1. Introduction

In recent years, excessive emissions of greenhouse gas carbon dioxide (CO

2) have led to global warming, and extreme weather events have severely affected human health and normal human production and life; thus, realizing a green transition and reducing CO

2 emissions are of great significance to the sustainable development of human beings. In response to these challenges, many countries across the globe have made low-carbon development an important goal [

1]. In 2020, China announced to the international community its ambition to achieve a peak in carbon emissions before 2030 and to strive for carbon neutrality by 2060 [

2]. Nowadays, a new round of technological revolution and industrial change driven by technologies such as artificial intelligence, cloud computing, and big data is reshaping the pattern of world economic development, which is accelerating into the era of digital economy. The development of digital inclusive finance (DIF), defined as the utilization of digital technology to provide financial services to populations traditionally excluded from the formal financial system [

3], takes full advantage of its low-cost and low-threshold features by utilizing its inclusive nature to break the time and space limitations of traditional financial services [

4]. It has been shown that the development of DIF can promote technological innovation (TE) and promote the optimization of industrial structure, while the development of scientific and technological innovation can accelerate the inclusive development of DIF and, at the same, time effectively improve the efficiency of energy use, reduce energy consumption per unit of GDP, and further curb carbon emissions, which helping to promote the greening transition.

At the present stage of rapid economic development, the contradiction between economic development and the ecological environment in China remains prominent [

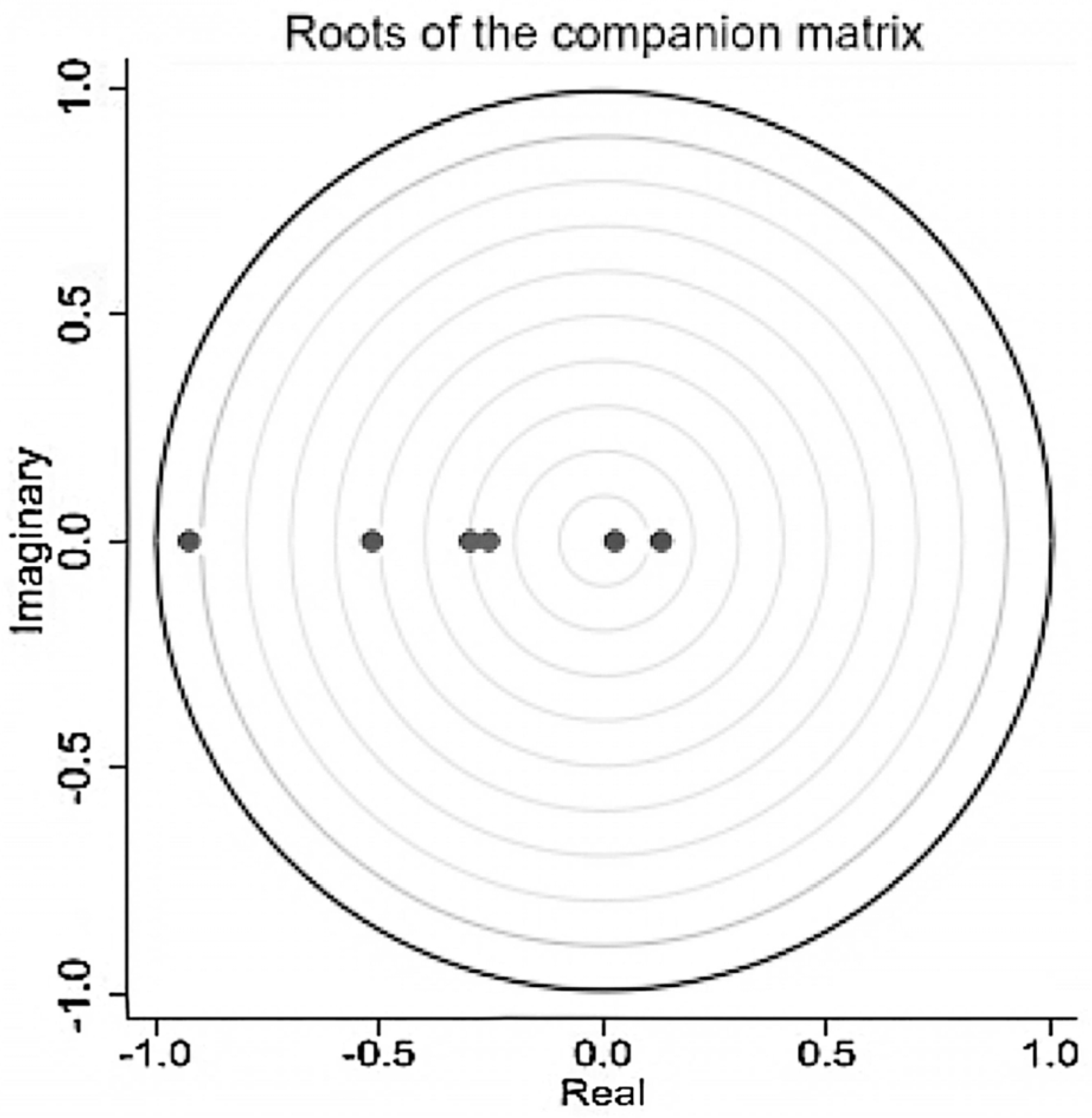

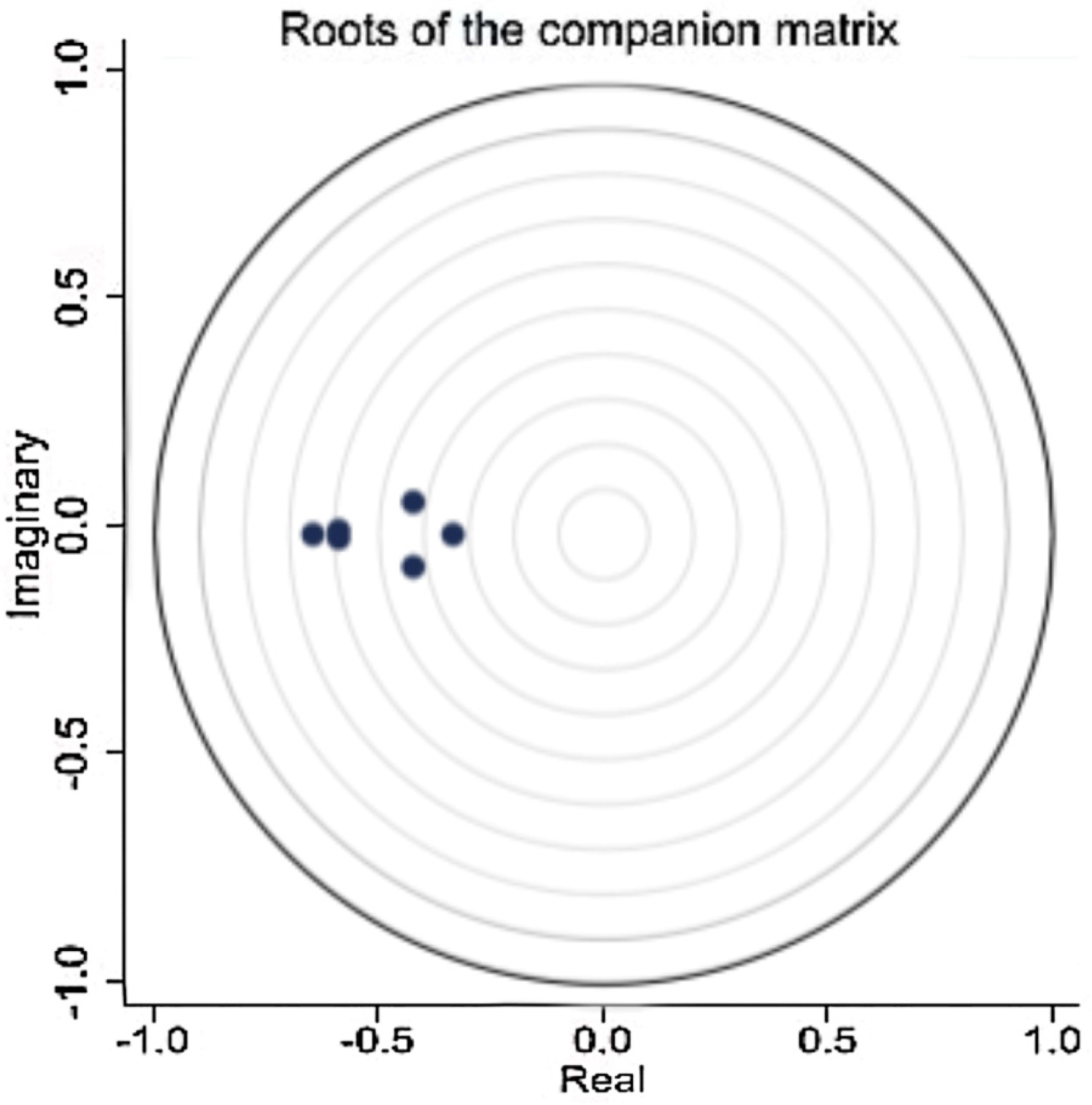

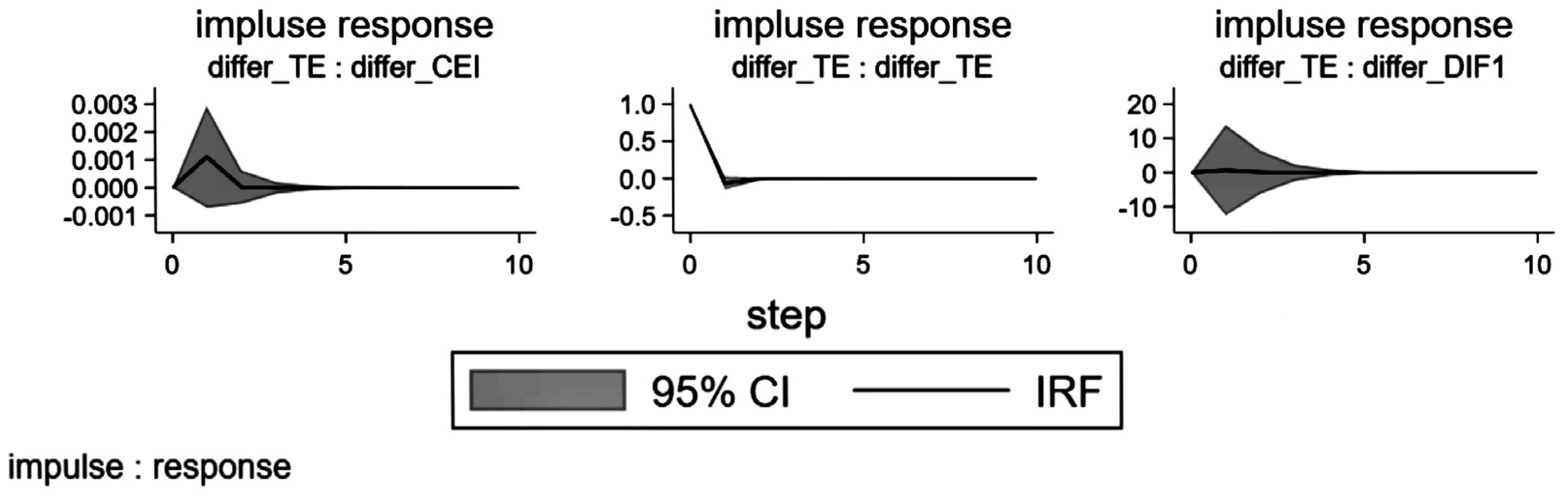

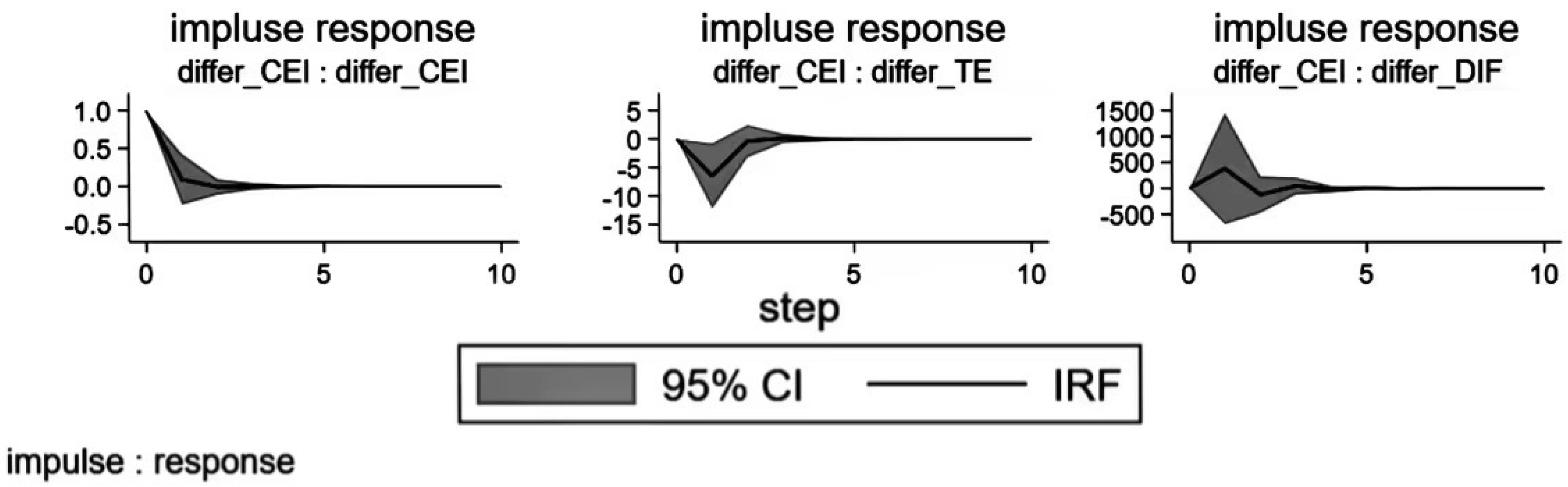

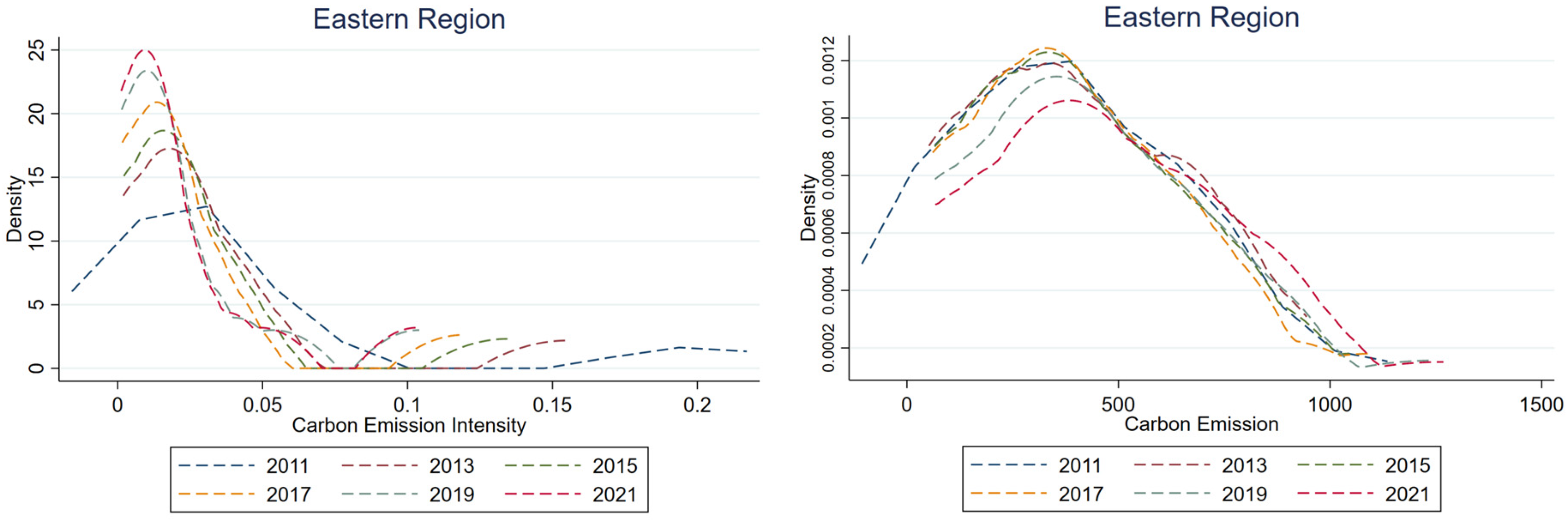

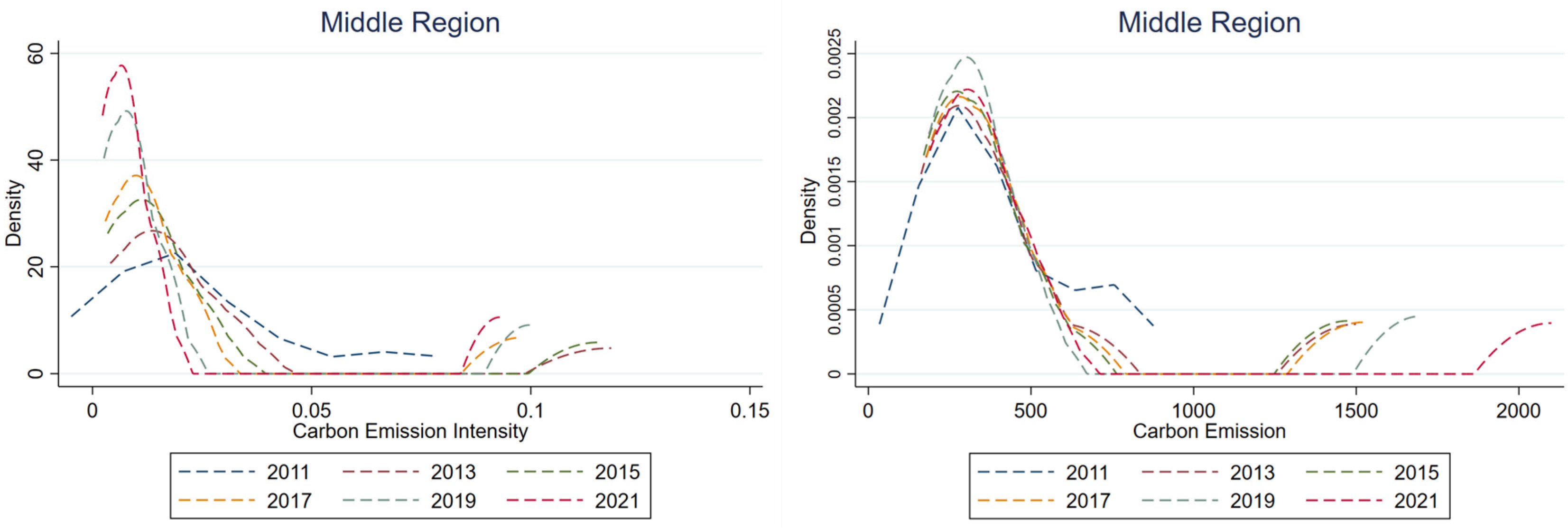

5]. Balancing the relationship between economic development and the reduction in carbon emissions and the protection of the ecological environment is one of the major concerns of government and society. To achieve the goal of carbon peaking and carbon neutrality, DIF, with its convenience and inclusiveness, is an important lever to promote low-carbon economic development, but the challenges are still arduous. In order to deeply understand and analyze the relationship between DIF, TE, and carbon emissions, this study empirically analyzes the impact mechanism of DIF on carbon emissions by using the Panel Vector Autoregression (PVAR) model and the panel data of 30 provinces in China from 2011 to 2021. In addition, the study examines carbon emissions in the eastern, central, and western regions of China from the perspective of regional heterogeneity. The findings and conclusions provide both theoretical insights and empirical evidence to support the advancement of dual carbon control policies and the achievement of the dual carbon objective.

3. Theoretical Analysis and Hypotheses

DIF provides innovative, convenient, and efficient financial services, simplifying transaction processes, boosting public engagement in environmental conservation, and helping reduce carbon dioxide emissions. First, at the individual consumer level, DIF enables financial institutions to utilize online digital service platforms, employing models like Internet banking to assist users in conducting online financial transactions and managing investments and payments. This approach helps decrease energy consumption associated with travel and reduces the resource usage of traditional offline services, ultimately leading to a reduction in direct carbon emissions [

29]. Alipay’s Ant Forest initiative motivates citizens to earn virtual credits by engaging in environmentally friendly actions like using public transport and making online payments. These credits are then transformed into real-world tree planting and reforestation projects, fostering green habits among citizens and contributing to environmental protection efforts [

30]. Additionally, Cainiao’s box recycling program and second-hand platforms like Xianyu improve resource efficiency through recycling and reuse, actively involving citizens in environmental conservation [

5]. At the enterprise level, DIF utilizes the capability of digital technology to transcend spatial boundaries, facilitating the cross-regional flow of financial capital and broadening the scope of capital supply and demand in the financial market [

31]. This development not only alleviates corporate financing constraints and addresses information asymmetry but also improves the efficiency of corporate investment and resource allocation. As a result, it incentivizes companies to engage in research and development related to green production technologies, integrating cleaner renewable energy sources such as solar and biomass energy into their manufacturing processes, thereby directly reducing total carbon emissions at the source [

21]. Consequently, this study proposes the following hypothesis:

It is essential to progress from the current dual control system for energy consumption to a new dual control framework focusing on both TCE and CEI with the aim of more effectively regulating and reducing carbon emissions while promoting the use of sustainable energy sources. Carbon trading is a market-based strategy for reducing CEI. It encourages companies to innovate technologically to lower their carbon emissions, promoting corporate transformation and innovation [

32]. The advancement of carbon trading depends on factors such as carbon finance parameters, indicator systems, and measurement methodologies. DIF can provide solutions for the carbon trading market, especially in areas like information disclosure and transaction pricing, which can improve transaction efficiency and effectively reduce CEI. Inclusive finance platforms gather carbon trading information and offer real-time data and analytical tools, enabling market participants to have a clearer understanding of market trends and fostering the disclosure and sharing of information. Moreover, these platforms deepen participants’ comprehension of the carbon trading mechanism and boost their enthusiasm for involvement through educational and training initiatives. DIF also alleviates funding pressures on small and medium-sized enterprises (SMEs), optimizes capital allocation, and draws more companies into the carbon trading market via crowdfunding and microcredit. This increases the number of market participants, enhances trading efficiency, and improves market liquidity and transparency, thereby effectively reducing carbon emission intensity [

33]. Therefore, this study proposes the following hypothesis:

H2. DIF has a negative inhibitory effect on CEI.

DIF provides convenient financial services to low-income groups, reducing the phenomenon of being unable to receive education due to economic reasons and directing funds towards the education sector, thereby providing a solid talent base for TE. DIF significantly boosts the appeal of regions known for their TE by enhancing the accessibility and efficiency of financial services. In these regions, it plays a crucial role in retaining local innovative talent, as well as attracting external funds. However, differences in the initial levels of TE across regions result in varying patterns of talent and capital movement. This diversity further contributes to the distinct heterogeneity in total carbon emissions among different regions [

34]. On the other hand, due to the high risks and cycles associated with TE, SMEs find it difficult to obtain sufficient R&D funds in traditional financial markets. DIF overcomes the conventional financial market’s preference for stable returns, thereby expanding the financing options for these enterprises. By addressing the issue of insufficient R&D funds and nurturing innovative talent, TE is consistently enhanced. This includes refining of existing production technologies and pioneering innovations in low-carbon technologies, which significantly contribute reductions in CO

2 emissions [

35]. It can be seen that DIF has a positive indirect impact on TCE by effectively promoting the improvement of the level of TE and effectively reducing TCE. Consequently, this study proposes the following hypothesis:

H3. DIF can reduce TCE by funding the improvement of TE.

Due to the negative correlation between GDP growth and CEI, CEI tends to decrease as an economy grows. DIF can fund the improvement of TE, which can effectively reduce this intensity. Additionally, DIF effectively addresses the imbalance in the distribution of financial capital, enabling it to flow smoothly into high-quality, low-energy-consuming enterprises, as well as SMEs. This allows these companies to allocate more resources to R&D, increasing their R&D spending and integrating internal innovation capabilities, thereby strongly supporting the enhancement of green and low-carbon technological innovation within the enterprise [

36], which leads to an effective reduction in carbon emission intensity. China’s vast territory, coupled with its complex and diverse ecological and climatic factors, results in significant regional variations in innovation levels and carbon emission patterns [

37]. In the western regions, the impact of TE on CEI is notably greater than in the eastern regions, while the gap in CEI among provinces in the central region is gradually narrowing. Therefore, this paper proposes the following hypothesis:

H4. DIF can diminish CEI through the mediating pathway of enhancing TE levels.

7. Conclusions

DIF plays a crucial role in carbon emissions reduction by fostering economic growth and advancing TE, which, in turn, optimizes the approach to carbon reduction. This study presents empirical evidence to support this notion. The analysis and findings not only aid in the realization of carbon peak and carbon neutrality objectives but also facilitate a balance between economic development and ecological conservation.

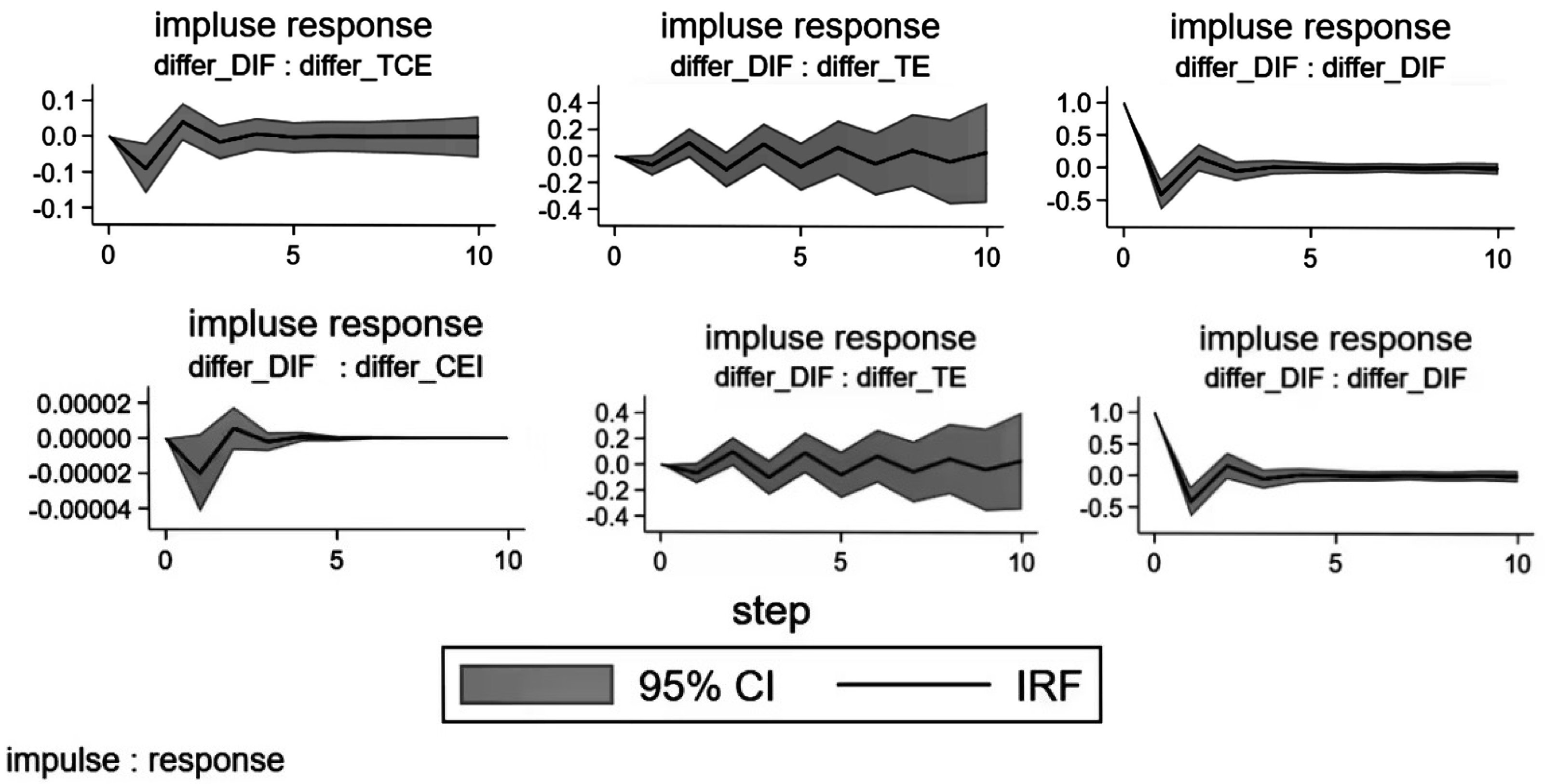

This study concludes that DIF has a direct inhibitory effect on both TCE and CEI, which is consistent with the research findings of Shahbaz et al. and Boutabba [

7,

8]. However, Awan et al. have shown that the influence of digital inclusive finance on carbon emissions follows an initial promotion, followed by inhibition, forming a U-shaped pattern [

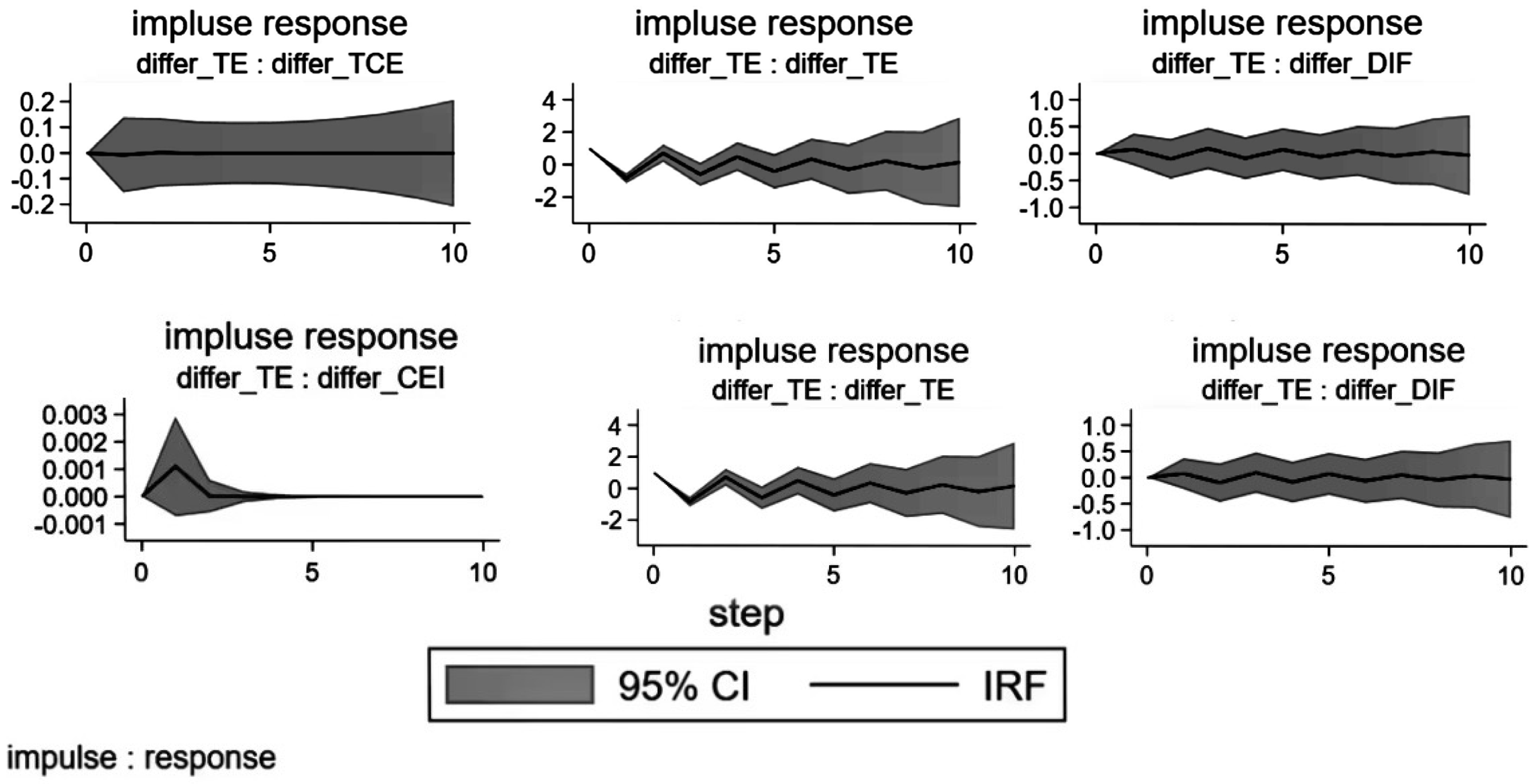

10]. This discrepancy might be attributed to variations in the time frames of the samples used in these studies. Secondly, the TE positively influences the dual control of carbon emissions, aligning closely with the research outcomes of Wu Ye et al. regarding the impact of TE on carbon emissions [

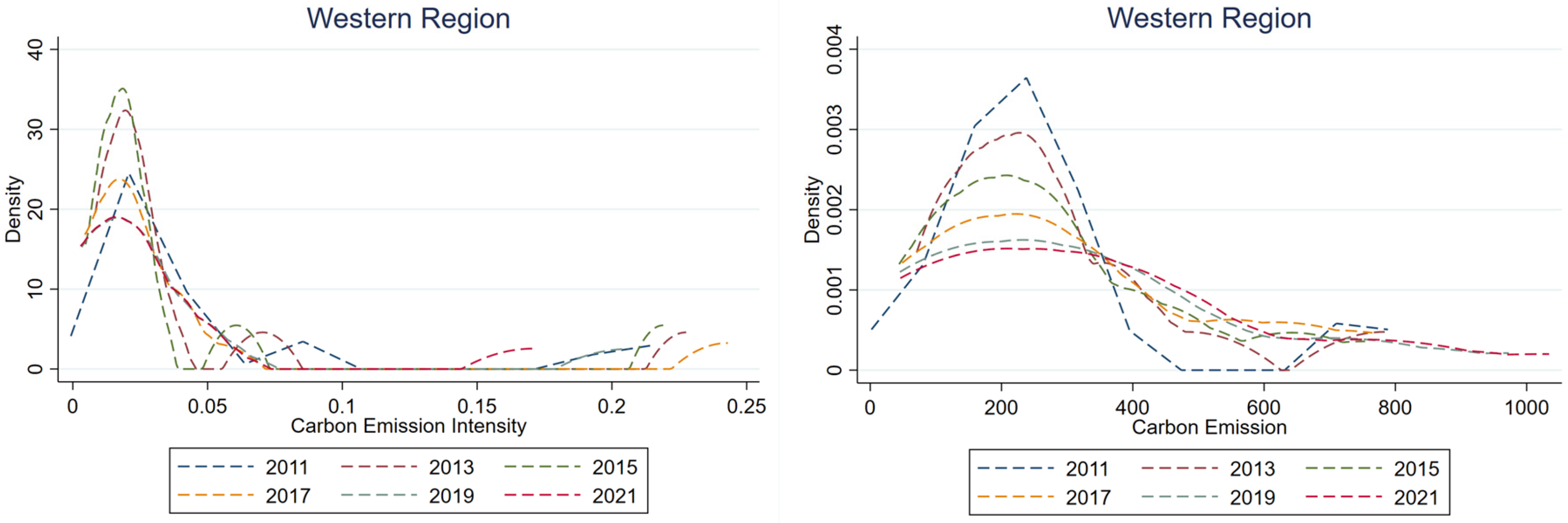

48]. Thirdly, analysis of Granger causality reveals that DIF promotes TE, suggesting that TE may be a critical factor in mediating the impact of DIF on TCE and CEI. The mechanism through which DIF affects TCE and CEI is mediated. The inhibitory effect of DIF on carbon emission operates through two primary channels: first, it directly reduces both TCE and CEI, and it enhances the TE, which, in turn, amplifies the inhibitory effect on carbon emissions. Consequently, DIF can optimize the pathway to carbon emissions reduction by fostering TE, thereby exerting a more substantial inhibitory effect on carbon emissions. Furthermore, a heterogeneity analysis conducted by categorizing the 30 provinces into three regions of east, central, and west reveals that the degree of inhibition varies according to the distinct economic development and TE levels in each region. The central region is affected by the spillover effect of the eastern region, and DIF has the greatest impact on TCE; TE in the western region has a greater impact on CEI than that in the eastern region, and the difference in CEI between provinces shows a trend of gradual reduction in the development process, which is basically consistent with the regional analysis results of Lu.Y et al. [

49].

This paper proposes three recommendations based on the conclusion. First, it is imperative to capitalize on advancements in DIF and expedite its development. On the one hand, financial institutions can leverage digital technology to lower the barriers for the general public to access financial services, thereby better serving SMEs and individuals. On the other hand, DIF contributes reductions in carbon emissions, which significantly impact industrial structure upgrading and industrial integration. Furthermore, the harmonious development of DIF and TE should be fostered. DIF can increase investment in green technological research and development and formulate corresponding financial policies to promote TE, thereby contributing to the optimization of the path of carbon emissions reduction. Additionally, establishing an information sharing mechanism between TE and financial services enables financial institutions to stay updated on the progress and needs of green technology projects, accurately allocate financial resources, and enhance the efficiency of financial support for green TE. Third, in the eastern region, where DIF is highly developed and CEI is low, it is essential to further leverage the advantages of digital technology to direct financial resources towards the research and application of low-carbon and zero-carbon technologies—for instance, by establishing specialized green finance funds and encouraging financial institutions to innovate in carbon finance. In the central and western regions, increasing investment in digital infrastructure is necessary to enhance the accessibility and coverage of financial services, thereby promoting local industrial development and structural transformation.

This paper focuses on DIF, TE, and regional carbon emissions within the same analytical framework against the backdrop of achieving the dual carbon goals. By establishing the PVAR model, it explores whether DIF and TE have the effects of improving the environment and promoting energy conservation from the perspective of the two dimensions of TCE and CEI, which broadens the understanding of the factors of carbon emissions reduction. Secondly, the Granger causality test reveals that the levels of DIF and TE not only predict future changes in TCE but also future changes in TCE. This finding establishes a basis for further research on how DIF directly and indirectly affects carbon emissions. Finally, through regression analysis, this study examines the inhibitory effect of DIF on carbon emissions and investigates the impact of regional variations in carbon emissions, offering a new theoretical perspective on the optimization of regional industrial structures and facilitating industrial transformation.

However, this paper still has limitations that provide valuable insights for future research. Firstly, variations in economic development and industrial structures across provinces in China can lead to missing or irregular data on the indicators. For instance, when calculating TCE, limitations in data collection may result in inconsistent statistical approaches across different provinces, which, to some extent, leads to the inaccuracy of the horizontal measurement results. Secondly, the study covers only 11 years from 2011 to 2021, which is a relatively small sample size and may introduce some bias in accurately assessing the impact on the dual carbon control targets. As more data are continuously added in the future, future analyses are expected to be more precise. Thirdly, this study finds that the inhibitory effect of DIF on carbon emissions exhibits regional heterogeneity. The analysis of spatial effects, either within a single country or across different countries, could be a potential necessity and direction for further research. Lastly, this paper indicates the need for further research on the impacts DIF and TE on carbon emissions under different time dimensions.

_Li.png)