Does an Environmental Protection Tax Promote or Inhibit the Market Value of Companies? Evidence from Chinese Polluting Companies

Abstract

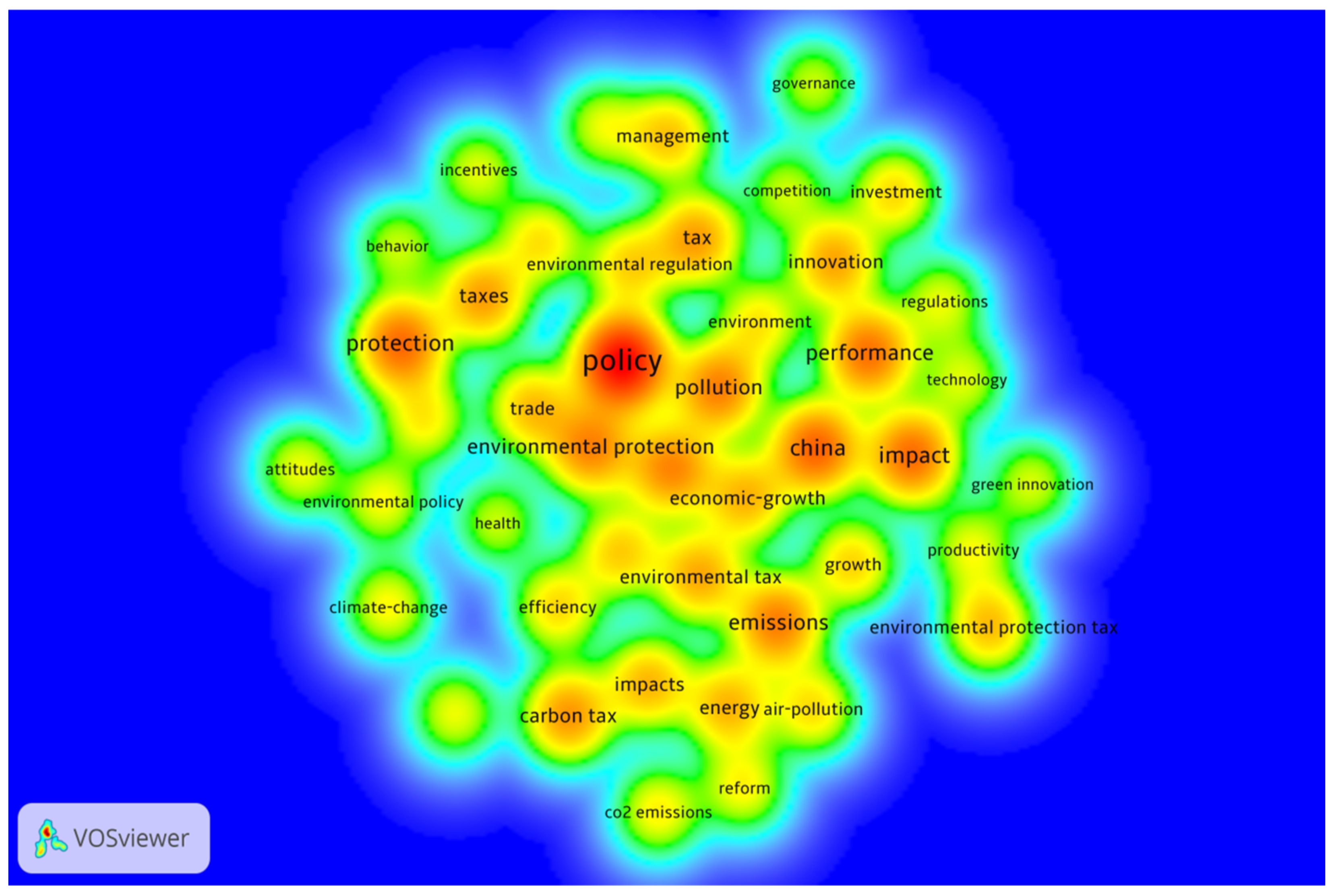

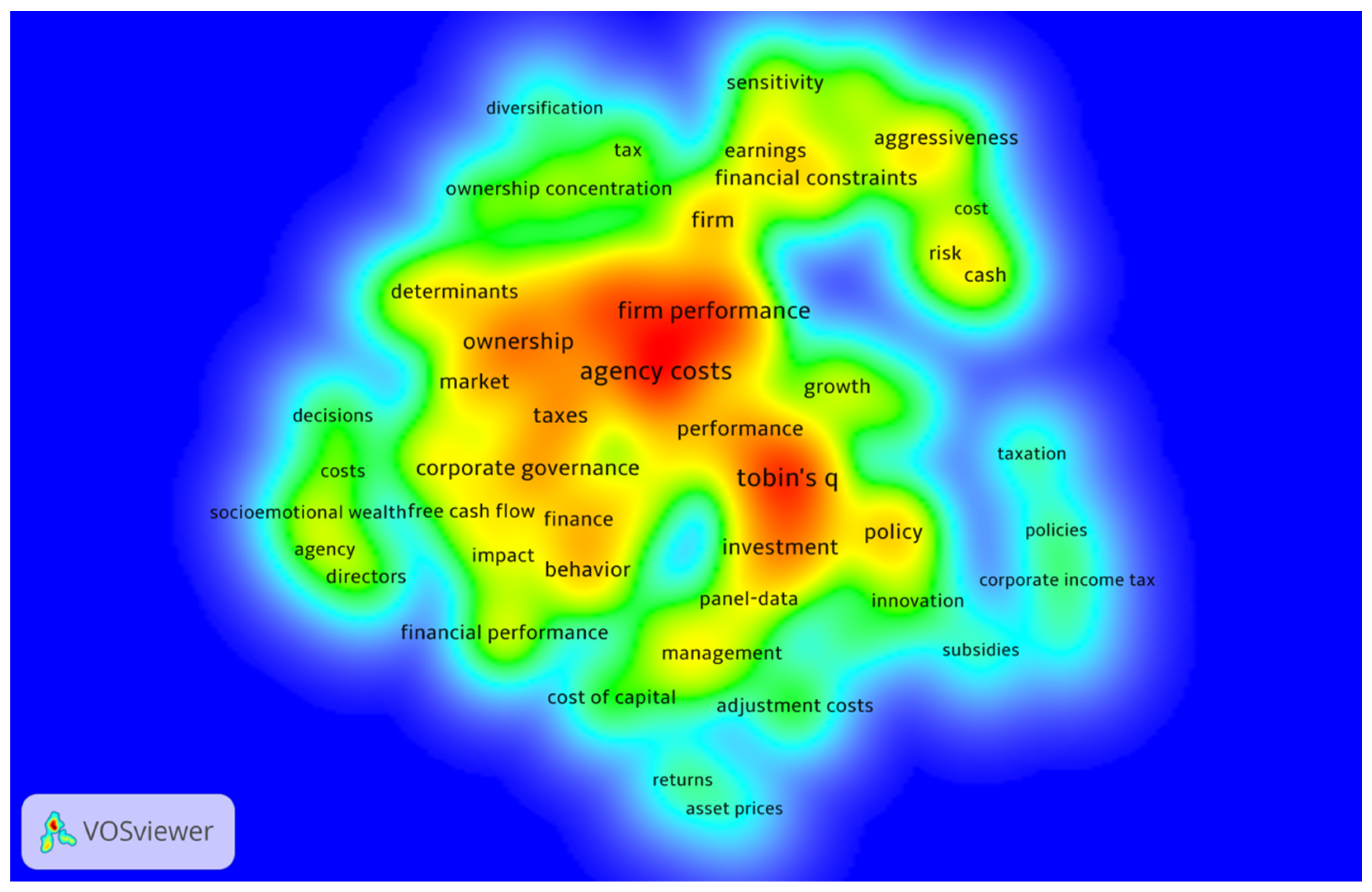

1. Introduction

2. Literature Review and Theoretical Basis

2.1. EPT Evolution Process

2.2. The Relationship Between the Evolution of Corporate Value and Taxation

2.3. Theoretical Basis and Research Hypothesis

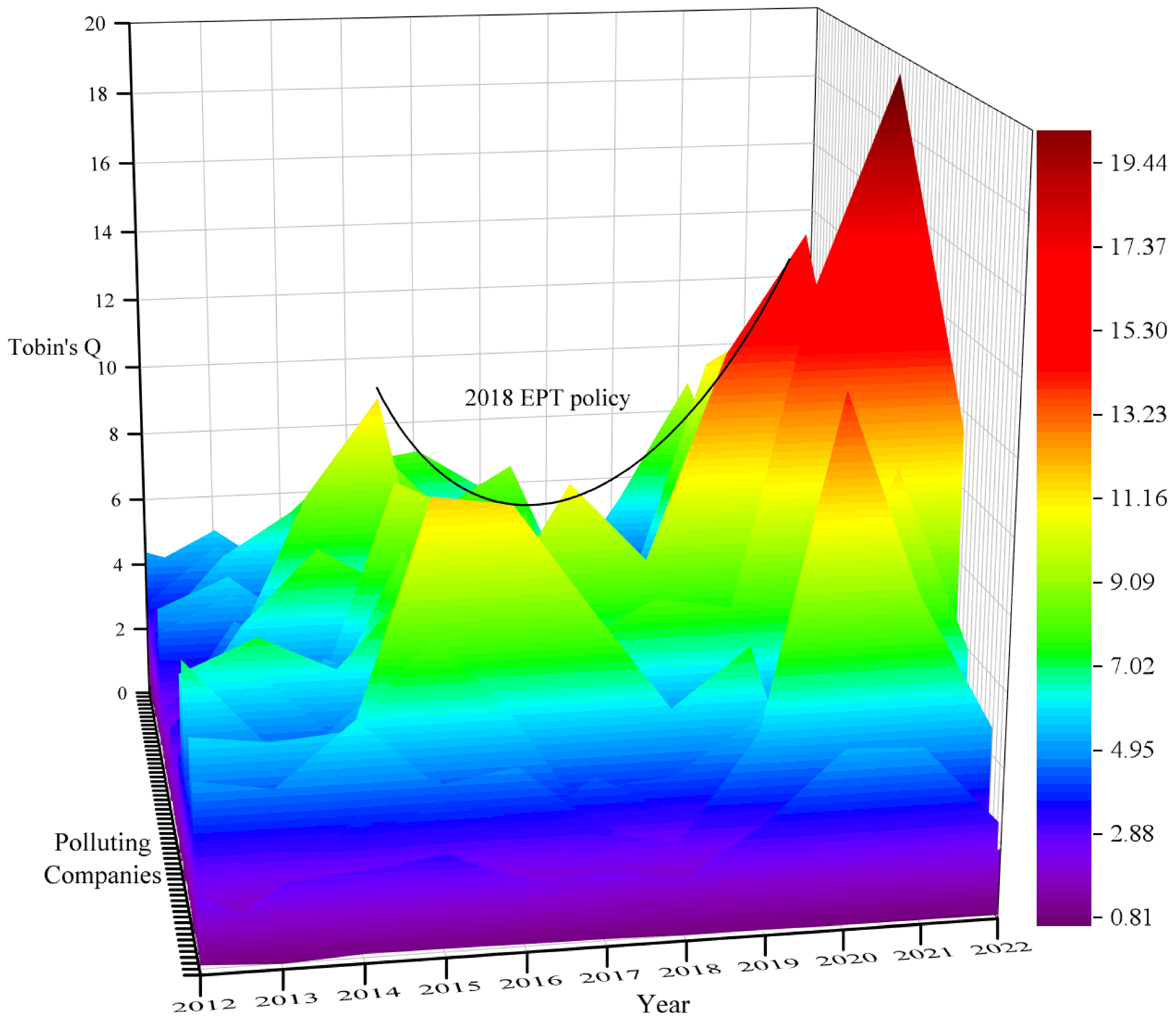

3. Data and Methodology

3.1. Variable Definition

3.1.1. Explained Variable

3.1.2. Core Explanatory Variables and Other Variables

3.2. Descriptive Statistics

3.3. Variable Correlation and VIF Test

4. Empirical Results

4.1. Preliminary OLS Regression

4.2. Model Selection

4.3. Benchmark Regression

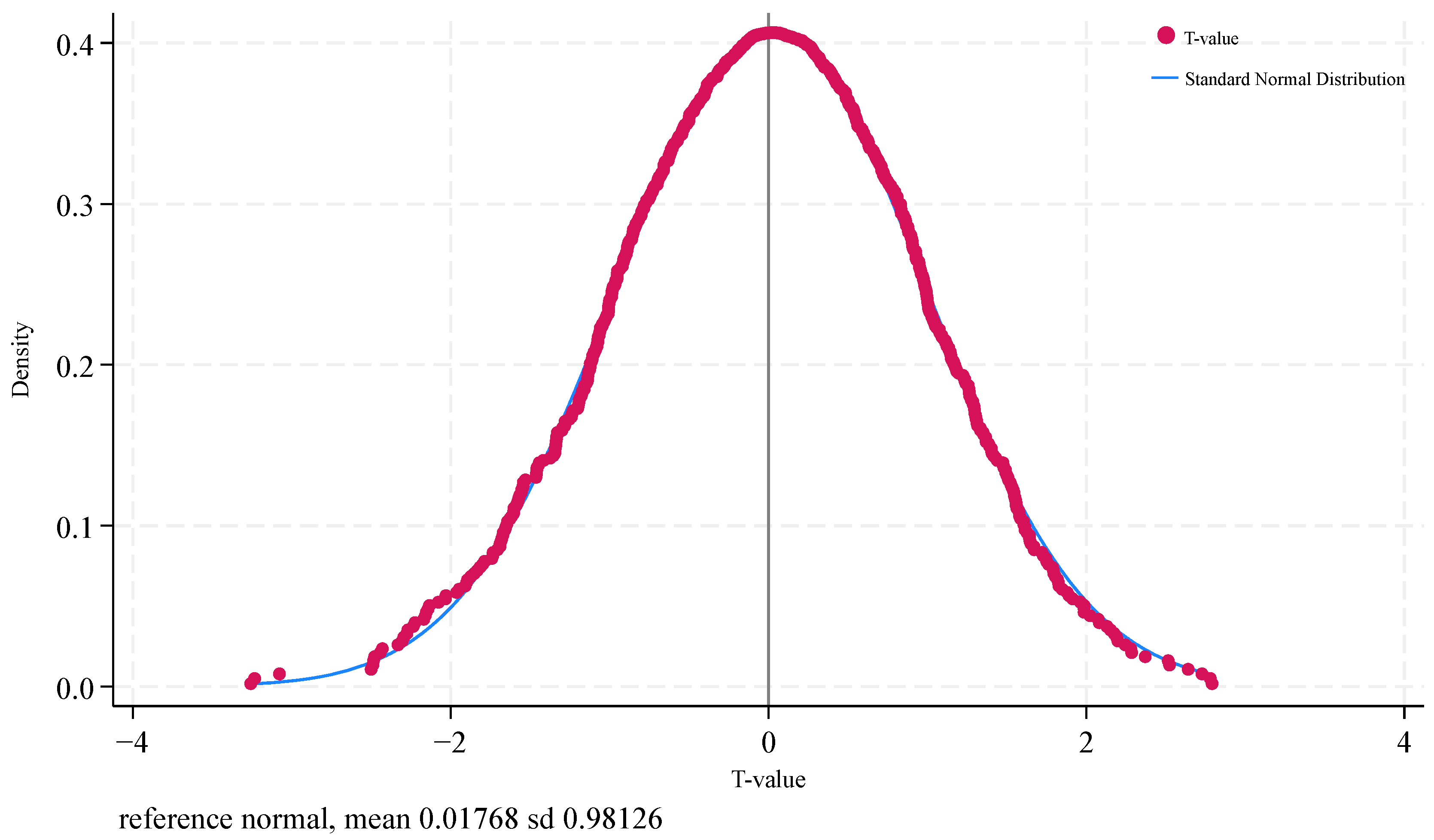

4.4. Robustness Test

4.4.1. Placebo Test

4.4.2. Alternative Variables

4.4.3. Distinguishing Sample Test

4.4.4. Endogeneity Test

4.5. Heterogeneity Test

4.6. Mechanism Test

4.6.1. Moderating Effect

4.6.2. Mediating Effect

5. Discussion

5.1. Verification of Hypothesis

5.2. Theoretical Contribution

5.3. Policy Implications

5.4. Limitations and Future Directions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Silveira, R.M.F.; Mcmanus, C.; da Siva, I.J.O. Global trends and research frontiers on machine learning in sustainable animal production in times of climate change: Bibliometric analysis aimed at insights and orientations for the coming decades. Environ. Sustain. Indic. 2024, 26, 100563. [Google Scholar] [CrossRef]

- Işık, C.; Ongan, S.; Yan, J.; Islam, H. Towards carbon neutrality & COP29 Baku/Azerbaijan-COP30 Belem/Brazil: Exploring the impacts of economic, environmental, social, and governance (ECON-ESG) factors on Climate Policy Uncertainty (CPU) for sustainable development. Heliyon 2025, 11, e41944. [Google Scholar] [CrossRef] [PubMed]

- Yang, G.; Zha, D.; Cao, D.; Zhang, G. Time for a change: Rethinking the global renewable energy transition from the Sustainable Development Goals and the Paris Climate Agreement. Innovation 2024, 5, 100582. [Google Scholar] [CrossRef] [PubMed]

- Santosh, M.; Groves, D.I.; Yang, C.X. Habitable planet to sustainable civilization: Global climate change with related clean energy transition reliant on declining critical metal resources. Gondwana Res. 2024, 130, 220–233. [Google Scholar] [CrossRef]

- Shah, A.A.; Zha, D. Economy-wide estimates of the energy rebound effect in BRICS: The role of environmental regulations and economic policy uncertainty. Energy 2025, 320, 135276. [Google Scholar] [CrossRef]

- Gao, X.; Lai, X.; Tang, X.; Li, Y. Does environmental regulation affect corporate environmental awareness? A quasi-natural experiment based on low-carbon city pilot policy. Econ. Anal. Policy 2024, 84, 1164–1184. [Google Scholar] [CrossRef]

- Qin, P.; Wang, J.; Xu, A.; Hussain, S. China’s green energy growth: Economic policies, environmental economics, and strategies for resilience in the global economy. Energy Strategy Rev. 2024, 54, 101475. [Google Scholar] [CrossRef]

- Fu, Y.; Huang, G.; Zhai, M.; Su, S. Factorial enviro-economic equilibrium analysis for the effects of hierarchical carbon policy on China’s socio-economic and environmental systems. Energy 2025, 320, 135311. [Google Scholar] [CrossRef]

- Kong, L.; Yao, Y.; Xu, K. Can environmental regulation improve the industrial ecology efficiency? Evidence from China’s environmental protection tax reform. J. Environ. Manag. 2025, 373, 123792. [Google Scholar] [CrossRef]

- Song, Y.; Zhang, Y.; Zhang, Y. Economic and environmental influences of resource tax: Firm-level evidence from China. Resour. Policy 2022, 77, 102751. [Google Scholar] [CrossRef]

- Soufiene, A.; Alvarado, R.; Abid, M.; Tillaguango, B.; Shahbaz, M. The role of taxation in environmental sustainability in G-20 economies: A double dividend theoretical assessment. J. Environ. Manag. 2025, 374, 123996. [Google Scholar] [CrossRef]

- Deng, Y.; Dong, K.; Taghizadeh-Hesary, F.; Xue, J. How does environmental regulation affect the double dividend for energy firms? Evidence from China’s EPT policy. Econ. Anal. Policy 2023, 79, 807–820. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B. Environmental policy and ‘double dividend’ in a transitional economy. Energy Policy 2019, 134, 110947. [Google Scholar] [CrossRef]

- Farooq, U.; Ahmed, J.; Akhter, W.; Tabash, M.I. Environmental regulations and trade credit activities of corporate sector: A new panel data evidence. J. Clean. Prod. 2022, 363, 132307. [Google Scholar] [CrossRef]

- Huang, Y.; Liu, C.; Wang, L.; Qi, Y. The Impact of Environmental Protection Tax on Corporate ESG Performance and Corporate Green Behavior. Res. Int. Bus. Financ. 2025, 75, 102772. [Google Scholar] [CrossRef]

- Jiang, C.; Li, X.; Xu, Q.; Liu, J. Does environmental protection tax impact corporate ESG greenwashing? A quasi-natural experiment in China. Econ. Anal. Policy 2024, 84, 774–786. [Google Scholar] [CrossRef]

- Li, Y.; Hua, Z. Environmental protection tax law and corporate ESG performance. Financ. Res. Lett. 2024, 64, 105423. [Google Scholar] [CrossRef]

- Wang, X.; Ye, Y. Environmental protection tax and firms’ ESG investment: Evidence from China. Econ. Model. 2024, 131, 106621. [Google Scholar] [CrossRef]

- Liu, A.; Dai, S.; Wang, Z. Environmental protection tax on enterprise environmental, social and governance performance: A multi-perspective analysis based on financing constraints. J. Asian Econ. 2023, 89, 101671. [Google Scholar] [CrossRef]

- Adamolekun, G.; Kwansa, N.A.; Kwabi, F. Corporate carbon emissions and market valuation of organic and inorganic investments. Econ. Lett. 2022, 221, 110887. [Google Scholar] [CrossRef]

- Yin, H.; Tang, Y.; Jin, H. Sustainability in the supply chain, environmental, social and corporate governance performance, and corporate value. Financ. Res. Lett. 2025, 77, 107061. [Google Scholar] [CrossRef]

- Liu, Y. Whether fintech, natural resources, green finance and environmental tax affect CO2 emissions in China? A step towards green initiatives. Energy 2025, 320, 135181. [Google Scholar] [CrossRef]

- Yang, Y.; Zhang, Y.; Zhang, Y.; Liu, T.; Xu, H. Environmental taxes promote the synergy between pollution and carbon reduction: Provincial evidence from China. J. Environ. Manag. 2024, 372, 123378. [Google Scholar] [CrossRef] [PubMed]

- Du, J.; Li, Z.; Shi, G.; Wang, B. Can “environmental protection fee to tax” reduce carbon emissions? Evidence from China. Financ. Res. Lett. 2024, 62, 105184. [Google Scholar] [CrossRef]

- Biktimirov, E.N.; Afego, P.N. Does investors’ valuation of corporate environmental activities vary between developed and emerging market firms? Financ. Res. Lett. 2022, 47, 102528. [Google Scholar] [CrossRef]

- Chenghao, Y.; Mayburov, I.A.; Hongjie, G. Can Environmental Protection Tax Reform Promote Green Comprehensive Efficiency Productivity? Evidence from China’s Provincial Panel Data. J. Tax Reform 2025, 11, 149–174. [Google Scholar] [CrossRef]

- Lu, H.; Oh, W.Y.; Kleffner, A.; Chang, Y.K. How do investors value corporate social responsibility? Market valuation and the firm specific contexts. J. Bus. Res. 2021, 125, 14–25. [Google Scholar] [CrossRef]

- Zhang, H.; Lai, J.; Kang, C. Green signalling under environmental pressure: Does local government environmental regulatory pressure promote corporate environmental information disclosure? Econ. Anal. Policy 2024, 83, 813–844. [Google Scholar] [CrossRef]

- Zhang, Z.; Zheng, X.; Lv, Q.; Meng, X. How institutional pressures influence corporate greenwashing strategies: Moderating effects of campaign-style environmental enforcement. J. Environ. Manag. 2025, 373, 123914. [Google Scholar] [CrossRef]

- Ugurlu-Yildirim, E.; Kocaarslan, B. The role of government integrity in the impact of environmental taxes on comparative advantage in environmental goods and climate change in emerging markets. J. Clean. Prod. 2024, 478, 144014. [Google Scholar] [CrossRef]

- Zhang, F.; Yin, X.; Zhang, H.; Zhan, X. Does environmental regulation enhance servitization in aspirant markets? Evidence from China’s manufacturing sector. Technovation 2024, 131, 102952. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Chenghao, Y.; Mayburov, I.A.; Ying, W. Fiscal Effects of Environmental Tax Reform: A Comparative Analysis of China, Germany and the United Kingdom. J. Tax Reform 2024, 10, 258–270. [Google Scholar] [CrossRef]

- Chenghao, Y.; Mayburov, I.A. The Impact of China’s Environmental Protection Tax on Regional Economic Effects. Econ. Reg. 2024, 20, 1315–1326. [Google Scholar] [CrossRef]

- Lin, J.; Cao, X.; Dong, X.; An, Y. Environmental regulations, supply chain relationships, and green technological innovation. J. Corp. Financ. 2024, 88, 102645. [Google Scholar] [CrossRef]

- Liu, Y.; Deng, W.; Wen, H.; Li, S. Promoting green technology innovation through policy synergy: Evidence from the dual pilot policy of low-carbon city and innovative city. Econ. Anal. Policy 2024, 84, 957–977. [Google Scholar] [CrossRef]

- Gyamfi, B.A.; Onifade, S.T.; Ofori, E.K.; Prah, S. Synergizing energy investments, environmental taxation, and innovative technology within carbon neutrality targets of E7 bloc: Do institutional pathways and structural changes matter? Appl. Energy 2025, 381, 125124. [Google Scholar] [CrossRef]

- Kinyar, A.; Bothongo, K. Public spending for environmental protection in the UK: The environmental impact of environmental taxes, renewable energy, and nuclear energy. Energy 2025, 314, 134117. [Google Scholar] [CrossRef]

- Pan, X.; Zhang, N. The impact of environmental tax on R&D investment of heavily polluting companies: Incentive or inhibition? Int. Rev. Econ. Financ. 2025, 97, 103826. [Google Scholar] [CrossRef]

- Yan, Z.; Jia, Y.; Zhang, B. Environmental protection taxes and green productivity: Evidence from listed companies in China. Econ. Syst. 2024, 48, 101213. [Google Scholar] [CrossRef]

- Erdogan, S. Linking green fiscal policy, energy, economic growth, population dynamics, and environmental degradation: Empirical evidence from Germany. Energy Policy 2024, 189, 114110. [Google Scholar] [CrossRef]

- Wang, L.; Ma, P.; Song, Y.; Zhang, M. How does environmental tax affect enterprises’ total factor productivity? Evidence from the reform of environmental fee-to-tax in China. J. Clean. Prod. 2023, 413, 137441. [Google Scholar] [CrossRef]

- Qian, Z.; Long, F.; Duan, X.; Bi, F.; Tian, X.; Qi, Z.; Ge, C. Environmental and economic impact analysis of levying VOCs environmental protection tax in China. Heliyon 2024, 10, e36738. [Google Scholar] [CrossRef] [PubMed]

- Kaldor, N. Marginal productivity and the macro-economic theories of distribution: Comment on Samuelson and Modigliani. Rev. Econ. Stud. 1996, 33, 309–319. [Google Scholar] [CrossRef]

- Tobin, J.; Brainard, W.C. Asset Markets and the Cost of Capital. Cowles Foundation Discussion Papers 427. 1976. Available online: https://ideas.repec.org/p/cwl/cwldpp/427.html (accessed on 1 May 2025).

- Min, J.H.; Prather, L.J. Tobin’s q, agency conflicts, and differential wealth effects of international joint ventures. Glob. Financ. J. 2001, 12, 267–283. [Google Scholar] [CrossRef]

- Thoma, G. Composite value index of trademark indicators: A market value analysis using Tobin’s Q. World Pat. Inf. 2021, 66, 102064. [Google Scholar] [CrossRef]

- Jia, F.; Hu, S.; Chen, L. Impact of carbon border adjustment mechanism on the stock market value of high-polluting firms in China: The role of supply chain risk management and internationalization capabilities. Transp. Res. Part E Logist. Transp. Rev. 2025, 197, 104041. [Google Scholar] [CrossRef]

- Senna, A.L.; de Araújo Moxotó, A.C. Carbon emissions and financial performance in the Brazilian stock market. J. Environ. Manag. 2025, 377, 124698. [Google Scholar] [CrossRef]

- Yuan, X.; Dong, Y.; Liang, L.; Wei, Y. The impact of carbon emission trading scheme policy on information asymmetry in the stock market: Evidence from China. Energy Policy 2025, 198, 114502. [Google Scholar] [CrossRef]

- Zhou, P.; Xu, H.; Liu, X.; Gao, D. Brand extension strategy in the presence of carbon tax regulation policy and social influence. Omega 2025, 131, 103210. [Google Scholar] [CrossRef]

- Hasan, M.M.; Lobo, G.J.; Qiu, B. Organizational capital, corporate tax avoidance, and firm value. J. Corp. Financ. 2021, 70, 102050. [Google Scholar] [CrossRef]

- Tang, M.; Hu, Y.; Hou, Y.G.; Oxley, L.; Goodell, J.W. Fintech development, corporate tax avoidance and firm value. Int. Rev. Financ. Anal. 2025, 97, 103765. [Google Scholar] [CrossRef]

- Ran, Z.; Ji, P. Environmental protection tax legislation and corporate reputation in China: A legal perspective. Financ. Res. Lett. 2025, 74, 106790. [Google Scholar] [CrossRef]

- Lv, W.; Meng, Q.; Cao, Y.; Liu, J. Impact and moderating mechanism of corporate tax avoidance on firm value from the perspective of corporate governance. Int. Rev. Financ. Anal. 2025, 99, 103926. [Google Scholar] [CrossRef]

- Jing, Z.; Zhang, W.; Zhao, P.; Zhao, Y. Environmental tax reform and corporate tax avoidance: A quasi-natural experiment on China’s environmental protection tax law. N. Am. J. Econ. Financ. 2025, 76, 102367. [Google Scholar] [CrossRef]

- Ostad, P.; Mella, J. The value relevance of corporate tax expenses in the presence of partisanship: International evidence. Glob. Financ. J. 2023, 57, 100832. [Google Scholar] [CrossRef]

- Marshall, A. Principles of Economics; Macmillan: London, UK, 1980. [Google Scholar]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Pan, J.; Du, L.; Wu, H.; Liu, X. Does environmental law enforcement supervision improve corporate carbon reduction performance? Evidence from environmental protection interview. Energy Econ. 2024, 132, 107441. [Google Scholar] [CrossRef]

- Li, S.; Zhang, Y. Environmental Risk and Stock Price Crash Risk: Evidence from Energy Substitution Policy Adoption. Int. Rev. Econ. Financ. 2025, 99, 103977. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. Available online: https://www.jstor.org/stable/1809766 (accessed on 10 May 2025).

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest (…); Harvard University Press: Cambridge, MA, USA, 1959. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Zhou, D.; Qiu, Y.; Wang, M. Does environmental regulation promote enterprise profitability? Evidence from the implementation of China’s newly revised Environmental Protection Law. Econ. Model. 2021, 102, 105585. [Google Scholar] [CrossRef]

- Zor, S. A neural network-based measurement of corporate environmental attention and its impact on green open innovation: Evidence from heavily polluting listed companies in China. J. Clean. Prod. 2023, 432, 139815. [Google Scholar] [CrossRef]

- Rao, M.; Vasa, L.; Xu, Y.; Chen, P. Spatial and heterogeneity analysis of environmental taxes’ impact on China’s green economy development: A sustainable development perspective. Sustainability 2023, 15, 9332. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, X. Study on the impact of environmental tax on industrial green transformation. Int. J. Environ. Res. Public Health 2022, 19, 16749. [Google Scholar] [CrossRef]

- Zhou, X.X.; Jia, M.Y.; Zhao, X. An empirical study and evolutionary game analysis of green finance promoting enterprise green technology innovation. China Ind. Econ. 2023, 6, 43–61. [Google Scholar] [CrossRef]

- Cai, X.; Lu, Y.; Wu, M.; Yu, L. Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 2016, 123, 73–85. [Google Scholar] [CrossRef]

- Ye, C.; Gao, H.; Mayburov, I.A. Exploring the Triple Dividend Effect and Threshold Effect of Environmental Protection Tax: Evidence from Chinese Listed Companies. Sustainability 2025, 17, 7038. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef] [PubMed]

- Zhao, X.; Lynch Jr, J.G.; Chen, Q. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Konar, S.; Cohen, M.A. Does the market value environmental performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Wei, R.; Yu, Z.; Zhen, D. The Differentiated Effect of China’s New Environmental Protection Law on Corporate ESG Performance. Econ. Anal. Policy 2025, 85, 2126–2141. [Google Scholar] [CrossRef]

- Liu, G.; Guo, L. How does mandatory environmental regulation affect corporate environmental information disclosure quality. Financ. Res. Lett. 2023, 54, 103702. [Google Scholar] [CrossRef]

- Wang, S.; Xu, B. Environmental protection tax policy and corporate risk-taking: Evidence from China. Int. Rev. Financ. Anal. 2024, 96, 103591. [Google Scholar] [CrossRef]

- Shu, Y.; Zhuang, X.; Xu, G.; Zhang, S.; Ying, R. Peer effects, environmental regulation and environmental financial integration—Empirical evidence from listed companies in heavily polluting industries. Econ. Anal. Policy 2024, 82, 1446–1458. [Google Scholar] [CrossRef]

- Chen, S.; Xiao, Y.; Zhang, Z. Value-added tax credit refund and environmental protection investment: Evidence from Chinese heavy-polluting enterprises. J. Clean. Prod. 2024, 450, 141945. [Google Scholar] [CrossRef]

- Xue, J.; Li, R.; Li, Y.; Zhao, L. A dynamic evolutionary game to discourage enterprise “greenwashing”. J. Clean. Prod. 2024, 477, 143823. [Google Scholar] [CrossRef]

- Yan, K.; Liu, N.; Shi, L.; Yang, L.; Lu, M. How does FinTech enable the expansion of green innovation boundaries: Evidence from the interventions of China’s environmental protection tax law. Energy Econ. 2025, 144, 108367. [Google Scholar] [CrossRef]

| Variable Types | Variable (Symbol) | Explanation and Calculation Methods (Original Unit) | Data Source |

|---|---|---|---|

| Explained variable | Tobin’s Q | Calculation formula: (market value of tradable shares + net asset value per share of non-tradable shares + book value of liabilities)/book value of assets (100 million yuan) | PPMANDATA |

| OGM | Operating income minus operating costs divided by operating income (100 million yuan) | ||

| Explanatory variables | EPT | Natural logarithm transformation of annual actual environmental protection tax payment (million yuan) | |

| EPTP | Natural logarithm transformation of EPT payable (million yuan) | ||

| TP | Natural logarithm transformation of taxes payable (million yuan) | ||

| TS | Natural logarithm transformation of taxes and surcharges (million yuan) | ||

| Control variable | Age | The natural logarithm of the listing year plus 1 (1) | CSMAR |

| MS | The stock price is multiplied by the natural logarithm transformation of the total number of shares to represent the market size (100 million yuan) | PPMANDATA | |

| NE | The natural logarithm of the number of employees in the company | ||

| FL | Total debt to shareholders’ equity ratio (100 million yuan) | CSMAR | |

| ROA | Ratio of net profit to total assets (100 million yuan) | ||

| NIA | Initial cost of intangible assets—accumulated amortization—impairment provision, then natural logarithm transformation (100 million yuan) | PPMANDATA | |

| FE | Natural logarithm transformation of financial expenses (million yuan) | ||

| RTSHS | The ratio of the total number of shares held by the top 10 shareholders to the total share capital (1) | ||

| PL | The chemical oxygen demand and ammonia nitrogen emissions in industrial wastewater, sulfur dioxide and nitrogen oxide emissions in industrial waste gas are standardized and converted into a unified pollution equivalent number, and the total is added with 1 to take the logarithm, which represents pollution level (pollution equivalent value) | ||

| Control and Moderating variable | DAR | Total liabilities to total assets ratio (million yuan) | |

| Moderating variable | OPM | Ratio of operating profit to operating income (100 million yuan) | |

| R&D | The natural logarithm of the amount of all R&D investment (1) | ||

| Mediating variable | PAQ | The calculation method will be introduced in detail in the subsequent mediation effect model analysis | |

| QAP | The calculation method will be introduced in detail in the subsequent mediation effect model analysis |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Tobin’s Q | 9592 | 1.860 | 1.156 | 0.615 | 21.296 |

| EPT | 9592 | 14.226 | 1.556 | 7.921 | 20.892 |

| Age | 9592 | 2.460 | 0.589 | 0.000 | 3.434 |

| MS | 9592 | 23.246 | 1.235 | 20.24 | 28.726 |

| NE | 9592 | 8.307 | 1.217 | 2.890 | 13.253 |

| FL | 9592 | 1.534 | 3.444 | −7.646 | 270.994 |

| ROA | 9592 | 0.035 | 0.067 | −1.856 | 0.759 |

| NIA | 9592 | 19.370 | 1.584 | 11.640 | 26.314 |

| FE | 9592 | 17.970 | 1.625 | 9.011 | 24.049 |

| RTSHS | 9592 | 55.668 | 14.526 | 8.780 | 98.585 |

| PL | 9592 | 0.144 | 0.004 | 0.134 | 0.153 |

| DAR | 9592 | 0.455 | 0.191 | 0.011 | 1.303 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VARIABLES | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q |

| EPT | −0.233 *** | −0.241 *** | −0.780 *** | −0.670 *** | −0.669 *** | −0.682 *** | −0.632 *** | −0.578 *** | −0.573 *** | −0.573 *** | −0.539 *** |

| (0.007) | (0.008) | (0.013) | (0.015) | (0.015) | (0.014) | (0.014) | (0.013) | (0.014) | (0.013) | (0.014) | |

| Age | 0.057 *** | −0.063 *** | −0.070 *** | −0.068 *** | −0.016 | −0.033 * | −0.068 *** | −0.096 *** | −0.022 | 0.005 | |

| (0.021) | (0.019) | (0.018) | (0.018) | (0.018) | (0.017) | (0.017) | (0.018) | (0.019) | (0.020) | ||

| MS | 0.808 *** | 0.877 *** | 0.876 *** | 0.840 *** | 1.020 *** | 1.112 *** | 1.118 *** | 1.140 *** | 1.136 *** | ||

| (0.016) | (0.017) | (0.017) | (0.016) | (0.017) | (0.017) | (0.017) | (0.017) | (0.017) | |||

| NE | −0.236 *** | −0.235 *** | −0.218 *** | −0.103 *** | −0.112 *** | −0.110 *** | −0.133 *** | −0.135 *** | |||

| (0.016) | (0.016) | (0.015) | (0.015) | (0.015) | (0.015) | (0.015) | (0.015) | ||||

| FL | −0.015 *** | −0.009 *** | −0.007 *** | −0.000 | −0.001 | −0.001 | 0.001 | ||||

| (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | |||||

| ROA | 3.775 *** | 3.133 *** | 2.529 *** | 2.569 *** | 2.500 *** | 1.979 *** | |||||

| (0.146) | (0.141) | (0.138) | (0.138) | (0.138) | (0.151) | ||||||

| NIA | −0.316 *** | −0.288 *** | −0.287 *** | −0.281 *** | −0.285 *** | ||||||

| (0.010) | (0.010) | (0.010) | (0.010) | (0.010) | |||||||

| FE | −0.190 *** | −0.190 *** | −0.195 *** | −0.183 *** | |||||||

| (0.007) | (0.007) | (0.007) | (0.008) | ||||||||

| RTSHS | −0.003 *** | −0.003 *** | −0.004 *** | ||||||||

| (0.001) | (0.001) | (0.001) | |||||||||

| PL | −23.959 *** | −26.819 *** | |||||||||

| (2.651) | (2.663) | ||||||||||

| DAR | −0.527 *** | ||||||||||

| (0.062) | |||||||||||

| Constant | 5.177 *** | 5.153 *** | −5.669 *** | −6.861 *** | −6.842 *** | −6.235 *** | −5.912 *** | −5.755 *** | −5.766 *** | −2.839 *** | −2.710 *** |

| (0.103) | (0.103) | (0.239) | (0.250) | (0.249) | (0.242) | (0.231) | (0.224) | (0.223) | (0.393) | (0.392) | |

| Observations | 9592 | 9592 | 9592 | 9592 | 9592 | 9592 | 9592 | 9592 | 9592 | 9592 | 9592 |

| R-squared | 0.098 | 0.099 | 0.280 | 0.296 | 0.298 | 0.344 | 0.404 | 0.443 | 0.444 | 0.448 | 0.452 |

| FE | RE | |

|---|---|---|

| VARIABLES | Tobin’s Q | Tobin’s Q |

| EPT | −0.329 *** | −0.419 *** |

| (0.016) | (0.015) | |

| Control variables | YES | YES |

| Constant | −7.843 *** | −5.594 *** |

| (0.478) | (0.405) | |

| Observations | 9592 | 9592 |

| Number of id | 872 | 872 |

| R-squared | 0.441 |

| (12) | (13) | (14) | |

|---|---|---|---|

| VARIABLES | Tobin’s Q | Tobin’s Q | Tobin’s Q |

| EPT | −0.329 *** | −0.275 *** | −0.274 *** |

| (0.034) | (0.035) | (0.034) | |

| Age | −0.149 ** | 0.044 | 0.043 |

| (0.064) | (0.071) | (0.072) | |

| MS | 1.486 *** | 1.314 *** | 1.314 *** |

| (0.066) | (0.076) | (0.076) | |

| NE | −0.429 *** | −0.399 *** | −0.400 *** |

| (0.046) | (0.044) | (0.044) | |

| FL | 0.0002 | −0.0012 | −0.0013 |

| (0.001) | (0.001) | (0.001) | |

| ROA | 0.272 | 0.450 * | 0.456 ** |

| (0.226) | (0.230) | (0.229) | |

| NIA | −0.336 *** | −0.306 *** | −0.305 *** |

| (0.036) | (0.035) | (0.035) | |

| FE | −0.0920 *** | −0.0841 *** | −0.0838 *** |

| (0.012) | (0.012) | (0.012) | |

| RTSHS | −0.00692 *** | −0.00520 *** | −0.00514 *** |

| (0.002) | (0.002) | (0.002) | |

| PL | −52.30 *** | 3.298 | 3.106 |

| (4.550) | (5.595) | (5.589) | |

| DAR | −0.299 * | −0.268 | −0.270 * |

| (0.163) | (0.165) | (0.162) | |

| Constant | −7.843 *** | −14.22 *** | −14.19 *** |

| (1.117) | (1.449) | (1.449) | |

| ID FE | YES | YES | YES |

| Year FE | NO | YES | YES |

| Industry FE | NO | NO | YES |

| Observations | 9592 | 9592 | 9592 |

| R-squared | 0.740 | 0.757 | 0.757 |

| (15) | (16) | (17) | (18) | |

|---|---|---|---|---|

| Replace the Explained Variable | Replace Explanatory Variables | |||

| VARIABLES | OPM | Tobin’s Q | Tobin’s Q | Tobin’s Q |

| EPT | −0.008 *** | |||

| (0.002) | ||||

| EPTP | −0.274 *** | |||

| (0.034) | ||||

| TP | −0.126 *** | |||

| (0.017) | ||||

| TS | −0.160 *** | |||

| (0.028) | ||||

| Control variables | YES | YES | YES | YES |

| Constant | −0.0780 | −14.14 *** | −14.99 *** | −13.50 *** |

| (0.107) | (1.449) | (1.564) | (1.463) | |

| Id FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observations | 9592 | 9592 | 9103 | 9592 |

| R-squared | 0.896 | 0.757 | 0.755 | 0.753 |

| (19) | (20) | |

|---|---|---|

| VARIABLES | Tobin’s Q (Year < 2018) | Tobin’s Q (Year ≥ 2018) |

| EPT | −0.220 *** | −0.250 *** |

| (0.037) | (0.048) | |

| Control variables | YES | YES |

| Constant | −13.44 *** | −23.75 *** |

| (1.699) | (2.718) | |

| Observations | 5232 | 4360 |

| R-squared | 0.803 | 0.859 |

| (21) | (22) | |

|---|---|---|

| Phase I | Phase II | |

| VARIABLES | EPT | Tobin’s Q |

| RLP | 0.218 *** | |

| (0.040) | ||

| EPT | −1.531 *** | |

| (0.324) | ||

| Control variables | YES | YES |

| Id FE | YES | YES |

| Year FE | YES | YES |

| Industry FE | YES | YES |

| Obs | 9592 | 9592 |

| F | 29.766 *** | 32.41 |

| CD Wald F | 96.226 | |

| 10% IV | 16.38 | |

| LM | 24.502 *** | |

| AR test | 42.24 *** |

| (23) | (24) | (25) | (26) | |

|---|---|---|---|---|

| 2013–2017 (Pollution Discharge Fees) | 2018–2022 (EPT) | Non-Heavy Pollution Industries | Heavy Polluting Industries | |

| VARIABLES | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q |

| Sewage charges | −0.220 *** | |||

| (0.037) | ||||

| EPT | −0.250 *** | −0.284 *** | −0.220 *** | |

| (0.048) | (0.038) | (0.044) | ||

| Control variables | YES | YES | YES | YES |

| Constant | −13.44 *** | −23.75 *** | −17.13 *** | −8.996 *** |

| (1.699) | (2.718) | (1.884) | (1.738) | |

| Id FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observations | 5232 | 4360 | 6647 | 2938 |

| R-squared | 0.803 | 0.859 | 0.761 | 0.766 |

| (27) | (28) | (29) | (30) | |

|---|---|---|---|---|

| VARIABLES | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q |

| EPT | −0.326 *** | −0.253 *** | −0.0384 | −0.142 *** |

| (0.049) | (0.049) | (0.119) | (0.0489) | |

| Control variables | YES | YES | YES | YES |

| Constant | −14.86 *** | −14.29 *** | −14.52 | −11.35 *** |

| (1.942) | (2.357) | (8.888) | (3.120) | |

| Id FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observations | 6463 | 1649 | 288 | 1190 |

| R-squared | 0.752 | 0.781 | 0.775 | 0.797 |

| (31) | (32) | (33) | |

|---|---|---|---|

| VARIABLES | Tobin’s Q | Tobin’s Q | Tobin’s Q |

| EPT | −0.143 *** | −0.271 *** | −0.224 *** |

| (0.048) | (0.034) | (0.035) | |

| Xijt × Modijt | −0.277 *** | −0.015 * | −0.003 *** |

| (0.099) | (0.008) | (0.001) | |

| Control variables | YES | YES | YES |

| Constant | −16.27 *** | −14.27 *** | −14.52 *** |

| (1.682) | (1.449) | (1.456) | |

| Id FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Industry FE | YES | YES | YES |

| Observations | 9592 | 9592 | 9592 |

| R-squared | 0.758 | 0.758 | 0.758 |

| (34) | (35) | (36) | (37) | (38) | (39) | |

|---|---|---|---|---|---|---|

| VARIABLES | R&D | Tobin’s Q | PAQ | Tobin’s Q | QAP | Tobin’s Q |

| EPT | 0.126 *** | −0.268 *** | 0.0109 *** | −0.272 *** | 0.008 *** | −0.273 *** |

| (0.020) | (0.034) | (0.004) | (0.034) | (0.003) | (0.034) | |

| R&D | −0.049 *** | |||||

| (0.014) | ||||||

| PAQ | −0.205 *** | |||||

| (0.079) | ||||||

| QAP | −0.137 * | |||||

| (0.075) | ||||||

| Control variables | YES | YES | YES | YES | YES | YES |

| Constant | 9.710 *** | −13.72 *** | 0.830 *** | −14.02 *** | 0.387 ** | −14.13 *** |

| (1.220) | (1.455) | (0.170) | (1.441) | (0.166) | (1.446) | |

| Id FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES |

| Observations | 9592 | 9592 | 9592 | 9592 | 9592 | 9592 |

| R-squared | 0.814 | 0.758 | 0.401 | 0.757 | 0.420 | 0.757 |

| Observed | Bootstrap | Normal-Based | ||||

|---|---|---|---|---|---|---|

| Coefficient | Std. Err. | z | p > |z| | [95% Conf. Interval] | ||

| M1 indirect effect | −0.034 | 0.006 | −5.53 | 0.000 | −0.046 | −0.022 |

| M1 direct effect | −0.268 | 0.025 | −10.74 | 0.000 | −0.317 | −0.219 |

| M2 indirect effect | −0.002 | 0.001 | −2.87 | 0.004 | −0.004 | −0.001 |

| M2 direct effect | −0.273 | 0.025 | −10.98 | 0.000 | −0.321 | −0.224 |

| M3 indirect effect | −0.002 | 0.001 | −2.92 | 0.004 | −0.005 | −0.001 |

| M3 direct effect | −0.272 | 0.025 | −10.95 | 0.000 | −0.321 | −0.223 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ye, C.; Mayburov, I.A. Does an Environmental Protection Tax Promote or Inhibit the Market Value of Companies? Evidence from Chinese Polluting Companies. Sustainability 2025, 17, 8938. https://doi.org/10.3390/su17198938

Ye C, Mayburov IA. Does an Environmental Protection Tax Promote or Inhibit the Market Value of Companies? Evidence from Chinese Polluting Companies. Sustainability. 2025; 17(19):8938. https://doi.org/10.3390/su17198938

Chicago/Turabian StyleYe, Chenghao, and Igor A. Mayburov. 2025. "Does an Environmental Protection Tax Promote or Inhibit the Market Value of Companies? Evidence from Chinese Polluting Companies" Sustainability 17, no. 19: 8938. https://doi.org/10.3390/su17198938

APA StyleYe, C., & Mayburov, I. A. (2025). Does an Environmental Protection Tax Promote or Inhibit the Market Value of Companies? Evidence from Chinese Polluting Companies. Sustainability, 17(19), 8938. https://doi.org/10.3390/su17198938