3. Theoretical Basis

The coordination between IFDI and OFDI is crucial because it moves beyond examining their isolated impacts and captures their synergistic interaction within an economy. A high degree of coordination signifies that a country is not merely a passive recipient of foreign capital (which could be clean or polluting) nor an unchecked exporter of domestic capital (which could lead to carbon leakage). Instead, it reflects a balanced, strategic approach to engaging with the global economy.

This balance is theorized to reduce carbon emission intensity through several mechanisms. Firstly, it helps mitigate the ‘pollution haven’ effect. A country actively engaged in OFDI is less likely to become a dumping ground for polluting industries from abroad through IFDI, as its own outbound investments often reflect a more advanced industrial structure and environmental standards. Conversely, the technological and managerial spillovers from high-quality IFDI can equip domestic firms with the capabilities to undertake OFDI in more technologically advanced and environmentally sustainable sectors, creating a virtuous cycle.

Secondly, coordination promotes industrial upgrading. IFDI and OFDI can reinforce each other in steering the domestic industrial structure towards less carbon-intensive tertiary and high-tech sectors. For instance, IFDI in green technology can boost a country’s capability, which then enables OFDI in similar sectors abroad, further consolidating its comparative advantage in low-carbon industries.

Therefore, the coordinated development index is not merely a statistical combination but a proxy for this strategic, balanced interaction that is hypothesized to be more conducive to sustainable development than the volume of IFDI or OFDI alone.

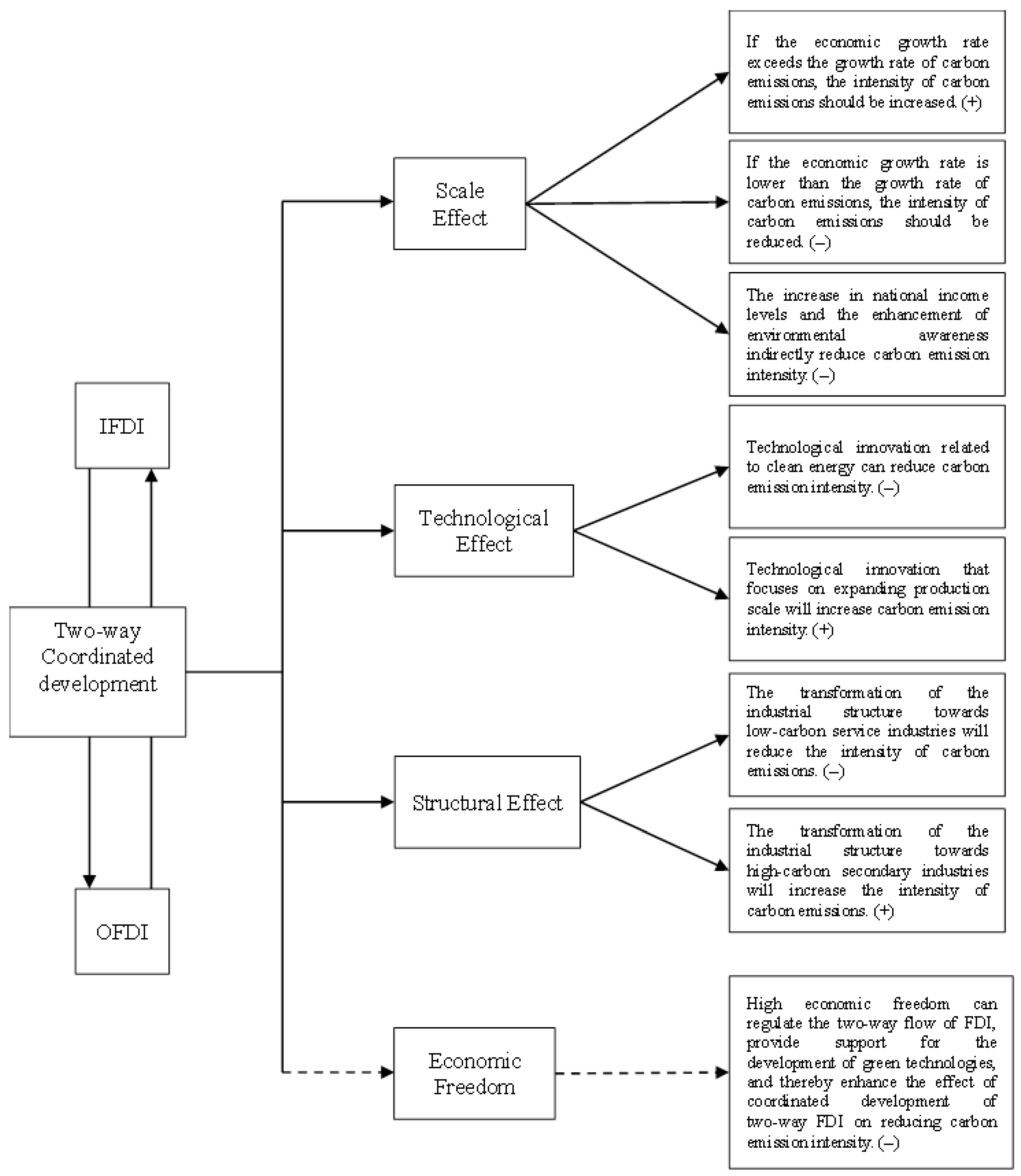

The deterioration or improvement of the environment is mainly achieved through changes in economic scale, alterations in production technology, and changes in economic structure. These three causative mechanisms—scale effect, technological effect, and structural effect—respectively constitute the foundational framework. Subsequent scholarly inquiries principally derive from this tripartite conceptualization. Consequently, this investigation theoretically scrutinizes the two-way FDI coordination–carbon emissions nexus using this analytical scaffolding.

The extensive impact of synchronized development in two-way Foreign Direct Investment (FDI) implies that enhancing the extent of such development will alter the economic scale of either the host or the originating country, consequently affecting carbon emissions. IFDI has the option to either directly increase its local output through the construction of factories in the host nation or indirectly enhance production by importing funds and technology. In the context of OFDI, a surge in OFDI results in a substantial return of capital to the originating country, thereby enlarging its economic magnitude (Wang and Duan, 2023) [

8]. Concurrently, a two-way FDI connection exists, and the deployment of IFDI is expected to invigorate rivalry between international and local capital, foster technological advancements in local businesses, thereby hastening the transition to a global scale; The increase in OFDI expands overseas markets and improves domestic technology, attracting more IFDI. This two-way FDI interaction creates a dynamic cycle that promotes market expansion and optimizes resource allocation, thereby increasing the size of the domestic economy. As the degree of coordinated development of two-way FDI grows, the economy will experience expansion. Typically, economic growth leads to higher carbon emissions; however, as regional GDP increases, the impact on carbon intensity depends on the relative growth rates of the economy and carbon emissions. If the economic growth rate surpasses that of carbon emissions, it will help reduce carbon intensity. Otherwise, carbon intensity will rise. Conversely, as economic growth escalates, inhabitants’ earnings rise, leading to increased environmental requirements. This surge in production capacity will coincide with more rigorous environmental safeguards, consequently diminishing carbon emissions for promoting sustainable development.

The technological impact of the coordinated development of two-way FDI indicates that as the degree of coordinated development between two-way FDI improves, it leads to changes in the technological capabilities of either the host or home country, consequently influencing carbon emissions [

32,

33]. Regarding IFDI, domestic firms, in their competition with foreign companies, are compelled to boost their investment in technological research and development to maintain market share. At the same time, domestic enterprises can imitate and learn from the technology brought by foreign enterprises, and improve and innovate on that basis to make it more suitable for production in the host country, thereby enhancing their own technological level. For OFDI, multinational companies can acquire technology by directly acquiring leading host enterprises through cross-border mergers and acquisitions, or by establishing subsidiaries or technology alliances overseas; Furthermore, in the case of an “inverse gradient” OFDI, the incoming nations exhibit greater economic growth and more sophisticated technology. By establishing factories in these countries for production, it can receive more advanced production technology feedback, thereby accelerating technological innovation to make it more adaptable to global production (Lee and Zhao, 2023) [

34]. Moreover, there is a two-way FDI interaction. When the influx of IFDI contributes to the enhancement of domestic technological capabilities, local companies gain a stronger ownership advantage, thus hastening their global expansion and leveraging OFDI to further boost domestic technological innovation. This cycle of “attracting-investing-attracting again” accelerates the exchange and development of technology. As a result, as the coordinated development of two-way FDI progresses, the level of technological innovation rises, which subsequently impacts carbon emissions. If the technological advancements driven by IFDI and OFDI focus on green and clean innovations, carbon emission intensity will decrease. Conversely, if the emphasis is placed on expanding production capacity with little focus on advancing clean technologies, carbon intensity will increase.

The structural impact of the coordinated development of two-way FDI refers to how an increase in the degree of such coordination can alter the industrial structure of either the host or the home country, which in turn affects carbon emissions. Regarding IFDI, when a nation enforces weaker environmental regulations, it may channel IFDI into high-carbon secondary industries, spurring industrialization and raising carbon intensity. However, if IFDI predominantly flows into the tertiary sector or other clean industries, promoting low-carbon development, carbon emissions intensity will decrease. As for OFDI, when developing nations acquire high-carbon industries from developed countries, such as steel production, they often utilize resource-seeking OFDI to meet domestic demands, accelerating industrialization and pushing the industrial structure toward high-carbon sectors. Conversely, more developed countries can move their high-pollution, energy-intensive production methods or industries abroad by investing in nations with less advanced economies and looser environmental regulations, offering both the space and financial backing necessary to foster clean industries and shift to low-carbon sectors (Wang and Duan, 2023) [

8]. In addition, there is a linkage between IFDI and OFDI. The introduction of IFDI can promote the development of target industries through financial support and technological innovation, narrow the gap with foreign industries, thereby promoting OFDI in corresponding industries and squeezing out the share of backward industries for the development of target industries. The increase in OFDI further develops the target industry and enhances the country’s location advantage to attract more IFDI. Through this dynamic process, two-way FDI can prioritize the growth of targeted industries. As the coordinated development of two-way FDI advances, it has the potential to transform a country’s industrial structure. If this transformation leads to a shift toward low-carbon industries, carbon emission intensity will decrease for promoting sustainable development.

Given the consistent growth in economic development among countries along the Belt and Road Initiative, the dissemination of environmental protection concepts through climate agreements like the Paris Agreement, the overall enhancement of industrial structures in these countries, and the implementation of various environmental policies, it is important to also recognize that the green technological innovation capabilities of many countries along the route remain relatively weak. Based on these factors, the following hypotheses are proposed:

While technological advancements can theoretically lead to either increased efficiency (reducing emissions) or increased scale of production (increasing emissions), the early stages of development and the current industrial focus in many BRI countries suggest that the scale-expanding effect of new technologies might initially dominate their efficiency-improving effect, leading to a potential ‘rebound effect’.

Structural transformation towards tertiary industries is generally associated with lower carbon intensity. Given the BRI’s increasing focus on connectivity and service sector projects, we hypothesize this effect will be significant.

The proposed theoretical framework and causal pathways are summarized in

Figure 1.

4. Empirical Research

This study began by gathering relevant data, specifically panel data from countries along the Belt and Road. Given data availability, 47 countries with relatively complete data from 2000 to 2020 were chosen as the sample for the analysis (

Table 1). For instances of missing data, an interpolation method was employed to fill in the gaps, following the approach outlined by Xiang and Dai (2022) [

32]. The primary data sources for this study include the UNCATD database, the World Bank’s WDI database, and the Heritage Foundation (HF).

The sample selection was based on the official list of BRI partner countries, with the primary criterion being the availability of continuous and reliable data for the key variables (IFDI, OFDI, CO2 emissions, GDP, etc.) throughout the study period (2000–2020). Countries with significant data gaps were excluded to ensure the robustness of the panel data analysis.

Regarding the primary factors, the variable elucidated in this study pertains to the carbon emission intensity chosen by Xiang and Dai (2022) [

32] and Haq et al. (2022) [

33], indicated by

, also employ per capita carbon emissions

as the variable explained in the robustness test, as denoted by, both sourced from the WDI database. In this paper, the STIRPAT model is used as the basic theoretical model, and thus the inherent independent variables of the STIRPAT model are added as control variables, namely population, economic development level and technology. The primary basis for choosing these variables stems from the work of Nie et al. (2022) [

9]. In this context, the measurement of population size is determined by the density of the population, economic growth is gauged by the GDP per person, and technological advancement is gauged by the intensity of energy, symbolized by

,

, and

respectively. The data used for the above variables are all from the WDI database. Citing earlier research, this document establishes various control variables, including external world openness, industrial configuration, and the rate of urbanization, as depicted by

,

and

. These variables are also from the WDI database. For the mechanism study section, this paper sets up three mechanism variables: technological innovation, industrial structure advancement, and economic freedom. Technological advancement

is gauged by the volume of publications in scientific and technological periodicals this year. Industrial structure upgrading

, gauged per

through tertiary-secondary sector output value ratios within current years, indicates structural progression. Both mediating variables’ datasets originate from WDI archives. Economic freedom (ECOF), sourced from the Heritage Foundation (HF) of the United States, is included as a moderating variable. This index primarily measures aspects of freedom relevant to business operation and investment. While its specific weighting methodology has been debated, it remains a widely referenced proxy for the regulatory and institutional environment affecting investment flows and economic decisions, as mentioned by Raghutla et al. (2024) [

30].

In this research, the key variable explained is the synchronized creation of two-way FDI, determined by merging IFDI and OFDI to produce novel variables. The IFDI and OFDI indicators used in this analysis are based on stock data. Stock data is preferred because it provides a clearer picture of the long-term effects of investment on carbon emissions, minimizing the influence of short-term fluctuations typical of flow data. Furthermore, investment returns generally extend beyond a single year, and using annual flow data might fail to capture the full impact of investment on carbon emissions. In terms of computational methods, this document utilizes techniques developed by academics such as Huang et al. (2018) [

35] and Gong and Liu (2018) [

36] employed the physics-based capacity coupling system model to assess the synchronized evolution of bidirectional foreign direct investment.

We now more clearly state that the Coupling Coordination Degree (CCD) model is adapted from physics and is widely established in sustainability, economic, and environmental studies to quantify the interaction and coordination level between two or more systems, making it suitable for measuring IFDI–OFDI coordination. Therefore, referring to the coupling system model, a bidirectional FDI coupling degree calculation formula is established, as shown in Formula (1), where

is the weight of IFDI and OFDI. The Belt and Road Initiative is an open and inclusive regional cooperation agreement that requires the active participation of all co-building countries. Under this initiative, foreign investment is as important as outbound investment, and currently IFDI and OFDI are developing in a distinct synchronous manner, complementing each other. α and β are set to 0.5 to assign equal importance to IFDI and OFDI, reflecting the BRI’s principle of balancing “bringing in” and “going global.” The value of γ (=2) is identified as following the convention set by the foundational methodological paper ([

35]) we built upon. Generally,

.

Whereas coupling metrics merely gauge interaction intensity between systems, coordination measurements—as established by (Ganda, 2024) [

29]—capture both interaction magnitude and individual system advancement levels, specifically two-way FDI scale. Consequently, this analysis further adopts the coordination paradigm Huang et al. (2018) [

35] integrated within coupling framework models to construct the two-way FDI coordinated development index. Herein, T signifies the comprehensive investment metric, with computational methodology detailed in Formula (2). According to this formula, a higher value of

, a stronger interaction between the two-way FDI of a country and a larger scale of two-way FDI, implying a higher level of coordinated development. If the interaction is strong but the scale is small, or if the interaction is weak but the scale is large, the degree of coordinated development of two-way FDI will be relatively low.

The Coupling Degree (CIO) measures interaction strength. The Comprehensive Development Index (T) measures scale. The Coupling Coordination Degree (IOFDI/DIO), our core variable that integrates both interaction and development level.

The variables used in this study, along with their definitions and data sources, are summarized in

Table 2.

Table 3 is a descriptive statistical table of the variables used in this study. In terms of the two-way FDI indicator, IFDI and OFDI have larger standard deviations, indicating significant differences in the ability to attract and invest among countries. In terms of carbon intensity, the maximum value reaches 1.889, meaning 1.889 kg of carbon dioxide are emitted for each dollar of GDP produced, while the minimum value stands at 0.062, with a standard deviation of 0.235, highlighting significant disparities in carbon intensity among countries. There is a significant disparity in the standard deviation of per capita GDP, marked by a substantial difference between the highest and lowest figures, highlighting substantial variances in economic growth among nations participating in the Belt and Road Initiative. The threshold effect model could be employed to examine how two-way FDI impacts carbon emissions at various levels. Additionally, there are marked variations in economic freedom and the number of articles published in scientific and technological journals, with the data suggesting that countries with larger economies tend to have more published scientific articles and higher levels of economic freedom. The interpolation method was primarily applied to OFDI stock data for certain countries in earlier years, and to a lesser extent, to the number of scientific publications (SCI) and the industrial structure upgrading index (INDG) for a few country-years. The final balanced panel contains 987 observations after these interpolations.

In constructing the regression equation, this paper builds upon the STIRPAT model and extends it by incorporating variables like the coordinated development of two-way FDI, the level of openness, industrial structure, and the urbanization rate. Subsequently, the paper conducted an f-test with a

p value less than 0.01, which rejected the assumption of using a mixed OLS model for regression.

where

represents the country,

represents time,

denotes individual fixed effects that remain constant over time,

signifies time fixed effects that stay uniform across individuals, and

stands for the residual term.

Table 4 delineates the sequential regression outcomes examining the two-way FDI coordination-carbon emissions nexus. column 1 incorporates solely the two-way FDI coordinated development variable. column 2 introduces three STIRPAT-model-specific control variables, while column 3 integrates supplementary controls. Acknowledging potential annual policy/event heterogeneity impacting carbon outputs, temporal fixed effects govern column 4, constituting a bidirectional fixed effect paradigm. The analysis reveals two-way FDI coordinated development consistently and significantly attenuates carbon emission intensity across all model specifications. Quantitatively, each 1% elevation in two-way FDI coordination magnitude induces a 0.0298% carbon intensity reduction. To illustrate the economic significance, a 1% increase in the two-way FDI coordination index is associated with a 0.030% decrease in carbon emission intensity. For a country with the sample’s average carbon intensity (0.356 kg per USD of GDP) and average GDP per capita (~

$10,142), this implies a meaningful reduction in absolute CO

2 emissions, underscoring the potential environmental benefit of promoting balanced two-way investment flows. This empirically substantiates Hypothesis 1.

Since the start of the 21st century, propelled by economic globalization and the Belt and Road Initiative, countries along the routes have attracted substantial IFDI. The inflow of foreign capital has supplied ample funds for local industry development, introduced advanced machinery and management philosophies, facilitating the expansion of domestic production capacity and elevating economic development levels. Moreover, the growth of domestic industries has stimulated the advancement of foreign investment. Nations along the route have used OFDI to extend their industrial chains regionally, bringing back profits and technologies acquired abroad to further enlarge production scale and enhance economic growth. Presently, two-way FDI primarily channels into the clean sectors along the Belt and Road, where economic growth outpaces carbon emission increases, thereby lowering carbon emission intensity and promoting sustainable development. Simultaneously, as economic development improves, the national income of countries along the route steadily rises, boosting environmental consciousness among their populations. This, in turn, affects foreign investment inflow and outflow policies shaped by their governments, leading to the implementation of more stringent environmental regulations. For example, many countries have already established green development plans. Key carbon-intensive nations along the route—such as India, Indonesia, Vietnam, Russia, Iran, and Turkey—have funneled maximum resources into eco-friendly sectors, thereby counterbalancing the scale expansion effect on carbon emissions and decreasing carbon emission intensity for promoting sustainable development.

From a technological standpoint, regarding IFDI, nations along the route can leverage multiple regional trade agreements, including the Belt and Road Initiative, to more effectively attract IFDI, thereby acquiring advanced technologies from foreign firms, fostering related domestic industries, and enhancing production efficiency. To promote economic development, countries along the route can also use OFDI to invest in more technologically advanced countries, develop new technologies using local resources, and then transfer these technologies back to their own countries. Moreover, under this initiative, both investment and introduction are given equal weight. Especially for some developing countries, after receiving investment from developed countries, their technology has advanced, production efficiency has improved, and they have promoted their enterprises to go global, further enhancing the promoting effect on technological innovation.

Regarding structural impacts, for IFDI, the nations along the route have progressively strengthened environmental regulations, and these countries have started emphasizing environmental concerns when attracting IFDI, speeding up the introduction of service sectors to facilitate industrial structure transformation and upgrading. This process reduces carbon emission intensity while advancing the growth of relevant domestic OFDI industries. For OFDI, in order to support domestic industrial development, developed countries along the route can more easily transfer high-carbon industries to less developed countries under a series of regional trade agreements and provide development space for the clean industry; The developing countries can take advantage of the “reverse gradient” OFDI to learn new management experience in the developed countries, thereby improving their own production efficiency and allowing more funds to be invested in the previously neglected environmental protection industry. At present, developing nations along the route are actively investing in low-carbon sectors abroad to advance industrial restructuring and thus lower carbon intensity. The shift in industrial structure alongside enhanced production efficiency has further drawn IFDI, and the reciprocal dynamics of two-way FDI have driven domestic industrial transformation. Additionally, multiple clean energy projects have been co-financed by countries along the route, decreasing reliance on traditional high-carbon energy extraction industries, which helps reduce carbon intensity. Consequently, as coordinated development of two-way FDI improves, the industrial structure transitions toward low-carbon sectors, diminishing carbon intensity for promoting sustainable development.

The earlier section empirically examined the connection between the coordinated development of two-way FDI and carbon emissions through a baseline model. This study now employs multiple approaches to address the model’s endogeneity and verify its robustness. To tackle the endogeneity issue, the paper initially applies the GMM method, utilizing the lagged terms of variables as instrumental variables, following the approach established. GMM models can be divided into differential GMM models and system GMM models. Differential GMM models use fewer instrumental variables, are simpler, but are less efficient and prone to weak instrumental variable problems. System GMM models have more instrumental variables, are more efficient, can mitigate weak instrumental variable problems, but increase the likelihood of overfitting problems. In practical research, scholars often use both models in combination to determine the optimal approach. These two categories of models can be further classified into one-step and two-step variants according to differing regression techniques. The two-step approach is preferable in cases with heteroscedasticity and generally offers greater efficiency; however, it might underestimate the standard errors of estimated parameters when sample size is limited. Conversely, the one-step method, though less efficient, can still yield consistent estimates. To guarantee the robustness of the regression findings, this study employs all four methods concurrently. The specific regression models of the GMM are shown below, where model 5 is the differential GMM model and model 6 is the system GMM model.

Table 5 presents the outcomes of the GMM regression models, where columns 5 and 7 utilize the difference GMM approach, and columns 6 and 8 apply the system GMM technique. Below the table, results for the AR and Sargan tests are displayed. Specifically, the AR(1) and AR(2) tests assess serial correlation; if the AR(2) test’s

p-value exceeds 0.1, it suggests no significant serial correlation exists. The Sargan test evaluates potential over-identification issues, with the null hypothesis stating the model lacks such problems.

p-value above 0.1 means the null cannot be rejected, indicating no over-identification. Consequently, after addressing endogeneity, regardless of the method or model, a rise in coordinated development of two-way FDI markedly reduces carbon emission intensity, with no notable changes in significance or direction for the two-way FDI coordination variable. Furthermore, all models passed both AR (2) and Sargan tests, confirming absence of serial correlation and over-identification problems.

To address potential endogeneity arising from reverse causality or omitted time-varying variables, we employ the Generalized Method of Moments (GMM) estimation. We estimate both difference and system GMM models, as specified in Equations (5) and (6). These models include the one-period lagged dependent variable, L.lnCO2 (i.e., lnCO2 at time t–1), as an explanatory variable to account for the persistence of carbon emissions over time. The coefficient of this lagged term captures the dynamic adjustment process.

For the robustness test, this paper first considers that the carbon emission intensity may gradually change over time. After controlling for individual fixed effects and other control variables, there is still a certain increasing or decreasing trend. If the potential time trend is overlooked, changes in carbon emissions might be mistakenly linked to the coordinated development of two-way FDI, causing a spurious regression issue. Hence, this study tests the robustness of controlling for time effects by incorporating a time trend variable into the model. The regression outcomes reveal that, across countries along the Belt and Road Initiative, enhancements in coordinated two-way FDI development continue to significantly decrease carbon emission intensity. This confirms that varying approaches to controlling time do not compromise the robustness of the findings.

This study further validates robustness by altering both the dependent variable and the structure of the explanatory variables. In

Table 6, Column 2, following Xiang and Dai (2022) [

32], per capita carbon emissions replace carbon emission intensity in the regression model. Regarding explanatory variables, prior research on two-way FDI coordination, including works by and Gong and Liu (2018) [

36], often employed interaction terms rather than coupled coordination models to capture coordinated development. Consequently, utilizing the STIRPAT model, this study amalgamates factors like IFDI, OFDI, and their interplay terms to evaluate the impact of synchronized two-way FDI on the intensity of carbon emissions. To mitigate multicollinearity, both IFDI and OFDI are mean-centered, with the detailed equations provided below:

Empirical outcomes demonstrate that the two-way FDI coordinated development variable persists in markedly diminishing carbon emission intensity following alternate substitutions of both explained and explanatory variables, confirming this study’s findings demonstrate considerable resilience.

The results in Column (11) of

Table 6, which decomposes the coordinated index into IFDI, OFDI, and their interaction term, provide further nuance. The positive and significant coefficients for both lnIFDI and lnOFDI suggest that, individually, the scale of each type of investment might be associated with higher carbon intensity in this context, possibly reflecting scale effects. However, the significantly positive coefficient for the interaction term (lnIFDI*lnOFDI) indicates that the interaction between them has a distinct, additional effect. This supports our core argument that the synergy between two-way FDI—captured by our coordination index (IOFDI)—is a critical factor. While the individual components might show certain pressures, their coordinated development creates a combined effect that ultimately leads to a reduction in carbon intensity, as consistently shown by the negative coefficient of the composite lnIOFDI variable in all other specifications.

To delve further, this part conducts a theoretical-based empirical study to investigate how the synchronized creation of two-way FDI affects carbon emissions. Initially, to examine Hypothesis 2, a novel equation is formulated following the three-step approach.

Technological innovation, however, has notably driven up carbon emission intensity, exhibiting a rebound effect (e.g., Sorrell, 2009) [

37]. This could stem from the fact that, despite numerous environmental protection projects established jointly by Belt and Road countries, the development and investment in new technologies require time, making immediate carbon control through innovation challenging. Moreover, as most selected nations along the route are developing countries with limited innovation capacity, their independent innovation often prioritizes scaling up production for economic growth rather than focusing on energy efficiency and emission cuts, thereby causing carbon intensity to rise.

Table 7,

Table 8 and

Table 9 primarily examine the technological impacts of two-way FDI on carbon emissions. This section focuses specifically on exploring the structural effects that two-way FDI exerts on carbon emissions.

The regression outcomes demonstrate that advancing the coordinated development of two-way FDI markedly accelerates industrial upgrading, specifically shifting the structure from secondary to tertiary sectors. Concurrently, this structural transformation plays a pivotal role in lowering carbon emission intensity and promoting sustainable development. Mediation analysis further confirms that industrial upgrading serves as a significant intermediary factor. These findings imply that in Belt and Road Initiative countries, coordinated two-way FDI development fosters industrial restructuring, which in turn mitigates carbon intensity. Hypothesis 3 is thus validated, showing that the structural influence of two-way FDI on carbon emissions is substantial—where the direct pathway contributes 73.6% and the indirect route through industrial upgrading accounts for 26.4%.

The mediation analysis results indicate that industrial structure upgrading is a significant channel. To quantify the contribution of each pathway, we calculated the proportion of the total effect mediated by the indirect effect. The direct effect of lnIOFDI on lnCO

2 from Equation (13) is −0.022 (See

Table 7, Column 18), and the indirect effect (via lnINDG) is −0.008 (derived from the product of the coefficient of lnIOFDI on lnINDG in Equation (12) (0.0453,

Table 7, Column 17) and the coefficient of lnINDG on lnCO

2 in Equation (13) (−0.1737,

Table 7, Column 18), i.e., 0.0453 × (−0.1737) ≈ −0.0079). The total effect is approximately −0.030 (−0.022 + −0.008). Consequently, the direct effect accounts for |(−0.022)/(−0.030)| ≈ 73.3%, and the indirect effect accounts for |(−0.008)/(−0.030)| ≈ 26.7% of the total effect. The figures of 73.6% and 26.4% mentioned in the text are from a similar calculation based on the bootstrap results in

Table 9, which provides a more robust estimation of the effects and their confidence intervals.

In countries engaged in the Belt and Road Initiative, safeguarding the environment has emerged as a more prominent aspect of industrial strategy. Across various nations, there is been an increase in the share of output from tertiary industries compared to the secondary sector, coupled with the initiation of multiple joint ventures in the service sector. For example, Saudi Arabia, Russia, Indonesia, Cambodia, etc., have all made efforts in the cultural and tourism industry. They are working with China and their neighboring countries on projects involving service platform construction, digital tourism, creative design and many other fields. In addition, many enterprises are investing in basic service industries such as logistics, digital technology and education along the route. These investment movements have enhanced the caliber of regional economic advancement while significantly diversifying the industrial frameworks within countries along the route. This transformation has supported a transition away from high-emission sectors toward lower-carbon industries, consequently driving down carbon emission intensity.

The theoretical framework suggests that economic freedom could influence the linkage between two-way FDI and carbon emissions for promoting sustainable development. To evaluate Hypothesis 4, this study incorporates an interaction term between economic freedom and the coordinated development of two-way FDI into the baseline regression model, aiming to examine the moderating role of economic freedom. This yields the following equation. In the actual regression process, to reduce the impact of multi-collinearity on the model, the independent and moderating variables were decentralized, and then the interaction term was calculated and added to the model.

For this moderating effect, under high economic freedom, high government integrity and moderate government low-carbon spending can help guide IFDI into low-carbon industries and boost domestic enterprises to make low-carbon investments abroad or transfer some high-carbon emission industries, thereby improving the local industrial structure. Such an approach will amplify the impact of synchronized two-way FDI development in diminishing carbon intensity. Concurrently, nations with greater economic liberty enjoy increased levels of free trade and investment, easing the challenges in technology exchange and capital movement, thus amplifying the technology overflow and the reverse effect of two-way FDI, along with the introduction of novel technologies. In addition, high economic freedom can attract larger IFDI and expand foreign investment, thus providing sufficient funds for technological innovation both at home and abroad.

Considering policy fluidity during economic advancement, coordinated two-way FDI development’s carbon emission impact may manifest heterogeneity. To holistically capture this relationship, this section adopts per capita GDP—following (Raza et al., 2025; Farabi et al., 2024) [

38,

39]—as the economic development proxy and threshold variable, examining differential effects across developmental phases. Model construction primarily employed the Bootstrap self-sampling method for threshold quantity determination. Regression outcomes revealed a dual-threshold phenomenon, establishing the subsequent equation:

Based on the regression outcomes (

Table 10 and

Table 11), the presence of a pronounced double threshold effect tied to economic development levels is evident. In the Belt and Road region, if a nation’s development dips beneath the initial level, improved synchronization of two-way FDI significantly reduces the intensity of carbon emissions. Should the developmental stage fall between the initial and secondary thresholds, enhanced synchronization of two-way FDI results in a slight increase in carbon intensity, albeit without statistical robustness. Once the second threshold is surpassed, advancing coordinated two-way FDI once again results in a significant decline in carbon intensity. This pattern closely mirrors the staged progression of environmental degradation depicted by the Environmental Kuznets Curve (EKC).

Threshold regression outcomes reveal economic development levels exert a significant moderating influence on how coordinated two-way FDI development affects carbon emissions, though this impact may manifest divergences contingent upon geographic dispersal and resource endowment disparities. This study segments Belt and Road nations into four divisions—East Asia and Southeast Asia; Central Asia and South Asia; West Asia and North Africa; plus Central/Eastern Europe and the Commonwealth of Independent States—based on variances in physical location, historical-cultural legacies, and economic configurations, subsequently performing grouped regressions to scrutinize regional heterogeneity concerning coordinated two-way FDI development’s impact upon carbon emission intensity. Results indicate that within East Asia/Southeast Asia and Central Asia/South Asia Belt and Road nations, enhanced coordinated two-way FDI development demonstrably diminishes carbon intensity for promoting sustainable development. Conversely, in West Asia and North Africa, coordinated two-way FDI development reduces carbon intensity yet fails to achieve statistical significance.

The regional heterogeneity, visualized in

Figure 2, may be attributed to differences in initial industrial structure, stringency of environmental regulations, and primary types of FDI received (e.g., resource-seeking vs. technology-seeking).