Abstract

This paper examines the impact of government-led green certification on enterprise green transformation, utilizing data from A-share-listed firms in China and focusing on the Green Factory Certification program launched by the Ministry of Industry and Information Technology in 2016. We find that government-led green certification has a significant environmental incentive effect, with certified green factories significantly accelerating enterprise green transformation compared to non-certified enterprises. These findings provide a strong response to the ongoing debate regarding the environmental performance of green certification policies. Unlike general green certification, government-led green certification incorporates both internal incentives and external monitoring. Green factory certification reduces financing costs and promotes internal green innovation, while also attracting the attention of green investors and media scrutiny, which in turn accelerates enterprise green transformation. Additionally, green factory certification has differential effects on enterprise green transformation. The effect of green factory certification on enterprise green transformation is more pronounced in regions with high public environmental concern, non-heavily polluting industries, non-state-owned enterprises, and large-scale enterprises. This paper broadens the policy pathways for enterprise green transformation from the perspective of government-led green certification, offering valuable insights for promoting such transformations.

1. Introduction

Amid escalating resource depletion and environmental challenges, the international community has acknowledged the necessity of promoting enterprise green transformation [1,2,3]. However, due to the real constraints of input costs and riskiness, a discrepancy remains between endogenous motivation and exogenous support for enterprise green transformation. In this context, various environmental policies have emerged as significant instruments to guide enterprise green transformation, including command environmental policies, market incentive environmental policies, and others [4,5,6]. The body of research on this topic has grown considerably, and scholars have argued that command-type environmental policies are prone to market distortions due to their coercive characteristics [7]. Although market incentive-type environmental policies can improve environmental performance by means of incentive guidance, their effect may fade quickly after the policy is withdrawn. To address these limitations, green certification policy has emerged as a significant instrument for managers, with numerous studies beginning to unravel the realization effects of green certification policy.

Green certification can be categorized into two distinct approaches: those that are government-led and those that are non-government-led. The efficacy of the implementation of non-government-led green certification policies has been a subject of considerable debate in academic circles [8,9,10], primarily due to concerns regarding the credibility of non-governmental green certification policies in terms of selection criteria, monitoring processes, and institutional safeguards, resulting in a disconnect between the environmental performance of enterprises and the objectives of non-governmental green certification policies. In essence, the efficacy of a non-governmental green certification policy may be hindered by an imperfect certification framework and the limited credibility of certification outcomes. Conversely, government-led green certification policies are backed by government credit and are characterized by rigorous management processes, effective incentive mechanisms, and comprehensive inspection and supervision systems. For instance, in 2016, China’s Ministry of Industry and Information Technology (MIIT) promulgated the Notice on the Construction of Green Manufacturing System, which actively encourages enterprises to voluntarily participate in the green factory certification policy. Green factory certification is a typical government-led green certification policy. This policy is characterized by its rigorous pre-inspection and post-supervision measures, which are designed to prevent free-riding behavior. Additionally, the policy demonstrates a clear tendency towards policy resource allocation, with selected enterprises receiving support in the form of government subsidies for sustainability, tax exemptions, government procurement orders, and access to green credit from financial institutions. The extant literature on the subject of green factory recognition has revealed a number of implementation effects, including but not limited to business credit [11], corporate sustainability [12], and labor income [13]. Wang et al. (2025) investigated the impact of green factory certification on corporate sustainability performance, but the study did not explore it in depth under the theoretical framework of combining internal incentives and external monitoring [13]. Green factory certification policies not only have internal incentives for companies but also external monitoring requirements. In view of the above considerations, this paper reveals the intrinsic link between green factory recognition and enterprise green transformation based on a theoretical framework combining internal incentives and external monitoring. This provides a new analytical framework for green factory recognition and enriches the literature on the influencing factors of enterprise green transformation.

Our research contributions span three key domains. First, existing studies remain divided on whether green certification policies exert significant environmental incentive effects. While some studies support their effectiveness, others question their impact. Our findings indicate that government-led green certification policies, such as green factory certification, have clear environmental incentive effects, thereby contributing to the discourse on green certification policies. Second, this study offers a novel perspective on advancing enterprise green transformation. Prior research has primarily focused on mandatory environmental policies, while insufficient attention has been paid to how government-led green certification, exemplified by green factory recognition, shapes enterprise green transformation. Third, from the perspective of the internal and external linkage of enterprises, we identify internal incentives and external supervision as key mechanisms through which green factory certification promotes enterprise green transformation. This analysis clarifies the intrinsic relationship between green factory recognition and enterprise greening. Finally, exploring the heterogeneous impacts of green factory certification across public, industry, and enterprise characteristics enhances the understanding of how green factories empower social governance and provides actionable empirical evidence for promoting enterprise green transformation globally.

2. Policy Background and Literature Review

2.1. Policy Background

The green factory certification policy, introduced by the MIIT, is distinct from the general green certification policy of environmental organizations. The policy requires green factories to adopt life-cycle thinking and promote green manufacturing in multiple aspects, including plant renovation, product design, production and recycling. This is conducted on the premise of ensuring product functionality, quality, and the occupational health and safety of employees during the manufacturing process. The selected enterprises are able to provide protection for all kinds of policy resources, including but not limited to government green subsidies, tax exemptions, government procurement orders, and bank green credit support. In addition, in contrast to other short-term certification models, enterprises that have been designated as green factories are subject to the constraints of the public service platform’s periodic spot checks and the ’three-year review’ mechanism. This ensures long-term and effective supervision of the enterprises. It is evident that the implementation of the green factory recognition policy has yielded notable outcomes, with over 1000 enterprises being distinguished as green factories, thereby generating a substantial positive impact.

2.2. Literature Review

2.2.1. Literature Related to Green Certification Policies

How certification policies affect enterprise green transformation has received much attention in the literature, with most studies focusing on high technology certification [14], ISO 14001 certification [15], and green building certification [8], among others, but there is some controversy over the effectiveness of their policies. This may be due to the fact that the possible viability of green certification policies of environmental organizations in general is controversial. Unlike them, the government-led green certification policy is to have government credit as a guarantee; with a standardized certification process and strict audit system, the effect of their policy implementation has significant results. The green factory recognition policy is a typical government-led green recognition policy [13], and there has been some literature attention on its policy effects. For example, Wang et al. (2025) found that green factory recognition policies have a catalytic effect on firms’ sustainability performance, with green innovation and green investor focus playing an important mechanistic role [12]. However, the study does not reveal the policy effects of green factory recognition under the theoretical framework of combining internal incentives and external monitoring. Green factory recognition policies may have different effects depending on the nature of the enterprise and industry attributes. Considering the special relationship between the government and SOEs, Liu et al. (2024) found that the green factory recognition policy can promote green innovation in non-SOEs [16]. Wang et al. (2025) argued that there are different efficacies of green factory certification policies on corporate sustainability in different industries [12]. Li et al. (2024) found that different market environments interfere with the effectiveness of green factory certification policies [11]. In highly monopolized or low reputation markets, the role of green factory recognition policies in prompting firms’ business credit is stronger. In summary, the relevant literature finds heterogeneous effects of green factory recognition policies. Then, we are interested in whether there are different implementation effects among enterprises, industries, and the public between green factory recognition policies and enterprise green transformation. Against this background, this paper reveals the intrinsic link between green factory recognition and enterprise green transformation based on a theoretical framework that combines internal incentives and external monitoring, which not only provides a new analytical framework for green factory recognition but also enriches the literature on the influencing factors of enterprise green transformation.

2.2.2. Research on Factors Influencing Green Transformation of Enterprises

Another strand of literature closely related to this study examines the factors influencing enterprise green transformation, primarily categorized into internal behavioral and external regulatory dimensions. First, internal behavioral factors focus on how enterprises’ internal actions drive green transformation. Key topics in this domain include green mergers and acquisitions [17], intelligent transformation [18], and digital transformation [19]. Second, external regulatory drivers highlight the role of external interventions in facilitating green transformation, particularly when enterprises lack the capacity for self-driven change. This body of research investigates areas such as digital infrastructure development [20], financial agglomeration [21], green credit [22], and government subsidies [23]. Historically, environmental policy, as a primary tool for governmental ecological management, has significantly influenced enterprise green transformation [24,25]. However, mandatory environmental regulation faces challenges such as high governance costs and limited temporal scope, often hindering the realization of desired governance outcomes. Compared to formal environmental regulations, which compel enterprises toward passive green transformation, green certification policies—characterized by voluntary enterprise participation in environmental protection—offer autonomy and flexibility. These attributes present a critical opportunity to address the shortcomings of mandatory environmental regulations in fostering enterprise green transformation. Despite this potential, existing research primarily explores enterprise green transformation through the lens of mandatory environmental regulation, with insufficient attention paid to the role of voluntary environmental regulation. This gap underscores the need for deeper investigation into how green certification policies can complement traditional regulatory approaches to drive sustainable enterprise practices.

2.2.3. Literature Summary

The existing literature has explored green certification policies and enterprise green transformation from various perspectives, providing valuable insights. However, several aspects require further exploration. First, there is ongoing controversy regarding the environmental incentive effects of green certification policies. This paper is particularly interested in whether a high-standard green certification policy led by a government agency has an environmental incentive effect, a topic that remains underexplored in the existing literature. Second, in studies examining the influence of environmental policies on enterprise green transformation, most concentrate on mandatory environmental policies. The role of government-led green certification policies, such as green factory recognition, in driving enterprise green transformation has been insufficiently examined. To address these research gaps, this research not only seeks to address the controversy surrounding green certification policies but also offers practical policy recommendations to facilitate enterprise green transformation.

3. Theoretical Analysis and Research Hypothesis

3.1. Impact of Green Factory Recognition on Enterprise Green Transformation

Green factory certification, as a government-led green certification tool, provides a comprehensive pathway combining incentives and supervision to facilitate enterprise green transformation. From an incentive perspective, green factory certification signals the redirection of resources toward green and sustainable initiatives, motivating enterprises to make their production and management systems greener, thereby advancing their green transformation. Enterprises designated as green factories receive not only an honorary title but also explicit resource support, such as environmental protection subsidies, special funds, and tax reductions. The green factory title, conferred by the central authority, enables awarded enterprises to utilize the green certification logo to establish favorable government–enterprise dynamics with local authorities, thereby accessing implicit resource support, such as reduced frequency of environmental inspections [26]. With these resource incentives, enterprises are motivated to assume responsibilities for sustainable production and management, continually enhancing their green transformation. From a supervisory perspective, enterprises awarded the green factory title serve as benchmarks in the industry and hold social influence in green sustainability, which facilitates external scrutiny and encourages faster green transformation. The Green Factory Demonstration List, recognized for its authority and credibility, ensures that selected enterprises garner multi-stakeholder attention. Policy issuers not only conduct regular spot-checks of green factory construction and publish CSR reports, but scrutiny from green investors and media outlets also imposes supervisory pressure on enterprises, thereby exerting a forcing effect that propels their green transformation.

H1:

Green factory certification accelerates enterprise green transformation.

3.2. Mechanism of Green Factory Recognition on Enterprise Green Transformation

3.2.1. Internal Incentives

Enterprise green transformation refers to the process of shifting traditional production and operational modes toward sustainable production, marked by significant investments, substantial innovation risks, and inherent uncertainties [27]. On one hand, green transformation necessitates that enterprises enhance investments in eco-friendly, energy-efficient equipment and skilled human capital. By utilizing green equipment, enterprises can minimize resource consumption and optimize economic efficiency, thereby achieving endogenous environmental governance and advancing green transformation [28]. Moreover, green transformation relies on robust green technology R&D efforts. Through the application of advanced environmental protection technologies and the revitalization of idle and inefficient resources, enterprises can achieve greater emission reductions and operational efficiency [29]. Sustaining green transformation efforts requires consistent investments and technological breakthroughs in green R&D. Green factory recognition serves as an institutional lever to motivate companies by reducing financing costs and fostering green innovation. From a financing perspective, enterprises designated as green factories act as government-endorsed green signals that instill investor confidence. This enables financial institutions to identify clear investment targets, granting awarded enterprises access to preferential financing terms for green credit and related investments. Additionally, the green signals emitted by green factory demonstrators function as a product differentiation strategy, fostering competitive advantage over non-green firms. This approach attracts green-conscious consumers willing to pay premium prices, ultimately yielding adequate financial returns. The green factory certification process, underpinned by high standards and strict constraints, requires enterprises to fulfill basic production processes, implement end-of-pollution technological transformations, and develop robust reserves of green knowledge and innovation. Furthermore, enterprises must focus on core green technologies to minimize resource consumption and environmental pollution, setting a benchmark for the industry.

H2:

In terms of internal incentives for enterprises, green factory recognition can reduce financing costs and promote green innovation, which in turn can help drive enterprise green transformation.

3.2.2. External Monitoring

The motivation for green transformation extends beyond internal incentives; it also requires external monitoring, including the engagement of green investors and media oversight [22]. With the rise in green sustainable development as a business philosophy, external green investors now integrate environmental performance into their investment assessments. Driven by green priorities, enterprises not only strengthen their environmental awareness and implement green practices but also operate under the scrutiny of green investors, demonstrating their commitment to green transformation. Meanwhile, the media, as a critical supervisor of market activities, applies public opinion pressure, amplifying reputational impacts. Media reports intensify public scrutiny of corporate pollution, urging polluting enterprises to enhance their environmental awareness. Regarding green transformation practices, media coverage helps enterprises build reputational capital, attract green investment, and accelerate transformation. From an external monitoring perspective, green factory recognition heightens green investor engagement and media oversight, thereby driving enterprises toward green transformation. Green factories, designated by the central authority, act as industry benchmarks for green practices, attracting significant attention from external stakeholders [13]. In this context, green investors are driven to prioritize enterprises holding green factory designations, closely monitoring and evaluating their green transformation progress. As core components of China’s green manufacturing system, green factories naturally garner extensive media coverage, generating public opinion pressure and reputational impacts that compel enterprises to accelerate their green transformation. Moreover, enterprises with the Green Factory designation must provide extensive, high-quality environmental disclosures and articulate social responsibility commitments. This transparency enhances the effectiveness of monitoring by media and stakeholders, offering insights into the enterprise’s developmental prospects.

H3:

From the external monitoring of enterprises, green factory recognition is conducive to increasing green investor attention and media monitoring, which in turn urges enterprise green transformation.

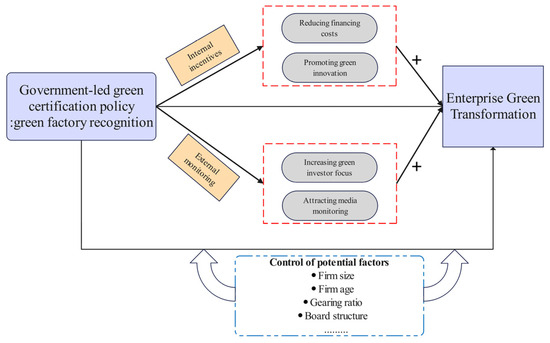

In summary, this paper argues that green factories operate as dual mechanisms, serving as internal incentives and external monitoring tools. Internally, they reduce financing costs and foster green innovation, while externally, they draw the attention of green investors and amplify media scrutiny. Together, these mechanisms effectively drive enterprise green transformation. The process and its underlying dynamics are depicted in Figure 1.

Figure 1.

Mechanism path of green factory certification on enterprise green transformation.

4. Research Design

4.1. Methodology

In this paper, the impact of government-led green certification on enterprise green transformation is examined using a multi-period difference-in-differences (DID) model. The DID approach was selected for several reasons that make it particularly well-suited for assessing the effects of policy interventions like the recognition of green factories. First, DID compares changes over time within the same unit (or group) rather than comparing levels across different units. This “double-differencing” removes the influence of unobserved factors that are constant over time—even if these factors differ between the treatment and control groups. In contrast, methods like PSM rely on matching observable characteristics and may still suffer from bias due to unobserved confounders. Second, green factory recognition policy is implemented in phases. The multi-period DID efficiently exploits both the cross-sectional and temporal variations in treatment timing. Synthetic control methods, while powerful for a single treated unit or a small number of units, are less flexible when multiple units receive treatment at different times. DID allows us to estimate the policy’s impact both immediately and as it evolves, which is crucial for understanding long-term effects. The benchmark model is set up as Equation (1).

In Equation (1), is the green transformation of firm i in year t; is a dummy variable for green factories; refers to the control variables; and are firm-fixed and year-fixed, respectively; and is the error term in the model.

This study employs the event study method, as outlined by Beck et al. (2010), to carry out a parallel trend test [30]. The specific econometric model construction is shown in Equation (2).

In Equation (2), captures the difference in variation between selected and non-selected firms before and after the green factory recognition during this period. In this paper, the first year of the sample period will be used as the base period as a reference point.

4.2. Variable Introduction

Enterprise Green Transformation (GT) is an explained variable. This paper employs textual analysis to measure enterprise green transformation. First, the initial stage of the study involved the selection of 113 keywords related to enterprise green transformation. This was achieved through an examination of relevant policy documents, including the Technical Guidelines for the Evaluation of Corporate Environmental Behavior and the Action Plan for Peak Carbon by 2030. The keywords were classified into five categories: publicity strategies, analytical concepts, technological developments, wastewater treatment, and monitoring and administration. Second, we employed a text analysis method to extract key information and insights presented in the annual reports of enterprises, counting the total frequency of green transformation keywords in each report. Finally, considering the fact that the statistical word frequency data are right-skewed, we took the natural logarithm of the word frequency data for enterprise green transformation keywords after adding 1.

Green Factory Recognition (did) is an explanatory variable—dummy variable for whether a corporation is rated as a green factory. In this paper, we manually compile a list of green factory demonstrations to determine whether a firm has been selected as a green factory demonstration. If the enterprise or the enterprise’s subsidiary is evaluated as a green factory demonstration enterprise in a certain year, it takes the value of 1 in a certain year and the following years; otherwise, it takes the value of 0.

Control variables. Referring to the relevant literature [22], the control variables include the following: The size of a firm is calculated according to the natural logarithm of the total value of its assets (Size). FirmAge is defined as the natural logarithm of the present year minus the year of the firm’s establishment, plus one. Gearing ratio (Lev) is calculated as total liabilities divided by total assets. Corporate return (ROE) is defined as net profit as a proportion of the average balance of shareholders’ equity. Total Asset Turnover (ATO) is measured by the ratio of operating income to average total assets. Number of Directors (Board) is represented by the natural logarithm of the number of directors on the board. Dual indicates whether the chairman of the board and the general manager are the same individual (1) or not (0). Balance1 is defined as the ratio of the second largest shareholder’s ownership to that of the largest shareholder.

4.3. Data Sources and Descriptive Statistics

In light of the implementation of green factory policy in 2017, this paper employs a sample of Chinese A-share companies from 2015 to 2022 to circumvent the disruption caused by the implementation of the Environmental Protection Law in 2015. The corporate financial data were sourced from the CSMAR. In terms of data cleaning, this paper performed the following: (1) excluded ST and ST* firms during the study period; (2) excluded financial sample firms; (3) excluded firms with missing key variables; and (4) applied a 1 percent up and down shrinkage to all continuous variables. After the above treatment, a total of 28,068 valid observations were obtained. Table 1 sets out the descriptive statistics for the principal variable. The findings indicate that the mean value of GT is 1.999 and standard deviation is 0.831, which varies up and down between 0 and 3.97, which indicates that green transformation of enterprises within the sample exhibits a considerable degree of variation. The mean value of did is 0.0961, which indicates that 9.6 percent of enterprises in the overall sample are green factory demonstration enterprises. The distribution of other control variables is more consistent with previous literature.

Table 1.

Descriptive statistics.

5. Empirical Results

5.1. Baseline Regression Results

Table 2 presents the outcomes obtained from the benchmark regression, which assesses the influence of green factory recognition on enterprise green transformation. The coefficient is 0.567, a value that is significantly positive at the 1% level, in column (1) in Table 2. This tentative suggestion is that green factory accreditation promotes enterprise green transformation. The accuracy of the regression results is improved by the addition of fixed effects and control variables, respectively, in columns (2) and (3). The results show that the coefficients pass the significance test at the 1% level with values of 0.0999 and 0.0807, respectively. Overall, the regression results prove that green factory recognition can promote enterprise green transformation. We observe that the effect of control variables such as FirmAge, Board, and Lev is not significant, which may be due to the following reasons. Firm age is often used as a proxy for experience or organizational maturity, but its impact may be diminished if older firms also suffer from inflexible systems that offset the benefits of accumulated expertise. The purpose of the board structure is to reflect the quality of corporate governance. An excessive number of directors may cause confusion in the internal governance of the enterprise, which does not have a significant impact on the enterprise green transformation. Lev is the corporate gearing ratio. Excessive enterprise debt ratios add to the financial pressure on enterprises and affect the investment of funds for green transformation.

Table 2.

Baseline regression results. Impact of green factory certification on enterprise green transformation.

We find that the policy of green subsidies achieves its effects mainly through financial incentives [31], and ISO certification leads to improved environmental performance through improved corporate reputation [32]. In contrast, the green factory certification policy, which is a government-led green certification policy with higher reliability, can improve corporate reputation and operations as well as enjoy government green subsidies. It has higher effectiveness on enterprise green transformation impact. Our findings suggest that green certification policies tend to significantly improve enterprise green transformation, which is largely consistent with but also different from the effects reported in previous studies on green credit policies. In contrast, our research on green certification policies emphasizes firms being subject to external monitoring and internal operational adjustments. However, the green credit policy emphasizes changing financing costs and investment behavior more to show the effect, which has been highlighted in previous studies [33], and the potential operation mechanisms of the two policies are different.

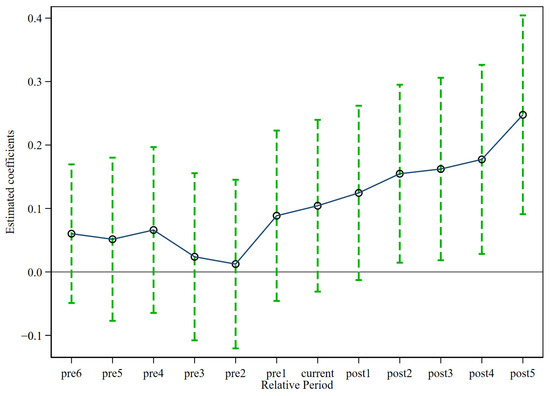

5.2. Parallel Trend Test

We chose the event study method for Parallel Trend Test [30]. First, the event study method is able to visualize the effect estimates for the periods before and after the intervention. By testing whether the pre-event coefficients are significant, one can effectively determine whether the treatment and control groups were systematically different before the intervention, which is crucial to the validity of the difference-in-differences method. Second, as the establishment of green factories is usually implemented in batches, the event study method can help us examine the heterogeneity of policy effects in different time periods and provide a basis for subsequent policy optimization. Figure 2 plots the dynamic coefficients and the results of the change in significance (90% confidence interval) of when GT is the explanatory variable. As might be expected, none of the regression coefficients exhibit a statistically significant difference from zero prior to the recognition of the green factory (i.e., before current). This suggests that there is no notable systematic discrepancy between the firms that were designated as green factories and those that were not prior to the enactment of the policy. Meanwhile, coefficients begin to increase and pass the significance test after the green factory recognition. The findings suggests that the adoption of a policy for the recognition of green factories has resulted in a significant improvement in the green transformation of the chosen companies as opposed to that of the non-chosen companies.

Figure 2.

Parallel trend test.

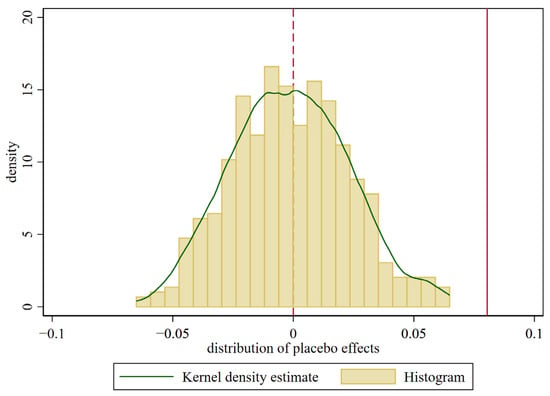

5.3. Placebo Test

The placebo test is a falsification exercise that checks whether our causal inference strategy is robust to potential biases. In our DID framework, we “pretend” that the treatment occurred in a pre-intervention period where no actual policy change took place. Under the key parallel trends assumption, we expect that—absent of the true treatment—the estimated effect should be statistically indistinguishable from zero. Choosing the placebo test method is advantageous because it directly tests for the presence of unobserved confounders or anticipation effects that might bias our DID estimates. In order to remove the confounding effects of these extraneous variables, this paper employs a placebo test on the baseline model [34]. The precise methodology is as follows: Ensuring that the shock time and the structure of the sample cohort remain unchanged, this paper randomly draws a number of individuals from the research sample without replacement, designating them as ‘pseudo-experimental individuals’ before conducting the estimation to obtain pseudo-estimates for the replacement test. Conducting 500 repetitions of this process yields a distribution plot of the placebo-tested effects. If there is a significant difference between the estimated coefficients of the baseline model and the pseudo-calculated coefficients from the placebo test, it suggests that the real-world redundancy components and green factory recognition are not the cause of the regression findings drawn from the baseline model. Figure 3 illustrates the distribution of the placebo tests. It is clear that the pseudo-estimated coefficients from 500 random permutations align closely with a normal distribution centered around 0, while the true baseline regression treatment effect estimates are positioned on the right side of the solid line in Figure 3. This implies that the pseudo-estimated coefficients and the baseline regression estimates disagree significantly.

Figure 3.

Placebo test.

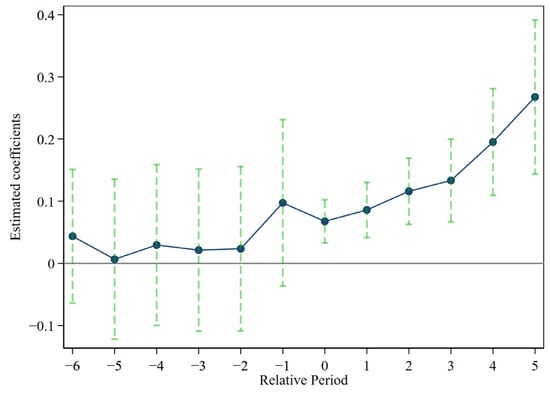

5.4. Treatment Effects Heterogeneity

It has been observed that DID models incorporating two-way fixed effects to estimate treatment effects at varying time points may be susceptible to heterogeneity in treatment issues, resulting in biased estimation conclusions [35]. This is because the heterogeneity of treatment effects across groups and time dimensions may introduce problems of negative weighting and bias in two-way fixed effects estimators. In this paper, we use robust estimators from the interpolation-based estimation framework provided by Borusyak to diagnose possible potential estimation bias [35]. Figure 4 plots the dynamic effect event study of the interpolated estimator. It can be found that after the estimation treatment based on the interpolation method, the influence of the green factory recognition on enterprise green transformation does not exist significantly before the green factory recognition, while after the green factory recognition, its impact effect begins to be highlighted. Taken together, after considering the heterogeneity treatment effect, its resulting average treatment effect is basically consistent with the treatment effect in the benchmark model, which indicates that the benchmark model passes the heterogeneity treatment effect test, further validating the validity of the benchmark conclusion.

Figure 4.

Treatment effects heterogeneity.

5.5. Sample Selection Issue

In the present study, Propensity score matching–double difference (PSM-DID) is used to re-estimate the model in an attempt to rule out the possibility that bias in sample selection may affect the outcome. A nearest neighbor approach with a 1:1 matching ratio is employed to align the control variables as covariates, with the successfully matched samples retained for re-estimation of the double difference. The findings of the PSM-DID are presented in column (1) of Table 3. It is discovered that the coefficients are positive at 1% significance, meaning that even after accounting for sample selection bias, the regression findings are still solid.

Table 3.

Other robustness tests.

5.6. Other Robustness Tests

Furthermore, the paper presents the results of the following additional tests. (1) Consider the lag effect; considering that the influence of green factory recognition on enterprise green transformation may only appear in the lag period, this paper sets enterprise green transformation as a future period for regression test. (2) Controlling for omitted variables; we further include industry fixed effects in the benchmark model to absorb industry-level unobservable and time-varying omitted variables. (3) Change the clustering criteria incorrectly; we further extend the clustering criteria to the city level to increase robustness considerations. (4) Change the sample interval; considering the epidemic shock, this paper excludes the post-2020 sample to enhance the reliability of the findings. Columns (2) to (5) of Table 3 report robustness findings, all of which pass the significance test.

6. Mechanism Testing and Heterogeneity Analysis

6.1. Mechanism Testing

6.1.1. Intra-Firm Incentives: Financing Costs and Green Innovation

Companies that are awarded green factories have significant competitive advantages in terms of financing costs and green innovation, providing internal incentives for green transformation. Enterprises obtaining the title of green factory can enjoy the advantage of financing facilitation in green credit and other related green investments. Green factory enterprises need to complete basic production process and end-of-pollution technological transformations, and also form a good green innovation knowledge and technology reserve. This paper utilizes the research methodology of Zhao et al. (2024) to verify the mechanism of financing cost and green innovation [36]. The methodology calculates the financing costs (Cost) of firms by dividing their total liabilities at the end of the period by the total amount of their interest expenses, fee expenses, and other financial costs. Based on the Sun et al. (2024) methodology [28], this study uses the natural logarithm of the number of patent applications for green inventions by firms plus one to measure green innovation (Giv).

The findings of the mechanism test for green innovation and financing costs are presented in Table 4. Table 4’s (1) and (2) columns provide the financing cost mechanism tests’ findings. It can be noticed that column (1) does not include the control variable, and the coefficient is −0.00112 and passes the test of significance at the 1% level. Column (2) includes the control variable, and the coefficient is −0.000706 and passes the test of significance at the 5% level. The conclusions indicate that green factories are identified as helping enterprises in green transformation by reducing financing costs. The outcomes of the green innovation mechanism test are shown in Table 4’s columns (3) and (4). Findings reveal that, in column (3), no control variables are present; the regression coefficient is 0.0354, passing the significance test at the fifth percentile; in column (4), control variables are present; the regression coefficient is 0.0296, passing the significance test at the tenth percentile. The above regression conclusion shows that green factory recognition helps enterprises to green turn by promoting green innovation. Taken together, Table 4 verifies that green factory recognition can create internal incentives for enterprises’ green transformation by reducing financing costs and promoting green innovation.

Table 4.

Mechanisms test: internal enterprise incentives.

6.1.2. External Oversight of Enterprises: Green Investor Concerns and Media Monitoring

The green factory recognition is also reflected in the external supervision of enterprise green transformation. Green investors have a strong motivation to pay attention to enterprises with the title of green factory and will effectively investigate the green transformation of enterprises and form an effective supervision of the green transformation of enterprises. Green factories belong to the core support unit of China’s green manufacturing system, and the importance of its recognition will inevitably lead to the media’s coverage of green factories. This paper builds on Feng and Yuan’s (2024) study to characterize green investor concern (Ginvt) by taking the natural logarithm of the number of firms’ green investors plus one [37]; it also draws on Deng et al. to characterize media monitoring (Media) by taking the natural logarithm of the number of times firms are reported by the media plus one [38].

The findings of the media monitoring and green investor concerns mechanism test are presented in Table 5. The green investor focus mechanism test findings are reported in Table 5’s columns (1) and (2). It can be observed that, in column (2), control variables are included and the regression coefficient is 0.106, passing the test of significance at the one percent level. In column (1), there are no control variables and the regression coefficient is 0.165. The above regression findings suggest that green factory recognition can provide transformational momentum for enterprise green transformation by increasing green investor attention. Table 5’s columns (3) and (4) present the media monitoring mechanism test findings. It can be observed that the control variable is absent from column (3), where the regression coefficient is 0.120 and passes the significance test at the one percent level; in contrast, the control variable is present in column (4), where the regression coefficient is 0.0954 and also passes the significance test at the one percent level. The above regression conclusions indicate that green factory recognition can provide transformational impetus for enterprise green transformation through media monitoring. Taken together, Table 5 verifies that green factory recognition can provide external supervision for enterprise green transformation through increased green investor attention and media monitoring.

Table 5.

Mechanism test: external oversight of enterprises.

6.2. Heterogeneity Analysis

6.2.1. Public Environmental Concerns

Public environmental concerns can affect the effectiveness of green factory recognition in enhancing the green transformation of enterprises. Local enterprises will place a high value on environmental governance in addition to the steady rise in public awareness of environmental protection. They will also aggressively comply with the standards of green factory planning in order to support businesses in their green transformation. This makes it easy to anticipate that the function that green factory accreditation plays in encouraging the green transformation of businesses will become more evident as public worries about the environment grow. In order to confirm the previously indicated hypothesis, this study employs the Baidu Haze Search Index to represent public environmental worry. It then categorizes the data into two groups: high and low public environmental concern, based on the regression test’s median. The results of the test for heterogeneity of public environmental concern are presented in Table 6, columns (1) and (2). The regression coefficient is found to be 0.108 in the group with strong public environmental concern, passing the test at the fifth percentile. The regression coefficients failed the significance test in the group that expressed the greatest level of public concern about the environment. In conclusion, areas where environmental concerns are highly held tend to have a more pronounced enhanced influence of green factory designation on businesses’ green transformation.

Table 6.

Heterogeneity: regions and sectors.

6.2.2. Industry Categories

Different environmentally sensitive industries have differential impacts on enterprise green transformation. For heavy polluting industries, China has clearly regulated the emission information to be disclosed by heavy polluting industries, the disclosure methods, and channels in the form of legislation, which makes the heavy polluting industries already subject to strict environmental supervision and relatively standardized disclosure of environmental information before the recognition of green factories. In contrast, for non-heavily polluting industries, being selected as a green factory can help these enterprises to better improve their environmental performance, thus contributing to their green transformation. This makes it simple to predict that companies in less polluting industries will be encouraged to turn into greener businesses the more obvious the green factory recognition is. We classify and manage the sample into heavy and non-heavy polluting industries using the “Listed Companies Environmental Verification Industry Classification and Management Directory”. Table 6 reports the industry pollution heterogeneity test findings in columns (3) and (4). The regression coefficient fails the significance test in highly polluted industries, but it is found to be statistically positive in non-heavily polluted industries. This suggests that in less polluted industries, the boosting effect of green factory recognition on the green transformation of firms is more evident.

6.2.3. Property Rights Attributes

State-owned enterprises are distinct from general enterprises in that they possess both political and economic qualities. They actively engage in social responsibility while fostering economic development, and there is little chance that they will skirt environmental protection obligations or lower the caliber of environmental information disclosed. As a result, the impact of green factory recognition will be minimal. Non-state firms can establish their green image, improve their reputation, and assist in achieving the aim of green transformation by actively participating in the green manufacturing program. This makes it easy to foresee more clearly that green factory identification promotes an enterprise’s green transformation among non-state-owned businesses. The paper separates the sample for group regressions into state-owned and non-state-owned enterprises in order to test the aforementioned supposition. Table 7’s (1) and (2) columns provide the findings of the test for ownership attribute heterogeneity. It is discovered that the regression coefficient in the non-state-owned businesses is 0.0876, passing the test at the one percent threshold. The regression coefficient fails the significance test in the group of state-owned companies. In conclusion, non-state-owned enterprises exhibit a more pronounced, enhanced effect of green factory recognition on the green transformation of their enterprise.

Table 7.

Heterogeneity: firm heterogeneity.

6.2.4. Size of Enterprises

There are significant differences between large and small enterprises in terms of information disclosure and resource optimization. Large enterprises receive more environmental attention, their information disclosure is more transparent, and the effect of green factory recognition may be more prominent. Based on this, the following hypothesis can be put forward: among large enterprises, the higher the recognition of green factories, the more likely it is to promote the enterprise green transformation process. The number of workers in companies is divided into large- and small-scale groups in this study based on the regression’s median. Table 7’s (3) and (4) columns provide the firm size heterogeneity test findings. In large-scale businesses, the regression coefficient is shown to be significantly positive, while in small-scale businesses, it fails the significance test. This suggests that in large-scale firms, the boosting effect of green factory recognition on the green transformation of enterprises is more evident.

7. Conclusions, Recommendations, and Future Perspectives

7.1. Conclusions

Enterprise green transformation forms a crucial foundation for achieving carbon neutrality. This paper investigates the impact of government-led green certification on enterprise green transformation, focusing on the internal and external linkages within enterprises, using the green factory certification policy initiated by the MIIT as a case study. The findings demonstrate that government-led green certification exerts a significant environmental incentive effect, as evidenced by the acceleration of enterprise green transformation through green factory certification. This result addresses ongoing debates surrounding the environmental performance of green certification policies. Mechanism analysis reveals that green factory certification functions as both an internal incentive and an external monitoring mechanism. Internally, it reduces financing costs and stimulates green innovation, while externally, it garners attention from green investors and media oversight, thereby driving enterprise green transformation. Heterogeneity analysis further shows that the transformative effect of green factory certification is more pronounced in regions with high public environmental concern, in non-heavily polluting industries, in non-state-owned enterprises, and among large-scale enterprises.

7.2. Recommendations

Based on these findings, this paper offers the following policy recommendations.

First, we will continue advancing the green factory assessment program, improving supporting measures, and maximizing the effectiveness of government-led green certification policy. The primary conclusion of this paper demonstrates that green factory recognition significantly enhances enterprises’ green transformation. This finding suggests that the government should target enterprises with high development potential, establish tailored cultivation plans, and provide guidance and support aligned with green factory construction standards. Moreover, the government should strengthen green factories’ performance in environmental protection supervision, energy conservation oversight, production auditing, and responsibility awareness within the regulatory framework and subsequent top-level design. Emphasizing the role of green factories as demonstrations and benchmarks, policymakers should monitor the transformation outcomes of enterprises in the green factory demonstration program and position them as industry exemplars. This approach will facilitate policy diffusion and encourage broader participation in green manufacturing transformation.

Second, to foster a dual incentive mechanism for enterprise green transformation, it is crucial to enhance external oversight and internal incentive mechanisms related to green factory accreditation. Enterprises should strictly adhere to green factory construction standards and focus on strengthening capabilities in project screening, technology evaluation, result promotion, and information sharing, thereby creating internal drivers for green transformation. Simultaneously, policymakers should establish user-friendly feedback platforms or engage external monitoring bodies, such as media organizations, to reinforce green factory oversight. This dual approach will deter short-term strategies like “greenwashing” and act as an external driver to accelerate green transformation efforts.

Finally, the green factory program should be implemented with differentiated and targeted strategies, fully considering regional, industrial, and enterprise-specific differences to optimize effectiveness. Green factory recognition has limited influence on enterprises with low public environmental concern and those in heavily polluting industries, state-owned enterprises, or small-scale operations. Consequently, policymakers should tailor green transformation policies and objectives to local contexts and industry characteristics in subsequent implementations. Efforts should focus on scientifically guiding these enterprises toward green practices and formulating precise, differentiated policy strategies to maximize policy incentives. For non-state-owned enterprises, the government should encourage active participation in green factory recognition to create an image of a responsible green enterprise and, thus, gain more market support. For large-scale enterprises, the government can appropriately tilt and focus its support to such enterprises when selecting green factories in the future so as to better drive enterprise green transformation through the demonstration and spillover effects of the benchmark enterprises.

7.3. Future Perspectives

The green factory certification program is an exemplar of how strategic government intervention can catalyze enterprise green transformation. By expanding the program’s reach, integrating technology, and aligning with stakeholder demands, a new model for industrial sustainability may be established. In the face of global climate crises, China’s experience highlights the critical role of policy innovation in achieving a balance between economic growth and environmental stewardship. Future efforts must strike a balance between ambition and pragmatism, ensuring that green certification remains a cornerstone of the global transition to net-zero.

Author Contributions

Conceptualization, S.N. and G.W.; methodology, S.N. and G.W.; software, S.N.; validation, S.N.; formal analysis, G.W.; investigation, G.W.; resources, G.W.; data curation, S.N.; writing—original draft preparation, S.N.; writing—review and editing, G.W.; visualization, G.W.; supervision, S.N. and G.W.; project administration, G.W.; funding acquisition, G.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (Grant number: [20BJY041]).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets used and/or analyzed during the current study are available from the corresponding authors upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Aung, T.S.; Fischer, T.B.; Shengji, L. Evaluating environmental impact assessment (EIA) in the countries along the belt and road initiatives: System effectiveness and the compatibility with the Chinese EIA. Environ. Impact Assess. Rev. 2020, 81, 106361. [Google Scholar] [CrossRef]

- Green, J.F. Explaining green industrial policy in an age of globalization. Nat. Clim. Change 2024, 14, 783–784. [Google Scholar] [CrossRef]

- Wang, L.; Cheng, Z. Impact of the Belt and Road Initiative on enterprise green transformation. J. Clean. Prod. 2024, 468, 143043. [Google Scholar] [CrossRef]

- Long, R.; Bao, S.; Wu, M.; Chen, H. Overall evaluation and regional differences of green transformation: Analysis based on “government-enterprise-resident” three-dimensional participants perspective. Environ. Impact Assess. Rev. 2022, 96, 106843. [Google Scholar] [CrossRef]

- Song, Y.; Niu, N.; Song, X.; Zhang, B. Decoding the influence of servitization on green transformation in manufacturing firms: The moderating effect of artificial intelligence. Energy Econ. 2024, 139, 107875. [Google Scholar] [CrossRef]

- Marsiglio, S.; Tolotti, M. Complexity in low-carbon transitions: Uncertainty and policy implications. Energy Econ. 2024, 138, 107803. [Google Scholar] [CrossRef]

- Tombe, T.; Winter, J. Environmental policy and misallocation: The productivity effect of intensity standards. J. Environ. Econ. Manag. 2015, 72, 137–163. [Google Scholar] [CrossRef]

- Qiu, Y.; Kahn, M.E. Impact of voluntary green certification on building energy performance. Energy Econ. 2019, 80, 461–475. [Google Scholar] [CrossRef]

- Ofori, E.K.; Asongu, S.A.; Ali, E.B.; Gyamfi, B.A.; Ahakwa, I. Environmental impact of ISO 14001 certification in promoting sustainable development: The moderating role of innovation and structural change in BRICS, MINT, and G7 economies. Energy Environ. 2024. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, I.; Boiral, O.; Díaz de Junguitu, A. Environmental Management Certification and Environmental Performance: Greening or Greenwashing? Bus. Strategy Environ. 2020, 29, 2829–2841. [Google Scholar] [CrossRef]

- Li, P.; Yao, S.; Fan, L.; Yin, S.; Du, H. Government certified environmental labels and trade credit: Evidence from green factories. Econ. Lett. 2024, 244, 112008. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Q.; Hao, J. How Does Green Factory Certification Affect Corporate Sustainability Performance: Evidence from China. Sustainability 2025, 17, 61. [Google Scholar] [CrossRef]

- Wei, X.; Jiang, F.; Su, Y. More green, less labor gains? Green factory and labor income share in China. Energy Econ. 2024, 133, 107481. [Google Scholar] [CrossRef]

- Liang, Z.; Shen, Y.; Yang, K.; Kuang, J. The Impact of High-Tech Enterprise Certification on Green Innovation: Evidence from Listed Companies in China. Sustainability 2025, 17, 147. [Google Scholar] [CrossRef]

- Arocena, P.; Orcos, R.; Zouaghi, F. The impact of ISO 14001 on firm environmental and economic performance: The moderating role of size and environmental awareness. Bus. Strategy Environ. 2021, 30, 955–967. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, H.; Mbanyele, W.; Wei, Z.; Li, X. How does green industrial policy affect corporate green innovation? Evidence from the green factory identification in China. Energy Econ. 2024, 141, 108047. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, Z.; Sun, M.; Zhou, Y. The effective path of green transformation of heavily polluting enterprises promoted by green merger and acquisition—Qualitative comparative analysis based on fuzzy sets. Environ. Sci. Pollut. Res. 2022, 29, 63277–63293. [Google Scholar] [CrossRef]

- Zhang, Z.; Li, P.; Huang, L.; Kang, Y. The impact of artificial intelligence on green transformation of manufacturing enterprises: Evidence from China. Econ. Chang. Restruct. 2024, 57, 1–36. [Google Scholar] [CrossRef]

- Yang, X.; Xu, Y.; Hossain, M.E.; Ran, Q.; Haseeb, M. The path to sustainable development: Exploring the impact of digitization on industrial enterprises’ green transformation in China. Clean Technol. Environ. Policy 2024, 1–15. [Google Scholar] [CrossRef]

- Guo, B.; Hu, P.; Lin, J. The effect of digital infrastructure development on enterprise green transformation. Int. Rev. Financ. Anal. 2024, 92, 103085. [Google Scholar] [CrossRef]

- Teng, M.; Tan, W. Bank branch agglomeration and corporate green transformation: Evidence from China. Financ. Res. Lett. 2023, 58, 104478. [Google Scholar] [CrossRef]

- Lu, Y.; Gao, Y.; Zhang, Y.; Wang, J. Can the green finance policy force the green transformation of high-polluting enterprises? A quasi-natural experiment based on “Green Credit Guidelines”. Energy Econ. 2022, 114, 106265. [Google Scholar] [CrossRef]

- Shao, Y.; Chen, Z. Can government subsidies promote the green technology innovation transformation? Evidence from Chinese listed companies. Econ. Anal. Policy 2022, 74, 716–727. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde CV, D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Boyd, G.A.; McClelland, J.D. The impact of environmental constraints on productivity improvement in integrated paper plants. J. Environ. Econ. Manag. 1999, 38, 121–142. [Google Scholar] [CrossRef]

- He, W.; Yang, W.; Choi, S.J. The interplay between private and public regulations: Evidence from ISO 14001 adoption among Chinese firms. J. Bus. Ethics 2018, 152, 477–497. [Google Scholar] [CrossRef]

- Li, Z.; Zhou, Q. Does Corporate Behavior Related to the Overseas Market Promote Enterprises’ Green Transformation?—Evidence from China. Sustainability 2024, 16, 4362. [Google Scholar] [CrossRef]

- Sun, J.; Qi, B.; Wang, J.; Nie, Y. Government guidance funds and green transformation of enterprises. Appl. Econ. Lett. 2024, 1–5. [Google Scholar] [CrossRef]

- Hou, X.; Kong, S.; Xiang, R. Extreme high temperatures and corporate low-carbon actions. Sci. Total Environ. 2024, 925, 171704. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks? The winners and losers from bank deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Han, F.; Mao, X.; Yu, X.; Yang, L. Government environmental protection subsidies and corporate green innovation: Evidence from Chinese microenterprises. J. Innov. Knowl. 2024, 9, 100458. [Google Scholar] [CrossRef]

- Wu, W.; An, S.; Wu, C.H.; Tsai, S.B.; Yang, K. An empirical study on green environmental system certification affects financing cost of high energy consumption enterprises-taking metallurgical enterprises as an example. J. Clean. Prod. 2020, 244, 118848. [Google Scholar] [CrossRef]

- Yao, S.; Pan, Y.; Sensoy, A.; Uddin, G.S.; Cheng, F. Green credit policy and firm performance: What we learn from China. Energy Econ. 2021, 101, 105415. [Google Scholar] [CrossRef]

- Chen, K.; Zhang, S. How does open public data impact enterprise digital transformation? Econ. Anal. Policy 2024, 83, 178–190. [Google Scholar] [CrossRef]

- Borusyak, K.; Jaravel, X.; Spiess, J. Revisiting event-study designs: Robust and efficient estimation. Rev. Econ. Stud. 2024, 91, 3253–3285. [Google Scholar] [CrossRef]

- Zhao, Y.; Gao, Y.; Hong, D. Sustainable Innovation and Economic Resilience: Deciphering ESG Ratings’ Role in Lowering Debt Financing Costs. J. Knowl. Econ. 2024, 1–35. [Google Scholar] [CrossRef]

- Feng, J.; Yuan, Y. Green investors and corporate ESG performance: Evidence from China. Financ. Res. Lett. 2024, 60, 104892. [Google Scholar] [CrossRef]

- Deng, J.; Li, Y.; Ding, Y.; Liu, F. Effect of media attention on corporate green technology innovation: Mechanism and evidence from China. Empir. Econ. 2024, 68, 697–727. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).