Does ESG Performance Help Corporate Deleveraging? Based on an Analysis of Excessive Corporate Debt

Abstract

1. Introduction

2. Literature Review

2.1. Economic Consequences of ESG Performance

2.2. Factors Affecting Excessive Debt of Enterprises

3. Theoretical Analysis and Research Design

3.1. Theoretical Analysis

3.2. Sample and Data

3.3. Definition of Variables

3.3.1. Dependent Variable

3.3.2. Independent Variable

3.3.3. Control Variables

3.4. Model Construction

4. Empirical Results Analysis

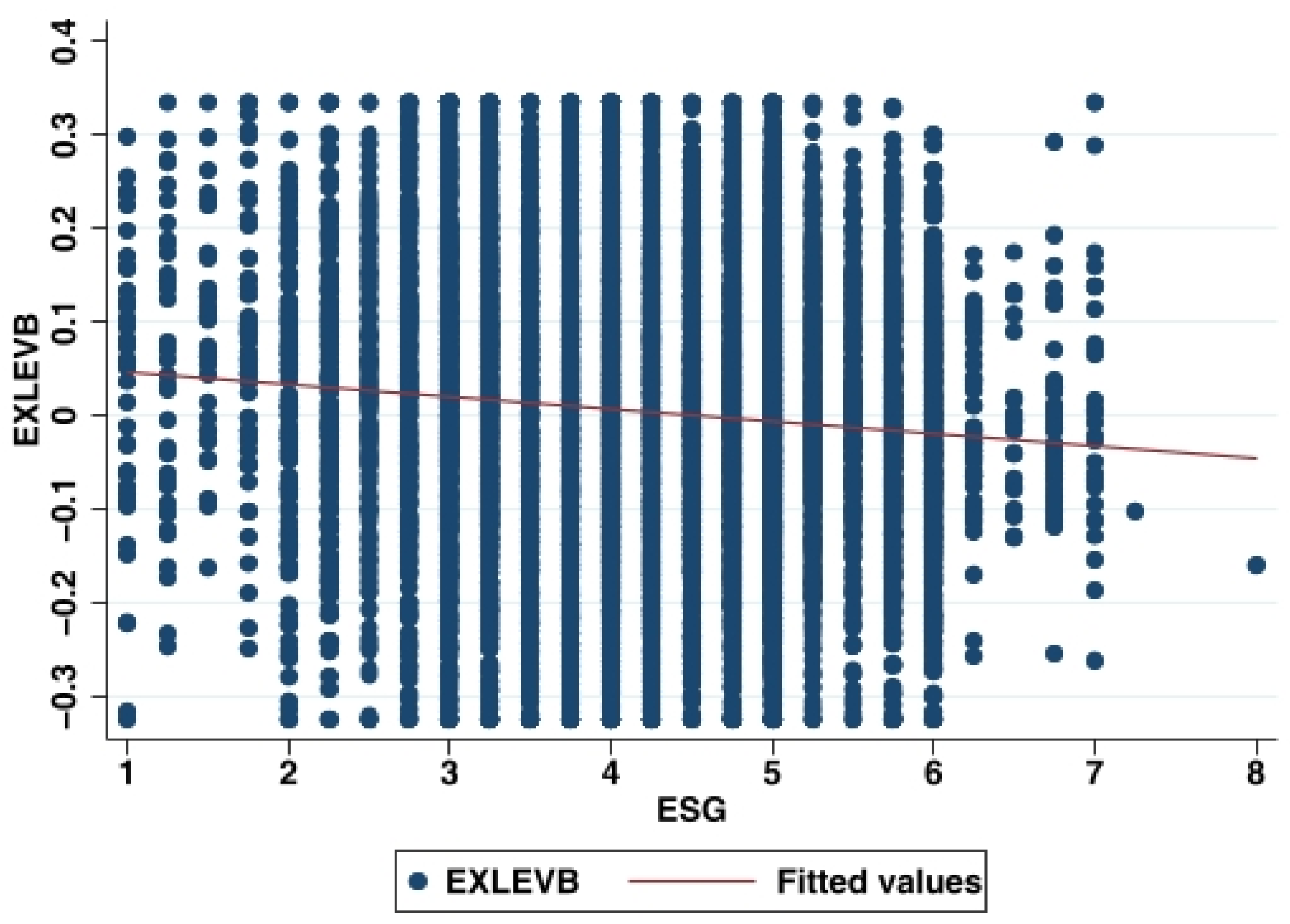

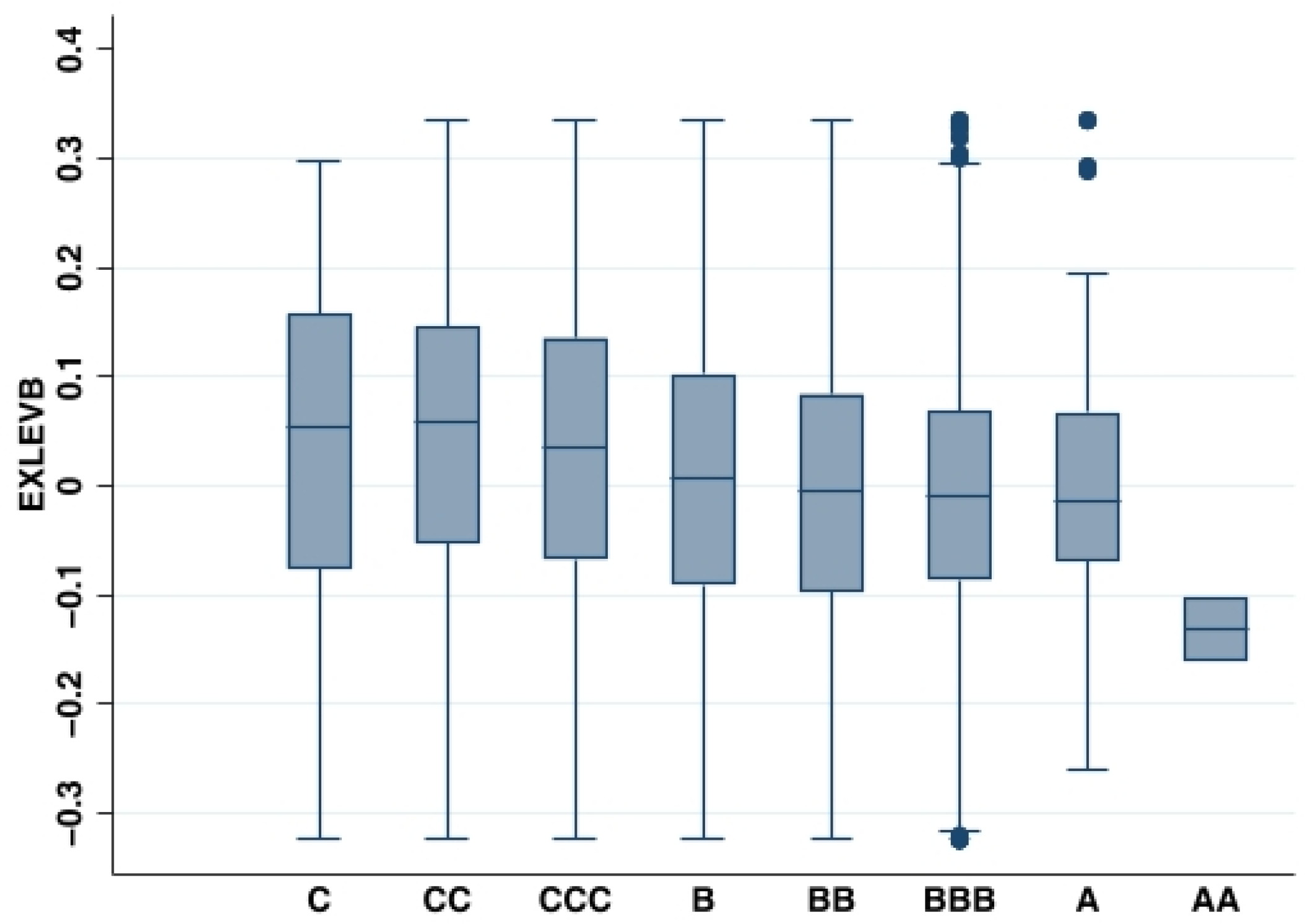

4.1. Descriptive Statistics

4.2. Benchmark Regression Results

4.3. Endogeneity Test

4.3.1. Instrumental Variables

4.3.2. Heckman Two-Step

4.3.3. Propensity Score-Matching Method

4.4. Other Robustness Test

4.5. Mechanism Analysis

4.6. Heterogeneity Analysis

4.6.1. Differences in Industry Environmental Sensitivity

4.6.2. Differences in Marketization

4.7. Moderation Effect

4.7.1. The Moderating Effect of Internal Control

4.7.2. The Moderating Effect of Analyst Attention

5. Conclusions and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bai, X.; Sun, H.; Lu, S.; Taghizadeh-Hesary, F. A Review of Micro-Based Systemic Risk Research from Multiple Perspectives. Entropy 2020, 22, 711. [Google Scholar] [CrossRef]

- Baker, S.H. Risk, Leverage and Profitability: An Industry Analysis. Rev. Econ. Stat. 1973, 55, 503–507. [Google Scholar] [CrossRef]

- Hurdle, G.J. Leverage, Risk, Market Structure and Profitability. Rev. Econ. Stat. 1974, 56, 478–485. [Google Scholar] [CrossRef]

- Marchica, M.-T.; Mura, R. Financial Flexibility, Investment Ability, and Firm Value: Evidence from Firms with Spare Debt Capacity. Financ. Manag. 2010, 39, 1339–1365. [Google Scholar] [CrossRef]

- Campello, M. Debt Financing: Does It Boost or Hurt Firm Performance in Product Markets? J. Financ. Econ. 2006, 82, 135–172. [Google Scholar] [CrossRef]

- Faulkender, M.; Flannery, M.J.; Hankins, K.W.; Smith, J.M. Cash Flows and Leverage Adjustments. J. Financ. Econ. 2012, 103, 632–646. [Google Scholar] [CrossRef]

- Caskey, J.; Hughes, J.; Liu, J. Leverage, Excess Leverage, and Future Returns. Rev. Account. Stud. 2012, 17, 443–471. [Google Scholar] [CrossRef]

- Alessi, L.; Detken, C. Identifying Excessive Credit Growth and Leverage. J. Financ. Stab. 2018, 35, 215–225. [Google Scholar] [CrossRef]

- Ni, K.; Zhang, R.; Tan, L.; Lai, X. How ESG Enhances Corporate Competitiveness: Mechanisms and Evidence. Financ. Res. Lett. 2024, 69, 106249. [Google Scholar] [CrossRef]

- Cohen, G. The Impact of ESG Risks on Corporate Value. Rev. Quant. Financ. Account. 2023, 60, 1451–1468. [Google Scholar] [CrossRef]

- Yoon, B.; Lee, J.H.; Byun, R. Does ESG Performance Enhance Firm Value? Evidence from Korea. Sustainability 2018, 10, 3635. [Google Scholar] [CrossRef]

- Kong, W. The Impact of ESG Performance on Debt Financing Costs: Evidence from Chinese Family Business. Financ. Res. Lett. 2023, 55, 103949. [Google Scholar] [CrossRef]

- Galletta, S.; Goodell, J.W.; Mazzù, S.; Paltrinieri, A. Bank Reputation and Operational Risk: The Impact of ESG. Financ. Res. Lett. 2023, 51, 103494. [Google Scholar] [CrossRef]

- Moskovics, P.; Wanke, P.; Tan, Y.; Gerged, A.M. Market Structure, ESG Performance, and Corporate Efficiency: Insights from Brazilian Publicly Traded Companies. Bus. Strategy Environ. 2024, 33, 241–262. [Google Scholar] [CrossRef]

- Feng, J.; Goodell, J.W.; Shen, D. ESG Rating and Stock Price Crash Risk: Evidence from China. Financ. Res. Lett. 2022, 46, 102476. [Google Scholar] [CrossRef]

- Zhai, Y.; Cai, Z.; Lin, H.; Yuan, M.; Mao, Y.; Yu, M. Does Better Environmental, Social, and Governance Induce Better Corporate Green Innovation: The Mediating Role of Financing Constraints. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1513–1526. [Google Scholar] [CrossRef]

- Maaloul, A.; Zéghal, D.; Ben Amar, W.; Mansour, S. The Effect of Environmental, Social, and Governance (ESG) Performance and Disclosure on Cost of Debt: The Mediating Effect of Corporate Reputation. Corp. Reput. Rev. 2023, 26, 1–18. [Google Scholar] [CrossRef]

- Steer, G. When Green Debt Turns Brown. Financial Times, 2024. Available online: https://www.ft.com/content/583b4747-c683-47c3-af8e-ebef47d0aca7 (accessed on 23 January 2025).

- 15 Banks Refuse to Back Vales Point Coal-Fired Power Station. Available online: https://www.theaustralian.com.au/business/mining-energy/delta-electricity-needs-urgent-rule-change-from-aemo-after-15-banks-refuse-to-offer-credit/news-story/841c0f8bf361ba887389be7db307872e (accessed on 23 January 2025).

- Yuan, X.; Li, Z.; Xu, J.; Shang, L. ESG Disclosure and Corporate Financial Irregularities—Evidence from Chinese Listed Firms. J. Clean. Prod. 2022, 332, 129992. [Google Scholar] [CrossRef]

- Guo, X.; Li, S.; Song, X.; Tang, Z. ESG, Financial Constraint and Financing Activities: A Study in the Chinese Market. Account. Financ. 2024, 64, 1637–1663. [Google Scholar] [CrossRef]

- Halbritter, G.; Dorfleitner, G. The Wages of Social Responsibility—Where Are They? A Critical Review of ESG Investing. Rev. Financ. Econ. 2015, 26, 25–35. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lu, M.; Wang, C.-W.; Cheng, C.-Y. ESG Engagement, Country-Level Political Risk and Bank Liquidity Creation. Pac.-Basin Financ. J. 2024, 83, 102260. [Google Scholar] [CrossRef]

- Delta Electronics. Available online: https://en.wikipedia.org/w/index.php?title=Delta_Electronics&oldid=1270724954 (accessed on 23 January 2025).

- First Capital REIT. Available online: https://en.wikipedia.org/w/index.php?title=First_Capital_REIT&oldid=1255591748 (accessed on 23 January 2025).

- Tsang, A.; Frost, T.; Cao, H. Environmental, Social, and Governance (ESG) Disclosure: A Literature Review. Br. Account. Rev. 2023, 55, 101149. [Google Scholar] [CrossRef]

- Gjergji, R.; Vena, L.; Sciascia, S.; Cortesi, A. The Effects of Environmental, Social and Governance Disclosure on the Cost of Capital in Small and Medium Enterprises: The Role of Family Business Status. Bus. Strategy Environ. 2021, 30, 683–693. [Google Scholar] [CrossRef]

- Rabaya, A.J.; Saleh, N.M. The Moderating Effect of IR Framework Adoption on the Relationship between Environmental, Social, and Governance (ESG) Disclosure and a Firm’s Competitive Advantage. Environ. Dev. Sustain. 2022, 24, 2037–2055. [Google Scholar] [CrossRef]

- Di Tommaso, C.; Thornton, J. Do ESG Scores Effect Bank Risk Taking and Value? Evidence from European Banks. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2286–2298. [Google Scholar] [CrossRef]

- Gigante, G.; Manglaviti, D. The ESG Effect on the Cost of Debt Financing: A Sharp RD Analysis. Int. Rev. Financ. Anal. 2022, 84, 102382. [Google Scholar] [CrossRef]

- Serafeim, G.; Yoon, A. Stock Price Reactions to ESG News: The Role of ESG Ratings and Disagreement. Rev. Account. Stud. 2023, 28, 1500–1530. [Google Scholar] [CrossRef]

- Fatemi, A.; Fooladi, I.; Tehranian, H. Valuation Effects of Corporate Social Responsibility. J. Bank. Financ. 2015, 59, 182–192. [Google Scholar] [CrossRef]

- Capelle-Blancard, G.; Petit, A. Every Little Helps? ESG News and Stock Market Reaction. J. Bus. Ethics 2019, 157, 543–565. [Google Scholar] [CrossRef]

- Garcia, A.S.; Orsato, R.J. Testing the Institutional Difference Hypothesis: A Study about Environmental, Social, Governance, and Financial Performance. Bus. Strategy Environ. 2020, 29, 3261–3272. [Google Scholar] [CrossRef]

- Liu, Y.; Deng, Y.; Liu, Y.; Li, C.; Twumasi, M.A.; Cheng, Y. Do Disclosure of ESG Information Policies Inhibit the Value of Heavily Polluting Enterprises?—Evidence from China. Heliyon 2023, 9, e22750. [Google Scholar] [CrossRef] [PubMed]

- Chowdhury, H.; Rahman, S.; Sankaran, H. Leverage Deviation from the Target Debt Ratio and Leasing. Account. Financ. 2021, 61, 3481–3515. [Google Scholar] [CrossRef]

- Firth, M.; Lin, C.; Liu, P.; Wong, S.M.L. Inside the Black Box: Bank Credit Allocation in China’s Private Sector. J. Bank. Financ. 2009, 33, 1144–1155. [Google Scholar] [CrossRef]

- Lai, X.; Zhang, F. Can ESG Certification Help Company Get out of Over-Indebtedness? Evidence from China. Pac.-Basin Financ. J. 2022, 76, 101878. [Google Scholar] [CrossRef]

- Lian, L. Outward Foreign Direct Investment, State Ownership and Excess Leverage. J. Shanghai Univ. Financ. Econ. 2019, 21, 111–127. [Google Scholar] [CrossRef]

- Zheng, M.; Li, W.; Liu, J. Interest Rate Liberalisation and Deleveraging of Over-Indebted Enterprises: A Perspective on Capital Structure Dynamics. J. World Econ. 2018, 41, 149–170. [Google Scholar] [CrossRef]

- Bilyay-Erdogan, S.; Danisman, G.O.; Demir, E. ESG Performance and Investment Efficiency: The Impact of Information Asymmetry. J. Int. Financ. Mark. Inst. Money 2024, 91, 101919. [Google Scholar] [CrossRef]

- Zhang, Z.; Xia, Y.; Zhang, X. Empowerment or Negative Energy: ESG Performance and Labor Investment Efficiency of Enterprises. Foreign Econ. Manag. 2024, 46, 69–85. [Google Scholar] [CrossRef]

- Chen, Y.; Sun, R. Corporate Financialization and the Long-Term Use of Short-Term Debt: Evidence from China. Financ. Res. Lett. 2023, 58, 104602. [Google Scholar] [CrossRef]

- Zhong, K.; Cheng, X.; Zhang, W. The Moderate Adjustment of Monetary Policy and the Phenomenon of Corporate Long-Term Investment with Short-Term Financing. J. Manag. World 2016, 3, 87–98+114+188. [Google Scholar] [CrossRef]

- Li, Z.; Chen, J. Corporate ESG Performance and Corporate Short-Term Debt for Long-Term Use. J. Quant. Technol. Econ. 2023, 40, 152–172. [Google Scholar] [CrossRef]

- Chen, H.; Zhang, L. ESG Performance, Digital Transformation and Enterprise Value Enhancement. J. Zhongnan Univ. Econ. Law 2023, 258, 136–149. [Google Scholar] [CrossRef]

- Riedl, A.; Smeets, P. Why Do Investors Hold Socially Responsible Mutual Funds? J. Financ. 2017, 72, 2505–2550. [Google Scholar] [CrossRef]

- Denis, D.J.; McKeon, S.B. Debt Financing and Financial Flexibility Evidence from Proactive Leverage Increases. Rev. Financ. Stud. 2012, 25, 1897–1929. [Google Scholar] [CrossRef]

- D’Mello, R.; Farhat, J. A Comparative Analysis of Proxies for an Optimal Leverage Ratio. Rev. Financ. Econ. 2008, 17, 213–227. [Google Scholar] [CrossRef]

- Yang, X.; Yang, T.; Lv, J.; Luo, S. The Impact of ESG on Excessive Corporate Debt. Sustainability 2024, 16, 6920. [Google Scholar] [CrossRef]

- Chang, C.; Chen, X.; Liao, G. What Are the Reliably Important Determinants of Capital Structure in China? Pac.-Basin Financ. J. 2014, 30, 87–113. [Google Scholar] [CrossRef]

- Liu, J.; Wang, B.; He, X. How Are Firms Motivated to Greenly Innovate under the Pressure of ESG Performance? Evidence from Chinese Listed Firms. Front. Environ. Sci. 2024, 12, 1469884. [Google Scholar] [CrossRef]

- Cheng, Z.; Su, Y. ESG and Chinese Corporate OFDI. Res. Int. Bus. Financ. 2024, 72, 102522. [Google Scholar] [CrossRef]

- He, J.; Huang, J.; Zhao, S. Internalizing Governance Externalities: The Role of Institutional Cross-Ownership. J. Financ. Econ. 2019, 134, 400–418. [Google Scholar] [CrossRef]

- Zeng, Y.; Wang, Y.; Wu, Z. ESG Rating Disagreement and Corporate Green Innovation: Empirical Evidence from China’s A-Share Listed Companies. Soft Sci. 2024, 38, 72–78. [Google Scholar] [CrossRef]

- Mo, Y.; Wei, F.; Huang, Y. Does Fulfilling ESG Responsibilities Curb Corporate Leverage Manipulation? Evidence from Chinese-Listed Companies. Sustainability 2024, 16, 5543. [Google Scholar] [CrossRef]

- He, F.; Du, H.; Yu, B. Corporate ESG Performance and Manager Misconduct: Evidence from China. Int. Rev. Financ. Anal. 2022, 82, 102201. [Google Scholar] [CrossRef]

- Xu, S.; Zheng, X.; Yang, R. Working Experience in SOEs, Entrepreneurial Talent and Enterprise Growth. China Ind. Econ. 2020, 1, 155–173. [Google Scholar] [CrossRef]

- Dhaliwal, D.; Hogan, C.; Trezevant, R.; Wilkins, M. Internal Control Disclosures, Monitoring, and the Cost of Debt. Account. Rev. 2011, 86, 1131–1156. [Google Scholar] [CrossRef]

- Guo, M.; He, Y.; Niu, J. Internal Control, Network Media Report and Enterprise ESG Performance. J. Manag. 2023, 36, 103–119. [Google Scholar] [CrossRef]

- Jun, W.; Shiyong, Z.; Yi, T. Does ESG Disclosure Help Improve Intangible Capital? Evidence From A-Share Listed Companies. Front. Environ. Sci. 2022, 10, 858548. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhang, L. Investor Attention and Corporate ESG Performance. Financ. Res. Lett. 2024, 60, 104887. [Google Scholar] [CrossRef]

| Variable Symbols | Variable Name | Variable Definition |

|---|---|---|

| EXLEVB | Over-indebtedness1 | The actual debt ratio of the enterprise minus the target debt ratio. |

| LEVBDUM | Over-indebtedness2 | If the enterprise’s over-indebtedness ratio is positive, it is assigned a value of 1; otherwise, it is 0. |

| ESG | ESG performance | Assign a value of 1–9 to C and CC to AAA in the ESG rating of Huazheng, respectively. |

| SOE | Nature of property rights | Assign a value of 1 to state-owned enterprises and 0 to non-state-owned enterprises. |

| ROA | Profitability | Operating profit/total assets. |

| INDLEVB | Industry debt ratio | Median debt-to-asset ratio of the industry. |

| GROWTH | Total assets growth rate | (Total assets at the end of this period − Total assets at the end of the previous period)/Total assets at the end of the previous period. |

| FATA | Fixed assets ratio | Fixed assets/total assets. |

| SIZE | Enterprise scale | Logarithm of total assets. |

| SHRCR1 | The largest shareholder’s shareholding | The proportion of the largest shareholder’s shareholding in the total share capital. |

| BM | Book-to-Market Ratio | Book value/market value. |

| MANEXP | Management expense ratio | Book value/market value. |

| NDTS | Non-debt tax shield | (Depreciation of fixed assets + depreciation of oil and gas assets + depreciation of productive biological assets)/total assets. |

| ETR | Income tax rate | Income tax/total profit. |

| VEBITTA | Earnings volatility | Earnings Before Interest and Tax/Three-year volatility of total assets. |

| VCF | Cash flow volatility | Total cash flow/Three-year volatility of total assets. |

| MANOWN | Management shareholding ratio | The proportion of total shares held by all senior managers of the company at the end of the year to the total share capital. |

| Variables | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| EXLEVB | 14,465 | 0.004 | 0.139 | −0.356 | 0.381 |

| LEVBDUM | 14,465 | 0.509 | 0.500 | 0 | 1.000 |

| ESG | 14,465 | 4.210 | 0.929 | 1.000 | 8.000 |

| SOE | 14,465 | 0.316 | 0.465 | 0 | 1.000 |

| ROA | 14,465 | 0.045 | 0.055 | −0.224 | 0.197 |

| IND_LEVB | 14,465 | 0.412 | 0.092 | 0.260 | 0.714 |

| GROWTH | 14,465 | 0.178 | 0.243 | −0.276 | 1.190 |

| FATA | 14,465 | 0.218 | 0.153 | 0.002 | 0.692 |

| SIZE | 14,465 | 22.476 | 1.290 | 19.963 | 26.262 |

| SHRCR1 | 14,465 | 33.747 | 14.456 | 9.200 | 74.300 |

| BM | 14,465 | 0.327 | 0.149 | 0.049 | 0.786 |

| MANEXP | 14,465 | 0.041 | 0.025 | 0.004 | 0.131 |

| NDTS | 14,465 | 0.02 | 0.014 | 0 | 0.066 |

| ETR | 14,465 | 0.151 | 0.147 | −0.49 | 0.728 |

| VEBITTA | 14,465 | 0.028 | 0.035 | 0.001 | 0.249 |

| VCF | 14,465 | 0.043 | 0.034 | 0.003 | 0.204 |

| MANOWN | 14,465 | 14.563 | 19.199 | 0 | 67.565 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | EXLEVB | LEVBDUM | EXLEVB | LEVBDUM |

| ESG | −0.0063 *** | −0.0722 *** | −0.0090 *** | −0.1014 *** |

| (−5.99) | (−5.63) | (−8.91) | (−7.18) | |

| SOE | −0.0117 *** | −0.1344 *** | −0.0022 | −0.0848 ** |

| (−4.79) | (−4.52) | (−0.92) | (−2.55) | |

| ROA | −0.5499 *** | −5.2045 *** | −0.5643 *** | −6.0618 *** |

| (−28.62) | (−20.41) | (−31.03) | (−21.32) | |

| IND_LEVB | −0.1446 *** | −1.1363 *** | −0.1957 *** | −2.2645 *** |

| (−12.68) | (−8.27) | (−5.35) | (−4.34) | |

| GROWTH | 0.0755 *** | 0.6698 *** | 0.1006 *** | 0.9570 *** |

| (18.18) | (12.02) | (25.72) | (16.09) | |

| FATA | 0.0587 *** | 0.5941 *** | 0.0784 *** | 0.9719 *** |

| (5.28) | (4.36) | (6.82) | (5.96) | |

| SIZE | 0.0112 *** | 0.1351 *** | 0.0077 *** | 0.1271 *** |

| (12.08) | (11.68) | (7.98) | (9.02) | |

| SHRCR1 | 0.0007 *** | 0.0056 *** | 0.0007 *** | 0.0060 *** |

| (11.00) | (6.69) | (11.48) | (6.55) | |

| BM | −0.4765 *** | −4.5871 *** | −0.5611 *** | −5.9273 *** |

| (−72.15) | (−49.66) | (−84.93) | (−52.05) | |

| manage | −0.2080 *** | −2.3172 *** | 0.1572 *** | 1.2646 ** |

| (−4.71) | (−4.23) | (3.49) | (2.00) | |

| NDTS | −0.3743 *** | −2.0569 | −0.4730 *** | −5.6622 *** |

| (−3.02) | (−1.35) | (−3.87) | (−3.24) | |

| ETR | 0.0183 *** | 0.1690 ** | 0.0217 *** | 0.2327 *** |

| (2.79) | (2.12) | (3.50) | (2.69) | |

| VEBITTA | −0.3303 *** | −3.2283 *** | −0.3331 *** | −3.5871 *** |

| (−10.61) | (−7.98) | (−11.28) | (−7.86) | |

| VCF | 0.4242 *** | 4.2933 *** | 0.3936 *** | 4.4268 *** |

| (14.33) | (11.48) | (13.94) | (10.74) | |

| MANOWN | 0.0003 *** | 0.0030 *** | 0.0003 *** | 0.0038 *** |

| (4.78) | (4.08) | (5.53) | (4.89) | |

| Year FE | N | N | Y | Y |

| Industry FE | N | N | Y | Y |

| Adj_R2 | 0.341 | 0.450 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ESG | EXLEVB | LEVBDUM | |

| Number of ESG fund holdings | 0.0154 *** | ||

| (8.13) | |||

| ESG | −0.2609 *** | −2.9524 *** | |

| (−7.58) | (−7.30) | ||

| Controls | Y | Y | Y |

| Year FE | Y | Y | Y |

| Industry FE | Y | Y | Y |

| Cragg-Donald Wald F/Wald test | 70.703 *** | 206.88 *** | |

| Adj_R2 | 0.169 | −2.173 |

| Heckman Two-Step | PSM | ||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| ESGDUM | EXLEVB | LEVBDUM | EXLEVB | LEVBDUM | |

| ESG | 3.1870 *** | −0.0100 *** | −0.1469 *** | −0.0075 *** | −0.0988 *** |

| (60.99) | (−3.52) | (−3.66) | (−5.37) | (−4.93) | |

| IMR | −0.0005 | −0.0222 | |||

| (−0.41) | (−1.21) | ||||

| Controls | Y | Y | Y | Y | |

| Year FE | Y | Y | Y | Y | |

| Industry FE | Y | Y | Y | Y | |

| Adj_R2 | 0.450 | 0.456 | |||

| Replace Explained Variable | Joint Fixed Effects | Firm Fixed Effects | Replace Explanatory Variables | |||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| exlevb | exdum | EXLEVB | LEVBDUM | EXLEVB | LEVBDUM | EXLEVB | LEVBDUM | |

| ESG | −0.0157 *** | −0.1531 *** | −0.0094 *** | −0.1145 *** | −0.0047 *** | −0.1309 *** | ||

| (−15.50) | (−9.52) | (−9.05) | (−7.59) | (−3.82) | (−6.37) | |||

| ESGpb | −0.0005 ** | −0.0096 *** | ||||||

| (−2.34) | (−2.87) | |||||||

| Controls | Y | Y | Y | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y | Y | Y | Y |

| Industry FE | Y | Y | Y | Y | Y | Y | Y | Y |

| Adj_R2 | 0.641 | 0.460 | 0.630 | 0.450 | ||||

| Information Transparency | Financing Costs, Short-Term Debt, and Long-Term Use | Business Performance | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Toumd | High | COD | SLEV | ROA | TobinQ | |

| ESG | 0.1253 *** | 0.2584 *** | −0.0024 *** | −0.0099 *** | 0.0071 *** | 0.0745 *** |

| (23.53) | (17.14) | (−4.92) | (−12.87) | (15.53) | (7.59) | |

| Controls | Y | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y | Y |

| Industry FE | Y | Y | Y | Y | Y | Y |

| Adj_R2 | 0.207 | 0.163 | 0.341 | 0.210 | 0.529 | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Non-Polluting Industries | Polluting Industries | Interaction Test | Non-Polluting Industries | Polluting Industries | Interaction Test | |

| EXLEVB | EXLEVB | EXLEVB | LEVBDUM | LEVBDUM | LEVBDUM | |

| ESG | −0.0070 *** | −0.0126 *** | −0.0586 *** | −0.1903 *** | ||

| (−5.63) | (−7.31) | (−3.37) | (−7.70) | |||

| ESGWR | −0.0049 ** | −0.1134 *** | ||||

| (−2.44) | (−3.92) | |||||

| Controls | Y | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y | Y |

| Industry FE | Y | Y | Y | Y | Y | Y |

| Adj_R2 | 0.447 | 0.458 | 0.450 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Low Marketization | A High Degree of Marketization | Interaction Test | Low Marketization | A High Degree of Marketization | Interaction Test | |

| EXLEVB | EXLEVB | EXLEVB | LEVBDUM | LEVBDUM | LEVBDUM | |

| ESG | −0.0122 *** | −0.0061 *** | −0.1564 *** | −0.0548 *** | ||

| (−8.38) | (−4.31) | (−7.52) | (−2.75) | |||

| ESGMAR | 0.0046 ** | 0.0864 *** | ||||

| (2.46) | (3.28) | |||||

| Controls | Y | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y | Y |

| Industry FE | Y | Y | Y | Y | Y | Y |

| Adj_R2 | 0.462 | 0.456 | 0.450 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| EXLEVB | LEVBDUM | EXLEVB | LEVBDUM | |

| ESG | 0.0015 | 0.1499 ** | −0.0055 *** | −0.0502 *** |

| (0.31) | (2.14) | (−4.11) | (−2.72) | |

| ESGICQ | −0.0016 ** | −0.0380 *** | ||

| (−2.08) | (−3.59) | |||

| ICQ | 0.0037 | 0.1086 *** | ||

| (1.23) | (2.62) | |||

| ESGHICQ | −0.0073 *** | −0.1062 *** | ||

| (−3.87) | (−4.00) | |||

| HICQ | 0.0272 *** | 0.4172 *** | ||

| (3.36) | (3.64) | |||

| Controls | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Industry FE | Y | Y | Y | Y |

| Adj_R2 | 0.450 | 0.450 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| EXLEVB | LEVBDUM | EXLEVB | LEVBDUM | |

| ESG | 0.0125 *** | 0.1598 *** | −0.0007 | 0.0062 |

| (5.62) | (4.98) | (−0.51) | (0.34) | |

| ESGAnalyst | −0.0094 *** | −0.1146 *** | ||

| (−9.43) | (−7.94) | |||

| Analyst | 0.0178 *** | 0.2392 *** | ||

| (4.04) | (3.76) | |||

| ESGHAnalyst | −0.0160 *** | −0.2066 *** | ||

| (−8.45) | (−7.66) | |||

| HAnalyst | 0.0449 *** | 0.6025 *** | ||

| (5.49) | (5.18) | |||

| Controls | Y | Y | ||

| Year FE | Y | Y | ||

| Industry FE | Y | Y | ||

| Adj_R2 | 0.466 | 0.457 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, T.; Liu, D.; Zhang, L. Does ESG Performance Help Corporate Deleveraging? Based on an Analysis of Excessive Corporate Debt. Sustainability 2025, 17, 1274. https://doi.org/10.3390/su17031274

Zhu T, Liu D, Zhang L. Does ESG Performance Help Corporate Deleveraging? Based on an Analysis of Excessive Corporate Debt. Sustainability. 2025; 17(3):1274. https://doi.org/10.3390/su17031274

Chicago/Turabian StyleZhu, Tao, Dongjiao Liu, and Lequan Zhang. 2025. "Does ESG Performance Help Corporate Deleveraging? Based on an Analysis of Excessive Corporate Debt" Sustainability 17, no. 3: 1274. https://doi.org/10.3390/su17031274

APA StyleZhu, T., Liu, D., & Zhang, L. (2025). Does ESG Performance Help Corporate Deleveraging? Based on an Analysis of Excessive Corporate Debt. Sustainability, 17(3), 1274. https://doi.org/10.3390/su17031274