1. Introduction

What drives consumers to make unplanned purchases in low-cost retail environments? This question becomes particularly relevant in emerging markets where consumers operate under income constraints and heightened price sensitivity. The rise of hard-discount formats across Latin America, and, in particular, their rapid expansion in Metropolitan Lima, underscores the importance of understanding the psychological and economic mechanisms behind impulsive consumption in such settings.

Impulsive buying has been extensively studied in traditional retail environments; however, little is known about how this behavior manifests in low-cost stores where utilitarian considerations often prevail. Existing research has focused on emotional gratification, social norms, or marketing stimuli, yet most fail to differentiate between the types of impulsive buying or the relative influence of internal versus external factors in price-sensitive contexts. This gap is particularly salient in developing economies, where cultural, economic, and structural conditions shape consumer decision-making in distinct ways, as evidenced by studies showing that intrinsic factors such as materialism, hedonic value, and trust significantly influence impulsive shopping in emerging markets [

1].

This study addresses this gap by examining the relationship between psychological, economic, social, and personal factors and the intensity of impulsive buying behavior. Using a structured survey administered to 380 consumers in Lima and applying both ordered logit and multinomial discrete choice models, we find that psychological and economic variables are the most significant predictors of impulsivity, while social influences are statistically insignificant. Personal factors, though less prominent, also exhibit a positive and measurable effect.

Our findings are threefold: First, psychological and economic factors emerge as the strongest predictors of impulsive buying across all model specifications. Consumers who exhibit higher emotional reactivity or face enticing economic incentives, such as time-limited promotions or perceived bargains, are significantly more likely to engage in spontaneous purchases. Second, social factors are not statistically significant in any model, contradicting conventional assumptions about peer influence in consumption behavior. Third, personal variables show moderate but consistent effects, suggesting that subjective evaluations and individual heuristics still shape decision-making, even in low-cost environments.

To test these relationships empirically, a structured questionnaire is designed and validated through expert judgment and a reliability analysis using Cronbach’s alpha . The survey includes items covering four dimensions of influencing factors—psychological, economic, social, and personal—as well as three dimensions of impulsive buying: remembered, suggested, and pure. Responses are measured on Likert-type scales and subsequently categorized into ordinal levels. The statistical strategy relies first on ordered logit regression models to account for the ordinal nature of the dependent variable. To test for potential violations of the proportional odds assumption and ensure robustness, the analysis incorporates multinomial logit and probit models. These methods allow for cross-validation of findings and provide a comprehensive understanding of how the explanatory factors operate across varying intensities of impulsive purchasing behavior.

In theoretical terms, this research advances the understanding of consumer behavior by situating impulsive buying within a low-income and cost-sensitive retail ecosystem. This dimension remains understudied in the broader marketing and behavioral economics literature. Practically, the results underscore the need for retailers to recalibrate their promotional strategies. Rather than relying on social persuasion or extensive branding, they should focus on immediate affective stimuli and clear economic triggers to stimulate unplanned purchases. By aligning with the cognitive and financial profile of the low-cost consumer, these strategies can generate higher conversion rates and foster store loyalty in an increasingly competitive market.

In this sense, the study contributes to the broader sustainability debate by showing that understanding the drivers of impulsive buying in low-cost retail is not only important for marketing effectiveness but also critical for promoting responsible consumption among vulnerable groups. By examining how economic and psychological factors shape unplanned purchases, the research offers evidence to support strategies that reduce financial stress in low-income households and encourage more sustainable retail practices. These insights align with the Sustainable Development Goals (SDGs), particularly Goal 12 on Responsible Consumption and Production, and provide guidance for balancing affordability, consumer protection, and long-term resilience in emerging markets. In line with previous research, sustainable purchasing is strongly influenced by psychological, social, and identity-based motivations, especially among younger generations [

2]. Furthermore, studies on willingness to pay for sustainable attributes in areas such as food consumption and mobility demonstrate that consumers are increasingly sensitive to the trade-offs between affordability and sustainability, highlighting the need to integrate these dimensions when addressing consumer behavior in emerging economies [

3,

4].

We also address two research gaps: The first is a cognitive gap, stemming from the limited understanding of impulsive buying among low-income consumers and in hard-discount retail formats, despite their growing importance in emerging markets. The second is an empirical gap, since prior studies have not combined ordered logit and multinomial models to test the robustness of results across specifications. In response, this article frames its research problem as the need to clarify the determinants of impulsive buying in low-cost retail contexts while ensuring methodological rigor. The central objective is to analyze the influence of psychological, economic, social, and personal factors on the intensity of impulsive purchases within a theoretical framework grounded in consumer behavior and behavioral economics. This positioning highlights both the substantive and methodological contributions of the study from the outset.

The remainder of this article is structured as follows:

Section 2 reviews the literature and develops the research hypotheses.

Section 3 presents the data, sampling design, and econometric methodology.

Section 4 reports the empirical results, while

Section 5 discusses their theoretical and practical implications.

Section 6 concludes the study, and

Section 7 highlights its main limitations and suggests directions for future research.

2. Literature Review

According to [

5,

6,

7], research on impulse buying remains in a consolidation stage and is characterized by fragmentation, with a predominance of studies based on surveys and experiments. These authors propose a conceptual framework that incorporates antecedents and mediators of impulsive behavior, emphasizing the need to integrate diverse theories and contexts to capture its complexity. This is particularly relevant in low-cost retail environments, where the drivers of unplanned purchases often differ from those observed in traditional formats.

A large body of psychological research has highlighted the central role of emotions in impulsive decision-making. Ref. [

8] demonstrated that positive experiences at the point of sale reduce cognitive resistance to spending, particularly among young consumers with a strong hedonic orientation. This effect is especially pronounced in discount stores, where visual stimuli and promotions are designed to encourage rapid responses, thereby explaining the high propensity for impulsive buying in these settings.

In the context of sustainable consumption, Ref. [

9] found that extrinsic motivations such as environmental concerns, health practices, and market access determine membership in specific lifestyle segments. Similarly, Ref. [

10] showed that sensory preferences and perceived quality reinforce sustainable choices, suggesting that subjective attributes can amplify impulsive behavior when linked to personal values or beliefs about sustainability. Broader market dynamics also matter. Refs. [

11,

12] argue that the financialization of agricultural commodities has reshaped price formation and risk management, with implications for food security and consumer perceptions of scarcity, which may indirectly affect impulsive purchasing. Complementarily, Ref. [

13] demonstrated that factors such as logistics costs, inventories, and assortment breadth influence the choice between online and physical channels, shaping consumer exposure to impulse buying stimuli.

From a methodological perspective, Ref. [

14] applied a multinomial logit model to distinguish between new and used vehicle purchases, discarding the nested logit model due to violations of the Independence of Irrelevant Alternatives (IIA) assumption. Subsequent evidence reinforced the robustness of these models in transportation safety valuation, where psychological factors and demographic characteristics explain the heterogeneous willingness to pay for accident risk reduction [

15]. Likewise, their application in competitive pricing strategies demonstrated that constrained multinomial logit models incorporating willingness to pay allow more precise equilibrium price estimations across market segments [

16]. More recent contributions continue to validate their versatility. Ref. [

17] estimated willingness to pay for energy efficiency improvements, Ref. [

18] analyzed housing tenure, and Ref. [

19] underscored the suitability of the multinomial logit model for nominal categories, in contrast to ordered logit models designed for ordinal responses.

Applications in some regions illustrated the versatility of discrete choice models. In the transportation field, it was shown early on that incorporating trip attributes improves the prediction of shopping center choice [

20], while later contributions provided theoretical foundations for their use in research on complex consumer choices [

21]. More recently, this approach was used to analyze the willingness to pay for enriched products in different contexts [

22,

23,

24], and ordered logit models were applied to study hierarchical categories [

25,

26], as well as binary logit models in dichotomous decisions, reaffirming the relevance of the multinomial logit model when the categories are multiple and unordered [

27]. Likewise, research in Latin America has classified Brazilian households according to poverty typologies using a multinomial logit model [

28], while other works have extended its application to the study of technology-sensitive markets and freemium platforms [

29,

30]. Together, these contributions reinforce the relevance of this methodological framework for addressing complex phenomena such as impulse buying in low-cost retail environments, particularly in cities like Metropolitan Lima.

Sustainability-related studies provide valuable insights into complementary dimensions of consumer behavior. Positive attitudes toward sustainable agricultural attributes, coupled with perceived behavioral control, have been shown to significantly influence willingness to pay, although budget constraints remain a limiting factor [

31]. Subsequently, research on younger generations, especially Generation Z, has highlighted the role of social identity and perceived norms in shaping responsible consumption practices, with environmental awareness and peer influence serving as central motivators [

32]. More recently, in emerging markets such as Saudi Arabia, consumers have displayed favorable attitudes toward eco-friendly alternatives; however, their purchasing decisions continue to be shaped by price sensitivity and value perceptions. Sustainability awareness can attenuate these barriers by highlighting the importance of clear communication and labeling for driving the adoption of eco-friendly packaging [

2]. In addition, sustainability is not limited to direct consumption choices; a longitudinal study on shared bicycles in Boston showed that these initiatives generate energy savings and emissions reductions, consolidating them as an effective environmental mitigation mechanism in urban contexts [

33].

Empirical evidence further indicates that willingness to adopt innovative and sustainable mobility services, such as shared autonomous vehicles, varies significantly across sociodemographic profiles, with higher-income and better-educated groups, as well as environmentally sensitive individuals, displaying greater readiness to embrace these options [

34]. Complementary findings highlight the heterogeneity of consumer preferences, as illustrated in China’s new-energy vehicle market, where attributes such as driving range and charging infrastructure condition both acceptance and the broader sustainability of technological transitions [

4]. Likewise, perceived consumer effectiveness has emerged as a significant determinant of purchase intentions and willingness to pay for sustainable food attributes, suggesting that trust in one’s ability to influence environmental outcomes reinforces the adoption of responsible consumption practices [

3].

3. Methodology

3.1. Sample

The empirical analysis was conducted using a sample of 380 individuals residing in the Chorrillos district of Metropolitan Lima. The sampling design was non-probabilistic and purposive, targeting adult consumers between the ages of 18 and 39 belonging to socioeconomic strata B and C who had reported recent purchasing experiences in low-cost retail stores, including those with hard-discount formats.

Although purposive sampling was employed, demographic quotas by age and gender were applied to maximize heterogeneity and reduce the risk of unbalanced representation. Furthermore, the statistical strategy incorporated robustness checks through alternative model specifications (ordered logit, multinomial logit, and multinomial probit), which consistently confirmed the stability of the findings. These measures mitigated potential sampling bias and provide greater internal validity to the results, even in the absence of randomization.

The selection criteria were based on demographic relevance and behavioral congruence with the research objectives. According to demographic projections and household income segmentation in Metropolitan Lima, these groups represent a significant proportion of the urban population actively engaged in price-sensitive consumption practices. Moreover, the Chorrillos district offers a representative density of discount retailers, making it an appropriate setting for the study.

Data collection was carried out through structured questionnaires administered online. The instrument was validated by a panel of three expert judges to ensure content and construct validity, and its internal consistency was confirmed through Cronbach’s alpha coefficient, which yielded a value of 0.757, indicating an acceptable level of reliability. The final sample configuration ensured variability in responses while maintaining internal consistency across the dimensions analyzed, thus allowing for robust statistical inference in subsequent modeling.

Table 1 presents a detailed structure of the main variables used in the study organized into two fundamental blocks: impulsive buying as the dependent variable and influencing factors as explanatory variables. In the first block, the impulsive buying variable is divided into three dimensions: remembered, suggested, and pure. Each of these dimensions is assessed through three indicators: frequency, reasons for purchase, and influences. All are measured using five-point Likert-type scales, which allows the intensity and nuances of the consumer’s impulsive behavior to be captured.

In the second block, the influencing factors are grouped into four dimensions: psychological, economic, social, and personal. Psychological factors consider internal aspects such as desires, motivations, needs, and emotions; economic factors include key indicators such as prices, income, and promotions; social factors encompass the influence of family, work, and friendship groups; and personal factors are operationalized through demographic variables such as age and gender (closed-ended questions), as well as preferences and perceptions, again assessed using Likert scales. This combination of indicators allows for the capture of both subjective and objective elements of consumer behavior.

The tripartite distinction among remembered, suggested, and pure impulsive buying is well established in the consumer behavior literature [

35,

36,

37]. Each type reflects qualitatively distinct mechanisms of unplanned purchasing: remembered impulse relates to items recalled in-store without prior planning; suggested impulse arises from external stimuli such as promotions or displays; and pure impulse captures spontaneous, affect-driven decisions. While some conceptual overlap may exist, the empirical separation of these dimensions allows for a more nuanced understanding of impulsive behavior in low-cost retail environments.

The table design demonstrates a robust and coherent conceptualization of the variables, allowing for rigorous measurement of the phenomenon under study. The use of standardized scales ensured comparability between indicators and facilitates the application of multivariate statistical techniques such as the ordered logit and multinomial models used in the empirical section of the study. Furthermore, the differentiation between types of impulsive buying and the inclusion of multiple explanatory factors allow for a more precise analysis of the determinants of consumer behavior in low-cost stores, providing relevant input for both consumer behavior theory and the design of specific commercial strategies.

Table 2 presents the ordinal categorization of the main study variables, segmenting them into ranges that allow for differentiating low, medium, and high levels of intensity in both impulsive buying and the factors that explain them. This recoding facilitates the statistical treatment of variables within models such as ordered logit and multinomial models by converting continuous scales into categories that more clearly capture consumer behavior. For example, the total impulsive buying index, with a possible range of 11 to 55 points, is divided into three levels, low (11–25), medium (26–40), and high (41–55), thus allowing for a precise interpretation of the degree of impulsiveness.

Similarly, the explanatory factors are also scaled into three levels, allowing for an assessment of their relative weight based on the intensity of the impulsive buying. For example, psychological factors, which range from 5 to 25 points, are classified as low if they score between 5 and 11, medium if they score between 12 and 18, and high if they score between 19 and 25. This structure facilitates comparisons between consumer groups with different profiles and allows for the identification of behavioral patterns. In short, this categorization contributes to the methodological rigor of the study while improving the robustness of statistical inferences and the applicability of the results in the design of differentiated commercial strategies.

The recategorization of Likert-type responses into low, medium, and high levels was applied to enhance interpretability and align with the assumptions of ordered and multinomial models. To verify that this discretization did not introduce systematic bias, we also tested alternative specifications using the original continuous Likert scores. The results were substantively consistent with the categorical approach, confirming that the main conclusions are robust regardless of scaling strategy.

The choice of the Chorrillos district as the study site was based on its high density of hard-discount stores and the significant participation of households from socioeconomic levels B and C, which make it a representative space for the urban segment of price-sensitive consumers in Metropolitan Lima. However, this representativeness must be understood contextually, as other districts with different socioeconomic configurations, commercial density, or urban infrastructure could show different impulse buying patterns. Therefore, while the geographic delimitation reinforces the methodological consistency with the stated objectives, it also restricts the possibility of generalizing the results to the entire metropolis, an aspect that opens the way for future comparative research.

3.2. Research Hypotheses

The theoretical and empirical literature on impulsive buying behavior in low-cost retail environments suggests that such behavior is not random, but rather influenced by a set of identifiable psychological, economic, social, and personal factors. Based on this foundation, the present study formulates a set of hypotheses aimed at examining the extent and nature of these associations, particularly within the urban Peruvian context.

The general hypotheses are structured as follows:

H0:

There is no significant relationship between influencing factors and impulsive buying behavior in low-cost retail stores.

H1:

There is a statistically significant relationship between influencing factors and impulsive buying behavior in low-cost retail stores.

This general formulation is refined into four specific hypotheses, each corresponding to one dimension of the independent variable:

Ha (Psychological factors):

Consumers with greater emotional reactivity, desires, and motivations are more likely to engage in impulsive buying, consistent with findings that emphasize affective activation as a central trigger of unplanned purchases.

Hb (Economic factors):

Price sensitivity, income constraints, and promotional incentives have a strong positive association with impulsive buying, reflecting the salience of economic triggers in discount retail.

Hc (Social factors):

Social influence through peers, family, or colleagues does not significantly affect impulsive buying in low-cost settings, where speed and economic considerations dominate decision-making.

Hd (Personal factors):

Demographic and preference-based characteristics (e.g., age, gender, product appreciation) have a moderate but positive association with impulsive buying, reflecting their role in conditioning—rather than determining—the effect of psychological and economic drivers.

Each hypothesis is empirically tested using both ordinal and multinomial regression models to assess the robustness and consistency of the observed relationships.

3.3. Regression Models

This research applies a multivariate estimation strategy to analyze the relationship between psychological, economic, social, and personal factors and impulsive buying behavior in low-cost stores. The dependent variable is categorized into low, medium, and high levels, which justifies the use of ordinal models such as the ordered logit model within the proportional odds framework [

38], as well as the explicit assessment of that assumption using the Brant test [

39]. For comparative validation, we also consider alternative specifications grounded in the generalization of probit analysis to multiple responses [

40] and in the stereotype approach to ordered categorical variables [

41].

Additional predictive margins and diagnostic checks are reported in

Appendix A (

Table A1 and

Table A2), which validate the consistency of the econometric specifications and confirm the absence of harmful multicollinearity among the explanatory factors.

3.3.1. Ordered Logit

The ordered logistic regression model is used to estimate the probability that an individual i would exhibit a given level of intensity in their impulsive buying behavior. Letting

be the ordinal dependent variable, the model is specified as follows:

where

,

represents the psychological factor,

represents the economic factor,

represents the social factor,

represents the personal factor,

represents the thresholds or cutoff points that delimit the categories of the dependent variable, and

is a logistically distributed error term with a zero mean and constant variance.

The cumulative form of the model is expressed as follows:

This model is estimated separately for each of the impulsive buying dimensions, as well as for the total index, using maximum likelihood and robust standard errors.

3.3.2. Multinomial Models

To check the stability of the results obtained with the ordered logit model and explore possible violations of the proportional odds assumption, the following regression models with a nominal dependent variable are used: the multinomial logit and multinomial probit.

- (a)

Multinomial logit model

where the reference category is low levels of impulsive buying. The coefficients are interpreted as relative risk ratios and estimated using maximum likelihood.

- (b)

Multinomial probit model

where

is the standard normal cumulative distribution function. This model allows for incorporating correlation between the errors of the different alternatives, thereby overcoming the IIA restriction of the multinomial logit model.

4. Results

4.1. Descriptive Statistics

Table 3 presents a summary of key descriptive statistics for the study’s main variables: impulsive buying and influencing factors (psychological, economic, social, and personal). The mode for impulsive buying is 3, indicating that the most frequent category among respondents corresponds to a high level of impulsive buying. Similarly, the median (

) also takes the value 3, suggesting a distribution skewed toward high levels of impulsiveness in consumer behavior. This trend is reinforced by the observation that more than 50% of respondents (50.5%) fall into category 3, corresponding to a high level of impulsive buying.

Regarding the explanatory factors, the social factor stands out, with a mode and median of 1, and 52.9% of respondents falling into the lowest level. This indicates a clear tendency for social influences (such as family, friends, or work groups) to play a marginal role in impulsive buying decisions in the context analyzed. In contrast, personal factors show a high concentration at the highest level (52.4%), reflecting the widespread perception that individual characteristics such as age, gender, preferences, and subjective assessment are relevant elements when making spontaneous purchasing decisions.

Psychological and economic factors, on the other hand, show a more balanced distribution. Although the mode and median are at the middle level (value 2), a significant proportion of respondents—48.4% for psychological factors and 50.3% for economic factors—are at the second level, with significant percentages also at the high level (36.6% and 38.4%, respectively). These results suggest that both internal drives (desires, emotions, needs) and economic conditions (prices, income, promotions) significantly but heterogeneously influence impulsive buying. Taken together, these descriptive patterns provide a solid empirical basis for advancing multivariate analysis to assess the specific contribution of each factor to the likelihood of developing impulsive buying behavior.

4.2. Statistical Analysis

Table 4 presents a combined cross-tabulation relating the levels of psychological, economic, social, and personal factors to the different degrees of impulsive buying (low, medium, and high). First, the psychological factor shows a clear relationship with the level of impulsivity; 56.8% of those with a high level of this factor also fall into the high level of impulsive buying, while only 4.7% with a high psychological level remain in the low purchasing category. This distribution suggests that emotional impulses, internal motivations, and personal needs are strongly associated with a greater predisposition towards unplanned buying.

In the case of the economic factor, the data reinforce its relevance as a key determinant. It is observed that none of the individuals with a low economic level falls into the high level of impulsive buying (0.0%), while 53.6% of those with a high score for this factor also fall into the highest level of impulsive buying. This highlights the explanatory power of economic factors such as prices, promotions, or income, and their catalytic effect on purchasing decisions. The transition from low to high levels of impulsivity is accentuated as perceived economic status increases, reinforcing its importance as a predictive variable.

Equations (

3)–(

5) illustrate how consumer characteristics shape the probability of belonging to different levels of impulsive buying. Equation (

3), the ordered logit model, indicates that psychological, economic, social, and personal factors shift individuals across thresholds that define low, medium, or high impulsivity. Equation (

4), the multinomial logit model, translates these effects into relative risk ratios, showing how stronger psychological or economic stimuli increase the likelihood of higher impulsivity compared to the baseline. Equation (

5), the multinomial probit model, incorporates correlations between alternatives, acknowledging that unobserved influences may affect multiple impulsivity levels simultaneously. These formulations align with the empirical patterns in

Table 4, where 53.6% of consumers with high economic scores and 56.8% with strong psychological factors fall into the high-impulsivity group, confirming that the models not only fit statistically but also reflect observed behavioral dynamics in low-cost retail contexts.

In contrast, social and personal factors exhibit distinct behaviors. In the case of the social factor, the data reveal a weak relationship; even among those with a high level of social influence, only 6.2% are at the high level of impulsive buying. This is consistent with previous findings that rule out a significant association between peer pressure and spontaneous purchasing decisions. In contrast, the personal factor shows a more marked trend; 60.4% of those with a high level of personal influence also have a high level of impulsivity. This pattern suggests that factors such as individual preferences, age, and subjective evaluation of the product do have a relevant effect, although it is not as decisive as that of psychological or economic factors. Overall, this table clearly maps how each dimension differentially influences impulsive buying behavior.

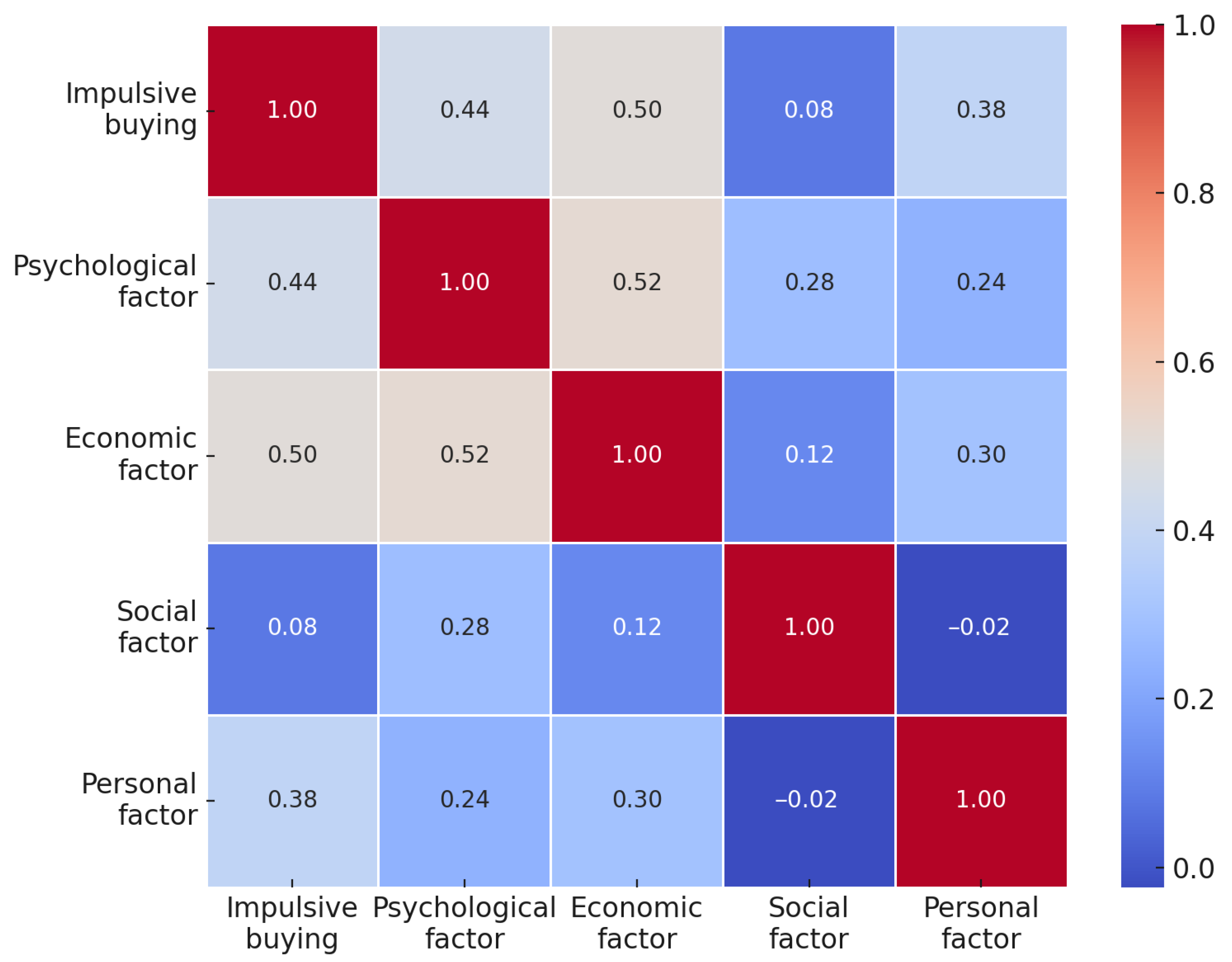

Figure 1 shows a correlation heatmap summarizing the linear associations between the study variables. It can be observed that the impulsive buying variable maintains moderately positive correlations with the economic (0.50), psychological (0.44), and personal (0.38) factors, suggesting that these three factors are positively associated with impulsive buying behavior. These correlations indicate that, the greater the intensity of the aforementioned factors, the greater the likelihood that individuals will make unplanned purchases. In contrast, the relationship with the social factor is barely perceptible (0.08), reinforcing the limited influence of social dynamics on this type of consumption decision, as evidenced in the previous analyses.

On the other hand, relevant correlations are also identified between the explanatory factors. For example, the psychological and economic factors present a moderately positive correlation (0.52), suggesting that emotions, desires, and motivations may be related to the perception of prices, promotions, or purchasing power. Likewise, it is observed that the psychological factor maintains a low but significant correlation with the social factor (0.28), which could indicate a slight interaction between personal emotions and the social environment, although it has little explanatory weight. Finally, the social factor exhibits a practically zero correlation with the personal factor (−0.02), demonstrating independence between external influences and the individual characteristics of the consumer. Overall, the figure reinforces the validity of considering the economic factor as the strongest predictor of impulsive buying, followed by the psychological factor and, to a lesser extent, the personal factor.

Figure 2 presents scatter plots with jittering that visualize the relationship between levels of impulsive buying and each of the explanatory factors (psychological, economic, social, and personal), using ordinal categories coded from 1 to 3. In the upper-left panel, a positive trend can be seen; as the level of the psychological factor increases, the concentration of observations at the highest levels of impulsive buying also increases. This arrangement suggests a direct association between emotions, desires, or personal motivations and unplanned consumption behavior.

A similar pattern can be observed in the upper-right panel, where a greater density of points is concentrated at the intersection between the high levels of both variables. This alignment reinforces the hypothesis that economic stimuli—such as low prices, promotions, or sales—directly influence the propensity to make impulsive purchases. The distribution shows less dispersion than in the case of the psychological factor, suggesting that the economic component could be even more predictive or consistent in its influence on consumer behavior.

In contrast, the lower panels, corresponding to the social and personal factors, show more diffuse relationships. In particular,

Figure 2 shows a lack of a defined pattern; the points are scattered without a clear direction, indicating that the influence of the social environment (family, friends, colleagues) is not systematically linked to the level of impulsiveness in buying. In contrast, the personal factor graph shows a slight positive trend, with a greater concentration of points in the upper-right quadrant. This suggests that individual characteristics such as age, gender, or personal preferences could also play a role in triggering impulsive buying, albeit less consistently and with less weight than psychological and economic factors.

4.3. Modeling

Table 5 presents the estimated marginal effects for three regression models, the ordered logit, multinomial logit, and multinomial probit, applied to three levels of impulsive buying intensity: low, medium, and high. The results show that psychological, economic, and personal factors have significant and consistent effects on the probability of belonging to different impulsiveness categories, while the social factor does not present statistically significant effects at any level or for any model. This finding reinforces the weak influence of social variables previously observed in the descriptive and graphical analyses.

In the case of high impulsive buying intensity, both the economic and psychological factors present positive and highly significant coefficients in all three models. For example, in the ordered logit model, an increase in the level of the economic factor increases the probability of falling into the high-impulsiveness category by 0.207 points, while the effect of the psychological factor is 0.166. These effects remain robust in the logit and multinomial probit models, indicating that consumers with greater price sensitivity and greater emotional intensity are more likely to frequently make unplanned purchases.

Conversely, the negative marginal effects observed at the low and medium levels suggest that an increase in economic, psychological, or personal factors decreases the likelihood that individuals will remain at low levels of impulsivity. For example, in the ordered logit model, the coefficient for the economic factor in the low category is −0.060 , implying that a greater weight for this factor shifts consumers toward higher levels of impulsive behavior. Overall, the table demonstrates not only the direction of the effects but also their magnitude and statistical significance, supporting the hypothesis that impulsive buying is strongly determined by internal and economic components, while social influence is practically null in this specific context.

Table 6 presents the fit indicators of the estimated econometric models: the ordered logit, multinomial logit, and multinomial probit. First, the log-likelihood values for the full model indicate that both the multinomial logit

and multinomial probit

models exhibit a better fit than the ordered logit model

, as values closer to zero reflect a greater likelihood. Furthermore, the likelihood ratio test (LR test) shows highly significant results

in all models, confirming that the inclusion of the explanatory variables significantly improves the predictive capacity compared to the null model with only the intercept.

Regarding the pseudo coefficients of determination, the multinomial logit and probit models perform better than the ordered model. In particular, McFadden’s reaches 0.262 in the multinomial logit model versus 0.222 in the ordered model, while other complementary indicators such as Cragg and Uhler’s (0.45) and the Count (0.442) also confirm the superiority of the multinomial model. This set of measures indicates that the models are able to explain a considerable proportion of the variability observed in impulsive buying behavior, although there is room for improvement if additional variables or nonlinear specifications are considered.

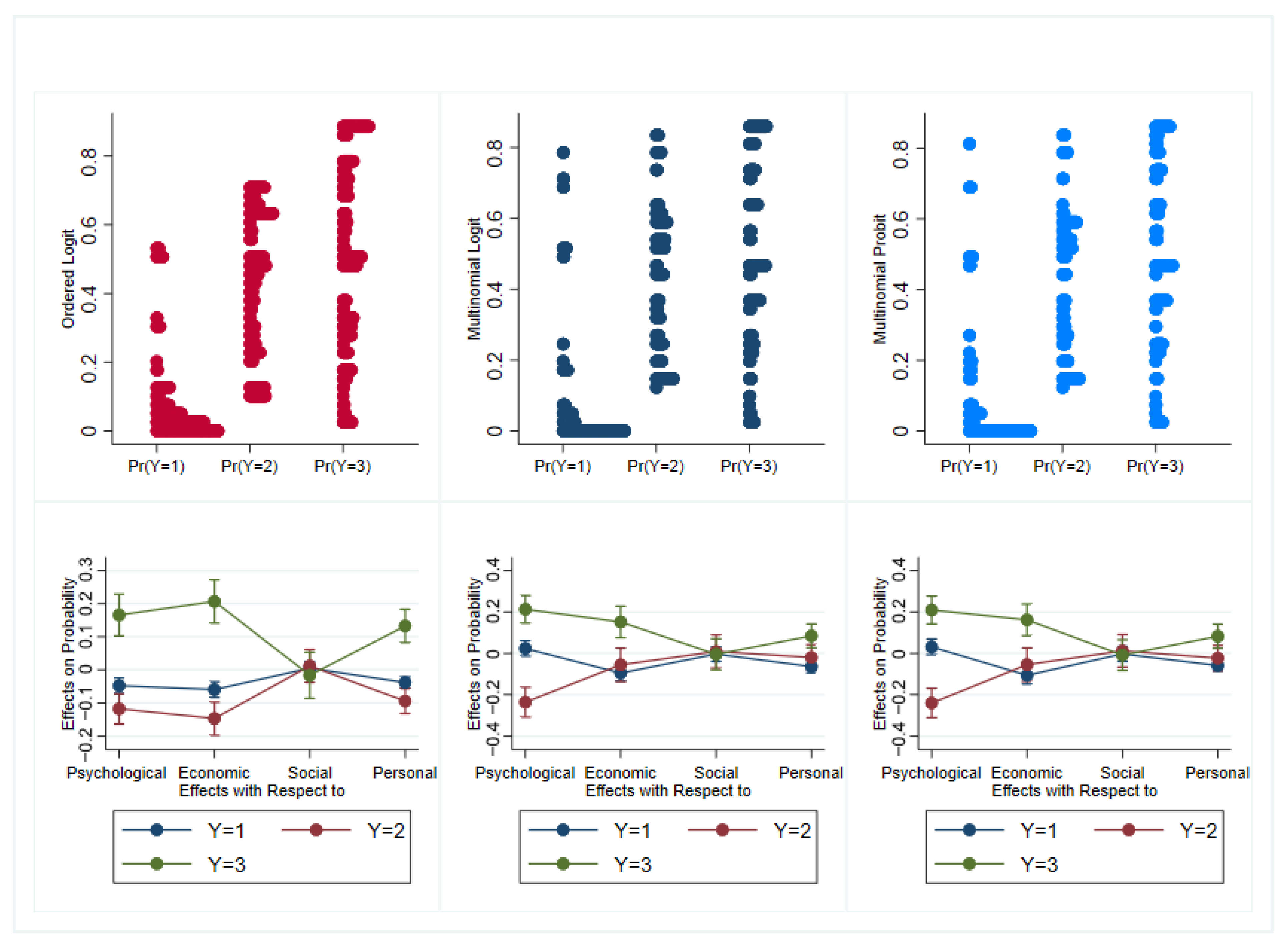

Figure 3 provides a graphical comparison of the three estimated models: the ordered logit, multinomial logit, and multinomial probit. The comparison is based on two types of visualizations: predicted probabilities for each impulsive buying level (top) and average marginal effects with 95% confidence intervals (bottom). At the top, scatter plots show the predicted probability of belonging to each of the three impulsive buying categories (

,

,

), according to the model considered. Adequate discrimination between categories is observed, particularly for the multinomial models, indicating their ability to capture the heterogeneity of consumer behavior.

At the bottom, line graphs reflect the average marginal effects of each factor on the probability of belonging to a given impulsive buying category. It can be seen that psychological and economic factors have a substantial differential effect on the three probabilities , with greater intensity at the high level , confirming their determining role. The effect of the psychological factor on the probability of high levels of impulsive purchasing (green line) is clearly positive and statistically significant, as shown by the narrow confidence intervals. Similarly, the economic factor also positively influences the probability of reaching the highest level of impulsivity, highlighting its relevance as a robust and stable predictor.

On the other hand, the effects of the social and personal factors present a flatter or more inconsistent behavior. In all three models, the line corresponding to the social factor remains close to the horizontal axis, indicating a marginally null or statistically insignificant influence on impulsive purchasing decisions, in line with the previous results. In contrast, the personal factor shows a slight positive trend for the probability of

, although with greater variability, suggesting that its effects are more contextual or dependent on the consumer’s profile. Overall,

Figure 3 graphically validates the econometric findings, confirming the superior explanatory power of psychological and economic factors and reaffirming the robustness of multinomial models compared to the ordered logit model.

5. Discussion

The evidence indicates that impulsive buying in low-cost retail is primarily shaped by psychological activation and economic triggers, with both factors exerting strong, positive, and statistically significant effects on the probability of falling into the highest impulsivity category across ordered and multinomial specifications. These results align with the meta-analytic and experimental research underscoring the role of affect and hedonic activation in lowering cognitive resistance at the point of sale [

8] and studies showing that salient price cues and promotions intensify spontaneous purchase tendencies in constrained settings [

13]. In our data, the economic factor shows the largest average marginal effect for the “high” category (e.g., 0.207 in the ordered logit model), with the psychological factor close behind (0.166), confirming their centrality as proximal drivers of unplanned purchases in hard-discount contexts.

Our second contribution concerns the weak and statistically non-significant role of social influence. While canonical accounts often assign an important role to peer norms and social proof in retail decisions, our models show no meaningful effect of the social factor at any intensity level, a pattern that is also reflected in the near-zero correlation between the social dimension and the overall impulsive buying measure. This divergence from conventional wisdom is consistent with the notion that, in discount formats emphasizing speed and transactional efficiency, social cues are overshadowed by immediate affective and price stimuli [

5]. The heatmap and jitter plots visually reinforce this interpretation, with dense massing for psychological/economic pairings and diffuse, non-directional scatter for the social factor.

Third, personal attributes—capturing demographic and preference-based heterogeneity—exert positive but comparatively smaller effects. This echoes the lifestyle segmentation work in the food and sustainability domains, where individual valuations and preferences modulate purchase propensities without eclipsing stronger emotional or economic levers [

9,

10]. In our estimates, the personal factor significantly increases the probability of high impulsivity in all three models, yet with magnitudes below those of psychological and economic factors. The descriptive matrices and correlations show a similar hierarchy of influence. Together, these results suggest that personal characteristics condition, rather than determine, the translation of affect and price cues into unplanned purchasing.

Methodologically, the study speaks for model choice in discrete outcomes. Tests decisively reject the parallel-slopes assumption for the ordered logit model, while a Hausman test does not reject the IIA, supporting the multinomial logit model as the preferred specification for these data. This is coherent with prior guidance stating that ordered models fit hierarchical responses whereas multinomial models better accommodate nominal categories and heterogeneous marginal effects across outcome levels [

14,

19]. Fit diagnostics also favor multinomial models (e.g., a higher McFadden’s

and superior likelihood), and graphical diagnostics show clearer category discrimination under multinomial structures—evidence that fine-grained heterogeneity across impulsivity tiers is empirically salient in discount retail settings.

From a sustainability perspective, these findings highlight a potential contradiction: impulsive buying can undermine responsible consumption by generating financial stress and reducing the ability of low-income households to make balanced and informed purchasing decisions. At the same time, understanding the psychological and economic triggers behind unplanned purchases provides an opportunity to design interventions—such as clearer labeling, balanced promotions, or store layouts that minimize excessive stimuli—that reconcile affordability with consumer protection. In this sense, impulse buying and sustainable consumption are not inherently opposed, but require careful management of retail strategies to ensure that short-term affective responses do not compromise long-term household well-being. This bridge between impulse buying and responsible consumption directly aligns with SDG 12, emphasizing the importance of fostering consumption environments that are both inclusive and sustainable.

Consequently, the findings have actionable implications for retail practice. Retailers operating in hard-discount formats should prioritize clean and salient price architectures—such as limited-time deals and transparent promotional schemes—while designing atmospherics that elicit positive but low-friction affect. In contrast, mechanisms based on social proof appear to have limited traction in this context [

5,

8]. Given the moderating role of personal factors, segmentation strategies should combine basic demographics with preference-based micro-segments, enabling retailers to calibrate the intensity of promotions and tailor message framing with greater precision. This approach aligns with broader insights from complexity research, where apparently chaotic behaviors reveal consistent underlying structures once the appropriate analytical lens is applied [

42].

At the policy level, recognizing that price salience and affective triggers can systematically shift unplanned consumption highlights the potential of “choice architecture” nudges to reduce over-spending risks among vulnerable consumers while maintaining access to genuine bargains [

21]. It should be emphasized, however, that these policy recommendations are extrapolations supported by behavioral economics theory and prior empirical evidence since this study did not involve direct intervention experiments.

Table 7 summarizes the study’s main theoretical and practical contributions, showing that the methodological combination of ordered and multinomial models provides a solid analytical framework for segmenting and predicting impulsive behavior; empirical evidence on the multidimensional nature of impulsive buying allows for the design of differentiated promotional strategies; and the validation of the differential impact of psychological, economic, social, and personal factors guides prioritizing the first two as central axes in marketing management in low-cost stores.

6. Conclusions

The results of this study provide robust evidence regarding the determinants of impulsive buying behavior in low-cost retail environments within an emerging urban context. Specifically, the empirical findings confirm that psychological and economic factors exert a statistically significant and consistent influence on the intensity of unplanned purchases, in both ordinal and multinomial model specifications. These dimensions, associated with emotional triggers, price sensitivity, and promotion-driven motivations, emerge as the most salient predictors of impulsive behavior.

In contrast, social factors—such as peer or group influence—do not demonstrate a significant relationship with impulsive buying, suggesting that, in this segment of the Peruvian retail market, social dynamics exert a negligible effect on spontaneous consumption decisions. This finding departs from the traditional assumptions in the consumer behavior literature and reinforces the context-dependent nature of such influences.

Personal factors, while less prominent than psychological or economic ones, also show a positive and significant association, particularly through individual preferences and subjective product valuation. These effects, although more modest in magnitude, reveal the heterogeneous character of consumer profiles and their impact on impulsivity.

Taken together, the findings suggest that retail strategies aimed at stimulating impulsive buying in discount settings should prioritize economic incentives and psychological stimuli rather than social positioning. This has direct implications for the design of promotional campaigns, store layout, and customer experience in price-sensitive segments. Moreover, the differentiated influence of each factor highlights the need for nuanced segmentation approaches that go beyond traditional demographic variables.

From a sustainability perspective, these findings underscore the importance of designing retail environments and promotional strategies that prevent the deepening of economic vulnerability while fostering informed and balanced consumption. By highlighting the predominance of psychological and economic triggers over social influences, the study stresses the need for interventions that reconcile affordability with consumer protection and long-term household well-being. In this sense, the contribution of the research transcends marketing practice, offering relevant evidence for the sustainability debate by demonstrating that the drivers of impulsive buying in low-cost retail contexts are consistent with broader findings on sustainable consumption and willingness to pay for eco-friendly products [

2,

3,

4,

32]. This reinforces the imperative for developing consumption environments that safeguard affordability without compromising long-term sustainability objectives, thereby advancing both economic inclusion and responsible consumption in emerging urban markets.

Building on this perspective, our results indicate that impulse buying in low-cost retail should not be examined solely in terms of commercial effectiveness but also in relation to its implications for sustainability. The identification of psychological and economic factors as decisive drivers of consumer behavior in highly price-sensitive contexts highlights the urgency of fostering retail strategies that, while ensuring affordability, also shield households from mechanisms that may intensify financial vulnerability. In doing so, the study provides empirical support for the design of purchasing environments that promote balanced and sustainable practices, demonstrating that the viability of low-cost formats can be fully compatible with responsible consumption, provided that market incentives are aligned with consumer protection and long-term economic inclusion in emerging markets.

Future research should extend the scope of analysis to other urban districts and incorporate temporal or situational factors—such as time pressure, shopping frequency, or digital stimuli—that may interact with the determinants of impulsive consumption identified in this study. Incorporating a cross-cultural comparative perspective would also enrich the theoretical generalization of the results and clarify how diverse economic and sociocultural contexts shape consumer behavior. Such extensions are particularly relevant for advancing sustainability research, as they can generate evidence to guide retail strategies and public policies aimed at reducing financial vulnerability, encouraging responsible consumption, and reinforcing the alignment between consumer behavior and long-term development goals.

7. Limitations and Future Research Directions

First, it should be noted that the study was conducted exclusively in the Chorrillos district, an urban area characterized by a high density of discount stores and a demographic profile similar to the target segment. This selection is methodologically relevant, but at the same time limits the representativeness of the findings to the entire Lima metropolitan area. Other districts with different socioeconomic configurations, commercial density, or urban infrastructure could exhibit different impulse buying patterns, so the conclusions should be interpreted with caution in terms of generalizability.

While Chorrillos is a district with a high density of hard-discount retailers and a demographic composition strongly aligned with socioeconomic strata B and C, we acknowledge that extrapolation to the entire Lima metropolitan area must be made with caution. Future research should extend this analysis to districts with different socioeconomic and retail configurations, such as San Juan de Lurigancho or Villa El Salvador, to assess the robustness of impulsive buying patterns across heterogeneous urban contexts.

Second, the sampling design was non-probabilistic and purposive, which implies inherent limitations regarding statistical inference to broader populations. Although the sample reflects heterogeneity in age, socioeconomic levels (B and C), and recent shopping experiences, the lack of randomization may have introduced selection bias. Stratified probability sampling, applied in future research, would strengthen external validity and offer comparable results with greater population accuracy.

A third critical aspect relates to the cross-sectional nature of the design. By capturing information at a single point in time, the study describes significant associations between psychological, economic, and personal factors and impulsive buying behavior, but it does not allow for the establishment of causal relationships or temporal dynamics. Consumption decisions are subject to seasonal variations, changes in the economic situation, and transformations in retail offerings. Therefore, the implementation of longitudinal studies or consumer panels would enrich the analysis by identifying trajectories and the stability of the observed effects.

Another limitation concerns the age composition of the sample, which focused on consumers aged 18–39. While this group represents the core segment of low-cost retail customers, the findings may not be directly generalizable to older cohorts who might display different impulsive buying patterns due to greater income stability, accumulated consumption experience, or distinct generational preferences. Future research should explicitly compare age cohorts and explore potential nonlinear relationships between age, income stability, and impulsivity in order to provide a more comprehensive understanding of how lifecycle factors shape consumer behavior.

Furthermore, the research could be exposed to problems of endogeneity and omitted variables. It is plausible that consumers with a greater tendency toward impulsivity perceive economic or psychological stimuli more intensely, which generates simultaneity in the relationship. Furthermore, factors not included, such as self-control, time pressure, financial stress, digital exposure, or access to credit, may simultaneously influence the predictors and purchasing behavior. These limitations invite future work to consider the use of instrumental variables, unobserved heterogeneity models, or structural approaches that reduce this risk.

Finally, measuring variables through self-administered questionnaires could have introduced social desirability biases and common method problems, given that psychological factors and impulsive behaviors were assessed using a single instrument. Although validation measures were adopted and anonymity was guaranteed, this methodological risk persists. Future research could complement survey data with in-store behavioral observations and records. Such work would help validate the practical effectiveness of proposed strategies and clarify their long-term impact on consumer welfare and sustainable consumption.