Optimal Strategy and Performance for a Closed-Loop Supply Chain with Different Channel Leadership and Cap-and-Trade Regulation

Abstract

1. Introduction

- What are the equilibrium outcomes of the three Stackelberg game models associated with different channel power structures and cap-and-trade regulation?

- How do remanufacturing-related and carbon-related parameters jointly affect the optimal pricing, collection, and emission reduction decisions of channel members, as well as supply chain profitability, total carbon emissions, and social welfare of the CLSC?

- Which proposed model is the best choice in terms of economic and environmental benefits as well as social welfare, respectively?

- In contrast to the previous literature, our work constructs three Stackelberg game models that correspond to different channel power structures in a CLSC involving third-party collection, and the optimal equilibrium outcomes of the proposed models are systematically analyzed and compared. The derived research conclusions are beneficial to the decision makers with a better understanding of their competitive strategies under different scenarios.

- Most of the previous works have not considered cap-and-trade regulation and different channel power structures simultaneously within a CLSC, whereas our study not only examines the simultaneous impacts of remanufactured-related and carbon-related parameters on economic and environmental benefits as well as social welfare, but also identifies the optimal choice for channel members from different perspectives.

2. Literature Review

2.1. Remanufacturing CLSC with Cap-and-Trade Regulation

2.2. CLSCs Involving Different Channel Power Structures

2.3. Research Gaps

- Although some prior works have discussed the optimal pricing and performance of CLSCs under different channel leadership, most have ignored the effect of cap-and-trade regulation on the optimal solutions and performance of the channel members and have not considered third-party collecting. In reality, cap-and-trade regulation significantly influences the operational efficiency of CLSCs, and third-party collectors play a vital role in recycling and remanufacturing processes.

- Several prior studies have explored the optimal emission reduction decisions and performance of the CLSCs in light of the cap-and-trade regulation policy. However, few works have investigated the combined effects of remanufacturing-related and carbon-related parameters on economic and environmental benefits, or social welfare under different CLSC settings.

3. Model Construction and Analysis

3.1. Notation

3.2. Assumptions

3.3. Three Stackelberg Game Models

3.3.1. Manufacturer-Led Model

- The manufacturer first determines the optimal wholesale price , emission reduction rate and transfer price .

- Then the retailer decides on optimal retail price and the third-party collector decides on optimal return rate based on the decision information announced by the manufacturer.

- (1)

- , , , ,

- (2)

- , , , ,

- (3)

- , , , , , ,

- The optimal wholesale price, retail price, and channel members’ profits are increasing in the cost coefficient of emission reduction , while the optimal emission reduction rate and collection rate are decreased in it. This can be explained by the fact that the larger indicates lower efficiency of the manufacturer’ green investment in curbing carbon emissions, which forces the manufacturer to cut down on green investment, so the emission reduction rate of the product goes down. Meanwhile, the wholesale price and retail price are enhanced as increases, resulting in the market demand and profits of the channel members being reduced, and then the third-party collector has less incentive to make more efforts to recycle used products, leading to a decrease in the return rate.

- The larger implies that the government enacts loose cap-and-trade regulation. It encourages manufacturers to actively engage in reducing carbon emissions by increasing green investments, which generates a higher emission reduction rate. Additionally, the larger means that the manufacturer suffers less capital pressure in carbon trading costs, which stimulates him to lower the wholesale price, and the retailer is willing to cut down the retail price, thereby enhancing market demand and improving the channel members’ profits. Furthermore, the increased market demand motivates the third-party collector to intensify their collection efforts, which leads to a rise in the return rate.

- The larger initial carbon emissions force the manufacturer to suffer more economic stress in reducing carbon emissions, which leads to the manufacturer preferring to purchase carbon credits from the carbon trading market. Consequently, the manufacturer tends to cut down on green investments and increase wholesale prices, so a lower emission reduction rate and a higher retail price are generated. Since the higher retail price has shrunk the market share of green products, the profits of channel members have declined. Accordingly, the third party has less incentive to recycle used products due to the narrowed market demand, but the larger initial carbon emissions are conducive to the third party capturing a higher transfer price and receiving more profits.

- (1)

- , , , ,

- (2)

- , , , ,

- (3)

- , , , ,

- The larger makes the third-party collector suffer more inefficiency in the take-back process, so it has less motivation to recycle more used products. Accordingly, fewer used products for the remanufacturing process leads to an increase in production costs, so the channel prices of the product will be increased, resulting in less market demand and profits for the channel members; in turn, the manufacturer lacks capital in emission reduction and a lower emission reduction rate is created.

- The greater means that the manufacturer can obtain more net production cost savings from remanufacturing. It is beneficial to prompt the manufacturer to transfer a higher payment to the third-party collector, which stimulates the third-party collector to recycle more used products, thereby resulting in production cost reduction. Consequently, the wholesale price and retail price charged by the manufacturer and retailer, respectively, become lower; then, the market demand is expanded and their profits are elevated. Meanwhile, the manufacturer gains sufficient capital to invest in carbon abatement, and therefore, the emission reduction rate rises.

- The larger , the carbon emissions are reduced by the remanufacturing process, which leads to the promotion effect of remanufacturing in emission reduction becoming less efficient. Thus, the total cost savings from remanufacturing decline and the transfer price paid to the third-party collector becomes lower, leading to not only higher carbon trading costs but also a lower collection rate, which entails higher wholesale prices and retail prices, resulting in turn in a narrowed market share and lower profit. Meanwhile, the manufacturer lacks the motivation to expend more effort on carbon reduction, and as a result, the emission reduction rate of the product becomes lower. From the above analysis, we can conclude that remanufacturing is conducive to curbing carbon emissions for the CLSC. Readers can refer to Appendix A for more details and explanations.

3.3.2. Retailer-Led Model

- The retailer first determines the optimal selling price to obtain the highest profit.

- Then, the manufacturer decides on the optimal wholesale price , emission reduction rate , and transfer price , which depend on the retailer’s decision.

- At last, the third-party collector makes the optimal decision on return rate based on the given decisions of the retailer and manufacturer.

3.3.3. Third-Party-Led Model

- The third-party collector firstly determines the optimum return rate and transfer price .

- Afterward, the manufacturer decides on the optimum wholesale price and emission reduction rate .

- Finally, the retailer makes the optimum retail price depend on the decision information of the manufacturer and third-party collector.

- (1)

- , , , , .

- (2)

- , , , , .

- (3)

- , , , , , , .

- (1)

- , , , , , , .

- (2)

- , , , , , , .

- (3)

- , , , , , , .

4. Comparative Analysis

5. Numerical Simulation

5.1. Impact of Carbon Trading Price

- Figure 2a–d are plotted to examine the optimal wholesale price, retail price, and return rate in three different game models, which increase with . Furthermore, the emission reduction rates in the manufacturer-led and retailer-led models increase with , while the emission reduction rate in the third-party-led model decreases with . The manufacturer’s carbon trading costs increase as the carbon trading price increases, which leads to the manufacturer preferring to invest more in emission reduction to seek more carbon quota surpluses or reducing carbon trading costs. In the manufacturer-led and retailer-led models, only if the profit gains from selling the carbon quota surplus are greater than the emission reduction cost will the emission reduction rate charged by the manufacturer be improved; otherwise, the emission reduction rate will decline, as presented in Figure 2e. Meanwhile, the manufacturer tends to reduce the wholesale price to expand product sales, which is conducive to raising his profit levels, but the retailer and third-party collector will also benefit from it, as displayed in Figure 2f,g. Furthermore, the manufacturer makes the highest transfer payment in the third-party-led model along with generating the highest return rate, leading to the manufacturer lacking the motivation to invest in emission reduction. Under this scenario, when the total carbon emissions of the manufacturer are larger than the total carbon quota, the manufacturer has to purchase the carbon credits from the carbon trading market, leading to a profit reduction for him.

- As illustrated in Figure 2h, the carbon trading price has a great impact on the total carbon emissions for different Stackelberg game models. When the carbon trading price is relatively low (, the retail-led model achieves the maximum value of the total carbon emissions, while the minimum value is achieved in the third-party-led model. With a mild increase in , , the manufacturer-led model obtains the best environmental performance and generates the least carbon emissions. However, when the carbon trading price is at a relatively high value (, the third-party-led model always yields more total carbon emissions than other models. As the carbon trading price increases to exceed a certain threshold , the retailer-led model leads to the lowest carbon emissions. Therefore, we can conclude that the leader of the CLSC is not always beneficial to enhancing environmental performance.

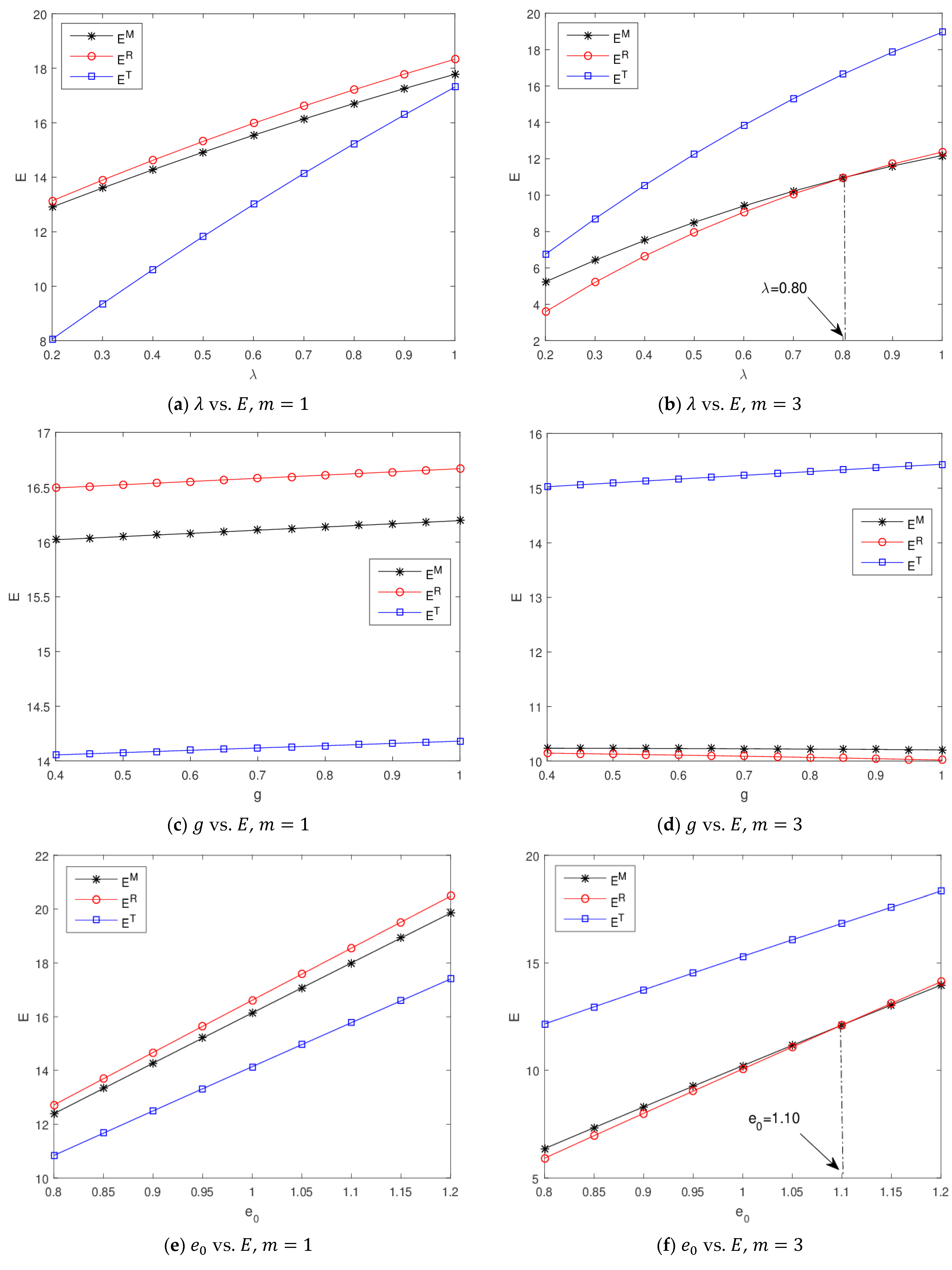

5.2. Impacts of Key Parameters on Total Carbon Emissions

- Figure 3a,b depict the total carbon emissions and the change in the emission intensity of the remanufactured product . One knows that the total carbon emissions in the three Stackelberg game models increase with , which indicates that a large is detrimental to improving the environmental benefits. The retailer-led model generates the most carbon emissions, and the third-party-led model creates the lowest carbon emissions when the carbon trading price is low, while the carbon emissions reach their maximum value in the third-party-led model when the carbon trading price is large, and the retailer-led model yields the lowest carbon emissions when . Otherwise, the manufacturer-led model is the most effective in enhancing environmental performance compared with other models.

- Figure 3c,d illustrates the total carbon emissions with the change in the carbon quota of a unit product . When the carbon trading price is smaller, a greater corresponds to higher total carbon emissions, which implies that the loose carbon regulation is detrimental to curbing carbon emissions in such a situation. However, the carbon emissions in the third-party-led model increase with , while the carbon emissions in the manufacturer-led and retailer-led models decrease with . Also, the retailer-led model always generates lower carbon emissions than other models. Therefore, the retailer-led model is the best option for the closed-loop supply chain when the carbon price is high from the perspective of environmental protection.

- In observing Figure 3e,f, it becomes evident that the total carbon emissions increase with the original carbon emissions per unit product in different game models, i.e., the larger , the more total carbon emissions are generated in the production process. Moreover, the third-party-led model yields the lowest carbon emissions when the carbon trading price is low while a high carbon trading price leads to the third-party-led model creating the most carbon emissions.

- Figure 3g,h presents the variation trend of the total carbon emissions with respect to the net production cost savings from remanufacturing in different game models. When the carbon price is low enough, the carbon emissions of the manufacturer-led and the third-party-led models are reduced significantly, but the total carbon emissions have a slight variation, with increasing in the retailer-led model. This demonstrates that the large ∆ can cause the manufacturer to pursue a higher emission reduction rate; thereby, the total carbon emissions are decreased. In addition, the third-party-led model achieves the greatest total carbon emissions, while the retailer-led model obtains the lowest total carbon emissions when exceeds a certain threshold in addition to the greater carbon trading price.

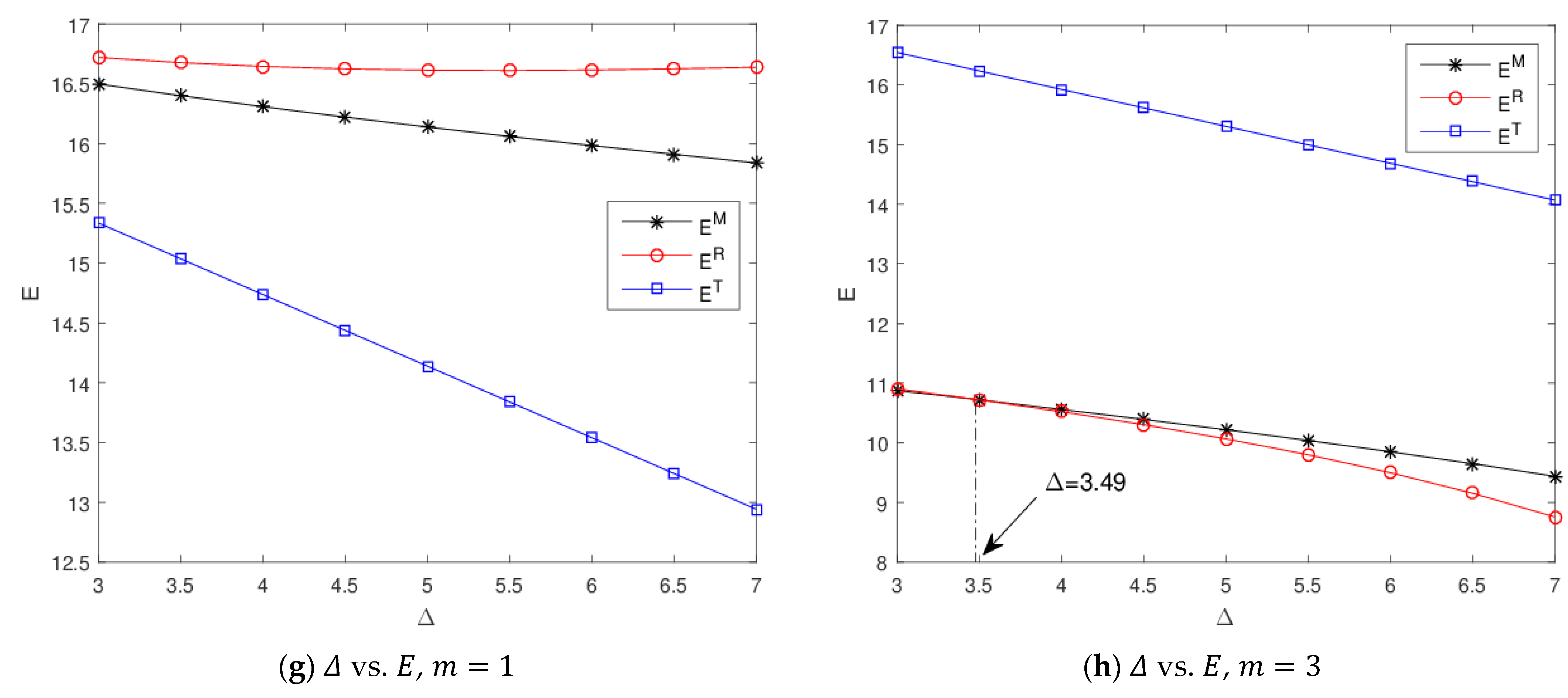

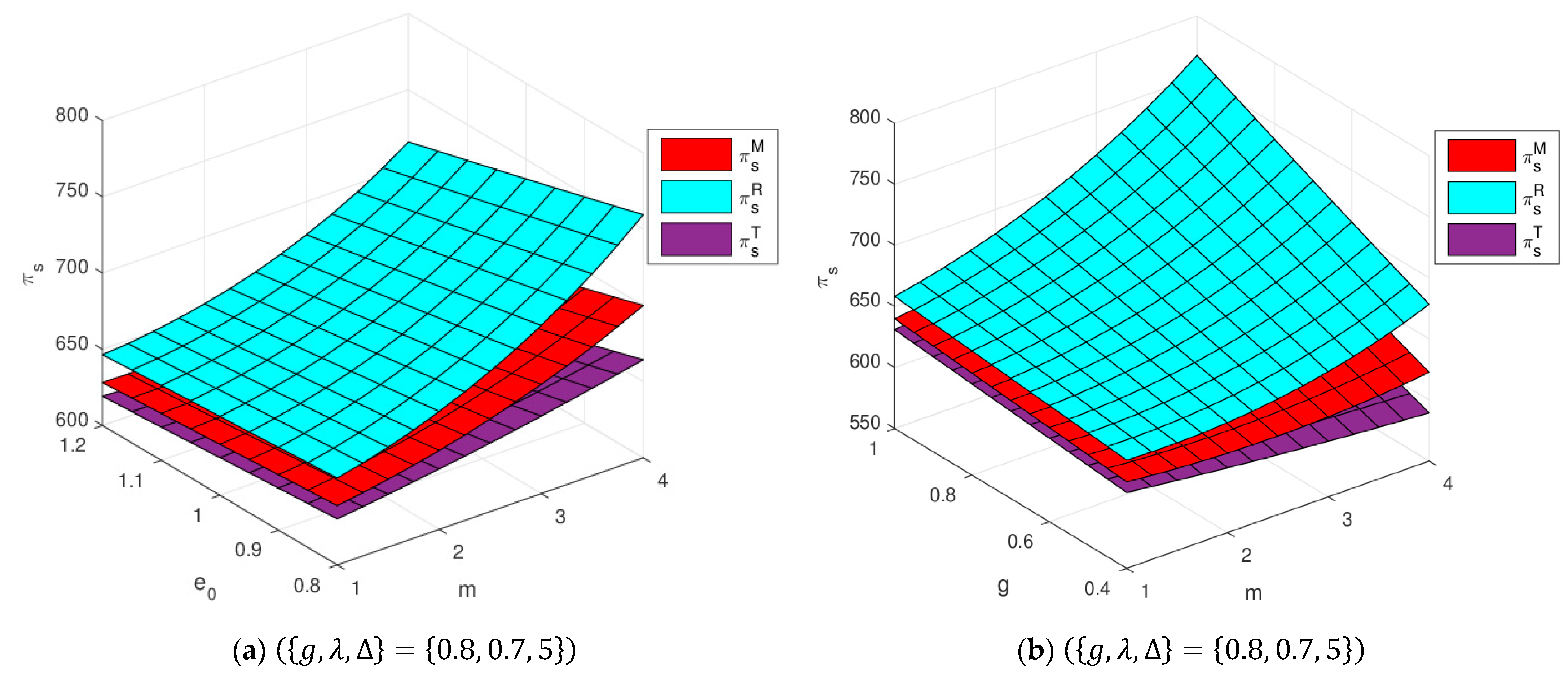

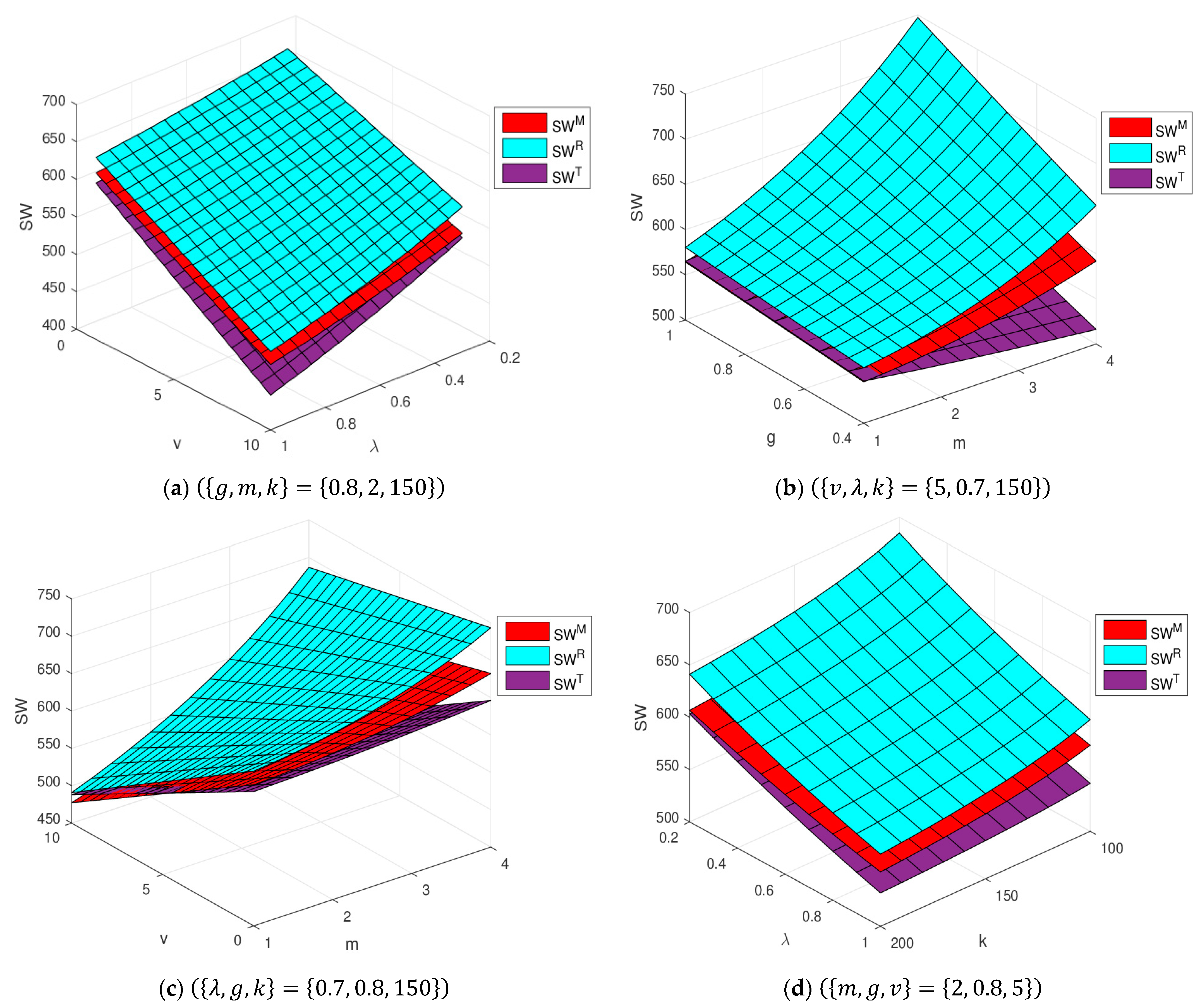

5.3. Impacts of Key Parameters on Profit of CLSC

- Figure 4 is proposed to study the joint effects of the two parameters on the total profits of three different game models. One can observe that the total profits in the retailer-led model are always greater than those in other models, and the third-party-led model gains the lowest profits, which indicates the third-party-led model is least preferred from the perspective of economic performance.

- The profit levels of the three game models are improved significantly with varying values of and their profit variations are not obvious with respect to , as shown in Figure 4a. The greater is beneficial to enhancing the profits of the entire closed-loop supply chain, and the larger is conducive to improving the economic performance for the manufacturer-led and retailer-led models, but it leads to a profit reduction for the third-party-led model, as shown in Figure 4b. By observing Figure 4c, one can see that the relatively low combined with the relatively high is always conducive to elevating total profits for three game models. Moreover, Figure 4d shows that the total profits in three Stackelberg game models are reduced simultaneously, which is associated with the higher values of and .

5.4. Impacts of Key Parameters on Social Welfare of CLSC

6. Conclusions, Managerial Implications, and Future Research Directions

6.1. Findings

- Under the cap-and-trade regulation, the highest/lowest optimal wholesale and retail prices are generated in the third-party-led/retailer-led model. Moreover, a looser cap-and-trade policy and the greater net production cost savings from remanufacturing correspond to a lower wholesale and retail price, respectively, whereas the larger values of initial carbon emissions per unit product, the emission intensity of the remanufactured product, and the emission reduction cost coefficient correspond to a higher wholesale and retail price, respectively.

- The optimal transfer payment is relative to the initial carbon emissions per unit of product, the net production cost savings of remanufacturing, and the carbon emission cost savings per unit of the remanufactured product. Furthermore, the optimal transfer price in the third-party-led model is higher than those in the manufacturer-led and retailer-led models.

- The return rate consistently reaches the highest level in the third-party-led model, while the return rate of the manufacturer-led model is the lowest. Moreover, which model can achieve the emission reduction rate and return rate depends on parameter conditions.

- The carbon trading price significantly impacts optimal solutions, environmental and economic benefits, as well as social welfare. A larger carbon trading price stimulates the manufacturer to make more of an effort to reduce carbon emissions. Moreover, the emission reduction rate and profits of channel members are positive correlated with the carbon trading price in the retailer-led and third-party-led models, while they are negatively correlated with the carbon trading price in the manufacturer-led model.

- The retailer-led model is the best option for the CLSC capturing more economic benefits. Whoever undertakes the leader role will obtain the highest profit levels among three Stackelberg game models, so each channel member is driven to play the leader role in the CLSC.

- The retailer-led model always creates the most social welfare compared with the other two game models. In addition, when the carbon trading price exceeds a certain threshold, the social welfare level in the manufacturer-led model is higher than that of the third party-led model.

6.2. Managerial Implications

- Remanufacturing and green investment are beneficial to curbing carbon emissions. To encourage enterprises to actively build reverse supply chains and invest in low-carbon technologies, the government should provide financial subsidies to the enterprises, which can accelerate the creation of the green production system and a low-carbon circular economy.

- A loose cap-and-trade regulation is conducive to improving the greenness of products and the recovery rate of end-of-life products, as well as elevating the overall profit of the CLSC. Therefore, at the beginning of the carbon emission reduction project, the carbon emission credits issued by government departments should not be too low, which is conducive to the enterprises making more efforts in green investment and remanufacturing.

- Under different channel power structures, the carbon trading price has different effects on the carbon emission reduction rate and the manufacturers’ profit. To promote manufacturers to reduce carbon emissions and operational costs, it is essential for government departments to regulate carbon trading prices to some extent, thereby improving the operational efficiency of the CLSC.

6.3. Research Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

Appendix D

References

- Yang, M. Green investment and e-commerce sales mode selection strategies with cap-and-trade regulation. Comput. Ind. Eng. 2023, 177, 109036. [Google Scholar] [CrossRef]

- Lyu, R.; Zhang, C.; Li, Z.; Li, Y. Manufacturers’ integrated strategies for emission reduction and recycling: The role of government regulations. Comput. Ind. Eng. 2021, 163, 107769. [Google Scholar] [CrossRef]

- Ghashghaei, M.; Golpîra, H. Optimal integration of electricity supply chain and sustainable closed-loop supply chain. Expert Syst. Appl. 2024, 241, 122464. [Google Scholar] [CrossRef]

- Zhu, C.; Ma, J. Dynamic strategies of horizontal low-carbon supply chains under double carbon policies: A bounded rationality perspective. Comput. Ind. Eng. 2023, 181, 109309. [Google Scholar] [CrossRef]

- Xu, S.; Govindan, K.; Wang, W.; Yang, W. Supply chain management under cap-and-trade regulation: A literature review and research opportunities. Int. J. Prod. Econ. 2024, 271, 109199. [Google Scholar] [CrossRef]

- Fang, H.; Yu, L.; Zhang, Z. Promoting consumer returns in closed-loop supply chains under cap-and-trade regulation: A cooperative recycling advertising perspective. J. Clean. Prod. 2024, 436, 140584. [Google Scholar] [CrossRef]

- Li, J.; Lai, K.K.; Li, Y.M. Remanufacturing and low-carbon investment strategies in a closed-loop supply chain under multiple carbon policies. Int. J. Logist. Res. App. 2022, 27, 170–192. [Google Scholar] [CrossRef]

- Kou, X.; Liu, H.; Liu, H.; Yu, X. Cooperative emission reduction in the supply chain: The value of green marketing under different power structures. Environ. Sci. Pollut. Res. 2022, 29, 68396–68409. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, D.; Cheng, T.; Zhou, R.; Gao, J. Decision and coordination of E-commerce closed-loop supply chain chains with fairness concern. Transp. Res. Part E Logist. Transp. Rev. 2023, 173, 103092. [Google Scholar] [CrossRef]

- Sabbaghnia, A.; Heydari, J.; Uelkue, M.A.; Zolfaghari, S. Sustainable supply chain coordination: Extant literature, trends, and future research directions. Ann. Oper. Res. 2024, 05852. [Google Scholar] [CrossRef]

- Mondal, C.; Giri, B.C. Retailers’ competition and cooperation in a closed-loop green supply chain under governmental intervention and cap-and-trade policy. Oper. Res. 2022, 22, 859–894. [Google Scholar] [CrossRef]

- Zhang, X.; Li, Q.; Liu, Z.; Chang, C. Optimal pricing and remanufacturing mode in a closed-loop supply chain of WEEE under government fund policy. Comput. Ind. Eng. 2021, 151, 106951. [Google Scholar] [CrossRef]

- Yang, L.; Hu, Y.; Huang, L. Collecting mode selection in a remanufacturing supply chain under cap-and-trade regulation. Eur. J. Oper. Res. 2020, 287, 480–496. [Google Scholar] [CrossRef]

- Cheng, P.; Ji, G.; Zhang, G.; Shi, Y. A closed-loop supply chain network considering consumer’s low carbon preference and carbon tax under the cap-and-trade regulation. Sustain. Prod. Consump. 2022, 29, 614–635. [Google Scholar] [CrossRef]

- Wang, J.; He, S. Government interventions in closed-loop supply chains with modularity design. Int. J. Prod. Econ. 2023, 264, 108965. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Van Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Dou, G.; Choi, T. Does implementing trade-in and green technology together benefit the environment? Eur. J. Oper. Res. 2021, 295, 517–533. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, M.; Yang, F. Joint emission reduction strategy considering channel inconvenience under different recycling structures. Comput. Ind. Eng. 2022, 169, 108159. [Google Scholar] [CrossRef]

- Wang, Z.; Wu, Q. Carbon emission reduction and product collection decisions in the closed-loop supply chain with cap-and-trade regulation. Int. J. Prod. Res. 2020, 59, 4359–4383. [Google Scholar] [CrossRef]

- Hu, X.; Yang, Z.; Sun, J.; Zhang, Y. Carbon tax or cap-and-trade: Which is more viable for Chinese remanufacturing industry? J. Clean. Prod. 2019, 243, 118606. [Google Scholar] [CrossRef]

- Zheng, B.; Jin, L.; Huang, G.; Chu, J. Retailer’s optimal CSR investment in closed-loop supply chains: The impacts of supply chain structure and channel power structure. 4OR 2023, 21, 301–327. [Google Scholar] [CrossRef]

- Gao, J.; Han, H.; Hou, L.; Wang, H. Pricing and effort decisions in a closed-loop supply chain under different channel power structures. J. Clean. Prod. 2016, 112, 2043–2057. [Google Scholar] [CrossRef]

- Maiti, T.; Giri, B.C. Two-way product recovery in a closed-loop supply chain with variable markup under price and quality dependent demand. Int. J. Prod. Econ. 2017, 183, 259–272. [Google Scholar] [CrossRef]

- Ranjbar, Y.; Sahebi, H.; Ashayeri, J.; Teymouri, A. A competitive dual recycling channel in a three-level closed loop supply chain under different power structures: Pricing and collecting decisions. J. Clean. Prod. 2020, 272, 122623. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhang, Y.; Wahab, M.I.M.; Goh, M. Channel leadership and performance for a closed-loop supply chain considering competition. Transp. Res. Part E Logist. Transp. Rev. 2023, 175, 103151. [Google Scholar] [CrossRef]

- Zhang, C.; Li, H.; Tian, Y.X. Manufacturer’s carbon abatement strategy and selection of spent power battery collecting mode based on echelon utilization and cap-and-trade policy. Comput. Ind. Eng. 2023, 177, 109079. [Google Scholar] [CrossRef]

- Yang, L.; Wang, G.; Ke, C. Remanufacturing and promotion in dual-channel supply chains under cap-and-trade regulation. J. Clean. Prod. 2018, 204, 939–957. [Google Scholar] [CrossRef]

- Chai, Q.; Sun, M.; Lai, K.; Xiao, Z. The effects of government subsidies and environmental regulation on remanufacturing. Comput. Ind. Eng. 2023, 178, 109126. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, J.; Diallo, C. Optimal production and pricing strategies for a remanufacturing firm. Int. J. Prod. Econ. 2018, 204, 290–315. [Google Scholar] [CrossRef]

- Tang, S.; Wang, W.; Zhou, G. Remanufacturing in a competitive market: A closed-loop supply chain in a Stackelberg game framework. Expert Syst. Appl. 2020, 161, 113655. [Google Scholar] [CrossRef]

- Zhang, C.; Lyu, R.; Li, Z.; MacMillen, S.J. Who should lead raw materials collection considering regulatory pressure and technological innovation? J. Clean. Prod. 2021, 298, 126762. [Google Scholar] [CrossRef]

- Wan, N. Impacts of sales mode and recycling mode on a closed-loop supply chain. Int. J. Syst. Sci. Oper. Logist. 2023, 10, 2221076. [Google Scholar] [CrossRef]

- Choi, T.; Li, Y.; Xu, L. Channel leadership, performance and coordination in closed loop supply chains. Int. J. Prod. Econ. 2013, 146, 371–380. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.; Zhang, K.; Bai, T.; Shang, J. Reward-penalty mechanism for closed-loop supply chains under responsibility-sharing and different power structures. Int. J. Prod. Econ. 2015, 170, 178–190. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Sadeghi, R. Pricing strategies in the competitive reverse supply chains with traditional and e-channels: A game theoretic approach. Int. J. Prod. Econ. 2019, 215, 48–60. [Google Scholar] [CrossRef]

- Liu, W.; Qin, D.; Shen, N.; Zhang, J.; Jin, M.; Xie, N.; Chen, J.; Chang, X. Optimal pricing for a multi-echelon closed loop supply chain with different power structures and product dual differences. J. Clean. Prod. 2020, 257, 120281. [Google Scholar] [CrossRef]

- Zheng, B.; Yang, C.; Yang, J.; Zhang, M. Dual-channel closed loop supply chains: Forward channel competition, power structures and coordination. Inter. J. Prod. R. 2017, 55, 3510–3527. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, K.B.; Wang, S.B.; Liu, W.J. Channel structures and information value in a closed-loop supply chain with corporate social responsibility based on the third-party collection. Appl. Math. Model. 2022, 106, 482–506. [Google Scholar] [CrossRef]

- Suvadarshini, P.; Biswas, I.; Srivastava, S. Impact of reverse channel competition, individual rationality, and information asymmetry on multi-channel closed-loop supply chain design. Int. J. Prod. Econ. 2023, 259, 108818. [Google Scholar] [CrossRef]

- Ding, J.; Chen, W.; Wang, W. Production and carbon emission reduction decisions for remanufacturing firms under carbon tax and take-back legislation. Comput. Ind. Eng. 2020, 143, 106419. [Google Scholar] [CrossRef]

- Wang, Q.; Xiu Xu, S.; Ji, X.; Zhao, N. Joint decisions on selling mode choice and emission reduction investment under cap-and-trade regulation. Int. J. Prod. Res. 2023, 62, 6753–6780. [Google Scholar] [CrossRef]

- Yang, Y.; Goodarzi, S.; Bozorgi, A.; Fahimnia, B. Carbon cap-and-trade schemes in closed-loop supply chains: Why firms do not comply? Transp. Res. Part E Logist. Transp. Rev. 2021, 156, 102486. [Google Scholar] [CrossRef]

- Lin, Y.; Yu, Z.; Wang, Y.; Goh, M. Performance evaluation of regulatory schemes for retired electric vehicle battery recycling within dual-recycle channels. J. Environ. Manag. 2023, 332, 117354. [Google Scholar] [CrossRef]

- Ghosh, S.K.; Seikh, M.R.; Chakrabortty, M. Analyzing a stochastic dual-channel supply chain under consumers’ low carbon preferences and cap-and-trade regulation. Comput. Ind. Eng. 2020, 149, 106765. [Google Scholar] [CrossRef]

- Narang, P.; Kanti De, P.; Peng Lim, C.; Kumari, M. Optimal recycling model selection in a closed-loop supply chain for electric vehicle batteries under carbon cap-trade and reward-penalty policies using the Stackelberg game. Comput. Ind. Eng. 2024, 196, 110512. [Google Scholar] [CrossRef]

- Xu, J.; Jia, R.; Wang, B.; Xu, A.; Zhu, X. The optimal emission reduction and recycling strategies in construction material supply chain under carbon cap–trade mechanism. Sustainability 2023, 15, 9181. [Google Scholar] [CrossRef]

- Chen, C.K.; Ulya, M.A. Analyses of the reward-penalty mechanism in green closed-loop supply chains with product remanufacturing. Int. J. Prod. Econ. 2019, 210, 211–223. [Google Scholar] [CrossRef]

- Reong, S.; Chen, J.-M.; Yu, J.C.-P.; Hsiao, Y.-L.; Wee, H.-M. Optimal inbound/outbound pricing model for remanufacturing in a closed-loop supply chain. Int. J. Ind. Eng. 2022, 29, 8309. [Google Scholar]

- Li, Z.; Pan, Y.; Yang, W.; Ma, J.; Zhou, M. Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energ. Econ. 2021, 101, 105426. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, T. Complex dynamics of a low-carbon supply chain with government green subsidies and carbon cap-and-trade policies. Int. J. Bifurcat. Chaos 2022, 32, 2250090. [Google Scholar] [CrossRef]

- Yenipazarli, A. Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur. J. Oper. Res. 2016, 249, 117–130. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, T. Dynamic analysis of a dual-channel closed-loop supply chain with fairness concerns under carbon tax regulation. Environ. Sci. Pollut. Res. 2022, 29, 57543–57565. [Google Scholar] [CrossRef] [PubMed]

- Tontini, G.; Söilen, K.S.; Zanchett, R. Nonlinear antecedents of customer satisfaction and loyalty in third-party logistics services (3PL). Asia Pac. J. Mark. Logist. 2017, 29, 1116–1135. [Google Scholar] [CrossRef]

| Research Paper | Stackelberg Game | Green Investment | CPT | CLSC | Third-Party Collection |

|---|---|---|---|---|---|

| Wang et al. [34] | √ | √ | √ | ||

| Zheng et al. [37] | √ | √ | √ | ||

| Zerang et al. [40] | √ | √ | √ | ||

| Ranjbar et al. [24] | √ | √ | √ | ||

| Liu et al. [29] | √ | √ | |||

| Yang et al. [13] | √ | √ | √ | √ | √ |

| Lyu et al. [2] | √ | √ | √ | √ | |

| Zhang et al. [12] | √ | √ | √ | ||

| Wang et al. [38] | √ | √ | √ | ||

| Mondal and Giri [22] | √ | √ | √ | ||

| Cheng et al. [14] | √ | √ | √ | ||

| Zhang et al. [26] | √ | √ | √ | √ | |

| Wang et al. [41] | √ | √ | √ | √ | |

| Fang et al. [6] | √ | √ | √ | √ | |

| Present research | √ | √ | √ | √ | √ |

| Symbol | Explanation |

|---|---|

| w | The wholesale price per unit product (USD, decision variable) |

| p | The retail price per unit product (USD, decision variable) |

| e | The emission reduction rate per unit product (decision variable), 0 < e < 1 |

| τ | The return rate of used products (decision variable), 0 < τ < 1 |

| The transfer price of the manufacturer to the third-party collector for per unit used product (USD, decision variable) | |

| The marginal cost of the new product with raw materials (USD) | |

| The marginal cost of the remanufactured product with used items (USD) | |

| The production cost savings of remanufacturing a new product with used products (USD), | |

| The carbon trading price (USD/ton) | |

| The emission intensity of unit remanufactured product, ; the larger denotes the more carbon emissions released in the remanufacturing process | |

| The initial carbon emission for per unit product (ton) | |

| The carbon quota for per unit product (ton) | |

| The base market demand (unit/year)) | |

| The price sensitivity to the market demand | |

| The coefficient of collection cost () | |

| The coefficient of emission reduction cost () | |

| Total cost savings from remanufacturing a new product with used items (USD), | |

| The channel member’s profit, the subscripted represents the manufacturer, retailer, third-party collector and the whole CLSC respectively; the superscripted represents the manufacturer-led, retailer-led, and third-party-led game models, respectively | |

| The total carbon emissions of different Stackelberg game models (ton) | |

| The social welfare of different Stackelberg game models |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Zhang, Q.; Hu, R.; Yang, M. Optimal Strategy and Performance for a Closed-Loop Supply Chain with Different Channel Leadership and Cap-and-Trade Regulation. Sustainability 2025, 17, 1042. https://doi.org/10.3390/su17031042

Zhang Y, Zhang Q, Hu R, Yang M. Optimal Strategy and Performance for a Closed-Loop Supply Chain with Different Channel Leadership and Cap-and-Trade Regulation. Sustainability. 2025; 17(3):1042. https://doi.org/10.3390/su17031042

Chicago/Turabian StyleZhang, Yuhao, Qian Zhang, Ren Hu, and Man Yang. 2025. "Optimal Strategy and Performance for a Closed-Loop Supply Chain with Different Channel Leadership and Cap-and-Trade Regulation" Sustainability 17, no. 3: 1042. https://doi.org/10.3390/su17031042

APA StyleZhang, Y., Zhang, Q., Hu, R., & Yang, M. (2025). Optimal Strategy and Performance for a Closed-Loop Supply Chain with Different Channel Leadership and Cap-and-Trade Regulation. Sustainability, 17(3), 1042. https://doi.org/10.3390/su17031042