Policy Coordination and Green Transformation of STAR Market Enterprises Under “Dual Carbon” Goals

Abstract

1. Introduction

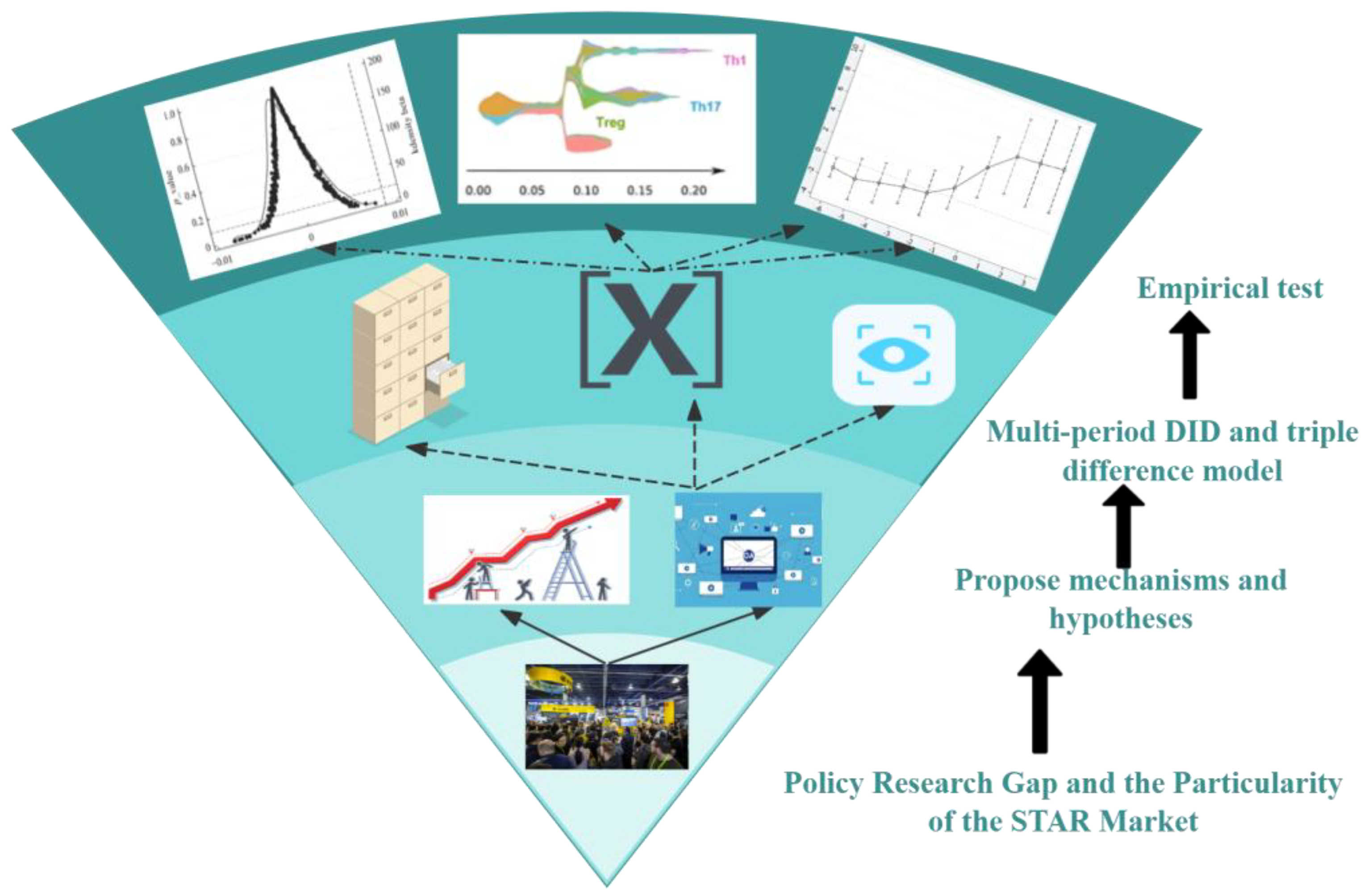

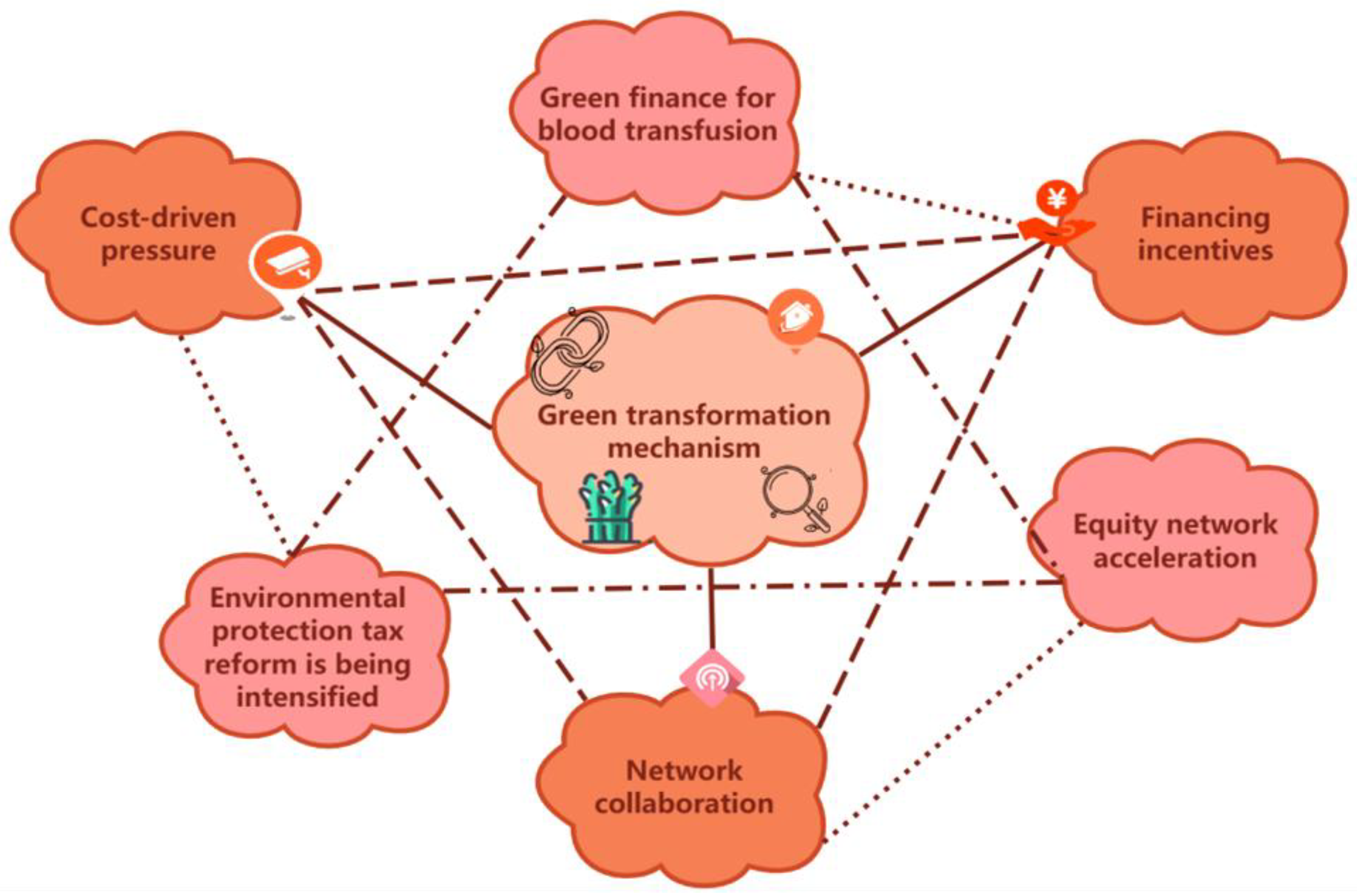

2. Green Transformation Framework

2.1. Theoretical Framework

2.2. Hypotheses

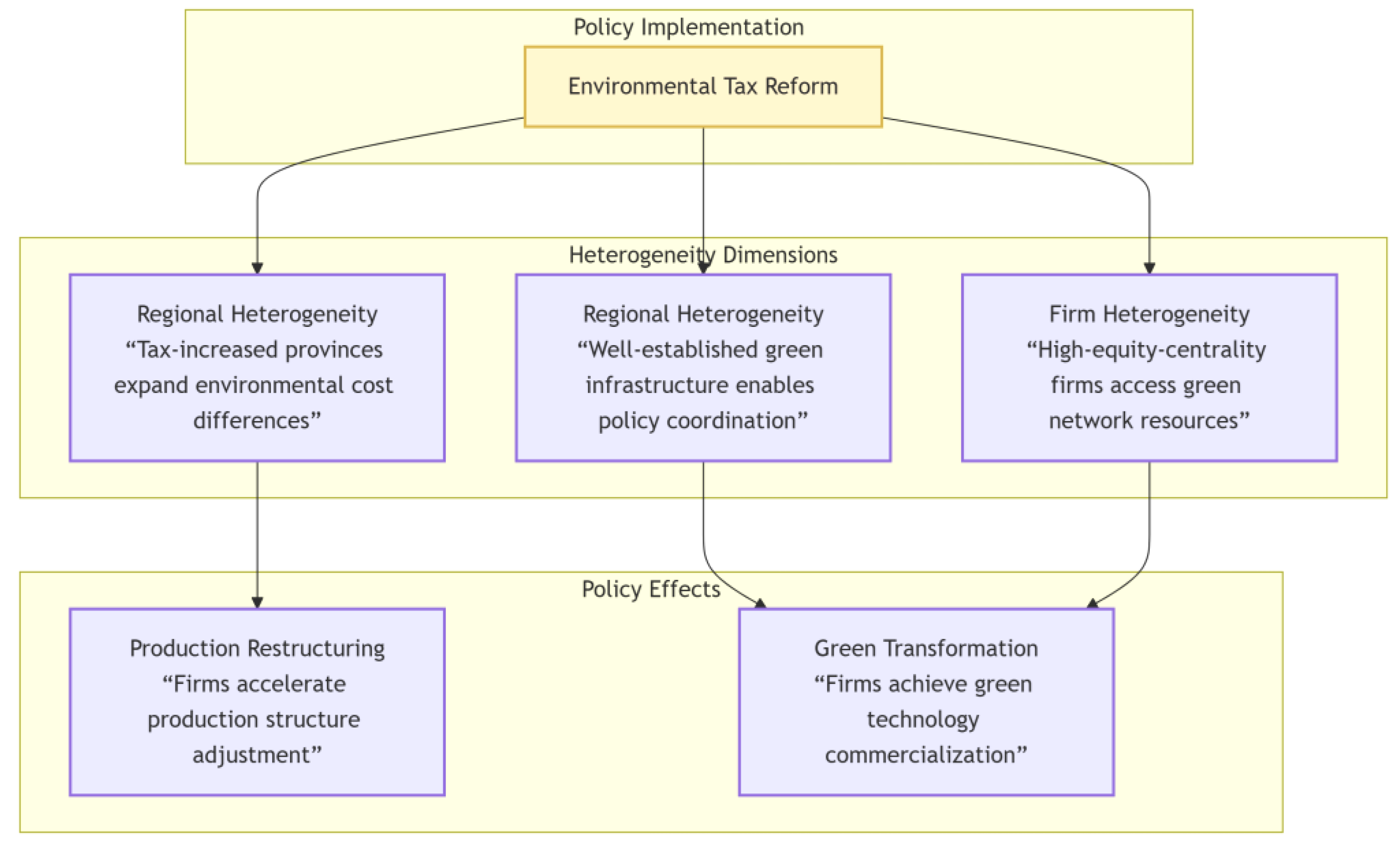

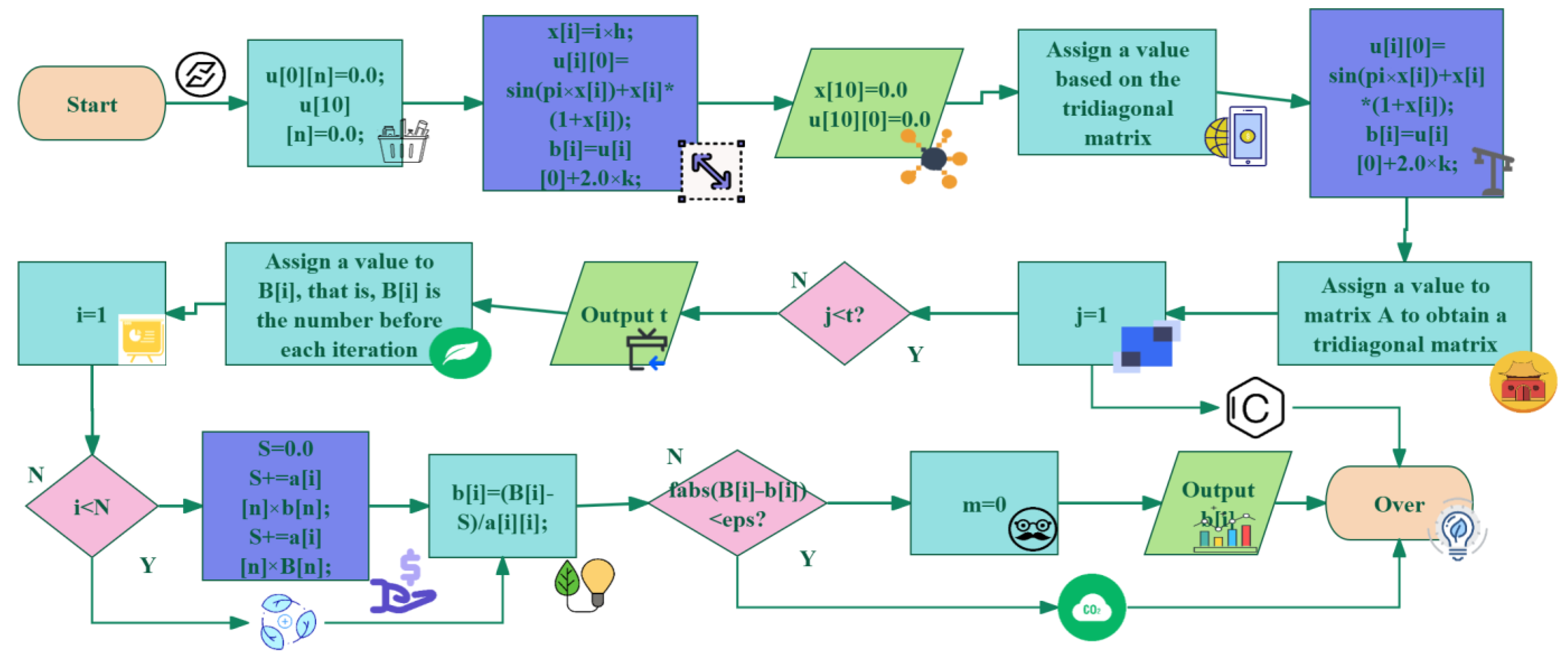

3. Multi-Period DID Model Design

3.1. Data Sources

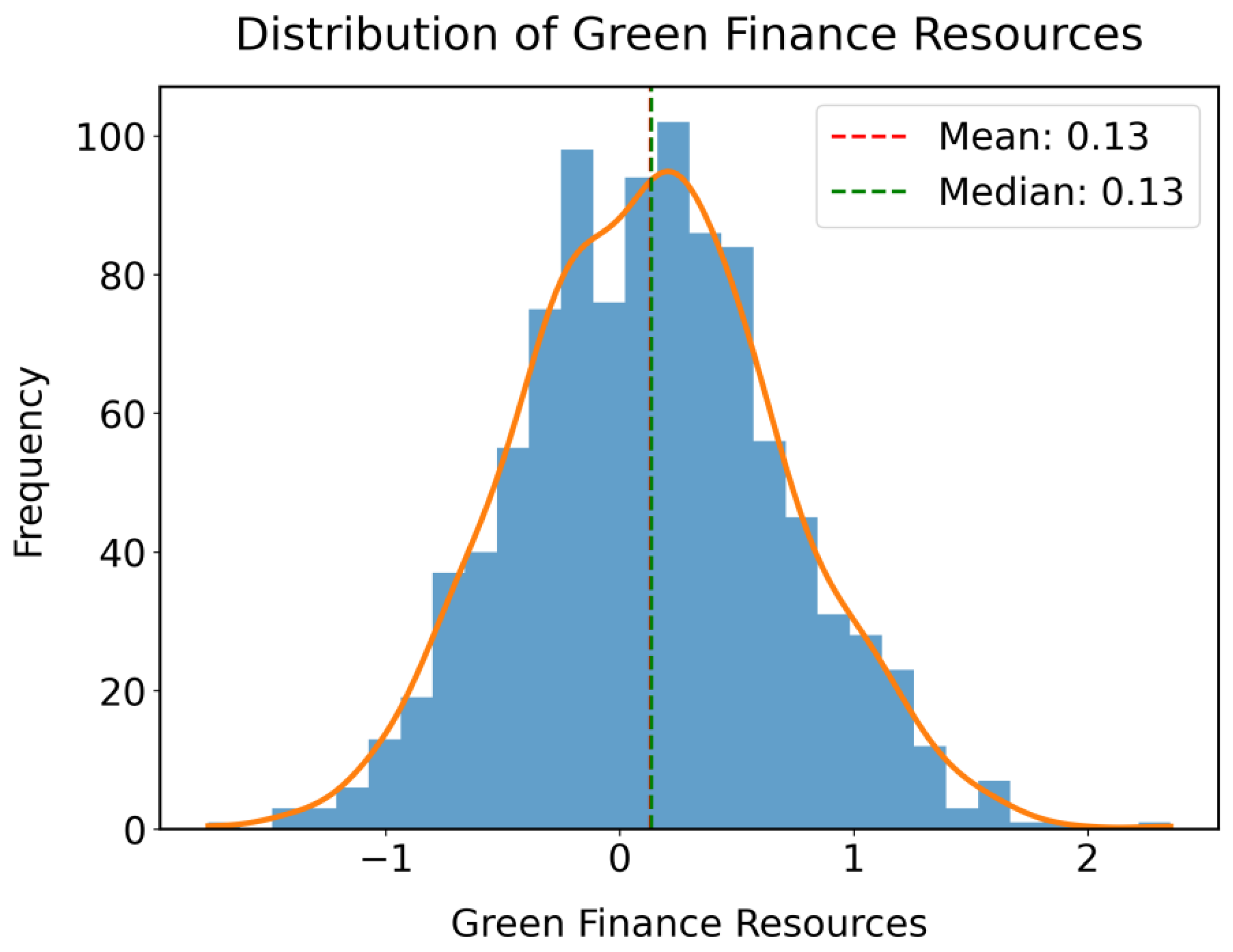

3.2. Variable Selection

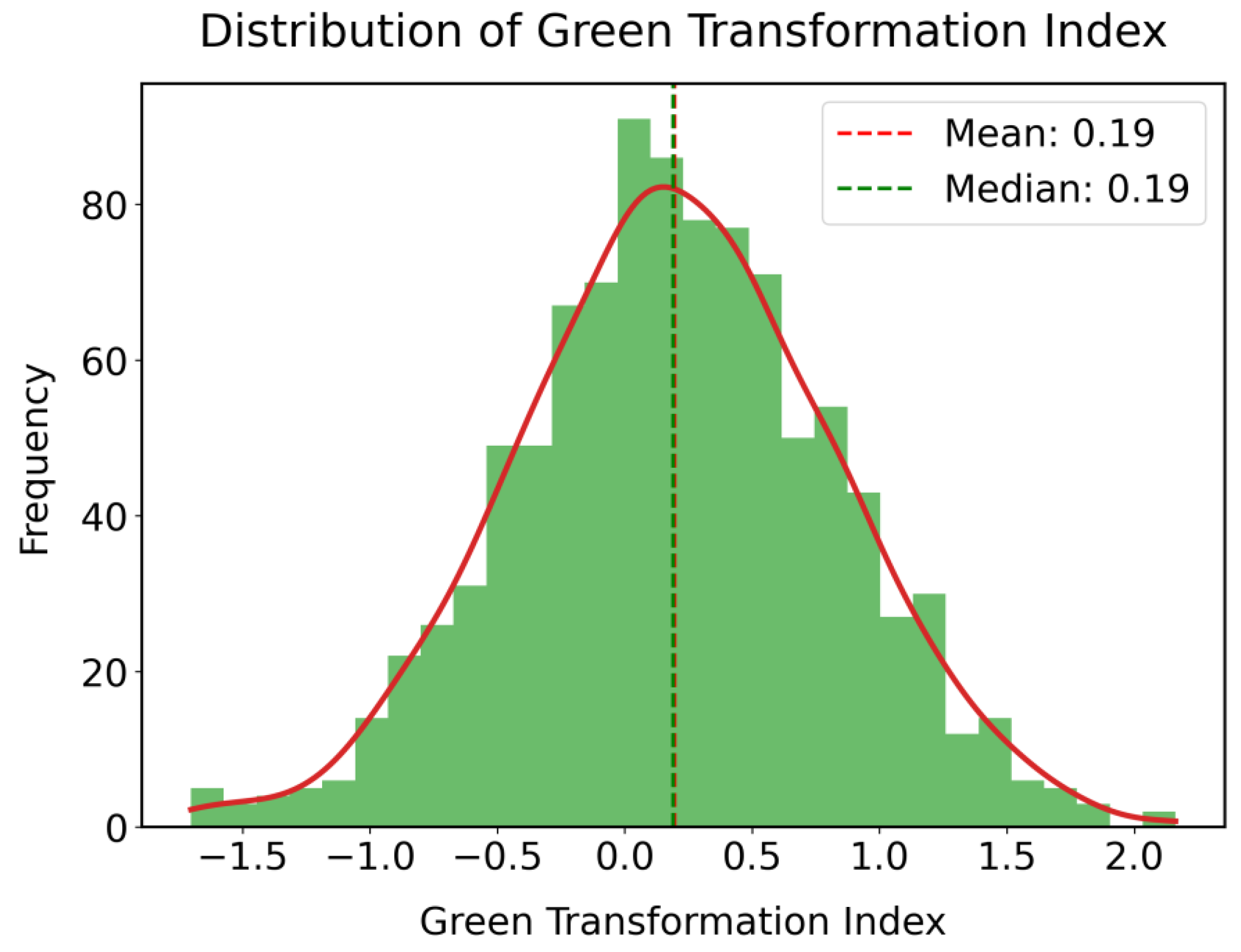

3.2.1. Explained Variable

3.2.2. Core Explanatory Variables

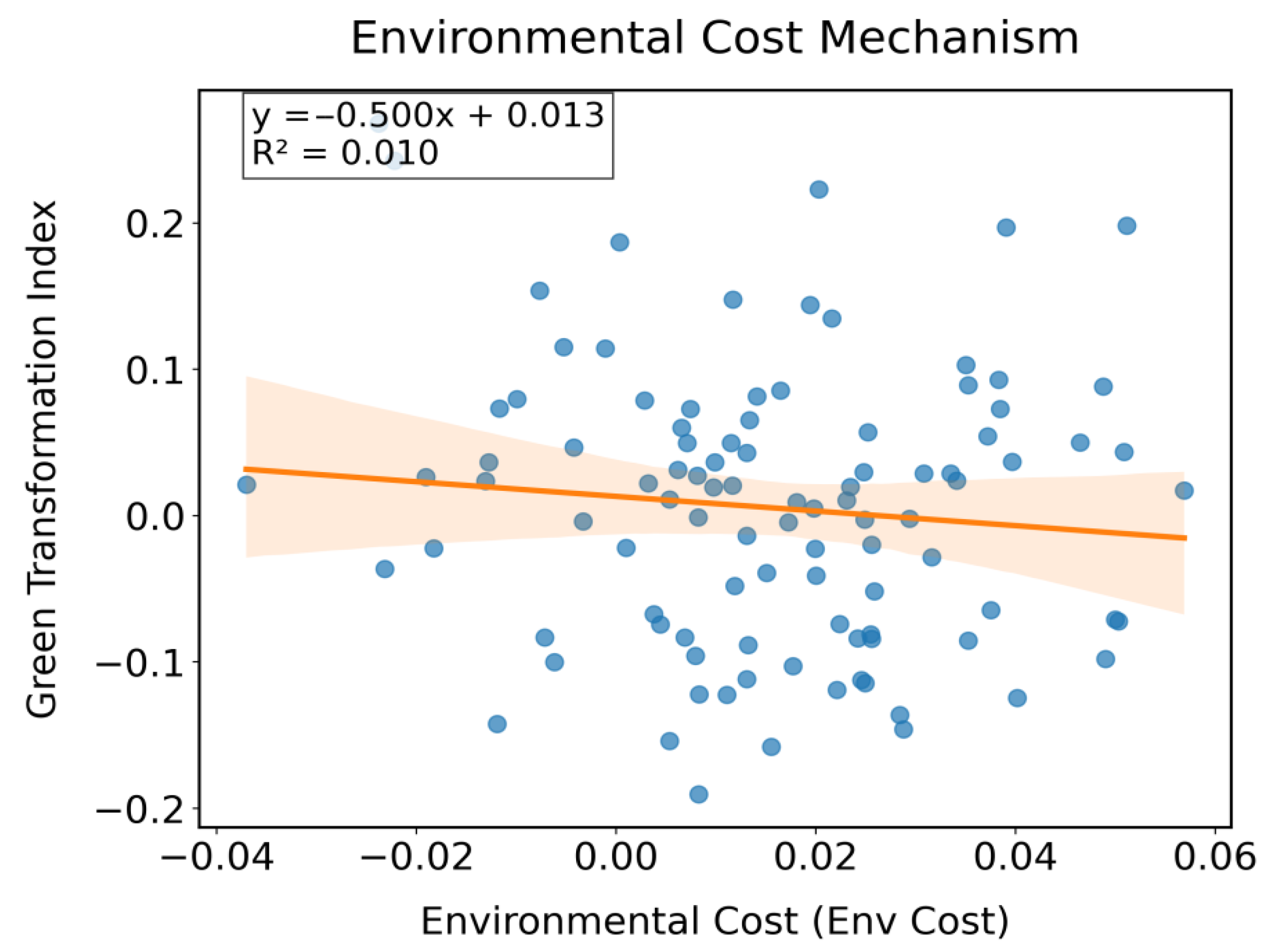

3.2.3. Mediating Variables

3.2.4. Control Variables

3.3. Model Construction

4. Emission Reduction Effect Test

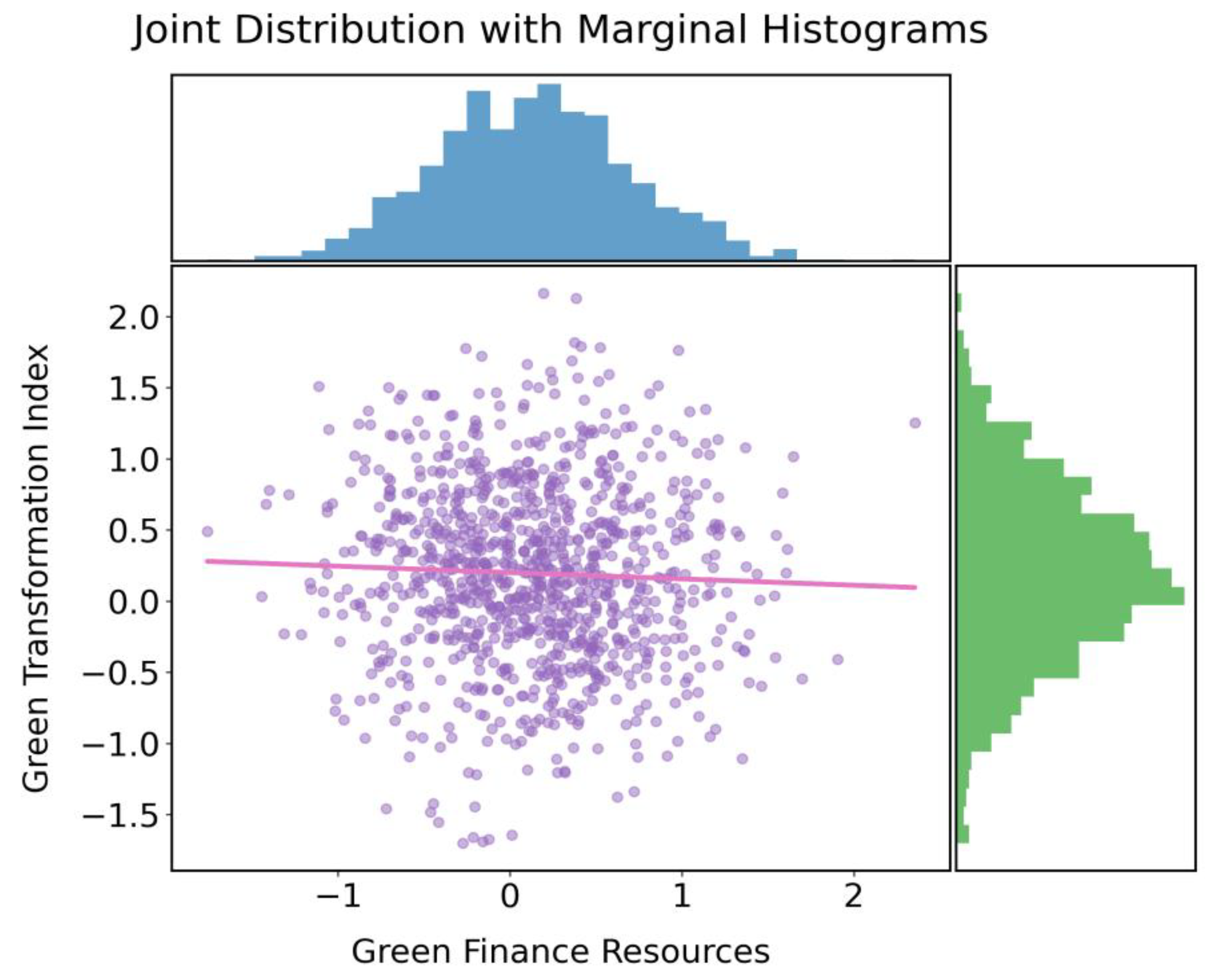

4.1. Correlation Analysis

4.2. Benchmark Regression Results

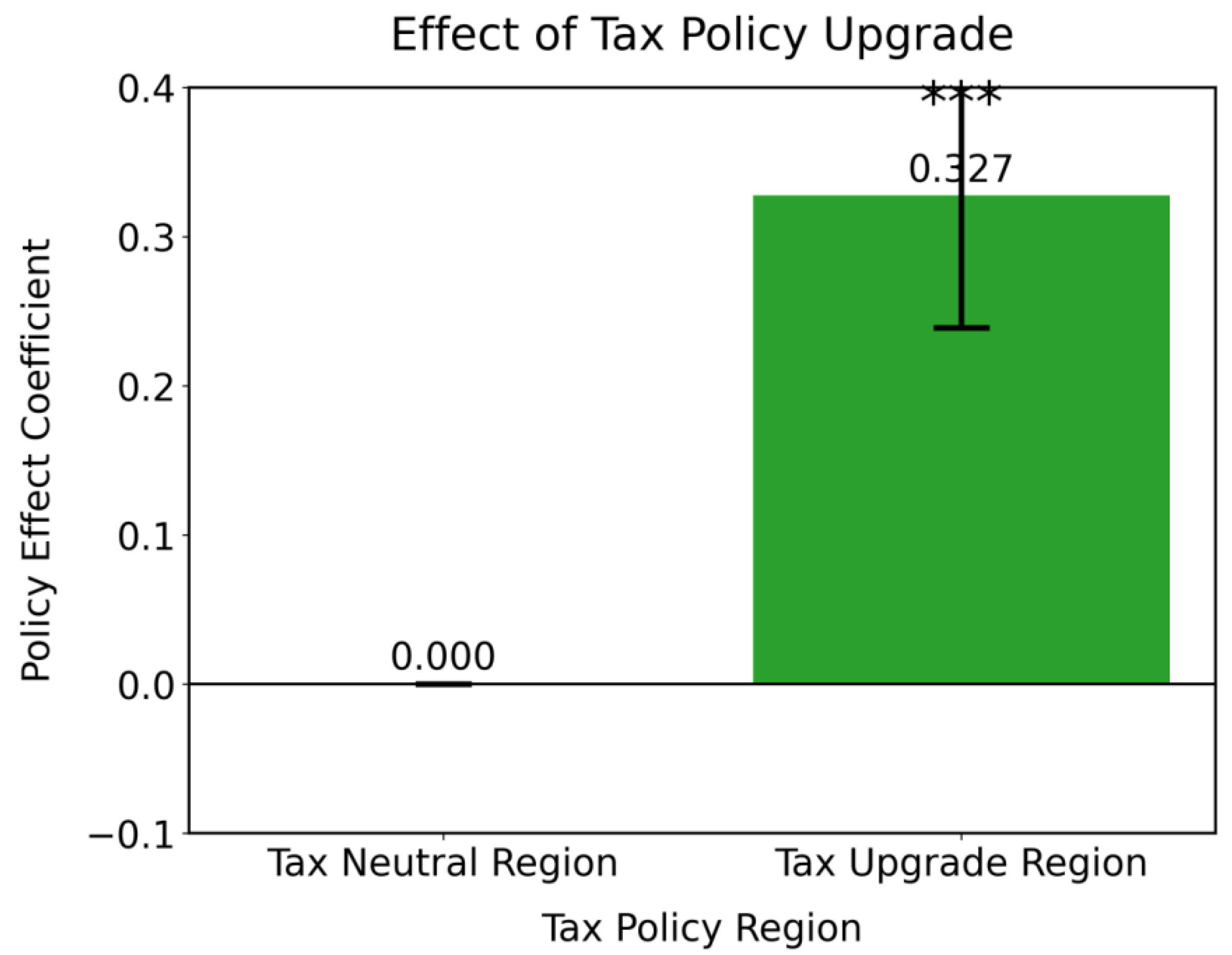

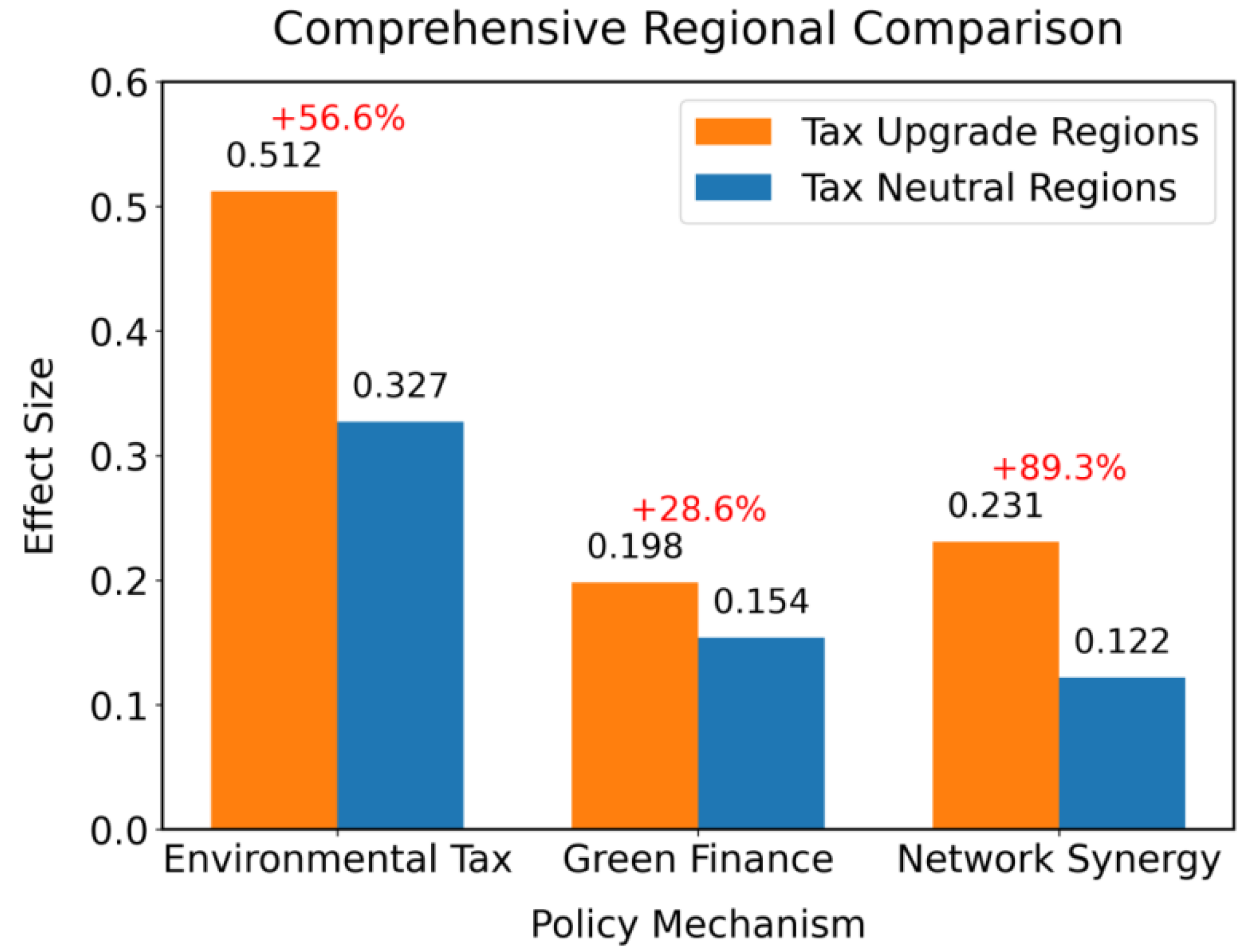

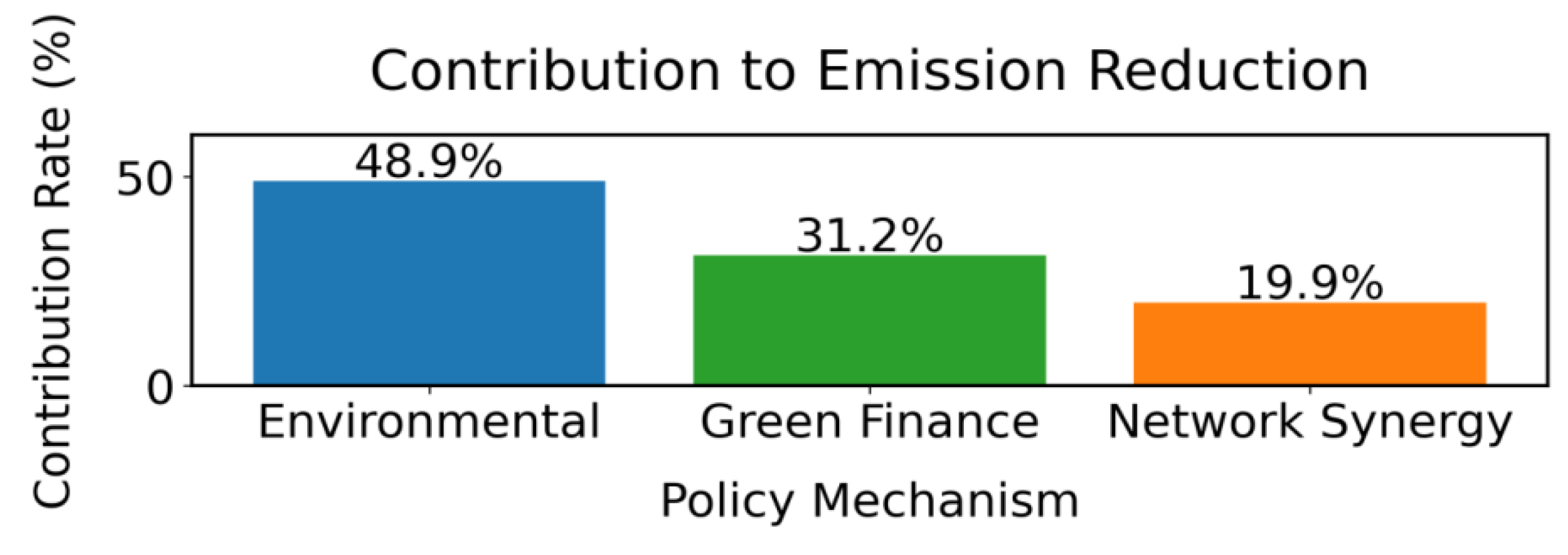

4.3. Decomposition of Emission Reduction Effect

4.4. Robustness Test

5. Discussion, Conclusions, and Policy Implications

5.1. Discussion

5.2. Conclusion and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Dong, X.; Meng, S.; Xu, L.; Xin, Y. Digital transformation and corporate green innovation forms: Evidence from China. J. Environ. Plan. Manag. 2025, 68, 2644–2672. [Google Scholar] [CrossRef]

- Li, N.; Dong, S.; Zhang, Y. Can mixed-ownership reform in state-owned enterprises promote urban green transformation? Evidence from Chinese cities. J. Clean. Prod. 2025, 519, 145923. [Google Scholar] [CrossRef]

- Chen, Y.; Huang, X.; Liu, C. Can AI computing power promote the green transformation of energy enterprises? Evidence from the nonlinear moderating effect of public environmental awareness. J. Environ. Manag. 2025, 391, 126455. [Google Scholar] [CrossRef] [PubMed]

- Niu, J.; Qiang, M.; Chen, M. Can the Management’s green cognition promote the Enterprise’s green Transformation? Based on the perspective of carbon emissions. Int. Rev. Econ. Financ. 2025, 102, 104290. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhang, L.; Li, S. Green game among government, enterprises, and the public: A study on the dynamics of enterprise green transformation from the perspective of Tripartite evolution. Sustain. Futures 2025, 10, 100894. [Google Scholar] [CrossRef]

- Wang, Y.; Chai, Z.; Zhu, X. The route towards green transformation: Mechanism of clean production enabled by enterprise digitization. Energy Rep. 2025, 14, 386–400. [Google Scholar] [CrossRef]

- Qian, S.; Yang, Z.; Fang, X. Bank fintech and corporate green transformation quality improvement: Based on greenwashing governance perspective. Econ. Anal. Policy 2025, 87, 401–423. [Google Scholar] [CrossRef]

- Niu, B.; Xue, X.; Sai, Y.; Xu, J. Impact of digitalization inputs on CO2 emissions in China’s construction industry under the “Dual Carbon” goal. Energy Build. 2025, 344, 116014. [Google Scholar] [CrossRef]

- Li, S. Environmental regulation policy, firm endogenous capability, and green technological innovation: Evidence from a multi-period DID study in heavily polluting industries. J. Environ. Manag. 2025, 391, 126436. [Google Scholar] [CrossRef]

- Sun, L.; Zhou, H.; Huang, F. How the introduction of the “Dual Carbon” targets drives ESG disclosure in manufacturing enterprises? Int. Rev. Econ. Financ. 2025, 101, 104242. [Google Scholar] [CrossRef]

- Yan, A.; Liu, Y.; Lin, C.; Gu, W.; Yin, Q.; Fu, X. How to promote green transformation of mariculture industry under the influence of financial constraints? A policy simulation based on peer incentive perspective. Mar. Pollut. Bull. 2025, 219, 118313. [Google Scholar] [CrossRef]

- Ali, S.; Yongzhi, M.; Xin, C.; Din, J.; Salman, M. Revolutionizing energy and logistics: A multilayered strategy for optimizing distribution networks and achieving dual carbon goals. Clean Technol. Environ. Policy 2025, 1–23, prepublish. [Google Scholar] [CrossRef]

- Li, C.; Zhang, S. Do innovation policies and fintech create synergistic effects for the sustainability of urban green innovation? An Empirical Test Based on a Triple Difference Approach. Sustain. Futures 2025, 9, 100696. [Google Scholar] [CrossRef]

- Zuo, J.; Wan, K.; Wu, J.; Tan, T. Design and implementation of industrial energy comprehensive control platform under the background of dual carbon. J. Phys. Conf. Ser. 2025, 3018, 012024. [Google Scholar] [CrossRef]

- Guo, Y.; Yang, Y.; He, L. Analysis of Energy Storage Technology Application Planning Under the “Dual Carbon” Goals. Hill Publ. 2025, 8, 39–43. [Google Scholar]

- Shi, J.-L.; Zhu, C.-S.; Qu, Y.; Zhou, Y.; Wang, N.; Wang, L.-Y.; Li, Q.; Wang, Q.-Y.; Liu, S.-X.; Cao, J.-J. Health risk assessment of source-specific elemental carbon (using dual carbon isotopes) and heavy metals in the Tibetan Plateau. J. Hazard. Mater. 2025, 492, 138094. [Google Scholar] [CrossRef]

- Zhang, C. The Impact of Large Shareholders’ Lock-up Expiration on Stock Prices: An Empirical Study Based on the STAR Market. Acad. J. Bus. Manag. 2025, 7, 369–401. [Google Scholar] [CrossRef]

- Jiang, C.; Liu, B.; He, W. The cross-board spillover effect of innovation information: Establishment of the Star Market and Main Board analyst forecasts. China J. Account. Res. 2024, 18, 100402–100408. [Google Scholar] [CrossRef]

- Liao, S. Analysis of the Path to Enhancing Green Electricity Consumption Capacity in the “Dual Carbon” Era. Forum Res. Innov. Manag. 2025, 3, 546–757. [Google Scholar]

- Wu, Z.; Zhang, D. HealthDID: An efficient and authorizable multi-party privacy-preserving EMR sharing system based on DID. Comput. Stand. Interfaces 2025, 93, 103967. [Google Scholar] [CrossRef]

- Benevit, B.; da Trindade, C.S.; de Melo Junior, R.B.; Uhr, D.D.A.P.; Uhr, J.G.Z. Deforestation policies in the Brazilian Legal Amazon: An analysis of the PPCDAm using the triple difference method. For. Econ. Rev. 2024, 6, 122–143. [Google Scholar] [CrossRef]

- Sasaki, Y. On “Imputation of Counterfactual Outcomes When the Errors Are Predictable”: Viewing the PUP as the DID and the LDV. J. Bus. Econ. Stat. 2024, 42, 1133–1136. [Google Scholar] [CrossRef]

- Yang, B.; Duan, J.; Liu, Z.; Jiang, L. Exploring Sustainable Development of New Power Systems under Dual Carbon Goals: Control, Optimization, and Forecasting. Energies 2024, 17, 3909. [Google Scholar] [CrossRef]

- Cheng, X.; Ye, K.; Du, A.M.; Bao, Z.; Chlomou, G. Dual carbon goals and renewable energy innovations. Res. Int. Bus. Finance 2024, 70 Pt B, 102406–102486. [Google Scholar] [CrossRef]

- Zhang, S.; Li, Y.; He, Y.; Liang, R. Do vocal cues matter in information disclosure? Evidence from IPO online roadshows in the SSE STAR market. Int. Rev. Financ. Anal. 2024, 93, 103229–103267. [Google Scholar] [CrossRef]

- Tao, M.; Wen, L.; Sheng, M.S.; Poletti, S. Appraising the role of energy conservation and emission reduction policy for eco-friendly productivity improvements: An entropy-balancing DID approach. Energy Econ. 2024, 132, 107422–107432. [Google Scholar] [CrossRef]

- Peng, X.; Jian, W. Do subsidy increases promote or inhibit innovation? Evidence from Chinese enterprises listed on the SSE STAR Market. Chin. Manag. Stud. 2024, 18, 107–128. [Google Scholar]

- Wu, H.F. Carbon Trading Market and Green Innovation of Enterprises—Based on the Triple Difference Model. J. Risk Anal. Crisis Response 2023, 13, 671–690. [Google Scholar] [CrossRef]

- Yang, B.; Li, Y.; Yao, W.; Jiang, L.; Zhang, C.; Duan, C.; Ren, Y. Optimization and Control of New Power Systems under the Dual Carbon Goals: Key Issues, Advanced Techniques, and Perspectives. Energies 2023, 16, 3904. [Google Scholar] [CrossRef]

- Li, G.Z.; Wu, Y.; Li, K.Y. Technical founders, digital transformation and corporate technological innovation: Empirical evidence from listed companies in China’s STAR market. Int. Entrep. Manag. J. 2023, 20, 3155–3180. [Google Scholar] [CrossRef]

- Huo, X.; Jiang, D.; Qiu, Z.; Yang, S. The impacts of dual carbon goals on asset prices in China. J. Asian Econ. 2022, 83, 101546. [Google Scholar] [CrossRef]

- Wang, G.; Wang, B.; Ye, T.; Wang, C.; Guo, L.; Xiao, J.; Chen, Z. Ultrasonic Ring Array-Based Transient Triplet Differential Photoacoustic Imaging for Strong Background Removal. Front. Mater. 2021, 8, 699433. [Google Scholar] [CrossRef]

- Chen, Q.; Chu, X.; Wang, S.; Zhang, B. A Triple-Difference Approach to Re-Evaluating the Impact of Chinas New Cooperative Medical Scheme on Incidences of Chronic Diseases Among Older Adults in Rural Communities. Risk Manag. Healthc. Policy 2020, 13, 643–659. [Google Scholar] [CrossRef]

- Ridder, A.G.D.; Gehrmann, T.; Glover, E.W.N.; Huss, A.; Pires, J. Triple Differential Dijet Cross Section at the LHC. Phys. Rev. Lett. 2019, 123, 102001. [Google Scholar] [CrossRef]

- Du, Q.; Pan, H.; Liang, S.; Liu, X. Can Green Credit Policies Accelerate the Realization of the Dual Carbon Goal in China? Examination Based on an Endogenous Financial CGE Model. Int. J. Environ. Res. Public Health 2023, 20, 4508. [Google Scholar] [CrossRef]

| Assuming Description | |

|---|---|

| H1 | The environmental tax reform has significantly increased the number of green patents held by enterprises on the Science and Technology Innovation Board |

| H2 | The pilot program of green finance has significantly reduced the financing constraints of enterprises on the Science and Technology Innovation Board and promoted the growth of green revenue |

| H3 | The emission reduction effect in regions with increased tax burden is significantly higher than that in regions with flat tax burden |

| H4 | The centrality of equity network positively moderates the impact of policies on green patents |

| H5 | The direct contribution of environmental tax reform to emission reduction effects is higher than the indirect contribution of green finance |

| Variable Type | Variable | Variable Symbol |

|---|---|---|

| Explained variable | Green transformation | Green transait |

| Core explanatory variable | Policy coordination index | Policy_cordpit |

| time | Postt | |

| High carbon | High carboni | |

| High constraint | High fci | |

| Control variable | Enterprise size | Size |

| Financial leverage | Lev | |

| Return on assets | ROA | |

| Tobin’s Q value | Tobin Q | |

| State control | SOE | |

| Marketization | Market index | |

| Intermediary variable | Environmental costs | Env Costait |

| Green financial resources | Green financeait | |

| Equity centrality | Network ceni |

| Variable Symbol | M | SD | Min | Med | Max |

|---|---|---|---|---|---|

| Green transait | 0.15 | 0.63 | −1.02 | 0.18 | 1 |

| Policy_cordpit | 0.62 | 0.48 | 0 | 1 | 1 |

| Postt | 0.53 | 0.5 | 0 | 1 | 1 |

| High carboni | 0.36 | 0.48 | 0 | 0 | 1 |

| High fci | 0.47 | 0.5 | 0 | 0 | 1 |

| Size | 22.3 | 1.4 | 19.1 | 22.2 | 25.8 |

| Lev | 0.45 | 0.19 | 0.12 | 0.45 | 0.9 |

| ROA | 0.06 | 0.08 | −0.15 | 0.05 | 0.25 |

| Tobin Q | 2.1 | 0.9 | 0.8 | 2 | 4.5 |

| SOE | 0.21 | 0.41 | 0 | 0 | 1 |

| Market index | 7.8 | 2.1 | 3.2 | 7.9 | 10 |

| Env costait | 0.018 | 0.021 | 0.001 | 0.012 | 0.097 |

| Green financeait | 0.12 | 0.58 | −0.89 | 0.05 | 1 |

| Network ceni | 0.21 | 0.14 | 0.03 | 0.19 | 0.67 |

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. Green trans | 1 | |||||||||

| 2. Policy_cordpit | 0.22 | 1 | ||||||||

| 3. Postt | 0.18 | 0.12 | 1 | |||||||

| 4. High carboni | −0.08 | 0.05 | 0.03 | 1 | ||||||

| 5. High fci | −0.17 | −0.09 | −0.05 | 0.11 | 1 | |||||

| 6. Env cost | 0.17 | 0.11 | 0.09 | 0.32 | −0.05 | 1 | ||||

| 7. Green finance | 0.29 | 0.25 | 0.19 | −0.12 | −0.31 | 0.07 | 1 | |||

| 8. Network ceni | 0.27 | 0.18 | 0.14 | −0.07 | −0.19 | 0.13 | 0.22 | 1 | ||

| 9. Size | 0.23 | 0.31 | 0.15 | 0.09 | −0.24 | 0.17 | 0.28 | 0.33 | 1 | |

| 10. Lev | −0.12 | −0.08 | −0.06 | 0.21 | 0.37 | 0.14 | −0.18 | −0.11 | −0.09 | 1 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Policy_cordpit | 0.318 *** (0.075) | 0.372 *** (0.083) | 0.356 *** (0.079) |

| Post | 0.192 ** (0.082) | 0.215 ** (0.091) | 0.204 ** (0.087) |

| Size | 0.041 (0.032) | 0.038 (0.030) | |

| Lev | −0.109 **(0.043) | −0.109 **(0.043) | |

| ROA | 0.285 ** (0.112) | 0.273 ** (0.105) | |

| Tobin Q | 0.064 *** (0.021) | 0.061 *** (0.019) | |

| SOE | −0.093 (0.078) | −0.087 (0.073) | |

| Market index | 0.019 * (0.010) | 0.021 ** (0.009) | |

| Constant | −0.702 *** (0.198) | −0.842 *** (0.214) | −0.816 *** (0.207) |

| Sample size | 3896 | 3896 | 3896 |

| R2 | 0.376 | 0.423 | 0.438 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| High carbon | −0.020592 | ||

| High fc | −0.214 ** (0.096) | ||

| Tax upgrade | 0.327 *** (0.088) | ||

| Size | 0.037 (0.035) | 0.034 (0.033) | 0.041 (0.036) |

| Lev | −0.008118 | −0.007434 | −0.00884 |

| ROA | 0.271 ** (0.119) | 0.263 ** (0.115) | 0.278 ** (0.122) |

| Tobin Q | 0.059 ** (0.024) | 0.062 ** (0.023) | 0.057 ** (0.025) |

| SOE | −0.087 (0.081) | −0.092 (0.079) | −0.083 (0.084) |

| Market index | 0.017 (0.011) | 0.020 * (0.010) | 0.015 (0.012) |

| Constant | −0.796 *** (0.231) | −0.812 *** (0.225) | −0.779 *** (0.238) |

| Sample size | 3896 | 3896 | 3896 |

| R2 | 0.437 | 0.441 | 0.432 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Env cost | 0.182 ** (0.075) | ||

| Green finance | 0.254 *** (0.069) | ||

| Network cen | 0.167 * (0.089) | ||

| Size | 0.043 (0.029) | 0.048 (0.031) | 0.039 (0.027) |

| Lev | −0.006322 | −0.007015 | −0.005555 |

| ROA | 0.293 ** (0.108) | 0.278 ** (0.112) | 0.302 ** (0.104) |

| Tobin Q | 0.067 *** (0.019) | 0.063 *** (0.021) | 0.071 *** (0.018) |

| SOE | −0.101 (0.073) | −0.095 (0.076) | −0.108 (0.071) |

| Market index | 0.021** (0.009) | 0.019 * (0.010) | 0.023 ** (0.008) |

| Constant | −0.873 *** (0.207) | −0.891 *** (0.215) | −0.852 *** (0.201) |

| Sample size | 3896 | 3896 | 3896 |

| R2 | 0.456 | 0.449 | 0.463 |

| Variable | Phase One Coefficient (Standard Error) | Phase Two Coefficient (Standard Error) |

|---|---|---|

| Instrumental variable | 0.218 *** (0.062) | |

| Policy coordination index | 0.127 ** (0.051) | 0.356 *** (0.079) |

| Equity network centrality | 0.184 ** (0.073) | |

| Control variable | YES | YES |

| Sample size | 3896 | 3896 |

| F-value in the first stage | 12.7 |

| Effect Type | Estimate | 95% Confidence Interval | Intermediary Ratio |

|---|---|---|---|

| Total | 0.356 | [0.282, 0.430] | |

| ADE | 0.272 | [0.198, 0.346] | 76.40% |

| ACME | 0.084 | [0.032, 0.136] | 23.60% |

| Variable | Assemble | Raise the Standard | Translation | Contribution Rate |

|---|---|---|---|---|

| Direct environmental tax reform | 0.428 *** (0.092) | 0.512 *** (0.105) | 0.327 ** (0.129) | 48.9 |

| Green finance indirectly | 0.267 *** (0.071) | 0.198 ** (0.083) | 0.154 * (0.081) | 31.2 |

| Network collaborative regulation | 0.185 * (0.098) | 0.231 ** (0.095) | 0.122 (0.104) | 19.9 |

| Marketization index adjustment | 0.117 * (0.063) | 0.142 * (0.075) | 0.089 (0.068) | - |

| Sample size | 3896 | 2143 | 1753 | - |

| R2 | 0.502 | 0.538 | 0.467 | - |

| Variable | Policy Implementation Quarter | Tall | Low | Difference |

|---|---|---|---|---|

| Policy accumulation | 0.112 → 0.429 *** | 0.463 *** (0.101) | 0.298 ** (0.118) | 16.5 |

| Cost push | 0.085 * → 0.203 *** | 0.237 *** (0.087) | 0.158 * (0.092) | 12.3 |

| Financing incentives | 0.062 → 0.184 *** | 0.219 ** (0.095) | 0.131 (0.107) | 9.8 |

| Network collaboration | 0.041 → 0.167 ** | 0.185 * (0.098) | 0.072 (0.112) | 14.7 |

| Moderating effect | −0.098 (0.081) | −0.124 (0.102) | −0.063 (0.091) | |

| Sample size | 3896 | 1952 | 1944 | |

| R2 | 0.486 | 0.521 | 0.452 |

| Variable | Coefficient | Standard Error | P | Sample Size | R2 |

|---|---|---|---|---|---|

| Pre3 | 0.032 | 0.065 | 0.621 | 3896 | 0.489 |

| Pre2 | 0.057 | 0.071 | 0.432 | 3896 | 0.489 |

| Pre1 | 0.089 | 0.073 | 0.214 | 3896 | 0.489 |

| Post1 | 0.112 ** | 0.048 | 0.02 | 3896 | 0.489 |

| Post2 | 0.238 *** | 0.063 | 0.001 | 3896 | 0.489 |

| Post3 | 0.351 *** | 0.085 | 0 | 3896 | 0.489 |

| Post4 | 0.429 *** | 0.092 | 0 | 3896 | 0.489 |

| Size | 0.041 | 0.032 | 0.198 | 3896 | 0.489 |

| Lev | −0.117 * | 0.062 | 0.058 | 3896 | 0.489 |

| Statistical Indicators | False | Real |

|---|---|---|

| Mean value | −0.012 | 0.372 *** |

| Standard deviation | 0.108 | 0.083 |

| Median | −0.008 | 0.369 |

| 1% quantile | −0.314 | |

| 5% quantile | −0.198 | |

| 95% quantile | 0.185 | |

| 99% quantile | 0.284 | |

| Skewness | 0.12 | |

| Kurtosis | 2.85 | |

| P | 0.008 |

| Variable Symbol | Coefficient | Standard Error | p |

|---|---|---|---|

| Green patent | 0.401 *** | 0.088 | p < 0.01 |

| Treat | 0.366 *** | 0.079 | p < 0.01 |

| Post | 0.208 ** | 0.085 | p < 0.05 |

| Tax upgrade | 0.317 *** | 0.076 | p < 0.01 |

| Network cen | 0.167 * | 0.089 | p < 0.10 |

| Size | 0.038 | 0.031 | p = 0.218 |

| Lev | −0.121 * | 0.064 | p < 0.10 |

| ROA | 0.276 ** | 0.11 | p < 0.05 |

| Tobin Q | 0.063 *** | 0.02 | p < 0.01 |

| Market index | 0.018 * | 0.009 | p < 0.10 |

| Constant | −0.804 *** | 0.207 | p < 0.01 |

| Adj.R2 | 0.478 |

| Treatment Method | Policy Coordination Index | Standard Error | Sample Size | p |

|---|---|---|---|---|

| 1% winsorization | 0.356 | 0.079 | 3896 | |

| 0.5% winsorization | 0.348 | 0.077 | 3896 | 0.75 |

| 2% winsorization | 0.362 | 0.081 | 3896 | 0.68 |

| MICE | 0.342 | 0.079 | 3896 | 0.82 |

| Complete case | 0.341 | 0.083 | 3521 | 0.79 |

| Index | This Study | Tradition | Raise the Standard | Translation | High-Tech Internet Enterprise | Low-Internet Enterprise |

|---|---|---|---|---|---|---|

| Directly related to environmental tax reform | 48.9 | 60–70 | 51.2 | 32.7 | ||

| Green finance indirectly | 31.2 | 15 October | 19.8 | 15.4 | ||

| Network collaborative regulation | 19.9 | 5 | 23.1 | 12.2 | 18.5 | 7.2 |

| Policy peak time | 4 | immediately | 3.8 | 4.5 | 3.2 | 4.8 |

| Green patent contribution | 72.5 | 34.5 | 75.3 | 68.9 | 81.2 | 63.4 |

| Attenuation of financing constraints | 31.4 | 15 | 28.6 | 33.9 | 25.7 | 36.1 |

| Environmental cost elasticity threshold | 15 | 20 | 13 | 17 | 11 | 19 |

| Market-based regulation | 18.3 | 9.7 | 21.5 | 8.9 | 24.7 | 7.3 |

| Enhancement of equity network centrality | 23.6 | 8 | 25.4 | 19.8 | 27.9 | 15.2 |

| Dynamic accumulation | 283 | 100 | 301 | 265 | 318 | 241 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, W.; Liu, Y.; Liu, Z. Policy Coordination and Green Transformation of STAR Market Enterprises Under “Dual Carbon” Goals. Sustainability 2025, 17, 8790. https://doi.org/10.3390/su17198790

Feng W, Liu Y, Liu Z. Policy Coordination and Green Transformation of STAR Market Enterprises Under “Dual Carbon” Goals. Sustainability. 2025; 17(19):8790. https://doi.org/10.3390/su17198790

Chicago/Turabian StyleFeng, Wenchao, Yueyue Liu, and Zhenxing Liu. 2025. "Policy Coordination and Green Transformation of STAR Market Enterprises Under “Dual Carbon” Goals" Sustainability 17, no. 19: 8790. https://doi.org/10.3390/su17198790

APA StyleFeng, W., Liu, Y., & Liu, Z. (2025). Policy Coordination and Green Transformation of STAR Market Enterprises Under “Dual Carbon” Goals. Sustainability, 17(19), 8790. https://doi.org/10.3390/su17198790