5.1. Theoretical Insights and Contributions

This study’s findings provide substantial theoretical insights that advance understanding of relationships among perceived ESG, green technology innovation, and enterprise competitive performance through social exchange theory extensions, revealing key theoretical mechanisms that demonstrate how sustainability practices create value through sophisticated stakeholder exchange processes rather than simple direct relationships.

First, the differential impacts of perceived ESG dimensions on green technology innovation (perceived environmental performance β = 0.299, perceived social responsibility β = 0.260, perceived corporate governance β = 0.181) reveal that different ESG domains activate distinct stakeholder exchange mechanisms. Perceived environmental performance triggers direct reciprocal exchanges with regulatory bodies, environmental organizations, and green consumers, providing immediate innovation support resources including technical expertise, regulatory flexibility, and market access Hu, Ma [

59]. This pattern aligns with social exchange theory predictions that clearer benefit expectations generate stronger reciprocal behaviors, explaining why environmental initiatives produce the strongest innovation effects [

63,

66].

Second, perceived social responsibility operates through network-mediated exchanges, establishing reinforcing relationships with multiple stakeholder groups including employees, communities, and suppliers, facilitating innovation through knowledge sharing, collaborative R&D, and operational support [

39]. The weaker coefficient indicates that these dispersed network benefits require longer development cycles but create more sustainable competitive advantages through relationship-building processes that are difficult to replicate. Perceived corporate governance’s moderate innovation effect but strong competitive performance impact (β = 0.251) suggests institutional exchange mechanisms, where governance excellence primarily influences financial stakeholders who provide capital and strategic resources rather than direct innovation inputs [

89].

Third, the significant mediation effects (20.98–24.03%) provide empirical evidence for temporal exchange sequences in social exchange theory applications, where initial perceived ESG commitments establish stakeholder trust and resource access, which firms subsequently convert into green technology innovation capabilities through sustained R&D investments and collaborative partnerships. These innovation capabilities then generate competitive performance benefits that reinforce stakeholder relationships, creating positive feedback loops that compound over time [

79]. The partial rather than complete mediation reveals dual value creation pathways, where perceived ESG practices create immediate stakeholder benefits through direct exchange relationships while simultaneously creating long-term innovation advantages through capability development processes.

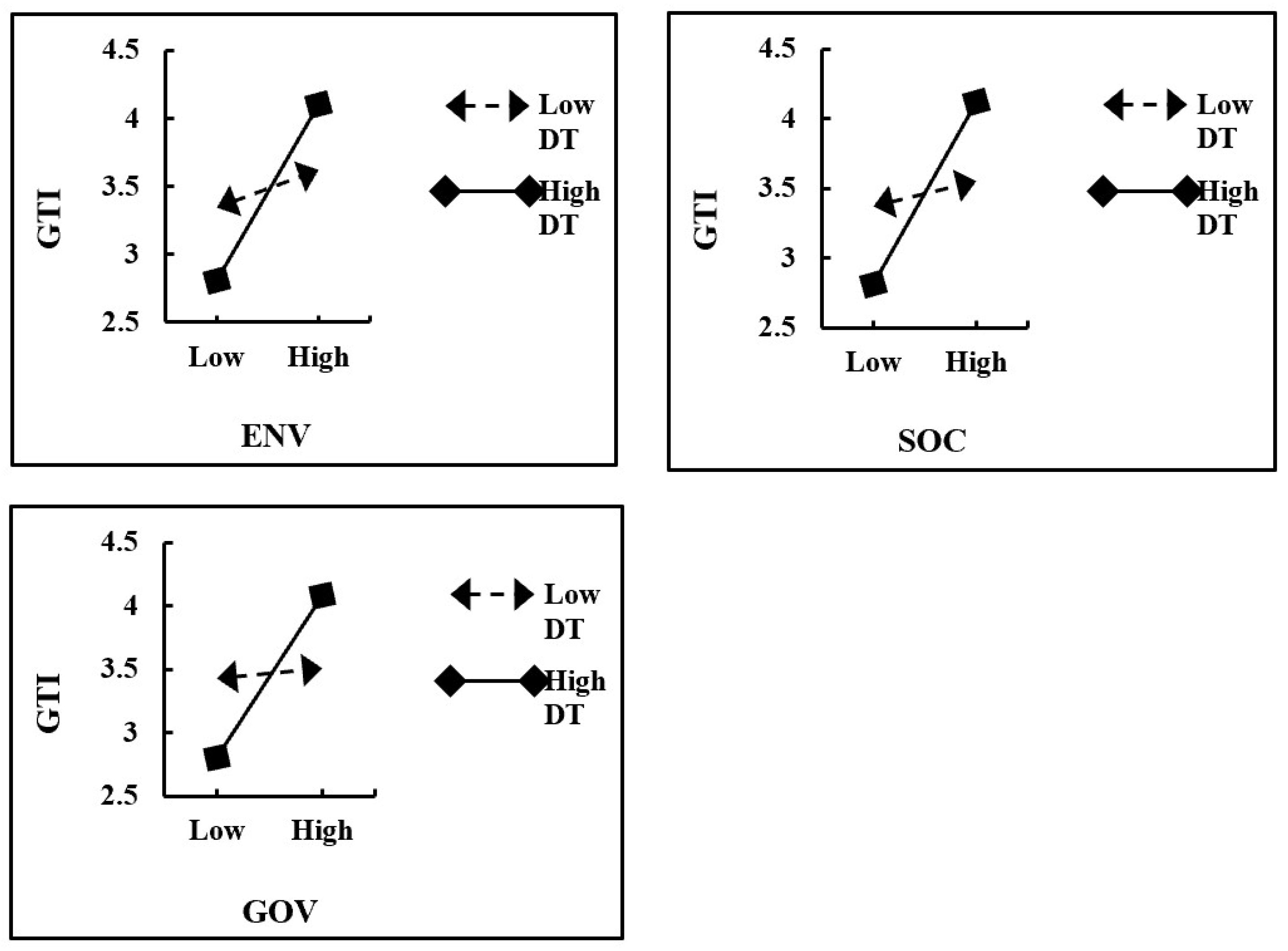

Fourth, digital transformation’s moderating effects (β increasing from 0.414 to 0.501) elucidate how technological capabilities alter fundamental social exchange dynamics by introducing exchange amplifier concepts that increase the speed, transparency, and scope of stakeholder interactions. Digital platforms enable real-time stakeholder communication, data-driven perceived ESG monitoring, and virtual collaboration spaces that overcome geographical and organizational barriers, transforming traditional intermittent stakeholder exchanges into continuous, data-rich interaction systems [

77,

78].

Fifth, China’s unique institutional framework creates distinctive dynamics among perceived ESG, green technology innovation, and competitive performance. The strong perceived environmental performance coefficient (β = 0.299) likely reflects China’s aggressive environmental policies, including the Environmental Protection Law and carbon emissions trading schemes, creating more direct innovation incentives compared to market-driven ESG environments. The significant perceived social responsibility effect (β = 0.260) aligns with China’s relationship-building (guanxi) cultural emphasis, where social responsibility fulfillment signals long-term relationship commitment, generating reciprocal support from business partners, local governments, and communities that facilitates collaborative innovation.

5.2. Practical Implications

The findings suggest several potential insights for enterprise managers, policymakers, and investors, while acknowledging the limitations of cross-sectional perceptual data in supporting specific operational recommendations.

For Enterprise Managers, the results suggest that perceived ESG dimensions differentially influence competitive performance through green technology innovation. The results suggest that perceived environmental initiatives may be associated with stronger innovation effects (β = 0.299), followed by social responsibility (β = 0.260) and governance mechanisms (β = 0.181). This pattern suggests that managers might consider exploring environmental initiatives as a potential pathway for innovation-driven returns, while maintaining balanced attention to social and governance dimensions for comprehensive stakeholder engagement.

The significant moderating role of digital transformation across all ESG dimensions (interaction effects ranging from 0.414 to 0.501) suggests that technological capabilities amplify the innovation benefits derived from ESG practices. The significant moderating role of digital transformation across all ESG dimensions (interaction effects ranging from 0.414 to 0.501) suggests that organizations with limited digital maturity might explore developing technological capabilities as a potential complement to ESG initiatives, though the optimal implementation sequence requires further investigation.

From a policy perspective, the observed differential effects across enterprise sizes (significant negative effects for small and micro enterprises compared to large enterprises) suggest that support mechanisms might benefit from being tailored to organizational capacity, though additional research is needed to validate optimal policy design approaches. These patterns suggest that smaller enterprises might potentially benefit from exploring technical assistance, shared resources, or graduated compliance approaches, though such policy interventions require careful pilot testing and evaluation before broad implementation. The strong digital transformation moderating effects indicate that policies promoting digital infrastructure development could amplify the effectiveness of ESG regulations and incentives.

For investors, the partial mediation results (20.98–24.03% through green technology innovation) suggest that ESG may create value through multiple pathways beyond innovation alone. This pattern indicates that investment evaluation frameworks might benefit from considering ESG practices not only for their innovation potential but also for their broader stakeholder relationship and operational efficiency implications, though additional research is needed to validate these value creation mechanisms across different market contexts.

5.3. Limitations and Future Research

This study is subject to several important limitations that require careful acknowledgment and critical reflection. The most salient concern arises from sampling bias and constraints on generalizability. By relying exclusively on MIIT-certified green manufacturing enterprises, the analysis systematically favors elite organizations with relatively advanced ESG capabilities, privileged government recognition, and stronger stakeholder management resources. These 1491 certified firms represent only 0.31% of China’s manufacturing population, leaving the vast majority of enterprises—99.69% without certification—outside the analytical scope. As a result, the findings may disproportionately reflect the practices and advantages of highly capable organizations, while underestimating the barriers faced by resource-constrained, uncertified, or newly established firms. This sampling strategy not only introduces systematic bias but also raises fundamental questions about the extent to which the observed ESG–performance linkages can be generalized to the broader industrial population. It is therefore plausible that the magnitude of observed relationships is inflated compared to what might be found in more representative samples.

Future research could address these sampling limitations through several strategic approaches. First, collaboration with industry associations and regional chambers of commerce could facilitate access to non-certified enterprises, enabling comparative analysis between certified and non-certified firms. Second, multi-stage sampling designs incorporating both certified and randomly selected manufacturing enterprises would provide more representative samples while maintaining analytical power. Third, partnership with government agencies beyond MIIT, such as provincial environmental protection bureaus or statistical offices, could enable broader enterprise access while ensuring data quality and response rates.

The observed firm size effects reveal graduated performance disadvantages for smaller enterprises, likely reflecting complex interactions between resource constraints, institutional access, and ESG implementation capacity in the Chinese context. However, our current design cannot examine potentially critical size–ownership interactions, which may be particularly relevant given China’s mixed ownership economy where state support mechanisms may differentially benefit smaller state-owned versus private enterprises. Future research should test these size–ownership interactions while drawing more extensively on Chinese-specific institutional literature to understand how guanxi networks, government support programs, and regulatory compliance burdens create differential ESG implementation challenges across enterprise categories. Additionally, longitudinal studies tracking enterprises across size categories over time could reveal whether apparent size disadvantages reflect temporary implementation barriers or fundamental structural constraints requiring targeted policy interventions.

The theoretical contributions are conceptual frameworks derived from cross-sectional evidence rather than fully validated dynamic theories. This design limits causal inference because simultaneous measurement prevents temporal precedence and allows reverse causality, and unobserved heterogeneity such as managerial quality or organizational culture may drive both ESG adoption and performance. A single-period snapshot also misses the dynamic and multi-temporal processes implied. These constraints point to longitudinal or panel designs with multi-source data and, where appropriate, ethnography to test the proposed orchestration and temporal mechanisms and to better identify causal effects. The apparent paradox in digital transformation, with a negative direct effect but a positive moderating effect, should be treated as provisional under cross-sectional evidence. Resolving this tension requires designs that track implementation phases and lagged effects, such as panel data with temporal lags or dynamic structural models that can separate short-term adjustment costs from longer-term complementarities.

Another concern relates to common method variance and measurement validity. Although multiple statistical and procedural controls were implemented, reliance on single-source managerial perceptions remains a vulnerability. Managers may overestimate their firms’ ESG performance relative to external evaluations, and self-reported competitive performance is particularly susceptible to social desirability bias, attributional distortions, and systematic over-reporting compared to objective financial benchmarks. These issues caution against overinterpreting the strength of observed relationships and highlight the importance of triangulating perceptual data with external ESG ratings, independent stakeholder assessments, or audited financial indicators in future research.

The cultural and institutional specificity of the Chinese context also presents limits to external validity. China’s state-led capitalist system, characterized by strong government-business linkages, extensive regulatory intervention, and cultural norms emphasizing long-term relational governance (guanxi), shapes ESG–stakeholder dynamics in ways unlikely to be replicated in liberal market economies. In such contexts, ESG advantages may be amplified by state support mechanisms, regulatory preferences, and political legitimacy channels that do not exist elsewhere. Consequently, the mechanisms identified here may travel only partially to other institutional settings, requiring careful adaptation when applied beyond China.

Finally, the study’s theoretical and measurement scope is necessarily constrained. By focusing on green technology innovation as the primary mediator, the model may simplify complex ESG–performance pathways, neglecting alternative mechanisms such as cost efficiencies, market premiums, enhanced resource access, or institutional legitimacy. Similarly, the treatment of digital transformation as a unidimensional moderator obscures potentially important differences across technologies, implementation strategies, and organizational capacities. These theoretical and operational simplifications limit explanatory breadth and call for more fine-grained models that integrate multiple mediating and moderating mechanisms.

5.4. Conclusions

This study demonstrates how perceived ESG influences competitive performance through green technology innovation, with digital transformation serving as a key moderator. Analysis of 453 Chinese manufacturing enterprises provides empirical support for social exchange theory extensions in sustainability contexts.

Key findings reveal that perceived environmental performance most strongly drives innovation, while perceived corporate governance most directly affects competitive performance. Green technology innovation mediates 20–24% of ESG–performance relationships, with digital transformation consistently amplifying these innovation benefits across all ESG dimensions.

This research proposes three conceptual frameworks for future theoretical development: stakeholder exchange orchestration mechanisms, digitally enhanced social exchange processes, and perception-based ESG measurement approaches in emerging markets. These conceptual contributions require longitudinal empirical validation to establish theoretical standing. Practically, the findings offer resource-constrained implementation strategies for enterprises and policy frameworks for tiered ESG requirements. Despite sampling and methodological limitations, this research establishes foundations for advancing ESG–innovation–performance understanding across diverse contexts.