Decentralization or Cooperation? The Impact of “Government–Market” Green Governance Synergy on Corporate Green Innovation: Evidence from China

Abstract

1. Introduction

- (1)

- The extant literature has largely focused on the isolated effects of individual governmental green governance instruments, leaving the systemic implications of GMGG influence on CGI behaviors underexplored. This study clarifies how GMGG synergy affects CGI and identifies the underlying transmission channels. It advances scholarly understanding of the economic consequences of green governance and extends both the conceptual breadth and theoretical depth of the field.

- (2)

- Scholars have primarily analyzed the drivers of green innovation within enterprises from internal and external perspectives, yet research on the coordinated influence of green governance from governmental and market perspectives remains scarce. This study introduces a capacity coupling coefficient model to quantify the synergy between governmental and market green governance systems. Empirical testing of the model evaluates the impact of GMGG synergy on CGI, thereby enhancing understanding of the factors driving green innovation.

2. Literature Review

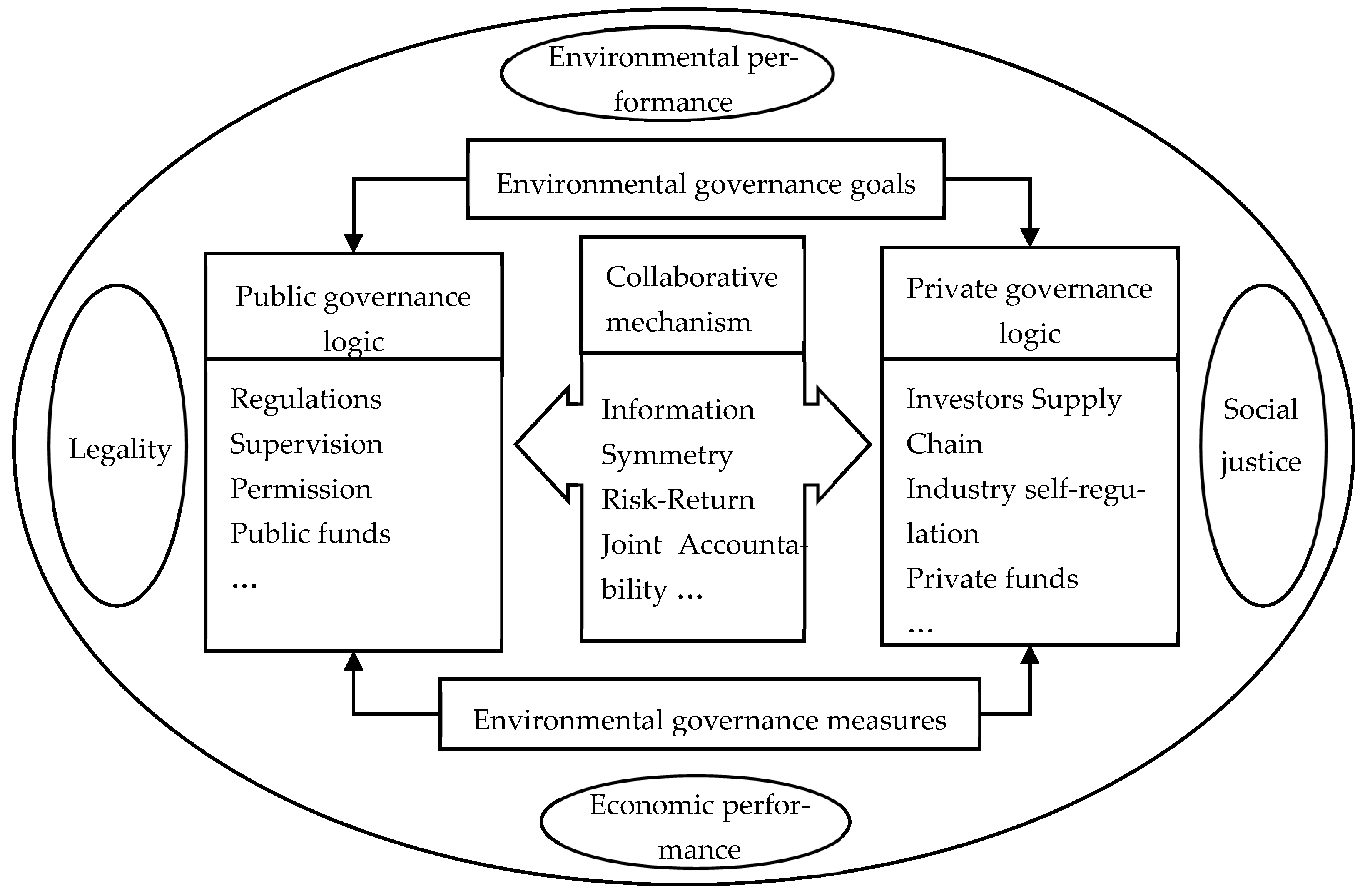

2.1. Research on the Relationship Between Government and Market in the Green Governance System

2.2. Research on the Synergistic Effects of Government Green Governance Instruments in Influencing Green Innovation

3. Research Hypotheses

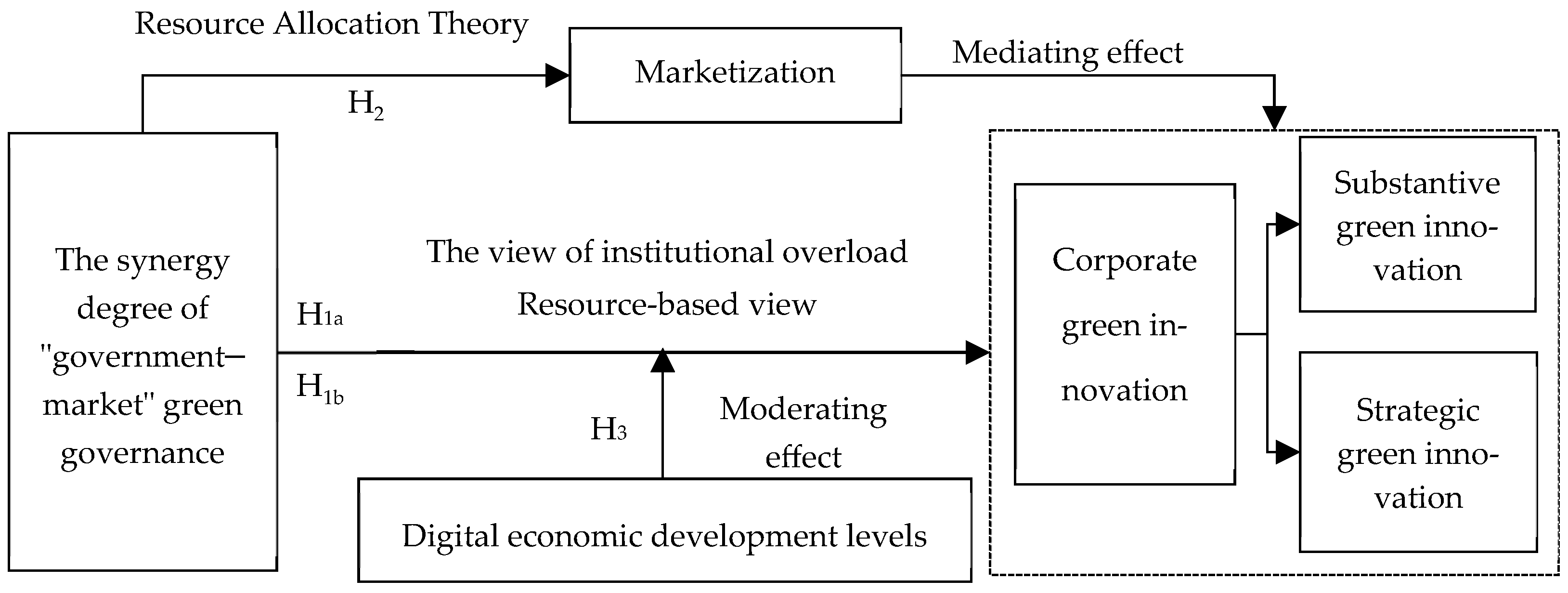

3.1. The Impact of the GMGG Synergy on CGI

3.2. The Intermediary Effect of Marketization Level

3.3. The Regulatory Effect of Digital Economic Development Levels

4. Research Design

4.1. Data Sources

4.2. Variable Selection

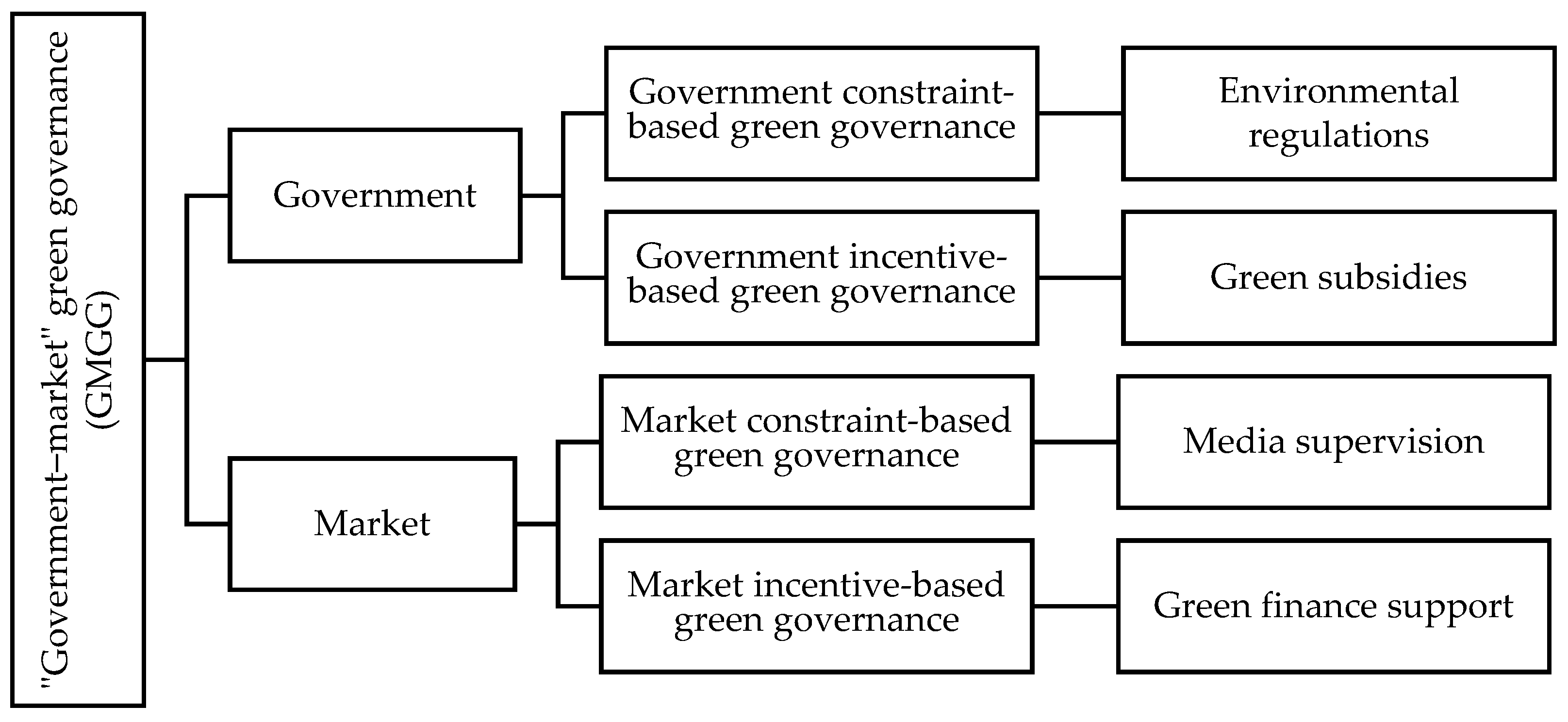

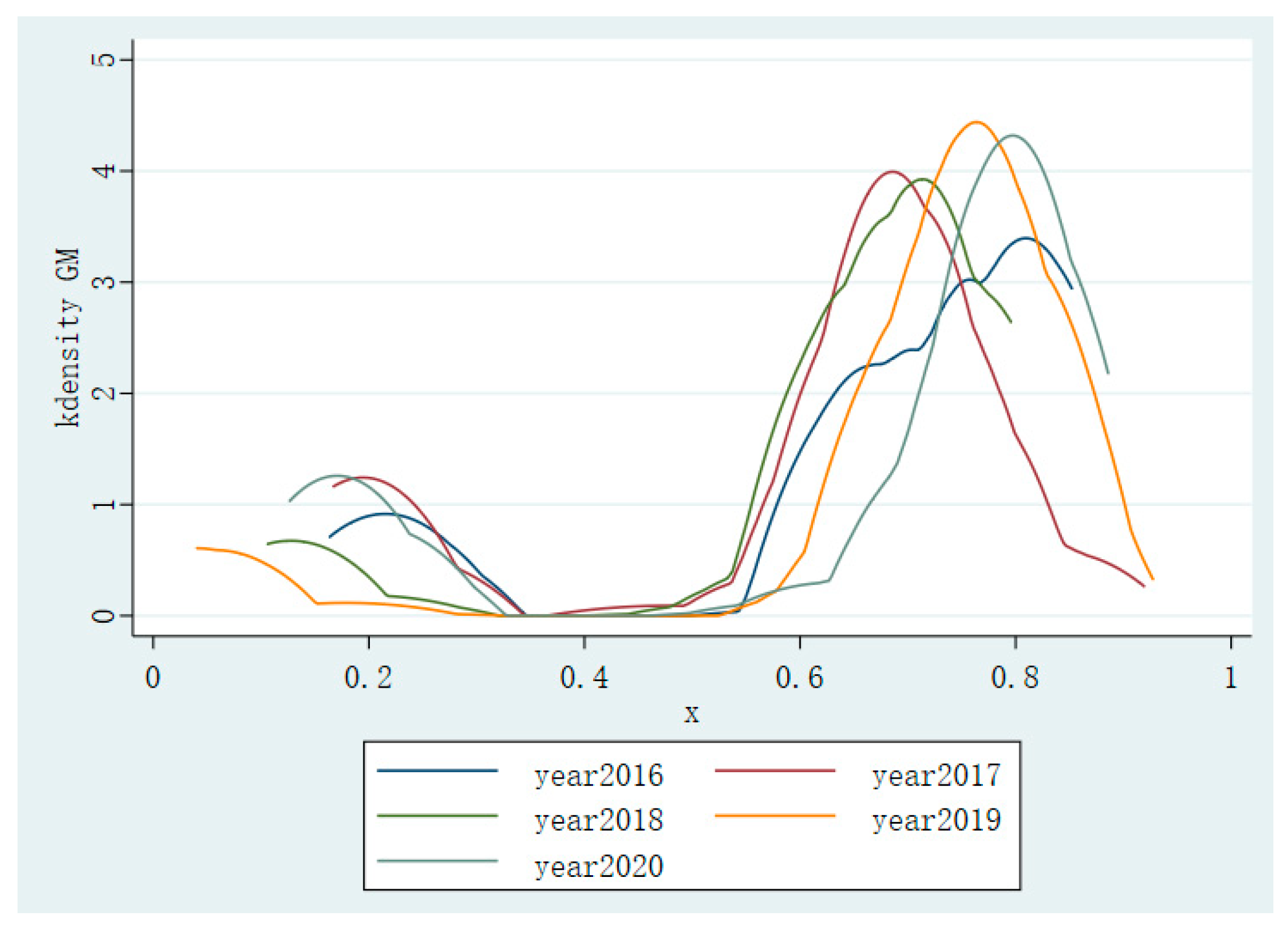

4.2.1. The Core Explanatory Variable

4.2.2. Explained Variables

4.2.3. The Mediating Variable

4.2.4. The Moderator Variable

4.2.5. Control Variables

4.3. Model Construction

4.4. Descriptive Statistics

5. Empirical Results

5.1. Baseline Regression

5.2. Robustness Test

5.2.1. Robustness Test with a Lag of Two Periods

5.2.2. Robustness Test for Replacing the Dependent Variables

5.2.3. Robustness Test Using an Alternative Measure of the Dependent Variables

5.3. Endogeneity Test

5.4. Transmission Mechanism

5.5. The Regulatory Effect of the Digital Economy

5.6. Heterogeneity Analysis

5.6.1. Group by the Property Right

5.6.2. Group by Whether They Are Heavy-Polluting Firms

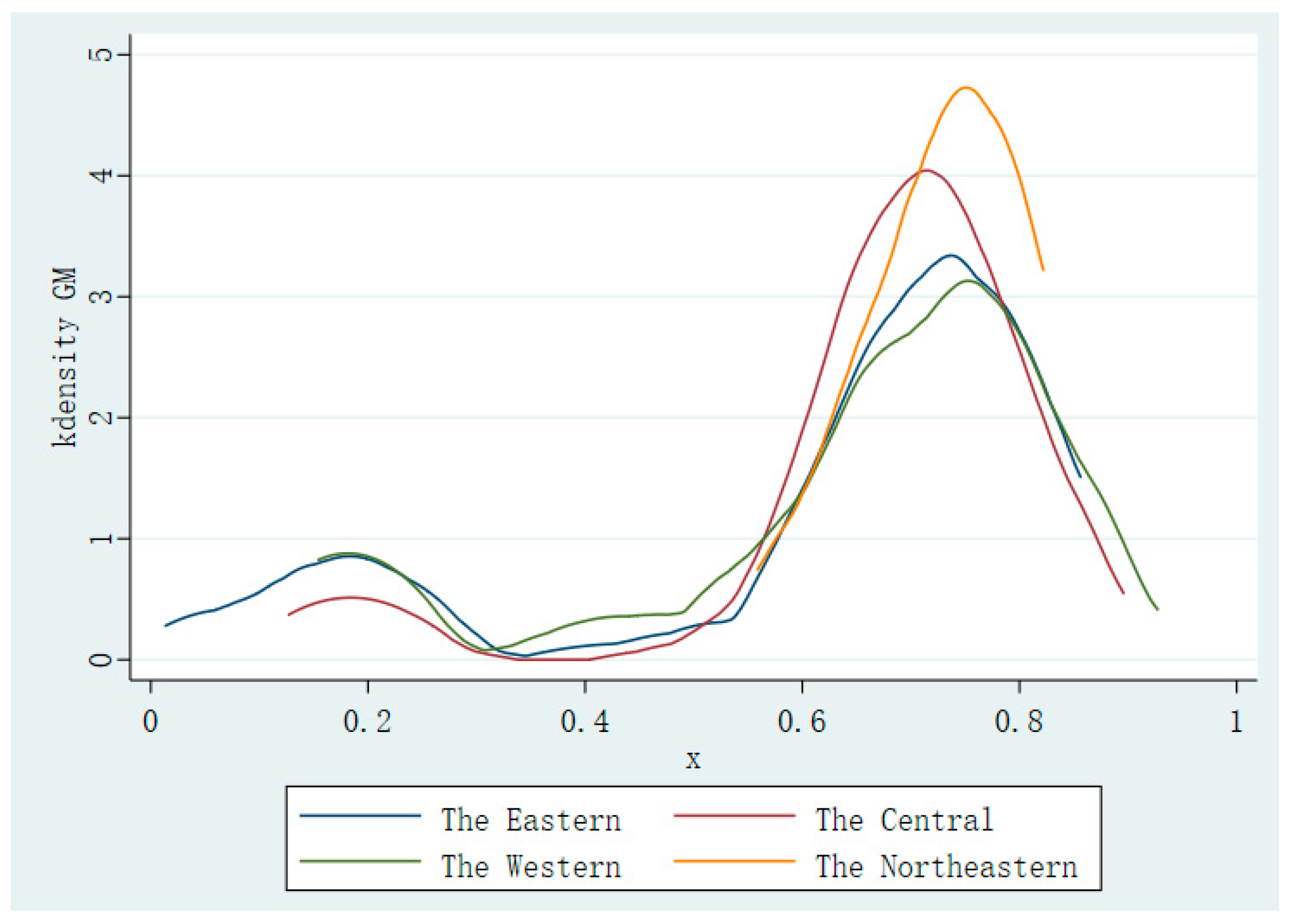

5.6.3. Group by the Region

6. Discussion

- (1)

- This study is confined to A-share listed firms, whose large size, high information transparency, and relatively loose financing constraints may limit the generalizability of our findings. Small and medium-sized enterprises (SMEs) and unlisted firms—often resource-constrained and heavily reliant on external finance—could exhibit markedly different sensitivities and response trajectories to GMGG. Consequently, caution is warranted when extrapolating our results to these populations. Future research should expand the sample to include SMEs, specialized and innovative “little giant” enterprises, and regional equity market entrants to test the external validity of our conclusions.

- (2)

- Although the sample spans multiple industries and provinces, data limitations preclude the incorporation of industry-specific fiscal incentives and environmental regulations, nor do we account for heterogeneous regional policies. Future research should employ difference-in-differences designs to estimate the green-innovation effects of targeted interventions.

- (3)

- Moreover, our reliance on two-way fixed effects captures only contemporaneous or one-period-lagged average effects, leaving the dynamic feedback between GMGG synergy and CGI, as well as potential path dependence and long-run equilibrium relationships, unexplored. Static specifications also fail to identify spatial or supply chain spillovers arising from green-technology interactions within regions or across upstream–downstream industries. Dynamic panel, spatial-econometric, or structural-equation models could address these shortcomings in future work.

- (4)

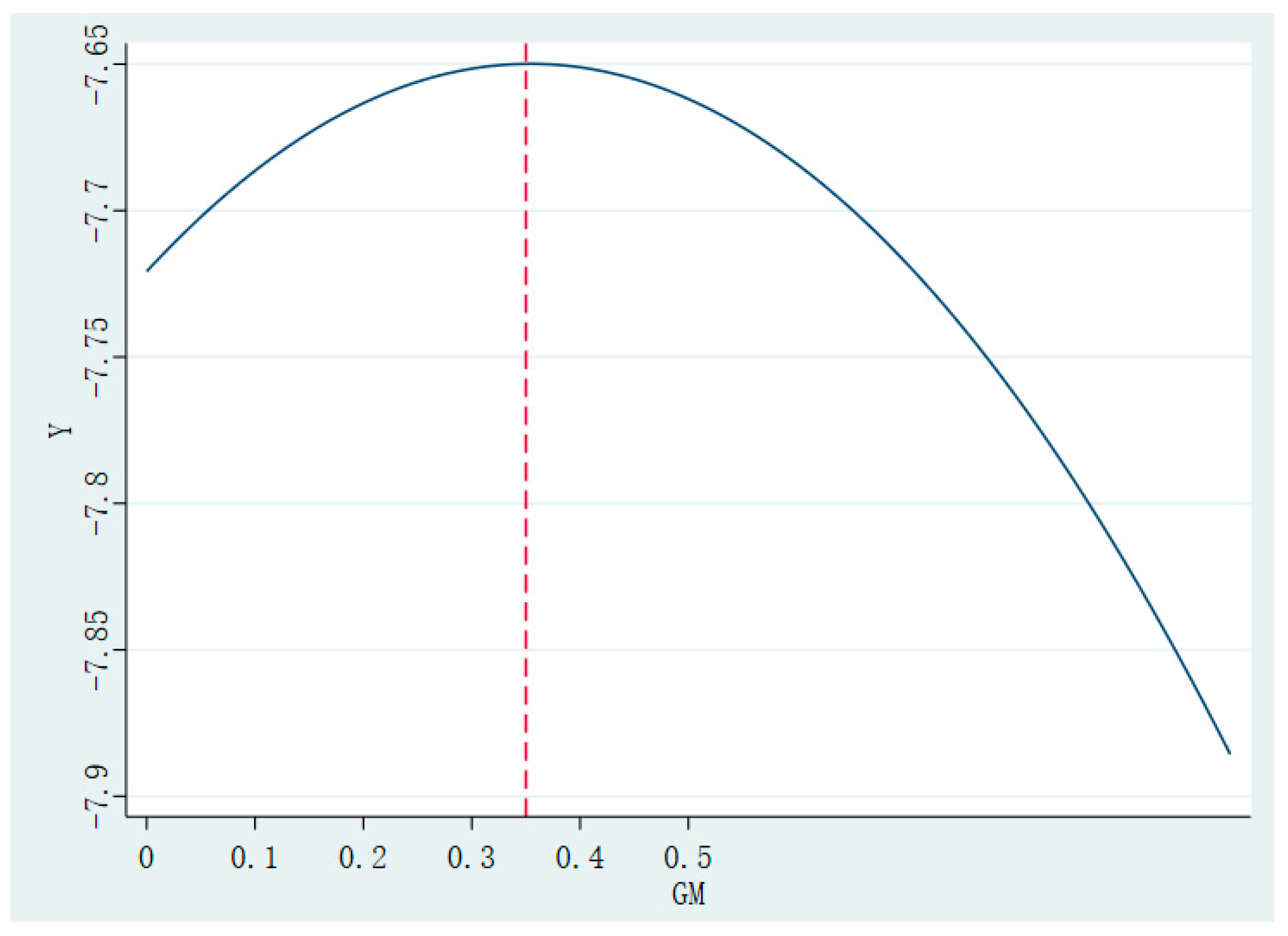

- Drawing on China’s green governance practices, this study has developed the GMGG synergy index and verified its diminishing marginal effects on CGI. The estimated inflection point reflects the optimal range under China’s specific institutional and market conditions only. Substantial cross-country heterogeneity in government capacity and firm-level innovation implies that the identified threshold cannot be directly extrapolated to other economies. Future research should recalibrate the inflection point in light of institutional differences and development levels across countries to test the global applicability of the GMGG framework.

- (5)

- Although the combined use of the AHP and EWM mitigates the biases inherent in purely subjective or objective weighting schemes, it remains susceptible to researcher-dependent judgments and entropy polarization in high-dimensional or sparse data. Future research should therefore incorporate dynamic weighting mechanisms to enhance robustness and temporal adaptability.

- (6)

- Following the existing literature, we employ the air circulation coefficient as an instrumental variable to mitigate endogeneity concerns. However, the effectiveness of the coefficient varies markedly across heterogeneous topographies and climatic zones, introducing non-negligible estimation errors. Future research could enhance identification by integrating higher-frequency pollution monitoring data with more refined meteorological simulations.

7. Conclusions and Recommendations

7.1. Conclusions

- (1)

- Empirical results reveal a significant Inverted-U relationship between GMGG synergy and CGI. The effect is positive and increasing up to a synergy level of 0.35, beyond which the impact diminishes monotonically, indicating pronounced diminishing marginal returns. Accordingly, guided by a ±0.1 “green-band” around the inflection point, the dynamic range for GMGG synergy should be tightened to 0.25–0.45, thereby preventing both under-synergy and over-synergy. Once GMGG synergy exceeds 0.45, authorities should progressively scale back fiscal subsidies and prescriptive regulations, while expanding market-based instruments and digital-economy policies to forestall a surge in strategic green innovation driven by excessive incentives.

- (2)

- This study empirically confirms the mediating role of marketization. It illustrates that GMGG synergy affects CGI by promoting market-oriented reforms, enhancing fair market competition, and optimizing resource allocation. Furthermore, the paper examines the moderating role of digital economic development in this process. It indicates that with the vigorous development of the digital economy, characterized by high penetration, integration, and innovation, it effectively mitigates the inverted U-shaped impact of GMGG synergy on CGI, providing new sources of momentum for green innovation growth.

- (3)

- Additionally, the study conducts detailed heterogeneity analysis, revealing differentiated responses of CGI behaviors among different economic entities to the influence of GMGG synergy. Particularly, non-state-owned firms, eastern-region firms, and those in non-heavy-polluting industries exhibit a higher responsiveness to changes in GMGG synergy.

7.2. Recommendations

- (1)

- Given the overlapping and converging boundaries of government and market in green governance, they are inseparable and share mutual interests. Achieving the driving effect of green innovation through green governance necessitates the rational enhancement of synergies between government and market. Diverse entities such as government departments and market organizations should prioritize information sharing, resource exchange, and joint actions to jointly promote energy conservation and environmental protection. It is crucial to strengthen collaborative mechanisms among government departments and between government and market entities, break down organizational barriers, and promote the establishment of functionally sound, coordinated, and efficient flat governance structures. Such efforts will enhance cooperation among different stakeholders and reduce administrative and communication costs. On the other hand, considering the marginal diminishing effect of GMGG synergy on CGI incentives, it is imperative for government and market entities to exercise prudence in the implementation intensity of policies during collaborative green governance processes. This helps prevent excessive reliance of enterprises on external regulatory and evaluation functions, thereby preserving the internal driving force for implementing green innovation activities. Drawing upon the empirical findings, the optimal range of GMGG synergy for effectively stimulating CGI is 0.25–0.45. At present, Beijing, Sichuan, and Chongqing in China have already positioned themselves within this threshold and should therefore maintain their current levels. In contrast, Sichuan, Jiangxi and Shanxi remain below the lower bound. Targeted policy interventions are required to increase their synergy. Conversely, Hainan, Hubei, and Shandong significantly exceed the upper bound, and a moderate downward adjustment is recommended to avert efficiency losses associated with excessive synergy.

- (2)

- To prevent excessive synergy, a negative list should delimit green technologies and market segments in which the government abstains from direct intervention—e.g., green-patent trading and carbon-financial-product pricing. Any government actions exceeding this list must be subject to automatic sunset clauses, ensuring their expiration and forestalling prolonged overreach. Direct subsidies for green technologies should be phased out and supplanted by ex-post tax credits tied to verified carbon-reduction performance, thereby mitigating governmental displacement of firms’ micro-level decisions. Mandatory environmental disclosure standards should be imposed on large and medium-sized firms. Their sustainability reports must be audited by independent third parties and released to the market at regular intervals to strengthen external oversight.

- (3)

- During the process of conducting green innovation activities, enterprises should leverage the constraints and incentive policies of government and market green governance to enhance their own quality of green innovation and achieve sustainable development. Firstly, green innovative enterprises should adhere strictly to government green environmental regulations, reducing compliance costs through innovative green technologies to enhance their own capabilities for sustainable development. Secondly, enterprises should actively participate in relevant green-subsidy programs by applying for and evaluating them, strategically planning and investing according to policy guidance to enhance their green orientation and operational compliance. They should also select and nurture projects with innovative potential and market prospects in order to obtain support from fiscal and taxation incentive policies [92]. Thirdly, enterprises should increase positive media attention on their green innovation activities, reducing information asymmetry to shape a positive corporate image and expand the market influence of green innovative products. Fourthly, enterprises should utilize green financial policies to alleviate financing constraints, increase investment in green innovation, and thereby enhance the quality of green innovation.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Pigou, A.C. The Economics of Welfare; Macmillan and Co.: London, UK, 1920. [Google Scholar]

- Mankiw, N.G. Principles of Economics; Cengage Learning: Boston, MA, USA, 2016. [Google Scholar]

- Wang, L. The New Keynesian Economic Theory Review: A Macroeconomic Theoretical Frontier Perspective. Contemporary Econ. Manag. 2014, 36, 5–8. [Google Scholar]

- Li, W.; Xu, J.; Zheng, M. Green Governance: New Perspective from Open Innovation. Sustainability 2018, 10, 3845. [Google Scholar] [CrossRef]

- Pane Haden, S.; Oyler, J.; Humphreys, J. Historical, Practical and Theoretical Perspective on Green Management: An Exploratory Analysis. Manag. Decis. 2009, 47, 1041–1055. [Google Scholar] [CrossRef]

- Debbarma, J.; Choi, Y. A Taxonomy of Green Governance: A Qualitative and Quantitative Analysis towards Sustainable Development. Sustain. Cities Soc. 2022, 79, 103693. [Google Scholar] [CrossRef]

- Ansell, C.; Gash, A. Collaborative Governance in Theory and Practice. J. Public Adm. Res. Theory 2008, 18, 543–571. [Google Scholar] [CrossRef]

- Porter, M.E. America’s Green Strategy. Sci. Am. 1991, 264, 168. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Arimura, T.H.; Hibiki, A.; Katayama, H. Is a Voluntary Approach an Effective Environmental Policy Instrument?: A Case for Environmental Management Systems. J. Environ. Econ. Manag. 2008, 55, 281–295. [Google Scholar] [CrossRef]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable Energy Policies and Technological Innovation: Evidence Based on Patent Counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Liu, M.; Lo, K. Governing Eco-Cities in China: Urban Climate Experimentation, International Cooperation, and Multilevel Governance. Geoforum 2021, 121, 12–22. [Google Scholar] [CrossRef]

- Li, Y.; Li, L.; Liu, J.X. Effective Government, Efficient Market and High-Quality Development Empirical Research Based on Moderating Effect and Threshold Effect. J. Shanxi Univer. Finan. Econ. 2022, 44, 16–30. [Google Scholar]

- Lu, X.X.; Teng, Y.H. How Innovation-Driven Policies Enhance Urban Economic Resilience: Analysis of Mechanism Based on Efficient Market and Effective Government. China Soft Sci. 2023, 7, 102–113. [Google Scholar]

- Wang, M.; Li, Y.; Chi, F. Synergistically Promoting Enterprises to Replace Old Growth Drivers with New Ones: The Roles of Market and Government. J. Asian Econ. 2024, 94, 101766. [Google Scholar] [CrossRef]

- Guo, A.J.; Zhang, N. The Effect of Market-Oriented Reform on Green Development Efficiency: A Theoretical Mechanism and Empirical Test. China Popul. Resour. Environ. 2020, 30, 118–127. [Google Scholar]

- Emerson, K.; Nabatchi, T.; Balogh, S. An Integrative Framework for Collaborative Governance. J. Public Adm. Res. Theory 2012, 22, 1–29. [Google Scholar] [CrossRef]

- Eccles, R.G.; Williamson, O.E. The Economic Institutions of Capitalism: Firms, Markets, Relational Contracting. Adm. Sci. Q. 1987, 32, 602. [Google Scholar] [CrossRef][Green Version]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Feiock, R.C. The Institutional Collective Action Framework. Policy Stud. J. 2013, 41, 397–425. [Google Scholar] [CrossRef]

- Sigel, K.; Klauer, B.; Pahl-Wostl, C. Conceptualising Uncertainty in Environmental Decision-Making: The Example of the EU Water Framework Directive. Ecol. Econ. 2010, 69, 502–510. [Google Scholar] [CrossRef]

- Pulver, S.; Ulibarri, N.; Sobocinski, K.L.; Alexander, S.M.; Johnson, M.L.; McCord, P.F.; Dell’angelo, J. Frontiers in Socio-Environmental Research: Components, Connections, Scale, and Context. Ecol. Soc. 2018, 23, 23. [Google Scholar] [CrossRef]

- Koppenjan, J.; Klijn, E.H. Managing Uncertainties in Networks: Public Private Controversies; Routledge: London, UK, 2004. [Google Scholar]

- Hutter, G. Collaborative Governance and Rare Floods in Urban Regions—Dealing with Uncertainty and Surprise. Environ. Sci. Policy 2016, 55, 302–308. [Google Scholar] [CrossRef]

- Sun, H.B.; Zhang, Z.; Liu, Z.L. Does Air Pollution Collaborative Governance Promote Green Technology Innovation? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 51609–51622. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, R.; Zhao, Y.; Li, C. A Public Participation Approach in the Environmental Governance of Industrial Parks. Environ. Impact Assess. Rev. 2023, 101, 107131. [Google Scholar] [CrossRef]

- Muradian, R.; Camilo Cardenas, J. From Market Failures to Collective Action Dilemmas: Reframing Environmental Governance Challenges in Latin America and beyond. Ecol. Econ. 2015, 120, 358–365. [Google Scholar] [CrossRef]

- Wang, J.F.; Li, S.X.; Xiang, J.Q. Networking of environmental governance space: Operational characteristics, existing risks, and improvement paths. Theor. Explor. 2022, 255, 71–77. [Google Scholar]

- Guo, J.; Bai, J. The Role of Public Participation in Environmental Governance: Empirical Evidence from China. Sustainability 2019, 11, 4696. [Google Scholar] [CrossRef]

- Wang, W.; Wang, X. Does Provincial Green Governance Promote Enterprise Green Investment? Based on the Perspective of Government Vertical Management. J. Clean. Prod. 2023, 396, 136519. [Google Scholar] [CrossRef]

- Zheng, M.N.; Ren, G.Q. Evolutionary game analysis of corporate green innovation behavior: Based on the perspective of environmental protection social organization participation. Opera. Res. Manag. 2021, 30, 15–21. [Google Scholar]

- Yi, Z.H.; Chen, X.; Tian, L. The impact of public environmental concerns on corporate green innovation. Econ Theory & Econ Manag. 2022, 42, 32–48. [Google Scholar]

- Newig, J.; Günther, D.; Pahl-Wostl, C. Synapses in the Network: Learning in Governance Networks in the Context of Environmental Management. Ecol. Soc. 2010, 15, 24. [Google Scholar] [CrossRef]

- Ashford, N.A. Understanding Technological Responses of Industrial Firms to Environmental Problems: Implications for Government Policy; Island Press: Washington, DC, USA, 1993. [Google Scholar]

- Jennings, P.D.; Zandbergen, P.A. Ecologically Sustainable Organizations: An Institutional Approach. Acad. Manag. Rev. 1995, 20, 1015–1052. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R. Do Environmental Regulations Influence Trade Patterns? Testing Old and New Trade Theories. World Econ. 2003, 26, 1163–1186. [Google Scholar] [CrossRef]

- Zhao, J.L.; Fan, S.; Yan, J. Overview of Business Innovations and Research Opportunities in Blockchain and Introduction to the Special Issue. Financ. Innov. 2016, 2, 28. [Google Scholar] [CrossRef]

- Bitat, A. Environmental Regulation and Eco-Innovation: The Porter Hypothesis Refined. Eurasian Bus. Rev. 2018, 8, 299–321. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental Regulation, Green Technology Innovation, and Industrial Structure Upgrading: The Road to the Green Transformation of Chinese Cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Arrigo, E.; Di Vaio, A.; Hassan, R.; Palladino, R. Followership Behavior and Corporate Social Responsibility Disclosure: Analysis and Implications for Sustainability Research. J. Clean. Prod. 2022, 360, 132151. [Google Scholar] [CrossRef]

- Mahmood, N.; Zhao, Y.; Lou, Q.; Geng, J. Role of Environmental Regulations and Eco-Innovation in Energy Structure Transition for Green Growth: Evidence from OECD. Technol. Forecast. Soc. Change 2022, 183, 121890. [Google Scholar] [CrossRef]

- Raza, A.; Hongliang, L.; Yue, Z.; Yang, T.; Wei, N. Environmental Regulations and Eco-Innovation as Catalysts for Green Agricultural Practices: Insights from Pakistan–China Agricultural Cooperation. Agric. Food Econ. 2025, 13, 29. [Google Scholar] [CrossRef]

- Dong, J.R.; Zhang, W.Q.; Chen, Y.K. Research on the Impact of Environmental Regulatory Tools and Government Support on Green Technological Innovation. Indust. Econo. Res. 2021, 3, 1–16. [Google Scholar]

- Yu, K.X.; Hu, Y.Q.; Song, Z. Environmental Regulation, Government Support and Green Technological Innovation: An Empirical Study Based on Resource-based Enterprises. J. Yunnan Univer. Finan. Econ. 2019, 35, 100–112. [Google Scholar]

- Liu, J.; Zhao, M.; Wang, Y. Impacts of Government Subsidies and Environmental Regulations on Green Process Innovation: A Nonlinear Approach. Technol. Soc. 2020, 63, 101417. [Google Scholar] [CrossRef]

- Li, Y.; Tong, Y.; Ye, F.; Song, J. The Choice of the Government Green Subsidy Scheme: Innovation Subsidy vs. Product Subsidy. Int. J. Prod. Res. 2020, 58, 4932–4946. [Google Scholar] [CrossRef]

- Sun, C.; Wu, P.Z.; Ding, W.W. Study on the impact of government environmental governance on regional innovation level. Nankai Econ. Stud. 2022, 12, 187–208. [Google Scholar]

- Yuan, L.J.; Zheng, X.F. Coupling Induction of Environmental Regulation and Government Subsidy on Enterprise Technological Innovation. Res. Sci. 2017, 39, 911–923. [Google Scholar]

- Wang, L.; Wang, H.; Dong, Z. Policy conditions for compatibility between economic growth and environmental quality: A test of policy bias effects from the perspective of the direction of environmental technological progress. Manag. World 2020, 36, 39–60. [Google Scholar]

- Guo, J.; Yang, L.C. Impact of Environmental Regulations and Government R&D Funding on Green Technology Innovation—An Empirical Analysis Based on Provincial Level Data in Mainland China. Sci. Technol. Prog. Policy 2020, 37, 37–44. [Google Scholar]

- He, X.G. Research on optimal regulation structure of green technology innovation—Basedon the dual interactive effect of r&d support and environmental regulation. J. Environ. Econ. Manag. 2014, 36, 144–153. [Google Scholar]

- Yang, Y.D. Can Environmental Regulations and R&D Subsidies Promote GTFP in Pharmaceutical Industry? Evidence from Chinese Provincial Panel Data. Front. Public Health 2022, 10, 1018968. [Google Scholar] [CrossRef]

- Wang, Y.G.; Li, X. Promoting or inhibiting: The impact of government R&D subsidies on the green innovation performance of firms. China Ind. Econ. 2023, 2, 131–149. [Google Scholar]

- Yi, M.; Wang, Y.; Yan, M.; Fu, L.; Zhang, Y. Government R&D Subsidies, Environmental Regulations, and Their Effect on Green Innovation Efficiency of Manufacturing Industry: Evidence from the Yangtze River Economic Belt of China. Int. J. Environ. Res. Public Health 2020, 17, 1330. [Google Scholar] [CrossRef]

- Zhang, B.C.; Zhao, S.K. Research on the impact of government subsidies on green innovation of enterprises: The moderating effect of political connection and environmental regulation. Sci. Res. Manag. 2022, 43, 154–162. [Google Scholar]

- Li, X.; Zhang, G.Y.; Qi, Y. Differentiated Environmental Regulations and Enterprise Innovation: The Moderating Role of Government Subsidies and Executive Political Experience. Environ. Dev. Sustain. 2023, 26, 3639–3669. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Xie, X.; Wang, M. Dark Side of Green Subsidies: Do Green Subsidies to a Focal Firm Crowd out Peers’ Green Innovation? Technovation 2025, 143, 103221. [Google Scholar] [CrossRef]

- Wu, W.C.; Zhao, Y.; Tian, Y.J.; Su, Z.H. Do the “Crowding-In Effect” and “Crowding-Out Effect” of R&D Subsidies Coexist? A Quantile Regression Analysis Based on the Re-Structured R&D Data. Accoun. Res. 2020, 8, 18–37. [Google Scholar]

- Zhang, Z.; Zheng, C.; Lan, L. Smart City Pilots, Marketization Processes, and Substantive Green Innovation: A Quasi-Natural Experiment from China. PLoS ONE 2023, 18, e0286572. [Google Scholar] [CrossRef]

- Padilla-Lozano, C.P.; Collazzo, P. Corporate Social Responsibility, Green Innovation and Competitiveness—Causality in Manufacturing. Compet. Rev. 2022, 32, 21–39. [Google Scholar] [CrossRef]

- Liao, Z.J.; Chen, J.; Weng, C.; Zhu, C.B. The Effects of External Supervision on Firm-Level Environmental Innovation in China: Are They Substantive or Strategic? Econ. Anal. Policy 2023, 80, 267–277. [Google Scholar] [CrossRef]

- Li, H.Q.; Lin, Q.N.; Jian, Z.Q.; Li, S.D. An Analysis of the Internal Relationship between the Digital Economy and Resource Allocation in Manufacturing Enterprises. J. Ind. Manag. Optim. 2025, 21, 335–355. [Google Scholar] [CrossRef]

- Chen, P.Y. Relationship between the Digital Economy, Resource Allocation and Corporate Carbon Emission Intensity: New Evidence from Listed Chinese Companies. Environ. Res. Commun. 2022, 4, 075005. [Google Scholar] [CrossRef]

- Lin, Y.; Wang, Q.J.; Zheng, M.Q. Nexus Among Digital Economy, Green Innovation, and Green Development: Evidence from China. Emerg. Mark. Financ. Trade 2024, 60, 704–723. [Google Scholar] [CrossRef]

- Lanoie, P.; Patry, M.; Lajeunesse, R. Environmental Regulation and Productivity: Testing the Porter Hypothesis. J. Product. Anal. 2008, 30, 121–128. [Google Scholar] [CrossRef]

- Carroll, C.E.; McCombs, M. Agenda-Setting Effects of Business News on the Public’s Images and Opinions about Major Corporations. Corp. Reput. Rev. 2003, 6, 36–46. [Google Scholar] [CrossRef]

- He, Y.; Lu, S.L.; Wei, R.; Wang, S.X. Local Media Sentiment towards Pollution and Its Effect on Corporate Green Innovation. Int. Rev. Financ. Anal. 2024, 94, 103332. [Google Scholar] [CrossRef]

- Soundarrajan, P.; Vivek, N. Green Finance for Sustainable Green Economic Growth in India. Agric. Econ. Ekon. 2016, 62, 35–44. [Google Scholar] [CrossRef]

- Liu, C.; Xiong, M.X. Green Finance Reform and Corporate Innovation: Evidence from China. Financ. Res. Lett. 2022, 48, 102993. [Google Scholar] [CrossRef]

- Li, X.; Wang, S.W.; Lu, X.; Guo, F. Quantity or Quality? The Effect of Green Finance on Enterprise Green Technology Innovation. Eur. J. Innov. Manag. 2023, 28, 1114–1140. [Google Scholar] [CrossRef]

- Jia, M.; Tong, L.; Viswanath, P.V.; Zhang, Z. Word Power: The Impact of Negative Media Coverage on Disciplining Corporate Pollution. J. Bus. Ethics 2016, 138, 437–458. [Google Scholar] [CrossRef]

- Zhang, L.C.; Mei, Z.H. Green Finance and Industrial Pollution: Empirical Research Based on Spatial Perspective. Front. Environ. Sci. 2022, 10, 1003327. [Google Scholar] [CrossRef]

- Xu, J.Q.; She, S.X.; Gao, P.P.; Sun, Y.P. Role of Green Finance in Resource Efficiency and Green Economic Growth. Resour. Policy 2023, 81, 103349. [Google Scholar] [CrossRef]

- Yang, Y.; Wang, R.; Tan, J. Coupling Coordination and Prediction Research of Tourism Industry Development and Ecological Environment in China. Discret. Dyn. Nat. Soc. 2021, 2021, 6647781. [Google Scholar] [CrossRef]

- Zou, Z.H.; Yun, Y.; Sun, J.N. Entropy Method for Determination of Weight of Evaluating Indicators in Fuzzy Synthetic Evaluation for Water Quality Assessment. J. Environ. Sci. 2006, 18, 1020–1023. [Google Scholar] [CrossRef]

- Lin, H.; Zeng, S.X.; Ma, H.Y.; Qi, G.Y.; Tam, V.W.Y. Can Political Capital Drive Corporate Green Innovation? Lessons from China. J. Clean. Prod. 2014, 64, 63–72. [Google Scholar] [CrossRef]

- Xu, A.; Zhu, Y.; Wang, W. Micro Green Technology Innovation Effects of Green Finance Pilot policy—From the Perspectives of Action Points and Green Value. J. Bus. Res. 2023, 159, 113724. [Google Scholar] [CrossRef]

- Zhao, T.; Zhang, Z.; Liang, S.K. Digital Economy, Entrepreneurial Activity and High-Quality Development. Manag. World 2020, 36, 65–76. [Google Scholar]

- Sasabuchi, S. A Test of a Multivariate Normal Mean with Composite Hypotheses Determined by Linear Inequalities. Biometrika 1980, 67, 429–439. [Google Scholar] [CrossRef]

- Lind, J.T.; Mehlum, H. With or without U? The Appropriate Test for a U-Shaped Relationship. Oxf. Bull. Econ. Stat. 2010, 72, 109–118. [Google Scholar] [CrossRef]

- Hering, L.; Poncet, S. Environmental Policy and Exports: Evidence from Chinese Cities. J. Environ. Econ. Manag. 2014, 68, 296–318. [Google Scholar] [CrossRef]

- Manuel Arellano and Stephen Bond Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [CrossRef]

- Blundell, R.; Bond, S. Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Shang, L.N.; Tan, D.Q.; Feng, S.L.; Zhou, W.T. Environmental Regulation, Import Trade, and Green Technology Innovation. Environ. Sci. Pollut. Res. 2022, 29, 12864–12874. [Google Scholar] [CrossRef]

- Zhang, N.; Deng, J.Q.; Ahmad, F.; Draz, M.U.; Abid, N. The Dynamic Association between Public Environmental Demands, Government Environmental Governance, and Green Technology Innovation in China: Evidence from Panel VAR Model. Environ. Dev. Sustain. 2023, 25, 9851–9875. [Google Scholar] [CrossRef]

- Zhang, M.; Yan, T.; Gao, W.; Xie, W.; Yu, Z. How Does Environmental Regulation Affect Real Green Technology Innovation and Strategic Green Technology Innovation? Sci. Total Environ. 2023, 872, 162221. [Google Scholar] [CrossRef] [PubMed]

- Dai, D.; Fan, Y.; Wang, G.; Xie, J. Digital Economy, R&D Investment, and Regional Green Innovation—Analysis Based on Provincial Panel Data in China. Sustainability 2022, 14, 6508. [Google Scholar] [CrossRef]

- Qiao, P.; Liu, S.; Fung, H.-G.; Wang, C. Corporate Green Innovation in a Digital Economy. Int. Rev. Econ. Financ. 2024, 92, 870–883. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Zhao, Y.H.; Lv, X.; Li, X.P.; Zheng, L.; Fan, S.N.; Zuo, S.M. Environmental Regulation and Green Innovation: Does State Ownership Matter? Energy Econ. 2024, 136, 107762. [Google Scholar] [CrossRef]

- Liu, M.; Li, Y. Environmental Regulation and Green Innovation: Evidence from China’s Carbon Emissions Trading Policy. Financ. Res. Lett. 2022, 48, 103051. [Google Scholar] [CrossRef]

- Feng, H.; Song, G.M.; Wang, F.Y.; Liu, L.L. Research on the Impact of Income Tax System on Chinese Enterprises’ OFDI Layout; China Economic Publishing: Beijing, China, 2024. [Google Scholar]

| Items | Proxy Variables | Explanation of Indicator Calculation |

|---|---|---|

| Government constraint-based green governance | Environmental regulations | The natural logarithm of the ratio of industrial pollution control investment to the added value of the industrial secondary industry in each province (city, district) for the current year. |

| Government incentive-based green governance | Green subsidies | The natural logarithm of the total amount of fiscal rewards, tax refunds, and other green subsidies related to green development. |

| Market constraint-based green governance | Media supervision | The natural logarithm of the number of negative keywords related to corporate environment and resources in media reports. |

| Market incentive-based green governance | Green finance support | Selection of five indicators: green credit, green investment, carbon finance, green securities, and green insurance, and calculation of a comprehensive index using the entropy method. |

| Primary Indicators | Secondary Indicators | Indicator Calculation Basis | Indicator Attributes |

|---|---|---|---|

| Digital economy index | Internet penetration rate | Internet users per 100 people | + |

| Number of Internet related practitioners | The proportion of computer service and software professionals to the total population of the region | + | |

| Internet related output | Per capita total telecommunications services | + | |

| Number of mobile Internet users | Number of mobile phone users per 100 people | + | |

| Digital Inclusive Finance Index | Digital Inclusive Finance Index released by Peking University | + |

| Type of Variables | Name of Variables | Symbol of Variables | Interpretation of Variables | |

|---|---|---|---|---|

| Explained variables | The number of CGI | Total number of CGI | CGI | The natural logarithm of the total number of green patent applications plus 1 and lagged by one period |

| The number of substantial CGI | CGI_S | The natural logarithm of the number of green invention patent applications plus 1 and lagged by one period | ||

| The number of strategic CGI | CGI_C | The natural logarithm of the number of green utility model patent applications plus 1 and lagged by one period | ||

| The proportion of CGI | The proportion of substantial CGI | CGI_SL | The proportion of green invention patent applications to the total number of green patents and lags behind by one period | |

| The proportion of strategic CGI | CGI_CL | The proportion of green utility model patent applications to the total number of green patents and lags behind by one period | ||

| The core explanatory variable | GMGG synergy | GM | Calculation using capacity coupling coefficient model | |

| The mediating variable | Marketization | Market | Using marketization index for calculation, representing the relative progress of marketization in each province (city, district) | |

| The moderator variable | Digital economy | Digital | Digital economy index calculated by EWM | |

| Control variables | The scale of enterprises | Scale | The natural logarithm of a company’s total assets | |

| Establishment time | Age | The natural logarithm of the establishment time of a company | ||

| Profitability | ROA | Net profit/total assets | ||

| Growth ability | Growth | Revenue growth/opening revenue | ||

| Debt paying ability | Debt | Total ending liabilities/total assets | ||

| Board size | Board | The natural logarithm of the number of board members | ||

| The proportion of independent directors | Indep | The proportion of independent directors to all directors | ||

| Equity concentration | Top10 | The shareholding ratio of the top 10 shareholders | ||

| Enterprise value | TQ | The value of Tobin Q | ||

| Symbol of Variables | N | Min | Max | Mean | SD |

|---|---|---|---|---|---|

| CGI | 28,451 | 0 | 7.319 | 0.846 | 1.167 |

| GM | 28,451 | 0.013 | 0.928 | 0.631 | 0.220 |

| Market | 28,451 | 2.330 | 12 | 8.518 | 1.826 |

| Digital | 26,825 | 0.0770 | 0.982 | 0.457 | 0.194 |

| Scale | 28,451 | 17.43 | 28.64 | 22.16 | 1.328 |

| Age | 28,451 | 0 | 4.143 | 2.842 | 0.371 |

| ROA | 28,451 | −0.366 | 0.206 | 0.0360 | 0.0670 |

| Growth | 28,451 | −0.789 | 10.29 | 0.437 | 1.272 |

| Debt | 28,451 | 0.0490 | 0.980 | 0.425 | 0.210 |

| Board | 28,451 | 1.386 | 2.944 | 2.245 | 0.179 |

| Indep | 28,451 | 0.125 | 0.800 | 0.375 | 0.0560 |

| Top10 | 28,451 | 0.837 | 4.627 | 4.049 | 0.295 |

| TQ | 28,451 | 0.515 | 4.814 | 1.055 | 0.358 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| CGI | CGI_S | CGI_C | CGI_SL | CGI_CL | |

| GM2 | −0.5653 *** | −0.4230 ** | −0.3355 ** | −0.1543 *** | −0.1006 ** |

| (0.1589) | (0.1358) | (0.1294) | (0.0384) | (0.0382) | |

| GM | 0.4004 ** | 0.2587 * | 0.2148 | 0.1265 *** | 0.0979 ** |

| (0.1514) | (0.1303) | (0.1236) | (0.0365) | (0.0358) | |

| Controls | YES | YES | YES | YES | YES |

| Cons | −7.7208 *** | −6.8603 *** | −5.3655 *** | −1.2985 *** | −0.6094 *** |

| (0.2312) | (0.2072) | (0.1872) | (0.0521) | (0.0487) | |

| Time FE | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES |

| N | 28,451 | 28,451 | 28,451 | 28,451 | 28,451 |

| R2 | 0.273 | 0.239 | 0.254 | 0.144 | 0.151 |

| Utest (Slope-U) | −0.6485 | −0.5261 | −0.4077 | −0.1598 | −0.0887 |

| Utest (Slope-L) | 0.3862 | 0.2481 | 0.2064 | 0.1226 | 0.0954 |

| Utest (Extreme Point) | 0.3541 | 0.3058 | 0.3202 | 0.4099 | 0.4867 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| CGI_2 | CGI_S2 | CGI_C2 | CGI_SL2 | CGI_CL2 | |

| GM2 | −0.4970 *** | −0.4122 *** | −0.2793 ** | −0.1324 *** | −0.0613 |

| (0.1627) | (0.1383) | (0.1317) | (0.0388) | (0.0381) | |

| GM | 0.3492 ** | 0.2537 * | 0.1827 | 0.1019 *** | 0.0654 * |

| (0.1541) | (0.1320) | (0.1245) | (0.0369) | (0.0354) | |

| Controls | YES | YES | YES | YES | YES |

| Cons | −6.6479 *** | −5.9730 *** | −4.5755 *** | −1.1159 *** | −0.4894 *** |

| (0.2345) | (0.2070) | (0.1888) | (0.0521) | (0.0493) | |

| Time FE | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES |

| N | 28,451 | 28,451 | 28,451 | 28,451 | 28,451 |

| R2 | 0.225 | 0.197 | 0.209 | 0.120 | 0.125 |

| Utest (Slope-U) | −0.5730 | −0.5111 | −0.3356 | −0.1437 | −0.0484 |

| Utest (Slope-L) | 0.3367 | 0.2433 | 0.1756 | 0.0985 | 0.0638 |

| Utest (Extreme Point) | 0.3513 | 0.3078 | 0.3270 | 0.3849 | 0.5328 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| CGIA | CGIA_S | CGIA_C | CGIA_SL | CGIA_CL | |

| GM2 | −0.2998 ** | −0.2282 *** | −0.1943 | −0.0660 ** | −0.0409 |

| (0.1351) | (0.0807) | (0.1213) | (0.0282) | (0.0468) | |

| GM | 0.1895 | 0.1306 * | 0.1389 | 0.0436 | 0.0423 |

| (0.1280) | (0.0776) | (0.1148) | (0.0273) | (0.0439) | |

| Controls | YES | YES | YES | YES | YES |

| Cons | −3.9965 *** | −1.8819 *** | −3.1368 *** | −0.3433 *** | −0.7066 *** |

| (0.1879) | (0.1117) | (0.1677) | (0.0362) | (0.0613) | |

| Time FE | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES |

| N | 28,130 | 28,130 | 28,130 | 28,130 | 28,130 |

| R2 | 0.182 | 0.098 | 0.159 | 0.051 | 0.129 |

| Utest (Slope-U) | −0.3668 | −0.2928 | −0.2216 | −0.0790 | −0.0336 |

| Utest (Slope-L) | 0.1820 | 0.1248 | 0.1340 | 0.0419 | 0.0413 |

| Utest (Extreme Point) | 0.3160 | 0.2861 | 0.3575 | 0.3297 | 0.5168 |

| Variables | (1) | ||

|---|---|---|---|

| CGI_2 | CGI_S2 | CGI_C2 | |

| GM2 | −0.8378 *** | −0.8205 *** | −0.6205 *** |

| (0.1819) | (0.1300) | (0.1650) | |

| GM | 0.6748 *** | 0.7664 *** | 0.4010 * |

| (0.1741) | (0.1228) | (0.1589) | |

| Controls | YES | YES | YES |

| Cons | −4.8969 *** | −3.3881 *** | −4.5520 *** |

| (0.2819) | (0.2136) | (0.2631) | |

| Time FE | YES | YES | YES |

| Industry FE | YES | YES | YES |

| N | 28,451 | 28,451 | 28,451 |

| R2 | 0.159 | 0.134 | 0.132 |

| Utest (Slope-U) | 0.6537 | 0.3854 | 0.7458 |

| Utest (Slope-L) | −0.8797 | −0.7502 | −0.7560 |

| Utest (Extreme Point) | 0.4027 | 0.3232 | 0.4671 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| The First Stage | The Second Stage | The Second Stage | The Second Stage | ||

| GM | GM2 | CGI | CGI_SL | CGI_CL | |

| IV2 | −0.4268 *** | −0.4331 *** | |||

| (0.0099) | (0.0087) | ||||

| IV | 5.9992 *** | 6.1099 *** | |||

| (0.1402) | (0.1230) | ||||

| GM2 | −5.1444 *** | −1.1492 *** | −0.7353 *** | ||

| (0.9839) | (−4.9280) | (0.2346) | |||

| GM | 5.7446 *** | 1.2274 *** | 0.8766 *** | ||

| (0.9635) | (5.3523) | (0.2308) | |||

| Controls | YES | YES | YES | YES | YES |

| Cons | −19.8236 *** | −20.5460 *** | −9.8863 *** | −1.6908 *** | −0.9587 *** |

| (0.5005) | (0.4394) | (0.3515) | (0.0801) | (0.0782) | |

| Time FE | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES |

| N | 28,451 | 28,451 | 28,451 | 28,451 | 28,451 |

| Kleibergen-Paap rk LM | 777.290 | ||||

| Cragg-Donald Wald F | 362.436 | ||||

| Stock-Yogo weak ID (10%) | 7.03 | ||||

| Variables | (1) | (2) |

|---|---|---|

| CGI | CGIA | |

| GM2 | −3.614 ** | −3.038 ** |

| (−2.083) | (−2.070) | |

| GM | 4.394 *** | 3.485 ** |

| (2.621) | (2.460) | |

| Controls | YES | YES |

| Cons | −10.397 *** | −5.877 *** |

| (−18.625) | (−12.893) | |

| Time FE | YES | YES |

| Industry FE | YES | YES |

| N | 11,748 | 11,535 |

| R2 | 0.282 | 0.198 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Market | CGI | CGI_S | CGI_C | |

| Market | 0.0530 *** | 0.0453 *** | 0.0372 *** | |

| (0.0037) | (0.0030) | (0.0030) | ||

| GM2 | −3.8755 *** | −0.3598 * | −0.2475 | −0.1913 |

| (0.2503) | (0.1585) | (0.1353) | (0.1292) | |

| GM | 2.4970 *** | 0.2680 | 0.1457 | 0.1219 |

| (0.2242) | (0.1508) | (0.1297) | (0.1232) | |

| Controls | YES | YES | YES | YES |

| Cons | 8.1681 *** | −8.1539 *** | −7.2301 *** | −5.6695 *** |

| (0.3203) | (0.2328) | (0.2094) | (0.1888) | |

| Time FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| N | 28,451 | 28,451 | 28,451 | 28,451 |

| R2 | 0.293 | 0.278 | 0.244 | 0.258 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| CGI | CGI_S | CGI_C | |

| DE × GM2 | 0.8136 *** | 0.4824 ** | 0.7469 *** |

| (0.2581) | (0.2273) | (0.2053) | |

| DE × GM | −0.1580 *** | −0.0933 * | −0.1340 *** |

| (0.0548) | (0.0485) | (0.0442) | |

| GM2 | −0.8866 *** | −0.6687 *** | −0.5152 *** |

| (0.1799) | (0.1514) | (0.1460) | |

| GM | 0.9940 *** | 0.7341 *** | 0.5952 *** |

| (0.1784) | (0.1499) | (0.1452) | |

| DE | 0.0797 *** | 0.0676 *** | 0.0620 *** |

| (0.0080) | (0.0069) | (0.0065) | |

| Controls | YES | YES | YES |

| Cons | −7.8703 *** | −7.0196 *** | −5.4373 *** |

| (0.2378) | (0.2137) | (0.1932) | |

| Time FE | YES | YES | YES |

| Industry FE | YES | YES | YES |

| N | 26,825 | 26,825 | 26,825 |

| R2 | 0.277 | 0.243 | 0.258 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| State-Owned Group | Non-State-Owned Group | |||||

| CGI | CGI_S | CGI_C | CGI | CGI_S | CGI_C | |

| GM2 | −0.0299 | −0.0604 | 0.0104 | −0.9299 *** | −0.2104 *** | −0.1619 ** |

| (0.2568) | (0.0596) | (0.0588) | (0.1999) | (0.0513) | (0.0516) | |

| GM | −0.1309 | 0.0521 | −0.0023 | 0.8437 *** | 0.1784 *** | 0.1570 ** |

| (0.2408) | (0.0551) | (0.0539) | (0.1914) | (0.0499) | (0.0491) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Cons | −8.1366 *** | −1.2715 *** | −0.6246 *** | −6.5213 *** | −1.2699 *** | −0.5284 *** |

| (0.3698) | (0.0857) | (0.0795) | (0.3291) | (0.0763) | (0.0723) | |

| Time FE | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES |

| N | 10,179 | 10,179 | 10,179 | 17,776 | 17,776 | 17,776 |

| R2 | 0.371 | 0.199 | 0.198 | 0.206 | 0.116 | 0.132 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Heavy-Polluting Group | Non-Heavy-Polluting Group | |||||

| CGI | CGI_S | CGI_C | CGI | CGI_S | CGI_C | |

| GM2 | −0.3237 | −0.2373 ** | 0.0133 | −0.4376 * | −0.1094 * | −0.1152 ** |

| (0.3012) | (0.0744) | (0.0831) | (0.1865) | (0.0449) | (0.0429) | |

| GM | 0.1160 | 0.2249 ** | −0.0177 | 0.3315 | 0.0856 * | 0.1177 ** |

| (0.2987) | (0.0729) | (0.0809) | (0.1752) | (0.0422) | (0.0397) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Cons | −8.5146 *** | −1.4507 *** | −0.9601 *** | −7.4267 *** | −1.2680 *** | −0.4227 *** |

| (0.4202) | (0.0942) | (0.1015) | (0.2753) | (0.0623) | (0.0556) | |

| Time FE | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES |

| N | 7652 | 7652 | 7652 | 20,689 | 20,689 | 20,689 |

| R2 | 0.277 | 0.117 | 0.140 | 0.295 | 0.161 | 0.172 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Eastern | Central | Western | Northeastern | |

| CGI | CGI | CGI | CGI | |

| GM2 | −0.7880 *** | −0.1802 | −0.7273 | 5.3449 |

| (0.1930) | (0.5266) | (0.4495) | (5.5364) | |

| GM | 0.6122 *** | 0.6381 | 0.3288 | −6.6766 |

| (0.1792) | (0.5258) | (0.4733) | (7.9709) | |

| Controls | YES | YES | YES | YES |

| Cons | −8.4176 *** | −7.8010 *** | −4.6966 *** | −5.6718 |

| (0.2877) | (0.5831) | (0.5855) | (3.0299) | |

| Time FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| N | 19,647 | 4032 | 3383 | 1389 |

| R2 | 0.304 | 0.259 | 0.231 | 0.207 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, F.; Song, G.; Liu, L. Decentralization or Cooperation? The Impact of “Government–Market” Green Governance Synergy on Corporate Green Innovation: Evidence from China. Sustainability 2025, 17, 8149. https://doi.org/10.3390/su17188149

Wang F, Song G, Liu L. Decentralization or Cooperation? The Impact of “Government–Market” Green Governance Synergy on Corporate Green Innovation: Evidence from China. Sustainability. 2025; 17(18):8149. https://doi.org/10.3390/su17188149

Chicago/Turabian StyleWang, Fengyan, Guomin Song, and Lanlan Liu. 2025. "Decentralization or Cooperation? The Impact of “Government–Market” Green Governance Synergy on Corporate Green Innovation: Evidence from China" Sustainability 17, no. 18: 8149. https://doi.org/10.3390/su17188149

APA StyleWang, F., Song, G., & Liu, L. (2025). Decentralization or Cooperation? The Impact of “Government–Market” Green Governance Synergy on Corporate Green Innovation: Evidence from China. Sustainability, 17(18), 8149. https://doi.org/10.3390/su17188149