Regional Concentration of FDI and Sustainable Economic Development

Abstract

1. Introduction

2. Literature Review

2.1. Inward FDI’s Investment Incentives

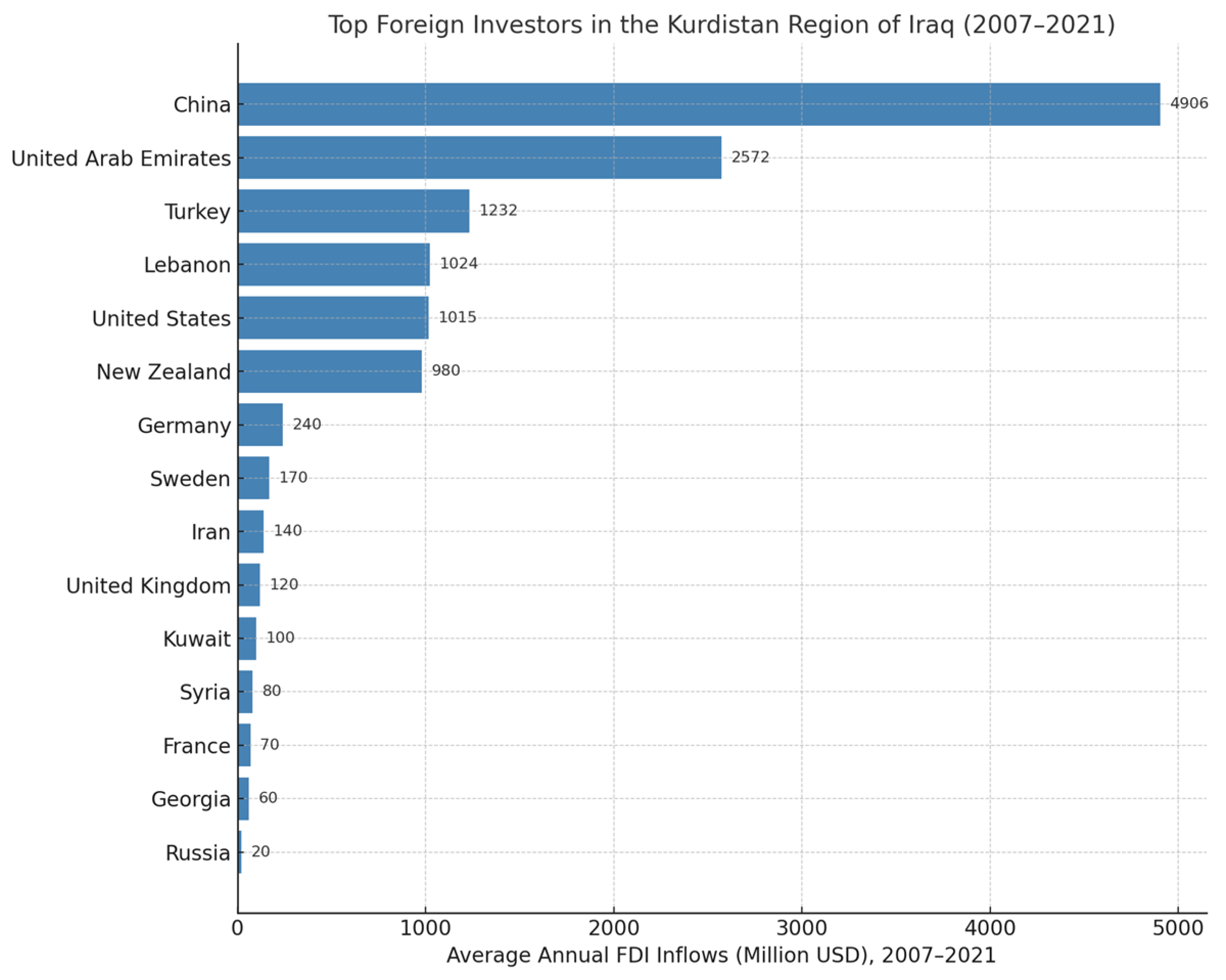

2.2. Inward FDI in the Kurdistan Region Versus Other Countries

2.3. Spatial Patterns of Firm Location in the Kurdistan Region

3. Research Design

3.1. Model Selection

3.2. Analytical Framework and Statistical Methodology

3.3. Data

4. Empirical Results

4.1. Descriptive Statistics

4.2. Main Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Year | License No | Location | Sector | Name of Project | Country Origin | Capital USD | Area km |

|---|---|---|---|---|---|---|---|

| 2007 | 10 | Erbil | Bank | Byblos Bank/Hawler/Branch | Lebanon | 700,000,000 | 0.23 |

| 2007 | 24 | Erbil | Tourism | Rotana Hotel/Hawler | Lebanon | 35,000,000 | 96 |

| 2008 | 145 | Erbil | Agriculture | IK cow building and dairy products | UK | 12,500,000 | 3 |

| 2008 | 72 | Erbil | Trading | American Jonder equipment | USA | 2,930,769 | 3.52 |

| 2009 | 161 | Erbil | Industry | Medical paper product factory | Lebanon | 13,621,654 | 8.31 |

| 2009 | 167 | Erbil | Tourism | Erbil Arjaan by Rotana | Lebanon | 24,323,257 | 1.6 |

| 2009 | 155 | Erbil | Housing | Nobel village | Sweden | 17,372,000 | 71.32 |

| 2009 | 147 | Erbil | Education | Belkent school | Turkey | 40,000,000 | 300 |

| 2009 | 194 | Erbil | Housing | Ozal village | Turkey | 45,000,000 | 150 |

| 2010 | 248 | Erbil | Health | German hospital | Germany | 8,450,000 | 1.6 |

| 2010 | 241 | Erbil | Education | Lebanese–France university | Lebanon/France | 7,082,207 | 20 |

| 2010 | 270 | Duhok | Housing | Avro City | Turkey | 55,7000,000 | 438.7 |

| 2010 | 281 | Erbil | Industry | Polteks Doga factory—production of iron | Turkey | 150,000,000 | 145.62 |

| 2011 | 407 | Erbil | Industry | Plastic pipes, PVC, and cement factory | Germany | 15,905,712 | 32 |

| 2011 | 341 | Erbil | Health | Antalya specialists complex | turkey | 2,300,000 | |

| 2011 | 344 | Erbil | Education | Tishk University | Turkey | 79,411,530 | 52 |

| 2011 | 4 | Duhok | Housing | Dubra City | Turkey | 74,652,60 | 52 |

| 2011 | 5 | Duhok | Housing | Stera zevi City | Turkey | 10,000,000 | 6.37 |

| 2011 | 11 | Duhok | Housing | Rona City | Turkey | 12,600,000 | 6.31 |

| 2011 | 368 | Erbil | Housing | The Atlantic | United States | 96,106 | 156 |

| 2012 | 36 | Erbil | Housing | Orbela | emirates | 14,286,5250 | 116.58 |

| 2012 | 64 | Duhok | Industry | Plastic recycling factory | Georgi | 60,000 | 3.06 |

| 2012 | 48 | Erbil | Trading | Dilan Resort Hotel | Iran | 14,950,802 | 4.5 |

| 2012 | 8 | Erbil | Housing | Lebanese village | Lebanon | 312,851,252 | 96 |

| 2012 | 46 | Erbil | Trading | Bakery and more | Lebanon | 250,0000 | 1.2 |

| 2012 | 46 | Erbil | Trading | Mali new centre | Lebanon | 2,500,000 | 1.2 |

| 2012 | 27 | Erbil | Housing | Deutsches dorf | Turkey | 150,000,000 | 147.47 |

| 2012 | 40 | Erbil | Industry | Fomex factory for carpet, spring beds, and furniture | Turkey | 115,346,610 | 44 |

| 2012 | 25 | Duhok | Industry | Yaseen factory for concrete molds | USA | 2,000,000 | 2 |

| 2012 | 37 | Erbil | Tourism | Doubletree Suites by Hilton Hotels | USA | 14,786,000 | 2.49 |

| 2013 | 32 | Erbil | Tourism | Downtown | Emirates | 2,384,350,750 | 220 |

| 2013 | 97 | Duhok | Industry | Stone crusher plant | Lebanon | 4,160,000 | 6.21 |

| 2013 | 68 | Erbil | Tourism | Dedaman 5-star hotel | Turkey | 31,122,200 | 1.02 |

| 2013 | 98 | Erbil | Industry | Almar plant for umbrellas and tents | Turkey | 2,876,000 | 2 |

| 2014 | 117 | Erbil | Industry | Kherat al-sharq for the production of sunflower oil | Turkey | 25,430,174 | 20 |

| 2014 | 132 | Duhok | Industry | Production factory of siramik and ponza block | Turkey | 617,199 | 2.4 |

| 2015 | 745 | Erbil | Industry | Gona factory for aluminium company | Turkey | 3,547,700 | 8 |

| 2016 | 761 | Duhok | Industry | Steel factory for iron production | Kuwait | 10,570,000 | 4.32 |

| 2016 | 765 | Erbil | Trading | Complex stores | Lebanon | 21,145,100 | 2.4 |

| 2016 | 781 | Erbil | Industry | Sivan dough | Syria | 8,300,000 | 4.6 |

| 2021 | 1055 | Erbil | Tourism | Happy City Complex project | China | 490,611,0000 | 2000 |

| 2007 | 12 | Erbil | Housing | Hawler commercial project | Iraq/United Kingdom | 100,000,000 | 41.6 |

| 2007 | 20 | Erbil | Agriculture | Rasson bird company for poultry | Iraq/Germany | 7,770,000 | 210 |

| 2007 | 23 | Sulaymaniyah | communication | Fiber optic network project | Iraq/Sweden | 20,893,549 | |

| 2007 | 26 | Sulaymaniyah | Education | American University in Iraq | Iraq/United States | 235,000,000 | 677.84 |

| 2007 | 38 | Erbil | Housing | American Khanzad village | Iraq/United States | 80,000,000 | 127 |

| 2007 | 41 | Erbil | Tourism | Aur tourists’ company | Iraq/Canada | 2,000,000 | 17.2 |

| 2007 | 43 | Erbil | Industry | Koya cigarette company | Iraq/South Africa | 12,000,000 | 50 |

| 2008 | 71 | Sulaymaniyah | Agriculture | Tara for agriculture exibitions | Iraq/United Kingdom | 9,000,000 | 43 |

| 2008 | 97 | Sulaymaniyah | Trading | City centre mall | Iraq/Kuwait | 51,250,000 | 24 |

| 2008 | 130 | Erbil | Tourism | Dewan Hotel | Iraq/Kuwait | 84,634,507 | 24 |

| 2008 | 146 | Erbil | Industry | Hareer canning plant for The production of tomato paste and fruit | Iraq/United States | 1,700,000 | 37 |

| 2009 | 195 | Duhok | Housing | War City | Iraq/Turkey | 54,016,013 | 500 |

| 2009 | 201 | Sulaymaniyah | Service | Kargaw village | Iraq/UAE | 28,109,000 | 100 |

| 2010 | 297 | Duhok | Housing | Roo City | Iraq/Turkey | 9,050,000 | 5.7 |

| 2011 | 360 | Duhok | Industry | M.S. factory for producing cleaning | Iraq/Turkey | 2,000,000 | 2.32 |

| 2011 | 396 | Erbil | Industry | Factory for producing PVC | Iraq/Spain | 3,284,530 | 9.5 |

| 2011 | 1 | Erbil | Housing | Korean village | Korea/Canada/Iraq | 343,132,266 | 1592 |

| 2011 | 14 | Duhok | Industry | Cakes, ice cream, juice jelly cubes, boxes, and silicon factory | Iraq/Jordan | 15,794,000 | 40.33 |

| 2012 | 224 | Duhok | industry | Excavator production factory | Iraq/New Zealand | 2,500,000 | - |

| 2012 | 53 | Duhok | Industry | Iron production factory | Iraq/Pakistan | 13,000,000 | 24 |

| 2012 | 71 | Duhok | Agriculture | Dry port of Duhok/PDP | Iraq/UAE | 400,000,000 | 360 |

| 2013 | 64 | Sulaymaniyah | Industry | Aluminium profile factory and glass enhancement | Iraq/Germany | 75,000,000 | 137 |

| 2013 | 64 | Sulaymaniyah | Industry | Arbat industrial city | Iraq/Iran | 2,000,000,000 | 1000 |

| 2014 | 132 | Erbil | industry | Edemli factory | Iraq/Turkey | 1,750,000 | 0.8 |

| 2015 | 729 | Sulaymaniyah | Industry | Ecocem station for waste recycling | Iraq/France | 52,872,278 | 204 |

| 2016 | 757 | Duhok | industry | Bahdare power station | Iraq/Turkey | 100,000,000 | 81.25 |

| 2016 | 759 | Erbil | Trading | Alhain Aldwalia Co. for insurance | Iraq/UAE | 5,599,200 | 1.19 |

| 2017 | 804 | Sulaymaniyah | Agriculture | Agricultural and gardening tools showroom | Iraq/Lebanon/France | 4,282,400 | 1.32 |

| 2020 | 971 | Erbil | Industry | Factory for investing hospital material | Iraq/Egypt/Canada | 4,240,000 | 10.8 |

| 2020 | 982 | Erbil | Trading | Ssvela Mall | Iraq/China | 13,326,000 | 4.41 |

| 2021 | 1061 | Erbil | Industry | Erbil factory for producing profael | Iraq/Turkey | 19,818,000 | 9 |

References

- Borensztein, E.; De Gregorio, J.; Lee, J.-W. How does foreign direct investment affect economic growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Cieślik, A. MNE activity in Poland: Horizontal, vertical or both? Emerg. Mark. Financ. Trade 2021, 57, 335–347. [Google Scholar] [CrossRef]

- Aitken, B.J.; Harrison, A.E. Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. Am. Econ. Rev. 1999, 89, 605–618. [Google Scholar] [CrossRef]

- Haig, B. New estimates of Australian GDP, 1861–1948/49. Aust. Econ. Hist. Rev. 2001, 41, 1–34. [Google Scholar] [CrossRef]

- UNCTAD. Investor Nationality: Policy Challenges; United Nations Publication: New York, NY, USA, 2016; pp. 1–213. Available online: https://unctad.org/system/files/official-document/wir2016_en.pdf (accessed on 13 June 2025).

- UNCTAD. Investing in the Sdgs: An Action Plan; United Nations Publication: New York, NY, USA, 2014; Available online: http://unctad.org/en/PublicationsLibrary/wir2014_en.pdf (accessed on 1 July 2025).

- Cai, Z.; Chen, L.; Fang, Y. A semiparametric quantile panel data model with an application to estimating the growth effect of FDI. J. Econom. 2018, 206, 531–553. [Google Scholar] [CrossRef]

- Paul, J.; Feliciano-Cestero, M.M. Five decades of research on foreign direct investment by MNEs: An overview and research agenda. J. Bus. Res. 2021, 124, 800–812. [Google Scholar] [CrossRef]

- Anderson, J.E.; Larch, M.; Yotov, Y.V. Trade and investment in the global economy: A multi-country dynamic analysis. Eur. Econ. Rev. 2019, 120, 103311. [Google Scholar] [CrossRef]

- Roser, M.; Cuaresma, J.C. Why is income inequality increasing in the developed world? Rev. Income Wealth 2016, 62, 1–27. [Google Scholar] [CrossRef]

- McGrattan, E.R. Transition to FDI openness: Reconciling theory and evidence. Rev. Econ. Dyn. 2012, 15, 437–458. [Google Scholar] [CrossRef]

- Wei, K.; Yao, S.; Liu, A. Foreign direct investment and regional inequality in China. Rev. Dev. Econ. 2009, 13, 778–791. [Google Scholar] [CrossRef]

- Phelps, N.A. Cluster or capture? Manufacturing foreign direct investment, external economies and agglomeration. Reg. Stud. 2008, 42, 457–473. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A.; Arbix, G. Strategies of waste: Bidding wars in the Brazilian automobile sector. Int. J. Urban Reg. Res. 2001, 25, 134–154. [Google Scholar] [CrossRef]

- Farole, T.; Winkler, D. Making Foreign Direct Investment Work for Sub-Saharan Africa: Local Spillovers and Competitiveness in Global Value Chains; World Bank Publications: Washington, DC, USA, 2014. [Google Scholar]

- Crescenzi, R.; Iammarino, S. Global investments and regional development trajectories: The missing links. In Transitions in Regional Economic Development; Routledge: London, UK, 2018; pp. 171–203. [Google Scholar]

- Crescenzi, R.; Di Cataldo, M.; Giua, M. FDI inflows in Europe: Does investment promotion work? J. Int. Econ. 2021, 132, 103497. [Google Scholar] [CrossRef]

- Dunning, J.H. Location and the multinational enterprise: A neglected factor? In The New Economic Analysis of Multinationals; Edward Elgar Publishing: Cheltenham, UK, 2003. [Google Scholar]

- Davies, R.B.; Markusen, J.R. What do multinationals do? The structure of multinational firms’ international activities. World Econ. 2021, 44, 3444–3481. [Google Scholar] [CrossRef]

- Markusen, J.R. Putting per-capita income back into trade theory. J. Int. Econ. 2013, 90, 255–265. [Google Scholar] [CrossRef]

- Baldwin, R.; Okubo, T. GVC journeys: Industrialisation and deindustrialisation in the age of the second unbundling. J. Jpn. Int. Econ. 2019, 52, 53–67. [Google Scholar] [CrossRef]

- Baldwin, R. The Great Convergence: Information Technology and the New Globalization; Harvard University Press: Cambridge, MA, USA, 2016. [Google Scholar]

- Krugman, P. What’s new about the new economic geography? Oxf. Rev. Econ. Policy 1998, 14, 7–17. [Google Scholar] [CrossRef]

- Vo, X.V. Determinants of capital flows to emerging economies-Evidence from Vietnam. Financ. Res. Lett. 2018, 27, 23–27. [Google Scholar] [CrossRef]

- Mutai, N.C.; Ibeh, L.; Nguyen, M.C.; Kiarie, J.W.; Ikamari, C. Sustainable economic development in Kenya: Influence of diaspora remittances, foreign direct investment and imports. Afr. J. Econ. Manag. Stud. 2025, 16, 61–78. [Google Scholar] [CrossRef]

- Markusen, J.R. Multinational Firms and the Theory of International Trade; MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Globerman, S.; Shapiro, D. Global foreign direct investment flows: The role of governance infrastructure. World Dev. 2002, 30, 1899–1919. [Google Scholar] [CrossRef]

- Cieślik, A.; Hamza, S. Institutional quality and inward FDI: Empirical evidence from GCC economies. Middle East Dev. J. 2023, 15, 261–290. [Google Scholar] [CrossRef]

- Aziz, O.G. Institutional quality and FDI inflows in Arab economies. Financ. Res. Lett. 2018, 25, 111–123. [Google Scholar] [CrossRef]

- Eken, S.; El-Erian, M.A.; Fennell, S.; Chauffour, J.-P. Achieving growth and stability in the Middle East and North Africa. In Growth and Stability in the Middle East and North Africa; International Monetary Fund: Washington, DC, USA, 1996. [Google Scholar]

- Krisztin, T.; Piribauer, P. A Bayesian spatial autoregressive logit model with an empirical application to European regional FDI flows. Empir. Econ. 2021, 61, 231–257. [Google Scholar] [CrossRef]

- Fu, X. Limited linkages from growth engines and regional disparities in China. J. Comp. Econ. 2004, 32, 148–164. [Google Scholar] [CrossRef]

- Cieślik, A. What attracts multinational enterprises from the new EU member states to Poland? Eurasian Bus. Rev. 2020, 10, 253–269. [Google Scholar] [CrossRef]

- Abdouli, M.; Hammami, S. Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. Int. Bus. Rev. 2017, 26, 264–278. [Google Scholar] [CrossRef]

- Cieślik, A.; Gurshev, O.; Hamza, S. Between the Eurozone crisis and the Brexit: The decade of British outward FDI into Europe. Empir. Econ. 2022, 63, 1159–1192. [Google Scholar] [CrossRef]

- Abdel-Gadir, S. Another look at the determinants of foreign direct investment in MENA countries: An empirical investigation. J. Econ. Dev. 2010, 35, 75–95. [Google Scholar] [CrossRef]

- Heshmati, A.; Davis, R. The Determinants of Foreign Direct Investment Flows to the Federal Region of Kurdistan; IZA Discussion Papers: Bonn, Germany, 2007. [Google Scholar]

- Natali, D. The spoils of peace in Iraqi Kurdistan. Third World Q. 2007, 28, 1111–1129. [Google Scholar] [CrossRef]

- Costantini, I. Statebuilding and foreign direct investment: The case of post-2003 Iraq. Int. Peacekeep. 2013, 20, 263–279. [Google Scholar] [CrossRef]

- Leibrecht, M.; Riedl, A. Modeling FDI based on a spatially augmented gravity model: Evidence for Central and Eastern European Countries. J. Int. Trade Econ. Dev. 2014, 23, 1206–1237. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Egger, P.; Pfaffermayr, M. Estimating models of complex FDI: Are there third-country effects? J. Econom. 2007, 140, 260–281. [Google Scholar] [CrossRef]

- Krugman, P. How the economy organizes itself in space: A survey of the new economic geography. In The Economy as an Evolving Complex System II; CRC Press: Boca Raton, FL, USA, 2018; pp. 239–262. [Google Scholar]

- Chakrabarti, A. A theory of the spatial distribution of foreign direct investment. Int. Rev. Econ. Financ. 2003, 12, 149–169. [Google Scholar] [CrossRef]

- Baser, B. Homeland calling: Kurdish diaspora and state-building in the Kurdistan region of Iraq in the post-Saddam era. Middle East Crit. 2018, 27, 77–94. [Google Scholar] [CrossRef]

- Edward, S. Middle East and North Africa Investment Policy Perspectives: Highlights; OECD Publishing: Paris, France, 2021. [Google Scholar]

- Wu, F. Intrametropolitan FDI firm location in Guangzhou, China A Poisson and negative binomial analysis: A Poisson and negative binomial analysis. Ann. Reg. Sci. 1999, 33, 535–555. [Google Scholar] [CrossRef]

- Cieślik, A. Determinants of the Location of Foreign Firms in Polish Regions: Does Firm Size Matter? Tijdschr. Voor Econ. En. Soc. Geogr. 2013, 104, 175–193. [Google Scholar] [CrossRef]

- Head, K.; Ries, J. Inter-city competition for foreign investment: Static and dynamic effects of China’s incentive areas. J. Urban Econ. 1996, 40, 38–60. [Google Scholar] [CrossRef]

- McFadden, D. Regression-based specification tests for the multinomial logit model. J. Econom. 1987, 34, 63–82. [Google Scholar] [CrossRef]

- Coughlin, C.C.; Segev, E. Location determinants of new foreign-owned manufacturing plants. J. Reg. Sci. 2000, 40, 323–351. [Google Scholar] [CrossRef]

- Correia, S.; Guimarães, P.; Zylkin, T. Fast Poisson estimation with high-dimensional fixed effects. Stata J. 2020, 20, 95–115. [Google Scholar] [CrossRef]

- Makabenta, M.P. FDI location and special economic zones in the Philippines. Rev. Urban Reg. Dev. Stud. 2002, 14, 59–77. [Google Scholar] [CrossRef]

- Cameron, A.C.; Trivedi, P.K. Econometric models based on count data. Comparisons and applications of some estimators and tests. J. Appl. Econom. 1986, 1, 29–53. [Google Scholar] [CrossRef]

- Cieślik, A.; Tarsalewska, M. External openness and economic growth in developing countries. Rev. Dev. Econ. 2011, 15, 729–744. [Google Scholar] [CrossRef]

- Beckerman, W. Distance and the pattern of intra-European trade. Rev. Econ. Stat. 1956, 38, 31–40. [Google Scholar] [CrossRef]

- Spies, J. Network and border effects: Where do foreign multinationals locate in Germany? Reg. Sci. Urban Econ. 2010, 40, 20–32. [Google Scholar] [CrossRef]

- World Bank. World Development Indicators; World Bank: Washington, DC, USA, 2021; Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 10 October 2023).

- Arauzo Carod, J.M.; Manjón Antolín, M.C. Firm size and geographical aggregation: An empirical appraisal in industrial location. Small Bus. Econ. 2004, 22, 299–312. [Google Scholar] [CrossRef]

- Guimón, J.; Chaminade, C.; Maggi, C.; Salazar-Elena, J.C. Policies to attract R&D-related FDI in small emerging countries: Aligning incentives with local linkages and absorptive capacities in Chile. J. Int. Manag. 2018, 24, 165–178. [Google Scholar]

- UNCTAD. International Production Beyond the Pandemic; UNCTAD: Geneva, Switzerland, 2020; Available online: https://unctad.org/en/PublicationsLibrary/wir2018_en.pdf (accessed on 3 June 2025).

- UNCTAD. Transnational Corporations, Agricultural Production and Development; UNCTAD: Geneva, Switzerland, 2009. [Google Scholar]

- Lewis, P.D.; Whyte, R. The Role of Subnational Investment Promotion Agencies; World Bank Group: Washington, DC, USA, 2022. [Google Scholar]

| Governorates Activities | FDI Inflows | % |

|---|---|---|

| Erbil | 9,397,603,720 | 93.97 |

| Sulaymaniyah | 0.00 | 0.00 |

| Duhok | 605,012,459 | 6.05 |

| Firm Size Year | Micro Firms | Small Firms | Medium Firms | Large Firms | All Firms |

|---|---|---|---|---|---|

| 2007 | 0.12 | 0.20 | 0.09 | 0.20 | 0.61 |

| 2008 | 0.08 | 0.15 | 0.09 | 0.10 | 0.42 |

| 2009 | 0.04 | 0.07 | 0.09 | 0.20 | 0.40 |

| 2010 | 0.04 | 0.07 | 0.18 | 0.30 | 0.59 |

| 2011 | 0.04 | 0.20 | 0.27 | 0.40 | 0.23 |

| 2012 | 0.24 | 0.33 | 0.36 | 0.40 | 1.33 |

| 2013 | 0.18 | 0.17 | 0.36 | 0.20 | 0.93 |

| 2014 | 0.20 | 0.17 | 0.09 | 0.16 | 0.62 |

| 2015 | 0.20 | 0.07 | 0.12 | 0.16 | 0.55 |

| 2016 | 0.08 | 0.09 | 0.01 | 0.16 | 0.34 |

| 2017 | 0.04 | 0.9 | 0.15 | 0.16 | 1.25 |

| 2018 | 0.16 | 0.12 | 0.13 | 0.16 | 0.57 |

| 2019 | 016 | 0.13 | 0.14 | 0.10 | 0.53 |

| 2020 | 0.16 | 0.15 | 0.14 | 0.10 | 0.55 |

| 2021 | 0.16 | 0.15 | 0.14 | 0.10 | 0.55 |

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Micro-firms | 223 | 4.369 | 0.404 | 1.071 | 9.236 |

| Small firms | 223 | 8.647 | 0.192 | 5.433 | 49.172 |

| Medium-sized firms | 223 | 6.847 | 0.315 | 9.071 | 50.172 |

| Large firms | 223 | 11.939 | 0.374 | 1.041 | 350.2 |

| Border | 223 | 0.359 | 0.481 | 0.000 | 1.000 |

| Syria border | 223 | 0.336 | 0.474 | 0.000 | 1.000 |

| Turkey border | 223 | 0.242 | 0.429 | 0.000 | 1.000 |

| Iran border | 223 | 0.112 | 0.316 | 0.000 | 1.000 |

| Capital | 223 | 13.35 | 0.415 | 12.766 | 13.687 |

| GDP | 223 | 8.502 | 0.256 | 7.72 | 8.797 |

| Labour | 223 | 3.768 | 0.016 | 3.726 | 3.802 |

| Market potential | 223 | 7.2361 | 2.138 | 2.654 | 8.796 |

| Mobile subscriptions | 223 | 76.537 | 11.976 | 48.921 | 93.604 |

| Airport | 223 | 0.664 | 0.474 | 0.000 | 1.000 |

| Transportation | 223 | 13.706 | 0.53 | 13.074 | 15.387 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Micro-firms | 1.000 | |||||||||||||

| Small firms | −0.492 | 1.000 | ||||||||||||

| Middle firms | −0.390 | −0.402 | 1.000 | |||||||||||

| Large firms | −0.245 | −0.253 | −0.101 | 1.000 | ||||||||||

| Border | −0.117 | 0.061 | 0.101 | 0.001 | 1.000 | |||||||||

| Syria border | −0.038 | 0.199 | −0.088 | −0.137 | −0.104 | 1.000 | ||||||||

| Turkey border | 0.139 | −0.093 | 0.040 | −0.097 | 0.070 | 0.283 | 1.000 | |||||||

| Iran border | 0.141 | −0.130 | −0.067 | 0.097 | −0.113 | 0.108 | 0.336 | 1.000 | ||||||

| Capital | −0.003 | −0.003 | −0.002 | 0.010 | −0.010 | 0.276 | 0.182 | −0.108 | 1.000 | |||||

| GDP | 0.112 | −0.067 | −0.071 | −0.017 | 0.072 | −0.373 | −0.116 | −0.279 | −0.013 | 1.000 | ||||

| Labour | 0.165 | −0.164 | 0.006 | −0.016 | 0.093 | 0.025 | 0.294 | 0.319 | 0.010 | −0.159 | 1.000 | |||

| Market potentials | 0.006 | 0.065 | 0.054 | −0.018 | −0.02 | 0.057 | 0.053 | 0.156 | 0.079 | −0.018 | 0.002 | 1.00 | 0 | |

| Mobile | 0.119 | −0.156 | −0.033 | 0.066 | 0.143 | −0.551 | −0.312 | −0.106 | 0.005 | 0.656 | 0.182 | 1.000 | ||

| Airport | 0.004 | 0.005 | 0.004 | −0.018 | −0.002 | 0.357 | 0.253 | −0.156 | 0.879 | −0.018 | 0.002 | −0.007 | 1.000 | |

| Transportation | 0.019 | −0.107 | −0.019 | 0.150 | −0.249 | −0.026 | −0.325 | 0.124 | 0.018 | −0.530 | 0.305 | 0.203 | −0.026 | 1.000 |

| Variable | Micro-Firms | Small Firms | Middle Firm Sizes | Large Firms | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Border | −0.870 * | - | −0.590 | - | 0.110 | - | −0.470 | - |

| (2.550) | - | (−1.770) | - | (0.500) | - | (−0.311) | - | |

| Syria border | −2.790 | 0.034 | 1.630 | −0.750 | 1.184 | −1.182 | 1.210 | −0.170 |

| (0.240) | (0.131) | (0.141) | (0.210) | (−0.801) | (−0.840) | (0.430) | (−0.301) | |

| Turkey border | 0.330 | 0.029 | −2.020 ** | −1.200 ** | 0.866 | 0.863 | −1.120 | −0.900 |

| (0.401) | (0.031) | (2.730) | (3.210) | (1.575) | (1.570) | (−0.240) | (−0.230) | |

| Iran border | 0.059 | 0.019 | −0.960 * | 0.610 | (0.340) | (0.341) | 1.660 | −0.340 |

| (0.110) | (0.020) | (2.220) | (1.580) | (−1.061) | (−1.060) | (1.011) | (−0.890) | |

| Capital | 3.000 | 2.003 | 0.371 | 0.300 | 0.123 | 0.120 | 0.412 | 0.201 |

| (0.480) | (0.322) | (0.742) | (0.320) | (2.131) | (2.131) | (0.513) | (0.342) | |

| GDP | 4.801 | 10.601 *** | 10.823 | 7.590 | 2.510 | 2.513 | 0.984 | −0.013 |

| (1.881) | (1.510) | (0.480) | (1.730) | (−1.710) | (1.710) | −0.105 | (0.451) | |

| Labour | 6.062 | 5.820 *** | 4.470 | 5.310 ** | −14.110 | −14.111 | −0.405 | −0.010 |

| (1.830) | (−0.871) | (0.390) | (3.120) | (−1.340) | (−1.303) | −0.220 | −0.240 | |

| Market potential | 0.141 | 0.190 | 1.053 *** | 0.041 ** | 0.340 *** | 0.530 ** | 0.061 *** | 0.340 *** |

| (0.060) | (0.980) | (0.700) | (0.600) | (0.010) | (0.412) | (0.130) | (0.020) | |

| Mobile subscription | −1.703 | 0.991 *** | 1.050 | 2.440 *** | 2.440 * | 2.440 * | 2.120 | 0.180 |

| (−0.550) | (0.720) | (0.740) | (0.661) | (2.120) | (2.122) | (0.531) | (0.150) | |

| Airport | 0.773 | 0.020 | 0.410 | 0.300 | 1.591 | 1.593 | −3.434 | 0.372 |

| (0.271) | (−0.010) | (−0.150) | (0.330) | (0.810) | (0.810) | (−0.440) | (0.170) | |

| Transportation | 1.790 | 0.111 *** | 0.790 | 3.250 | 0.770 | 0.771 | −0.890 | 0.690 |

| (1.630) | (0.443) | (−1.500) | (2.430) | (−1.670) | (−1.672) | (−0.711) | (0.632) | |

| _cons | 642.601 | 6778.501 | 262.700 | 1095.40 | −582.201 * | −582.201 * | −555.4000 | 452.60 |

| (−0.720) | (−0.791) | (0.710) | (0.800) | (−1.970) | (−1.972) | (−0.43) | (−0.720) | |

| Lnalpha | (0.730) | 0.880 *** | 0.281 * | (35.300) | ||||

| (−1.750) | (6.630) | (2.551) | (2.505) | |||||

| No. observations | 223.000 | 223.000 | 223.000 | 223.000 | 223.000 | 223.000 | 223.000 | 223.000 |

| Time effect | No | Yes | No | Yes | No | Yes | No | Yes |

| Number of clusters | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 |

| Pseudo R2 | 0.315 | 0.044 | 0.094 | 0.607 | ||||

| Log likelihood | (125.691) | (412.989) | (624.243) | (23.504) | ||||

| Variable | Erbil | Sulaymaniyah | Duhok | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Micro (1) | Small (2) | Medium (3) | Large (4) | Micro (5) | Small (6) | Medium (7) | Large (8) | Micro (9) | Small (10) | Medium (11) | Large (12) | |

| Syria border | 0.191 | 0.519 | −0.580 | −0.560 | 2.131 | 1.160 | 1.580 | 3.421 *** | 1.050 | −1.481 | −2.080 * | −1.031 |

| (0.460) | (0.260) | (0.890) | (0.790) | (0.311) | (0.760) | (0.430) | (2.250) | (0.211) | (0.210) | (0.010) | (1.110) | |

| Turkey border | 0.690 | −1.680 | 0.180 | 2.710 ** | 1.830 | −0.241 | −0.111 | 1.970 | 1.862 | 0.112 | 1.693 | 4.190 ** |

| (0.501) | (1.730) | (0.160) | (2.750) | (1.550) | (0.181) | (0.072) | (2.643) | (1.384) | (0.082) | (0.911) | (3.160) | |

| Iran border | −0.180 | −1.410 * | −0.610 | 1.480 | 0.531 | −1.080 | −0.401 | 3.180 ** | 1.040 | −0.740 | −0.250 | 0.300 |

| (0.170) | (2.050) | (−0.880) | (2.161) | (0.540) | (1.011) | (0.432) | (2.290) | (1.600) | (1.211) | (0.410) | (0.502) | |

| Capital | 0.731 | −0.420 | −9.570 | −0.511 | 0.290 * | 0.450 | −0.980 | −0.610 * | 0.491 * | 0.910 | 0.610 | −0.62 *** |

| (1.232) | (1.170) | (−0.041) | (2.201) | (2.301) | (0.320) | (−0.230) | (2.31) | (2.350) | (0.700) | (1.010) | (4.371) | |

| GDP | 5.740 | 0.802 | 0.610 | 4.191 | 2.382 | −3.971 | 2.050 | 5.222 | −2.621 | −5.070 | −3.532 | −7.833 |

| (1.412) | (0.360) | (0.200) | (1.911) | (0.662) | (1.121) | (0.401) | (1.920) | (0.715) | (1.500) | (0.510) | (3.300) | |

| Labour | 0.531 | 0.240 | 1.381 | 0.802 ** | 0.250 | −2.121 | 1.270 | 0.420 | 0.762 | −2.581 | −9.420 | 2.311 ** |

| (1.44) | (1.370) | −0.071 | (2.100) | (1.462) | (0.790) | (0.471) | (2.140) | (1.502) | (1.171) | (0.611) | (2.680) | |

| Market potential | −4.540 | 2.781 | 0.050 | 4.100 * | −1.440 * | −0.630 | 0.560 | 4.490 | −1.651 * | −1.652 | −3.152 | 7.331 *** |

| (1.270) | (1.183) | (0.012) | (2.112) | (2.321) | (−0.261) | (0.200) | (2.150) | (2.350) | (0.680) | (1.060) | (4.310) | |

| Mobile subscription | −4.540 | 2.780 | 0.052 | 4.102 * | −1.403 * | −0.674 | 0.560 | 4.490 | −1.610 * | −1.650 | −3.150 | 7.311 *** |

| (1.270) | (1.183) | −0.020 | (2.110) | (2.302) | (−0.231) | (0.202) | (2.151) | (2.300) | (0.600) | (1.600) | (4.310) | |

| Airport | −0.601 | −0.990 | 0.011 | 4.330 *** | −0.320 | −0.420 | 0.310 *** | 2.291 | −0.612 | −1.333 | −1.101 | 4.334 |

| (0.682) | (0.300) | −0.940 | (2.110) | (0.101) | (−0.270) | (4.480) | (2.150) | (2.300) | (0.500) | (1.001) | (2.101) | |

| Transportation | 0.6700 | −0.690 | 0.860 | 1.821 *** | −1.525 | −1.484 | 1.071 | 1.745 ** | −1.638 | −1.604 | 0.173 | 0.241 |

| (0.553) | (0.870) | (0.807) | (2.050) | (0.915) | (1.511) | (1.094) | (2.511) | (0.912) | (1.710) | (0.180) | (0.320) | |

| _cons | −170.300 | 680.800 | 190.500 | 120.900 * | −361.800 | −951.100 | 102.000 | 109.6000 | −323.500 | −289.7000 | −808.000 | 181.80 *** |

| (1.530) | (1.101) | (0.270) | (2.208) | (1.830) | (0.154) | (0.140) | (1.910) | (1.901) | (0.711) | (1.072) | (3.721) | |

| Lnalpha | 0.7400 ** | 0.661 ** | 0.822 *** | 0.751 *** | 0.644 *** | 0.842 *** | 0.890 *** | 0.710 *** | 0.410 *** | 0.900 *** | 0.910 *** | 0.741 *** |

| (4.420) | (3.210) | (5.105) | (5.190) | (3.400) | (3.540) | (5.111) | (4.360) | (1.310) | (3.850) | (5.180) | (4.620) | |

| No. observations | 98.000 | 98.000 | 98.000 | 98.000 | 72.000 | 72.000 | 72.000 | 72.000 | 53.000 | 53.000 | 53.000 | 53.000 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number of clusters | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 | 3.000 |

| Prob > chi2 | 0.3755 | 0.0237 | 0.8084 | 0.0002 | 0.5083 | 0.4083 | 0.9422 | 0.0003 | 0.456 | 0.456 | 0.8188 | 0.0001 |

| Pseudo R2 | 0.0881 | 0.0591 | 0.0138 | 0.053 | 0.089 | 0.037 | 0.009 | 0.0574 | 0.0348 | 0.0348 | 0.0129 | 0.059 |

| Log likelihood | −66.8 | −187.26 | −274.64 | −330.7 | −135.12 | −135.12 | −227.03 | −271.19 | −136.36 | −136.36 | −227.82 | −282.06 |

| Variable | All Firms (1) | All Firms (2) | Micro-Firms (3) | Small Firms (4) | Middle Firms (5) | Large Firms (6) |

|---|---|---|---|---|---|---|

| Border | 0.150 ** | |||||

| (0.021) | ||||||

| Iraq border | 0.340 | 0.110 | (0.100) | 0.030 | 0.170 ** | 0.560 ** |

| (1.342) | (1.472) | (−0.180) | (0.152) | (0.041) | (0.121) | |

| Syria border | 0.086 | 0.200 | 0.041 | 0.121 | 0.172 | 0.143 |

| (0.520) | (1.530) | (0.011) | (1.101) | (1.011) | (0.730) | |

| Turkey border | 1.410 | 0.56 *** | 0.222 | 0.321 | 0.243 *** | 0.120 *** |

| (0.800) | (0.010) | (0.120) | (0.170) | (0.010) | −0.300 | |

| Iran border | −0.220 * | 0.180 *** | (0.010) | 0.012 | 0.051 | 0.171 ** |

| (−2.410) | −6.691 | (0.030) | (0.171) | (0.500) | (0.300) | |

| 1.121 *** | 1.381 | 1.700 | −2.090 * | 0.670 | 2.781 | |

| (0.021) | (0.122) | (1.040) | (−2.041) | (0.550) | −1.551 | |

| −2.972 *** | 0.050 | 0.320 | 0.340 | 0.790 | −1.180 | |

| (3.901) | (0.021) | (0.080) | (0.520) | (1.000) | (0.960) | |

| 1.550 | 1.086 | 1.700 | 1.331 | 1.442 | 1.973 | |

| (1.340) | (0.560) | (0.660) | (1.760) | (0.480) | (1.300) | |

| 0.091 | 0.122 *** | 0.020 | 0.040 *** | 0.130 *** | 0.391 *** | |

| (0.710) | (5.042) | (0.110) | (0.031) | (0.112) | (0.303) | |

| 0.012 *** | −0.051 | 0.052 | 0.040 | 0.080 | −0.087 | |

| (0.141) | (1.042) | (0.361) | (0.550) | (0.060) | (0.660) | |

| Airport | 1.770 ** | 0.036 | 0.047 | 0.451 | 0.172 ** | 0.421 *** |

| (1.610) | (0.430) | (0.070) | (0.501) | (0.040) | (0.300) | |

| 0.305 *** | 0.067 ** | 0.153 | 0.093 | 0.122 | 0.770 | |

| (4.066) | (2.087) | (0.158) | (1.701) | (0.722) | (1.930) | |

| _cons | 55.55 | 48.33 | 290.9 | 82.13 | 12.05 | 48.33 |

| (0.985) | (0.847) | (0.567) | (1.865) | (0.306) | (0.845) | |

| Lnalpha | 0.92 *** | −35.33 ** | 35.33 ** | 20.40 ** | 0.36 ** | −35.33 ** |

| −11.450 | 0.391 | (0.390) | (0.322) | (0.173) | (0.524) | |

| No. observations | 210.000 | 210.000 | 210.000 | 210.000 | 210.000 | 210.000 |

| Time effect | No | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khdir, S.; Cieślik, A. Regional Concentration of FDI and Sustainable Economic Development. Sustainability 2025, 17, 7449. https://doi.org/10.3390/su17167449

Khdir S, Cieślik A. Regional Concentration of FDI and Sustainable Economic Development. Sustainability. 2025; 17(16):7449. https://doi.org/10.3390/su17167449

Chicago/Turabian StyleKhdir, Sarhad, and Andrzej Cieślik. 2025. "Regional Concentration of FDI and Sustainable Economic Development" Sustainability 17, no. 16: 7449. https://doi.org/10.3390/su17167449

APA StyleKhdir, S., & Cieślik, A. (2025). Regional Concentration of FDI and Sustainable Economic Development. Sustainability, 17(16), 7449. https://doi.org/10.3390/su17167449