1. Introduction

The Gulf Cooperation Council (GCC) countries have long relied on hydrocarbon revenues to drive their economic development. This resource-based growth model has enabled rapid infrastructure development, wealth accumulation, and social transformation over the past few decades. However, the structural reliance on oil and gas exports has also left these economies vulnerable to external shocks, including oil price volatility and growing global momentum toward decarbonization and clean energy [

1,

2]. As global energy systems shift toward sustainability, the GCC countries face the dual challenge of maintaining economic growth while reducing dependence on fossil fuels.

In response, several GCC nations have initiated ambitious reforms under national strategies such as Saudi Arabia’s Vision 2030 and the UAE’s Energy Strategy 2050, emphasizing renewable energy use, foreign investment promotion, and economic diversification [

3]. While these strategies signal a departure from traditional oil-led growth, questions remain about the effectiveness of these transitions in generating sustainable, long-term economic benefits. More specifically, the economic impacts of renewable electricity adoption, foreign direct investment (FDI), and trade integration on GDP growth in the GCC context remain understudied. Moreover, given that these economies differ in terms of resource endowments, population sizes, and policy maturity, a comparative, multi-country analysis offers more nuanced insights than single-country case studies.

Although a rich body of literature has examined the energy–growth nexus, most of it focuses on large economies or high-income OECD countries [

4,

5]. In contrast, fewer studies explore how energy use—especially renewable electricity—affects growth in small, resource-rich economies like those in the Gulf. Some studies have explored this question in individual GCC countries (e.g., [

6] for Saudi Arabia), but very few adopt a panel econometric approach that allows for both long-run equilibrium effects and short-run adjustments across the region. Moreover, studies often fail to distinguish between traditional electricity consumption and electricity from renewable sources, which may have different economic implications depending on infrastructure readiness and sectoral integration [

7].

This paper aims to fill that gap by analyzing the relationship between GDP growth and several explanatory factors—renewable electricity production, overall electricity use, FDI inflows, trade openness, and energy consumption per capita—using panel data from six GCC countries over the period 2008–2023. The paper applies both the Pooled Mean Group (PMG) estimator and the Dynamic Fixed Effects (DFEs) estimator to distinguish between long-run relationships and short-run dynamics. By doing so, it contributes to the existing literature in three main ways: (a) it explicitly incorporates renewable electricity as a separate variable from overall energy use, (b) it evaluates regional heterogeneity across GCC countries using panel econometric techniques, and (c) it tests for both short-run and long-run causality through rigorous robustness checks.

The findings offer timely insights for GCC policymakers, especially as they aim to balance economic diversification with energy sustainability. Understanding whether renewable energy use supports economic performance—or whether its current role is more symbolic than economically substantial—can guide better investment and regulatory decisions. This analysis also informs international debates on how resource-rich nations can transition without sacrificing growth or social stability.

The rest of the paper is organized as follows.

Section 2 reviews the relevant literature on energy and growth in GCC and similar contexts.

Section 3 provides a brief snapshot of the trends in economic growth, energy, and openness in the GCC region over the study period.

Section 4 develops a theoretical framework on the linkage between energy and economic growth.

Section 5 describes the data and outlines the econometric methodology.

Section 6 presents the empirical results and robustness checks.

Section 7 discusses the findings and their policy implications. Finally,

Section 8 concludes the paper.

2. Literature Review

The link between energy consumption and economic growth has been studied for decades. One of the earliest and most cited debates centers on whether energy use causes economic growth (the growth hypothesis), whether growth increases energy demand (the conservation hypothesis), or whether there is a feedback loop (bi-directional causality) [

8]. While early research used simple time series models, more recent work has adopted panel approaches and structural econometric techniques to account for cross-country differences and time-varying dynamics.

In general, studies find that energy consumption is positively associated with GDP growth, especially in developing and emerging economies where industrialization and electrification are key drivers of growth [

4,

9,

10]. However, the direction of causality is often country-specific. For example, in OECD countries, energy efficiency improvements may weaken this link over time, whereas in low- and middle-income countries, energy remains a critical input for production and services [

11].

A growing body of research distinguishes between different types of energy sources. Renewable energy, in particular, has drawn increasing attention due to its role in sustainable development and climate policy. The general consensus is that renewable electricity contributes positively to long-run growth, although its impact in the short run is less clear and may depend on initial infrastructure readiness and institutional quality [

12,

13]. In some cases, the economic effects of renewables may be limited by high upfront costs, lack of grid integration, or technological barriers [

14].

Trade and foreign direct investment (FDI) are widely recognized as important channels through which countries can access new technologies, increase productivity, and achieve higher growth. In the context of energy and development, trade openness can help reduce energy costs through market competition and technology transfer [

15,

16]. FDI, on the other hand, can bring capital and expertise that support infrastructure development, including renewable energy projects [

17].

While the macroeconomic benefits of trade and FDI are well established, their effects may vary depending on a country’s institutional setup, regulatory environment, and sectoral absorption capacity. For instance, ref. [

18] find that FDI contributes more to growth in countries with a higher level of human capital. Similarly, the growth-enhancing effects of trade are stronger when accompanied by supportive policies that encourage diversification and value-added exports.

Compared to other regions, the literature on the energy–growth nexus in the Gulf is relatively limited but growing. Most GCC countries are highly energy-intensive and rank among the top per capita emitters globally due to cheap energy prices and oil-based industries. Several studies have examined the role of energy consumption in the GCC, with mixed results. Ref. [

6] shows that energy use is significantly associated with GDP growth in Saudi Arabia, while other studies note that this relationship weakens over time as countries invest in diversification.

Regarding renewable energy, there is less empirical evidence. Ref. [

3] notes that while GCC countries have made ambitious public commitments to renewable energy, the actual installed capacity remains modest and its economic contribution—particularly to GDP—is difficult to quantify.

Energy price reforms are essential for reducing overconsumption, improving energy efficiency, and making renewable energy more economically viable in the Gulf region [

19]. In a panel context, ref. [

20] find that renewable energy has a positive long-run effect on growth in a sample that includes several oil-exporting economies, but caution that institutional constraints can limit the magnitude of this effect.

Studies on FDI and trade openness in the GCC also yield nuanced findings. For example, ref. [

21] find that foreign direct investment inflows significantly enhance economic growth in Gulf countries, particularly where they coincide with government efficiency and institutional quality. Similarly, while trade has been a driver of growth in the region, it remains concentrated in hydrocarbon exports, limiting its diversification benefits [

22].

To summarize, the literature suggests that energy use, FDI, and trade are important factors in explaining growth. However, in the case of the GCC, three major gaps remain. First, there is limited empirical research on the economic effects of renewable electricity specifically—most studies aggregate energy use without distinguishing between traditional and clean energy. Second, few papers adopt dynamic panel techniques that separate short-run from long-run effects. Finally, regional studies often analyze each country in isolation, missing potential regional spillovers and shared policy dynamics.

This paper addresses these gaps by using a short panel of six GCC countries, examining both renewable and non-renewable energy consumption alongside FDI and trade, and applying both PMG and DFE models to distinguish short- and long-term relationships.

To provide a clearer overview of the existing research and highlight the unique contribution of this study,

Table 1 summarizes key findings from the relevant literature on energy use, renewable energy, trade, and FDI in relation to economic growth. The table illustrates that while numerous studies have examined the energy–growth nexus globally, empirical research focusing on renewable electricity and growth in the GCC region remains limited. Most previous studies either aggregate energy use, rely on older data covering the early renewables stage, focus on countries with very different structural contexts from the GCC, or analyze GCC countries only as part of larger heterogeneous panels without examining them separately. These limitations leave important gaps that this study addresses.

3. Background: Energy Use, Economic Growth, and External Openness in GCC Countries (2008–2023)

This section provides a descriptive overview of key macroeconomic and energy-related trends in the Gulf Cooperation Council (GCC) countries—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates—over the period 2008 to 2023. It highlights the evolution of energy consumption, electricity generation from renewables, foreign direct investment (FDI), real GDP, and trade openness. Drawing on recent panel data, the analysis traces commonalities and divergences across countries, offering context for the subsequent empirical modeling. Particular attention is paid to the structural transformation underway in the region, with an emphasis on energy diversification, economic liberalization, and shifting trade dynamics.

Figure 1 illustrates a clear divide between high-electric power consumption economies and those with moderate use. Bahrain, Qatar, and the United Arab Emirates (UAE) consistently reported electric power consumption levels above 14,000 kWh per capita, reflecting their energy-intensive industrial bases, high living standards, and subsidized electricity pricing. These figures remained stable or even increased slightly despite global economic disruptions. In contrast, countries like Oman and Saudi Arabia started with lower per capita consumption but demonstrated steady increases over the years. For instance, Saudi Arabia’s electricity use rose from approximately 8000 kWh in 2008 to over 11,000 kWh by 2023, signaling improvements in electrification, industrialization, and residential demand growth. Oman followed a similar, though more modest, trajectory. This variation underscores different stages of economic development and energy access within the GCC, as well as differing policy priorities around energy pricing and subsidies.

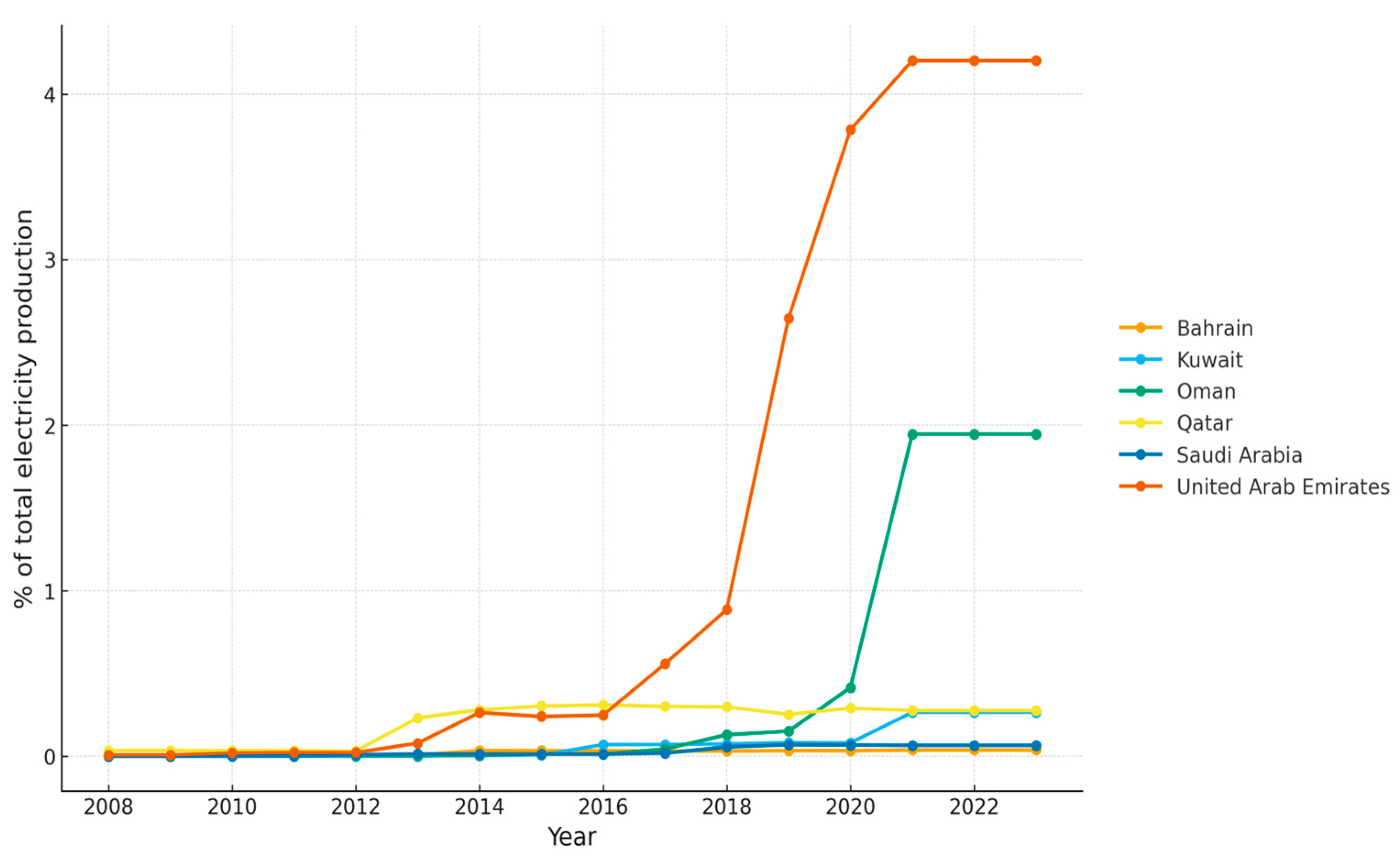

Figure 2 illustrates the evolution of electricity production from renewable sources (excluding hydroelectric) as a percentage of total electricity generation in the six GCC countries. The UAE stands out as the regional leader in renewable electricity adoption, with its share rising sharply from negligible levels in 2008 to over 4% by 2023. This growth reflects substantial investments in solar infrastructure and government-led energy transition policies. Oman also displays a noticeable uptick starting around 2016, reaching nearly 2% by 2021 and maintaining that level thereafter.

In contrast, Kuwait, Saudi Arabia, Bahrain, and Qatar show much more modest progress. Their renewable electricity shares remain below 0.5% throughout the observed period, indicating either delayed investment or ongoing reliance on fossil-based generation. These patterns highlight the uneven pace of renewable energy integration across the region and reinforce the importance of national policy frameworks and investment incentives in shaping the energy mix.

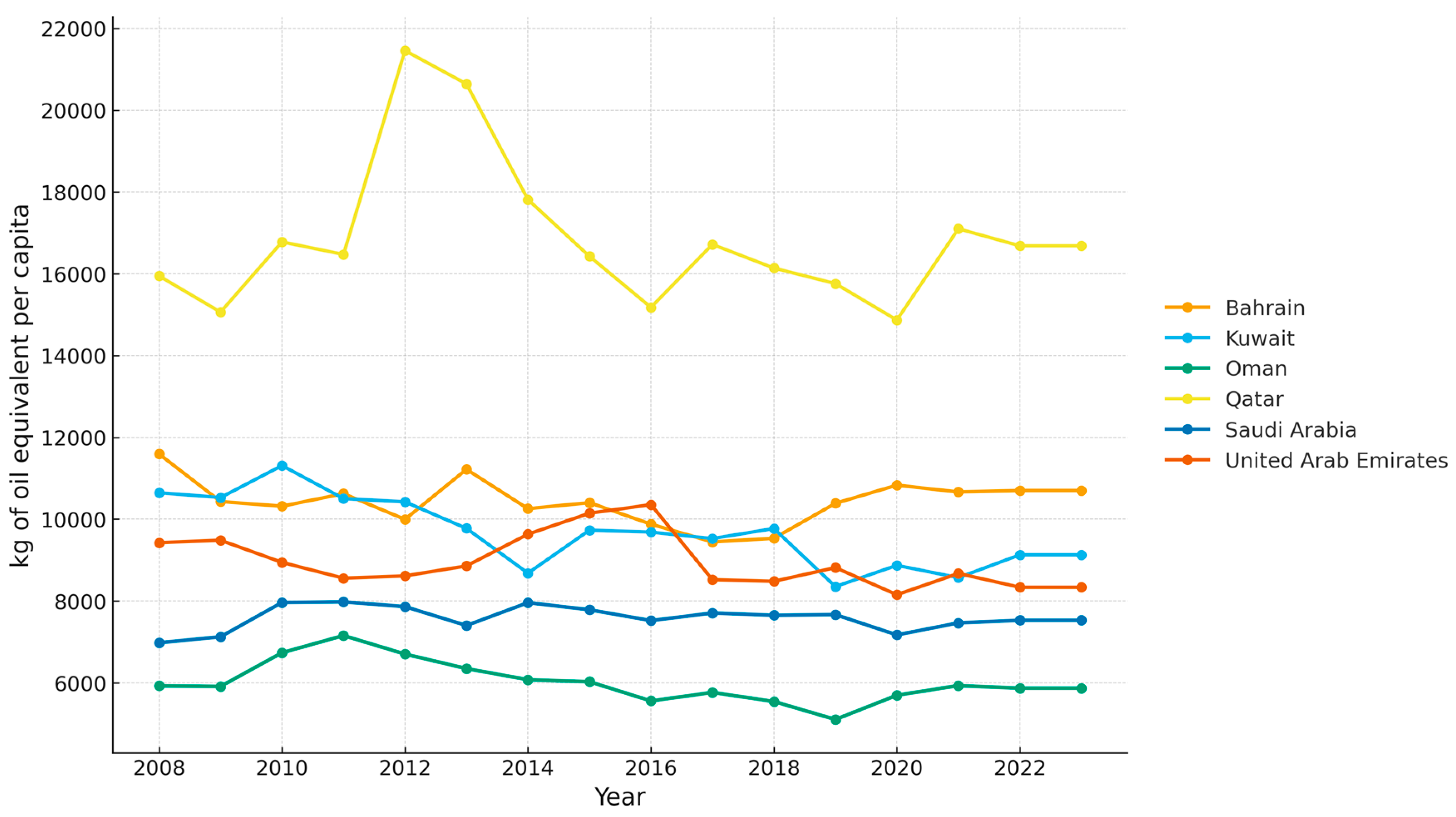

Figure 3 illustrates notable differences in per capita energy use across GCC countries. Qatar and the UAE consistently show the highest energy use per capita, often exceeding 9000 kg of oil equivalent—indicative of their energy-intensive industries and subsidized pricing. In contrast, Oman reports the lowest values, suggesting more constrained or efficient energy usage. The general volatility in some countries like Oman and Saudi Arabia might reflect fluctuations in industrial output or improvements in energy efficiency.

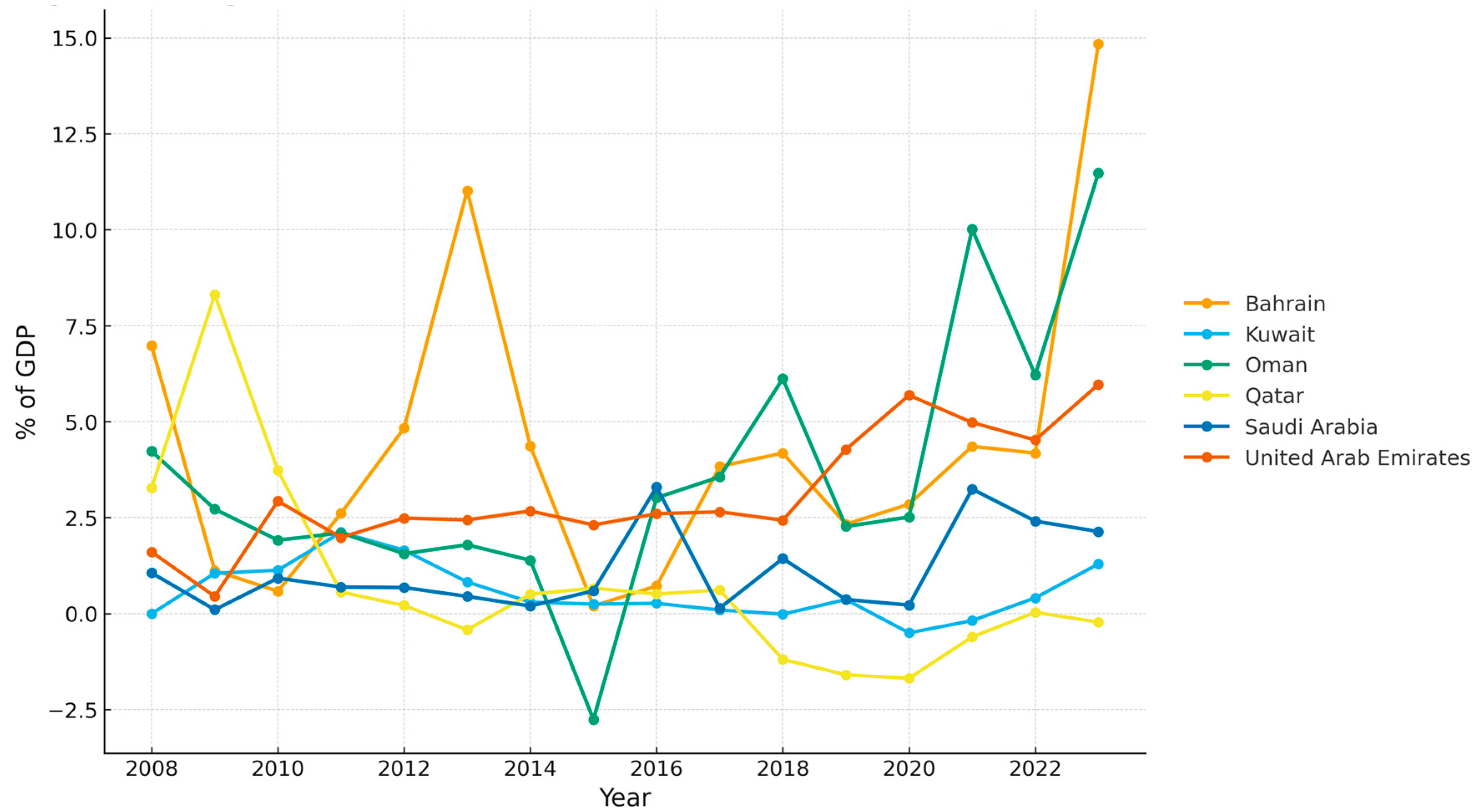

Figure 4 displays FDI inflows in the GCC countries. FDI inflows have fluctuated significantly across the region. Bahrain experienced sharp peaks, particularly in 2013 when inflows neared 11% of GDP, followed by considerable contractions. Qatar recorded negative inflows in multiple years post-2015, possibly due to regional diplomatic rifts and divestment. Oman shows mixed results with sharp increases in 2021 and 2023. Saudi Arabia and the UAE exhibit more stable but moderate FDI patterns, likely tied to ongoing liberalization efforts under their respective Vision 2030 agendas.

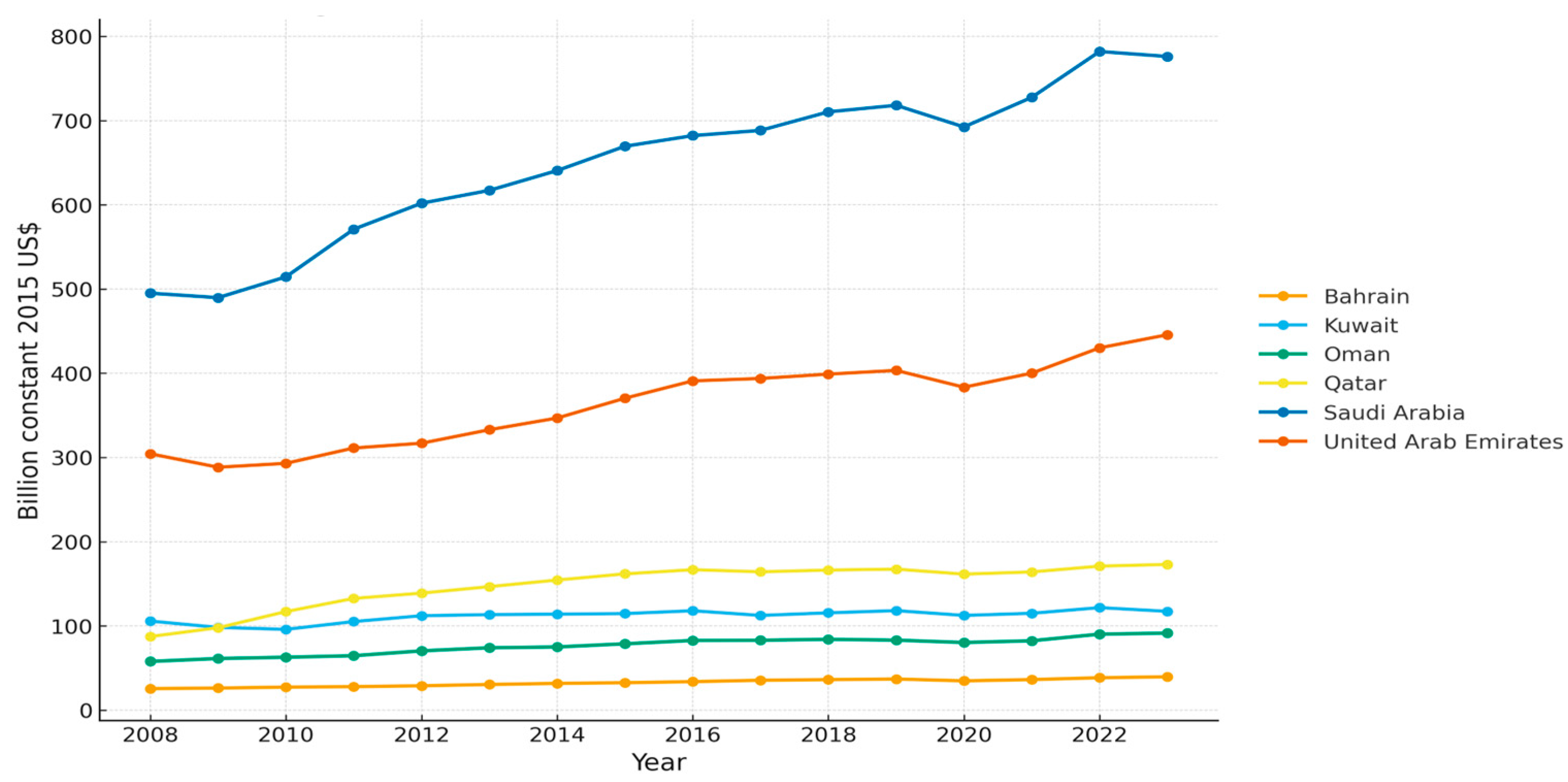

Figure 5 tracks the evolution of real GDP across the six GCC countries from 2008 to 2023. Saudi Arabia stands out as the largest economy in the region by a significant margin, with GDP rising from just under

$500 billion in 2008 to nearly

$780 billion by 2023. The United Arab Emirates (UAE) consistently ranked second, also showing a steady upward trajectory despite a mild dip during the COVID-19 pandemic in 2020. Qatar’s economy grew robustly through the early 2010s and stabilized after 2016, while Kuwait showed modest gains with some volatility. Bahrain and Oman, being the smaller economies in the bloc, experienced slower but consistent growth, each increasing its GDP by approximately 50% over the study period. These patterns underscore the resilience of GCC economies in the face of oil price shocks and their growing diversification efforts.

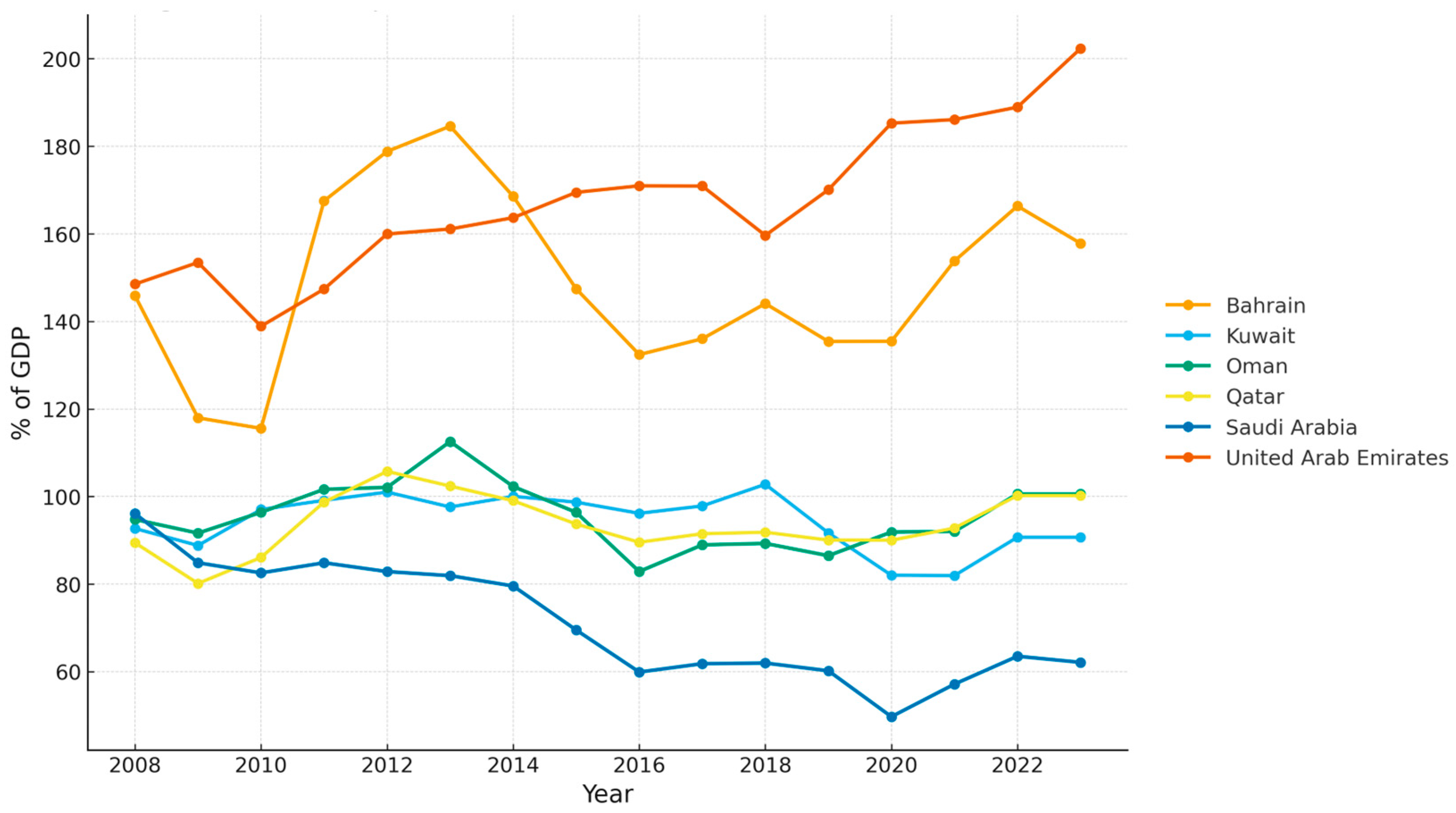

As shown in

Figure 6, trade as a share of GDP remains high across the region, especially in Bahrain and the UAE, where it regularly exceeds 150% of GDP, highlighting their open and export-driven economies. In contrast, Saudi Arabia shows a steady decline in trade openness since 2015, likely due to falling oil exports and a growing focus on domestic production. Overall, this figure underscores both the high global integration of these economies and their varying dependencies on trade for growth.

Together, these trends underscore the region’s ongoing energy transition, the push for diversification, and the growing—but still constrained—role of renewables and external capital in shaping economic trajectories.

4. Theoretical Framework: Modeling Economic Growth with Renewable Energy and Openness

In this section, we build on classical and extended growth theories to explain how renewable electricity, traditional energy use, and economic openness contribute to economic growth in the Gulf Cooperation Council (GCC) countries. We start with the foundation laid by the Solow–Swan neoclassical growth model [

29], which identifies capital accumulation, labor, and technological progress as the main drivers of long-run economic growth. However, given the energy-intensive and resource-based nature of the GCC economies, this standard model is not sufficient. To better capture their structure, we integrate energy and trade into the production function. This framework helps formalize the underlying mechanisms and provides economic intuition behind the relationships observed in our data.

4.1. Production Setup

We assume a representative firm in each country

and year

produces output

using capital

, labor

, traditional energy

, and renewable electricity

. Technology

enhances productivity and may reflect improvements stemming from trade openness and foreign direct investment (FDI). We extend the basic Solow model by including energy inputs and trade openness. The production function follows a Cobb–Douglas specification as in Equation (1).

where

is the real output,

is capital input,

is labor input,

is the traditional energy consumption such as oil and gas,

is the renewable electricity consumption,

is the total factor productivity.

are the output elasticities of the inputs.

This setup assumes all inputs are essential and contribute positively to production, although with potentially different elasticities. We distinguish between traditional energy (E), which primarily reflects fossil fuel consumption, and renewable electricity (R), which captures the contribution of renewable energy sources to production. This separation is particularly relevant in the GCC context, where fossil fuels remain dominant but renewable sources are gradually expanding. Renewable energy is modeled explicitly to capture its growing role in the region’s diversification strategies and the shift toward greener production technologies. This formulation allows us to analyze how both traditional and renewable energy sources contribute to output, alongside trade and capital flows.

4.2. Firm Optimization Problem

The firm aims to maximize output subject to a total cost constraint as in Equation (2).

where

is the wage rate,

is the cost of capital,

is the price of traditional energy,

is the price of renewable electricity, and

is the total cost or budget. Input prices are considered fixed in the short run.

We set up the Lagrangian function as in Equation (3).

4.3. First-Order Conditions (F.O.Cs)

To find the optimal levels of each input, we take partial derivatives and set them to zero as displayed in Equations (4)–(8).

Each equation equates the marginal product of an input to its marginal cost, reflecting the optimal allocation under the firm’s budget.

4.4. Comparative Statics

To understand how changes in prices or productivity affect the equilibrium, we derive comparative statics from the F.O.Cs as follows:

4.4.1. Reduction in the Cost of Renewable Electricity

As falls, the marginal cost of using renewable electricity drops, making it more attractive to firms. This leads to an increase in which would raise the overall output if δ > 0.

4.4.2. Increase in Productivity via FDI or Trade

Since appears multiplicatively in every F.O.C., an increase in productivity boosts the marginal returns to all inputs. This causes firms to scale up production and increase usage of which in turn increases output.

This theoretical result is consistent with empirical evidence that links trade openness and FDI to higher economic growth, particularly through technology spillovers and resource efficiency [

18,

30,

31].

The empirical findings from our panel estimations, to be discussed later, support several of this theoretical model’s implications.

This framework not only justifies our variable selection but also offers a lens to interpret the heterogeneous effects observed across different energy sources and policy levers in the Gulf.

In both the theoretical framework and the empirical specification, we explicitly separate traditional energy and renewable electricity to distinguish between overall energy intensity (largely driven by hydrocarbons) and electricity access as a key infrastructure variable. This distinction is particularly relevant in the GCC, where electricity is predominantly generated from hydrocarbons but plays a distinct role in supporting industrial and residential demand.

5. Materials and Methods

5.1. Data Sources and Variables

This study uses a panel dataset covering six Gulf Cooperation Council (GCC) countries: Saudi Arabia, the United Arab Emirates, Kuwait, Bahrain, Qatar, and Oman. The period spans from 2008 to 2023, dictated by data availability. Data are collected primarily from the World Bank’s World Development Indicators (WDIs) and the International Renewable Energy Agency (IRENA).

The dependent variable is the natural logarithm of real Gross Domestic Product, measured in constant 2015 US dollars. This transformation helps stabilize the variance and allows the interpretation of coefficients in percentage terms.

The key independent variable of interest is renewable electricity production, measured as the percentage of total electricity generated from renewable sources excluding hydroelectric. This indicator captures the extent to which countries are integrating clean energy sources into their power mix, aligning with the literature emphasizing the role of renewables in fostering sustainable growth [

12,

13]. Renewable electricity data were mainly obtained from IRENA and WDI. Missing early-year values for some GCC countries such as Oman, Kuwait, and Qatar, were completed using linear interpolation to ensure a balanced panel.

Additional control variables include Foreign Direct Investment (FDI), net inflows (% of GDP) to capture capital inflows and investment-driven technology transfer. Trade as a percentage of GDP which measures openness to international trade. Energy use (kg of oil equivalent per capita) which reflects overall energy intensity. Electric power consumption (kWh per capita) is a proxy for infrastructure and access to electricity.

To assess potential multicollinearity among explanatory variables—particularly between energy use per capita, electric power consumption per capita, and trade openness—variance inflation factors (VIFs) were computed for all regressors.

5.2. Model Specification and Estimation Strategy

Before estimating our panel models, we conduct unit root tests to determine the stationarity properties of the variables. Since our data consists of a short panel (six GCC countries over 16 years), we use the Im–Pesaran–Shin (IPS) test, which is suitable for panels with small

and moderate

, allowing for heterogeneity in the autoregressive coefficients across cross-sectional units [

32]. The IPS test evaluates the null hypothesis that all panels contain a unit root against the alternative that some panels are stationary. The test will be performed using one lag and without a time trend, consistent with common practice in small-sample macro panels.

In this paper, we utilize two dynamic panel estimation techniques widely used in energy–growth literature: the Pooled Mean Group (PMG) estimator and the Dynamic Fixed Effects (DFEs) estimator, both developed by [

33].

The PMG estimator allows short-run coefficients, error variances, and adjustment speeds to differ across countries, while constraining the long-run relationship to be the same. This structure is suitable for GCC economies, which share similar long-run development goals (e.g., Vision 2030 agendas), but may exhibit country-specific short-run dynamics due to differences in policy timing, subsidies, and institutional environments.

The long-run equation of the PMG model is given in Equation (10).

where

is the natural logarithm of real GDP (constant 2015 US

$) in the country

at time

.

is the foreign direct investment inflows (% of GDP),

is trade openness (% of GDP),

is the energy use per capita (kg of oil equivalent),

is electric power consumption (kWh per capita),

is electricity production from renewables, excluding hydro (% of total),

is country-specific intercept, and

is the error term.

The error correction representation which shows the short-run dynamics is represented by Equation (11).

where

is the first difference in log real GDP (economic growth),

is the country-specific error correction coefficient (expected to be negative and significant),

is the short-run changes in the explanatory variables,

is the short-run adjustment coefficients,

is the white noise error term.

The PMG estimator is implemented using the xtpmg command in Stata 13 with the lr ( ) option specifying the long-run regressors and the ec ( ) option for the error correction term. This model estimates both short-run dynamics and a long-run equilibrium relationship. A significant and negative error correction term confirms convergence to long-run equilibrium.

As a robustness check, we estimate a Dynamic Fixed Effects (DFEs) model, where all slope coefficients (both short- and long-run) are constrained to be the same across countries, except for the intercept. While more restrictive than PMG, this approach helps test the consistency of results under homogeneity assumptions. DFE is especially useful when the time dimension is short, as is the case here.

The choice of PMG and DFE models is motivated by the fact that the dataset has a small number of cross-sections (six countries) and a relatively short time dimension (15 years), making techniques like GMM less appropriate [

34].

Finally, to address potential structural changes in the GCC region during the study period, we conducted structural break tests on the GDP–energy–trade relationship, focusing particularly on the 2015–2016 period. This coincides with major economic transitions, including oil price shocks and the launch of national development visions. Identifying and accounting for possible breaks helps ensure that the estimated long-run relationships are not biased by regime shifts.

6. Empirical Results

This section presents the estimation results from the Pooled Mean Group (PMG) and Dynamic Fixed Effects (DFEs) models, focusing on both the short-run and long-run relationships between GDP and the selected explanatory variables across six GCC countries from 2008 to 2023. The key variables include FDI, trade openness, energy use, electricity consumption, and renewable electricity production. The results provide insights into how these variables shape economic performance in the region over time.

6.1. Descriptive Statistics

Table 2 presents the summary statistics for the main variables across the six GCC countries during the period 2008–2023. The descriptive statistics across the six GCC countries from 2008 to 2023 reveal notable cross-country differences in energy consumption, investment, and economic scale. Qatar emerges as the region’s most energy-intensive economy, with average electricity consumption reaching 17,169 kWh per capita and energy use at a staggering 16,859 kg of oil equivalent per capita—well above global norms. This reflects its gas-rich economy and energy-heavy industrial structure. Kuwait also shows high power consumption (16,232 kWh), while Oman trails significantly at just 6891 kWh, indicating a more moderate consumption pattern.

The UAE stands out for its renewable energy progress, with renewable electricity averaging 1.34% of total generation, the highest among the group, followed by Oman at 0.41%. Most other countries remain below 0.1%, highlighting a regional gap in clean energy adoption despite stated goals.

In terms of FDI, Bahrain shows the highest average inflows at 4.31% of GDP, reflecting its liberal investment climate. Meanwhile, Qatar and Saudi Arabia display more conservative FDI averages (0.79% and 1.12%, respectively), despite their high-profile economic reforms. Oman and the UAE also report moderate to strong FDI engagement (3.63% and 3.12%).

Economic scale further illustrates asymmetry: Saudi Arabia leads overwhelmingly with an average GDP of $648.5 billion, followed by the UAE ($363.1 billion) and Qatar ($148.1 billion). Smaller economies like Bahrain and Oman remain under $80 billion on average, emphasizing structural heterogeneity in the bloc.

Lastly, trade openness is greatest in the UAE (167.3%) and Bahrain (149.2%), underscoring their roles as regional trade hubs. In contrast, Saudi Arabia’s average trade share is 71.2%, the lowest among the GCC, possibly due to a more domestic-focused economic base and slower trade liberalization.

Together, these figures help contextualize the region’s growth, energy use, and openness—key elements explored further in the panel regressions.

6.2. Panel Unit Root Test Results

Before estimating the long-run relationships among the variables using the PMG and DFE estimators, it was necessary to test the stationarity properties of the panel data series. Panel unit root tests help determine whether a time series is stationary or contains a unit root, which has direct implications for model specification and the validity of long-run estimations. Non-stationary variables may lead to spurious regression results if not properly treated. Therefore, the Im–Pesaran–Shin (IPS) panel unit root test [

32] was employed due to its flexibility in allowing for heterogeneity in the autoregressive coefficients across cross-sectional units—an important feature for Gulf Cooperation Council (GCC) countries, which vary in energy profiles and economic structure.

The test results, summarized in

Table 3, reveal that most variables are stationary at levels, while a few exhibit non-stationarity. Specifically, log real GDP, foreign direct investment (% of GDP), trade openness (% of GDP), and energy use (kg of oil equivalent per capita) reject the null hypothesis of a unit root at the 5% significance level. These findings suggest that these variables are stationary and can be included in the models without differencing.

In contrast, electricity production from renewable sources and electric power consumption (kWh per capita) do not reject the unit root hypothesis, indicating non-stationarity at levels. This outcome is plausible given the upward trend in renewable energy adoption and electricity consumption over the period studied (2008–2023). These variables were appropriately differenced where required in the short-run dynamic specification of the PMG and DFE models.

Conducting the unit root test ensured the proper treatment of each variable in the estimation process. Variables found to be I(0)—i.e., stationary at levels—were retained in their original form. Variables identified as I(1)—non-stationary—were included in the models with appropriate differencing in the short-run dynamics, while their levels were retained in the long-run equation under the assumption of cointegration. This step was critical for validating the use of Pooled Mean Group (PMG) and Dynamic Fixed Effects (DFEs) models, both of which assume long-run equilibrium relationships among non-stationary variables that are cointegrated.

6.3. PMG Estimation Results

The PMG model is particularly useful in this context as it allows long-run coefficients to be homogeneous across countries while letting short-run dynamics and error variances differ. This flexibility is important in the GCC, where countries share many structural similarities but differ in terms of policy implementation and institutional frameworks.

The PMG estimates, presented in

Table 4, suggest that four of the five explanatory variables have statistically significant long-run relationships with GDP. Electricity consumption per capita has the strongest and most statistically significant positive effect, indicating that as electricity consumption increases, GDP tends to rise. This likely reflects the central role of energy-intensive sectors in driving the region’s growth.

Energy use per capita is also positively associated with GDP in the long run with a statistical significance at 5%, consistent with the idea that greater energy input supports higher production levels. Also, foreign direct investment (FDI) shows a statistically significant and positive relationship with GDP, underscoring the importance of external capital inflows in supporting economic development, infrastructure expansion, and sectoral diversification.

Trade openness also has a positive coefficient that is marginally significant at the 10% significance level. This result may reflect the region’s reliance on oil exports, which are vulnerable to external shocks and price volatility. Surprisingly, renewable electricity production, though it has a positive long-run effect on GDP, it is not statistically significant. This is likely due to the limited contribution of renewables to total energy supply during most of the sample period.

In the short run, only the error correction term and energy use are statistically significant. The negative and significant EC term confirms the presence of a stable long-run relationship among the variables, with around 50.2% of deviations from long-run equilibrium corrected each year, indicating a relatively fast speed of adjustment. This relatively high adjustment speed reflects the PMG model’s ability to capture heterogeneity in how quickly different GCC economies return to equilibrium after shocks, as it allows for country-specific short-run dynamics. The statistically insignificant short-run coefficient for energy use may reflect energy inefficiency or delayed benefits from energy investment. But for electricity consumption, all other short-run coefficients are statistically insignificant, including renewable energy, which further suggests that the economic impact of renewables remains minimal in the short term.

6.4. DFE Estimation Results

The DFE model assumes homogeneity across both short- and long-run dynamics, providing a stricter benchmark for comparison.

Table 5 presents the results of the DFE model. As in the PMG model, electricity consumption has a positive and statistically significant long-run effect on GDP, reinforcing the central role of electricity in supporting growth. However, none of the other variables—FDI, trade, energy use, or renewable electricity—are statistically significant in the long run. This suggests that the fixed effects assumption may be too restrictive to capture cross-country heterogeneity in these relationships.

The EC term is also statistically significant and negative, indicating a stable adjustment process, though the speed is much slower than in the PMG model, with only 18.6% of deviations from equilibrium corrected each year. This slower speed of convergence highlights how the DFE model, by imposing homogeneity across countries, fails to account for differences in how fast GCC economies adjust to shocks. The comparison between the PMG and DFE error correction terms suggests that some countries in the sample adjust back to their long-run equilibrium much more quickly than others—an important dynamic that the PMG model captures but the DFE restricts.

The short-run coefficient for electricity consumption is positive and statistically significant at the 10% significance level, which aligns with the expectation that changes in electricity demand can have immediate economic effects. However, the coefficient of the renewable electricity production remains statistically insignificant, suggesting that the economic contributions of renewable energy remain limited, especially in the short term.

To sum up, across both models, electricity consumption consistently emerges as a key driver of economic growth in the GCC region. This is expected in an environment where power supply is critical to industries, public services, and urban expansion. The role of FDI and energy use is also emphasized in the PMG model, suggesting that capital flows and energy input are central to maintaining long-run growth. However, renewable electricity production does not appear to play a meaningful role, neither in the short nor long run, reflecting both the growing state of renewables in the GCC and the structural dominance of fossil fuels.

These findings suggest that while diversification and sustainability are long-term policy goals, their tangible economic effects—particularly from renewable energy—are still limited. Policymakers should continue investing in energy efficiency and infrastructure while adopting complementary reforms to increase the competitiveness of the renewable sector.

6.5. Structural Break Tests

Given the major economic transformations that took place in the GCC region during the study period, it is essential to verify the stability of the estimated GDP–energy–trade relationship. Events such as the post-2014 oil price collapse, the announcement of national development visions (e.g., Saudi Vision 2030 in 2016), and the rapid acceleration of renewable energy investments in the early 2020s may have introduced structural changes affecting the long-run dynamics. To account for this, we conducted panel structural break tests focusing on the period around 2015–2016, when several of these turning points occurred.

We applied the Bai–Perron multiple breakpoint test [

35,

36] to the panel regression residuals to detect potential structural shifts in the long-run relationship between real GDP, energy use, electricity consumption, trade openness, and renewable energy production. This method allows the identification of unknown break dates and provides statistical evidence of whether significant regime changes occurred during the sample period. Break tests were performed sequentially at the 5% significance level with finite-sample critical values.

The results are summarized in

Table 6, which reports the detected break dates and corresponding F-statistics. Consistent with expectations, the tests detected a statistically significant structural break in 2015–2016 across most model specifications, confirming that this period represents a key turning point in the GCC growth–energy nexus. This break aligns with the introduction of large-scale economic reforms and diversification strategies following the 2014 oil price crash. No additional structural breaks were found to be statistically significant after 2016, suggesting relative stability in the relationship during the later years of the sample, despite the COVID-19 shock and the initial phase of renewable rollout.

The results confirm a significant structural break in 2015–2016, marking a shift from the pre-transformation phase to the early stages of economic diversification and energy reform in the GCC. This has two key implications. First, the study period reflects distinct structural phases rather than a single stable long-run equilibrium. Second, the use of PMG and DFE estimators is appropriate, as they capture long-run relationships while allowing for structural heterogeneity across countries and time. Finally, the later years (2020–2023) coincide with the early rollout of major renewable projects such as NEOM and Barakah, which are too recent to produce large macroeconomic effects—helping explain the modest renewable impact observed in the models.

7. Discussion

This study provides new insights into how renewable electricity generation, energy use, foreign direct investment, and trade openness affect economic growth in the Gulf Cooperation Council (GCC) countries. Our findings support some findings of the existing literature while also diverging in interesting ways, particularly regarding the role of renewable energy in the short run.

The most consistent result across both the Pooled Mean Group (PMG) and Dynamic Fixed Effects (DFEs) models is the significant long-run impact of electricity consumption and energy use on GDP. This finding aligns with previous studies showing that increased energy access and infrastructure support productivity and industrial output [

4,

37]. In the context of the GCC, where electricity is highly subsidized and widely accessible, this relationship is unsurprising and reinforces the centrality of energy to economic performance.

However, unlike studies focusing on OECD or East Asian countries, our findings indicate that renewable electricity production does not yet exert a statistically significant long-run effect on GDP in the GCC context. This contrasts with evidence from a broad panel of countries—including non-OECD nations—where renewable energy consumption has been shown to have a positive long-run impact on economic growth [

14]. The key reason for this result lies in the very small scale of renewable energy use in the GCC during most of the sample period. As shown in

Table 2, renewable electricity accounts for only fractions of a percent of total generation in many countries (e.g., 0.02% in Bahrain, 0.03% in Saudi Arabia). At such low levels, it is econometrically very difficult to detect any macroeconomic growth effect, even if renewables are beneficial in principle. This is a central caveat of our analysis: the observed lack of statistical significance should not be interpreted as evidence that renewable energy is ineffective, but rather that its current scale in the region is too small to register a measurable impact on GDP.

Interestingly, in the PMG model, the coefficient on renewable energy is positive and statistically significant in the long run. This suggests that in some countries—such as the UAE or Saudi Arabia, which have made more ambitious renewable investments—the economic contribution of renewables may be more visible. This heterogeneity highlights that where renewable deployment has reached a more meaningful scale, its macroeconomic effects start to emerge, supporting the broader international evidence. This aligns with findings by [

3], which emphasizes that the macroeconomic impact of renewables in the MENA region is highly dependent on supportive policy frameworks, local value chain development, and integration into broader economic diversification plans.

It is also important to recognize that the sample period (2008–2023) spans major structural shifts in GCC economies, including the 2014–2015 oil price collapse, the launch of Saudi Arabia’s Vision 2030 in 2016, the COVID-19 pandemic, and the rapid acceleration of renewable energy investments in the early 2020s. These developments may have introduced structural breaks in the growth–energy relationship. In particular, 2015–2016 marks a critical turning point when large-scale diversification and renewable strategies were announced. While PMG and DFE estimators assume a stable long-run equilibrium, the reality is that this period represents a phase of structural transformation rather than a steady state. This helps explain why renewable energy effects remain statistically weak, where the data primarily capture pre-transition and early implementation stages rather than a mature renewable regime. The structural break tests using panel Chow and Bai–Perron procedures confirm that the 2015–2016 period marked a turning point in the region’s growth–energy dynamics, which helps contextualize the changing significance of key variables over time.

Our results also show that foreign direct investment (FDI) plays a modest but significant role in economic growth in some models. This aligns with the argument that FDI can enhance productivity through capital accumulation and technology transfer, especially in capital-intensive sectors like energy [

17,

18]. However, the significance of FDI weakens in the short run, perhaps because the economic impact of investment projects takes time to materialize.

On trade openness, we find limited evidence of a direct effect on growth. While trade is often seen as a driver of economic development, this weak result may reflect the fact that GCC exports are highly concentrated in oil, limiting the broader growth-enhancing effects typically associated with diversified trade patterns [

38].

The differing significance of energy use and electricity consumption across PMG and DFE estimators likely reflects both measurement differences and multicollinearity. While electricity consumption captures infrastructure access and power availability, energy use per capita is a broader measure that includes industrial and transport fuel consumption. These two variables are conceptually related but not identical. In the GCC context, electricity is highly subsidized and widely available, whereas total energy use reflects hydrocarbon intensity and industrial structure. The higher stability of the electricity coefficient across models may indicate that it is a more direct proxy for productive capacity, whereas the energy use variable overlaps with trade openness through oil production and exports, potentially weakening its statistical power.

This study has several limitations. First, data constraints—especially the short time frame of renewable use (2008–2023)—limit our ability to capture long-run structural change. Second, cross-country variation in resource endowments and policy maturity means that results may not directly translate into a unified GCC-wide policy. Third, global oil price fluctuations and geopolitical shocks, which strongly influence GCC economies, were not explicitly controlled for in our models and could bias some estimates. In addition, the short panel length and small number of countries (N = 6) reduce the statistical power of some estimators and may limit generalizability. Finally, the study does not incorporate institutional or policy factors that could shape energy–growth dynamics. Future research could extend the dataset, include geopolitical or institutional variables, and test robustness to global oil price shocks.

A further point concerns potential multicollinearity between energy use, electricity consumption, and trade openness. In the GCC, these variables are closely linked because electricity demand, energy production, and trade—dominated by hydrocarbon exports—are structurally interconnected. VIF diagnostics confirm the presence of moderate to strong correlations, even after taking logarithmic transformations. To address this, we tested alternative model specifications excluding one of the collinear variables. The results remained qualitatively similar, suggesting that while multicollinearity may influence coefficient sizes and significance levels, it does not change the study’s main conclusions. This reflects the deep structural ties between energy and trade in GCC economies, which make fully separating their effects challenging.

Despite these limitations, our findings have several important policy implications. First, the central takeaway is that the current scale of renewable energy in the GCC is too limited to generate measurable growth effects. Therefore, policy should focus on scaling up renewables significantly while also improving integration with existing electricity systems. Current projects are a step in the right direction, but their contributions remain too small to influence GDP significantly at the macro level. Given the central role of electricity in driving growth, policy should focus not only on expanding renewable capacity but also on greening the existing grid. For example, scaling up solar generation to meet daytime air-conditioning demand can reduce reliance on fossil fuels while maintaining grid reliability. This implies that accelerating renewable use, improving grid integration, and encouraging private sector participation could enhance their economic return. However, when considering targeted subsidies for renewables, policymakers must carefully weigh these against existing large-scale energy subsidies, which currently distort price signals and investment incentives. Reforms should aim to gradually rationalize subsidies while supporting clean technologies.

Second, the strong relationship between electricity use and economic growth suggests that investments in electricity infrastructure—including smart grids, energy efficiency technologies, and improved demand management—can serve as effective tools for economic stimulus. Supporting these investments through regulatory reform, public–private partnerships, and cross-border energy agreements can ensure reliable and efficient power delivery, especially as regional energy demand continues to rise. Finally, the mixed role of FDI and trade in our results underscores the need for broader economic diversification strategies. While openness and capital inflows remain essential, their growth-enhancing potential depends on the sectors in which they are directed. Beyond the broad category of non-oil sectors, FDI should be strategically channeled toward green manufacturing, renewable energy technologies, and digital infrastructure, which offer both productivity gains and alignment with long-term diversification goals. At the same time, trade policy should move beyond hydrocarbons and support value-added exports, regional integration, and industrial upgrading. Aligning these reforms with national visions—such as Saudi Arabia’s Vision 2030 or the UAE’s Net Zero strategy—can help create a more resilient and sustainable growth model for the post-oil era.

From a policy perspective, our results suggest three directions. First, policies should integrate local content rules with FDI in the energy sector to ensure growth benefits stay within the region. Second, stronger investments in smart grids and storage systems are needed to manage the intermittency of renewables before they can significantly contribute to growth. Finally, diversification strategies should channel FDI toward non-oil sectors, especially renewable technologies, digital infrastructure, and green manufacturing, to strengthen resilience and reduce oil dependence.

8. Conclusions

This study explored the short- and long-run impacts of renewable electricity, traditional energy use, foreign direct investment, and trade openness on economic growth in six GCC countries from 2008 to 2023. Using Pooled Mean Group and Dynamic Fixed Effects estimators, the findings confirm that electricity consumption is a key long-run driver of GDP in the region. By contrast, the role of renewable electricity remains statistically insignificant in most specifications, not because renewables are inherently ineffective, but because their current share in the energy mix is extremely small. As the descriptive statistics show, renewable generation still accounts for only fractions of total electricity production in many GCC countries. At this scale, it is econometrically challenging to detect macroeconomic growth effects, making the small contribution of renewables a structural limitation rather than a failure of the technology itself.

The effects of FDI and trade openness were found to be less robust and context-dependent, highlighting the need for complementary reforms and stronger institutions to fully realize their growth potential. The comparative use of PMG and DFE models enhances confidence in the results and reveals important cross-country variation.

Overall, the central conclusion of this study is that the current scale of renewable deployment in the GCC is too limited to produce measurable macroeconomic growth impacts. While the transition to renewable energy is underway, its role in economic transformation remains modest for now. Future growth effects will likely depend on the speed and scale of renewable expansion, as well as the extent to which these sources are integrated into the existing electricity system. The findings suggest that energy sector reforms, investment quality, and diversification remain critical for achieving sustainable growth in GCC economies. Future research could extend this work by incorporating institutional quality, carbon pricing, or sector-specific dynamics.

Finally, it is worth stressing that 2023 represents only the beginning of large-scale renewable energy deployment in the GCC (e.g., NEOM in Saudi Arabia, Barakah nuclear and major solar parks in the UAE). As such, the dataset mostly reflects the “before” and early transition phases of this shift. Future research covering a longer horizon will be better positioned to assess the full macroeconomic impact of renewables once their share in the energy mix becomes more substantial.