Balancing Employment and Environmental Goals: Evidence from BRICS and Other Emerging Economies, 1991–2020

Abstract

1. Introduction

2. Theoretical Background and Empirical Literature on the Environment, Employment, Trade and Growth Links

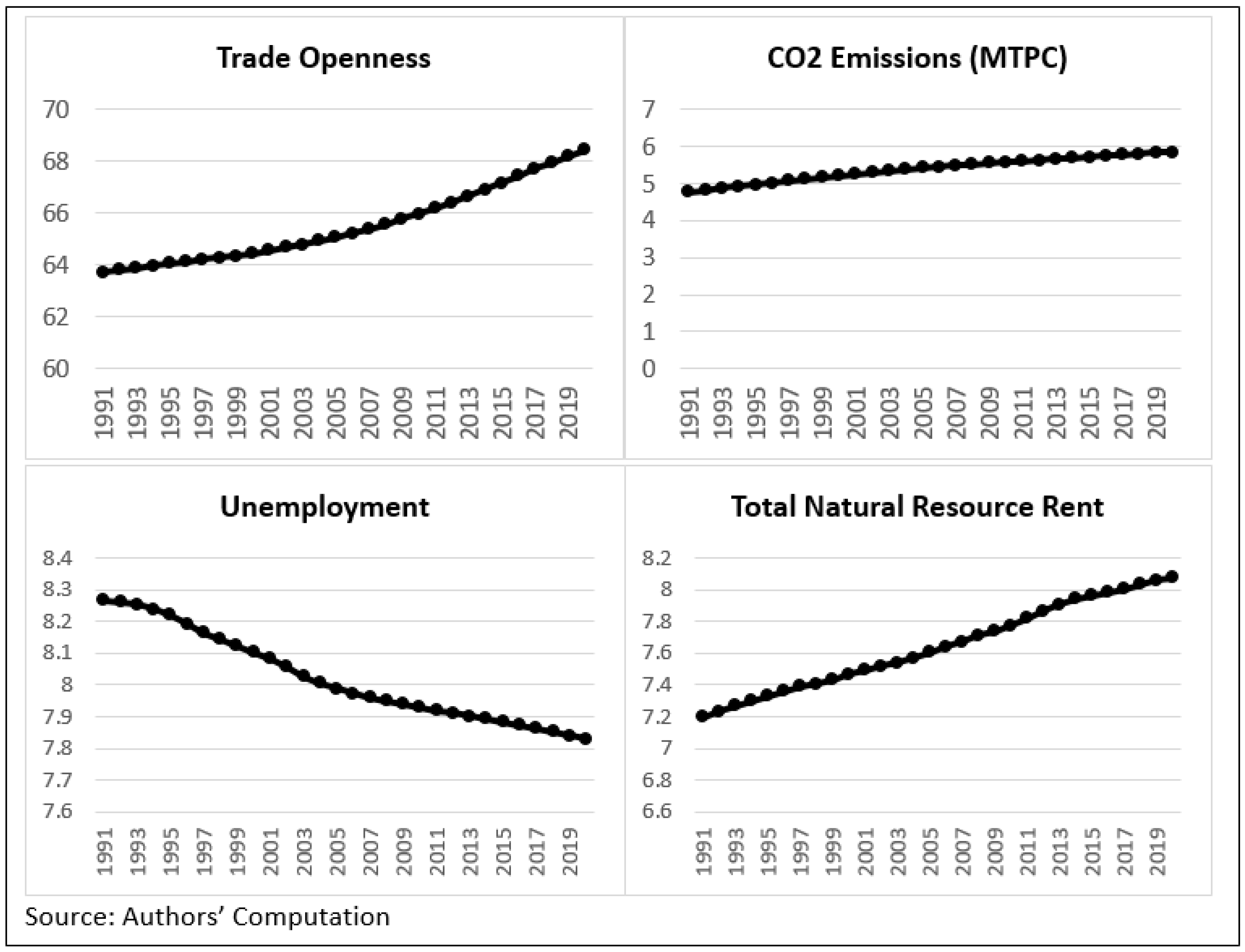

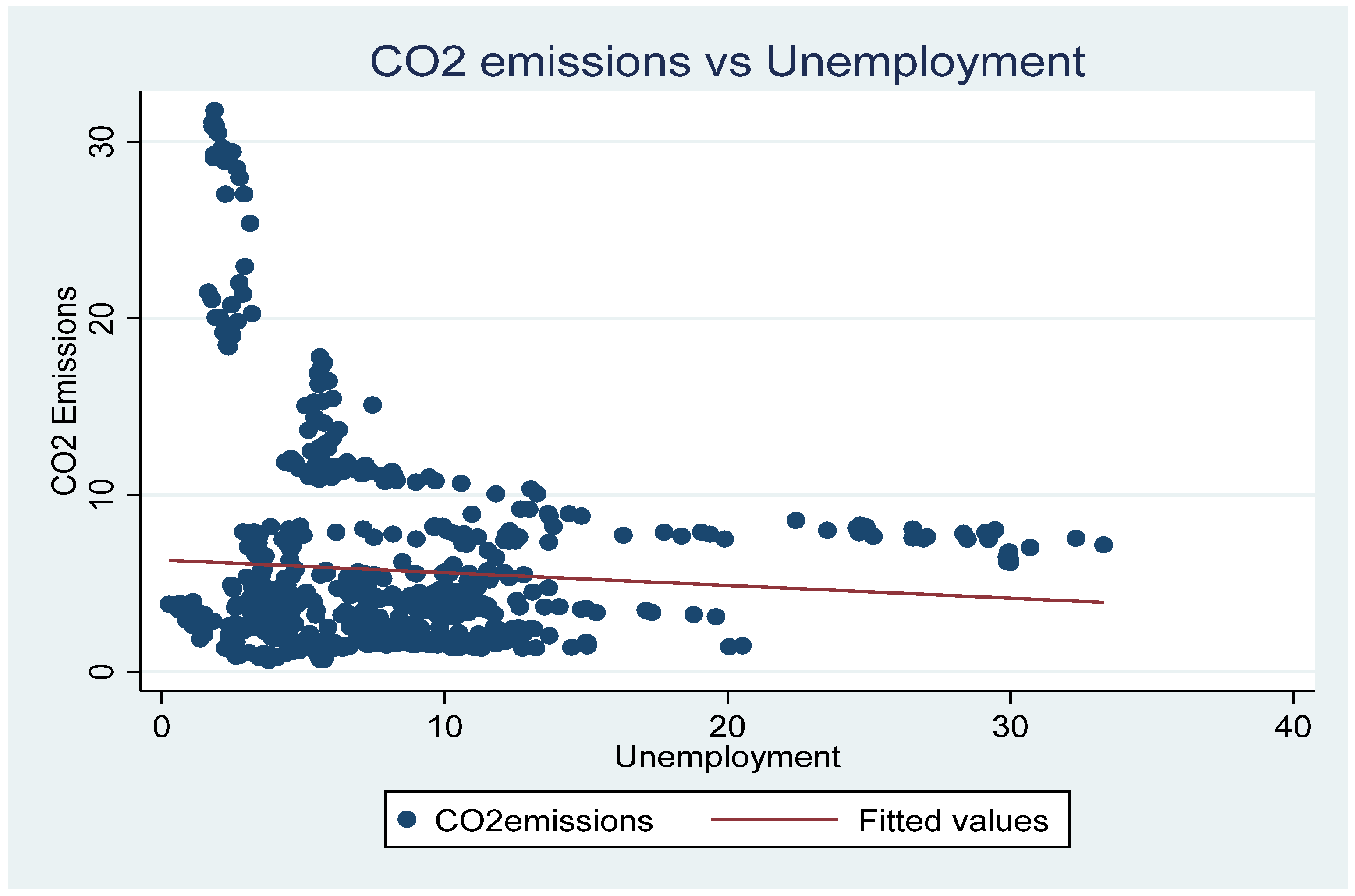

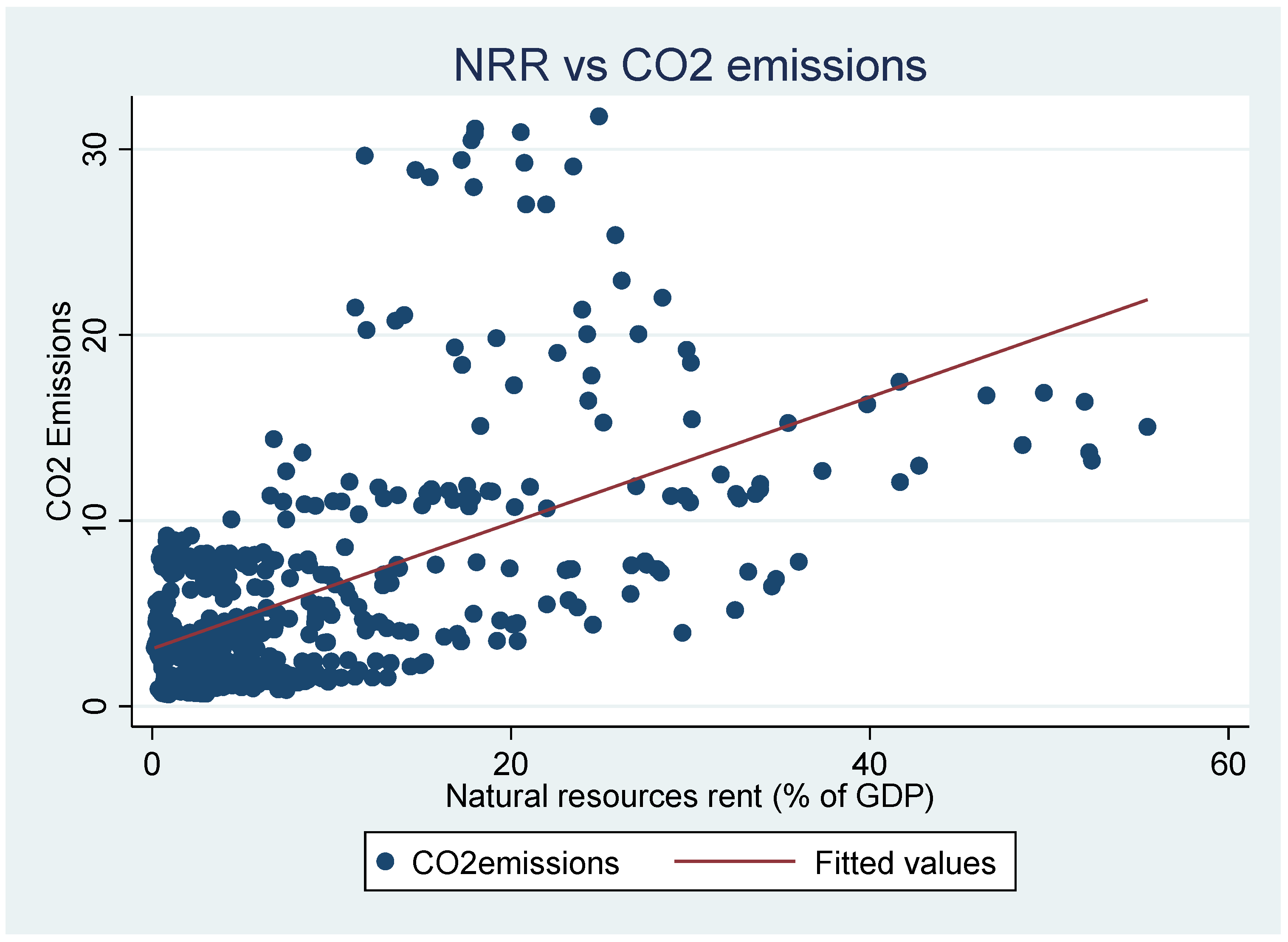

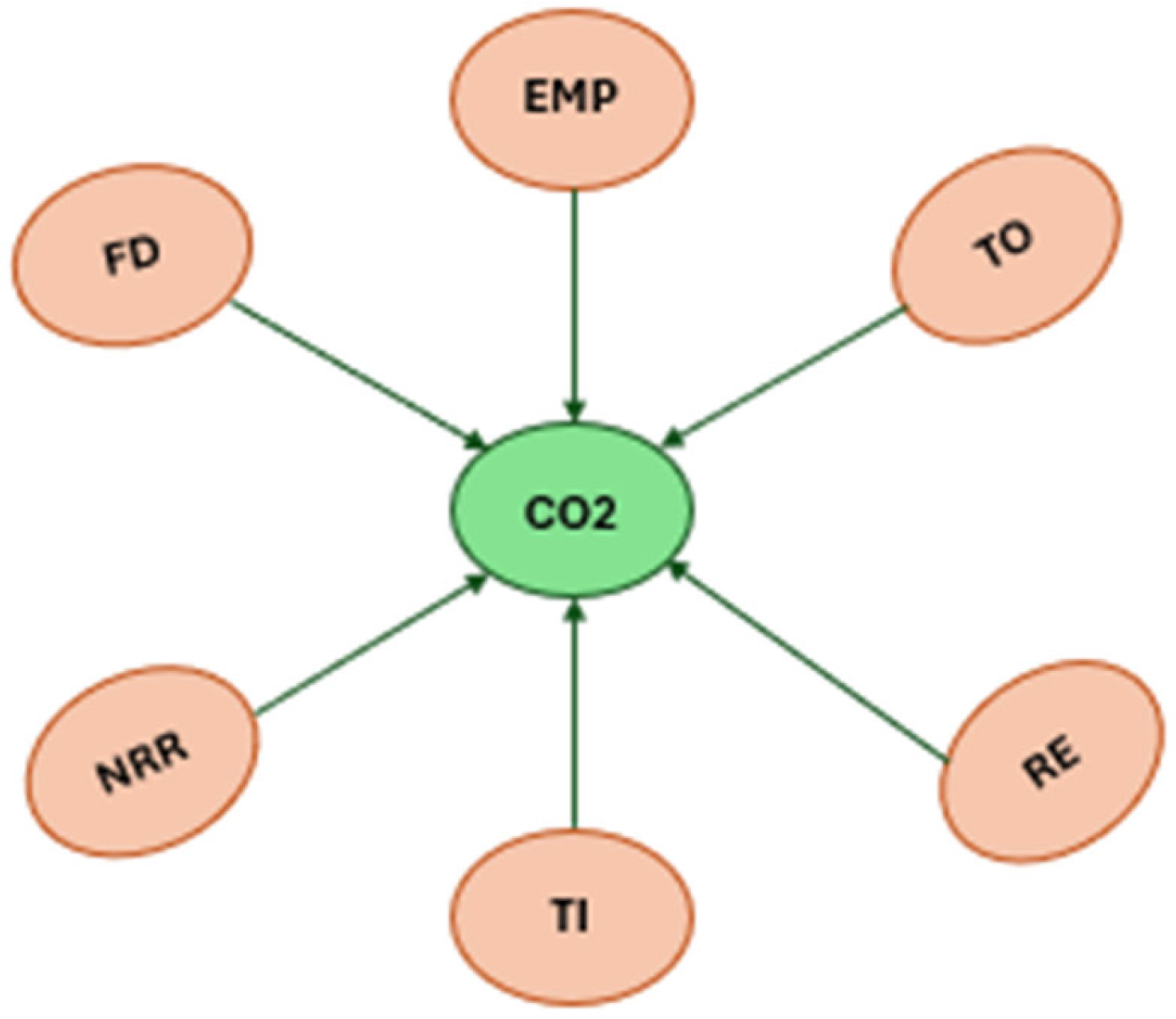

3. Data and Methodology

4. Discussion of Results and Policy Implications

4.1. Discussion of Results

4.2. Policy Implications

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Correction Statement

References

- Durani, F.; Bhowmik, R.; Sharif, A.; Anwar, A.; Syed, Q.R. Role of economic uncertainty, financial development, natural resources, technology, and renewable energy in the environmental Phillips curve framework. J. Clean. Prod. 2023, 420, 138334. [Google Scholar] [CrossRef]

- Kashem, M.A.; Rahman, M.M. Environmental Phillips curve: OECD and Asian NICs perspective. Environ. Sci. Pollut. Res. 2020, 27, 31153–31170. [Google Scholar] [CrossRef] [PubMed]

- Rahman, M.M.; MiçOoğulları, S.A.; Değirmen, S.; Alancıoğlu, E.; Moalla, M. Exploring the environmental Phillips Curve: How do globalization, economic growth, and institutional quality shape load capacity factors in highly globalized European countries? J. Environ. Manag. 2025, 390, 126322. [Google Scholar] [CrossRef] [PubMed]

- Jain, N.; Mohapatra, G. Examining the trade-led Kuznets hypothesis for emerging economies: A multivariate framework. Int. J. Emerg. Mark. 2023, 20, 961–979. [Google Scholar] [CrossRef]

- Masi, T.; Savoia, A.; Sen, K. Is there a fiscal resource curse? Resource rents, fiscal capacity and political institutions in developing economies. World Dev. 2024, 177, 106532. [Google Scholar] [CrossRef]

- Hayat, A.; Tahir, M. Foreign direct investment, natural resources and economic growth: A threshold model approach. J. Econ. Stud. 2021, 48, 929–944. [Google Scholar] [CrossRef]

- Shao, S.; Yang, L. Natural resource dependence, human capital accumulation, and economic growth: A combined explanation for the resource curse and the resource blessing. Energy Policy 2014, 74, 632–642. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. The inverted-U: What does it mean? Environ. Dev. Econ. 1996, 1, 119–122. [Google Scholar] [CrossRef]

- Mahmood, H. Spatial effects of trade, foreign direct investment (FDI), and natural resource rents on carbon productivity in the GCC region. PeerJ 2023, 11, e16281. [Google Scholar] [CrossRef]

- Dou, Y.; Zhao, J.; Malik, M.N.; Dong, K. Assessing the impact of trade openness on CO2 emissions: Evidence from China-Japan-ROK FTA countries. J. Environ. Manag. 2021, 296, 113241. [Google Scholar] [CrossRef]

- Jain, N. A comparative analysis of export-led and domestic demand-led growth hypotheses in BRICS economies. Theor. Appl. Econ. 2022, 29, 125–138. [Google Scholar]

- Udeagha, M.C.; Ngepah, N. Does trade openness mitigate the environmental degradation in South Africa? Environ. Sci. Pollut. Res. 2022, 29, 19352–19377. [Google Scholar] [CrossRef]

- Chhabra, M.; Giri, A.K.; Kumar, A. Do trade openness and institutional quality contribute to carbon emission reduction? Evidence from BRICS countries. Environ. Sci. Pollut. Res. 2023, 30, 50986–51002. [Google Scholar] [CrossRef]

- Jain, N.; Verma, A.; Mohapatra, G. Driving human development through ecological impact for emerging economies: The role of trade openness. Environ. Sci. Pollut. Res. 2024, 31, 54804–54814. [Google Scholar] [CrossRef] [PubMed]

- Felbermayr, G.; Prat, J.; Schmerer, H.-J. Trade and unemployment: What do the data say? Eur. Econ. Rev. 2011, 55, 741–758. [Google Scholar] [CrossRef]

- Gozgor, G. The impact of trade openness on the unemployment rate in G7 countries. J. Int. Trade Econ. Dev. 2013, 23, 1018–1037. [Google Scholar] [CrossRef]

- Raifu, I.A. On the determinants of unemployment in Nigeria: What are the roles of trade openness and current account balance? Rev. Innov. Compet. A J. Econ. Soc. Res. 2017, 3, 5–30. [Google Scholar] [CrossRef]

- Onifade, S.T.; Ay, A.; Asongu, S.; Bekun, F.V. Revisiting the trade and unemployment nexus: Empirical evidence from the Nigerian economy. J. Public Affairs 2020, 20, 40–55. [Google Scholar] [CrossRef]

- Jain, N.; Mohapatra, G. Dynamic linkages between trade, growth, inequality, and poverty in emerging countries: An application of panel ARDL approach. J. Int. Trade Econ. Dev. 2023, 33, 1074–1090. [Google Scholar] [CrossRef]

- Madanizadeh, S.A.; Pilvar, H. The impact of trade openness on labour force participation rate. Appl. Econ. 2019, 51, 2654–2668. [Google Scholar] [CrossRef]

- Awad, A.; Yussof, I. International trade and unemployment: Evidence from selected Arab countries. Middle East Dev. J. 2016, 8, 198–229. [Google Scholar] [CrossRef]

- Liu, Z.; Ngo, T.Q.; Saydaliev, H.B.; He, H.; Ali, S. How do trade openness, public expenditure and institutional performance affect unemployment in OIC countries? Evidence from the DCCE approach. Econ. Syst. 2022, 46, 101023. [Google Scholar] [CrossRef]

- Ali, S.; Yusop, Z.; Kaliappan, S.R.; Chin, L.; Meo, M.S. Impact of trade openness, human capital, public expenditure and institutional performance on unemployment: Evidence from OIC countries. Int. J. Manpow. 2022, 43, 1108–1125. [Google Scholar] [CrossRef]

- Huang, S.-Z.; Sadiq, M.; Chien, F. The impact of natural resource rent, financial development, and urbanization on carbon emission. Environ. Sci. Pollut. Res. 2023, 30, 42753–42765. [Google Scholar] [CrossRef]

- Hasan, R.; Mitra, D.; Ranjan, P.; Ahsan, R.N. Trade liberalization and unemployment: Theory and evidence from India. J. Dev. Econ. 2012, 97, 269–280. [Google Scholar] [CrossRef]

- Lopez, R. The environment as a factor of production: The effects of economic growth and trade liberalization 1. In International Trade and the Environment; Routledge: London, UK, 2017; pp. 239–260. [Google Scholar]

- Chien, F.; Ajaz, T.; Andlib, Z.; Chau, K.Y.; Ahmad, P.; Sharif, A. The role of technology innovation, renewable energy and globalization in reducing environmental degradation in Pakistan: A step towards sustainable environment. Renew. Energy 2021, 177, 308–317. [Google Scholar] [CrossRef]

- Sun, Y.; Yesilada, F.; Andlib, Z.; Ajaz, T. The role of eco-innovation and globalization towards carbon neutrality in the USA. J. Environ. Manag. 2021, 299, 113568. [Google Scholar] [CrossRef]

- Ertugrul, H.M.; Cetin, M.; Seker, F.; Dogan, E. The impact of trade openness on global carbon dioxide emissions: Evidence from the top ten emitters among developing countries. Ecol. Indic. 2016, 67, 543–555. [Google Scholar] [CrossRef]

- Appiah, K.; Worae, T.A.; Yeboah, B.; Yeboah, M. The causal nexus between trade openness and environmental pollution in selected emerging economies. Ecol. Indic. 2022, 138, 108872. [Google Scholar] [CrossRef]

- Khan, H.; Weili, L.; Khan, I. Environmental innovation, trade openness and quality institutions: An integrated investigation about environmental sustainability. Environ. Dev. Sustain. 2022, 24, 3832–3862. [Google Scholar] [CrossRef]

- Yu, C.; Nataliia, D.; Yoo, S.-J.; Hwang, Y.-S. Does trade openness convey a positive impact for the environmental quality? Evidence from a panel of CIS countries. Eurasian Geogr. Econ. 2019, 60, 333–356. [Google Scholar] [CrossRef]

- Canh, N.P.; Schinckus, C.; Thanh, S.D. The natural resources rents: Is economic complexity a solution for resource curse? Resour. Policy 2020, 69, 101800. [Google Scholar] [CrossRef]

- Ali, A.; Zulfiqar, K. An assessment of association between natural resources agglomeration and unemployment in Pakistan. MPRA Pap. 2018, 89022, 1–15. [Google Scholar]

- Yu, Y. Role of Natural resources rent on economic growth: Fresh empirical insight from selected developing economies. Resour. Policy 2023, 81, 103326. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Mehlum, H.; Moene, K.; Torvik, R. Institutions and the resource curse. Econ. J. 2006, 116, 1–20. [Google Scholar] [CrossRef]

- James, A.; Aadland, D. The curse of natural resources: An empirical investigation of US counties. Resour. Energy Econ. 2011, 33, 440–453. [Google Scholar] [CrossRef]

- Shittu, W.; Adedoyin, F.F.; Shah, M.I.; Musibau, H.O. An investigation of the nexus between natural resources, environmental performance, energy security and environmental degradation: Evidence from Asia. Resour. Policy 2021, 73, 102227. [Google Scholar] [CrossRef]

- Tu, Y.T. Drivers of Environmental Performance in Asian economies: Do natural resources, green innovation and Fintech really matter? Resour. Policy 2024, 90, 104832. [Google Scholar]

- Nathaniel, S.P.; Yalçiner, K.; Bekun, F.V. Assessing the environmental sustainability corridor: Linking natural resources, renewable energy, human capital, and ecological footprint in BRICS. Resour. Policy 2021, 70, 101924. [Google Scholar] [CrossRef]

- Ali, Q.; Yaseen, M.R.; Anwar, S.; Makhdum, M.S.A.; Khan, M.T.I. The impact of tourism, renewable energy, and economic growth on ecological footprint and natural resources: A panel data analysis. Resour. Policy 2021, 74, 102365. [Google Scholar] [CrossRef]

- Anser, M.K.; Apergis, N.; Syed, Q.R.; Alola, A.A. Exploring a new perspective of sustainable development drive through environmental Phillips curve in the case of the BRICST countries. Environ. Sci. Pollut. Res. 2021, 28, 48112–48122. [Google Scholar] [CrossRef] [PubMed]

- Ng, C.-F.; Yii, K.-J.; Lau, L.-S.; Go, Y.-H. Unemployment rate, clean energy, and ecological footprint in OECD countries. Environ. Sci. Pollut. Res. 2022, 30, 42863–42872. [Google Scholar] [CrossRef] [PubMed]

- Rayhan, I.; Al Nahian, M.A.; Siddika, A. Re-evaluating the environmental Kuznets curve and environmental Phillips curve in Bangladesh: An augmented ARDL bounds test approach with a structural break. Jahangirnagar Econ. Rev. 2020, 31, 109–134. [Google Scholar]

- Tanveer, A.; Song, H.; Faheem, M.; Chaudhry, I.S. Validation of environmental Philips curve in Pakistan: A fresh insight through ARDL technique. Environ. Sci. Pollut. Res. 2022, 29, 25060–25077. [Google Scholar] [CrossRef]

- Bhowmik, R.; Syed, Q.R.; Apergis, N.; Alola, A.A.; Gai, Z. Applying a dynamic ARDL approach to the environmental Phillips curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environ. Sci. Pollut. Res. 2022, 29, 14914–14928. [Google Scholar] [CrossRef]

- Tariq, S.; Mehmood, U.; Haq, Z.U.; Mariam, A. Exploring the existence of environmental Phillips curve in South Asian countries. Environ. Sci. Pollut. Res. 2022, 29, 35396–35407. [Google Scholar] [CrossRef]

- Duttagupta, R.; Pazarbasioglu, C. MILES to Go. Finance & Development, International Monetary Fund. 2021. Available online: https://www.imf.org/external/pubs/ft/fandd/2021/06/the-future-of-emerging-markets-duttagupta-and-pazarbasioglu.htm (accessed on 10 March 2025).

- Zaman, Q.U.; Wang, Z.; Zaman, S.; Rasool, S.F. Investigating the nexus between education expenditure, female employers, renewable energy consumption and CO2 emission: Evidence from China. J. Clean. Prod. 2021, 312, 10–1016. [Google Scholar] [CrossRef]

- Wijeweera, A.; Wilson, C.; Athukorala, W.; Rajapaksa, D.; Managi, S. Demand for electricity and its determinants in Australia: Policy implications. J. Dev. Areas 2025, 59, 115–128. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean. Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Rehman, A.; Alam, M.M.; Ozturk, I.; Alvarado, R.; Murshed, M.; Işık, C.; Ma, H. Globalization and renewable energy use: How are they contributing to upsurge the CO2 emissions? A global perspective. Environ. Sci. Pollut. Res. 2023, 30, 9699–9712. [Google Scholar] [CrossRef]

- Yang, T.; Wang, Q. The nonlinear effect of population aging on carbon emission-Empirical analysis of ten selected provinces in China. Sci. Total Environ. 2020, 740, 140057. [Google Scholar] [CrossRef]

- Sharma, M.; Mohapatra, G.; Giri, A.K.; Wijeweera, A.; Wilson, C. Examining the tourism-induced environmental Kuznets curve hypothesis for India. Environ. Dev. Sustain. 2025, 27, 9107–9126. [Google Scholar] [CrossRef]

- Wang, Q.; Li, L. The effects of population aging, life expectancy, unemployment rate, population density, per capita GDP, urbanization on per capita carbon emissions. Sustain. Prod. Consum. 2021, 28, 760–774. [Google Scholar] [CrossRef]

- Pham, P.M.H.; Nguyen, T.D.; Nguyen, M.; Tran, N.T. FDI inflows and carbon emissions: New global evidence. Discov. Sustain. 2025, 6, 432. [Google Scholar] [CrossRef]

- Omojolaibi, J.A.; Egwaikhide, F.O. Oil price volatility, fiscal policy and economic growth: A panel vector autoregressive (PVAR) analysis of some selected oil-exporting African countries. OPEC Energy Rev. 2014, 38, 127–148. [Google Scholar] [CrossRef]

- Dartey-Baah, K.; Amponsah-Tawiah, K.; Aratuo, D. Emerging―Dutch disease in emerging oil economy: Ghana‘s perspective. Soc. Buses Rev. 2012, 7, 185–199. [Google Scholar] [CrossRef]

- Weber, J.G. The effects of a natural gas boom on employment and income in Colorado, Texas, and Wyoming. Energy Econ. 2012, 34, 1580–1588. [Google Scholar] [CrossRef]

- Pack, H. Endogenous growth theory: Intellectual appeal and empirical shortcomings. J. Econ. Perspect. 1994, 8, 55–72. [Google Scholar] [CrossRef]

- Sun, Y.; Li, H.; Andlib, Z.; Genie, M.G. How do renewable energy and urbanization cause carbon emissions? Evidence from advanced panel estimation techniques. Renew. Energy 2022, 185, 996–1005. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G. Environmental decentralization, environmental protection investment, and green technology innovation. Environ. Sci. Pollut. Res. 2020, 29, 12740–12755. [Google Scholar] [CrossRef]

- Hsu, C.-C.; Quang-Thanh, N.; Chien, F.; Li, L.; Mohsin, M. Evaluating green innovation and performance of financial development: Mediating concerns of environmental regulation. Environ. Sci. Pollut. Res. 2021, 28, 57386–57397. [Google Scholar] [CrossRef]

- Ju, S.; Andriamahery, A.; Qamruzzaman; Kor, S. Effects of financial development, FDI and good governance on environmental degradation in the Arab nation: Dose technological innovation matters? Front. Environ. Sci. 2023, 11, 1094976. [Google Scholar] [CrossRef]

- Xu, R. How does control of corruption determine the structure of energy consumption? New empirical insights from ASEAN countries. J. Environ. Manag. 2025, 390, 126373. [Google Scholar] [CrossRef] [PubMed]

- Xu, R.; Chen, X.; Dong, P. Nexus among financial technologies, oil rents, governance and energy transition: Panel investigation from Asian Economies. Resour. Policy 2024, 90, 104746. [Google Scholar] [CrossRef]

- Acheampong, A.O. Modelling for insight: Does financial development improve environmental quality? Energy Econ. 2019, 83, 156–179. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Jung, B.C.; Song, S.H. Testing for heteroskedasticity and serial correlation in a random effects panel data model. J. Econom. 2010, 154, 122–124. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M.H. Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econom. 2015, 188, 393–420. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61 (Suppl. S1), 653–670. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/1468-0084.0610s1653 (accessed on 25 January 2025).

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Shastri, S.; Mohapatra, G.; Giri, A.K. The Environmental Philips Curve from a gender perspective: Empirical evidence from India. Environ. Sci. Pollut. Res. 2023, 30, 17487–17496. [Google Scholar] [CrossRef]

- Fattah, E.R.A. Natural resource rents and unemployment in oil exporting countries. Asian Econ. Financ. Rev. 2017, 7, 952. [Google Scholar] [CrossRef]

- Carrère, C.; Fugazza, M.; Olarreaga, M.; Robert-Nicoud, F. On the Heterogeneous Effect of Trade on Unemployment (No. P180). FERDI. 2016. Available online: https://unctad.org/publication/heterogeneous-effect-trade-unemployment (accessed on 25 January 2025).

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

| Terminology | Parameter Name | Scale of Measurement | Data Extracted |

|---|---|---|---|

| lCO2 | Growth in CO2 emissions | Per person carbon dioxide emissions (metric tons) | World Development Indicators (WDI), World Bank |

| lunemp | Unemployment Rate | The labor force that is not finding work but is available for and are job seekers (in percentage) | |

| ltnrr | Total natural resource rent | Total revenue generated from extracting natural resources as a share of Gross Domestic Product | |

| ltrade | Trade openness | Summation of exports and imports of goods and services as a proportion of Gross Domestic Product | |

| lgdppc | Economic growth | Growth in per head gross domestic product (constant 2010 USD) | |

| lrec | Use of renewable energy | Proportion of renewable energy in aggregate final energy consumption | |

| linnov | Innovation | Research and development expenditure (% of GDP) | |

| PG | Population growth | Yearly percentage | |

| FDI | Foreign direct investment | FDI net inflows (BoP, current US dollars) | |

| linflation | Inflation | GDP deflator (yearly percentage) | |

| FD | Financial development | The relative ranking of countries based on access, depth, and efficiency of their financial institutions and financial markets is the Financial Development Index. | International Monetary Fund (IMF) |

| Delta | Delta adj. | p-Value | |

|---|---|---|---|

| Model 1 | 23.759 *** | 27.162 *** | 0.000 |

| Model 2 | 17.576 *** | 19.659 *** | 0.000 |

| Model 3 | 19.307 *** | 23.332 *** | 0.000 |

| Variables | CD-Test | p-Value |

|---|---|---|

| lCO2 | 20.36 *** | 0.000 |

| lunemp | 4.93 *** | 0.000 |

| lgdppc | 53.26 *** | 0.000 |

| ltnrr | 40.04 *** | 0.000 |

| ltrade | 24.79 *** | 0.000 |

| lrec | 16.23 *** | 0.000 |

| FD | 39.26 *** | 0.000 |

| linnov | 25.49 *** | 0.000 |

| PG | 30.99 *** | 0.000 |

| FDI | 7.51 *** | 0.000 |

| linflation | 23.49 *** | 0.000 |

| Variables | At Level | First Difference |

|---|---|---|

| lCO2 | −1.716 | −4.316 *** |

| lunemp | −1.529 | −3.860 *** |

| lgdppc | −1.794 | −3.434 *** |

| ltnrr | −1.876 | −5.357 *** |

| ltrade | −2.056 * | |

| lrec | −2.305 *** | |

| FD | −2.635 *** | |

| linnov | −2.789 *** | |

| PG | −1.992 | −2.642 *** |

| FDI | −2.642 *** | |

| linflation | −3.523 *** |

| Parameters | Model 1 (lCO2) | Model 2 (lunemp) | Model 3 (lCO2) |

|---|---|---|---|

| lunemp | −0.035 * (0.019) | 0.059 ** (0.024) | |

| lgdppc | 0.356 *** (0.106) | −1.112 ** (0.456) | 0.250 ** (0.117) |

| lrec | −0.284 *** (0.060) | −0.363 *** (0.070) | |

| PG | −0.032 (0.040) | ||

| FDI | 0.000 (0.002) | ||

| ltnrr | 0.006 * ((0.049) | −0.002 * (0.023) | |

| ltrade | −0.329 *** (0.076) | −0.027 * (0.035) | |

| linflation | −0.034 (0.047) | ||

| FD | 0.068 (0.128) | ||

| linnov | −0.009 (0.014) | ||

| ECT(−1) | −0.866 *** (0.038) | −0.665 *** (0.147) | −0.821 *** (0.041) |

| Variables | Model 1 (lCO2) | Model 2 (lunemp) | Model 3 (lCO2) |

|---|---|---|---|

| lunemp | −0.044 * (0.023) | −0.082 ** (0.036) | |

| lgdppc | 0.389 *** (0.129) | −3.412 ** (1.471) | 0.282 ** (0.129) |

| lLrec | −0.330 *** (0.075) | −0.499 *** (0.142) | |

| PG | −0.039 (0.050) | ||

| FDI | 0.000 (0.002) | ||

| ltnrr | −0.074 * (0.094) | −0.019 * (0.034) | |

| ltrade | −0.388 ** (0.155) | −0.040 * (0.062) | |

| linflation | 0.088 (0.140) | ||

| FD | 0.139 (0.170) | ||

| linnov | −0.015 (0.018) |

| Variables | Z-Bar Statistics | p-Value |

|---|---|---|

| FD→CO2 | 7.883 *** | 0.000 |

| REC→CO2 | 5.483 ** | 0.032 |

| NRR→CO2 | 8.638 *** | 0.000 |

| TO→CO2 | 14.641 *** | 0.000 |

| TI→CO2 | 4.346 *** | 0.000 |

| UNEMP→CO2 | 7.955 *** | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jain, N.; Wijeweera, A.; Mohapatra, G.; Wilson, C. Balancing Employment and Environmental Goals: Evidence from BRICS and Other Emerging Economies, 1991–2020. Sustainability 2025, 17, 8635. https://doi.org/10.3390/su17198635

Jain N, Wijeweera A, Mohapatra G, Wilson C. Balancing Employment and Environmental Goals: Evidence from BRICS and Other Emerging Economies, 1991–2020. Sustainability. 2025; 17(19):8635. https://doi.org/10.3390/su17198635

Chicago/Turabian StyleJain, Neha, Albert Wijeweera, Geetilaxmi Mohapatra, and Clevo Wilson. 2025. "Balancing Employment and Environmental Goals: Evidence from BRICS and Other Emerging Economies, 1991–2020" Sustainability 17, no. 19: 8635. https://doi.org/10.3390/su17198635

APA StyleJain, N., Wijeweera, A., Mohapatra, G., & Wilson, C. (2025). Balancing Employment and Environmental Goals: Evidence from BRICS and Other Emerging Economies, 1991–2020. Sustainability, 17(19), 8635. https://doi.org/10.3390/su17198635