Unlocking the Digital Dividend: How Does Digitalization Promote Corporate Carbon Emission Reduction?

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Research Hypothesis

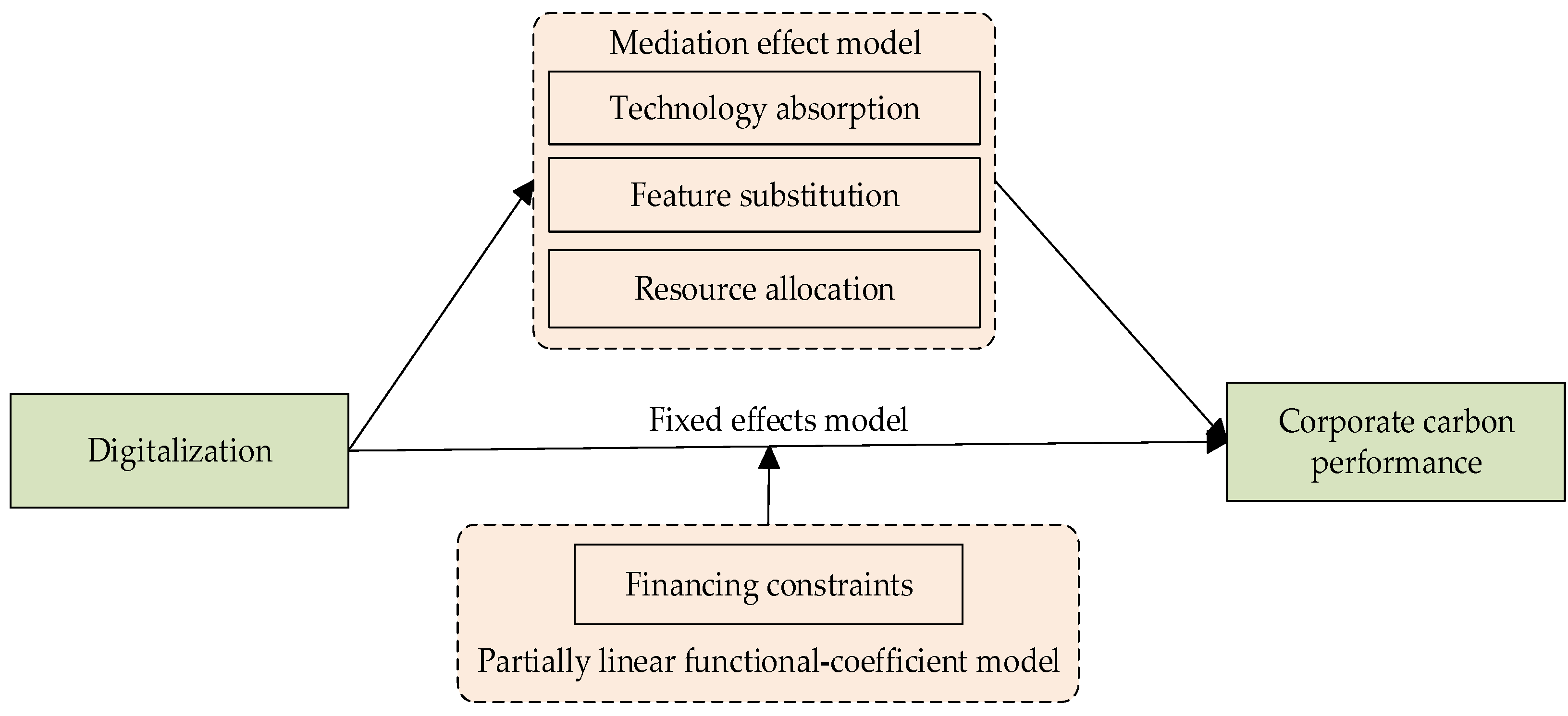

3.1. Direct Mechanism

3.2. Indirect Mechanism

3.3. The Role of Financing Constraints

4. Research Design

4.1. Model

4.1.1. Baseline Model

4.1.2. Mediation Effect Model

4.1.3. Partially Linear Functional-Coefficient Model

4.2. Variable Measurement

4.3. Data and Sample

5. Results Analysis

5.1. Baseline Regression Results

5.2. Robustness Test

5.2.1. Addressing the Omitted Variable Problem

5.2.2. Excluding Other Policy Interference

5.2.3. Excluding Samples Without Digital Technology Innovation

5.3. Endogeneity Test

5.4. Mediation Mechanism Analysis

5.5. Moderation Effect Analysis

6. Conclusions and Implications

6.1. Conclusions

6.2. Policy Implications

6.3. Limitations and Future Directions

Author Contributions

Funding

Conflicts of Interest

References

- Zheng, R.; Wu, G.; Cheng, Y.; Liu, H.; Wang, Y.; Wang, X. How does digitalization drive carbon emissions? The inverted U-shaped effect in China. Environ. Impact Assess. 2023, 102, 107203. [Google Scholar] [CrossRef]

- Mao, S.; Tang, T.; Yang, G. Does digital transformation reduce China’s corporate pollution emission intensity? Financ. Res. Lett. 2025, 78, 107141. [Google Scholar] [CrossRef]

- Feng, Y.; Yan, Y.; Shi, K.; Zhang, Z. Reducing carbon emission at the corporate level: Does artificial intelligence matter? Environ. Impact Assess. 2025, 114, 107911. [Google Scholar] [CrossRef]

- Li, K.; Wang, H.; Xie, X. Mechanism and spatial spillover effect of the digital economy on urban carbon Productivity: Evidence from 271 prefecture-level cities in China. J. Environ. Manag. 2025, 382, 125435. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, J. Digital transformation and firm cost stickiness: Evidence from China. Financ. Res. Lett. 2023, 52, 103510. [Google Scholar] [CrossRef]

- Salahuddin, M.; Alam, K. Internet usage, electricity consumption and economic growth in Australia: A time series evidence. Telemat. Inform. 2015, 32, 862–878. [Google Scholar] [CrossRef]

- Yang, Y.; Mukhopadhaya, P.; Yu, Z. How does enterprise digitalization affect corporate carbon emission in China: A firm-level study. China Econ. Rev. 2024, 88, 102285. [Google Scholar] [CrossRef]

- Chen, J.; Guo, Z.; Lei, Z. Research on the mechanisms of the digital transformation of manufacturing enterprises for carbon emissions reduction. J. Clean. Prod. 2024, 449, 141817. [Google Scholar] [CrossRef]

- Shang, Y.; Raza, S.A.; Huo, Z.; Shahzad, U.; Zhao, X. Does enterprise digital transformation contribute to the carbon emission reduction? Micro-level evidence from China. Int. Rev. Econ. Financ. 2023, 86, 1–13. [Google Scholar] [CrossRef]

- Li, J.; Ji, L.; Zhang, S.; Zhu, Y. Digital technology, green innovation, and the carbon performance of manufacturing enterprises. Front. Environ. Sci. 2024, 12, 1384332. [Google Scholar] [CrossRef]

- Shen, Y.; Yang, Z.; Zhang, X. Impact of digital technology on carbon emissions: Evidence from Chinese cities. Front. Ecol. Evol. 2023, 11, 1166376. [Google Scholar] [CrossRef]

- Wang, T.; Li, R.; Zhang, Q.; Sun, S. Digitalization and urban carbon emissions: Unraveling the mechanisms of agglomeration economics. J. Environ. Manag. 2025, 387, 125855. [Google Scholar] [CrossRef] [PubMed]

- Romer, P.M. Endogenous Technological Change. J. Polit. Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef]

- Lyu, Y.; Zhang, L.; Wang, D. The impact of digital transformation on low-carbon development of manufacturing. Front. Environ. Sci. 2023, 11, 1134882. [Google Scholar] [CrossRef]

- Wang, H.; Peng, G.; Du, H.; Wang, J. Effective approach toward low-carbon development: Digital economy development enhances carbon efficiency in cities. J. Clean. Prod. 2024, 470, 143292. [Google Scholar] [CrossRef]

- Ma, J.; Li, Q.; Zhao, Q.; Liou, J.; Li, C. From bytes to green: The impact of supply chain digitization on corporate green innovation. Energy Econ. 2024, 139, 107942. [Google Scholar] [CrossRef]

- Lan, L.; Zhou, Z. Complementary or substitutive effects? The duality of digitalization and ESG on firm’s innovation. Technol. Soc. 2024, 77, 102567. [Google Scholar] [CrossRef]

- Huang, C.; Lin, B. The impact of digital economy on energy rebound effect in China: A stochastic energy demand frontier approach. Energy Policy 2025, 196, 114418. [Google Scholar] [CrossRef]

- Sun, G.; Fang, J.; Li, J.; Wang, X. Research on the impact of the integration of digital economy and real economy on enterprise green innovation. Technol. Forecast. Soc. 2024, 200, 123097. [Google Scholar] [CrossRef]

- Zhu, Y.; Lan, M. Digital economy and carbon rebound effect: Evidence from Chinese cities. Energy Econ. 2023, 126, 106957. [Google Scholar] [CrossRef]

- Sadorsky, P. Information communication technology and electricity consumption in emerging economies. Energy Policy 2012, 48, 130–136. [Google Scholar] [CrossRef]

- Hittinger, E.; Jaramillo, P. Internet of Things: Energy boon or bane? Science 2019, 364, 326–328. [Google Scholar] [CrossRef] [PubMed]

- Tang, K.; Yang, G. Does digital infrastructure cut carbon emissions in Chinese cities? Sustain. Prod. Consump. 2023, 35, 431–443. [Google Scholar] [CrossRef]

- Bonab, S.B.; Haseli, G.; Ghoushchi, S.J. Digital technology and information and communication technology on the carbon footprint. In Decision Support Systems for Sustainable Computing; Academic Press: Cambridge, MA, USA, 2024; pp. 101–122. [Google Scholar]

- Peng, H.; Zhang, Y.; Liu, J. The energy rebound effect of digital development: Evidence from 285 cities in China. Energy 2023, 270, 126837. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, N.; Huo, Y. Impact of digital technology innovation on carbon emission reduction and energy rebound: Evidence from the Chinese firm level. Energy 2025, 320, 135187. [Google Scholar] [CrossRef]

- Lee, C.; Yan, J. Will artificial intelligence make energy cleaner? Evidence of nonlinearity. Appl. Energy 2024, 363, 123081. [Google Scholar] [CrossRef]

- Yang, Z.; Shen, Y. The impact of intelligent manufacturing on industrial green total factor productivity and its multiple mechanisms. Front. Environ. Sci. 2023, 10, 1058664. [Google Scholar] [CrossRef]

- Luan, F.; Yang, X.; Chen, Y.; Regis, P.J. Industrial robots and air environment: A moderated mediation model of population density and energy consumption. Sustain. Prod. Consump. 2022, 30, 870–888. [Google Scholar] [CrossRef]

- Huang, Y.; Zhang, Y. Digitalization, positioning in global value chain and carbon emissions embodied in exports: Evidence from global manufacturing production-based emissions. Ecol. Econ. 2023, 205, 107674. [Google Scholar] [CrossRef]

- Li, W.; Fang, S.; Yan, C.; Gong, W.; Wang, C. Research on the impact of digital economy on industrial carbon emission efficiency—An analysis based on spatial threshold model. J. Clean. Prod. 2025, 515, 145755. [Google Scholar] [CrossRef]

- Wang, W.; Zhou, S.; Li, D.; Wang, Y.; Liu, X. Disentangling the non-linear relationships and interaction effects of urban digital transformation on carbon emission intensity. Urban Clim. 2025, 59, 102283. [Google Scholar] [CrossRef]

- Huang, C.; Lin, B. Digital economy solutions towards carbon neutrality: The critical role of energy efficiency and energy structure transformation. Energy 2024, 306, 132524. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Y.; Ramsey, T.S.; Hewings, G.J.D. Will researching digital technology really empower green development? Technol. Soc. 2021, 66, 101638. [Google Scholar] [CrossRef]

- Qian, Q.; Xian, B.; Wang, Y.; Li, X. The impact of digital economy on carbon emissions: Based on the rebound effect. Energy 2025, 333, 137345. [Google Scholar] [CrossRef]

- Bai, L.; Guo, T.; Xu, W.; Liu, Y.; Kuang, M.; Jiang, L. Effects of digital economy on carbon emission intensity in Chinese cities: A life-cycle theory and the application of non-linear spatial panel smooth transition threshold model. Energy Policy 2023, 183, 113792. [Google Scholar] [CrossRef]

- Li, G.; Lai, S.; Lu, M.; Li, Y. Digitalization, Carbon Productivity and Technological Innovation in Manufacturing—Evidence from China. Sustainability 2023, 15, 11014. [Google Scholar] [CrossRef]

- Nie, C.; Xie, L.; Feng, Y. The digital path to carbon neutrality: Examining the carbon abatement effect of digital place-based policy in China. Energy Econ. 2025, 147, 108537. [Google Scholar] [CrossRef]

- Tao, W.; Weng, S.; Chen, X.; ALHussan, F.B.; Song, M. Artificial intelligence-driven transformations in low-carbon energy structure: Evidence from China. Energy Econ. 2024, 136, 107719. [Google Scholar] [CrossRef]

- Wang, X.; Gan, Y.; Zhou, S.; Wang, X. Digital technology adoption, absorptive capacity, CEO green experience and the quality of green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105271. [Google Scholar] [CrossRef]

- Fu, H.; Li, M.; Guo, W.; Huang, J. Digital transformation and carbon reduction: Evidence from Chinese listed companies. Financ. Res. Lett. 2025, 83, 107652. [Google Scholar] [CrossRef]

- Blouch, R.; Khan, M.M.; Shakeel, W. A bottom-up role of information asymmetry: Opening the black-box of firms’ resource allocation mechanism. Glob. Knowl. Mem. Commun. 2023, 72, 210–230. [Google Scholar] [CrossRef]

- Jiang, L.; Li, B.; Zhang, M. The impact of digital transformation on the efficiency of corporate resource allocation: Internal mechanisms and external environment. Technol. Forecast. Soc. 2025, 215, 124107. [Google Scholar] [CrossRef]

- Kuang, Y.; Fan, M.; Fan, Y.; Jiang, Y.; Bin, J. Digitalization, financing constraints and firm performance. Front. Environ. Sci. 2023, 11, 1090537. [Google Scholar] [CrossRef]

- Qian, S. The effect of ESG on enterprise value under the dual carbon goals: From the perspectives of financing constraints and green innovation. Int. Rev. Econ. Financ. 2024, 93, 318–331. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- An, Y.; Cheng, H.; Dong, L. Semiparametric Estimation of Partially Linear Varying Coefficient Panel Data Models. In Essays in Honor of Aman Ullah; Academic Press: Cambridge, MA, USA; Emerald Group Publishing Limited: Leeds, UK, 2016; pp. 47–65. [Google Scholar]

- Zhang, Y.; Zhou, Q. Partially linear functional-coefficient dynamic panel data models: Sieve estimation and specification testing. Economet. Rev. 2021, 40, 983–1006. [Google Scholar] [CrossRef]

- Chen, N.; Sun, D.; Chen, J. Digital transformation, labour share, and industrial heterogeneity. J. Innov. Knowl. 2022, 7, 100173. [Google Scholar] [CrossRef]

- Guo, X.; Li, M.; Wang, Y.; Mardani, A. Does digital transformation improve the firm’s performance? From the perspective of digitalization paradox and managerial myopia. J. Bus. Res. 2023, 163, 113868. [Google Scholar] [CrossRef]

- Lewbel, A. Constructing Instruments for Regressions with Measurement Error when no Additional Data are Available, with an Application to Patents and R&D. Econometrica 1997, 65, 1201–1214. [Google Scholar] [CrossRef]

- Lyu, Y.; Zhang, L.; Wang, D. Does digital economy development reduce carbon emission intensity? Front. Ecol. Evol. 2023, 11, 1176388. [Google Scholar] [CrossRef]

- Goldsmith-Pinkham, P.; Sorkin, I.; Swift, H. Bartik Instruments: What, When, Why, and How. Am. Econ. Rev. 2020, 110, 2586–2624. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, X. Intelligent manufacturing, green technological innovation and environmental pollution. J. Innov. Konwl. 2023, 8, 100384. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, X. The impact of artificial intelligence on employment: The role of virtual agglomeration. Hum. Soc. Sci. Commun. 2024, 11, 122. [Google Scholar] [CrossRef]

- Wang, H.; Yi, R.; Cao, Y.; Lyu, B. Are industry associations conducive to radical innovation in biopharmaceutical companies?—The dual effect of absorptive capacity and digital investment. Technol. Forecast. Soc. 2024, 207, 123619. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, X.; Shen, Y. Technology-driven carbon reduction: Analyzing the impact of digital technology on China’s carbon emission and its mechanism. Technol. Forecast. Soc. Chang. 2024, 200, 123124. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, X. Towards a low-carbon and beautiful world: Assessing the impact of digital technology on the common benefits of pollution reduction and carbon reduction. Environ. Monit. Assess. 2024, 196, 695. [Google Scholar] [CrossRef] [PubMed]

- Lin, W.; Wang, Y.; Zhang, Q.; Peron, M.; Lu, J. Emerging opportunities or paradoxes: Assessing the effect of digital technology adoption on corporate carbon performance. J. Environ. Manag. 2025, 391, 126399. [Google Scholar] [CrossRef] [PubMed]

- Bai, T.; Qi, Y.; Li, Z.; Xu, D. Digital economy, industrial transformation and upgrading, and spatial transfer of carbon emissions: The paths for low-carbon transformation of Chinese cities. J. Environ. Manag. 2023, 344, 118528. [Google Scholar] [CrossRef]

- Yang, Y.; Han, J. Digital transformation, financing constraints, and corporate environmental, social, and governance performance. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 3189–3202. [Google Scholar] [CrossRef]

| Reference | Effect | Independent Variable | Key Findings |

|---|---|---|---|

| Huang and Lin [33] | Technological and structural effects | Digital economy | Digital economy promotes regional carbon reduction through energy efficiency and energy structure optimization. |

| Wang et al. [12] | Agglomeration economies | Digitalization | Digitalization reduces urban carbon emission intensity by increasing urban population density and promoting green technological innovation. |

| Wang et al. [15] | Spillover effect | Digital economy | The digital economy can reduce not only local carbon emission intensity but also that of neighboring regions. |

| Liu et al. [26] | Energy rebound effect | Digital technology | Digital technology innovation can generate an energy rebound effect, which may partially offset the impact of emission reductions. |

| Rahnamay Bonab et al. [24] | Scale effect | Digitalization | The production of digital devices increases carbon emissions through the generation of electronic waste and electricity consumption. |

| Tang and Yang [23] | Scale effect | Digital infrastructure | Digital infrastructure has significantly increased carbon emission intensity in Chinese cities. |

| Wang et al. [34]; Salahuddin and Alam [6] | Scale effect | ICT | The widespread expansion of ICT has led to a sharp increase in energy demand. |

| Qian et al. [35] | Rebound effect | Digital economy | The digital economy increases local carbon intensity while reducing emissions in neighboring regions. |

| Bai et al. [36]; Huang and Zhang [30] | Hybrid effect | Digital economy | There is an “inverted U-shaped” relationship between the digital economy and carbon emission intensity. |

| Wang et al. [32] | Threshold effect | Digital transformation | Digital transformation exerts a carbon reduction effect after reaching a certain threshold. |

| Li et al. [31] | Nonlinear effect | Digital economy | The digital economy exhibits a nonlinear impact on urban carbon emission efficiency. |

| Our research | Technological–structural–scale framework | Digitalization | Digitalization improves corporate carbon performance through technology adoption, factor substitution, and optimized resource allocation. Under the influence of financing constraints, the carbon reduction effect of digitalization exhibits an “inverted U-shape”. |

| Variables | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| 20,922 | 8.408 | 1.819 | 3.204 | 15.32 | |

| 20,922 | 0.272 | 0.473 | 0.000 | 4.201 | |

| 20,922 | 5.430 | 1.149 | 2.809 | 9.364 | |

| 20,922 | 1.969 | 0.914 | 0.000 | 3.701 | |

| 20,922 | 0.390 | 0.192 | 0.040 | 0.923 | |

| 20,922 | 0.060 | 0.148 | −1.152 | 0.387 | |

| 20,922 | 3.423 | 0.459 | 2.016 | 4.347 | |

| 20,922 | 2.116 | 0.190 | 1.609 | 2.709 | |

| 20,922 | 0.311 | 0.461 | 0.000 | 1.000 | |

| 20,922 | 11.39 | 0.551 | 9.603 | 12.25 | |

| 20,922 | 0.802 | 0.237 | 0.278 | 1.564 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| 0.9047 *** | 0.1207 ** | 0.8485 *** | 0.1163 ** | 0.6946 *** | 0.1158 ** | |

| (15.5946) | (2.4485) | (14.8620) | (2.3801) | (12.2116) | (2.3821) | |

| 0.0625 | 0.0386 | 0.0682 * | 0.0389 | |||

| (1.6377) | (1.2803) | (1.8775) | (1.3002) | |||

| −0.0990 ** | −0.0606 ** | −0.1007 *** | −0.0565 ** | |||

| (−2.5650) | (−2.1030) | (−2.7775) | (−1.9661) | |||

| −1.4876 *** | −0.0326 | −1.4568 *** | −0.0390 | |||

| (−7.5028) | (−0.3032) | (−7.5699) | (−0.3635) | |||

| 0.2798 * | 0.3910 *** | 0.1945 | 0.3900 *** | |||

| (1.8387) | (7.1470) | (1.4191) | (7.1213) | |||

| −0.3747 *** | 0.0047 | −0.3320 *** | 0.0079 | |||

| (−4.6937) | (0.0849) | (−4.3630) | (0.1424) | |||

| −0.9374 *** | 0.0421 | −0.5994 *** | 0.0432 | |||

| (−6.1871) | (0.7917) | (−4.0947) | (0.8121) | |||

| 0.3526 *** | 0.0347 | 0.2148 *** | 0.0367 | |||

| (5.9256) | (1.3107) | (3.7791) | (1.3852) | |||

| 1.0232 *** | 0.2556 *** | |||||

| (16.7680) | (2.6670) | |||||

| −10.4878 | −1.2981 | |||||

| (−1.0957) | (−0.3180) | |||||

| −1.0486 *** | −0.8353 *** | 2.8302 *** | −0.8733 *** | −9.5271 *** | −3.7940 *** | |

| (−23.6580) | (−62.2943) | (6.2461) | (−3.9543) | (−10.5745) | (−3.3921) | |

| Firm FE | ||||||

| Time FE | ||||||

| 20,922 | 20,922 | 20,922 | 20,922 | 20,922 | 20,922 | |

| 0.0554 | 0.8964 | 0.1207 | 0.8973 | 0.2118 | 0.8976 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| 0.1138 ** | 0.1135 ** | 0.0694 * | 0.1040 ** | |

| (2.3221) | (2.3558) | (1.8912) | (2.0689) | |

| 0.0362 | 0.0431 | 0.0373 | 0.0292 | |

| (1.2052) | (1.2905) | (1.3865) | (0.9138) | |

| −0.0583 ** | −0.0283 | −0.0877 *** | −0.0581 * | |

| (−2.0244) | (−0.9001) | (−3.0960) | (−1.8495) | |

| −0.0452 | −0.0514 | −0.0179 | −0.0572 | |

| (−0.4219) | (−0.4409) | (−0.1697) | (−0.4871) | |

| 0.3935 *** | 0.3816 *** | 0.3468 *** | 0.3963 *** | |

| (7.2176) | (6.4510) | (6.4359) | (6.9117) | |

| 0.0039 | 0.0259 | −0.0118 | 0.0175 | |

| (0.0697) | (0.4163) | (−0.2236) | (0.2956) | |

| 0.0440 | 0.0361 | 0.0419 | 0.0567 | |

| (0.8241) | (0.4453) | (0.8632) | (1.0365) | |

| 0.0361 | 0.0111 | 0.0427 * | 0.0196 | |

| (1.3706) | (0.3873) | (1.7536) | (0.6961) | |

| 0.2692 *** | 0.4448 *** | 0.1284 | 0.2131 ** | |

| (2.8063) | (4.2346) | (1.2525) | (2.1874) | |

| −0.9755 | −6.5877 | 2.4376 | −1.8830 | |

| (−0.2389) | (−1.5746) | (0.6130) | (−0.4250) | |

| −0.0007 | ||||

| (−0.1057) | ||||

| −3.9635 *** | −6.0888 *** | −2.1111 * | −3.2740 *** | |

| (−3.5399) | (−4.9451) | (−1.7787) | (−2.8420) | |

| Firm FE | ||||

| Time FE | ||||

| 20,922 | 15,472 | 18,300 | 17,322 | |

| 0.8979 | 0.8989 | 0.9136 | 0.9027 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| 5.3733 *** | 0.0777 * | 0.1144 ** | ||||

| (4.5532) | (1.9189) | (2.4125) | ||||

| 0.5666 *** | ||||||

| (4.5791) | ||||||

| 0.1902 *** | ||||||

| (25.1207) | ||||||

| 0.9356 *** | ||||||

| (117.5446) | ||||||

| −0.0090 | 0.0734 | 0.0026 | 0.0387 | 0.0020 | 0.0389 | |

| (−0.7413) | (1.1801) | (0.3314) | (1.2920) | (1.4372) | (1.2999) | |

| −0.0201 | 0.0075 | −0.0266 ** | −0.0570 ** | −0.0032 | −0.0566 ** | |

| (−1.1851) | (0.1145) | (−2.3529) | (−1.9819) | (−1.5980) | (−1.9669) | |

| −0.0154 | 0.0971 | 0.0027 | −0.0400 | 0.0014 | −0.0391 | |

| (−0.3779) | (0.4372) | (0.1015) | (−0.3726) | (0.3828) | (−0.3638) | |

| 0.0031 | 0.3642 *** | 0.0041 | 0.3902 *** | −0.0020 | 0.3900 *** | |

| (0.1535) | (3.1298) | (0.2930) | (7.1235) | (−0.9082) | (7.1215) | |

| 0.0235 | −0.0886 | −0.0022 | 0.0086 | −0.0011 | 0.0080 | |

| (0.9865) | (−0.6487) | (−0.1346) | (0.1550) | (−0.6027) | (0.1429) | |

| 0.0377 | −0.1403 | 0.0178 | 0.0446 | 0.0038 | 0.0433 | |

| (1.4594) | (−1.0071) | (1.0049) | (0.8362) | (1.4449) | (0.8130) | |

| 0.0099 | −0.0229 | 0.0081 | 0.0371 | 0.0006 | 0.0367 | |

| (0.9208) | (−0.3768) | (1.1920) | (1.4022) | (0.6219) | (1.3860) | |

| −0.0099 | 0.2204 | −0.0128 | 0.2558 *** | −0.0011 | 0.2556 *** | |

| (−0.3585) | (1.4156) | (−0.6884) | (2.6664) | (−0.4145) | (2.6670) | |

| −0.7049 | −0.1036 | −0.3428 | −1.3068 | 0.1051 | −1.2984 | |

| (−0.4877) | (−0.0128) | (−0.3442) | (−0.3202) | (0.7028) | (−0.3181) | |

| Firm FE | ||||||

| Time FE | ||||||

| Kleibergen-Paap rk LM | 17.827 [0.0000] | 71.166 [0.0000] | 144.049 [0.0000] | |||

| Kleibergen-Paap rk Wald F | 20.968 {8.96} | 631.048 {8.96} | 14,000.00 {8.96} | |||

| 20,922 | 20,922 | 20,922 | 20,922 | 20,922 | 20,922 | |

| 0.7887 | −4.0249 | 0.9049 | 0.0137 | 0.9950 | 0.0139 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| 0.4394 ** | 1.1254 ** | 1.6097 *** | 0.0977 *** | 0.0579 ** | 0.0884 *** | |

| (2.0229) | (2.1101) | (2.8264) | (3.9859) | (2.4230) | (3.6240) | |

| 0.1375 | 2.5119 *** | −0.4530 | 0.0403 * | 0.0745 *** | 0.3645 *** | |

| (1.1472) | (3.5432) | (−1.4500) | (1.9598) | (3.3326) | (17.0389) | |

| −0.0579 | −0.3263 | 1.0551 *** | 0.0638 *** | 0.1181 *** | 0.1053 *** | |

| (−0.5864) | (−1.3764) | (3.8765) | (2.7647) | (4.9297) | (4.3661) | |

| −1.9739 *** | 1.9691 ** | 1.7111 * | 0.3962 *** | 0.4573 *** | 0.4013 *** | |

| (−3.2034) | (2.5060) | (1.9470) | (5.5448) | (6.3395) | (5.5942) | |

| −3.2238 *** | 2.5563 | −0.9642 ** | 0.7181 *** | 0.7155 *** | 0.7191 *** | |

| (−8.8781) | (1.5782) | (−2.0185) | (16.7920) | (16.9182) | (16.8352) | |

| −0.0695 | −1.5196 * | −0.8722 | 0.0013 | 0.0108 | 0.0109 | |

| (−0.3051) | (−1.8478) | (−1.5859) | (0.0402) | (0.3233) | (0.3344) | |

| −0.2486 | 0.0853 | −0.0894 | 0.0584 * | 0.0704 ** | 0.0590 * | |

| (−0.7975) | (0.0573) | (−0.1740) | (1.7774) | (2.0675) | (1.7140) | |

| −0.0105 | 1.2406 | 0.0353 | 0.0070 | 0.0059 | 0.0078 | |

| (−0.1007) | (1.5170) | (0.1583) | (0.5095) | (0.4290) | (0.5601) | |

| 0.5907 | 1.0656 ** | 0.0721 | 0.0431 | 0.0451 | 0.0475 | |

| (1.4938) | (2.0982) | (0.1075) | (1.1291) | (1.1309) | (1.2279) | |

| −52.9846 *** | −90.8511 | −89.8283 ** | 1.5174 | 1.6441 | 1.4036 | |

| (−3.1300) | (−0.9316) | (−2.5158) | (0.7904) | (0.8399) | (0.7199) | |

| 0.1710 | −7.6004 * | 12.1581 | 4.4633 *** | 5.3222 *** | 6.7711 *** | |

| (0.0411) | (−1.9261) | (1.4985) | (9.2160) | (10.5318) | (13.7788) | |

| Firm FE | ||||||

| Time FE | ||||||

| 19,501 | 19,501 | 19,501 | 19,430 | 19,430 | 19,430 | |

| 0.8601 | 0.8526 | 0.8112 | 0.8272 | 0.8452 | 0.8824 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, L.; Wu, H.; Shen, Y. Unlocking the Digital Dividend: How Does Digitalization Promote Corporate Carbon Emission Reduction? Sustainability 2025, 17, 7222. https://doi.org/10.3390/su17167222

Zhang L, Wu H, Shen Y. Unlocking the Digital Dividend: How Does Digitalization Promote Corporate Carbon Emission Reduction? Sustainability. 2025; 17(16):7222. https://doi.org/10.3390/su17167222

Chicago/Turabian StyleZhang, Leifeng, Hui Wu, and Yang Shen. 2025. "Unlocking the Digital Dividend: How Does Digitalization Promote Corporate Carbon Emission Reduction?" Sustainability 17, no. 16: 7222. https://doi.org/10.3390/su17167222

APA StyleZhang, L., Wu, H., & Shen, Y. (2025). Unlocking the Digital Dividend: How Does Digitalization Promote Corporate Carbon Emission Reduction? Sustainability, 17(16), 7222. https://doi.org/10.3390/su17167222