Abstract

The transition to a green economy requires a workforce equipped with green skills to meet the demands of sustainable development and environmental stewardship. This study investigates the alignment between university educational outcomes and industry requirements in Ireland, addressing the persistent gap in green skills. Using a mixed-methods approach, surveys were conducted with students from three Irish universities and companies across diverse sectors. The findings reveal a strong recognition of the importance of green skills among students and companies, yet significant barriers remain. Students report challenges in accessing practical learning experiences, balancing education with personal commitments, and navigating the costs of green certifications. Companies acknowledge the growing need for sustainability expertise but often fail to integrate green skills into recruitment and training strategies, citing high competition for talent and limited awareness of emerging green roles. This study highlights the need for systemic changes in both education and industry. Universities should adopt experiential learning approaches, expand industry collaborations, and ensure flexible access to green education. Companies must prioritise upskilling programmes and align hiring practices with sustainability goals. Policymakers are encouraged to foster public–private partnerships and incentivise investments in green skills development. Addressing these challenges can strengthen the country’s position as a leader in the global green transition, fostering innovation and inclusivity in its workforce.

1. Introduction

The global climate crisis has brought into focus the need for systemic changes in economic and social structures. With the advent of initiatives like the European Climate Law, which mandates achieving net-zero greenhouse gas emissions by 2050, the European Union (EU) has positioned itself as a leader in sustainability-driven transformation [1]. Central to these efforts is the development of a green economy that reconciles environmental stewardship with economic progress by promoting innovation and creating opportunities for sustainable growth [2,3]. However, the success of this transition centres on the availability of a workforce equipped with green skills. These skills can range from engineering expertise for design and production to management expertise for implementation, operations, and monitoring environmental consequences [4] and are a gap that remains a significant challenge globally and in Ireland.

Skills gaps have been studied across the whole education system [5] and in relation to emerging job markets [6]. Green jobs, in particular, contribute to environmental preservation and sustainability and lie at the heart of this transformation. Yet, a growing disparity between the availability of these jobs and the skillsets of the workforce poses a serious threat to progress [7,8,9]. The transition to a net-zero economy will require a workforce equipped with specialised green skills, particularly in sectors like renewable energy, construction, and sustainable agriculture. A report by the UK National Grid highlights that, by 2050, the energy sector alone will need hundreds of thousands of skilled workers to support decarbonisation efforts, emphasising the urgent need for investment in green skills development and training programmes [8]. According to a report by the European Expert Network on Economics of Education (EENEE), the development of green skills is critical for ensuring a just transition to a low-carbon economy. The report highlights the need for reforms in education and vocational training to better integrate green competencies, particularly in high-emission industries [9]. Ireland, in particular, faces unique challenges due to its reliance on agriculture and energy sectors, which are significant contributors to greenhouse gas emissions. These sectors require a skilled workforce capable of implementing sustainable practices to meet ambitious climate targets [10,11]. The agricultural sector alone accounts for 37.5% of the country’s emissions, driven by cattle production and soil management practices [12]. Despite Ireland’s National Climate Action Plan outlining legally binding carbon budgets and sectoral emission ceilings, achieving the goal of a 51% reduction in emissions by 2030 remains a challenge [10]. Green skills encompass a range of technical, behavioural, and core competencies [13]. Despite their importance, these skills remain underrepresented in Ireland’s current workforce, with businesses reporting significant gaps in areas such as renewable energy, environmental law, and sustainable resource management [14]. The gap between industry needs and academic preparation is evident and highlights the lack of practical training opportunities. Additionally, businesses face challenges in recruiting candidates with the required green skills, due to high competition for talent and the absence of standardised qualifications [15,16]. Without proactive policy measures and strategic investments in workforce training, Ireland risks falling behind in its climate commitments while also missing out on the economic opportunities presented by the green transition.

The integration of sustainability into education is paramount for addressing these challenges. The National Recovery and Resilience Plan emphasises embedding sustainability across disciplines and fostering collaboration between academia and industry to develop comprehensive skills frameworks [17]. Initiatives like the Climate Ready Academy exemplify this approach, providing targeted training in renewable energy, energy efficiency, and sustainable transportation [18]. However, these efforts need to be scaled up to meet the growing demand for green skills.

Ireland’s socio-economic and environmental landscape underscores the urgency of this endeavour. With its strong economy and robust service and agricultural sectors, Ireland is uniquely positioned to lead in the green transition. Yet, this potential can only be realised through concerted efforts to align academic outcomes with industry requirements [8,9,11]. By fostering collaboration between stakeholders, academic institutions can embed sustainability into all disciplines, creating a pipeline of talent capable of driving Ireland’s green transition [18].

Businesses, too, play a critical role in this transformation. There is a pressing need for companies to adopt standardised certifications and reporting frameworks, such as ESG (Environmental, Social, and Governance) metrics, to track and communicate sustainability efforts effectively [19], further underscoring the importance of digital competencies in green jobs [14].

In addition to technical and behavioural skills, green jobs require a shift in organisational culture. Companies must embrace cross-disciplinary collaboration and systems thinking, concepts central to emerging frameworks like the circular economy [20]. For instance, nature-based solutions and resilience strategies are increasingly integrated into business models, offering innovative pathways to sustainability [21]. Such approaches not only enhance environmental outcomes but also drive economic resilience by aligning business practices with global sustainability goals. Previous studies have examined green skills needs by focusing either on the educational supply or industry demand. However, they have often treated these aspects in isolation, without fully integrating both perspectives to understand how education aligns with industry requirements and facilitates the transition to employment in the green economy. Therefore, the aim of this study was to explore the alignment of green skills preparation provided by third-level education and the needs of industry by analysing the perceptions of students and industry leaders in Ireland to identify actionable guidelines for bridging the gap between academic outcomes and industry requirements. Ireland is representative of the likely trajectory of many nations because it has one of the highest rates of demand for green skills (12.4% in 2024, up 22.1% year on year compared to the global average of 11.6%) in the workforce in the world [22]. By leveraging insights from literature reviews and online surveys with students and entrepreneurs, this study aims to provide comprehensive guidance for aligning education and industry in the context of a green economy.

2. Methodology

This study employs a mixed-methods approach to investigate the gaps in sustainability skills by analysing survey responses from two distinct populations: students enrolled in three universities in Ireland and Irish companies operating across various sectors. Ireland is at the forefront of the demand for green skills in the workforce and also has one of the highest rates of university attendance in the world [23], making it an ideal testbed to evaluate the skills gap and identify corrective actions. The research integrates both qualitative and quantitative data to provide a comprehensive understanding of perceptions, priorities, and expectations regarding sustainability skills. The surveys were designed to adhere to standard approaches [24] to ensure all members of the target populations had an equal opportunity to contribute and could express opinions by both degree of agreement (ordinal scale data) and narrative response.

A total of 126 students from three universities in Ireland participated in the survey. The 126 students surveyed were from three universities in Ireland, selected to ensure diversity in academic disciplines and student demographics. The sample primarily reflects students from institutions with a strong focus on sustainability-related programmes, business, and engineering, as these fields are most relevant to the study’s objectives. The representativeness of this sample was evaluated using a 95% confidence level, based on total student enrolment at the selected universities in 2023. While the findings may not be generalisable to all students, they provide valuable insights into the perspectives of those most likely to engage with sustainability-related education and career paths. The sample size aligns with commonly reported figures in the literature [25]. The survey targeted students at various stages of their academic journeys, including undergraduate, postgraduate, and professional certification programmes. Participants were recruited through university mailing lists and direct outreach by faculty members.

The student survey was designed to capture insights into (1) the importance, awareness, and relevance of sustainability skills to their academic and professional aspirations; (2) the evaluation of existing academic programmes and their alignment with sustainability goals; (3) students’ self-assessment of their preparedness to contribute to organisational sustainability initiatives; and (4) challenges faced in developing sustainability-related competencies. The survey included both closed-ended questions (using a Likert scale from 1 to 5) and open-ended questions to gather qualitative insights. Questions were structured to ensure alignment with the objectives of identifying gaps and potential areas for curriculum improvement.

The second survey involved 117 Irish companies representing a broad spectrum of industries, including technology, construction, agriculture, manufacturing, and professional services. All companies had an equal opportunity to participate in the survey. Participants included decision-makers such as human resource managers, sustainability officers, and senior executives responsible for talent acquisition and strategy development. Companies were selected based on their active involvement in Ireland’s labour market and their potential demand for sustainability-related skills. The representativeness of the industry sample was evaluated using a 95% confidence level, based on the total number of registered companies in Ireland [26], resulting in a margin of error of 9.06%.

The company survey focused on the following: (1) identification of specific skills prioritised by organisations in their hiring practices; (2) perceptions of deficiencies in the labour market related to sustainability competencies; (3) anticipated changes in skill requirements driven by environmental policies and market dynamics; and (4) existing programmes and strategies to upskill employees in sustainability-related areas. This survey also employed a mix of Likert scale questions, multiple-choice items, and open-ended questions. The design emphasised the alignment of organisational needs with the competencies of incoming graduates. The surveys were distributed electronically via a secure online platform to ensure anonymity and ease of participation. Both surveys remained open for responses for a duration of four weeks.

Quantitative data from Likert scale questions were analysed using descriptive and inferential statistics. Measures such as the mean, median, and standard deviation were calculated to summarise responses. Comparative analyses were conducted to identify significant differences between student and company perceptions. Responses to open-ended questions were analysed using thematic analysis. Key themes were identified by coding and categorising data, focusing on recurring patterns and unique insights related to sustainability skills and training gaps.

To explore the alignment between students’ perceptions and companies’ expectations, correlation analyses were conducted for comparable survey items. For instance, student responses about the skills they aimed to develop were correlated with company responses regarding the skills they sought in candidates.

In terms of limitations, although efforts were made to ensure diverse participation, the findings may not fully represent all Irish universities or industries. In addition, participants’ responses might reflect aspirational views rather than actual practices or competencies. The surveys focused primarily on sustainability skills and may not capture broader factors influencing employability and skill development.

3. Results

3.1. Students’ Perception

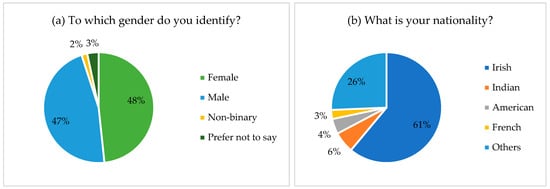

Figure 1 displays the gender identity distribution among respondents and helps assess inclusivity and diversity in the survey. It also provides an overview of the nationality distribution of participants in the survey, highlighting the diverse backgrounds of those interested in green skills education.

Figure 1.

Distribution of survey respondents’ profiles by (a) gender and (b) nationality.

The gender breakdown reveals a near balance between female (48%) and male (47%) participants, with representation from non-binary individuals and those who preferred not to disclose their gender. The nationality distribution shows that the majority of respondents (61%) are Irish, followed by participants of Indian (6%), American (4%), French (3%), and other (26%) nationalities, which emphasises the importance of considering international perspectives in designing educational programmes to ensure they address the unique needs and challenges of a diverse audience.

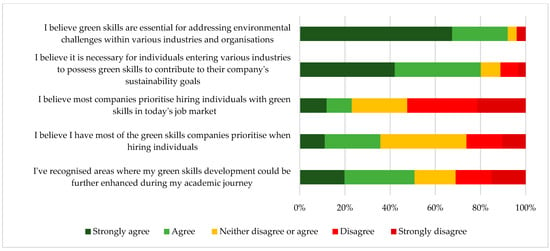

Figure 2 illustrates respondents’ perspectives on the importance of green skills and how these skills are perceived in the job market. A significant majority of respondents (92%) either agree or strongly agree that green skills are essential for addressing environmental challenges across industries. This consensus underscores the growing awareness that sustainability and green practices are critical to the future of business and industry, reflecting a shift towards environmentally responsible strategies. There is also strong agreement (approximately 80%) on the necessity for individuals to possess green skills when entering industries. However, the graph also shows a notable portion of respondents who remain neutral (neither disagree nor agree). This might suggest that while the importance of green skills is recognised, there could be gaps in understanding how these skills translate into individual career success.

Figure 2.

Perceptions of the importance and relevance of green skills in the job market.

While respondents largely agree that green skills are important, the belief that companies prioritise hiring individuals with green skills shows more variability. Around 52% of respondents disagree with this statement, indicating a disconnect between the perceived importance of green skills and the extent to which they are emphasised in hiring practices. When it comes to respondents’ confidence in their own green skills, there is a more balanced distribution. While some feel they possess the skills companies seek, a substantial percentage (about 25%) disagree or strongly disagree, indicating a lack of confidence in their current green skills. This could reflect an area where educational programmes or professional development could make an impact.

In addition, half of the respondents have recognised areas where their green skills could be enhanced during their academic journey, indicating an ongoing need for further training and education. This trend emphasises the importance of integrating green skills development into curricula and offering more practical experiences, internships, or industry collaborations.

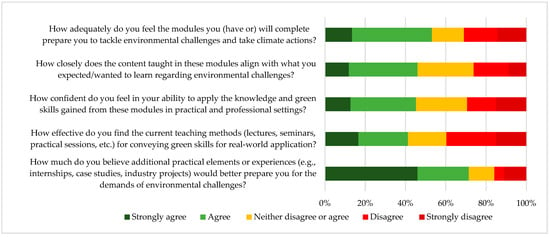

Figure 3 provides insight into how students perceive the effectiveness of their academic modules and the extent to which these modules prepare them to tackle environmental challenges. A significant proportion of respondents (over 50%) agree or strongly agree that the modules they have completed will adequately prepare them to address environmental challenges. However, a minority remains either neutral or in disagreement, indicating that some students feel their prior courses may not fully equip them for real-world climate action.

Figure 3.

Student perceptions on the effectiveness of green skills modules and practical learning experiences.

Responses regarding the alignment between what students expect to learn and what is actually taught show a mixed pattern. Although approximately 46% agree that the content aligns with their expectations, 28% remain neutral, while 26% disagree or strongly disagree. This suggests that while most modules are meeting student expectations, there are gaps in delivering the desired content. The graph also highlights students’ confidence in applying the green skills gained in practical or professional settings. While around 45% of the respondents express confidence, the remainder are either neutral or lack confidence in their ability to translate classroom learning into real-world application. This gap points to a need for more hands-on or experiential learning opportunities.

There is a fairly even distribution across the spectrum regarding how students rate the effectiveness of current teaching methods (e.g., lectures, seminars) in conveying green skills. While many students agree with the effectiveness of these methods, a significant portion feels otherwise. This could indicate that traditional teaching methods may not be sufficient for the practical nature of green skills development, and alternative approaches such as case studies or workshops might be more beneficial. A clear consensus exists regarding the need for additional practical experiences, such as internships and industry projects, with an overwhelming majority agreeing or strongly agreeing that these would better prepare them for environmental challenges. This response highlights the critical role of practical exposure in supplementing theoretical knowledge and preparing students for the demands of the workforce.

Figure 4 depicts how often respondents face challenges in finding educational or career opportunities that align with their green skills and interests. The distribution reveals that navigating green-related opportunities can be a frequent or occasional challenge for many individuals. The largest portion of respondents indicates that they occasionally encounter challenges when seeking opportunities that align with their green skills. This suggests that while opportunities are available, they may not always be easily accessible or regularly aligned with individual interests and career paths. There could be gaps in the availability of specialised opportunities in certain industries or regions. Nearly a quarter of respondents frequently face challenges in this area. This could point to a need for better career services, clearer pathways, or an increased number of green-related jobs and educational programmes.

Figure 4.

Frequency of challenges in finding career opportunities aligned with green skills.

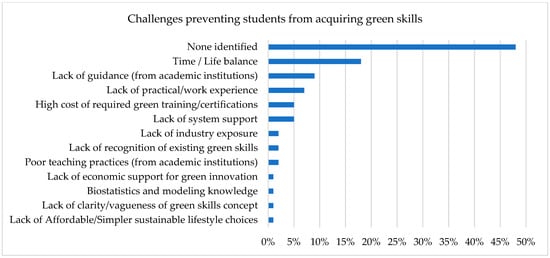

Figure 5 highlights the various challenges students face when trying to acquire green skills. A significant portion of students cite difficulties in balancing personal life and educational commitments. This suggests that time management or workload issues can hinder students’ ability to fully engage with green skills education, especially for those juggling multiple responsibilities. Programmes that offer more flexible, self-paced learning modules or part-time activities that allow students to balance education with other life commitments could be a solution. Furthermore, programmes that offer a blend of online and in-person learning are highly valued, as they enable students to better manage their time, particularly those juggling demanding work schedules or personal commitments.

Figure 5.

Challenges preventing students from acquiring green skills.

Almost 10% of respondents note a lack of guidance from academic institutions, which highlights a gap in support or clear pathways for students looking to specialise in green skills. This points to a need for more structured mentorship or advisory programmes to help students navigate their green education journey. In addition, practical, hands-on experience is crucial for green skills development, yet 7% of respondents feel this is lacking. This indicates that academic programmes could benefit from integrating more real-world applications, internships, or collaborations with industry to bridge this gap. To overcome this challenge, one alternative is to partner with industries and organisations to create internships, apprenticeships, or practical project opportunities, allowing students to gain hands-on experience and apply their green skills in real-world settings. In addition, offering project-based learning opportunities that simulate real-world scenarios within the classroom or online environment can provide students with practical experience even before entering the job market.

The cost associated with obtaining required green certifications is also seen as a barrier by some respondents. While not a primary concern for the majority, it highlights that affordability could be a limitation for students seeking to advance their skills further through specialised training. Some respondents also highlight a lack of system support and industry exposure as barriers, underscoring the need for more comprehensive institutional and industry collaboration to enhance green skills education.

3.2. Companies’ Perception

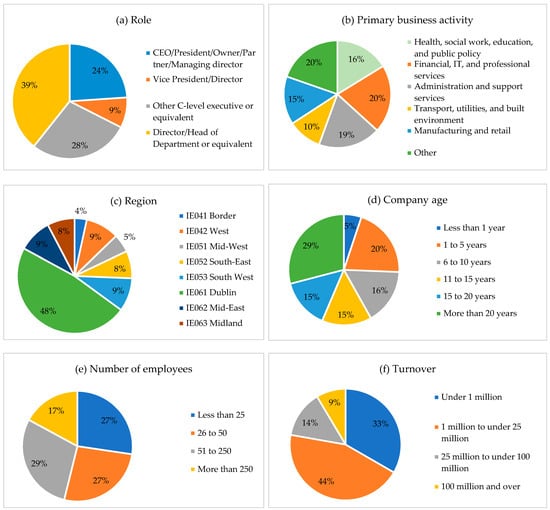

In total, 117 participants from different companies, regions, and roles were interviewed. Figure 6 presents the demographic and organisational characteristics of respondents. The largest group of respondents (39%) consists of directors or heads of departments, which suggests that individuals in high-level decision-making positions are actively engaging in discussions about green skills and sustainability. The second-largest group (28%) comprises C-level executives or equivalent. The survey respondents are distributed across several business sectors, with the most significant representation from the financial, IT, and professional services sectors (20%). Close behind is the administration and support services sector, highlighting that green skills are relevant across a range of industries. Sectors such as health, social, transport, utilities, manufacturing, and retail are also represented, indicating a diverse set of industries engaging with sustainability.

Figure 6.

Demographic and organisational characteristics of respondents.

The respondents are spread across multiple Irish regions, with the largest group (48%) from Dublin. Other regions such as the West, South-West, and Mid-East are also well represented, while smaller regions like Border account for a minority (4%) of the respondents. This geographic distribution could reflect regional differences in access to green skills training and sustainability resources. The majority of companies (29%) are well established, with more than 20 years of experience. A significant number of respondents (20%) represent companies that have been operating for 1 to 5 years, indicating a mix of both established and newer businesses.

Most businesses surveyed (27%) have fewer than 25 employees, with an additional 27% of businesses having between 26 and 50 employees. Larger companies with more than 250 employees (17%) also represent a significant proportion. In terms of company turnover, the largest category (44%) comprises businesses with turnover between EUR 1 million and EUR 25 million. A substantial portion (33%) is represented by companies with less than EUR 1 million in revenue, while 9% of the companies have turnover exceeding EUR 100 million.

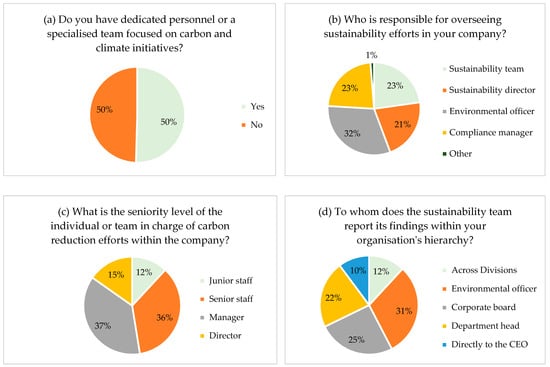

Figure 7 provides insight into the internal organisation of companies regarding sustainability and carbon reduction efforts, highlighting who is responsible for overseeing these initiatives, the seniority of individuals involved, and the reporting structure. It shows an equal split, with 50% of respondents reporting that their company has dedicated personnel or a specialised team focused on carbon and climate initiatives, while the other 50% do not. Half of the companies have made a clear organisational commitment by allocating specific resources to address climate challenges, while the other half may be addressing these concerns more generally or through shared responsibilities.

Figure 7.

Organisational structures and roles in sustainability and carbon reduction efforts.

The largest portion of respondents (32%) indicate that an environmental officer is responsible for overseeing sustainability efforts, followed by a sustainability team (23%) and a compliance manager (23%). These results show that while specialised roles such as environmental officers and sustainability teams are common, many companies may still be distributing sustainability responsibilities across a range of departments or roles.

The majority of companies (37%) have managers leading carbon reduction efforts, while 36% have senior staff in charge and 15% report that directors are responsible. Junior staff lead carbon reduction initiatives in 12% of companies. This distribution indicates that companies tend to place responsibility for these efforts with mid- to senior-level management, but a significant number of organisations also allocate these responsibilities to junior staff, which may suggest variability in how carbon reduction is prioritised within the organisational structure. Environmental officers are the most common point of contact for reporting sustainability findings within the organisation, with 31% of respondents reporting to them.

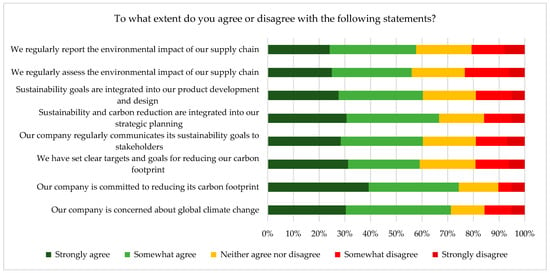

Figure 8 highlights the degree to which companies integrate sustainability and carbon reduction into their operations, product development, and strategic planning, as well as their commitment to reducing their environmental impact. Around 57% of respondents agree or strongly agree that they regularly report the environmental impact of their supply chains. However, approximately 21% disagree or strongly disagree, and the remaining 22% neither agree nor disagree. This suggests that while a portion of companies is proactive in monitoring their supply chain’s environmental impact, many either do not prioritise it or lack the systems to do so effectively.

Figure 8.

Company commitment and integration of sustainability practices.

Approximately 60% of respondents agree or strongly agree that sustainability goals are integrated into product development and design, while 19% disagree or strongly disagree. This indicates that although sustainability is becoming more central to product design for some companies, more than a quarter of respondents still do not see it as a significant focus. Around 65% of respondents agree or strongly agree that sustainability and carbon reduction are integrated into their strategic planning, while 15% disagree or strongly disagree. While sustainability is a priority for most companies, some of them may still be working on fully integrating these concerns into their strategic goals.

About 60% of respondents agree or strongly agree that their company regularly communicates its sustainability goals to stakeholders. This suggests that a large majority of companies understand the importance of transparency and stakeholder engagement in their sustainability efforts. Around 60% of respondents agree or strongly agree that their company has set clear carbon reduction targets. However, 19% disagree or strongly disagree, while the remaining 21% neither agree nor disagree. While many companies are setting measurable goals, some are still in the process of establishing concrete carbon reduction targets.

An overwhelming 75% of respondents agree or strongly agree that their company is committed to reducing its carbon footprint. This strong commitment indicates a broad recognition of the importance of carbon reduction in corporate strategy. More than 70% of respondents agree or strongly agree that their company is concerned about global climate change, with 13% neither agreeing nor disagreeing and another 15% disagreeing or strongly disagreeing. This highlights a broad consensus across companies that climate change is a critical issue, though a small percentage still may not view it as a top concern.

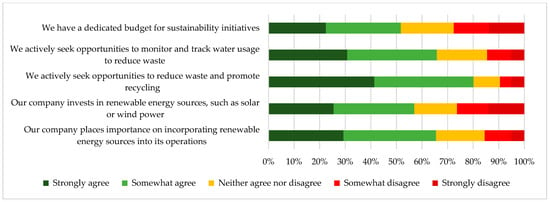

Figure 9 illustrates the extent to which companies are engaging with sustainability initiatives, including budget allocation, waste reduction, water usage monitoring, and investments in renewable energy. Over 50% of respondents agree or strongly agree that their company has a dedicated budget for sustainability initiatives. However, approximately 30% disagree or strongly disagree, and 20% neither agree nor disagree. This distribution suggests that while many companies are committing financial resources to sustainability, a significant portion still lacks a dedicated budget, potentially hindering their ability to fully implement green initiatives.

Figure 9.

Company efforts and investments in sustainability and renewable energy.

Around 65% of respondents agree or strongly agree that their company actively seeks opportunities to monitor and track water usage to reduce waste and around 15% disagree or strongly disagree. These results indicate that most companies are taking steps to improve water management, which is a critical aspect of sustainability in operations. In addition, a strong majority (approximately 80%) of respondents agree or strongly agree that their company actively seeks to reduce waste and promote recycling. This commitment to waste reduction and recycling shows that companies are embracing circular economy practices to minimise their environmental footprint.

Around 58% of respondents agree or strongly agree that their company places importance on incorporating renewable energy into its operations, such as solar or wind power. About 16% neither agree nor disagree, and 26% disagree or strongly disagree. This demonstrates that most companies recognise the importance of renewable energy, though some are still in the early stages of making it a priority in their operational strategies. Around 56% of respondents agree or strongly agree that their company invests in renewable energy sources. 17% neither agree nor disagree, while 26% disagree or strongly disagree. Although a majority of companies are investing in renewable energy, the significant neutral and negative responses suggest that more organisations could be encouraged or supported to adopt renewable energy solutions.

Figure 10 illustrates how companies collaborate with and contribute to local communities regarding climate and environmental sustainability. The responses highlight various degrees of involvement across a range of community-focused initiatives. Approximately 52% of respondents agree or strongly agree that their company collaborates with local schools for climate and environmental outreach, while around 20% disagree or strongly disagree. A moderate level of engagement with educational institutions was observed, though a significant portion of companies may not yet prioritise partnerships with schools for sustainability outreach. Nearly 55% of companies agree or strongly agree that they engage in partnerships with local non-profits supporting environmental and climate causes. This reflects a strong but not universal tendency for companies to collaborate with non-profits in advancing climate-related goals.

Figure 10.

Company Engagement with local communities on climate and environmental initiatives.

Around 59% of respondents agree or strongly agree that their company has a dedicated budget for local climate-focused initiatives, while 20% disagree or strongly disagree, indicating that some companies may lack the budgetary commitment to support such efforts. In total, 61% of respondents agree or strongly agree that their company encourages employees to volunteer in local climate-related projects. However, nearly 23% disagree or strongly disagree, indicating that many companies still do not have policies or incentives in place to encourage employee participation in these activities.

Approximately 57% of companies agree or strongly agree that they seek feedback from local communities to improve their climate-focused operations, while 23% neither agree nor disagree, and about 20% disagree or strongly disagree. This suggests that a majority of companies value community input to refine their environmental strategies, though some may not actively engage local communities in this way. Overall, 60% of respondents agree or strongly agree that their company communicates its sustainability efforts and achievements related to climate and the environment to local communities, indicating a high level of communication and reflecting a commitment by many companies to transparency and local engagement.

More than 55% of companies agree or strongly agree that they have a clear strategy for addressing local communities’ climate and environmental concerns. However, 18% disagree or strongly disagree, indicating that some companies still lack a formalised approach to engaging with local environmental issues. Around 65% of respondents agree or strongly agree that their company supports and participates in community-led climate action programmes, while 20% neither agree nor disagree, and 15% disagree or strongly disagree. This suggests that while many companies are involved in grassroots climate efforts, a portion may not be actively supporting such programmes.

Approximately 67% of respondents agree or strongly agree that their company contributes financially to local environmental sustainability projects, while 18% disagree or strongly disagree. This indicates that financial support for local initiatives is not universal across companies. About 55% of companies agree or strongly agree that they collaborate with local communities on climate-friendly initiatives, while 22% disagree or strongly disagree. The overwhelming majority of respondents (75%) agree or strongly agree that it is important for their company to contribute positively to the community in terms of environmental and social impacts. Only 8.5% disagree or strongly disagree. This consensus suggests that most companies acknowledge the importance of corporate social responsibility, especially in relation to climate and environmental sustainability. But despite acknowledging this, the results show that actual engagement in specific community-focused sustainability initiatives varies significantly.

Figure 11 examines how companies perceive and act upon green skills within their workforce, including identifying skill gaps, prioritising green skills in hiring, awareness of green skills importance, and providing employee training on carbon and climate initiatives.

Figure 11.

Company awareness and action on green skills and training gaps.

Around 52% of respondents agree or strongly agree that their company has identified specific gaps in green skills within their organisation. However, approximately 20% disagree or neither agree nor disagree, indicating that many companies are either not actively assessing green skill gaps or may not yet recognise them. In all, 50% of companies agree or strongly agree that they prioritise hiring candidates with green skills when recruiting new employees. However, about 25% of respondents disagree or strongly disagree, suggesting that not all organisations consider green skills a critical factor in their hiring processes. This split highlights that while some companies are beginning to incorporate sustainability-focused criteria in recruitment, others are still lagging behind.

A significant majority (over 60%) agree or strongly agree that their company is aware of the importance of green skills in today’s workforce. Only 15% disagree or strongly disagree, indicating a high level of awareness. This consensus suggests that most companies understand the growing relevance of green skills, even if they are not fully addressing them in their hiring or training strategies. Despite the high level of awareness, only half of the respondents agree or strongly agree that their employees receive training on carbon and climate initiatives. This indicates a significant gap between recognising the importance of green skills and actually providing the necessary training to equip employees with those skills.

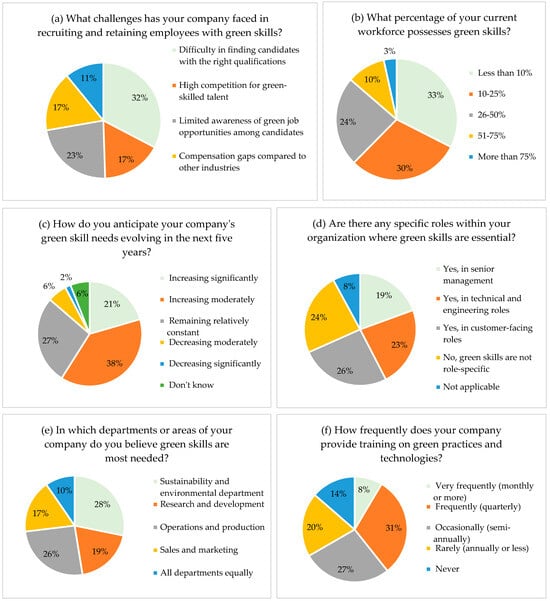

Figure 12 provides insights into the challenges companies face in recruiting and retaining employees with green skills, the current state of green skills within the workforce, anticipated future needs, and the frequency of green skills training across various departments.

Figure 12.

Green skills recruitment, needs, and training practices in organisations.

The most common challenge cited by 32% of respondents is the difficulty in finding candidates with the right qualifications. This is followed by high competition for green-skilled talent and limited awareness of green job opportunities (23% and 17%, respectively). The results highlight that companies are struggling to find and retain individuals with the necessary green skills, with external offers contributing to retention challenges (11%). These challenges underline the growing demand for green-skilled workers and the competitive nature of this market.

Over half of the respondents (63%) report that less than 25% of their workforce possesses green skills, while 24% indicate that 26–50% of their workforce is equipped with these skills. Only a small percentage (13%) report a workforce where more than 51% possess green skills. This indicates that the green skills gap remains significant for most organisations, with many businesses having a limited percentage of employees equipped to meet sustainability objectives.

The majority of respondents (38%) anticipate their company’s green skill needs to increase moderately in the next few years, while 21% foresee these needs increasing significantly. This demonstrates a clear trend toward growing demand for green skills, suggesting that companies expect sustainability to play an even larger role in their operations and workforce requirements in the near future. The largest portion of respondents (26%) believe green skills are essential for customer-facing roles, followed by technical and engineering roles (23%). About 24% of respondents indicate that green skills are needed across all roles. These findings suggest that green skills are becoming increasingly important not just for specialised roles but for leadership and customer engagement as well. The most commonly cited department in need of green skills is sustainability and environmental management (28%), followed by operations and production (26%) and research and development (19%). Around 10% of respondents believe that green skills are needed equally across all departments. This suggests that while specialised sustainability roles remain crucial, the integration of green skills across all areas of the company is becoming increasingly important for comprehensive sustainability efforts.

About 31% of companies provide green skills training frequently (quarterly), while 27% offer training occasionally (semi-annually). A total of 230 provide training rarely (annually or less), and 14% of respondents report that their companies never offer such training. This indicates that while a majority of companies provide some form of green skills training, many do so infrequently, which may hinder the rapid development of green competencies needed to meet growing sustainability demands.

4. Discussion

The findings presented here suggest that significant progress has been made in raising awareness of green skills, but significant work is needed to bridge the gap between university outcomes and industry requirements.

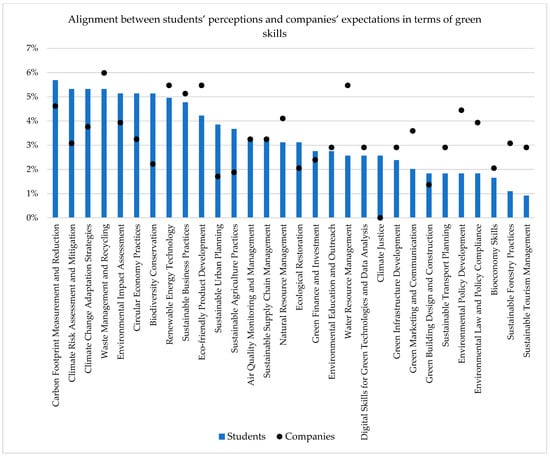

The results reveal a mismatch between students’ academic experiences and the green skills sought by employers. While most students recognise the importance of green skills, their confidence in applying these competencies professionally is mixed. This gap reflects broader global trends where sustainability education often remains disconnected from industry needs [8,9,16]. To explore the alignment between students’ perceptions and companies’ expectations, correlation analyses were conducted for comparable survey items. For instance, student responses about the skills they aimed to develop were correlated with company responses regarding the skills they sought in candidates (Figure 13).

Figure 13.

Distribution of focus areas in green skills development among students and in-demand green skills that companies are seeking in candidates.

Figure 13 shows which areas of sustainability and climate-related education students would like to develop or prioritise in their learning journey. Carbon footprint measurement and reduction presented the highest number of mentions, highlighting a strong interest among students in understanding and reducing carbon emissions. As industries increasingly focus on carbon neutrality, this is an essential skill for future professionals.

Climate risk assessment and mitigation and climate change adaptation strategies are both categories that rank highly, reflecting the growing importance of climate resilience in business and policy. Students appear to recognise the need for skills in assessing climate risks and developing strategies to adapt to the impacts of climate change. Waste management and environmental impact assessments are also heavily prioritised, demonstrating students’ focus on understanding and mitigating the environmental impacts of industrial and organisational practices.

Another significant focus area, circular economy practices, shows that students are engaging with models that emphasise the reuse and recycling of resources, which are essential for sustainable business operations. The biodiversity conservation and renewable energy technology categories also rank high, underscoring a strong interest in preserving natural ecosystems and exploring sustainable energy solutions. These areas are critical for reducing dependency on fossil fuels and protecting global biodiversity. At the other end of the spectrum, topics like bioeconomy skills, sustainable tourism management, and sustainable forestry practices have fewer mentions. While still important, these areas may be seen as more niche or industry-specific compared to more universally applicable green skills.

In terms of the specific green skills that companies are seeking in potential candidates, Figure 13 showcases a wide array of sustainability-focused competencies that are increasingly valuable in today’s job market. The most sought-after skills are waste management and recycling, eco-friendly product development, and water resource management, with approximately 30 companies expressing a need for candidates with these skills. These areas reflect a growing corporate focus on managing waste effectively, reducing environmental impacts through sustainable product development, and ensuring the responsible use of water resources.

Skills related to renewable energy technology and sustainable business practices are also highly in demand, with over 25 companies prioritising candidates with these qualifications. This indicates that companies are increasingly integrating renewable energy solutions into their operations and seeking candidates who can help drive sustainability throughout the business landscape. Skills such as environmental policy development, environmental law and policy compliance, and environmental impact assessment are needed by around 20 companies. This points to the growing importance of regulatory knowledge and compliance as companies navigate complex environmental laws and seek to mitigate their impacts. Carbon Footprint measurement and reduction and climate change adaptation strategies are essential skills for approximately 20 companies, reflecting the pressing need for expertise in reducing carbon emissions and adapting business models to meet the challenges posed by climate change.

Sustainable supply chain management and green marketing and communication are key focus areas for many companies, with 15 to 20 companies seeking these skills. This highlights the importance of creating environmentally responsible supply chains and effectively communicating sustainability initiatives to customers and stakeholders. Skills such as circular economy practices, sustainable forestry practices, and air quality monitoring and management are moderately sought after, with 10 to 15 companies looking for candidates in these areas. As circular economy models gain traction and industries become more focused on air quality and sustainable forestry, these skills are likely to grow in demand.

While still important, skills such as green finance and investment, biodiversity conservation, and sustainable agriculture practices are in demand by fewer companies (less than 10). This may indicate that these are more niche areas or reflect industries where these skills are less immediately required. Overall, the diversity of skills listed shows that companies are looking for candidates with a broad range of green expertise, from managing operational impacts to compliance, innovation, and strategic sustainability leadership. This demand suggests that sustainability is not limited to specialised roles but is spreading across all levels and departments of organisations.

To fill this gap, universities should engage with employers to co-develop curricula that emphasise real-world applications of green competencies. Programmes such as the GreenComp framework proposed by the European Commission or the Turas Programme developed by IKC3 project provide a roadmap for integrating sustainability into education systems [1,27]. Moreover, the establishment of standardised green skill frameworks, such as the European Green Deal’s skills agenda, can help harmonise expectations between academia and industry. Clear frameworks enable companies to articulate their needs more effectively, guiding educational institutions in aligning their curricula accordingly [1].

Traditional teaching methods, while foundational, may not fully equip students with the practical problem-solving skills demanded by the green economy. Evidence from other contexts supports the adoption of experiential learning approaches, including project-based learning, simulations, and interdisciplinary collaborations [28]. These methods not only enhance skill acquisition but also foster critical thinking and adaptability, qualities essential for addressing complex environmental challenges. Additionally, embedding sustainability into all disciplines, not just environmental science or engineering, can broaden the impact of green education [29].

Challenges such as balancing personal commitments, the cost of green certifications, and the lack of mentorship are prominent among respondents. Flexible learning models, such as hybrid and online courses, can help students manage competing demands while pursuing green education [30]. Additionally, subsidised certifications and employer-sponsored training programmes can alleviate financial barriers, enabling a wider range of students to access specialised qualifications. Structured mentorship programmes, drawing from industry professionals, could further guide students toward successful careers in sustainability-focused roles [31].

While many companies acknowledge the importance of green skills, the integration of these competencies into recruitment, training, and operations remains inconsistent. This reflects a global trend where organisations recognise sustainability as a strategic priority but often lack actionable frameworks to embed green skills into their workforce [29,32]. To address this, companies must prioritise upskilling and reskilling programmes, particularly for technical and leadership roles where green skills are critical [33].

Policy interventions play a crucial role in fostering green skills development. Tax incentives, grants, and public–private partnerships can encourage businesses to invest in sustainability initiatives and workforce development. For example, government-funded programmes targeting renewable energy and waste management sectors can drive demand for green skills while creating new opportunities for students and professionals [34].

At the institutional level, regional disparities in access to green education and resources must be addressed. Policymakers should ensure that green education programmes are equitably distributed across urban and rural areas, providing equal opportunities for students nationwide. Incentivising universities to partner with local industries can also help address regional skill gaps and support community-level sustainability efforts [35].

The integration of green skills across disciplines and sectors is essential for driving the green transition. This requires a systemic approach that involves not only academia and industry but also government and civil society. Establishing multi-stakeholder platforms to facilitate ongoing dialogue and collaboration can ensure that green education evolves in response to emerging challenges and opportunities [31].

Looking ahead, further research is needed to explore the long-term impacts of green education on career outcomes and industry transformation. Longitudinal studies tracking graduates’ career trajectories can provide valuable insights into the effectiveness of current interventions and inform future strategies. Additionally, exploring the intersection of green skills with emerging fields such as digital transformation and artificial intelligence can identify new opportunities for innovation and growth in the green economy.

5. Conclusions

The transition to a green economy represents one of the most significant societal and economic transformations of the 21st century, and its success hinges on a workforce equipped with the necessary green skills. Understanding the gap between education and industry in terms of skill provision is critical for skill provision. Ireland’s strong demand for green skills and high university attendance rates make it an ideal setting to assess the skills gap and explore solutions. This study has illustrated the critical gaps between university outcomes and industry requirements, offering insights into the challenges and opportunities inherent in addressing this mismatch.

While both students and companies acknowledged the importance of green skills, a significant misalignment of educational outcomes and industry demands is occurring. Students have enthusiasm for acquiring green skills but face obstacles such as limited practical exposure, insufficient institutional support, and the high cost of green certifications. However, they lack confidence in their green skills, which might be solved by increasing exposure to problem-based and project-based learning and providing structured mentorship programmes. In addition, access to upskilling could be improved by using flexible learning models, such as hybrid and online courses, and providing financial support.

Companies recognise the growing need for green skills yet fail to prioritise sustainability in recruitment (even if it is part of the process) and through the provision of internal training programmes. Companies must go beyond acknowledging the importance of sustainability by embedding green competencies into their hiring and training practices. This requires a cultural shift toward viewing green skills as integral to organisational success rather than as optional or secondary attributes.

Author Contributions

Conceptualisation, T.d.C. and N.M.H.; methodology, T.d.C., N.M.H. and Q.G.C.; validation, T.d.C., N.M.H., C.P., F.Q., Q.G.C. and H.M.; formal analysis, T.d.C. and L.I.A.L.; investigation, T.d.C. and L.I.A.L.; resources, N.M.H.; data curation, T.d.C. and L.I.A.L.; writing—original draft preparation, T.d.C. and L.I.A.L.; writing—review and editing, N.M.H., C.P., F.Q., Q.G.C. and H.M.; visualisation, T.d.C.; supervision, N.M.H.; project administration, N.M.H., Q.G.C. and H.M.; funding acquisition, N.M.H., Q.G.C. and H.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by funding from the Higher Education Authority (HEA) and the Human Capital Initiative (HCI) under the Ireland’s Knowledge Centre for Carbon, Climate and Community Action (IKC3) project (18401299).

Institutional Review Board Statement

The study was conducted according to the University College Dublin guidelines and approved by the Human Research Ethics Committee (protocol code LS-C-23-260-daCosta-Holden on 21 November 2023).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data supporting the findings of this study are available upon request from the corresponding author. The datasets were generated as part of the research conducted and include survey responses, job postings analysis, and secondary data from publicly available sources. Due to privacy and confidentiality agreements with survey participants, some data may be restricted.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- European Commission. Regulation (EU) 2021/1119 of the European Parliament and of the Council of 30 June 2021 Establishing the Framework for Achieving Climate Neutrality and Amending Regulations (EC) No 401/2009 and (EU) 2018/1999 (‘European Climate Law’); European Commission: Brussels, Belgium, 2021. [Google Scholar]

- OECD. Greener Skills and Jobs. Organisation for Economic Co-Operation and Development; OECD: Paris, France, 2014; ISBN 9789264208698. [Google Scholar]

- Eurostat. Environmental Economy-Statistics on Employment and Growth. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Environmental_economy_%E2%80%93_statistics_on_employment_and_growth (accessed on 17 March 2025).

- Vona, F.; Marin, G.; Consoli, D.; Popp, D. Environmental Regulation and Green Skills: An Empirical Exploration. J. Assoc. Environ. Resour. Econ. 2018, 5, 713–753. [Google Scholar] [CrossRef]

- Helyer, R. Aligning Higher Education with the World of Work. High. Educ. Ski. Work-Based Learn. 2011, 1, 95–105. [Google Scholar] [CrossRef]

- Pauceanu, A.M.; Rabie, N.; Moustafa, A. Employability under the Fourth Industrial Revolution. Econ. Sociol. 2020, 3, 269–283. [Google Scholar] [CrossRef]

- Strachan, S.; Greig, A.; Jones, A. Going Green Post COVID-19: Employer Perspectives on Skills Needs. Local Econ. 2022, 37, 481–506. [Google Scholar] [CrossRef] [PubMed]

- National Grid. Net Zero Energy Workforce: Future Skills and Employment Needs for the Energy Transition. 2020. Available online: https://www.nationalgrid.com/document/126256/download (accessed on 10 November 2024).

- Janta, B.; Kritikos, E.; Clack, T. The Green Transition in the Labour Market: How to Ensure Equal Access to Green Skills Across Education and Training Systems; EENEE Analytical Report; Publications Office of the European Union: Luxembourg, 2023. [Google Scholar] [CrossRef]

- DECC. Climate Action Plan 2024; Department of the Environment, Climate and Communications, Government of Ireland: Dublin, Ireland, 2024. [Google Scholar]

- Environmental Protection Agency. EPA Ireland Projected to Fall Short of Climate Targets. 2023. Available online: https://www.epa.ie/news-releases/news-releases-2023/ireland-projected-to-fall-well-short-of-climate-targets-says-epa.php (accessed on 17 March 2025).

- DAFM. Food Vision 2030—A World Leader in Sustainable Food Systems; Department of Agriculture, Food and the Marine, Government of Ireland: Dublin, Ireland, 2024. [Google Scholar]

- Ozilhan Ozbey, D.; Coskun Degirmen, G.; Berk, O.N.; Sardagi, E.; Celep, E.; Koc, D.; Gozen, E. Green Core Competencies, Green Process Innovation, and Firm Performance: The Moderating Role of Sustainability Consciousness, a Mixed Method Study on Golf Hotels. Sustainability 2024, 16, 4181. [Google Scholar] [CrossRef]

- IDA Ireland. Labour Market Pulse. 2023. Available online: https://www.idaireland.com/latest-news/publications/labour-market-pulse-edition-8 (accessed on 1 October 2024).

- Buckley, Y. Green Skills Needed for Mainstream Economy. Irish Times. 2023. Available online: https://www.irishtimes.com/science/2023/07/27/green-skills-needed-for-mainstream-economy/ (accessed on 2 October 2024).

- CEDEFOP. Skills for Green Jobs. European Centre for the Development of Vocational Training. European Synthesis Report. 2018. Available online: https://www.cedefop.europa.eu/files/3078_en.pdf (accessed on 2 October 2024).

- DPENDR. Ireland’s National Recovery and Resilience Plan 2021; Department of Public Expenditure, NDP Delivery and Reform: Dublin, Ireland, 2021. [Google Scholar]

- DFHERIS. Impact 2030: Ireland’s Research and Innovation Strategy; Department of Further and Higher Education, Research, Innovation and Science: Dublin, Ireland, 2022. [Google Scholar]

- UNEP. Green Jobs: Towards Decent Work in a Sustainable, Low-Carbon World. United Nations Environmental Programme. 2008. Available online: https://www.unep.org/resources/report/green-jobs-towards-sustainable-work-low-carbon-world (accessed on 4 October 2024).

- EMF. 2024. Available online: https://www.ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview (accessed on 4 October 2024).

- Barker, A.; Garcia-Blanco, G.; Garcia, I.; Aguirre-Such, A. The Role of Strategic Planning in Nature- Based Solutions (NBS) Transformation: An Evaluation of the Green Cities Framework in Mainstreaming NBS in 6 European Countries. Nat.-Based Solut. 2024, 6, 100157. [Google Scholar] [CrossRef]

- IDA Labour Market Pulse Reveals Demand for Green Skills in Ireland Growing Twice the Rate of Global. IDA Ireland. Available online: https://www.idaireland.com/latest-news/press-release/ida-labour-market-pulse-reveals-demand-for-green-skills-in-ireland-growing-twice-the-rate-of-global (accessed on 28 February 2025).

- Most Educated Countries. 2024. Available online: https://worldpopulationreview.com/country-rankings/most-educated-countries (accessed on 28 February 2025).

- Burns, K.E.A.; Duffett, M.; Kho, M.E.; Meade, M.O.; Adhikari, N.K.J.; Sinuff, T.; Cook, D.J. A Guide for the Design and Conduct of Self-Administered Surveys of Clinicians. CMAJ 2008, 179, 245–252. [Google Scholar] [CrossRef] [PubMed]

- Bae, T.J.; Qian, S.; Miao, C.; Fiet, J.O. The Relationship between Entrepreneurship Education and Entrepreneurial Intentions: A Meta–Analytic Review. Entrep. Theory Pract. 2014, 38, 217–254. [Google Scholar] [CrossRef]

- Companies Registration Office Report 2022. Available online: https://cro.ie/wp-content/uploads/2024/04/2022-CRO-Annual-Report.pdf (accessed on 2 November 2024).

- IKC3. Turas Learning Programme. 2024. Available online: https://ikc3.ie/knowledge-centre/turas-learning-programmes/ (accessed on 2 October 2024).

- Kolmos, A.; de Graaff, E. Problem-Based and Project-Based Learning in Engineering Education. In Cambridge Handbook of Engineering Education Research; Cambridge University Press: Cambridge, UK, 2014; pp. 141–160. [Google Scholar]

- Deloitte Global Impact Report. 2024. Available online: https://www.deloitte.com/global/en/about/governance/global-impact-report.html (accessed on 2 October 2024).

- World Bank. Skilling “Youth on the Move” to Help Power the Green Economy. 2024. Available online: https://blogs.worldbank.org/en/education/skilling--youth-on-the-move--to-help-power-the-green-economy (accessed on 3 October 2024).

- ILO. Green Jobs: Toward Decent Work in a Sustainable Economy. International Labour Organization. 2021. Available online: https://www.ilo.org/publications/green-jobs-towards-decent-work-sustainable-low-carbon-world-full-report (accessed on 3 October 2024).

- IEAM. A Blueprint for Green Workforce Transformation. Institute of Environmental Management and Assessment. 2022. Available online: https://www.iema.net/media/mqqhx1cw/a-blueprint-for-green-workforce-transformation-april-2022.pdf (accessed on 20 October 2024).

- OECD. Assessing and Anticipating Skills for the Green Transition. Organisation for Economic Co-Operation and Development. 2023. Available online: https://www.oecd.org/en/publications/assessing-and-anticipating-skills-for-the-green-transition_28fa0bb5-en.html (accessed on 1 November 2024).

- WEF. The Future of Jobs Report 2023. World Economic Forum. 2023. Available online: https://www.weforum.org/publications/the-future-of-jobs-report-2023/ (accessed on 1 November 2024).

- UNESCO. Education for Sustainable Development. United Nations Educational, Scientific and Cultural Organization. 2022. Available online: https://www.unesco.org/en/sustainable-development/education (accessed on 1 November 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).