Spatial-Temporal Evolution and Driving Factors of the Synergistic Development of Green Finance and Low-Carbon Innovation

Abstract

1. Introduction

- (1)

- The Connotation and Measurement of Green Finance: Höhne et al. (2012) [7] defined green finance as financial resources directed toward green development projects, environmental products, and policies that encourage sustainable economic growth. Berrou et al. (2019) [8] emphasized that green finance encompasses financial stocks and flows aimed at achieving environmentally related sustainable development goals. Lindenberg (2014) [9] argued that green finance is often used interchangeably with green investment, referring to the allocation of capital into green development sectors to improve the environment, address climate change, and enhance resource efficiency. Regarding the measurement of green finance, existing studies primarily evaluate its performance from single dimensions, such as green credit, green bonds, green investment, green funds, or green equity. These indicators have been widely employed to assess the impact of green finance on corporate green production efficiency, renewable energy innovation, ecological improvement, and sustainable development [10,11,12,13,14]. With the continuous refinement of China’s green finance policy framework, some scholars have attempted to construct multi-dimensional evaluation systems. For instance, Zhou et al. (2022) [15] assessed the level of green finance development comprehensively from the perspectives of green credit, green investment, and green insurance. D’Orazio and Thole (2022) [16] proposed a “Climate-related Financial Policy Index” to compare cross-country differences in green finance policy performance. Similarly, Bhatnagar (2024) [17] designed a transnational Green Finance and Investment Index to evaluate the overall development of green finance across 15 countries.

- (2)

- Measurement and Evaluation of Low-Carbon Innovation: From the input perspective, Furman et al. (2002) [18] and Riddel and Schwer (2003) [19] argued that regional innovation represents a comprehensive capability determined by the potential to produce related or innovative products, and it is typically measured through research and development (R&D) investment. Cantone et al. (2023) [20] developed a negative binomial regression model based on carbon pricing to evaluate the efficiency of low-carbon innovation, suggesting that higher carbon prices provide effective incentives for low-carbon innovation. From the output perspective, the performance of low-carbon innovation reflects its direct outcomes. Li et al. (2021) [21] assessed low-carbon technological innovation efficiency using firm performance as the ultimate output indicator. Ma (2024) [22] employed carbon emissions as a measure of low-carbon innovation output, finding that in firms with low ownership concentration or operating in high-tech industries, high carbon emissions intensify emission-reduction pressures, thereby encouraging increased R&D investment to foster low-carbon innovation. Bonnet (2020) [23], on the other hand, evaluated low-carbon innovation capacity using patent data and further incorporated the application of low-carbon energy technologies to assess innovation efficiency. Johnstone et al. (2010) [24] analyzed OECD patent data to investigate international differences in renewable energy technology innovation.

- (3)

- The Impact of Green Finance on Low-Carbon Innovation: From the perspective of green credit, Chen et al. (2022) [25] found that green credit policies exert a more significant positive effect on low-carbon technological innovation among state-owned enterprises and ESG-certified firms. Specifically, such policies promote corporate low-carbon innovation by increasing R&D investment and improving managerial efficiency; Similarly, Aizawa and Yang (2010) [26] highlighted that green credit policies can improve capital allocation efficiency and risk assessment mechanisms, thereby guiding capital flows into low-carbon technological innovation in emerging markets. In contrast, Pang et al. (2022) [27] argued that green credit may have a short-term inhibitory effect on low-carbon innovation. From the perspective of green bonds, Li et al. (2025) [28] reported that green bond policies significantly increase the number of corporate green patent applications, particularly green invention patents, and have a more pronounced effect on stimulating green technological innovation in highly polluting industries. However, Flammer et al. (2021) [29] noted that the relationship between green bonds and low-carbon innovation is not entirely positive. In practice, some issuers exhibit forms of environmental misrepresentation, including overstating environmental commitments, selectively disclosing sustainability goals, or making misleading claims about the environmental benefits of projects. Such practices, aimed at securing easier access to green financing channels and related policy support, constitute instances of greenwashing in green finance. Likewise, Larcker and Watts (2020) [30] revealed evidence from U.S. firms indicating a disconnect between environmental disclosures in the green bond market and firms’ actual emission-reduction behaviors. From the perspective of green insurance, Hu et al. (2023) [31] demonstrated a positive correlation between green insurance and low-carbon innovation. Green insurance significantly increases the number of green patent applications, enabling insured enterprises to access more resources, bear greater risks, and consequently enhance their willingness to engage in low-carbon innovation.

2. Mechanism of Action

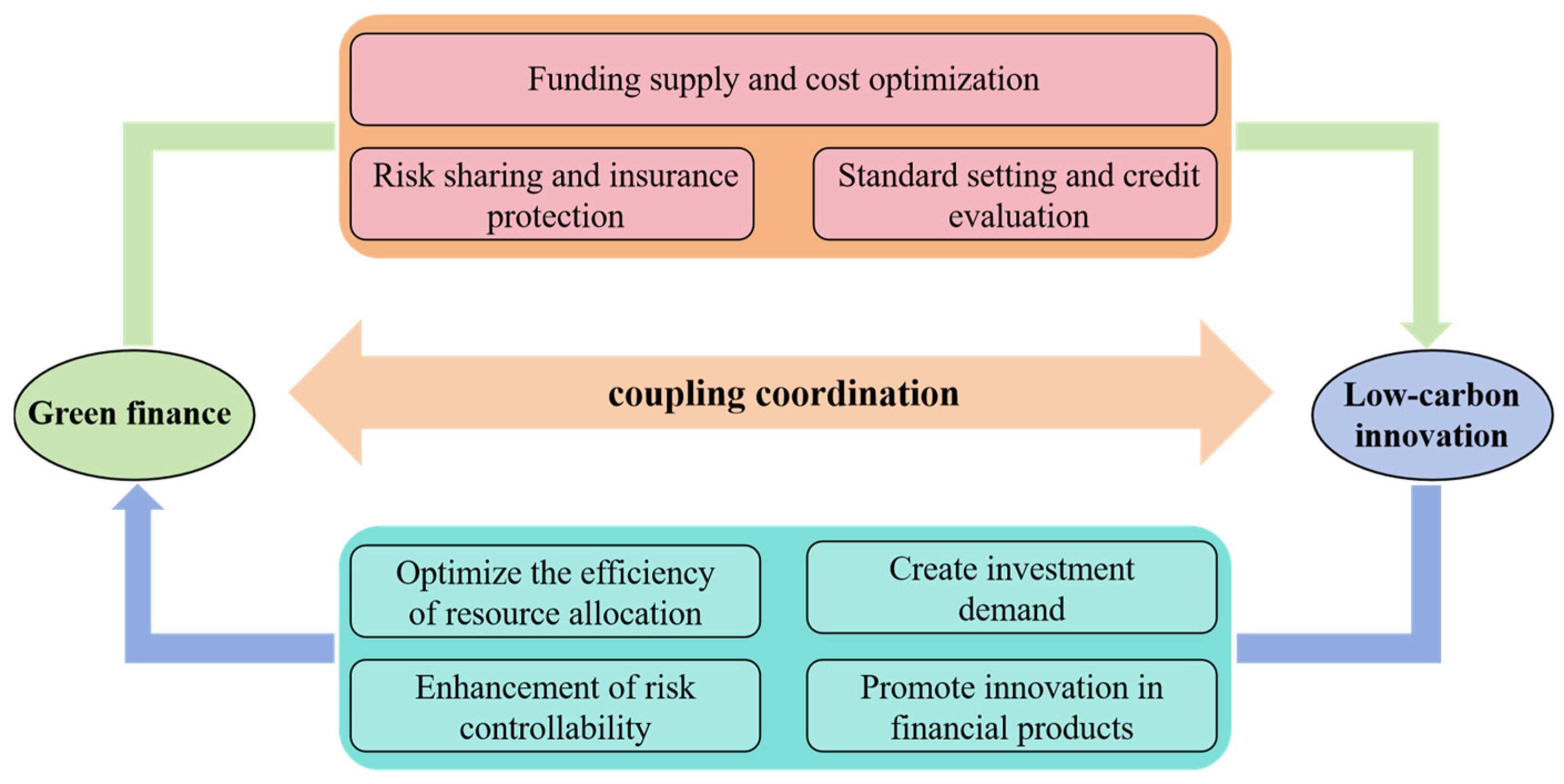

2.1. The Mechanism of the Synergistic Development of Green Finance and Low-Carbon Innovation

2.2. The Driving Mechanisms of the Synergistic Development of Green Finance and Low-Carbon Innovation

3. Research Design

3.1. Variable

3.2. Modeling and Research Methods

3.2.1. Entropy Weight Method

3.2.2. Coupling Coordination Model

3.2.3. Dagum Gini Coefficient and Decomposition

3.2.4. Spatial Autocorrelation Model

3.2.5. Spatial Durbin Model

3.3. Data Source and Processing

4. Empirical Analysis

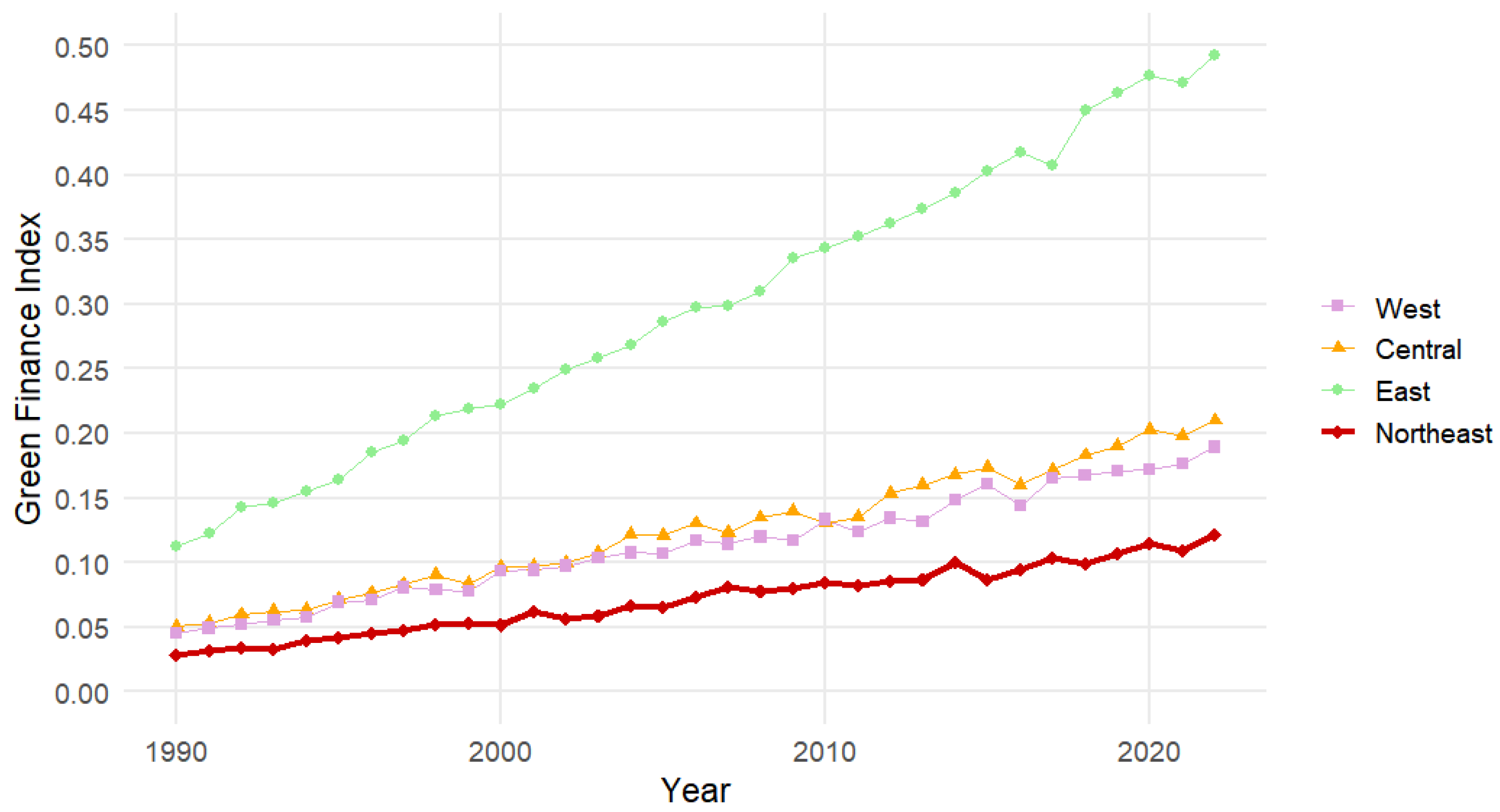

4.1. Evaluation of Green Finance and Low-Carbon Innovation Development Levels

4.1.1. Evaluation of Green Finance Development Levels

4.1.2. Evaluation of Low-Carbon Innovation Development Levels

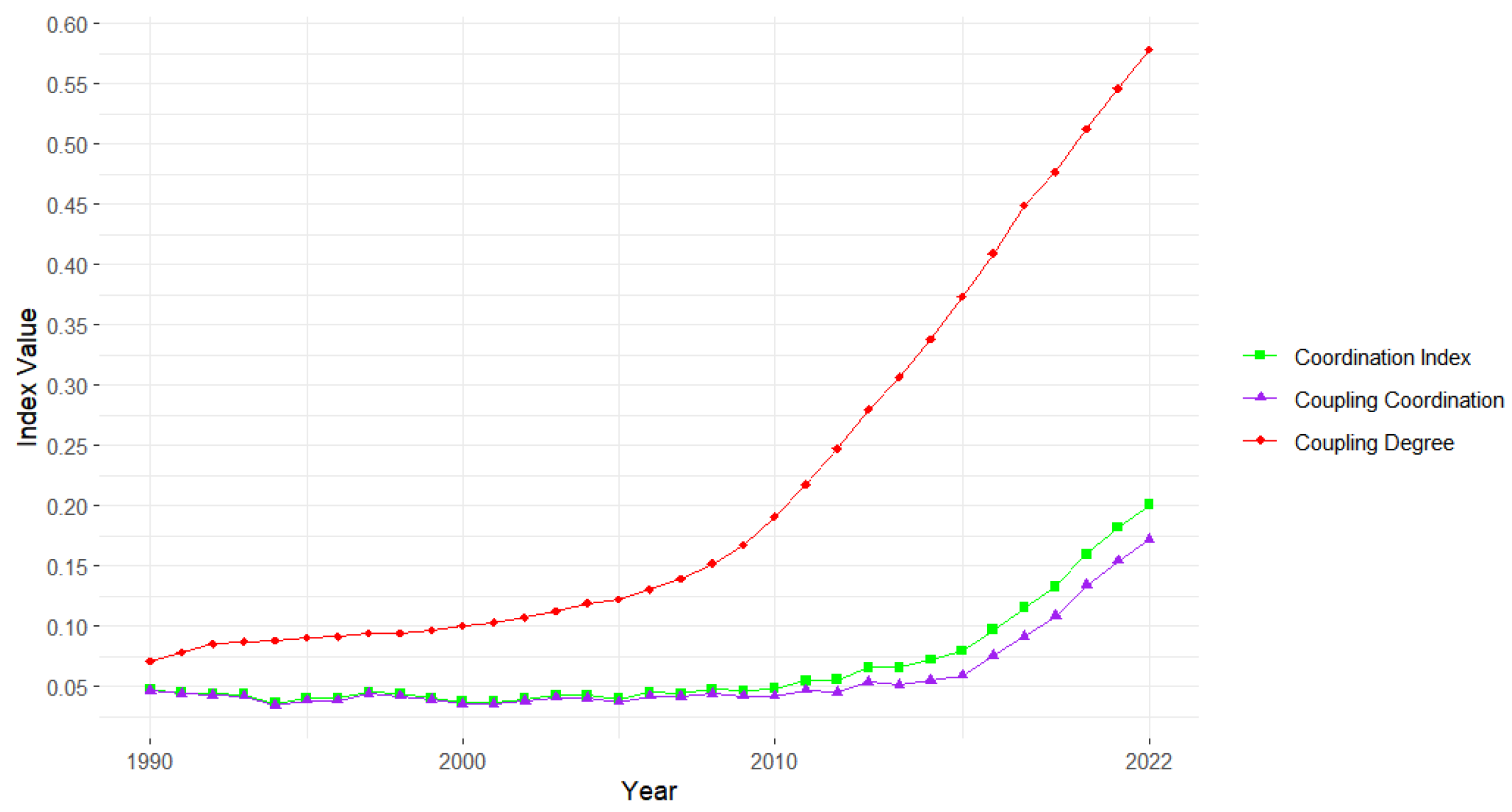

4.2. Temporal Characteristics of the Synergistic Development of Green Finance and Low-Carbon Innovation

4.2.1. National Temporal Characteristics of the Synergistic Development of Green Finance and Low-Carbon Innovation

- (1)

- Overall, the synergistic development level of green finance and low-carbon innovation in China demonstrates a steady upward trajectory, with the coupling coordination degree increasing rapidly and consistently.

- (2)

- From the perspective of the coupling degree, its values during the sample period fall within the range of [0,0.3), indicating that the coupling between green finance and low-carbon innovation remains relatively weak. This suggests that their interactions are not yet significant and that the two systems have not fully achieved synchronized or synergistic development.

- (3)

- In terms of coupling coordination degree, during 1990–2010 it remained within the interval of [0,0.2), reflecting that green finance and low-carbon innovation were in a prolonged state of severe imbalance. From 2011 to 2016, the degree rose to the range of [0.2,0.4), entering a stage of low coordination where interactive effects began to emerge. By 2017–2022, the degree had improved to the interval of [0.4,0.6), indicating that the two systems had stepped into a stage of moderate coordination, with their coupling relationship becoming more balanced.

4.2.2. Temporal Characteristics of the Synergistic Development of Green Finance and Low-Carbon Innovation Across Chinese Provinces

- (1)

- 1990–2016: All provinces remained in the stage of severe imbalance, with little improvement in their coupling coordination degree.

- (2)

- 2017–2019: Although most provinces did not experience fundamental changes in their coordination stages, the overall coordination degree improved moderately, and several provinces achieved upward shifts. Specifically, in 2017, Jiangsu and Guangdong were the first to enter the low coordination stage, with Guangdong further advancing to the moderate coordination stage in 2018. In the same year, Beijing and Shandong also progressed to the low coordination stage, followed by Zhejiang and Henan in 2019. Provinces that took the lead in upgrading their coordination levels were predominantly concentrated in eastern China.

- (3)

- 2019–2022: Guangdong took the lead by reaching a coupling coordination degree of 0.610 in 2019, becoming the first province to enter the high coordination stage. Jiangsu followed in 2021 with a score of 0.701. Both provinces continued to rise rapidly, reaching 0.921 and 0.853, respectively, in 2022, thereby entering the stage of extreme coordination and demonstrating a clear leading effect.

- (4)

- Regional disparities by 2022: Despite these advances, the majority of provinces still remained in the stage of severe imbalance, particularly in central, northeastern, and western China. Within these regions, Anhui in central China (0.173), Liaoning in the northeast (0.065), and Sichuan in the west (0.101) performed relatively better than their regional counterparts but still remained at low overall levels.

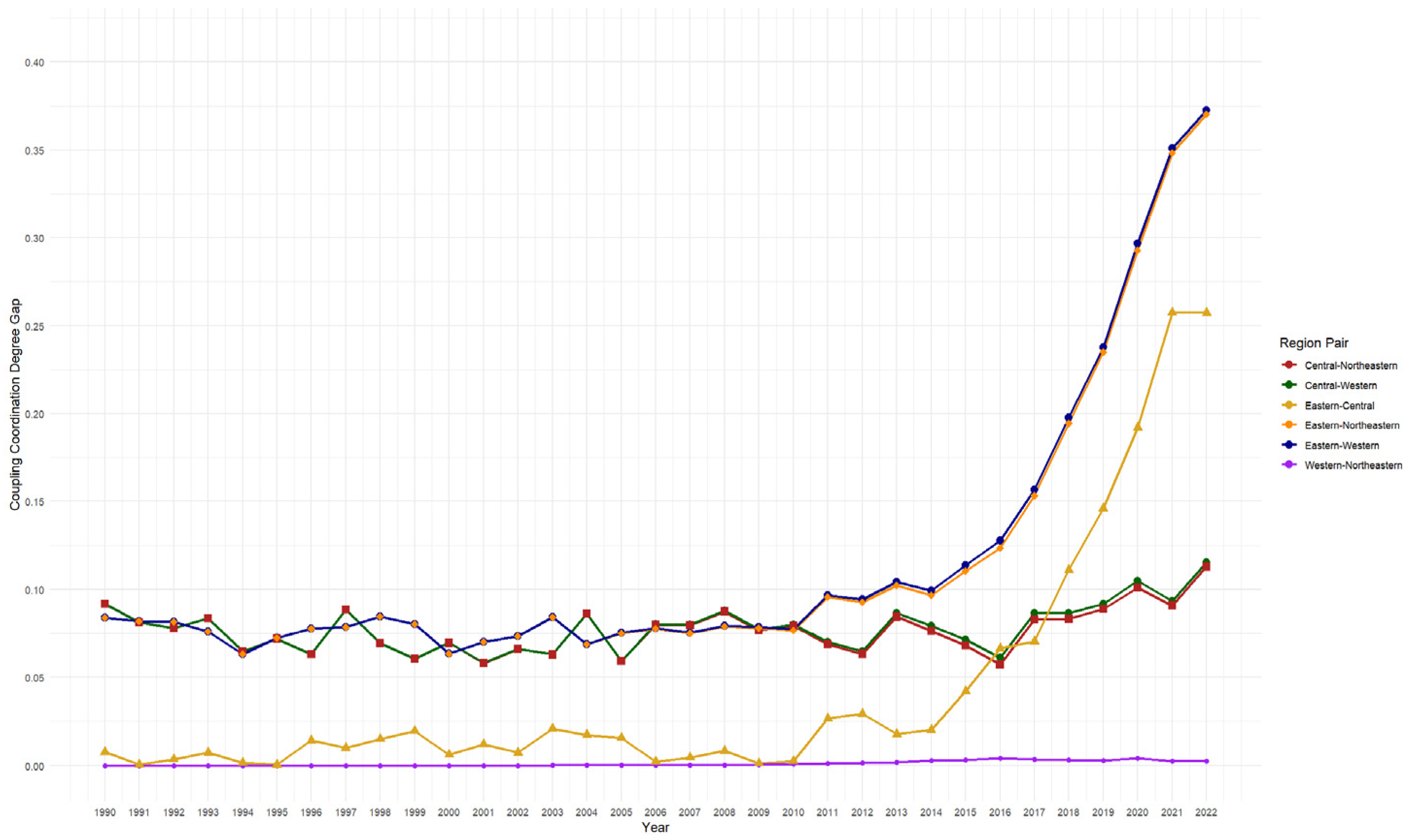

4.3. Spatial Differences in the Synergistic Development Level of Green Finance and Low-Carbon Innovation

4.3.1. Overall Spatial Differentiation Analysis

4.3.2. Intra- and Inter-Regional Disparity Analysis

- (1)

- Eastern region. As the hub of China’s most developed capital markets and green finance infrastructure—including the Shanghai and Shenzhen stock exchanges and the green finance reform and innovation pilot zones—the eastern region offers a significantly higher supply of green finance and greater financial instrument diversity than other regions. However, resource distribution follows a “core–periphery” pattern, with Beijing, Shanghai, Shenzhen, Guangzhou, Jiangsu, and Zhejiang forming highly concentrated financial and innovation “cores.” The coexistence of digital services, advanced manufacturing, and traditional processing industries produces a highly differentiated industrial structure, further amplifying disparities in project reserves, technology conversion efficiency, and financial accessibility across provinces.

- (2)

- Central region. Dominated by manufacturing industries, with a relatively high share of energy-intensive sectors such as energy and transportation equipment, the central region exhibits a relatively homogeneous industrial structure. Green finance here is primarily policy- and bank-driven, while equity and bond markets remain underdeveloped. Nonetheless, Hubei, benefiting from its carbon market pilot and strong educational resources, has enabled the Wuhan metropolitan area to take the lead in green credit and innovation transformation, generating moderate divergence. Consequently, intra-regional disparity in the central region ranks second only to that of the east.

- (3)

- Northeast region. Long constrained by a heavy reliance on state-owned enterprises and heavy industries, coupled with population decline and shrinking demand, the northeast mainly relies on the green transformation of existing credit stock. Market-based capital and innovation platforms are scarce, and project pipelines and technology applications are generally weak and homogeneous. As a result, intra-regional disparities are relatively limited, yielding lower Gini coefficients compared to the east and central regions.

- (4)

- Western region. Most provinces face common bottlenecks, including shallow financial depth, the absence of robust project identification and certification systems, and limited capacity to attract talent and research resources. Green finance and low-carbon innovation generally remain at the stage of “low-level homogeneous initiation.” Although Sichuan and Chongqing benefit from hydropower and equipment manufacturing advantages, these strengths are offset by common constraints, leading to the lowest intra-regional Gini coefficients.

- (1)

- From 1990 to 2010, Regional disparities fluctuated slightly within the range of 0.06–0.10, reflecting low-level volatility and moderate variation. This suggests that China was still in the institutional groundwork stage of green finance and low-carbon innovation, with policies and market-based instruments not yet generating significant regional differentiation. Between 2011 and 2016, as green credit, green bonds, carbon trading pilots, and disclosure rules were gradually introduced, the eastern region was the first to benefit. Consequently, the gaps between “East–Northeast,” “East–West,” and “East–Central” widened, while other regional pairs experienced relatively mild changes. From 2016 to 2022, a divergence pattern emerged with the east as the “core pole.” Disparities in “East–Northeast,” “East–West,” and “East–Central” expanded rapidly, reaching nearly 0.375 for the first two and approximately 0.253 for the latter by 2022. In contrast, the Gini coefficients for “Central–West” and “Central–Northeast” increased only slightly, while the “West–Northeast” gap remained minimal and persistently close to zero.

- (2)

- East–West. Institutional construction and the completeness of the green industrial chain are the decisive factors. The east established comprehensive standards and disclosure systems earlier, enabling rapid and effective policy implementation. The west, by contrast, exhibited delays in both institutional execution and market cultivation, resulting in weak policy transmission. Moreover, while the east has developed a complete low-carbon industry chain encompassing R&D, production, and application—facilitating deep integration of green finance and technological innovation—the west, despite abundant energy resources, lacks adequate supporting industries and innovation chains, leading to a mismatch between green finance support and low-carbon technology adoption.

- (3)

- East–Northeast. Disparities here stem primarily from industrial path dependence and differences in the pace of economic transition. The east has steadily advanced institutional reforms and low-carbon industry cultivation, creating interactive advantages between finance and innovation. In contrast, the northeast has long relied on heavy industries and energy-intensive sectors, facing structural obstacles to green transformation. Even under green finance policies, its green patent output and low-carbon technology iteration remain limited. Capital outflows and population decline further erode its financial vitality, exacerbating the gap.

- (4)

- Central–West. Differences are mainly linked to industrial upgrading and resource allocation efficiency. The central region has fostered clusters of green manufacturing and clean energy industries by absorbing industrial transfers from the east, supported by green credit and government initiatives. The west, though rich in renewable resources, often confines its green finance and innovation activities to primary resource utilization, with insufficient industrial chain extension. A weaker financial system and limited availability of green financial products further constrain synergistic interaction.

- (5)

- Central–Northeast. Divergence reflects differences in policy implementation capacity. The central region has demonstrated strong execution in green finance pilots and fiscal guidance, effectively translating policy resources into support for low-carbon innovation. By contrast, the northeast, despite adopting supportive measures, suffers from limited fiscal capacity and weak execution, which dilute policy effectiveness and widen disparities.

- (6)

- West–Northeast. Both regions demonstrate a “dual disadvantage.” The west suffers from inadequate financial depth and limited market openness, while the northeast remains constrained by rigid industrial structures and a weak foundation for green innovation. Neither region has formed a robust ecosystem integrating green finance with technological innovation, resulting in persistently low interaction levels and disparities that remain close to zero, reflecting a state of low-level convergence.

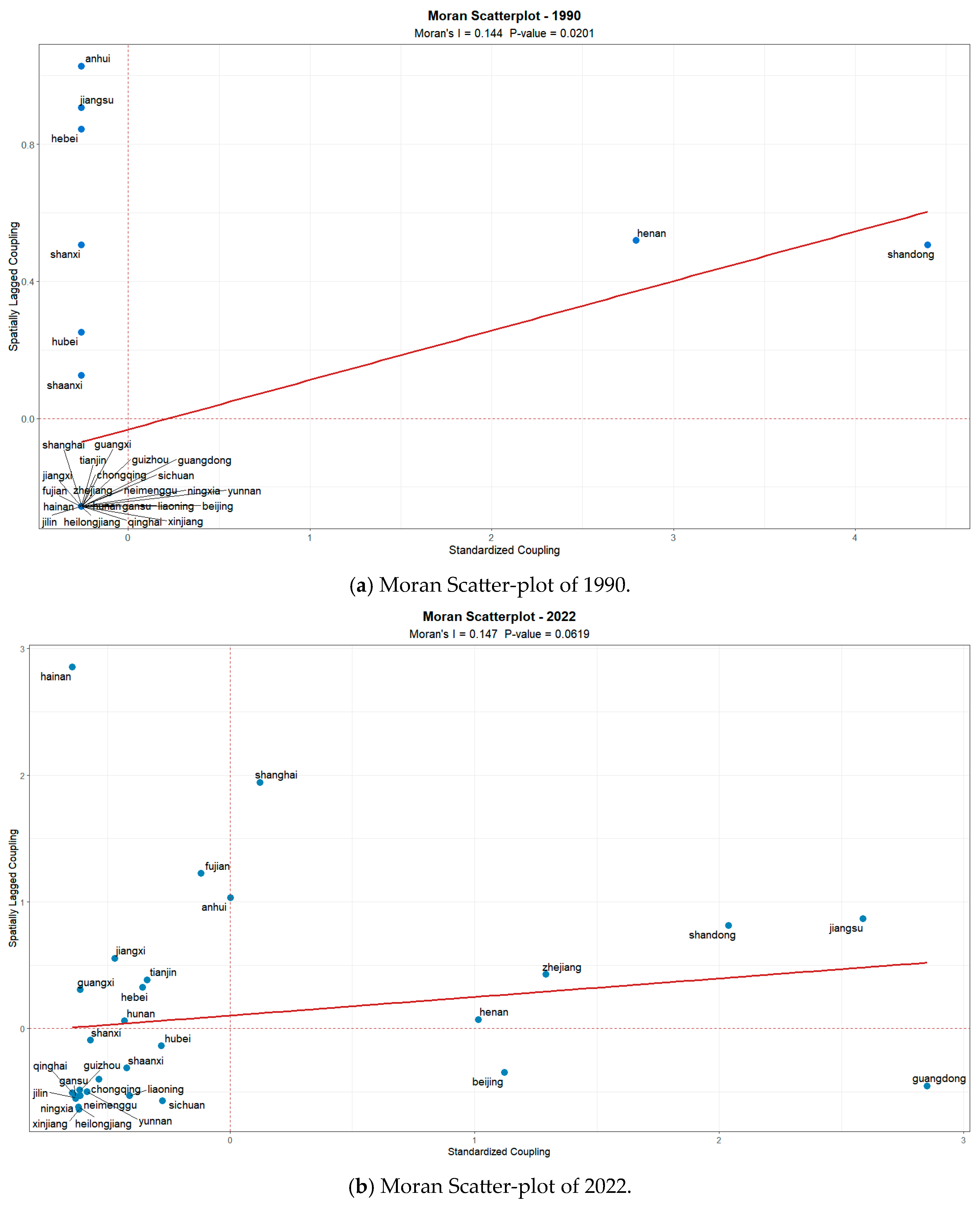

4.4. Spatial Correlation Analysis

4.4.1. Global Spatial Autocorrelation

4.4.2. Local Spatial Autocorrelation

4.5. Analysis of the Driving Factors of the Synergistic Development Level of Green Finance and Low-Carbon Innovation

4.5.1. Model Selection

4.5.2. Spatial Weight Matrix Selection and Robustness Tests

4.5.3. Analysis of the Driving Factors

5. Discussion

- (1)

- From 1990 to 2022, the synergistic development level of green finance and low-carbon innovation followed a clear upward trajectory, progressing from severe imbalance to moderate coordination. Regionally, the ranking of coordination levels from high to low is as follows: eastern, central, northeast, and western provinces.

- (2)

- During 1990–2022, the overall Gini coefficient fluctuated between 0.688 and 0.946, showing an evolutionary pattern of “initial fluctuating increase—subsequent fluctuating decline—final linear decrease.” Inter-regional differences consistently dominated spatial disparities, contributing an average of 55.259%, followed by intra-regional differences (25.629%), while hypervariable density had the smallest effect (19.103%).

- (3)

- Global Moran’s I values were positive and statistically significant in most years, confirming the existence of significant spatial correlation. At the local clustering level, H–H clusters were primarily concentrated in the eastern region (e.g., Shandong, Jiangsu), whereas L–L clusters were concentrated in the western region (e.g., Inner Mongolia, Ningxia, Gansu, Qinghai, Xinjiang) and the northeast (e.g., Heilongjiang, Jilin, Liaoning). L–H clusters appeared in some central provinces such as Jiangxi and Anhui, while H–L clusters were observed in several eastern provinces including Guangdong and Beijing.

- (4)

- Economic development, human capital, industrial structure, and government policy support exert heterogeneous effects on the synergistic development and spatial dynamics of green finance and low-carbon innovation. Among the positive drivers, the relative strength is as follows: government policy support > human capital > economic development. Industrial structure serves as the main negative driver, suggesting that the predominance of heavy industries and structural rigidity significantly constrain synergy improvement.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kong, F.; Luo, R.; Xu, C. Change Characteristics of the Green Finance Development Level and Its Influencing Factors and Scenario Prediction in Counties of Zhejiang Province. Econ. Geogr. 2024, 44, 132–140. [Google Scholar]

- Merler, S. How to improve the European Union’s sustainable finance framework. Bruegel Policy Brief. 2025. Available online: https://www.bruegel.org/policy-brief/how-improve-european-unions-sustainable-finance-framework (accessed on 12 July 2025).

- Evro, S.; Oni, B.A.; Tomomewo, O.S. Global strategies for a low-carbon future: Lessons from the US, China, and EU’s pursuit of carbon neutrality. J. Clean. Prod. 2024, 461, 142635. [Google Scholar] [CrossRef]

- Novák, Z.; Fáth, G.; Ge, C.; Kumar, P. Inclusive green finance: As an approach of developing a comprehensive indicator for BRICS and other emerging economies. J. Econ. Struct. 2025, 14, 10. [Google Scholar] [CrossRef]

- Feng, W.; Bilivogui, P.; Wu, J.; Mu, X. Green finance: Current status, development, and future course of actions in China. Environ. Res. Commun. 2023, 5, 035005. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Karim, S. Unveiling the synergy: Green finance, technological innovation, green energy, and carbon neutrality. PLoS ONE 2024, 19, e0308170. [Google Scholar] [CrossRef]

- Höhne, N.; Khosla, S.; Fekete, H.; Gilbert, A. Mapping of Green Finance Delivered by IDFC Members in 2011. 2012. Available online: https://www.idfc.org/wp-content/uploads/2019/03/idfc_green_finance_mapping_report_2012_06-14-12.pdf (accessed on 12 August 2025).

- Berrou, R.; Dessertine, P.; Migliorelli, M. An overview of green finance. In The Rise of Green Finance in Europe: Opportunities and Challenges for Issuers, Investors and Marketplaces; Palgrave Macmillan: London, UK, 2019; pp. 3–29. [Google Scholar]

- Lindenberg, N. Definition of Green Finance. 2014. Available online: https://www.cbd.int/financial/gcf/definition-greenfinance.pdf (accessed on 12 July 2025).

- Lv, C.; Fan, J.; Lee, C.C. Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 2023, 397, 136573. [Google Scholar] [CrossRef]

- Fatica, S.; Panzica, R. Green bonds as a tool against climate change? Bus. Strategy Environ. 2021, 30, 2688–2701. [Google Scholar] [CrossRef]

- Bhutta, U.S.; Tariq, A.; Farrukh, M.; Raza, A.; Iqbal, M.K. Green bonds for sustainable development: Review of literature on development and impact of green bonds. Technol. Forecast. Soc. Change 2022, 175, 121378. [Google Scholar] [CrossRef]

- Gilchrist, D.; Yu, J.; Zhong, R. The limits of green finance: A survey of literature in the context of green bonds and green loans. Sustainability 2021, 13, 478. [Google Scholar] [CrossRef]

- Heinkel, R.; Kraus, A.; Zechner, J. The effect of green investment on corporate behavior. J. Financ. Quant. Anal. 2001, 36, 431–449. [Google Scholar] [CrossRef]

- Zhou, T.; Ding, R.; Du, Y.; Zhang, Y.; Cheng, S.; Zhang, T. Study on the coupling coordination and spatial correlation effect of green finance and high-quality economic development—Evidence from China. Sustainability 2022, 14, 3137. [Google Scholar] [CrossRef]

- D’Orazio, P.; Thole, S. Climate-related financial policy index: A composite index to compare the engagement in green financial policymaking at the global level. Ecol. Indic. 2022, 141, 109065. [Google Scholar] [CrossRef]

- Bhatnagar, S.; Sharma, D.; Bundel, R. Green finance and investment index for assessing scenario and performance in selected countries. World Dev. Sustain. 2024, 5, 100183. [Google Scholar] [CrossRef]

- Furman, J.L.; Porter, M.E.; Stern, S. The determinants of national innovative capacity. Res. Policy 2002, 31, 899–933. [Google Scholar] [CrossRef]

- Riddel, M.; Schwer, R.K. Regional innovative capacity with endogenous employment: Empirical evidence from the US. Rev. Reg. Stud. 2003, 33, 73–84. [Google Scholar] [CrossRef]

- Cantone, B.; Evans, D.; Reeson, A. The effect of carbon price on low carbon innovation. Sci. Rep. 2023, 13, 9525. [Google Scholar] [CrossRef]

- Li, F.; Xu, X.; Li, Z.; Du, P.; Ye, J. Can low-carbon technological innovation truly improve enterprise performance? The case of Chinese manufacturing companies. J. Clean. Prod. 2021, 293, 125949. [Google Scholar] [CrossRef]

- Ma, J. Carbon emissions and low-carbon innovation in firms. PLoS ONE 2024, 19, e0312759. [Google Scholar] [CrossRef]

- Bonnet, C. Measuring Knowledge with Patent Data: An Application to Low Carbon Energy Technologies. 2020. Available online: https://ideas.repec.org/p/hal/wpaper/hal-02971680.html (accessed on 9 August 2025).

- Johnstone, N.; Haščič, I.; Popp, D. Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, Y.; Wang, H.; Ouyang, X.; Xie, Y. Can green credit policy promote low-carbon technology innovation? J. Clean. Prod. 2022, 359, 132061. [Google Scholar] [CrossRef]

- Aizawa, M.; Yang, C. Green credit, green stimulus, green revolution? China’s mobilization of banks for environmental cleanup. J. Environ. Dev. 2010, 19, 119–144. [Google Scholar] [CrossRef]

- Pang, L.; Zhu, M.N.; Yu, H. Is green finance really a blessing for green technology and carbon efficiency? Energy Econ. 2022, 114, 106272. [Google Scholar] [CrossRef]

- Li, C.; Cao, X.; Wang, Z.; Zhang, J.; Liu, H. The impact of green bond issuance on corporate green innovation: A signaling perspective. Int. Rev. Financ. Anal. 2025, 102, 104113. [Google Scholar] [CrossRef]

- Flammer, C. Corporate green bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Larcker, D.F.; Watts, E.M. Where’s the greenium? J. Account. Econ. 2020, 69, 101312. [Google Scholar] [CrossRef]

- Hu, Y.; Du, S.; Wang, Y.; Yang, X. How does green insurance affect green innovation? Evidence from China. Sustainability 2023, 15, 12194. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, J.; Duan, C. How does green finance affect the low-carbon economy? Capital allocation, green technology innovation and industry structure perspectives. Econ. Res.-Ekon. Istraživanja 2023, 36, 2110138. [Google Scholar] [CrossRef]

- Zheng, M.; Wu, L.; Feng, G.-F.; Chang, C.-P. The impact of green finance on sustainable development: An investigation into national ESG performance. J. Appl. Econ. 2025, 28, 2528672. [Google Scholar] [CrossRef]

- Shao, J.; Huang, P. The policy mix of green finance in China: An evolutionary and multilevel perspective. Clim. Policy 2023, 23, 689–703. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Lu, N.; Wu, J.; Liu, Z. How does green finance reform affect enterprise green technology innovation? Evidence from China. Sustainability 2022, 14, 9865. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.C.; Zhou, F. Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 2021, 94, 105099. [Google Scholar] [CrossRef]

- Yang, Y. Impact of low carbon orientation on green finance in highly polluted areas based on STIRPAT spatial panel model. Sci. Rep. 2025, 15, 20516. [Google Scholar] [CrossRef] [PubMed]

- Safiullah, M.; Phan, D.H.B.; Kabir, M.N. Green innovation and corporate default risk. J. Int. Financ. Mark. Inst. Money 2024, 95, 102041. [Google Scholar] [CrossRef]

- Meles, A.; Salerno, D.; Sampagnaro, G.; Verdoliva, V.; Zhang, J. The influence of green innovation on default risk: Evidence from Europe. Int. Rev. Econ. Financ. 2023, 84, 692–710. [Google Scholar] [CrossRef]

- De Haas, R.; Popov, A. Finance and green growth. Econ. J. 2023, 133, 637–668. [Google Scholar] [CrossRef]

- Song, W.; Meng, L.; Zang, D. Exploring the impact of human capital development and environmental regulations on green innovation efficiency. Environ. Sci. Pollut. Res. 2023, 30, 67525–67538. [Google Scholar] [CrossRef]

- Kogan, L.; Papanikolaou, D.; Seru, A.; Stoffman, N. Technological innovation, resource allocation, and growth. Q. J. Econ. 2017, 132, 665–712. [Google Scholar] [CrossRef]

- Nesta, L.; Vona, F.; Nicolli, F. Environmental policies, competition and innovation in renewable energy. J. Environ. Econ. Manag. 2014, 67, 396–411. [Google Scholar] [CrossRef]

- Zhu, B.; Zhang, M.; Zhou, Y.; Wang, P.; Sheng, J.; He, K.; Wei, Y.-M.; Xie, R. Exploring the effect of industrial structure adjustment on interprovincial green development efficiency in China: A novel integrated approach. Energy Policy 2019, 134, 110946. [Google Scholar] [CrossRef]

- Costantini, V.; Mazzanti, M. On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res. Policy 2012, 41, 132–153. [Google Scholar] [CrossRef]

- Zhang, Y.; Feng, N.; Wang, X. Can the green finance pilot policy promote the low-carbon transformation of the economy? Int. Rev. Econ. Financ. 2024, 93, 1074–1086. [Google Scholar] [CrossRef]

- Aglietta, M.; Espagne, É. Climate and Finance Systemic Risks, More than An Analogy? The Climate Fragility Hypothesis. CEPII, Centre D’etudes Prospectives et D’informations Internationales. 2016. Available online: https://www.cepii.fr/PDF_PUB/wp/2016/wp2016-10.pdf (accessed on 12 July 2025).

- Campiglio, E. Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef]

- Zhou, Y.; Liu, H.; Wang, J.; Yang, H.; Liu, Z.; Peng, G. Spatial differentiation and influencing factors of green finance development level in China. Front. Environ. Sci. 2022, 10, 1023690. [Google Scholar] [CrossRef]

- Lv, C.; Bian, B.; Lee, C.-C.; He, Z. Regional gap and the trend of green finance development in China. Energy Econ. 2021, 102, 105476. [Google Scholar] [CrossRef]

- Ma, J.; Hu, Q.; Shen, W.; Wei, X. Does the low-carbon city pilot policy promote green technology innovation? Based on green patent data of Chinese A-share listed companies. Int. J. Environ. Res. Public Health 2021, 18, 3695. [Google Scholar] [CrossRef] [PubMed]

- Block, J.; Lambrecht, D.; Willeke, T.; Cucculelli, M.; Meloni, D. Green patents and green trademarks as indicators of green innovation. Res. Policy 2025, 54, 105138. [Google Scholar] [CrossRef]

- Wang, X.; Zhao, H.; Bi, K. The measurement of green finance index and the development forecast of green finance in China. Environ. Ecol. Stat. 2021, 28, 263–285. [Google Scholar] [CrossRef]

- Li, Z.; Li, Y.; Wang, Y.; Zhang, D. Study on coupling and coordination of eco-environment and socio-economic development of drinking water sources: A case study of Songhuaba Reservoir in Kunming City. J. Environ. Eng. Technol. 2022, 12, 2132–2139. [Google Scholar]

- Dou, R.Y.; Liang, B.Y.; Li, K.Y.; Zhang, C.; Zhao, Y.F. The spatio-temporal coupling and coordination characteristics and spatio effects of carbon emission intensity and high-quality economic development in China. Appl. Ecol. Environ. Res. 2025, 23, 3335–3357. [Google Scholar] [CrossRef]

- Jiang, T.; Xu, J.; Yu, Y.; Jahanger, A.; Balsalobre-Lorente, D. The spatial pattern and association network of green finance development: Empirical evidence from China. Nat. Resour. Forum 2025, 49, 2324–2348. [Google Scholar] [CrossRef]

- Yang, C.; Liu, S. Spatial correlation analysis of low-carbon innovation: A case study of manufacturing patents in China. J. Clean. Prod. 2020, 273, 122893. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [PubMed]

| Variable Name | Variable Measurement | Unit | Direction | Weight |

|---|---|---|---|---|

| Green credit | Share of total credit allocated to green and environmental protection projects in the province | % | + | 0.141 |

| Green investment | Ratio of investment in environmental pollution control to GDP | % | + | 0.141 |

| Green insurance | Share of environmental liability insurance premium income in total premium income | % | + | 0.141 |

| Green bonds | Share of green bond issuance in total bond issuance | % | + | 0.140 |

| Government policy support | Share of fiscal expenditure on environmental protection in total general budget expenditure | % | + | 0.144 |

| Green funds | Share of green fund market value in total fund market value | % | + | 0.142 |

| Green equity | Market capitalization share of environmental protection enterprises in the A-share market | % | + | 0.151 |

| Coupling Degree | Coupling Level |

|---|---|

| [0,0.3) | The coupling degree remains at a relatively low level, with limited mutual influence between the two systems. |

| [0.3,0.5) | The coupling degree is in an antagonistic state, where the two systems find it difficult to fully absorb and integrate each other’s effects. |

| [0.5,0.8) | The coupling degree gradually evolves toward a benign coupling, with the two systems progressively converging toward a common trend and stable state. |

| [0.8,1.0] | The coupling degree reaches a high level of coordinated development, with the two systems mutually integrated and inclusive. |

| Stage | Coupling Coordination Degree | Coordination Level |

|---|---|---|

| Coordination Level | [0,0.1) | Extreme disorder and decline |

| [0.1,0.2) | Severe disorder and decline | |

| Low Coordination Stage | [0.2,0.3) | Moderate disorder and decline |

| [0.3,0.4) | Mild disorder and decline | |

| Moderate Coordination Stage | [0.4,0.5) | On the verge of disorder and decline |

| [0.5,0.6) | Barely coordinated development | |

| High Coordination Stage | [0.6,0.7) | Primary coordinated development |

| [0.7,0.8) | Intermediate coordinated development | |

| Extreme Coordination Stage | [0.8,0.9) | Good coordinated development |

| [0.9,1.0] | Excellent coordinated development |

| Quadrant | Type | Relationship |

|---|---|---|

| First Quadrant | H-H | Both the study area and its neighboring provinces exhibit a high coupling coordination degree. |

| Second Quadrant | L-H | The study area shows a low coupling coordination degree, while neighboring provinces show a high level, reflecting spatial heterogeneity. |

| Third Quadrant | L-L | Both the study area and its neighboring provinces exhibit a low coupling coordination degree. |

| Fourth Quadrant | H-L | The study area shows a high coupling coordination degree, while neighboring provinces show a low level, reflecting spatial heterogeneity. |

| Variable Name | Variable Code | Variable Measurement |

|---|---|---|

| Economic development | Eco | GDP per capita |

| Human capital | Hum | The sum of students enrolled in regular higher education institutions per 10,000 people |

| Industrial structure | IS | By the natural logarithm of the interest expenditure of energy-intensive industries |

| Government policy support | Gov | Fiscal general budget expenditure divided by gross domestic product |

| Region | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 |

| East | 0.112 | 0.122 | 0.143 | 0.146 | 0.155 | 0.164 | 0.186 | 0.194 | 0.214 | 0.219 | 0.223 |

| Central | 0.050 | 0.053 | 0.060 | 0.062 | 0.064 | 0.071 | 0.076 | 0.083 | 0.090 | 0.084 | 0.096 |

| West | 0.045 | 0.049 | 0.052 | 0.055 | 0.058 | 0.069 | 0.071 | 0.081 | 0.079 | 0.078 | 0.093 |

| Northeast | 0.028 | 0.032 | 0.034 | 0.033 | 0.039 | 0.042 | 0.045 | 0.047 | 0.052 | 0.053 | 0.051 |

| Region | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| East | 0.235 | 0.249 | 0.259 | 0.268 | 0.286 | 0.298 | 0.298 | 0.310 | 0.336 | 0.343 | 0.353 |

| Central | 0.097 | 0.100 | 0.107 | 0.122 | 0.121 | 0.130 | 0.123 | 0.135 | 0.140 | 0.131 | 0.135 |

| West | 0.094 | 0.097 | 0.104 | 0.107 | 0.107 | 0.117 | 0.114 | 0.120 | 0.117 | 0.133 | 0.123 |

| Northeast | 0.062 | 0.056 | 0.059 | 0.067 | 0.066 | 0.073 | 0.081 | 0.078 | 0.080 | 0.084 | 0.082 |

| Region | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| East | 0.363 | 0.374 | 0.387 | 0.403 | 0.418 | 0.407 | 0.450 | 0.436 | 0.477 | 0.471 | 0.493 |

| Central | 0.153 | 0.160 | 0.168 | 0.173 | 0.160 | 0.172 | 0.183 | 0.190 | 0.203 | 0.198 | 0.210 |

| West | 0.134 | 0.131 | 0.148 | 0.161 | 0.144 | 0.165 | 0.168 | 0.171 | 0.172 | 0.177 | 0.189 |

| Northeast | 0.086 | 0.087 | 0.100 | 0.087 | 0.095 | 0.103 | 0.099 | 0.107 | 0.114 | 0.109 | 0.121 |

| Region | Average (Number of Patents) | Average Ranking | Average Annual Growth Rate (%) | Growth Rate Ranking |

|---|---|---|---|---|

| Beijing | 1655 | 4 | 60.87 | 11 |

| Tianjin | 442 | 12 | 58.15 | 12 |

| Hebei | 417 | 13 | 73.42 | 9 |

| Shanxi | 173 | 19 | 31.06 | 17 |

| Inner Mongolia | 109 | 21 | 25.85 | 18 |

| Liaoning | 376 | 14 | 19.90 | 21 |

| Jilin | 81 | 26 | 18.61 | 23 |

| Heilongjiang | 94 | 25 | 16.18 | 24 |

| Shanghai | 893 | 6 | 153.03 | 2 |

| Jiangsu | 2915 | 2 | 68.34 | 10 |

| Zhejiang | 1725 | 3 | 94.41 | 6 |

| Anhui | 732 | 7 | 137.33 | 3 |

| Fujian | 653 | 8 | 118.88 | 5 |

| Jiangxi | 310 | 17 | 47.03 | 13 |

| Shandong | 955 | 5 | 93.94 | 7 |

| Henan | 534 | 9 | 44.55 | 14 |

| Hubei | 506 | 11 | 119.58 | 4 |

| Hunan | 347 | 15 | 16.16 | 25 |

| Guangdong | 3868 | 1 | 336.80 | 1 |

| Guangxi | 109 | 21 | 9.02 | 29 |

| Hainan | 43 | 29 | 42.70 | 15 |

| Chongqing | 227 | 18 | 19.21 | 22 |

| Sichuan | 511 | 10 | 81.09 | 8 |

| Guizhou | 109 | 21 | 9.02 | 29 |

| Yunnan | 153 | 20 | 15.23 | 27 |

| Shaanxi | 336 | 16 | 36.80 | 16 |

| Gansu | 73 | 27 | 13.33 | 28 |

| Qinghai | 40 | 30 | 7.58 | 30 |

| Ningxia | 72 | 28 | 15.67 | 26 |

| Xinjiang | 97 | 24 | 20.24 | 20 |

| Year | Overall Disparity | Gw | Contribution Rate | Gnb | Contribution Rate | Gt | Contribution Rate |

|---|---|---|---|---|---|---|---|

| 1990 | 0.940 | 0.247 | 26.291% | 0.4778 | 50.817% | 0.215 | 22.891% |

| 1991 | 0.942 | 0.250 | 26.570% | 0.468 | 49.650% | 0.224 | 23.780% |

| 1992 | 0.942 | 0.252 | 26.677% | 0.472 | 50.116% | 0.219 | 23.207% |

| 1993 | 0.940 | 0.247 | 26.278% | 0.478 | 50.876% | 0.215 | 22.846% |

| 1994 | 0.941 | 0.249 | 26.473% | 0.470 | 49.919% | 0.222 | 23.609% |

| 1995 | 0.942 | 0.250 | 26.566% | 0.467 | 49.644% | 0.224 | 23.791% |

| 1996 | 0.945 | 0.256 | 27.111% | 0.491 | 52.005% | 0.197 | 20.885% |

| 1997 | 0.940 | 0.246 | 26.196% | 0.482 | 51.271% | 0.212 | 22.532% |

| 1998 | 0.944 | 0.256 | 27.093% | 0.490 | 51.929% | 0.198 | 20.977% |

| 1999 | 0.946 | 0.258 | 27.318% | 0.500 | 52.905% | 0.187 | 19.777% |

| 2000 | 0.940 | 0.247 | 26.268% | 0.478 | 50.910% | 0.215 | 22.827% |

| 2001 | 0.944 | 0.256 | 27.069% | 0.490 | 51.855% | 0.199 | 21.076% |

| 2002 | 0.943 | 0.253 | 26.835% | 0.479 | 50.861% | 0.210 | 22.303% |

| 2003 | 0.945 | 0.258 | 27.319% | 0.501 | 52.986% | 0.186 | 19.695% |

| 2004 | 0.937 | 0.242 | 25.853% | 0.495 | 52.853% | 0.200 | 21.294% |

| 2005 | 0.944 | 0.256 | 27.160% | 0.495 | 52.409% | 0.193 | 20.431% |

| 2006 | 0.939 | 0.248 | 26.414% | 0.470 | 50.008% | 0.221 | 23.578% |

| 2007 | 0.938 | 0.247 | 26.301% | 0.473 | 50.439% | 0.218 | 23.261% |

| 2008 | 0.936 | 0.245 | 26.140% | 0.478 | 51.070% | 0.213 | 22.790% |

| 2009 | 0.935 | 0.247 | 26.387% | 0.467 | 49.928% | 0.221 | 23.685% |

| 2010 | 0.928 | 0.242 | 26.070% | 0.467 | 50.360% | 0.219 | 23.570% |

| 2011 | 0.925 | 0.248 | 26.844% | 0.499 | 53.964% | 0.178 | 19.192% |

| 2012 | 0.910 | 0.241 | 26.515% | 0.501 | 55.068% | 0.168 | 18.417% |

| 2013 | 0.893 | 0.229 | 25.639% | 0.477 | 53.380% | 0.187 | 20.982% |

| 2014 | 0.869 | 0.218 | 25.110% | 0.474 | 54.553% | 0.177 | 20.338% |

| 2015 | 0.844 | 0.210 | 24.920% | 0.493 | 58.379% | 0.141 | 16.702% |

| 2016 | 0.807 | 0.197 | 24.369% | 0.507 | 62.761% | 0.104 | 12.870% |

| 2017 | 0.788 | 0.185 | 23.441% | 0.492 | 62.444% | 0.111 | 14.115% |

| 2018 | 0.760 | 0.175 | 23.005% | 0.504 | 66.350% | 0.081 | 10.645% |

| 2019 | 0.747 | 0.168 | 22.540% | 0.511 | 68.390% | 0.068 | 9.070% |

| 2020 | 0.734 | 0.163 | 22.198% | 0.514 | 70.032% | 0.057 | 7.770% |

| 2021 | 0.716 | 0.156 | 21.756% | 0.521 | 72.829% | 0.039 | 5.146% |

| 2022 | 0.688 | 0.145 | 21.043% | 0.499 | 72.599% | 0.044 | 6.357% |

| Year | Northeast | East | Central | West |

|---|---|---|---|---|

| 1990 | 0.667 | 0.900 | 0.833 | 0.646 |

| 1991 | 0.527 | 0.900 | 0.833 | 0.661 |

| 1992 | 0.531 | 0.900 | 0.833 | 0.583 |

| 1993 | 0.531 | 0.900 | 0.833 | 0.615 |

| 1994 | 0.537 | 0.900 | 0.833 | 0.566 |

| 1995 | 0.507 | 0.900 | 0.833 | 0.558 |

| 1996 | 0.504 | 0.900 | 0.833 | 0.535 |

| 1997 | 0.480 | 0.900 | 0.833 | 0.491 |

| 1998 | 0.498 | 0.900 | 0.833 | 0.518 |

| 1999 | 0.510 | 0.900 | 0.833 | 0.530 |

| 2000 | 0.521 | 0.899 | 0.833 | 0.557 |

| 2001 | 0.506 | 0.899 | 0.833 | 0.569 |

| 2002 | 0.517 | 0.899 | 0.833 | 0.573 |

| 2003 | 0.555 | 0.899 | 0.833 | 0.542 |

| 2004 | 0.547 | 0.898 | 0.833 | 0.559 |

| 2005 | 0.568 | 0.897 | 0.833 | 0.611 |

| 2006 | 0.556 | 0.896 | 0.833 | 0.638 |

| 2007 | 0.547 | 0.894 | 0.833 | 0.642 |

| 2008 | 0.543 | 0.890 | 0.833 | 0.637 |

| 2009 | 0.551 | 0.884 | 0.832 | 0.661 |

| 2010 | 0.536 | 0.869 | 0.830 | 0.668 |

| 2011 | 0.539 | 0.857 | 0.825 | 0.667 |

| 2012 | 0.548 | 0.824 | 0.817 | 0.665 |

| 2013 | 0.540 | 0.791 | 0.812 | 0.657 |

| 2014 | 0.545 | 0.744 | 0.799 | 0.638 |

| 2015 | 0.549 | 0.700 | 0.778 | 0.612 |

| 2016 | 0.536 | 0.639 | 0.737 | 0.611 |

| 2017 | 0.529 | 0.596 | 0.734 | 0.606 |

| 2018 | 0.520 | 0.556 | 0.686 | 0.600 |

| 2019 | 0.510 | 0.532 | 0.659 | 0.580 |

| 2020 | 0.507 | 0.516 | 0.613 | 0.560 |

| 2021 | 0.490 | 0.494 | 0.508 | 0.551 |

| 2022 | 0.477 | 0.458 | 0.496 | 0.541 |

| Year | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 |

| Moran’s I | 0.144 | 0.138 | 0.135 | 0.145 | 0.140 | 0.138 | 0.121 | 0.146 | 0.122 | 0.114 | 0.145 |

| P | 0.020 | 0.020 | 0.020 | 0.020 | 0.020 | 0.020 | 0.019 | 0.020 | 0.019 | 0.019 | 0.020 |

| Year | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Moran’s I | 0.122 | 0.130 | 0.114 | 0.152 | 0.119 | 0.141 | 0.143 | 0.146 | 0.139 | 0.144 | 0.119 |

| P | 0.019 | 0.020 | 0.019 | 0.021 | 0.019 | 0.020 | 0.020 | 0.021 | 0.020 | 0.020 | 0.018 |

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Moran’s I | 0.124 | 0.147 | 0.158 | 0.159 | 0.148 | 0.156 | 0.138 | 0.095 | 0.120 | 0.094 | 0.147 |

| P | 0.016 | 0.016 | 0.014 | 0.011 | 0.017 | 0.033 | 0.057 | 0.129 | 0.089 | 0.131 | 0.062 |

| Variable | Spatial Distance Matrix (Inverse Squared) | Nested Spatial–Geographic Weight Matrix | Spatial Economic Weight Matrix (Inverse Squared) |

|---|---|---|---|

| −0.006 (0.054) | −0.159 (0.083) | −0.008 (0.033) | |

| Eco | 4.10 × 10−6 *** (2.00 × 10−7) | 4.40 × 10−6 *** (3.00 × 10−7) | 3.50 × 10−6 *** (5.00 × 10−7) |

| Hum | 0.001 *** (9.05 × 10−5) | 0.001 *** (9.12 × 10−5) | 7.71 × 10−4 *** (9.21 × 10−5) |

| IS | −0.028 *** (0.007) | −0.032 *** (0.007) | −0.027 *** (0.008) |

| Gov | 0.323 *** (0.063) | 0.341 *** (0.059) | 0.391 *** (0.058) |

| W × Eco | −5.00 × 10−7 (5.00 × 10−7) | 5.00 × 10−7 (1.30 × 10−6) | 1.70 × 10−6 (7.00 × 10−7) |

| W × Hum | −0.001 *** (3.12 × 10−4) | −0.002 *** (5.52 × 10−4) | −5.19 × 10−4 (1.64 × 10−4) |

| W × IS | −0.019 (0.015) | −0.064 * (0.036) | −0.070 (0.010) |

| W × Gov | 0.035 (0.150) | 0.888 ** (0.363) | 0.225 (0.126) |

| R2 | 0.474 | 0.484 | 0.491 |

| 0.003 | 0.003 | 0.003 | |

| N | 990 | 990 | 990 |

| Method | Statistic | p Value | Conclusion |

|---|---|---|---|

| Kao test | −2.528 | 0.005 | Stationary |

| Pedroni test | −4.202 | 0.000 | Stationary |

| Variable | Coef. | Std. Err. | Z Value | p Value |

|---|---|---|---|---|

| Eco | 1.00 × 10−6 *** | 0.000 | 8.428 | 0.000 |

| Hum | 5.32 × 10−4 *** | 2.80 × 10−5 | 18.781 | 0.000 |

| IS | −0.006 *** | 0.002 | −2.617 | 0.009 |

| Gov | 0.056 *** | 0.018 | 3.176 | 0.001 |

| W × Eco | 0.000 ** | 0.000 | 2.013 | 0.044 |

| W × Hum | −1.61 × 10−4 *** | 5.30 × 10−5 | −3.054 | 0.002 |

| W × IS | −0.024 *** | 0.003 | −7.990 | 0.000 |

| W × Gov | 0.084 ** | 0.039 | 2.178 | 0.029 |

| R2 | 0.813 | |||

| Variable | Direct Effect | Indirect Effect | Total Effect |

|---|---|---|---|

| Economic development | 4.00 × 10−6 | 1.00 × 10−6 | 5.00 × 10−6 |

| Human capital | 7.73 × 10−4 | −5.23 × 10−4 | 2.50 × 10−4 |

| Industrial structure | −0.0269 | −0.0695 | −0.0964 |

| Government policy support | 0.391 | 0.221 | 0.612 |

| Policy Recommendation | Local Practices (Examples) | Operational Highlights |

|---|---|---|

| Provincial Green Project Database and Joint Credit Granting. | In the Guangzhou Green Finance Reform and Innovation Pilot Zone, the Administrative Measures for the Green Enterprise and Project Database were implemented to specify entry standards and promote multi-institutional coordination. As a result, the balance of green credit more than doubled within five years. | Unified project entry and due diligence templates → fiscal subsidies + relending (aligned with PBoC tools) → multiple banks engaging in “joint evaluation, joint credit granting, and joint risk management” |

| Cross-Provincial Collaborative Platform. | In the Yangtze River Delta Integration Demonstration Zone, a unified project management platform and parallel approval mechanism were established. The Development and Construction Management Authority was granted provincial-level project management authority, enabling the unified acceptance and circulation of cross-regional projects. | Joint construction of a “projects–finance–data–standards” platform → establishment of dedicated task forces and risk-sharing clauses → mutual recognition of third-party verifications |

| Approval and Certification Mutual Recognition. | The Guangzhou Project Database Measures were aligned with the national Green Bond and Green Credit Guidelines, the Catalogue of Green Bond-Supported Projects, and relevant exchange regulations. This alignment opened multi-tiered market channels from the municipal project database, facilitating consistency in project standards and enhancing the circulation of green financial products across different markets. | Unified ESG/carbon certification standards → routine spot checks and information disclosure → establishment of interprovincial mutual recognition lists |

| Carbon Price–Financing Linkage. | The Shanghai Environment and Energy Exchange introduced pioneering carbon finance products, including carbon quota pledge loan guarantee insurance and grassland carbon sink index insurance. These instruments enhanced credit support and risk mitigation mechanisms, thereby strengthening the linkage between carbon pricing, financing, and technological innovation. | Matching cash flows with emission reduction pathways → using quota/CCER revenues for credit enhancement or repayment support → integration with exchange and registry systems |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.; Luo, Y.; Fang, J. Spatial-Temporal Evolution and Driving Factors of the Synergistic Development of Green Finance and Low-Carbon Innovation. Sustainability 2025, 17, 8222. https://doi.org/10.3390/su17188222

Chen J, Luo Y, Fang J. Spatial-Temporal Evolution and Driving Factors of the Synergistic Development of Green Finance and Low-Carbon Innovation. Sustainability. 2025; 17(18):8222. https://doi.org/10.3390/su17188222

Chicago/Turabian StyleChen, Junying, Yuxin Luo, and Junzhi Fang. 2025. "Spatial-Temporal Evolution and Driving Factors of the Synergistic Development of Green Finance and Low-Carbon Innovation" Sustainability 17, no. 18: 8222. https://doi.org/10.3390/su17188222

APA StyleChen, J., Luo, Y., & Fang, J. (2025). Spatial-Temporal Evolution and Driving Factors of the Synergistic Development of Green Finance and Low-Carbon Innovation. Sustainability, 17(18), 8222. https://doi.org/10.3390/su17188222