Abstract

An investigation of the difficulties that confronted SMMEs in uMhlathuze Municipality because of the COVID-19 crisis was the purpose of this research. Given the novelty and severity of the COVID-19 pandemic, this research was motivated by the desire to obtain information that can be used by both the government and the SMMEs to prepare for future disasters. The research embraced a qualitative research design and a case study research approach and used semi-structured interviews to extract data from 12 purposefully sampled SMMEs. The thematic analysis technique and Atlas.ti software version 23.2.3.27778 were used to analyse the collected data. Research findings revealed that a loss of customers and income; disruption of business operations; health-related challenges; difficulties in accessing government aid; challenges in fulfilling financial obligations; business activities not compatible with power saving; government corruption and incompetency; increases in operating costs; losses due to stock which decayed; and supply chain disruptions were the challenges that confronted SMMEs during COVID-19. Basing on these findings, the researchers recommend that the government should equip SMMEs with disaster management skills to enable these entities to better circumvent future challenges. Additionally, in these volatile times, SMMEs should strive to set some savings aside to fall back on in times of need.

1. Introduction

The coronavirus 19 (COVID-19) left indelible bitter memories to millions across the globe. Originating in Wuhan in the People’s Republic of China, COVID-19 took the world by storm. When many thought it was just an outbreak that would be quickly contained within the confines of China, the virus was already in their backyards reaping havoc. In no time, COVID-19 transformed from an outbreak to a fully-fledged pandemic [1]. Societies and economies suffered unprecedently from this virus that seemed to be surrounded by mystery and secrecy. More than four years since COVID-19′s first detection, “intense political and scientific debates about its origins still continue” [2]. Again, many researchers assert that the pandemic transcends other pandemics that have occurred in the history of mankind in terms of both economic and human losses [3].

In the business realm, COVID-19 afflicted businesses in diverse ways. The pandemic robbed businesses of vital employees, customers, suppliers, and more through deaths, sickness, resignations, and so on [4]. Furthermore, containment measures were introduced by all governments the world over to extenuate the spread of the virus such as travel restrictions, frontier closures, and curfews, which unwittingly harmed businesses [5,6]. These government actions were drastic and resulted in many business operations coming to a halt [7]. Consequently, operating costs soared, supply chains were disrupted, the demand of goods and services declined, revenues dropped, and more [6,8]. Even though all businesses across the business spectrum were impacted by COVID-19, the impact was more on small businesses because of a variety of factors. These small businesses are known by various names the world over. They are called small-to-medium enterprises (SMEs); micro, small, and medium enterprises (MSMEs); and small, medium, and micro enterprises (SMMEs) [9,10]. In this article, the term SMMEs will be adopted.

SMMEs were impacted more than their larger counterparts because of resource constraints, poor business skills, and more [5,8,11]. Again, the impact of COVID-19 was not homogeneous across the different SMME sectors [7]. The essential sectors, made up of SMMEs in the “medical and laboratory services; food and beverage production; financial and insurance services; disaster management, firefighting and emergency services; financial services necessary to maintain the functioning of banking and payments environment including the JSE and similar exchanges; electricity, water, gas and fuel production, supply and maintenance” could operate at all levels of lockdowns and were hence less impacted [12]. SMMEs in the non-essential sectors such as hotels, tourism, and hospitality; entertainment; personal services; and more were affected more by the pandemic woes because they were only permitted to operate at certain lockdown levels during the pandemic [5]. Even among the non-essential SMMEs, the level of impact was also dissimilar. For example, SMMEs in the textile and clothing business were permitted to operate at level 4 of the lockdowns [13], but those in the tourism sector (hotels, casinos, sit-in restaurants, and more) were only permitted to operate under advanced level 3 of the lockdowns [14]. Based on this, one can presume that the COVID-19 challenges experienced by SMMEs in the different sectors differed.

Geographically, the degree of COVID-19 impacts also varied. Businesses in developed economies like the USA were less impacted than those in developing economies like South Africa [15,16]. On a local scale, Gauteng, the Western Cape, and KwaZulu Natal (KZN) provinces were the hardest hit provinces in terms of the number of infections and deaths [17]. Even at the provincial level, the impact varied across districts and municipalities [17]. UMhlathuze Municipality was one of the worst affected municipalities in KZN by the deadly virus [17] to the extent that in December of 2020, the municipality was inundated by COVID-19-related deaths, with a record fifty burials taking place in one week in two of the municipality’s cemeteries [18]. The municipality also suffered from economic stagnation, the disruption of value chains, and high unemployment because of lockdowns [19]. These lockdown-related challenges left a substantial number of SMMEs closed in the municipality [20].

Against this backdrop, even though the literature on the challenges SMMEs in South Africa faced due to COVID-19 is available, much of it comes from government department reports and academics such as the authors of [5], who used desk research to conduct their research. Such studies might not adequately disclose what happened in individual municipalities with regard to the challenges SMMEs faced due to COVID-19. Additionally, the pandemic impact also varied geographically across the country in terms of economic losses and the number of infections and loss of life [5,16]. In this context, the researchers are of the view that a better understanding of the challenges SMMEs in South Africa faced due to the pandemic, that can be used by both the government and SMMEs to prepare for future disasters, can only be obtained by conducting research that is focused on SMMEs in individual municipalities. This is the gap this research seeks to fill by conducting research on the challenges SMMEs in uMhlathuze Municipality incurred due to the COVID-19 pandemic.

This paper will proceed in the following manner: the literature review, research methodology, discussion of outcomes, research findings, and recommendations will be outlined, respectively.

The research questions the paper seeks to answer are as follows:

- What challenges did SMMEs in uMhlathuze Municipality encounter because of the COVID-19 pandemic?

- What made the SMMEs susceptible to the challenges?

2. Literature Review

Disasters have a direct, indirect, and wider impact on businesses [21]. A direct impact relates to “the destruction of assets and stocks such as damage of machinery, buildings, merchandise etc.” [21]. With reference to COVID-19, a direct impact, among others, would include the loss of human resources due to COVID-19-related deaths and resignations [5,8]. Indirectly, disasters impact businesses through “business interruptions due to direct losses or supply chain interruptions” [21]. Vis-à-vis COVID-19, an indirect impact on business would comprise labour shortages, a decline in sales or revenue due to lockdowns and social distancing regulations, etc. [6,15]. The wider impacts of a disaster on business pertain to “other consequences such as loss of market share, and macroeconomic effects” such as a decline in gross domestic product (GDP), unemployment, poverty, and more [21].

Regardless of the form of impact, disasters disrupt the usual way of conducting business and in many cases, usher in an environment that is difficult for businesses to operate in [22]. Because of COVID-19, operating costs soared, customers were lost, supply chains were disrupted, valuable human resources were lost, etc. [5,6,8]. In all this misery, SMMEs tend to suffer more than large businesses because of an array of factors discussed next.

2.1. Why SMMEs Were Vulnerable to COVID-19–Related Challenges

Refs. [15,23] assert that SMMEs are weak financially; hence, when a disaster strikes, many of them find it difficult to recover from the impact of the disaster. Arguing further, Ref. [24] affirms that because of a lack of financial resources, many SMMEs rely on financial aid from family and friends, as well as from informal lenders, to recover from disaster loses. This reliance on family, friends, and informal lenders for capital contributed to the financial woes of many SMMEs during the pandemic because most of these (family, friends, informal lenders) were also financially constrained during this period and could not help [25]. Consequently, many SMMEs resorted to personal savings and selling private property to cope during COVID-19 [26]. Ref. [12] also reveals that many SMMEs are without personal savings for use during emergencies, hence why they struggled financially during COVID-19. Echoing similar sentiments, Ref. [11] asserts that having savings aside is critical for SMME survival when business activity is low, for example, during crises like COVID-19. However, the use of personal savings to survive crises is not sustainable since the money will run out if the disaster prolongs [26].

Ref. [11] argues that SMMEs are weak financially because both public and private funders are reluctant to fund these entities because of poorly formulated business plans, lack of collateral security, and more. Correspondingly, Ref. [11] states that risky business ventures and the inability to satisfy minimum borrowing requirements prevent many SMMEs from accessing loans or any funding from banks and other financial institutions. Furthermore, Ref. [12] asserts that informal SMMEs have “limited or no access to operational and growth funding” because investors are not keen in investing in these businesses. Echoing similar sentiments, refs. [5,27] reveal that during COVID-19, many SMMEs in South Africa struggled financially because informal and foreign-owned SMMEs were excluded from government COVID-19 relief aid. A poor financial resource base was not good for SMMEs during COVID-19 because the pandemic brought about a “new normal”, which required businesses to adjust and adapt [28]. To adapt to this “new normal”, SMMEs needed to change business models, find new ways of marketing and selling products/services, keep up with hygiene regulations, and more [5,28]. All this required a sound financial base, without which the SMME would struggle to survive.

The vulnerability of SMMEs to the COVID-19 pandemic is also attributable to the poor and outdated business skills many of these entities employ [29]. Resonating with these sentiments, Ref. [23] declares that SMMEs are “less digitized and generally have a lower technical know-how than larger firms”. Since SMME survival during the pandemic required embracing digital technologies, modification of business models, and innovative skills to adapt to the new operating environment [30], a lack of these would put an SMME in a vulnerable position.

In another observation, Ref. [31] affirms that SMMEs are labour-intensive. Through deaths, infection with the virus, and more, labour was one business functions that was severely affected by COVID-19 [5,8]. Being labour-intensive also meant that costs would remain high even during lockdowns [7]. Based on this, being labour-intensive was a weakness during the pandemic that put SMMEs in a vulnerable position.

Many SMMEs are characterised by informality and, as such, do not practice standard business practises, which limits their capacity to access loans, grants, and so forth from banks, the government, and other financial institutions [5,11]. For example, to acquire government COVID-19 funding in South Africa required SMMEs to be formerly registered, tax compliant, etc. [10]. In this regard, informality limited the ability of SMMEs to access funding during the pandemic, something that was ruinous to their survival.

Another factor that exposed SMMEs to COVID-19 challenges was the lack of diversity in business activities [5,6]. Many SMMEs rely on a single business venture and even those who have more than one tend to concentrate them in one sector [11]. In the event of a crisis such as COVID-19, this lack of diversification impedes the spread of risks and results in heavy economic losses [11].

Having discussed why SMMEs were vulnerable to the pandemic requires us to also critically look at some of the challenges these entities encountered because of the pandemic. The discussion that follows outlines these challenges.

2.2. Challenges SMMEs Encountered Because of COVID-19

Though COVID-19-related challenges on SMMEs could have differed across geographical areas and SMME sectors, research reveals that in general, these challenges stemmed directly from the pandemic itself as well as from the measures governments across the world embraced in a bid to curb the spread of the virus [5,7,8].

SMMEs lost employees, customers, managers, suppliers, and more to COVID-19 because over 524 million people worldwide contracted COVID-19 and more than 6 million of them succumbed to the virus [4]. In South Africa, over 4 million were infected with the virus and more than 102,000 people died from COVID-19 [17]. Employees who fell sick from the virus were given time to recuperate at home and this caused staff shortages and a disruption of business operations [6]. Watching colleagues dying or falling ill from the virus psychologically affected other employees to the point that some slipped into depression and others resigned due to fear of contracting the virus [32]. In short, COVID-19 affected the labour force of many SMMEs, and labour is a core asset of any business, such that anything that compromises it weakens the entire organisation [33].

Besides this direct impact of COVID-19 on SMMEs, the containment measures adopted by governments to mitigate the spread of the virus were drastic and wounded business operations, particularly those for SMMEs [7]. Containment measures embraced by governments included partial or complete lockdowns, frontier closures, travel restrictions, curfews, social distancing regulations, and more [5,15]. As a result of these measures, non-essential business closures of varying degrees ensued, and SMMEs in the non-essential sectors suffered in the process [7]. In South Africa, [25] alleges that as of August 2020, some SMMEs in the non-essential sectors which had closed for lengthy periods due to lockdowns reported an 80–90% drop in revenue. A decline in business revenue also meant a decline in family income, a factor that would lead to a drop in the demand for goods and services and further revenue losses [12].

The containment measures adopted by governments also resulted in permanent or temporary job losses [5,8]. The job loses reduced consumers’ spending power, resulting in a further decline in business revenue. The loss of income by consumers also affected SMMEs in the essential sectors as well, even if they could operate at all levels of the lockdown. Ref. [25] reported that by August 2020, some SMMEs in the essential sectors experienced a 20% decline in revenue because of a shrink in the demand of goods and services emanating from a decline in consumer income. Additionally, social distancing regulations also caused sales to drop for many SMMEs [25]. For example, due to social distancing guidelines, SMMEs in the transport sector were forced to reduce their loads, resulting in massive declines in revenue [25].

Owing to financial losses, revenue declines, and more, SMMEs had problems in meeting their financial obligations. A report by Ref. [25] revealed that some SMMEs defaulted on their mortgages and other debts due to prolonged lockdowns. Furthermore, some SMMEs failed to pay their workers, causing some of the employees to quit [25]. The resignation of employees led to a loss of vital employees, disruption of operations, low morale in the workplace, and more [25].

Because of lockdowns, travel restrictions, and more, SMMEs also had difficulties in accessing markets and clients, which resulted in heavy financial loses. This problem affected SMMEs that dealt with perishables mainly. Lockdowns restricted travelling and as such prevented or limited access to markets and clients. Ref. [34] alleges that after failing to deliver their milk to markets on account of lockdowns, some SMMEs in the dairy farming business incurred huge losses when their milk went bad and had to be thrown away. In a similar observation, Ref. [27] reveals that during the pandemic, survivalist entrepreneurs who sold fresh produce suffered big losses after their wares went bad because of lockdowns that reduced the movement of people. In the United States of America, lockdowns resulted in farmers having to dump thousands of litres of milk, smashing eggs, and destroying vegetables because travel restrictions prevented them from reaching their customers [35].

Containment measures adopted by governments also disrupted business operations. Some SMMEs were forced to lay off workers in a bid to reduce operating costs, but this inadvertently disturbed the smooth running of business operations [36]. Echoing the same sentiments, Ref. [12] reveals that in South Africa, “lockdown restrictions hampered the productivity, production capacity and delivery of goods”. In fact, all lockdown-induced business closures simply meant a cessation of business operations, especially for those SMMEs that could not move their operations online. Resonating the same sentiments, Ref. [36] discloses that “partial and full lockdowns strongly affected business operations of service companies”, whose businesses could not be moved online since they require personal contact with customers. Ref. [25] also points out that after the hard lockdown, “informal traders and township businesses who had been out of trade for months were required to obtain a licence to operate from the local municipality”. Because lockdowns were still in place, it was not easy to obtain the licences; hence, most of these businesses had to shelve operations for months. In another scenario, many informal SMMEs in the recycling business had to halt operations because hotel, restaurant, and school closures during lockdowns meant less recycling material was now available [3,25].

Another challenge that confronted SMMEs owing to the various policy measures espoused by governments to reduce the spread of the COVID-19 virus was the disruption of supply chains [5]. Frontier closures and travel restrictions, among others, resulted in the disruption of global supply chains [15]. SMMEs suffered more from these disruptions than big businesses because they often do not stock much because of inadequate financial resources, a lack of storage space, and the like [25]. In South Africa, supply chains were disrupted by inter-provincial bans and the need to obtain permits to move goods across the country [5]. The disruption of supply chains made it difficult for SMMEs to replenish stock, secure spare parts, and more [34]. In fact, supply chain disruptions created shortages, which led to price increases and a surge in operating costs [25].

The COVID-19 pandemic challenges forced many SMMEs to turn to the government for various forms of assistance to survive the crisis. In line with this, Ref. [7] declares that government funding is critical for SMME survival during crises. However, due to complicated application procedures, corruption, and requirements many SMMEs could not meet, government assistance was out of reach for many SMMEs [36,37]. In the United States of America, for example, bureaucratic application processes and banks, which were not keen to work with small black-owned businesses, denied many SMMEs access to government funding [38,39]. Comparably, in South Africa, qualifying for government funding required SMMEs “to be registered, tax compliant, UIF compliant, have 6 months bank statements and financial projections”, requirements many SMMEs could not meet [36]. Echoing similar sentiments, Ref. [25] asserts that government aid in South Africa also excluded foreign-owned SMMEs.

Lockdowns also had an impact on the psychological well-being of entrepreneurs. Forced business closures and the issue of working from home isolated people and disrupted workplace social relationships, causing some people to slip into depression [6]. In a similar observation, Ref. [25] alleges that solo entrepreneurs felt very isolated during lockdowns, as they did not have business partners or workmates to check in on their well-being during the stressful period. Additionally, school closures due to lockdowns forced many women entrepreneurs to quit employment to look after children who were now full-time at home [32]. Such developments had financial and psychological effects on entrepreneurs. Furthermore, the fear of going bankrupt and closing completely because of prolonged lockdowns was enough to trigger anxiety and burnout in some entrepreneurs during the pandemic [40].

In conclusion, the literature review laid bare the importance of SMMEs to societies and economies, why these entities were vulnerable to COVID-19 woes, and the challenges the SMMEs encountered because of the pandemic. The next section of this research will look at the various methodological approaches that were adopted for this study.

3. Methodology

Research methodology is defined as “how research should be undertaken, including the theoretical and philosophical assumptions upon which research is based and the implications of these for the method or methods adopted” [41]. In simple terms, research methodologies are the assumptions undergirding research and the steps followed when performing the research. The components of research methodology include the research philosophy, research design, research approach, data collection and analysis techniques, and more [41].

3.1. Research Philosophy

Research philosophy refers to a “system of beliefs and assumptions about the development of knowledge” [41]. This research is anchored on the interpretivism research philosophy, which is based on the belief that the sources of knowledge in societies are people’s experiences, perceptions, and the like [41]. Ontologically, this philosophy holds that because people’s experiences and perceptions differ, reality or the truth is subjective and cannot be explained in one way. For this reason, diverse experiences with the COVID-19 pandemic challenges by SMMEs in this municipality based on their individual perceptions were used to draw conclusions in this research. Epistemologically, interpretivism suggests that knowledge is communicated through “narratives, perceptions, and interpretations” [41]. For this reason, semi-structured interviews were used to gather data that were used in this research. Axiologically, interpretivism proposes that “the values and beliefs of the researcher influence the interpretation of research materials and data” [41]. To mitigate this negative interference, all the interviews with SMMEs were recorded to capture the precise responses.

3.2. Research Approach

Approaches to research involve induction, deduction, and abduction [41,42,43]. The inductive approach was espoused for this research. With this kind of approach, data are collected first before any theory is developed [41,43]. Accordingly, prior to making any conclusions on how COVID-19 negatively impacted SMMEs in uMhlathuze Municipality, interviews were conducted. The inductive approach was chosen because it helps “to understand the way in which humans interpret their social world” [41]. It is also the kind of approach that aligned with the interpretive research philosophy adopted.

3.3. Methodological Choice

Methodological choice is all about how one chooses to conduct their research. Research can be conducted quantitatively, qualitatively, or using mixed methods [44]. This research was conducted qualitatively. Qualitative research is “a social or behavioural science research that explores the processes that underlie human behaviour using such exploratory research techniques as interviews, surveys, case studies and other relatively personal techniques” [44]. Furthermore, qualitative research is suitable when exploring experiences and insights, identifying patterns, and the like [41]. In line with this, the desire to explore the challenges SMMEs in uMhlathuze faced due to COVID-19 motivated the choice of qualitative research. As such, interviews (exploratory qualitative techniques) were used to ask probing questions to obtain detailed insights into the challenges the SMMEs encountered because of the pandemic. Qualitative research was also chosen because it aligns with the interpretive research philosophy and inductive research espoused for this study.

3.4. Research Strategies

A research strategy is “a plan of how researchers go about answering their research questions”, and this plan includes how data are collected and analysed [41]. The case study research strategy was used in this research. A case study is “an in-depth inquiry into a topic or phenomenon within its real-life setting and the ‘case’ may refer to a person, work group, organisation, or any other type of a case subject” [41]. In this research, uMhlathuze Municipality was the “case” which the researchers used to carry out a comprehensive inquiry into the challenges SMMEs encountered because of the COVID-19 pandemic.

3.5. Time Horizon

The length of time it takes to conduct a research project is its time horizon. Depending on many factors such as research objectives, the nature of the research, and more, the research time horizon can be cross-sectional (taking place over a few weeks or months) or longitudinal (taking place over many months or years) [41]. The time horizon for this research was cross-sectional. Within two months, a sample of selected 12 SMMEs from uMhlathuze Municipality were interviewed. Such a time horizon was chosen because of time constraints since the research is for academic purposes.

3.6. Target Population and Sampling

A target population is “the population that is the actual focus or target of research inquiry” [41]. The target population of this research was all the registered formal SMMEs in uMhlathuze Municipality established before the arrival of COVID-19 in South Africa (before 6 March 2020).

Sampling is “the process used to draw participants to a study from the target population” [43]. It is the process of selecting a representative sample from the target population. In this research, purposive sampling (a non-probability sampling method based on the researcher’s judgement) was used to sample 12 formal SMMEs established before COVID-19 from uMhlathuze Municipality. The 12 SMMEs were selected purposefully from the SMME database obtained from the Zululand Chamber of Commerce and Industry (ZCCI) (an association of SMMEs in uMhlathuze Municipality). Purposive sampling was utilised with a view of selecting participants knowledgeable in the research topic and willing to partake in the research, as emphasised by Ref. [41]. A sample size of 12 participants was also chosen because small sample sizes are fit for interviews that are used to gather data. With interviews, data saturation is quickly realised and “information obtained per respondent is much”; hence, sample sizes ought to be small [43].

3.7. Research Instruments and Data Collection

Research instruments are the means used to collect data in research [41]. These instruments can be questionnaires, experiments, interviews, and more. Since this is qualitative research, interviews were the instruments chosen to collect data. An interview is “a purposeful conversation between 2 or more people requiring the interviewer to establish rapport and ask concise and unambiguous questions to which the interviewee is willing to respond and listen attentively” [41]. Semi-structured interviews were used to collect data for this research. With semi-structured interviews, an interview guide with questions to guide the interviewer is used, but the order in which the questions are asked vary from interview to interview [41]. An interview guide with more than 15 questions was prepared by the researchers and was used to conduct the interviews. The researchers used interviews to collect data because they allow one to probe, rephrase questions, clarify, and more to obtain accurate data from respondents [41].

With regard to the actual data collection, the contact numbers and physical addresses of participants were obtained from the Zululand Chamber of Commerce and Industry (ZCCI) offices. First contact with participants was carried out through site visits or telephonically. Interview dates were arranged telephonically after the first meeting. Participants were also provided with interview questions for familiarisation before the interviews. With the aid of the interview guide, the researchers administered all the 12 interviews personally, face to face.

Since semi-structured interviews were used, the wording and order of questions varied to suit each interview. However, in general, some of the questions asked were as follows:

What kind of business are you involved in?

For how long have you been in the business?

How did you fare during the pandemic?

Did you encounter any problems?

If yes, please state the problems and how they affected your business?

If no problems were faced, explain why?

If problems were encountered, did they have an equal impact on business? Please elaborate.

What measures did you take to solve, reduce, or cope with the challenges?

Were there any difficulties you encountered in trying to deal with the challenges you faced?

The interviews were conducted between February and March 2024. All the interviews were also audio recorded using the researcher’s smart phone to capture the full details, and data saturation was reached after the 10th interview.

Vis-à-vis ethical considerations, pseudonyms (participant 1, participant 2, and so on) were used to identity participants. Participation was also voluntary, and participants were provided with letters of consent before data collection commenced. These letters, among other issues, notified participants of their right to pull out from the research anytime without giving a reason. In addition, permission to conduct the research was obtained from the municipality and ZCCI as well.

4. Data Analysis and Interpretation

Data for this research comprised 12 interviews conducted with 12 SMME owners or managers in uMhlathuze Municipality to establish the kind of challenges COVID-19 imposed on these SMMEs. Each interview was assigned a code for identification, such as participant 1, participant 2, right up to participant 12. After, all the audio recorded interviews were “transcribed through reproducing them verbatim as a word-processed account” [45].

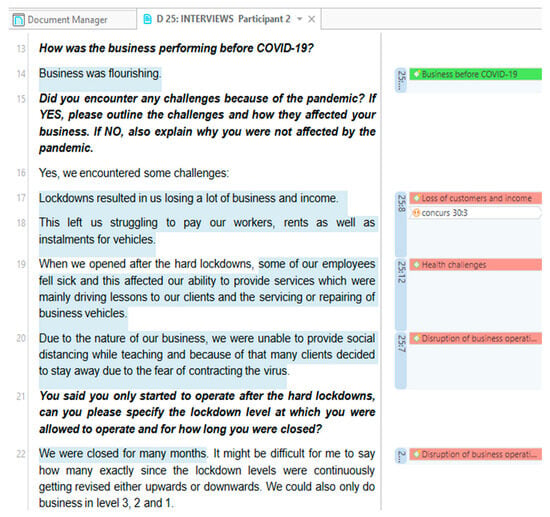

Afterwards, the data were analysed using the thematic analysis technique and Atlas.ti software version 23.2.3.27778. “Thematic Analysis involves the researcher coding his/her qualitative data to identify themes or patterns related to his/her research question” [41]. The excerpt below shows how the transcribed interviews were coded.

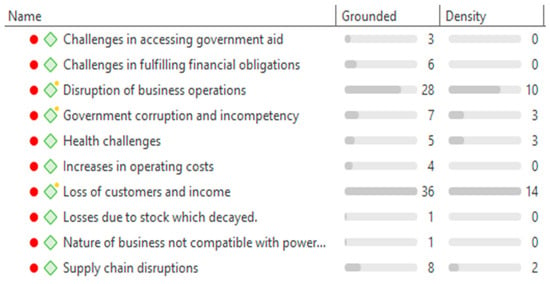

After coding the transcribed interviews as shown in Figure 1 below, codes that were created were later grouped to form themes. The themes that emerged from the data with respect to the kind of challenges the COVID-19 pandemic imposed on SMMEs in uMhlathuze Municipality are shown in Figure 2 below.

Figure 1.

Excerpt of coded data.

Figure 2.

Challenges faced by SMMEs because of COVID-19.

Figure 2 above shows that during the analysis of data, the challenges SMMEs in uMhlathuze faced because of COVID-19 can be grouped into 10 themes (challenges).

4.1. Analysis of Themes

As shown in Figure 1, the challenges of “loss of customers and income” and “disruption of business operations” were outstanding challenges with grounded values of 36 and 28, respectively. In Atlas.ti, grounded values reveal the number of text segments or quotations that were coded with a particular theme [45]. In other words, these two challenges have a lot of codes attached to them (high grounded values) because they affected all the participants in this research. A further analysis of each of the themes shown in Figure 2 follows below.

4.2. Loss of Customers and Income

Basing on the grounded values shown in Figure 2, the biggest challenge SMMEs in uMhlathuze faced during COVID-19 was “loss of customers and income”. All participants in this study were affected by this challenge. The quotations below reveal what the 12 participants said with respect to this challenge.

P 1: In this kind of business, we were put under lockdowns. As a result, we did not have any income, but the expenses were still there, the rent was still there.

P 2: Lockdowns resulted in us losing a lot of business. This left us struggling to pay workers, rents, and mortgages.

P 3: There was no income for all the time we were closed.

P 4: Lockdowns meant no business and no money to pay rent, salaries, and other expenses.

P 5: Lockdowns and social distance regulations reduced the number of people coming to our shop. That led to a substantial decline in sales and income.

P 6. Many people stayed at home during the pandemic. This is business. Fewer clients mean less money.

P 7: We only did business in the morning and afternoon. The rule was to transport people to work in the morning and bring them back in the evening. That was it and nothing else.

P 8: Due to lockdown regulations, our clients could not reach the farm to buy vegetables. It was also difficult for us to make deliveries because one needed a permit to be on the road.

P 9: With COVID-19, everything changed, and sales went down.

P 10: Again, schools were closed for most of the time during COVID-19. That affected our sales a lot because most of our clients are schools.

P 11: During COVID-19, people were not free to travel hence business was slow. That had financial implications for us.

P 12: Thing took a drop because many people became unemployed. A lot of companies we did business with closed. To be honest with you, almost 30% of the companies we supplied closed.

The quotations above reveal that during the pandemic, SMMEs lost customers and income through lockdowns that restricted the movement of people, social distancing regulations, school closures, and unemployment that followed lockdowns and business closures.

4.3. Disruption of Business Operations

Another challenge that emerged from this study in relation to how SMMEs suffered because of COVID-19 was the “disruption of business operations”. This challenge affected all the SMMEs that participated in this study. Below are some of the quotations that reveal how the SMMEs’ business operations were disrupted by the COVID-19 pandemic. Please note that P1, P2, P3, and so on stand for participant 1, participant 2, and so on.

P 1: With this kind of business, we were forced to close for at least two months.

P 2: We were closed for many months.

P 3: Some of our employees got infected with COVID-19. This caused staff shortages.

P 6: Social distance regulations prevented us from seeing many clients to cover up for the time we were closed

P 7: Because of social distancing, we were now carrying 7 people instead of 15 in a taxi.

P 9: With lockdowns, we were forced to operate a few hours a day.

P 10: When we opened in September, we could only do limited things like sales but could not do technical, call outs or anything of that sort because of social distance regulations.

P 12: Yes, we lost our skilled personnel. Sometimes when one partner lost employment because of COVID-19, it would prompt the whole family to relocate to a new province. With that also, when their replacements came in, you must remember that it takes time before they can grasp on what is really supposed to be done.

The quotations above show that lockdowns forced businesses to completely close for several months or to operate for a few hours a day, as indicated by participants 1, 2, and 9. All this interrupted the smooth running of business operations. The disruption of business operations also occurred because of workers who contracted the virus and fell sick or died, causing staff shortages, as revealed by participant 3. Social distancing regulations as well as a loss of skilled employees also interrupted the smooth running of business operations, as disclosed by participants 6, 7, 10, and 12.

4.4. Business Activities Not Compatible with Saving Power During Lockdowns

One of the challenges SMMEs in this study encountered during the pandemic was that of businesses that were not compatible with the requirements of lockdowns. Lockdowns required businesses who had been ordered to shut down to switch off electricity from their premises to cut down on operating expenses. However, one participant in the electronics business revealed that during the time they were closed, they could not save power (reduce operating costs) by switching off electricity from their premises due to the nature of their business, which requires some gadgets to be plugged into power all the time. As such, for all the time they were closed, they still incurred power bills. The following quotation attests to this:

P 10: Here there are things you cannot turn off. Savers for example must keep running no matter what. Because of that, our electricity bill was there throughout the time we were closed and that was a big challenge for us.

4.5. Difficulties in Accessing Government Aid

This challenge affected three participants, as highlighted in the quotations below.

P 3: When we applied for Unemployment Insurance Fund (UIF), the challenge was that some of our workers got it while others failed.

P 9: We applied for government loans but got nothing.

P 4: The Department of Labour was cruel on us, they never helped us in any way.

The quotations above reveal that receiving financial help from the government was difficult to the extent that some SMMEs in the end completely failed to receive any such help (participants 4 and 9), while others partially received it (participant 3).

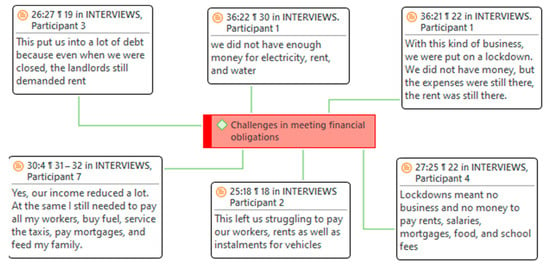

4.6. Difficulties in Fulfilling Financial Obligations

Five participants revealed that they had challenges in fulfilling their financial obligations when they were due because of the financial constraints they were in after lockdowns, which slowed down business or forced them to close. Quotations in Figure 3 in the network diagram below reveal what the participants said in this regard.

Figure 3.

Network diagram.

4.7. Health-Related Challenges

Five participants confirmed that they experienced some health-related challenges during COVID-19. They explained how their workers’ physical and mental health was affected by COVID-19. The following quotations highlight this:

P 2: Some of our workers fell sick….

P 3: When we reopened in August 2020, some of our employees got infected with COVID.

P 5: Our workers fell sick after getting infected with the virus and this affected everyone’s morale.

P 8: Some employees fell sick and 2 died after contracting the virus. This triggered stress and anxiety in other employees.

P 11: Some workers fell ill, so we had to give them time to recover at home.

4.8. Supply Chain Disruptions

Five participants disclosed that they experienced supply chain disruptions during COVID-19. The quotations below reveal what some of them said pertaining to this challenge.

P 4: There was a time when our local suppliers could not supply us when we ran out of stock. Border closures and travel restrictions had hindered their capacity to restock. We then had to look for alternative suppliers from Durban and that was costly in terms of transport.

P 5: Frontier closures and restricted movements resulted in some items going out of stock for a couple of months and that further strained business and sales.

P 9: We buy the fabrics we sell here from Durban and Johannesburg. Because they wanted permits on the roads, it was difficult to bring the fabric here.

P 11: Some of the staff we sell got finished during strict lockdowns. So, we had to take the risk of going to Johannesburg at night to get more stock.

4.9. Increases in Operating Costs

Participants 1, 4, and 6 revealed that another challenge they experienced because of COVID-19 was a surge in operating costs. Adhering to hygienic regulations using masksand sanitisers all increased operating costs, as revealed by participants 1 and 6 in the quotations below. Operating costs also went up during the pandemic because the prices of goods had gone up, as indicated by participant 4.

P 1: When we opened after the lockdown, you know we had to operate with sanitisers and social distance rules.

P 4: The prices of goods went up because of COVID-19 and that gave us problems in terms of operating costs.

P 6: The need to buy sanitisers and other staff made it expensive to run the business.

4.10. Government Corruption and Incompetency

With respect to “Government corruption and incompetency”, three participants were affected by this challenge. The quotations below reveal what these participants had to say about their experiences.

P 8: I applied for a government loan but did not get it. You know how corrupt these people are.

P 9: We needed permits to move goods on the roads during COVID. The permits were difficult to get, there was corruption there.

P 12: And I tell you what, we had harassment after harassment. Besides the COVID challenge, we had challenges in dealing with the police.

They never understood the law plus corruption. They would not listen even if you showed them the certificate of trade.

The quotations above disclose that due to the corruption and incompetency of government officials, SMMEs were harassed, failed, or had difficulties in accessing permits and financial aid from the government.

4.11. Losses Due to Stock Which Decayed

Participants 3 and 12 affirmed that they incurred some losses after their stock decayed during the pandemic. Participant 3 revealed that the sudden introduction of lockdowns and business closures without warning caused perishables they used in their businesses to rot. Participant 12 divulged that the loss of skilled personnel because of COVID-19-related woes resulted in the decay of perishable goods in their business. The following quotations reveal what the participants said:

P 3: Again, lockdowns came suddenly. Overnight we were told to close our businesses indefinitely. Perishable goods expired and decayed. We suffered heavy losses.

P 12: Yes, we lost our skilled personnel. With that also, when their replacements came in, you must remember that it takes time before they can grasp on what is really supposed to be done. In that interim, they do make mistakes which you cannot blame them, and then there were losses because certain products were damaged or went bad, and we had to throw them away.

To sum up the data analysis, Table 1 below gives a synopsis of all the challenges participants faced.

Table 1.

Summary of the challenges faced by participants owing to the pandemic.

After analysing the data in this section, the subsequent section will focus on the discussion of the research findings.

5. Discussion of Research Findings

The research questions this paper seeks to answer are as follows:

- What challenges did SMMEs in uMhlathuze Municipality encounter because of the COVID-19 pandemic?

- What made the SMMEs susceptible to the challenges?

Consequently, this discussion of findings is based on these two questions, as well as the literature review findings.

Results from this research reveal that SMMEs in uMhlathuze Municipality were confronted with COVID-19-related challenges that can be summarised into 10 categories/themes as follows:

- Loss of customers and income.

- Disruption of business operations.

- Businesses not compatible with saving power during lockdowns.

- Difficulties in accessing government aid.

- Difficulties in meeting financial obligations.

- Government corruption and incompetency.

- Health-related challenges.

- Increases in operating costs.

- Losses due to stock which decayed.

- Supply chain disruptions.

With respect to loss of customers, research findings revealed that all participants in this research were affected by this challenge regardless of whether they were in essential or non-essential business. Lockdowns, travel restrictions, and social distancing regulations caused the SMMEs to lose customers and income during the pandemic. These findings align with those of [34], stating that lockdowns and travel restrictions impacted SMMEs in both the essential and non-essential sectors.

Pandemic-induced lockdowns forced SMMEs in the non-essential sectors such as beauty parlours and saloons, driving schools, and more to close for prolonged periods of time, causing such SMMEs to lose customers and income in the interim. Furthermore, research evidence revealed that lockdowns and travel restrictions also limited clients that could visit businesses while making it difficult for some SMMEs to reach out to their customers as well. Additionally, research also showed that social distancing regulations contributed to a loss of customers and income during the pandemic. For example, participant 7 in the passenger taxi transport sector revealed that social distancing regulations reduced the carrying capacity of short-distance taxis from 15 to 10. Again, social distancing regulations also limited the number of people who could be in a shop or building at any given time. All these scenarios caused the affected SMMEs to lose revenue. Such revelations agree with the observations made by Ref. [5], which states that lockdowns and travel restrictions slowed down business and caused the demand and supply of goods and services to decline, resulting in revenue losses and liquidity problems for SMMEs.

COVID-19-induced unemployment also contributed to SMMEs losing revenue and clients according to the research findings. During COVID-19, many people lost their jobs and were no longer able to afford what they used to when they were still employed. Relating to this, participant 12 stated that unemployment resulted in their business losing about 30% of their customers. Concurring with this finding, Ref. [5] reveals that people lost jobs and income because of COVID-19.

Findings also revealed that a lack of diversification in business activities of the SMMEs exposed them to the problem of losing customers and income during COVID-19. Reliance on a single or a few businesses in one sector meant losses in the business could not be offset anywhere. This finding resonates with the literature review findings. Ref. [11] reveals that a lack of diversity in business activities put SMMEs in a vulnerable position during the pandemic.

Disruption of business operations was another challenge that affected all SMMEs involved in this research. Day-to-day business operations were disrupted by lockdowns, social distancing regulations, and sick employees according to research findings. Participants affirmed that business closures brought business operations to a protracted standstill. Again, some SMMEs who were allowed to operate were only permitted to do so for a few hours per day in some situations. This also disrupted the smooth or usual running of business activities. These findings echo with what came out of the literature review, finding that lockdowns imposed by governments across the world disrupted the daily functioning of businesses [34].

Evidence from the research also revealed that workers who fell sick after contracting the COVID-19 virus disrupted the day-to-day functioning of the SMMEs as well. The sick workers were given time off to recuperate at home and in the interim, causing staff shortages that would disrupt business operations. Morale in the organisations was also affected when colleagues got sick or passed on due to the COVID-19 virus. Furthermore, the fear of contracting the virus also affected the psychological well-being of some staff members. This too affected the smooth execution of business operations. These observations echo those of Ref. [8], stating that COVID-19 also impacted SMMEs through affecting the health of their employees, customers, suppliers, and more.

Social distancing guidelines also had a share in the disruption of business operations. Two participants revealed that social distancing guidelines prevented them from operating at full capacity. Ref. [23] mentions as well that social distancing guidelines impacted SMMEs in many ways.

Another key finding that came out of this research is that the disruption of business operations was also caused by a loss of skilled personnel. One participant revealed that their skilled workers relocated to other provinces after their spouses or partners lost their jobs in uMhlathuze Municipality (KZN) because of COVID-19. As a result, the business operations of the SMME suffered. The researcher also noted that this finding offers a new dimension by which key employees were lost during the COVID-19 pandemic, a view that never surfaced in the literature review. Evidence from the literature review only suggests that vital employees were lost through COVID-19-related deaths, [4], retrenchments, or employees quitting out of fear of contracting the virus [32].

Concerning businesses not compatible with saving power during lockdowns, research results confirmed that some SMMEs in the electronic business could not switch off power from their premises to cut on energy costs during the time they were closed because of the nature of their business. Electronic gadgets like savers need to be connected to power all the time hence electricity could not be switched off. Accordingly, for all the time these SMMEs were closed, they still incurred power bills. This was another unique finding of this research. This was another unique finding of this research. It was unique in the sense that no such challenge/factor came out in the literature review.

As regards difficulties in accessing government aid, evidence from the research showed that some SMMEs indeed had difficulties in accessing government aid during the pandemic. Receiving financial help from the government was difficult for several SMMEs to the extent that some SMMEs completely failed to obtain it in the end, while others partially received it. This observation resonates with that made in [36], stating that SMME access to government help was hindered by complicated application processes, requirements and requirements many SMMEs could not meet, and so forth such as being tax compliant, being in possession of a 6-month bank statement, and more.

Relating to difficulties in fulfilling financial obligations, research indicated that some SMMEs had challenges in paying rents and salaries as well as vehicle and housing mortgages during the pandemic because of decline in income triggered by many pandemic related challenges. These results mirror the findings made by refs. [5,8], stating that lockdowns and concomitant business closures and reduced business activity left many SMMEs struggling financially. Furthermore, a report by Ref. [25] reveals that some SMMEs defaulted on their mortgages and other debts because of prolonged lockdowns.

The researchers also concluded that a weak financial resource base including a lack of savings also made it difficult for the SMMEs to honour their financial commitments during the pandemic. Had the SMMEs had a robust financial reserve, they would have used it to cushion themselves during the pandemic. In support of this conclusion, the literature findings reveal that SMMEs are weak financially; hence, whenever a crisis unfolds, they struggle to survive [11,22].

Evidence from the research also confirmed that government corruption and incompetency prevented or made it hard for SMMEs to access government COVID-19 relief funds and permits to transport goods during lockdowns. Furthermore, research evidence revealed that corrupt police officers (government workers) harassed some SMMEs during lockdowns in a bid to solicit bribes from the SMMEs. All these findings concur with what came out of the literature review. The study in [5] affirms that government corruption resulted in certain SMMEs failing to receive COVID-19 relief aid, while Ref. [39] asserts that the South African government failed its people during COVID-19 because of the massive looting of COVID-19 funds that happened under its watch.

As concerns health-related challenges, findings showed that COVID-19 affected the physical and mental health of SMMEs’ employees, managers, and owners. Some workers even succumbed to the virus. These health-related challenges affected the labour supply and the smooth running of the SMMEs’ business operations. Such findings resonate with the report in [4], which found that the pandemic took a heavy toll on people’s physical and psychological well-being.

In respect of increases in operating costs, evidence from this research reveal that SMMEs experienced a surge in operating costs because of the imposed hygienic regulations (wearing of masks and use of sanitizers) and social distancing regulations, which had reduced their operating capacity. Again, operating costs also soared during COVID-19 because the prices of goods went up during this period. In agreement with these findings, refs. [25,36] maintain that social distancing regulations and the need to keep up with hygienic regulations during the pandemic resulted in an increase in operating costs.

Research findings also revealed that another challenge that confronted SMMEs during the pandemic were losses incurred due to perishables, which decayed during lockdowns. The sudden introduction of lockdowns with no warning and the resultant closure of some SMMEs overnight resulted in the decay of perishable stock that these SMMEs had. Evidence from this research also showed that the loss of skilled personnel because of COVID-19-related woes led to the spoilage of some SMMEs’ perishable stock when inexperienced workers were left in charge of the business operations. Resonating with these findings, Ref. [12] indicates that lockdowns and business closures had serious ramifications on the operations of small businesses.

With reference to supply chain disruptions, findings showed that many SMMEs had their supply chains disrupted by lockdowns, travel restrictions, and border closures. The disruption of supply chains slowed business and sales, increased operating costs when alternative suppliers had to be made use of in certain instances, and prompted some SMMEs to break lockdown rules in a bid to replace depleted stock. These findings concur with those made by Ref. [8], stating that lockdowns, travel restrictions, and frontier closures disrupted crucial supply chains and, resultantly, business operations [7,11,26].

With regard to the vulnerability of SMMEs to COVID-19 challenges, findings from this research reveal that the external environment (the government) under which these SMMEs operated made them vulnerable to COVID-19-related challenges, among other factors. In this case, the corruption and incompetency of government officials led to them denying these SMMEs access to funds they so desperately needed, exposing them to further challenges like the inability to meet financial obligations and more. However, this factor did not come out in the literature review.

6. Conclusions and Recommendations

Establishing the challenges that SMMEs encountered because of the COVID-19 pandemic was the purpose of this research. In line with the research questions, an analysis of the reasons behind SMMEs’ susceptibility to disasters like COVID-19 and the challenges faced by these entities during the pandemic was delineated in the literature review to guide readers on expected outcomes. Methodologically, the research embraced a qualitative research design and a case study research approach. Semi-structured interviews were used to extract data from 12 purposefully sampled SMMEs in uMhlathuze Municipality. Research findings revealed that SMMEs in uMhlathuze Municipality faced several COVID-19-induced challenges, which could be grouped into ten categories/themes. These challenges were the loss of customers and income; the disruption of business operations; health-related challenges; difficulties in accessing government aid; challenges in fulfilling financial obligations; business operations that were not compatible with saving power during lockdowns; government corruption and incompetency; increased operating costs; losses due to stock which decayed; and supply chain disruptions. Only two of these challenges affected all the SMMEs and these were the “loss of customers and income” and the “disruption of business operations”. The rest of the challenges were, however, not common to all the SMMEs.

Every research has some limitations, and this one is no exception. One of the limitations of this research is that it was exclusively conducted with SMMEs in uMhlathuze Municipality in KZN. Since the geographical impact of COVID-19 differed across the different municipalities, districts, and provinces of South Africa, it is difficult to generalise results obtained from this research to other parts of the country as a result. Another limitation emanates from the research design, approach, and sampling method adopted by the researchers. The researchers adopted the qualitative research design, the case study approach, and the purposive sampling technique, which limits the generalisability of the research findings to other settings. Furthermore, the majority (10 out of 12) of the SMMEs involved in the study were in the tertiary sector. As such, it could be possible that if more SMMEs in the primary or secondary sectors were involved, results obtained would be different.

After analysing what came out of this research in the previous section, the researchers made the following recommendations to both the South African government and the SMMEs:

- The government should equip SMMEs with disaster management skills since disasters are increasingly becoming the norm.

- SMMEs should engage in business networks and clusters where they can share ideas and resources, especially during a crisis.

- The government should establish communication channels that facilitate easy communication with SMMEs, and in the process allow it to quickly respond to SMME challenges during disasters.

- SMMEs should also practice consequent management as a way of preparing themselves for any eventuality in these unstable times.

- To facilitate the easy access of government aid and to reduce the defalcation of relief funds, the government should adopt streamlined and less bureaucratic aid application processes that are difficult for unscrupulous public servants to manipulate.

- In these volatile times, SMMEs should strive to have some savings aside to fall back on in times of need.

Basing on the outcomes of this research, the researchers recommend that future research could focus on the following:

- Establishing the role that SMMEs, the government, and other stakeholders can play in ensuring SMME sustainability in these volatile times.

- How the impact of uninsurable risks (pandemics, wars, natural disasters, etc.) on SMMEs can be mitigated.

- The challenges experienced by informal SMMEs during the COVID-19 pandemic.

- Investigating SMME disaster preparedness in disaster-prone provinces like KZN.

Author Contributions

Conceptualisation, E.P. and N.F.R.; Methodology E.P.; Software, E.P.; Validation, N.F.R.; Formal analysis, E.P.; Investigation, E.P.; Resources, E.P. and N.F.R.; Data curation, E.P. and N.F.R.; Writing—original draft preparation, E.P.; Writing—review and editing, N.F.R.; Visualisation, E.P.; Supervision, N.F.R.; Project administration, N.F.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the Ethics Committee of University of South Africa Ref # 0909 and date of approval: 7 June 2023).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Akinola, A.; Tella, O. COVID-19 and South Africa–China Asymmetric Relations. World Aff. 2022, 185, 587–614. [Google Scholar] [CrossRef]

- Gostin, L.; Gronvall, G. The Origins of COVID-19. Why it matters (and why it does not). N. Engl. J. Med. 2023, 1, 2305–2308. [Google Scholar] [CrossRef] [PubMed]

- Delladio, S.; Caputo, A.; Magrini, A.; Pellegrini, M. Italian entrepreneurial decision-making under lockdown: Path to resilience. Manag. Decis. 2023, 61, 272–294. [Google Scholar] [CrossRef]

- World Economic Forum. Global Risks Report. 2022. Available online: https://www.weforum.org (accessed on 12 September 2023).

- Ladzani, M. The impact of COVID-19 on small and micro-enterprises in South Africa. Int. J. Glob. Environ. Issues 2022, 21, 23–38. [Google Scholar] [CrossRef]

- Belitski, M.; Guenther, C.; Kritikos, A.; Thurik, R. Economic effects of the COVID-19 pandemic on entrepreneurship and small businesses. Small Bus. Econ. 2021, 58, 593–609. [Google Scholar] [CrossRef]

- Biyela, N.Y.; Utete, R. Agenda for future business resilience and survival avenues in crisis times: A systematic literature review of the effects of COVID-19 on SMEs’ productivity in South Africa. Soc. Sci. Humanit. Open 2024, 10, 100982. [Google Scholar] [CrossRef]

- Statistics South Africa. Business Impact Survey of the COVID-19 Pandemic in South Africa. 2020. Available online: http://www.statssa.gov.za (accessed on 15 June 2022).

- Phetla, G.; Mathipa, R. An Exploration of Challenges Faced by Small-Medium Enterprises Caused by COVID-19: The Case of South Africa. Acad. Entrep. J. 2021, 27, 1–13. [Google Scholar]

- Department of Small Business Department. Government Gazette: Revised Schedule 1 of the National Definition of Small Enterprise in South Africa. 2020. Available online: http://www.gpwonline.co.za (accessed on 15 March 2024).

- Department of Small Business Development, South Africa. SMMEs & Co-Operatives: Funding Policy for South Africa. 2023. Available online: http://www.gpwonline.co.za (accessed on 11 July 2024).

- Catalyst For Growth. The Impact of COVID-19 on African SMME Operations: Insights from Entrepreneurs and Business Development Service (BDS) Providers; Catalyst for Growth Research Institute: Johannesburg, South Africa, 2020. [Google Scholar]

- Bhengu, C. Mzansi on level 4 lockdown: ‘How is this logical?’ Times LIVE. 2020. Available online: https://www.timeslive.co.za (accessed on 23 March 2023).

- Savides, M. The Dos and Don’ts of Level 3 Lockdown. Sowetan Live. 2020. Available online: https://www.sowetanlive.co.za (accessed on 30 January 2024).

- Bartik, A.; Bertrand, M.; Cullen, Z.; Glaeser, E.; Luca, M.; Stanton, C. The impact of COVID-19 on small business outcomes and expectations. Proc. Natl. Acad. Sci. USA 2020, 117, 17656–17666. [Google Scholar] [CrossRef]

- Labia, N. COVID-19 Scarred the Global Economy in Permanent But Unequal Ways. 2024. Available online: https://www.dailymaverick.ca.za (accessed on 23 April 2024).

- National Institute for Communicable Diseases. Confirmed Cases of COVID-19 in South Africa; Department of Health: Pretoria, South Africa, 2022; Available online: https://www.nicd.ac.za (accessed on 27 June 2023).

- Singh, O. Richards Bay Cemetery Staff Battling to Cope with Soaring Number of Burials. 2021. Available online: http://www.timeslive.co.za (accessed on 30 January 2024).

- UMhlathuze Social Relief Programme Report. City of uMhlathuze Reports. 2022. Available online: https://www.umhlathuze.gov.za (accessed on 29 January 2024).

- UMhlathuze Annual Report. UMhlathuze City 2020/2021 Annual Report. 2021. Available online: https://www.umhlathuze.gov.za (accessed on 30 January 2024).

- Leitold, R.; Garschagen, M.; Tran, V.; Diez, J. Flood risk reduction and climate change adaptation of manufacturing firms: Global knowledge gaps and lessons from Ho Chi Minh City. Int. J. Risk Reduct. 2021, 61, 102351. [Google Scholar] [CrossRef]

- Steinerowska-Streb, I.; Glod, G.; Diez, J. What do we know about small and medium enterprises’ survival in a post-global economic crisis context. Local Econ. 2022, 37, 259–278. [Google Scholar] [CrossRef]

- Braunerhjelm, P. Rethinking stabilization policies; Including supply-side measures and entrepreneurial processes. Small Bus. Econ. 2021, 58, 963–983. [Google Scholar] [CrossRef]

- Ballesteros, M.; Domingo, S. Building Philippine SMEs Resilience to Natural Disasters; Philippine Institute for Development Studies: Metro Manila, Philippines, 2015; Discussion Paper Series no. 2015-20. [Google Scholar]

- Small Business Research Specialists. Reflections on the Impact of COVID-19 on Small Businesses (SMEs) in South Africa. 2020. Available online: https://www.smallbusinessinstitute.co.za (accessed on 16 May 2023).

- Department of Tourism, Republic of South Africa. Enabling Small, Medium and Micro Enterprises (SMMEs) Survival and Growth During/Post COVID-19. Final Report. Pretoria: Department of Tourism. 2020. Available online: https://www.tkp.tourism (accessed on 16 May 2023).

- Mapuranga, M.; Maziriri, E.; Rukuni, T. A Hand to Mouth Existence: Hurdles Emanating from the COVID-19 Pandemic for Women Survivalist Entrepreneurs in Johannesburg, South Africa. Afr. J. Gend. Soc. Dev. 2021, 10, 113–140. [Google Scholar] [CrossRef]

- Donga, G.; Ngirande, H.; Chinyakata, R. Business as Unusual: Carving Out the South African Small, Medium, and Micro-Sized Enterprises’ Path for Navigating Past COVID-19 Pandemic. Himal. Econ. Bus. Manag. 2021, 2, 48–56. [Google Scholar]

- Jibril, H.; Wishart, M.; Roper, S. From adversity to advice: Survival threats as a trigger for sustained engagement with external business support in small firms. Int. Small Bus. J. 2023, 41, 488–507. [Google Scholar] [CrossRef]

- Akpan, I.J.; Effiom, L.; Akpanobong, A.C. Towards developing a knowledge base for small business survival techniques during COVID-19 and sustainable growth strategies for the po 1st pandemic era. J. Small Bus. Entrep. 2023, 36, 921–943. [Google Scholar] [CrossRef]

- Fatoki, O. COVID-19 and South Africa’s Small, Medium, and Micro Enterprises: Challenges and recommendations. J. Entrep. Innov. 2021, 2, 16–18. [Google Scholar] [CrossRef]

- Kalenkoski, C.; Pabilonia, S. Impacts of COVID-19 on the self-employed. Small Bus. Econ. 2021, 58, 741–768. [Google Scholar] [CrossRef]

- Kimaro, M.E.; Chiutsi, S.; Heita, J.; Lendelvo, S.; Tawodzera, G.; Kazembe, L.; Muhoho-Minni, W. An Analysis of the Enablers & Barriers to a Tourism Destination’s Resilience: A case of the Erongo Region in Namibia. Afr. J. Hosp. Tour. Leis. 2023, 12, 1834–1853. [Google Scholar]

- Bowman, A.; Nair, R. COVID-19 Has Hit SMEs in South Africa’s Food Sector Hard. What Can Be Done to Help Them? The Conversation. 2020. Available online: https://theconversation.com/covid-19-has-hit-smes-in-south-africas-food-sector-hard-what-can-be-done-to-help-them-142064 (accessed on 12 September 2022).

- Yaffe-Bellany, D.; Corkery, M. Dumped Milk, Smashed Eggs, Plowed Vegetables: Food Wastage of the Pandemic. 2020. Available online: https://www.nytimes.com/2020/04/11/business/coronavirus-destroying-food.html (accessed on 30 January 2024).

- National Youth Development Agency Unit. Impact of COVID-19 on Small Medium and Micro Enterprises Since Lockdown; Department of Small Business Development: Pretoria, South Africa, 2020. Available online: http://www.nyda.gov.za (accessed on 27 June 2023).

- Naudé, W.; Cameron, M. Failing to pull together: South Africa’s troubled response to COVID-19. Transform. Gov. 2021, 15, 219–235. [Google Scholar] [CrossRef]

- Fairlie, R.; Fossen, F.M. Did the Paycheck Protection Program and Economic Injury Disaster Loan Program get disbursed to minority communities in the early stages of COVID-19? Small Bus. Econ. 2021, 58, 829–842. [Google Scholar] [CrossRef]

- Atkins, R.; Cook, L.; Seamans, R. Discrimination in lending? Evidence from the Paycheck Protection Program. Small Bus. Econ. 2021, 58, 843–865. [Google Scholar] [CrossRef] [PubMed]

- Torrès, O.; Benzari, A.; Fisch, C.; Mukerjee, J.; Swalhi, A.; Thurik, R. Risk of Burnout in French Entrepreneurs During the COVID-19 crisis. Small Bus. Econ. 2021, 58, 717–739. [Google Scholar] [CrossRef]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 7th ed.; Pearson: Essex, UK, 2016. [Google Scholar]

- Melnikovas, A. Towards an Explicit Research Methodology: Adapting Research Onion Model for Future Studies. J. Future Stud. 2018, 23, 29–44. [Google Scholar]

- Wiid, J.; Diggines, C. Marketing Research, 2nd ed.; Juta: Cape Town, South Africa, 2013. [Google Scholar]

- Bekwa, N.; Grobler, S.; Olivier, B.; Sadiki, M.; Van Niekerk, N. Economic and Management Research for HMEMS80, UNISA Custom Edition; Pearson: Essex, UK, 2019. [Google Scholar]

- Archer, E.; van Vuuren, H.J.; Van der Walt, H. Introduction to Atlas.ti. Basic Operations, Tips, and Tricks for Coding, 6th ed.; Research Rescue: Pretoria, South Africa, 2017. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).