Abstract

Artisanal and small-scale gold mining (ASGM) constitutes an essential livelihood strategy for marginalized communities, yet it is also associated with severe environmental and social challenges. Persistent inequality and poverty underpin miners’ dependence on informal practices, where access to safer technologies is limited. Mercury use remains critical in ASGM, often mismanaged in processing, applied in amalgamation, and released into air, water, and soils. An estimated 1000–2000 tonnes are emitted annually despite Minamata Convention commitments. This paper examines how mining governance can foster sustainable transitions in ASGM, focusing on the Chilean National Mining Company (ENAMI) as a case study. ENAMI’s model—combining regulatory oversight, institutional support, and inclusive decision-making—shows how public governance can reduce mercury reliance, mitigate environmental degradation, and enhance social inclusion. Findings highlight the importance of regulation, community participation, capacity-building, and addressing structural inequalities as integral components of sustainability. The study argues that sustainable ASGM requires not only technical innovation but also culturally sensitive institutional reforms capable of overcoming resistance and promoting long-term behavioral change. By situating ASGM within the broader framework of sustainable rural development, this research provides insights for policymakers, practitioners, and scholars seeking to reconcile economic inclusion with environmental stewardship in vulnerable contexts.

1. Introduction

The artisanal and small-scale gold mining (ASGM) sector currently faces a critical juncture at the intersection of environmental sustainability and economic development. Defined by rudimentary processes and technologies, insufficient reclamation practices, and unsafe working conditions [1,2,3], ASGM remains a central component of global gold production. It is sustained through labor-intensive methods carried out by individuals, groups, or cooperatives with constrained financial capacity [4,5]. Deeply embedded in structural poverty and inequality, ASGM often constitutes the only feasible livelihood option in marginalized regions where state presence is limited or absent [4]. Despite its informality and precariousness, the sector is tightly linked to global markets—illustrating that “the ore and mercury do not see borders” and that local extractive practices are situated within transnational class dynamics and global commodity chains.

Amid the multifaceted challenges surrounding ASGM, the prospect of effective public mining governance emerges as a potential pathway toward sustainability. The sector contributes significantly to production, approximately 20% of global gold production and directly involves more than 20 million miners, while indirectly sustaining the livelihoods of around 100 million people [6]. Nevertheless, despite its economic relevance, ASGM continues to be severely constrained by the pervasive problem of mercury pollution.

Mercury is frequently mismanaged in gold recovery processes within the ASGM sector, generating severe risks for both communities and ecosystems [2,7,8]. Although the Minamata Convention was expected to significantly reduce mercury consumption, this objective has not yet been achieved. The UN Global Mercury Assessment [9] reported that ASGM activities released more than 1200 tonnes of mercury into the environment in 2015, representing approximately 38% of global annual emissions. More recent estimates suggest that annual releases from ASGM are in the range of 1000 to 2000 tonnes, with the upper bound reaching around 2000 tonnes [1,10]. Estimates indicate that South America contributes between 18–20% [10] and 30–45% [1] of global mercury emissions from ASGM, the references coincide with an emission of about 340 tonnes. The ASGM still has a significant mercury supply, making it difficult for governments to prevent its use.

In the artisanal and small-scale gold mining (ASGM) sector, the link between gold extraction and mercury use is especially strong, as mercury provides miners with a rapid and inexpensive method to recover gold from ore. Despite its apparent advantages, this practice generates severe environmental and health risks, making ASGM the largest anthropogenic source of mercury pollution worldwide.

Another key driver is the limited awareness among miners of its toxic effects. Mercury is also relatively easy to transport and apply [11]. In the short term, it constitutes a cheaper option compared to investments in alternative technologies, particularly for artisanal miners who often operate informally and lack the financial resources required to transition toward cleaner methods [12]. Cultural dimensions further reinforce this dependence, as traditional practices are transmitted intergenerationally and skepticism toward external interventions remains strong. The supply of mercury is also actively maintained by gold buyers and intermediaries who frequently provide it as part of their commercial transactions, reinforcing a structural lock-in effect that makes these relationships particularly resistant to change.

From a governance perspective, both governments and international organizations have recognized the urgency of addressing this issue. The Minamata Convention, ratified by more than 140 countries, establishes a global commitment to eliminate mercury use in mining, yet its implementation has been uneven. Many governments face challenges in enforcement due to the informality and dispersion of ASGM, while international organizations emphasize that prohibitions alone are insufficient. They advocate complementary measures, including governance frameworks, access to mercury-free processing facilities, and inclusive policies that reduce miners’ dependence on mercury while safeguarding their livelihoods.

In recent years, ASGM has expanded substantially under the influence of rising gold prices. Observed market trends show that prices escalated from approximately US $1944 per ounce in 2023 to US $2407 in 2024, reaching record highs of over US $3600 in 2025 [13]. Looking ahead, forecasts suggest that gold may end 2025 near US $3200 per ounce with peaks of US $3800 [14,15] and prices potentially rising to approximately US $4000 by mid-2026 [16]. These projections reinforce the enduring allure of gold mining and underscore the urgent need for robust and responsive public mining governance frameworks.

The sustained escalation in gold prices, particularly between 2023 and 2025, combined with high-end forecasts for 2026, is poised to amplify the expansion of artisanal and small-scale gold mining (ASGM). Elevated prices provide strong economic incentives for increased participation in informal gold extraction, which in turn accelerates environmental degradation, especially through mercury use and ecosystem disruption. Recent research confirms that rising global demand directly drives ASGM expansion in biodiversity-rich regions, exacerbating deforestation and pollution [17]. Without targeted financial and institutional interventions to support miners—such as access to credit, shared processing facilities, or regulatory incentives—higher gold prices are unlikely to foster cleaner production. Instead, they risk deepening cycles of informality, environmental risk, and socio-economic vulnerability, underscoring the urgent need for governance frameworks that reconcile economic opportunity with sustainability objectives [18,19].

Public mining governance constitutes a fundamental framework for addressing the multifaceted challenges associated with mineral extraction under state responsibility. It encompasses the development of comprehensive regulations, policies, and institutional mechanisms designed to advance sustainable and responsible mining practices [20]. The overarching objective is to mitigate the adverse impacts of mining activities while enhancing their potential contributions to society, with an emphasis on transparency, accountability, environmental protection, and social responsibility [21]. When effectively implemented, public mining governance can harmonize the interests of diverse stakeholders, including governments, mining companies, the ASGM sector, local communities, and environmental organizations. It provides a structured approach to mineral resource management that seeks to balance economic development with environmental stewardship and social equity. By fostering robust regulatory frameworks, inclusive decision-making, and proactive strategies to address environmental and social challenges, public mining governance offers a viable pathway to achieving the Sustainable Development Goals (SDGs) while safeguarding the long-term viability of the mining sector [22].

As noted, ASGM holds considerable economic potential but also presents complex challenges, particularly those associated with mercury pollution. Effective public governance is therefore essential to leverage the opportunities provided by artisanal and small-scale gold mining while minimizing its adverse impacts. In this context, examining the potential of public governance is critical for identifying pathways toward sustainable development in the ASGM sector. Such pathways can be delineated through the analysis of regulatory frameworks, community engagement strategies, environmental management practices, and capacity-building initiatives. This article highlights a successful case in which public mining governance has effectively reduced mercury use and pollution in ASGM, illustrating the opportunities such an approach could represent not only for countries like Brazil, Colombia, Ecuador, and Peru but also for the private extractive sector.

In preparing this manuscript, artificial intelligence (AI) tools were employed solely to assist in language editing and stylistic refinement. Specifically, GPT-5 (OpenAI) and Microsoft 365 Copilot were used to improve clarity, grammar, and readability. No AI tools were used for data analysis, interpretation, or generation of scientific content. All AI-assisted outputs were critically reviewed and edited by the authors to ensure accuracy and consistency with the study’s methodology and findings. The authors accept full responsibility for the content of this publication.

2. ENAMI Chile: Public Mining Governance for Sustainable ASGM

ENAMI is a state-owned company established in 1960 with the mandate of promoting small- and medium-scale mining. According to its official website, the company currently operates in more than 50 locations across northern and central Chile. Its central role lies in supporting small-scale miners by providing purchasing capacity and institutional backing. In the Chilean context, small-scale mining is defined as the extraction of up to 2000 tonnes of raw material per month [23]. The structure of ENAMI’s support system is outlined below.

- Access to Markets. Provides small-scale miners with access to international markets under commercial conditions comparable to those available to large producers operating in Chile. ENAMI purchases run-of-mine (ROM) ore, processes and sells minerals, and offers beneficiation services. The company buys copper, gold, and silver ores.

- Price Stabilization Mechanism. Mitigates the impact of low copper price cycles by enabling small miners to remain productively active. The mechanism operates through a stabilization fund that supports prices below the reference level set by the Ministry of Finance, with recovery and capitalization during periods of high prices.

- Resources and Reserves. Offers a subsidy instrument that reduces business risk by financing the development of technically and economically viable mining projects.

- District Studies. Provides basic geological information on mining districts, including metallogenic models to guide the exploration of unrecognized deposits and to inform subsequent recognition and development strategies.

- Competitive Capabilities. Supports small-scale miners in acquiring and strengthening technical and managerial skills to enhance their business competitiveness.

- Technical Assistance. Delivers consulting services and specialized advice to small-scale mining projects, facilitating execution and improving productivity.

- Credits for Mining Development. Extends credit to mineral producers who sell through tariffs or contracts, as established in the Regulations for the Purchase of Minerals and Mining Products. This mechanism targets miners without access to formal financial markets but those who hold viable mining projects.

- Safe Production Program. Finances initiatives aimed at improving occupational safety, quality of life, and environmental standards in small-scale mining operations, while also providing guidance to ensure compliance with existing legal requirements.

- Mining Work Reactivation Program. Provides financing, through a Venture Capital Fund, to reactivate inactive mining sites and restore productive operations.

In the case of gold, ores are processed in mercury-free plants, thereby preventing the use of mercury in ASGM operations. The authors of [24] analyze the Chilean process of formalization and legalization through ENAMI, identifying key challenges such as competitiveness, modernization, productivity, adoption of new technologies, and long-term economic sustainability.

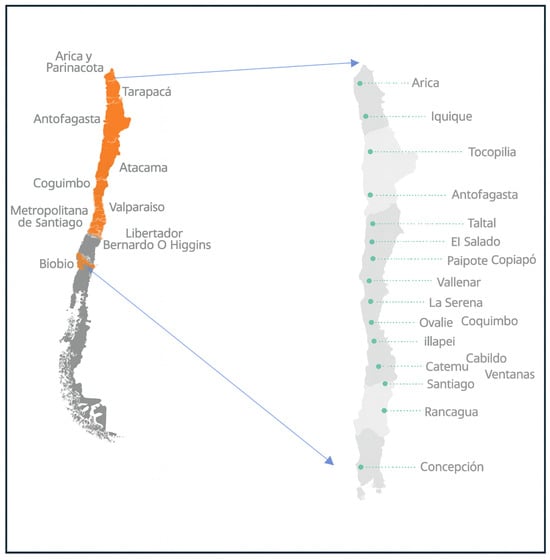

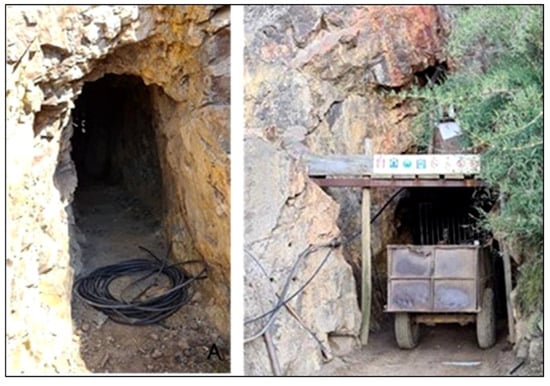

Figure 1 shows the distribution of ENAMI facilities throughout Chile, with a presence in the country’s main mining regions. Figure 2 illustrates artisanal mines that, despite their rudimentary nature, do not process their own gold ore but instead sell it to ENAMI.

Figure 1.

Geographical location map of ENAMI. The regions highlighted in orange represent ENAMI’s areas of operation.

Figure 2.

Artisanal gold mines in Chancón, central Chile.

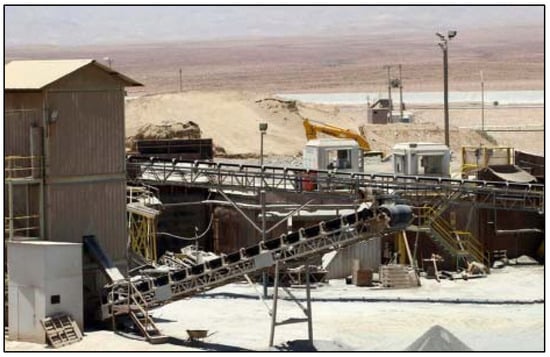

Figure 3 depicts ENAMI’s main gold processing plant located in Vallenar, north-central Chile, which has a capacity of 21,000 metric tonnes of sulfide ore per month and 300 metric tonnes of oxide ore per month. Commissioned in 1973, the plant is equipped with flotation and leaching facilities for mineral processing.

Figure 3.

ENAMI Plant in Vallenar, Chile.

3. Status of ASGM: Selected Examples from South America

The ENAMI model exemplifies a successful case of public mining governance by supporting small-scale miners while ensuring the responsible acquisition and processing of minerals. A key indicator of this achievement is that approximately 90% of Chilean ASGM operations are formalized [23]. Countries such as Brazil, Colombia, Ecuador, and Peru—where governments own and manage mineral resources—have significant opportunities to establish similar models that capture the economic and social benefits of ASGM while mitigating its adverse impacts. In these contexts, governments can play a pivotal role in regulating ASGM activities and addressing environmental risks such as mercury pollution by prioritizing inclusive decision-making, implementing proactive environmental measures, and developing regulatory systems in which legislation and enforcement are effectively integrated to ensure compliance [25].

The evolution of artisanal and small-scale gold mining in Latin America has also been strongly shaped by environmental legislation and protection measures, which vary across countries and play a decisive role in shaping mining practices. While these legal frameworks are crucial, the present article does not attempt to provide a detailed comparative analysis of them. Instead, our contribution highlights the institutional opportunity of centralized processing plants that purchase ore from miners, as exemplified by the Chilean ENAMI model, under the guiding principle of “Let the miners mine and the processors process” [12].

3.1. Brazil

Mining operations in Brazil are governed by federal legislation established under the Mining Code [26]. Oversight of the sector is exercised primarily by federal institutions, including the Ministry of Mines and Energy (MME), the National Mining Agency (ANM), and the Geological Service of Brazil (CPRM). Additional governmental bodies are responsible for regulating labor conditions, environmental protection, and occupational safety. It is also important to recognize that subnational regulations may apply in specific cases, particularly in relation to environmental management [27,28,29].

Brazil possesses significant potential for gold extraction, supported by its extensive land area and mineral endowments. According to the United States Geological Survey Brazil has 3.75% of the world’s gold reserves, 2400 metric tons, placing it ninth in the world [30]. In terms of production, Brazil contributed around 84 tonnes of gold in 2024, accounting for a substantial share of regional output in the Americas [31,32].

Gold mining plays a significant role in contributing to the country’s economy. In 2022, the country’s Gross Domestic Product (GDP) reached a robust US $1920 billion [33], and the gold mining sector alone contributed revenue of US $2515 million and tax revenues of over US $190 billion to the government coffers. Furthermore, the gold industry generated internal payments of over US $2600 million, which played a crucial role in the development of communities and the livelihoods of thousands of Brazilians [34]. This is especially important considering that roughly 600,000 miners are involved in the ASGM sector alone [35]. According to the information reported, the gold mining industry in Brazil is a crucial economic driver, creating employment opportunities and promoting economic development in the regions.

The ASGM sector plays a significant role in Brazil’s gold industry, accounting for more than 28% of total national production [36]. Brazil has specific legislation for artisanal mining, including a permit known as garimpo. However, the commercialization of gold produced by ASGM remains highly fragmented and weakly regulated. Local trading centers often purchase amalgamated gold without adequate traceability, thereby hindering transparency and effective oversight of the supply chain.

Despite regulatory and supervisory efforts, the ASGM sector in Brazil continues to generate significant negative impacts under insufficient controls, particularly through the indiscriminate release of mercury [37]. This practice contributes to severe environmental contamination and exposes surrounding communities to serious health risks [12,38,39,40]. Current estimates indicate that ASGM activities are responsible for releasing more than 49.8 tonnes of mercury into the environment annually [41,42]

The article [43] examines the evolving role of cooperatives in artisanal and small-scale gold mining (ASGM) as key mechanisms for formalization, political negotiation, and socio-environmental governance. Drawing on empirical evidence, the study highlights how cooperatives not only facilitate access to financial and technological resources but also serve as platforms for community organization and institutional engagement. Despite structural challenges—such as limited institutional capacity, market pressures, and persistent environmental concerns—cooperatives demonstrate significant potential to enhance resilience, promote more sustainable practices, and strengthen the integration of mining communities into broader development strategies. The findings suggest that cooperatives, when supported by inclusive public policies, can play a pivotal role in reconciling economic inclusion with environmental sustainability in the Amazonian context.

3.2. Colombia

Colombia’s mining industry is regulated by constitutional and technical provisions governing mineral exploitation. The 1991 Constitution establishes that the state retains ownership of the subsoil and non-renewable natural resources, while allowing individuals to acquire rights for their use. Accordingly, the state oversees the regulation of mineral production, operation, exploitation, and distribution, which has given rise to a specific legal framework for the mining sector.

The principal regulation governing mining in Colombia is the Mining Code, enacted through Law 685 of 2001, which establishes the legal framework for relationships between the state and individuals across all stages of mining activity. In addition, the Ministry of Mines and Energy, through its Vice Ministry of Mines, is responsible for formulating and coordinating sectoral policies. Several institutions play a vital role in implementing this framework. The National Mining Agency (ANM) oversees the granting and registration of mining titles, provides technical assistance, and promotes compliance with concession requirements. The Mining and Energy Planning Unit (UPME) is tasked with comprehensive sector planning, data production and dissemination, and the development of policy guidelines. The Colombian Geological Service (SGC) conducts scientific research and evaluation of subsoil resource potential. Environmental and natural resource management falls primarily under the authority of the Ministry of Environment and Sustainable Development [44].

Colombia has considerable mining potential to develop gold projects with broad economic and social benefits [45]. Historically, mining legislation has primarily aimed to attract investment in medium- and large-scale projects and to maximize foreign direct investment. Nevertheless, gold extraction in Colombia has traditionally been dominated by small-scale and largely informal miners, who often disregard the cost of legal compliance and make suboptimal use of mineral resources [46,47,48].

In 2023, Colombia produced 61 tonnes of gold, followed by a slight decline to 60 tonnes in 2024 [49]. The ASGM sector accounted for more than 53%, underscoring its leading role in national production [50].

Gold mining makes a notable contribution to Colombia’s economy. In 2022, the country’s GDP reached US $344 billion, with total gold production of 1.6 million ounces generating approximately US $415 million in revenues and US $140 million in tax income [51,52]. That same year, mining exports reached a record US $20.4 billion, with gold representing 16.8% of the sector’s value and 6% of the national total [53].

While gold mining has the potential to drive sustainable growth, the negative impacts of the ASGM sector remain a pressing concern. Law 1658 of 2013 prohibits the use and commercialization of mercury in all industrial activities, with a specific ban on mining since July 2018. Yet, according to UN Environment [9], ASGM activities in Colombia still release more than 56 tonnes of mercury annually, severely affecting ecosystems and exposing local communities to health risks.

3.3. Ecuador

The 2008 Constitution of Ecuador declares that the State is the exclusive owner of all natural resources. Mining activity is regulated primarily by the 2009 Mining Law, which is grounded in the principles of sovereignty and environmental protection. This law guarantees the State a greater share of the benefits generated by the mining industry, even when compared to private enterprises. It also established a new institutional framework that includes the Sector Ministry, the Mining Regulation and Control Agency (ARCOM), the National Institute of Geological, Mining and Metallurgical Research (INIGEMM) now called Geological and Energy Research Institute (IIGE), the National Mining Company (ENAMI EP), and municipal governments within their respective jurisdictions. This framework seeks to promote efficient and timely sector administration [54,55]. Furthermore, before any mining concession can become operational, an environmental license must be obtained from the Ministry of Environment.

For many years, Ecuador’s main export product has been oil. Gold did not become a significant export until November 2019, when the Fruta del Norte project, operated by Lundin Gold, began producing gold [55]. However, in Ecuador, gold mining dates back long before oil extraction began, and for many years, it has been a way of life and subsistence for thousands of miners and their families [56]. In 2022, Ecuador produced a significant amount of gold, approximately 22.8 tons, which constituted 0.63% of the world’s gold production and 14.93% of the production of Central and South America [57]. It is important to note that gold mining in Ecuador has been growing rapidly, and it is projected that gold will continue to rebound as the main export mineral [58]. Estimates from 2020 indicate that between 85% and 95% of Ecuador’s gold production originated from ASGM, involving approximately 150,000 miners [59,60].

Ecuador’s mining sector surpassed the previous year’s performance in 2022, with export revenues rising by 33% [61]. Gold and gold concentrate exports reached USD 1476 million, representing 53.3% of total mining exports and 4.5% of national exports [58]. The government has expressed its commitment to maximizing the country’s gold reserves as a means to attract foreign direct investment. With these positive figures, authorities project an increase in investment from USD 845.05 million in 2022 to USD 846.10 million by 2025 [62].

Despite economic fluctuations, gold mining has emerged as a critical pillar of Ecuador’s economy [63]. Nonetheless, the negative impacts of the ASGM sector, particularly mercury use and environmental pollution, remain a pressing concern [9,56,64,65,66]. Ecuador ratified the Minamata Convention in 2016, reaffirming its commitment to eliminate mercury from industrial processes; however, progress in implementation has been limited [66,67]. Alarmingly, the ASGM sector still consumes approximately 29 tonnes of mercury annually, releasing around 27.6 tonnes into the environment [9].

Nevertheless, mercury-free private plants are already operating in the country, contributing to a partial reduction of mercury use in gold ore processing (see example in Figure 4).

Figure 4.

A private, clean gold processing plant in Portovelo, Ecuador, operating by cyanidation and flotation.

Since 2011, in accordance with numeral 32 of Article 36 of the Organic Monetary and Financial Code, the Central Bank of Ecuador has been mandated to commercialize gold originating from ASGM, either directly or through public and private economic agents previously authorized by the institution [68].

Between 2012 and 2015, gold purchases by the Central Bank of Ecuador remained relatively modest, averaging around 1.6 tonnes per year. In 2016, purchases increased to 11 tonnes, reaching a peak of 71 tonnes in 2018, before declining to 41 tonnes in 2019, 27 tonnes in 2020 and 13 in 2022. In 2023, a new policy for the registration of authorized gold vendors was implemented.

This purchasing scheme is designed not only to strengthen the Central Bank’s gold reserves but also to contribute to the formalization of ASGM. By requiring registration and authorization of vendors, the system improves traceability, enhances fiscal oversight, and provides artisanal and small-scale miners with access to formal markets at competitive prices. Consequently, the policy represents a step toward integrating ASGM into the formal economy while reducing incentives for informal and illicit trade. However, the number of venders is low. In 2024, the Central Bank of Ecuador purchased 16 tonnes of gold from 64 authorized agents: 3 traders, 6 artisanal miners, and 55 small-scale miners [68]. References [69,70] detail the difficulties faced by miners in selling gold to the Central Bank of Ecuador.

3.4. Peru

In Peru, ASGM is one of the main sources of mercury emissions in South America. Recent estimates indicate that artisanal and small-scale gold mining activities in the country release approximately 110 tonnes of mercury per year [1], making Peru one of the largest national contributors in the region. This high level of emissions is closely associated with extensive informal and illegal mining activities, particularly in Madre de Dios, where gold extraction often occurs within or near protected areas. The magnitude of mercury use reflects both the lack of accessible mercury-free processing alternatives and the challenges of state enforcement in remote Amazonian territories.

Gold production in Peru was 100 tonnes in both 2023 and 2024, representing approximately 3% of global output, making it the largest producer in Central and South America and the seventh largest globally. The country reached a peak of 153 tonnes in 2016 and registered a low of 86 tonnes in 2020 [71].

Peru’s mining regulatory framework is designed to manage and promote the sustainable development of the sector, seeking to balance economic growth with the environmental and social responsibilities associated with mining projects [72]. The regulatory system is grounded in civil law and supported by four key legal instruments: (i) the Political Constitution of the Republic of Peru, (ii) the General Mining Law, (iii) the Law for the Promotion of Investment in the Mining Sector, and (iv) the Organic Law for the Sustainable Use of Natural Resources [73].

The General Mining Law establishes the fundamental regulations governing mining concessions, outlining concessionaires’ rights, obligations, and financial responsibilities. The Ministry of Energy and Mines (MINEM) is the authority responsible for overseeing Peru’s energy and mining sector. To regulate the industry effectively, MINEM works in coordination with specialized agencies. The Institute of Geology, Mining, and Metallurgy (INGEMMET) manages the administration of mining concessions, while the General Directorate of Mining (DGM) grants authorizations for exploration and exploitation projects. Environmental oversight is carried out by the Environmental Assessment and Supervision Agency (OEFA), which ensures compliance with environmental regulations. In addition, the General Directorate of Mining Environmental Affairs (DGAAM) and the National Environmental Certification Service (SENACE) are responsible for issuing environmental certifications [74].

Gold mining is a fundamental contributor to the Peruvian economy, generating substantial revenues through exports and supporting both economic growth and the balance of payments. As a labor-intensive sector, it creates direct employment in mining operations and indirect employment in related industries such as equipment manufacturing logistics, particularly in regions with limited alternative opportunities. In 2022, Peru’s GDP was estimated at USD 243 billion, with the gold mining sector contributing approximately USD 141.1 billion, thereby strengthening the country’s economic performance [75].

Gold exports alone exceeded USD 10.1 billion, accounting for 26.65% of total national exports, while the sector directed USD 1.17 billion to domestic suppliers, further stimulating the local economy. The sector generated more than 238,860 formal direct jobs, and it is estimated that each direct position creates approximately 8.2 additional jobs in related activities and supply chains [52,76]. Overall, gold mining functions as a key driver of Peru’s economic development, fostering both national growth and integration into international markets. the ASGM sector, approximately 100,000 direct jobs are generated, and production accounts for about 23% of the country’s total gold output [77,78].

Small-scale and artisanal mining (ASM) sector in Peru has an evolving formalization framework anchored in Law No. 27651, which provides a legal basis for integrating informal miners into the legal economy. The implementation of the Registro Integral de Formalización Minera (REINFO) since 2017 has facilitated the registration of thousands of miners, although progress remains uneven. In 2022, the government introduced a national ASM policy to reinforce regulatory alignment and supportive governance [79]. More recently, REINFO has been extended through 2025 to better accommodate informal miners seeking legal status, while a newly proposed mining fund aims to provide access to preferential financing, formal commercial channels, and technical assistance. Despite these efforts, challenges persist, mainly the informality in ASM.

3.5. Challenges

The artisanal and small-scale gold mining (ASGM) sectors of Brazil, Colombia, Ecuador, and Peru face unique challenges; however, they also share common opportunities in the realm of public governance that must be seized. Addressing the harmful effects of mercury pollution requires decisive action to strengthen regulatory frameworks, enhance enforcement mechanisms, and promote sustainable mining practices. It is critical to reinforce the economic contributions of ASGM while minimizing its environmental and public health impacts. Moreover, these countries must recognize that effective public governance has the potential to catalyze transformative change. By learning from Chile’s experience and adopting best practices, they can pave the way for more resilient and responsible mining industries. Ultimately, successful ASGM governance protects ecosystems and communities while securing a more sustainable economic future for the sector. Regional collaboration can amplify these efforts, as countries affected by ASGM can share best practices, exchange technical expertise, and coordinate regulatory frameworks.

Table 1 compares Chile, Brazil, Colombia, Ecuador, and Peru following the logical chain of problem–cause–countermeasure. While all five countries face mercury-related challenges, the specific problems, underlying causes, and countermeasures vary.

Table 1.

Problem–Cause–Countermeasure Table for ASGM in South America.

In Chile, ASGM is highly formalized (≈90%) thanks to ENAMI’s governance model, but miners in northern regions and Valparaíso still rely on mercury. The main reason is the distance between mines and ENAMI plants, combined with limited processing capacity, which creates bottlenecks and restricts access to mercury-free facilities. The countermeasure here is not institutional change, but rather expanding ENAMI’s territorial coverage and plant capacity to ensure universal access to clean processing.

By contrast, Brazil, Colombia, Ecuador, and Peru struggle with more fundamental issues: high mercury use linked to informality, weak enforcement, and limited alternatives to amalgamation. In Brazil, the vastness of the Amazon hinders effective control; in Colombia, criminal economies tied to illegal gold undermine formalization; in Ecuador, despite a Minamata National Action Plan (2020), coordination and infrastructure remain weak; and in Peru, widespread illegal ASGM in Madre de Dios has generated acute mercury contamination.

This comparative framework shows that while the principle of “Let the miners mine and the processors process” is broadly applicable, its implementation must be adapted to each context. In Chile, strengthening ENAMI’s reach can eliminate the remaining mercury hotspots, whereas in neighboring countries the priority is to establish new governance mechanisms and clean processing plants capable of replacing mercury use in the first place.

These cases demonstrate that effective ASGM governance is essential not only for national development but also for advancing the Sustainable Development Goals (SDGs). Strengthening public mining governance directly contributes to SDG 3 (Good Health and Well-Being) by reducing mercury-related health risks; SDG 8 (Decent Work and Economic Growth) by promoting formalization and fair labor conditions; SDG 12 (Responsible Consumption and Production) by advancing cleaner technologies; and SDG 15 (Life on Land) by mitigating deforestation and ecosystem degradation. Furthermore, SDG 17 (Partnerships for the Goals) highlights the importance of regional collaboration, where knowledge exchange and coordinated governance can amplify impacts across Latin America.

4. Opportunities in the Private Sector

Opportunities exist for constructive collaboration between artisanal mining and conventional companies. The authors of [12] cite two cases in Colombia where models of coexistence have been developed. In the first, a company established a small processing plant (20 tonnes per day) dedicated exclusively to artisanal miners. In the second, a private company constructed two small plants designed for artisanal mining, enabling 2000 miners to bring and process their ore. The same study also describes an arrangement resembling a private-sector version of ENAMI’s model, in which a processing company purchases ore from artisanal miners for treatment in its large-scale plants. In this scheme, miners deliver truckloads of ore that are sampled and analyzed in the company’s chemical laboratory. Payments vary according to ore grade: around 40% of the gold content for low-grade ores and over 60% for high-grade ores, with each company maintaining its own payment table based on grades and volumes. Notably, Veiga and Fadina also highlight the persistent issue of mistrust—similar to that observed in ENAMI’s operations—where miners demand transparency in the processing cycle and require processors to visit mining sites to build confidence in the results of chemical analyses.

Ref. [47] elaborates on the concept of coexistence between artisanal miners and companies: they say it works when companies and miners have a good relationship and where there is an infrastructure that allows the transportation of ores to the processing plants. The authors analyze 17 cases of somehow coexistence in which companies purchase ore from artisanal miners. They conclude that coexistence “is the only strategy available to artisanal miners for generating more money,” since it allows miners to avoid the capital costs of acquiring processing equipment and, by using industrial plants, eliminates direct exposure to mercury and cyanide.

Another example can be found in northern Chile. Although this case involves copper extraction where mercury is not present, it provides a useful illustration of collaborative business models between miners and private companies. ENAMI plants apply a specific cut-off grade to determine the ore they purchase, with each plant setting its own threshold. In Chile’s II Region, two medium-sized mining companies—Rayrock and Sierra de Atacama—accept low-grade ore that falls below ENAMI’s cut-off and assume responsibility for its transport, whereas transport to ENAMI plants is borne by the miners. These companies require large volumes, generally exceeding 1000 tonnes, but miners can stockpile their ore until the necessary quantity is reached. ENAMI actively encourages miners to sell their low-grade ore to private companies.

This triangular coexistence among miners, the public company, and private companies has proven effective in sustaining the business of all parties involved. Another form of ENAMI–private collaboration consists of gold processing plants that operate under agreements with ENAMI, allowing miners to sell their ore under the same tariffs applied in ENAMI-owned plants (see Figure 5). ENAMI also purchases concentrates, so miners negotiating directly with the plant can either sell run-of-mine ore or participate in the sale of concentrates.

Figure 5.

Private Hg-free plant in Cabildo, Chile, operating with flotation.

5. Discussion

This article focuses on solutions related to the commercialization of gold, while acknowledging that other technical aspects of mining—such as the use of explosives, mine planning, and business development—are also important but fall outside the scope of this discussion.

Alternative mercury-free processing routes for gold ores and concentrates—and the reasons for their uneven uptake in ASGM—are comprehensively reviewed by [12]. Rather than re-describing technologies, our contribution examines governance and institutional solutions—using ENAMI in Chile as a national-scale example—capable of enabling their adoption (‘let the miners mine and the processors process’; see also [47]). This approach represents an alternative that governments could adopt, depending on their policy priorities and institutional capacities. The timeframe for implementation will inevitably vary according to the specific project and locality; however, based on practical experience, a small modular processing plant could become fully operational within approximately 1–2 years.

Efforts to quantify the full social and environmental costs of industrial sectors, including mining, are still evolving, and in low-capacity governments such tools may be difficult to implement. The relationship between mining, society, and the environment remains complex, shaped by rapidly changing technologies and social expectations that often outpace financial, economic, and geological considerations. Legal frameworks governing mining and environmental protection frequently intersect—and sometimes conflict—over land use, particularly where land tenure is insecure. Although advances in mining management and technology can mitigate negative impacts, they cannot fully resolve these structural tensions.

The challenges posed by ASGM are multifaceted, arising from a convergence of technological limitations, institutional weaknesses, socio-cultural dynamics, and global market pressures. Mercury emissions remain a central concern, as ASGM is the largest anthropogenic source of mercury pollution worldwide [80,81], despite the efforts of multiple stakeholders. Although many interventions have emphasized technical improvements—such as mercury capture systems, fume hoods, and retorts, the root of the problem lies in the structural and governance dimensions of the sector. This underscores the need for public governance models and capacity-building programs that not only provide access to cleaner technologies but also address cultural perceptions [82], build trust with local communities, and empower miners to transition toward more sustainable practices.

The author of [83] identified that ENAMI’s approach addresses not only the elimination of mercury use but also several other key aspects, including gold recovery, tailings management, gold commercialization, access to loans, and the promotion of partnerships.

Cultural resistance should not be interpreted as irrational behavior; rather, it reflects rational survival strategies in contexts where state presence is limited, formalization processes are excessively bureaucratic, and miners have little influence in regulatory decision-making. This reality underscores the importance of participatory and inclusive governance frameworks that avoid imposing top-down solutions and instead build trust through dialogue, technical assistance, and equitable benefit-sharing.

Chile’s ENAMI model exemplifies this approach by providing infrastructure, market access, and financial support while respecting the autonomy of small-scale miners [83]. Beyond formalization, the model contributes to restructuring the sector’s political economy by reducing dependence on mercury, integrating miners into legal markets, and strengthening capacities through technical and financial instruments [24]. It also implicitly addresses transnational class dynamics: while ore and mercury move freely across borders, miners often remain confined to local conditions of inequality and informality. ENAMI helps disrupt this asymmetry by redistributing value and risk in ways that empower local actors.

All four countries analyzed are signatories to the Minamata Convention; however, only Colombia and Ecuador have published their National Action Plans, in 2020 and 2023, respectively. While adherence to the Convention has not yet translated into substantial practical improvements, ratification nonetheless signals a commitment to eliminating mercury use. Significant opportunities remain to advance mineral processing technologies that can fully replace mercury in ASGM.

Finally, regional cooperation has the potential to amplify national efforts. Shared experiences, common challenges, and the transboundary flows of mercury and gold highlight the need for coordinated action. Establishing a regional framework for clean processing facilities, information exchange, and technology transfer—possibly under the umbrella of existing environmental or trade agreements—could strengthen the position of ASGM communities and foster more coherent and effective public governance.

6. Conclusions

ASGM is an important sector in developing countries that cannot be overlooked, providing livelihoods for an estimated 15–20 million people worldwide and contributing up to 20% of global gold production [9]. At the same time, it is the largest source of anthropogenic mercury emissions, releasing around 38% of the global total [9].

The findings of this study suggest that, whether through private or public initiatives, eliminating mercury use requires processing ore in clean facilities. These can take the form of decentralized micro-plants distributed across mining regions or centralized plants that serve multiple producers. Evidence from suppliers indicates that modular clean plants can become fully operational within approximately 1–2 years, making this a realistic and scalable option.

The future of the ASGM sector depends on the implementation of effective public mining governance capable of balancing economic benefits with environmental stewardship. A key indicator of success is Chile, where approximately 90% of ASGM operations are formalized, largely thanks to ENAMI’s network of mercury-free processing plants [23]. By learning from such cases and capitalizing on opportunities in countries with State-led mineral governance, stakeholders can chart a path toward sustainable ASGM practices, ensuring a cleaner and more equitable future.

Artisanal and small-scale gold mining remains a critical livelihood strategy for millions, particularly in economically marginalized and structurally unequal regions. However, the sector’s dependence on mercury and informal practices continues to pose serious environmental and public health risks. This study demonstrates that eliminating mercury use is not only technically feasible but also institutionally achievable through targeted public governance interventions. Chile’s ENAMI model illustrates how state-supported, mercury-free processing infrastructure, inclusive policies, and economic incentives can formalize ASGM and foster sustainability.

Countries such as Brazil, Colombia, Ecuador, and Peru possess both the regulatory authority and the structural opportunity to implement similar models. Yet, evidence shows that in these countries fewer than 20% of miners can comply with legal requirements without institutional support [12]. Realizing this potential therefore requires political will, cultural sensitivity, and sustained investment.

The future of ASGM lies in governance models that acknowledge the global nature of mineral flows, address local inequalities, and support the transition to cleaner, more dignified forms of mining. By balancing regulation with inclusion, and technological alternatives with cultural realities, states can advance environmentally and socially responsible ASGM.

Author Contributions

Conceptualization, J.S. and O.J.R.-B.; methodology, T.M. and J.T.-A.; validation, J.S. and T.M.; investigation, J.S., T.M., J.T.-A. and O.J.R.-B.; resources, J.S. and T.M.; data curation, T.M.; writing—original draft preparation, J.S., T.M., J.T.-A. and O.J.R.-B.; writing—review and editing, T.M.; visualization, J.S.; supervision, J.S. and O.J.R.-B.; project administration, J.S.; funding acquisition, J.S. and T.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by ANID (Chilean National Agency for Research and Development) via the grants FONDECYT 3190485 and FONDECYT 11200114.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

During the preparation of this manuscript/study, the author(s) used GPT-5 and Microsoft 365 Copilot for the purposes of improving language skills. The authors have reviewed and edited the output and take full responsibility for the content of this publication.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Marin, T.; Seccatore, J.; Cheng, Y. Mapping the Reality of Hg-Free Artisanal Small-Scale Gold Mining. Sustainability 2023, 15, 13207. [Google Scholar] [CrossRef]

- Sousa, R.; Veiga, M.; Van Zyl, D.; Telmer, K.; Spiegel, S.; Selder, J. Policies and regulations for Brazil’s artisanal gold mining sector: Analysis and recommendations. J. Clean. Prod. 2011, 19, 742–750. [Google Scholar] [CrossRef]

- Veiga, M.M.; Angeloci, G.; Ñiquen, W.; Seccatore, J. Reducing mercury pollution by training Peruvian artisanal gold miners. J. Clean. Prod. 2015, 94, 268–277. [Google Scholar] [CrossRef]

- Amoah, N.; Stemn, E. Siting a centralised processing centre for artisanal and small-scale mining—A spatial multicriteria approach. J. Sustain. Min. 2018, 17, 215–225. [Google Scholar] [CrossRef]

- Bosse Jønsson, J.; Charles, E.; Kalvig, P. Toxic mercury versus appropriate technology: Artisanal gold miners’ retort aversion. Resour. Policy 2013, 38, 60–67. [Google Scholar] [CrossRef]

- World Gold Council. Lessons learned on managing the interface between large-scale and artisanal and small-scale gold mining. World Gold Counc. Rep. 2022, 1–42. Available online: https://www.gold.org/esg/artisanal-and-small-scale-gold-mining (accessed on 15 September 2025).

- Esdaile, L.J.; Chalker, J.M. The Mercury Problem in Artisanal and Small-Scale Gold Mining. Chem. Eur. J. 2018, 24, 6905–6916. [Google Scholar] [CrossRef]

- Yoshimura, A.; Suemasu, K.; Veiga, M.M. Estimation of mercury losses and gold production by artisanal and small-scale gold mining (ASGM). J. Sustain. Metall. 2021, 7, 1045–1059. [Google Scholar] [CrossRef]

- UN Environment. Global Mercury Assessment 2018; UN Environment Programme Chemicals and Health Branch: Geneva, Switzerland, 2019; ISBN 978-92-807-3744-8. Available online: https://www.unep.org/resources/publication/global-mercury-assessment-2018 (accessed on 15 September 2025).

- PlanetGold. ASGM 101: A Primer on Mercury Use in Artisanal and Small-Scale Gold Mining. PlanetGold. 2019. Available online: https://www.planetgold.org/asgm-101 (accessed on 15 September 2025).

- PlanetGold. Reducing Mercury Use and Improving Efficiency with Better Practices and Technologies. PlanetGold. 2019. Available online: https://www.planetgold.org/technical-solutions (accessed on 15 September 2025).

- Veiga, M.M.; Fadina, O. A review of the failed attempts to curb mercury use at artisanal gold mines and a proposed solution. Extr. Ind. Soc. 2020, 7, 1135–1146. [Google Scholar] [CrossRef]

- APMEX. Gold Price Today. APMEX. 2025. Available online: https://www.apmex.com/gold-price (accessed on 15 September 2025).

- ANZ Group. ANZ Raises 2025 Year-End Gold Price Forecast to $3,800, Expects Peak Near $4,000 by June 2026. Reuters, 10 September 2025. Available online: https://www.reuters.com/business/anz-hikes-gold-price-forecast-3800-solid-investment-demand-2025-09-10/ (accessed on 15 September 2025).

- HSBC. HSBC Raises Average Gold Price Forecasts for 2025 and 2026. Reuters, 1 July 2025. Available online: https://www.reuters.com/business/hsbc-raises-average-gold-price-forecasts-2025-2026-2025-07-01/ (accessed on 15 September 2025).

- J.P.Morgan. Research. Gold Price Outlook: $3,675 by End-2025; $4,000 by Q2 2026. J.P.Morgan. 2025. Available online: https://www.jpmorgan.com/insights/global-research/commodities/gold-prices (accessed on 15 September 2025).

- Aldous, A.R.; Tear, T.; Fernandez, L.E. The global challenge of reducing mercury contamination from artisanal and small-scale gold mining (ASGM): Evaluating solutions using generic theories of change. Ecotoxicology 2024, 33, 506–517. [Google Scholar] [CrossRef]

- Agustiani, T.; Sulistia, S.; Sudaryanto, A.; Kurniawan, B.; Poku, P.A.; Elwaleed, A.; Kobayashi, J.; Ishibashi, Y.; Anan, Y.; Agusa, T. Mercury contamination and human health risk by artisanal small-scale gold mining (ASGM) activity in Gunung Pongkor, West Java, Indonesia. Earth 2025, 6, 67. [Google Scholar] [CrossRef]

- McLagan, D.S.; Eboigbe, E.O.; Strickman, R.J. Reviews and syntheses: Artisanal small-scale gold mining (ASGM)-derived mercury contamination in agricultural systems: What we know and need to know. EGUsphere, 2025; preprint. [Google Scholar] [CrossRef]

- McKay, S. Entering the critical era: A review of contemporary research on artisanal and small-scale mining. Extr. Ind. Soc. 2025, 21, 101590. [Google Scholar] [CrossRef]

- Veiga, M.M.; Delgado-Jimenez, J.A. Can small mining be beautiful? In Heavy Metal: Earth’s Minerals and the Future of Sustainable Societies; Hudson-Edwards, K., Ed.; Open Book Publishers: Cambridge, UK, 2024; pp. 117–126. [Google Scholar] [CrossRef]

- Hilson, G.; Maconachie, R. Artisanal and small-scale mining and the Sustainable Development Goals: Opportunities and new directions for sub-Saharan Africa. Geoforum 2020, 111, 125–141. [Google Scholar] [CrossRef]

- Meller, P.; Meller, A. La Empresa Nacional de Minería (ENAMI) de Chile: Modelo y Buenas Prácticas para Promover la Sostenibilidad de la Minería Pequeña y Artesanal en la Región Andina; Documentos de Proyectos (LC/TS.2021/63); Comisión Económica para América Latina y el Caribe (CEPAL): Santiago, Chile, 2021; Available online: https://minsus.net/Media-Publicaciones/la-empresa-nacional-de-mineria-enami-de-chile-modelo-y-buenas-practicas-para-promover-la-sostenibilidad-de-la-mineria-pequena-y-artesanal-en-la-region-andina/ (accessed on 15 September 2025).

- Atienza, M.; Scholvin, S.; Irarrázaval, F.; Arias-Loyola, M. Formalization beyond legalization: ENAMI and the promotion of small-scale mining in Chile. J. Rural Stud. 2023, 98, 123–133. [Google Scholar] [CrossRef]

- O’Faircheallaigh, C.; Corbett, T. Understanding and improving policy and regulatory responses to artisanal and small scale mining. Extr. Ind. Soc. 2016, 3, 961–971. [Google Scholar] [CrossRef]

- Brazilian Mining Code. Código de Minas (Decree-Law No. 227/1967). 1967. Available online: https://www.planalto.gov.br/ccivil_03/decreto-lei/del0227.htm (accessed on 15 September 2025).

- Landin, M.; Murgi, R. Business Opportunities in the Mining Sector in Brazil. Suomi Ulkomailla-Sivustot. 2024. Available online: https://finlandabroad.fi/web/bra/ajankohtaista/-/asset_publisher/TV8iYvdcF3tq/content/business-opportunities-in-the-mining-sector-in-brazil/384951 (accessed on 15 September 2025).

- Mallett, A.; França, E.L.B.; Alves, Í.; Mills, L. Environmental impacts of mining in Brazil and the environmental licensing process: Changes needed for changing times? Extr. Ind. Soc. 2021, 8, 100952. [Google Scholar] [CrossRef]

- Monteiro, N.B.R.; Bezerra, A.K.L.; Moita Neto, J.M.; Silva, E.A.D. Mining law: In search of sustainable mining. Sustainability 2021, 13, 867. [Google Scholar] [CrossRef]

- U.S. Geological Survey. Mineral Commodity Summaries 2025; U.S. Geological Survey: Reston, VA, USA, 2025. [CrossRef]

- Visual Capitalist. Charted: Global Gold Production by Region. Visual Capitalist, 12 February 2025. Available online: https://www.visualcapitalist.com/charted-global-gold-production-by-region/ (accessed on 15 September 2025).

- World Gold Council. Gold Mine Production by Country. Goldhub. 2025. Available online: https://www.gold.org/goldhub/data/gold-production-by-country (accessed on 15 September 2025).

- The World Bank. The World Bank in Brazil. World Bank. 2024. Available online: https://www.worldbank.org/en/country/brazil/overview#1 (accessed on 15 September 2025).

- World Gold Council. Gold Demand Trends 2023: Brazil; World Gold Council: London, UK, 2023; Available online: https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2023 (accessed on 15 September 2025).

- Artisanalmining.org. ASM Inventory. Artisanalmining.Org. 2022. Available online: https://artisanalmining.org/Inventory/ (accessed on 15 September 2025).

- Castilhos, Z.; Borges, L. A picture of artisanal and small-scale gold mining (ASGM) in Brazil and its mercury emissions and releases. Environ. Geochem. Health 2024, 46, 101. [Google Scholar] [CrossRef]

- Rodrigues, L.A. Brazil’s journey against illegal mining. Braz. Polit. Sci. Rev. 2025, 19, e0006. [Google Scholar] [CrossRef]

- Adler Miserendino, R.; Guimarães, J.R.D.; Schudel, G.; Ghosh, S.; Godoy, J.M.; Silbergeld, E.K.; Lees, P.S.J.; Bergquist, B.A. Mercury pollution in Amapá, Brazil: Mercury amalgamation in artisanal and small-scale gold mining or land-cover and land-use changes? ACS Earth Space Chem. 2018, 2, 441–450. [Google Scholar] [CrossRef]

- Maisonnave, F. Mercury Exposure Widespread Among Yanomami Tribe in Amazon, Report Finds. Washington Post, 4 April 2024. Available online: https://www.washingtonpost.com/world/2024/04/04/amazon-mercury-gold-mining-yanomami-brazil-indigenous/18447918-f2ac-11ee-a4c9-88e569a98b58_story.html (accessed on 15 September 2025).

- The World Bank. Regional Collaboration to Address the Impacts of Mercury Pollution in the Amazon. World Bank. 2023. Available online: https://www.worldbank.org/en/news/feature/2023/10/27/colaboraci-n-regional-para-abordar-los-impactos-de-la-contaminaci-n-por-mercurio-en-la-amazon-a (accessed on 15 September 2025).

- NAP Mineração/USP. Project ASGM Sustainability in Peixoto. 2020. Available online: https://www.delvedatabase.org/uploads/resources/Final-report-ASGM-Sustainability-in-Peixoto.pdf (accessed on 15 September 2025).

- UN Environment. Global Mercury Assessment. 2024. Available online: https://www.unep.org/topics/chemicals-and-pollution-action/pollution-and-health/heavy-metals/mercury/global-mercury-2 (accessed on 15 September 2025).

- Araujo, C.H.X.; De Tomi, G. Reframing small-scale gold mining cooperatives: Evidence from Brazilian Amazon. Extr. Ind. Soc. 2025, 24, 101728. [Google Scholar] [CrossRef]

- Ministerio de Minas y Energía. Estructura del Sector [Sector Structure]. Colombia Potencia de la Vida. 2025. Available online: https://www.minenergia.gov.co/es/ministerio/estructura-organizacional/estructura-del-sector/ (accessed on 15 September 2025).

- Prieto, R.G.; Guatame, C.L.; Cárdenas, S.C. Recursos Minerales de Colombia [Mineral Resources of Colombia]; Servicio Geológico Colombiano: Bogotá, Colombia, 2019. [CrossRef]

- Rochlin, J. Informal gold miners, security and development in Colombia: Charting the way forward. Extr. Ind. Soc. 2018, 5, 330–339. [Google Scholar] [CrossRef]

- Veiga, M.M.; Restrepo-Baena, O.J.; De Tomi, G. Coexistence of artisanal gold mining with companies in Latin America. Extr. Ind. Soc. 2022, 12, 101177. [Google Scholar] [CrossRef]

- Restrepo-Baena, O.J.; Pérez-Zapata, S.; Gamarra, M.M.; Tobón, J.I.; Viana, G. Methodology to determine the associative potential of small-scale mining communities. Mining 2025, 5, 46. [Google Scholar] [CrossRef]

- U.S. Geological Survey. Mineral Commodity Summaries, January 2025 (Gold); U.S. Department of the Interior: Reston, VA, USA, 2025. Available online: https://pubs.usgs.gov/periodicals/mcs2025/mcs2025-gold.pdf (accessed on 15 September 2025).

- Gonzalez, G.L.; Carrasco Rincon, E.; Herrera Ospina, F.A.; Sanchez Delgado, S.F.; Cuadrado Castañeda, S. Estudio Sobre las Dinámicas, Ofertas, Demanda e Intermediación de Oro [Study on the Demand and Intermediation of Gold]; UPME: Bogotá, Colombia, 2023. [Google Scholar]

- UPME. Oro [Gold]. Sistema de Información Minero Colombiano. 2024. Available online: https://www1.upme.gov.co/simco/Cifras-Sectoriales/Paginas/oro.aspx (accessed on 15 September 2025).

- World Gold Council. Gold Demand Trends 2023: Colombia; World Gold Council: London, UK, 2023; Available online: https://www.gold.org/goldhub/research/gold-demand-trends (accessed on 15 September 2025).

- Asociación Colombiana de Minería. Minería en Cifras 2023 [Mining in Figures 2023]. 2023. Available online: https://acmineria.com.co/sitio/wp-content/uploads/2023/09/ACM-MineriaEnCifras-2023-06Sep.pdf (accessed on 15 September 2025).

- Mestanza-Ramón, C.; Mora-Silva, D.; D’orio, G. Artisanal and small-scale gold mining (ASGM): Management and socioenvironmental impacts in the Northern Amazon of Ecuador. Sustainability 2022, 14, 6854. [Google Scholar] [CrossRef]

- Bustamante, R.B.; Bustamante, C. Ecuador: Law and Practice. Chambers and Partners Mining. 2024. Available online: https://practiceguides.chambers.com/practice-guides/mining-2025/ecuador (accessed on 15 September 2025).

- Mestanza-Ramón, C.; Ordoñez-Alcivar, R.; Arguello-Guadalupe, C.; Carrera-Silva, K.; D’orio, G.; Straface, S. History, socioeconomic problems and environmental impacts of gold mining in the Andean region of Ecuador. Int. J. Environ. Res. Public Health 2022, 19, 1190. [Google Scholar] [CrossRef]

- World Gold Council. Global Mine Production. World Gold Council. 2023. Available online: https://www.gold.org/goldhub/data/gold-production-by-country#from-login=1 (accessed on 15 September 2025).

- Banco Central del Ecuador. Informe de Evolución de la Economía Ecuatoriana en 2023 y Perspectivas 2024 [Report on the Evolution of the Ecuadorian Economy in 2023 and Prospects for 2024]; Banco Central del Ecuador: Quito, Ecuador, 2024; Available online: https://contenido.bce.fin.ec/documentos/Administracion/EvolEconEcu_2023pers2024.pdf (accessed on 15 September 2025).

- Programa de las Naciones Unidas para el Desarrollo (PNUD). Análisis de Escenarios Focalizados: La Minería Artesanal y de Pequeña Escala (MAPE) Responsable en Ecuador; PNUD: Quito, Ecuador, 2021; Available online: https://files.acquia.undp.org/public/migration/ec/TSA-FINAL-2021-pnud-ec.pdf (accessed on 15 September 2025).

- Ministerio del Ambiente (AGC/GEF/UNIDO). Línea Base Nacional para la Minería Artesanal y en Pequeña Escala de oro en Ecuador, Conforme la Convención de Minamata Sobre Mercurio; GEF/UNIDO: Vienna, Austria, 2020. Available online: https://www.ambiente.gob.ec/wp-content/uploads/downloads/2020/06/NAP-Inventario-de-Mercurio-Ecuador.pdf (accessed on 15 September 2025).

- International Trade Administration. Ecuador—Country Commercial Guide; International Trade Administration: Washington, DC, USA, 2024. Available online: https://www.trade.gov/country-commercial-guides/ecuador-mining (accessed on 15 September 2025).

- Secretaría Nacional de Planificación. Plan de Desarrollo para el Nuevo Ecuador 2024–2025 [Development Plan for the New Ecuador 2024–2025]; Secretaría Nacional de Planificación: Quito, Ecuador, 2024; Available online: https://www.planificacion.gob.ec/plan-de-desarrollo-para-el-nuevo-ecuador-2024-2025/# (accessed on 15 September 2025).

- Cámara de Minería del Ecuador (CME). Cifras Récord en Exportaciones Mineras del 2023 Alcanzan los USD 3.324 Millones [Record Mining Exports Figures for 2023 Reach USD 3,324 Million]. CME. 11 March 2024. Available online: https://cme.org.ec/noticias/cifras-record-en-exportaciones-mineras-del-2023-alcanzan-los-usd-3-324-millones-2/ (accessed on 15 September 2025).

- Adler Miserendino, R.; Bergquist, B.A.; Adler, S.E.; Guimarães, J.R.D.; Lees, P.S.J.; Niquen, W.; Velasquez-López, P.C.; Veiga, M.M. Challenges to measuring, monitoring, and addressing the cumulative impacts of artisanal and small-scale gold mining in Ecuador. Resour. Policy 2013, 38, 713–722. [Google Scholar] [CrossRef]

- Gonçalves, A.O.; Marshall, B.G.; Kaplan, R.J.; Moreno-Chavez, J.; Veiga, M.M. Evidence of reduced mercury loss and increased use of cyanidation at gold processing centers in southern Ecuador. J. Clean. Prod. 2017, 165, 836–845. [Google Scholar] [CrossRef]

- Instituto de Investigación Geológico y Energético. Un Acuerdo Mundial para Proteger la Salud y el Ambiente Frente al Mercurio [A Global Agreement to Protect Health and Environment from Mercury]. El Nuevo Ecuad. 2020. Available online: https://www.geoenergia.gob.ec/un-acuerdo-mundial-para-proteger-la-salud-y-el-ambiente-frente-al-mercurio/# (accessed on 15 September 2025).

- Ministry of Environment of Ecuador. Minamata Convention Secretariat. National Action Plan—Ecuador (May 2020). 2020. Available online: https://minamataconvention.org/sites/default/files/documents/national_action_plan/NAP-Ecuador-May2020-EN.pdf (accessed on 15 September 2025).

- Banco Central del Ecuador. Informe de Rendición de Cuentas 2022; Banco Central del Ecuador: Quito, Ecuador, 2022; Available online: https://www.bce.fin.ec/storage/BCE/rendicion_cuentas/2022/Informe-Rendicion-Cuentas2022-JPRM-BCE.pdf (accessed on 15 September 2025).

- Banco Central del Ecuador. Informe Final de Rendición de Cuentas 2024; Banco Central del Ecuador: Quito, Ecuador, 2024; Available online: https://www.bce.fin.ec/storage/BCE/rendicion_cuentas/2024/Informe-final-Rendicion-Cuentas-2024-JPRM-BCE.pdf (accessed on 15 September 2025).

- Thomas, M.J.; Veiga, M.M.; Marshall, B.G.; Dunbar, W.S. Artisanal gold supply chain: Measures from the Ecuadorian Government. Resour. Policy 2019, 64, 101505. [Google Scholar] [CrossRef]

- CEIC Data. Peru—Gold Production. 2025. Available online: https://www.ceicdata.com/en/indicator/peru/gold-production (accessed on 15 September 2025).

- Ministerio de Energía y Minas. Mining Policy. Plataforma Digital Única del Estado Peruano. 2024. Available online: https://mineria.minem.gob.pe/en/institucional/mining-policy/ (accessed on 15 September 2025).

- Ministerio de Energía y Minas. Peru’s Mining & Metals Investment Guide 2017/2018; Ministerio de Energía y Minas: Lima, Peru, 2017.

- Ministerio de Energía y Minas. Entidades del Estado Peruano [Peruvian State Entities]. Plataforma Digital Unica del Estado Peruano. 2024. Available online: https://www.minem.gob.pe/_detalle.php?idSector=10&idTitular=268&idMenu=sub266&idCateg=222 (accessed on 15 September 2025).

- Ministerio de Energía y Minas. Boletín Estadístico Minero [Mining Statistical Bulletin]; Ministerio de Energía y Minas: Lima, Peru, 2023. Available online: https://cdn.www.gob.pe/uploads/document/file/5847456/5185432-bem-dic2023.pdf?v=1707938622 (accessed on 15 September 2025).

- Ministerio de Energía y Minas (MINEM). Anuario Minero 2024 [Mining Yearbook 2024]; Ministerio de Energía y Minas: Lima, Peru, 2023. Available online: https://www.gob.pe/institucion/minem/informes-publicaciones/6827926-anuario-minero-2024 (accessed on 15 September 2025).

- Delve Database. 2019 Country Profile: Peru. Delve ASM Database 2019. Available online: https://www.delvedatabase.org/uploads/resources/2019-Country-Profile-Peru_Final.pdf (accessed on 15 September 2025).

- Aranoglu, F.; Flamand, T.; Duzgun, S. Analysis of artisanal and small-scale gold mining in Peru under climate impacts using system dynamics modeling. Sustainability 2022, 14, 7390. [Google Scholar] [CrossRef]

- Chacon, T. Formalizar a 80,000 Mineros del Reinfo Incrementaría en 1% el PBI Peruano [Formalizing 80,000 Reinfo Miners Would Increase Peruvian GDP by 1%]. Rumbo Minero. 2022. Available online: https://www.rumbominero.com/peru/noticias/mineria/formalizar-mineros-reinfo-pbi-peru/ (accessed on 15 September 2025).

- Pang, Q.; Gu, J.; Wang, H.; Zhang, Y. Global health impact of atmospheric mercury emissions from artisanal and small-scale gold mining. iScience 2022, 25, 104881. [Google Scholar] [CrossRef]

- Veiga, M.M.; Anene, N.C.; Silva, E.M. Four decades of efforts to reduce or eliminate mercury pollution in artisanal gold mining. Minerals 2025, 15, 376. [Google Scholar] [CrossRef]

- Martinez, G.; Smith, N.M.; Malone, A. “I am formal, what comes next?”: A proposed framework for achieving sustainable artisanal and small-scale mining formalization in Peru. Extr. Ind. Soc. 2023, 13, 101227. [Google Scholar] [CrossRef]

- Smith, N.M. “Our gold is dirty, but we want to improve”: Challenges to addressing mercury use in artisanal and small-scale gold mining in Peru. J. Clean. Prod. 2019, 222, 646–654. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).