The Formation and Evolution of the Resilience of Resource-Based Enterprises Under Continuous Institutional Shocks: An Explanation from the Perspective of Organizational Legitimacy

Abstract

1. Introduction

2. Mechanism Interpretation and Model Construction

2.1. Theoretical Foundation

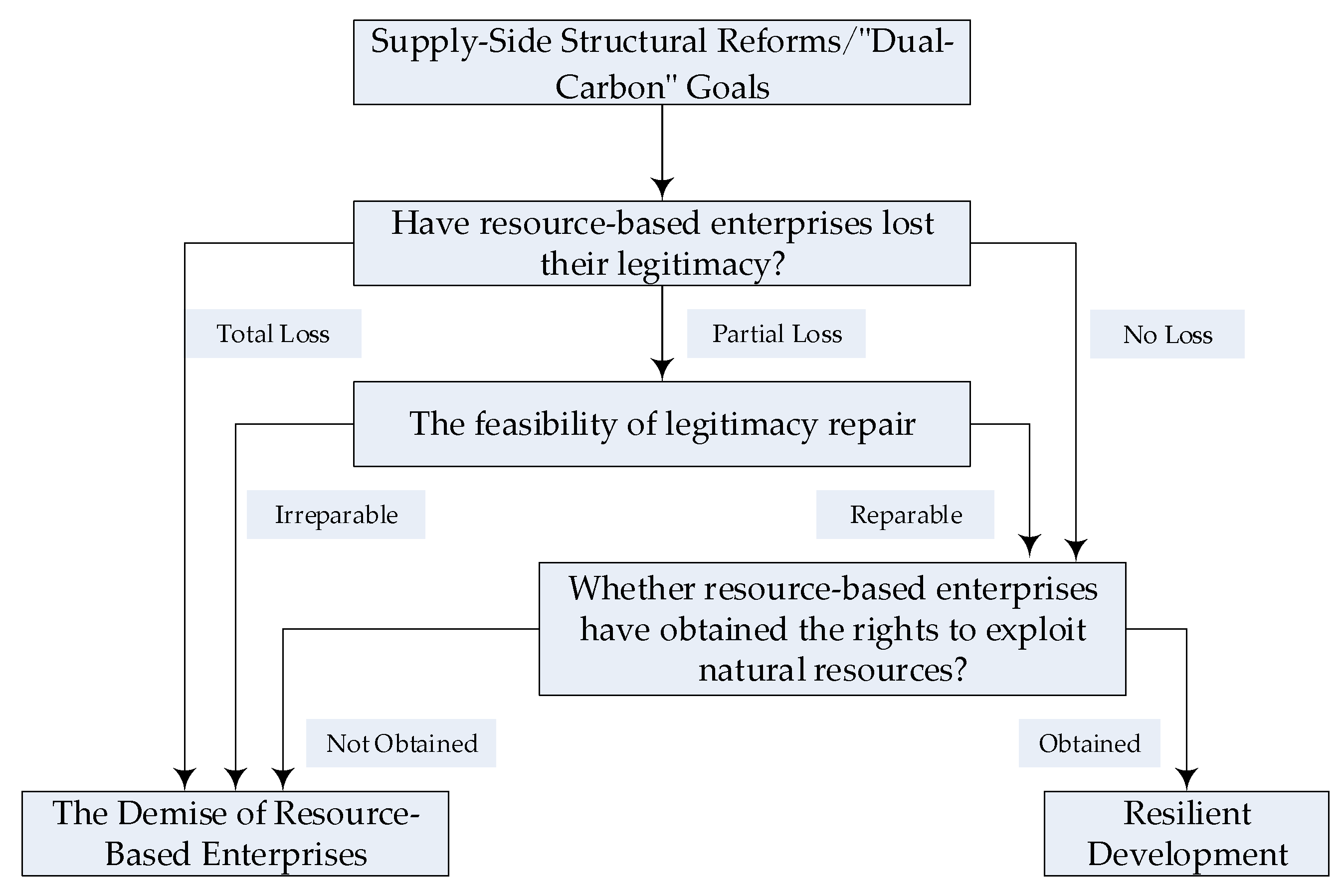

2.2. The Resilience of Resource-Based Enterprises Under Institutional Shocks

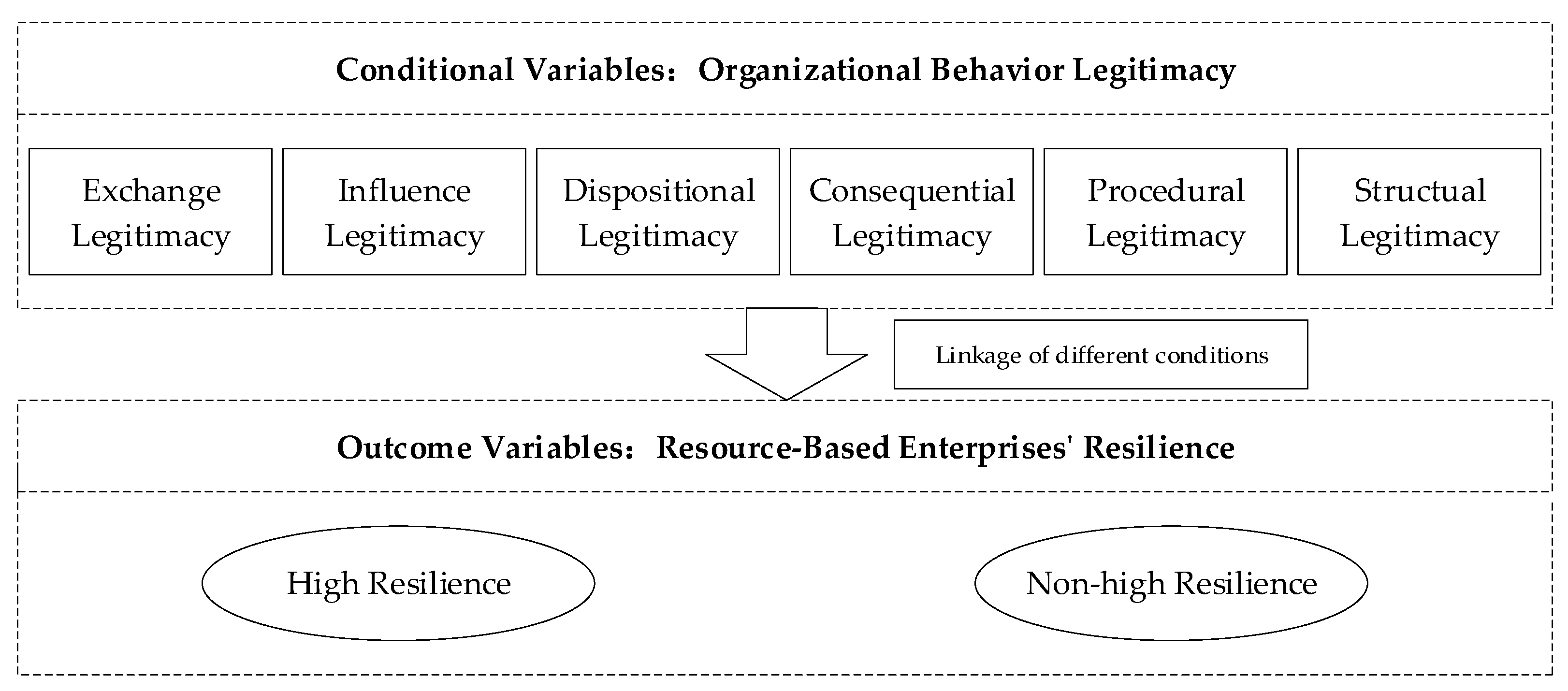

2.3. The Mechanism of Organizational Behavioral Legitimacy on the Resilience of Resource-Based Enterprises

2.3.1. The Mechanism of Pragmatic Legitimacy on the Resilience of Resource-Based Enterprises

- The Mechanism of Exchange Legitimacy on the Resilience of Resource-Based Enterprises

- The Mechanism of Influence Legitimacy on the Resilience of Resource-Based Enterprises

- The Mechanism of Dispositional Legitimacy on the Resilience of Resource-Based Enterprises

2.3.2. The Mechanism of Moral Legitimacy on the Resilience of Resource-Based Enterprises

- The Mechanism of Consequential Legitimacy on the Resilience of Resource-Based Enterprises

- The Mechanism of Procedural Legitimacy on the Resilience of Resource-Based Enterprises

- The Mechanism of Structural Legitimacy on the Resilience of Resource-Based Enterprises

2.4. Differences in Resilience Formation Pathways of Resource-Based Enterprises Under Continuous Institutional Shocks

2.5. Research Framework

3. Research Design

3.1. Research Method

3.2. Case Selection and Data Sources

3.3. Variables Measurement and Calibration

3.3.1. Outcome Variables

3.3.2. Conditional Variables

3.3.3. Calibration

4. Data Analysis

4.1. Necessary Conditions Analysis

4.2. Configuration Analysis

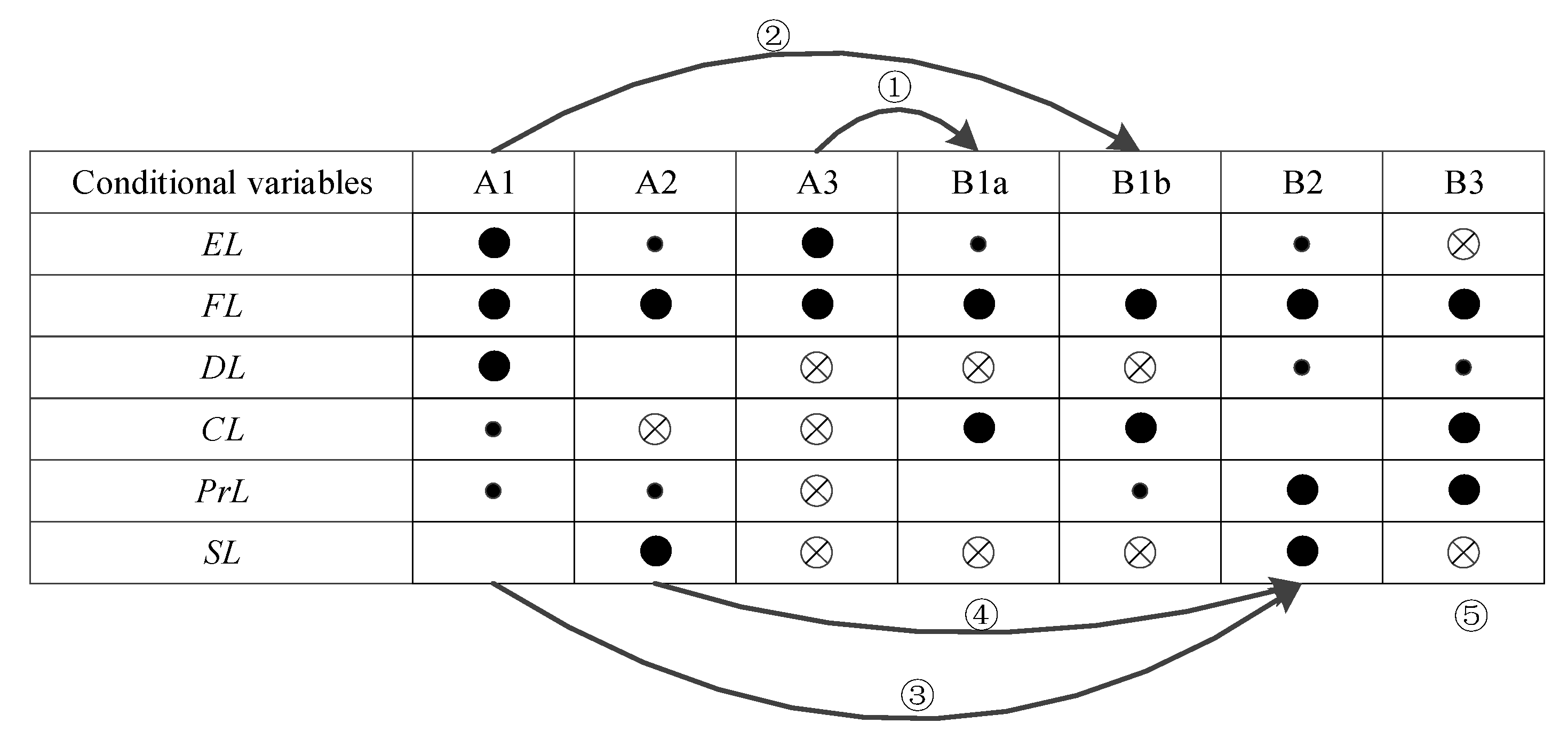

4.2.1. Configurations of High Resilience of Resource-Based Enterprises Under the Impact of Supply-Side Structural Reforms

- Pragmatic Legitimacy Oriented Type (Configuration A1: EL*IL*DL*CL*PrL)

- Influence-Structural Legitimacy Oriented Type (Configuration A2: EL*IL*~CL*PrL*SL)

- Exchange-Influence Legitimacy Oriented Type (ConfigurationA3: EL*IL*~DL*~CL*~PrL*~SL)

4.2.2. Configurations of High Resilience of Resource-Based Enterprises Under the Impact of the “Dual-Carbon” Goals

- Influence-Consequential Legitimacy Oriented Type (Configuration B1a and B1b: EL*IL*~DL*CL*~SL + IL*~DL*CL*Prl*~SL)

- Influence-Procedural-Structural Legitimacy Oriented Type (Configuration B2: EL*IL*DL*Prl*SL)

- Influence-Consequential-Procedural Legitimacy Oriented Type (Configuration B3: ~EL*IL*DL*CL*PrL*~SL)

4.3. Robustness

5. Evolutionary Analysis of the Formation Pathways of High Resilience of Resource-Based Enterprises Under Continuous Institutional Shocks

5.1. A Comparative Analysis of High-Resilience Pathways of Resource-Based Enterprises Under the Impacts of Supply-Side Structural Reforms and the “Dual-Carbon” Goals

5.2. The Evolution of High-Resilience Pathways of Resource-Based Enterprises Under the Impacts of Supply-Side Structural Reforms and the “Dual-Carbon” Goals

- Under continuous institutional shocks, the core conditions for the high-resilience pathways of the resource-based enterprises have continuity.

- Under continuous institutional shocks, the behavioral legitimacy model of high resilience of the resource-based enterprises has evolved from being dominated by pragmatic legitimacy to being co-dominated by both pragmatic legitimacy and moral legitimacy.

- Under continuous institutional shocks, the evolution of high-resilience pathways by the resource-based enterprises shows the characteristics of pathway breakthrough.

6. Conclusions

6.1. Discussion and Implications

6.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yang, D.H.; Zhang, Y.F.; Li, P.F. Supply-side structural reform and transformation of resource-based industries in China. China Popul. Resour. Environ. 2017, 27, 18–24. [Google Scholar]

- Lian, X.; Pei, T.X.; Wang, W.S.; Tang, Y.S. The impact of carbon trading mechanism and technology application on carbon emission reduction in China’s coal-fired power industry: Multi agent simulation based on reinforcement Learning. Resour. Sci. 2024, 46, 1186–1197. [Google Scholar]

- Yuan, H.Y.; Li, F.Q. On mechanism and countermeasures of the impact of “Carbon Peaking and Carbon Neutrality Goals” on supply-side structural reform. Theor. Investig. 2022, 1, 140–145. [Google Scholar]

- Gittell, J.H.; Cameron, K.; Lim, S.; Rivas, V. Relationships, layoffs and organizational resilience: Airline industry responses to September 11. J. Appl. Behav. Sci. 2006, 42, 300–329. [Google Scholar] [CrossRef]

- Witmer, H.; Mellinger, M.S. Organizational resilience: Nonprofit organizations’ response to change. Work 2016, 54, 255–265. [Google Scholar] [CrossRef]

- Zhang, G.Y.; Zhang, C.; Liu, W.Q. Turning danger into safety: A literature review and prospect of organizational resilience. Bus. Manag. J. 2020, 42, 192–208. [Google Scholar]

- Zhang, Q.; Ge, F.L.; Zhang, L.; Qi, L.; Hao, B. Review and outlook of the research on the resilience of domestic and foreign enterprises. Sci. Technol. Prog. Policy 2024, 41, 37–48. [Google Scholar]

- Mochizuki, J.; Chang, S.E. Disasters as opportunity for change: Tsunami recovery and energy transition in Japan. Int. J. Disaster Risk Reduct. 2017, 21, 331–339. [Google Scholar] [CrossRef]

- Jesse, B.J.; Heinrichs, H.U.; Kuckshinrichs, W. Adapting the theory of resilience to energy systems: A review and outlook. Energy Sustain. Soc. 2019, 9, 27. [Google Scholar] [CrossRef]

- Gasser, P.; Lustenberger, P.; Cinelli, M.; Kim, W.; Spada, M.; Burgherr, P.; Hirschberg, S.; Stojadinovic, B.; Sun, T.Y. A review on resilience assessment of energy systems. Sustain. Resilient Infrastruct. 2021, 6, 273–299. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990; pp. 30–45. [Google Scholar]

- Dowling, J.; Pfeffer, J. Organizational legitimacy: Social values and organizational behavior. Pac. Sociol. Rev. 1975, 18, 122–136. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations: Ideas, Interests and Identities; Sage Publications: London, UK, 2013; pp. 70–80. [Google Scholar]

- Xing, S.H. A Strategic Research for the Resource-Based Enterprises: From the Perspective of Legitimation Theory. Ph.D. Thesis, Wuhan University, Wuhan, China, 2012; pp. 8–25. [Google Scholar]

- Wang, F.Z.; Liu, Y.J.; Sun, Y. Institutional environment, open innovation and transformation of resource-based enterprises. Sci. Technol. Prog. Policy 2020, 37, 114–123. [Google Scholar]

- Zhang, H.Y.; Xue, K.; Wu, M.Y.; Chen, X.L.; Fang, X.L. Technological complementarity and legitimacy effects in international strategic alliance. Stud. Sci. Sci. 2018, 36, 1975–1985. [Google Scholar]

- He, Y.B.; Ye, L.F.; Wang, Z.W.; Lin, Q.X. How start-ups successfully carry out disruptive innovation: A case study based on the perspective of ecosystem legitimacy. Stud. Sci. Sci. 2024, 42, 2216–2227. [Google Scholar]

- Fu, H.; Guo, X.J.; Xiao, X.H. How legitimacy configurations lead to the scaling of unicorns: A fuzzy-set qualitative comparative analysis. China Soft Sci. 2024, 9, 132–141. [Google Scholar]

- Liu, Y.W.; Wang, T.; Xu, L. Rational strategy in the internationalization of Chinese brands: An institutional theory perspective. Macroeconomics 2017, 3, 18–127. [Google Scholar]

- Handelman, J.M.; Arnold, S.J. The role of marketing actions with a social dimension: Appeals to the institutional environment. J. Mark. 1999, 63, 33–48. [Google Scholar] [CrossRef]

- Powell, W.W.; DiMaggio, P.J. (Eds.) The New Institutionalism in Organizational Analysis; University of Chicago Press: Chicago, IL, USA, 1991; pp. 125–130. [Google Scholar]

- Goodman, P.S.; Pennings, J.M. New Perspectives on Organizational Effectiveness; Jossey-Bass: San Francisco, CA, USA, 1977; pp. 76–90. [Google Scholar]

- Yu, L.H.; Jin, Y.J. Dynamic characteristics of green development in China’s mining industry and policy implications: From the perspective of firm heterogeneity. Resour. Sci. 2022, 44, 554–569. [Google Scholar] [CrossRef]

- Linnenluecke, M.K. Resilience in business and management research: A review of influential publications and a research agenda. Int. J. Manag. Rev. 2017, 19, 4–30. [Google Scholar] [CrossRef]

- Li, P.; Zhu, J.Z. A literature review of organizational resilience. Foreign Econ. Manag. 2021, 43, 25–41. [Google Scholar]

- Wang, H.P.; Zhang, Y.; Tian, M.; Tan, L.M. A configuration study on the impact of corporate social responsibility and competitive strategy on organizational resilience. Sci. Sci. Manag. S.& T. 2023, 44, 152–166+182. [Google Scholar]

- Liu, S.B. Organizational resilience: The ability to grow in a crisis. Tsinghua Bus. Rev. 2020, 6, 90–95. [Google Scholar]

- Guo, Z.J.; Jiang, R.K.; Chen, J. Separation of ownership and regulation of natural resource assets owned by the whole people. China Land Sci. 2022, 36, 31–37. [Google Scholar]

- Meyer, J.W.; Rowan, B. Institutionalized organizations: Formal structure as myth and ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Naughton, B. The Chinese Economy: Transitions and Growth; MIT Press: Cambridge, MA, USA, 2007; pp. 48–67. [Google Scholar]

- Luo, X.W.; Xiang, G.P.; Ning, P.; Cheng, C. The impact of BMI on new venture performance: The effects of legitimacy and policy orientation. Stud. Sci. Sci. 2017, 35, 1073–1084. [Google Scholar]

- Wood, D.J. Corporate social performance revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar] [CrossRef]

- Wang, G.F.; Liu, H.; Wang, D.D.; Pang, Y.H.; Wu, L.X. High-quality energy development and energy security under the new situation for China. Bull. Chin. Acad. Sci. 2023, 38, 23–37. [Google Scholar]

- Jia, M.; Xiang, Y.; Wang, H.L.; Zhang, Z. From corporate social responsibility (CSR) to corporate sustainable business (CSB): Reflection and future. Manag. Rev. 2023, 35, 228–242. [Google Scholar]

- Aguinis, H.; Glavas, A. What we know and don’t know about corporate social responsibility: A review and research agenda. J. Manag. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Wang, S.H. A study of the influence of management background characteristics on corporate social responsibility—Empirical evidence from Chinese A—share listed companies. Account. Res. 2016, 11, 53–60+96. [Google Scholar]

- Zhang, S.J.; Jia, M.; Zhang, Z. Altruistic corporate social responsibility and organizational resilience: Treating on covid-19 as an exogenous event. Soft Sci. 2024, 38, 109–115. [Google Scholar]

- Ding, Y.; Miao, Z.Z.; Ji, H.Y.; Wang, J. Technological diversity, substantive corporate social responsibility disclosure and innovation diffusion. Sci. Technol. Prog. Policy 2022, 39, 127–135. [Google Scholar]

- Luo, Z.W.; Lv, L.X.; Huang, X.X.; Guo, Y. The effect of institutional corporate social responsibility on consumers’ perceived moral capital. Manag. Rev. 2022, 34, 136–145. [Google Scholar]

- Chen, Y.F.; Jin, B.X.; Ren, Y. Impact mechanism of corporate social responsibility on technological innovation performance: The mediating effect based on social capital. Sci. Res. Manag. 2020, 41, 87–98. [Google Scholar]

- Xu, J.H.; Dai, Y.Y.; Li, S.M. Corporate social responsibility, shareholder resources and actual corporate control of the founder. Chin. J. Manag. 2019, 16, 1820–1829. [Google Scholar]

- Zhang, M.T.; Zhang, S.T. The effect of relationship network on organizational resilience: The mediating role of ambidextrous innovation. Sci. Res. Manag. 2022, 43, 163–170. [Google Scholar]

- Li, X.J.; He, X.F.; Peng, Y.C.; Yang, X.J. The coupling of identity gap, legitimacy and social capital: A study on the legitimacy of overseas M&A of Chinese enterprise. J. Manag. Case Stud. 2022, 15, 347–358. [Google Scholar]

- Fombrun, C.; Shanley, M. What’s in a name? Reputation building and corporate strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar] [CrossRef]

- Gao, X.H.; Gao, Y.; Yu, J.H. Institutional evolution of low-carbon transition in resource-based enterprise: A multi-case study based on grounded theory. East China Econ. Manag. 2024, 38, 76–84. [Google Scholar]

- Luo, D.X.; Shi, K.; Peng, H.T. Research on organizational resilience. Hum. Resour. Dev. China 2010, 8, 9–13. [Google Scholar]

- Ragin, C.C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2008; pp. 2–10. [Google Scholar]

- Du, Y.Z.; Jia, L.D. Configuration perspective and qualitative comparative analysis (QCA): A new approach to management research. J. Manag. World 2017, 06, 155–167. [Google Scholar]

- Du, Y.Z.; Liu, Q.C.; Cheng, J.Q. What kind of ecosystem for doing business will contribute to city-level high entrepreneurial activity? A research based on institutional configurations. J. Manag. World 2020, 36, 141–155. [Google Scholar]

- Wang, F.Z.; Guo, X.C. Effects of environmental regulation intensity on green technological innovation of resource-based industries. China Popul. Resour. Environ. 2015, 25 (Suppl. S1), 143–146. [Google Scholar]

- Du, Y.Z.; Li, J.X.; Liu, Q.C.; Zhao, S.T.; Chen, K.W. Configurational theory and QCA method from a complex dynamic perspective: Research progress and future directions. J. Manag. World 2021, 37, 180–197+12–13. [Google Scholar]

- Vis, B.; Woldendorp, J.; Keman, H. Examining variation in economic performance using Fuzzy-Sets. Qual. Quant. 2013, 47, 1971–1989. [Google Scholar] [CrossRef]

- Smith, J. Resilience in mining: Preparing for environmental and economic shocks. Am. J. Min. Eng. 2024, 5, 7–15. [Google Scholar]

- Harman, U.; Thomson, I. Understanding resilience in the mining sector. In Rural Development for Sustainable Social-Ecological Systems: Putting Communities First; Springer International Publishing: Cham, Switzerland, 2023; pp. 389–413. [Google Scholar]

- Mao, J.; Guo, Y.Q.; Cao, J.; Xu, J.W. Local government financing vehicle debt and environmental pollution control. J. Manag. World 2022, 38, 96–118. [Google Scholar]

- Schneider, C.Q.; Wagemann, C. Set-Theoretic Methods for the Social Sciences: A Guide to Qualitative Comparative Analysis; Cambridge University Press: Cambridge, UK, 2012; pp. 223–250. [Google Scholar]

- ISO 14001:2015; Environmental Management Systems—Requirements with Guidance for Use. International Organization for Standardization: Geneva, Switzerland, 2015.

- Chen, J.W.; Yao, X.T. The Co-evolving of organizations and institutions: Dissecting and exploring the institutional theory of organization. Manag. Rev. 2015, 27, 135–144. [Google Scholar]

- Young, O.R. Institutional dynamics: Resilience, vulnerability and adaptation in environmental and resource regimes. Glob. Environ. Change 2010, 20, 378–385. [Google Scholar] [CrossRef]

- Ma, Q.; Li, X.L.; Shen, J.; Wang, C. Evolvement path and framework construction of legitimation strategy research of start-up enterprises. Foreign Econ. Manag. 2015, 37, 46–57. [Google Scholar]

| Legitimacy Dimension | Sub-Dimension | Description | The Influence on Organizational Resilience |

|---|---|---|---|

| Pragmatic Legitimacy | Exchange Legitimacy | Exchange legitimacy refers to the fact that customers, from the perspective of transactions, judge whether organizational behavior is reasonable based on whether it benefits their interests. | Exchange legitimacy contributes to the development of organizational resilience. |

| Influence Legitimacy | Influence legitimacy is the judgment made by stakeholders on the reasonableness of organizational behavior from the perspective of their own interests [11]. | Influence legitimacy contributes to the development of organizational resilience. | |

| Dispositional Legitimacy | Dispositional legitimacy refers to the overall quality, that is, the intrinsic quality of an enterprise, presented by an enterprise that has established a modern enterprise management system through the realization of the organic combination of various production and management elements. | Dispositional legitimacy contributes to the development of organizational resilience. | |

| Moral Legitimacy | Consequential Legitimacy | Consequential legitimacy refers to the evaluation made by the public of the results or consequences produced by enterprises [22]. | Consequential legitimacy contributes to the development of organizational resilience. |

| Procedural Legitimacy | Procedural legitimacy refers to whether the enterprises adopt techniques and procedures recognized by society and industry in their production processes [23]. | Procedural legitimacy contributes to the development of organizational resilience. | |

| Structural Legitimacy | Structural legitimacy pertains to the extent to which an enterprise establishes its organizational structure in alignment with societal norms during its operational processes [11]. | Structural legitimacy contributes to the development of organizational resilience. |

| Period | Period 1 (2016–2019) | Period 2 (2020–2022) | ||||

|---|---|---|---|---|---|---|

| Full Membership | Crossover Point | Full Non-Membership | Full Membership | Crossover Point | Full Non-Membership | |

| EER | 3.328 | 0.473 | 0.024 | 7.757 | 1.098 | 0.063 |

| EL | 16.963 | 5.999 | 1.743 | 53.790 | 17.371 | 2.826 |

| IL | 8.190 | 6.750 | 4.060 | 6.610 | 5.920 | 5.550 |

| DL | 2.969 | 1.485 | 1.043 | 3.311 | 1.650 | 1.115 |

| CL | −0.14482 | −0.14532 | −0.14575 | −0.14856 | −0.14901 | −0.14903 |

| PrL | 0.0000 | −0.010 | −0.100 | 0.000 | −0.010 | −0.050 |

| SL | 2.000 | 1.333 | 1.000 | 2.000 | 1.500 | 1.000 |

| Period | Period 1 (2016–2019) EER1 | Period 2 (2020–2022) EER2 | |||

|---|---|---|---|---|---|

| Conditional Variable | Consistency | Coverage | Consistency | Coverage | |

| EL | 0.696 | 0.673 | 0.642 | 0.671 | |

| ~EL | 0.429 | 0.397 | 0.451 | 0.416 | |

| IL | 0.697 | 0.649 | 0.660 | 0.635 | |

| ~IL | 0.443 | 0.425 | 0.450 | 0.450 | |

| DL | 0.518 | 0.513 | 0.512 | 0.531 | |

| ~DL | 0.587 | 0.531 | 0.560 | 0.520 | |

| CL | 0.496 | 0.462 | 0.615 | 0.617 | |

| ~CL | 0.662 | 0.636 | 0.467 | 0.448 | |

| PrL | 0.865 | 0.516 | 0.888 | 0.553 | |

| ~PrL | 0.230 | 0.522 | 0.208 | 0.480 | |

| SL | 0.316 | 0.821 | 0.354 | 0.764 | |

| ~SL | 0.762 | 0.440 | 0.733 | 0.465 | |

| Period | Period 1 (2016–2019) EER1 | Period 2 (2020–2022) EER2 | ||||||

|---|---|---|---|---|---|---|---|---|

| Conditional Variable | A1 | A2 | A3 | B1a | B1b | B2 | B3 | |

| Pragmatic legitimacy | EL | ⬤ | • | ⬤ | • | • | ⊗ | |

| IL | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | |

| DL | ⬤ | ⊗ | ⊗ | ⊗ | • | • | ||

| Moral legitimacy | CL | • | ⊗ | ⊗ | ⬤ | ⬤ | ⬤ | |

| PrL | • | • | ⊗ | • | ⬤ | ⬤ | ||

| SL | ⬤ | ⊗ | ⊗ | ⊗ | ⬤ | ⊗ | ||

| Consistency | 0.899 | 0.913 | 0.888 | 0.937 | 0.922 | 0.896 | 0.842 | |

| Raw coverage | 0.198 | 0.205 | 0.077 | 0.211 | 0.162 | 0.227 | 0.090 | |

| Unique coverage | 0.145 | 0.140 | 0.024 | 0.115 | 0.041 | 0.110 | 0.035 | |

| Overall solution consistency | 0.895 | 0.878 | ||||||

| Overall solution coverage | 0.376 | 0.440 | ||||||

| Dimensions | The High-Resilience Pathways of Resource-Based Enterprises Under the Supply-Side Structural Reforms | The High-Resilience Pathways of Resource-Based Enterprises Under the “Dual-Carbon” Goals |

|---|---|---|

| Initial conditions | Exogenous, episodic, unpredictable behavioral patterns | Controllability, continuous action to be embedded in the institutional environment |

| Self-reinforcing mechanism | Passively conforming to the requirements of the institutions, spontaneously | Strategic actions are taken to meet the requirements of institutions |

| Core conditions | Exchange legitimacy, influence legitimacy, dispositional legitimacy, and structural legitimacy | Influence legitimacy, consequential legitimacy, procedural legitimacy, and structural legitimacy |

| Nature | Self-organizing, non-global random process | Constructiveness, a conscious creative process |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, H.; Wang, Z.; Liu, D.; Han, L. The Formation and Evolution of the Resilience of Resource-Based Enterprises Under Continuous Institutional Shocks: An Explanation from the Perspective of Organizational Legitimacy. Sustainability 2025, 17, 7215. https://doi.org/10.3390/su17167215

Chen H, Wang Z, Liu D, Han L. The Formation and Evolution of the Resilience of Resource-Based Enterprises Under Continuous Institutional Shocks: An Explanation from the Perspective of Organizational Legitimacy. Sustainability. 2025; 17(16):7215. https://doi.org/10.3390/su17167215

Chicago/Turabian StyleChen, Hong, Zhiying Wang, Dongxia Liu, and Linda Han. 2025. "The Formation and Evolution of the Resilience of Resource-Based Enterprises Under Continuous Institutional Shocks: An Explanation from the Perspective of Organizational Legitimacy" Sustainability 17, no. 16: 7215. https://doi.org/10.3390/su17167215

APA StyleChen, H., Wang, Z., Liu, D., & Han, L. (2025). The Formation and Evolution of the Resilience of Resource-Based Enterprises Under Continuous Institutional Shocks: An Explanation from the Perspective of Organizational Legitimacy. Sustainability, 17(16), 7215. https://doi.org/10.3390/su17167215