Traceability Decisions and Coordination Contracts in Agricultural Supply Chains Under Different Power Structures

Abstract

1. Introduction

- RQ1: What are the optimal traceability levels, wholesale price, retail price, and order quantity under different supply chain power structures? Based on this research question, we assume that under different power structures, firms’ optimal decisions on traceability level, pricing, and order quantity will vary systematically.

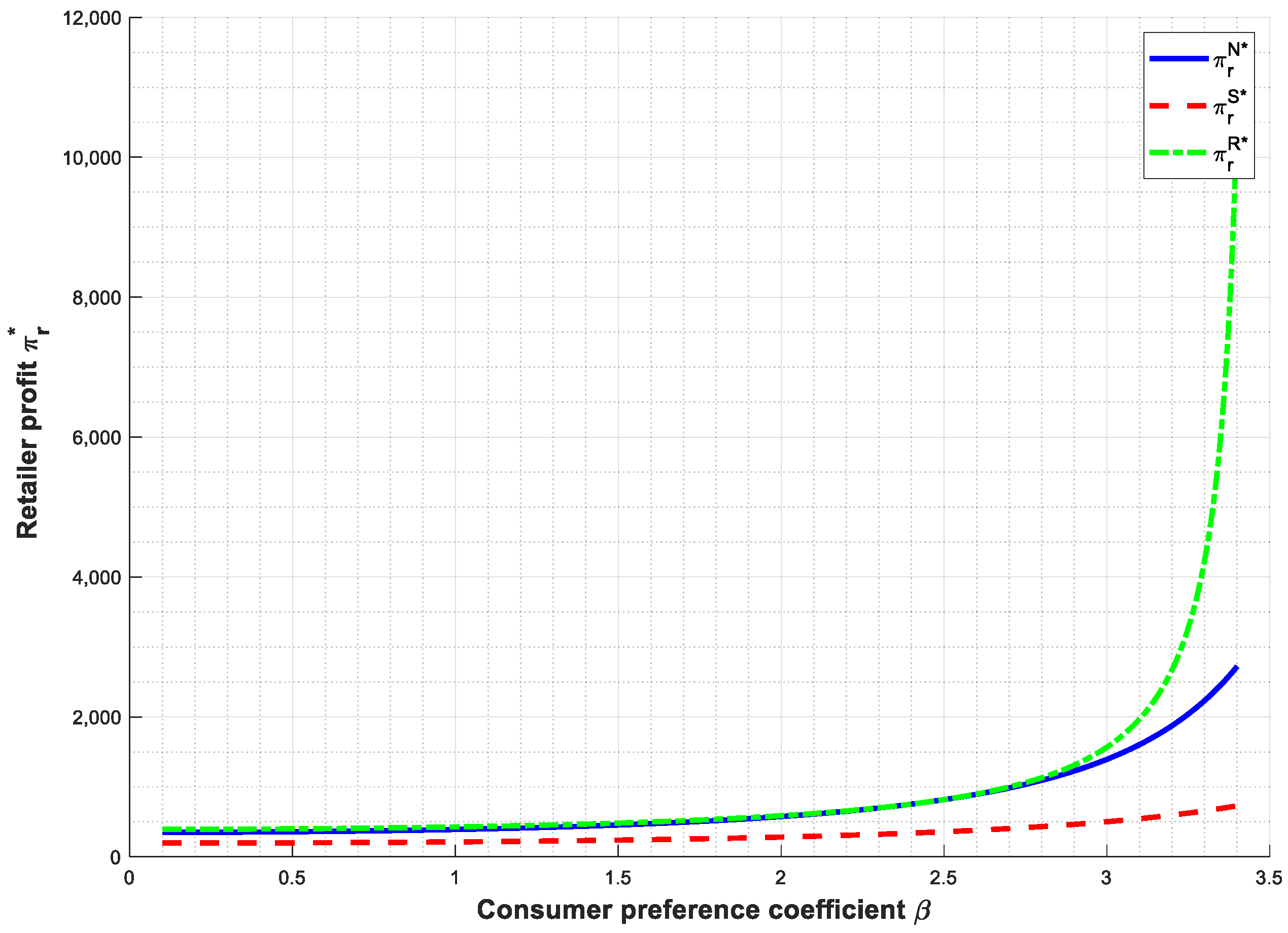

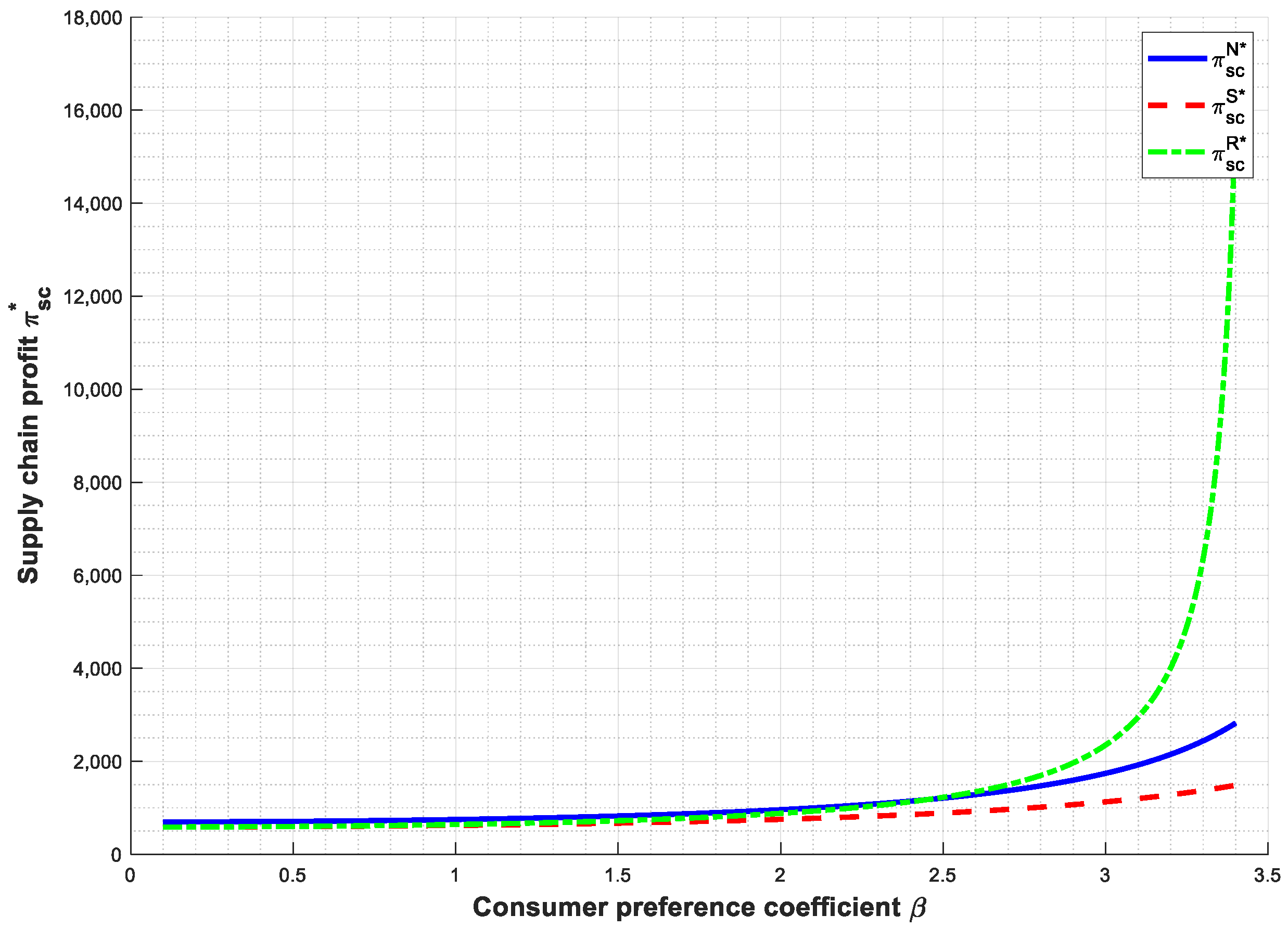

- RQ2: Which supply chain power structure most effectively enhances supply chain traceability? And how does each structure affect supplier and retailer profitability? Based on this research question, we assume that supply chain power structures significantly influence overall traceability levels and the distribution of profits between suppliers and retailers.

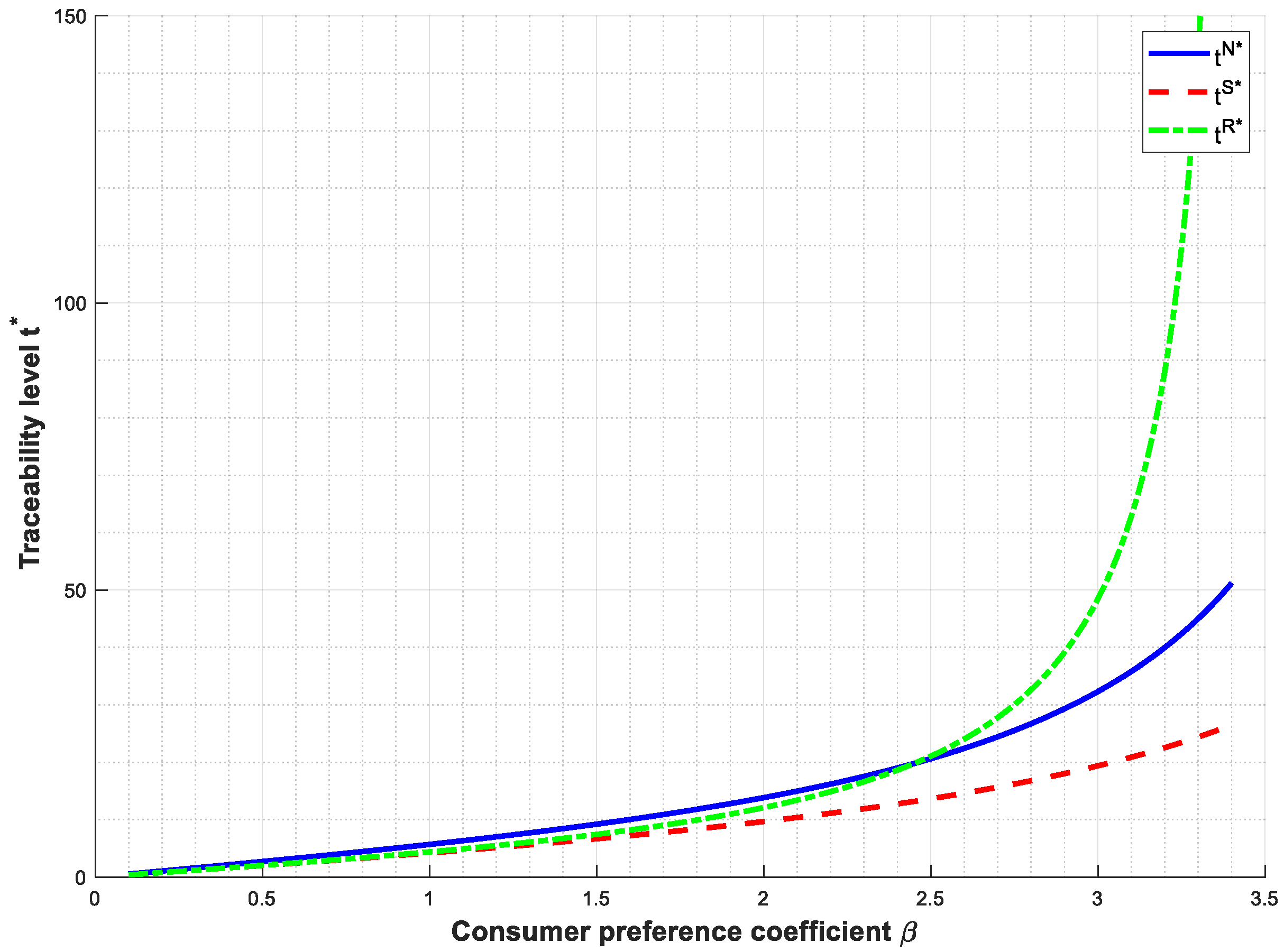

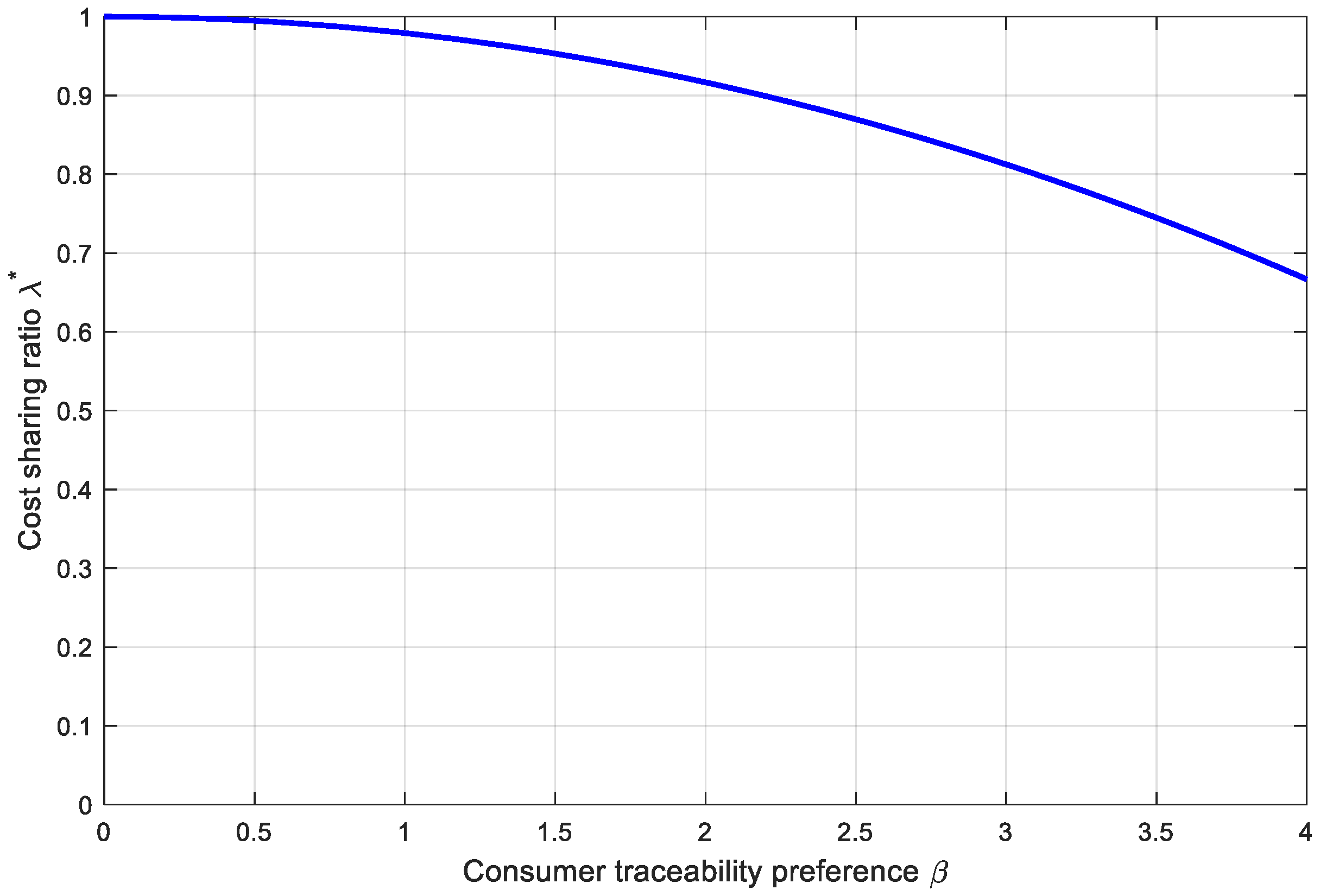

- RQ3: How does consumer preference for traceability impact firms’ traceability investments? Based on this research question, we assume that stronger consumer preferences for traceable products increase firms’ incentives to invest in traceability across supply chain tiers.

- RQ4: How can contractual arrangements (e.g., revenue-sharing and cost-sharing) coordinate decentralized supply chains to incentivize traceability enhancement? Based on this research question, we assume that cost-sharing and revenue-sharing contracts mitigate incentive misalignments in decentralized supply chains and enhance traceability performance.

2. Literature Review

2.1. Supply Chain Traceability and Traceability Level

2.2. Investment Decision in Agricultural Traceability Systems

2.3. The Influence of Supply Chain Power Structures on Firm Behavioral Differences

2.4. Supply Chain Coordination Mechanisms and Contract Design

2.5. Research Gaps and Positioning

3. Problem Description, Assumption, and Basic Model

4. The Optimal Pricing Strategies of the Agricultural Supply Chain

4.1. Scenario C

4.2. Scenario N

4.3. Scenario S

4.4. Scenario R

5. Analysis of Comparative Static

5.1. The Impact of Consumer Preferences on Supply Chain Traceability

5.2. The Impact of Supply Chain Power Structure on the Equilibrium Solution

5.2.1. Comparison Between the Centralized Decision Model and the Game Models Under Three Power Structures

- 1.

- ; and universally;

- 2.

- exhibits parameter-dependent ordering: , when ; when

5.2.2. Comparison Among the Game Models Under Three Power Structures

- (a)

- Comparing the traceability level under different power structures, we get the following proposition (Proposition 5).

- (b)

- Comparing the wholesale price w under different power structures, we get the following proposition (Proposition 6).

- (c)

- Comparing the retail price p under different power structures, we can obtain the following proposition (Proposition 7).

- (d)

- Comparing the demand q under different power structures, the following proposition (Proposition 8) is obtained.

- (e)

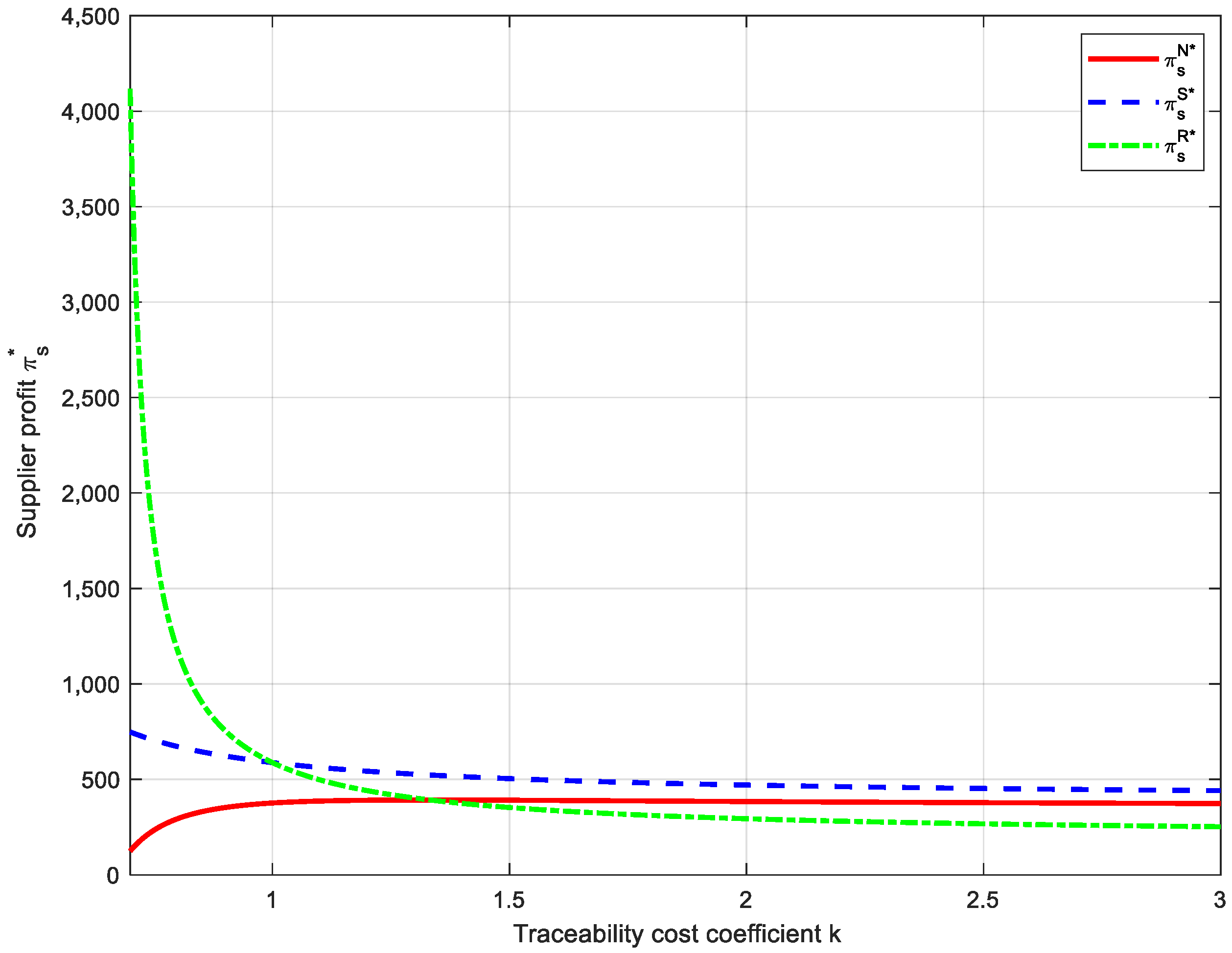

- Comparing the supplier profit under different power structures, we obtain the following proposition (Proposition 9).

- (f)

- Comparing the retailer profit under different power structures, we get the following proposition (Proposition 10).

- (g)

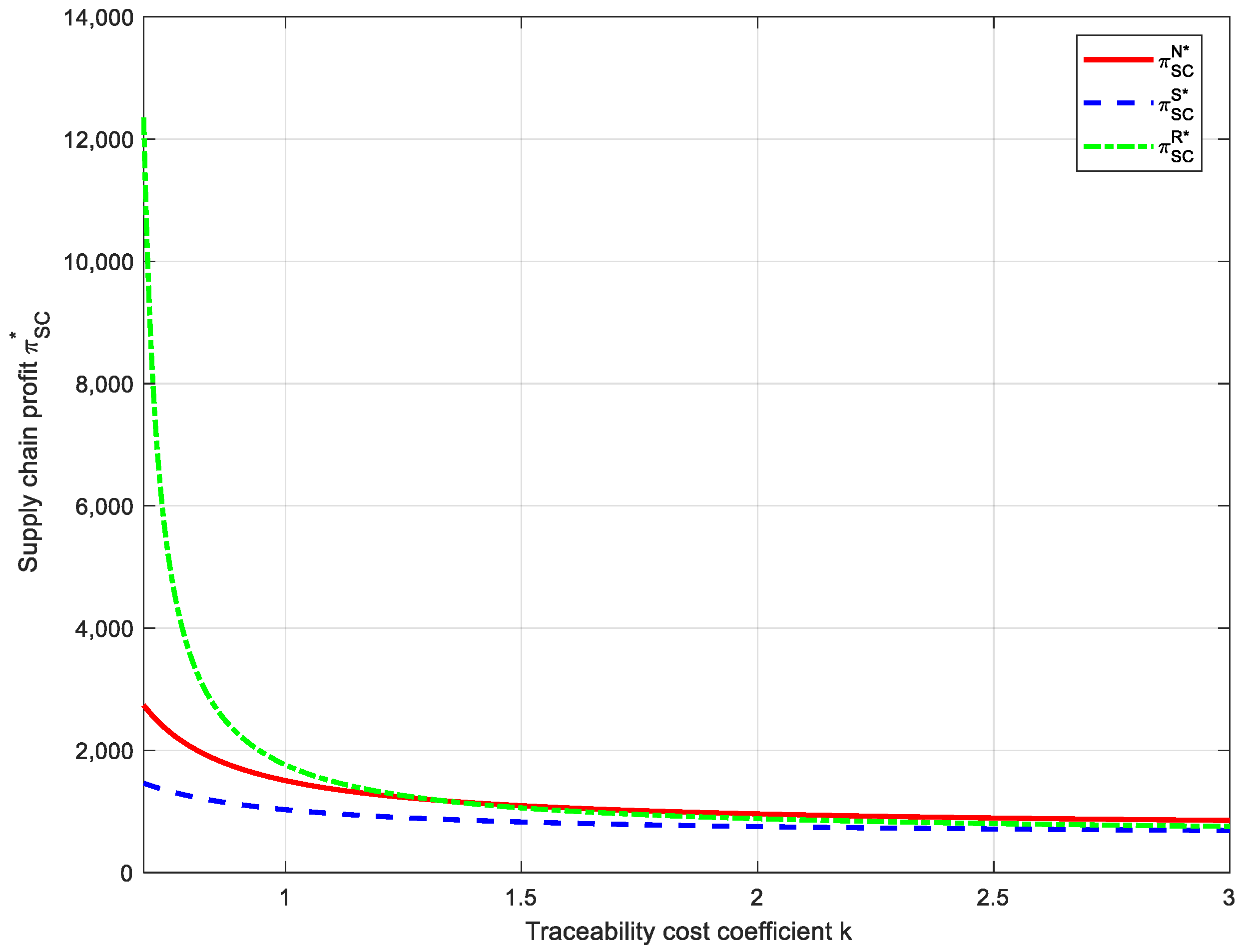

- Comparing the supply chain profit under different power structures, we get the following proposition (Proposition 11).

6. Analysis of Supply Chain Coordination

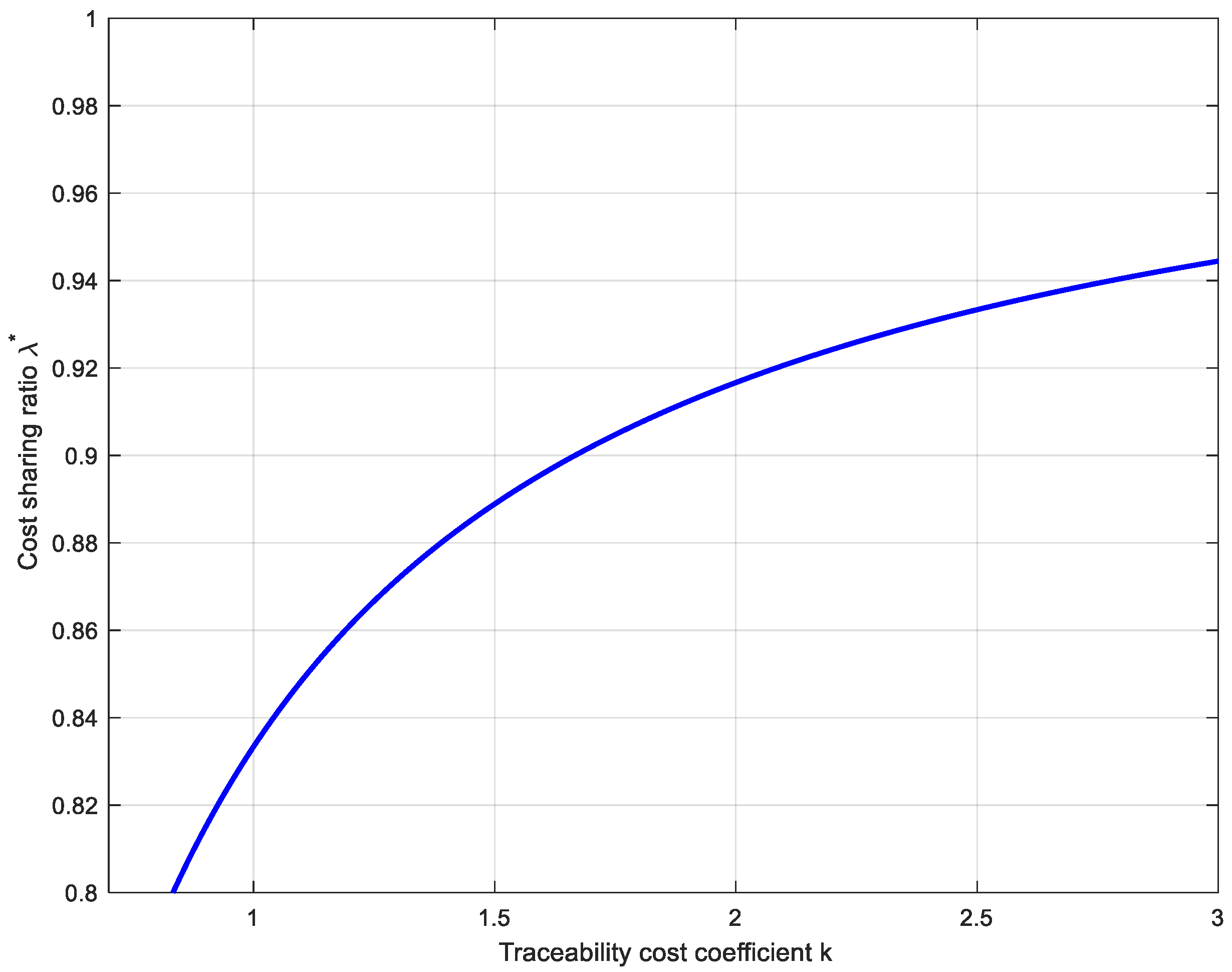

6.1. Coordination Through Cost-Sharing Contracts

6.1.1. Scenario N

6.1.2. Scenario S

6.1.3. Scenario R

6.2. Coordination Through Revenue-Sharing Contracts

7. Numerical Analysis

7.1. Effects of Consumer Traceability Preference

7.2. Effects of Traceability Cost Coefficient k on Supply Chain Traceability Performance

8. Discussion

8.1. Main Findings

8.2. Theoretical Contributions

8.3. Managerial Implication

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Regattieri, A.; Gamberi, M.; Manzini, R. Traceability of food products: General framework and experimental evidence. J. Food Eng. 2007, 81, 347–356. [Google Scholar] [CrossRef]

- Aung, M.M.; Chang, Y.S. Traceability in a food supply chain: Safety and quality perspectives. Food Control 2014, 39, 172–184. [Google Scholar] [CrossRef]

- Resende-Filho, M.A.; Hurley, T.M. Information asymmetry and traceability incentives for food safety. Int. J. Prod. Econ. 2012, 139, 596–603. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Golan, E.; Krissoff, B.; Kuchler, F. Traceability in the US Food Supply: Economic Theory and Industry Studies; United States Department of Agriculture, Economic Research Service: Washington, DC, USA, 2004. [Google Scholar]

- Feng, H.; Wang, X.; Duan, Y.; Zhang, J.; Zhang, X. Applying blockchain technology to improve agri-food traceability A review of development methods, benefits and challenges. J. Clean. Prod. 2020, 260, 121031. [Google Scholar] [CrossRef]

- Dabbene, F.; Gay, P.; Tortia, C. Traceability issues in food supply chain management: A review. Biosyst. Eng. 2014, 120, 65–80. [Google Scholar] [CrossRef]

- Iyengar, G.; Saleh, F.; Sethuraman, J.; Wang, W. Blockchain Adoption in a Supply Chain with Manufacturer. Manag. Sci. 2023, 70, 6158–6178. [Google Scholar] [CrossRef]

- Opara, L.U. Traceability in agriculture and food supply chain: A review of basic concepts, technological implications, and future prospects. Eur. J. Oper. Res. 2003, 1, 101–106. [Google Scholar]

- Zhou, X.Y.; Pullman, M.; Xu, Z.D. The impact of food supply chain traceability on sustainability. Oper. Manag. Res. 2021, 15, 93–115. [Google Scholar] [CrossRef]

- Zhang, A.; Mankad, A.; Ariyawardana, A. Establishing confidence in food safety: Is traceability a solution? J. Consum. Prot. Food Saf. 2020, 15, 99–107. [Google Scholar] [CrossRef]

- Angulo, A.M.; Gil, J.M. Consumer willingness to pay for traceable meat. Agric. Econ. 2007, 37, 219–230. [Google Scholar]

- Dickinson, D.L.; Bailey, D. Meat Traceability: Are U.S. consumers willing to pay for it. J. Agric. Resour. Econ. 2002, 27, 348–364. [Google Scholar]

- Wang, F.; Zhang, J.; Mu, W.; Fu, Z.; Zhang, X. Consumers’ perception toward quality and safety of fishery products, Beijing, China. Food Control 2009, 20, 918–922. [Google Scholar] [CrossRef]

- Jin, S.S.; Zhang, Y.; Xu, Y.N. Amount of information and the willingness of consumers to pay for food traceability in China. Food Control 2017, 77, 163–170. [Google Scholar] [CrossRef]

- Hobbs, J.E. Traceability and supply chain coordination in the agri-food sector. Annu. Rev. Resour. Econ. 2020, 12, 225–246. [Google Scholar]

- Manos, B.; Manikas, I. Traceability in the Greek fresh produce sector drivers and constraints. Br. Food J. 2010, 112, 640–652. [Google Scholar] [CrossRef]

- Opara, L.; Mazaud, F. Food traceability from field to plate. Outlook Agric. 2001, 30, 239–247. [Google Scholar] [CrossRef]

- Stranieri, S.; Orsi, L.; Banterle, A. Traceability and risks an extended transaction cost perspective. Supply Chain. Manag. Int. J. 2017, 22, 145–159. [Google Scholar] [CrossRef]

- Mcentire, J.; Arens, S.; Bernstein, M.; Bugusu, B.; Busta, F.; Cole, M.; Davis, A.; Fisher, W.; Geisert, S.; Jensen, H.; et al. Traceability (Product Tracing) in Food Systems: An IFT report submitted to the FDA, volume 1: Technical aspects and recommendations. Compr. Rev. Food Sci. Food Saf. 2010, 9, 159–175. [Google Scholar]

- Zhong, J.; Cheng, H.; Jia, F. Adoption decision of agricultural product traceability system in small and micro enterprises. Ind. Manag. Data Syst. 2024, 124, 1263–1298. [Google Scholar] [CrossRef]

- Heyder, M.; Theuvsena, L.; Hollmann-Hespos, T. Investments in tracking and tracing systems in the food industry: A PLS analysis. Food Policy 2012, 37, 102–113. [Google Scholar] [CrossRef]

- Mattevi, M.; Jones, J.A. Traceability in the food supply chain Awareness and attitudes of UK Small and Medium-sized Enterprises. Food Control 2016, 64, 120–127. [Google Scholar] [CrossRef]

- Cui, Y.; Gaur, V.; Liu, J.C. Supply Chain Transparency and Blockchain Design. Manag. Sci. 2023, 70, 3245–3263. [Google Scholar] [CrossRef]

- Yang, M.D.; Min, S.; Qing, P. Consumer Preferences and Willingness to Pay for A Blockchain-Based Food Traceability System: A Case Study of Fresh Pork in China. J. Consum. Prot. Food Saf. 2025, 20, 19–28. [Google Scholar] [CrossRef]

- Duong, C.D.; Nguyen, T.H.; Ngo, T.V.N.; Tran, Q.Y.; Nguyen, M.H.; Pham, T.T.P. How does Blockchain-Based Food Traceability System Drive Consumers’ Repurchase and Word-of-Mouth Intentions toward Organic Food: A Curvilinear Role of Producer-Retailer (in) Congruence. Asia Pac. J. Mark. Logist. 2025, 37, 1357–1383. [Google Scholar] [CrossRef]

- Resende-Filho, M.A.; Buhr, B.L. A principal-agent model for evaluating the economic value of a traceability system A case study with injection-site lesion control in fed cattle. Am. J. Agric. Econ. 2008, 90, 1091–1102. [Google Scholar] [CrossRef]

- Zheng, Y.; Xu, Y.; Qiu, Z. Blockchain traceability adoption in agricultural supply chain coordination: An evolutionary game analysis. Agriculture 2023, 13, 184. [Google Scholar] [CrossRef]

- Song, Y.; Lv, C.; Liu, J. Quality and safety traceability system of agricultural products based on Multi-agent. J. Intell. Fuzzy Syst. 2018, 35, 2731–2740. [Google Scholar] [CrossRef]

- Shi, R.X.; Zhang, J.; Ru, J. Impacts of Power Structure on Supply Chains with uncertain demand. Prod. Oper. Manag. Soc. 2013, 22, 1232–1249. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Ma, P.; Wang, H.; Shang, J. Supply chain channel strategies with quality and marketing effort-dependent demand. Int. J. Prod. Econ. 2013, 144, 572–581. [Google Scholar] [CrossRef]

- Gao, J.; Han, H.; Hou, L.; Wang, H. Pricing and effort decisions in a closed-loop supply chain under different channel power structures. J. Clean. Prod. 2016, 112, 2043–2057. [Google Scholar] [CrossRef]

- Li, M.; Mizuno, S.J. Dynamic pricing and inventory management of a dual-channel supply chain under different power structures. Eur. J. Oper. Res. 2022, 303, 273–285. [Google Scholar] [CrossRef]

- Vasileiou, M.; Kyrgiakos, L.S.; Kleisiari, C.; Lappas, P.; Tsinopoulos, C.; Kleftodimos, G.; Ntemou, A.; Kateris, D.; Moulogianni, C.; Vlontzos, G. Digital Transformation of Food Supply Chain Management Using Blockchain: A Systematic Literature Review Towards Food Safety and Traceability. Bus. Inf. Syst. Eng. 2025; advance online publication. [Google Scholar] [CrossRef]

- Lumineau, F.; Shang, G.; Swaminathan, J.M.; Tsoukalas, G.; Wagner, S.M.; Zhao, J.L. Charting the Future of Blockchain in Operations and Supply Chain Management: Opportunities and Challenges. J. Oper. Manag. 2025, 71, 886–892. [Google Scholar] [CrossRef]

- Canavari, M.; Centonze, R.; Hingley, M.; Spadoni, R. Traceability as part of competitive strategy in the fruit supply chain. Br. Food J. 2010, 112, 171–186. [Google Scholar] [CrossRef]

- Pan, K.; Lai, K.; Leung, S.C.; Xiao, D. Revenue-sharing versus wholesale price mechanisms under different channel. Eur. J. Oper. Res. 2010, 203, 532–538. [Google Scholar] [CrossRef]

- Choi, T.M.; Li, Y.J.; Xu, L. Channel leadership, performance and coordination in closed loop. Int. J. Prod. Econ. 2013, 146, 371–380. [Google Scholar] [CrossRef]

- Chen, J.X.; Liang, L.; Yang, F. Cooperative quality investment in outsourcing. Int. J. Prod. Econ. 2015, 162, 174–191. [Google Scholar] [CrossRef]

- Keskin, N.B.; Li, C.H.; Song, J.S. The Blockchain Newsvendor: Value of Freshness Transparency and Smart Contracts. Manag. Sci. 2024, 71, 6666–6682. [Google Scholar] [CrossRef]

- Hobbs, J.E.; Bailey, D.; Dickinson, D.L.; Haghiri, M. Traceability in the Canadian red meat sector: Do consumers care? Can. J. Agric. Econ. 2005, 53, 47–65. [Google Scholar] [CrossRef]

- Zhang, C.P.; Bai, J.F.; Wahl, T.I. Consumers’ willingness to pay for traceable pork, milk, and cooking oil in Nanjing, China. Food Control 2012, 27, 21–28. [Google Scholar] [CrossRef]

- Ma, P.; Wang, H.; Shang, J. Contract Design for Two-Stage Supply Chain Coordination: Integrating Manufacturer-Quality and Retailer-Marketing Efforts. Int. J. Prod. Econ. 2013, 146, 745–755. [Google Scholar] [CrossRef]

- Xue, W.; Xu, Z. The impacts of government subsidies and consumer preferences on food supply chain traceability under different power structures. Sustainability 2023, 15, 470. [Google Scholar] [CrossRef]

- Fan, Z.P.; Wu, X.Y.; Cao, B.B. Considering the traceability awareness of consumers: Should the supply chain adopt the blockchain technology? Ann. Oper. Res. 2022, 309, 837–860. [Google Scholar] [CrossRef]

- Vriezen, R.; Plishka, M.; Cranfield, J. Consumer willingness to pay for traceable food products: A scoping review. Br. Food J. 2023, 125, 1631–1665. [Google Scholar] [CrossRef]

- Cui, Y.; Hu, M.; Liu, J. Values of Traceability in Supply Chains. Manuf. Serv. Oper. Manag. 2020, 22, 1–18. [Google Scholar] [CrossRef]

- Morgan, R.; Doran, D.; Morgan, S.J. Strong contracts: The relationship between power and action. Int. J. Oper. Prod. Manag. 2018, 38, 272–294. [Google Scholar] [CrossRef]

- Shou, Y.; Zhao, X.; Dai, J.; Xu, D. Matching traceability and supply chain coordination: Achieving operational innovation for superior performance. Transp. Res. Part E Logist. Transp. Rev. 2021, 145, 102181. [Google Scholar] [CrossRef]

- Zhou, X.; Zhu, Q.; Xu, Z. The role of contractual and relational governance for the success of digital traceability: Evidence from Chinese food producers. Int. J. Prod. Econ. 2023, 255, 108659. [Google Scholar] [CrossRef]

| Symbol | Definition | |

|---|---|---|

| Decision variable | w | Manufacturer’s unit wholesale price |

| p | Retailer’s unit retail price | |

| t | Traceability level | |

| Other parameters and variables | c | Manufacturer’s unit production cost |

| k | Traceability cost coefficient | |

| a | Potential market demand | |

| b | Consumer price sensitivity coefficient | |

| Consumer preference coefficient for traceable products | ||

| q | Market demand | |

| Traceability cost | ||

| Manufacturer’s profit | ||

| Retailer’s profit | ||

| Supply chain profit | ||

| Superscript | N | Vertical Nash game |

| S | Manufacturer-dominated | |

| R | Retailer-dominated |

| Equilibrium Results | Conditions | |

|---|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, W.; Zhou, X.; Xu, Z. Traceability Decisions and Coordination Contracts in Agricultural Supply Chains Under Different Power Structures. Sustainability 2025, 17, 9460. https://doi.org/10.3390/su17219460

Xue W, Zhou X, Xu Z. Traceability Decisions and Coordination Contracts in Agricultural Supply Chains Under Different Power Structures. Sustainability. 2025; 17(21):9460. https://doi.org/10.3390/su17219460

Chicago/Turabian StyleXue, Weixia, Xiongyong Zhou, and Zhiduan Xu. 2025. "Traceability Decisions and Coordination Contracts in Agricultural Supply Chains Under Different Power Structures" Sustainability 17, no. 21: 9460. https://doi.org/10.3390/su17219460

APA StyleXue, W., Zhou, X., & Xu, Z. (2025). Traceability Decisions and Coordination Contracts in Agricultural Supply Chains Under Different Power Structures. Sustainability, 17(21), 9460. https://doi.org/10.3390/su17219460