Abstract

China launched a nationwide unified Emissions Trading System (ETS) in 2021 and issued the Interim Regulations on the Administration of Carbon Emissions Trading in 2024 to regulate trading activities. To examine the effectiveness of China’s ETS policies, this study collected dynamic high-frequency data from 915 trading days, spanning from 16 July 2021 to 29 April 2025, and constructed a policy evaluation model based on the double machine learning framework. The findings indicate that China’s ETS policies have significantly increased the total trading volume of carbon emission allowances. This result has passed a series of robustness tests. Mechanism tests show that China’s ETS trading policies have significantly increased the transaction price and trading volume of carbon emission allowances. Compared with ETS in other countries and regions, China’s ETS policies are characterized by effectiveness, stability, and incrementalism, which can promote the orderly and efficient operation of the carbon emissions trading market. By refining the time span of the data and introducing cutting-edge causal inference methods, this study summarizes the successful experiences in the supervision and development of China’s carbon emissions trading market, providing precise evidence and feasible insights for global climate action and the development of ETS in developing countries.

1. Introduction

China established a national unified emissions trading market in 2021, and this event is widely recognized as significant in addressing global climate change. In terms of emission scale, China ranks first in the world in carbon emissions, reaching 1.27 × 1010 tons of CO2 equivalent in 2022 (https://www.climatewatchdata.org/, accessed on 26 August 2025). In terms of regional cooperation, China is a well-deserved leader in climate action among Asian developing countries and can facilitate multilateral cooperation through its leading position in technology and economy [1]. In particular, China’s global leading role has become increasingly prominent due to the withdrawal of the US government from global climate action [2]. Therefore, evaluating China’s emissions trading policies has become a key research topic.

The emissions trading system (ETS) has long been regarded by academia as the cornerstone of global climate action, capable of skillfully integrating the forces of the government and the market. The role of the government mainly focuses on total quantity control and quota allocation and influences the emission reduction effect of emissions trading [3,4,5,6,7,8,9,10]. The power of the market mainly drives enterprises’ green behaviors through price signals [11,12,13]. Bai and Rub argue that compared with climate policies such as taxes and subsidies, emissions trading can deliver substantial emission reductions with low transaction costs, and thus should be applied as a major climate policy [14]. Thanks to these ingenious designs, countries and regions such as the United States and Europe have successively carried out attempts at emissions trading. Of course, some scholars also have concerns about emissions trading. For instance, the European Union Emissions Trading System (EU ETS), the first transnational ETS established by the EU, has been plagued by issues such as inappropriate quota allocation [5,11,15], insufficient market vitality [4,16], sharp price fluctuations [15], and inadequate government supervision [15]. These problems have led to the emergence of issues like carbon premium [5,7] and carbon leakage [4,13].

Since China’s emissions trading market was established later than those in Europe and the United States, the risk of temporal and spatial carbon leakage is more severe [17]. There are three potential reasons for this risk. First, the mechanisms for total quantity control and quota allocation are incomplete, and the baseline method and free quotas struggle to create emission reduction pressure on enterprises [18,19,20]. Second, the quality of corporate data is weak and non-transparent, and governments lack effective monitoring methods [18,19,21]. Third, low industry coverage and a single range of products make it difficult to form effective market competition [18,21,22,23]. In response, China issued an emissions trading management policy in 2024 called the “Interim Regulations on the Administration of Carbon Emissions Trading” (hereinafter referred to as the “Regulations”) to improve the ETS and standardize trading activities. The core contents of this policy include gradually increasing the proportion of paid quotas, strengthening corporate data disclosure, clarifying standards for key enterprises, and diversifying product types. Although this policy has been implemented for a year, it has not been accurately evaluated. Therefore, it is difficult to answer questions about whether China’s emissions trading market policies are effective and how they take effect, nor can we summarize the experiences and lessons of China’s ETS.

Therefore, it is necessary to make innovations in terms of evidence and methodology. In terms of evidence, the lessons learned from European and American countries have alerted China to introduce policies to reduce the possibility of failure. However, there is a lack of direct evidence to prove the effectiveness of this policy. In terms of methodology, existing studies have not thoroughly examined the nonlinear relationships in dynamic high-frequency data of emissions trading. Evidence from existing studies is generally annual or monthly, and they generally adopt linear assumptions. This not only wastes a great deal of valid information hidden in the data, but also causes research results to potentially lack real significance due to endogeneity. Accordingly, this paper attempts to make the following three marginal contributions.

MG 1. Supplement relevant research on impact assessment of China’s government emissions trading policies. This paper shifts the research focus from developed countries to China, an emerging economy, aiming to address the neglect of emerging economies in existing studies. In particular, the Regulations are selected as the main intervention variable for the study, which can answer whether policy innovations in terms of quotas, data, market entities, and products are worth promoting.

MG 2. Refine emissions trading data and introduce nonlinear analysis methods. This paper collects daily trading data since the launch of China’s national unified carbon emissions trading market and conducts policy evaluation through double machine learning. While deeply exploring the hidden information in the data, double machine learning can overcome the limitations of traditional methods in handling high-dimensional data and nonlinear relationships, thereby enhancing the accuracy and credibility of evaluation results.

MG 3. Summarize the successful experiences of China’s emissions trading. This paper forms theoretical hypotheses by analyzing the content of the Regulations and evaluates the impact of policy implementation on carbon emissions trading. The results of the policy evaluation will extract the successful experiences of China’s government supervision, and then provide affordable, operable, and intuitive experiences for emerging economies in building and developing carbon markets.

2. Policy Review and Theoretical Hypotheses

2.1. Policy Review

Globally, developed countries and regions such as the United States, the United Kingdom, and the European Union were early explorers in establishing emissions trading markets. In 1990, the United States amended the “Clean Air Act”, formally establishing a sulfur dioxide emission allowance trading system [24,25]. In 2002, the United Kingdom established the UK ETS, the world’s first national-level carbon ETS [26]. In 2005, the European Union established the EU ETS, the world’s first international carbon ETS [4]. Currently, emerging economies have become the main force in the development of carbon emissions trading markets; countries such as Vietnam and Indonesia have successively adopted a model of policy-driven and industry gradual progress to build national-level carbon emissions trading markets.

In recent years, the development of China’s ETS has attracted worldwide attention. China’s emissions trading market originated in 2011. In that year, the General Office of the National Development and Reform Commission (NDRC) issued the Notice on Launching Carbon Emissions Trading Pilots, announcing the establishment of regional carbon trading pilots in seven provinces and municipalities: Beijing, Tianjin, Shanghai, Chongqing, Guangdong, Hubei, and Shenzhen. Starting in 2013, these pilot regions sequentially established their own carbon markets. In 2016, Fujian Province joined as an additional pilot. In 2020, China’s Ministry of Ecology and Environment (MEE) introduced the Measures for the Administration of Carbon Emissions Trading (for Trial Implementation), followed by the launch of a nationwide unified carbon market in 2021. This marked China’s transition to a national-level carbon trading system. The implementation of the Interim Regulations on Carbon Emissions Trading Management in 2024 signaled a new phase of market deepening and expansion. On 21 March 2025, the Work Plan for Expanding the National Carbon Emissions Trading Market to Cover the Iron and Steel, Cement, and Aluminum Smelting Industries was unveiled, adding three high-carbon-intensive sectors to the national market. This expansion increased the carbon market’s coverage to 60% of China’s total emissions, solidifying its role as a cornerstone of the country’s climate policy framework.

As the primary policy basis for regulating carbon emissions trading at the current stage, the Regulations aims to give full play to the role of market mechanisms in addressing climate change and promoting green and low-carbon development, drive greenhouse gas emission reductions, and standardize national carbon emissions trading and related activities. The main contents of the Regulations include three aspects: In terms of quota management, the Regulations stipulate two types of allocation measures: free allocation and paid allocation, and propose to gradually increase the proportion of paid allocation. In terms of product types, the Regulations provide a basis for the timely addition of trading products in the carbon market other than carbon emission rights. In terms of regulatory intensity, the Regulations adopt multiple measures such as data disclosure, social supervision, administrative penalties, and judicial management to strengthen supervision over key enterprises’ orderly participation in trading.

Compared with carbon emissions trading in developed countries and regions, the development process of China’s carbon market is more closely aligned with the actual conditions of emerging economies. In terms of driving forces, China’s carbon market is policy-driven, evolving from regional pilots to a national market in a gradual manner. In terms of industry coverage, China’s carbon market adopts a phased approach, gradually incorporating high-carbon industries into the carbon emission rights quota management system. Therefore, evaluating the impact of the Regulations on carbon emissions trading can not only timely optimize policies for the development of China’s carbon market but also provide direct evidence and experiences for other emerging economies to prevent market failure, government failure, and inter-industry carbon leakage.

2.2. Theoretical Hypotheses

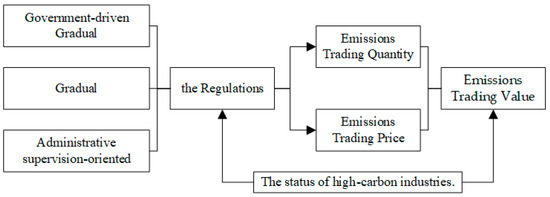

Markets and policies are the core of the ETS (see Figure 1). The emissions trading market is an institutional arrangement aimed at achieving emission reduction targets at the lowest cost. This mechanism operates on the premise of setting emission caps for specific industries or regions, realized through the allocation of emission allowances and the permission of market transactions, with the core being the price of emission rights [27,28]. Emissions trading policies are a series of requirements for regulating, supervising, and controlling trading behaviors, including how to determine emission caps, how to allocate emission allowances, and how to account for and settle final emission quantities [29]. Through intervening in the emissions trading market, policies can promote the sound operation of trading behaviors and ultimately improve the economic performance in addressing climate change.

Figure 1.

The causal effect of the Regulations on ETS.

Overall, the intervention effect of policies on the emissions trading market is reflected in expanding the volume of transactions, reflecting the true value of emission rights, and thereby promoting an overall increase in the total volume of emissions trading. According to economic principles, when consumer surplus and producer surplus are minimized, the total volume of market transactions reaches its highest level, and welfare is fully realized [30,31,32]. The enhanced standardization and stringency of emissions trading policies create conditions for minimizing such surpluses. First, the gradual tightening of emission caps, increasingly precise quota management, and more stringent incentive measures can enhance the scarcity and marginal benefits of emission rights [33,34]. Second, due to the high-frequency trading characteristic of the emissions trading market, trading entities can purchase or sell emission rights at the first opportunity when prices align with their psychological expectations [22,35]. The realization of this process can greatly reduce the generation of surpluses, leading to an increase in total transaction volume. In the context of China’s Regulations, emission caps and quota allocation have become more stringent. Meanwhile, enterprises that falsify or conceal emission data, fail to surrender emission allowances on time, or obstruct government supervision and management face heavy penalties. These provisions meet the preconditions for reducing surpluses and increasing total volume, and thus can promote an overall increase in the volume of emissions trading. Thus, the first research hypothesis of this paper is derived:

H1.

The implementation of the Regulations has a positive impact on the volume of carbon emissions trading.

Specifically, trading price and trading volume are two core elements of the operation of market mechanisms, as well as two key focal points for policies to intervene in the emissions trading market. Therefore, it is necessary to conduct a detailed analysis of the specific impacts of the implementation of the Regulations on emissions trading prices and trading volumes.

In terms of price, the implementation of the Regulations can reflect the true value of emission rights, thereby increasing the trading price. The relationship between supply and demand is the main factor in the formation of trading prices. On the supply side, emissions trading policies aim to gradually tighten emission caps, thereby gradually reducing the supply of emission rights. On the demand side, since key enterprises cannot significantly improve the innovation and application of green technologies in the short term, it is difficult to reduce their rigid demand for emission rights [19,36,37,38]. Considering that China’s emissions trading market is in its early stage of establishment, the supply of emission rights was inflated in the absence of effective information disclosure and government supervision [39,40,41]. Therefore, the implementation of the Regulations can not only increase the trading price through stricter emission caps but also in particular eliminate unnecessary supply to push up the trading price. Relevant provisions include mandatory disclosure of environmental data of key enterprises, encouragement of the implementation of social supervision mechanisms, and rechecking of enterprises’ emission situations. These provisions can reduce the inflated supply of emission rights, thereby increasing the emissions trading price. In addition, as the Regulations increase the proportion of paid allocation in quota management and the cost of obtaining quotas rises, which in turn increases the trading price of emission rights. Thus, the second research hypothesis of this paper is proposed:

H2.

The implementation of the Regulations increases the carbon emissions trading price.

In terms of trading volume, the intervention effect of the Regulations involves two diametrically opposed processes. On the one hand, the Regulations can increase the supply and demand of emissions trading by expanding trading entities and trading products, thereby increasing the trading volume. At the level of trading entities, the Regulations clarify the criteria for identifying key enterprises and encourage enterprises and other entities to participate in standardized trading of carbon emission rights. The newly added trading entities increase the necessary demand for transactions, thereby expanding the overall scale of the carbon market. In terms of trading products, the Regulations provide room for the launch of new carbon market trading products, which serves as a legal premise for the subsequent expansion of climate action. On the other hand, the implementation of the Regulations has a regulatory effect on speculative arbitrage in carbon emissions trading, which may reduce a portion of such transactions. Therefore, it is necessary to evaluate the specific impact of the Regulations on the volume of carbon emissions trading to assess the development of the carbon market. This leads to the third theoretical hypothesis of this paper:

H3.

The implementation of the Regulations will exert a net positive effect on the trading volume of carbon emission rights.

The testing of the above three theoretical hypotheses can systematically evaluate the development of China’s carbon emissions trading, compare the development during the national market stage and the stage of deepened development and expansion, and further summarize the advantages, disadvantages, gains, and losses in this process.

3. Research Design

3.1. Variable Setting

To assess the average treatment effect of China’s emissions trading policies on trading behaviors, we construct a causal inference model with the Regulations as the intervention variable and the volume of carbon emissions trading as the outcome variable. The specific variable settings are as follows:

- (1)

- Outcome variable. The trading volume in the emissions trading market is selected as an indicator to measure emissions trading activities. This variable setting is based on policy objectives and theoretical analysis. In terms of policy objectives, regulating and promoting emissions trading activities is the core goal of implementing the Regulations, and trading volume can directly measure the scale of such activities. At the theoretical level, trading volume integrates information from multiple aspects such as price, supply, and demand, and intuitively reflects the outcomes of the implementation of the Regulations.

- (2)

- Treatment variable. The treatment variable is defined as whether the Regulations are implemented. Specifically, as stipulated in the Regulations, they were formally put into effect on 1 May 2024. Prior to this date, the treatment variable is assigned a value of 0; after this date, it is assigned a value of 1. This policy was selected due to its comprehensiveness and significance. It directly regulates multiple aspects, including participating entities in emissions trading, determination of emission caps, quota allocation, data disclosure, and rewards and penalties. Moreover, it remains one of the few policies and regulations in China that directly act on the emissions market to date.

- (3)

- Control variables: The industry dynamics of four high-carbon industries—electric power, iron and steel, cement, and non-ferrous metals—are selected as control variables. At the theoretical level, there exists a complex and subtle relationship between the ETS and high-carbon industries. On one hand, policy signals released by emissions trading policies may lead key enterprises in high-carbon industries to preemptively adjust their strategies, adopting measures such as deception or resistance that could interfere with trading activities. On the other hand, emissions trading policies directly act on the behaviors of high-carbon industries to alter trading practices. Methodologically, the selection of control variables should follow the “backdoor criterion,” which requires controlling for factors that may influence both the treatment variable and the outcome variable. The dynamics of high-carbon industries align with this principle. From the perspective of policy practice, the electric power industry was the first to be included in China’s emission caps and trading system by the government, while the other three industries were incorporated into the ETS in 2025. For these three reasons, the industry dynamics of these sectors are chosen as control variables to exclude the interference of confounding factors and enhance the accuracy of policy evaluation.

- (4)

- Mediating Variables. Based on theoretical Hypotheses H2 and H3, it is necessary to assess the impact of the implementation of the Regulations on the price and volume of emissions trading. Therefore, trading price and trading volume serve as the mediating variables in the study to decompose the causal effect of the implementation of the Regulations on the volume of carbon emissions trading.

3.2. Research Methods

To evaluate the impact of the implementation of the Regulations on emissions trading, it is crucial to address the endogeneity issue between the treatment variable and the outcome variable. The main methods in traditional econometrics for reducing endogeneity include difference-in-differences, instrumental variables, and regression discontinuity, among others [42]. Drawing on the study by Chernozhukov et al., this paper adopts a double machine learning framework to mitigate the risk of endogeneity and achieve accurate causal inference [43]. Compared with traditional econometric methods, the double machine learning framework assumes nonlinear relationships between control variables, the treatment variable, and the outcome variable. Thus, it can adapt to high-dimensional data and improve the accuracy of estimation results.

According to the double machine learning framework, this paper specifies the benchmark model as follows:

Among them, CET represents the outcome variable, i.e., the trading volume of emissions trading; Policy denotes the treatment variable, i.e., the implementation of the Regulations; W is the vector of control variables, representing indicators related to high-carbon industries. θ0 is the average treatment effect; U and V are the disturbance terms of the outcome variable and the treatment variable, respectively. l(·) and m(·) represent the nonlinear correlation functions of control variables with the outcome variable and the treatment variable, respectively. As can be seen from combining Equations (1) and (2), the double machine learning framework reduces the risk of endogeneity in regressing the outcome variable on the treatment variable by eliminating potential confounding factors in the disturbances, thereby improving the accuracy of policy evaluation results.

Specifically, the workflow of double machine learning is as follows. First, the outcome variable, treatment variable, and control variables of the model are clarified. Second, an appropriate DML model is selected and the machine learning tools and specifications are clarified. Third, the average treatment effect is estimated.

3.3. Data Sources

This paper has two main data sources. Specifically, emissions trading data are obtained from the Shanghai Environment and Energy Exchange (https://www.cneeex.com/qgtpfqjy/mrgk/, accessed on 29 April 2025), and high-carbon industry data are sourced from China Securities Index Co., Ltd. (https://www.csindex.com.cn/#/indices/family/list?index_series=1, accessed on 29 April 2025, for Shanghai, China). The time span of data collection starts from the launch of China’s national unified carbon market (i.e., 16 July 2021) to 29 April 2025, covering 915 trading days.

The reasons for choosing daily data include two aspects. First, the dynamic nature. Trading in China’s national unified carbon emissions trading market is a process of gradual improvement, and the dynamic nature of the capital market leads to high-frequency interactions with high-carbon industries, which is reflected in the refinement of the time dimension. Second, periodicity. The intervention effects of emissions trading policies manifest in both short-term and long-term dimensions, and daily data can provide direct support for measuring such periodic issues.

The data processing process is divided into the following two steps. First, the daily bulletins of trading in China’s national unified carbon emissions trading market are obtained. Data on trading volume and transaction quantity are extracted from the text through matching with regular expressions. Trading prices are calculated as the ratio of daily trading volume to transaction quantity. For trading days with no actual transactions, the data are imputed based on the linear mean of the trading prices of the two adjacent trading days (the day before and the day after). Second, the industry indices of high-carbon industries are obtained. Using trading days as the index, the data of high-carbon industries are aligned with those of the carbon emissions trading market to form a complete dataset. See Table 1 for the descriptive statistical analysis of the data.

Table 1.

Descriptive Statistical Analysis of Key Variable Indicators.

4. Results

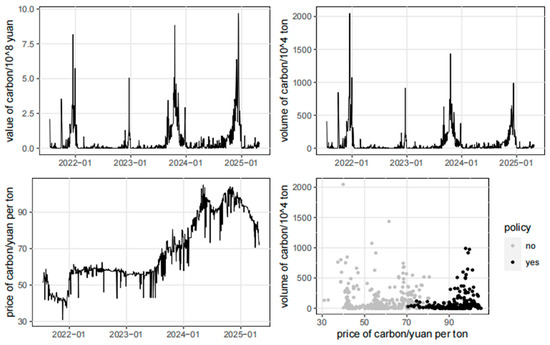

4.1. Stylized Facts

Figure 2 reports the dynamic trends in the development of China’s national unified carbon market from three dimensions: transaction value, trading volume, and transaction price of emission trading, and intuitively illustrates the relationship between price and volume before and after the implementation of the Regulations. In terms of transaction value, China’s emission trading shows a trend of cyclical fluctuations. There is a distinct peak in emission trading at the end of each year, which may be related to the compliance of emission allowances. In terms of trading volume, China’s emission trading also exhibits cyclical fluctuations. In contrast to transaction value, the overall peak of such fluctuations has declined. In terms of transaction price, China’s emission trading generally shows a fluctuating upward trend. As of 29 April 2025, the minimum transaction price of China’s emission trading was recorded on 19 November 2021 (30.92 yuan), while the maximum appeared on 6 May 2024 (105.00 yuan). The relationship between volume and price indicates that emission trading showed significant discreteness before the implementation of the Regulations, but the relationship tends to converge after implementation. In other words, there is a negative correlation between the trading volume and transaction price of emission trading after the implementation of the Regulations.

Figure 2.

Dynamic trends of transaction value, transaction price and trading volume in the carbon market.

Based on the stylized facts, two inferences can be drawn as follows. First, some emission trading activities are triggered by speculative behavior, and such transactions have been curbed after the implementation of the Regulations. Second, the implementation of the Regulations has driven up the transaction price of emission trading. Meanwhile, the transaction value of emission trading shows cyclical patterns, which need to be controlled in subsequent policy evaluations.

4.2. Results of Baseline Estimation

The impact of the implementation of the Regulations on the transaction value of carbon emission trading is evaluated using double machine learning (Table 2). Since the policy, as the treatment variable, is discrete, this paper adopts an IRM-type model. In the ML tool phase, a random forest classifier is used to fit the function of the treatment variable, and a random forest regressor is used to fit the function of the outcome variable. In the ML specification phase, the sample is split in a 1:4 ratio to implement K-fold cross-validation.

Table 2.

Results of Baseline Analysis.

Columns (1) to (3) in Table 2 report in turn the causal effects of the implementation of the Regulations on the transaction value of emission trading under different control conditions. The results show that under the conditions of comprehensively controlling for high-carbon industries, cyclicality, and other factors, the coefficient of the treatment variable is 0.5393, which is significant at the 0.01 significance level. This can preliminarily verify H1, i.e., the implementation of the Regulations can positively increase the transaction value of carbon emission trading.

4.3. Robustness Test Results

This paper addresses the factors that may cause bias in estimation results to ensure the robustness of the baseline estimation results; the test results are shown in Table 3.

Table 3.

Robustness Test Results.

- (1)

- Replacing the outcome variable. Column (1) presents the results after replacing the outcome variable with the transaction volume of emission allowances through listed agreement trading. According to the trading forms in China’s emission trading market, emission trading includes two categories: listed agreement trading and block agreement trading. Since block agreement trading is relatively concentrated, the transaction volume of listed agreement trading is chosen as the outcome variable. The results show that the coefficient estimate of policy is 0.0973, and this estimate is significant at the 0.01 level.

- (2)

- Controlling for other important policies. Column (2) presents the results of controlling for other significant policy interventions. This paper takes the policy information collected in the “National Policies” module of the Shanghai Energy Exchange as the scope for policy screening. After excluding guiding policies and policy discussion drafts, two other policies are obtained. They are the Measures for the Administration of Mandatory Disclosure of Enterprise Environmental Information in Accordance with Law (implemented on 8 February 2022) and the Work Plan for the National Carbon Emission Rights Trading Market to Cover the Iron and Steel, Cement, and Aluminum Smelting Industries (issued on 21 March 2025). The results show that the coefficient estimate of policy is 0.5097, and this estimate is significant at the 0.01 level.

- (3)

- Handling of Outliers. Column (3) presents the results after 2.5% winsorization on both tails of the outcome variable. After excluding the potential estimation bias of the average treatment effect caused by outliers, the coefficient estimate of policy is 0.3753, and this estimate is significant at the 0.01 significance level.

- (4)

- Replacing the ML method. Column (4) presents the results of replacing the ML tool with the Lasso learner. Unlike the random forest learner used in the baseline estimation, the Lasso learner belongs to generalized linear methods. Therefore, this is to exclude estimation bias caused by ML overfitting. The results show that the coefficient estimate of policy is 0.2583, and this estimate is significant at the 0.01 significance level.

The above robustness tests have successively ruled out estimation bias caused by indicator selection, policy superposition, data anomalies, and method selection, verifying that the result that the implementation of the Regulations significantly increases the transaction value of emission trading is reliable.

4.4. Results of Mechanism Testing

In this section, the focus of the test shifts to the internal characteristics of emission trading. Specifically, since the implementation of the Regulations can convey correct price signals and unlock effective trading demand, it can promote the development of emission trading. To this end, this paper respectively estimats the average treatment effects of the implementation of the Regulations on the price and quantity of emission trading; the test results are shown in Table 4.

Table 4.

Results of Mechanism Testing.

- (1)

- The implementation of the Regulations has significantly increased the emission trading price. Column (1) in the table presents the estimated results of the average treatment effect of the Regulations on the emission trading price. The implementation of the Regulations has led to an increase in the carbon emission rights price by 28.0884 yuan, and this estimate is significant at the 0.01 significance level. The potential reason for this phenomenon is that the implementation of the Regulations has increased the proportion of paid allocation in emission rights quotas, which in turn has intensified the scarcity of emission rights. Moreover, the price increase may create a reverse incentive for high-carbon enterprises: when enterprises attempt to raise output value and income by expanding production scale, they must take into account the high-cost constraints of emission rights. Therefore, enterprises need to develop zero-carbon and negative-carbon technologies to reduce energy consumption per unit of output value and the cost of carbon emission rights. By increasing the proportion of paid allocation, the Regulations can truly reflect the value of emissions, thereby realizing the internalization of negative externalities in enterprises’ production activities.

- (2)

- The implementation of the Regulations has significantly increased the emission trading quantity. Column (2) in the table presents the estimated results of the average treatment effect of the implementation of the Regulations on the emission trading quantity, with a coefficient estimate of 30.7443 and a significance level of 0.01. This estimate seems to contradict the stylized facts. In the stylized facts, the peak of the quantity of carbon emission rights trading in 2024 was lower than those in 2021 and 2023. By comparing the results of the stylized facts and the average treatment effect, a potential fact can be inferred: the implementation of the Regulations has reduced speculative arbitrage activities in the emission trading market, and the increased trading quantity can be regarded as mainly driven by enterprises’ necessary demand. In other words, the implementation of the Regulations can standardize trading behaviors in the emission market and unlock necessary demand. The reason for this phenomenon is that the Regulations have strengthened the accountability and punishment mechanisms for enterprises’ carbon emission behaviors, especially the falsification of carbon emission data. Therefore, a large amount of hidden carbon emissions have been incorporated into the carbon market, and the possibility of speculative arbitrage has been significantly reduced.

5. Discussion

5.1. The Regulations Implemented in China Greatly Promote the Standardized Development of the Emission Market

Given China’s important position in global climate action and the wider reference significance of China’s national unified carbon emission trading market [1,2], we evaluated the responses of the market’s transaction volume, trading price, and trading quantity to policy intervention. China’s emission trading has faced questions regarding emission caps, quota allocation, and data quality, among other aspects [18,19,20,21,22]. In response, the Regulations have focused on regulating the aforementioned aspects.

We used double machine learning to analyze the high-frequency dynamic data of China’s emission trading. This analysis constructs a causal inference model with the implementation of the Regulations as the treatment variable and the emission trading volume as the outcome variable. Among them, high-frequency dynamic data can reflect in detail the subtle changes in emission trading caused by policy intervention. The double machine learning method can break through the constraints of the curse of dimensionality and linear assumptions, reduce endogeneity risk, and improve the accuracy of policy evaluation [43]. The main findings of the study include the following three points.

First, the implementation of the Regulations can promote an overall increase in emission trading volume. The study finds that the intervention effect of the implementation of the Regulations on emission trading volume is 0.5393, with a significance level below 0.01, and this result has passed a series of robustness tests. Combined with theoretical analysis, this promoting effect is the result of the gradual tightening of emission trading policies. Since the implementation of the Regulations has standardized emission rights caps, paid quota allocation, disclosure of environmental data, and government environmental supervision, the consumer surplus in emission rights trading has been reduced, which is largely converted into trading volume. It can be seen that China’s emission trading system is gradually overcoming inefficiency issues.

Second, the implementation of the Regulations can truly reflect the value of emission rights. The study finds that the implementation of the Regulations has a significant boosting effect on the emission trading price, with an estimated average intervention effect of 28.0884 and a significance level of 0.01. According to the relevant provisions of the Regulations, the supply of emission trading is gradually tightened due to the constraints of emission caps. Enterprises can hardly falsify excess emission rights, so they need to obtain the required emission rights through market transactions. Existing studies have shown that after China implemented total quantity control on emissions, a large number of enterprises did not reduce emissions per unit through technological innovation, but instead resorted to falsification and production reduction to avoid emission costs. The price-boosting effect of the implementation of the Regulations truly reflects enterprises’ demand for emission rights. Combined with the gradually tightened emission caps, it will undoubtedly push enterprises to adopt green technologies to maintain long-term production.

Third, the Regulations have increased the quantity of emission trading, and these trading increments have excluded speculative trading. The study finds that peaks occur in emission trading during annual quota compliance, and as policies are gradually improved, the peaks tend to flatten. The implementation of the Regulations has a boosting effect of 30.7443 on trading quantity at the 0.01 significance level. Due to a series of measures such as the disclosure of environmental data, this boosting effect represents real demand after excluding speculative behaviors.

In summary, the implementation of the Regulations can promote the improvement of the emission trading market from multiple aspects such as supply and demand, information, and supervision, reflecting the real price and demand of emission rights. Although the construction of China’s emission market is in the initial stage, it continues to be optimized through policy innovation.

5.2. Strong Policy Intervention Serves as a Condition for China’s Participation in Global Climate Action

From a global perspective, emission trading systems are often used to address climate change, resulting from the combined role of a proactive government and an efficient market. For example, the EU ETS is a direct outcome of the Kyoto Protocol [4]. However, because such international actions rely excessively on market mechanisms, their effectiveness is subject to the voluntariness of participating entities and often faces the risk of market failure. At the participant level, the UK’s withdrawal has led to direct operational losses for the EU ETS [44]. More critically, market failure entails issues such as regional and sectoral market segmentation, distortion of market price signals, prevalence of speculative behaviors, and insufficient regulatory intensity [11,19], among others. Therefore, when China launched emission trading pilots and the national unified market, it also faced the same doubts.

China’s measure to avoid the aforementioned market failure issues is the timely adoption of proactive and prudent policy intervention. For example, China launched the national unified market in 2021 to avoid the issue of market segmentation; in 2022, it promulgated the Measures for the Administration of Lawful Disclosure of Enterprise Environmental Information, laying the foundation for real price signals. In particular, the promulgation and implementation of the Regulations have generally standardized the operation of China’s emission trading market. First, China has clarified the standards for key enterprises and adopted top–down measures to require these enterprises to participate in the emission trading market. This measure has avoided the chaos of arbitrary withdrawal by participating entities. Second, China has adopted measures such as mandatory disclosure of environmental data, strengthened data verification, and increased penalties, such that falsification, concealment, and speculative behaviors have been suppressed. Meanwhile, due to the increase in the proportion of paid allocation, China has largely avoided speculative behaviors in terms of quota allocation. In addition, extensive social supervision has filled the gaps in government supervision. The example of the Regulations shows that China’s success in the emission trading market is inseparable from the intervention of a proactive government.

Proactive government’s strong intervention in emission trading is necessary in at least two types of scenarios. The first scenario is the initial stage of emission trading construction. At this stage, aspects such as trading mechanisms, supervision technologies, and even public acceptance are underdeveloped, resulting in many drawbacks in emission trading. Strong government intervention can improve trading mechanisms, guide rapid public acceptance, and thereby promote the improvement of the emission trading system. The second scenario is the construction of emission trading systems in emerging economies. Emerging economies have weak market mechanisms, filled with monopolistic and speculative behaviors. Therefore, strong government supervision must be accompanied to realize the construction of the emission trading system. It should be noted that the strong intervention of a proactive government is usually applicable to national-level emission trading systems. This is similar to the US Clean Air Act. However, the direct reason for the introduction of the Clean Air Act was environmental incidents such as smog and acid rain. China, on the other hand, proactively and independently participates in global climate action, which also demonstrates that a stable and strong government is indispensable in the process of improving the emission trading system.

Overall, the experience from the construction of China’s emission trading system can be summarized into the following three points. First, relying on a stable and strong government to implement strong policy intervention. Second, achieving “steady and rapid progress through incremental steps” through early-stage pilots and a series of policies. Third, compensating for the weaknesses in markets, technologies, and social psychology, among other aspects, through policy innovation.

5.3. The Government’s Role in the Construction of the Emission Trading System Should Be Strengthened

Based on the successful experience from the implementation of China’s Regulations, in emerging economies or in the early stage of emission trading system construction, it is necessary to strengthen the role of government forces from the following three aspects.

In terms of construction entities, it is necessary to strengthen the government’s strong authority in formulating and enforcing environmental regulations. Relying on the government’s control over heavy and chemical industries, it should mandate key enterprises in high-carbon industries to participate in the construction of the emission trading system. For the operation of the emission trading system, strong supervision should be implemented and punishment intensity should be strengthened by relying on administrative and judicial authority.

In terms of core content, it is necessary to promote the scientificity of formulating emission caps and the effectiveness of quota allocation. First, promoting the disclosure of environmental data and improving data quality is a premise for scientifically formulating emission caps. Based on statistical data, the government needs to conduct re-verification of environmental data by combining new technologies such as remote sensing monitoring. Second, it is necessary to dynamically reduce the total quantity control of emission caps to achieve emission reduction targets. Third, a paid form should be adopted for quota allocation to avoid speculative behaviors caused by excessively low acquisition costs.

In terms of advancement pace, it is necessary to adopt a “steady and rapid progress through incremental steps” construction rhythm. To avoid biases in policy intervention caused by government failure, it is essential to adopt a pilot-first and gradual improvement approach, constructing the emission trading system in phases. In the meantime, timely evaluation of policy effects should be conducted to accelerate the advancement of the emission system construction.

6. Conclusions

This study evaluates the intervention effects of China’s carbon emission trading policies on market behavior to determine whether it is reasonable for China to rely on policy-driven improvements to the ETS. Specifically, this evaluation includes the intervention effects of the Regulations on the total trading volume, trading quantity, and trading price of carbon emission rights. The estimation of these intervention effects aims to clarify whether China’s policies can promote ETS development, enhance necessary trading activities, and reflect the true price of carbon emission rights—all of which serve as important bases for judging whether the ETS develops stably and healthily.

To accurately identify the intervention effects of the Regulations, a double machine learning (DML) framework was used to analyze dynamic high-frequency data. The data collection covers the period from 16 July 2021, to 29 May 2025, i.e., all trading data from the establishment of China’s national unified ETS to the conduct of this study. The policy evaluation model was constructed based on the double machine learning framework. This framework fits and excludes the non-linear relationship between control variables and outcome variables, minimizes endogeneity issues, and improves the accuracy of estimation results.

The study finds that the implementation of the Regulations can increase the total trading volume of China’s ETS, and this result has passed a series of robustness tests. This promotion effect is reflected in two dimensions: trading quantity and trading price. This result indicates that the strong, stable, and gradual policy interventions adopted by China have a significant positive impact. By comparing with the ETS of other countries, China’s policy-driven model can be used as a reference for emerging economies or regions in the initial stage of ETS construction.

Author Contributions

Conceptualization, Y.C.; methodology, P.X.; software, J.L.; formal analysis, P.X. and J.L.; data curation, J.L.; writing—original draft preparation, P.X.; writing—review and editing, J.L. and Y.C.; funding acquisition, Y.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Heilongjiang Provincial Educational Science Planning Research Project (CN), grant number GJB1425001.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Massetti, E.; Tavoni, M. A developing Asia emission trading scheme (Asia ETS). Energy Econ. 2012, 34, S436–S443. [Google Scholar] [CrossRef]

- Dargusch, P. China must lead on emissions trading. Science 2017, 357, 1106–1107. [Google Scholar] [CrossRef]

- Boehringer, C.; Dijkstra, B.; Rosendahl, K.E. Sectoral and regional expansion of emissions trading. Resour. Energy Econ. 2014, 37, 201–225. [Google Scholar] [CrossRef]

- Bailey, I. The EU emissions trading scheme. Wiley Interdiscip. Rev.-Clim. Change 2010, 1, 144–153. [Google Scholar] [CrossRef]

- Jong, T.; Couwenberg, O.; Woerdman, E. Does EU emissions trading bite? An event study. Energy Policy 2014, 69, 510–519. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Oestreich, A.M.; Tsiakas, I. Carbon emissions and stock returns: Evidence from the EU Emissions Trading Scheme. J. Bank. Financ. 2015, 58, 294–308. [Google Scholar] [CrossRef]

- Wang, Z.; Paavola, J. Emissions trading in China: New political economy dynamics. Environ. Policy Gov. 2023, 33, 504–516. [Google Scholar] [CrossRef]

- Wen, F.; Wu, N.; Gong, X. China’s carbon emissions trading and stock returns. Energy Econ. 2020, 86, 104627. [Google Scholar] [CrossRef]

- Wu, J.; Guo, Q.; Yuan, J.; Lin, J.; Xiao, L.; Yang, D. An integrated approach for allocating carbon emission quotas in China’s emissions trading system. Resour. Conserv. Recycl. 2019, 143, 291–298. [Google Scholar] [CrossRef]

- Manea, S. Defining Emissions Entitlements in the Constitution of the EU Emissions Trading System. Transnatl. Environ. Law 2012, 1, 303–323. [Google Scholar] [CrossRef]

- Monnet, C.; Temzelides, T. Monetary emissions trading mechanisms. Int. J. Econ. Theory 2016, 12, 85–100. [Google Scholar] [CrossRef]

- Stuhlmacher, M.; Patnaik, S.; Streletskiy, D.; Taylor, K. Cap-and-trade and emissions clustering: A spatial-temporal analysis of the European Union Emissions Trading Scheme. J. Environ. Manag. 2019, 249, 109352. [Google Scholar] [CrossRef]

- Bai, J.; Rub, H. Carbon Emissions Trading and Environmental Protection: International Evidence. Manag. Sci. 2024, 70, 4167–4952. [Google Scholar] [CrossRef]

- Wang, J.; Gu, F.; Liu, Y.; Fan, Y.; Guo, J. Bidirectional interactions between trading behaviors and carbon prices in European Union emission trading scheme. J. Clean. Prod. 2019, 224, 435–443. [Google Scholar] [CrossRef]

- Kim, J.; Park, K. Improving liquidity in emission trading schemes. J. Futures Mark. 2021, 41, 1397–1411. [Google Scholar] [CrossRef]

- Ge, X.; Li, Y.; Yang, H. The green paradox of time dimension: From pilot to national carbon emission trading system in China. Environ. Impact Assess. Rev. 2024, 109, 107642. [Google Scholar] [CrossRef]

- Duan, M.; Pang, T.; Zhang, X. Review of Carbon Emissions Trading Pilots in China. Energy Environ. 2014, 25, 527–549. [Google Scholar] [CrossRef]

- Wang, X.-Q.; Su, C.-W.; Lobont, O.-R.; Li, H.; Nicoleta-Claudia, M. Is China’s carbon trading market efficient? Evidence from emissions trading scheme pilots. Energy 2022, 245, 123240. [Google Scholar] [CrossRef]

- Zhang, D.; Springmann, M.; Karplus, V.J. Equity and emissions trading in China. Clim. Change 2016, 134, 131–146. [Google Scholar] [CrossRef][Green Version]

- Wang, P.; Liu, L.; Tan, X.; Liu, Z. Key challenges for China’s carbon emissions trading program. Wiley Interdiscip. Rev.-Clim. Change 2019, 10, e599. [Google Scholar] [CrossRef]

- Jiang, J.; Xie, D.; Ye, B.; Shen, B.; Chen, Z. Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 2016, 178, 902–917. [Google Scholar] [CrossRef]

- Tang, T.H.; Bao, H.X.H. Political uncertainty and carbon emission trading: Evidence from China. Cities 2024, 145, 104713. [Google Scholar] [CrossRef]

- Lane, R. The promiscuous history of market efficiency: The development of early emissions trading systems. Environ. Politics 2012, 21, 583–603. [Google Scholar] [CrossRef]

- Wilkins, J.M. The Validity of the Clean Power Plan’s Emissions Trading Provisions. N. Y. Univ. Law Rev. 2016, 91, 1386–1417. [Google Scholar]

- Smith, S.; Swierzbinski, J. Assessing the performance of the UK emissions trading scheme. Environ. Resour. Econ. 2007, 37, 131–158. [Google Scholar] [CrossRef]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- Zakeri, A.; Dehghanian, F.; Fahimnia, B.; Sarkis, J. Carbon pricing versus emissions trading: A supply chain planning perspective. Int. J. Prod. Econ. 2015, 164, 197–205. [Google Scholar] [CrossRef]

- Huang, W.; Wang, Q.; Li, H.; Fan, H.; Qian, Y.; Klemes, J.J. Review of recent progress of emission trading policy in China. J. Clean. Prod. 2022, 349, 131480. [Google Scholar] [CrossRef]

- Corchon, L.C.; Torregrosa, R.J. Two extensions of consumer surplus. Ser.-J. Span. Econ. Assoc. 2022, 13, 557–579. [Google Scholar] [CrossRef]

- Galera, F.; Garcia-del-Barrio, P.; Mendi, P. Consumer surplus bias and the welfare effects of price discrimination. J. Regul. Econ. 2019, 55, 33–45. [Google Scholar] [CrossRef]

- ten Raa, T. Consumer surplus and CES demand. Oxf. Econ. Pap.-New Ser. 2015, 67, 1165–1173. [Google Scholar] [CrossRef]

- Tsikalakis, A.G.; Hatziargyriou, N.D. Environmental benefits of distributed generation with and without emissions trading. Energy Policy 2007, 35, 3395–3409. [Google Scholar] [CrossRef]

- Zhu, B.; Jia, T.; Zhang, T.; Liu, C. Cities’ marginal carbon abatement costs’ heterogeneity and the potential benefits from emission trading schemes in the Yangtze River Delta Region. Environ. Dev. Sustain. 2025, 27, 715–737. [Google Scholar] [CrossRef]

- Suleman, M.T.; Rehman, M.U.; Sheikh, U.A.; Kang, S.H. Dynamic time-frequency connectedness between European emissions trading system and sustainability markets. Energy Econ. 2023, 123, 106726. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 2021, 168, 120744. [Google Scholar] [CrossRef]

- Jia, L.; Zhang, X.; Wang, X.; Chen, X.; Xu, X.; Song, M. Impact of carbon emission trading system on green technology innovation of energy enterprises in China. J. Environ. Manag. 2024, 360, 121229. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Li, Y.; Liu, C.; Wang, J.; Wang, Y.; Yang, X.; Li, Y. Data fraud in the carbon emissions trading market: A tripartite evolutionary game analysis from China. Util. Policy 2024, 91, 101848. [Google Scholar] [CrossRef]

- Song, Y.; Luo, X.; Lu, Y.; Qian, J.; Zhang, W.; Liu, L.; Huang, J.; Zhao, X.; Zhang, D. Improving the data quality of CO2 continuous emissions monitoring systems: In the context of China’s emissions trading scheme. Environ. Impact Assess. Rev. 2025, 115, 108037. [Google Scholar] [CrossRef]

- Zeng, X.; Duan, M.; Yu, Z.; Li, W.; Li, M.; Liang, X. Data-related challenges and solutions in building China’s national carbon emissions trading scheme. Clim. Policy 2018, 18, 90–105. [Google Scholar] [CrossRef]

- Hill, A.D.; Johnson, S.G.; Greco, L.M.; O’Boylee, E.H.; Walter, S.L. Endogeneity: A Review and Agenda for the Methodology-Practice Divide Affecting Micro and Macro Research. J. Manag. 2021, 47, 105–143. [Google Scholar] [CrossRef]

- Chernozhukov, V.; Chetverikov, D.; Demirer, M.; Duflo, E.; Hansen, C.; Newey, W.; Robins, J. Double/debiased machine learning for treatment and structural parameters. Econom. J. 2018, 21, C1–C68. [Google Scholar] [CrossRef]

- Tol, R.S.J. Policy Brief-Leaving an Emissions Trading Scheme: Implications for the United Kingdom and the European Union. Rev. Environ. Econ. Policy 2018, 12, 183–189. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).