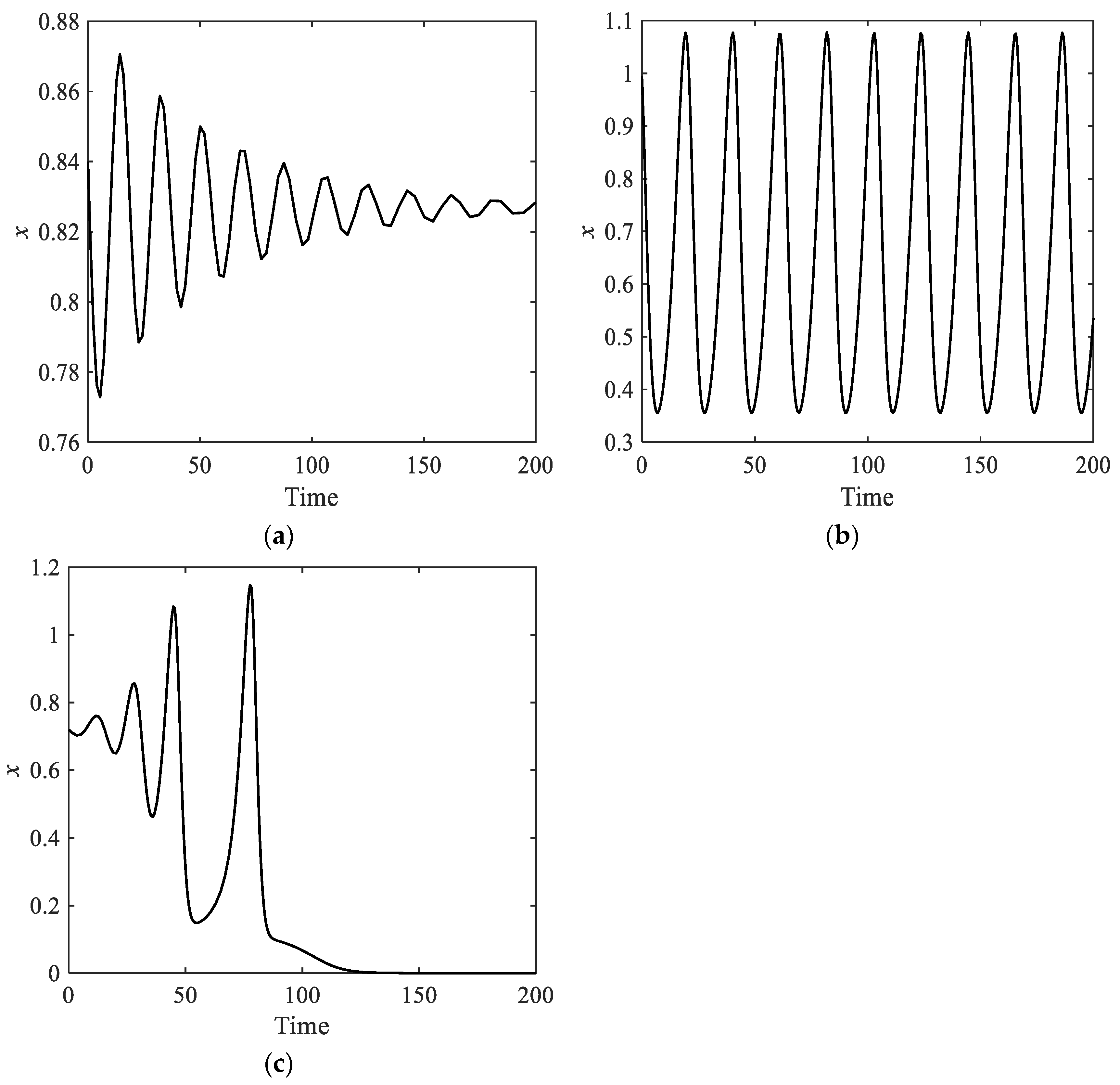

To ensure the robustness of the results, we use two different sets of parameter values as shown in

Table 1 for discussion and compare them with the original results. Due to space limitations, this paper only presents the influence of wage income changes on the potential market size of innovative products in scenarios where the impact of the distributive system on the dynamics of effective production capacity is insignificant. The results are shown in

Figure 8. The parameters for

Figure 8a,b correspond to the last two columns of

Table 1, respectively. In

Figure 8a, the initial value is at the steady state corresponding to

, we analyze two directions: (1) at the initial moment, if

rises to 3,

tends towards a lower steady state value (as indicated by

the dashed line in the 0–200th period); then, at the 200th period, if

rises further to 3.5,

tends towards the steady state value of 0 (as shown by the dashed line in the 200–300th period); (2) alternatively, at the initial time,

drops to 2.1,

approaches a lower steady state value (as shown by the solid line in the 0–100th period); then, in the 100th period,

decreases further to 1.4,

approaches a cyclical solution (as indicated by the solid line in the 100–200 period); and finally, in the 200th period,

decreases to 1,

approaches the steady state value of 0. Similarly,

Figure 8b exhibits the same dynamics, with the initial value at the steady state value corresponding to

, rising sequentially to 1.75 and 2 in the first direction, and decreasing sequentially to 1.15, 0.9, and 0.5 in the second direction. The dynamic characteristics of

under both sets of parameter values are consistent with those as shown in

Figure 4b, indicating that the model has strong robustness.