How Does the Circular Economy Asymmetrically Affect Clean Energy Adoption in EU Economies?

Abstract

1. Introduction

2. Theoretical Framework

2.1. Understanding the Circular Economy

2.2. Circular Economy and Renewable Energy Adoption: Transmission Channels

3. Methodology

3.1. Econometric Model

3.2. Method of Moments Quantile Regression (MMQR)

- where is an indicator function. Ensuring that the estimated ατ corresponds to the τ-th conditional quantile. This loss function ensures that the solution ατ corresponds to the τ-th conditional quantile of the dependent variable. When applied to the nonlinear specification in Equation (3), the quantile-regression models can be written as

- −

- Lower quantiles (0.10–0.30): Countries with limited clean energy adoption

- −

- Middle quantiles (0.40–0.60): Countries with moderate clean energy adoption

- −

- Higher quantiles (0.70–0.90): Countries with advanced clean energy adoption.

3.3. MMQR Implementation and Computational Procedures

- −

- Quantile specifications: Estimations were performed across nine quantiles (τ = 0.10, 0.20, 0.30, 0.40, 0.50, 0.60, 0.70, 0.80, 0.90) to capture comprehensive distributional effects across the entire conditional distribution of renewable energy adoption.

- −

- Bootstrap procedures: Standard errors were computed using bootstrap resampling methods with 500 replications to ensure robust inference and account for potential heteroskedasticity in the panel structure.

- −

- Convergence criteria: The optimization algorithm achieved convergence for all quantile specifications, with convergence tolerance set at 1 × 10−6 and maximum iterations capped at 1000. All models converged successfully within the specified computational parameters.

- −

- Fixed effect treatment: The mmqreg command automatically accommodates location-scale transformations, effectively addressing individual fixed effects without requiring explicit dummy variable inclusion. This approach circumvents the incidental parameters problem inherent in traditional fixed effects quantile regression.

3.4. Data

3.4.1. Sample Selection and Data Sources

3.4.2. Dependent Variable

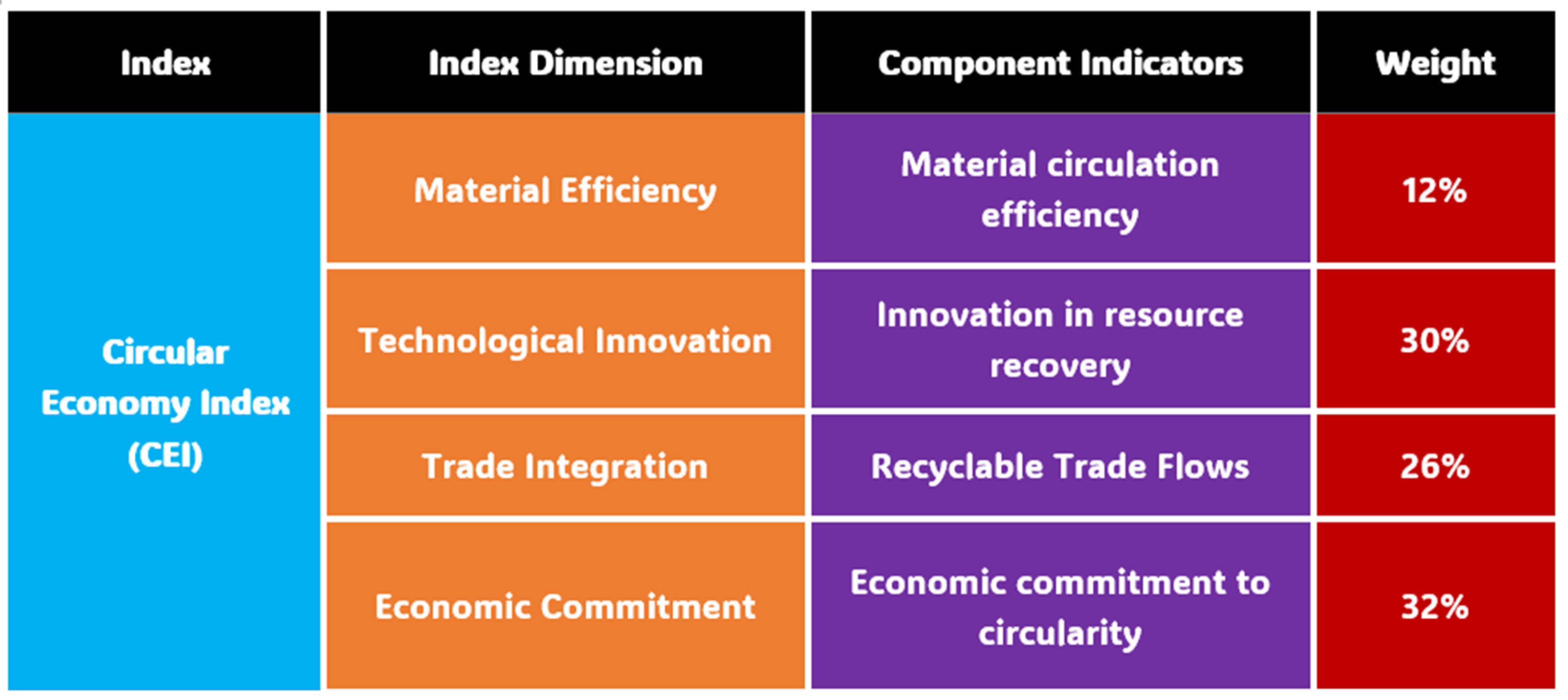

3.4.3. Explanatory Variable

- (a)

- Normalization phase: All metrics undergo standardization procedures to enable comparison across disparate measurement scales and units.

- (b)

- Information-entropy computation: Unbiased weights emerge from calculations based on informational entropy properties of each pillar.

- (c)

- Composite synthesis: Combined scores are derived by applying calculated weights for each nation and temporal observation.

3.4.4. Other Variables

4. Empirical Results and Discussion

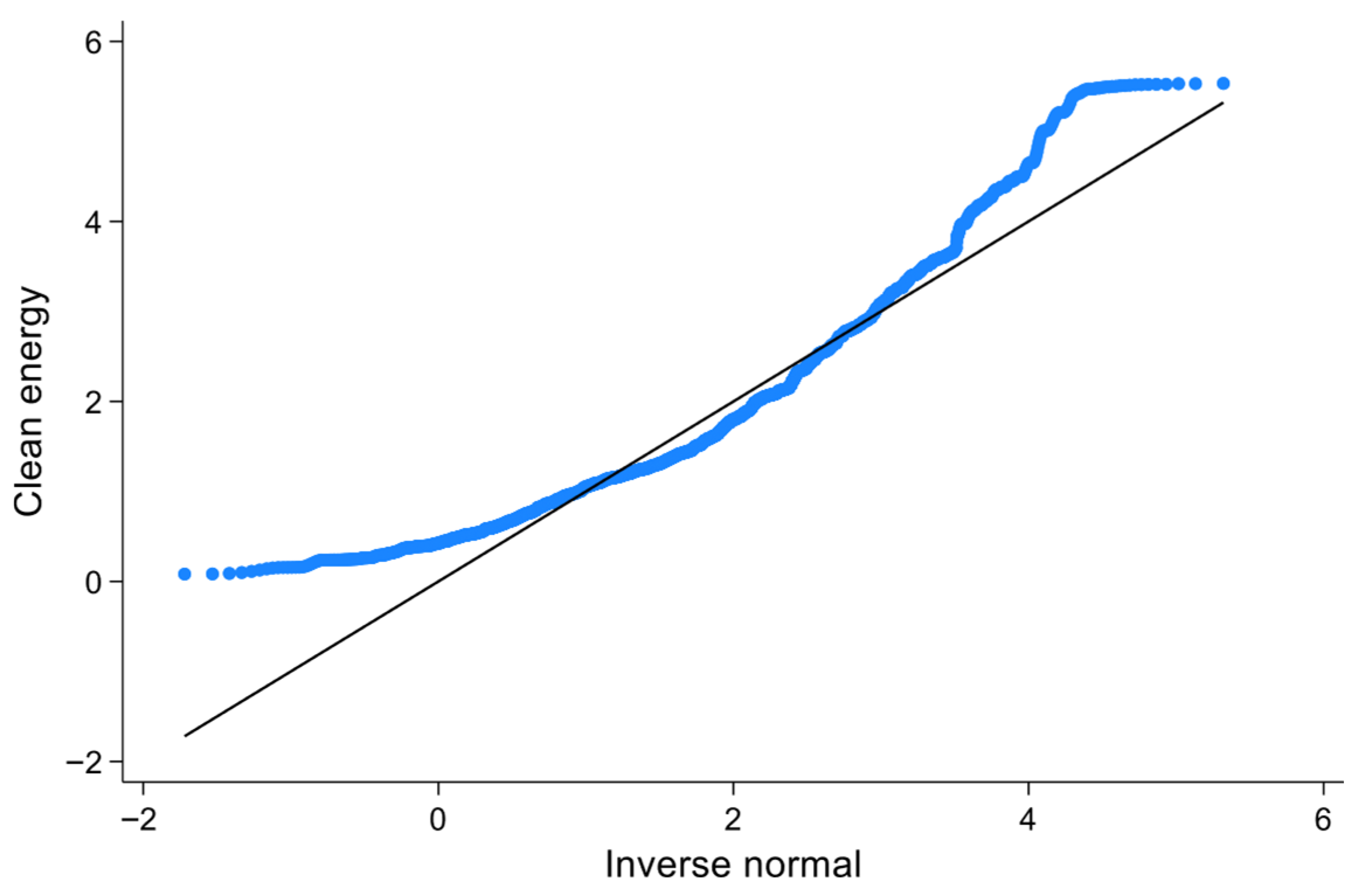

4.1. Validation of Distributional Characteristics

4.2. Analysis of Cross-Sectional Dependence and Parameter Heterogeneity

4.3. Panel Unit Root Testing

4.4. Asymmetric MMQR Estimation Results

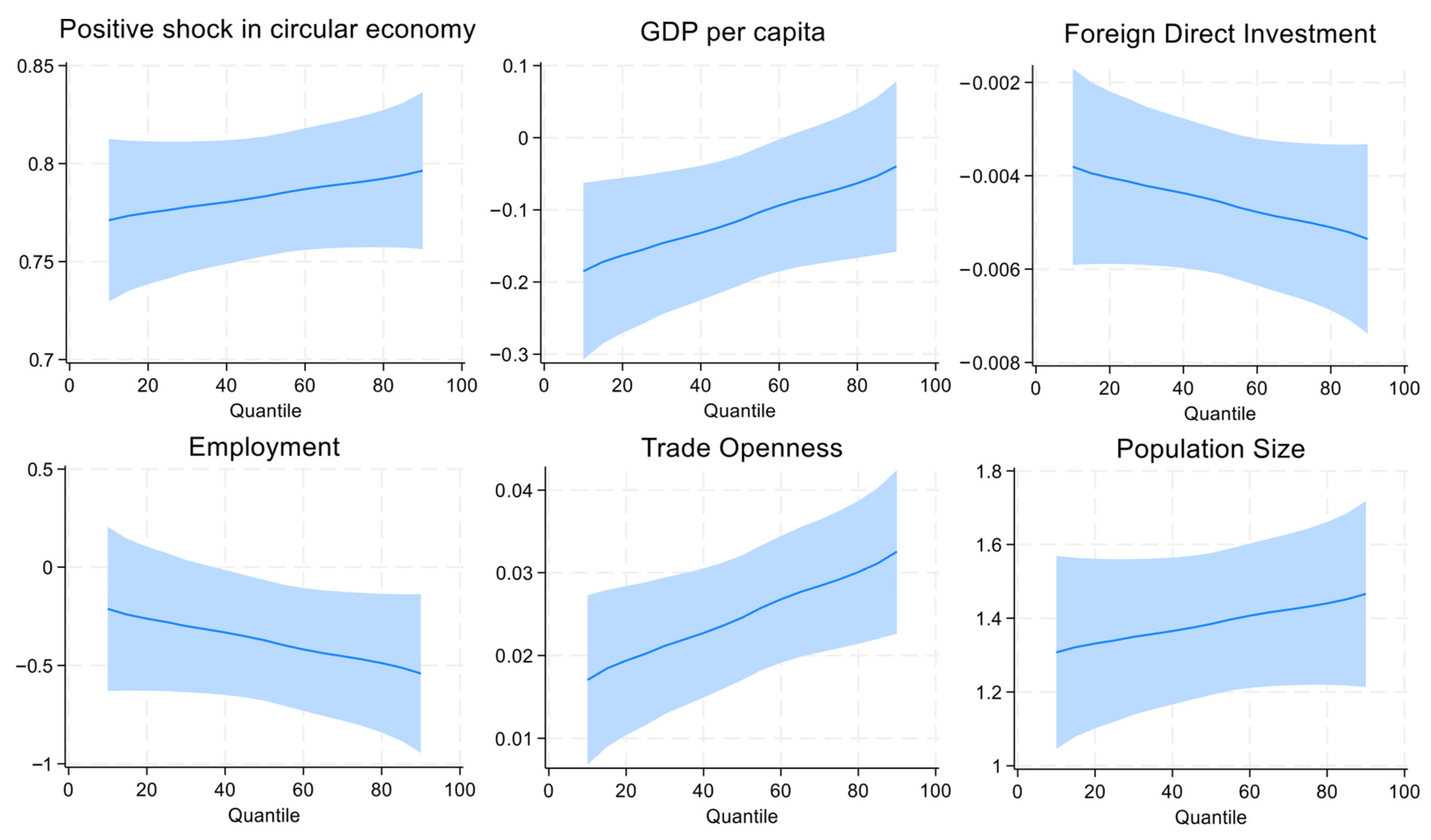

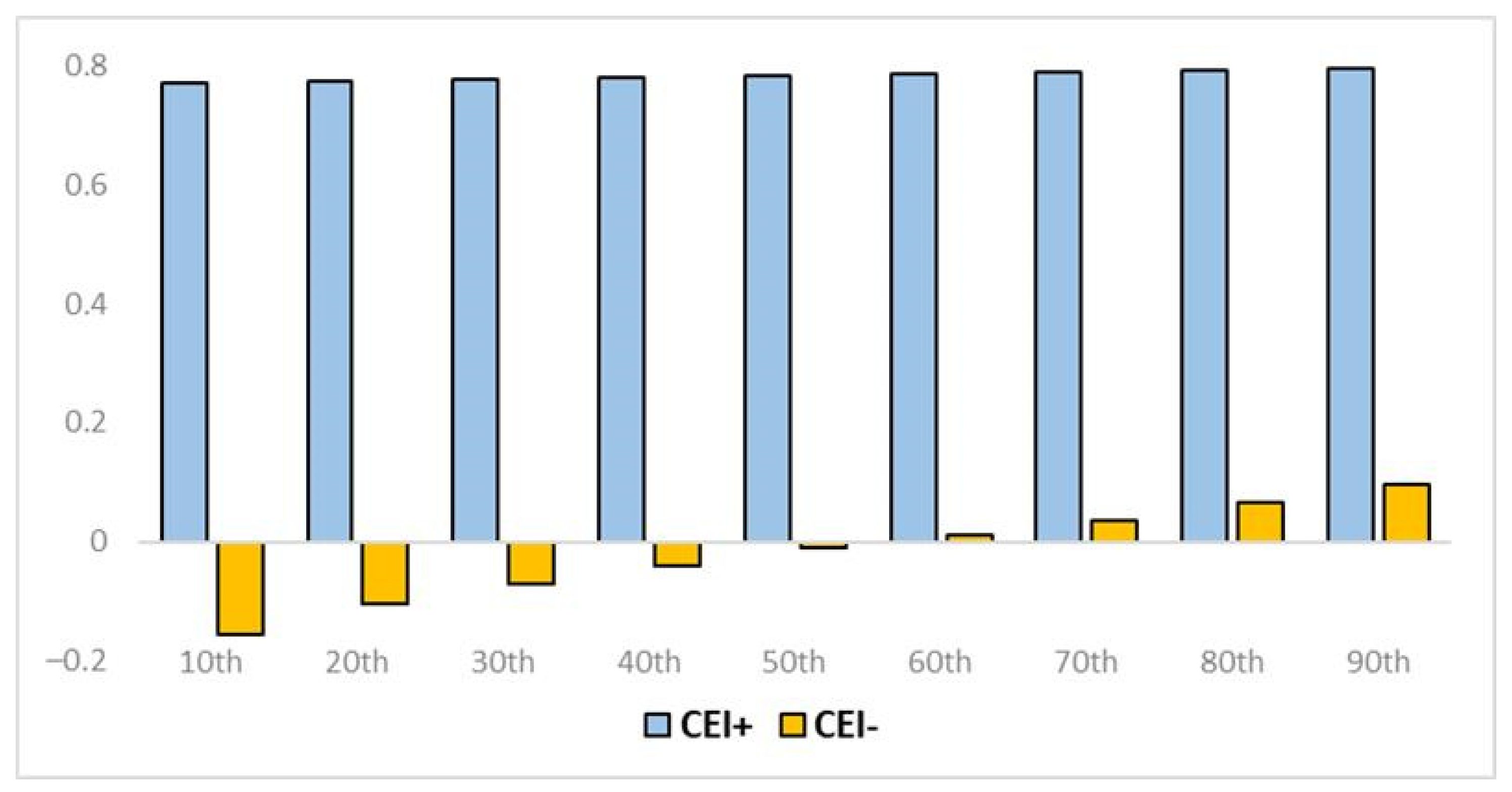

4.4.1. Impact of Positive Shocks in CEI on Clean Energy Adoption

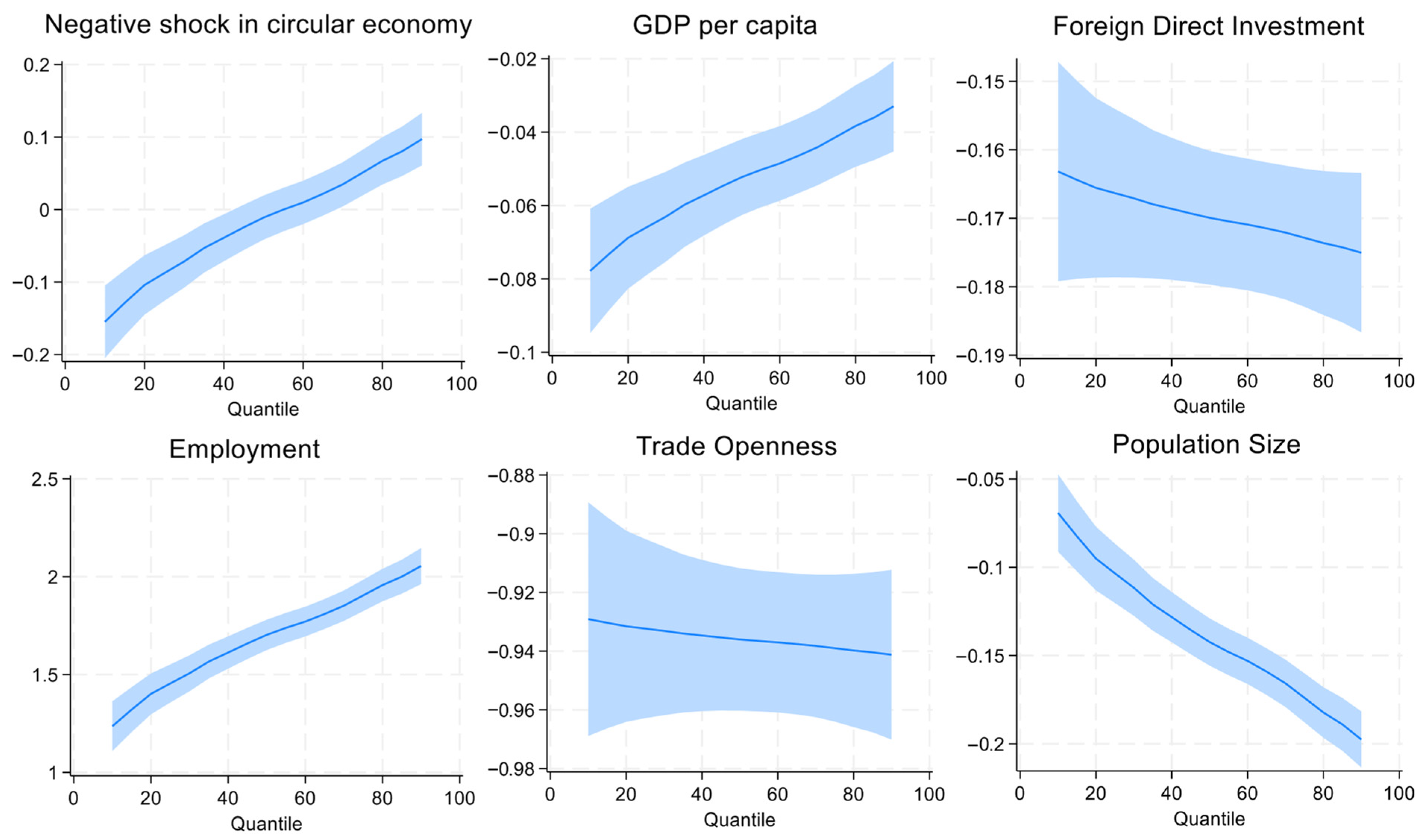

4.4.2. Impact of Negative Shocks in CEI on Clean Energy Adoption

4.4.3. Effect of Control Variables on Clean Energy Adoption

4.5. Robustness Check

4.6. Heterogeneous Panel Causality Analysis

5. Concluding Remarks

5.1. Conclusions

5.2. Policy Implications

5.3. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Park, J.; Sarkis, J.; Wu, Z. Creating Integrated Business and Environmental Value within the Context of China’s Circular Economy and Ecological Modernization. J. Clean. Prod. 2010, 18, 1494–1501. [Google Scholar] [CrossRef]

- Ciliberto, C.; Szopik-Depczyńska, K.; Tarczyńska-Łuniewska, M.; Ruggieri, A.; Ioppolo, G. Enabling the Circular Economy Transition: A Sustainable Lean Manufacturing Recipe for Industry 4.0. Bus. Strategy Environ. 2021, 30, 3255–3272. [Google Scholar] [CrossRef]

- Iacovidou, E.; Millward-Hopkins, J.; Busch, J.; Purnell, P.; Velis, C.A.; Hahladakis, J.N.; Zwirner, O.; Brown, A. A Pathway to Circular Economy: Developing a Conceptual Framework for Complex Value Assessment of Resources Recovered from Waste. J. Clean. Prod. 2017, 168, 1279–1288. [Google Scholar] [CrossRef]

- Gusmerotti, N.M.; Testa, F.; Corsini, F.; Pretner, G.; Iraldo, F. Drivers and Approaches to the Circular Economy in Manufacturing Firms. J. Clean. Prod. 2019, 230, 314–327. [Google Scholar] [CrossRef]

- Schroeder, P.; Anggraeni, K.; Weber, U. The Relevance of Circular Economy Practices to the Sustainable Development Goals. J. Ind. Ecol. 2019, 23, 77–95. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards Circular Economy Implementation: A Comprehensive Review in Context of Manufacturing Industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Kaygusuz, K. Energy and Environmental Issues Relating to Greenhouse Gas Emissions for Sustainable Development in Turkey. Renew. Sustain. Energy Rev. 2009, 13, 253–270. [Google Scholar] [CrossRef]

- Yasmeen, R.; Yao, X.; Ul Haq Padda, I.; Shah, W.U.H.; Jie, W. Exploring the Role of Solar Energy and Foreign Direct Investment for Clean Environment: Evidence from Top 10 Solar Energy Consuming Countries. Renew. Energy 2022, 185, 147–158. [Google Scholar] [CrossRef]

- Yasmeen, R.; Zhang, X.; Sharif, A.; Shah, W.U.H.; Sorin Dincă, M. The Role of Wind Energy towards Sustainable Development in Top-16 Wind Energy Consumer Countries: Evidence from STIRPAT Model. Gondwana Res. 2023, 121, 56–71. [Google Scholar] [CrossRef]

- Razmjoo, A.; Ghazanfari, A.; Jahangiri, M.; Franklin, E.; Denai, M.; Marzband, M.; Astiaso Garcia, D.; Maheri, A. A Comprehensive Study on the Expansion of Electric Vehicles in Europe. Appl. Sci. 2022, 12, 11656. [Google Scholar] [CrossRef]

- Menghi, R.; Papetti, A.; Germani, M.; Marconi, M. Energy Efficiency of Manufacturing Systems: A Review of Energy Assessment Methods and Tools. J. Clean. Prod. 2019, 240, 118276. [Google Scholar] [CrossRef]

- Bergougui, B.; Ben-Salha, O. The Impact of Environmental Governance on Energy Transitions: Evidence from a Global Perspective. Sustainability 2025, 17, 8759. [Google Scholar] [CrossRef]

- Bergougui, B.; Meziane, S. Assessing the Impact of Green Energy Transition, Technological Innovation, and Natural Resources on Load Capacity Factor in Algeria: Evidence from Dynamic Autoregressive Distributed Lag Simulations and Machine Learning Validation. Sustainability 2025, 17, 1815. [Google Scholar] [CrossRef]

- Napp, T.A.; Gambhir, A.; Hills, T.P.; Florin, N.; Fennell, P.S. A Review of the Technologies, Economics and Policy Instruments for Decarbonising Energy-Intensive Manufacturing Industries. Renew. Sustain. Energy Rev. 2014, 30, 616–640. [Google Scholar] [CrossRef]

- Rashid, S.; Malik, S.H. Transition from a Linear to a Circular Economy. In Renewable Energy in Circular Economy; Bandh, S.A., Malla, F.A., Hoang, A.T., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 1–20. ISBN 978-3-031-42220-1. [Google Scholar]

- Olabi, A.G. Circular Economy and Renewable Energy. Energy 2019, 181, 450–454. [Google Scholar] [CrossRef]

- Taifouris, M.; Martín, M. Towards Energy Security by Promoting Circular Economy: A Holistic Approach. Appl. Energy 2023, 333, 120544. [Google Scholar] [CrossRef]

- Pearce, D. Economics of Natural Resources and the Environment; Johns Hopkins University Press: Baltimore, MD, USA, 2023; ISBN 0801839866. [Google Scholar]

- Castro, C.G.; Trevisan, A.H.; Pigosso, D.C.A.; Mascarenhas, J. The Rebound Effect of Circular Economy: Definitions, Mechanisms and a Research Agenda. J. Clean. Prod. 2022, 345, 131136. [Google Scholar] [CrossRef]

- Nobre, G.C.; Tavares, E. The Quest for a Circular Economy Final Definition: A Scientific Perspective. J. Clean. Prod. 2021, 314, 127973. [Google Scholar] [CrossRef]

- Abad-Segura, E.; de la Fuente, A.B.; González-Zamar, M.D.; Belmonte-Ureña, L.J. Effects of Circular Economy Policies on the Environment and Sustainable Growth: Worldwide Research. Sustainability 2020, 12, 5792. [Google Scholar] [CrossRef]

- Joensuu, T.; Edelman, H.; Saari, A. Circular Economy Practices in the Built Environment. J. Clean. Prod. 2020, 276, 124215. [Google Scholar] [CrossRef]

- Andersen, M.S. An Introductory Note on the Environmental Economics of the Circular Economy. Sustain. Sci. 2007, 2, 133–140. [Google Scholar] [CrossRef]

- Veleva, V.; Bodkin, G. Corporate-Entrepreneur Collaborations to Advance a Circular Economy. J. Clean. Prod. 2018, 188, 20–37. [Google Scholar] [CrossRef]

- Korhonen, J.; Honkasalo, A.; Seppälä, J. Circular Economy: The Concept and Its Limitations. Ecol. Econ. 2018, 143, 37–46. [Google Scholar] [CrossRef]

- Manavalan, E.; Jayakrishna, K. An Analysis on Sustainable Supply Chain for Circular Economy. Procedia Manuf. 2019, 33, 477–484. [Google Scholar] [CrossRef]

- Klemeš, J.J.; Varbanov, P.S.; Walmsley, T.G.; Foley, A. Process Integration and Circular Economy for Renewable and Sustainable Energy Systems. Renew. Sustain. Energy Rev. 2019, 116, 109435. [Google Scholar] [CrossRef]

- Mutezo, G.; Mulopo, J. A Review of Africa’s Transition from Fossil Fuels to Renewable Energy Using Circular Economy Principles. Renew. Sustain. Energy Rev. 2021, 137, 110609. [Google Scholar] [CrossRef]

- Mignacca, B.; Locatelli, G.; Velenturf, A. Modularisation as Enabler of Circular Economy in Energy Infrastructure. Energy Policy 2020, 139, 111371. [Google Scholar] [CrossRef]

- Mol, A.P.J.; Spaargaren, G. Ecological Modernisation Theory in Debate: A Review. Env. Polit. 2000, 9, 17–49. [Google Scholar] [CrossRef]

- Bergougui, B. Institutional Adaptability, Skill-Bias Technological Shifts, and Energy Efficiency in Global Decarbonization Pathways: Exploring the Role of Artificial Intelligence Patents. Technol. Soc. 2025, 83, 103029. [Google Scholar] [CrossRef]

- Chen, H.; Zhao, G.; Ramzan, M. The Path to Environmental Sustainability: How Circular Economy, Natural Capital, and Structural Economic Changes Shape Greenhouse Gas Emissions in Germany. Sustainability 2025, 17, 5982. [Google Scholar] [CrossRef]

- Grin, J.; Rotmans, J.; Schot, J. Transitions to Sustainable Development; Routledge: Oxford, UK, 2010; ISBN 9780203856598. [Google Scholar]

- Jonsdottir, A.T.; Johannsdottir, L.; Davidsdottir, B. A Systems Approach to Circular Economy Transition: Creating Causal Loop Diagrams for the Icelandic Building Industry. Clean. Environ. Syst. 2025, 17, 100276. [Google Scholar] [CrossRef]

- Gennari, F. The Transition towards a Circular Economy. A Framework for SMEs. J. Manag. Gov. 2023, 27, 1423–1457. [Google Scholar] [CrossRef]

- Quito, B.; Río-Rama, M.d.l.C.d.; Álvarez-García, J.; Durán-Sánchez, A. Impacts of Industrialization, Renewable Energy and Urbanization on the Global Ecological Footprint: A Quantile Regression Approach. Bus. Strategy Environ. 2023, 32, 1529–1541. [Google Scholar] [CrossRef]

- Wyszomierski, R.; Bórawski, P.; Bełdycka-Bórawska, A.; Brelik, A.; Wysokiński, M.; Wiluk, M. The Cost-Effectiveness of Renewable Energy Sources in the European Union’s Ecological Economic Framework. Sustainability 2025, 17, 4715. [Google Scholar] [CrossRef]

- Saadaoui, J.; Smyth, R.; Vespignani, J. Ensuring the Security of the Clean Energy Transition: Examining the Impact of Geopolitical Risk on the Price of Critical Minerals. Energy Econ. 2025, 142, 108195. [Google Scholar] [CrossRef]

- Aydin, M.; Erdem, A. Analyzing the Impact of Resource Productivity, Energy Productivity, and Renewable Energy Consumption on Environmental Quality in EU Countries: The Moderating Role of Productivity. Resour. Policy 2024, 89, 104613. [Google Scholar] [CrossRef]

- Agyemang, A.O.; Osei, A.; Kongkuah, M. Exploring the ESG-Circular Economy Nexus in Emerging Markets: A Systems Perspective on Governance, Innovation, and Sustainable Business Models. Bus. Strategy Environ. 2025, 34, 5901–5924. [Google Scholar] [CrossRef]

- Khan, T. Circular-ESG Model for Regenerative Transition. Sustainability 2024, 16, 7549. [Google Scholar] [CrossRef]

- Provensi, T.; Marcon, M.L.; Sehnem, S.; Campos, L.M.S.; Queiroz, A.F.S.L.D. Exploring ESG and Circular Economy in Brazilian Companies: The Role of Stakeholder Engagement. Benchmarking Int. J. 2025; ahead of print. [Google Scholar] [CrossRef]

- Arsawan, I.W.E.; Kartikasari, A.; Suhartanto, D.; Choirisa, S.F. Transitioning Towards Circular Economy Practices: The Role of Organizational Capabilities and Environmental Dynamism—Evidence From Indonesia. Bus. Strategy Environ. 2025, 1–18. [Google Scholar] [CrossRef]

- Garefalakis, A.; Dimitras, A. Looking Back and Forging Ahead: The Weighting of ESG Factors. Ann. Oper. Res. 2020, 294, 151–189. [Google Scholar] [CrossRef]

- Malinauskaite, J.; Jouhara, H.; Czajczyńska, D.; Stanchev, P.; Katsou, E.; Rostkowski, P.; Thorne, R.J.; Colón, J.; Ponsá, S.; Al-Mansour, F.; et al. Municipal Solid Waste Management and Waste-to-Energy in the Context of a Circular Economy and Energy Recycling in Europe. Energy 2017, 141, 2013–2044. [Google Scholar] [CrossRef]

- Sohail, M.T.; Ullah, S.; Sohail, S. How Does the Circular Economy Affect Energy Security and Renewable Energy Development? Energy 2025, 320, 135348. [Google Scholar] [CrossRef]

- Su, C.; Urban, F. Circular Economy for Clean Energy Transitions: A New Opportunity under the COVID-19 Pandemic. Appl. Energy 2021, 289, 116666. [Google Scholar] [CrossRef] [PubMed]

- Machado, J.A.F.; Santos Silva, J.M.C. Quantiles via Moments. J. Econom. 2019, 213, 145–173. [Google Scholar] [CrossRef]

- Bergougui, B.; Murshed, S.M.; Shahbaz, M.; Zambrano-Monserrate, M.A.; Samour, A.; Aldawsari, M.I. Towards Secure Energy Systems: Examining Asymmetric Impact of Energy Transition, Environmental Technology and Digitalization on Chinese City-Level Energy Security. Renew. Energy 2025, 238, 121883. [Google Scholar] [CrossRef]

- Bergougui, B. Circular Pathways to Sustainability: Asymmetric Impacts of the Circular Economy on the EU’s Capacity Load Factor. Land 2025, 14, 1216. [Google Scholar] [CrossRef]

- Eurostat. Share of Renewable Energy in Gross Final Energy Consumption [{%}]. Eur. Eu 2013. Available online: https://ec.europa.eu/eurostat/databrowser/view/sdg_07_40/default/table?lang=en (accessed on 18 October 2025).

- Kakar, S.K.; Wang, J.; Arshed, N.; Le Hien, T.T.; Akhter, S.; Abdullahi, N.M. The Impact of Circular Economy, Sustainable Infrastructure, and Green FinTech on Biodiversity in Europe: A Holistic Approach. Technol. Soc. 2025, 81, 102841. [Google Scholar] [CrossRef]

- Ozturk, I.; Ullah, S.; Sohail, S.; Sohail, M.T. How Do Digital Government, Circular Economy, and Environmental Regulatory Stringency Affect Renewable Energy Production? Energy Policy 2025, 203, 114634. [Google Scholar] [CrossRef]

- Esposito, L. Renewable Energy Consumption and per Capita Income: An Empirical Analysis in Finland. Renew. Energy 2023, 209, 558–568. [Google Scholar] [CrossRef]

- Doğan, B.; Khalfaoui, R.; Bergougui, B.; Ghosh, S. Unveiling the Impact of the Digital Economy on the Interplay of Energy Transition, Environmental Transformation, and Renewable Energy Adoption. Res. Int. Bus. Financ. 2025, 76, 102837. [Google Scholar] [CrossRef]

- Bergougui, B. Can Artificial Intelligence Mitigate Environmental Inequality? Evidence from Leading Robotic-Driven Economies Using Quantile-Based Methods. Borsa Istanb. Rev. 2025, in press. [CrossRef]

- Bergougui, B.; Satrovic, E. Towards Eco-Efficiency of OECD Countries: How Does Environmental Governance Restrain the Destructive Ecological Effect of the Excess Use of Natural Resources? Ecol. Inform. 2025, 87, 103093. [Google Scholar] [CrossRef]

- Dossou, T.A.M.; Ndomandji Kambaye, E.; Asongu, S.A.; Alinsato, A.S.; Berhe, M.W.; Dossou, K.P. Foreign Direct Investment and Renewable Energy Development in Sub-Saharan Africa: Does Governance Quality Matter? Renew. Energy 2023, 219, 119403. [Google Scholar] [CrossRef]

- Bergougui, B.; Murshed, S.M. Heterogeneous Spillover Effects: How FDI in Resources Extraction, Manufacturing, and Services Affect Sectoral Carbon Emissions in the MENA Region. In Natural Resources Forum; Blackwell Publishing Ltd.: Oxford, UK, 2025. [Google Scholar] [CrossRef]

- Li, Y.; Bergougui, B.; Murshed, S.M. China Trade Shock: Is There a Reversal of Dutch Disease for Exporters of Primary Commodities? J. Int. Trade Econ. Dev. 2025, 34, 1709–1736. [Google Scholar] [CrossRef]

- Zhang, M.; Zhang, S.; Lee, C.C.; Zhou, D. Effects of Trade Openness on Renewable Energy Consumption in OECD Countries: New Insights from Panel Smooth Transition Regression Modelling. Energy Econ. 2021, 104, 105649. [Google Scholar] [CrossRef]

- Zhang, R.; Li, W.; Li, Y.; Li, H. Job Losses or Gains? The Impact of Supply-Side Energy Transition on Employment in China. Energy 2024, 308, 132804. [Google Scholar] [CrossRef]

- Lee, C.C.; Yan, J.; Xuan, C. Blessing or Curse? The Effect of Population Aging on Renewable Energy. Energy 2025, 320, 135279. [Google Scholar] [CrossRef]

- Hussain, K.; Jian, Z.; Khan, A. Circular Economy and EU’s Energy Transition: The Moderating and Transitioning Effects of Financial Structure and Circular Carbon Technology Innovation: Evidence from C-Lasso and PSTR Approaches. J. Clean. Prod. 2025, 505, 145434. [Google Scholar] [CrossRef]

- Johansson, N. Does the EU’s Action Plan for a Circular Economy Challenge the Linear Economy? Environ. Sci. Technol. 2021, 55, 15001–15003. [Google Scholar] [CrossRef]

- Kandpal, V.; Jaswal, A.; Santibanez Gonzalez, E.D.R.; Agarwal, N. Sustainable Energy Transition; Circular Economy and Sustainability; Springer Nature: Cham, Switzerland, 2024; ISBN 978-3-031-52942-9. [Google Scholar]

- Xiao, J.; Karavias, Y.; Juodis, A.; Sarafidis, V.; Ditzen, J. Improved tests for Granger noncausality in panel data. Stata J. 2023, 23, 230–242. [Google Scholar] [CrossRef]

- Bergougui, B.; Zambrano-Monserrate, M.A. Assessing the relevance of the Granger non-causality test for energy policymaking: Theoretical and empirical insights. Energy Strategy Rev. 2025, 59, 101743. [Google Scholar] [CrossRef]

| Variable | Code | Operational Definition | Data Source |

|---|---|---|---|

| Renewable energy share | CLEAN | Proportion of total energy output derived from renewable sources | Eurostat |

| Circular Economy Index | CEI | Entropy-weighted index comprising material reuse rates, innovation metrics, trade in secondary materials, and CE investments | Compiled from Eurostat data |

| GDP per capita | GDP | Gross domestic product divided by population (measured in current USD) | World Bank |

| FDI inflows | FDI | Net foreign direct investment inflows as a percentage of GDP | World Bank |

| Employment | EMP | Percentage of individuals aged 15+ who are employed | World Bank |

| Trade openness | TO | Sum of exports and imports expressed as a percentage of GDP | World Bank |

| Total population | POP | Mid-year national resident count | World Bank |

| Variable | Mean | Std. Dev. | Min. | Max. | Skewness | Kurtosis | Shapiro–Wilk | Prob. | VIF |

|---|---|---|---|---|---|---|---|---|---|

| Clean | 0.970 | 0.341 | 0.229 | 1.793 | 0.137 | 2.592 | 6.882 | 0.000 | - |

| CEI | 5.859 | 1.535 | 3.067 | 9.203 | 0.213 | 2.073 | 10.956 | 0.000 | 1.20 |

| GDP | 23.486 | 1.478 | 20.575 | 26.440 | 0.123 | 2.214 | 10.562 | 0.000 | 2.06 |

| FDI | 0.358 | 0.752 | −2.023 | 3.245 | 1.424 | 8.159 | 16.867 | 0.000 | 1.10 |

| EMP | 1.703 | 0.088 | 1.455 | 1.888 | −0.464 | 3.074 | 10.198 | 0.000 | 2.92 |

| TO | 2.397 | 0.395 | 1.712 | 3.490 | 0.392 | 2.838 | 11.094 | 0.000 | 4.23 |

| POP | 13.332 | 1.342 | 10.497 | 15.751 | −0.108 | 2.511 | 11.368 | 0.000 | 4.29 |

| Panel (A). Cross-Sectional Dependence Test | ||||

|---|---|---|---|---|

| Tests | LM Test | p-Values | Pesaran Test | p-Values |

| Clean | 5951.810 *** | 0.000 | 62.693 *** | 0.000 |

| CEI | 20,083.530 *** | 0.000 | 40.102 *** | 0.000 |

| GDP | 216,515.590 *** | 0.000 | 12.467 *** | 0.000 |

| FDI | 973,180.730 *** | 0.000 | 21.867 *** | 0.000 |

| EMP | 70,884.010 *** | 0.000 | 20.327 *** | 0.000 |

| TO | 2348.510 *** | 0.000 | 63.412 *** | 0.000 |

| POP | 140,372.750 *** | 0.000 | 25.551 *** | 0.000 |

| Panel (B). Homogeneity test | ||||

| Test value | Prob. | |||

| Tilde (Delta) | 191.180 *** | 0.0000 | ||

| Adjusted tilde (Delta) | 195.902 *** | 0.0000 | ||

| Variable | Level | First Difference |

|---|---|---|

| Clean | −5.641 *** | −6.190 *** |

| CEI | −5.999 *** | −6.157 *** |

| GDP | −5.136 *** | −6.190 *** |

| FDI | −5.450 *** | −6.096 *** |

| EMP | −5.273 *** | −6.129 *** |

| TO | −4.767 *** | −6.031 *** |

| POP | −4.510 *** | −6.190 *** |

| Lower Quantile Limited Clean Energy Adoption | Middle Quantile Moderate Clean Energy Adoption | Upper Quantile Advanced Clean Energy Adoption | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 10th | 20th | 30th | 40th | 50th | 60th | 70th | 80th | 90th | |

| Model I | |||||||||

| CEI+ | 0.771 *** | 0.775 *** | 0.778 *** | 0.780 *** | 0.783 *** | 0.787 *** | 0.790 *** | 0.792 *** | 0.796 *** |

| (0.021) | (0.019) | (0.017) | (0.016) | (0.016) | (0.016) | (0.017) | (0.018) | (0.020) | |

| GDP | −0.185 *** | −0.163 *** | −0.146 *** | −0.132 *** | −0.115 ** | −0.094 ** | −0.079 | −0.063 | −0.04 |

| (0.062) | (0.055) | (0.050) | (0.048) | (0.046) | (0.047) | (0.049) | (0.053) | (0.060) | |

| FDI | −0.004 *** | −0.004 *** | −0.004 *** | −0.004 *** | −0.005 *** | −0.005 *** | −0.005 *** | −0.005 *** | −0.005 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| EMP | −0.212 | −0.262 | −0.300 * | −0.332 ** | −0.372 ** | −0.418 *** | −0.453 *** | −0.488 *** | −0.541 *** |

| (0.213) | (0.187) | (0.171) | (0.162) | (0.157) | (0.159) | (0.167) | (0.180) | (0.206) | |

| TO | 0.017 *** | 0.019 *** | 0.021 *** | 0.023 *** | 0.025 *** | 0.027 *** | 0.028 *** | 0.030 *** | 0.033 *** |

| (0.005) | (0.005) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.005) | |

| POP | 1.307 *** | 1.331 *** | 1.350 *** | 1.365 *** | 1.384 *** | 1.407 *** | 1.423 *** | 1.440 *** | 1.466 *** |

| (0.134) | (0.117) | (0.108) | (0.102) | (0.098) | (0.100) | (0.105) | (0.113) | (0.129) | |

| Lower Quantile Limited Clean Energy Adoption | Middle Quantile Moderate Clean Energy Integration | Upper Quantile Advanced Clean Energy Transition | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 10th | 20th | 30th | 40th | 50th | 60th | 70th | 80th | 90th | |

| Model II | |||||||||

| CEI− | −0.155 *** | −0.104 *** | −0.072 *** | −0.039 ** | −0.011 | 0.01 | 0.035 ** | 0.067 *** | 0.097 *** |

| (0.026) | (0.021) | (0.018) | (0.017) | (0.016) | (0.015) | (0.016) | (0.017) | (0.018) | |

| GDP | −0.078 *** | −0.069 *** | −0.063 *** | −0.057 *** | −0.052 *** | −0.049 *** | −0.044 *** | −0.038 *** | −0.033 *** |

| (0.009) | (0.007) | (0.006) | (0.006) | (0.005) | (0.005) | (0.005) | (0.006) | (0.006) | |

| FDI | −0.163 *** | −0.166 *** | −0.167 *** | −0.169 *** | −0.170 *** | −0.171 *** | −0.172 *** | −0.174 *** | −0.175 *** |

| (0.008) | (0.007) | (0.006) | (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | (0.006) | |

| EMP | 1.236 *** | 1.401 *** | 1.507 *** | 1.613 *** | 1.703 *** | 1.771 *** | 1.852 *** | 1.957 *** | 2.055 *** |

| (0.065) | (0.053) | (0.047) | (0.042) | (0.040) | (0.039) | (0.040) | (0.042) | (0.047) | |

| TO | −0.929 *** | −0.932 *** | −0.933 *** | −0.935 *** | −0.936 *** | −0.937 *** | −0.938 *** | −0.940 *** | −0.941 *** |

| (0.020) | (0.017) | (0.015) | (0.013) | (0.012) | (0.012) | (0.012) | (0.013) | (0.015) | |

| POP | −0.069 *** | −0.095 *** | −0.112 *** | −0.128 *** | −0.142 *** | −0.153 *** | −0.166 *** | −0.182 *** | −0.198 *** |

| (0.011) | (0.009) | (0.008) | (0.007) | (0.007) | (0.007) | (0.007) | (0.007) | (0.008) | |

| DOLS | FMOLS | IV-2SLS | HD-FE | COVID-19 | Russia-Ukraine Conflict | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (1) | (2) | (1) | (2) | (1) | (2) | (1) | (2) | (1) | (2) | |

| CEI+ | 0.213 *** | 0.221 *** | 0.218 *** | 0.039 *** | 0.117 *** | 0.144 *** | ||||||

| [0.080] | [0.076] | [0.009] | [0.007] | [0.018] | [0.032] | |||||||

| CEI− | −0.238 * | −0.338 ** | −0.056 *** | −0.054 *** | −0.248 *** | −0.072 ** | ||||||

| [0.124] | [0.133] | [0.010] | [0.010] | [0.023] | [0.035] | |||||||

| GDP | −0.044 | −0.05 | −0.070 * | −0.06 | −0.043 *** | −0.200 *** | −0.194 *** | −0.199 *** | −0.456 *** | −0.465 *** | 0.014 | 0.073 |

| [0.044] | [0.043] | [0.042] | [0.046] | [0.005] | [0.013] | [0.013] | [0.013] | [0.040] | [0.038] | [0.058] | [0.057] | |

| FDI | −0.182 *** | −0.183 *** | −0.349 *** | −0.313 *** | −0.175 *** | −0.019 *** | −0.021 *** | −0.019 *** | −0.006 *** | −0.004 ** | −0.015 *** | −0.016 *** |

| [0.036] | [0.035] | [0.034] | [0.037] | [0.004] | [0.001] | [0.001] | [0.001] | [0.002] | [0.002] | [0.003] | [0.003] | |

| EMP | 1.758 *** | 1.844 *** | 2.271 *** | 2.207 *** | 1.748 *** | 0.621 *** | 0.574 *** | 0.614 *** | 0.507 *** | 0.381 *** | 0.791 *** | 0.626 *** |

| [0.352] | [0.341] | [0.337] | [0.367] | [0.042] | [0.032] | [0.033] | [0.032] | [0.081] | [0.077] | [0.133] | [0.136] | |

| TO | −0.932 *** | −0.890 *** | −1.017 *** | −0.918 *** | −0.929 *** | 0.198 *** | 0.207 *** | 0.203 *** | 0.148 *** | 0.198 *** | −0.106 *** | −0.124 *** |

| [0.098] | [0.095] | [0.094] | [0.102] | [0.012] | [0.012] | [0.012] | [0.012] | [0.024] | [0.023] | [0.022] | [0.023] | |

| POP | −0.142 ** | −0.123 ** | −0.166 *** | −0.138 ** | −0.141 *** | 1.130 *** | 1.128 *** | 1.119 *** | 2.455 *** | 2.368 *** | 0.513 *** | 0.647 *** |

| [0.057] | [0.055] | [0.054] | [0.059] | [0.007] | [0.024] | [0.023] | [0.024] | [0.143] | [0.136] | [0.113] | [0.109] | |

| Obs. | 4533 | 4533 | 4535 | 4535 | 4509 | 4509 | 4536 | 4536 | 972 | 972 | 648 | 648 |

| H0 | Wald Test | Prob | Conclusion |

|---|---|---|---|

| CEI+ does not Granger-cause CLEAN | 104.0123 | 0.0000 | One-way causality |

| CLEAN does not Granger-cause CEI+ | 2.0960 | 0.1477 | |

| CEI− does not Granger-cause CLEAN | 2.4816 | 0.1152 | One-way causality |

| CLEAN does not Granger-cause CEI− | 12.3576 | 0.0004 | |

| GDP does not Granger-cause CLEAN | 181.3812 | 0.0000 | Two-way causality |

| CLEAN does not Granger-cause GDP | 192.1882 | 0.0000 | |

| FDI does not Granger-cause CLEAN | 9.5842 | 0.0020 | Two-way causality |

| CLEAN does not Granger-cause FDI | 8.8671 | 0.0029 | |

| EMP does not Granger-cause CLEAN | 52.1987 | 0.0000 | Two-way causality |

| CLEAN does not Granger-cause EMP | 171.6536 | 0.0000 | |

| TO does not Granger-cause CLEAN | 28.2672 | 0.0000 | Two-way causality |

| CLEAN does not Granger-cause TO | 3.0114 | 0.0827 | |

| POP does not Granger-cause CLEAN | 5.6344 | 0.0176 | Two-way causality |

| CLEAN does not Granger-cause POP | 12.4801 | 0.0004 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bergougui, B.; Ben-Salha, O. How Does the Circular Economy Asymmetrically Affect Clean Energy Adoption in EU Economies? Sustainability 2025, 17, 9523. https://doi.org/10.3390/su17219523

Bergougui B, Ben-Salha O. How Does the Circular Economy Asymmetrically Affect Clean Energy Adoption in EU Economies? Sustainability. 2025; 17(21):9523. https://doi.org/10.3390/su17219523

Chicago/Turabian StyleBergougui, Brahim, and Ousama Ben-Salha. 2025. "How Does the Circular Economy Asymmetrically Affect Clean Energy Adoption in EU Economies?" Sustainability 17, no. 21: 9523. https://doi.org/10.3390/su17219523

APA StyleBergougui, B., & Ben-Salha, O. (2025). How Does the Circular Economy Asymmetrically Affect Clean Energy Adoption in EU Economies? Sustainability, 17(21), 9523. https://doi.org/10.3390/su17219523