1. Introduction

The global energy transition and carbon neutrality targets have elevated the strategic importance of the new energy industry. As a high-tech and capital-intensive sector, new energy enterprises are crucial for reducing dependence on fossil fuels, building low-carbon and efficient energy systems, and supporting sustainable development. In China, policies including the

14th Five-Year Plan for the Modern Energy System and the

Carbon Peaking Action Plan before 2030 have emphasized technological innovation and the gradual establishment of a power system dominated by renewable energy. These policies position new energy firms as central to national sustainability goals, while simultaneously intensifying demands for technological breakthroughs and efficiency improvements. Digital transformation has emerged as a crucial pathway for new energy enterprises to enhance their competitiveness. For example, State Grid’s smart-grid projects demonstrate how digital integration enables large-scale renewable energy deployment while ensuring system stability [

1,

2]. Similarly, CATL has developed a digitalized battery management platform that supports real-time monitoring and intelligent scheduling, effectively extending battery life and improving energy efficiency [

3,

4]. Although many Chinese new energy enterprises have improved factor productivity under digital transformation, many new energy firms still face significant obstacles. These include financing constraints, heavy R&D expenditures, and uncertainties associated with rapidly evolving technologies [

5,

6]. Recent evidence highlights these bottlenecks. For instance, CATL’s 2024 annual report discloses multi-billion RMB investments in R&D, with its R&D-to-revenue ratio continuing to rise, underscoring sustained innovation pressure in the battery and storage sectors [

7]. Moreover, the integration of smart-grid technologies is complicated by frequent technological iteration and evolving regulatory standards, which create long-term strategic uncertainty [

2]. These cases collectively confirm that financing frictions, R&D intensity, and technological uncertainty jointly constitute the major barriers to digital transformation in the new energy industry. In this context, Environmental, Social, and Governance (ESG) practices are increasingly recognized as a strategic driver of digital transformation. Strong ESG performance enhances stakeholder trust, facilitates resource acquisition, and improves collaboration within industrial ecosystems [

8]. For new energy enterprises, these advantages help alleviate barriers to digital transformation and support the integration of internal and external resources. Thus, ESG performance is expected to play a crucial role in enabling new energy firms to achieve digital transformation while advancing environmental sustainability.

However, current research perspectives remain limited. Most existing studies focus on digital transformation and innovation in the manufacturing and service sectors. These studies emphasize how digital technologies improve production efficiency, optimize service models, and enhance market competitiveness [

9,

10]. In contrast, the new energy sector has received relatively little systematic attention. This sector is characterized by high technological intensity and strong policy dependence. Compared with traditional industries, new energy enterprises face higher R&D investment requirements and greater exposure to uncertainty. At the same time, they carry the critical mission of contributing to the national “dual carbon” goals [

11]. These distinctive features suggest that the relationship between ESG performance and digital transformation in the new energy sector may involve unique mechanisms. This issue merits further academic investigation.

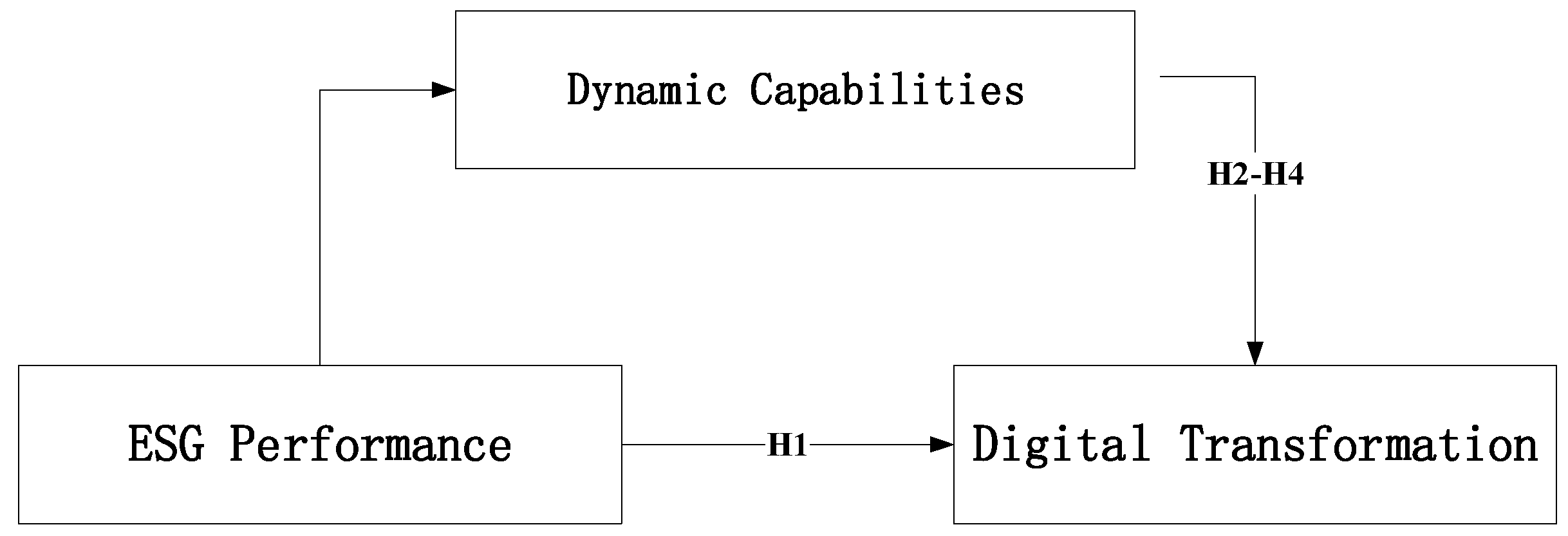

To address these gaps, this study investigates the effect of ESG performance on digital transformation in Chinese new energy enterprises. Using panel data from A-share listed firms between 2010 and 2023, this study employs ESG ratings from the CNRDS database as the core explanatory variable. A two-way fixed effects model is applied to examine the relationship between ESG performance and digital transformation, controlling for both firm–year-specific unobserved heterogeneity. In addition, the study explores the mechanisms through which ESG influences digital transformation, focusing on absorptive capacity, adaptive capability, and innovation capability as dynamic channels. Theoretically, this study extends the resource-based and capability perspectives by conceptualizing ESG performance as a tool for enhancing firms’ resource capabilities. ESG practices strengthen the development of dynamic capabilities—such as absorptive capacity, adaptive capability, and innovation capability—that enable firms to integrate and reconfigure resources in response to environmental and technological challenges. Through this process, ESG becomes a strategic driver that facilitates digital transformation. This perspective provides a deeper understanding of how sustainability-oriented practices are converted into transformation.

The structure of the paper is as follows:

Section 2 reviews related literature and develops the theoretical framework.

Section 3 introduces data sources, variable definitions, and methodology.

Section 4 presents empirical results, robustness tests, heterogeneity analysis, and mechanism verification.

Section 5 concludes with the main findings, theoretical and practical implications, limitations, and future research directions.

4. Results

4.1. Descriptive and Correlation Analysis

Table 1 presents the descriptive statistics for the main variables, reporting the mean, median, standard deviation, minimum, and maximum values. The dataset consists of 2331 firm-year observations from an unbalanced panel covering Chinese listed firms.

For the dependent variable, the mean and median values of DT are 0.039 and 0.020, respectively, with a minimum of 0 and a maximum of 0.500. The standard deviation of 0.065 indicates that digital innovation output remains relatively low overall, with limited variation across firms. The key explanatory variable, ESG, has a mean value of 4.100, a median of 4, and ranges from 1 to 7, with a standard deviation of 0.978. This suggests substantial heterogeneity in ESG practices across firms, reflecting differences in the extent to which ESG principles are adopted and implemented.

The control variables include firm age (lnAge), firm size (Size), profitability (ROA), financial leverage (Lev), ownership concentration (Top1), board independence (Lninde), state ownership (SOE), CEO duality (Duality), and firm value (TobinQ). These variables show distributions consistent with theoretical expectations. Overall, the descriptive statistics confirm that the dataset is well-structured and does not exhibit severe outliers, providing a reliable basis for subsequent regression analysis.

4.2. Benchmark Regression

Table 2 reports the regression results of

ESG on

DT using different model specifications. Columns (1) and (2) present benchmark results without and with fixed effects, respectively. In both cases, the coefficient of

ESG remains significantly positive at the 1% level, indicating that higher ESG scores are associated with greater

DT output. Column (3) incorporates a two-way fixed effects specification, controlling for both firm- and year-level unobserved heterogeneity. The results show that

ESG continues to exert a positive and significant impact on

DT, with a coefficient of 0.006 at the 1% significance level. This provides strong evidence that the positive relationship between

ESG and

DT is robust even after accounting for potential confounding effects. Overall, these findings suggest that ESG performance plays an important role in promoting firms’ digital transformation activities and serves as a driving force for sustainable digital improvement.

4.3. Endogeneity Test

Omitted variables and reverse causality often cause endogeneity problems. These issues may weaken the reliability of regression results. To address this concern, this study applies three methods: instrumental variable (IV) estimation, the SYS-GMM model, and the propensity score matching (PSM) method. The results of the robustness tests are summarized in

Table 3.

Firstly, the instrumental variable method. The lagged industry–year average of ESG ratings (

Peer) is selected as the instrument. Columns (1) and (2) in

Table 3 report the IV results. The first-stage regression shows that the instrument is valid. In the second stage, the impact of

ESG on

DT remains significant. The Cragg-Donald statistic value is greater than the critical value 16.38, which rules out the problem of weak instruments. The Hansen test supports the exogeneity of the instrument. These results suggest that the conclusion has strong causal explanatory power.

Secondly, the SYS-GMM model. As shown in column (3), the sample passes the AR(1), AR(2), and Hansen tests, satisfying the assumptions of first-order autocorrelation, no second-order autocorrelation, and no over-identification. This confirms the validity of the model specification. The regression coefficient of ESG remains significantly positive under the SYS-GMM dynamic panel estimation, which is consistent with the baseline regression results.

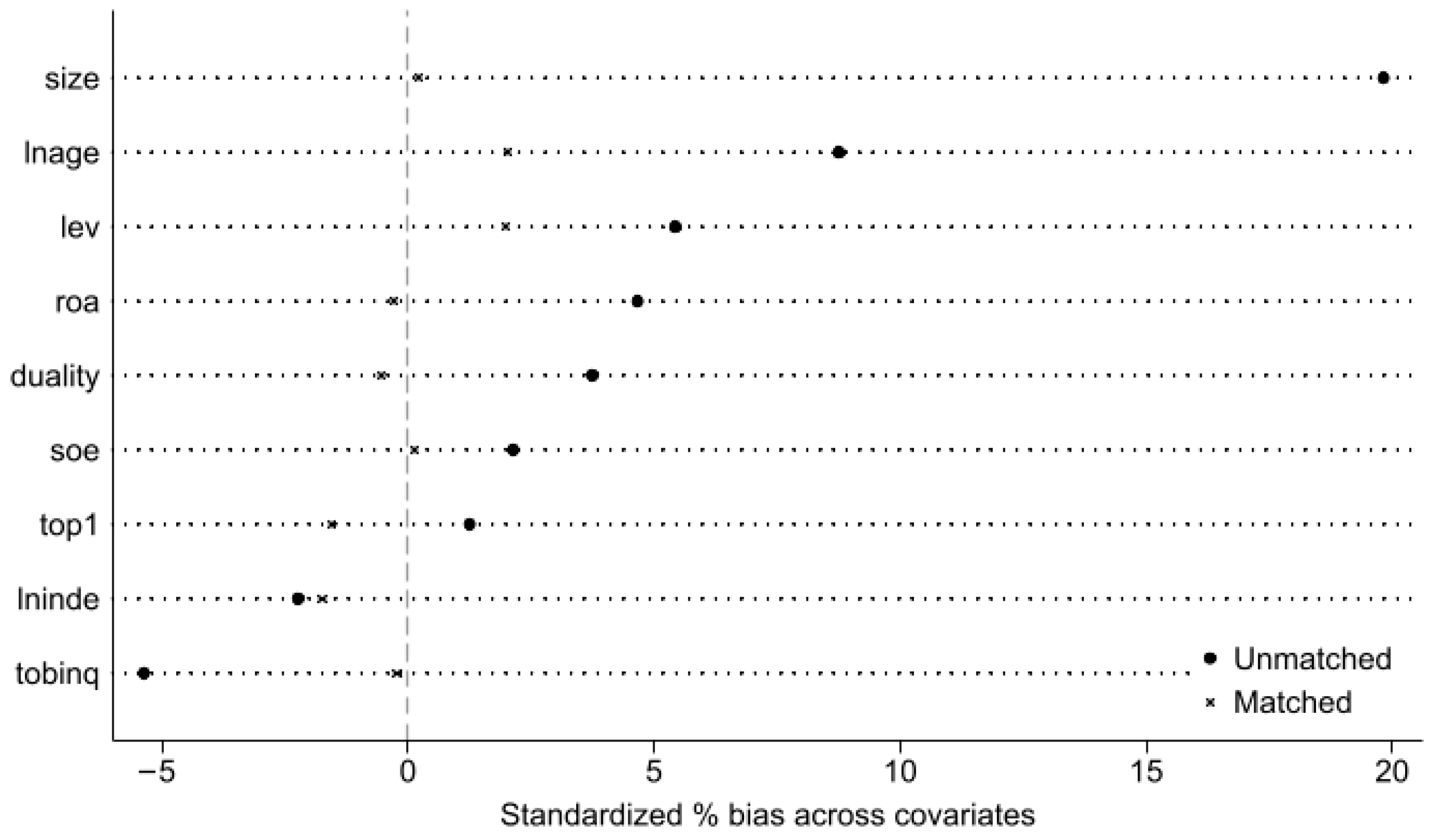

Thirdly, the PSM estimation. The treatment group is defined as firms with higher ESG performance, while the control group consists of firms with lower ESG performance. The propensity scores are estimated through a logit model, with all the covariates in Model 1, while controlling for industry and year effects.

Figure 2 reports the standardized mean differences in covariates before and after matching, showing that most covariates approach zero after matching.

Table 4 reports the average treatment effect on the treated (

ATT). Before matching, the difference in digital transformation between the treatment and control groups was 0.136, which was significant at the 1% level. After matching, the

ATT remained positive at 0.076, with a

t-statistic of 1.68, indicating that firms with higher ESG performance exhibit a higher level of digital transformation compared to their matched counterparts. Although the level of significance is reduced after matching, the positive ATT supports the baseline findings and confirms that the effect of

ESG on digital

DT is robust after addressing potential sample selection bias.

In addition, to ensure the scientific validity of variable selection, the following procedures were conducted: Firstly, the time window was adjusted. To mitigate the potential impact of reverse causality on the regression results, the lagged value of

ESG was used as the explanatory variable to re-estimate Model (1). Secondly, the core explanatory variable was replaced. Given that ESG rating systems vary across different agencies and that differences exist in the weighting of indicators, the

Huazheng ESG rating system for Chinese enterprises was adopted for re-examination. Both the mean (

HZH_mean) and median (

HZH_median) values of

Huazheng ESG ratings were included in the regression models. Thirdly, the dependent variable was replaced to address potential concerns regarding measurement validity. In the baseline analysis,

DT is measured with the logarithmic frequency of digitalization-related terms in annual reports of listed firms. Recognizing that text-based proxies may have limitations in precision and contextual interpretation,

Digitalrate is introduced as the alternative measurement, defined as the ratio of digital intangible assets to total intangible assets. The results based on this alternative specification remain consistent in direction and significance, confirming the robustness of the baseline findings. The robustness test results are reported in

Table 5. The findings are consistent with the baseline regression results, further confirming the reliability of the benchmark model.

4.4. Mechanism Channels Analysis

The study elaborates on the theoretical mechanism underlying the relationship between

ESG and

DT, and empirical analysis was conducted to test its impact. Building on this foundation, the mechanism analysis further explores the pathways through which

ESG facilitates

DT. During the practice of

ESG, different dimensions of dynamic capabilities can be enhanced, thereby promoting

DT. Following the two-step approach proposed, Model (2) is constructed as follows:

where

represents absorptive capacity (

Absorb), adaptive capacity (

Adapt), and innovation efficiency (

Innovation). The other parameters remain consistent with the baseline regression settings. The test results are summarized in

Table 6.

4.4.1. Absorbative Capability

To examine the mediating role of absorptive capacity, this study introduces Absorb as the mediating variable. The ratio of firms’ R&D investment to operating revenue is used as a proxy to measure absorptive capacity. A higher value of this indicator reflects stronger absorptive capacity.

The regression results in Column (1) of

Table 6 show that

ESG has a significant positive effect on

Absorb, with a coefficient of 0.003, significant at the 10% level. This indicates that firms with higher ESG performance tend to have stronger absorptive capacity, reflected in a higher ratio of R&D investment to operating revenue. Li et al. (2024) [

30] demonstrated that absorptive capacity plays a positive role in promoting digital transformation, and the present findings further confirm its role as a mediating channel. Specifically, firms with stronger ESG performance place greater emphasis on long-term development goals and are more likely to allocate resources to sustainable transformation activities [

34]. At the same time, ESG-oriented firms are generally more sensitive to technological changes and external knowledge, which enables them to better identify, absorb, and utilize new technologies. Therefore, ESG performance enhances firms’ absorptive capacity, thereby laying a solid foundation for digital transformation.

4.4.2. Adaptive Capability

This study introduces adaptive capacity as a mediating variable. The five-year moving standard deviation of firms’ profit margins is used as a proxy for adaptive capacity, denoted as Adapt. A higher value of this indicator reflects a stronger ability to adapt to external environmental changes.

Column (2) of

Table 6 reports that

ESG has a significantly positive effect on

Adapt, with a coefficient of 0.001, significant at the 10% level. Stronger adaptive capacity enables firms to adjust strategies and reallocate resources promptly in response to technological upgrades and rapid shifts in the industrial environment, thereby reducing risks associated with uncertainty [

35]. For digital transformation, an improvement in adaptive capacity allows firms to adopt and apply new technologies more efficiently and to adjust organizational processes accordingly, ensuring the smooth progress of digital transformation [

30]. Thus, enhancing adaptive capacity strengthens firms’ resilience while providing sustained momentum and support for digital transformation.

4.4.3. Innovation Capability

To examine the mediating role of innovation capability, this study introduces Innovation as the mediating variable. The ratio of the natural logarithm of the total number of invention, utility model, and design patent applications plus one to firms’ R&D expenditure is used as a proxy to measure innovation capability. A higher value of this indicator reflects stronger innovation capability.

The regression results in Column 3 of

Table 6 show that ESG has a significant positive effect on

Innovation, with a coefficient of 0.001, significant at the 5% level. This result indicates that firms with higher ESG performance tend to have stronger innovation capability, measured by patent output relative to R&D expenditure. Previous studies suggest that innovation capability is an important driver of digital transformation [

36,

37]. It allows firms to convert R&D investment into technological achievements and organizational improvements [

6]. The findings of this study further confirm its role as a mediating channel. Firms with stronger ESG performance are more likely to pursue sustainable innovation, increase the efficiency of R&D use, and produce higher quality patents [

38]. The innovation outcomes enhance firms’ technological competitiveness and provide the technological basis for digital transformation.

4.5. Heterogeneity Test

To further test whether firm differences affect the baseline results, this study conducts heterogeneity analysis. Corporate strategies and transformation paths are shaped by development stage and geographic location. Firms at different stages vary in resources, governance, and innovation capability, which may lead to different effects of ESG on DT. Geographic location reflects institutional environment, policy support, and market conditions. These regional differences may also influence how ESG performance affects digital transformation. Based on this, heterogeneity tests are conducted from the perspectives of development stage and geographic location.

4.5.1. Heterogeneity in Development Stage

To test the heterogeneity of the impact of

ESG on

DT at different stages of firm development, the sample is divided into three groups: growth stage (

Life = 0), maturity stage (

Life = 1), and decline stage (

Life = 2). The classification of firm development stages follows the approach of Dickinson [

39]. The regression results are reported in Columns (1)–(3) of

Table 7.

The results show that ESG has a significant positive effect on DT during the maturity stage, while the effects in the growth and decline stages are not statistically significant. This suggests that firms in the maturity stage are better positioned to translate ESG performance into digital transformation outcomes. One possible explanation is that mature firms have more stable resources, stronger governance structures, and clearer strategic orientations, which enhance their ability to integrate ESG practices with digital innovation. By contrast, firms in the growth stage face resource constraints, and firms in the decline stage face survival pressures, both of which may limit the role of ESG performance in driving digital transformation.

4.5.2. Heterogeneity in Geographic Location

Regional characteristics constitute an important external factor shaping corporate activities. Firms located in regions with more favorable conditions are more likely to attract capital inflows and benefit from a supportive business environment. In this study, the variable

Area is defined according to whether a firm is registered in a Yangtze River Economic Belt city. Firms located within the Yangtze River Economic Belt are assigned a value of 1, and those outside the region are assigned a value of 0. In addition, the level of digital infrastructure is considered, as it provides critical support for digital transformation. Cities designated as part of the “Broadband China” pilot program are identified as having relatively advanced digital infrastructure and are assigned a value of 1, while all other cities are assigned a value of 0. This variable is denoted as

Digital. Based on these classifications, grouped regressions are conducted using Model 1, and the results are presented in

Table 8.

Table 8 reports the heterogeneity tests based on geographic location. Columns (1) and (2) present the results for firms located inside and outside the Yangtze River Economic Belt. The coefficient of

ESG is significantly positive for firms within the

Yangtze River Economic Belt, with a value of 0.010 at the 1% level, while the effect is insignificant for firms outside the region. This suggests that the

Yangtze River Economic Belt provides a favorable institutional and market environment that allows ESG practices to be more effectively transformed into

DT. The concentration of policy support, industrial clusters, and financial resources in this region may enhance firms’ capacity to integrate ESG performance with digital transformation.

Columns (3) and (4) report the results for cities with different levels of digital infrastructure. For firms located in Broadband China pilot cities, the effect of ESG on DT is positive but not significant. In contrast, for firms in non-pilot cities, the coefficient of ESG is significantly positive at the 5% level, with a value of 0.009. This indicates that in regions where digital infrastructure is less developed, firms rely more on ESG performance to obtain external resources, thereby promoting digital transformation.

5. Conclusions and Discussion

This study examines the impact of

ESG on

DT in Chinese listed new energy enterprises from 2010 to 2023. The following conclusions are drawn: First, strong ESG significantly promotes

DT. Specifically, firms with better ESG demonstrate stronger resource capabilities, which provide better conditions for their digital transformation and technological upgrading. These findings highlight the important role of ESG as a strategic driver of digital transformation in the new energy sector. The above results are generally consistent with the findings of Cheng et al. (2025) [

33]. Second, the impact of

ESG on

DT varies across different stages of development and regional contexts. Firms in the maturity stage of development and those located in regions with favorable institutional and market conditions show a stronger positive relationship between

ESG and

DT. In contrast, the effect is weaker in firms in the growth and decline stages, as well as those in regions with limited external resources. Third, by applying the dynamic capabilities perspective, this study further explains the mechanisms through which ESG influences digital transformation. ESG enhances firms’ adaptability, absorptive capacity, and innovation capabilities, which in turn improve

DT.

In summary, this study draws on the perspective of dynamic capabilities to conceptualize ESG performance as a tool for enhancing resource capabilities. Existing studies adopt two approaches when considering the relationship between ESG and corporate digital transformation: one treats ESG outcomes as the research subject, focusing on the role of ESG in resource acquisition and capability enhancement during digital transformation [

40]. The other considers the long-term and dynamic nature of ESG performance, viewing it as a dynamic process [

41]. Regarding the pathway to achieving ESG and DT, this study supports the second view. Prior research has often positioned ESG within institutional and signaling theory frameworks [

42,

43]. In contrast, this study adopts the dynamic capabilities perspective, highlighting ESG’s role as a crucial channel for enhancing capabilities and achieving digital transformation goals. This approach deepens the understanding of ESG’s contribution to corporate transformation. In the traditional Resource-Based View, ESG is seen as a heterogeneous resource [

26]. It acts as a link between internal and external networks, helping firms gain a competitive advantage during the transformation process. However, this view does not account for the dynamic nature of ESG. This study redefines ESG through the lens of dynamic capabilities, emphasizing it not only as an opportunity for enhancing resource capabilities but also as a process of “learning by doing.” This perspective offers a more comprehensive explanation of ESG’s role in corporate transformation.

This study provides practical implications for both policymakers and enterprise managers seeking to foster ESG-driven digital transformation in the new energy sector.

For policymakers, there are three suggestions. First, an ESG-oriented governance framework tailored to the specific characteristics of the new energy industry should be developed. Unlike traditional manufacturing sectors, new energy enterprises face distinct challenges such as high policy dependence, rapid technological evolution, and volatile production cycles. ESG standards and disclosure frameworks should therefore reflect these sectoral characteristics. Specifically, regulators may require firms to disclose indicators such as carbon emission reduction per kilowatt-hour, localization rate of key components, digital management level of energy storage systems, and the proportion of renewable energy utilized. These metrics capture both environmental and digital dimensions and can help evaluate firms’ innovation capacity and technological integration.

Second, a targeted capacity-building mechanism should be established to assist firms—particularly those in growth or transition phases—in formulating and implementing ESG strategies. This could include ESG training programs, pilot demonstration projects, and third-party advisory support, focusing on areas such as carbon accounting, green finance integration, and smart manufacturing practices.

Third, although not a central focus of this study, the heterogeneity analysis reveals that ESG’s positive impact on digital transformation is less pronounced in central and western regions. These areas often face limitations in resource endowment and digital infrastructure. Accordingly, context-sensitive policy instruments such as regional ESG guidance funds, land and energy access for R&D, and public investment in green infrastructure may help reduce structural constraints. These recommendations, while supplementary, reflect spatial disparities in ESG effectiveness and support more inclusive transformation outcomes. Empirical evidence indicates that firms with higher ESG performance often exhibit stronger capabilities in resource integration, technological absorption, and organizational innovation. Therefore, beyond policy intervention, strategic responses at the enterprise level constitute a critical factor in facilitating effective transformation. Incorporating ESG considerations into strategic planning processes can facilitate the pursuit of low-carbon objectives while simultaneously improving operational efficiency and environmental governance through digital means. It exhibits not only regional heterogeneity but is also shaped by firms’ technological capabilities and stages of development. Enterprises should consider advancing ESG-oriented digital tools in key application areas such as energy storage optimization, smart grid operations, and carbon asset management. The development of digital ESG performance indicators and multi-dimensional evaluation frameworks can help better align corporate sustainability efforts with technological transformation goals. Technologies such as blockchain and big data analytics may further improve the accuracy, transparency, and reliability of ESG information disclosure, which is essential for enhancing external credibility and stakeholder engagement.

Moreover, the technological complexity, extended supply chains, and policy sensitivity characteristic of the new energy sector necessitate differentiated approaches to ESG capability-building. Case evidence from leading firms suggests that industry best practices offer replicable frameworks. For example, CATL has implemented an internal mechanism for dynamically adjusting technology strategies in response to policy changes under an ESG-oriented framework [

4]. LONGi has developed a structured knowledge management system to facilitate employee learning in green and digital technologies [

44,

45].

Finally, the institutionalization of ESG practices requires formal governance structures within firms, including the appointment of dedicated roles such as Chief ESG Officers and the integration of ESG criteria into digital transformation performance management systems. The arrangements will enhance internal accountability and position ESG as a core strategic function in enterprise-level innovation.

While this study provides valuable insights into the long-term impact of ESG on DT, there are some limitations that should be considered. First, this research primarily focuses on the long-term effects of ESG performance and does not address the potential short-term impacts that may arise from unexpected external shocks, such as public health crises, geopolitical conflicts, or economic disruptions. These short-term disruptions could influence how firms manage their ESG obligations and allocate resources during periods of uncertainty. Another limitation of this study is that, while we have focused on exploring the relationship between ESG performance and digital transformation, particularly in the context of new energy enterprises, we have not extended the analysis to the economic and environmental consequences of ESG performance and digital technology innovation. These aspects, including economic impacts such as profitability, productivity, and market performance, as well as environmental outcomes such as carbon emission reduction and resource efficiency improvement, are crucial for a comprehensive understanding of the broader effects of ESG practices.

In future research, it is suggested that the economic and environmental consequences of ESG performance and digital innovation be further explored. Such analysis would contribute to a more holistic understanding of how digital transformation, driven by ESG initiatives, influences not only corporate performance but also the broader societal and environmental impacts. These additional dimensions would provide valuable insights into the sustainability of digital transformation and the long-term benefits of ESG adoption. Furthermore, future studies could build upon this research by investigating the short-term effects of ESG performance under external shocks, offering a more comprehensive understanding of how firms balance their ESG commitments with the immediate demands of digital transformation. Examining how firms in different industries or regions respond to such external shocks could provide a more nuanced understanding of ESG’s role in crisis management and its impact on digital transformation in volatile environments.